Stock market today: Dow, S&P 500, Nasdaq sink as Russia-Ukraine tensions spur rush to havens

US stock futures fell on Tuesday as worries about a nuclear escalation to the Russia-Ukraine war rattled markets, stealing focus from Nvidia (NVDA) earnings and other corporate results.

Dow Jones Industrial Average futures (YM=F) led declines, down 0.6%, while S&P 500 futures (ES=F) slid roughly 0.4%. Contracts on the tech-heavy Nasdaq 100 (NQ=F) dropped 0.3%, on the heels of a mixed day for the major gauges.

Stocks are retreating as investors assess news that President Vladimir Putin has signed a revised nuclear doctrine that allows Russia to expand its use of atomic weapons. The changes mean any large-scale aerial attack could prompt a nuclear response, and come just days after President Biden gave Ukraine the go-ahead to use US long-range missiles to strike inside Russia.

US bond prices climbed alongside gains for the yen (JPY=X), gold (GC=F), and other safe-haven assets as the risk-off trade kicked in. Treasury yields — which move inversely to bond prices — fell, with the 10-year benchmark yield (^TNX) down 5 basis points to around 4.37%. Gold jumped almost 1% to trade at around $2,639 an ounce.

The geopolitical situation blotted out themes such as corporate earnings, President-elect Trump’s cabinet picks, the path of interest rates, and Wall Street’s view of where stocks are headed.

Walmart (WMT) and Lowe’s (LOW) are lined up to post quarterly reports before the bell. Investors will watch the major retailers’ results for hints of consumers under pressure that could reflect stress in the economy.

Meanwhile, the countdown is on to Nvidia earnings on Wednesday, seen as a test of the AI trade that has powered gains on Wall Street. The chipmaker’s stock edged higher in premarket trading after getting bruised by a report of overheating issues with its flagship new AI product.

Goldman Sachs strategists said they expect outperformance by Nvidia and its “Magnificent Seven” tech megacap peers to narrow next year, in an S&P 500 (^GSPC) forecast setting a 6,500 target by the end of next year.

LIVE 3 updatesGDS Holdings Limited Reports Third Quarter 2024 Results

SHANGHAI, China, Nov. 19, 2024 (GLOBE NEWSWIRE) — GDS Holdings Limited (“GDS Holdings”, “GDS” or the “Company”) GDS HKEX: 9698)), a leading developer and operator of high-performance data centers in China and South East Asia, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Highlights

- Net revenue increased by 17.7% year-over-year (“Y-o-Y”) to RMB2,965.7 million (US$422.6 million) in the third quarter of 2024 (3Q2023: RMB2,519.0 million).

- Net loss was RMB231.1 million (US$32.9 million) in the third quarter of 2024 (3Q2023: net loss of RMB420.8 million).

- Adjusted EBITDA (non-GAAP) increased by 15.0% Y-o-Y to RMB1,295.7 million (US$184.6 million) in the third quarter of 2024 (3Q2023: RMB1,126.3 million). See “Non-GAAP Disclosure” and “Reconciliations of GAAP and non-GAAP results” elsewhere in this earnings release.

- Adjusted EBITDA margin (non-GAAP) was 43.7% in the third quarter of 2024 (3Q2023: 44.7%).

Third Quarter 2024 Operating Highlights

- Total area committed and pre-committed increased by 20.2% Y-o-Y to 785,692 sqm as of September 30, 2024 (September 30, 2023: 653,732 sqm).

- Area in service increased by 16.8% Y-o-Y to 647,468 sqm as of September 30, 2024 (September 30, 2023: 554,210 sqm).

- Commitment rate for area in service was 92.7% as of September 30, 2024 (September 30, 2023: 91.9%).

- Area under construction was 234,741 sqm as of September 30, 2024 (September 30, 2023: 189,585 sqm).

- Pre-commitment rate for area under construction was 79.2% as of September 30, 2024 (September 30, 2023: 76.1%).

- Area utilized increased by 20.9% Y-o-Y to 481,819 sqm as of September 30, 2024 (September 30, 2023: 398,674 sqm).

- Utilization rate for area in service was 74.4% as of September 30, 2024 (September 30, 2023: 71.9%).

“In the third quarter of 2024, we delivered solid performance across key strategic fronts,” said Mr. William Huang, Chairman and CEO of GDS. “In China, the accelerated move-in trend continued, as we executed our strategy of delivering the backlog while being selective on new orders. Internationally, our recent equity raise is a major step forward, and positions us well to capture the tremendous opportunities for growth in the international markets.”

“In the third quarter of 2024, we grew revenue by 18% and adjusted EBITDA by 15% year-over-year,” said Mr. Dan Newman, Chief Financial Officer. “The US$1 billion equity raise for GDSI will support our ambitious international expansion plans, further affirming the underlying value GDSI brings to our shareholders.”

Third Quarter 2024 Financial Results

Net revenue in the third quarter of 2024 was RMB2,965.7 million (US$422.6 million), a 17.7% increase over the same period last year of RMB2,519.0 million. The Y-o-Y increase was mainly due to continued ramp-up of our data centers and business growth.

- Net revenue for China1 was RMB2,619.6 million (US$373.3 million), a 6.1% increase over the same period last year of RMB2,470.1 million.

- Net revenue for International2 was RMB363.2 million (US$51.8 million), a 636.3% increase over the same period last year of RMB49.3 million.

Cost of revenue in the third quarter of 2024 was RMB2,308.8 million (US$329.0 million), a 11.5% increase over the same period last year of RMB2,071.6 million. The Y-o-Y increase was in line with the continued growth of our business.

Gross profit was RMB656.9 million (US$93.6 million) in the third quarter of 2024, a 46.8% increase over the same period last year of RMB447.4 million.

Gross profit margin was 22.2% in the third quarter of 2024, compared with 17.8% in the same period last year. The Y-o-Y increase was mainly due to the ramp-up of our international business.

Adjusted Gross Profit (“Adjusted GP”) (non-GAAP) is defined as gross profit excluding depreciation and amortization, operating lease cost relating to prepaid land use rights, accretion expenses for asset retirement costs and share-based compensation expenses allocated to cost of revenue. Adjusted GP was RMB1,502.3 million (US$214.1 million) in the third quarter of 2024, a 20.4% increase over the same period last year of RMB1,247.3 million. See “Non-GAAP Disclosure” and “Reconciliations of GAAP and non-GAAP results” elsewhere in this earnings release.

Adjusted GP margin (non-GAAP) was 50.7% in the third quarter of 2024, compared with 49.5% in the same period last year. The Y-o-Y increase was mainly due to the ramp-up of our international business.

Selling and marketing expenses, excluding share-based compensation expenses of RMB7.3 million (US$1.0 million), were RMB27.7 million (US$3.9 million) in the third quarter of 2024, a 5.4% increase over the same period last year of RMB26.3 million (excluding share-based compensation of RMB12.6 million). The Y-o-Y increase was mainly due to fast expansion of our international business.

General and administrative expenses, excluding share-based compensation expenses of RMB31.0 million (US$4.4 million), depreciation and amortization expenses of RMB98.6 million (US$14.0 million) and operating lease cost relating to prepaid land use rights of RMB16.1 million (US$2.3 million), were RMB147.4 million (US$21.0 million) in the third quarter of 2024, a 32.4% increase over the same period last year of RMB111.3 million (excluding share-based compensation expenses of RMB53.3 million, depreciation and amortization expenses of RMB135.9 million and operating lease cost relating to prepaid land use rights of RMB16.8 million). The Y-o-Y increase was mainly due to fast expansion of our international business.

Research and development costs were RMB8.6 million (US$1.2 million) in the third quarter of 2024, compared with RMB10.5 million in the same period last year.

Net interest expenses for the third quarter of 2024 were RMB535.0 million (US$76.2 million), a 6.3% increase over the same period last year of RMB503.2 million. The Y-o-Y increase was mainly due to a higher level of total borrowings.

Foreign currency exchange loss for the third quarter of 2024 was RMB32.5 million (US$4.6 million), compared with a gain of RMB0.9 million in the same period last year.

Others, net for the third quarter of 2024 was RMB6.1 million (US$0.9 million), compared with RMB21.7 million in the same period last year.

Income tax benefits for the third quarter of 2024 were RMB10.0 million (US$1.4 million), compared with income tax expenses of RMB20.9 million in the same period last year.

Net loss in the third quarter of 2024 was RMB231.1 million (US$32.9 million), compared with a net loss of RMB420.8 million in the same period last year.

Adjusted EBITDA (non-GAAP) is defined as net loss excluding net interest expenses, income tax expenses (benefits), depreciation and amortization, operating lease cost relating to prepaid land use rights, accretion expenses for asset retirement costs, share-based compensation expenses, gain from purchase price adjustment and impairment losses of long-lived assets. Adjusted EBITDA was RMB1,295.7 million (US$184.6 million) in the third quarter of 2024, a 15.0% increase over the same period last year of RMB1,126.3 million.

- Adjusted EBITDA for China was RMB1,204.9 million (US$171.7 million), a 3.6% increase over the same period last year of RMB1,163.1 million.

- Adjusted EBITDA for International was RMB97.0 million (US$13.8 million), compared with negative RMB36.5 million in the same period last year.

Adjusted EBITDA margin (non-GAAP) was 43.7% in the third quarter of 2024, compared with 44.7% in the same period last year. The Y-o-Y decrease was mainly due to higher level of corporate expenses for International business.

Basic and diluted loss per ordinary share in the third quarter of 2024 was RMB0.14 (US$0.02), compared with RMB0.30 in the same period last year.

Basic and diluted loss per American Depositary Share (“ADS”) in the third quarter of 2024 was RMB1.12 (US$0.16), compared with RMB2.37 in the same period last year.

Liquidity:

As of September 30, 2024, cash was RMB9,408.5 million (US$1,340.7 million).

- Cash for GDSH was RMB7,757.9 million (US$1,105.5 million).

- Cash for GDSI was RMB1,650.6 million (US$235.2 million).

Total short-term debt was RMB6,638.0 million (US$945.9 million), comprised of short-term borrowings and the current portion of long-term borrowings of RMB6,034.3 million (US$859.9 million), the current portion of convertible bonds payable of RMB561 thousand (US$80 thousand) and the current portion of finance lease and other financing obligations of RMB603.1 million (US$85.9 million). Total long-term debt was RMB42,648.0 million (US$6,077.3 million), comprised of long-term borrowings (excluding current portion) of RMB26,573.3 million (US$3,786.7 million), the non-current portion of convertible bonds payable of RMB8,356.5 million (US$1,190.8 million) and the non-current portion of finance lease and other financing obligations of RMB7,718.2 million (US$1,099.8 million).

- Total gross debt for GDSH, comprised of short-term and long-term borrowings, convertible bonds payable and finance lease and other financing obligations, was RMB43,361.6 million (US$6,179.0 million).

- Total gross debt for GDSI, comprised of short-term and long-term borrowings, was RMB5,924.4 million (US$844.2 million).

During the third quarter of 2024, the Company obtained new debt financing and refinancing facilities of RMB380.0 million (US$54.2 million), all for GDSH.

Third Quarter 2024 Operating Results

China

Sales

Total area committed and pre-committed at the end of the third quarter of 2024 was 626,783 sqm, compared with 609,140 sqm at the end of the third quarter of 2023 and 614,094 sqm at the end of the second quarter of 2024, an increase of 2.9% Y-o-Y and 2.1% quarter-over-quarter (“Q-o-Q”), respectively. In the third quarter of 2024, gross additional total area committed was 20,913 sqm, mainly contributed by data centers in Beijing and Langfang. Net additional total area committed was 12,689 sqm.

Data Center Resources

Area in service at the end of the third quarter of 2024 was 595,606 sqm, compared with 540,606 sqm at the end of the third quarter of 2023 and 580,165 sqm at the end of the second quarter of 2024, an increase of 10.2% Y-o-Y and 2.7% Q-o-Q. In the third quarter of 2024, net additional area in service for China was 15,441 sqm, mainly from data centers in Shanghai and Langfang.

Area under construction at the end of the third quarter of 2024 was 120,422 sqm, compared with 150,116 sqm at the end of the third quarter of 2023 and 117,861 sqm at the end of the second quarter of 2024, a decrease of 19.8% Y-o-Y and an increase of 2.2% Q-o-Q, respectively. During the third quarter of 2024, we initiated the construction of additional phases in existing data centers in Langfang, namely LF14 Phase 2, LF16 Phase 4 and LF18 Phase 2 & 3, with a total net floor area of 17,436 sqm and a pre-commitment rate of 85.1% across these new phases.

Commitment rate for area in service was 92.1% at the end of the third quarter of 2024, compared with 91.7% at the end of the third quarter of 2023 and 92.3% at the end of the second quarter of 2024. Pre-commitment rate for area under construction was 65.1% at the end of the third quarter of 2024, compared with 75.4% at the end of the third quarter of 2023 and 66.9% at the end of the second quarter of 2024.

Move-In

Area utilized at the end of the third quarter of 2024 was 438,654 sqm, compared with 393,225 sqm at the end of the third quarter of 2023 and 419,976 sqm at the end of the second quarter of 2024, an increase of 11.6% Y-o-Y and 4.4% Q-o-Q. In the third quarter of 2024, gross additional area utilized was 25,942 sqm, mainly contributed by data centers in Shanghai, Changshu, and Langfang. Net additional area utilized was 18,678 sqm.

Utilization rate for area in service was 73.6% at the end of the third quarter of 2024, compared with 72.7% at the end of the third quarter of 2023 and 72.4% at the end of the second quarter of 2024.

International

Sales

Total area committed and pre-committed at the end of the third quarter of 2024 was 158,910 sqm, compared with 44,593 sqm at the end of the third quarter of 2023 and 142,898 sqm at the end of the second quarter of 2024, an increase of 256.4% Y-o-Y and 11.2% Q-o-Q. In the third quarter of 2024, net additional total area committed was 16,011 sqm, mainly contributed from our NTP site in Johor, Malaysia, and NDP site in Batam, Indonesia.

Data Center Resources

Area in service at the end of the third quarter of 2024 was 51,862 sqm, compared with 13,605 sqm at the end of the third quarter of 2023 and 50,798 sqm at the end of the second quarter of 2024, an increase of 281.2% Y-o-Y and 2.1% Q-o-Q. In the third quarter of 2024, net additional area in service was 1,064 sqm, mainly from HK1 Phase 1 data center.

Area under construction at the end of the third quarter of 2024 was 114,319 sqm, compared with 39,469 sqm at the end of the third quarter of 2023 and 108,411 sqm at the end of the second quarter of 2024, an increase of 189.6% Y-o-Y and 5.4% Q-o-Q. During the third quarter of 2024, we initiated the construction of two new data centers on our NDP site in Batam, Indonesia, namely NDP2 and NDP3, with a total net floor area of 7,417 sqm, and both are 100% pre-committed.

Commitment rate for area in service was 99.3% at the end of the third quarter of 2024, compared with 100% at the end of the third quarter of 2023 and 95.2% at the end of the second quarter of 2024. Pre-commitment rate for area under construction was 93.9% at the end of the third quarter of 2024, compared with 78.5% at the end of the third quarter of 2023 and 87.2% at the end of the second quarter of 2024.

Move-In

Area utilized at the end of the third quarter of 2024 was 43,165 sqm, compared with 5,449 sqm at the end of the third quarter of 2023 and 42,698 sqm at the end of the second quarter of 2024, an increase of 692.1% Y-o-Y and 1.1% Q-o-Q. In the third quarter of 2024, net additional area utilized was 467 sqm, mainly contributed by NTP5 and HK1 data centers.

Utilization rate for area in service was 83.2% at the end of the third quarter of 2024, compared with 40.1% at the end of the third quarter of 2023 and 84.1% at the end of the second quarter of 2024.

Recent Development

On Oct. 29, 2024, the Company announced that its international affiliate, DigitalLand Holdings Limited (“GDS International” or “GDSI”), which acts as the holding company for GDSH’s data center assets and operations outside of mainland China, has entered into definitive agreements for certain institutional private equity investors to subscribe for US$1.0 billion of Series B convertible preferred shares (the “Series B”) newly issued by GDSI.

Post closing and on an as-converted basis, GDSH will own approximately 37.6% of the equity interest of GDSI in the form of ordinary shares. The value of GDSH’s equity interest in GDSI implied by the Series B subscription price is approximately US$1.3 billion, equivalent to approximately US$6.75 per American Depositary Share of GDSH. Post closing, GDSH will no longer consolidate GDSI for accounting purposes and GDSH will no longer have the right to appoint a majority of directors to the Board of GDSI.

Business Outlook

The Company confirms that the previously provided guidance of total revenues for the year of 2024 of RMB11,340 – RMB11,760 million, Adjusted EBITDA of RMB4,950 – RMB5,150 million remain unchanged.

The Company revised the previously provided capex guidance of RMB6,500 million, which includes RMB2,500 million for China and RMB4,000 million for International, to RMB 11,000 million, which includes RMB3,000 million for China as required to support move-in, and RMB8,000 million for International, reflecting an acceleration of business expansion.

This forecast reflects the Company’s preliminary view on the current business situation and market conditions, which are subject to change.

Conference Call

Management will hold a conference call at 8:00 a.m. U.S. Eastern Time on November 19, 2024 (9:00 p.m. Beijing Time on November 19, 2024) to discuss financial results and answer questions from investors and analysts.

Participants should complete online registration using the link provided below at least 15 minutes before the scheduled start time. Upon registration, participants will receive the conference call access information, including dial-in numbers, a personal PIN and an e-mail with detailed instructions to join the conference call.

Participant Online Registration:

https://register.vevent.com/register/BI2347220aa72a4610bafc061a7977f70a

A live and archived webcast of the conference call will be available on the Company’s investor relations website at investors.gds-services.com.

Non-GAAP Disclosure

Our management and board of directors use Adjusted EBITDA, Adjusted EBITDA margin, Adjusted GP and Adjusted GP margin, which are non-GAAP financial measures, to evaluate our operating performance, establish budgets and develop operational goals for managing our business. We believe that the exclusion of the income and expenses eliminated in calculating Adjusted EBITDA and Adjusted GP can provide useful and supplemental measures of our core operating performance. In particular, we believe that the use of Adjusted EBITDA as a supplemental performance measure captures the trend in our operating performance by excluding from our operating results the impact of our capital structure (primarily interest expense), asset base charges (primarily depreciation and amortization, operating lease cost relating to prepaid land use rights, accretion expenses for asset retirement costs and impairment losses of long-lived assets), other non-cash expenses (primarily share-based compensation expenses), and other income and expenses which we believe are not reflective of our operating performance, whereas the use of adjusted gross profit as a supplemental performance measure captures the trend in gross profit performance of our data centers in service by excluding from our gross profit the impact of asset base charges (primarily depreciation and amortization, operating lease cost relating to prepaid land use rights and accretion expenses for asset retirement costs) and other non-cash expenses (primarily share-based compensation expenses) included in cost of revenue.

We note that depreciation and amortization is a fixed cost which commences as soon as each data center enters service. However, it usually takes several years for new data centers to reach high levels of utilization and profitability. The Company incurs significant depreciation and amortization costs for its early stage data center assets. Accordingly, gross profit, which is a measure of profitability after taking into account depreciation and amortization, does not accurately reflect the Company’s core operating performance.

We also present these non-GAAP measures because we believe these non-GAAP measures are frequently used by securities analysts, investors and other interested parties as measures of the financial performance of companies in our industry.

These non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. These non-GAAP financial measures have limitations as analytical tools, and when assessing our operating performance, cash flows or our liquidity, investors should not consider them in isolation, or as a substitute for gross profit, net income (loss), cash flows provided by (used in) operating activities or other consolidated statements of operations and cash flow data prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures instead of their nearest GAAP equivalent. First, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted GP, and Adjusted GP margin are not substitutes for gross profit, net income (loss), cash flows provided by (used in) operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP. Second, other companies may calculate these non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of these non-GAAP financial measures as tools for comparison. Finally, these non-GAAP financial measures do not reflect the impact of net interest expenses, incomes tax benefits (expenses), depreciation and amortization, operating lease cost relating to prepaid land use rights, accretion expenses for asset retirement costs, share-based compensation expenses, gain from purchase price adjustment and impairment losses of long-lived assets, each of which have been and may continue to be incurred in our business.

We mitigate these limitations by reconciling the non-GAAP financial measure to the most comparable U.S. GAAP performance measure, all of which should be considered when evaluating our performance. We do not provide forward-looking guidance for certain financial data, such as depreciation, amortization, accretion, share-based compensation and net income (loss); the impact of such data and related adjustments can be significant. As a result, we are not able to provide a reconciliation of forward-looking U.S. GAAP to forward-looking non-GAAP financial measures without unreasonable effort. Such forward-looking non-GAAP financial measures include the forecast for Adjusted EBITDA in the section captioned “Business Outlook” set forth in this press release.

For more information on these non-GAAP financial measures, please see the table captioned “Reconciliations of GAAP and non-GAAP results” set forth at the end of this press release.

Exchange Rate

This announcement contains translations of certain RMB amounts into U.S. dollars (“USD”) at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB7.0176 to US$1.00, the noon buying rate in effect on September 30, 2024 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred could be converted into USD or RMB, as the case may be, at any particular rate or at all.

Statement Regarding Preliminary Unaudited Financial Information

The unaudited financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when audit work has been performed for the Company’s year-end audit, which could result in significant differences from this preliminary unaudited financial information.

About GDS Holdings Limited

GDS Holdings Limited GDS HKEX: 9698)) is a leading developer and operator of high-performance data centers in mainland China and, through an equity investment in its international affiliate, in Hong Kong and South East Asia. The Company’s facilities are strategically located in primary economic hubs where demand for high-performance data center services is concentrated. The Company also builds, operates and transfers data centers at other locations selected by its customers in order to fulfill their broader requirements. The Company’s data centers have large net floor area, high power capacity, density and efficiency, and multiple redundancies across all critical systems. GDS is carrier and cloud-neutral, which enables its customers to access the major telecommunications networks, as well as the largest PRC and global public clouds, which are hosted in many of its facilities. The Company offers co-location and a suite of value-added services, including managed hybrid cloud services through direct private connection to leading public clouds, managed network services, and, where required, the resale of public cloud services. The Company has a 23-year track record of service delivery, successfully fulfilling the requirements of some of the largest and most demanding customers for outsourced data center services in China. The Company’s customer base consists predominantly of hyperscale cloud service providers, large internet companies, financial institutions, telecommunications carriers, IT service providers, and large domestic private sector and multinational corporations.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “aim,” “anticipate,” “believe,” “continue,” “estimate,” “expect,” “future,” “guidance,” “intend,” “is/are likely to,” “may,” “ongoing,” “plan,” “potential,” “target,” “will,” and similar statements. Among other things, statements that are not historical facts, including statements about GDS Holdings’ beliefs and expectations regarding the growth of its businesses and its revenue for the full fiscal year, the business outlook and quotations from management in this announcement, as well as GDS Holdings’ strategic and operational plans, are or contain forward-looking statements. GDS Holdings may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”) on Forms 20-F and 6-K, in its current, interim and annual reports to shareholders, in announcements, circulars or other publications made on the website of the Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”), in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause GDS Holdings’ actual results or financial performance to differ materially from those contained in any forward-looking statement, including but not limited to the following: GDS Holdings’ goals and strategies; GDS Holdings’ future business development, financial condition and results of operations; the expected growth of the market for high-performance data centers, data center solutions and related services in China and South East Asia; GDS Holdings’ expectations regarding demand for and market acceptance of its high-performance data centers, data center solutions and related services; GDS Holdings’ expectations regarding building, strengthening and maintaining its relationships with new and existing customers; the continued adoption of cloud computing and cloud service providers in China and South East Asia; risks and uncertainties associated with increased investments in GDS Holdings’ business and new data center initiatives; risks and uncertainties associated with strategic acquisitions and investments; GDS Holdings’ ability to maintain or grow its revenue or business; fluctuations in GDS Holdings’ operating results; changes in laws, regulations and regulatory environment that affect GDS Holdings’ business operations; competition in GDS Holdings’ industry in China and South East Asia; security breaches; power outages; and fluctuations in general economic and business conditions in China, South East Asia and globally, and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks, uncertainties or factors is included in GDS Holdings’ filings with the SEC, including its annual report on Form 20-F, and with the Hong Kong Stock Exchange. All information provided in this press release is as of the date of this press release and are based on assumptions that GDS Holdings believes to be reasonable as of such date, and GDS Holdings does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

GDS Holdings Limited

Laura Chen

Phone: +86 (21) 2029-2203

Email: ir@gds-services.com

Piacente Financial Communications

Ross Warner

Phone: +86 (10) 6508-0677

Email: GDS@tpg-ir.com

Brandi Piacente

Phone: +1 (212) 481-2050

Email: GDS@tpg-ir.com

GDS Holdings Limited

________________

- For the purpose of this earnings release, “China” or “GDSH” refers to GDS’s assets and operations in Mainland China, including third party data centers in Hong Kong and Macau. The reported segment financial numbers include the inter-company charges.

- For the purpose of this earnings release, “International” or “GDSI” refers to GDS’s assets and operations outside Mainland China, excluding third party data centers in Hong Kong and Macau. The reported segment financial numbers include the inter-company charges.

| GDS HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

|||||||

| As of December 31, 2023 | As of September 30, 2024 | ||||||

| RMB | RMB | US$ | |||||

| Assets | |||||||

| Current assets | |||||||

| Cash | 7,710,711 | 9,408,464 | 1,340,695 | ||||

| Accounts receivable, net of allowance for credit losses | 2,545,913 | 3,756,149 | 535,247 | ||||

| Value-added-tax (“VAT”) recoverable | 214,385 | 248,551 | 35,418 | ||||

| Prepaid expenses and other current assets | 512,644 | 882,448 | 125,748 | ||||

| Total current assets | 10,983,653 | 14,295,612 | 2,037,108 | ||||

| Non-current assets | |||||||

| Property and equipment, net | 47,499,494 | 52,048,470 | 7,416,848 | ||||

| Prepaid land use rights, net | 22,388 | 21,927 | 3,125 | ||||

| Operating lease right-of-use assets | 5,436,288 | 5,332,954 | 759,940 | ||||

| Goodwill and intangible assets, net | 7,765,055 | 7,607,461 | 1,084,055 | ||||

| Other non-current assets | 2,739,812 | 3,035,849 | 432,604 | ||||

| Total non-current assets | 63,463,037 | 68,046,661 | 9,696,572 | ||||

| Total assets | 74,446,690 | 82,342,273 | 11,733,680 | ||||

| Liabilities, Mezzanine Equity and Equity | |||||||

| Current liabilities | |||||||

| Short-term borrowings and current portion of long-term borrowings | 2,833,953 | 6,034,303 | 859,881 | ||||

| Convertible bonds payable, current | 0 | 561 | 80 | ||||

| Accounts payable | 3,424,937 | 3,640,199 | 518,724 | ||||

| Accrued expenses and other payables | 1,318,336 | 1,533,221 | 218,482 | ||||

| Operating lease liabilities, current | 180,403 | 166,279 | 23,695 | ||||

| Finance lease and other financing obligations, current | 547,847 | 603,099 | 85,941 | ||||

| Total current liabilities | 8,305,476 | 11,977,662 | 1,706,803 | ||||

| Non-current liabilities | |||||||

| Long-term borrowings, excluding current portion | 26,706,256 | 26,573,316 | 3,786,667 | ||||

| Convertible bonds payable, non-current | 8,434,766 | 8,356,467 | 1,190,787 | ||||

| Operating lease liabilities, non-current | 1,395,981 | 1,325,820 | 188,928 | ||||

| Finance lease and other financing obligations, non-current | 7,894,185 | 7,718,233 | 1,099,839 | ||||

| Other long-term liabilities | 1,586,223 | 1,597,397 | 227,627 | ||||

| Total non-current liabilities | 46,017,411 | 45,571,233 | 6,493,848 | ||||

| Total liabilities | 54,322,887 | 57,548,895 | 8,200,651 | ||||

| Mezzanine equity | |||||||

| Redeemable preferred shares | 1,064,766 | 1,053,300 | 150,094 | ||||

| Redeemable non-controlling interests | 0 | 4,797,484 | 683,636 | ||||

| Total mezzanine equity | 1,064,766 | 5,850,784 | 833,730 | ||||

| GDS Holdings Limited shareholders’ equity | |||||||

| Ordinary shares | 516 | 527 | 75 | ||||

| Additional paid-in capital | 29,337,095 | 29,513,306 | 4,205,612 | ||||

| Accumulated other comprehensive loss | (974,393 | ) | (661,437 | ) | (94,254 | ) | |

| Accumulated deficit | (9,469,758 | ) | (10,233,666 | ) | (1,458,286 | ) | |

| Total GDS Holdings Limited shareholders’ equity | 18,893,460 | 18,618,730 | 2,653,147 | ||||

| Non-controlling interests | 165,577 | 323,864 | 46,152 | ||||

| Total equity | 19,059,037 | 18,942,594 | 2,699,299 | ||||

| Total liabilities, mezzanine equity and equity | 74,446,690 | 82,342,273 | 11,733,680 | ||||

| GDS HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”) except for number of shares and per share data) |

||||||||||||||||

| Three months ended | Nine months ended | |||||||||||||||

| September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 | September 30, 2024 | ||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||

| Net revenue | ||||||||||||||||

| Service revenue | 2,518,978 | 2,826,369 | 2,965,713 | 422,611 | 7,399,447 | 8,419,449 | 1,199,762 | |||||||||

| Equipment sales | 55 | 0 | 0 | 0 | 564 | 0 | 0 | |||||||||

| Total net revenue | 2,519,033 | 2,826,369 | 2,965,713 | 422,611 | 7,400,011 | 8,419,449 | 1,199,762 | |||||||||

| Cost of revenue | (2,071,584 | ) | (2,188,544 | ) | (2,308,792 | ) | (329,000 | ) | (5,909,878 | ) | (6,551,029 | ) | (933,514 | ) | ||

| Gross profit | 447,449 | 637,825 | 656,921 | 93,611 | 1,490,133 | 1,868,420 | 266,248 | |||||||||

| Operating expenses | ||||||||||||||||

| Selling and marketing expenses | (38,912 | ) | (26,516 | ) | (35,020 | ) | (4,990 | ) | (108,946 | ) | (95,164 | ) | (13,561 | ) | ||

| General and administrative expenses | (317,326 | ) | (284,787 | ) | (293,022 | ) | (41,755 | ) | (876,349 | ) | (888,644 | ) | (126,631 | ) | ||

| Research and development expenses | (10,529 | ) | (10,889 | ) | (8,628 | ) | (1,229 | ) | (25,359 | ) | (29,497 | ) | (4,203 | ) | ||

| Income from operations | 80,682 | 315,633 | 320,251 | 45,637 | 479,479 | 855,115 | 121,853 | |||||||||

| Other income (expenses): | ||||||||||||||||

| Net interest expenses | (503,156 | ) | (505,231 | ) | (535,008 | ) | (76,238 | ) | (1,457,055 | ) | (1,543,715 | ) | (219,978 | ) | ||

| Foreign currency exchange gain (loss), net | 908 | 11,829 | (32,500 | ) | (4,631 | ) | (1,114 | ) | (25,198 | ) | (3,591 | ) | ||||

| Others, net | 21,680 | 5,876 | 6,140 | 875 | 67,716 | 18,250 | 2,601 | |||||||||

| Loss before income taxes | (399,886 | ) | (171,893 | ) | (241,117 | ) | (34,357 | ) | (910,974 | ) | (695,548 | ) | (99,115 | ) | ||

| Income tax (expenses) benefits | (20,945 | ) | (59,875 | ) | 10,008 | 1,426 | (209,775 | ) | (112,260 | ) | (15,997 | ) | ||||

| Net loss | (420,831 | ) | (231,768 | ) | (231,109 | ) | (32,931 | ) | (1,120,749 | ) | (807,808 | ) | (115,112 | ) | ||

| Net (income) loss attributable to non-controlling interests | (350 | ) | (3,438 | ) | 3,337 | 476 | (3,350 | ) | (997 | ) | (142 | ) | ||||

| Net loss attributable to redeemable non-controlling interests | 0 | 9,465 | 35,432 | 5,049 | 0 | 44,897 | 6,398 | |||||||||

| Net loss attributable to GDS Holdings Limited shareholders | (421,181 | ) | (225,741 | ) | (192,340 | ) | (27,406 | ) | (1,124,099 | ) | (763,908 | ) | (108,856 | ) | ||

| Cumulative dividend on redeemable preferred shares | (13,745 | ) | (13,477 | ) | (13,618 | ) | (1,941 | ) | (39,946 | ) | (40,553 | ) | (5,779 | ) | ||

| Net loss available to GDS Holdings Limited ordinary shareholders | (434,926 | ) | (239,218 | ) | (205,958 | ) | (29,347 | ) | (1,164,045 | ) | (804,461 | ) | (114,635 | ) | ||

| Loss per ordinary share | ||||||||||||||||

| Basic and diluted | (0.30 | ) | (0.16 | ) | (0.14 | ) | (0.02 | ) | (0.79 | ) | (0.55 | ) | (0.08 | ) | ||

| Weighted average number of ordinary share outstanding | ||||||||||||||||

| Basic and diluted | 1,468,336,869 | 1,470,013,200 | 1,476,130,132 | 1,476,130,132 | 1,467,583,364 | 1,472,056,703 | 1,472,056,703 | |||||||||

| GDS HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

||||||||||||||||

| Three months ended | Nine months ended | |||||||||||||||

| September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 | September 30, 2024 | ||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||

| Net loss | (420,831 | ) | (231,768 | ) | (231,109 | ) | (32,931 | ) | (1,120,749 | ) | (807,808 | ) | (115,112 | ) | ||

| Foreign currency translation adjustments, net of nil tax | 20,261 | (16,334 | ) | 538,739 | 76,770 | (242,792 | ) | 466,380 | 66,459 | |||||||

| Comprehensive (loss) income | (400,570 | ) | (248,102 | ) | 307,630 | 43,839 | (1,363,541 | ) | (341,428 | ) | (48,653 | ) | ||||

| Comprehensive income attributable to non-controlling interests | (6 | ) | (2,323 | ) | (5,287 | ) | (753 | ) | (3,897 | ) | (7,707 | ) | (1,098 | ) | ||

| Comprehensive loss (income) attributable to redeemable non-controlling interests | 0 | 5,548 | (107,365 | ) | (15,299 | ) | 0 | (101,817 | ) | (14,509 | ) | |||||

| Comprehensive (loss) income attributable to GDS Holdings Limited shareholders | (400,576 | ) | (244,877 | ) | 194,978 | 27,787 | (1,367,438 | ) | (450,952 | ) | (64,260 | ) | ||||

| GDS HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

|||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||

| September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 | September 30, 2024 | |||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | |||||||||

| Net loss | (420,831 | ) | (231,768 | ) | (231,109 | ) | (32,931 | ) | (1,120,749 | ) | (807,808 | ) | (115,112 | ) | |

| Depreciation and amortization | 886,142 | 874,168 | 911,274 | 129,856 | 2,603,610 | 2,642,181 | 376,508 | ||||||||

| Amortization of debt issuance cost and debt discount | 42,058 | 31,364 | 41,859 | 5,965 | 131,976 | 111,785 | 15,929 | ||||||||

| Share-based compensation expense | 107,957 | 75,682 | 61,194 | 8,720 | 255,851 | 213,522 | 30,427 | ||||||||

| Others | 11,356 | (34,653 | ) | (73,811 | ) | (10,518 | ) | 15,788 | (96,237 | ) | (13,714 | ) | |||

| Changes in operating assets and liabilities | (116,236 | ) | (260,556 | ) | (67,893 | ) | (9,675 | ) | (770,609 | ) | (1,092,664 | ) | (155,703 | ) | |

| Net cash provided by operating activities | 510,446 | 454,237 | 641,514 | 91,417 | 1,115,867 | 970,779 | 138,335 | ||||||||

| Purchase of property and equipment and land use rights | (1,478,410 | ) | (1,960,947 | ) | (2,898,805 | ) | (413,077 | ) | (4,935,688 | ) | (6,454,859 | ) | (919,811 | ) | |

| Payments related to acquisitions and investments | (94,000 | ) | (70,791 | ) | 0 | 0 | (236,448 | ) | (70,791 | ) | (10,088 | ) | |||

| Net cash used in investing activities | (1,572,410 | ) | (2,031,738 | ) | (2,898,805 | ) | (413,077 | ) | (5,172,136 | ) | (6,525,650 | ) | (929,899 | ) | |

| Net proceeds from financing activities | 442,341 | 3,833,394 | 1,941,787 | 276,704 | 2,765,599 | 7,397,150 | 1,054,086 | ||||||||

| Net cash provided by financing activities | 442,341 | 3,833,394 | 1,941,787 | 276,704 | 2,765,599 | 7,397,150 | 1,054,086 | ||||||||

| Effect of exchange rate changes on cash and restricted cash | (10,222 | ) | 30,883 | (28,109 | ) | (4,008 | ) | 149,597 | (7,135 | ) | (1,016 | ) | |||

| Net (decrease) increase of cash and restricted cash | (629,845 | ) | 2,286,776 | (343,613 | ) | (48,965 | ) | (1,141,073 | ) | 1,835,144 | 261,506 | ||||

| Cash and restricted cash at beginning of period | 8,370,564 | 7,809,913 | 10,096,689 | 1,438,767 | 8,882,066 | 7,917,932 | 1,128,296 | ||||||||

| Reclassification as assets of disposal group classified as held for sale | (324 | ) | 0 | 0 | 0 | (598 | ) | 0 | 0 | ||||||

| Cash and restricted cash at end of period | 7,740,395 | 10,096,689 | 9,753,076 | 1,389,802 | 7,740,395 | 9,753,076 | 1,389,802 | ||||||||

| GDS HOLDINGS LIMITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”) except for percentage data) |

||||||||||||||||

| Three months ended | Nine months ended | |||||||||||||||

| September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 | September 30, 2024 | ||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||

| Gross profit | 447,449 | 637,825 | 656,921 | 93,611 | 1,490,133 | 1,868,420 | 266,248 | |||||||||

| Depreciation and amortization | 748,658 | 773,302 | 811,434 | 115,628 | 2,215,559 | 2,340,696 | 333,548 | |||||||||

| Operating lease cost relating to prepaid land use rights | 10,434 | 10,706 | 11,536 | 1,644 | 28,177 | 32,876 | 4,685 | |||||||||

| Accretion expenses for asset retirement costs | 1,708 | 1,690 | 1,730 | 247 | 5,165 | 4,908 | 699 | |||||||||

| Share-based compensation expenses | 39,005 | 27,934 | 20,678 | 2,947 | 87,401 | 74,936 | 10,678 | |||||||||

| Adjusted GP | 1,247,254 | 1,451,457 | 1,502,299 | 214,077 | 3,826,435 | 4,321,836 | 615,858 | |||||||||

| Adjusted GP margin | 49.5 | % | 51.4 | % | 50.7 | % | 50.7 | % | 51.7 | % | 51.3 | % | 51.3 | % | ||

| GDS HOLDINGS LIMITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”) except for percentage data) |

||||||||||||||||

| Three months ended | Nine months ended | |||||||||||||||

| September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 | September 30, 2024 | ||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||

| Net loss | (420,831 | ) | (231,768 | ) | (231,109 | ) | (32,931 | ) | (1,120,749 | ) | (807,808 | ) | (115,112 | ) | ||

| Net interest expenses | 503,156 | 505,231 | 535,008 | 76,238 | 1,457,055 | 1,543,715 | 219,978 | |||||||||

| Income tax expenses (benefits) | 20,945 | 59,875 | (10,008 | ) | (1,426 | ) | 209,775 | 112,260 | 15,997 | |||||||

| Depreciation and amortization | 886,142 | 874,168 | 911,274 | 129,856 | 2,603,610 | 2,642,181 | 376,508 | |||||||||

| Operating lease cost relating to prepaid land use rights | 27,211 | 27,316 | 27,602 | 3,933 | 80,760 | 82,521 | 11,759 | |||||||||

| Accretion expenses for asset retirement costs | 1,708 | 1,690 | 1,730 | 247 | 5,165 | 4,908 | 699 | |||||||||

| Share-based compensation expenses | 107,957 | 75,682 | 61,194 | 8,720 | 255,851 | 213,522 | 30,427 | |||||||||

| Adjusted EBITDA | 1,126,288 | 1,312,194 | 1,295,691 | 184,637 | 3,491,467 | 3,791,299 | 540,256 | |||||||||

| Adjusted EBITDA margin | 44.7 | % | 46.4 | % | 43.7 | % | 43.7 | % | 47.2 | % | 45.0 | % | 45.0 | % | ||

| GDS HOLDINGS LIMITED SELECTED SEGMENT INFORMATION (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

||||||||||||||||||||||||||||||

| Three months ended September 30, 2023 | Three months ended June 30, 2024 | Three months ended September 30, 2024 | ||||||||||||||||||||||||||||

| GDSH | GDSI | Elimination | Total | GDSH | GDSI | Elimination | Total | GDSH | GDSI | Elimination | Total | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | RMB | RMB | RMB | RMB | RMB | RMB | US$ | ||||||||||||||||||

| Net revenue |

2,470,125 | 49,328 | (420 | ) | 2,519,033 | 2,579,594 | 255,533 | (8,758 | ) | 2,826,369 | 2,619,578 | 363,209 | (17,074 | ) | 2,965,713 | 422,611 | ||||||||||||||

| Net loss |

(309,236 | ) | (111,272 | ) | (323 | ) | (420,831 | ) | (172,845 | ) | (55,666 | ) | (3,257 | ) | (231,768 | ) | (152,146 | ) | (76,227 | ) | (2,736 | ) | (231,109 | ) | (32,931 | ) | ||||

| Net interest expenses | 468,951 | 34,205 | 0 | 503,156 | 450,271 | 57,043 | (2,083 | ) | 505,231 | 463,327 | 74,999 | (3,318 | ) | 535,008 | 76,238 | |||||||||||||||

| Income tax expenses (benefits) | 20,943 | 2 | 0 | 20,945 | 59,864 | 11 | 0 | 59,875 | (347 | ) | (9,661 | ) | 0 | (10,008 | ) | (1,426 | ) | |||||||||||||

| Depreciation and amortization | 845,901 | 40,241 | 0 | 886,142 | 790,901 | 83,430 | (163 | ) | 874,168 | 803,535 | 107,903 | (164 | ) | 911,274 | 129,856 | |||||||||||||||

| Operating lease cost relating to prepaid land use rights | 26,907 | 304 | 0 | 27,211 | 27,603 | (287 | ) | 0 | 27,316 | 27,602 | 0 | 0 | 27,602 | 3,933 | ||||||||||||||||

| Accretion expenses for asset retirement costs | 1,656 | 52 | 0 | 1,708 | 1,690 | 0 | 0 | 1,690 | 1,730 | 0 | 0 | 1,730 | 247 | |||||||||||||||||

| Share-based compensation expenses | 107,957 | 0 | 0 | 107,957 | 75,682 | 0 | 0 | 75,682 | 61,194 | 0 | 0 | 61,194 | 8,720 | |||||||||||||||||

| Adjusted EBITDA |

1,163,079 | (36,468 | ) | (323 | ) | 1,126,288 | 1,233,166 | 84,531 | (5,503 | ) | 1,312,194 | 1,204,895 | 97,014 | (6,218 | ) | 1,295,691 | 184,637 | |||||||||||||

| Net cash provided by (used in) operating activities |

578,723 | (68,277 | ) | 0 | 510,446 | 599,443 | (106,926 | ) | (38,280 | ) | 454,237 | 639,878 | 1,636 | 0 | 641,514 | 91,417 | ||||||||||||||

| Net cash (used in) provided by investing activities |

(1,355,859 | ) | (804,475 | ) | 587,924 | (1,572,410 | ) | 654,451 | (1,146,380 | ) | (1,539,809 | ) | (2,031,738 | ) | (788,123 | ) | (2,110,682 | ) | 0 | (2,898,805 | ) | (413,077 | ) | |||||||

| – | Purchase of property and equipment and land use rights | (673,935 | ) | (804,475 | ) | 0 | (1,478,410 | ) | (852,847 | ) | (1,146,380 | ) | 38,280 | (1,960,947 | ) | (788,123 | ) | (2,110,682 | ) | 0 | (2,898,805 | ) | (413,077 | ) | ||||||

| – | Payments related to acquisitions and investments | (94,000 | ) | 0 | 0 | (94,000 | ) | (70,791 | ) | 0 | 0 | (70,791 | ) | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| – | GDSH investment in GDSI | (587,924 | ) | 0 | 587,924 | 0 | 1,578,089 | 0 | (1,578,089 | ) | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Net cash provided by (used in) financing activities |

81,629 | 948,636 | (587,924 | ) | 442,341 | (119,209 | ) | 2,374,514 | 1,578,089 | 3,833,394 | (392,325 | ) | 2,334,112 | 0 | 1,941,787 | 276,704 | ||||||||||||||

| GDS HOLDINGS LIMITED SELECTED SEGMENT INFORMATION CONT’D (Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

||||||

| As of December 31, 2023 | As of September 30, 2024 | |||||

| RMB | RMB | US$ | ||||

| Property and equipment, net | ||||||

| GDSH | 40,098,416 | 40,210,445 | 5,729,943 | |||

| GDSI | 7,408,567 | 11,855,262 | 1,689,361 | |||

| Elimination | (7,489 | ) | (17,237 | ) | (2,456 | ) |

| Total | 47,499,494 | 52,048,470 | 7,416,848 | |||

| Gross debt (Note) | ||||||

| GDSH | 42,547,203 | 43,361,579 | 6,178,975 | |||

| GDSI | 5,170,653 | 5,924,400 | 844,220 | |||

| Elimination | (1,300,849 | ) | 0 | 0 | ||

| Total | 46,417,007 | 49,285,979 | 7,023,195 | |||

| Cash | ||||||

| GDSH | 7,301,976 | 7,757,903 | 1,105,492 | |||

| GDSI | 408,735 | 1,650,561 | 235,203 | |||

| Total | 7,710,711 | 9,408,464 | 1,340,695 | |||

Note: Gross debt comprised of short-term and long-term borrowings, convertible bonds payable and finance lease and other financing obligations. For GDSI, for December 31, 2023, gross debt also includes the amounts due to GDSH.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Soldier System Market Size is Projected to Reach USD 17.0 billion by 2031, with a 5.2% CAGR | Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Nov. 19, 2024 (GLOBE NEWSWIRE) — The global soldier system market (군인 시스템 시장) is estimated to flourish at a CAGR of 5.2% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for soldier system is estimated to reach US$ 17.0 billion by the end of 2031. A prominent force is the focus on psychological well-being within soldier-centric technologies.

As the understanding of the mental toll of combat deepens, innovations addressing stress, fatigue, and mental health in soldier systems are gaining traction. Solutions ranging from augmented reality for stress relief to cognitive performance-enhancing technologies contribute to a holistic approach in optimizing soldier effectiveness.

The utilization of artificial intelligence (AI) in soldier systems is quietly revolutionizing operational capabilities. AI-driven analytics provide real-time insights into situational awareness, aiding decision-making on the battlefield. From predictive maintenance for equipment to AI-assisted threat analysis, the integration of AI enhances the overall efficiency of soldier systems.

Download Sample PDF of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85472

The advent of smart textiles and adaptive materials in soldier gear represents a novel driver. These textiles offer enhanced functionality, adjusting to environmental conditions and providing dynamic support to soldiers. From self-healing fabrics to adaptive camouflage, smart textiles contribute to soldier comfort, survivability, and mission success.

Soldier System Market: Competitive Landscape

The soldier system market is marked by intense competition, featuring key players like Elbit Systems, Rheinmetall AG, and Thales Group. These industry leaders drive innovation, offering comprehensive soldier-centric solutions, from advanced communication systems to integrated wearable technologies.

Robust research and development initiatives, strategic partnerships, and a focus on meeting evolving military requirements define the competitive landscape. With a global outlook, the market witnesses continuous advancements, as companies vie for contracts and collaborations to deliver cutting-edge soldier systems that enhance military capabilities and ensure optimal performance in diverse operational scenarios.

Some prominent manufacturers are as follows:

- ASELSAN A.S

- Avon Protection plc

- Banc 3 Inc.

- Elbit Systems Ltd.

- Inmarsat Global Limited

- L3Harris Technologies Inc.

- Metravib Defence

- Rheinmetall AG

- Safran Vectronix AG

- Teldat Group

- Textron Systems

- Thales Group

Key Findings of the Market Report

- Body armor leads the soldier system market, prioritizing soldier safety with advanced protective gear for diverse operational environments.

- Defense is the leading end-user segment in the soldier system market, driving innovations and investments in advanced military technologies.

- North America leads the soldier system market, propelled by substantial defense investments, advanced technological capabilities, and ongoing soldier modernization programs.

Soldier System Market Growth Drivers & Trends

- Ongoing innovations in communication, sensors, and wearable technologies drive soldier system market growth, enhancing soldier capabilities and battlefield effectiveness.

- Demand for comprehensive, integrated soldier systems rises, focusing on seamless communication, real-time data sharing, and interoperability across military platforms.

- Rising global security concerns propel investments in soldier modernization programs, fostering market growth as nations prioritize advanced equipment and technologies to counter evolving threats.

- A trend towards lightweight yet durable materials in soldier equipment enhances mobility and comfort, driving market growth with a focus on soldier safety and effectiveness.

- Worldwide defense modernization efforts, particularly in North America, Europe, and Asia Pacific, contribute to the soldier system market’s expansion, fostering a globally competitive landscape.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85472

Global Soldier System Market: Regional Profile

- North America dominates the soldier system market, driven by the United States’ formidable defense investments. Advanced soldier modernization programs, led by companies like Lockheed Martin and General Dynamics, fuel the region’s market. Emphasis on next-gen technologies, integrated communication systems, and soldier-wearable solutions characterize the North American landscape.

- Europe stands as a key player, with countries like the UK, Germany, and France leading the region’s soldier system advancements. Companies such as BAE Systems and Rheinmetall AG contribute to a robust market, focusing on interoperability, situational awareness, and lightweight yet highly protective soldier equipment.

- The Asia Pacific region showcases substantial growth, driven by defense modernization initiatives in countries like China and India. Rising security concerns propel the demand for advanced soldier systems, and local companies, including Bharat Electronics Limited and Norinco Group, contribute significantly to the region’s dynamic market, focusing on enhancing soldier survivability and effectiveness.

Product Portfolio

- ASELSAN A.S. leads in defense technology with an extensive product portfolio. From communication systems to electronic warfare solutions, their innovative technologies ensure national security, offering cutting-edge solutions to military and defense organizations globally.

- Avon Protection plc specializes in respiratory protection and defense equipment. Their product portfolio includes advanced gas masks, filters, and respiratory systems, providing unmatched safety and protection for military, law enforcement, and first responders.

- Banc 3 Inc. excels in providing cutting-edge technology solutions. From cybersecurity to advanced analytics, their diverse product portfolio meets the evolving needs of government and private sector clients, ensuring efficient and secure operations.

Soldier System Market: Key Segments

By Type

- Body Armor

- Tactical Terminal Tablets

- Laser Target Acquisition Systems

- Respiratory Protective Equipment

- Night Vision Glasses

- Communication Devices

- Others (Navigation Devices, Training & Simulation)

By End User

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report – https://www.transparencymarketresearch.com/checkout.php?rep_id=85472<ype=S

More Trending Report by Transparency Market Research:

Microturbines Market (سوق التوربينات الدقيقة) – The global microturbines market is projected to grow at a CAGR of 8.6% from 2022 to 2031.

Water Analysis Instruments Market (水分析機器市場) – The global water analysis instruments market was valued at US$ 5.2 billion in 2021. It is projected to expand at a CAGR of 6.8% during the forecast period from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BlackRock's Spot Bitcoin ETF To Open For Options Trading: Here's Why It Could Be A Big Deal For Bitcoin

Options trading for spot Bitcoin BTC/USD exchange-traded funds are all set to launch on Wall Street on Tuesday, marking a new era of the leading cryptocurrency’s integration into traditional finance.

What happened: Nasdaq head of ETP listings Alison Hennessy told Bloomberg they plan to list options for iShares Bitcoin Trust ETF IBIT “as early as” Tuesday.

The approved options would be listed on the Nasdaq under the ticker symbol “IBIT,” paving the way for institutional investors and traders to hedge their exposure to Bitcoin more efficiently.

But why is it a big deal?

In a video posted on X Monday and reshared by Bloomberg’s senior ETF analyst Eric Balchunas, analyst and head of growth at Bitcoin custody firm Theya, Joe Consorti, said that the launch will open the “floodgates” for Bitcoin’s next evolution in financial markets.

Consorti stated the importance of options trading, especially for institutional investors. He explained that in sectors like equities and commodities, derivatives are 10 to 20 times the size of the underlying market cap.

On the other hand, Bitcoin’s derivatives market was much lower, with its total Open interest, or OI, being a fraction of its spot market capitalization.

See Also: Bitfinex Bitcoin Laundering Case Lands ‘Crocodile Of Wall Street’ In Jail

“So Bitcoins are vastly underdeveloped, and this limits the market majority because there is a huge institutional demand for these vehicles from a hedging perspective and an allocation perspective,” Consorti said.

With the debut of options trading, the analyst expected Bitcoin’s derivatives market to balloon into something “much, much larger.”

Why It Matters: Retail investors, who constitute nearly 44% of the listed equities options market, had trouble accessing Bitcoin ETF options due to the OTC (over-the-counter) nature of trading on platforms like Deribit.

However, all this changes with IBIT options, as investors previously excluded would be able to join the Bitcoin derivatives market, giving a boost to the investor base and demand.

“A robust derivatives ecosystem reduces volatility, improves price discovery, and allows institutional capital to engage with Bitcoin at scale,” Consorti emphasized.

The IBIT spot ETF was the biggest Bitcoin-related fund, according to SoSo Value, with assets worth more than $43 billion as of this writing.

Price Action: At the time of writing, Bitcoin was trading at $91,727.36, up 0.08% in the last 24 hours, according to data from Benzinga Pro.

What’s Next: The launch coincides with Benzinga’s Future of Digital Assets event on Nov. 19, where the focus will be on Bitcoin’s role in institutional portfolios, regulatory clarity, and the evolving crypto market landscape.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Magnificent High-Yield REIT Stock Down 39% to Buy and Hold Forever

It’s hard to find dependable dividend stocks with large yields. Often, a high dividend yield is a red flag, a warning from the market of potential risks within the company. However, certain types of companies are better suited to affording generous dividends.

Real estate is a great place to look. Companies that acquire and lease property, called real estate investment trusts (REITs), must distribute at least 90% of their income to shareholders to avoid paying corporate income tax. W.P. Carey (NYSE: WPC) was a highly regarded REIT but encountered some challenges after the pandemic and cut its dividend.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Today, the stock is down nearly 40% from its high. Given the dividend cut and the stock’s decline, it’s easy to say, “I’ll pass.”

Yet, that could be a big mistake. I’ll explain what makes W.P. Carey a top-notch REIT worth buying today and holding potentially forever.

Most investors hold REITs for the dividend income, so cutting the dividend will (naturally) not go over well. Here’s what happened. W.P. Carey had significant exposure to office properties, which became troublesome after COVID-19 due partly to lockdowns and work-from-home policies. Approximately 16% of W.P. Carey’s rental income came from offices.

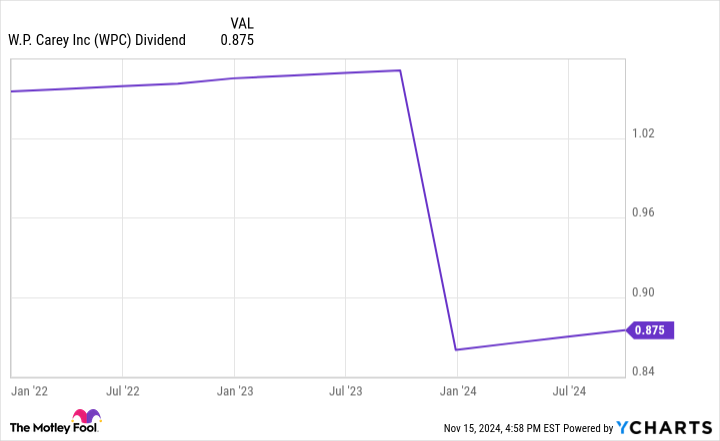

W.P. Carey decided to spin off its office properties (it wasn’t the only REIT to do so), which prompted a dividend cut last year:

Note that management has resumed dividend increases. However, it will take time for W.P. Carey to grow enough to pay as large a dividend as it once did. Analysts expect W.P. Carey to grow its funds from operations (FFO) at a low to mid-single-digit rate over the next few years.

The story of W.P. Carey’s dividend cut is somewhat ironic because it’s one of the most diversified REITs.

The company owns approximately 1,430 properties and leases to 346 tenants. W.P. Carey focuses on single-tenant commercial properties and uses net leases, meaning the tenant is responsible for the property’s overhead expenses, such as taxes, maintenance, and insurance. That de-risks W.P. Carey from unexpected costs. It also has a self-storage portfolio of 78 additional properties.

Its properties are divided roughly 2-to-1 between North America and Europe. Additionally, no tenant represents more than 2.7% of its rental income, and its top 10 combine for just 20%. Its properties include industrial buildings, warehouses, retail buildings, and others. The tenants come from dozens of end markets, ranging from retailers to cargo transporters.

Warren Buffett Just Bought 4 Stocks. Here's the Best of the Bunch.

One of the world’s greatest investors isn’t doing much investing these days. Warren Buffett was a net seller of stocks for the eighth consecutive quarter in Q3. He again slashed Berkshire Hathaway‘s position in Apple and sold shares of six other holdings.

However, Buffett and his two investment managers (Ted Weschler and Todd Combs) still put some of Berkshire’s massive cash stockpile to work. He recently bought four stocks. One of them stands out as the best of the bunch.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Berkshire initiated new positions in only two stocks in the last quarter. Its biggest addition was 1.28 million shares of pizza franchiser Domino’s Pizza (NYSE: DPZ). At the end of Q3, Berkshire’s stake in Domino’s was worth $549.4 million.

The conglomerate also dipped its toes in the water with swimming pool supplies distributor Pool Corporation (NASDAQ: POOL). Berkshire bought over 404,000 shares of Pool valued at nearly $152.3 million at the end of Q3.

Besides those two additions, Berkshire increased its positions in only two existing holdings. Its stake in satellite radio operator Sirius XM Holdings (NASDAQ: SIRI) increased by 6.99%. Some of this increase was due to the merger of Sirius XM and Liberty SiriusXM Holdings. Berkshire previously owned shares of the two tracking stocks reflecting Liberty Media’s interest in Sirius XM. However, Buffett or his investment managers also bought more shares of Sirius XM Holdings in October.

Finally, Berkshire boosted its position in Heico (NYSE: HEI) by 0.52% in Q3 after first buying shares in Q2. The conglomerate’s stake in the aerospace and electronics company was worth roughly $214 million at the end of the quarter.

If we only focused on performance this year, Heico would beat the other recent Buffett additions handily. The stock has skyrocketed over 50%. Domino’s comes in second with a year-to-date gain of less than 5%. Pool and Sirius XM are in negative territory with declines of around 10% and 53%, respectively.

The picture looks much different, though, when we look at valuations. Sirius XM Holdings has a bargain-basement forward price-to-earnings ratio of 7.3. Domino’s again grabs the second spot with a forward earnings multiple of 24.3. Pool is somewhat more expensive with its shares trading at 29.8 times forward earnings. Heico is the outlier with a sky-high forward earnings multiple of 63.7.

Energizer Holdings, Inc. Announces Fiscal 2024 Fourth Quarter and Full Year Results and Financial Outlook for Fiscal 2025

- Delivered fiscal 2024 Net Sales and Adjusted EBITDA in line with our outlook, and Adjusted EPS above our originally guided range.(1)

- Gross margin for the full year was 38.3% and on an adjusted basis 40.9%, up 190 basis points to prior year largely driven by the benefits of Project Momentum initiatives.(1)

- Operating cash flow was $429.6 million and Free cash flow was 11.7% of Net Sales for the fiscal year.(1)

- Reduced net leverage to 4.9 times in fiscal 2024 driven by $200 million of debt pay down and Adjusted EBITDA growth.(1)

- Delivered earnings per share of $0.52 and Adjusted Earnings per share of $3.32 for the fiscal year, an increase of 7% on an adjusted basis.(1)

- Company expects fiscal 2025 organic revenue growth of 1% to 2% and Adjusted EBITDA and Adjusted earnings per share in the ranges of $625 to $645 million and $3.45 to $3.65, respectively.(1)

ST. LOUIS, Nov. 19, 2024 /PRNewswire/ — Energizer Holdings, Inc. ENR today announced results for the fourth fiscal quarter and full fiscal year, which ended September 30, 2024.

“We finished fiscal 2024 with solid performances across both Battery and Auto Care, driving adjusted earnings growth above our initial expectations,” said Mark LaVigne, President and Chief Executive Officer.

“Our results are further proof that our strategies are working. We generated organic growth in the back half of the year, strengthened our gross margins and delivered strong free cash flow, which enabled significant investment behind our long term growth objectives.”

“We enter fiscal 2025 having significantly advanced the Company’s strategic foundation and financial position. I am confident we are well positioned to deliver our financial algorithm, anchored by consistent, ratable growth and continued improvement in our operating margins.”

(1) See Press Release attachments and supplemental schedules for additional information, including the GAAP to Non-GAAP reconciliations.

Top-Line Performance

Net sales were $805.7 million for the fourth fiscal quarter compared to $811.1 million in the prior year period and $2,887.0 million for the fiscal year compared to $2,959.7 million for the prior fiscal year.

|

Fourth |

% Chg |

Full Fiscal |

% Chg |

|||||

|

Net Sales – FY’23 |

$ 811.1 |

$ 2,959.7 |

||||||

|

Organic |

0.3 |

— % |

(66.2) |

(2.2) % |

||||

|

Change in Argentina operations |

(2.2) |

(0.3) % |

(7.8) |

(0.3) % |

||||

|

Impact of currency |

(3.5) |

(0.4) % |

1.3 |

— % |

||||

|

Net Sales – FY’24 |

$ 805.7 |

(0.7) % |

$ 2,887.0 |

(2.5) % |

For the fiscal quarter, organic net sales were consistent with prior year due to the following items: (1)

- Volume increases in the Battery & Lights segment driven by improved category trends and new distribution globally which resulted in 1.3% organic growth; and

- Volume increases in the Auto Care segment resulted in organic growth of 0.5% from distribution gains and early holiday sales, partially offset by timing of refrigerant sales that benefited the third quarter.

- These volume increases were offset by pricing declines of 1.8% driven by planned strategic pricing and promotional investments in the period.

For the fiscal year, organic net sales decreased 2.2% due to the following items: (1)

- The Battery & Lights segment experienced volume declines of approximately 0.7% primarily due to the timing of holiday orders compared to the prior year, which benefited the fourth quarter of 2023, partially offset by distribution gains and improved category trends; and

- Pricing declines of 2.2%, primarily within the Battery & Lights segment, driven by planned strategic pricing and promotional investments in the period.

- Offsetting these declines was increased Auto Care segment volumes of 0.7% largely driven by distribution gains in the period.

Gross Margin

Gross margin percentage on a reported basis for the fourth fiscal quarter was 38.1%, versus 37.9% in the prior year quarter. Excluding the current and prior year restructuring costs and the current year network transition costs and integration costs, Adjusted Gross margin was 42.2%, up 220 basis points from the prior year quarter and 70 basis points from the third fiscal quarter of 2024.(1)

Gross margin percentage on a reported basis for fiscal 2024 was 38.3%, versus 38.0% in the prior year. Excluding the current and prior year restructuring costs and the current year network transition costs and integration costs, Adjusted Gross margin was 40.9% for the fiscal year, up 190 basis points from prior year.(1)

|

Fourth Quarter |

Full Fiscal Year |

|||

|

Gross Margin – FY’23 Reported |

37.9 % |

38.0 % |

||

|

Prior year impact of restructuring costs |

2.1 % |

1.0 % |

||

|

Adjusted Gross Margin – FY’23 (1) |

40.0 % |

39.0 % |

||

|

Project Momentum initiatives |

2.2 % |

1.9 % |

||

|

Product cost impacts |

1.3 % |

1.8 % |

||

|

Pricing |

(1.1) % |

(1.5) % |

||

|

Currency impact and other |

(0.2) % |

(0.3) % |

||

|

Gross margin – FY’24 Adjusted |

42.2 % |

40.9 % |

||

|

Current year impact of restructuring, network transition and integration costs |

(4.1) % |

(2.6) % |

||

|

Gross margin – FY’24 Reported |

38.1 % |

38.3 % |

Adjusted Gross margin improvement in the fourth fiscal quarter was driven by both Project Momentum initiatives, which delivered savings of approximately $18 million, as well as lower input costs, including improved commodity and material pricing. These benefits were partially offset by the planned strategic pricing and promotional investments noted above.

Adjusted Gross margin improvement in fiscal 2024 was driven by both Project Momentum initiatives, which delivered savings of approximately $59 million, as well as lower input costs, including improved commodities pricing and lower ocean freight. These benefits were partially offset by the planned strategic pricing and promotional investments noted above.

Selling, General and Administrative Expense (SG&A)

SG&A for the fourth fiscal quarter was 15.3% of net sales, or $123.0 million, as compared to 14.2% of net sales, or $115.5 million, in the prior year when excluding restructuring and related costs, acquisition and integration costs and a litigation matter. The year-over-year increase was primarily driven by an increase in labor and benefit costs, higher travel expense, increased depreciation expense related to our digital transformation initiatives and increased legal fees. This increase was partially offset by savings from Project Momentum of approximately $7 million.(1)

SG&A for fiscal 2024 was $473.1 million, or 16.4% of net sales, as compared to $459.4 million, or 15.5% of net sales, in the prior year when excluding restructuring and related costs, acquisition and integration costs, and a litigation matter. The year-over-year increase was primarily driven by an increase in labor and benefit costs, higher travel expense, increased depreciation expense related to our digital transformation initiatives and increased legal, factoring and environmental fees. This increase was partially offset by Project Momentum savings of approximately $29 million in the period.(1)

Advertising and Promotion Expense (A&P)

A&P was 4.6% of net sales for the fourth fiscal quarter and 5.0% of net sales for fiscal 2024. A&P spending in the prior year was 4.1% for the fourth fiscal quarter of 2023 and 4.8% for fiscal 2023. For the quarter, this was an increase of 50 basis points, or $4.5 million and for fiscal 2024 this was an increase of 20 basis points or $1.4 million.

|

Earnings Per Share and Adjusted EBITDA |

Fourth Quarter |

Full Fiscal Year |

||||||

|

(In millions, except per share data) |

2024 |

2023 |

2024 |

2023 |

||||

|

Net earnings |

$ 47.6 |

$ 19.7 |

$ 38.1 |

$ 140.5 |

||||

|

Diluted net earnings per common share |

$ 0.65 |

$ 0.27 |

$ 0.52 |

$ 1.94 |

||||

|

Adjusted net earnings(1) |

$ 89.3 |

$ 86.8 |

$ 241.3 |

$ 224.0 |

||||

|

Adjusted diluted net earnings per common share(1) |

$ 1.22 |

$ 1.20 |

$ 3.32 |

$ 3.09 |

||||

|

Adjusted EBITDA(1) |

$ 187.3 |

$ 185.4 |

$ 612.4 |

$ 597.3 |

||||

|

Currency neutral Adjusted diluted net earnings per common share(1) |

$ 1.26 |

$ 3.35 |

||||||

|

Currency neutral Adjusted EBITDA(1) |

$ 191.0 |

$ 614.9 |

||||||

The increase in net earnings in the fourth fiscal quarter was driven by the prior year settlement charge on the US pension plan annuity buy out of $50.2 million of previously unamortized actuarial losses. The decrease in net earnings in the fiscal year was driven by the current year non-cash pre-tax impairment charge of $110.6 million compared to no impairments in fiscal 2023 as well as the Argentina devaluation recorded in the current fiscal year, partially offset by the prior year US pension plan annuity buy out.

For the fourth fiscal quarter, the increase in Adjusted earnings per share and Adjusted EBITDA reflects an increase in Gross margin due to Project Momentum savings, partially offset by higher SG&A and A&P spending as well as unfavorable currency in the current year. Adjusted earnings per share further benefited from lower interest expense as the Company’s overall debt balance has decreased, partially offset by increased tax expense.

For the full year, Adjusted net earnings per share and Adjusted EBITDA reflects the Gross margin improvement as well as decreased R&D spend. This was partially offset by higher A&P and SG&A spend and the unfavorable currency movement in the full year. Adjusted earnings per share further benefited from lower interest expense as the Company’s overall debt balance has decreased and lower amortization expense, partially offset by increased tax expense.

For the quarter, currency had an unfavorable pre-tax impact of $3.7 million, or $0.04 per share, and for fiscal 2024, currency had an unfavorable pre-tax impact of $2.5 million, or $0.03 per share.

Capital Allocation

- Operating cash flow for the quarter was $168.9 million and for fiscal 2024 was $429.6 million. Fiscal year 2024 free cash flow was $339.0 million, or 11.7% of Net Sales.

- The Company completed two acquisitions in fiscal 2024 including the acquisition of battery manufacturing equipment, raw materials and a leased facility in Belgium for $11.6 million in the first fiscal quarter and an Auto Care appearance and fragrance manufacturer and distributor based in Southern Brazil for $10.6 million during the third fiscal quarter.

- The Company paid down an additional $50 million of debt in the fourth quarter and $200 million in fiscal 2024. In fiscal 2024, Net debt decreased by $138.5 million and Net debt to Adjusted EBITDA was 4.9 times as of September 30, 2024, down from 5.2 times as of September 30, 2023.

- The Company paid dividends in the quarter of $21.6 million, or $0.30 per common share. Dividend payments for the year were $87.4 million, or $1.20 per common share.