Inflation Could Surge To 3% If Trump Applies Universal Tariffs: Goldman Sachs

Inflation is expected to surge back to 3% should the incoming Republican administration proceed with a potential universal tariff on imports, Goldman Sachs economist David Mericle said in a Sunday note.

The sweeping trade measure, floated by President-elect Donald Trump, could complicate the Federal Reserve’s efforts to keep inflation anchored at 2% and potentially slow the pace of rate cuts in 2025.

Could Tariffs Push Inflation Back To 3%?

Goldman Sachs estimates that a potential universal tariff would raise core personal consumption expenditures (PCE) inflation — the Fed’s favorite inflation gauge — by 0.9-1.2 percentage points (pp) at its peak, pushing inflation back to 3%.

“Our analysis of past tariffs suggests that every 1pp increase in the effective tariff rate raises core PCE prices by 0.1pp,” Mericle said.

Under the Republican baseline scenario, more targeted tariffs on imports from China and autos are likely to increase the effective tariff rate by 3-4pp, adding 0.3-0.4pp to core PCE inflation.

This would nudge inflation to 2.4% by December 2025. However, the implementation of a 10% universal tariff would triple this impact, causing a much sharper price surge.

While the inflationary bump is expected to be a one-time effect, such a move would force Fed policymakers to rethink the roadmap for rate cuts.

Tariff Risks: China, Autos, and Beyond

The baseline scenario includes a 20 percentage point (pp) increase in tariffs on Chinese imports—less for consumer goods and as much as 60pp for non-consumer items. Tariffs on auto imports, which were hotly debated during Trump’s first term, are also expected to return.

Goldman Sachs views these measures as disruptive but manageable, given their moderate inflationary impact. However, the specter of a 10%-20% universal tariff on all imports raises the stakes.

If enacted, such a policy could shave 0.75-1.25pp off GDP growth, depending on whether it is offset by additional fiscal stimulus, such as tax cuts.

Tax Cuts And Spending: Fiscal Stimulus Expected To Rise

On the fiscal front, Republicans are likely to extend the 2017 tax cuts, which are set to expire in 2025, according to Goldman Sachs.

The extension includes reinstating certain expired business investment incentives and adding modest personal tax cuts worth 0.2% of GDP.

Currently, the deficit sits at about 5% of GDP higher than historical norms for an economy operating at full employment. Meanwhile, the U.S. debt-to-GDP ratio is approaching record highs at 120%, raising concerns about fiscal sustainability.

Goldman Sachs warns that these imbalances could push bond yields higher, tightening financial conditions and creating additional headwinds for economic growth.

The Fed’s Balancing Act: What’s Next For Interest Rates?

Despite fiscal and tariff uncertainties, the Federal Reserve remains on track to cut interest rates in 2024 and 2025. Goldman expects the terminal rate to settle between 3.25% and 3.5%, higher than last cycle’s 2.25%-2.5%.

“Non-monetary tailwinds, like fiscal deficits and resilient risk sentiment, are offsetting the drag from higher rates,” said Mericle.

Yet, the expert warns that fiscal imbalances and potential tariff shocks could complicate the Fed’s strategy, especially if inflationary pressures or market volatility resurface.

Now Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Preview For Medtronic

Medtronic MDT is gearing up to announce its quarterly earnings on Tuesday, 2024-11-19. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Medtronic will report an earnings per share (EPS) of $1.25.

Investors in Medtronic are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

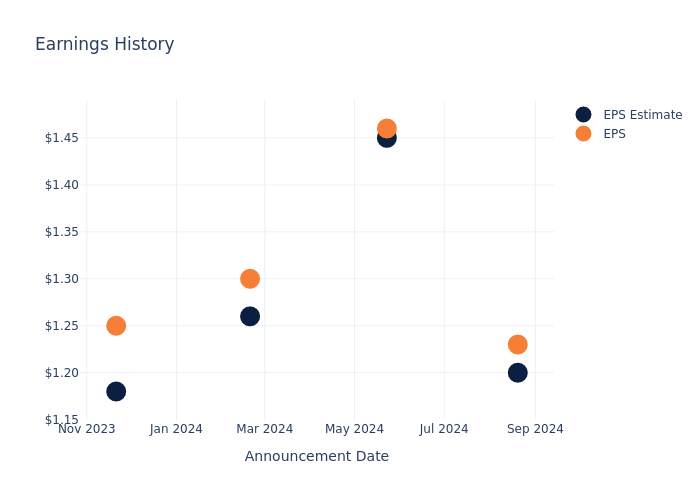

Earnings History Snapshot

Last quarter the company beat EPS by $0.03, which was followed by a 2.53% increase in the share price the next day.

Here’s a look at Medtronic’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.20 | 1.45 | 1.26 | 1.18 |

| EPS Actual | 1.23 | 1.46 | 1.30 | 1.25 |

| Price Change % | 3.0% | 1.0% | 0.0% | -0.0% |

Stock Performance

Shares of Medtronic were trading at $87.53 as of November 15. Over the last 52-week period, shares are up 12.07%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Medtronic

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Medtronic.

A total of 13 analyst ratings have been received for Medtronic, with the consensus rating being Neutral. The average one-year price target stands at $95.85, suggesting a potential 9.51% upside.

Analyzing Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Boston Scientific, Stryker and Becton Dickinson, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- As per analysts’ assessments, Boston Scientific is favoring an Buy trajectory, with an average 1-year price target of $96.63, suggesting a potential 10.4% upside.

- Stryker received a Outperform consensus from analysts, with an average 1-year price target of $395.16, implying a potential 351.46% upside.

- As per analysts’ assessments, Becton Dickinson is favoring an Buy trajectory, with an average 1-year price target of $282.5, suggesting a potential 222.75% upside.

Peers Comparative Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Boston Scientific, Stryker and Becton Dickinson, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Medtronic | Neutral | 2.77% | $5.15B | 2.12% |

| Boston Scientific | Buy | 19.34% | $2.90B | 2.28% |

| Stryker | Outperform | 11.92% | $3.52B | 4.18% |

| Becton Dickinson | Buy | 8.96% | $2.31B | 1.63% |

Key Takeaway:

Medtronic ranks in the middle among its peers for revenue growth. It is at the bottom for gross profit and return on equity.

Delving into Medtronic’s Background

One of the largest medical-device companies, Medtronic develops and manufactures therapeutic medical devices for chronic diseases. Its portfolio includes pacemakers, defibrillators, heart valves, stents, insulin pumps, spinal fixation devices, neurovascular products, advanced energy, and surgical tools. The company markets its products to healthcare institutions and physicians in the United States and overseas. Foreign sales account for roughly 50% of the company’s total sales.

Financial Milestones: Medtronic’s Journey

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Medtronic displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 2.77%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Medtronic’s net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 13.16%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Medtronic’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.12%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Medtronic’s ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 1.16%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Medtronic’s debt-to-equity ratio is below the industry average. With a ratio of 0.58, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Medtronic visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shore Power Market Size Anticipated to Hit USD 3.3 Billion by 2031, Growing at 10.2% CAGR| Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Nov. 18, 2024 (GLOBE NEWSWIRE) — The global shore power market is estimated to flourish at a CAGR of 10.2% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for shore power is estimated to reach US$ 3.3 billion by the end of 2031. The emergence of sophisticated smart grid integration solutions is gaining traction. These systems optimize power distribution, enhancing the efficiency of shore power infrastructure and catering to evolving energy demands.

The exploration of synergies with renewable energy sources, such as wind and solar, is a novel driver. Combining shore power with renewable energy contributes to a cleaner and more sustainable maritime power ecosystem. Novel financing models are reshaping the landscape. As the market matures, innovative financial structures, including public-private partnerships and incentive-based funding, are emerging, making shore power investments more attractive to stakeholders.

Click to Request Sample PDF Report and Drive Impactful Decisions: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=72066

A growing focus on cold ironing specifically for cruise ships is noteworthy. Cruise liners are adopting shore power solutions while docked, significantly reducing emissions during layovers and enhancing their environmental credentials. The uptake of shore power solutions in offshore vessels is an intriguing trend. Offshore platforms and support vessels are exploring shore power options, contributing to a more sustainable offshore energy sector.

Key Findings of the Market Report

- The >10 MVA power output segment leads the shore power market, catering to larger vessels and supporting the maritime industry’s sustainability goals.

- Retrofit installations lead the shore power market, as existing ports upgrade to integrate sustainable shore power solutions, driving environmental compliance.

- Shore power to ship connection segment leads the shore power market, ensuring sustainable energy supply to vessels, reducing emissions in ports.

Shore Power Market Growth Drivers & Trends

- Increasing global focus on reducing maritime emissions propels the adoption of shore power solutions, driven by stringent environmental regulations in key markets.

- Growing commitment to sustainable practices worldwide fuels the demand for shore power infrastructure, aligning with global sustainability goals.

- Ongoing innovations in shore power technologies, including smart grid integration and automation, contribute to increased efficiency and reliability, driving market growth.

- Strategic partnerships between shore power solution providers and port authorities accelerate the development and implementation of shore power infrastructure, fostering market expansion.

- Booming global maritime trade amplifies the need for cleaner energy solutions, positioning shore power as a crucial element in mitigating environmental impact and supporting sustainable port operations.

Global Shore Power Market: Regional Profile

- In North America, stringent environmental regulations and a commitment to reducing maritime emissions drive the shore power market. Ports in the United States and Canada embrace shore power solutions, with companies like Cavotec SA leading in infrastructure development.

- In Europe, the shore power market thrives amid ambitious sustainability goals. Ports in the European Union, propelled by initiatives like the Green Deal, adopt shore power technologies. Companies such as Siemens and Schneider Electric play pivotal roles, providing advanced solutions to support the region’s green maritime transition.

- The Asia Pacific, with its booming maritime trade, experiences a surge in shore power adoption. Port expansions and a growing awareness of environmental impact drive market growth. Regional players, alongside global leaders, contribute to shaping the Asia Pacific’s evolving shore power market landscape, catering to the demands of a dynamic maritime industry.

Download Sample PDF Brochure from Here: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=72066

Shore Power Market: Competitive Landscape

The shore power market is characterized by intense competition driven by the growing emphasis on sustainable maritime practices. Key players such as Siemens, Schneider Electric, and Cavotec SA dominate, offering comprehensive shore power solutions for vessels.

Technological advancements, including smart grid integration and automation, set the pace for innovation. Strategic collaborations and partnerships with port authorities and shipping companies define market dynamics.

Regulatory initiatives promoting emissions reduction further intensify competition, prompting companies to enhance product efficiency and reliability. As the global maritime industry pivots toward green energy, the shore power market’s competitive landscape evolves, fostering advancements in clean, shore-based power solutions. Some prominent manufacturers are as follows:

- ABB

- Wärtsilä

- Cavotec SA

- Siemens

- Yara Marine Technologies

- PowerCon A/S

- Preen (AC Power Corp.)

- Danfoss

- Hareid Group

- Schneider Electric

- Wabtec Corporation

- General Electric

- Blueday Technology AS

Product Portfolio

- Wabtec Corporation pioneers transportation solutions with cutting-edge products and services. Specializing in rail and transit technology, they lead in innovation, offering a comprehensive portfolio that enhances efficiency and safety across the global transportation landscape.

- General Electric stands as a global industry leader, providing transformative solutions in healthcare, aviation, and power. Their diverse product portfolio, ranging from advanced medical equipment to efficient aircraft engines, reflects a commitment to shaping a sustainable future.

- Blueday Technology AS is at the forefront of digital innovation, offering state-of-the-art solutions in artificial intelligence and data analytics. Their product portfolio empowers businesses to optimize operations, make informed decisions, and navigate the complexities of the modern digital landscape.

Shore Power Market: Key Segments

By Power Output

- Up to 3 MVA

- 3 MVA to 10 MVA

- >10 MVA

By Installation

By Connection

- Port Terminal

- Shore Power to Ship

- Ro-Ro Vessels

- Cruise Ships

- Container Ships

- LNG Carrier

- Tankers

- Bulk Carriers

- Offshore Vessels

- Others

By Component

- Transformer

- Power Distribution System

- Control Panel

- Frequency Converter

- Cable Reel and Connectors

- Switchboard

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report @ https://www.transparencymarketresearch.com/checkout.php?rep_id=72066<ype=S

Explore Trending Reports of Energy-

- Land Incineration Plants Market – The global land incineration plants market is estimated to grow at a CAGR of 5.5% from 2023 to 2031 and reach US$ 96.4 Billion by the end of 2031.

- Peaking Power Plant Market – The global peaking power plant market is projected to grow at a CAGR of 2.1% from 2023 to 2031 and reach US$ 1.2 Trillion by the end of 2031.

- Hydrogen Storage Market – The global Hydrogen Storage Market is estimated to advance at a CAGR of 20.6% from 2023 to 2031 and reach US$ 9.4 Billion by the end of 2031.

- Water Desalination Equipment Market – The global Water Desalination Equipment Market is projected to expand at a CAGR of 8.9% from 2023 to 2031 and reach US$ 16.3 Billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

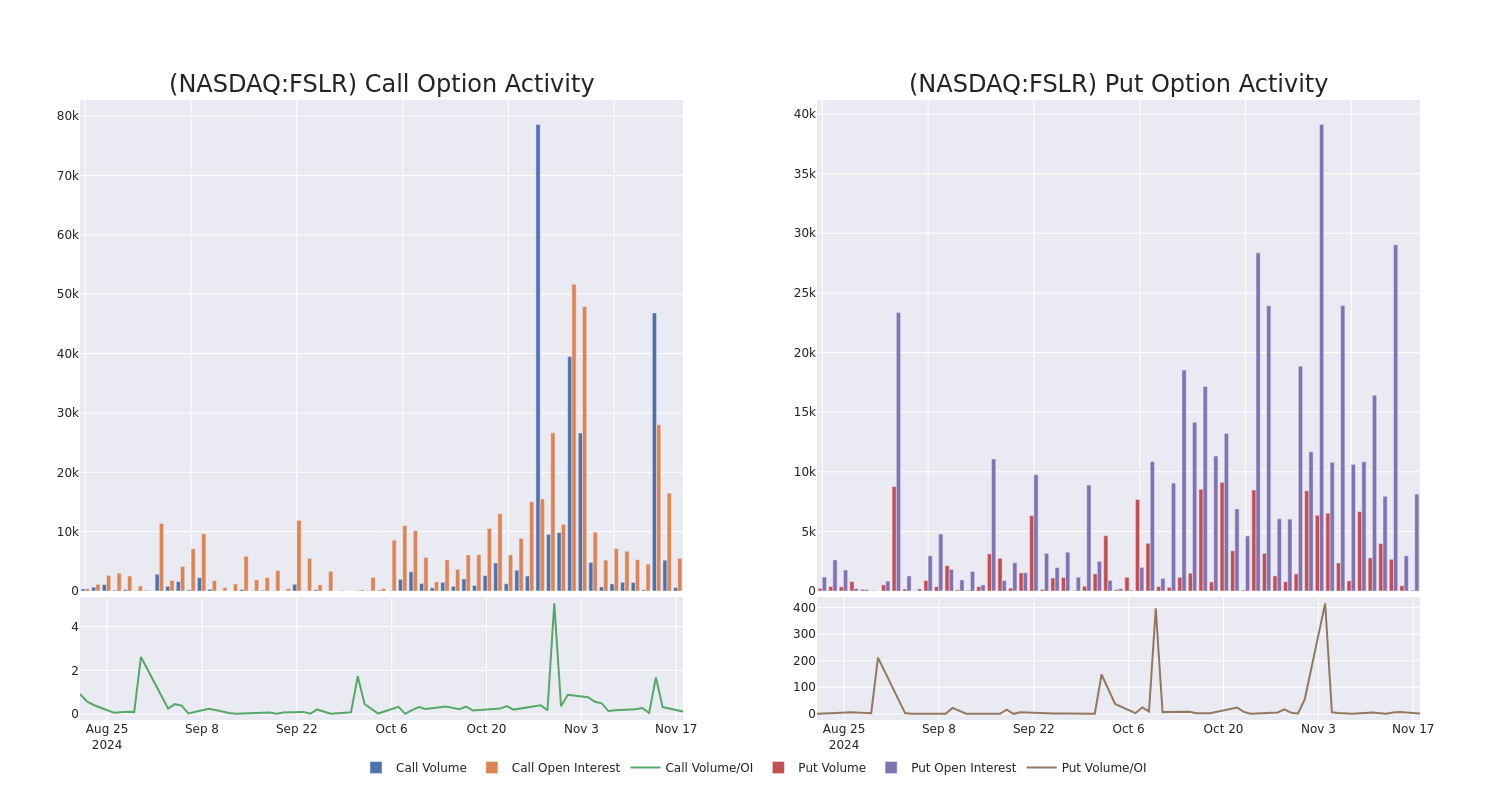

Smart Money Is Betting Big In FSLR Options

Investors with a lot of money to spend have taken a bullish stance on First Solar FSLR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with FSLR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for First Solar.

This isn’t normal.

The overall sentiment of these big-money traders is split between 77% bullish and 22%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $149,230, and 6 are calls, for a total amount of $299,265.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $180.0 to $230.0 for First Solar during the past quarter.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for First Solar options trades today is 1704.12 with a total volume of 671.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for First Solar’s big money trades within a strike price range of $180.0 to $230.0 over the last 30 days.

First Solar Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FSLR | CALL | SWEEP | BULLISH | 02/21/25 | $19.75 | $18.7 | $19.1 | $195.00 | $95.4K | 6 | 59 |

| FSLR | PUT | TRADE | BULLISH | 01/17/25 | $17.5 | $17.35 | $17.35 | $195.00 | $72.8K | 620 | 43 |

| FSLR | CALL | SWEEP | BULLISH | 12/20/24 | $2.25 | $2.03 | $2.25 | $230.00 | $56.2K | 3.5K | 260 |

| FSLR | CALL | TRADE | BEARISH | 01/17/25 | $13.7 | $13.65 | $13.65 | $200.00 | $54.6K | 1.7K | 67 |

| FSLR | PUT | TRADE | BULLISH | 06/20/25 | $23.55 | $22.5 | $22.5 | $180.00 | $45.0K | 7.4K | 20 |

About First Solar

First Solar designs and manufactures solar photovoltaic panels, modules, and systems for use in utility-scale development projects. The company’s solar modules use cadmium telluride to convert sunlight into electricity. This is commonly called thin-film technology. First Solar is the world’s largest thin-film solar module manufacturer. It has production lines in Vietnam, Malaysia, the United States, and India.

Present Market Standing of First Solar

- Trading volume stands at 610,149, with FSLR’s price up by 1.29%, positioned at $192.91.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 99 days.

Expert Opinions on First Solar

5 market experts have recently issued ratings for this stock, with a consensus target price of $276.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on First Solar with a target price of $269.

* In a cautious move, an analyst from BMO Capital downgraded its rating to Outperform, setting a price target of $260.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for First Solar, targeting a price of $240.

* An analyst from Guggenheim persists with their Buy rating on First Solar, maintaining a target price of $335.

* An analyst from RBC Capital persists with their Outperform rating on First Solar, maintaining a target price of $280.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest First Solar options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

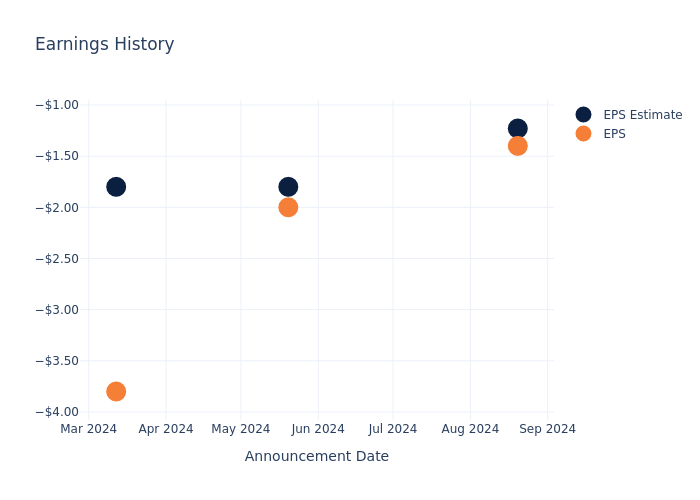

Preview: Workhorse Gr's Earnings

Workhorse Gr WKHS is gearing up to announce its quarterly earnings on Tuesday, 2024-11-19. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Workhorse Gr will report an earnings per share (EPS) of $-1.20.

Anticipation surrounds Workhorse Gr’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Historical Earnings Performance

In the previous earnings release, the company missed EPS by $0.17, leading to a 8.69% drop in the share price the following trading session.

Here’s a look at Workhorse Gr’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -1.23 | -1.8 | -1.8 | -2.4 |

| EPS Actual | -1.40 | -2 | -3.8 | -2.8 |

| Price Change % | -9.0% | -9.0% | -2.0% | 3.0% |

Workhorse Gr Share Price Analysis

Shares of Workhorse Gr were trading at $1.25 as of November 15. Over the last 52-week period, shares are down 82.4%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Insights Shared by Analysts on Workhorse Gr

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Workhorse Gr.

Workhorse Gr has received a total of 1 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $0.25, the consensus suggests a potential 80.0% downside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Winnebago Industries and Polestar Automotive, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus among analysts is an Buy trajectory for Winnebago Industries, with an average 1-year price target of $67.67, indicating a potential 5313.6% upside.

- Polestar Automotive received a Outperform consensus from analysts, with an average 1-year price target of $2.35, implying a potential 88.0% upside.

Overview of Peer Analysis

The peer analysis summary presents essential metrics for Winnebago Industries and Polestar Automotive, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Workhorse Gr | Neutral | -78.76% | $-6.46M | -41.76% |

| Winnebago Industries | Buy | -6.50% | $94.20M | -2.25% |

| Polestar Automotive | Outperform | -16.43% | $1.74M | -191.61% |

Key Takeaway:

Workhorse Gr ranks at the bottom for Revenue Growth and Gross Profit, indicating significant underperformance compared to its peers. Additionally, it has the lowest Return on Equity, reflecting poor profitability relative to others in the group. The consensus rating for Workhorse Gr is neutral, suggesting mixed market sentiment towards the company.

About Workhorse Gr

Workhorse Group Inc is a technology company with a vision to pioneer the transition to zero-emission commercial vehicles. Its focus is to provide sustainable and cost-effective solutions to the commercial transportation sector. It designs and manufactures all-electric delivery trucks and drone systems, including the technology that optimizes the way these vehicles operate. It’s focused on a core competency of bringing electric delivery vehicle platforms to serve the last-mile delivery market. Its products are marketed under the Workhorse brand.

Workhorse Gr’s Financial Performance

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Workhorse Gr’s revenue growth over a period of 3 months has faced challenges. As of 30 June, 2024, the company experienced a revenue decline of approximately -78.76%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Workhorse Gr’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -3124.26%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -41.76%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -24.01%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Workhorse Gr’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.3.

To track all earnings releases for Workhorse Gr visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ald Equipment Market Size to Surpass USD 12,179.82 Million by 2032 | Straits Research

New York, United States, Nov. 18, 2024 (GLOBE NEWSWIRE) — Atomic Layer Deposition is an advanced thin-film deposition method that creates layers at the atomic scale with unmatched precision and consistency. This technique is critical in industries where precise coating control is essential, such as semiconductor manufacturing, energy storage, and high-performance optics. ALD works through a cycle of sequential, self-limiting chemical reactions, which enable the formation of ultra-thin films with excellent uniformity, even on complex surfaces. This makes ALD ideal for applications that require high-performance coatings on intricate structures.

Download Free Sample Report PDF @ https://straitsresearch.com/report/ald-equipment-market/request-sample

Market Dynamics

Rising demand for high-performance semiconductors in electronics drives the global market

The global market is seeing rapid growth driven by rising demand for high-performance semiconductors in the electronics sector. As consumer electronics—such as smartphones, tablets, and wearables—become more advanced, there is an increased need for semiconductors that deliver high performance, miniaturization, and energy efficiency.

Atomic Layer Deposition plays a pivotal role here, enabling the precise application of ultra-thin films with atomic-level control, which is essential for producing the next generation of semiconductor devices with improved functionality and reliability.

- For example, in 5G-enabled devices, smaller and more efficient semiconductors are crucial to support faster processing speeds and connectivity. ALD technology supports this demand by facilitating the deposition of conformal, high-quality films necessary for these advanced chips.

As semiconductor designs grow more complex and the electronics industry continually innovates, the need for ALD equipment will only intensify. This demand underscores the importance of meeting stringent performance standards and maintaining a competitive edge in a technology-focused market.

Growing investments in research and development for ALD technology create tremendous opportunities

The global market is set for significant growth as investments in research and development (R&D) for Atomic Layer Deposition technology surge. These R&D efforts are enhancing ALD capabilities, enabling innovation across sectors. Collaborative projects between semiconductor companies, universities, and research institutions are propelling the development of advanced ALD materials and processes.

For instance, partnerships between leading semiconductor firms and academic researchers have led to ALD advancements for flexible electronics and high-efficiency solar cells, broadening ALD’s applications. In addition, companies like ASM International and Applied Materials are pioneering new deposition techniques that reduce processing times and costs, making ALD more efficient and scalable.

The influx of R&D funding accelerates ALD advancements, opening opportunities for market growth. This progress allows for ALD adoption across diverse fields, including biotechnology and energy solutions, while enabling the production of high-performance components that meet the evolving demands of next-generation technologies.

Regional Analysis

Asia-Pacific leads the global market, holding a substantial 45% share, largely due to its strong semiconductor manufacturing and electronics production industries. This dominance is fueled by rapid industrialization, major investments in technological infrastructure, and rising demand for consumer electronics and advanced materials.

Key players in this growth include China, South Korea, and Taiwan. China’s commitment to becoming self-sufficient in semiconductor production, bolstered by government support and investments, has significantly boosted demand for advanced deposition technologies like ALD. In South Korea, tech giants such as Samsung and SK Hynix are investing heavily in ALD to improve the performance of their next-gen memory chips and processors.

Additionally, Asia-Pacific’s expanding electronics manufacturing sector is supported by increasing R&D investment, which is advancing ALD technology applications in flexible electronics, high-efficiency solar cells, and innovative materials. These factors collectively strengthen Asia-Pacific’s leading position in the ALD equipment market and support its sustained growth trajectory.

Ask for Customization @ https://straitsresearch.com/report/ald-equipment-market/request-sample

Key Highlights

- The global ALD (Atomic Layer Deposition) equipment market size was valued at USD 5,600.23 million in 2023 and is projected to grow from USD 6,171.21 million in 2024 to reach USD 12,179.82 million by 2032, expanding at a CAGR of 10.2% during the forecast period (2024–2032).

- By type, batch Atomic Layer Deposition (ALD) is the dominant segment in the global market, primarily due to its efficiency in processing multiple wafers simultaneously.

- By application, semiconductors dominate the market, fueled by the surging demand for advanced electronic devices and integrated circuits.

- By end-user industry, the electronics sector is the largest end-user, driven by its crucial role in semiconductor manufacturing.

- Asia-Pacific is the highest shareholder in the global market.

Competitive Players

- Applied Materials, Inc.

- ASM International N.V.

- Tokyo Electron Limited

- Lam Research Corporation

- Hitachi High-Tech Corporation

- Veeco Instruments Inc.

- Oxford Instruments plc

- KLA Corporation

- Sentech Instruments GmbH

- ULVAC, Inc.

- Semilab Semiconductor Physics Laboratory

- Kurt J. Lesker Company

- Nano-Master, Inc.

- AIXTRON SE

- TSMC

Recent Developments

- In June 2024, ASM International announced a substantial $300 million investment to expand its semiconductor research and development (R&D) operations in Arizona, USA. This strategic move underscores the company’s commitment to advancing semiconductor technology and meeting the rising demand for high-performance electronic components.

Segmentation

- By Type

-

- Batch ALD

- Spatial ALD

- By Applications

-

- Semiconductors

- Energy Storage

- Optical Coatings

- Medical Devices

- By End-User Industry

-

- Electronics

- Automotive

- Healthcare

- Aerospace & Defense

- Energy

Get Detailed Market Segmentation @ https://straitsresearch.com/report/ald-equipment-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Phone: +1 646 905 0080 (U.S.)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

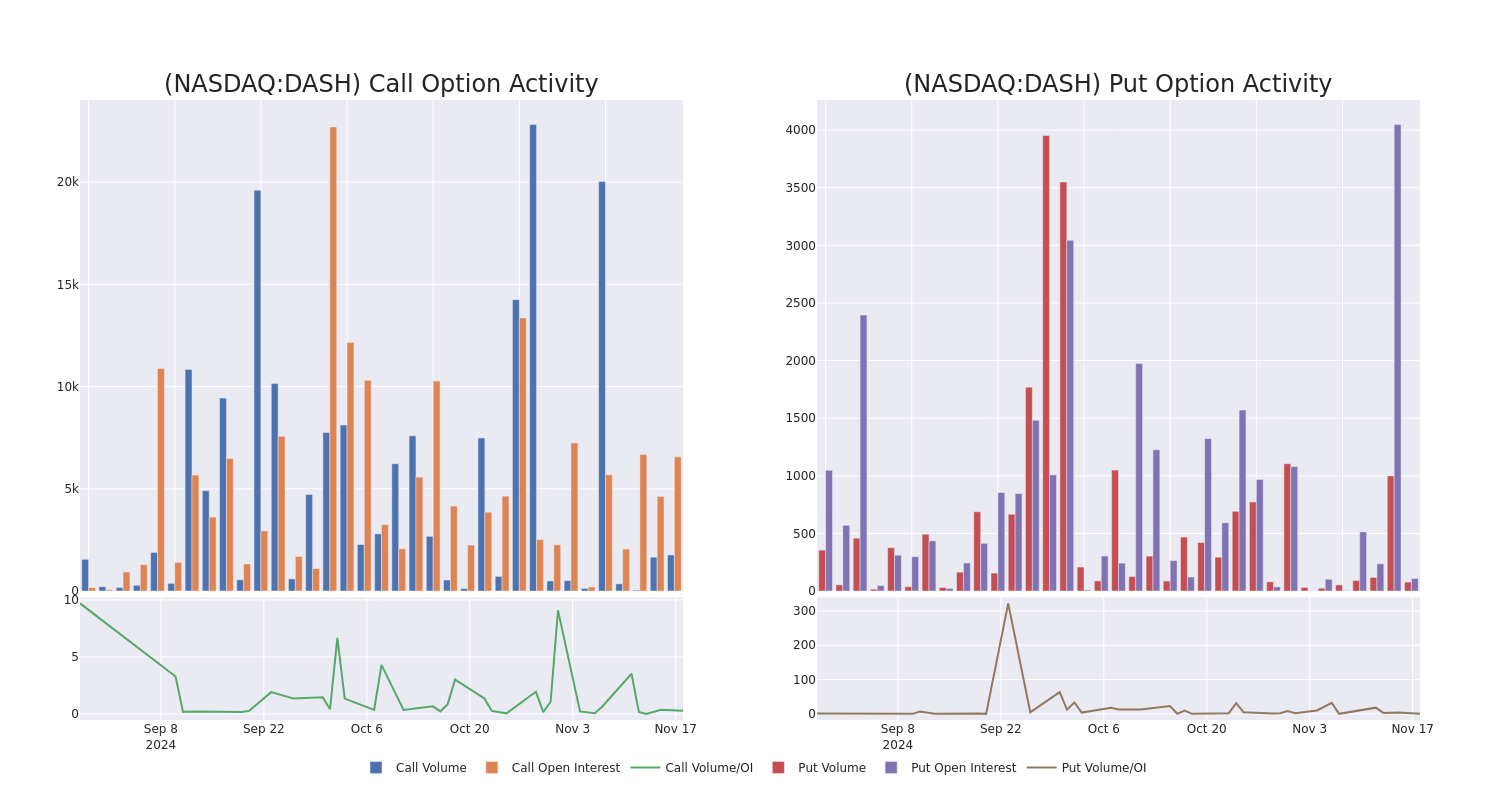

Decoding DoorDash's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on DoorDash DASH.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DASH, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 12 options trades for DoorDash.

This isn’t normal.

The overall sentiment of these big-money traders is split between 41% bullish and 58%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $32,065, and 11, calls, for a total amount of $996,583.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $190.0 for DoorDash during the past quarter.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for DoorDash’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across DoorDash’s significant trades, within a strike price range of $130.0 to $190.0, over the past month.

DoorDash Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DASH | CALL | SWEEP | BULLISH | 01/17/25 | $25.9 | $25.55 | $25.75 | $150.00 | $374.7K | 2.5K | 145 |

| DASH | CALL | SWEEP | BEARISH | 12/20/24 | $1.68 | $1.01 | $1.22 | $190.00 | $118.0K | 68 | 1.0K |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.2 | $39.7 | $39.85 | $135.00 | $79.7K | 1.6K | 71 |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.55 | $39.85 | $39.85 | $135.00 | $79.7K | 1.6K | 27 |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.25 | $40.0 | $40.0 | $135.00 | $76.0K | 1.6K | 143 |

About DoorDash

Founded in 2013 and headquartered in San Francisco, DoorDash is an online food order demand aggregator. Consumers can use its app to order food on-demand for pickup or delivery from merchants mainly in the US. Through the acquisition of Wolt in 2022, the firm also provides this service in Europe. DoorDash provides a marketplace for the merchants to create a presence online, market their offerings, and meet demand by making the offerings available for pickup or delivery. The firm provides similar service to businesses in addition to restaurants, such as grocery, retail, pet supplies, and flowers.

After a thorough review of the options trading surrounding DoorDash, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is DoorDash Standing Right Now?

- Currently trading with a volume of 598,876, the DASH’s price is up by 2.57%, now at $173.78.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 87 days.

Professional Analyst Ratings for DoorDash

In the last month, 5 experts released ratings on this stock with an average target price of $179.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities persists with their Buy rating on DoorDash, maintaining a target price of $172.

* An analyst from Jefferies persists with their Buy rating on DoorDash, maintaining a target price of $180.

* Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for DoorDash, targeting a price of $190.

* An analyst from RBC Capital persists with their Outperform rating on DoorDash, maintaining a target price of $175.

* An analyst from BMO Capital persists with their Outperform rating on DoorDash, maintaining a target price of $180.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DoorDash with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cold Chain Monitoring Market Size is Projected to Reach USD 23.29 Billion by 2033, Growing at a CAGR of 13.2%: Straits Research

New York, United States, Nov. 18, 2024 (GLOBE NEWSWIRE) — In underdeveloped countries, the market for cold chain monitoring is ripe for expansion. An in-depth analysis of the cold chain monitoring market is shown in the study, which provides insights into the present trends, development prospects, and possibilities. The market segmentation and competition analysis are covered throughout the scope of the study.

There is projected to be an increase in demand for cold chain monitoring solutions as governments worldwide focus on improving food, dairy, and pharmaceutical supply chains that require cold chain monitoring systems. Cold chain monitoring systems are to come in demand with strict laws governing the storage and shipping of pharmaceutical items. Over the forecast period, the market for cold chain monitoring is to develop increased expenditures in refrigerated warehouses and initiatives by the government to decrease the spoiling of food and other temperature-sensitive items.

Download Free Sample Report PDF @ https://straitsresearch.com/report/cold-chain-monitoring-market/request-sample

Market Dynamics

Market Potential of Cold Chain Monitoring in the World

Due to increased food waste and the growing desire for better food quality, the cold chain monitoring market is expected to rise in popularity in the next few years. The market for cold chain monitoring solutions shall grow shortly because of the high cost of implementation and the difficulties associated with monitoring and installing these systems. Governments are increasingly concerned about laws on supply chain efficiency in the pharmaceutical industry, which is expected to spur market growth over the next several years.

The global need for temperature-sensitive pharmaceuticals is expected to rise as the healthcare sector continues to grow at a rapid pace. These developments are expected to keep the entire industry growing. Additional potential prospects are expected to be available for the companies in emerging economies, which is expected to fuel market expansion in the coming years.

Monitoring the Cold Chain can be Challenging Due to the Complexity of Installing and Monitoring Systems

The tremendous rise in customer expectations has made cold chain monitoring even more difficult in recent years. Multi-sourcing supply chains have become more complicated as a result of globalization. Temperature-controlled transportation and storage facilities, retail chains and restaurants are part of a cold chain network that can span a geographic region. It’s a huge endeavor to install sensors in all these places. Additional mapping is required for optimal data management from these sensors in a dispersed network. To optimize profit data must be examined. Such challenges as scale visualization, error type identification, and response formulation might be hard.

There are a variety of devices that need to be calibrated for a variety of different uses. As a result, installation service providers in the cold chain monitoring industry face a bigger challenge in providing enough network connectivity in varied places. Cold chain monitoring services must overcome these obstacles to succeed in the market.

Regional Outlook

Geographically, the cold chain market will be dominated by North America and Europe in the future. The growth is expected to be accelerated by well-established healthcare and pharmaceutical sectors in the next few years. North America’s growth is expected to be bolstered by strict laws and regulations governing the monitoring of cold chains. Demand for frozen and chilled meals is expected to expand soon, contributing to the expansion. European economies are expected to develop steadily over several years, followed by those in the Asia-Pacific region.

COVID-19 impact on global Cold chain monitoring market, in 2021

Global economic instability and change have been triggered by the pandemic, in 2020. As a result of the epidemic, several businesses have been forced to close their doors, limit travel, and allow their workers to do their jobs from home. It is assumed that the first three-quarters of FY 20–21 saw minimal growth in the cold chain monitoring market, followed by a steady rebound in the fourth quarter of FY 20–21, according to the realistic approach. The market for cold chain monitoring is predicted to develop at a CAGR of 11.6 percent between 2021 and 2026 in the most probable scenario. Because of the COVID-19 pandemic, the market is predicted to expand by a single-digit percentage in FY 20–21.

To Gather Additional Insights on the Regional Analysis of the Used Cooking Oil Market @ https://straitsresearch.com/report/cold-chain-monitoring-market/request-sample

Key Highlights

- The global cold chain monitoring market size was valued at USD 7.63 billion in 2024 and is projected to reach from USD 8.64 billion in 2025 to USD 23.29 billion by 2033, growing at a CAGR of 13.2% during the forecast period (2025-2033).

- It is projected that the need for pharmaceutical items, particularly in emerging nations, would boost the market for cold chain monitoring.

- Additionally, remote temperature monitoring technologies can assist prevent any public health problems associated with food and medications that are not stored at the proper temperature.

- The cold chain monitoring market is dominated by North America and Europe in the coming years.

Competitive Players

- ORBCOMM (U.S.)

- Sensitech (U.S.)

- Elpro-Buchs (Switzerland)

- Berlinger & Co. (Switzerland)

- Monnit (U.S.)

- Control (Iceland)

Recent Developments

- April 2022: CoolKit Selects ORBCOMM for Monitoring the U.K.’s Largest Fleets of Temperature-Controlled Vans. ORBCOMM Inc., a global provider of IoT solutions, announced that it had been selected by CoolKit, the largest manufacturer of temperature-controlled vans in the United Kingdom, to deliver temperature monitoring, management and compliance for the refrigerated vehicles it provides to customers in the pharmaceutical, healthcare, food & beverage and agricultural industries.

Segmentation

- By Temperature Types

- Frozen

- Chilled

- By Logistics

-

- Storage

- Transportation

- By Applications

-

- Fruits and vegetables

- Fruit pulp & concentrates

- Dairy products

- Fish

- Meat and seafood

- Processed food

- Pharmaceuticals

- Bakery & confectionaries

- By Region

-

- North America

- Europe

- Asia Pacific

- Middle East And Africa

- Latin America

Get Detailed Market Segmentation @ https://straitsresearch.com/report/cold-chain-monitoring-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Phone: +1 646 905 0080 (U.S.)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.