Earnings Outlook For S&W Seed

S&W Seed SANW is set to give its latest quarterly earnings report on Tuesday, 2024-11-19. Here’s what investors need to know before the announcement.

Analysts estimate that S&W Seed will report an earnings per share (EPS) of $-1.40.

S&W Seed bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

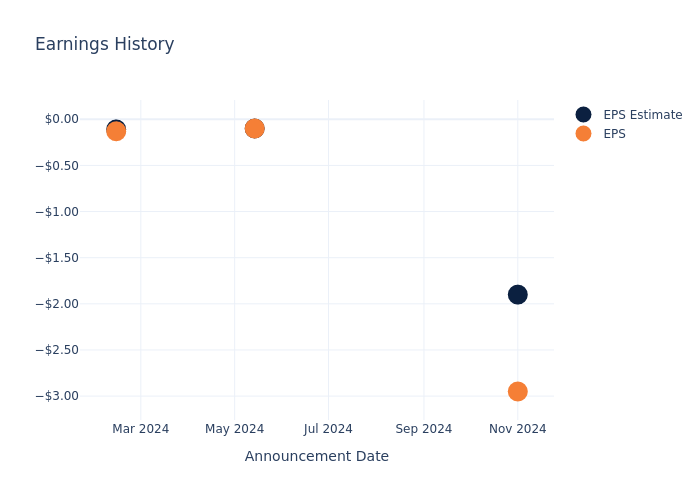

Earnings History Snapshot

In the previous earnings release, the company missed EPS by $1.05, leading to a 0.0% drop in the share price the following trading session.

Here’s a look at S&W Seed’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | -1.90 | -0.1 | -0.11 | -0.10 |

| EPS Actual | -2.95 | -0.1 | -0.13 | -0.11 |

| Price Change % | -1.0% | 7.000000000000001% | -11.0% | -4.0% |

Tracking S&W Seed’s Stock Performance

Shares of S&W Seed were trading at $2.25 as of November 15. Over the last 52-week period, shares are down 81.12%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for S&W Seed visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Must See Chart For Prudent Investors, Trump To Help Tesla Dominate, Nvidia Heat Problem

To gain an edge, this is what you need to know today.

The Trump Trade

Please click here for an enlarged chart comparing SPDR S&P Biotech ETF XBI to Dogecoin to United States Dollar DOGE/USD.

Note the following:

- The chart shows that biotech XBI has lost 5.35% since Trump’s election. Companies in this ETF are producing innovative life saving drugs, employ brilliant scientists, own significant intellectual property, and are often bought out at large premiums.

- The chart shows that Dogecoin has gained 48.78% since Trump’s election. Dogecoin was initially developed as a joke. At one time, it was endorsed by Elon Musk; its name is the same as the acronym of Trump’s Department of Government Efficiency. The main use of Dogecoin is speculation by the meme crowd. Dogecoin has an active meme crowd community behind it.

- The contrast between the performance of XBI and Dogecoin shown on the chart is emblematic of, in large part, what investors are buying and selling in the wake of Trump’s re-election.

- On top of investors rushing into speculative assets, sentiment is extremely positive. Historically, extremely positive sentiment is a contrary indicator. In plain English, it means sell. As we have previously stated, sentiment is not a precise timing indicator.

- In spite of all the warning signals, The Arora Report call remains to buy the dips. There are two main reasons:

- There is an old saying on Wall Street that no one has ever been fired for losing clients’ money. However, money managers get fired for lagging far behind their benchmarks. No money manager, irrespective of his/her view of the market, wants to commit career suicide by not chasing the market at the year end. Bearish money managers who have missed out on this rally are likely to buy the dips and chase the stock market into the year end.

- Right now, hopium is at an extreme. There is nothing in the way of hopium. Since Trump is not yet president, there is no reality to confront hopium. Right now, the momo crowd is buying based on the best case of all of the positives that may come out of Trump’s policies, and they are ignoring all of the negatives.

- The plan is to start taking profits on new buys before hopium meets reality between Christmas and Trump’s inauguration.

- As a note of caution, this is not a call for wholesale buying. This is a call to buy on the margin based on the protection band.

- Trump’s transition team is starting the work to help those who helped Trump get elected. An example is the Trump team wanting to change the rules around self-driving cars in the U.S. to help Tesla Inc TSLA. Musk has been a big supporter of Trump. Over a period of time, expect many such moves from Trump’s team. As a full disclosure, The Arora Report gave a signal to buy TSLA after Trump’s win. The trade has been nicely profitable. The system has also triggered a signal for a trade around position in TSLA, but publication of the signal may be delayed because TSLA stock has gapped up significantly.

- Trump has appointed Chris Wright as the next Department of Energy Secretary. Wright is the CEO of Liberty Energy Inc LBRT. Liberty Energy is engaged in fracking. Wright is also on the board of smart modular reactor company Oklo Inc OKLO that is backed by OpenAI founder Sam Altman. Money is flowing into gas and nuclear stocks on Wright’s appointment.

- The most important event for the market this week is NVIDIA Corp NVDA earnings that will be released on Wednesday after the close. This morning, NVDA is seeing aggressive selling because of a report of Blackwell chips heating up in data centers.

- In the early trade, retail investors are aggressively buying Trump stocks based on the weekend pump. Professional investors are front running retail investors as they hope to sell at higher prices to retail investors later.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, TSLA, and Apple Inc AAPL.

In the early trade, money flows are neutral in Meta Platforms Inc META and Microsoft Corp MSFT.

In the early trade, money flows are negative in NVDA.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is range bound.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. The proprietary protection band from The Arora Report is very popular. The protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Glimpse of Northern Technologies's Earnings Potential

Northern Technologies NTIC is gearing up to announce its quarterly earnings on Tuesday, 2024-11-19. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Northern Technologies will report an earnings per share (EPS) of $0.19.

Investors in Northern Technologies are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

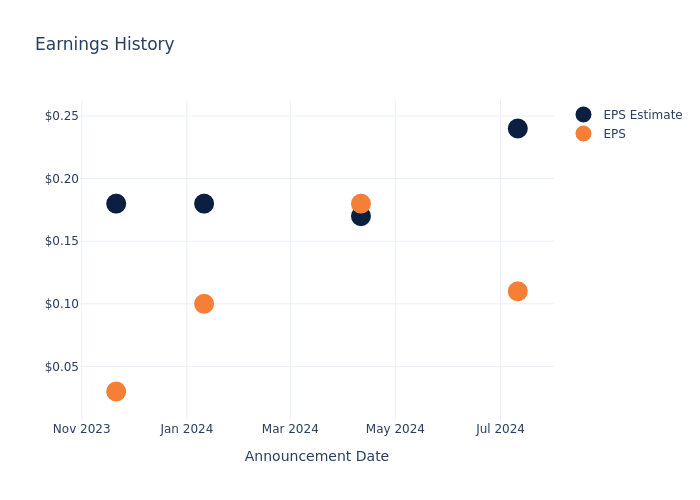

Earnings History Snapshot

The company’s EPS missed by $0.13 in the last quarter, leading to a 6.87% drop in the share price on the following day.

Here’s a look at Northern Technologies’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.24 | 0.17 | 0.18 | 0.18 |

| EPS Actual | 0.11 | 0.18 | 0.10 | 0.03 |

| Price Change % | -7.000000000000001% | 1.0% | 6.0% | -1.0% |

Tracking Northern Technologies’s Stock Performance

Shares of Northern Technologies were trading at $12.94 as of November 15. Over the last 52-week period, shares are up 19.63%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Northern Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

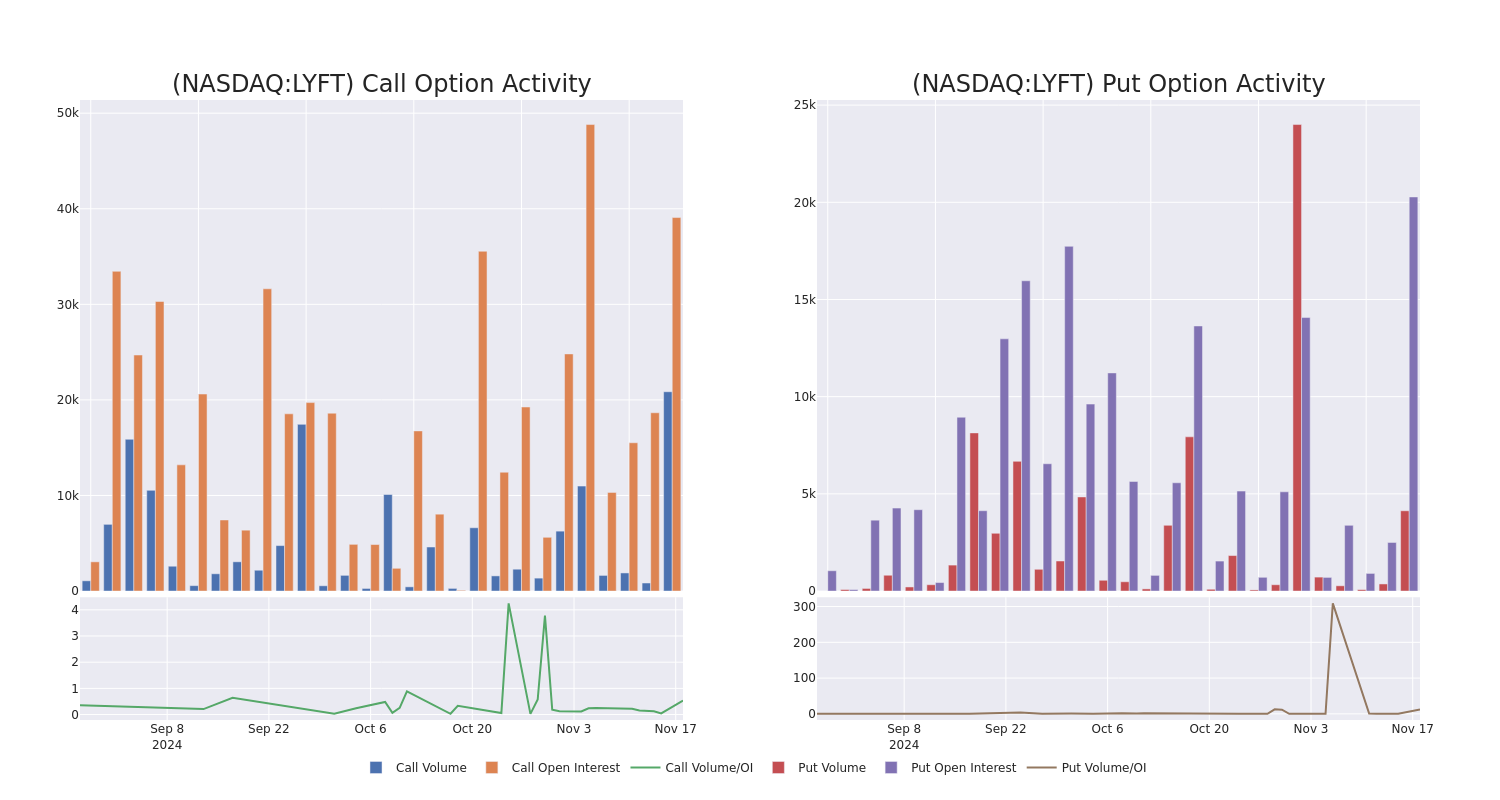

A Closer Look at Lyft's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on Lyft.

Looking at options history for Lyft LYFT we detected 23 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 60% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $837,299 and 17, calls, for a total amount of $664,250.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $22.5 for Lyft over the recent three months.

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Lyft’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lyft’s whale activity within a strike price range from $12.0 to $22.5 in the last 30 days.

Lyft 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LYFT | PUT | SWEEP | BEARISH | 01/16/26 | $1.5 | $1.38 | $1.47 | $12.00 | $292.8K | 4.3K | 2.0K |

| LYFT | PUT | SWEEP | NEUTRAL | 04/17/25 | $1.46 | $1.29 | $1.38 | $15.00 | $276.0K | 301 | 2.0K |

| LYFT | PUT | SWEEP | BEARISH | 09/19/25 | $2.2 | $2.11 | $2.2 | $15.00 | $122.0K | 371 | 557 |

| LYFT | PUT | SWEEP | BULLISH | 01/17/25 | $3.3 | $3.25 | $3.25 | $20.00 | $80.6K | 2.6K | 249 |

| LYFT | CALL | SWEEP | BEARISH | 12/20/24 | $0.15 | $0.14 | $0.14 | $21.00 | $56.6K | 2.6K | 4.0K |

About Lyft

Lyft is the second-largest ride-sharing service provider in the US and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

Following our analysis of the options activities associated with Lyft, we pivot to a closer look at the company’s own performance.

Current Position of Lyft

- With a trading volume of 13,191,006, the price of LYFT is down by -5.55%, reaching $17.11.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 85 days from now.

What The Experts Say On Lyft

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $16.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from TD Cowen persists with their Hold rating on Lyft, maintaining a target price of $18.

* Maintaining their stance, an analyst from Jefferies continues to hold a Hold rating for Lyft, targeting a price of $13.

* Maintaining their stance, an analyst from DA Davidson continues to hold a Neutral rating for Lyft, targeting a price of $16.

* An analyst from B of A Securities has decided to maintain their Buy rating on Lyft, which currently sits at a price target of $19.

* An analyst from BMO Capital has decided to maintain their Market Perform rating on Lyft, which currently sits at a price target of $18.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lyft with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street forecasts 'normal' year for stocks in 2025 after historic rally

After two years of annual gains north of 20% for the S&P 500 (^GSPC), Wall Street strategists think 2025 will see a more measured year for stocks.

On Monday, BMO Capital Markets chief investment strategist Brian Belski initiated a 2025 year-end target of 6,700 for the S&P 500. On Sunday, Morgan Stanley chief investment officer Mike Wilson issued a 12-month target of 6,500 for the S&P 500.

Belski’s target reflects about 14% upside from Friday’s close; the strategist already has a 6,100 year-end target for 2024. This puts Belski’s forecast for returns in 2025 at 9.8%, right in line with the index’s average historical gain. Wilson’s 12-month target represents a nearly 11% increase for the benchmark index over the next year.

Should the S&P 500 finish 2024 with a gain above 20%, it would mark the first time the benchmark index has posted consecutive years with gains of 20% or more since the tech bubble of 1998-1999.

Any way you slice it, then, these outlooks say the outsized returns the S&P 500 has enjoyed for each of the past two years will come to an end in 2025.

“It is clearly time for markets to take a somewhat of a breather,” Belski wrote.

“Bull markets can, will and should slow their pace from time-to-time, a period of digestion that in turn only accentuates the health of the underlying secular bull. So we believe 2025 will likely [be] defined by a more normalized return environment with more balanced performance across sectors, sizes, and styles.”

Belski points out that the historical pattern for bull markets sees returns in year three come in below gains for the first two years and below the index’s typical average return.

“Now that inflation, interest rates (zero percent is NOT normal) and employment are showing signs of stabilizing (volatility diminishing), US stock fundamentals have their best chance to normalize,” Belski wrote.

“According to our work, an environment of high single digit annual price gains coupled with at or near double digit earnings growth and price to earnings ratios in the high teens to low twenties over the next few years would be a good start on the path to normalization.”

With the Federal Reserve cutting interest rates while US economic growth remains strong, both Belski and Wilson believe in a continued broadening of the stock market rally, where more than just a few high-flying tech names are driving the market action.

“We expect this broadening in earnings growth to continue as the Fed cuts rates into next year and business cycle indicators continue to improve,” Wilson wrote. “A potential rise in corporate animal spirits post the election could catalyze a more balanced earnings profile across the market in 2025.”

SPZI: JP3E Reports Significant Revenue Growth and Strong Consolidated Financial Results for Nine Months Ended September 30, 2024

SOMERSET, N.J., Nov. 18, 2024 (GLOBE NEWSWIRE) — JP 3E Holdings, Inc. (“JP3E”) formerly known as Spooz, Inc. SPZI, a provider of innovative financial and commodity trading solutions, has announced its consolidated financial results for the nine months ended September 30, 2024. The results reflect strong revenue growth, strategic acquisitions, and operational efficiency, signaling a period of robust expansion and innovation for the company.

Key Highlights for Consolidated Financials Nine Months Ended September 30, 2024:

- Revenue: $112.2 million, marking the first recorded revenue for JP3E, driven by contributions from recently acquired Bloxcross, Inc.

- Gross Profit: $14.4 million, showcasing the company’s ability to manage cost of goods sold effectively.

- Net Income: $6.1 million, a significant improvement from a net loss of $14,014 in Q3 2023.

- Total Assets: Increased to $43.5 million from $8,774 as of December 31, 2023, reflecting acquisitions and asset appreciation.

- Earnings Per Share: $0.001, emphasizing the impact of JP3E’s expanded operations.

Strategic Developments

- JP3E acquired Bloxcross, Inc., a digital assets innovation company that specializes in blockchain-driven solutions for global trade and cross-border payments. This acquisition significantly contributed to the company’s revenue growth and enhanced its intellectual property portfolio, valued at $25.3 million.

- The company also integrated Hamilton Associates LLC., adding $18.2 million in land and building assets.

Operational Efficiency

- Total expenses were managed at $5.7 million, enabling the company to report operating income of $8.7 million.

Chairman/President Statement:

“During the third quarter, we transitioned and added Diego Baez, CEO of Bloxcross, to become the CEO of JP3E. Since going live on August 8, 2024, with the Bloxcross trading platform, Diego and his team have proven to be instrumental in immediately bringing substantial valuation to JP3E,” said John K. Park, Chairman and President of JP3E.

Looking Ahead

JP3E continues to explore opportunities for expansion in the blockchain and commodity trading sectors. In September 2024, the company executed its first shipment of Grade A Chicken Paws to China under its February 2024 contract, marking a significant milestone in its commodity trading operations. Our commodity business is progressing with chicken, sugar, coal, aluminum, and gold transactions. We anticipate our revenues from these commodities to be reflected in the near term with additional shipment and delivery confirmations. The company remains focused on enhancing shareholder value through strategic growth initiatives and operational excellence.

For a more detailed and complete analysis of the Company’s financial results for the nine months ended as of September 30, 2024, please refer to the Company’s Financials under Disclosure, which were filed earlier on OTC Markets. https://www.otcmarkets.com/stock/SPZI/disclosure

To receive information on JP3E, sign up for email news alerts at https://www.jp3e.com/subscription.

For additional information on the Global Trade Financing Platform via Bloxcross, Inc., reach out to sgallegos@bloxcross.com.

About JP 3E Holdings, Inc.:

JP3E is a global leader in commodity trading, known for its innovative approach to optimizing trade processes and solutions across numerous sectors. With a commitment to sustainability and market leadership, JP3E continues to drive new trends and solutions in global commodity markets.

About Bloxcross, Inc.:

Bloxcross is at the forefront of financial technology, specializing in blockchain-based solutions for cross-border payments and trade finance. Dedicated to streamlining global financial transactions, Bloxcross provides secure, fast, and cost-effective services to clients worldwide. To learn more about their groundbreaking solutions, visit https://www.blox.global/.

Company Contact:

John K. Park, Chairman

john.park@jp3eholdings.com

732-241-0598 Office

Websites: https://www.jp3e.com/

https://www.jp3eholdings.com/

Twitter: http://www.twitter.com/SpoozInc

Facebook: http://www.Facebook.com/SpoozInc

E-Mail: info@jp3e.com

Safe Harbor Notice

Certain statements contained herein are “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). The Companies caution that statements, and assumptions made in this news release constitute forward-looking statements and makes no guarantee of future performance. Forward-looking statements are based on estimates and opinions of management at the time statements are made. These statements may address issues that involve significant risks, uncertainties, and estimates made by management. Actual results could differ materially from current projections or implied results. The Companies undertake no obligation to revise these statements following the date of this news release.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crude Oil Rises Sharply; US Homebuilder Sentiment Surges In November

U.S. stocks traded mostly higher midway through trading, with the Nasdaq Composite gaining by more than 100 points on Monday.

The Dow traded down 0.04% to 43,427.62 while the NASDAQ rose 0.69% to 18,809.65. The S&P 500 also rose, gaining, 0.42% to 5,895.43.

Check This Out: How To Earn $500 A Month From Apple Stock

Leading and Lagging Sectors

Consumer discretionary shares rose by 1.5% on Monday.

In trading on Monday, information technology shares fell by 0.3%.

Top Headline

The NAHB/Wells Fargo Housing Market Index climbed to 46 in November, recording the highest reading in seven months, compared to 43 in October.

Equities Trading UP

- HCW Biologics Inc. HCWB shares shot up 237% to $1.02 after the company entered into an exclusive licensing deal with WY Biotech for immunotherapy development.

- Shares of Amylyx Pharmaceuticals, Inc. AMLX got a boost, surging 17% to $5.55 after Baird upgraded the stock from Neutral to Outperform and raised its price target from $3 to $11.

- Twist Bioscience Corporation TWST shares were also up, gaining 11% to $40.80 after the company reported better-than-expected fourth-quarter EPS and sales.

Equities Trading DOWN

- CareMax, Inc. CMAX shares dropped 54% to $0.7812. CareMax reached agreements to sell Management Services Organization and Core Centers’ assets.

- Shares of Neurogene Inc. NGNE were down 39% to $21.00 after the company announced it brought its high-dose gene therapy trial to a halt after a serious adverse event in a Rett syndrome patient.

- IonQ, Inc. IONQ was down, falling 22% to $22.79.

Commodities

In commodity news, oil traded up 2.8% to $68.88 while gold traded up 1.8% at $2,616.60.

Silver traded up 2.3% to $31.12 on Monday, while copper rose 0.4% to $4.0805.

Euro zone

European shares were mostly lower today. The eurozone’s STOXX 600 fell 0.33%, Germany’s DAX fell 0.32% and France’s CAC 40 fell 0.11%. Spain’s IBEX 35 Index fell 0.15%, while London’s FTSE 100 rose 0.31%.

The Eurozone reported a trade surplus of €12.5 billion in September versus a year-ago surplus of €9.8 billion, compared to market expectations of €7.9 billion.

Asia Pacific Markets

Asian markets closed lower on Monday, with Japan’s Nikkei 225 falling 1.09%, Hong Kong’s Hang Seng Index gaining 0.77%, China’s Shanghai Composite Index declining 0.21% and India’s BSE Sensex falling 0.31%.

Economics

The NAHB/Wells Fargo Housing Market Index climbed to 46 in November, recording the highest reading in seven months, compared to 43 in October.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

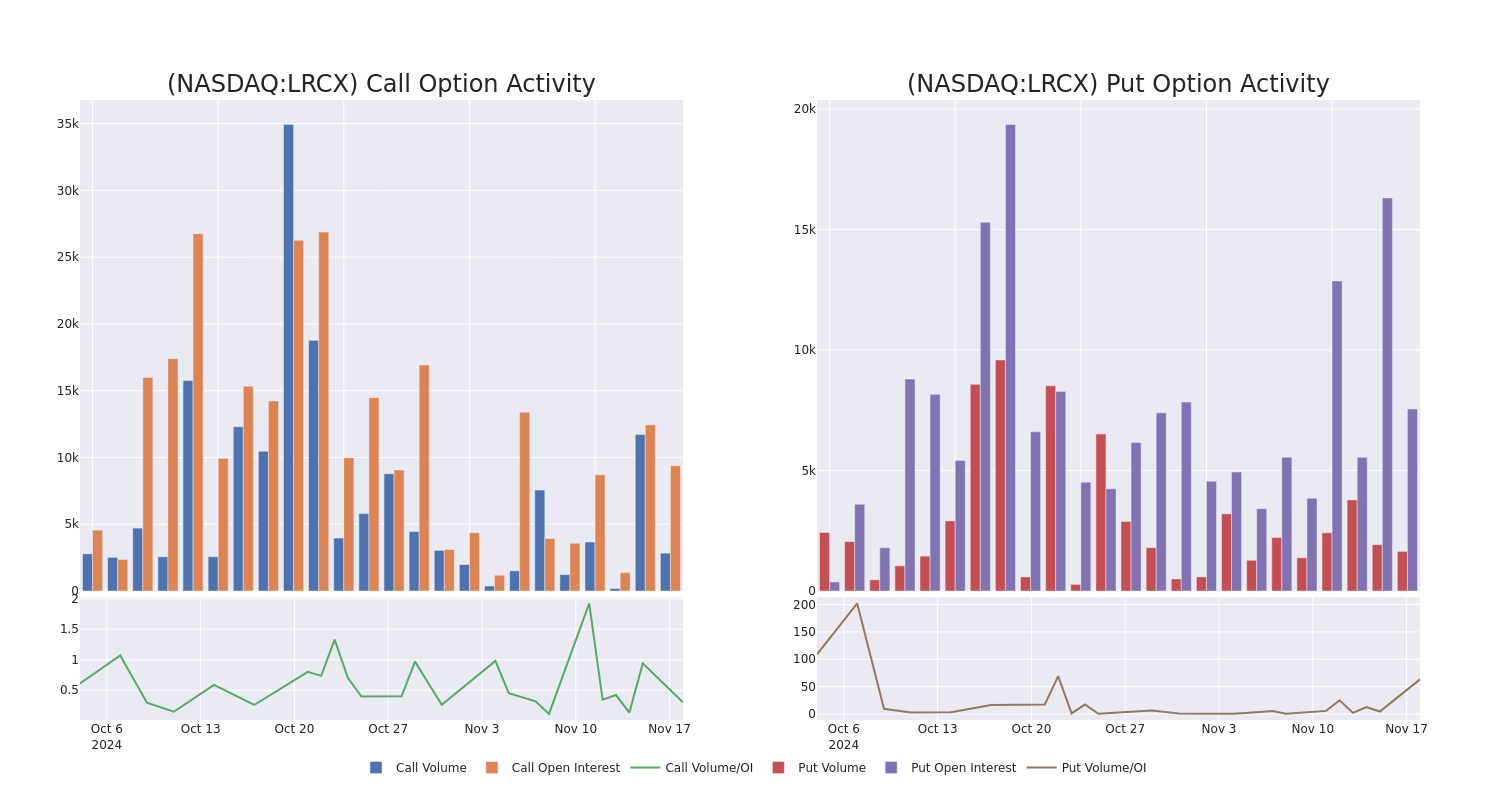

Lam Research Options Trading: A Deep Dive into Market Sentiment

Deep-pocketed investors have adopted a bullish approach towards Lam Research LRCX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LRCX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 22 extraordinary options activities for Lam Research. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 36% bearish. Among these notable options, 8 are puts, totaling $728,630, and 14 are calls, amounting to $1,401,202.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $56.0 to $105.0 for Lam Research during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Lam Research’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lam Research’s whale trades within a strike price range from $56.0 to $105.0 in the last 30 days.

Lam Research Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | CALL | TRADE | BEARISH | 01/16/26 | $6.4 | $6.2 | $6.2 | $92.00 | $775.0K | 360 | 1.2K |

| LRCX | PUT | TRADE | BEARISH | 12/20/24 | $9.85 | $9.8 | $9.85 | $80.00 | $226.5K | 3.0K | 235 |

| LRCX | PUT | SWEEP | BULLISH | 01/16/26 | $32.9 | $30.1 | $30.35 | $99.00 | $118.4K | 68 | 39 |

| LRCX | PUT | TRADE | BULLISH | 06/20/25 | $11.0 | $10.8 | $10.8 | $75.00 | $93.9K | 687 | 87 |

| LRCX | PUT | SWEEP | BEARISH | 03/21/25 | $4.65 | $4.55 | $4.65 | $67.00 | $86.0K | 406 | 219 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment manufacturers in the world. It specializes in deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Following our analysis of the options activities associated with Lam Research, we pivot to a closer look at the company’s own performance.

Present Market Standing of Lam Research

- Trading volume stands at 3,543,399, with LRCX’s price up by 0.38%, positioned at $70.31.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 65 days.

What The Experts Say On Lam Research

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $94.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Needham downgraded its action to Buy with a price target of $100.

* An analyst from B. Riley Securities downgraded its action to Buy with a price target of $110.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Lam Research with a target price of $85.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Lam Research with a target price of $76.

* In a cautious move, an analyst from Stifel downgraded its rating to Buy, setting a price target of $100.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lam Research, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.