Toronto Hydro Corporation reports its third quarter financial results for 2024

TORONTO, Nov. 20, 2024 /CNW/ – Toronto Hydro Corporation (Toronto Hydro) has announced its financial and operating results for the third quarter ended September 30, 2024.

|

Selected financial and operational highlights (in millions of Canadian dollars) |

||||

|

Three months ended September 30 |

Nine months ended September 30 |

|||

|

2024 $ |

2023 $ |

2024 $ |

2023 $ |

|

|

Distribution revenue |

246.4 |

219.9 |

705.3 |

629.1 |

|

Net income after net movements in regulatory balances |

45.0 |

39.3 |

121.3 |

119.5 |

|

Capital expenditures |

204.4 |

202.3 |

621.1 |

541.7 |

KEY FINANCIAL HIGHLIGHTS

Distribution revenue for the nine months ended Sep. 30, 2024 was $705.3 million:

- Increase of $76.2 million compared to the comparable period in 2023

- The increase was driven by higher revenue collected through Ontario Energy Board (OEB)-approved rate riders, higher 2024 distribution rates and higher electricity consumption

Net income after net movements in regulatory balances for the nine months ended Sep. 30, 2024 was $121.3 million:

- Increase of $1.8 million compared to the comparable period in 2023

- The increase was primarily due to higher distribution revenue

- This was partially offset by lower other gains related to variable consideration recognized in the prior period, higher operating expenses, higher financing costs, and higher depreciation and amortization expense

Capital expenditures for the nine months ended Sep. 30, 2024 were $621.1 million:

- Increase of $79.4 million compared to the comparable period in 2023

- Capital initiatives in 2024 included the delivery of customer connections, replacement of overhead and underground infrastructures, and customer-initiated plant relocations and expansions

CORPORATE DEVELOPMENTS

On Sep. 18, the maturity date of Toronto Hydro’s revolving credit facility was extended from Sep. 18, 2028 to Sep. 18, 2029.

On Sep. 26, Toronto Hydro issued $250.0 million of 3.99% senior unsecured debentures due on Sep. 26, 2034.

On Oct. 30, S&P Global Ratings raised Toronto Hydro’s issuer rating and senior unsecured debentures rating from “A” to “A+” and revised Toronto Hydro’s issuer rating outlook from “positive” to “stable.”

On Nov. 12, the OEB issued a decision in relation to Toronto Hydro’s 2025–2029 Custom Incentive Rate-setting Application, in which it approved the Settlement Proposal as filed, and provided for a process through which the OEB can finalize the electricity distribution rates for the first year of the five-year rate period effective Jan. 1, 2025. The OEB decision approves a custom incentive rate-setting index for the period commencing on Jan. 1, 2026 and ending on Dec. 31, 2029.

On Nov. 20, Toronto Hydro’s Board of Directors declared a dividend in the amount of $20.9 million with respect to the fourth quarter of 2024, which is payable to the City of Toronto by Dec. 31, 2024.

QUICK FACTS

- Toronto Hydro’s financial and operational results are reported quarterly and available at torontohydro.com/reports and through sedarplus.ca

- Toronto Hydro is required to submit a plan for its proposed rates and spending to the OEB through an open and transparent process known as a rate application

- Toronto Hydro continues to invest in its grid to maintain safety and reliability, support a growing city, enable clean energy, and prepare for and respond to extreme weather. For more information about Toronto Hydro’s next five-year plan, please visit torontohydro.com/investmentplan

QUOTE

“Toronto Hydro remains committed to providing safe and reliable electricity to the many homes and businesses of Toronto, while continuing to invest in expanding, modernizing and sustaining the grid and our operations to meet the current and future needs of our customers. The decision from the OEB this quarter on our 2025–2029 rate application and investment plan will help ensure that we can continue with this important work for years to come.”

– Jana Mosley, President and CEO, Toronto Hydro

ABOUT TORONTO HYDRO

Toronto Hydro is a holding company which wholly owns two subsidiaries:

- Toronto Hydro-Electric System Limited (THESL) – distributes electricity; and

- Toronto Hydro Energy Services Inc. – provides streetlighting and expressway lighting services in the city of Toronto

The principal business of Toronto Hydro and its subsidiaries is the distribution of electricity by THESL, which owns and operates the electricity distribution system for Canada’s largest city. Recognized as a Sustainable Electricity Leader™ by Electricity Canada, it has approximately 794,000 customers located in the city of Toronto and distributes approximately 18 per cent of the electricity consumed in Ontario.

SOCIAL MEDIA ACCOUNTS

X: x.com/torontohydro

Instagram: instagram.com/torontohydro

Facebook: facebook.com/torontohydro

YouTube: youtube.com/torontohydro

LinkedIn: linkedin.com/company/toronto-hydro

FORWARD-LOOKING INFORMATION

Certain information included in this news release constitutes “forward-looking information” within the meaning of applicable securities legislation. All information, other than statements of historical fact, which address activities, events or developments that we expect or anticipate may or will occur in the future, are forward-looking information. The words “anticipates,” “believes,” “budgets,” “can,” “committed,” “continual,” “could,” “estimates,” “expects,” “focus,” “forecasts,” “further notice,” “future,” “impact,” “increasingly,” “intends,” “may,” “might,” “objective,” “once,” “ongoing,” “outlook,” “plans,” “propose,” “projects,” “schedule,” “seek,” “should,” “trend,” “will,” “would,” or the negative or other variations of these words or other comparable words or phrases, are intended to identify forward-looking information, although not all forward-looking information contains these identifying words. The purpose of the forward-looking information (including any financial outlook) contained herein is to provide Toronto Hydro’s current expectations regarding its future results of operations, performance, business prospects and opportunities, and readers are cautioned that such information may not be appropriate for other purposes. All forward-looking information is given pursuant to the “safe harbour” provisions of applicable Canadian securities legislation.

Specific forward-looking information in this news release includes, but is not limited to, statements regarding the payment of dividends to the City of Toronto as shareholder.

The forward-looking information reflects Toronto Hydro’s current beliefs and is based on information currently available to Toronto Hydro. The forward-looking information is based on estimates and assumptions made by Toronto Hydro’s management in light of past experience and perception of historical trends, current conditions and expected future developments, as well as other factors that management believes to be reasonable in the circumstances, including, but not limited to: the amount of indebtedness of Toronto Hydro; changes in funding requirements; the future course of the economy and financial markets; no unforeseen delays and costs in Toronto Hydro’s capital projects; no unforeseen changes to project plans; compliance with covenants; the receipt of favourable judgments; no unforeseen changes in electricity distribution rate orders or rate-setting methodologies; no unfavourable changes in environmental regulation; the ratings issued by credit rating agencies; the level of interest rates; Toronto Hydro’s ability to borrow; and assumptions regarding general business and economic conditions.

Forward-looking information is subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or results anticipated by the forward-looking information. The factors which could cause results or events to differ from current expectations include, but are not limited to: risks associated with the execution of Toronto Hydro’s capital and maintenance programs necessary to maintain the performance of aging distribution assets and make required infrastructure improvements, including to deliver a modernized grid and meet electrification requirements to achieve government net-zero greenhouse gas (GHG) emissions targets; risks associated with capital projects; risks associated with changing weather patterns due to climate change and resultant impacts to electricity consumption based on historical seasonal trends; risks of changing government policy and regulatory requirements, including in respect of climate change and the energy transition; risks of municipal government activity, including the risk that the City could introduce rules, policies or directives, including those relating to net-zero GHG emissions targets, that could potentially limit Toronto Hydro’s ability to meet its business objectives as laid out in its Shareholder Direction principles; risks of Toronto Hydro being unable to retain necessary qualified external contracting forces relating to its capital, maintenance and reactive infrastructure program; risk that Toronto Hydro is not able to arrange sufficient and cost-effective debt financing to repay maturing debt and to fund capital expenditures and other obligations; risk that Toronto Hydro is unable to maintain its financial health and performance at acceptable levels; risk that insufficient debt or equity financing will be available to meet Toronto Hydro’s requirements, objectives or strategic opportunities; risk of downgrades to Toronto Hydro’s credit rating; risks related to the timing and extent of changes in prevailing interest rates and discount rates and their effect on future revenue requirements and future post-employment benefit obligations; risks arising from inflation, the course of the economy and other general macroeconomic factors; risk associated with the impairment to Toronto Hydro’s image in the community, public confidence or brand; risk associated with Toronto Hydro failing to meet its material compliance obligations under legal and regulatory instruments; and risks associated with market expectations with respect to increases in demand for electricity.

The Corporation cautions the reader that the above list of factors is not exhaustive, and there may be other factors that cause actual events or results to differ materially from those described in forward-looking information. Some of the other factors are discussed more fully under the heading “Risk Factors” in Toronto Hydro’s Annual Information Form for the year ended December 31, 2023.

All forward-looking information in this document is qualified in its entirety by the above cautionary statements. Furthermore, unless otherwise stated, all forward-looking information contained herein is made as of the date hereof, and Toronto Hydro undertakes no obligation to revise or update any forward-looking information as a result of new information, future events or otherwise, except as required by law.

SOURCE Toronto Hydro Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/20/c4150.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/20/c4150.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Wayfair: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bullish move on Wayfair. Our analysis of options history for Wayfair W revealed 12 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $498,510, and 9 were calls, valued at $470,319.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $130.0 for Wayfair during the past quarter.

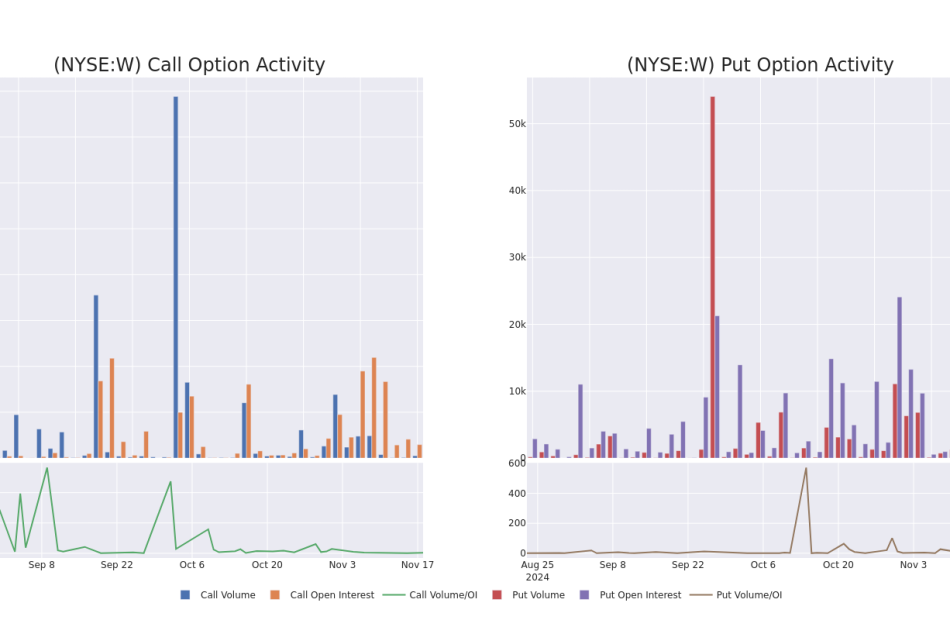

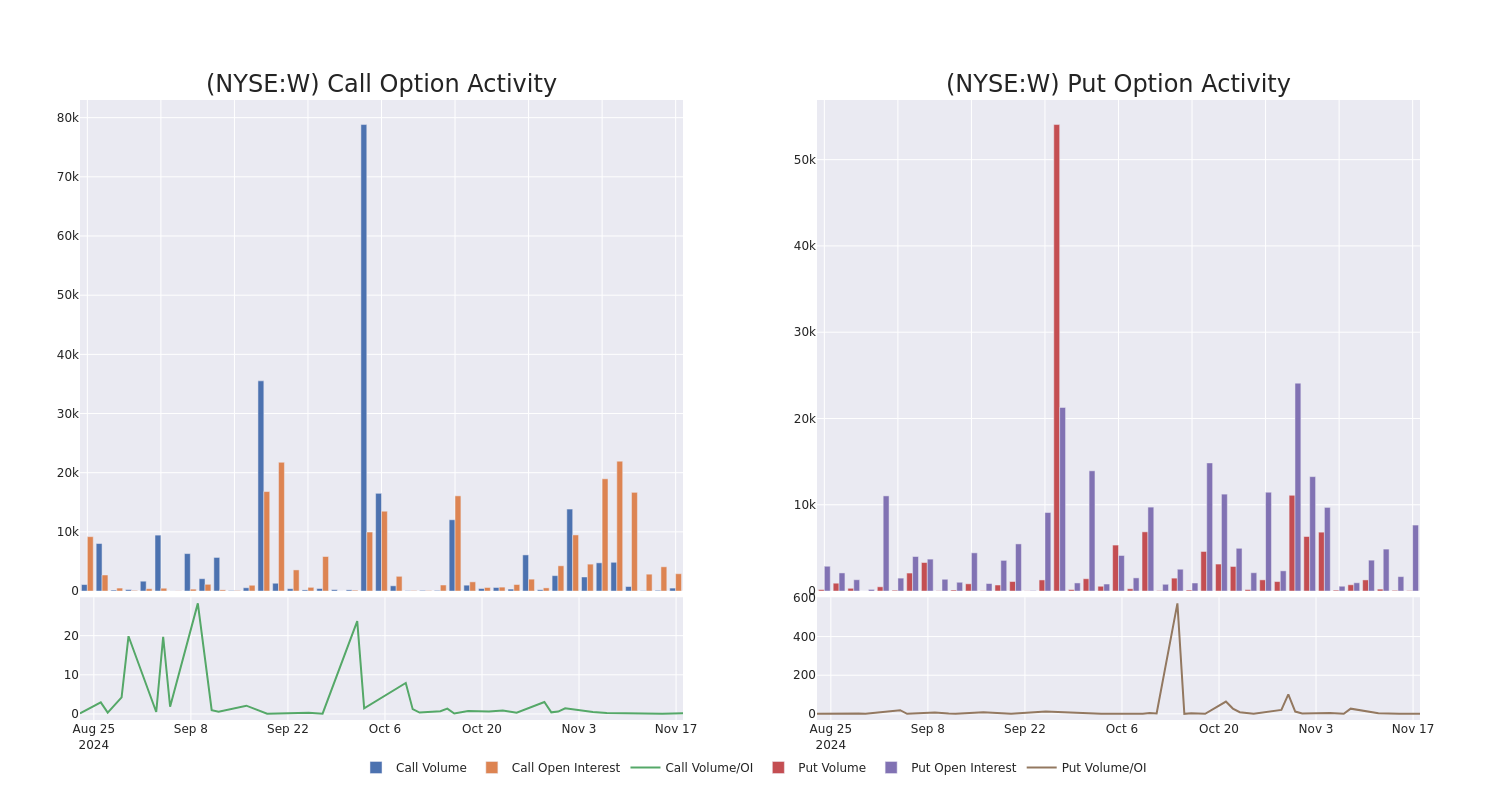

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Wayfair’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Wayfair’s significant trades, within a strike price range of $25.0 to $130.0, over the past month.

Wayfair Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| W | PUT | TRADE | BULLISH | 12/19/25 | $3.15 | $2.88 | $2.9 | $25.00 | $292.6K | 2.9K | 1.0K |

| W | PUT | SWEEP | BEARISH | 12/06/24 | $8.0 | $7.85 | $8.0 | $50.00 | $180.0K | 305 | 225 |

| W | CALL | TRADE | NEUTRAL | 12/19/25 | $1.49 | $1.28 | $1.4 | $130.00 | $140.0K | 1.2K | 1.0K |

| W | CALL | TRADE | BEARISH | 01/17/25 | $1.86 | $1.78 | $1.78 | $50.00 | $58.0K | 2.6K | 1.1K |

| W | CALL | TRADE | NEUTRAL | 05/16/25 | $8.65 | $8.35 | $8.52 | $42.50 | $51.9K | 97 | 61 |

About Wayfair

Wayfair engages in e-commerce in the United States (87% of 2023 sales), Canada, the United Kingdom, Germany, and Ireland. It’s also embarked on expansion into the brick-and-mortar landscape, with a handful of stores between the AllModern, Birch Lane, Joss & Main, and Wayfair banners. At the end of 2023, the firm offered more than 30 million products from more than 20,000 suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Its offerings include furniture, everyday and seasonal decor, decorative accents, housewares, and other home goods. Wayfair was founded in 2002 and began trading publicly in 2014.

In light of the recent options history for Wayfair, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Wayfair Standing Right Now?

- With a trading volume of 2,701,071, the price of W is up by 4.21%, reaching $42.47.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 92 days from now.

What The Experts Say On Wayfair

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $55.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Mizuho continues to hold a Outperform rating for Wayfair, targeting a price of $60.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Wayfair with a target price of $54.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Wayfair, targeting a price of $63.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Wayfair with a target price of $50.

* An analyst from BMO Capital persists with their Market Perform rating on Wayfair, maintaining a target price of $50.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wayfair options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On JD.com

Investors with a lot of money to spend have taken a bearish stance on JD.com JD.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with JD, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 20 uncommon options trades for JD.com.

This isn’t normal.

The overall sentiment of these big-money traders is split between 40% bullish and 45%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $550,850, and 15 are calls, for a total amount of $2,486,931.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $28.0 to $70.0 for JD.com over the recent three months.

Volume & Open Interest Development

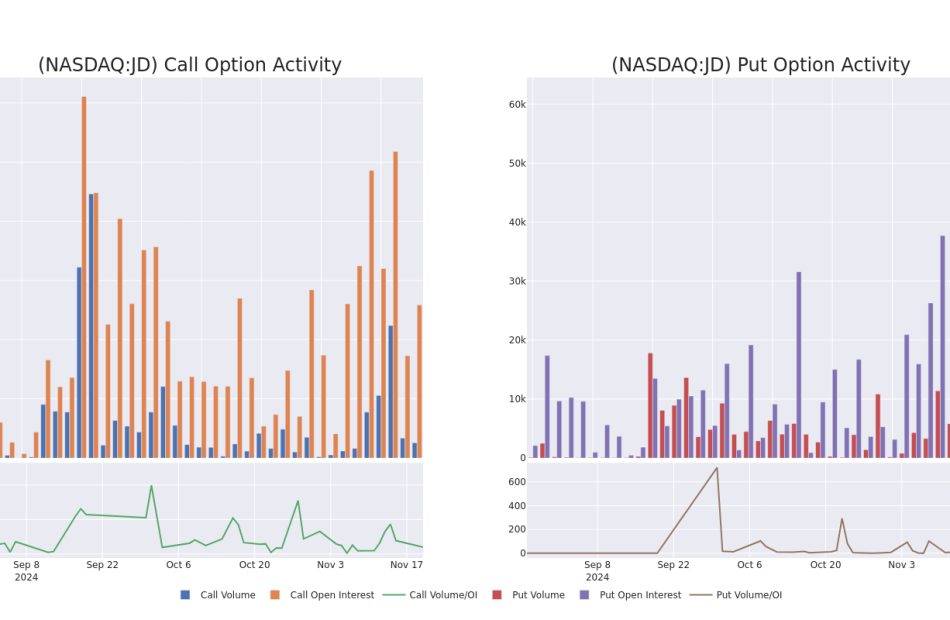

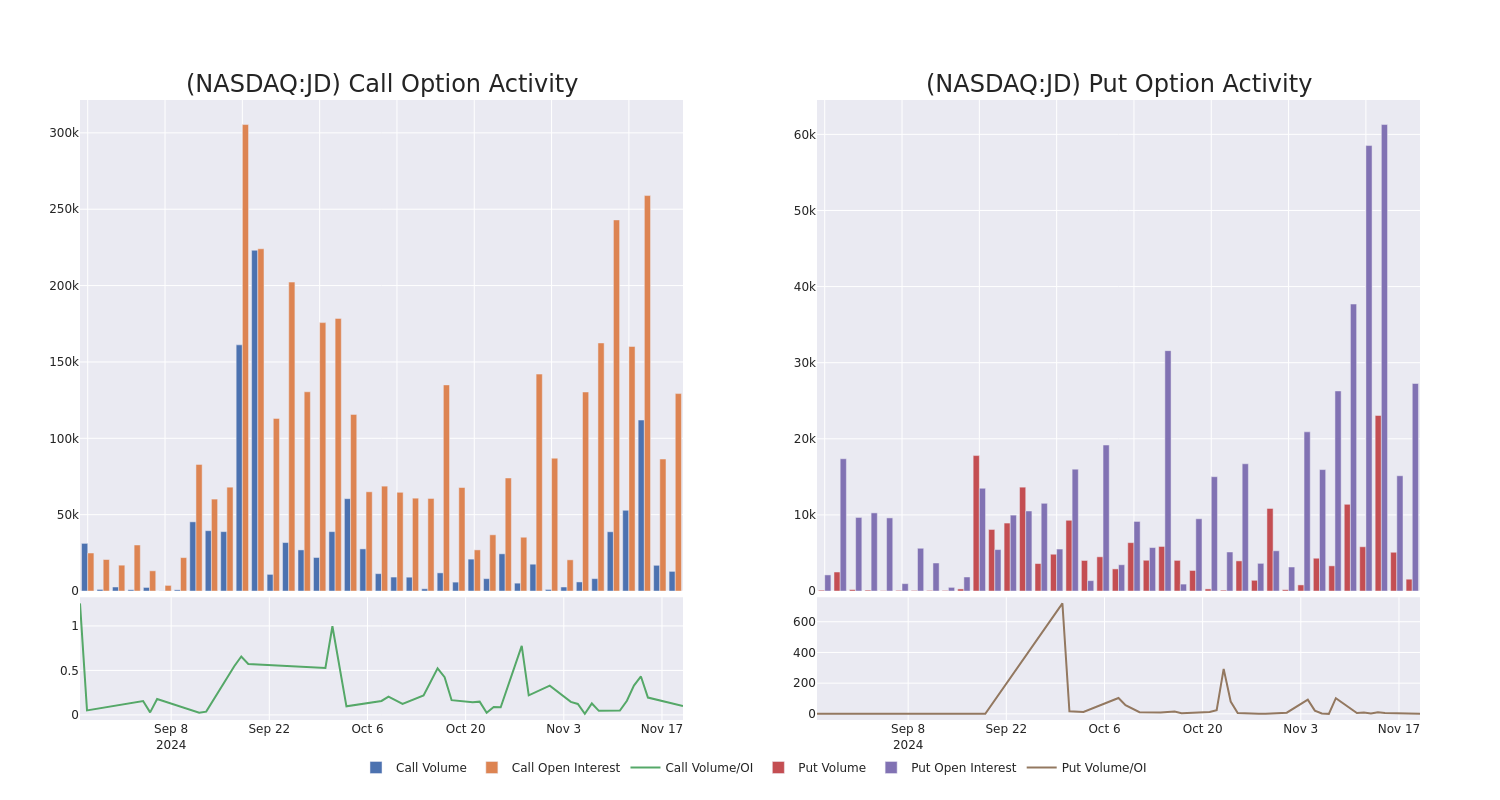

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in JD.com’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to JD.com’s substantial trades, within a strike price spectrum from $28.0 to $70.0 over the preceding 30 days.

JD.com Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | TRADE | BULLISH | 03/21/25 | $2.53 | $2.47 | $2.51 | $39.00 | $815.7K | 528 | 0 |

| JD | CALL | SWEEP | NEUTRAL | 01/17/25 | $5.85 | $5.75 | $5.75 | $30.00 | $287.5K | 25.1K | 1.5K |

| JD | CALL | TRADE | BULLISH | 01/17/25 | $5.75 | $5.7 | $5.75 | $30.00 | $287.5K | 25.1K | 1.0K |

| JD | CALL | SWEEP | BULLISH | 01/17/25 | $5.75 | $5.7 | $5.75 | $30.00 | $287.5K | 25.1K | 1.0K |

| JD | CALL | SWEEP | BEARISH | 01/17/25 | $5.8 | $5.75 | $5.75 | $30.00 | $287.5K | 25.1K | 504 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

In light of the recent options history for JD.com, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is JD.com Standing Right Now?

- With a trading volume of 5,083,311, the price of JD is down by -0.26%, reaching $35.1.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 105 days from now.

What Analysts Are Saying About JD.com

In the last month, 2 experts released ratings on this stock with an average target price of $49.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $47.

* An analyst from Citigroup persists with their Buy rating on JD.com, maintaining a target price of $51.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JD.com options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MicroStrategy Stock Surges Further as Big Bitcoin Buys Pay Off

CFOTO / Future Publishing via Getty Images

-

MicroStrategy shares surged again Wednesday, lifted by bitcoin’s recent record-high.

-

The technology company is the largest corporate holder of bitcoin, with about $31 billion worth in its portfolio.

-

MicroStrategy stock is up nearly 700% this year, even outperforming bitcoin itself.

MicroStrategy (MSTR) shares rocketed higher again Wednesday, as the largest corporate holder of bitcoin reaps the benefits of record high prices for the cryptocurrency.

The price of bitcoin hit a record of more than $94,000 on Tuesday, and MicroStrategy has been buying a ton of it. Over a six-day span earlier this month, the technology company acquired 51,780 bitcoin for roughly $4.6 billion, according to a recent regulatory filing, even with some prices already having crossed the $90,000 threshold.

All told, as of Sunday MicroStrategy held 331,200 bitcoin, which is worth about $31 billion at current prices. In fact, its shares have outperformed bitcoin this year, soaring nearly 700% this year as bitcoin has a bit more than doubled. Its stock, which has doubled this month, surged a further 15% to $495.98 in recent trading.

Notably, MicroStrategy still holds far less than the 474,627 bitcoin held as of yesterday by BlackRock’s iShares Bitcoin Trust (IBIT), which is the largest bitcoin exchange-traded fund (ETF).

Donald Trump Reportedly Eyeing The First Crypto-Focused Role In The White House

President-elect Donald Trump’s transition team is considering creating the first-ever White House role dedicated to cryptocurrency policy, signaling a potential shift in the U.S. government’s approach to digital assets.

What Happened: The Trump transition team is evaluating candidates for a role that would act as a bridge between the White House, Congress, and regulatory agencies like the SEC and CFTC.

Bloomberg reported on Wednesday that while the exact nature of the position remains unclear, industry advocates are pushing for direct access to Trump.

The creation of this position aligns with Trump’s campaign promises to overhaul crypto regulation, including replacing SEC Chair Gary Gensler and forming a new crypto advisory council.

Key industry players are already vying for influence.

Brian Brooks, a former executive at Coinbase and Binance.US, met with Trump at Mar-a-Lago, while Coinbase CEO Brian Armstrong reportedly held discussions with the president-elect this week.

Also Read: A Hedge Fund Hit Big On Trump’s Rumored Crypto Acquisition And Could Be Up $14.15 Million

Why It Matters: Trump’s connection to the crypto industry runs deep.

During his campaign, he promised substantial reforms and frequently engaged with Bitcoin mining firms and exchange executives.

In July, he even addressed a Bitcoin conference, further solidifying his interest in the sector by stating he will U.S. the crypto capital of the planet.

Beyond policy, Trump has made personal forays into the crypto space, including the release of his fourth NFT collection.

His media venture, Trump Media & Technology Group, has also expressed interest in acquiring Bakkt Holdings, a company specializing in crypto custody and trading.

Meanwhile, private equity billionaire Marc Rowan, a potential Treasury Secretary pick, admitted limited expertise in crypto’s role within the U.S. financial system, indicating the potential significance of a dedicated crypto-focused role.

Read Next:

Image: Shuterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DoubleTree by Hilton Greensboro Airport Celebrates Grand Reopening with Ribbon-Cutting Event After Extensive Renovations

GREENSBORO, N.C., Nov. 20, 2024 /PRNewswire/ — DoubleTree by Hilton Greensboro Airport successfully held its grand opening and ribbon-cutting ceremony, celebrating the completion of extensive renovations to the property. The event welcomed local dignitaries, business leaders, members of the Greensboro Chamber of Commerce, Visit Greensboro, and members of the community to experience the revitalized spaces. The hotel is managed by Commonwealth Hotels, a Covington, Kentucky-based hotel management company, and owned by SMP Greensboro LLC which is a part of the Scale My Portfolio group which partners with retail investors to buy Commercial real estate assets such as hotels and Apartment communities around the country.

Located just minutes from Piedmont Triad International Airport, DoubleTree by Hilton Greensboro Airport has served as a prominent hospitality venue in Greensboro. The newly updated property now combines DoubleTree brand’s signature comfort with modern design and enhanced amenities, meeting the needs of today’s travelers.

Renovations included newly designed guestrooms, modernized lobby and public spaces, refreshed dining options, and enhanced meeting and event spaces.

Guests at the event had the opportunity to tour the renovated spaces, meet with the hotel’s management team, and enjoy light refreshments. A memorable photograph was taken as local leaders and hotel representatives participated in the ceremonial ribbon cutting.

“We are thrilled to welcome guests to see our transformed property and experience our commitment to excellence firsthand,” said Jennifer Porter, president of Commonwealth Hotels. “These renovations reflect our dedication to providing the highest quality of service and comfort to all who stay with us.”

With these renovations, DoubleTree by Hilton Greensboro Airport remains a top choice for travelers to Greensboro, offering all the signature touches of the brand, including its iconic warm chocolate chip cookie at check-in.

For more information about the DoubleTree by Hilton Greensboro Airport or to book your stay, please visit DoubleTree by Hilton Greensboro Airport or call 336-668-0421.

About Commonwealth Hotels

Commonwealth Hotels was founded in 1986 and is a proven partner in providing hotel management services with superior financial results. The company has extensive experience managing premium branded full-service and select-service hotels. Additional information may be found at commonwealthhotels.com

About Scale My Portfolio

Scale My Portfolio has been involved in over $400mm of Commercial Real Estate transactions across 16 properties over the past 10+ years. The company has over 650 investors who it partners with to invest in assets such as hotels and apartment communities and it offers investors above average returns for investing passively in these assets. Additional Information can be found at www.ScaleMyPortfolio.com

Contact

Barbara E. Willen

Commonwealth Hotels, LLC

bwillen@commonwealthhotels.com

859.392-2254

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/doubletree-by-hilton-greensboro-airport-celebrates-grand-reopening-with-ribbon-cutting-event-after-extensive-renovations-302311974.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/doubletree-by-hilton-greensboro-airport-celebrates-grand-reopening-with-ribbon-cutting-event-after-extensive-renovations-302311974.html

SOURCE Commonwealth Hotels, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Broadcom (AVGO) Stock?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

As NVIDIA Corp prepares to release its highly anticipated earnings report Wednesday evening, investors are watching closely for the potential ripple effects on the broader market—and particularly on peer stocks like Broadcom Inc (NASDAQ:AVGO).

What To Know: Nvidia’s dominance in AI-driven technology and its pivotal role in the S&P 500’s performance make its results a market-moving event, with implications for key players in the semiconductor industry.

Broadcom, like Nvidia, has leveraged the surging demand for AI infrastructure. It supplies high-performance networking chips and custom silicon that power data centers—critical components for Nvidia’s AI-focused operations.

Don’t Miss:

A strong earnings beat from Nvidia could reinforce investor confidence in AI growth prospects, lifting sentiment around Broadcom as a beneficiary of the same demand drivers. Conversely, a disappointing Nvidia report could signal a slowdown in AI investments, weighing on Broadcom’s outlook.

Historically, Broadcom’s stock has moved in tandem with Nvidia’s during major market reactions. Nvidia’s implied one-day move of 12.5% adds volatility to the semiconductor sector, underscoring the high stakes.

By now you’re likely curious about how to participate in the market for Broadcom – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy ‘fractional shares,’ which allows you to own portions of stock without buying an entire share. For example, some stock, like Berkshire Hathaway, can cost thousands of dollars to own just one share. However, if you only want to invest a fraction of that, brokerages will allow you to do so.

If you’re looking to bet against a company, the process is more complex. You’ll need access to an options trading platform, or a broker who will allow you to ‘go short’ a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Smart Money Move: Michael J Roper Grabs $149K Worth Of Sadot Group Stock

A new SEC filing reveals that Michael J Roper, Chief Executive Officer at Sadot Group SDOT, made a notable insider purchase on November 20,.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Roper purchased 44,642 shares of Sadot Group. The total transaction amounted to $149,997.

The latest update on Wednesday morning shows Sadot Group shares up by 5.96%, trading at $3.2.

Delving into Sadot Group’s Background

Sadot Group Inc operates in the food supply chain sector, connecting producers and consumers across the globe, delivering agri-commodities from producing geographies such as the Americas, Africa, and the Black Sea to consumer markets in Southeast Asia, China, and the Middle East/North Africa (MENA) region. Its reportable segment includes Sadot food service and Sadot agri-foods. The key revenue is coming from the Sadot agri-foods segment which engaged in farming, commodity trading, and shipping of food and feed.

Financial Insights: Sadot Group

Revenue Growth: Sadot Group’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 10.74%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 1.22%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Sadot Group’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.25.

Debt Management: Sadot Group’s debt-to-equity ratio is below the industry average. With a ratio of 0.11, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 10.07 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.02 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 3.41, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Unlocking the Meaning of Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Sadot Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.