Deep-pocketed investors have adopted a bearish approach towards Lockheed Martin LMT, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LMT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Lockheed Martin. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 50% bearish. Among these notable options, 4 are puts, totaling $141,995, and 6 are calls, amounting to $294,124.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $450.0 to $560.0 for Lockheed Martin over the recent three months.

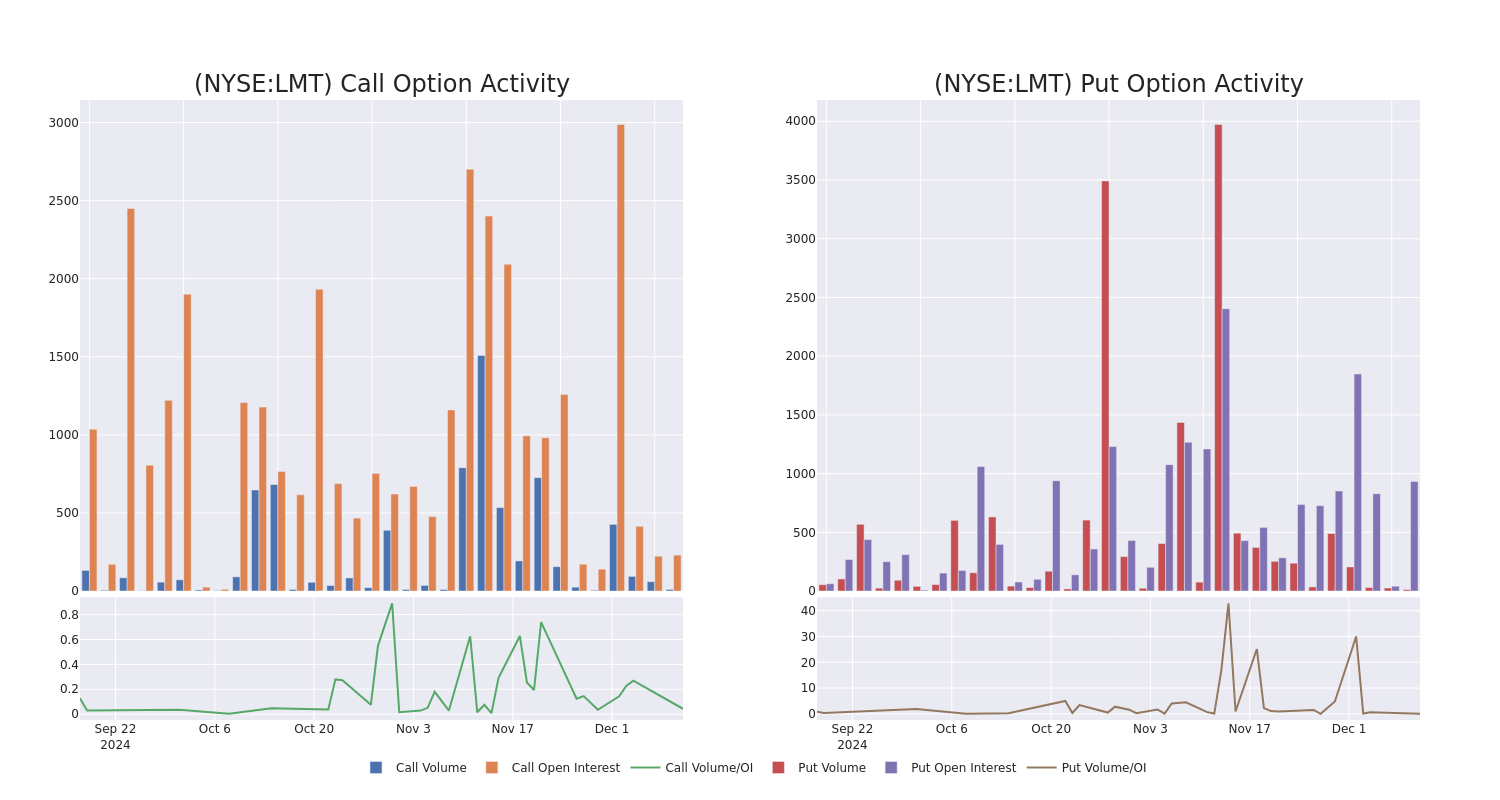

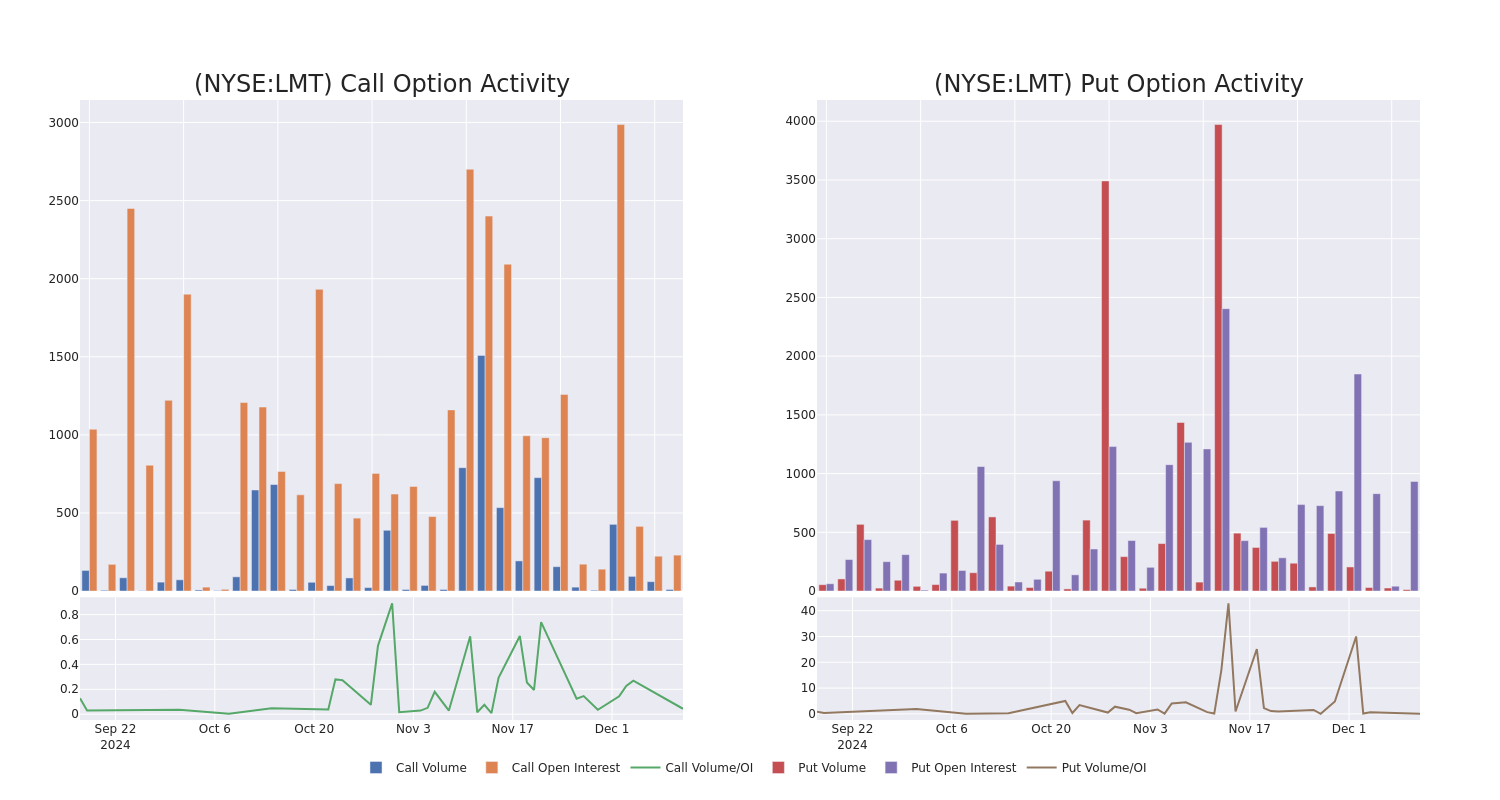

Insights into Volume & Open Interest

In today's trading context, the average open interest for options of Lockheed Martin stands at 380.0, with a total volume reaching 466.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lockheed Martin, situated within the strike price corridor from $450.0 to $560.0, throughout the last 30 days.

Lockheed Martin Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | SWEEP | BULLISH | 03/21/25 | $5.6 | $4.8 | $5.6 | $560.00 | $67.2K | 290 | 122 |

| LMT | CALL | SWEEP | BULLISH | 06/20/25 | $11.6 | $11.3 | $11.6 | $560.00 | $63.8K | 77 | 62 |

| LMT | CALL | SWEEP | BEARISH | 06/20/25 | $12.5 | $11.6 | $11.6 | $560.00 | $56.8K | 77 | 135 |

| LMT | CALL | TRADE | BULLISH | 01/15/27 | $67.6 | $64.1 | $67.3 | $500.00 | $53.8K | 47 | 13 |

| LMT | PUT | TRADE | BEARISH | 09/19/25 | $19.1 | $16.9 | $18.3 | $450.00 | $47.5K | 221 | 26 |

About Lockheed Martin

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

After a thorough review of the options trading surrounding Lockheed Martin, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Lockheed Martin Standing Right Now?

- With a trading volume of 695,248, the price of LMT is down by -1.4%, reaching $497.17.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 40 days from now.

Professional Analyst Ratings for Lockheed Martin

In the last month, 1 experts released ratings on this stock with an average target price of $543.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Wells Fargo persists with their Equal-Weight rating on Lockheed Martin, maintaining a target price of $543.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lockheed Martin options trades with real-time alerts from Benzinga Pro.

Overview Rating:

Speculative

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.