Super Micro Computer Stock Is Rebounding Today. Is It Time to Buy?

Super Micro Computer (NASDAQ: SMCI) stock has been in free fall for the last six months. A myriad of issues related to its accounting practices have spooked investors. After the company announced it would have to delay the release of its 10-K annual report for its fiscal 2024 ended June 30, it also faced the possibility of its stock being delisted from the Nasdaq Stock Exchange.

It has now hit the deadline for a Nasdaq delisting, but today it is planning a filing that could result in the company avoiding being delisted, reports Barron’s. That has led to a spike in shares today, to the tune of 17.5% as of 12:30 p.m. ET. Though the stock is still lower by about 75% in the last six months.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

If the company does indeed manage to avoid being delisted from the major exchange, it is certainly good news for shareholders. So it makes sense that investors sent shares soaring today. But that isn’t the end of the company’s problems.

The 10-K filing delay followed a short-seller report questioning Supermicro’s accounting practices. Since then the company’s auditor resigned, and it said it will also be forced to delay its fiscal 2025 first-quarter report while searching for a new auditing firm.

Supermicro management did release an update on Nov. 5 saying preliminary results for its September quarter would be below expectations. But it also added that a three-month independent counsel investigation found “no evidence of fraud or misconduct on the part of management or the board of directors.”

But investors have to be concerned about the business ramifications as well. Supermicro could be losing orders as it struggles to right its ship. And today’s bounce is likely from a short squeeze as short sellers cover positions and take profits. Short sellers held about 19% of the stock float as of the end of October, according to MarketWatch.

Those interested in owning the stock should probably wait for better official news. Today’s bounce isn’t a sign that the business itself is back in growth mode.

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

An Overview of Kore Group Holdings's Earnings

Kore Group Holdings KORE is gearing up to announce its quarterly earnings on Tuesday, 2024-11-19. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Kore Group Holdings will report an earnings per share (EPS) of $-0.63.

The announcement from Kore Group Holdings is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

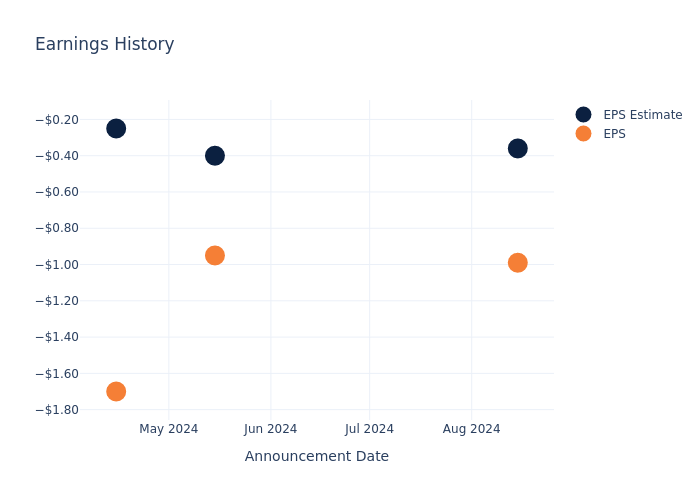

Historical Earnings Performance

In the previous earnings release, the company missed EPS by $0.63, leading to a 12.41% drop in the share price the following trading session.

Here’s a look at Kore Group Holdings’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.36 | -0.40 | -0.25 | -0.5 |

| EPS Actual | -0.99 | -0.95 | -1.70 | -1 |

| Price Change % | -12.0% | -0.0% | -1.0% | -15.0% |

Performance of Kore Group Holdings Shares

Shares of Kore Group Holdings were trading at $2.0 as of November 15. Over the last 52-week period, shares are down 33.38%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

To track all earnings releases for Kore Group Holdings visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Royal Caribbean Cruises (RCL) Stock Hit A New All-Time High This Month

Royal Caribbean Cruises Ltd RCL stock has surged to an all-time high of $238.10 in November following Donald Trump’s presidential election win, as investors anticipate a favorable economic environment for the travel and leisure industry.

Trump’s pro-business policies, including proposed tax cuts for individuals and corporations, could increase disposable income for consumers, potentially driving a surge in discretionary spending on cruises and vacations.

What To Know: Trump’s emphasis on deregulation is also seen as a positive for Royal Caribbean. Easing restrictions on the travel industry, particularly those introduced during the pandemic, could streamline operations and reduce compliance costs. This regulatory flexibility may help the cruise operator expand routes and develop new destinations, enhancing its competitive edge.

Read Also: How To Earn $500 A Month From Walmart Stock Ahead Of Q3 Earnings

Additionally, Trump’s stance on energy production could benefit Royal Caribbean by keeping fuel prices stable or even reducing them. With fuel being a significant operating expense for cruise lines, lower energy costs could directly improve Royal Caribbean’s profit margins.

The potential rollback of environmental regulations may also have implications for Royal Caribbean’s fleet upgrades. While the company has committed to sustainability initiatives, relaxed emissions standards could reduce the urgency and cost of compliance, freeing up resources for growth and marketing.

Furthermore, Trump’s broader economic policies, including infrastructure investments, could indirectly benefit Royal Caribbean by enhancing port facilities and boosting international trade and travel. If Trump’s administration fosters stronger consumer confidence and economic growth, Royal Caribbean could capitalize on the demand for leisure travel.

Read Also: Spirit Airlines Eyes Restructuring With Chapter 11 Filing And Equity Injection

How To Buy RCL Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Royal Caribbean’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

According to data from Benzinga Pro, RCL has a 52-week high of $238.10 and a 52-week low of $102.77.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Advocacy Group Calls Ohio Senate's Hemp Ban 'Catastrophic,' Push For Governor's Veto

The Ohio Healthy Alternatives Association (OHAA) has called on state senators to oppose Senate Bill 326, a proposed regulation targeting hemp products. OHAA, which represents nearly 3,000 small businesses and over 26,000 workers, warns that the bill could have severe economic repercussions on the industry.

Introduced by State Senator Steve Huffman (R), SB 326 seeks to impose stricter THC limits than the 2018 Farm Bill, reducing the allowable delta-9 THC content to just 0.5 milligrams per serving. Proponents argue that the bill aims to safeguard public health, particularly for minors, mirroring recent restrictive measures in states like California. However, critics say it goes too far, potentially removing many popular hemp products, such as full-spectrum CBD oils and THC beverages from the shelves in Ohio.

“Senator Huffman said, ‘he did not have any data as to how many could be impacted.’” OHAA noted, “SB 326 is rushed, flawed and catastrophic for our members.” They estimate the bill could lead to over 20,000 job losses and financial disruptions, including defaulted leases and unpaid vendor debts.

Read Also: Ohio’s Cannabis Market Surges, Reaching $143M In Just 4 Months

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

“While over 36 states including Georgia, Tennessee, North Carolina, and Florida have successfully chosen to regulate this much needed industry, SB 326 proposes a flawed total ban bill that will cause systematic chaos overnight,” adds the statement.

The debate over the bill comes as Ohio’s cannabis market thrives, with recreational sales reaching $143 million within four months of legalization. The contrast between support for regulated cannabis and a potential hemp crackdown highlights ongoing regulatory challenges.

Controversial Alliance

OHAA is part of the American Healthy Alternatives Association (AHAA), a national hemp advocacy group. On their website, OHAA is urging Ohio Governor Mike DeWine (R) to veto SB 326, while simultaneously celebrating a recent victory in Florida, where Governor Ron DeSantis vetoed similar legislation restricting hemp products.

“Thank you Gov. DeSantis for working with us,” reads OHAA’s website. DeSantis has a strong stance against adult-use cannabis legalization and played an instrumental role in blocking a marijuana legalization ballot initiative.

But unlike De Santis, DeWine has previously voiced support for tighter regulations on hemp-derived products, citing concerns about public health and youth safety.

COVER: OHAA website

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Goldman Sachs Turns Bearish On Redfin: 'Affordability Could Weigh On A Housing Recovery'

Goldman Sachs analyst Michael Ng, CFA, downgraded Redfin Corp. RDFN from Neutral to Sell on Monday, citing growing competition, agent commission pressures and affordability challenges in the U.S. housing market.

According to the expert, Redfin currently screens rich valuations despite a still weak U.S. housing market.

Redfin shares have gained 22% in the past 12 months, lagging the S&P 500’s 29% rise. The stock now trades at 88x its 2025 enterprise value-to-EBITDA (EV/EBITDA), far above Compass Inc. COMP at 14x and Zillow Group ZG at 25x.

“Housing affordability is the worst-on-record,” according to the National Association of Realtors (NAR).

Goldman Sachs metrics based on the ratio of monthly mortgage payments to U.S. median household income, incorporating the median home sales price and 30-year fixed mortgage rates, show affordability is at its worst level since at least 2004.

As of November 2024, the average 30-year fixed mortgage rate stood at 6.79%, a slight decline from 7.5% a year ago. Despite this drop, affordability remains deeply constrained due to persistently high home prices and stagnant income growth.

In September 2024, U.S. existing home sales fell 3.5% year-over-year to a seasonally adjusted annual rate (SAAR) of 3.84 million — the slowest pace since 2010 outside of the pandemic, NAR data shows.

Fannie Mae projects U.S. existing home sales to rebound by 11% in 2025, reaching 4.5 million SAAR. However, Ng sees risks to this outlook, citing elevated mortgage rates, unaffordable home prices and limited income growth.

“We believe affordability could weigh on a housing recovery, creating risk to forecasts including Fannie Mae’s outlook for 4.5 mn U.S. existing home sales in 2025,” Ng wrote

Declining agent commission rates across the real estate industry pose another challenge for Redfin’s business model.

Following the Sitzer/Burnett v. NAR ruling in 2023, buyer agent commissions fell to 2.34% as of October 2024, creating additional headwinds for Redfin’s revenue growth.

“Industry agent commission pressure may result in Redfin further lowering its commissions or result in a headwind to conversion as its low-commission model becomes less differentiated,” Ng said.

In the Rentals segment, Redfin’s 2023 revenue rose 19% year-over-year, driven by rising U.S. rental vacancy rates, which reached 6.9% in Q3 2024.

However, competition from Zillow is intensifying. Zillow’s rentals revenue surged 30% year-over-year to $430 million, dwarfing Redfin’s $201 million (+14%), and Zillow continues to invest heavily in scaling its platform.

“Zillow’s greater scale and growth visibility,” will hit on Redfin’s profits.

The company’s gross margins from Real Estate Services declined by 260 basis points year-over-year in the third quarter of 2024 to 27.8%, falling short of consensus expectations.

“Redfin Rentals is seeing competition intensify as larger, more well-capitalized competitors like Zillow also pursue the Rentals opportunity,” Goldman Sachs wrote.

Ng also flagged Redfin’s “Redfin Next” program, which offers agents commission splits up to 75% for self-sourced sales, as a key driver of margin pressures.

Market reactions: Shares of Redfin fell 3.82% to $8.05 on Monday, hitting the lowest levels in three months. Goldman Sachs analyst Ng foresees a 12-month price target of $6.50 on Redfin shares, reflecting a 23% downside.

Read Now:

Photo. T. Schneider via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Star Equity Hldgs Earnings Preview

Star Equity Hldgs STRR is gearing up to announce its quarterly earnings on Tuesday, 2024-11-19. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Star Equity Hldgs will report an earnings per share (EPS) of $-0.26.

Investors in Star Equity Hldgs are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

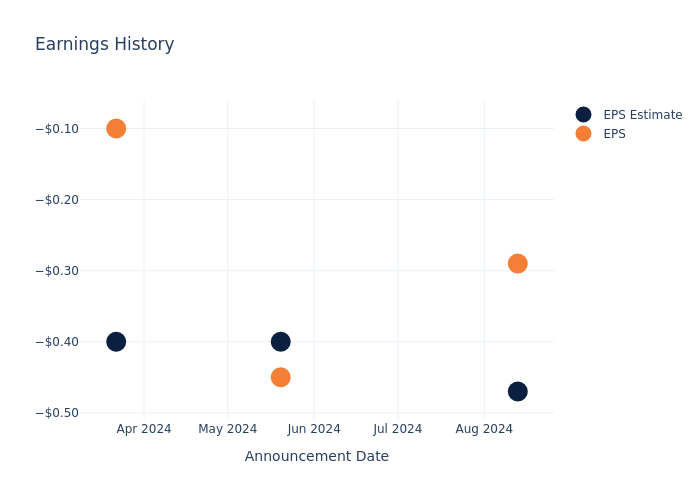

Earnings History Snapshot

The company’s EPS beat by $0.18 in the last quarter, leading to a 2.79% drop in the share price on the following day.

Here’s a look at Star Equity Hldgs’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.47 | -0.40 | -0.4 | -0.60 |

| EPS Actual | -0.29 | -0.45 | -0.1 | 0.05 |

| Price Change % | -3.0% | -2.0% | 3.0% | -1.0% |

Performance of Star Equity Hldgs Shares

Shares of Star Equity Hldgs were trading at $3.1 as of November 15. Over the last 52-week period, shares are down 38.51%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Star Equity Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

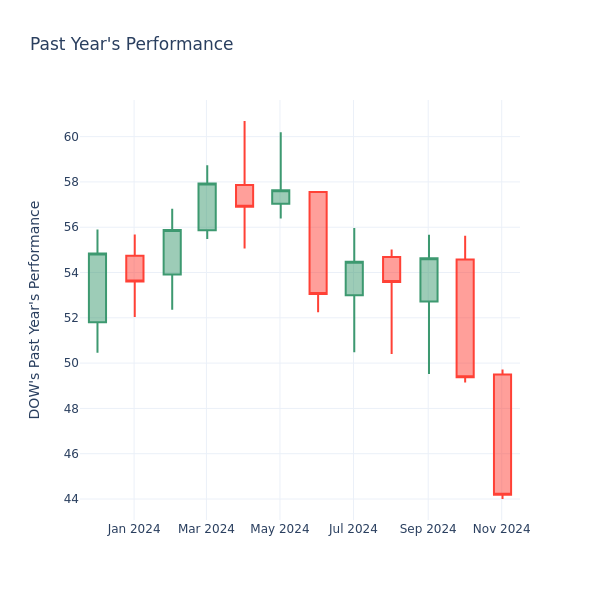

P/E Ratio Insights for Dow

In the current market session, Dow Inc. DOW price is at $44.20, after a 0.36% spike. However, over the past month, the stock decreased by 15.14%, and in the past year, by 14.59%. Shareholders might be interested in knowing whether the stock is undervalued, even if the company is performing up to par in the current session.

Dow P/E Compared to Competitors

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Dow has a lower P/E than the aggregate P/E of 35.65 of the Chemicals industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.