Whales with a lot of money to spend have taken a noticeably bullish stance on MicroStrategy.

Looking at options history for MicroStrategy MSTR we detected 83 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 27% with bearish.

From the overall spotted trades, 22 are puts, for a total amount of $1,284,737 and 61, calls, for a total amount of $8,784,547.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $80.0 to $1080.0 for MicroStrategy over the last 3 months.

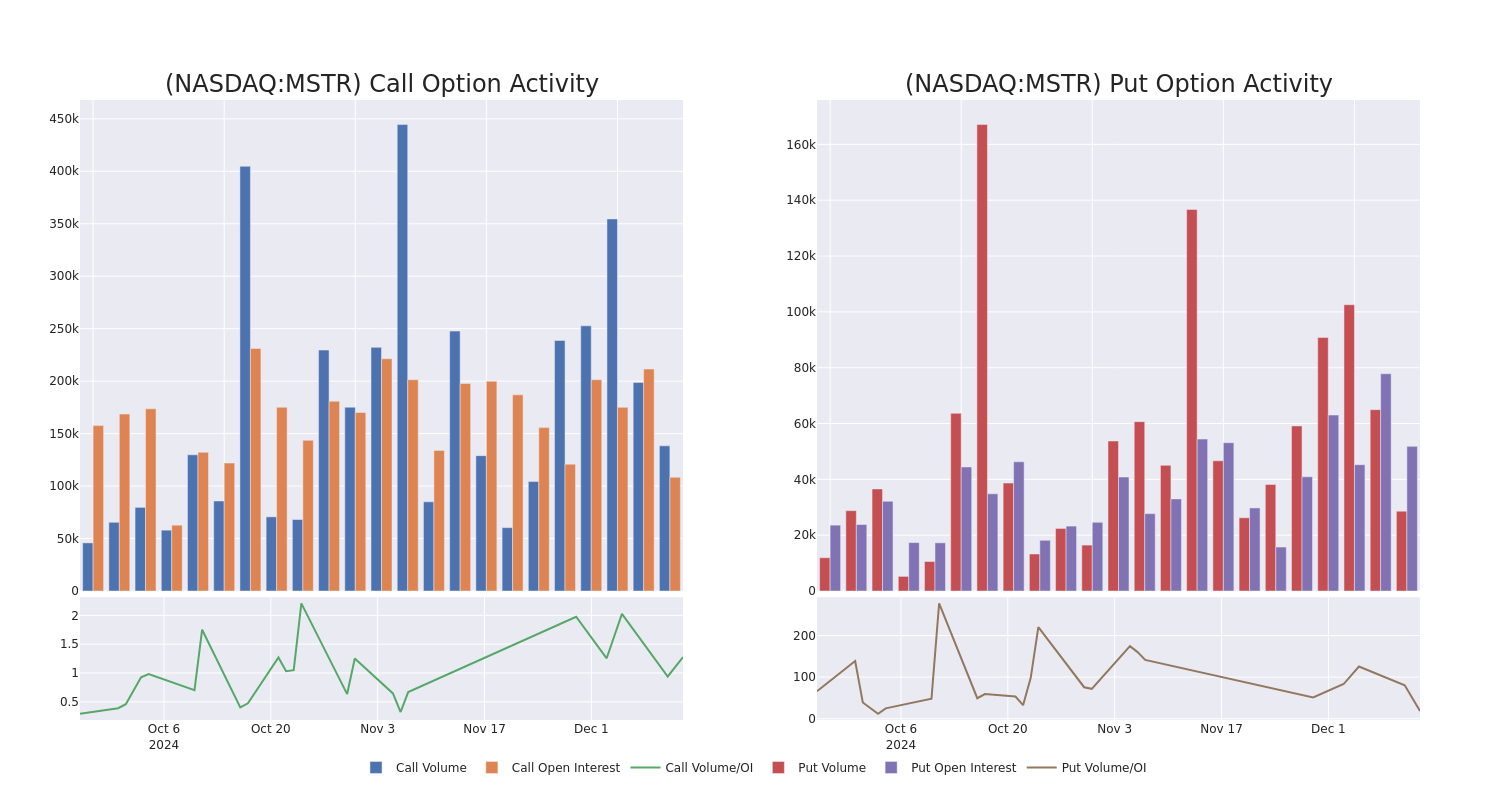

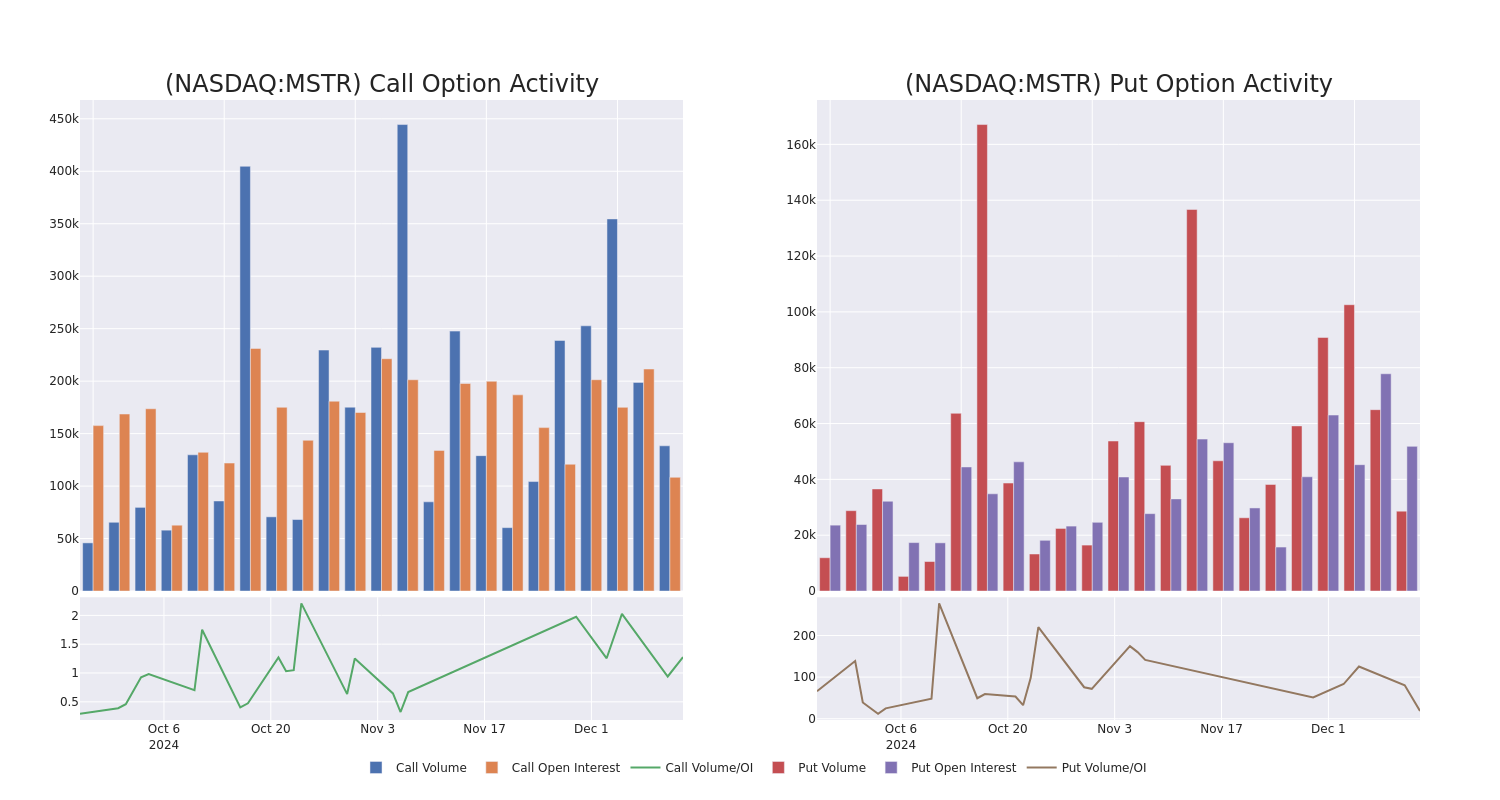

Volume & Open Interest Development

In today's trading context, the average open interest for options of MicroStrategy stands at 2250.29, with a total volume reaching 34,343.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MicroStrategy, situated within the strike price corridor from $80.0 to $1080.0, throughout the last 30 days.

MicroStrategy Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | SWEEP | BULLISH | 01/03/25 | $35.25 | $33.75 | $35.25 | $430.00 | $1.7M | 383 | 515 |

| MSTR | CALL | SWEEP | NEUTRAL | 12/20/24 | $20.7 | $20.0 | $20.34 | $420.00 | $1.0M | 6.3K | 1.7K |

| MSTR | CALL | SWEEP | NEUTRAL | 02/21/25 | $84.85 | $82.55 | $83.89 | $430.00 | $554.0K | 506 | 115 |

| MSTR | CALL | SWEEP | NEUTRAL | 02/21/25 | $65.4 | $63.8 | $64.47 | $500.00 | $432.3K | 2.5K | 92 |

| MSTR | CALL | SWEEP | NEUTRAL | 02/21/25 | $88.4 | $87.0 | $87.72 | $420.00 | $350.8K | 525 | 87 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

Following our analysis of the options activities associated with MicroStrategy, we pivot to a closer look at the company's own performance.

Current Position of MicroStrategy

- With a trading volume of 7,063,198, the price of MSTR is up by 2.83%, reaching $420.24.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 50 days from now.

What The Experts Say On MicroStrategy

In the last month, 5 experts released ratings on this stock with an average target price of $559.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Benchmark persists with their Buy rating on MicroStrategy, maintaining a target price of $450. * An analyst from BTIG persists with their Buy rating on MicroStrategy, maintaining a target price of $570. * Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on MicroStrategy with a target price of $650. * In a cautious move, an analyst from Bernstein downgraded its rating to Outperform, setting a price target of $600. * Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on MicroStrategy with a target price of $525.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.