Carlyle Credit Income Fund Announces Fourth Quarter and Full Year 2024 Financial Results and Declares Monthly Common and Preferred Dividends

NEW YORK, Nov. 20, 2024 (GLOBE NEWSWIRE) — Carlyle Credit Income Fund (“we,” “us,” “our,” “CCIF” or the “Fund”) CCIF today announced its financial results for its fourth quarter and full year ended September 30, 2024. The full detailed presentation of the Fund’s fourth quarter and full year ended September 30, 2024, financial results can be viewed on the Fund’s website carlylecreditincomefund.com/investor-dashboard.

Lauren Basmadjian, CCIF’s Chief Executive Officer said, “We’re pleased with our 4Q and FY results and continue to execute the strategy we laid out when we first became investment advisor to CCIF in July 2023. Since becoming investment advisor, we almost doubled the dividend rate from 7.8% to 15.2%, an increase of 7.4%. As we enter 2025, we will continue to work to find attractive CLO equity opportunities for our shareholders.”

Over the past quarter, the Fund has successfully:

- Maintained the monthly dividend of 10.5 cents through February 2025, equating to a 15.16% annualized dividend based on share price as of November 19, 2024, or 16.64% based on the Fund’s NAV as of October 31, 2024.

- Funded $39.6 million in new CLO investments with a weighted average GAAP yield of 16.5%. The aggregate portfolio weighted average GAAP yield was 18.6% as of September 30, 2024.

- Completed a private placement of 5-year, 7.125% convertible preferred shares due 2029 for net proceeds of $10.7 million.

- Completed a registered direct placement of common shares at a premium to NAV for net proceeds of $11.5 million.

- Sold 850,000 common shares in connection with the ATM offering program at a premium to NAV for net proceeds of $6.8 million.

Net investment income was $0.30 per common share and core net investment income was $0.45 per common share for the fourth quarter of 2024. Net asset value per common share was $7.64 as of September 30, 2024. The total fair value of investments was $173.5 million as of September 30, 2024.

Dividends

CCIF is maintaining a monthly dividend on shares of the Fund’s common stock of $0.1050 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Common Stock | $0.1050 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

CCIF is also pleased to announce the declaration of dividends on shares of the Fund’s 8.75% Series A Term Preferred Shares of $0.1823 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Series A Preferred Shares | $0.1823 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

Conference Call

The Fund will host a conference call at 10:00 a.m. EDT on Thursday, November 21, 2024, to discuss its fourth quarter financial results. Please register for the conference call here. The conference call information will also be available via a link on Carlyle Credit Income Fund’s website and the recording will be available on our website soon after the call’s completion.

About Carlyle Credit Income Fund

Carlyle Credit Income Fund CCIF is an externally managed closed-end fund focused on investing in primarily equity and junior debt tranches of collateralized loan obligations (“CLOs”). The CLOs are collateralized by a portfolio consisting primarily of U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. CCIF is externally managed by Carlyle Global Credit Investment Management L.L.C. (“CGCIM”), an SEC-registered investment adviser and wholly owned subsidiary of Carlyle. CCIF draws upon the significant scale and resources of Carlyle as one of the world’s largest CLO managers.

Web: www.carlylecreditincomefund.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make it. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission, and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Carlyle Credit Income Fund Announces Fourth Quarter and Full Year 2024 Financial Results and Declares Monthly Common and Preferred Dividends

NEW YORK, Nov. 20, 2024 (GLOBE NEWSWIRE) — Carlyle Credit Income Fund (“we,” “us,” “our,” “CCIF” or the “Fund”) CCIF today announced its financial results for its fourth quarter and full year ended September 30, 2024. The full detailed presentation of the Fund’s fourth quarter and full year ended September 30, 2024, financial results can be viewed on the Fund’s website carlylecreditincomefund.com/investor-dashboard.

Lauren Basmadjian, CCIF’s Chief Executive Officer said, “We’re pleased with our 4Q and FY results and continue to execute the strategy we laid out when we first became investment advisor to CCIF in July 2023. Since becoming investment advisor, we almost doubled the dividend rate from 7.8% to 15.2%, an increase of 7.4%. As we enter 2025, we will continue to work to find attractive CLO equity opportunities for our shareholders.”

Over the past quarter, the Fund has successfully:

- Maintained the monthly dividend of 10.5 cents through February 2025, equating to a 15.16% annualized dividend based on share price as of November 19, 2024, or 16.64% based on the Fund’s NAV as of October 31, 2024.

- Funded $39.6 million in new CLO investments with a weighted average GAAP yield of 16.5%. The aggregate portfolio weighted average GAAP yield was 18.6% as of September 30, 2024.

- Completed a private placement of 5-year, 7.125% convertible preferred shares due 2029 for net proceeds of $10.7 million.

- Completed a registered direct placement of common shares at a premium to NAV for net proceeds of $11.5 million.

- Sold 850,000 common shares in connection with the ATM offering program at a premium to NAV for net proceeds of $6.8 million.

Net investment income was $0.30 per common share and core net investment income was $0.45 per common share for the fourth quarter of 2024. Net asset value per common share was $7.64 as of September 30, 2024. The total fair value of investments was $173.5 million as of September 30, 2024.

Dividends

CCIF is maintaining a monthly dividend on shares of the Fund’s common stock of $0.1050 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Common Stock | $0.1050 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

CCIF is also pleased to announce the declaration of dividends on shares of the Fund’s 8.75% Series A Term Preferred Shares of $0.1823 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Series A Preferred Shares | $0.1823 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

Conference Call

The Fund will host a conference call at 10:00 a.m. EDT on Thursday, November 21, 2024, to discuss its fourth quarter financial results. Please register for the conference call here. The conference call information will also be available via a link on Carlyle Credit Income Fund’s website and the recording will be available on our website soon after the call’s completion.

About Carlyle Credit Income Fund

Carlyle Credit Income Fund CCIF is an externally managed closed-end fund focused on investing in primarily equity and junior debt tranches of collateralized loan obligations (“CLOs”). The CLOs are collateralized by a portfolio consisting primarily of U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. CCIF is externally managed by Carlyle Global Credit Investment Management L.L.C. (“CGCIM”), an SEC-registered investment adviser and wholly owned subsidiary of Carlyle. CCIF draws upon the significant scale and resources of Carlyle as one of the world’s largest CLO managers.

Web: www.carlylecreditincomefund.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make it. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission, and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At United Parcel Service's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards United Parcel Service UPS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UPS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for United Parcel Service. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 37% bearish. Among these notable options, 4 are puts, totaling $114,507, and 4 are calls, amounting to $444,526.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $160.0 for United Parcel Service over the last 3 months.

Insights into Volume & Open Interest

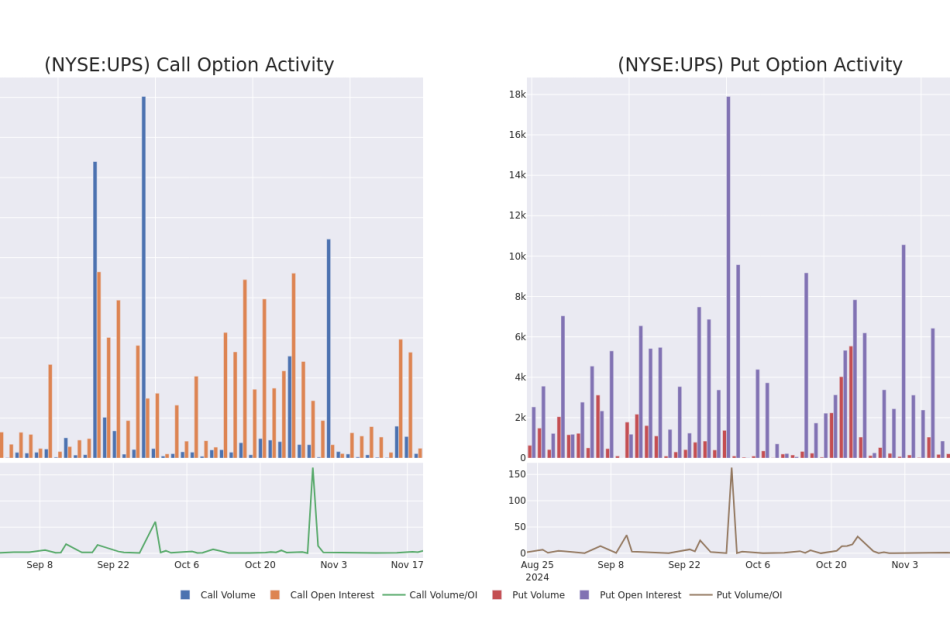

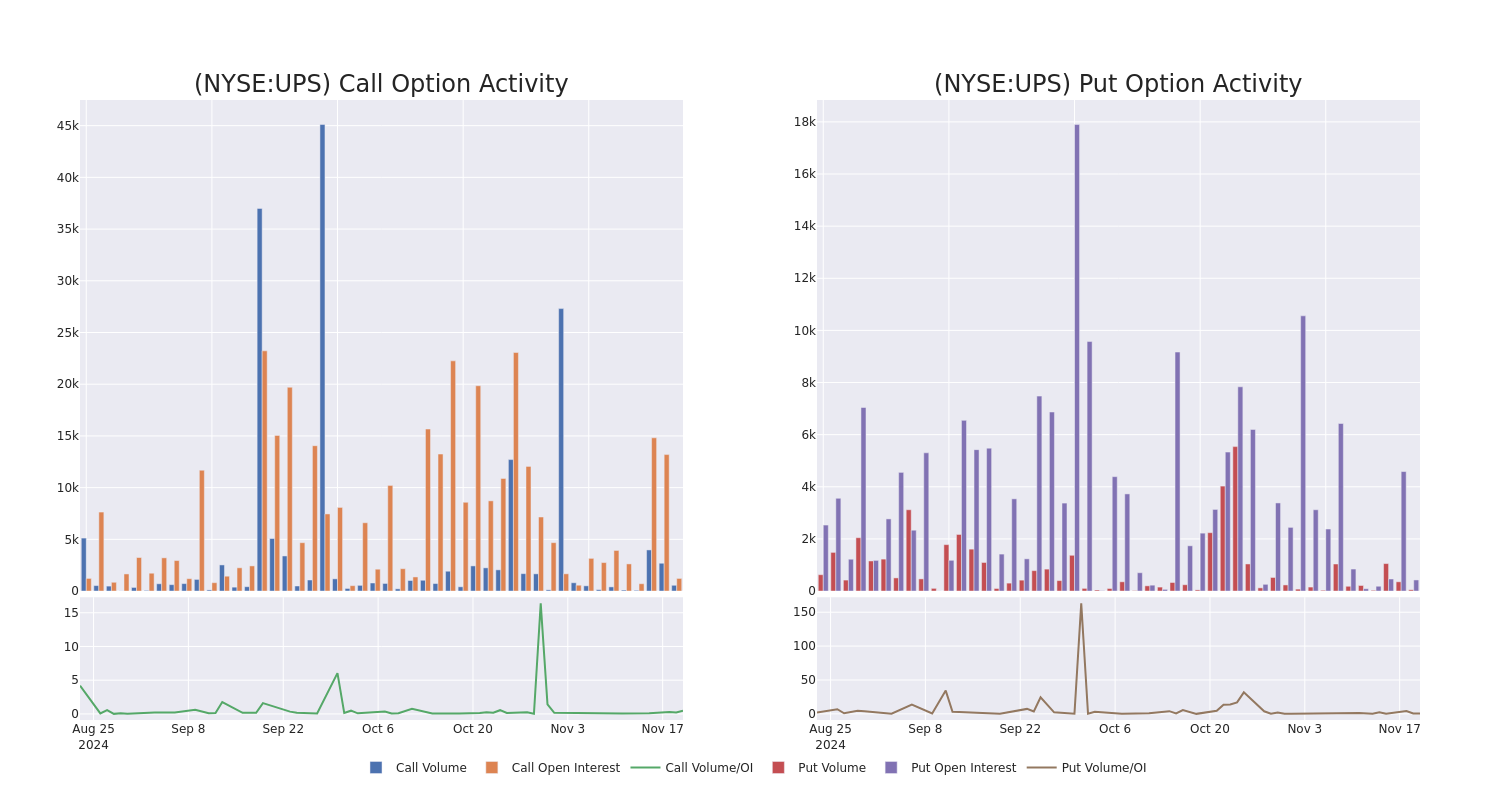

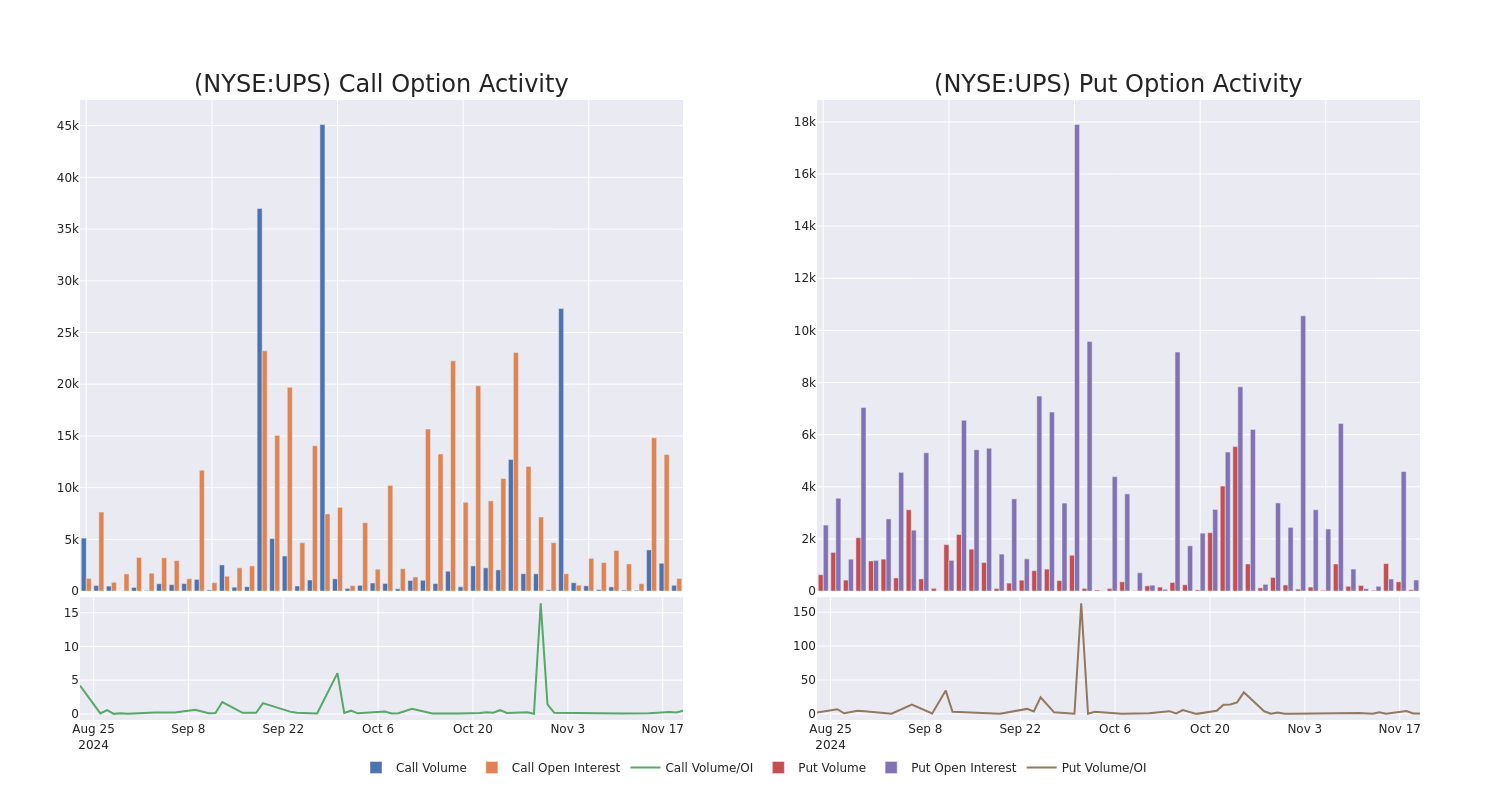

In today’s trading context, the average open interest for options of United Parcel Service stands at 234.86, with a total volume reaching 606.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $120.0 to $160.0, throughout the last 30 days.

United Parcel Service Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | TRADE | BULLISH | 01/17/25 | $13.15 | $12.95 | $13.1 | $120.00 | $327.5K | 547 | 250 |

| UPS | CALL | SWEEP | BEARISH | 11/29/24 | $6.35 | $6.0 | $6.0 | $126.00 | $60.0K | 10 | 100 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $33.85 | $31.5 | $31.5 | $160.00 | $31.5K | 247 | 10 |

| UPS | CALL | SWEEP | BULLISH | 01/16/26 | $14.8 | $14.7 | $14.78 | $130.00 | $29.5K | 653 | 1 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $28.6 | $28.2 | $28.2 | $155.00 | $28.2K | 99 | 20 |

About United Parcel Service

As the world’s largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS’ domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing “strategic alternatives” for its truck brokerage unit, Coyote, which it acquired in 2015.

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company’s own performance.

Where Is United Parcel Service Standing Right Now?

- With a volume of 1,493,806, the price of UPS is down -1.34% at $131.41.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 69 days.

Expert Opinions on United Parcel Service

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $153.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Evercore ISI Group persists with their In-Line rating on United Parcel Service, maintaining a target price of $141.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for United Parcel Service, targeting a price of $170.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on United Parcel Service with a target price of $146.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on United Parcel Service with a target price of $150.

* An analyst from Citigroup persists with their Buy rating on United Parcel Service, maintaining a target price of $158.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for United Parcel Service, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At United Parcel Service's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards United Parcel Service UPS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UPS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for United Parcel Service. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 37% bearish. Among these notable options, 4 are puts, totaling $114,507, and 4 are calls, amounting to $444,526.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $160.0 for United Parcel Service over the last 3 months.

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of United Parcel Service stands at 234.86, with a total volume reaching 606.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $120.0 to $160.0, throughout the last 30 days.

United Parcel Service Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | TRADE | BULLISH | 01/17/25 | $13.15 | $12.95 | $13.1 | $120.00 | $327.5K | 547 | 250 |

| UPS | CALL | SWEEP | BEARISH | 11/29/24 | $6.35 | $6.0 | $6.0 | $126.00 | $60.0K | 10 | 100 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $33.85 | $31.5 | $31.5 | $160.00 | $31.5K | 247 | 10 |

| UPS | CALL | SWEEP | BULLISH | 01/16/26 | $14.8 | $14.7 | $14.78 | $130.00 | $29.5K | 653 | 1 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $28.6 | $28.2 | $28.2 | $155.00 | $28.2K | 99 | 20 |

About United Parcel Service

As the world’s largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS’ domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing “strategic alternatives” for its truck brokerage unit, Coyote, which it acquired in 2015.

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company’s own performance.

Where Is United Parcel Service Standing Right Now?

- With a volume of 1,493,806, the price of UPS is down -1.34% at $131.41.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 69 days.

Expert Opinions on United Parcel Service

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $153.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Evercore ISI Group persists with their In-Line rating on United Parcel Service, maintaining a target price of $141.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for United Parcel Service, targeting a price of $170.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on United Parcel Service with a target price of $146.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on United Parcel Service with a target price of $150.

* An analyst from Citigroup persists with their Buy rating on United Parcel Service, maintaining a target price of $158.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for United Parcel Service, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Beats Q3 Revenue, EPS Estimates, Supply Constraints Ding Stock: Huang Says 'Age Of AI Is In Full Steam' (UPDATED)

Editor’s note: This story has been updated with additional information.

NVIDIA Corporation NVDA continued its streak of beating expectations with third-quarter revenue and earnings per share coming in ahead of Street estimates Wednesday

Nvidia’s Key Q3 Numbers: Nvidia reported third-quarter revenue of $35.1 billion, up 94% year-over-year, which beat a Street consensus estimate of $33.12 billion, according to data from Benzinga Pro.

The company reported earnings per share of 81 cents, which beat Street consensus estimate of 75 cents per share.

The company beat analyst estimates for revenue in nine straight quarters.

The company beat analyst estimates for earnings per share in eight straight quarters.

Analysts and Benzinga readers predicted Nvidia would meet or exceed third-quarter expectations ahead of the report.

“What’s your boldest prediction for Nvidia’s earnings report on Wednesday?” Benzinga asked readers.

The results were:

- Meets expectations: 45%

- Blowout beat: 42%

- Misses expectations: 13%

The majority of Benzinga readers expected the company to meet or beat the estimates from analysts. While more readers expected the company to meet estimates, 42% believed the company would beat estimates Wednesday.

Read Also: Nvidia Stock Historically Drops In December After Q3 Earnings

Nvidia’s Q3 Performance By Segment: The data center business posted a quarterly record for revenue in the third quarter.

Here is a look at the revenue performance by operating business segment.

| Segment | Revenue | Year-over-Year change | Quarter-over-Quarter change |

| Data Center | $30.8 billion | +112% | +17% |

| Gaming & AI PC | $3.3 billion | +15% | +14% |

| Professional Vizualization | $486 million | +17% | +7% |

| Auto | $449 million | +72% | +30% |

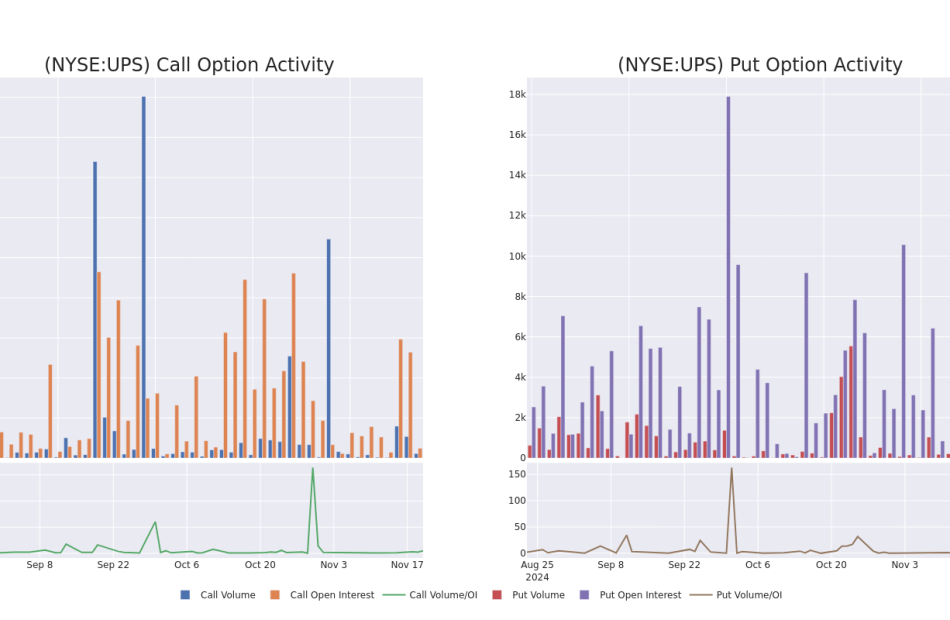

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” Nvidia CEO Jensen Huang said.

“Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.

Huang said countries have “awakened to the importance” of AI.

“AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI.”

Nvidia Q4 Outlook: Nvidia said it expects fourth-quarter revenue to be $37.5 billion plus or minus 2%.

The company said Blackwell production shipments are scheduled to begin in the fourth quarter of 2025 and will ramp into fiscal 2026. Nvidia said there is a continued demand for Hopper and the initial ramp of Blackwell. Both are seeing “certain supply constraints,” but the company said it was working as hard as it could to ramp up supply.

Demand for the Blackwell greatly exceeds supply and the Blackwell guidance remains on track, the company said.

Nvidia expects Blackwell margins to be in mid-70s% when ramped. “Demand for our infrastructure is really great,” Huang said. “Will deliver more Blackwells this quarter than previously estimated.”

Demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026, the company said.

Earnings Call Highlights: Nvidia executives told investors that Blackwell is “in full production” with customers racing to be the first to market with the company’s new product.

The company said the pipeline continues to build and enterprise AI and industrial AI are accelerating.

Nvidia’s gaming segment had a “great quarter” in the third quarter with strong back-to-school sales, the company added. The company said the channel inventory for gaming remains healthy and Nvidia is gearing up for the holiday shopping season.

What’s Next: With the chance of an earnings beat, Benzinga recently asked readers about their expectations for the stock if Nvidia blows out earnings estimates.

“If Nvidia shatters expectations, how high could its stock go by the end of 2024?” Benzinga asked.

The results were:

- $150 to $180: 55%

- $180 to $200: 26%

- Above $200: 18%

Benzinga readers predicted the stock will hit new all-time highs if third-quarter results come in ahead of analyst estimates.

If the stock goes higher, CEO Huang will continue to benefit as one of the key shareholders of the stock. Huang’s wealth soared to $128 billion in 2024, ranking 11th in the world according to Bloomberg.

Huang added $84.3 billion to his wealth and is around $17 billion away from cracking the top 10 richest people in the world milestone. If shares continue to trade higher to the end of the year, this milestone could be within reach.

NVDA Price Action: Nvidia stock is down 2.7% to $141.93 in after-hours trading Wednesday versus a 52-week trading range of $45.01 to $149.76. The stock closed Wednesday down 0.8% to $145.89. Nvidia stock was up over 200% year-to-date ahead of Wednesday’s earnings report

Read Next:

Nvidia CEO Jensen Huang. Photo courtesy of Nvidia.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Zscaler

Whales with a lot of money to spend have taken a noticeably bearish stance on Zscaler.

Looking at options history for Zscaler ZS we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $485,321 and 6, calls, for a total amount of $239,539.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $185.0 to $240.0 for Zscaler over the last 3 months.

Insights into Volume & Open Interest

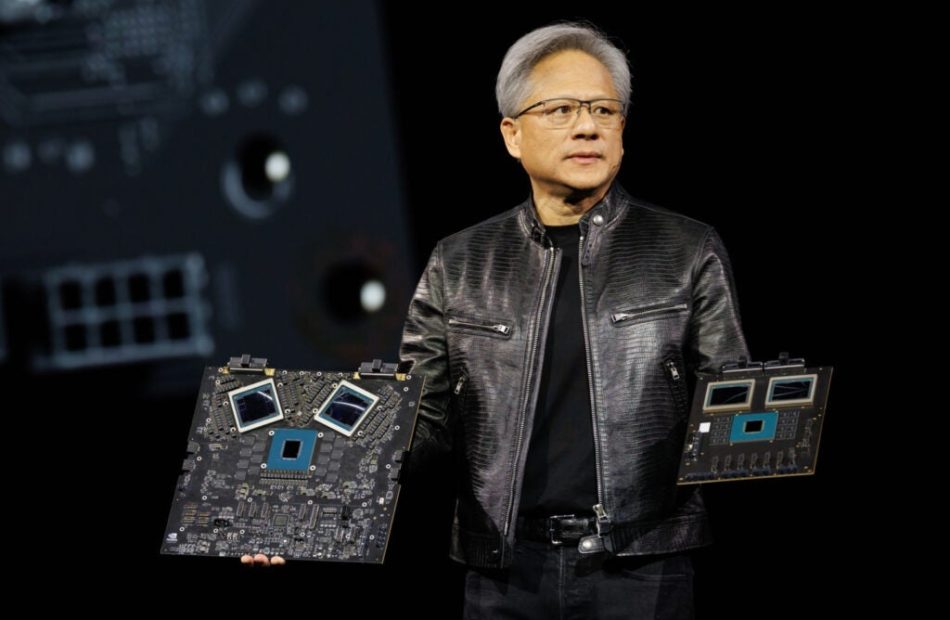

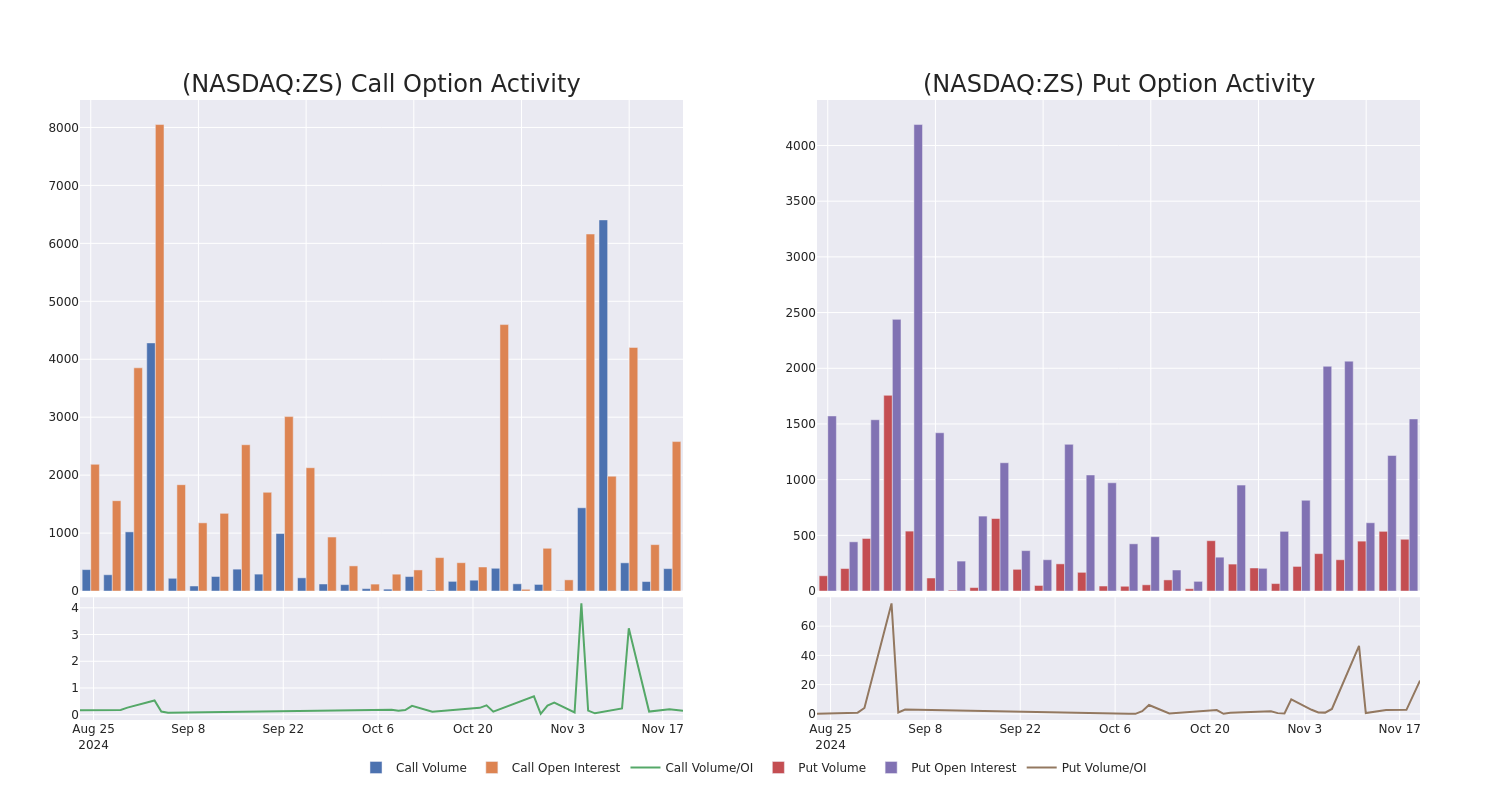

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Zscaler’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Zscaler’s whale trades within a strike price range from $185.0 to $240.0 in the last 30 days.

Zscaler 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZS | PUT | SWEEP | NEUTRAL | 12/18/26 | $32.85 | $29.9 | $32.85 | $185.00 | $98.6K | 30 | 0 |

| ZS | PUT | SWEEP | BULLISH | 12/20/24 | $21.1 | $20.3 | $20.35 | $215.00 | $85.8K | 5 | 81 |

| ZS | CALL | TRADE | BEARISH | 12/06/24 | $8.25 | $7.9 | $7.99 | $210.00 | $79.9K | 145 | 109 |

| ZS | PUT | SWEEP | BULLISH | 12/20/24 | $6.4 | $6.1 | $6.12 | $185.00 | $61.4K | 536 | 100 |

| ZS | PUT | TRADE | BEARISH | 01/17/25 | $19.3 | $18.7 | $19.3 | $210.00 | $50.1K | 763 | 4 |

About Zscaler

Zscaler is a software-as-a-service, or SaaS, firm focusing on providing cloud-native cybersecurity solutions to primarily enterprise customers. Zscaler’s offerings can be broadly partitioned into Zscaler Internet Access, which provides secure access to external applications, and Zscaler Private Access, which provides secure access to internal applications. The firm is headquartered in San Jose, California, and went public in 2018.

Having examined the options trading patterns of Zscaler, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Zscaler

- Trading volume stands at 626,595, with ZS’s price down by -0.18%, positioned at $203.99.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 12 days.

Expert Opinions on Zscaler

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $252.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $270.

* An analyst from Stifel has decided to maintain their Buy rating on Zscaler, which currently sits at a price target of $235.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Zscaler, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Copa Holdings Reports Financial Results for the Third Quarter of 2024

PANAMA CITY, Panama, Nov. 20, 2024 (GLOBE NEWSWIRE) — Copa Holdings, S.A. CPA, today announced financial results for the third quarter of 2024 (3Q24). The terms “Copa Holdings” and the “Company” refer to the consolidated entity. The following financial information, unless otherwise indicated, is presented in accordance with International Financial Reporting Standards (IFRS). See the accompanying reconciliation of non-IFRS financial information to IFRS financial information included in the financial tables section of this earnings release. Unless otherwise stated, all comparisons with prior periods refer to the third quarter of 2023 (3Q23).

OPERATING AND FINANCIAL HIGHLIGHTS

- Copa Holdings reported a net profit of US$146.0 million for 3Q24 or US$3.50 per share, a US$28.4 million decrease compared to 3Q23 on an adjusted basis. The Company reported an operating profit of US$173.7 million and an operating margin of 20.3%, a decrease of US$31.3 million and 3.3 percentage points respectively, compared to 3Q23.

- Consolidated capacity, measured in available seat miles (ASMs), increased by 9.5% in the quarter compared to 3Q23.

- Passenger traffic for the quarter, measured in terms of revenue passenger miles (RPMs), increased by 7.6% compared to 3Q23.

- The Company reported an 86.2% load factor in 3Q24, a 1.6 percentage-point decrease compared to 3Q23.

- Operating cost per available seat mile excluding fuel (Ex-fuel CASM) decreased by 1.6% in the quarter to 5.7 cents when compared to 3Q23.

- Revenue per available seat mile (RASM) decreased by 10.1% to 11.0 cents compared to 3Q23, driven by a decrease of 8.7% in passenger yields and 1.6 percentage points in load factor.

- The Company ended the quarter with approximately US$1.3 billion in cash, short-term and long-term investments, which represent 36% of the last twelve months’ revenues.

- The Company closed the quarter with total debt, including lease liabilities, of US$1.9 billion, while the Adjusted Net Debt to EBITDA ratio ended at 0.6 times.

- During the quarter, the Company took delivery of one Boeing 737 MAX 8 aircraft, ending the quarter with a consolidated fleet of 110 aircraft – 67 Boeing 737-800s, 32 Boeing 737 MAX 9s, 9 Boeing 737-700s, 1 Boeing 737 MAX 8, and 1 Boeing 737-800 freighter.

- Copa Airlines had an on-time performance for the quarter of 87.3% and a flight completion factor of 99.6%, once again positioning itself among the best in the industry.

Subsequent Events

- Copa Holdings will make its third dividend payment of the year of US$1.61 per share on December 13, 2024, to all Class A and Class B shareholders on record as of December 2, 2024.

| Consolidated Financial & Operating Highlights |

3Q24 | 3Q23 | Variance Vs 3Q23 |

2Q24 | Variance Vs 2Q24 |

|||||

| Revenue Passengers Carried (000s) | 3,449 | 3,272 | 5.4 | % | 3,303 | 4.4 | % | |||

| Revenue Passengers OnBoard (000s) | 5,187 | 4,873 | 6.4 | % | 4,970 | 4.4 | % | |||

| RPMs (millions) | 6,711 | 6,239 | 7.6 | % | 6,446 | 4.1 | % | |||

| ASMs (millions) | 7,785 | 7,109 | 9.5 | % | 7,424 | 4.9 | % | |||

| Load Factor | 86.2 | % | 87.8 | % | -1.6 | p.p | 86.8 | % | -0.6 | p.p |

| Yield (US$ Cents) | 12.2 | 13.4 | (8.7 | )% | 12.1 | 0.6 | % | |||

| PRASM (US$ Cents) | 10.5 | 11.7 | (10.3 | )% | 10.5 | (0.1 | )% | |||

| RASM (US$ Cents) | 11.0 | 12.2 | (10.1 | )% | 11.0 | (0.5 | )% | |||

| CASM (US$ Cents) | 8.7 | 9.3 | (6.2 | )% | 8.9 | (1.6 | )% | |||

| CASM Excl. Fuel (US$ Cents) | 5.7 | 5.8 | (1.6 | )% | 5.6 | 1.9 | % | |||

| Fuel Gallons Consumed (millions) | 91.3 | 83.9 | 8.8 | % | 87.6 | 4.3 | % | |||

| Avg. Price Per Fuel Gallon (US$) | 2.60 | 3.00 | (13.3 | )% | 2.79 | (6.9 | )% | |||

| Average Length of Haul (miles) | 1,946 | 1,907 | 2.0 | % | 1,952 | (0.3 | )% | |||

| Average Stage Length (miles) | 1,267 | 1,238 | 2.4 | % | 1,253 | 1.2 | % | |||

| Departures | 37,478 | 35,468 | 5.7 | % | 36,313 | 3.2 | % | |||

| Block Hours | 120,975 | 112,114 | 7.9 | % | 116,062 | 4.2 | % | |||

| Average Aircraft Utilization (hours) | 12.0 | 11.9 | 0.1 | % | 11.9 | 0.9 | % | |||

| Operating Revenues (US$ millions) | 854.7 | 867.7 | (1.5 | )% | 819.4 | 4.3 | % | |||

| Operating Profit (Loss) (US$ millions) | 173.7 | 205.0 | (15.3 | )% | 159.5 | 8.9 | % | |||

| Operating Margin | 20.3 | % | 23.6 | % | -3.3 | p.p | 19.5 | % | 0.9 | p.p |

| Net Profit (Loss) (US$ millions) | 146.0 | 187.4 | (22.1 | )% | 120.3 | 21.4 | % | |||

| Adjusted Net Profit (Loss) (US$ millions) (1) | 146.0 | 174.4 | (16.3 | )% | 120.3 | 21.4 | % | |||

| Basic EPS (US$) | 3.50 | 4.72 | (25.8 | )% | 2.88 | 21.4 | % | |||

| Adjusted Basic EPS (US$) (1) | 3.50 | 4.39 | (20.3 | )% | 2.88 | 21.4 | % | |||

| Shares for calculation of Basic EPS (000s) | 41,728 | 39,730 | 5.0 | % | 41,715 | — | % | |||

(1) Excludes Special Items. This earnings release includes a reconciliation of non-IFRS financial measures to the comparable IFRS measures.

FULL 3Q24 EARNINGS RELEASE AVAILABLE FOR DOWNLOAD AT:

https://copa.gcs-web.com/financial-information/quarterly-results

3Q24 EARNINGS RESULTS CONFERENCE CALL AND WEBCAST

About Copa Holdings

Copa Holdings is a leading Latin American provider of passenger and cargo services. The Company, through its operating subsidiaries, provides service to countries in North, Central, and South America and the Caribbean. For more information visit: www.copaair.com.

CONTACT: Copa Holdings S.A.

Investor Relations:

Ph: 011 507 304-2774

www.copaair.com (IR section)

This release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current plans, estimates, and expectations, and are not guarantees of future performance. They are based on management’s expectations that involve several business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statement. The risks and uncertainties relating to the forward-looking statements in this release are among those disclosed in Copa Holdings’ filed disclosure documents and are, therefore, subject to change without prior notice.

CPA-G

Copa Holdings, S. A. and Subsidiaries

Consolidated statement of profit or loss

(In US$ thousands)

| Unaudited | Unaudited | % | Unaudited | % | |||||||||

| 3Q24 | 3Q23 | Change | 2Q24 | Change | |||||||||

| Operating Revenues | |||||||||||||

| Passenger revenue | 818,381 | 833,306 | (1.8 | %) | 781,497 | 4.7 | % | ||||||

| Cargo and mail revenue | 24,446 | 23,431 | 4.3 | % | 25,184 | (2.9 | %) | ||||||

| Other operating revenue | 11,881 | 10,973 | 8.3 | % | 12,722 | (6.6 | %) | ||||||

| Total Operating Revenue | 854,708 | 867,711 | (1.5 | %) | 819,403 | 4.3 | % | ||||||

| Operating Expenses | |||||||||||||

| Fuel | 238,714 | 252,077 | (5.3 | %) | 246,011 | (3.0 | %) | ||||||

| Wages, salaries, benefits and other employees’ expenses | 117,877 | 108,416 | 8.7 | % | 114,878 | 2.6 | % | ||||||

| Passenger servicing | 26,232 | 23,147 | 13.3 | % | 27,579 | (4.9 | %) | ||||||

| Airport facilities and handling charges | 65,029 | 58,243 | 11.7 | % | 62,768 | 3.6 | % | ||||||

| Sales and distribution | 49,716 | 54,058 | (8.0 | %) | 52,210 | (4.8 | %) | ||||||

| Maintenance, materials and repairs | 34,860 | 29,528 | 18.1 | % | 10,883 | 220.3 | % | ||||||

| Depreciation and amortization | 82,797 | 78,359 | 5.7 | % | 79,462 | 4.2 | % | ||||||

| Flight operations | 31,901 | 29,476 | 8.2 | % | 31,914 | — | % | ||||||

| Other operating and administrative expenses | 33,871 | 29,394 | 15.2 | % | 34,190 | (0.9 | %) | ||||||

| Total Operating Expense | 680,998 | 662,697 | 2.8 | % | 659,896 | 3.2 | % | ||||||

| Operating Profit/(Loss) | 173,710 | 205,014 | (15.3 | %) | 159,507 | 8.9 | % | ||||||

| Non-operating Income (Expense): | |||||||||||||

| Finance cost | (23,523 | ) | (82,926 | ) | (71.6 | %) | (20,632 | ) | 14.0 | % | |||

| Finance income | 15,565 | 15,108 | 3.0 | % | 13,537 | 15.0 | % | ||||||

| Gain (loss) on foreign currency fluctuations | (2,491 | ) | (1,566 | ) | 59.1 | % | (16,097 | ) | (84.5 | %) | |||

| Net change in fair value of derivatives | (762 | ) | 77,058 | (101.0 | %) | 2,533 | (130.1 | %) | |||||

| Other non-operating income (expense) | 6,787 | 1,867 | 263.6 | % | 1,766 | 284.4 | % | ||||||

| Total Non-Operating Income/(Expense) | (4,425 | ) | 9,540 | (146.4 | %) | (18,892 | ) | (76.6 | %) | ||||

| Profit before taxes | 169,285 | 214,555 | (21.1 | %) | 140,615 | 20.4 | % | ||||||

| Income tax expense | (23,259 | ) | (27,179 | ) | (14.4 | %) | (20,362 | ) | 14.2 | % | |||

| Net Profit/(Loss) | 146,026 | 187,375 | (22.1 | %) | 120,253 | 21.4 | % | ||||||

Copa Holdings, S. A. and Subsidiaries

Consolidated statement of financial position

(In US$ thousands)

| September 2024 | December 2023 | |||||

| ASSETS | (Unaudited) | (Audited) | ||||

| Cash and cash equivalents | 275,245 | 206,375 | ||||

| Short-term investments | 758,560 | 708,809 | ||||

| Total cash, cash equivalents and short-term investments | 1,033,805 | 915,184 | ||||

| Accounts receivable, net | 201,327 | 156,720 | ||||

| Accounts receivable from related parties | 2,782 | 2,527 | ||||

| Expendable parts and supplies, net | 123,571 | 116,604 | ||||

| Prepaid expenses | 40,422 | 44,635 | ||||

| Prepaid income tax | 5,802 | 66 | ||||

| Other current assets | 23,708 | 32,227 | ||||

| 397,612 | 352,780 | |||||

| TOTAL CURRENT ASSETS | 1,431,416 | 1,267,963 | ||||

| Long-term investments | 219,731 | 258,934 | ||||

| Long-term prepaid expenses | 8,849 | 9,633 | ||||

| Property and equipment, net | 3,363,353 | 3,238,632 | ||||

| Right of use assets | 337,684 | 281,146 | ||||

| Intangible, net | 94,097 | 87,986 | ||||

| Net defined benefit assets | 6,442 | 5,346 | ||||

| Deferred tax assets | 22,729 | 30,148 | ||||

| Other Non-Current Assets | 24,053 | 17,048 | ||||

| TOTAL NON-CURRENT ASSETS | 4,076,938 | 3,928,872 | ||||

| TOTAL ASSETS | 5,508,354 | 5,196,836 | ||||

| LIABILITIES | ||||||

| Loans and borrowings | 205,144 | 222,430 | ||||

| Current portion of lease liability | 59,779 | 68,304 | ||||

| Accounts payable | 175,443 | 182,303 | ||||

| Accounts payable to related parties | 1,312 | 1,228 | ||||

| Air traffic liability | 639,211 | 611,856 | ||||

| Frequent flyer deferred revenue | 136,520 | 124,815 | ||||

| Taxes Payable | 41,535 | 44,210 | ||||

| Accrued expenses payable | 50,085 | 64,940 | ||||

| Income tax payable | 7,331 | 26,741 | ||||

| Other Current Liabilities | 1,320 | 1,403 | ||||

| TOTAL CURRENT LIABILITIES | 1,317,680 | 1,348,229 | ||||

| Loans and borrowings long-term | 1,298,106 | 1,240,261 | ||||

| Lease Liability | 295,777 | 215,353 | ||||

| Deferred tax Liabilities | 57,297 | 36,369 | ||||

| Other long-term liabilities | 223,541 | 234,474 | ||||

| TOTAL NON-CURRENT LIABILITIES | 1,874,721 | 1,726,457 | ||||

| TOTAL LIABILITIES | 3,192,400 | 3,074,685 | ||||

| EQUITY | ||||||

| Class A – 34,195,954 issued and 30,654,831 outstanding | 23,244 | 23,201 | ||||

| Class B – 10,938,125 | 7,466 | 7,466 | ||||

| Additional Paid-In Capital | 212,877 | 209,102 | ||||

| Treasury Stock | (254,532 | ) | (204,130 | ) | ||

| Retained Earnings | 1,893,880 | 1,581,739 | ||||

| Net profit | 442,345 | 514,098 | ||||

| Other comprehensive loss | (9,326 | ) | (9,326 | ) | ||

| TOTAL EQUITY | 2,315,953 | 2,122,150 | ||||

| TOTAL EQUITY LIABILITIES | 5,508,354 | 5,196,836 | ||||

Copa Holdings, S. A. and Subsidiaries

Consolidated statement of cash flows

For the nine months ended

(In US$ thousands)

| 2024 | 2023 | 2022 | |||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | |||||||||

| Cash flow from operating activities | 659,392 | 764,586 | 543,471 | ||||||||

| Cash flow (used in) investing activities | (322,575 | ) | (274,166 | ) | (387,334 | ) | |||||

| Cash flow (used in) financing activities | (267,947 | ) | (375,966 | ) | (168,474 | ) | |||||

| Netincrease (decrease)in cash and cash equivalents | 68,870 | 114,454 | (12,337 | ) | |||||||

| Cash and cash equivalents on January 1 | 206,375 | 122,424 | 211,081 | ||||||||

| Cash and cash equivalents at September 30 | $ | 275,245 | $ | 236,878 | $ | 198,744 | |||||

| Short-term investments | 758,560 | 754,799 | 752,812 | ||||||||

| Long-term investments | 219,731 | 177,835 | 168,114 | ||||||||

| Total cash and cash equivalents and investments at September 30 | $ | 1,253,536 | $ | 1,169,512 | $ | 1,119,670 | |||||

Copa Holdings, S.A.

NON-IFRS FINANCIAL MEASURE RECONCILIATION

This press release includes the following non-IFRS financial measures: Adjusted Net Profit, Adjusted Basic EPS, and Operating CASM Excluding Fuel. This supplemental information is presented because we believe it is a useful indicator of our operating performance and is useful in comparing our performance with other companies in the airline industry. These measures should not be considered in isolation and should be considered together with comparable IFRS measures, in particular operating profit, and net profit. The following is a reconciliation of these non-IFRS financial measures to the comparable IFRS measures:

| Reconciliation of Adjusted Net Profit | 3Q24 | 3Q23 | 2Q24 | ||||||||

| Net Profit as Reported | $ | 146,026 | $ | 187,375 | $ | 120,253 | |||||

| Interest expense related to the settlement of the convertible notes | $ | — | $ | 64,894 | $ | — | |||||

| Net change in fair value of derivatives | $ | — | $ | (77,058 | ) | $ | — | ||||

| Net change in fair value of financial investments | $ | — | $ | (810 | ) | $ | — | ||||

| Adjusted Net Profit | $ | 146,026 | $ | 174,401 | $ | 120,253 | |||||

| Reconciliation of Adjusted Basic EPS | 3Q24 | 3Q23 | 2Q24 | ||||||||

| Adjusted Net Profit | $ | 146,026 | $ | 174,401 | $ | 120,253 | |||||

| Shares used for calculation of Basic EPS | 41,728 | 39,730 | 41,715 | ||||||||

| Adjusted Basic Earnings per share (Adjusted Basic EPS) | $ | 3.50 | $ | 4.39 | $ | 2.88 | |||||

| Reconciliation of Operating Costs per ASM | |||||||||||

| Excluding Fuel (CASM Excl. Fuel) | 3Q24 | 3Q23 | 2Q24 | ||||||||

| Operating Costs per ASM as Reported (in US$ Cents) | 8.7 | 9.3 | 8.9 | ||||||||

| Aircraft Fuel Cost per ASM (in US$ Cents) | 3.1 | 3.5 | 3.3 | ||||||||

| Operating Costs per ASM excluding fuel (in US$ Cents) | 5.7 | 5.8 | 5.6 | ||||||||

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

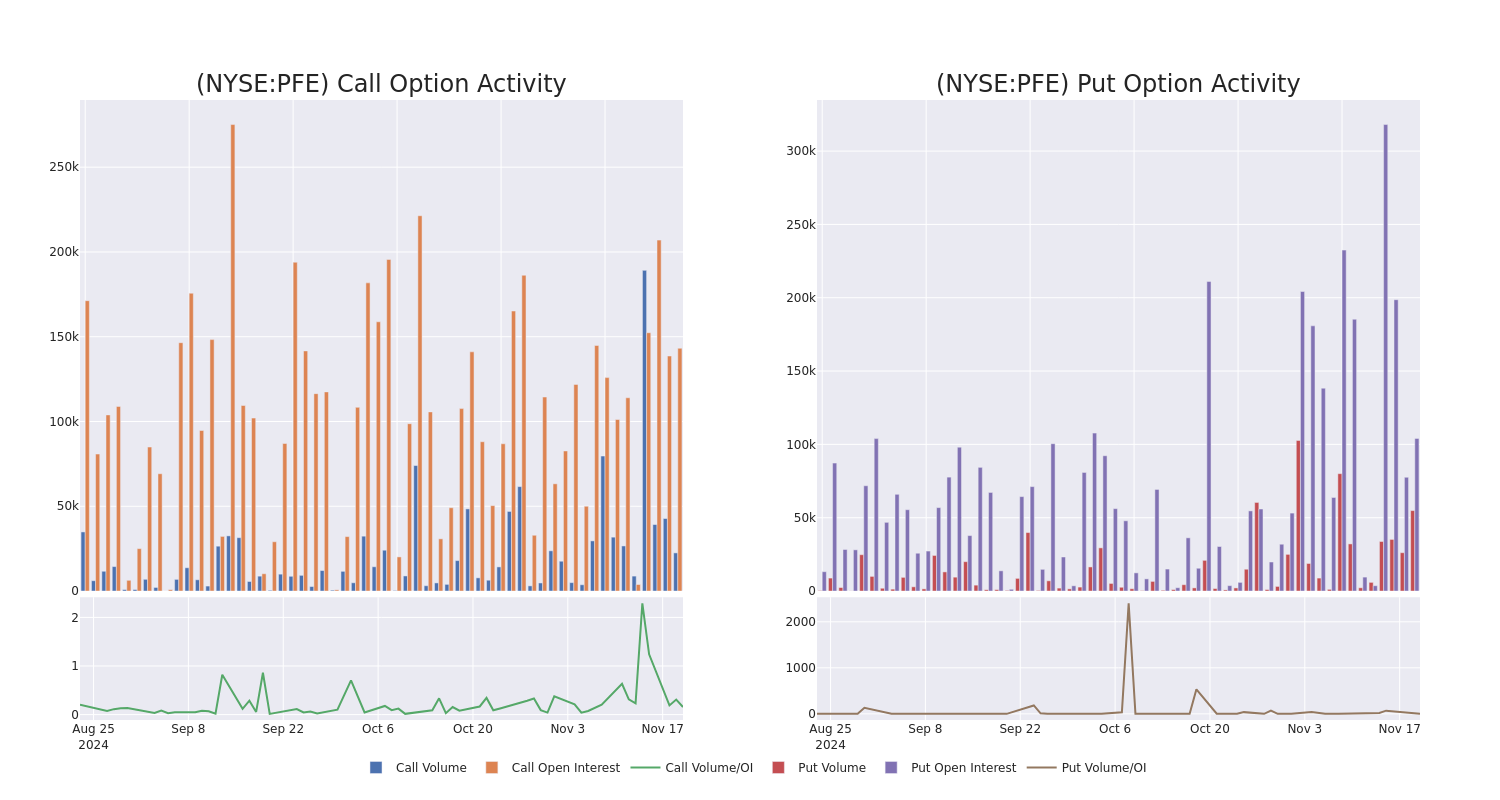

Pfizer Unusual Options Activity For November 20

Whales with a lot of money to spend have taken a noticeably bearish stance on Pfizer.

Looking at options history for Pfizer PFE we detected 40 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 18 are puts, for a total amount of $881,278 and 22, calls, for a total amount of $1,564,167.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $30.0 for Pfizer over the last 3 months.

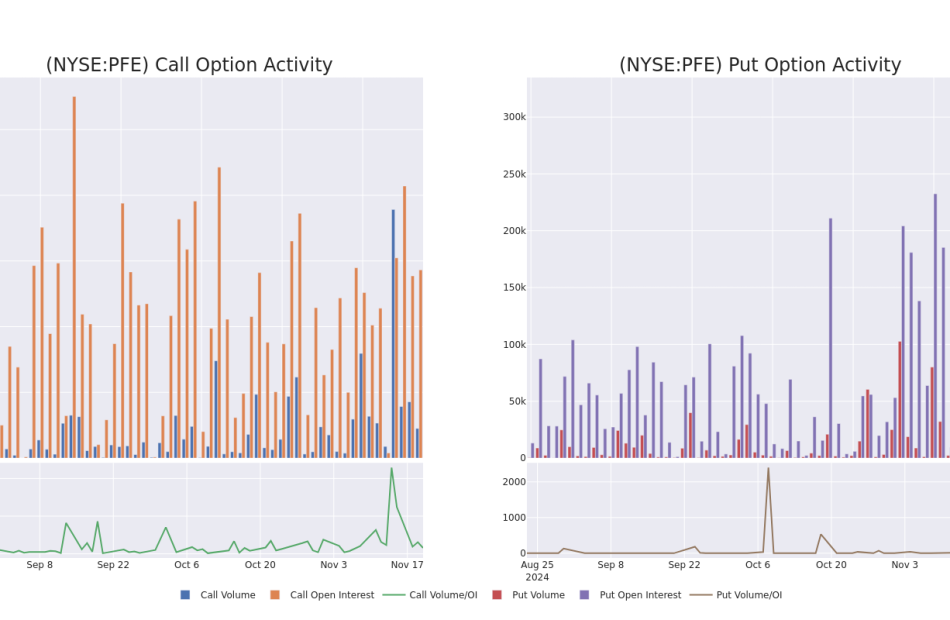

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Pfizer’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Pfizer’s significant trades, within a strike price range of $20.0 to $30.0, over the past month.

Pfizer Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | CALL | SWEEP | BEARISH | 12/20/24 | $0.82 | $0.81 | $0.81 | $25.00 | $212.4K | 29.7K | 1.1K |

| PFE | CALL | SWEEP | BEARISH | 01/16/26 | $1.23 | $1.15 | $1.15 | $30.00 | $170.4K | 60.2K | 3.0K |

| PFE | PUT | SWEEP | BEARISH | 11/29/24 | $0.41 | $0.41 | $0.41 | $25.00 | $151.4K | 6.0K | 3.7K |

| PFE | CALL | TRADE | NEUTRAL | 06/20/25 | $0.77 | $0.65 | $0.7 | $29.00 | $140.0K | 1.7K | 2.0K |

| PFE | CALL | SWEEP | BULLISH | 05/16/25 | $4.55 | $4.45 | $4.55 | $21.00 | $130.1K | 92 | 287 |

About Pfizer

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding covid-19-related product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

After a thorough review of the options trading surrounding Pfizer, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Pfizer

- Trading volume stands at 34,661,607, with PFE’s price down by -0.89%, positioned at $24.88.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 69 days.

What The Experts Say On Pfizer

In the last month, 3 experts released ratings on this stock with an average target price of $38.333333333333336.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

* In a cautious move, an analyst from Wolfe Research downgraded its rating to Underperform, setting a price target of $25.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $45.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Pfizer options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.