Evolv Technologies (EVLV) Delays Filing Quarterly Report After Previously Admitting To Improper Revenue Recognition – Hagens Berman

SAN FRANCISCO, Nov. 18, 2024 (GLOBE NEWSWIRE) — On Nov. 13, 2024 Evolv Technologies Holdings, Inc. EVLV announced that it would not timely file its quarterly report with the Securities and Exchange Commission because of its pending investigations into the company’s sales practices.

The company said that “certain sales, including sales to one of its largest channel partners, were subject to extra-contractual terms and conditions, some of which were not shared with the Company’s accounting personnel, and that certain Company personnel engaged in misconduct in connection with those transactions.”

Evolv further said that “among other things, revenue was prematurely or incorrectly recognized in connection with financial statements prepared for the periods between the second quarter of 2022 and the second quarter of 2024[]” and that “these misstatements are material[.]”

The company has not yet quantified the amounts of improperly recognized revenues and other financial metrics.

A securities class action lawsuit was previously filed against Evolv Technologies Holdings, Inc. and certain of its executives, alleging violations of federal securities laws. The lawsuit, filed in the U.S. District Court for the District of Massachusetts, is brought on behalf of investors who purchased Evolv securities between August 19, 2022, and October 30, 2024.

Hagens Berman urges investors in Evolv who suffered substantial losses to submit your losses now.

Class Period: Aug. 19, 2022 – Oct. 30, 2024

Lead Plaintiff Deadline: Dec. 31, 2024

Visit: www.hbsslaw.com/investor-fraud/evlv

Contact the Firm Now: EVLV@hbsslaw.com | 844-916-0895

Evolv Technologies Holdings, Inc. Securities Class Action (EVLV):

The complaint alleges that Evolv’s financial statements for the period between the second quarter of 2022 and the second quarter of 2024 contained material misrepresentations and omissions related to the company’s revenue recognition and other financial metrics.

On October 25, 2024, Evolv issued a press release acknowledging material weaknesses in its internal controls over financial reporting and disclosing that certain sales, particularly to a major channel partner, were subject to undisclosed terms and conditions. The company also revealed that certain employees engaged in misconduct related to these transactions. Following this announcement, Evolv’s stock price plummeted approximately 40%.

Then, on October 31, 2024, Evolv announced the termination of its CEO, Peter George. The company’s stock price declined further, falling approximately 8% on the news.

The lawsuit alleges that Evolv and its executives misled investors by failing to disclose material information about the company’s financial performance and internal controls. Investors who suffered losses during the class period may be eligible to recover their damages.

Shareholder rights firm Hagens Berman is investigating the allegations.

“We are deeply concerned by the recent revelations regarding Evolv Technologies’ financial reporting and sales practices. Our investigation will rigorously examine the company’s internal controls, revenue recognition methods, and the role of senior management in this alleged misconduct,” said Reed Kathrein, the partner leading the investigation.

If you invested in Evolv or have knowledge that may assist the firm’s investigation, submit your losses now.

If you’d like more information and answers to frequently asked questions about the Evolv investigation, read more.

Whistleblowers: Persons with non-public information regarding Evolv should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email EVLV@hbsslaw.com.

About Hagens Berman

Hagens Berman is a global plaintiffs’ rights complex litigation firm focusing on corporate accountability. The firm is home to a robust practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and other wrongdoings. Hagens Berman’s team has secured more than $2.9 billion in this area of law. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

Contact:

Reed Kathrein, 844-916-0895

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Nvidia Earnings May Trigger Massive S&P 500 Volatility

Investors and speculators are gearing up for Nvidia Corp.‘s NVDA earnings report on Wednesday, an event that’s expected to send ripples, if not tidal waves, across the U.S. stock market.

If the options market is right, Nvidia’s results could spark moves in the S&P 500 index – as tracked by the SPDR S&P 500 ETF Trust SPY – larger than those typically triggered by key economic data like the employment and inflation reports.

Nvidia’s dominance in the AI-driven technology trade has turned its earnings into a barometer for overall market sentiment, and its influence on the stock market is unparalleled.

Over the past year, Nvidia accounted for 20% of the S&P 500’s total returns and Bank of America’s derivatives analyst Gonzalo Asis didn’t mince words: “It remains the most dominant stock in the market… expected to drive nearly 25% of the S&P 500’s EPS growth in 3Q.”

In essence, whether Nvidia beats or misses expectations, the ripple effects will likely extend far beyond its ticker.

S&P 500 Implied Move Is Higher Than Inflation Or Jobs Data

The options market implies a potential 1.05% move in the S&P 500—higher than what traders expect from next month’s Non-Farm Payroll (NFP) data, Consumer Price Index (CPI) print, and in line with the Federal Reserve’s December meeting.

“Options are assigning more broad-market risk around NVDA earnings than around next month’s NFP and CPI days, and as much as the Dec FOMC,” the analyst noted.

For Nvidia shares themselves, the implied one-day move is even more eye-popping: 12.5%.

“We remain cautious of fragility risks in single names around earnings, but NVDA hedges themselves are not particularly cheap relative to how much the stock has reacted to results in the last two years,” Assis wrote.

The analyst also warned that the recent easing of post-election euphoria and heightened single-stock fragility can be reasons for traders to hedge against potential market turbulence if Nvidia disappoints.

A Strategy For Hedging The Nasdaq Impact

For traders seeking to hedge the broader market risks tied to Nvidia’s performance, Bank of America recommended an option strategy using put spreads on the Nasdaq-100 ETF, the Invesco QQQ Trust QQQ. Specifically, the QQQ 22Nov 490-480 put spreads are priced at $2 and could offer a 5x payout if the Nasdaq-100 falls by roughly 3.3% this week.

Despite the potential need for hedges, the bank also noted that hedging NVDA earnings directly is not cheap, considering how significantly the stock has reacted to its last few earnings reports.

Historical Nvidia Earnings Data

Data from Benzinga Pro shows that over the last 12 quarters, Nvidia has exceeded earnings-per-share (EPS) expectations 10 times and missed revenue expectations only once.

On average, Nvidia shares moved 5.3% in the single trading day following its earnings release.

The largest 1-day gain followed its first quarter 2024 earnings, when the stock surged 24.4%, while the worst reaction occurred after fourth quarter 2024 results, with a decline of 7.6%.

Here’s a snapshot of the company’s recent earnings performance:

| Fiscal Quarter | Date Announced | Surprise % EPS | Surprise % Revenue | 1-Day % NVDA Move |

|---|---|---|---|---|

| Q2-2025 | 8/28/24 | 6.25% | 4.73% | -6.38% |

| Q1-2025 | 5/22/24 | 2.86% | 5.66% | 9.32% |

| Q4-2024 | 2/21/24 | 11.45% | 7.19% | 16.40% |

| Q3-2024 | 11/21/23 | 19.64% | 12.39% | -2.46% |

| Q2-2024 | 8/23/23 | 29.19% | 20.38% | 0.10% |

| Q1-2024 | 5/24/23 | 18.48% | 10.31% | 24.37% |

| Q4-2023 | 2/22/23 | 8.64% | 0.68% | 14.02% |

| Q3-2023 | 11/16/22 | -15.94% | 2.79% | -1.46% |

| Q2-2023 | 8/24/22 | -59.20% | -17.23% | 4.01% |

| Q1-2023 | 5/25/22 | 5.43% | 2.07% | 5.16% |

| Q4-2022 | 2/16/22 | 8.20% | 3.01% | -7.56% |

| Q3-2022 | 11/17/21 | 6.36% | 4.00% | 8.25% |

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

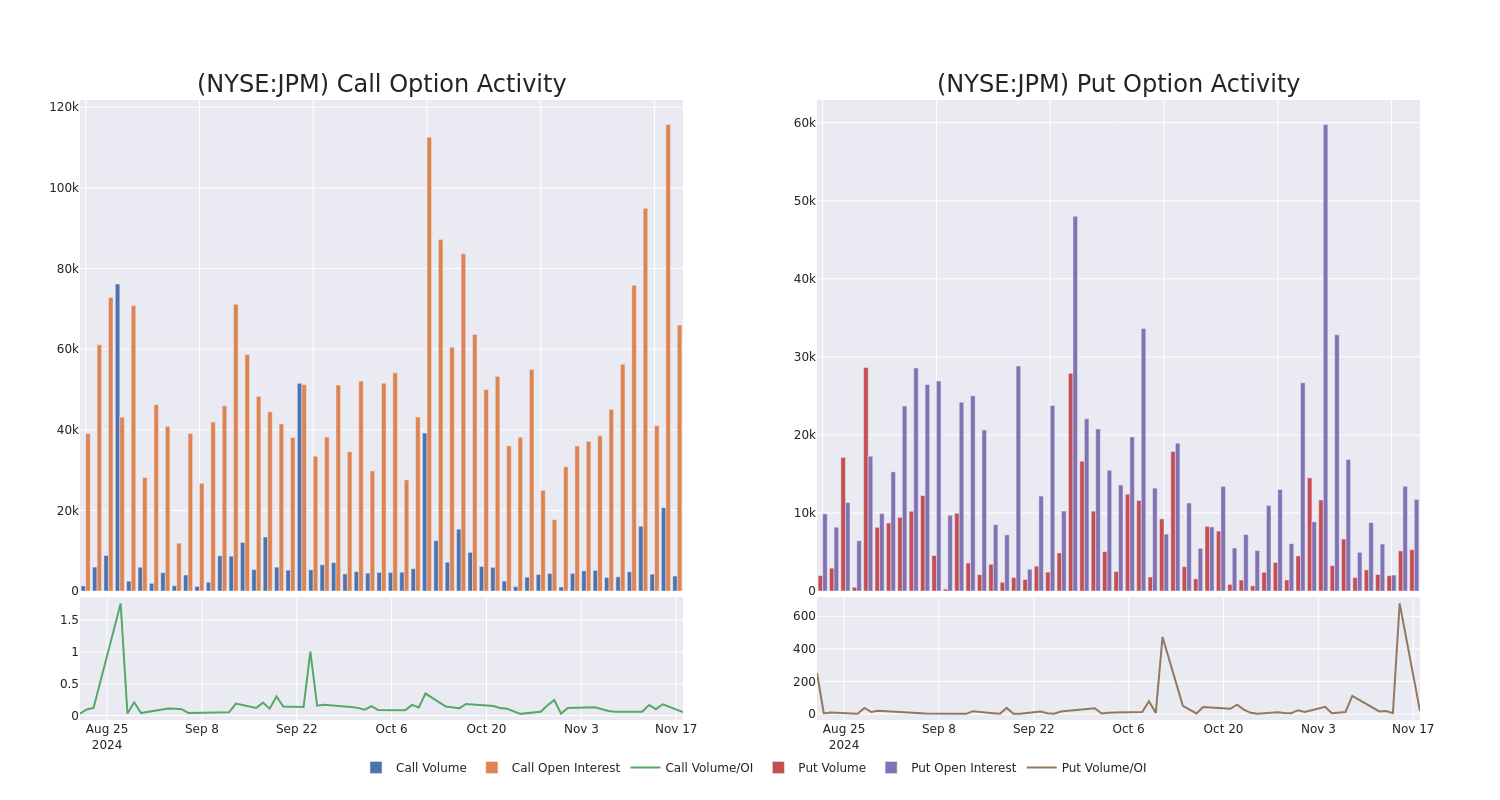

Spotlight on JPMorgan Chase: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on JPMorgan Chase.

Looking at options history for JPMorgan Chase JPM we detected 44 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 18 are puts, for a total amount of $1,479,655 and 26, calls, for a total amount of $4,497,476.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $300.0 for JPMorgan Chase during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JPMorgan Chase’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JPMorgan Chase’s whale activity within a strike price range from $130.0 to $300.0 in the last 30 days.

JPMorgan Chase Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | TRADE | BULLISH | 01/16/26 | $57.25 | $56.45 | $57.6 | $200.00 | $2.8M | 4.2K | 502 |

| JPM | PUT | TRADE | BEARISH | 01/16/26 | $7.9 | $7.65 | $7.9 | $200.00 | $395.0K | 5.5K | 500 |

| JPM | PUT | TRADE | BEARISH | 01/16/26 | $6.1 | $5.9 | $6.1 | $190.00 | $305.0K | 3.8K | 500 |

| JPM | CALL | TRADE | BEARISH | 12/20/24 | $4.25 | $4.15 | $4.15 | $250.00 | $207.5K | 6.8K | 1.1K |

| JPM | CALL | SWEEP | NEUTRAL | 01/17/25 | $22.85 | $22.6 | $22.67 | $225.00 | $188.3K | 2.5K | 86 |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments–consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

Present Market Standing of JPMorgan Chase

- Trading volume stands at 4,827,830, with JPM’s price down by -0.05%, positioned at $245.2.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 58 days.

Professional Analyst Ratings for JPMorgan Chase

In the last month, 2 experts released ratings on this stock with an average target price of $255.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for JPMorgan Chase, targeting a price of $241.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for JPMorgan Chase, targeting a price of $270.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JPMorgan Chase with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tuya Reports Third Quarter 2024 Unaudited Financial Results

SANTA CLARA, Calif., Nov. 18, 2024 /PRNewswire/ — Tuya Inc. (“Tuya” or the “Company“) TUYA HKEX: 2391)), a global leading cloud platform service provider, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Highlights

- Total revenue was US$81.6 million, up approximately 33.6% year over year (3Q2023: US$61.1 million).

- IoT platform-as-a-service (“PaaS”) revenue was US$57.9 million, up approximately 26.4% year over year (3Q2023: US$45.8 million).

- Software-as-a-service (“SaaS”) and others revenue was US$9.9 million, up approximately 16.7% year over year (3Q2023: US$8.5 million).

- Smart solution revenue was US$13.8 million, up approximately 102.9% year over year (3Q2023: US$6.8 million).

- Overall gross margin was 46.0%, down 0.7 percentage points year over year (3Q2023: 46.7%). Gross margin of IoT PaaS increased to 46.9%, up 2.3 percentage points year over year (3Q2023: 44.6%).

- Operating margin was negative 21.0%, improved by 9.3 percentage points year over year (3Q2023: negative 30.3%). Non-GAAP operating margin was 9.1%, improved by 14.8 percentage points year over year (3Q2023: negative 5.7%).

- Net margin was negative 5.4%, improved by 2.6 percentage points year over year (3Q2023: negative 8.0%). Non-GAAP net margin was 24.7%, improved by 8.2 percentage points year over year (3Q2023: 16.5%).

- Net cash generated from operating activities was US$23.9 million (3Q2023: US$16.1 million).

- Total cash and cash equivalents, time deposits and treasury securities recorded as short-term and long-term investments were US$1,023.9 million as of September 30, 2024, compared to US$984.3 million as of December 31, 2023.

For further information on the non-GAAP financial measures presented above, see the section headed “Use of Non-GAAP Financial Measures.”

Third Quarter 2024 Operating Highlights

- IoT PaaS customers[1] for the third quarter of 2024 were approximately 2,200 (3Q2023: approximately 2,100). Total customers for the third quarter of 2024 were approximately 3,100 (3Q2023: approximately 3,000).

- Premium IoT PaaS customers[2] for the trailing 12 months ended September 30, 2024 were 286 (3Q2023: 263). In the third quarter of 2024, the Company’s premium IoT PaaS customers contributed approximately 85.6% of its IoT PaaS revenue (3Q2023: approximately 83.5%).

- Dollar-based net expansion rate (“DBNER”)[3] of IoT PaaS for the trailing 12 months ended September 30, 2024 was 124% (3Q2023: 78%).

- Registered IoT device and software developers were over 1,260,000 as of September 30, 2024, up 26.9% from approximately 993,000 developers as of December 31, 2023.

1. The Company defines an IoT PaaS customer for a given period as a customer who has directly placed orders for IoT PaaS with the Company during that period.

2. The Company defines a premium IoT PaaS customer as a customer as of a given date that contributed more than US$100,000 of IoT PaaS revenue during the immediately preceding 12-month period.

3. The Company calculates DBNER of IoT PaaS for a trailing 12-month period by first identifying all customers in the prior 12-month period (i.e., those have placed at least one order for IoT PaaS during that period), and then calculating the quotient from dividing the IoT PaaS revenue generated from such customers in the current trailing 12-month period by the IoT PaaS revenue generated from the same group of customers in the prior 12-month period. The Company’s DBNER may change from period to period, due to a combination of various factors, including changes in the customers’ purchase cycles and amounts and the Company’s customer mix, among other things. DBNER indicates the Company’s ability to expand customer use of the Tuya platform over time and generate revenue growth from existing customers.

Mr. Xueji (Jerry) Wang, Founder and Chief Executive Officer of Tuya, commented, “I’m pleased that in the third quarter, we delivered robust financial performance across all our business segments, featuring high growth, stable margins and tight operating budget control. These solid results reaffirm our position as a growing and profitable smart cloud platform leader with a clear strategy and strong execution capabilities. Our performance was driven by robust demand from existing customers, as reflected in a Dollar-Based Net Expansion Rate of 124%. We also strengthened global partnerships, particularly in Europe and emerging markets, and expanded our developer community to 1.26 million registered developers. Looking ahead, we remain focused on empowering developers and delivering innovative solutions to meet the growing demand for smart products.”

Mr. Yi (Alex) Yang, Co-Founder and Chief Financial Officer of Tuya, added, “Third quarter financial results were solid, highlighted by an approximately 34% year-over-year revenue increase, a non-GAAP operating margin of approximately 9%, and a non-GAAP net profit margin of approximately 25%. Importantly, we generated an operating cash flow of $23.9 million, strengthening our net cash balance to further increase to around $1.02 billion. This solid financial position supports our growth initiatives as we continue invest in product innovation, and user experience enhancements to meet evolving market needs. We believe these efforts, combined with strong execution and focus on long-term growth, will unlock meaningful value as we move forward.”

Third Quarter 2024 Unaudited Financial Results

REVENUE

Total revenue in the third quarter of 2024 increased by 33.6% to US$81.6 million from US$61.1 million in the same period of 2023, mainly due to the increase in IoT PaaS revenue and smart solution revenue.

- IoT PaaS revenue in the third quarter of 2024 increased by 26.4% to US$57.9 million from US$45.8 million in the same period of 2023, primarily due to increasing demand fueled by global economic recovery compared with the same period of 2023 and the Company’s strategic focus on customer needs and product enhancements. As a result, the Company’s DBNER of IoT PaaS for the trailing 12 months ended September 30, 2024 increased to 124% from 78% for the trailing 12 months ended September 30, 2023.

- SaaS and others revenue in the third quarter of 2024 increased by 16.7% to US$9.9 million from US$8.5 million in the same period of 2023, primarily due to an increase in revenue from cloud software products. During the quarter, the Company remained committed to offering value-added services and a diverse range of software products with compelling value propositions to its customers.

- Smart solution revenue in the third quarter of 2024 increased by 102.9% to US$13.8 million from US$6.8 million in the same period of 2023, primarily due to the increasing customer demand for the Company’s differentiated smart device solutions.

COST OF REVENUE

Cost of revenue in the third quarter of 2024 increased by 35.4% to US$44.1 million from US$32.6 million in the same period of 2023, generally in line with the increase in the Company’s total revenue.

GROSS PROFIT AND GROSS MARGIN

Total gross profit in the third quarter of 2024 increased by 31.5% to US$37.5 million from US$28.5 million in the same period of 2023 and gross margin was 46.0% in the third quarter of 2024, compared to 46.7% in the same period of 2023.

- IoT PaaS gross margin in the third quarter of 2024 was 46.9%, compared to 44.6% in the same period of 2023, primarily due to increased product value.

- SaaS and others gross margin in the third quarter of 2024 was 71.6%, remained relatively stable compared to 73.9% in the same period of 2023.

- Smart solution gross margin in the third quarter of 2024 was 23.5%, compared to 26.9% in the same period of 2023, primarily due to the changes in product solution mix provided to customers during the quarter.

OPERATING EXPENSES

Operating expenses were US$54.6 million in the third quarter of 2024, compared to US$47.0 million in the same period of 2023, primarily due to a one-time increase in share-based compensation expenses resulting from the repricing of options to enhance employee incentives. Non-GAAP operating expenses decreased by 5.9% to US$30.1 million in the third quarter of 2024 from US$32.0 million in the same period of 2023. For further information on the non-GAAP financial measures presented above, see the section headed “Use of Non-GAAP Financial Measures.”

- Research and development expenses in the third quarter of 2024 were US$24.9 million, compared to US$24.9 million in the same period of 2023, primarily due to a one-time increase in share-based compensation expenses, partially offset by the decrease in employee-related costs. During this quarter, average salaried employee headcount of the Company’s research and development team was down approximately 6.2% year over year, but remained relatively stable compared to the previous quarter. Non-GAAP adjusted research and development expenses in the third quarter of 2024 were US$19.9 million, compared to US$21.8 million in the same period of 2023.

- Sales and marketing expenses in the third quarter of 2024 were US$9.7 million, compared to US$9.4 million in the same period of 2023, primarily due to a one-time increase in share-based compensation expenses, partially offset by the decrease in employee-related costs. Non-GAAP adjusted sales and marketing expenses in the third quarter of 2024 were US$8.0 million, compared to US$8.7 million in the same period of 2023.

- General and administrative expenses in the third quarter of 2024 were US$22.3 million, compared to US$15.8 million in the same period of 2023, primarily due to a one-time increase in share-based compensation expenses, partially offset by the decrease in employee-related costs. Non-GAAP adjusted general and administrative expenses in the third quarter of 2024 were US$4.4 million, compared to US$4.8 million in the same period of 2023.

- Other operating income, net in the third quarter of 2024 was US$2.2 million, primarily due to the receipt of software value-added tax refunds and various general subsidies for enterprises.

LOSS/PROFIT FROM OPERATIONS AND OPERATING MARGIN

Loss from operations in the third quarter of 2024 narrowed by 7.4% to US$17.1 million from US$18.5 million in the same period of 2023. The Company had a non-GAAP profit from operations of US$7.4 million in the third quarter of 2024, compared to a non-GAAP loss from operations of US$3.5 million in the same period of 2023, consistently achieving operating profitability on a non-GAAP basis.

Operating margin in the third quarter of 2024 was negative 21.0%, improved by 9.3 percentage points from negative 30.3% in the same period of 2023. Non-GAAP operating margin in the third quarter of 2024 was 9.1%, improved by 14.8 percentage points from negative 5.7% in the same period of 2023.

NET LOSS/PROFIT AND NET MARGIN

The Company had a net loss of US$4.4 million in the third quarter of 2024, compared to a net loss of US$4.9 million in the same period of 2023.

The difference between loss from operations and net loss in the third quarter of 2024 was primarily because of a US$13.0 million interest income achieved mainly due to well implemented treasury strategies on the Company’s cash, time deposits and treasury securities recorded as short-term and long-term investments.

The Company had a non-GAAP net profit of US$20.1 million in the third quarter of 2024, up 99.5% compared to US$10.1 million in the same period of 2023, demonstrating the Company’s ability to sustain strong profitability on a non-GAAP basis.

Net margin in the third quarter of 2024 was negative 5.4%, improving by 2.6 percentage points from negative 8.0% in the same period of 2023. Non-GAAP net margin in the third quarter of 2024 was 24.7%, improving by 8.2 percentage points from 16.5% in the same period of 2023.

BASIC AND DILUTED NET LOSS/PROFIT PER ADS

Basic and diluted net loss per ADS was US$0.01 in the third quarter of 2024, compared to basic and diluted net loss of US$0.01 in the same period of 2023. Each ADS represents one Class A ordinary share.

Non-GAAP basic and diluted net profit per ADS was US$0.04 in the third quarter of 2024, compared to non-GAAP basic and diluted net profit of US$0.02 in the same period of 2023.

CASH AND CASH EQUIVALENTS, TIME DEPOSITS AND TREASURY SECURITIES RECORDED AS SHORT-TERM AND LONG-TERM INVESTMENTS

Cash and cash equivalents, time deposits and treasury securities recorded as short-term and long-term investments were US$1,023.9 million as of September 30, 2024, compared to US$984.3 million as of December 31, 2023, which the Company believes is sufficient to meet its current liquidity and working capital needs.

NET CASH GENERATED FROM OPERATING ACTIVITIES

Net cash generated from operating activities in the third quarter of 2024 was US$23.9 million, compared to US$16.1 million in the same period of 2023. The net cash generated from operating activities for the third quarter of 2024 improved mainly due to the increase in the Company’s revenue and improved operating leverage.

For further information on non-GAAP financial measures presented above, see the section headed “Use of Non-GAAP Financial Measures.”

Business Outlook

With the stabilizing macroeconomic environment and normalizing downstream inventory levels, the industry is currently on a positive trajectory. With the effective implementation of the Company’s customer and product strategies, along with the utilization and innovation of emerging technologies like AI, the Company is confident in its business prospects.

The Company will remain committed to continuously iterating and improving its products and services, further enhancing software and hardware capabilities, expanding key customer base, investing in innovations and new opportunities, diversifying revenue streams, and further optimizing operating efficiency. At the same time, the Company understands that future trajectories may encounter challenges, including shifting consumer spending patterns, regional economic disparities, inventory management, foreign exchange rate and interests rate volatility, and broader geopolitical uncertainties.

Conference Call Information

The Company’s management will hold a conference call at 07:30 P.M. Eastern Time on Monday, November 18, 2024 (08:30 A.M. Beijing Time on Tuesday, November 19, 2024) to discuss the financial results. In advance of the conference call, all participants must use the following link to complete the online registration process. Upon registering, each participant will receive access details for this conference including a conference access code, a PIN number (personal access code), the dial-in number, and an e-mail with detailed instructions to join the conference call.

Online registration: https://register.vevent.com/register/BI10b2a0be2587453aa3081615bdeaf624

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.tuya.com, and a replay of the webcast will be available following the session.

About Tuya Inc.

Tuya Inc. TUYA HKEX: 2391)) is a global leading cloud platform service provider with a mission to build a smart solutions developer ecosystem and enable everything to be smart. Tuya has pioneered a purpose-built cloud developer platform with cloud and generative AI capabilities that delivers a full suite of offerings, including Platform-as-a-Service, or PaaS, Software-as-a-Service, or SaaS, and smart solutions for developers of smart device, commercial applications, and industries. Through its cloud developer platform, Tuya has activated a vibrant global developer community of brands, OEMs, AI agents, system integrators and independent software vendors to collectively strive for smart solutions ecosystem embodying the principles of green and low-carbon, security, high efficiency, agility, and openness.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses non-GAAP financial measures, such as non-GAAP operating expenses, non-GAAP (loss)/profit from operations (including non-GAAP operating margin), non-GAAP net profit (including non-GAAP net margin), and non-GAAP basic and diluted net profit per ADS, as supplemental measures to review and assess its operating performance. The presentation of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP“). The Company defines non-GAAP financial measures by excluding the impact of share-based compensation expenses, credit-related impairment of long-term investments and litigation costs from the respective GAAP financial measures. The Company presents the non-GAAP financial measures because they are used by the management to evaluate its operating performance and formulate business plans. The Company also believes that the use of the non-GAAP financial measures facilitates investors’ assessment of its operating performance.

Non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations as analytical tools. One of the key limitations of using the aforementioned non-GAAP financial measures is that they do not reflect all items of expenses that affect the Company’s operations. Share-based compensation expenses, credit-related impairment of long-term investments and litigation costs have been and may continue to be incurred in the business and are not reflected in the presentation of non-GAAP measures. Further, the non-GAAP financial measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP measures to the most directly comparable U.S. GAAP measures, all of which should be considered when evaluating the Company’s performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

Reconciliations of Tuya’s non-GAAP financial measures to the most comparable U.S. GAAP measures are included at the end of this press release.

Safe Harbor Statement

This press release contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company’s beliefs, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause actual results to differ materially from those contained in any forward-looking statement. In some cases, forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “anticipate”, “target”, “aim”, “estimate”, “intend”, “plan”, “believe”, “potential”, “continue”, “is/are likely to” or other similar expressions. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the SEC. The forward-looking statements included in this press release are only made as of the date hereof, and the Company disclaims any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances, except as required by law. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty.

Investor Relations Contact

Tuya Inc.

Investor Relations

Email: ir@tuya.com

The Blueshirt Group

Gary Dvorchak, CFA

Phone: +1 (323) 240-5796

Email: gary@blueshirtgroup.co

|

TUYA INC. |

||||||||||||||

|

As of December 31, |

As of September 30, |

|||||||||||||

|

ASSETS |

||||||||||||||

|

Current assets: |

||||||||||||||

|

Cash and cash equivalents |

498,688 |

610,901 |

||||||||||||

|

Restricted cash |

– |

154 |

||||||||||||

|

Short-term investments |

291,023 |

201,114 |

||||||||||||

|

Accounts receivable, net |

9,214 |

7,628 |

||||||||||||

|

Notes receivable, net |

4,955 |

10,036 |

||||||||||||

|

Inventories, net |

32,865 |

28,303 |

||||||||||||

|

Prepayments and other current assets, net |

11,053 |

17,265 |

||||||||||||

|

Total current assets |

847,798 |

875,401 |

||||||||||||

|

Non-current assets: |

||||||||||||||

|

Property, equipment and software, net |

2,589 |

2,959 |

||||||||||||

|

Operating lease right-of-use assets, net |

7,647 |

4,866 |

||||||||||||

|

Long-term investments |

207,489 |

222,830 |

||||||||||||

|

Other non-current assets, net |

877 |

9,647 |

||||||||||||

|

Total non-current assets |

218,602 |

240,302 |

||||||||||||

|

Total assets |

1,066,400 |

1,115,703 |

||||||||||||

|

LIABILITIES AND SHAREHOLDERS‘ EQUITY |

||||||||||||||

|

Current liabilities: |

||||||||||||||

|

Accounts payable |

11,577 |

18,040 |

||||||||||||

|

Advances from customers |

31,776 |

29,906 |

||||||||||||

|

Deferred revenue, current |

6,802 |

7,303 |

||||||||||||

|

Accruals and other current liabilities |

32,807 |

63,606 |

||||||||||||

|

Incomes tax payables |

689 |

– |

||||||||||||

|

Lease liabilities, current |

3,883 |

3,718 |

||||||||||||

|

Total current liabilities |

87,534 |

122,573 |

||||||||||||

|

Non-current liabilities: |

||||||||||||||

|

Lease liabilities, non-current |

3,904 |

1,251 |

||||||||||||

|

Deferred revenue, non-current |

506 |

596 |

||||||||||||

|

Other non-current liabilities |

3,891 |

1,534 |

||||||||||||

|

Total non-current liabilities |

8,301 |

3,381 |

||||||||||||

|

Total liabilities |

95,835 |

125,954 |

||||||||||||

|

TUYA INC. |

||||||||||||||

|

As of December 31, |

As of September 30, |

|||||||||||||

|

Shareholders‘ equity: |

||||||||||||||

|

Class A ordinary shares |

25 |

25 |

||||||||||||

|

Class B ordinary shares |

4 |

4 |

||||||||||||

|

Treasury stock |

(53,630) |

(29,386) |

||||||||||||

|

Additional paid-in capital |

1,616,105 |

1,614,161 |

||||||||||||

|

Accumulated other comprehensive loss |

(17,091) |

(15,419) |

||||||||||||

|

Accumulated deficit |

(574,848) |

(579,636) |

||||||||||||

|

Total shareholders‘ equity |

970,565 |

989,749 |

||||||||||||

|

Total liabilities and shareholders‘ equity |

1,066,400 |

1,115,703 |

||||||||||||

|

TUYA INC. |

||||||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||||||||

|

Revenue |

61,090 |

81,617 |

165,579 |

216,558 |

||||||||||

|

Cost of revenue |

(32,567) |

(44,102) |

(89,387) |

(114,366) |

||||||||||

|

Gross profit |

28,523 |

37,515 |

76,192 |

102,192 |

||||||||||

|

Operating expenses: |

||||||||||||||

|

Research and development expenses |

(24,946) |

(24,877) |

(79,471) |

(71,344) |

||||||||||

|

Sales and marketing expenses |

(9,418) |

(9,663) |

(29,503) |

(28,033) |

||||||||||

|

General and administrative expenses |

(15,843) |

(22,301) |

(56,909) |

(54,636) |

||||||||||

|

Other operating incomes, net |

3,197 |

2,213 |

7,491 |

7,997 |

||||||||||

|

Total operating expenses |

(47,010) |

(54,628) |

(158,392) |

(146,016) |

||||||||||

|

Loss from operations |

(18,487) |

(17,113) |

(82,200) |

(43,824) |

||||||||||

|

Other income |

||||||||||||||

|

Other non-operating incomes, net |

779 |

766 |

2,335 |

3,413 |

||||||||||

|

Financial income, net |

13,066 |

12,985 |

31,841 |

38,244 |

||||||||||

|

Foreign exchange (loss)/gain, net |

(251) |

(638) |

652 |

(1,000) |

||||||||||

|

Loss before income tax expense |

(4,893) |

(4,000) |

(47,372) |

(3,167) |

||||||||||

|

Income tax expense |

(12) |

(373) |

(2,127) |

(1,621) |

||||||||||

|

Net loss |

(4,905) |

(4,373) |

(49,499) |

(4,788) |

||||||||||

|

Net loss attributable to Tuya Inc. |

(4,905) |

(4,373) |

(49,499) |

(4,788) |

||||||||||

|

Net loss attribute to ordinary shareholders |

(4,905) |

(4,373) |

(49,499) |

(4,788) |

||||||||||

|

Net loss |

(4,905) |

(4,373) |

(49,499) |

(4,788) |

||||||||||

|

Other comprehensive (loss)/income |

||||||||||||||

|

Changes in fair value of long-term investments |

(1,417) |

– |

(2,470) |

(139) |

||||||||||

|

Transfer out of fair value changes of long-term investments |

– |

– |

8,050 |

(65) |

||||||||||

|

Foreign currency translation |

760 |

2,904 |

(4,494) |

1,876 |

||||||||||

|

Total comprehensive loss attributable to Tuya Inc. |

(5,562) |

(1,469) |

(48,413) |

(3,116) |

||||||||||

|

TUYA INC. |

||||||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||||||||

|

Net loss attributable to Tuya Inc. |

(4,905) |

(4,373) |

(49,499) |

(4,788) |

||||||||||

|

Net loss attributable to ordinary shareholders |

(4,905) |

(4,373) |

(49,499) |

(4,788) |

||||||||||

|

Weighted average number of ordinary shares used in |

555,782,518 |

569,821,232 |

554,914,108 |

562,913,590 |

||||||||||

|

Net loss per share attributable to |

(0.01) |

(0.01) |

(0.09) |

(0.01) |

||||||||||

|

Share-based compensation expenses were included in: |

3,165 |

4,978 |

11,288 |

11,860 |

||||||||||

|

Sales and marketing expenses |

758 |

1,675 |

3,984 |

4,229 |

||||||||||

|

General and administrative expenses |

11,025 |

17,663 |

34,008 |

39,450 |

||||||||||

|

TUYA INC. |

||||||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||||||

|

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||||

|

Net cash generated from operating activities |

16,070 |

23,851 |

4,683 |

50,170 |

||||||||||

|

Net cash generated from/(used in) investing activities |

55,027 |

(28,213) |

32,692 |

61,872 |

||||||||||

|

Net cash used in financing activities |

(318) |

(328) |

(2,385) |

(178) |

||||||||||

|

Effect of exchange rate changes on cash and cash |

953 |

826 |

(1,877) |

503 |

||||||||||

|

Net increase/(decrease) in cash and cash equivalents, |

71,732 |

(3,864) |

33,113 |

112,367 |

||||||||||

|

Cash and cash equivalents, restricted cash at the |

94,542 |

614,919 |

133,161 |

498,688 |

||||||||||

|

Cash and cash equivalents, restricted cash |

166,274 |

611,055 |

166,274 |

611,055 |

||||||||||

|

TUYA INC. |

||||||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||||||||

|

Reconciliation of operating expenses to non-GAAP |

||||||||||||||

|

Research and development expenses |

(24,946) |

(24,877) |

(79,471) |

(71,344) |

||||||||||

|

Add: Share-based compensation expenses |

3,165 |

4,978 |

11,288 |

11,860 |

||||||||||

|

Adjusted Research and development expenses |

(21,781) |

(19,899) |

(68,183) |

(59,484) |

||||||||||

|

Sales and marketing expenses |

(9,418) |

(9,663) |

(29,503) |

(28,033) |

||||||||||

|

Add: Share-based compensation expenses |

758 |

1,675 |

3,984 |

4,229 |

||||||||||

|

Adjusted Sales and marketing expenses |

(8,660) |

(7,988) |

(25,519) |

(23,804) |

||||||||||

|

General and administrative expenses |

(15,843) |

(22,301) |

(56,909) |

(54,636) |

||||||||||

|

Add: Share-based compensation expenses |

11,025 |

17,663 |

34,008 |

39,450 |

||||||||||

|

Add: Credit-related impairment of long-term investments |

52 |

– |

8,102 |

189 |

||||||||||

|

Add: Litigation costs |

– |

200 |

– |

2,300 |

||||||||||

|

Adjusted General and administrative expenses |

(4,766) |

(4,438) |

(14,799) |

(12,697) |

||||||||||

|

Reconciliation of loss from operations to non-GAAP |

||||||||||||||

|

Loss from operations |

(18,487) |

(17,113) |

(82,200) |

(43,824) |

||||||||||

|

Add: Share-based compensation expenses |

14,948 |

24,316 |

49,280 |

55,539 |

||||||||||

|

Add: Credit-related impairment of long-term investments |

52 |

– |

8,102 |

189 |

||||||||||

|

Add: Litigation costs |

– |

200 |

– |

2,300 |

||||||||||

|

Non-GAAP (loss)/profit from operations |

(3,487) |

7,403 |

(24,818) |

14,204 |

||||||||||

|

Non-GAAP Operating margin |

(5.7) % |

9.1 % |

(15.0) % |

6.6 % |

||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||||||||

|

Reconciliation of net loss to non-GAAP |

||||||||||||||

|

Net loss |

(4,905) |

(4,373) |

(49,499) |

(4,788) |

||||||||||

|

Add: Share-based compensation expenses |

14,948 |

24,316 |

49,280 |

55,539 |

||||||||||

|

Add: Credit-related impairment of long-term investments |

52 |

– |

8,102 |

189 |

||||||||||

|

Add: Litigation costs |

– |

200 |

– |

2,300 |

||||||||||

|

Non-GAAP Net profit |

10,095 |

20,143 |

7,883 |

53,240 |

||||||||||

|

Non-GAAP Net margin |

16.5 % |

24.7 % |

4.8 % |

24.6 % |

||||||||||

|

Weighted average number of ordinary shares used in |

||||||||||||||

|

– Basic |

555,782,518 |

569,821,232 |

554,914,108 |

562,913,590 |

||||||||||

|

– Diluted |

586,434,725 |

571,386,571 |

586,533,052 |

585,311,819 |

||||||||||

|

Non-GAAP net profit per share attributable |

||||||||||||||

|

– Basic |

0.02 |

0.04 |

0.01 |

0.09 |

||||||||||

|

– Diluted |

0.02 |

0.04 |

0.01 |

0.09 |

||||||||||

![]() View original content:https://www.prnewswire.com/news-releases/tuya-reports-third-quarter-2024-unaudited-financial-results-302308881.html

View original content:https://www.prnewswire.com/news-releases/tuya-reports-third-quarter-2024-unaudited-financial-results-302308881.html

SOURCE Tuya Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

REI Capital Growth Receives SEC Qualification for Regulation A+ Offering

STAMFORD, Conn., Nov. 18, 2024 /PRNewswire/ — On Friday November 15th, REI Capital Growth LLC (“REICG”), an innovative real estate investment fund, received qualification of its Regulation A+ Tier 2 offering. This milestone allows REICG the opportunity to fulfill its goal of democratizing small-balance investor access to institutional quality commercial real estate. Historically, this asset class has not been readily available to small-balance investors. Qualification makes it possible for REICG to offer non-accredited investors a seat at the table.

Commercial Real Estate Investment Fund achieves SEC qualification, allowing investments directly from the public

“We are incredibly proud that we can offer a compounding commercial real estate investment to those investors that could benefit the most,” said Alan Blair, CEO of REICG. “We have taken an institutional investment structure known as an Interval Fund and paired that with Reg A+ qualification, which delivers a great product to a market of investors that have been largely ignored by the commercial real estate industry.”

Key highlights of REICG’s Regulation A+ Tier 2 offering include:

- An ability to raise up to $75 million annually from both non-accredited and accredited investors;

- A long-term, tax efficient, compounding reinvestment growth strategy;

- Low annual administrative and asset management fees of less than 2%, aligning investor interests with REICG’s performance;

- An investment minimum as low as $500; and

- Leveraging over 75 years of combined real estate experience within the REICG team.

Historically the SEC has required companies to be listed on a stock or over-the-counter exchange to make a public offering, but with Regulation A+ companies like REICG can directly market to and raise capital from the public.

“Our goal has always been to empower small balance-investors with access to the wealth generating power of US Commercial Real Estate,” added Gregg Saunders, CFO. “This SEC qualification is a testament to our commitment to these principles and marks an exciting new chapter for real estate investment, REICG, and our investors.”

Interested investors can learn more about REICG’s offering and the benefits associated with Regulation A+ investing by visiting www.reicapitalgrowth.com or SEC Qualified Offering Circular

About REICG

REI Capital Growth is a real estate investment fund specializing in commercial real estate investments. With a focus on long-term value creation and disciplined investment strategies, REICG aims to deliver consistent returns to its investors while maintaining the highest standards of transparency and compliance. REI Capital Growth LLC is a Delaware limited liability company sponsored by REI Capital Management, LLC.

Contact: Alan Blair, CEO

REI Capital Growth LLC

info@reicapitalgrowth.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/rei-capital-growth-receives-sec-qualification-for-regulation-a-offering-302308956.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/rei-capital-growth-receives-sec-qualification-for-regulation-a-offering-302308956.html

SOURCE REI Capital Growth

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

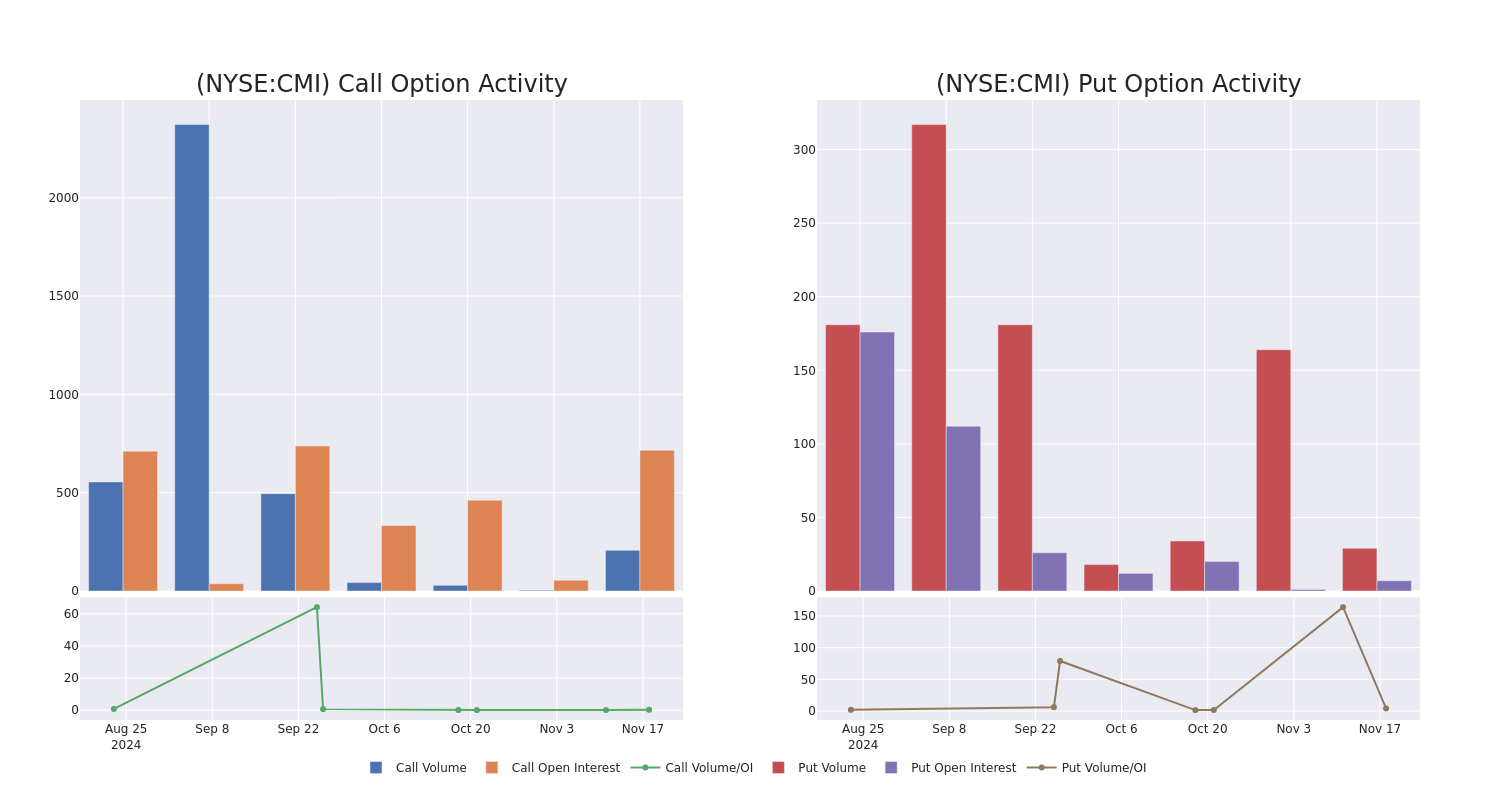

Unpacking the Latest Options Trading Trends in Cummins

High-rolling investors have positioned themselves bullish on Cummins CMI, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CMI often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 10 options trades for Cummins. This is not a typical pattern.

The sentiment among these major traders is split, with 60% bullish and 20% bearish. Among all the options we identified, there was one put, amounting to $95,969, and 9 calls, totaling $692,546.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $400.0 for Cummins during the past quarter.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Cummins’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cummins’s whale trades within a strike price range from $240.0 to $400.0 in the last 30 days.

Cummins Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMI | CALL | TRADE | NEUTRAL | 01/16/26 | $47.5 | $43.0 | $45.4 | $360.00 | $127.1K | 132 | 29 |

| CMI | CALL | SWEEP | BULLISH | 01/16/26 | $28.6 | $26.1 | $28.6 | $400.00 | $114.4K | 339 | 50 |

| CMI | CALL | SWEEP | BULLISH | 01/16/26 | $37.0 | $34.0 | $37.0 | $380.00 | $111.0K | 27 | 80 |

| CMI | CALL | TRADE | BULLISH | 01/16/26 | $37.2 | $34.5 | $37.0 | $380.00 | $99.9K | 27 | 50 |

| CMI | PUT | SWEEP | BEARISH | 01/16/26 | $34.5 | $30.5 | $33.04 | $360.00 | $95.9K | 7 | 29 |

About Cummins

Cummins is the top manufacturer of diesel engines used in commercial trucks, off-highway machinery, and railroad locomotives, in addition to standby and prime power generators. The company also sells powertrain components, which include transmissions, turbochargers, aftertreatment systems, and fuel systems. Cummins is in the unique position of competing with its primary customers, heavy-duty truck manufacturers, who make and aggressively market their own engines. Despite robust competition across all its segments and increasing government regulation of carbon emissions, Cummins has maintained its leadership position in the industry.

After a thorough review of the options trading surrounding Cummins, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Cummins

- With a volume of 267,274, the price of CMI is up 0.68% at $364.32.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 78 days.

What The Experts Say On Cummins

In the last month, 3 experts released ratings on this stock with an average target price of $383.3333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Goldman Sachs persists with their Neutral rating on Cummins, maintaining a target price of $370.

* An analyst from Evercore ISI Group upgraded its action to Outperform with a price target of $408.

* An analyst from Baird persists with their Neutral rating on Cummins, maintaining a target price of $372.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Cummins, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

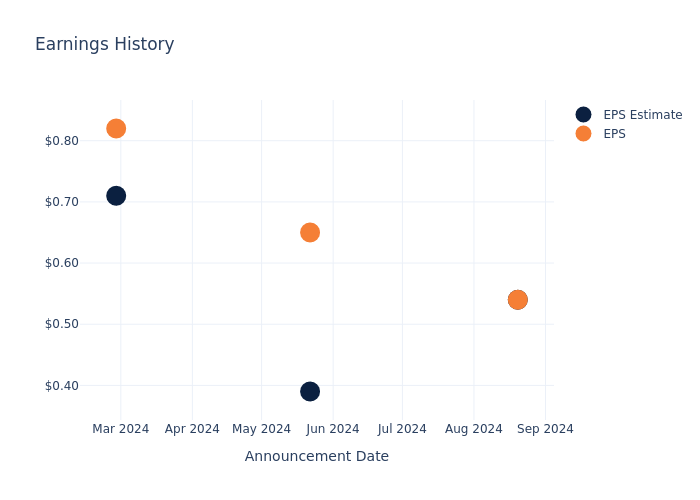

Insights Ahead: Vipshop Holdings's Quarterly Earnings

Vipshop Holdings VIPS is set to give its latest quarterly earnings report on Tuesday, 2024-11-19. Here’s what investors need to know before the announcement.

Analysts estimate that Vipshop Holdings will report an earnings per share (EPS) of $0.42.

Vipshop Holdings bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Earnings Track Record

Last quarter the company missed EPS by $0.00, which was followed by a 9.86% increase in the share price the next day.

Here’s a look at Vipshop Holdings’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.54 | 0.39 | 0.71 | 0.40 |

| EPS Actual | 0.54 | 0.65 | 0.82 | 0.46 |

| Price Change % | 10.0% | -4.0% | -1.0% | 7.000000000000001% |

Vipshop Holdings Share Price Analysis

Shares of Vipshop Holdings were trading at $13.93 as of November 15. Over the last 52-week period, shares are down 12.19%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for Vipshop Holdings visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

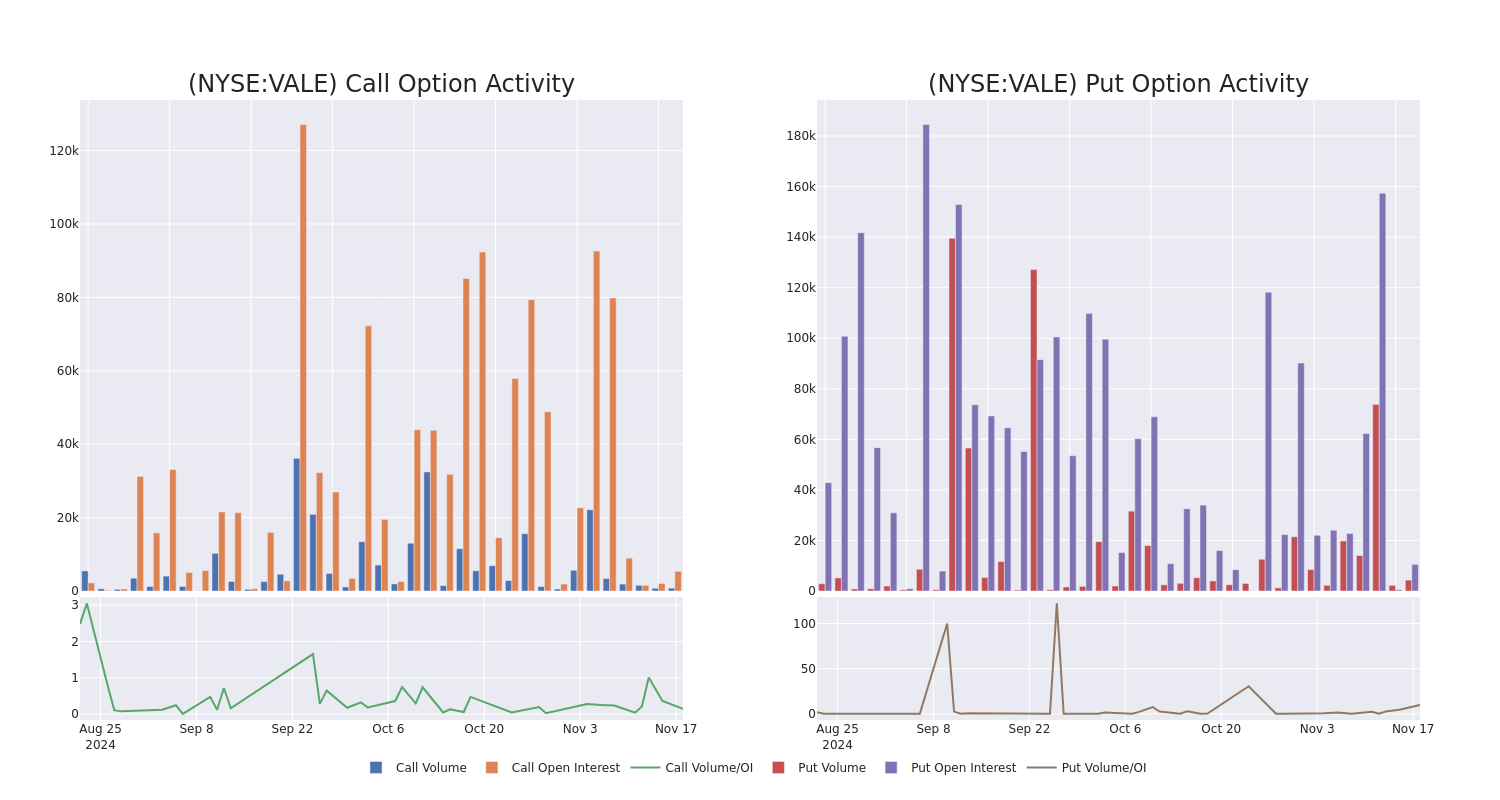

Unpacking the Latest Options Trading Trends in Vale

Investors with a lot of money to spend have taken a bullish stance on Vale VALE.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with VALE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 18 uncommon options trades for Vale.

This isn’t normal.

The overall sentiment of these big-money traders is split between 55% bullish and 22%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $534,303, and 16 are calls, for a total amount of $1,541,550.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1.0 to $12.0 for Vale over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Vale’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vale’s whale activity within a strike price range from $1.0 to $12.0 in the last 30 days.

Vale Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VALE | PUT | TRADE | BULLISH | 12/20/24 | $2.45 | $1.9 | $1.99 | $12.00 | $497.5K | 10.3K | 2.5K |

| VALE | CALL | TRADE | BULLISH | 03/21/25 | $9.2 | $8.2 | $9.0 | $1.00 | $135.0K | 500 | 300 |

| VALE | CALL | TRADE | BULLISH | 03/21/25 | $9.0 | $8.2 | $9.0 | $1.00 | $135.0K | 500 | 150 |

| VALE | CALL | TRADE | BULLISH | 12/20/24 | $9.15 | $8.2 | $8.95 | $1.00 | $134.2K | 1.2K | 300 |

| VALE | CALL | TRADE | BULLISH | 12/20/24 | $9.15 | $8.2 | $8.95 | $1.00 | $134.2K | 1.2K | 150 |

About Vale

Vale is a large global miner and the world’s largest producer of iron ore and pellets. In recent years the company has sold noncore assets such as its fertilizer, coal, and steel operations to concentrate on iron ore, nickel, and copper. Earnings are dominated by the bulk materials division, primarily iron ore and iron ore pellets. The base metals division is much smaller, consisting of nickel mines and smelters along with copper mines producing copper in concentrate. In 2024, Vale sold a minority 10% stake in energy transition metals, its base metals business, likely the first step in separating base metals and iron ore.

After a thorough review of the options trading surrounding Vale, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Vale

- With a volume of 16,007,543, the price of VALE is up 2.5% at $10.05.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 94 days.

What The Experts Say On Vale

In the last month, 1 experts released ratings on this stock with an average target price of $11.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from UBS downgraded its action to Neutral with a price target of $11.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Vale, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.