If you blinked on May 14, 2025, you might’ve missed a wild mix of calm headlines, soaring tech stocks, collapsing healthcare giants, and two small-caps that decided to go full rocket ship mode.

Let’s break it all down, because this wasn’t your average market day – it was a cocktail of macro relief, AI-fueled euphoria, and a couple of jaw-dropping stock moves that had Reddit and Stocktwits buzzing.

Relief Rally… With a Twist

The big indexes didn’t move much on paper. The Nasdaq climbed another +0.7% – that’s its sixth day in a row of gains – while the S&P 500 barely nudged +0.1%. Meanwhile, the Dow slipped –0.2%. So far, sounds boring, right?

But under the hood, it was anything but.

Investors were feeling a lot better, thanks to two big stories over the weekend:

- A U.S.–China trade truce finally cooled the years-long tariff war. The U.S. slashed its 145% import duties down to 30%, while China dropped its tariffs from 125% to just 10%. That’s a massive reset.

- Inflation cooled off – April’s CPI clocked in at just 2.3% year-over-year. That’s the lowest in four years. Even better? Core inflation came in soft too.

Together, these gave investors exactly what they wanted: global tensions dialing down, and the Fed maybe backing off. Hopes for a rate cut later this year are now officially back on the table.

Big Tech Goes on a Tear

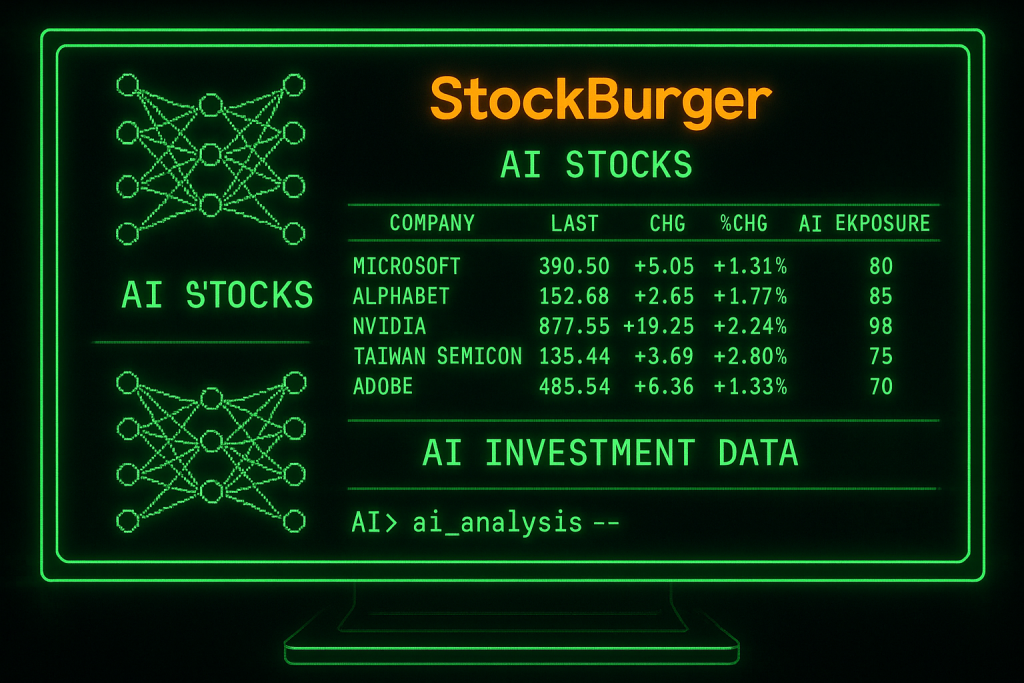

This wasn’t just a general tech bounce – it was a full-on AI-driven rally.

NVIDIA and Tesla led the charge, both up +4% on the day. Nvidia’s push came after news broke that it would ship 18,000 top-tier AI chips to Saudi Arabia. Huge win. Tesla’s rise was more broad-based – just pure momentum, risk-on buying.

Not to be outdone, Alphabet jumped nearly 4%, while Microsoft and Meta also gained. The only big names sitting out? Apple and Amazon – slightly red, likely some profit-taking after their recent strength.

Over in semiconductors, AMD popped +4% after announcing a surprise $6 billion stock buyback. That’s a big flex from management – and investors loved it. Chip stocks broadly rallied on the back of this.

And the biggest gainer in the entire S&P 500? Super Micro Computer , which soared +16%. That’s on top of a monster gain the day before, after inking a $20 billion deal with Saudi data center firm DataVolt. That’s not a typo – $20 billion. For SMCI, that’s a game-changer.

Palantir ? Quietly broke another record high. It’s up over 100% since April. AI is hot, and PLTR is riding the wave.

After the bell, Cisco surprised everyone with a strong earnings beat and upgraded forward guidance. The stock jumped +3–4% after hours, thanks to robust AI-related infrastructure demand. Even the “old” tech names are cashing in now.

But Healthcare Got Hammered

While tech was partying, healthcare was bleeding.

UnitedHealth Group had its worst week in years. After Tuesday’s shocking move – CEO Andrew Witty resigned and the company pulled its full-year guidance – the stock was still reeling. On May 14, UNH managed a weak +0.5% bounce, but it’s still down nearly 38% for the year.

Investors are worried about rising medical costs and what this means for Medicare plans and health insurance margins. The whole sector took a hit.

Then came another gut punch: President Trump signed a surprise executive order to lower U.S. drug prices. That hit Big Pharma like a freight train.

Merck dropped ~4%, and Moderna tanked almost –6%. Ouch. The Healthcare Select Sector ETF (XLV) underperformed hard, as investors rotated out of the space. It was clear: the market was chasing growth, not defense.

Small Caps Go Full Rocket Mode

Two names stole the spotlight, though: KindlyMD and Nuvve .

Let’s start with KDLY. It’s a small healthcare data firm that nobody talked about – until it exploded +600–700% in one day. Why?

It announced a surprise merger with Nakamoto Holdings, backed by crypto investor David Bailey, to become a public Bitcoin treasury. Yep, a healthcare-to-crypto pivot. They’re also raising $710 million to fund it.

Naturally, traders went nuts. KDLY went from a sleepy $3 stock to nearly $31 intraday. It pulled back by the close, but the point was made: nothing moves like a wild headline.

Then there’s NVVE, an electric vehicle charging micro-cap. It jumped over +125% recently, including big moves on May 14. Why? Three reasons:

- Acquisition of Fermata Energy’s V2G assets.

- Announced crypto initiative “Nuvve-DigitalAssets.”

- Brought on James Altucher as a strategic advisor.

That’s a lot of news for a tiny company. Traders saw a growth story – and pounced.

Why It All Matters

So what can we take away from this market cocktail?

- Macro still matters – The trade truce and CPI figures shaped the mood.

- AI is king – From Nvidia to Palantir, money is flowing into anything connected to artificial intelligence.

- Policy risk is real – Healthcare got smacked, fast and hard.

- Earnings drive moves – Cisco, AMD, and others showed how company-level actions still rule the tape.

- Speculation is alive and well – KDLY and NVVE remind us: the market loves a crazy story.

Bottom line? May 14 wasn’t just another Wednesday. It was a real-time case study in how sentiment, policy, tech, and surprise headlines all fight for control over the market’s direction.

And the week’s not over yet.