Financial giants have made a conspicuous bearish move on Freeport-McMoRan. Our analysis of options history for Freeport-McMoRan FCX revealed 14 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $1,050,840, and 8 were calls, valued at $458,377.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $35.0 to $45.0 for Freeport-McMoRan over the last 3 months.

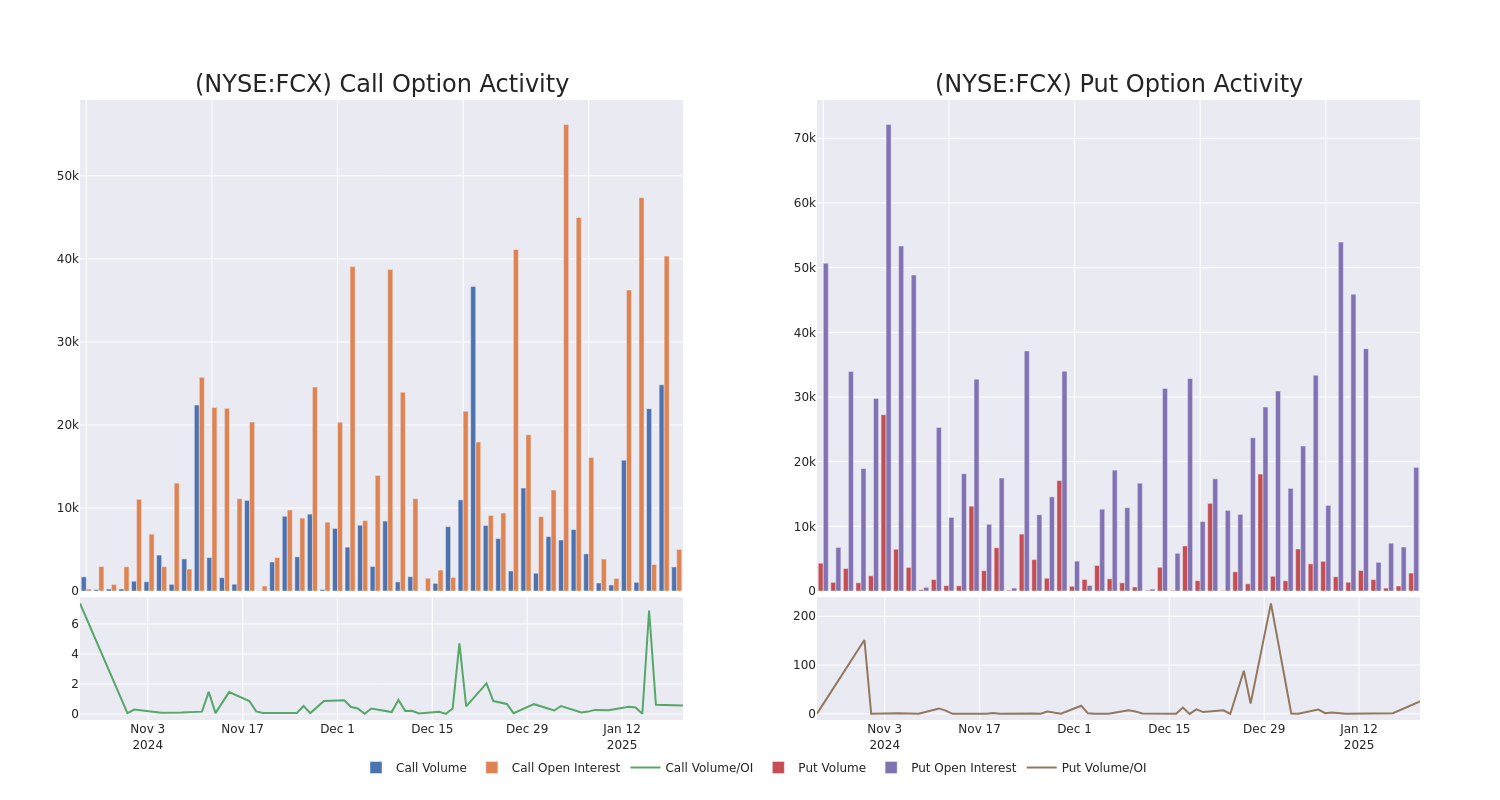

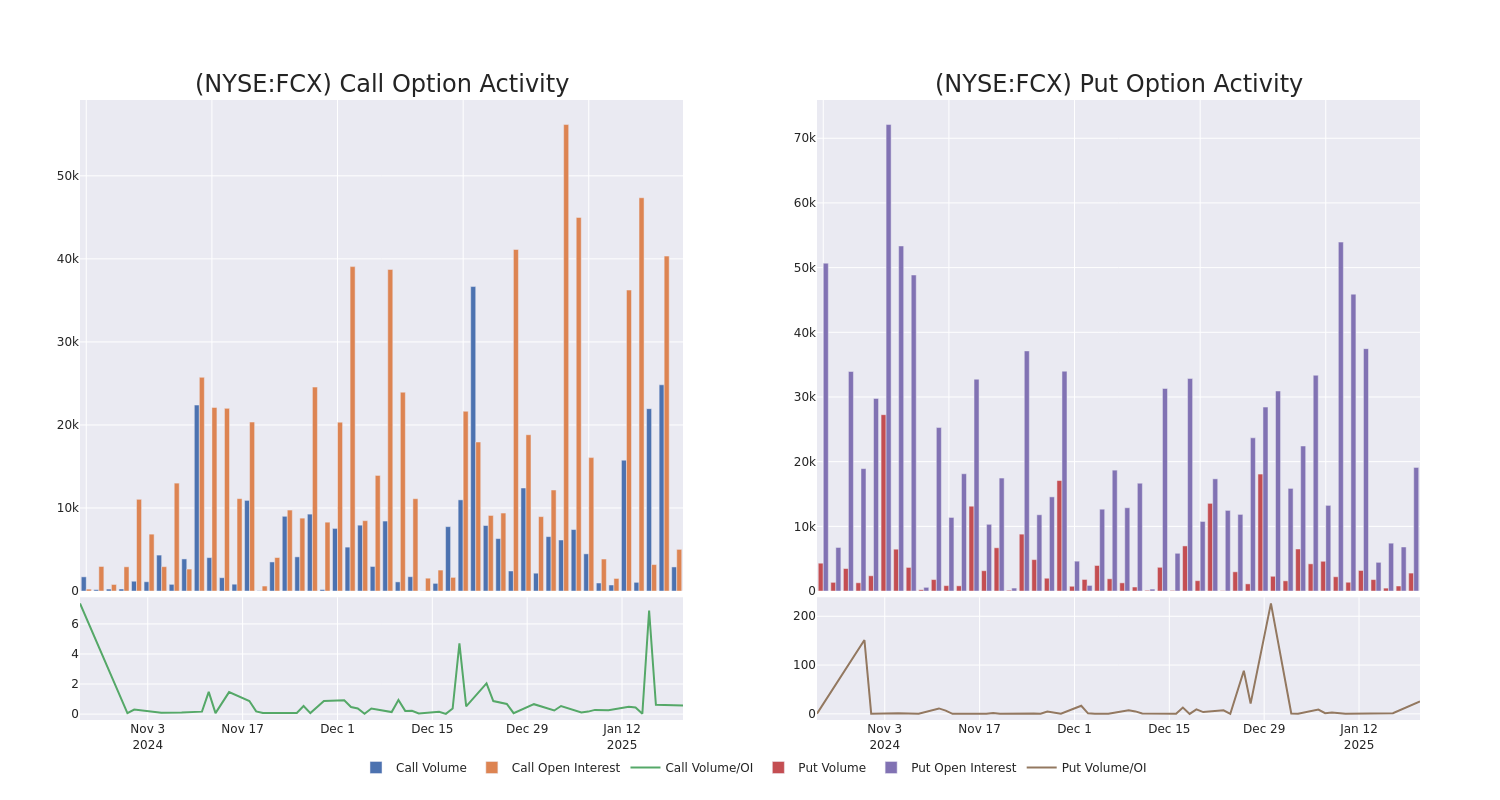

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Freeport-McMoRan's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Freeport-McMoRan's whale activity within a strike price range from $35.0 to $45.0 in the last 30 days.

Freeport-McMoRan Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | PUT | TRADE | BULLISH | 06/20/25 | $6.2 | $6.05 | $6.05 | $45.00 | $605.0K | 8.4K | 1.0K |

| FCX | PUT | TRADE | BULLISH | 06/20/25 | $1.34 | $1.22 | $1.25 | $35.00 | $125.0K | 10.5K | 1.0K |

| FCX | CALL | TRADE | BEARISH | 03/21/25 | $2.25 | $2.14 | $2.15 | $41.00 | $107.5K | 3.0K | 507 |

| FCX | PUT | SWEEP | BEARISH | 06/20/25 | $4.8 | $4.7 | $4.8 | $43.00 | $99.3K | 30 | 416 |

| FCX | PUT | SWEEP | BEARISH | 06/20/25 | $4.75 | $4.65 | $4.75 | $43.00 | $88.3K | 30 | 188 |

About Freeport-McMoRan

Freeport-McMoRan owns stakes in 10 copper mines, led by its 49% ownership of the Grasberg copper and gold operations in Indonesia, 55% of the Cerro Verde mine in Peru, and 72% of Morenci in Arizona. It sold around 1.2 million metric tons of copper (its share) in 2023, making it the one of the world's largest copper miners by volume. It also sold about 900,000 ounces of gold, mostly from Grasberg, and 70 million pounds of molybdenum. About 75% of 2023 revenue was from copper, with a further 15% from gold and about 10% from molybdenum. It had about 25 years of copper reserves at end December 2023. we expect it to sell similar amounts of copper midcycle in 2028, though we expect gold volumes to decline to about 700,000 ounces then due to falling production at Grasberg.

After a thorough review of the options trading surrounding Freeport-McMoRan, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Freeport-McMoRan's Current Market Status

- Trading volume stands at 4,637,467, with FCX's price down by -0.19%, positioned at $40.15.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 2 days.

Expert Opinions on Freeport-McMoRan

In the last month, 4 experts released ratings on this stock with an average target price of $47.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Freeport-McMoRan, targeting a price of $48. * Reflecting concerns, an analyst from Bernstein lowers its rating to Market Perform with a new price target of $46. * Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on Freeport-McMoRan with a target price of $48. * An analyst from Scotiabank has decided to maintain their Sector Perform rating on Freeport-McMoRan, which currently sits at a price target of $48.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Freeport-McMoRan options trades with real-time alerts from Benzinga Pro.

Overview Rating:

Speculative

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.