Partners Value Investments L.P. Announces Q3 2024 Interim Results

TORONTO, Nov. 18, 2024 (GLOBE NEWSWIRE) — Partners Value Investments Inc. ((the “Company”, TSX:PVF, PVF.PR.V)) announced today its financial results for the nine months ended September 30, 2024. All amounts are stated in U.S. dollars.

The Company recorded net loss of $1.2 billion for the three months ended September 30, 2024, compared to a net income of $72.1 million in the prior year quarter. The decrease in income was primarily due to current period remeasurement losses of $1.1 billion associated with the retractable shares, compared to remeasurement gains of $35.0 million in the prior year quarter. The Company’s retractable common shares are classified as liabilities due to their cash retraction feature. The remeasurement gains or losses in a given period are driven by the respective appreciation or depreciation of the Partners Value Investments L.P. (the “Partnership”) unit price as the exchangeable shares are recognized at fair value based on the quoted price of the Partnership’s Equity LP units. During the quarter, the Partnership unit price increased by $15.57 compared to a decrease of $0.52 in the prior year quarter.

Excluding retractable share and warrant liability remeasurement gains and dividends paid on retractable shares, Adjusted Earnings for the Company was $17.1 million for the three months ended September 30, 2024, compared to Adjusted Earnings of $29.4 million in the prior year quarter. Adjusted Earnings were lower in the current quarter as a result of foreign currency losses, partially offset by investment valuation gains.

As at September 30, 2024, the market prices of a Brookfield Corporation ((the “Corporation”, TSX:BN) and Brookfield Asset Management Ltd. ((the “Manager”, TSX:BAM) share were $53.15 and $47.29, respectively. As at November 15, 2024, the market prices of a BN and BAM share were $56.79 and $55.77, respectively.

Consolidated Statements of Operations

| (Unaudited) (Thousands, US dollars) For the periods ended September 30 |

Three months ended | Nine months ended | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Investment income | |||||||||||||||

| Dividends | $ | 27,627 | $ | 24,120 | $ | 81,307 | $ | 71,984 | |||||||

| Other investment income | 4,645 | 2,862 | 12,840 | 8,297 | |||||||||||

| 32,272 | 26,982 | 94,147 | 80,281 | ||||||||||||

| Expenses | |||||||||||||||

| Operating expenses | (1,162 | ) | (1,398 | ) | (4,047 | ) | (2,240 | ) | |||||||

| Financing costs | (10,236 | ) | (8,399 | ) | (28,606 | ) | (25,112 | ) | |||||||

| Retractable preferred share dividends | (8,446 | ) | (8,855 | ) | (25,248 | ) | (26,495 | ) | |||||||

| 12,428 | 8,330 | 36,246 | 26,434 | ||||||||||||

| Other items | |||||||||||||||

| Investment valuation gains (losses) | 9,469 | (4,746 | ) | 10,836 | (6,732 | ) | |||||||||

| Remeasurement (losses) gains on retractable shares | (1,079,255 | ) | 35,036 | (1,198,295 | ) | 142,280 | |||||||||

| Warrant liability remeasurement (losses) gains | (114,498 | ) | 13,705 | (125,950 | ) | 38,284 | |||||||||

| Amortization of deferred financing costs | (873 | ) | (848 | ) | (2,628 | ) | (2,538 | ) | |||||||

| Current taxes (expense) recovery | (421 | ) | (286 | ) | 5,906 | (1,103 | ) | ||||||||

| Deferred taxes (expense) recovery | (3,349 | ) | 1,532 | (2,642 | ) | (3,061 | ) | ||||||||

| Foreign currency (losses) gains | (7,809 | ) | 19,423 | 11,524 | 269 | ||||||||||

| Net (loss) income | $ | (1,184,308 | ) | $ | 72,146 | $ | (1,265,003 | ) | $ | 193,833 | |||||

Financial Profile

The Company’s principal investments are its interest in 121 million Class A Limited Voting Shares of the Corporation and approximately 31 million Class A Limited Voting Shares of the Manager. This represents approximately an 8% interest in the Corporation and a 7% interest in the Manager as at September 30, 2024. In addition, the Company owns a diversified investment portfolio of marketable securities and private fund interests.

The information in the following table has been extracted from the Company’s Consolidated Statements of Financial Position:

Consolidated Statements of Financial Position

| (Unaudited) As at (Thousands, US dollars) |

September 30, 2024 |

December 31, 2023 |

|||||

| Assets | |||||||

| Cash and cash equivalents | $ | 157,740 | $ | 199,856 | |||

| Accounts receivable and other assets | 47,781 | 31,456 | |||||

| Deferred tax assets | — | 4,309 | |||||

| Investment in Brookfield Corporation1 | 6,429,443 | 4,853,261 | |||||

| Investment in Brookfield Asset Management Ltd.2 | 1,456,905 | 1,237,554 | |||||

| Other investments carried at fair value | 1,115,777 | 889,398 | |||||

| $ | 9,207,646 | $ | 7,215,834 | ||||

| Liabilities and equity | |||||||

| Accounts payable and other liabilities | $ | 21,547 | $ | 34,916 | |||

| Corporate borrowings | 221,317 | 225,789 | |||||

| Preferred shares3 | 742,580 | 757,254 | |||||

| Retractable common shares | 4,918,113 | 3,718,510 | |||||

| Warrant liability | 339,774 | 218,051 | |||||

| Deferred tax liabilities | 2,969 | — | |||||

| 6,246,300 | 4,954,520 | ||||||

| Equity | |||||||

| Accumulated deficit | (4,299,016 | ) | (3,034,013 | ) | |||

| Accumulated other comprehensive income | 7,248,382 | 5,283,347 | |||||

| Non-controlling interest | 11,980 | 11,980 | |||||

| $ | 9,207,646 | $ | 7,215,834 | ||||

- The investment in Brookfield Corporation consists of 121 million Corporation shares with a quoted market value of $53.15 per share as at September 30, 2024 (December 31, 2023 – $40.12).

- The investment in Brookfield Asset Management Ltd. consists of 31 million Manager shares with a quoted market value of $47.29 per share as at September 30, 2024 (December 31, 2023 – $40.17).

- Represents $753 million of retractable preferred shares less $10 million of unamortized issue costs as at September 30, 2024 (December 31, 2023 – $767 million less $10 million).

For further information, contact Investor Relations at ir@pvii.ca.

Note: This news release contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of applicable Canadian securities regulations. The words “potential” and “estimated” and other expressions which are predictions of or indicate future events, trends or prospects and which do not relate to historical matters, identify forward-looking information.

Although the Company believes that its anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond its control, which may cause the actual results, performance or achievements of the Company to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward‐looking statements and information include, but are not limited to: the financial performance of Brookfield Corporation, the impact or unanticipated impact of general economic, political and market factors; the behavior of financial markets, including fluctuations in interest and foreign exchanges rates; limitations on the liquidity of our investments; global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; strategic actions including dispositions; changes in accounting policies and methods used to report financial condition (including uncertainties associated with critical accounting assumptions and estimates); the effect of applying future accounting changes; business competition; operational and reputational risks; technological change; changes in government regulation and legislation; changes in tax laws; risks associated with the use of financial leverage; catastrophic events, such as earthquakes and hurricanes; the possible impact of international conflicts and other developments including terrorist acts; and other risks and factors detailed from time to time in the Company’s documents filed with the securities regulators in Canada.

The Company cautions that the foregoing list of important factors that may affect future results is not exhaustive. When relying on the Company’s forward-looking statements and information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statements and information, whether written or oral, that may be as a result of new information, future events or otherwise.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Freeport-McMoRan: Analyzing the Surge in Options Activity

Benzinga’s options scanner just detected over 30 options trades for Freeport-McMoRan FCX summing a total amount of $2,124,128.

At the same time, our algo caught 7 for a total amount of 381,224.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $33.0 and $55.0 for Freeport-McMoRan, spanning the last three months.

Volume & Open Interest Trends

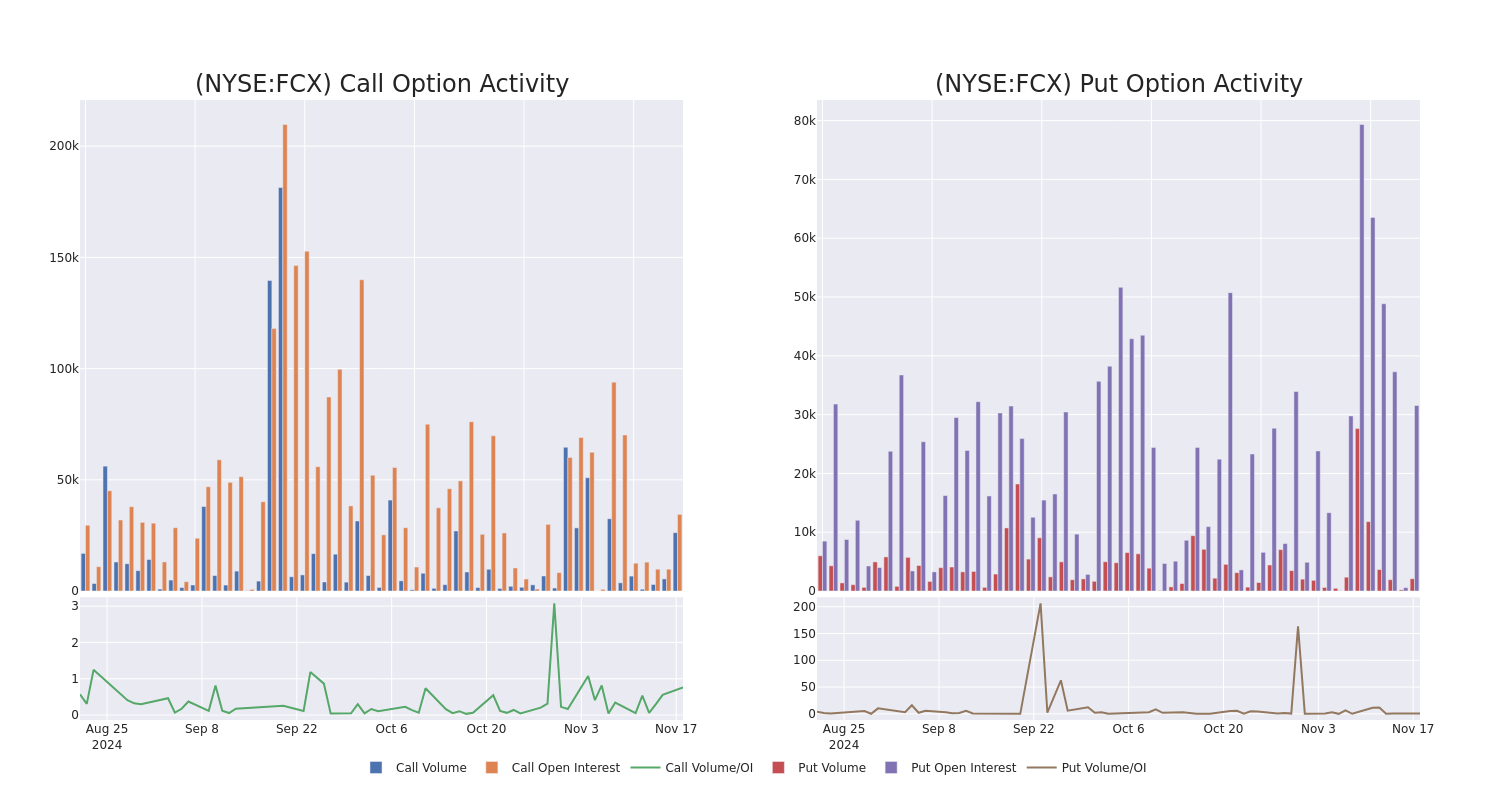

In today’s trading context, the average open interest for options of Freeport-McMoRan stands at 3474.58, with a total volume reaching 28,080.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Freeport-McMoRan, situated within the strike price corridor from $33.0 to $55.0, throughout the last 30 days.

Freeport-McMoRan 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | CALL | SWEEP | BULLISH | 05/16/25 | $3.95 | $3.9 | $3.94 | $45.00 | $338.1K | 351 | 876 |

| FCX | CALL | SWEEP | BULLISH | 01/17/25 | $1.62 | $1.61 | $1.62 | $46.00 | $157.9K | 4.0K | 2.2K |

| FCX | PUT | TRADE | BULLISH | 12/20/24 | $1.36 | $1.31 | $1.32 | $42.00 | $132.0K | 8.4K | 1.0K |

| FCX | CALL | SWEEP | BULLISH | 12/20/24 | $1.8 | $1.78 | $1.79 | $44.00 | $118.2K | 3.6K | 745 |

| FCX | CALL | SWEEP | BULLISH | 03/21/25 | $3.15 | $3.05 | $3.15 | $45.00 | $108.0K | 3.7K | 577 |

About Freeport-McMoRan

Freeport-McMoRan Inc is an international mining company. It has organized its mining operations into four primary divisions: North America copper mines, South America mining, Indonesia mining and Molybdenum mines. Its reportable segments include the Morenci, Cerro Verde and Grasberg (Indonesia mining) copper mines, the Rod & Refining operations and Atlantic Copper Smelting and Refining. It derives key revenue from the sale of Copper.

Following our analysis of the options activities associated with Freeport-McMoRan, we pivot to a closer look at the company’s own performance.

Freeport-McMoRan’s Current Market Status

- With a trading volume of 7,082,008, the price of FCX is up by 1.81%, reaching $43.48.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 65 days from now.

What Analysts Are Saying About Freeport-McMoRan

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $54.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Perform rating for Freeport-McMoRan, targeting a price of $52.

* An analyst from Raymond James persists with their Outperform rating on Freeport-McMoRan, maintaining a target price of $57.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Freeport-McMoRan, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FinVolution Group Reports Third Quarter 2024 Unaudited Financial Results

-Third Quarter Total Transaction Volume reached RMB52.2 billion, up 1.8% year-over-year-

-Third Quarter International Transaction Volume reached RMB2.7 billion, up 22.7% year-over-year-

-Third Quarter International Revenues increased to RMB635.5 million, up 8.7% year-over-year, contributing 19.4% of total net revenues–

SHANGHAI, Nov. 18, 2024 /PRNewswire/ — FinVolution Group (“FinVolution” or the “Company”) FINV, a leading fintech platform in China, Indonesia and the Philippines, today announced its unaudited financial results for the third quarter ended September 30, 2024.

|

For the Three Months Ended/As of |

YoY Change |

||

|

September 30, |

September 30, |

||

|

Total Transaction Volume (RMB in billions)[1] |

51.3 |

52.2 |

1.8 % |

|

Transaction Volume (China’s Mainland)[2] |

49.1 |

49.5 |

0.8 % |

|

Transaction Volume (International)[3] |

2.2 |

2.7 |

22.7 % |

|

Total Outstanding Loan Balance (RMB in billions) |

65.9 |

68.1 |

3.3 % |

|

Outstanding Loan Balance (China’s Mainland)[4] |

64.6 |

66.5 |

2.9 % |

|

Outstanding Loan Balance (International)[5] |

1.3 |

1.6 |

23.1 % |

Third Quarter 2024 China Market Operational Highlights

- Cumulative registered users[6] reached 166.8 million as of September 30, 2024, an increase of 9.3% compared with September 30, 2023.

- Cumulative borrowers[7] reached 26.3 million as of September 30, 2024, an increase of 6.0% compared with September 30, 2023.

- Number of unique borrowers[8] for the third quarter of 2024 was 2.0 million, a decrease of 13.0% compared with the same period of 2023.

- Transaction volume[2] reached RMB49.5 billion for the third quarter of 2024, an increase of 0.8% compared with the same period of 2023.

- Transaction volume facilitated for repeat individual borrowers[9] for the third quarter of 2024 was RMB43.0 billion, an increase of 1.4% compared with the same period of 2023.

- Outstanding loan balance[4] reached RMB66.5 billion as of September 30, 2024, an increase of 2.9% compared with September 30, 2023.

- Average loan size[10] was RMB10,066 for the third quarter of 2024, compared with RMB8,505 for the same period of 2023.

- Average loan tenure[11] was 8.0 months for the third quarter of 2024, compared with 8.2 months for the same period of 2023.

- 90 day+ delinquency ratio[12] was 2.50% as of September 30, 2024, compared with 1.67% as of September 30, 2023.

Third Quarter 2024 International Market Operational Highlights

- Cumulative registered users[13] reached 32.4 million as of September 30, 2024, an increase of 44.0% compared with September 30, 2023.

- Cumulative borrowers[14] for the international market reached 6.3 million as of September 30, 2024, an increase of 43.2% compared with September 30, 2023.

- Number of unique borrowers[15] for the third quarter of 2024 was 1.4 million, an increase of 50.5% compared with the same period of 2023.

- Number of new borrowers[16] for the third quarter of 2024 was 0.67 million, an increase of 59.5% compared with the same period of 2023.

- Transaction volume[3] reached RMB2.7 billion for the third quarter of 2024, an increase of 22.7% compared with the same period of 2023.

- Outstanding loan balance[5] reached RMB1.6 billion as of September 30, 2024, an increase of 23.1% compared with September 30, 2023.

- International business revenue was RMB635.5 million (US$90.6 million) for the third quarter of 2024, an increase of 8.7% compared with the same period of 2023, representing 19.4% of total revenue for the third quarter of 2024.

Third Quarter 2024 Financial Highlights

- Net revenue was RMB3,276.1 million (US$466.8 million) for the third quarter of 2024, compared with RMB3,197.5 million for the same period of 2023.

- Net profit was RMB624.1 million (US$88.9 million) for the third quarter of 2024, compared with RMB574.7 million for the same period of 2023.

- Non-GAAP adjusted operating income,[17] which excludes share-based compensation expenses before tax, was RMB599.8 million (US$85.5 million) for the third quarter of 2024, compared with RMB583.8 million for the same period of 2023.

- Diluted net profit per American depositary share (“ADS”) was RMB2.40 (US$0.34) and diluted net profit per share was RMB0.48 (US$0.07) for the third quarter of 2024, compared with RMB2.05 and RMB0.41 for the same period of 2023 respectively.

- Non-GAAP diluted net profit per ADS was RMB2.55 (US$0.36) and non-GAAP diluted net profit per share was RMB0.51 (US$0.07) for the third quarter of 2024, compared with RMB2.16 and RMB0.43 for the same period of 2023 respectively. Each ADS of the Company represents five Class A ordinary shares of the Company.

|

[1] Represents the total transaction volume facilitated in China’s Mainland and the international markets on the Company’s platforms during the period presented. |

|

[2] Represents our transaction volume facilitated in China’s Mainland during the period presented. During the third quarter, RMB14.6 billion were facilitated under the capital-light model, for which the Company does not bear principal risk. |

|

[3] Represents our transaction volume facilitated in markets outside China’s Mainland during the period presented. |

|

[4] Outstanding loan balance (China’s Mainland) as of any date refers to the balance of outstanding loans in China’s Mainland market excluding loans delinquent for more than 180 days from such date. As of September 30, 2024, RMB21.4 billion were facilitated under the capital-light model, for which the Company does not bear principal risk. |

|

[5] Outstanding loan balance (international) as of any date refers to the balance of outstanding loans in the international markets excluding loans delinquent for more than 30 days from such date. |

|

[6] On a cumulative basis, the total number of users in China’s Mainland market registered on the Company’s platform as of September 30, 2024. |

|

[7] On a cumulative basis, the total number of borrowers in China’s Mainland market registered on the Company’s platform as of September 30, 2024. |

|

[8] Represents the total number of borrowers in China’s Mainland who have successfully borrowed on the Company’s platform during the period presented. |

|

[9] Represents the transaction volume facilitated for repeat borrowers in China’s Mainland who successfully completed a transaction on the Company’s platform during the period presented. |

|

[10] Represents the average loan size on the Company’s platform in China’s Mainland during the period presented. |

|

[11] Represents the average loan tenor on the Company’s platform in China’s Mainland during the period presented. |

|

[12] “90 day+ delinquency ratio” refers to the outstanding principal balance of loans, excluding loans facilitated under the capital-light model, that were 90 to 179 calendar days past due as a percentage of the total outstanding principal balance of loans, excluding loans facilitated under the capital-light model on the Company’s platform as of a specific date. Loans that originated outside China’s Mainland are not included in the calculation. |

|

[13] On a cumulative basis, the total number of users registered on the Company’s platforms outside China’s Mainland market, as of September 30, 2024. |

|

[14] On a cumulative basis, the total number of borrowers on the Company’s platforms outside China’s Mainland market, as of September 30, 2024. |

|

[15] Represents the total number of borrowers outside China’s Mainland who have successfully borrowed on the Company platforms during the period presented. |

|

[16] Represents the total number of new borrowers outside China’s Mainland whose transactions were facilitated on the Company’s platforms during the period presented. |

|

[17] Please refer to “UNAUDITED Reconciliation of GAAP And Non-GAAP Results” for reconciliation between GAAP and Non-GAAP adjusted operating income. |

Mr. Tiezheng Li, Chief Executive Officer of FinVolution, commented, “Through strong execution of our Local Excellence, Global Outlook strategy, we have cumulatively served 32.6 million borrowers across China, Indonesia and the Philippines as of the end of the third quarter. We continued to prioritize the acquisition of high-quality borrowers, once again driving the total number of new borrowers across all our platforms beyond the one million mark. Total transaction volume reached RMB52.2 billion, while total outstanding loan balance reached RMB68.1 billion, up 1.8% and 3.3% year-over-year, respectively.

“Our international markets continued to deliver faster growth with solid progress across numerous metrics. The number of new borrowers in the international markets surpassed the number of new borrowers in the China market for the second consecutive quarter, reaching 671 thousand, up 59.5% year-over-year. Also, the international market’s transaction volume and outstanding loan balances rose to RMB2.7 billion and RMB1.6 billion, up 22.7% and 23.1% year-over-year, respectively, validating our deep commitment to international expansion,” concluded Mr. Li.

Mr. Jiayuan Xu, FinVolution’s Chief Financial Officer, continued, “Our financial performance improved progressively with net revenues for the third quarter reaching RMB3,276.1 million (US$466.8 million), up 2.5% year-over-year. Contributions from international revenue grew further to RMB635.5 million (US$90.6 million), up 8.7% year-over-year, and accounted for 19.4% of total revenue. Our total liquidity position as of September 30, 2024 stood at RMB8,970.3 million (US$1,278.3 million), up 13.1% from December 31, 2023, reflecting our ability to deliver consistent growth across all our markets while strengthening our capital return program.

“As part of our commitment to consistently return value to shareholders through business growth and capital return, we deployed US$24.3 million in the third quarter of 2024 to repurchase our shares on the secondary market. For the first nine months of 2024, we deployed US$81.1 million to repurchase our shares on the secondary market, up 23.2% year-over-year. Cumulatively, we have returned a total of US$686.1 million to our shareholders through our capital return program since 2018, demonstrating our dedication to consistent and sustainable shareholder value creation,” concluded Mr. Xu.

Third Quarter 2024 Financial Results

Net revenue for the third quarter of 2024 was RMB3,276.1 million (US$466.8 million), compared with RMB3,197.5 million for the same period of 2023. This increase was primarily due to the increase in loan facilitation service fees, guarantee income and other revenue.

Loan facilitation service fees was RMB1,253.1 million (US$178.6 million) for the third quarter of 2024, compared with RMB1,129.8 million for the same period of 2023. The increase was primarily due to the increase in the transaction volume.

Post-facilitation service fees was RMB425.3 million (US$60.6 million) for the third quarter of 2024, compared with RMB498.9 million for the same period of 2023. This decrease was primarily due to the rolling impact of deferred transaction fees in the China market.

Guarantee income was RMB1,234.8 million (US$176.0 million) for the third quarter of 2024, compared with RMB1,152.0 million for the same period of 2023. This increase was primarily due to the increased outstanding loan balance of off-balance sheet loans in the international market, as well as the rolling impact of deferred guarantee income. The fair value of quality assurance commitment upon loan origination is released as guarantee income systematically over the term of the loans subject to quality assurance commitment.

Net interest income was RMB185.7 million (US$26.5 million) for the third quarter of 2024, compared with RMB273.3 million for the same period of 2023.This decrease was primarily due to the decrease in the average outstanding loan balances of on-balance sheet loans in the international markets.

Other revenue was RMB177.1 million (US$25.2 million) for the third quarter of 2024, compared with RMB143.5 million for the same period of 2023. This increase was primarily due to the increase in the contributions from other revenue streams.

Origination, servicing expenses and other costs of revenue was RMB603.1 million (US$85.9 million) for the third quarter of 2024, compared with RMB520.0 million for the same period of 2023. This increase was primarily due to the increase in facilitation costs and loan collection expenses as a result of higher outstanding loan balances.

Sales and marketing expenses was RMB560.2 million (US$79.8 million) for the third quarter of 2024, compared with RMB530.1 million for the same period of 2023, as a result of our more proactive customer acquisition efforts focusing on quality borrowers in both China and the international markets.

Research and development expenses was RMB130.7 million (US$18.6 million) for the third quarter of 2024, compared with RMB132.6 million for the same period of 2023. This decrease was primarily due to our improvements in technology development efficiency.

General and administrative expenses was RMB116.8 million (US$16.6 million) for the third quarter of 2024, compared with RMB98.6 million for the same period of 2023. This increase was primarily due to the increased benefits we provided to our employees.

Provision for accounts receivable and contract assets was RMB99.0 million (US$14.1 million) for the third quarter of 2024, compared with RMB86.9 million for the same period of 2023. This increase was primarily due to the increase in transaction loan volume in both China and international markets.

Provision for loans receivable was RMB82.4 million (US$11.7 million) for the third quarter of 2024, compared with RMB176.8 million for the same period of 2023. This decrease was primarily due to the decrease in the loan volume and the outstanding loan balances of on-balance sheet loans in the international markets.

Credit losses for quality assurance commitment was RMB1,123.6 million (US$160.1 million) for the third quarter of 2024, compared with RMB1,099.2 million for the same period of 2023. The increase was primarily due to the increased outstanding loan balances of off-balance sheet loans in the international markets.

Operating profit was RMB560.2 million (US$79.8 million) for the third quarter of 2024, compared with RMB553.4 million for the same period of 2023.

Non-GAAP adjusted operating income, which excludes share-based compensation expenses before tax, was RMB599.8 million (US$85.5 million) for the third quarter of 2024, compared with RMB583.8 million for the same period of 2023.

Other income was RMB185.5 million (US$26.4 million) for the third quarter of 2024, compared with RMB124.4 million for the same period of 2023. The increase was mainly due to the increase in government subsidies.

Income tax expense was RMB121.7 million (US$17.3 million) for the third quarter of 2024, compared with RMB103.1 million for the same period of 2023. This increase was mainly due to the increase in pre-tax profit and the change in effective tax rate.

Net profit was RMB624.1 million (US$88.9 million) for the third quarter of 2024, compared with RMB574.7 million for the same period of 2023.

Net profit attributable to ordinary shareholders of the Company was RMB623.6 million (US$88.9 million) for the third quarter of 2024, compared with RMB566.0 million for the same period of 2023.

Diluted net profit per ADS was RMB2.40 (US$0.34) and diluted net profit per share was RMB0.48 (US$0.07) for the third quarter of 2024, compared with RMB2.05 and RMB0.41 for the same period of 2023 respectively.

Non-GAAP diluted net profit per ADS was RMB2.55 (US$0.36) and non-GAAP diluted net profit per share was RMB0.51 (US$0.07) for the third quarter of 2024, compared with RMB2.16 and RMB0.43 for the same period of 2023 respectively. Each ADS represents five Class A ordinary shares of the Company.

As of September 30, 2024, the Company had cash and cash equivalents of RMB5,104.3 million (US$727.4 million) and short-term investments, mainly in wealth management products and term deposits, of RMB3,866.0 million (US$550.9 million).

The following chart shows the historical cumulative 30-day plus past due delinquency rates by loan origination vintage for loan products facilitated through the Company’s platform in China’s Mainland as of September 30, 2024. Loans facilitated under the capital-light model, for which the Company does not bear principal risk, are excluded from the chart.

Click here to view the chart: https://mma.prnewswire.com/media/2560279/Picture1.jpg?p=publish

Shares Repurchase Update

For the third quarter of 2024, the Company deployed a total of US$24.3 million to repurchase its own Class A ordinary shares in the form of ADSs in the market. As of September 30, 2024, in combination with the Company’s historical and existing share repurchase programs, the Company had cumulatively repurchased its own Class A ordinary shares in the form of ADSs with a total aggregate value of approximately US$361.1 million since 2018.

Business Outlook

While the macroeconomic recovery continued to gain traction with pockets of improvement since the beginning of 2024, uncertainties persist in the markets in which we operate. The Company has observed encouraging signs of recovery and will continue to closely monitor macro conditions across our pan-Asian markets and remain prudent in our business operations. The Company reiterates its full-year 2024 transaction volume guidance for the China market in the range of RMB195.7 billion to RMB205.0 billion, representing year-over-year growth of approximately 5.0% to 10.0%. At the same time, the Company expects its full-year 2024 transaction volume for the international markets to be in the range of RMB9.4 billion to RMB11.0 billion, representing year-over-year growth of approximately 20.0% to 40.0%.

The above forecast is based on the current market conditions and reflects the Company’s current preliminary views and expectations on market and operational conditions and the regulatory and operating environment, as well as customers’ and institutional partners’ demands, all of which are subject to change.

Conference Call

The Company’s management will host an earnings conference call at 7:30 PM U.S. Eastern Time on November 18, 2024 (8:30 AM Beijing/Hong Kong Time on November 19, 2024).

Dial-in details for the earnings conference call are as follows:

|

United States (toll free): |

+1-888-346-8982 |

|

Canada (toll free): |

+1-855-669-9657 |

|

International: |

+1-412-902-4272 |

|

Hong Kong, China (toll free): |

800-905-945 |

|

Hong Kong, China: |

+852-3018-4992 |

|

Mainland, China: |

400-120-1203 |

Participants should dial in at least five minutes before the scheduled start time and ask to be connected to the call for “FinVolution Group.”

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.finvgroup.com.

A replay of the conference call will be accessible approximately one hour after the conclusion of the live call until November 25, 2024, by dialing the following telephone numbers:

|

United States (toll free): |

+1-877-344-7529 |

|

Canada (toll free): |

+1-855-669-9658 |

|

International: |

+1-412-317-0088 |

|

Replay Access Code: |

3196612 |

About FinVolution Group

FinVolution Group is a leading fintech platform with strong brand recognition in China, Indonesia and the Philippines, connecting borrowers of the young generation with financial institutions. Established in 2007, the Company is a pioneer in China’s online consumer finance industry and has developed innovative technologies and has accumulated in-depth experience in the core areas of credit risk assessment, fraud detection, big data and artificial intelligence. The Company’s platforms, empowered by proprietary cutting-edge technologies, features a highly automated loan transaction process, which enables a superior user experience. As of September 30, 2024, the Company had 199.2 million cumulative registered users across China, Indonesia and the Philippines.

For more information, please visit https://ir.finvgroup.com

Use of Non-GAAP Financial Measures

We use non-GAAP adjusted operating income, non-GAAP operating margin, non-GAAP net profit, non-GAAP net profit attributable to FinVolution Group, and non-GAAP basic and diluted net profit per share and per ADS which are non-GAAP financial measures, in evaluating our operating results and for financial and operational decision-making purposes. We believe that these non-GAAP financial measures help identify underlying trends in our business by excluding the impact of share-based compensation expenses and expected discretionary measures. We believe that non-GAAP financial measures provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects and allow for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

Non-GAAP adjusted operating income, non-GAAP operating margin, non-GAAP net profit, non-GAAP net profit attributable to FinVolution Group, and non-GAAP basic and diluted net profit per share and per ADS are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. These non-GAAP financial measures have limitations as analytical tool, and when assessing our operating performance, cash flows or our liquidity, investors should not consider it in isolation, or as a substitute for net income, cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP. The Company encourages investors and others to review our financial information in its entirety and not rely on a single financial measure.

For more information on this non-GAAP financial measure, please see the table captioned “Reconciliations of GAAP and Non-GAAP results” set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.0176 to US$1.00, the rate in effect as of September 30, 2024 as certified for customs purposes by the Federal Reserve Bank of New York.

Safe Harbor Statement

This press release contains forward-looking statements. These statements constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “target,” “confident” and similar statements. Such statements are based upon management’s current expectations and current market and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited to, uncertainties as to the Company’s ability to attract and retain borrowers and investors on its marketplace, its ability to increase volume of loans facilitated through the Company’s marketplace, its ability to introduce new loan products and platform enhancements, its ability to compete effectively, laws, regulations and governmental policies relating to the online consumer finance industry in China, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs on the NYSE, including its ability to cure any non-compliance with the NYSE’s continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and FinVolution does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

FinVolution Group

Head of Capital Markets

Jimmy Tan, IRC

Tel: +86 (21) 8030-3200 Ext. 8601

E-mail: ir@xinye.com

Piacente Financial Communications

Jenny Cai

Tel: +86 (10) 6508-0677

E-mail: finv@tpg-ir.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: finv@tpg-ir.com

|

FinVolution Group |

|||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS |

|||

|

(All amounts in thousands, except share data, or otherwise noted) |

|||

|

As of December 31, |

As of September 30, |

||

|

2023 |

2024 |

||

|

RMB |

RMB |

USD |

|

|

Assets |

|||

|

Cash and cash equivalents |

4,969,319 |

5,104,262 |

727,352 |

|

Restricted cash |

1,800,071 |

1,828,148 |

260,509 |

|

Short-term investments |

2,960,821 |

3,866,027 |

550,904 |

|

Investments |

1,135,133 |

1,169,383 |

166,636 |

|

Quality assurance receivable, net of credit loss allowance for |

1,755,615 |

1,722,136 |

245,402 |

|

Intangible assets |

98,692 |

137,298 |

19,565 |

|

Property, equipment and software, net |

140,933 |

637,928 |

90,904 |

|

Loans receivable, net of credit loss allowance for loans receivable |

1,127,388 |

2,217,496 |

315,991 |

|

Accounts receivable and contract assets, net of credit loss |

2,208,538 |

2,208,504 |

314,709 |

|

Deferred tax assets |

1,624,325 |

2,395,800 |

341,399 |

|

Right of use assets |

38,110 |

29,987 |

4,273 |

|

Prepaid expenses and other assets |

3,384,317 |

1,411,192 |

201,093 |

|

Goodwill |

50,411 |

50,411 |

7,184 |

|

Total assets |

21,293,673 |

22,778,572 |

3,245,921 |

|

Liabilities and Shareholders’ Equity |

|||

|

Deferred guarantee income |

1,882,036 |

1,629,253 |

232,167 |

|

Liability from quality assurance commitment |

3,306,132 |

3,166,283 |

451,192 |

|

Payroll and welfare payable |

261,528 |

229,497 |

32,703 |

|

Taxes payable |

207,477 |

637,803 |

90,886 |

|

Short-term borrowings |

5,756 |

5,995 |

854 |

|

Funds payable to investors of consolidated trusts |

436,352 |

435,669 |

62,082 |

|

Contract liability |

5,109 |

11,573 |

1,649 |

|

Deferred tax liabilities |

340,608 |

464,312 |

66,164 |

|

Accrued expenses and other liabilities |

941,899 |

1,286,654 |

183,347 |

|

Leasing liabilities |

35,878 |

25,266 |

3,600 |

|

Total liabilities |

7,422,775 |

7,892,305 |

1,124,644 |

|

Commitments and contingencies |

|||

|

FinVolution Group Shareholders’ equity |

|||

|

Ordinary shares |

103 |

103 |

15 |

|

Additional paid-in capital |

5,748,734 |

5,811,096 |

828,075 |

|

Treasury stock |

(1,199,683) |

(1,730,759) |

(246,631) |

|

Statutory reserves |

762,472 |

762,472 |

108,651 |

|

Accumulated other comprehensive income |

80,006 |

64,421 |

9,180 |

|

Retained Earnings |

8,357,153 |

9,618,263 |

1,370,592 |

|

Total FinVolution Group shareholders’ equity |

13,748,785 |

14,525,596 |

2,069,882 |

|

Non-controlling interest |

122,113 |

360,671 |

51,395 |

|

Total shareholders’ equity |

13,870,898 |

14,886,267 |

2,121,277 |

|

Total liabilities and shareholders’ equity |

21,293,673 |

22,778,572 |

3,245,921 |

|

FinVolution Group |

||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE |

||||||

|

(All amounts in thousands, except share data, or otherwise noted) |

||||||

|

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||

|

2023 |

2024 |

2023 |

2024 |

|||

|

RMB |

RMB |

USD |

RMB |

RMB |

USD |

|

|

Operating revenue: |

||||||

|

Loan facilitation service fees |

1,129,776 |

1,253,113 |

178,567 |

3,413,070 |

3,349,581 |

477,311 |

|

Post-facilitation service fees |

498,916 |

425,348 |

60,612 |

1,474,274 |

1,279,776 |

182,367 |

|

Guarantee income |

1,152,047 |

1,234,752 |

175,951 |

3,211,480 |

3,879,794 |

552,866 |

|

Net interest income |

273,274 |

185,742 |

26,468 |

821,953 |

635,852 |

90,608 |

|

Other Revenue |

143,514 |

177,096 |

25,236 |

403,071 |

464,129 |

66,138 |

|

Net revenue |

3,197,527 |

3,276,051 |

466,834 |

9,323,848 |

9,609,132 |

1,369,290 |

|

Operating expenses: |

||||||

|

Origination, servicing expenses and other cost of |

(519,985) |

(603,071) |

(85,937) |

(1,548,373) |

(1,717,857) |

(244,793) |

|

Sales and marketing expenses |

(530,110) |

(560,220) |

(79,831) |

(1,396,061) |

(1,482,724) |

(211,286) |

|

Research and development expenses |

(132,588) |

(130,736) |

(18,630) |

(383,381) |

(370,483) |

(52,793) |

|

General and administrative expenses |

(98,641) |

(116,759) |

(16,638) |

(274,813) |

(300,978) |

(42,889) |

|

Provision for accounts receivable and contract assets |

(86,884) |

(99,018) |

(14,110) |

(217,535) |

(221,917) |

(31,623) |

|

Provision for loans receivable |

(176,776) |

(82,394) |

(11,741) |

(479,281) |

(255,667) |

(36,432) |

|

Credit losses for quality assurance commitment |

(1,099,154) |

(1,123,628) |

(160,116) |

(3,153,288) |

(3,512,299) |

(500,499) |

|

Total operating expenses |

(2,644,138) |

(2,715,826) |

(387,003) |

(7,452,732) |

(7,861,925) |

(1,120,315) |

|

Operating profit |

553,389 |

560,225 |

79,831 |

1,871,116 |

1,747,207 |

248,975 |

|

Other income, net |

124,387 |

185,517 |

26,436 |

327,065 |

284,178 |

40,495 |

|

Profit before income tax expense |

677,776 |

745,742 |

106,267 |

2,198,181 |

2,031,385 |

289,470 |

|

Income tax expenses |

(103,061) |

(121,666) |

(17,337) |

(343,528) |

(324,295) |

(46,212) |

|

Net profit |

574,715 |

624,076 |

88,930 |

1,854,653 |

1,707,090 |

243,258 |

|

Net profit attributable to non-controlling interest |

8,757 |

481 |

69 |

38,377 |

4,649 |

662 |

|

Net profit attributable to FinVolution Group |

565,958 |

623,595 |

88,861 |

1,816,276 |

1,702,441 |

242,596 |

|

Foreign currency translation adjustment, net of nil tax |

(88,159) |

21,206 |

3,022 |

(36,624) |

(15,585) |

(2,221) |

|

Total comprehensive income attributable to FinVolution Group |

477,799 |

644,801 |

91,883 |

1,779,652 |

1,686,856 |

240,375 |

|

Weighted average number of ordinary shares used in |

||||||

|

Basic |

1,356,802,618 |

1,273,874,143 |

1,273,874,143 |

1,385,417,916 |

1,294,603,294 |

1,294,603,294 |

|

Diluted |

1,382,049,817 |

1,300,972,157 |

1,300,972,157 |

1,414,900,795 |

1,325,385,787 |

1,325,385,787 |

|

Net profit per share attributable to FinVolution Group’s ordinary shareholders |

||||||

|

Basic |

0.42 |

0.49 |

0.07 |

1.31 |

1.32 |

0.19 |

|

Diluted |

0.41 |

0.48 |

0.07 |

1.28 |

1.28 |

0.18 |

|

Net profit per ADS attributable to FinVolution Group’s ordinary shareholders (one ADS equal five ordinary shares) |

||||||

|

Basic |

2.09 |

2.45 |

0.35 |

6.55 |

6.58 |

0.94 |

|

Diluted |

2.05 |

2.40 |

0.34 |

6.42 |

6.42 |

0.92 |

|

FinVolution Group |

|||||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||||||

|

(All amounts in thousands, except share data, or otherwise noted) |

|||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2023 |

2024 |

2023 |

2024 |

||||||||

|

RMB |

RMB |

USD |

RMB |

RMB |

USD |

||||||

|

Net cash provided by operating |

178,370 |

1,577,985 |

224,861 |

1,357,273 |

2,737,763 |

390,128 |

|||||

|

Net cash provided by/(used in) |

591,067 |

(1,895,758) |

(270,143) |

1,516,238 |

(1,547,729) |

(220,550) |

|||||

|

Net cash used in financing activities |

(110,924) |

(253,744) |

(36,158) |

(1,516,270) |

(1,024,661) |

(146,013) |

|||||

|

Effect of exchange rate changes on |

(11,383) |

27,198 |

3,876 |

27,416 |

(2,353) |

(334) |

|||||

|

Net increase/ (decrease) in cash, cash |

647,130 |

(544,319) |

(77,564) |

1,384,657 |

163,020 |

23,231 |

|||||

|

Cash, cash equivalent and restricted |

7,216,614 |

7,476,729 |

1,065,425 |

6,479,087 |

6,769,390 |

964,630 |

|||||

|

Cash, cash equivalent and restricted |

7,863,744 |

6,932,410 |

987,861 |

7,863,744 |

6,932,410 |

987,861 |

|||||

|

FinVolution Group |

||||||

|

UNAUDITED Reconciliation of GAAP and Non-GAAP Results |

||||||

|

(All amounts in thousands, except share data, or otherwise noted) |

||||||

|

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||

|

2023 |

2024 |

2023 |

2024 |

|||

|

RMB |

RMB |

USD |

RMB |

RMB |

USD |

|

|

Net Revenues |

3,197,527 |

3,276,051 |

466,834 |

9,323,848 |

9,609,132 |

1,369,290 |

|

Less: total operating expenses |

(2,644,138) |

(2,715,826) |

(387,003) |

(7,452,732) |

(7,861,925) |

(1,120,315) |

|

Operating Income |

553,389 |

560,225 |

79,831 |

1,871,116 |

1,747,207 |

248,975 |

|

Add: share-based compensation expenses |

30,376 |

39,599 |

5,643 |

82,192 |

109,988 |

15,673 |

|

Non-GAAP adjusted operating income |

583,765 |

599,824 |

85,474 |

1,953,308 |

1,857,195 |

264,648 |

|

Operating Margin |

17.3 % |

17.1 % |

17.1 % |

20.1 % |

18.2 % |

18.2 % |

|

Non-GAAP operating margin |

18.3 % |

18.3 % |

18.3 % |

20.9 % |

19.3 % |

19.3 % |

|

Non-GAAP adjusted operating income |

583,765 |

599,824 |

85,474 |

1,953,308 |

1,857,195 |

264,648 |

|

Add: other income, net |

124,387 |

185,517 |

26,436 |

327,065 |

284,178 |

40,495 |

|

Less: income tax expenses |

(103,061) |

(121,666) |

(17,337) |

(343,528) |

(324,295) |

(46,212) |

|

Non-GAAP net profit |

605,091 |

663,675 |

94,573 |

1,936,845 |

1,817,078 |

258,931 |

|

Net profit attributable to non-controlling interest shareholders |

8,757 |

481 |

69 |

38,377 |

4,649 |

662 |

|

Non-GAAP net profit attributable to FinVolution |

596,334 |

663,194 |

94,504 |

1,898,468 |

1,812,429 |

258,269 |

|

Weighted average number of ordinary shares used in |

||||||

|

Basic |

1,356,802,618 |

1,273,874,143 |

1,273,874,143 |

1,385,417,916 |

1,294,603,294 |

1,294,603,294 |

|

Diluted |

1,382,049,817 |

1,300,972,157 |

1,300,972,157 |

1,414,900,795 |

1,325,385,787 |

1,325,385,787 |

|

Non-GAAP net profit per share attributable to |

||||||

|

Basic |

0.44 |

0.52 |

0.07 |

1.37 |

1.40 |

0.20 |

|

Diluted |

0.43 |

0.51 |

0.07 |

1.34 |

1.37 |

0.19 |

|

Non-GAAP net profit per ADS attributable to |

||||||

|

Basic |

2.20 |

2.60 |

0.37 |

6.85 |

7.00 |

1.00 |

|

Diluted |

2.16 |

2.55 |

0.36 |

6.71 |

6.84 |

0.97 |

![]() View original content:https://www.prnewswire.com/news-releases/finvolution-group-reports-third-quarter-2024-unaudited-financial-results-302308772.html

View original content:https://www.prnewswire.com/news-releases/finvolution-group-reports-third-quarter-2024-unaudited-financial-results-302308772.html

SOURCE FinVolution Group

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RBC Indigo Asset Management Inc. announces the refiling of certain Fund Facts for certain RBC Indigo Mutual Funds and RBC Indigo Pooled Funds

TORONTO, Nov. 18, 2024 /CNW/ – RBC Indigo Asset Management Inc. (“RBC Indigo Inc.”) today announced the refiling of certain Fund Facts for certain RBC Indigo Mutual Funds and RBC Indigo Pooled Funds to correct the following errors:

The Portfolio Manager listed in the “Quick facts” section of the English version of the following Fund Facts documents was corrected:

|

Fund Name |

Series |

Corrected Portfolio Manager |

|

RBC Indigo Global Inflation Linked Bond Pooled Fund |

F |

HSBC Global Asset Management (UK) Limited |

|

RBC Indigo Emerging Markets Debt Pooled Fund |

F |

RBC Indigo Asset Management Inc. |

|

RBC Indigo U.S. Equity Pooled Fund |

F |

HSBC Bank USA, N.A. |

The short-term trading fee in the “How much does it cost?” section of the English and French versions of the following Fund Facts document was removed:

|

Fund Name |

Series |

|

RBC Indigo Canadian Money Market Pooled Fund |

F |

The management fee in the “How much does it cost?” section of the following Fund Facts documents was corrected:

|

Fund Name |

Series |

Language |

Management Fee |

|

|

Current |

Corrected |

|||

|

RBC Indigo Mortgage Pooled Fund |

F |

English |

0.85 % |

0.675 % |

|

RBC Indigo Mortgage Pooled Fund |

F |

French |

0.35 % |

0.675 % |

|

RBC Indigo Canadian Bond Pooled Fund |

F |

French |

0.35 % |

0.50 % |

|

RBC Indigo Global High Yield Bond Pooled Fund |

F |

English |

1.00 % |

0.75 % |

|

RBC Indigo Global High Yield Bond Pooled Fund |

F |

French |

0.35 % |

0.75 % |

|

RBC Indigo Global Inflation Linked Bond Pooled Fund |

F |

English |

0.85 % |

0.675 % |

|

RBC Indigo Global Inflation Linked Bond Pooled Fund |

F |

French |

0.35 % |

0.675 % |

|

RBC Indigo Emerging Markets Debt Pooled Fund |

F |

English |

1.00 % |

0.75 % |

|

RBC Indigo Emerging Markets Debt Pooled Fund |

F |

French |

0.35 % |

0.75 % |

|

RBC Indigo Canadian Dividend Pooled Fund |

F |

English |

0.90 % |

0.75 % |

|

RBC Indigo Canadian Dividend Pooled Fund |

F |

French |

0.35 % |

0.75 % |

|

RBC Indigo Canadian Equity Pooled Fund |

F |

English |

0.90 % |

0.75 % |

|

RBC Indigo Canadian Equity Pooled Fund |

F |

French |

0.35 % |

0.75 % |

|

RBC Indigo Canadian Small Cap Equity Pooled Fund |

F |

French |

0.35 % |

1.00 % |

|

RBC Indigo U.S. Equity Pooled Fund |

F |

French |

0.35 % |

1.00 % |

|

RBC Indigo International Equity Pooled Fund |

F |

French |

0.35 % |

1.00 % |

|

RBC Indigo Emerging Markets Pooled Fund |

F |

English |

1.25 % |

1.125 % |

|

RBC Indigo Emerging Markets Pooled Fund |

F |

French |

0.35 % |

1.125 % |

|

RBC Indigo Global Real Estate Equity Pooled Fund |

F |

French |

0.35 % |

1.00 % |

|

RBC Indigo U.S. Dollar Monthly Income Fund |

FT |

English |

1.05 % |

0.775 % |

|

RBC Indigo U.S. Dollar Monthly Income Fund |

FT |

French |

1.05 % |

0.775 % |

The fund expenses disclosure under the “How much does it cost?” section of the French version of the following Fund Facts documents was corrected:

|

Fund Name |

Series |

Corrected |

|

RBC Indigo U.S. Dollar Monthly Income Fund |

FT |

Added: “You don’t pay these expenses directly. They |

|

RBC Indigo Emerging Markets Equity Index Fund |

Premium |

Added: “The Fund’s expenses are made up of the |

|

RBC Indigo Strategic Moderate Conservative Fund |

Institutional |

Removed “management fee” from the following “The Fund’s expenses are made up of the |

Information was added to the “Who is this Fund for?” section of the French version of the following Fund Facts document:

|

Fund Name |

Series |

Corrected |

|

RBC Indigo Canadian Bond Pooled Fund |

F |

“It is not suitable for investors who have a short- |

The information in the section “What does this Fund invest in?” in both the English and French versions of the following Fund Facts documents was replaced entirely with the following correct information:

|

Fund Name |

Series |

Corrected |

|

RBC Indigo Strategic Conservative Fund |

Investor F Manager Institutional |

“The fund invests in a diversified portfolio of |

The risk rating was reviewed for each of the funds above. All risk ratings remain the same, except for the following fund:

|

Fund Name |

Series |

Current |

Updated Rating |

|

RBC Indigo Strategic |

Investor F Manager Institutional |

Low |

Low to Medium |

The increase in risk rating does not change the investment objectives, strategy or management of the fund. The risk rating is based on the methodology mandated by the Canadian Securities Administrators to determine the risk level of mutual funds. RBC Indigo Inc. reviews the risk rating for each fund at least annually and any time we determine that the current investment risk level is no longer reasonable in the circumstances.

The revised Fund Facts will be available on SEDAR+ at www.sedarplus.ca and on the RBC Indigo Asset Management Inc. website at www.rbcindigo.com.

Please consult your advisor and read the prospectus or Fund Facts document before investing. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

RBC Indigo Mutual Funds and RBC Indigo Pooled Funds are offered by RBC Indigo Inc. and distributed through authorized dealers in Canada. RBC Indigo Inc. is a member of the RBC Global Asset Management group of companies and a wholly owned subsidiary of Royal Bank of Canada.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 100,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 18 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/peopleandplanet.

About RBC Global Asset Management

RBC Global Asset Management (“RBC GAM”) is the asset management division of Royal Bank of Canada (RBC). RBC GAM is a provider of global investment management services and solutions to institutional, high-net-worth and individual investors through separate accounts, pooled funds, mutual funds, hedge funds, exchange-traded funds and specialty investment strategies. RBC Funds, BlueBay Funds, PH&N Funds and RBC ETFs are offered by RBC Global Asset Management Inc. (“RBC GAM Inc.”) and distributed through authorized dealers in Canada. The RBC GAM group of companies, which includes RBC GAM Inc. (including PH&N Institutional) and RBC Indigo Asset Management Inc., manage approximately $660 billion in assets and have approximately 1,600 employees located across Canada, the United States, Europe and Asia.

For more information, please contact:

Brandon Dorey, RBC GAM Corporate Communications, 416-955-7397

SOURCE RBC Global Asset Management Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/18/c2950.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/18/c2950.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro stock surges as company files plan to avoid Nasdaq delisting

Super Micro Computer (SMCI) said in a filing with the Securities and Exchange Commission late Monday that it has submitted a compliance plan to avoid delisting from the Nasdaq.

The company said its compliance plan shows it is on track to submit delayed filings to the SEC “and become current with its periodic reports within the discretionary period available to the Nasdaq staff to grant.”

Barron’s reported on Friday after the bell that Super Micro would submit its plan to prevent delisting by Monday’s deadline, citing people familiar with the matter. Super Micro shares jumped over 25% in after hours trading following the filing late Monday; the stock surged roughly 16% during regular trading to start the week.

Shares have tumbled roughly 65% over the past three months. After gaining as much as 300% earlier this year, SMCI stock is now down over 20% in 2024.

The AI server maker and Nvidia (NVDA) customer also said Monday that the company has hired a new auditor, BDO, after its prior accountant, EY, resigned in late October.

Super Micro has been grappling with the fallout from an August report by short selling firm Hindenburg Research, which shed light on potential accounting malpractices, violations of export controls, and shady relationships between top executives and Super Micro partners.

Following the report, the company delayed its annual 10-K filing to the Securities and Exchange Commission. Last week, Super Micro also delayed filing its most recent quarterly 10-Q report to the SEC. Adding to its woes, the company is reportedly being investigated by the Department of Justice. The barrage of bad news has sent shares tumbling — EY’s resignation, in particular, pushed Super Micro stock down more than 30% in a single day in late October.

Shares of the company also fell sharply following Super Micro’s fiscal first quarter earnings report Nov. 5, which missed Wall Street’s expectations, sending shares down 18% in the day following the results.

Elsewhere on Monday, the company announced product updates during the Supercomputing Conference in Atlanta, including its next generation AI servers using Nvidia Blackwell chips.

“Supermicro has the expertise, delivery speed, and capacity to deploy the largest liquid-cooled AI data center projects in the world, containing 100,000 GPUs, which Supermicro and NVIDIA contributed to and recently deployed,” said CEO Charles Liang in a statement Monday.

“We now have solutions that use the NVIDIA Blackwell platform.”

Nvidia will report its next quarterly earnings for its fiscal third quarter on Wednesday.

MGPI Investigation Reminder: Kessler Topaz Meltzer & Check, LLP Encourages MGP Ingredients, Inc. (NASDAQ: MGPI) Investors with Significant Losses to Contact the Firm

RADNOR, Pa., Nov. 18, 2024 (GLOBE NEWSWIRE) — The law firm of Kessler Topaz Meltzer & Check, LLP (www.ktmc.com) is currently investigating potential violations of the federal securities laws on behalf of investors of MGP Ingredients, Inc. MGPI (“MGP Ingredients”).

On October 17, 2024, MGP Ingredients revised its full year 2024 guidance and released its preliminary financial results for the third quarter ended September 30, 2024. In the results, MGP Ingredients revealed that the company expects declines in sales, adjusted net income, and adjusted EBITDA compared to the third quarter of 2023, and that the company “now expects financial results to be below the expectations confirmed during its second quarter conference call held on August 1, 2024.”

On this news, the price of MGP shares declined by $19.71, or approximately 24.16%, from $81.57 per share on October 17, 2024, to close at $61.86 per share on October 18, 2024.

If you are an MGP Ingredients investor and would like to learn more about our investigation, please CLICK HERE to fill out our online form or contact Kessler Topaz Meltzer & Check, LLP: Jonathan Naji, Esq. (484) 270-1453 or E-mail at info@ktmc.com. You can also click on the following link or paste it in your browser: https://www.ktmc.com/mgp-ingredients-inc-investigation?utm_campaign=mei&mktm=r&utm_source=PR&utm_medium=link&utm_campaign=mgpi&mktm=r

Kessler Topaz Meltzer & Check, LLP prosecutes class actions in state and federal courts throughout the country involving securities fraud, breaches of fiduciary duties and other violations of state and federal law. Kessler Topaz Meltzer & Check, LLP is a driving force behind corporate governance reform, and has recovered billions of dollars on behalf of institutional and individual investors from the United States and around the world. The firm represents investors, consumers and whistleblowers (private citizens who report fraudulent practices against the government and share in the recovery of government dollars). For more information about Kessler Topaz Meltzer & Check, LLP, please visit www.ktmc.com.

CONTACT:

Kessler Topaz Meltzer & Check, LLP

Jonathan Naji, Esq.

280 King of Prussia Road

Radnor, PA 19087

(484) 270-1453

info@ktmc.com

May be considered attorney advertising in certain jurisdictions. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trip.com Group Limited Reports Unaudited Third Quarter of 2024 Financial Results

SINGAPORE, Nov. 18, 2024 /PRNewswire/ — Trip.com Group Limited TCOM HKEX: 9961)) (“Trip.com Group” or the “Company”), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged tours, and corporate travel management, today announced its unaudited financial results for the third quarter of 2024.

Key Highlights for the Third Quarter of 2024

- International businesses experienced robust growth across all segments in the third quarter of 2024

– Outbound hotel and air reservations rebounded to approximately 120% of the pre-COVID level for the same period in 2019.

– Air ticket and hotel reservations on the Company’s international OTA brand increased by over 60% year-over-year.

- The Company delivered solid results in the third quarter of 2024

– Net revenue for the third quarter grew by 16% year-over-year.

– Net income for the third quarter was RMB6.8 billion (US$970 million), compared to RMB4.6 billion for the same period in 2023.

– Adjusted EBITDA for the third quarter was RMB5.7 billion (US$808 million), improving from RMB4.6 billion for the same period last year.

“During the third quarter of 2024, both domestic and international travel exhibited robust growth,” said James Liang, Executive Chairman. “With increasing consumer confidence and heightened travel sentiment, we are optimistic about the continued growth of the travel industry. Additionally, we are confident that the AI-driven technological revolution will play a pivotal role in shaping the future of the global travel industry.”

“We are delighted to witness the resilience of the travel market. Through our hard work, we are proud to create new job opportunities for young people and bring new business volume to our partners in the travel industry,” said Jane Sun, Chief Executive Officer. “Travel is a catalyst for economic growth, a bridge to understanding, and a pathway to a peaceful world. We will continue to offer excellent service, drive business for our partners, and introduce China to the world through travel.”

Third Quarter of 2024 Financial Results and Business Updates

For the third quarter of 2024, Trip.com Group reported net revenue of RMB15.9 billion (US$2.3 billion), representing a 16% increase from the same period in 2023, primarily driven by stronger travel demand. Net revenue for the third quarter of 2024 increased by 24% from the previous quarter, primarily due to seasonality.

Accommodation reservation revenue for the third quarter of 2024 was RMB6.8 billion (US$969 million), representing a 22% increase from the same period in 2023, primarily driven by an increase in accommodation reservations. Accommodation reservation revenue for the third quarter of 2024 increased by 32% from the previous quarter, primarily due to seasonality.

Transportation ticketing revenue for the third quarter of 2024 was RMB5.7 billion (US$805 million), representing a 5% increase from the same period in 2023 primarily driven by an increase in transportation reservations. Transportation ticketing revenue for the third quarter of 2024 increased by 16% from the previous quarter, primarily due to seasonality.

Packaged-tour revenue for the third quarter of 2024 was RMB1.6 billion (US$222 million), representing a 17% increase from the same period in 2023, primarily driven by an increase in packaged-tour reservations. Packaged-tour revenue for the third quarter of 2024 increased by 52% from the previous quarter, primarily due to seasonality.

Corporate travel revenue for the third quarter of 2024 was RMB656 million (US$93 million), representing an 11% increase from the same period in 2023, primarily driven by an increase in corporate travel reservations. Corporate travel revenue for the third quarter of 2024 increased by 4% from the previous quarter.

Cost of revenue for the third quarter of 2024 increased by 13% to RMB2.8 billion (US$399 million) from the same period in 2023 and increased by 21% from the previous quarter, which was generally in line with the increase in net revenue from the respective periods. Cost of revenue as a percentage of net revenue was 18% for the third quarter of 2024.

Product development expenses for the third quarter of 2024 increased by 2% to RMB3.6 billion (US$519 million) from the same period in 2023 and increased by 22% from the previous quarter, primarily due to an increase in product development personnel related expenses. Product development expenses as a percentage of net revenue was 23% for the third quarter of 2024.

Sales and marketing expenses for the third quarter of 2024 increased by 23% to RMB3.4 billion (US$482 million) from the same period in 2023 and increased by 19% from the previous quarter, primarily due to the increase in expenses relating to sales and marketing promotion activities. Sales and marketing expenses as a percentage of net revenue was 21% for the third quarter of 2024.

General and administrative expenses for the third quarter of 2024 increased by 2% to RMB1.0 billion (US$149 million) from the same period in 2023 and decreased by 3% from the previous quarter. General and administrative expenses as a percentage of net revenue was 7% for the third quarter of 2024.

Income tax expense for the third quarter of 2024 was RMB721 million (US$103 million), compared to RMB448 million for the same period in 2023 and RMB693 million for the previous quarter. The change in Trip.com Group’s effective tax rate was primarily due to the combined impacts of changes in respective profitability of its subsidiaries with different tax rates, changes in deferred tax liabilities relating to withholding tax, certain non-taxable income or loss resulting from the fair value changes in equity securities investments and exchangeable senior notes recorded in other income/(expense), and changes in valuation allowance provided for deferred tax assets.

Net income for the third quarter of 2024 was RMB6.8 billion (US$970 million), compared to RMB4.6 billion for the same period in 2023 and RMB3.9 billion for the previous quarter. Adjusted EBITDA for the third quarter of 2024 was RMB5.7 billion (US$808 million), compared to RMB4.6 billion for the same period in 2023 and RMB4.4 billion for the previous quarter.

Net income attributable to Trip.com Group’s shareholders for the third quarter of 2024 was RMB6.8 billion (US$962 million), compared to RMB4.6 billion for the same period in 2023 and RMB3.8 billion for the previous quarter. Excluding share-based compensation charges, fair value changes of equity securities investments and exchangeable senior notes recorded in other income/(expense), and their tax effects, non-GAAP net income attributable to Trip.com Group’s shareholders for the third quarter of 2024 was RMB6.0 billion (US$847 million), compared to RMB4.9 billion for the same period in 2023 and RMB5.0 billion for the previous quarter.

Diluted earnings per ordinary share and per ADS was RMB9.93 (US$1.42) for the third quarter of 2024. Excluding share-based compensation charges, fair value changes of equity securities investments and exchangeable senior notes recorded in other income/(expense), and their tax effects, non-GAAP diluted earnings per ordinary share and per ADS was RMB8.75 (US$1.25) for the third quarter of 2024. Each ADS currently represents one ordinary share of the Company.

As of September 30, 2024, the balance of cash and cash equivalents, restricted cash, short-term investment, and held to maturity time deposit and financial products was RMB86.9 billion (US$12.4 billion).

Conference Call

Trip.com Group’s management team will host a conference call at 7:00 PM on November 18, 2024, U.S. Eastern Time (or 8:00 AM on November 19, 2024, Hong Kong Time) following the announcement.

The conference call will be available live on Webcast and for replay at: https://investors.trip.com. The call will be archived for twelve months on our website.

All participants must pre-register to join this conference call using the Participant Registration link below:

https://register.vevent.com/register/BIacab26e628b84d85a1589994ea124dc9

Upon registration, each participant will receive details for this conference call, including dial-in numbers and a unique access PIN. To join the conference, please dial the number provided, enter your PIN, and you will join the conference instantly.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “may,” “will,” “expect,” “anticipate,” “future,” “intend,” “plan,” “believe,” “estimate,” “is/are likely to,” “confident,” or other similar statements. Among other things, quotations from management in this press release, as well as Trip.com Group’s strategic and operational plans, contain forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Potential risks and uncertainties include, but are not limited to, severe or prolonged downturn in the global or Chinese economy, general declines or disruptions in the travel industry, volatility in the trading price of Trip.com Group’s ADSs or shares, Trip.com Group’s reliance on its relationships and contractual arrangements with travel suppliers and strategic alliances, failure to compete against new and existing competitors, failure to successfully manage current growth and potential future growth, risks associated with any strategic investments or acquisitions, seasonality in the travel industry in the relevant jurisdictions where Trip.com Group operates, failure to successfully develop Trip.com Group’s existing or future business lines, damage to or failure of Trip.com Group’s infrastructure and technology, loss of services of Trip.com Group’s key executives, adverse changes in economic and business conditions in the relevant jurisdictions where Trip.com Group operates, any regulatory developments in laws, regulations, rules, policies or guidelines applicable to Trip.com Group and other risks outlined in Trip.com Group’s filings with the U.S. Securities and Exchange Commission or the Stock Exchange of Hong Kong Limited. All information provided in this press release and in the attachments is as of the date of the issuance, and Trip.com Group does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

About Non-GAAP Financial Measures