📊 STOCKBURGER EXCLUSIVE ANALYSIS 📊

Professional insights for serious investors

Today’s trading session delivered dramatic moves across multiple sectors, with technology stocks leading both the winners and losers. Our comprehensive analysis covers the biggest market movers that are reshaping portfolios and driving after-hours activity.

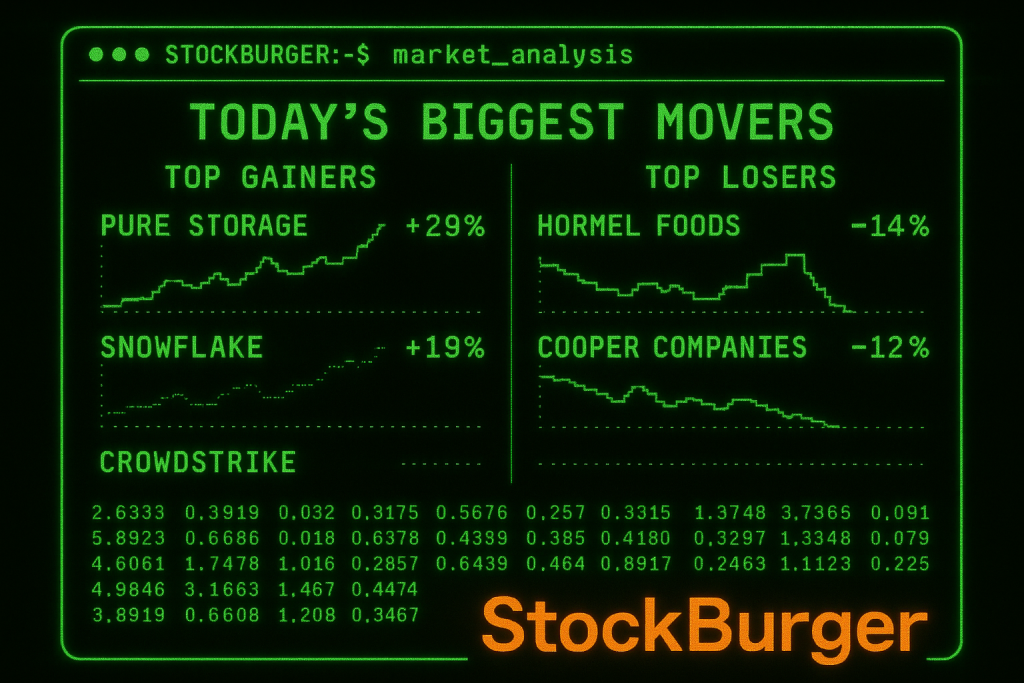

🚀 Today’s Biggest Winners

TOP GAINERS - AUGUST 27, 2025 ============================= PSTG Pure Storage +29.13% 8.59 SNOW Snowflake Inc. +19.00% 38.47 BILL BILL Holdings +13.21% 7.13 GPRE Green Plains +13.97% 1.34 BURL Burlington Stores +7.22% 00.54 VOLUME LEADERS: SNOW: 17M shares (5x average) PSTG: 8.12M shares (3x average) BILL: 4.28M shares (4x average)

Pure Storage (PSTG) – Storage Revolution

Pure Storage, Inc. (Official Website | NASDAQ: PSTG) surged an impressive 29.13% to 8.59 following exceptional Q2 2026 earnings results that crushed analyst expectations across all key metrics.

Key Performance Drivers:

- Revenue jumped 32% year-over-year to 45 million vs 80 million expected

- Subscription revenue grew 41% to 25 million, showing strong recurring revenue momentum

- AI and machine learning workloads driving enterprise storage demand

- Raised full-year guidance to .2-.3 billion from previous .0-.1 billion

Snowflake (SNOW) – Recovery Rally

Snowflake Inc. (Official Website | NASDAQ: SNOW) rebounded strongly with a 19% gain to 38.47, recovering from recent weakness as investors focused on the company’s AI initiatives and improved consumption trends.

Recovery Catalysts:

- Management commentary on stabilizing consumption patterns

- New AI and machine learning product launches gaining traction

- Enterprise customer additions accelerating in Q2

- Analyst upgrades citing oversold conditions

BILL Holdings (BILL) – Fintech Momentum

BILL Holdings, Inc. (Official Website | NASDAQ: BILL) jumped 13.21% to 7.13 as the financial technology company reported strong Q2 results with accelerating small business adoption.

📉 Notable Decliners

TOP LOSERS - AUGUST 27, 2025 ============================ HRL Hormel Foods -14.35% 4.85 COO Cooper Companies -12.49% 4.85 TLX Telix Pharma -12.64% 0.57 BBWI Bath & Body Works -9.38% 8.58 NTNX Nutanix Inc. -7.41% 4.44 HIGH VOLUME DECLINES: HRL: 7.2M shares (2x average) COO: 6.5M shares (2.4x average) BBWI: 5.7M shares (normal)

Hormel Foods (HRL) – Earnings Disappointment

Hormel Foods Corporation (Official Website | NASDAQ: HRL) plummeted 14.35% to 4.85 after reporting Q3 2025 results that missed expectations due to rising input costs and weakening demand.

Challenges Facing Hormel:

- Commodity cost inflation pressuring margins

- Consumer shift away from processed foods

- Competitive pricing pressure in retail channels

- Lowered full-year guidance citing macro headwinds

Cooper Companies (COO) – Medical Device Concerns

The Cooper Companies, Inc. (Official Website | NASDAQ: COO) fell 12.49% to 4.85 following Q2 2026 earnings that showed slowing growth in the contact lens segment.

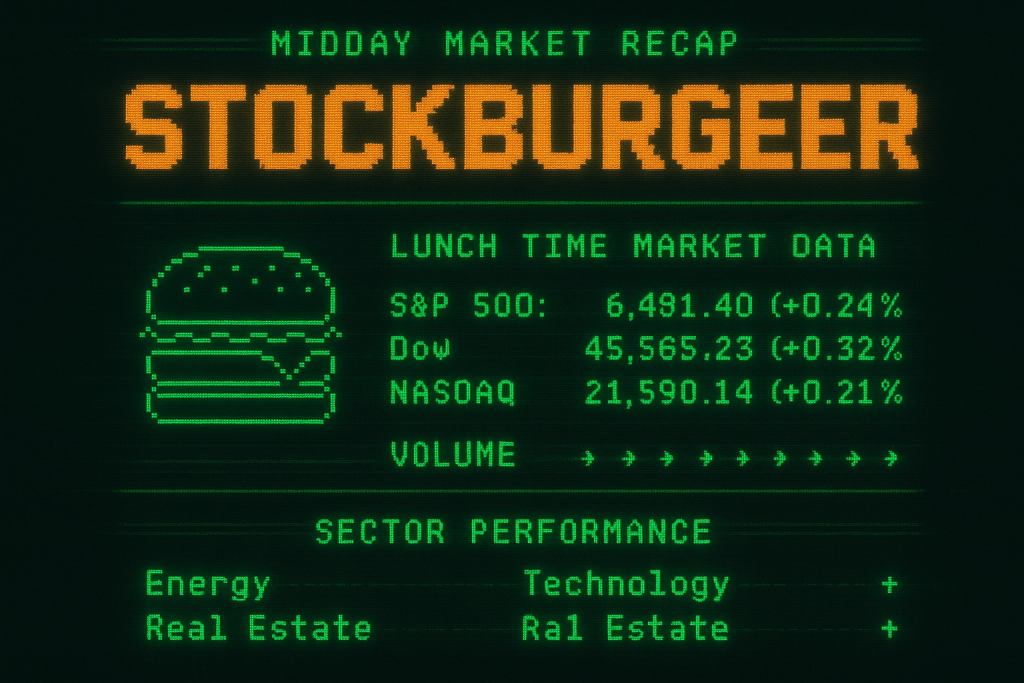

📊 Market Analysis

StockBurger Research Team Analysis

Today’s market action highlights the continued bifurcation in technology stocks. Companies with strong AI exposure and recurring revenue models (PSTG, SNOW) are being rewarded, while traditional consumer staples (HRL) face headwinds from changing consumption patterns and cost pressures.

🎯 Sector Rotation Insights

Today’s movers reveal several important market themes:

Technology Leadership

- AI Infrastructure: Pure Storage benefits from AI workload storage demands

- Cloud Recovery: Snowflake showing signs of consumption stabilization

- Fintech Growth: BILL Holdings capturing small business digitization

Consumer Staples Under Pressure

- Cost Inflation: Hormel struggling with commodity price increases

- Demand Shifts: Consumers moving away from processed foods

- Margin Compression: Pricing power limited in competitive markets

⚡ STOCKBURGER INVESTMENT RATING

Market Outlook: SELECTIVE – Focus on AI-enabled technology leaders

Top Picks: PSTG, SNOW (on recovery) | Avoid: HRL, COO

🔍 Technical Analysis

TECHNICAL LEVELS - KEY MOVERS

=============================

PSTG: Breakout above 5 resistance

Next target: 5-0

Support: 0, 5

SNOW: Reclaimed 30 support level

Resistance: 50, 70

Key support: 20, 00

HRL: Broke below 8 support

Next support: 2-4

Resistance: 8, 0

VOLUME ANALYSIS:

- PSTG: 8.1M vs 3.1M avg (260% increase)

- SNOW: 17M vs 3.5M avg (485% increase)

- HRL: 7.2M vs 3.3M avg (218% increase)

📈 Trading Opportunities

💡 StockBurger Pro Strategy

Momentum Plays: PSTG showing strong breakout potential

Recovery Trades: SNOW if it holds 30 support level

Contrarian Opportunities: HRL oversold but wait for stabilization

Sector Rotation: Technology infrastructure over consumer staples

🎯 After-Hours Catalysts

Key events driving continued volatility:

- Earnings Reactions: Multiple companies reporting after close

- Guidance Updates: Management commentary on Q3/Q4 outlook

- AI Infrastructure: Continued focus on data center and storage plays

- Consumer Spending: Economic data impacting staples sector

📈 Stock Tickers & Performance

FEATURED STOCK TICKERS: PSTG - Pure Storage, Inc. SNOW - Snowflake Inc. BILL - BILL Holdings, Inc. GPRE - Green Plains, Inc. BURL - Burlington Stores, Inc. HRL - Hormel Foods Corporation COO - The Cooper Companies, Inc. TLX - Telix Pharmaceuticals Limited BBWI - Bath & Body Works, Inc. NTNX - Nutanix, Inc.

🚨 Risk Management

⚠️ Key Risks

- Momentum Reversals: High-flying stocks can correct quickly

- Sector Rotation: Technology leadership may not persist

- Economic Sensitivity: Consumer staples vulnerable to macro changes

- Earnings Volatility: Results driving extreme price movements

📊 Long-term Investment Themes

Today’s market action reinforces several key investment themes:

- AI Infrastructure: Storage and compute demand accelerating

- Digital Transformation: Fintech adoption continuing to grow

- Consumer Evolution: Shift toward healthier, less processed foods

- Quality Focus: Investors favoring companies with pricing power

💡 StockBurger Pro Tip

Focus on companies benefiting from structural trends like AI adoption and digital transformation. Today’s winners (PSTG, SNOW) demonstrate how technology infrastructure plays can deliver outsized returns when execution meets market demand.

Disclaimer: This analysis is for informational purposes only and not financial advice. Stock prices can be volatile and past performance does not guarantee future results. Always conduct your own research and consider your risk tolerance before investing.