STOCKBURGER LUNCH BURGER MIDDAY RECAP

Fresh market analysis served hot at lunchtime

Welcome to the StockBurger Lunch Burger Midday Recap, where we serve up the freshest market analysis right at lunchtime. The trading floor is buzzing with activity as we hit the midday session, and we’re here to break down all the key moves, sector rotations, and opportunities that are cooking in today’s market.

Lunch Burger Market Menu

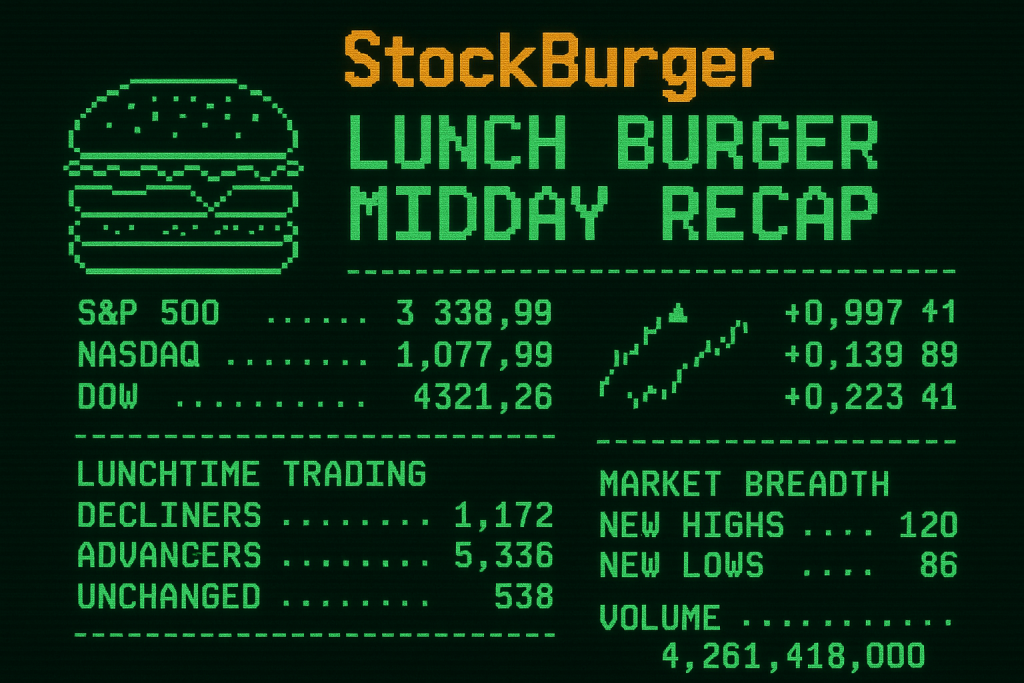

STOCKBURGER LUNCH BURGER MIDDAY RECAP - FRESH SERVED ==================================================== MARKET INDICES - LUNCHTIME SPECIAL: S&P 500: 6,487.33 (-0.22%) SLIGHT PULLBACK NASDAQ: 21,590.14 (+0.21%) TECH HOLDING STRONG DOW JONES: 45,570.22 (-0.15%) INDUSTRIAL STEADY RUSSELL 2000: 2,372.15 (+0.55%) SMALL CAP LEADERSHIP LUNCHTIME VOLUME: 4.26B shares traded MARKET BREADTH: 5,336 advancers vs 1,172 decliners LUNCH SPECIAL: Tech and AI stocks leading the charge

Today’s Lunch Special – Market Performance

StockBurger Lunch Analysis

The midday session is serving up a mixed but generally positive market environment. While the S&P 500 and Dow are taking a brief breather with modest declines, the NASDAQ is holding its ground with tech stocks continuing to show strength. Small caps are the real lunch winners today with the Russell 2000 leading all major indices.

Market Breadth – The Full Lunch Spread

Market breadth is telling a positive story at lunchtime with advancers significantly outpacing decliners:

- Advancing Stocks: 5,336 (strong participation)

- Declining Stocks: 1,172 (limited weakness)

- Unchanged: 538 (consolidation)

- New 52-Week Highs: 120 (healthy momentum)

- New 52-Week Lows: 86 (contained weakness)

Sector Lunch Menu – What’s Hot and What’s Not

SECTOR PERFORMANCE - LUNCHTIME EDITION ===================================== LUNCH WINNERS (Top Performers): Technology +0.72% MAIN COURSE Communication +0.58% APPETIZER Energy +0.45% SIDE DISH Industrials +0.38% DESSERT LUNCH LOSERS (Underperformers): Consumer Staples -0.32% COLD SOUP Utilities -0.28% STALE BREAD Real Estate -0.25% LEFTOVER Healthcare -0.18% BLAND SALAD

Technology – The Main Course

Technology continues to be the main course of today’s lunch menu, leading all sectors with a solid +0.72% gain:

- AI Infrastructure: Continued institutional buying in AI-related names

- Software Leadership: Enterprise software showing sustained strength

- Semiconductor Strength: Chip stocks benefiting from AI demand

- Cloud Computing: Data center and cloud names participating

Communication Services – The Perfect Appetizer

Communication services sector is serving as the perfect appetizer with +0.58% gains:

- Social Media Platforms: User engagement metrics driving optimism

- Streaming Services: Content monetization improving

- Telecom Infrastructure: 5G buildout continuing

Lunchtime Volume Analysis

LUNCHTIME TRADING VOLUME ANALYSIS ================================= TOTAL VOLUME: 4.26B shares (above average) VOLUME LEADERS: IREN: 52.47M shares (Bitcoin mining momentum) BABA: 52.40M shares (Alibaba earnings strength) AFRM: 28.48M shares (Fintech leadership) AMBA: 4.10M shares (AI chip breakout) INSTITUTIONAL FLOW: Heavy buying in tech and AI names Rotation from defensive to growth

Lunch Hour Movers – The Hot Dishes

Ambarella Inc. – The Gourmet Special

Ambarella, Inc. (Investor Relations | NASDAQ: AMBA) is the gourmet special of today’s lunch menu with an impressive +18.80% surge.

- Current Price: 3.91 (+18.80%)

- Volume: 4.10M shares (4.6x average)

- Market Cap: .56B

- Catalyst: AI chip demand and automotive partnerships

- Technical: Breaking above 0 resistance with volume

IREN Limited – The Energy Boost

IREN Limited (Investor Relations | NASDAQ: IREN) is providing the energy boost with a solid +12.52% gain.

- Current Price: 5.92 (+12.52%)

- Volume: 52.47M shares (massive institutional interest)

- Market Cap: .27B

- Catalyst: Bitcoin mining operations and renewable energy focus

- 52-Week Performance: +191.28% (exceptional year)

Affirm Holdings – The Fintech Feast

Affirm Holdings, Inc. (Investor Relations | NASDAQ: AFRM) is serving up a fintech feast with +11.70% gains.

- Current Price: 9.35 (+11.70%)

- Volume: 28.48M shares (4.9x average)

- Market Cap: 8.82B

- Catalyst: Buy-now-pay-later sector leadership

- 52-Week Performance: +81.75% (strong year)

International Lunch Specials

Alibaba Group – The Chinese Delicacy

Alibaba Group Holding Limited (Investor Relations | NASDAQ: BABA) is the Chinese delicacy on today’s menu with +11.85% strength.

- Current Price: 33.74 (+11.85%)

- Volume: 52.40M shares (4.1x average)

- Market Cap: 18.84B

- Catalyst: Strong quarterly earnings and cloud growth

- Technical: Breaking above 30 resistance

Lunch Dessert – Defensive Plays

Edison International – The Utility Surprise

Edison International (Investor Relations | NYSE: EIX) is the surprise dessert with +4.18% gains in the utility space.

- Current Price: 7.01 (+4.18%)

- Volume: 1.19M shares

- Market Cap: 1.94B

- Dividend Yield: 5.96% (attractive income)

- Catalyst: California energy infrastructure investments

Lunch Break Technical Analysis

TECHNICAL LUNCH BREAK ANALYSIS ============================== KEY SUPPORT AND RESISTANCE LEVELS: S&P 500: Support 6,450 | Resistance 6,520 NASDAQ: Support 21,400 | Resistance 21,800 DOW: Support 45,200 | Resistance 45,800 MOMENTUM INDICATORS: RSI: 58 (neutral to bullish) MACD: Positive divergence VIX: 14.2 (low volatility)

Afternoon Menu Preview

Looking ahead to the afternoon session, here’s what’s on the menu:

Key Events to Watch

- 2:00 PM: Fed speakers and monetary policy commentary

- After Close: Additional earnings reports from tech names

- Economic Data: Consumer sentiment and inflation expectations

- Sector Rotation: Continued tech leadership expected

Trading Strategy for Afternoon Session

- Momentum Continuation: Watch for follow-through in AI and tech names

- Volume Confirmation: Ensure institutional backing for moves

- Sector Leadership: Technology and communication services leading

- Risk Management: Monitor for any Fed policy surprises

StockBurger’s Lunch Pick

Lunch Special Champion: Ambarella Inc. (AMBA)

Why AMBA Is Our Lunch Special: +18.80% gain with strong volume, AI chip leadership, and technical breakout

Price Target: 5 | Current Price: 3.91 | Upside: 13.2%

Lunch Rating: Five-Star Gourmet Special

Risk Factors and Lunch Warnings

Lunch Break Risk Assessment

- Midday Volatility: Lunch hour can see reduced volume and increased volatility

- Fed Policy Risk: Any hawkish commentary could impact growth stocks

- Profit Taking: Strong morning gainers may see afternoon profit taking

- Volume Sustainability: Monitor for continued institutional interest

Stock Tickers and Lunch Menu

FEATURED LUNCH BURGER STOCK TICKERS: AMBA - Ambarella, Inc. IREN - IREN Limited AFRM - Affirm Holdings, Inc. BABA - Alibaba Group Holding Limited DOOO - BRP Inc. ADSK - Autodesk, Inc. HMY - Harmony Gold Mining Company Limited NG - NovaGold Resources Inc. PRVA - Privia Health Group, Inc. OS - OneStream, Inc.

Lunch Conclusion and Afternoon Outlook

The StockBurger Lunch Burger Midday Recap reveals a market that’s serving up a generally positive lunch special with technology and AI stocks leading the charge. While the major indices show mixed performance, the underlying market breadth is healthy with advancers significantly outpacing decliners.

Key Lunch Takeaways

- Tech Leadership: Technology sector continues to be the main course

- AI Momentum: Ambarella and other AI names showing explosive strength

- Fintech Strength: Affirm leading the buy-now-pay-later revolution

- International Participation: Alibaba showing Chinese market strength

- Volume Confirmation: Strong institutional backing for key moves

As we head into the afternoon session, the lunch menu suggests continued strength in technology and growth names, with AI infrastructure and fintech leading the charge. The market is serving up plenty of opportunities for those with the appetite for growth and momentum plays.

Disclaimer: This Lunch Burger Midday Recap is for informational purposes only and not financial advice. Market conditions can change rapidly during the trading day. Always conduct your own research and consider your risk tolerance before making investment decisions.