Mid-cap stocks, often called the “sweet spot” of investing, are gaining strong investor attention in 2025. These companies, typically valued between $2 billion and $10 billion, strike a balance between the explosive growth potential seen in small-cap stocks and the financial stability offered by large-cap giants. For many investors, mid-caps provide a compelling mix of scalability, innovation, and moderate risk — making them a valuable addition to a diversified portfolio.

This article highlights top-performing mid-cap stocks this year, explores key sector trends, and explains why mid-caps have become such an appealing segment for investors seeking both growth and resilience.

Top Mid-Cap Picks for 2025

**Note: This image was generated using AI for illustrative purposes only. It does not depict an actual product, location, event, or individual.

Several standout mid-cap companies are capturing investor attention thanks to strong earnings performance, innovation, and strategic positioning.

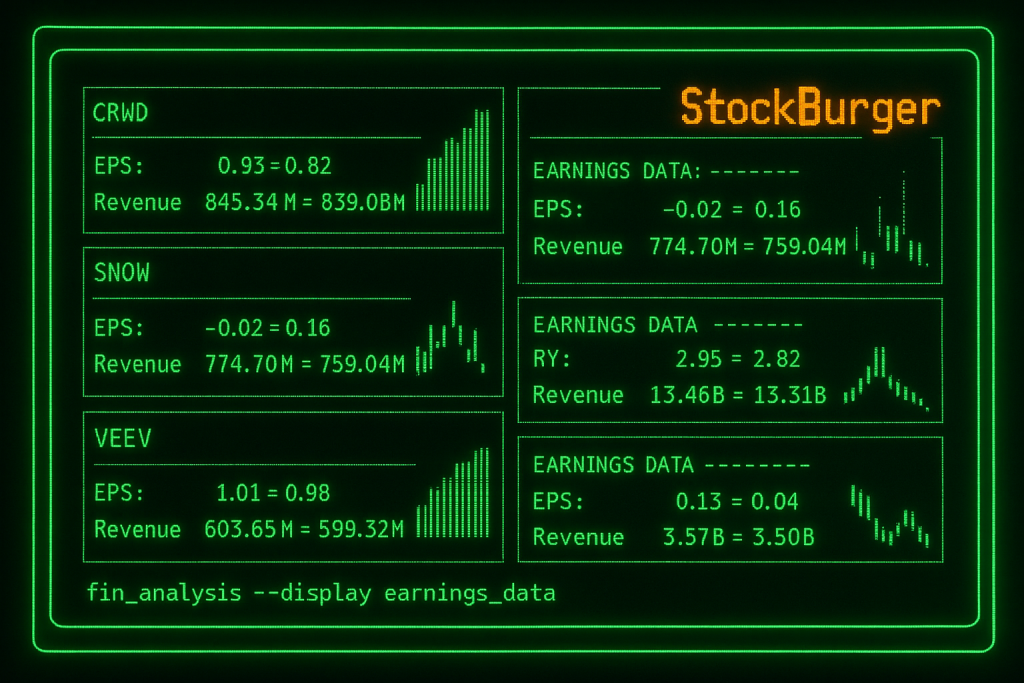

CrowdStrike (NASDAQ: CRWD)

CrowdStrike is a leader in the fast-growing cybersecurity space, offering cloud-native endpoint protection and threat intelligence solutions. With cyber threats on the rise globally, demand for CrowdStrike’s services has surged, driving a 30 percent year-over-year increase in revenue. Shares are up 15 percent in 2025 as the company continues to expand its customer base and leverage its scalable SaaS (Software as a Service) model to fuel growth. Analysts praise CrowdStrike’s recurring revenue streams and robust balance sheet, positioning it as a top mid-cap pick in the tech sector.

Twilio (NYSE: TWLO)

Twilio, a cloud communications platform, enables businesses to embed messaging, voice, and video into applications. As digital engagement remains a key priority across industries, Twilio has seen steady demand for its API-based solutions, lifting its share price by 14 percent this year. Investors are encouraged by Twilio’s deep integration with enterprise clients, its expanding product portfolio, and its ability to capture market share in the evolving communications landscape.

Five Below (NASDAQ: FIVE)

Discount retailer Five Below continues to thrive, capitalizing on consumer demand for affordable, trend-driven merchandise. The company’s aggressive store expansion strategy and focus on experiential in-store shopping have helped drive a 12 percent stock gain in 2025. Analysts note that Five Below’s proven ability to navigate economic shifts and maintain brand loyalty makes it an attractive mid-cap option within the consumer discretionary space.

Etsy (NASDAQ: ETSY)

Etsy, the online marketplace specializing in handmade and vintage goods, is capitalizing on niche e-commerce trends and the rising appetite for personalized, artisanal products. With a strong community of sellers and an engaged customer base, Etsy’s shares have climbed 11 percent this year. Analysts highlight Etsy’s pricing power, efficient marketing strategies, and focus on expanding its international reach as key drivers of continued success.

SolarEdge Technologies (NASDAQ: SEDG)

SolarEdge Technologies, a provider of smart energy solutions, has seen a 16 percent share price increase in 2025, driven by strong demand for solar inverters and energy storage systems. As the global transition toward renewable energy accelerates, SolarEdge’s innovative technology and global footprint position it well to capture market share. Analysts view the company’s robust order book and continued investment in R&D as major strengths supporting long-term growth.

Why Mid-Caps Matter for Investors

According to Jason Reed, mid-cap strategist at GrowthLine, “Mid-caps provide a balance of growth and financial strength, appealing to investors looking for moderate risk.”

Here’s why mid-cap stocks have become a focal point for investors:

- Growth with Maturity: Unlike small-cap startups that are still proving their business models, many mid-cap companies already have established customer bases, tested products, and scalable operations. This makes them better positioned to capitalize on new opportunities while managing risks.

- Attractive Valuations: Compared to large-cap stocks, mid-caps are often less expensive on a relative valuation basis, giving investors the potential to capture growth at a more favorable price point.

- Potential M&A Targets: Larger companies frequently look to mid-caps as attractive acquisition targets, aiming to expand product lines, enter new markets, or acquire innovative technology. This acquisition potential can provide an additional boost to mid-cap stock valuations.

Sector Trends Driving Mid-Cap Performance

Several key industry trends are shaping the outlook for mid-cap stocks:

- Technology: Mid-cap tech firms, particularly in areas like SaaS, cloud communications, and cybersecurity, are thriving as businesses across sectors accelerate their digital transformation efforts. These companies benefit from scalable business models and recurring revenue streams that support long-term growth.

- Consumer Discretionary: Brands like Five Below and Etsy have carved out loyal customer bases by offering differentiated products or value-driven experiences. These companies are successfully leveraging e-commerce platforms, data analytics, and agile supply chains to stay competitive.

- Renewable Energy: As the global push toward sustainability gains momentum, mid-cap companies in the renewable energy sector — including solar, wind, and energy storage firms — are capturing significant market share. With supportive government policies and increasing demand for clean energy solutions, these companies are poised for expansion.

Analyst Insights on Choosing Mid-Caps

While mid-cap stocks offer appealing growth prospects, analysts recommend focusing on a few critical factors when selecting investments.

“Look for mid-caps with strong cash flows, clear growth paths, and experienced management,” advises Sarah Kim, equity strategist at CoreEdge. She emphasizes that earnings quality and balance sheet strength are essential for navigating economic uncertainty and capitalizing on market opportunities.

Kim also notes that not all mid-caps are created equal: “Investors should pay attention to company-specific fundamentals rather than relying solely on sector trends. Look for businesses with differentiated products, strong customer relationships, and a track record of execution.”

**Note: This image was generated using AI for illustrative purposes only. It does not depict an actual product, location, event, or individual.

Conclusion

Mid-cap stocks occupy a unique and valuable position in the investment landscape, offering a blend of growth potential, operational maturity, and moderate risk. In 2025, companies across technology, consumer goods, and renewable energy are demonstrating that mid-caps can deliver both resilience and upside, making them an attractive option for investors seeking to balance ambition with caution.

For investors aiming to diversify their portfolios and capture the next wave of market leaders, mid-cap stocks provide an exciting opportunity — combining the dynamism of emerging companies with the stability and scalability of more established players.