Sigma Lithium Achieves Production Guidance Amid Growing Demand, Lower Costs

Sigma Lithium Corp. SGML, the global lithium producer helping power the next generation of electric vehicles, showcased its operational progress during the third quarter, achieving its lithium production target and maintaining what it says is one of the lowest cash unit operating costs in the industry.

For the third quarter, Sigma reported production of its Quintuple Zero Lithium Concentrate totaled 60,237 tons, up 22% from the second quarter and slightly higher than the 60,000 tons it had forecasted. During the quarter, the miner reports that it set several daily production records and experienced periods of sustained operations above 860 tons per day. For the fourth quarter, Sigma expects production of lithium concentrate to reach at least 60,000 tons.

“This quarter we achieved our production and low industry cost targets, generating robust free cash flow and demonstrating our operational resilience to lithium cycles,” said Sigma Lithium CEO Ana Cabral. “We also benefited from our shifted commercial strategy to navigate industry seasonality, enabling us to secure higher average realized prices compared to benchmarks.”

Shipping Up As Demand Grows

Thanks to improvements in operations Sigma said it was able to further increase its shipping cadence to quasi-monthly volumes sold of 22,000 tons. During the quarter the miner made two full 20,000-ton shipments and was able to supplement that with 13,483 tons sold at the Port customs warehouse. All told, Sigma Lithium sold 57,483 tons of its Quintuple Zero Green lithium, up 9% quarter-over-quarter.

The company reports that it did that while maintaining one of the lowest cash unit operating costs in the industry. The miner’s cost, insurance and freight (CIF) in China averaged $513 per ton, down from $515 per ton in the second quarter.

Sigma Lithium also benefited from a lower export credit risk, increasing the availability and lowering the interest rate of its trade finance lines from nearly 15.5% in 4Q23 to 9.0% in 3Q24. The amount of available export trade lines exceeded $100 million in the year. The better borrowing costs enabled Sigma Lithium to expand geographically to three distributors: Glencore AG (Europe), Mitsubishi Corporation RtM International Pte. Ltd (Japan/ Singapore) and International Resources Holdings (UAE/Abu Dhabi).

The company recently changed its commercial strategy shifting to a distributor model. This enabled Sigma to capitalize on annual restocking trends of chemical refiners, manage weather seasonality more effectively and outperform market price benchmarks, reported Sigma.

Expansion Underway

As for the company’s phase 2 Greentech Plant expansion, Sigma initiated earthworks by completing the clearing of the terrain for arid and semi-arid vegetation suppression for the entire industrial project, including future phase 3 construction of the production plant. Total building and commissioning are expected to occur over a 12-month period, with budgeted capex for phase 2 of $90 million at current exchange rates. Sigma ended the third quarter with $65.6 million in cash and $32 million in cash flow. Cash generation during the quarter enabled it to pay down export credit debt and reduce outstanding trade line balances.

“Over the last year we are proud to have transformed Sigma from an emerging producer into an industry leader, demonstrating the operational and financial resilience of a mature producer, with dependability and consistency,” said Cabral. “We have delivered on all of our climate goals, reaching Net Zero one year in advance of our target and 27 years ahead of the industry, with our Quintuple Zero Green Lithium. We are confident that over the lithium cycles, our capabilities to execute to strategy will deliver long-term value for Sigma and all of its stakeholders.”

From boosting production to meeting demand, Sigma Lithium had a busy third quarter. It accomplished that while keeping costs down. With the company projecting that demand will only continue to grow, Sigma Lithium is one step closer to morphing into the industry leader it aims to become.

Featured photo by MiningWatch Portugal on Unsplash.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PyroGenesis Signs Initial Energy Transition Contract with One of the Largest Multinational Steel Manufacturers

MONTREAL, Nov. 19, 2024 (GLOBE NEWSWIRE) — PyroGenesis Inc. (“PyroGenesis”) (http://pyrogenesis.com) PYR PYRGF 8PY, a high-tech company that designs, develops, manufactures and commercializes advanced plasma processes and sustainable solutions which are geared to reduce greenhouse gases (GHG) and address environmental pollutants, announces that it has signed a contract with one of the three largest steelmakers in the world to assess the applicability of PyroGenesis’ fully electric plasma torches for use in part of the customer’s electric arc furnace (EAF) steelmaking and casting process. The client has previously been referred to as Client C and is one of the world’s largest companies in both steelmaking and iron ore pelletization. The client’s name shall remain anonymous for competitive and confidentiality reasons.

As outlined in its recent third quarter financial results, PyroGenesis has been working with Client C over the past few years on various initiatives related to using plasma in decarbonization. Recently, PyroGenesis was awarded official supplier status to Client C, as part of an impending initiative which is announced today.

The project agreement outlines the steps for analyzing plasma torches in support of the client’s energy-transition goals, with a duration of approximately 60-90 days, commencing in Q4 2024.

“Client C has taken a methodical approach to its decarbonization initiatives, and we are very pleased our work with them over the past few years has led to official supplier status for PyroGenesis, and resulted in this initial engagement,” said P. Peter Pascali, President and CEO of PyroGenesis. “Steelmaking is an industry where we continue to make inroads and which we believe offers enormous global potential for plasma use.”

The client’s goal is to determine how plasma can be used following the EAF process which turns scrap metal, and direct reduced iron (DRI), into molten steel. By using electricity in EAFs, the process offers the steelmaking industry a significantly lower carbon footprint with at least 75% less CO2 emissions vs the traditional blast furnace method that burns coking coal or “coke”. i Direct emissions from EAF are negligible, particularly if the electricity is sourced from renewable energy. As of 2021, steelmaking using EAF accounted for 30% of global steel production. ii Planned steelmaking capacity based on EAF is now 43%. iii

PyroGenesis’ development of plasma torches for use in high temperature applications are part of its three-tiered solution ecosystem that aligns with economic drivers that are key to global heavy industry. Plasma torches for furnace burners are part of its Energy Transition & Emissions Reduction vertical, where fuel switching to its electric-powered plasma torches helps heavy industry reduce fossil fuel use and greenhouse gas emissions.

About PyroGenesis

PyroGenesis, a high-tech company, is a proud leader in the design, development, manufacture and commercialization of advanced plasma processes and sustainable solutions which reduce greenhouse gases (GHG) and are economically attractive alternatives to conventional “dirty” processes. PyroGenesis has created proprietary, patented and advanced plasma technologies that are being vetted and adopted by multiple multibillion dollar industry leaders in four massive markets: iron ore pelletization, aluminum, waste management, and additive manufacturing. With a team of experienced engineers, scientists and technicians working out of its Montreal office, and its 3,800 m2 and 2,940 m2 manufacturing facilities, PyroGenesis maintains its competitive advantage by remaining at the forefront of technology development and commercialization. The operations are ISO 9001:2015 and AS9100D certified, having been ISO certified since 1997. PyroGenesis’ shares are publicly traded on the TSX in Canada PYR, the OTCQX in the US PYRGF, and the Frankfurt Stock Exchange in Germany 8PY. For more information, please visit: www.pyrogenesis.com.

Cautionary and Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management’s current beliefs, expectations, estimates and projections regarding future events and operating performance.

Forward-looking statements are necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by PyroGenesis as of the date of this release, are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, but are not limited to, the risk factors identified under “Risk Factors” in PyroGenesis’ latest annual information form, and in other periodic filings that it has made and may make in the future with the securities commissions or similar regulatory authorities, all of which are available under PyroGenesis’ profile on SEDAR+ at www.sedarplus.ca. These factors are not intended to represent a complete list of the factors that could affect PyroGenesis. However, such risk factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. PyroGenesis undertakes no obligation to publicly update or revise any forward-looking statement, except as required by applicable securities laws.

Neither the Toronto Stock Exchange, its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) nor the OTCQX Best Market accepts responsibility for the adequacy or accuracy of this press release.

For further information please contact:

Rodayna Kafal, Vice President, IR/Comms. and Strategic BD

E-mail: ir@pyrogenesis.com

RELATED LINK: http://www.pyrogenesis.com

ii https://worldsteel.org/wp-content/uploads/Fact-sheet-raw-materials-2023.pdf

iii https://globalenergymonitor.org/wp-content/uploads/2023/07/GEM_SteelPlants2023.pdf

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JLL Income Property Trust Fully Subscribes $100 Million Diversified DST

CHICAGO, Nov. 18, 2024 /PRNewswire/ — JLL Income Property Trust, an institutionally-managed daily NAV REIT (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX) with approximately $6.6 billion in portfolio equity and debt investments, announced today that it has fully subscribed JLLX Diversified V, DST. The $100 million program was structured as a Delaware Statutory Trust designed to provide 1031 exchange investors the opportunity to reinvest proceeds from the sale of appreciated real estate while also deferring taxes.

JLLX Diversified V, DST consisted of a 192 unit institutional-quality apartment community in North Andover, MA, and two Class A industrial distribution facilities totaling 400,000 square feet located in Elgin, IL.

“We are pleased to have fully subscribed JLLX Diversified V, DST,” said Drew Dornbusch, Head of JLL Exchange. “This is a testament to the strong demand we continue to see from 1031 exchange investors and their advisors who are seeking estate planning solutions which can facilitate the transfer of generational wealth, while mitigating the significant tax consequences associated with the sale of appreciated investment real estate.”

“The residential and industrial sectors continue to show strong fundamentals, as rental growth trends remain resilient,” said Allan Swaringen, President and CEO of JLL Income Property Trust. “JLLX Diversified V, DST provided investors access to these high-conviction property sectors in an investment solution designed to allow investors to maintain their real estate exposure while enjoying a range of tax and estate planning benefits.”

Since its inception in 2019, JLLX has attracted more than $1.5 billion across 24 DST offerings from property owners seeking to maintain a meaningful allocation to real estate in a tax efficient manner. JLL Income Property Trust has completed 14 full cycle UPREIT transactions totaling $960 million to date.

For more information on JLL Income Property Trust, please visit our website at www.jllipt.com.

About JLL Exchange

The JLL Exchange program offers private placements through the sale of interests in Delaware Statutory Trusts (DSTs) holding core real estate investment properties. For more information, visit www.jllexchange.com.

About JLL Income Property Trust, Inc. (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX)

JLL Income Property Trust, Inc. is a daily NAV REIT that owns and manages a diversified portfolio of high quality, income-producing residential, industrial, grocery-anchored retail, healthcare and office properties located in the United States. JLL Income Property Trust expects to further diversify its real estate portfolio over time, including on a global basis. For more information, visit www.jllipt.com.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

Valuations, Forward Looking Statements and Future Results

This press release may contain forward-looking statements with respect to JLL Income Property Trust. Forward-looking statements are statements that are not descriptions of historical facts and include statements regarding management’s intentions, beliefs, expectations, research, market analysis, plans or predictions of the future. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. Past performance is not indicative of future results and there can be no assurance that future dividends will be paid.

Contacts:

Alissa Schachter

LaSalle Investment Management

Telephone: +1 (312) 228-2048

Email: alissa.schachter@lasalle.com

Doug Allen

Dukas Linden Public Relations

Telephone: +1 646 722 6530

Email: JLLIPT@DLPR.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-fully-subscribes-100-million-diversified-dst-302306347.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-fully-subscribes-100-million-diversified-dst-302306347.html

SOURCE JLL Income Property Trust

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro stock surges after company files plan to avoid Nasdaq delisting

Super Micro Computer (SMCI) stock rose as much as 29% in premarket trade on Tuesday after the AI server maker late Monday submitted a compliance plan with the SEC to avoid delisting from the Nasdaq.

The company said its compliance plan shows it is on track to submit delayed filings to the SEC “and become current with its periodic reports within the discretionary period available to the Nasdaq staff to grant.”

Investors had eagerly awaited the filing following a Barron’s report on Friday after the bell, which stated that Super Micro would submit its plan to prevent delisting by the deadline on Monday per Nasdaq rules, citing people familiar with the matter. The stock surged roughly 16% during regular trading Monday.

The AI server maker and Nvidia (NVDA) customer also said Monday that the company has hired a new auditor, BDO, after its prior accountant, EY, resigned in late October.

Even with this week’s surge, shares have tumbled roughly 56% over the past three months. After gaining as much as 300% earlier this year, SMCI stock is now down over 20% in 2024.

Super Micro has been grappling with the fallout from an August report by short seller firm Hindenburg Research, which shed light on potential accounting malpractices, violations of export controls, and shady relationships between top executives and Super Micro partners.

Following the Hindenburg report, the company delayed its annual 10-K filing to the Securities and Exchange Commission. And last week, Super Micro also delayed filing its most recent quarterly 10-Q report to the SEC. Adding to its woes, the company is reportedly being investigated by the Department of Justice. The barrage of bad news has sent shares tumbling — EY’s resignation, in particular, pushed Super Micro stock down more than 30% in a single day in late October.

Shares of the company also fell sharply following Super Micro’s fiscal first quarter earnings report Nov. 5, which missed Wall Street’s expectations, sending shares down 18% in the day following the results.

Elsewhere on Monday, the company announced product updates during the Supercomputing Conference in Atlanta, including its next-generation AI servers using Nvidia Blackwell chips.

“Supermicro has the expertise, delivery speed, and capacity to deploy the largest liquid-cooled AI data center projects in the world, containing 100,000 GPUs, which Supermicro and NVIDIA contributed to and recently deployed,” said CEO Charles Liang in a statement Monday.

“We now have solutions that use the NVIDIA Blackwell platform.”

Walmart Q3 Earnings: Revenue Beat, eCommerce Growth Shines, Issues Bullish Outlook For FY25

Walmart Inc WMT shares are trading higher on Tuesday after the company announced third-quarter results and raised its fiscal-2025 guidance.

The retailer reported adjusted EPS of 58 cents, beating the consensus of 53 cents.

Sales were $169.59 billion, up 5.5% year over year or 6.2% (at constant currency), beating the consensus of $167.72 billion.

The gross margin rate was up 21 bps, aided by improvement in the Walmart U.S.

Operating income was up $0.5 billion, or 8.2%, and up 9.8% year over year (at constant currency) on higher gross margins, growth in membership income, and reduced eCommerce losses.

Global eCommerce sales rose 27%, driven by store-fulfilled pickup and delivery as well as marketplace growth. Global advertising business grew 28%, including 26% for Walmart Connect in the U.S.

Walmart U.S same-store sales climbed by 5.3% year over year, excluding fuel, aided by strong broad-based growth in merchandise categories and physical and digital channels.

Read: Will Walmart’s Streak Of Earnings Beats Continue Tuesday? Analysts Say Retailer A ‘Core Holding’

At Sam’s Club, same-store sales rose 7.0% year over year, excluding fuel, led by food and health and wellness categories, along with increased transactions and unit volumes.

Doug McMillon, President and CEO, said, “In the U.S., in-store volumes grew, pickup from store grew faster, and delivery from store grew even faster than that. Our teams are executing and delighting our customers and members with the value and convenience they expect from Walmart.”

Walmart generated an operating cash flow of $22.9 billion and free cash flow of $6.2 billion in nine months ended October 31, 2024. It ended the quarter with cash and equivalents of $10.0 billion.

Guidance: For FY25, the big box retailer raised its adjusted EPS outlook to $2.42 – $2.47 (from $2.35 – $2.43), vs. the consensus of $2.45.

Walmart boosted FY25 net sales (at constant currency) growth guidance to 4.8% – 5.1% from 3.75% – 4.75% earlier.

Investors can gain exposure to the stock via Vanguard Consumer Staples ETF VDC and Fidelity MSCI COnsumer Staples Index ETF FSTA.

Price Action: WMT shares are up 3.59% at $87.10 premarket at the last check Tuesday.

Image by Sundry Photography on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street's Most Accurate Analysts Give Their Take On 3 Energy Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

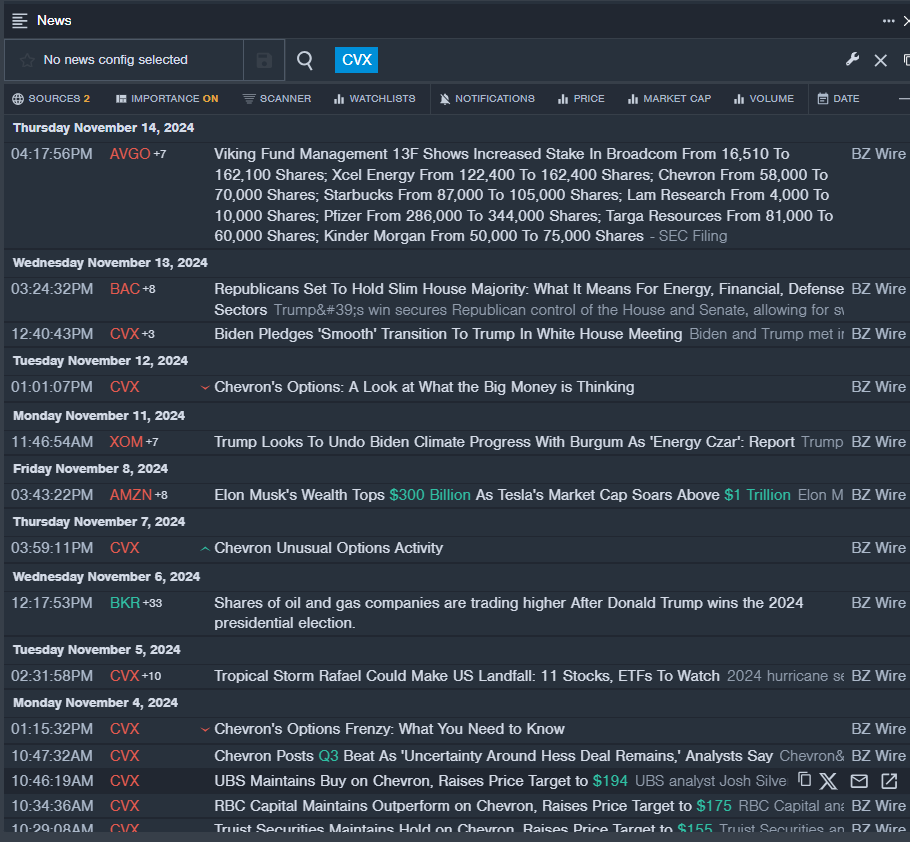

Chevron Corporation CVX

- Dividend Yield: 4.04%

- UBS analyst Josh Silverstein maintained a Buy rating and raised the price target from $192 to $194 on Nov. 4. This analyst has an accuracy rate of 63%.

- Truist Securities analyst Neal Dingmann maintained a Hold rating and boosted the price target from $150 to $155 on Nov. 4. This analyst has an accuracy rate of 72%.

- Recent News: On Nov. 1, the company posted upbeat quarterly earnings.

- Benzinga Pro’s real-time newsfeed alerted to latest CVX news

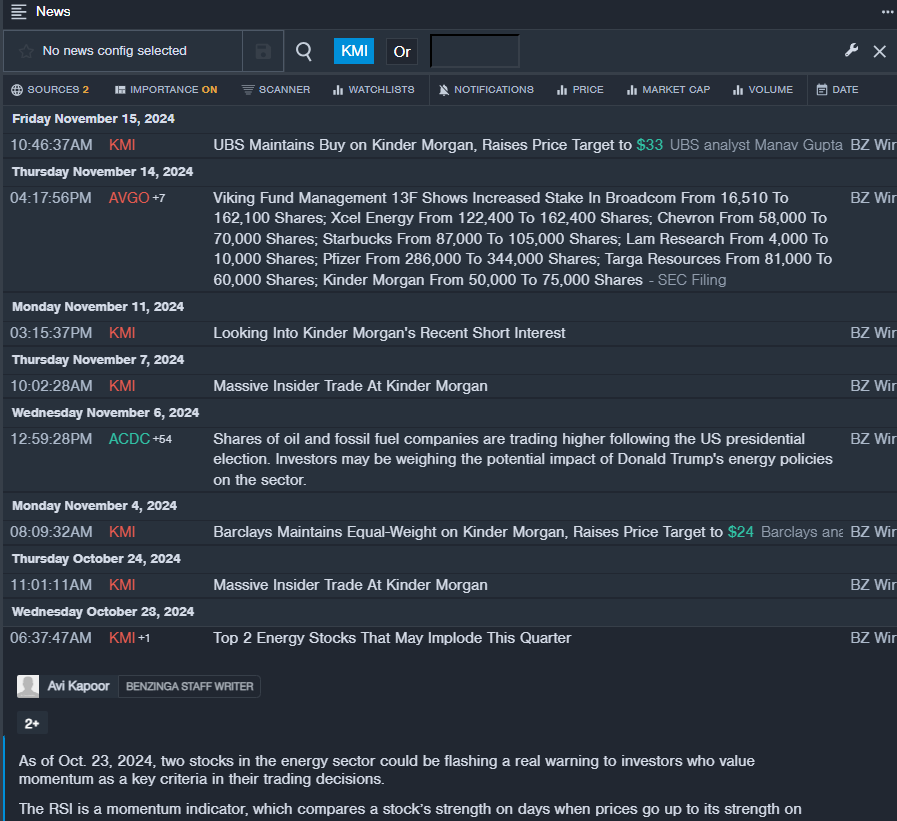

Kinder Morgan, Inc. KMI

- Dividend Yield: 4.14%

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and raised the price target from $22 to $24 on Nov. 4. This analyst has an accuracy rate of 81%.

- Wells Fargo analyst Michael Blum maintained an Overweight rating and increased the price target from $22 to $27 on Oct. 17. This analyst has an accuracy rate of 67%.

- Recent News: On Oct. 16, Kinder Morgan reported third-quarter revenue of $3.699 billion, missing the consensus estimate of $3.975 billion, according to Benzinga Pro.

- Benzinga Pro’s real-time newsfeed alerted to latest KMI news

Northern Oil and Gas, Inc. NOG

Dividend Yield: 4.07%

- Piper Sandler analyst Mark Lear maintained a Neutral rating and raised the price target from $40 to $41 on Nov. 18. This analyst has an accuracy rate of 66%.

- Truist Securities analyst Neal Dingmann maintained a Buy rating and boosted the price target from $44 to $51 on Nov. 7. This analyst has an accuracy rate of 72%.

- Recent News: On Nov. 5, Northern Oil & Gas posted better-than-expected quarterly earnings.

- Benzinga Pro’s charting tool helped identify the trend in NOG stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: Nvidia Will Be the World's First $4 Trillion Company

As measured by market capitalization, there has never been a company worth $4 trillion, but Nvidia (NASDAQ: NVDA) is starting to close in. At the time of this writing, Nvidia was worth around $3.6 trillion. At that size, it only has to rise in value another 11% before it crosses this threshold. This is significant because second-place Apple (NASDAQ: AAPL), which needs to rise 16% in value to beat Nvidia to the mark, was the first company to cross the $1 trillion, $2 trillion, and $3 trillion market cap thresholds.

For those who care about such financial measurements, the central question is: Can Nvidia hit the next valuation milestone before Apple does?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia and Apple took two different paths to get to this point. Apple has steadily grown its revenue and earnings through its various consumer products (most notably the iPhone), although that growth has significantly slowed in recent years.

Nvidia’s primary product is the graphics processing unit (GPU), originally developed to process gaming graphics quickly. The GPU’s unique ability to process multiple calculations in parallel makes it a top pick for anything that requires intense calculations. This makes GPUs strong choices for other difficult tasks, like drug research and engineering simulations.

However, the largest use for Nvidia GPUs has arrived recently: artificial intelligence (AI) model training. Creating a powerful AI model requires a ton of computing resources, and the AI hyperscalers are all buying Nvidia GPUs by the truckload to build out the capacity they need.

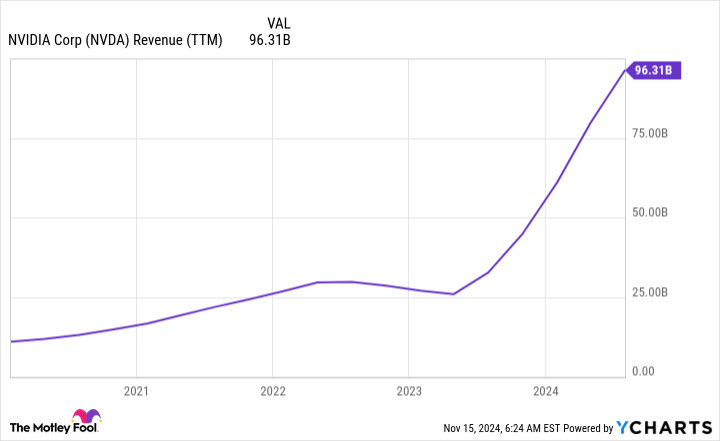

This demand has caused Nvidia’s revenue to surge, sometimes tripling year over year over the past few quarters.

Alongside its revenue surge, Nvidia’s profit margins have skyrocketed because it didn’t need to hire many more people or build out a lot of production to handle the surging demand. The combined effect of rising revenue and increasing profit margins caused Nvidia’s profits to grow faster than revenue.

The chart above may look unimpressive until you look at the scale and see that Nvidia’s profits were rising more than 10x year over year during 2023.

Nvidia’s growth is starting to slow, but it’s still impressive.

In the third quarter of fiscal year 2025 (ending in October), Nvidia expects its revenue to come in around $32.5 billion, indicating 80% revenue growth. That’s still really fast, but it is starting to come down a fair amount from previous levels. That’s because Nvidia is starting to face more difficult year-over-year comparisons as it laps another period of strong growth from a year ago.

Asia Up, Europe Markets Slip; Oil Prices Pressured While Gold Strengthens – Global Markets Today While US Slept

On Monday, November 18, U.S. markets ended mixed, partially recovering losses as investors awaited Nvidia’s highly anticipated Q3 earnings, seen as a key gauge of AI-driven market momentum.

Tesla shares climbed on optimism over potential policy shifts under the incoming Trump administration. While analysts note a widening focus beyond Nvidia, its influence on market sentiment remains significant.

In economic data, the NAHB/Wells Fargo Housing Market Index rose to 46 in November, marking its highest level in seven months, up from 43 in October.

S&P 500 sectors rose Monday, led by energy, communication services, and consumer discretionary stocks, while industrials declined.

The Dow Jones Industrial Average was down 0.13% and closed at 43,389.60, the S&P 500 gained 0.39% to 5,893.62, and the Nasdaq Composite rose 0.60% to finish at 18,791.81.

Asia Markets Today

- On Tuesday, Japan’s Nikkei 225 gained 0.45% and ended the session at 38,405.00, led by gains in the Paper & Pulp, Steel, and Warehousing sectors.

- Australia’s S&P/ASX 200 rose 0.89% and ended the day at 8,374.00, led by gains in the Gold, IT, and Telecoms Services sectors.

- India’s Nifty 50 closed 0.07% higher at 23,470.45, and Nifty 500 up 0.23% at 21,950.85, led by gains in the Auto, Real Estate and Consumer Durables sectors.

- China’s Shanghai Composite gained 0.67% to close at 3,346.01, and the Shenzhen CSI 300 rose 0.67%, finishing the day at 3,976.89.

- Hong Kong’s Hang Seng gained 0.44% and closed the session at 19,663.67.

Eurozone at 05:30 AM ET

- The European STOXX 50 index was down 1.47%.

- Germany’s DAX slid 1.07%.

- France’s CAC fell 1.32.

- FTSE 100 index traded lower by 0.50%

Commodities at 05:30 AM ET

- Crude Oil WTI was trading lower by 0.88% at $68.56/bbl, and Brent was down 0.75% at $72.75/bbl.

- Oil prices dipped as Norway’s Johan Sverdrup oilfield resumed production, offsetting geopolitical tensions and Kazakhstan’s output cut. A stronger U.S. dollar also pressured prices while investors monitored escalating Russia-Ukraine tensions and weakening market structure signals.

- Natural Gas rose 0.30% to $2.982.

- Gold was trading higher by 0.94% at $2,639.20, Silver gained 0.92% to $31.508, and Copper fell 0.45% to $4.1015.

U.S. Futures at 05:30 AM ET

Dow futures declined 0.53%, S&P 500 futures were down 0.38% and Nasdaq 100 futures fell 0.27%.

Forex at 05:30 AM ET

The U.S. dollar index gained 0.14% to 106.42, the USD/JPY was down 0.66% to 153.63, and the USD/AUD rose 0.17% to 1.5391.

Photo by Pavel Bobrovskiy via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.