STARLIGHT U.S. RESIDENTIAL FUND ANNOUNCES Q3-2024 RESULTS INCLUDING NORMALIZED SAME PROPERTY NOI GROWTH OF 2.8%

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES./

TORONTO, Nov. 18, 2024 /CNW/ – Starlight U.S. Residential Fund SURF SURF (the “Fund”) announced today its results of operations and financial condition for the three months ended September 30, 2024 (“Q3-2024”) and nine months ended September 30, 2024 (“YTD-2024”). Certain comparative figures are included for the three months ended September 30, 2023 (“Q3-2023”) and nine months ended September 30, 2023 (“YTD-2023”)

All amounts in this press release are in thousands of United States (“U.S.”) dollars except for average monthly rent (“AMR”) or unless otherwise stated. All references to “C$” are to Canadian dollars.

“The Fund owns a high-quality, well located and diversified portfolio of multi-family communities which reported an increase in normalized same property net operating income of 2.8% from Q3-2023 to Q3-2024,” commented Evan Kirsh, the Fund’s President. “The Fund continues to focus on increasing net operating income at its properties through active asset management and navigating the current challenging capital markets environment with the goal of maximizing the total return for investors upon exit.”

Q3-2024 HIGHLIGHTS

- Q3-2024 total portfolio revenue was $9,849 (Q3-2023 – $9,709), representing an increase of $140, primarily due to strong same property revenue growth of 3.3%. Net operating income (“NOI”)1 was $6,228 (Q3-2023 – $6,439) representing a decrease of $211, primarily due to the disposition of 94 single-family properties (“SF Properties”) since the second quarter of 2023 (“Primary Variance Driver”), partially offset by normalized same property NOI1 growth of 2.8%.

- The Fund completed 45 in-suite light value-add upgrades at the multi-family properties (“MF Properties”) during Q3-2024, which generated an average rental premium of $95 and an average return on cost of approximately 30.9%.

- The Fund achieved economic occupancy1 during Q3-2024 of 92.9%.

- As at November 15, 2024, the Fund had collected approximately 99.3% of rents for Q3-2024, with further amounts expected to be collected in future periods, demonstrating the Fund’s high quality resident base and operating performance.

- The Fund reported a net loss and comprehensive loss attributable to unitholders for Q3-2024 of $4,727 (Q3-2023 – $14,563) with Q3-2023 including an amount for fair value loss on investment properties at the MF Properties.

- During Q3-2024, the Fund continued with the disposition program of the SF Properties completing eight dispositions during the quarter for net proceeds of $2,245 (Q3-2023 – 9 SF Property dispositions for net proceeds of $2,653).

- On September 9, 2024 the Fund amended the Fund’s credit facility to a $16,000 revolving credit facility with a maturity date of December 31, 2026 (“Fund Credit Facility”).

YTD-2024 HIGHLIGHTS

- YTD-2024 total portfolio revenue and NOI were $29,878 and $18,802 (YTD-2023 – $29,578 and $18,415), respectively, with the increases resulting primarily from the same property revenue growth of 4.1% and normalized same property NOI growth of 5.5% from YTD-2023 to YTD-2024, partially offset by the disposition of 94 SF Properties since the second quarter of 2023.

- The Fund completed 113 in-suite light value-add upgrades at the MF Properties during YTD-2024, which generated an average rental premium of $95 and an average return on cost of approximately 31.1%.

- The Fund reported a net loss and comprehensive loss attributable to unitholders for YTD-2024 of $19,007 (YTD-2023 – $52,707), with the decrease primarily resulting from the higher fair value loss on investment properties reported in YTD-2023.

- On May 1, 2024, the Fund amended the Ventura loan payable to extend the term to February 9, 2026, discharge its obligation to purchase a replacement interest rate cap and defer a portion of the debt service at the property, whereby the Fund can defer up to $125 per month subject to certain terms.

- On April 29, 2024, the board of trustees of the Fund (the “Board”) approved the first one-year extension of the Fund’s term to November 15, 2025 to provide the Fund with additional flexibility to capitalize on anticipated improvements in the real estate investment market.

- On June 28, 2024, the Fund refinanced the existing Indigo Apartments loan payable by entering into a new first mortgage for $62,223 with a five-year term and monthly interest only (“IO”) payments bearing interest at a fixed rate of 5.85%. In addition, a subsidiary of the Fund entered into an unsecured financing amounting to $18,277 for a three-year term, bearing monthly IO payments at a minimum of 4.00% per annum (“Unsecured Financing”). Upon completion of the Unsecured Financing, a portion of the proceeds were used to repay $14,700 towards the Fund Credit Facility.

|

1 This metric is a non-IFRS measure. Non-IFRS financial measures do not have standardized meanings prescribed by IFRS (see “non-IFRS financial measures”). |

FINANCIAL CONDITION AND OPERATING RESULTS

Highlights of the financial and operating performance of the Fund as at September 30, 2024 and for Q3-2024 and YTD-2024, including a comparison to December 31, 2023 and Q3-2023 and YTD-2023, as applicable, are provided below:

|

September 30, 2024 |

December 31, 2023 |

||||

|

Key Multi-Family Operational Information |

|||||

|

Number of multi-family properties owned |

6 |

6 |

|||

|

Total multi-family suites |

1,973 |

1,973 |

|||

|

Economic occupancy(1) |

92.9 % |

90.5 % |

|||

|

Physical occupancy(1)(2) |

93.7 % |

92.7 % |

|||

|

AMR (in actual dollars)(1)(2) |

$ 1,600 |

$ 1,617 |

|||

|

AMR per square foot (in actual dollars)(1) |

$ 1.68 |

$ 1.70 |

|||

|

Estimated gap to market versus in-place rents(2) |

2.2 % |

1.4 % |

|||

|

Number of Single-Family Rental Homes |

4 |

25 |

|||

|

September 30, 2024 |

December 31, 2023 |

||||

|

Selected Financial Information |

|||||

|

Gross book value(2) |

$ 553,430 |

$ 563,338 |

|||

|

Indebtedness(2) |

$ 468,894 |

$ 460,692 |

|||

|

Indebtedness to gross book value(2)(3) |

84.7 % |

81.8 % |

|||

|

Weighted average interest rate – as at period end(4) |

5.85 % |

5.78 % |

|||

|

Weighted average loan term to maturity(4) |

1.93 years |

0.84 years |

|||

|

Q3-2024 |

Q3-2023 |

YTD-2024 |

YTD-2023 |

||

|

Summarized Income Statement (Excluding Non-Controlling Interest)(5) |

|||||

|

Revenue from property operations |

$ 9,849 |

$ 9,709 |

$ 29,878 |

$ 29,578 |

|

|

Property operating costs |

$ (2,717) |

$ (2,595) |

$ (7,870) |

$ (7,817) |

|

|

Property taxes(6) |

$ (904) |

$ (675) |

$ (3,206) |

$ (3,346) |

|

|

Adjusted income from operations / NOI |

$ 6,228 |

$ 6,439 |

$ 18,802 |

$ 18,415 |

|

|

Fund and trust expenses |

$ (856) |

$ (821) |

$ (2,463) |

$ (2,645) |

|

|

Finance costs(7) |

$ (10,036) |

$ (9,146) |

$ (28,436) |

$ (24,454) |

|

|

Other income and expenses(8) |

$ (63) |

$ (11,035) |

$ (6,910) |

$ (44,023) |

|

|

Net loss and comprehensive loss – attributable to unitholders(5) |

$ (4,727) |

$ (14,563) |

$ (19,007) |

$ (52,707) |

|

|

Other Selected Financial Information |

|||||

|

Funds from operations (“FFO”)(2) |

$ (2,507) |

$ (1,600) |

$ (5,938) |

$ (5,276) |

|

|

FFO per unit – basic and diluted |

$ (0.08) |

$ (0.05) |

$ (0.19) |

$ (0.17) |

|

|

Adjusted funds from operations (“AFFO”)(2) |

$ (1,013) |

$ (1,047) |

$ (2,987) |

$ (3,544) |

|

|

AFFO per unit – basic and diluted |

$ (0.03) |

$ (0.03) |

$ (0.09) |

$ (0.11) |

|

|

Weighted average interest rate – average during period(4) |

5.85 % |

5.75 % |

5.92 % |

5.46 % |

|

|

Interest and indebtedness coverage ratio(2)(9) |

0.84 x |

0.84 x |

0.84 x |

0.80 x |

|

|

Weighted average units outstanding (000s) – basic/diluted |

31,818 |

31,820 |

31,818 |

31,820 |

|

|

(1) |

Economic occupancy for Q3-2024 and Q4-2023 and physical occupancy as at the end of each applicable reporting period. The decrease in AMR and AMR per square foot from Q4-2023 to Q3-2024 was primarily due to the Fund focusing on occupancy at the MF Properties which increased from 90.5% economic occupancy during Q4-2023 to 93.7% during Q3-2024. |

||||

|

(2) |

This metric is a non-IFRS measure. Non-IFRS financial measures do not have standardized meanings prescribed by IFRS (see “non-IFRS financial measures and reconciliations”). The increase in AFFO, interest coverage ratio and indebtedness coverage ratio from Q3-2023 to Q3-2024 is primarily due to increases in NOI, partially offset by increases in interest costs (excluding any accrued interest costs payable upon maturity of the applicable loans payable). The AFFO, interest coverage ratio and indebtedness coverage ratio presented herein exclude $1,015 and $1,497 of interest costs for Q3-2024 and YTD-2024 or debt service shortfall funding from applicable lenders which are payable upon maturity of the applicable loan payable. |

||||

|

(3) |

The maximum allowable leverage ratio under the Declaration of Trust restricts the Fund from entering into any additional indebtedness whereby at the time of entering into such indebtedness, the leverage ratio does not exceed 75% (as defined in the Declaration of Trust). As of the date of issuance of this MD&A, the Fund met the maximum leverage condition and continues to focus on managing the Fund’s capital structure, including the overall leverage. |

||||

|

(4) |

The weighted average interest rate on loans payable is presented as at September 30, 2024 reflecting the prevailing index rate, 30-day New York Federal Reserve Secured Overnight Financing Rate (“NY SOFR”) or one-month term Secured Overnight Financing Rate (“Term SOFR” and together with NY SOFR, “SOFR”), as at that date or based on the average rate for the applicable periods as it relates to quarterly rates. As at November 18, 2024, the Fund had interest rate caps, swaps or fixed rate debt in place in certain instances, which protect the Fund from increases in SOFR above stipulated levels (as at September 30, 2024, the SOFR rate was 4.96%). The weighted average interest rate presented above as at September 30, 2024 assumes the minimum interest rate on the Unsecured Financing of 4.00%. The weighted average term to maturity presented as at September 30, 2024 assumes the Fund has taken advantage of the one-year extension option of certain loans payable which are subject to certain conditions. |

||||

|

(5) |

The Fund acquired a 90% interest in The Ventura on May 25, 2022, with the remaining non-controlling interest owned by an affiliate of the manager of the Fund. The summarized income statement figures presented above reflect the net loss attributable to unitholders only, and excludes any amounts attributable to the non-controlling interest. |

||||

|

(6) |

Property taxes include the International Financial Reporting Interpretations Committee 21 – Levies fair value adjustment and treats property taxes as an expense that is amortized during the fiscal year for the purpose of calculating NOI. |

||||

|

(7) |

Finance costs include interest expense on loans payable, non-cash amortization of deferred financing costs, loss on early extinguishment of debt and fair value changes in derivative financial instruments. |

||||

|

(8) |

Includes dividends to preferred shareholders, unrealized foreign exchange gain (loss), realized foreign exchange gain, fair value adjustment of investment properties, provision for carried interest and deferred income taxes. The Fund paused monthly distributions effective with the November 2022 distribution, that would have been payable on December 15, 2022. |

||||

|

(9) |

The Fund’s interest and indebtedness coverage ratios were 0.84x and 0.84x during Q3-2024 and YTD-2024, with the Fund’s operating results having been offset by increases in the Fund’s interest costs as a result of the Fund utilizing a variable rate debt strategy which allows the Fund to maintain maximum flexibility for the potential sale of the Fund’s properties at the end of, or during, the Fund’s term. These calculations exclude $1,015 and $1,497 of interest costs or debt service shortfall funding for Q3-2024 and YTD-2024 as these amounts are accrued and payable only at maturity of the applicable loan payable. The Fund also had interest rate caps, swaps or fixed rate debt in place as at September 30, 2024 which in certain instances protect the Fund from increases SOFR beyond stipulated levels on its mortgages at the Fund’s properties. Given the Fund was also formed as a “closed-end” trust with an initial term of three years, a targeted pre-tax yield of 4.0% and a pre-tax targeted annual total return of 11% across all classes of units, the Fund continues to monitor interest and indebtedness coverage ratios with the goal of maximizing the total return for investors during the Fund’s term. On April 29, 2024, the Board approved the first one-year extension of the term to November 15, 2025 to provide the Fund with additional flexibility to capitalize on anticipated improvements in the real estate investment market. |

||||

NON-IFRS FINANCIAL MEASURES AND RECONCILIATIONS

The Fund’s condensed consolidated interim financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). Certain terms that may be used in this press release including AFFO, AMR, adjusted net income and comprehensive income, cash provided by operating activities including interest costs, economic occupancy, estimated gap to market versus in-place rents, FFO, gross book value, indebtedness, indebtedness coverage ratio, indebtedness to gross book value, interest coverage ratio, same property NOI and NOI (collectively, the “Non-IFRS Measures”), as well as other measures discussed elsewhere in this press release, do not have a standardized definition prescribed by IFRS and are, therefore, unlikely to be comparable to similar measures presented by other reporting issuers. The Fund uses these measures to better assess the Fund’s underlying performance and financial position and provides these additional measures so that investors may do the same. Further details on Non-IFRS Measures are set out in the Fund’s management’s discussion and analysis (“MD&A”) in the “Non-IFRS Financial Measures” section for Q3-2024 available on the Fund’s profile on SEDAR+ at www.sedarplus.ca.

A reconciliation of the Fund’s interest coverage ratio and indebtedness coverage ratio are provided below:

|

Interest and indebtedness coverage ratio |

Q3-2024 |

Q3-2023 |

YTD-2024 |

YTD-2023 |

|

|

Net loss and comprehensive loss |

$ (4,727) |

$ (14,563) |

$ (19,007) |

$ (52,707) |

|

|

(Deduct) / Add: non-cash or one-time items including distributions(1) |

2,663 |

13,463 |

14,526 |

48,940 |

|

|

Adjusted net loss and comprehensive loss(2) |

$ (2,064) |

$ (1,100) |

$ (4,481) |

$ (3,767) |

|

|

Interest coverage ratio(3)(4) |

0.84x |

0.84x |

0.84x |

0.80x |

|

|

Indebtedness coverage ratio(4)(5) |

0.84x |

0.84x |

0.84x |

0.80x |

|

|

(1) |

Comprised of unrealized foreign exchange gain, deferred income taxes, amortization of financing costs, loss on early extinguishment of debt, fair value adjustments on derivative instruments and fair value adjustment on investment properties. |

|||||||

|

(2) |

This metric is a non-IFRS measure. Non-IFRS financial measures do not have standardized meanings prescribed by IFRS (see “non-IFRS financial measures”). |

|||||||

|

(3) |

Interest coverage ratio is calculated as adjusted net loss and comprehensive loss plus interest expense divided by interest expense. |

|||||||

|

(4) |

These calculations exclude $1,015 and $1,497 of interest costs or debt service shortfall funding for Q3-2024 and YTD-2024 as these amounts are accrued and payable only at maturity of the applicable loan payable. |

|||||||

|

(5) |

Indebtedness coverage ratio is calculated as adjusted net loss and comprehensive loss plus interest expense divided by interest expense and mandatory principal payments on the Fund’s loans payable. |

|||||||

The Fund’s interest coverage ratio and indebtedness coverage ratio were each 0.84x during Q3-2024. Both ratios remained the same during Q3-2024 relative to Q3-2023, due to increases in NOI and a reduction in interest costs included in such calculation (excluding any accrued interest costs payable at maturity of the applicable loan) primarily due to the Fund having the ability to defer a portion of interest costs which are excluded from the calculations above amounting to $1,015 in Q3-2024. Although the interest coverage and indebtedness coverage ratios have been negatively impacted by the increases in SOFR, operating results for the Fund’s properties have remained favourable. During Q3-2024, the Fund covered any operating shortfall through cash on hand, including any proceeds from financing activities as applicable.

The Fund also utilizes interest rate caps, swaps or fixed rate debt in certain instances to limit the potential impact on the Fund’s financial performance from any increases in interest rates. As at September 30, 2024, the Fund’s weighted average interest rate was 5.85%.

CASH PROVIDED BY OPERATING ACTIVITIES RECONCILIATION TO FFO and AFFO

The Fund was formed as a “closed-end” trust with an initial term of three years, a targeted yield of 4.0% and a pre-tax targeted total annual return of 11% across all classes of units of the Fund. For Q3-2024, basic and diluted AFFO and AFFO per Unit were $(1,013) and $(0.03), respectively (Q3-2023 – $(1,047) and $(0.03)), primarily as a result of higher same property NOI normalized for the impact of certain adjustments for property taxes included in both periods and the impact of accrued interest costs of $1,015 added back to AFFO in Q3-2024 with no comparable amounts Q3-2023, partially offset by increases in the Fund’s interest costs and reduction in NOI from the sale of SF Properties. The Fund covered any shortfall between cash used by operating activities, including interest costs1, through either cash from operating activities during such applicable periods, cash on hand, or the Fund Credit Facility, including any proceeds from financing activities as applicable.

|

1 This metric is a non-IFRS measure. Non-IFRS financial measures do not have standardized meanings prescribed by IFRS (see “non-IFRS financial measures”). |

A reconciliation of the Fund’s cash provided by operating activities determined in accordance with IFRS to FFO and AFFO for Q3-2024, YTD-2024, Q3-2023 and YTD-2023 is provided below:

|

Q3-2024 |

Q3-2023 |

YTD-2024 |

YTD-2023 |

||

|

Cash provided by operating activities |

$ 4,896 |

$ 4,602 |

$ 16,090 |

$ 14,874 |

|

|

Less: interest costs |

(7,619) |

(6,846) |

(21,297) |

(19,772) |

|

|

Cash used in operating activities – including interest costs |

$ (2,723) |

$ (2,244) |

$ (5,207) |

$ (4,898) |

|

|

Add / (Deduct): |

|||||

|

Change in non-cash operating working capital |

(551) |

(1,007) |

(1,975) |

(1,790) |

|

|

Loss on early extinguishment of debt |

— |

— |

(94) |

— |

|

|

Transaction costs |

171 |

140 |

392 |

514 |

|

|

Change in restricted cash |

1,122 |

2,101 |

2,515 |

2,775 |

|

|

Net loss attributable to non-controlling interests |

101 |

— |

208 |

— |

|

|

Amortization of financing costs |

(627) |

(590) |

(1,777) |

(1,877) |

|

|

FFO |

$ (2,507) |

$ (1,600) |

$ (5,938) |

$ (5,276) |

|

|

Add / (Deduct): |

|||||

|

Amortization of financing costs |

623 |

653 |

1,778 |

2,051 |

|

|

Loss on early extinguishment of debt |

— |

— |

94 |

— |

|

|

Vacancy costs associated with the Fund’s properties upgrade program |

4 |

50 |

24 |

130 |

|

|

Sustaining capital expenditures and suite or home renovation reserves |

(148) |

(150) |

(442) |

(449) |

|

|

Accrued interest costs(1) |

1,015 |

— |

1,497 |

— |

|

|

AFFO |

$ (1,013) |

$ (1,047) |

$ (2,987) |

$ (3,544) |

|

|

(1) These amounts represent interest costs that are deferred and payable only at maturity of the applicable loan payable. |

|||||

FUTURE OUTLOOK

Since early 2022, concerns over elevated levels of inflation have resulted in a significant increase in interest rates with the U.S. Federal Reserve raising the Federal Funds Rate by approximately 525 basis points. During the third quarter of 2024, the U.S. Federal Reserve reduced the Federal Funds Rate by 50 basis points and in November 2024 reduced the rate by a further 25 basis points to approximately 450 basis points as of November 18, 2024. Further interest rate reductions are expected later in 2024 and into 2025 with uncertainty remaining regarding the extent of these potential reductions. Interest rate increases typically lead to increases in borrowing costs for the Fund, reducing cash flow, given the Fund primarily employs a variable rate debt strategy due to the Fund’s initial three-year term in order to provide maximum flexibility upon the eventual sale of the Fund’s properties during or at the end of the Fund’s term. Similarly, as interest rates drop, the Fund’s floating rate debt can benefit from such reductions. Historically, investments in multi-family properties have provided an effective hedge against inflation given the short-term nature of each resident lease which has been somewhat reflected in the rent growth achieved at the Fund’s properties where AMR increased by 1.1% from Q3-2023 to Q3-2024. Furthermore, the Fund does have certain interest rate caps, swaps or fixed rate debt in place which protect the Fund from increases in interest rates beyond stipulated levels and for stipulated terms as described in detail in the Fund’s condensed consolidated interim financial statements for the three and nine months ended September 30, 2024 and the audited consolidated financial statements for the year ended December 31, 2023, which are available at www.sedarplus.ca. The Fund also continues to closely monitor the U.S. employment and inflation data as well as the U.S. Federal Reserve’s monetary policy decisions in relation to future interest rates and resulting impact these may have on the Fund’s financial performance in future periods.

The primary markets in which the Fund operates in have seen an elevated level of new supply delivered during 2023 and 2024 which contributed to the deceleration in rent growth in the primary markets during late 2023, relative to levels achieved in 2022 and earlier in 2023. Interest rates also continue to remain elevated which, along with higher levels of inflation and a softening in market conditions in late 2023, has significantly disrupted active and new construction of comparable communities in the primary markets in which the Fund operates in that would otherwise have been delivered in the second half of 2025 or 2026. This potential reduction in construction may create a temporary imbalance in the supply of comparable multi-suite residential properties and single-family rental homes in future periods. This imbalance, alongside the continued economic strength and solid fundamentals may be supportive of favourable supply and demand conditions for the Fund’s properties in future periods and could result in future increases in occupancy and rent growth. The Fund believes it is well positioned to take advantage of these conditions should they transpire given the quality of the Fund’s properties and the benefit of having a resident pool employed across a diverse job base.

The reductions in the Federal Funds rate announced by the Federal Reserve in September and November 2024 have helped to reduce the volatility of short-term interest rate expectations but long-term interest rates continue to be volatile. Although inflation has reduced significantly from its peak, markets and the Federal Reserve continue to closely monitor inflation and unemployment figures as well as integrate the potential impacts of anticipated changes to legislation and regulation resulting from the recent U.S. election that may impact the future outlook for interest rates. The Fund continues to closely monitor these trends including the potential impact of elevated interest rates on the Fund’s liquidity and financial performance, including the costs of purchasing interest rate caps required to be replaced under certain of the Fund’s loan payables and further reduction in interest rates which markets are expecting later in 2024 and through early 2025. Market forecasts from RealPage anticipate a potential reduction in rent growth and occupancy in 2024 for the markets in which the Fund operates in relative to the levels achieved in 2023, which the Fund considers along with a range of potential outcomes for financial performance when evaluating the Fund’s liquidity position. During this period of capital markets uncertainty, the Fund may also enter into additional financing or evaluate potential asset sales to allow the Fund to maintain sufficient liquidity to provide the Fund with the opportunity to capitalize on more robust market dynamics with the goal of maximizing the total return for investors during the Fund’s term.

Further disclosure surrounding the Future Outlook is included in the Fund’s MD&A in the “Future Outlook” section for Q3-2024 under the Fund’s profile, which is available on SEDAR+ at www.sedarplus.ca.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release constitute forward-looking information within the meaning of Canadian securities laws and which reflect the Fund’s current expectations regarding future events, including the overall financial performance of the Fund and its properties, as well as the impact of elevated levels of inflation and interest rates.

Forward-looking information is provided for the purposes of assisting the reader in understanding the Fund’s financial performance, financial position and cash flows as at and for the periods ended on certain dates and to present information about management’s current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes.

Forward-looking information may relate to future results, the impact of inflation levels and interest rates, the ability of the Fund to make and the resumption of future distributions, the trading price of the Fund’s TSX Venture Exchange listed class A and U units (“Listed Units”) and the value of the Fund’s unlisted units, which include all Units other than the Listed Units, acquisitions, financing, performance, achievements, events, prospects or opportunities for the Fund or the real estate industry and may include statements regarding the financial position, business strategy, budgets, litigation, projected costs, capital expenditures, financial results, occupancy levels, AMR, taxes, and plans and objectives of or involving the Fund. Particularly, matters described in “Future Outlook” are forward-looking information. In some cases, forward-looking information can be identified by terms such as “may”, “might”, “will”, “could”, “should”, “would”, “occur”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “seek”, “aim”, “estimate”, “target”, “goal”, “project”, “predict”, “forecast”, “potential”, “continue”, “likely”, “schedule”, or the negative thereof or other similar expressions concerning matters that are not historical facts.

Forward-looking statements involve known and unknown risks and uncertainties, which may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities may not be achieved. Those risks and uncertainties include: the extent and sustainability of potential higher levels of inflation and the potential impact on the Fund’s operating costs; the pace at which and degree of any changes in interest rates that impact the Fund’s weighted average interest rate may occur; the Fund’s ability to sell single-family homes; the ability of the Fund to make and the resumption of future distributions; the trading price of the Listed Units; changes in government legislation or tax laws which would impact any potential income taxes or other taxes rendered or payable with respect to the Fund’s properties or the Fund’s legal entities; the impact of elevated interest rates and inflation as well as supply chain issues have on new supply of multi-family communities; the extent to which favorable operating conditions achieved during historical periods may continue in future periods; the applicability of any government regulation concerning the Fund’s residents or rents; and the availability of debt financing or ability of the Fund to extend loans as loans payable become due during the Fund’s term. A variety of factors, many of which are beyond the Fund’s control, affect the operations, performance and results of the Fund and its business, and could cause actual results to differ materially from current expectations of estimated or anticipated events or results.

Information contained in forward-looking information is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including management’s perceptions of historical trends, current conditions and expected future developments, as well as other considerations that are believed to be appropriate in the circumstances, including the following: the elevated levels of inflation on the Fund’s operating costs; the impact of future interest rates on the Fund’s financial performance; the availability of debt financing as loans payable become due during the Fund’s term and any resulting impact on the Fund’s liquidity; the trading price of the Listed Units; the applicability of any government regulation concerning the Fund’s residents or rents; the realization of property value appreciation and timing thereof; the inventory of residential real estate properties (including single-family rental homes); the availability of residential properties for potential future acquisition, if any, and the price at which such properties may be acquired; the ability of the Fund to benefit from any value add program the Fund conducts at certain properties; the price at which the Fund’s properties may be disposed and the timing thereof; closing and other transaction costs in connection with the acquisition and disposition of the Fund’s properties; the extent of competition for residential properties; the impact of interest costs, inflation and supply chain issues have on new supply of multi-family communities; the extent to which favorable operating conditions achieved during historical periods may continue in future periods; the growth in NOI generated and from its value-add initiatives; the population of residential real estate market participants; assumptions about the markets in which the Fund operates; expenditures and fees in connection with the maintenance, operation and administration of the Fund’s properties; the ability of the ability of Starlight Investments US AM Group LP or its affiliates (the “Manager”) to manage and operate the Fund’s properties or achieve similar returns to previous investment funds managed by the Manager; the global and North American economic environment; foreign currency exchange rates; the ability of the Fund to realize the estimated gap in market versus in-place rents through future rental rate increases; and governmental regulations or tax laws. Given this period of uncertainty, there can be no assurance regarding: (a) operations and performance or the volatility of the Units; (b) the Fund’s ability to mitigate such impacts; (c) credit, market, operational, and liquidity risks generally; (d) the Manager or any of its affiliates, will continue its involvement as asset manager of the Fund in accordance with its current asset management agreement; and (e) other risks inherent to the Fund’s business and/or factors beyond its control which could have a material adverse effect on the Fund.

The forward-looking information included in this press release relates only to events or information as of the date on which the statements are made in this press release. Except as specifically required by applicable Canadian securities law, the Fund undertakes no obligation to update or revise publicly any forward-looking information, whether because of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

ABOUT STARLIGHT U.S. RESIDENTIAL FUND

The Fund is a “closed-end” fund formed under and governed by the laws of the Province of Ontario, pursuant to a declaration of trust dated September 23, 2021, as amended and restated The Fund was established for the primary purpose of directly or indirectly acquiring, owning and operating a portfolio primarily composed of income producing residential properties in the U.S. residential real estate market that can achieve significant increases in rental rates as a result of undertaking high return, value-add capital expenditures and active asset management. As at September 30, 2024, the Fund owned interests in six multi-family properties consisting of 1,973 suites as well as four single-family rental homes.

For the Fund’s complete condensed consolidated interim financial statements and MD&A for the three and nine months ended September 30, 2024 and any other information related to the Fund, please visit www.sedarplus.ca. Further details regarding the Fund’s unit performance and distributions, market conditions where the Fund’s properties are located, performance by the Fund’s properties and a capital investment update are also available in the Fund’s November 2024 Newsletter which is available on the Fund’s profile at www.starlightinvest.com.

Please visit us at www.starlightinvest.com and connect with us on LinkedIn at www.linkedin.com/company/starlight-investments-ltd-

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Starlight U.S. Residential Fund

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/18/c0781.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/18/c0781.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Power Inflow Alert: Monolithic Power Systems Inc. Receives Alert And Rises Over 22 Points

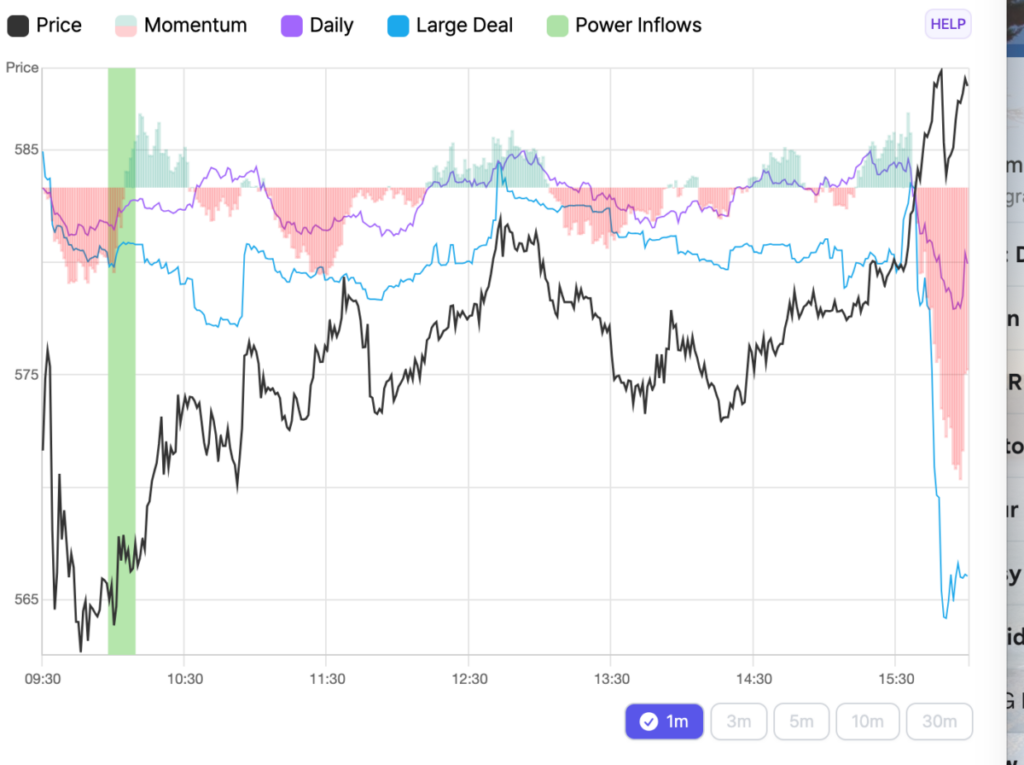

STOCK CLIMBS 3.9% AT HIGH

Today, at 10:07 AM on November 18th, a significant trading signal occurred for Monolithic Power, Inc. MPWR as it demonstrated a Power Inflow at a price of $187.80. This indicator is crucial for traders who want to know directionally where institutions and so-called “smart money” moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Monolithic Power’s stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Monolithic Power’s stock price, interpreting this event as a bullish sign.

Signal description

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted as a bullish signal by active traders.

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock’s overall direction, powered by institutional activity in the stock, for the remainder of the day.

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let’s not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

If you want to stay updated on the latest options trades for MPWR, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

The price at the time of the Power Inflow was $566.26. The returns on the High price ($588.52) and Close price ($587.84) after the Power Inflow were respectively 3.9% and 3.8%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case, the high of the day and close were very close but that is not always the case

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DJT, Bakkt stocks pop on report Trump Media in talks to acquire crypto trading platform

Trump Media & Technology Group (DJT) stock closed over 16% higher on Monday following a report from the Financial Times that said the company, which operates the social network Truth Social, is in advanced talks to acquire crypto exchange Bakkt (BKKT).

Bakkt stock gained over 162% on Monday following the report. The company is majority-owned by NYSE parent company Intercontinental Exchange (ICE).

President-elect Donald Trump maintains a roughly 60% interest in DJT, which boasts a market cap of around $7.1 billion. Trump reiterated earlier this month that he has no intention of selling his stock in the company.

Trump’s election win has pushed bitcoin prices to all-time highs, with the administration viewed as generally more friendly to the alternative asset class.

In July, Trump attended a bitcoin conference in Nashville and has since pledged to usher in more supportive regulation. His promises also include appointing a crypto Presidential Advisory Council and firing current SEC Chair Gary Gensler.

On Monday, bitcoin (BTC-USD) rose over 2% to trade just below $92,000 a token.

Other crypto-adjacent names were also on the move higher.

Shares of MicroStrategy (MSTR), which owns nearly 280,000 bitcoins, closed almost 13% higher after it announced the purchase of an additional 51,780 bitcoins for $4.6 billion. The company now holds $16.5 billion worth of bitcoin.

Coinbase (COIN) stock also jumped over 6% on Monday, with the Wall Street Journal reporting its CEO, Brian Armstrong, was set to meet with Trump.

Bakkt, which has a market cap of around $190 million, has seen its stock fall sharply since going public in 2021. Intercontinental Exchange, its majority owner, is led by CEO Jeff Sprecher, who is married to former Georgia Sen. Kelly Loeffler, co-chair of Trump’s inaugural committee.

Trump founded Truth Social after he was kicked off major social media apps like Facebook (META) and Twitter, now X, following the Jan. 6, 2021, Capitol riots. Trump has since been reinstated on those platforms. He officially returned to posting on X in mid-August after about a year’s hiatus.

As Truth Social attempts to take on social media incumbents, the fundamentals of the company have long been in question.

On Nov. 5, just a few hours before the polls closed, DJT dropped third quarter results that revealed a net loss of $19.25 million for the quarter ending Sept. 30. DJT also reported revenue of $1.01 million. It held about $370 million in cash at the end of the quarter.

The stock is up 10% over the last month.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

MongoDB, Inc. Announces Date of Third Quarter Fiscal 2025 Earnings Call

NEW YORK, Nov. 18, 2024 /PRNewswire/ — MongoDB, Inc. MDB today announced it will report its third quarter fiscal year 2025 financial results for the three months ended October 31, 2024, after the U.S. financial markets close on Monday, December 9, 2024.

In conjunction with this announcement, MongoDB will host a conference call on Monday, December 9, 2024, at 5:00 p.m. (Eastern Time) to discuss the Company’s financial results and business outlook. A live webcast of the call will be available on the “Investor Relations” page of the Company’s website at http://investors.mongodb.com. To access the call by phone, please go to this link (registration link), and you will be provided with dial in details. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time. A replay of the webcast will also be available for a limited time at http://investors.mongodb.com.

About MongoDB

Headquartered in New York, MongoDB’s mission is to empower innovators to create, transform, and disrupt industries by unleashing the power of software and data. Built by developers, for developers, MongoDB’s developer data platform is a database with an integrated set of related services that allow development teams to address the growing requirements for today’s wide variety of modern applications, all in a unified and consistent user experience. MongoDB has tens of thousands of customers in over 100 countries. The MongoDB database platform has been downloaded hundreds of millions of times since 2007, and there have been millions of builders trained through MongoDB University courses. To learn more, visit mongodb.com.

Investor Relations

Brian Denyeau

ICR for MongoDB

646-277-1251

ir@mongodb.com

Media Relations

MongoDB

press@mongodb.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mongodb-inc-announces-date-of-third-quarter-fiscal-2025-earnings-call-302309005.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mongodb-inc-announces-date-of-third-quarter-fiscal-2025-earnings-call-302309005.html

SOURCE MongoDB, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Short Squeezes With Big Promises

Short squeezes have been making and breaking investors for a century. One of the greatest short squeezes in history started on a SubReddit, where hundreds of thousands of retail investors drove the price of GameStop GME shares up to an all-time high. While this will always a risky bet, GameStop remains a symbol of a company that went from representing retail struggles to executing a turnaround that defied expectations and conventions. Guided by an unorthodox CEO, just like the EV king Tesla Inc TSLA made history with its flamboyant CEO, Game Stop is an example of a remarkable shift that was led also by the company’s largest shareholder. By transitioning from the pandemic-era turmoil to creating a robust financial footing, GameStop defied the logic of not only retail but of general business as it showed that one can survive by not growing.

But there are also lesser-known companies when it comes to the shorted universe, especially when it comes to the Tesla-made EV sector promising to revolutionize the future of the world.

Among such, there’s an EV charging company EVgo Inc EVGO with extremely volatile shares that just reported a record breaking third quarter. Over the last year, EVgo counted 78 moves greater than 5% till mid-October. EVgo was awareded by the market for signing a memorandum of understanding with its longtime technology partner, Delta Electronics Inc to co-develop next-generation charging architecture to offer a superior experience for its customers and advance long-term charging solutions, improving convenience and reliability. With its latest quarterly results, things are looking even more bullish as EVgo is doing a good job at containing losses, reporting revenue growth of 92% YoY as revenue amounted to $68 million, topping forecasts by 2.4%. Moreover, EVgo posted a record network throughput of 78 GWh which represents a 111% YoY increase as it added more than 270 new operational charging stalls. In addition, its customer base expanded with 147,000 new accounts, with the total now exceeding 1.2 million. While it did post a net loss of $33.3 million, strategic investments and cost management did result in an improved adjusted EBITDA.

Then there’s also Worksport Ltd WKSP, a manufacturer and innovator of “made-in-USA” tonneau covers, as well as hybrid and clean energy solutions for the light truck and consumer goods sectors, with very high short interest upon its latest earnings report. Worksport continues to write a remarkable early growth story filled with groundbreaking innovation. Worksport is eyeing a record 2025 as it just reported significant YoY revenue growth for the third quarter. During the third quarter, Worksport posted that revenue surged 581% YoY to $3.12 million, with B2C sales making 51% of total revenue as they grew from last year’s $21,599 to now adding as much as $1.59 million to the overall sales table.

Back in August, Worksport reported just as impressive second quarter results for the period ended on June 30th, with revenue rising 860% YoY and 275% sequentially as it reached a new record of $1.92 million, and this was before several key launches. In September, Worksport launched the Alpha release of its clean energy off-grid power duo, the SOLIS solar-powered tonneau cover and COR portable battery system. The full launch is expected next year, while the AL4 tonneau cover will be released in the fourth quarter, bringing in substantial revenue in 2025. In 2025, Worksport is aiming to make 200 tonneau covers per day as well as to achieve cash flow positivity. Moreover, Worksport opened another growth pathway by getting a U.S. government agency among its buyers.

Capitalizing on the rapid growth of another prominent EV startup, Rivian Automotive RIVN, Worksport revealed that its existing lineup of premium tonneau covers is nearly finished compatibility engineering with the Rivian R1T, as it plans to also integrate its SOLIS solar cover and COR portable battery system in the future. Moreover, also in September, Worksport reported successful lab test results of its COR portable energy system as a range extender for Tesla EVs, including Model 3 and the Cybertruck, which opens further growth opportunities.

While Worksport and EVgo do not play at a level Tesla does, at least for now, they are still prominent EV players, and such shorted companies tell interesting growth tales that sometimes go down in history for their potential to revolutionize industries.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Symbotic Stock Rallies After Strong Q4 Results: Details

Symbotic Inc. SYM reported its fourth-quarter results after Monday’s closing bell. Here’s a look at the details from the report.

The Details: Symbotic reported quarterly earnings of five cents per share, which beat the analyst consensus estimate of three cents. Quarterly revenue came in at $576.76 million, which beat the analyst consensus estimate of $470.27 million and is an increase over sales of $391.88 million from the same period last year.

“I’m pleased with our performance this year, as our focus on innovation and customer success has delivered robust growth. This year’s results, driven by the hard work and dedication of our team, underscore the strength of our long-term strategy and commitment to driving sustainable, long-term growth for our customers, shareholders, and employees,” said Rick Cohen, CEO of Symbotic.

Outlook: For the first quarter of fiscal 2025, Symbotic expects revenue of $495 million to $515 million, versus the $495.73 million estimate, and adjusted EBITDA of $27 million to $31 million.

SYM Price Action: According to Benzinga Pro, Symbotic shares are up 23.21% after-hours at $37.44 at the time of publication Monday.

Read More:

• Will Walmart’s Streak Of Earnings Beats Continue Tuesday? Analysts Say Retailer A ‘Core Holding’

Photo: Courtesy of Symbotic, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding Trump Media & Technology's Options Activity: What's the Big Picture?

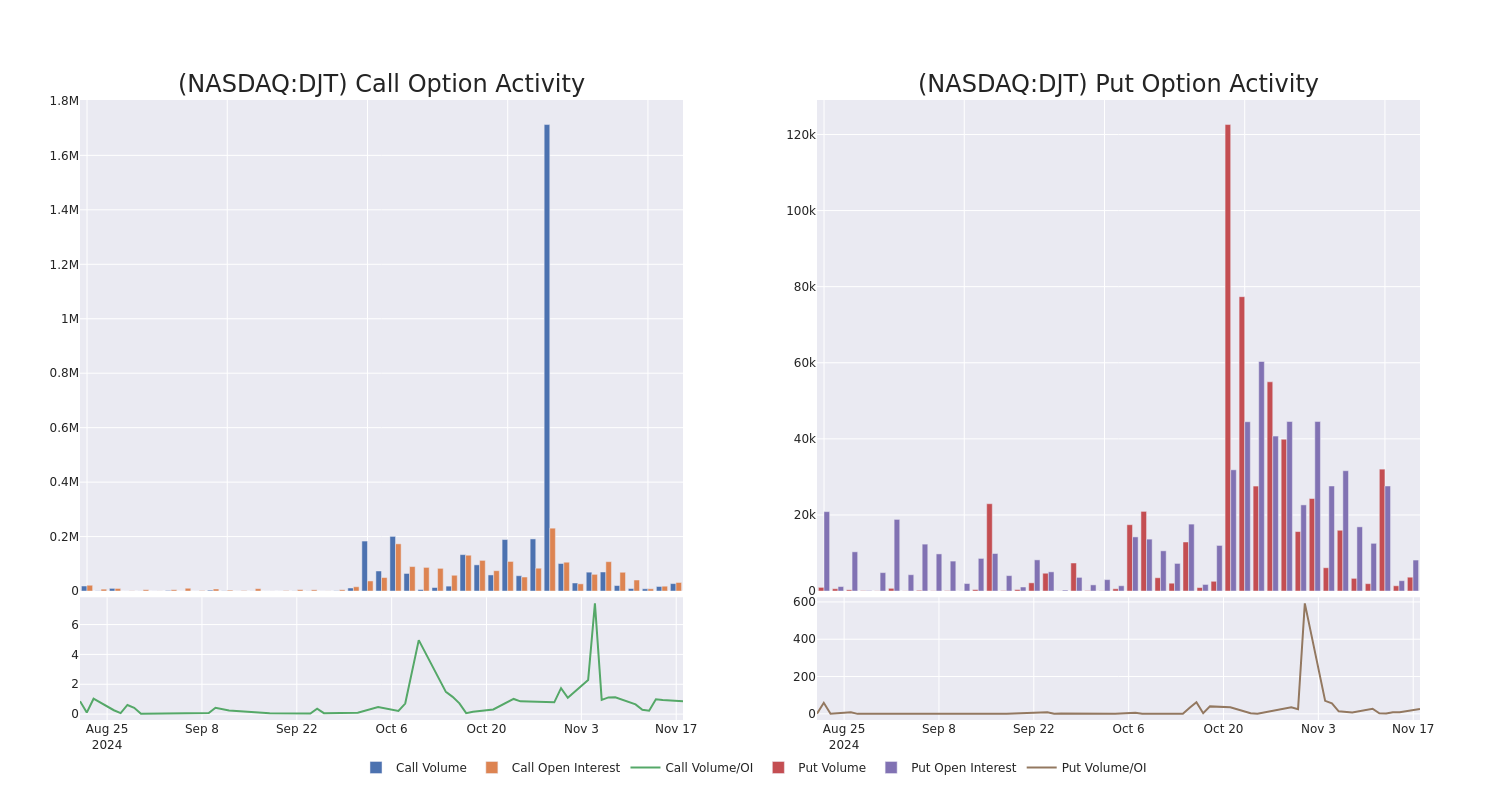

Financial giants have made a conspicuous bearish move on Trump Media & Technology. Our analysis of options history for Trump Media & Technology DJT revealed 58 unusual trades.

Delving into the details, we found 39% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 22 were puts, with a value of $1,154,360, and 36 were calls, valued at $3,115,636.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $24.0 to $115.0 for Trump Media & Technology over the recent three months.

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Trump Media & Technology’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Trump Media & Technology’s substantial trades, within a strike price spectrum from $24.0 to $115.0 over the preceding 30 days.

Trump Media & Technology Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DJT | CALL | SWEEP | BULLISH | 01/16/26 | $12.5 | $11.65 | $12.5 | $25.00 | $249.8K | 416 | 200 |

| DJT | CALL | TRADE | NEUTRAL | 01/16/26 | $13.1 | $11.55 | $12.35 | $25.00 | $247.0K | 416 | 400 |

| DJT | CALL | TRADE | BEARISH | 01/16/26 | $12.45 | $12.1 | $12.1 | $25.00 | $242.0K | 416 | 600 |

| DJT | PUT | SWEEP | BEARISH | 12/19/25 | $10.85 | $10.4 | $10.4 | $25.00 | $156.0K | 455 | 300 |

| DJT | CALL | TRADE | BEARISH | 01/16/26 | $7.35 | $7.05 | $7.05 | $50.00 | $141.0K | 1.2K | 835 |

About Trump Media & Technology

Trump Media & Technology Group Corp is a media and technology company rooted in social media, digital streaming, information technology infrastructure, and more. Its initial product launch will focus on its social media platform, Truth Social, which encourages an open, free, and honest global conversation without discriminating against political ideology.

In light of the recent options history for Trump Media & Technology, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Trump Media & Technology

- With a volume of 12,214,290, the price of DJT is down -2.48% at $27.4.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 77 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Trump Media & Technology with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can Trump's Return Save The Cannabis Sector? Debt Mounts As Giants Face Post-Election Reckoning

The post-election landscape raises uncertainty for cannabis MSOs, with investors hoping for potential relief from the new administration. Verano VRNOF, Green Thumb GTBIF, and Gold Flora GRAM show mixed results, balancing strategic gains with regulatory challenges. While full federal legalization remains a distant possibility, Pablo Zuanic, from Zuanic & Associates, suggests a gradual shift towards rescheduling cannabis to Schedule III, potentially extending into late 2025.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Verano Holdings: Market Headwinds

Verano posted Q3 results reflecting a mixed performance, with $227 million in sales, marking a 5% sequential decline. The drop was partly attributed to seasonality and market pressures in key states like Florida. Despite acquiring assets from The Cannabist Company CBSTF, which were only partially reflected in Q3, Verano’s financial health is strained by a high debt burden—standing at 40% of the last twelve months (LTM) sales, and substantial tax liabilities of 32%. Adjusted EBITDA margins fell by 200 basis points to 30%, indicating pressure on profitability.

The company remains Overweight in Zuanic’s ratings, but concerns about its exposure to the Florida market may hinder short-term recovery, particularly given the state’s rejection of adult-use legalization in the recent election. This has led to a 44% drop in Verano’s stock post-election, highlighting the vulnerability of Florida-dependent operators.

Green Thumb Industries: Resilient But Cautious

Green Thumb reported a stronger Q3 performance, with $287 million in sales, up 2% sequentially. The company stands out with robust cash flow management, generating an adjusted operating cash flow of $139 million, representing 17% of sales.

With relatively low leverage—net debt at just 7% of LTM sales—and healthier adjusted EBITDA margins of 31%, Green Thumb appears well-positioned to navigate the current regulatory uncertainty.

In terms of financial leverage, Cresco Labs CRLBF carries the highest combined debt and tax liabilities at 80% of last twelve months (LTM) sales, followed closely by Curaleaf CURLF at 79% and Verano at 72%. Green Thumb, on the other hand, stands out with a low leverage ratio of 9% of LTM sales, bolstered by strong cash flow performance.

Gold Flora: Expansion Amidst Market Challenges

Gold Flora, a California-focused operator, showcased significant operational improvements in Q3 2024. The company’s adjusted gross margins surged from 54% in Q1 to 65% in Q3, with EBITDA margins reaching 9%, a notable turnaround from -6% in the first half of the year. The brand’s strategic push into the vaping segment, particularly with its Gramlin line, has been met with strong market reception, becoming a top-10 brand in California.

However, according to Zuanic Gold Flora’s financial stability remains a concern. The company’s debt obligations have increased, with tax liabilities now at $44 million, up from $28 million at year-end 2023. A planned expansion of indoor cultivation capacity by 50% and new store openings are aimed at bolstering revenue growth.

Benchmarking Tier 1 MSOs: Financial Health

- EBITDA Margins: In Q3 2024, Trulieve led with a 34% EBITDA margin, followed by Green Thumb at 31%, and Verano at 30%, each down sequentially. Cresco held steady at 29%, while Curaleaf improved to 23%.

- Cash Flow Performance: Green Thumb excelled with an adjusted operating cash flow (OCF) of $139 million (17% of sales). Trulieve and Verano followed with $37 million (4%) and $30 million (5%), respectively. Curaleaf broke even at $4 million, while Cresco lagged at -$3 million.

- Valuation Comparisons: Green Thumb and Curaleaf trade at an EV-to-sales ratio of 2.2x. Trulieve is at 1.8x, with Cresco and Verano at 1.6x. For EV to EBITDA, Curaleaf leads at 10x, Green Thumb at 7x, and the rest between 5.2x and 5.5x.

Read Next: Selling Weed Is Like A Sneaker Drop: Running Out Isn’t A Problem For This Company

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.