Decoding DoorDash's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on DoorDash DASH.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DASH, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 12 options trades for DoorDash.

This isn’t normal.

The overall sentiment of these big-money traders is split between 41% bullish and 58%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $32,065, and 11, calls, for a total amount of $996,583.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $190.0 for DoorDash during the past quarter.

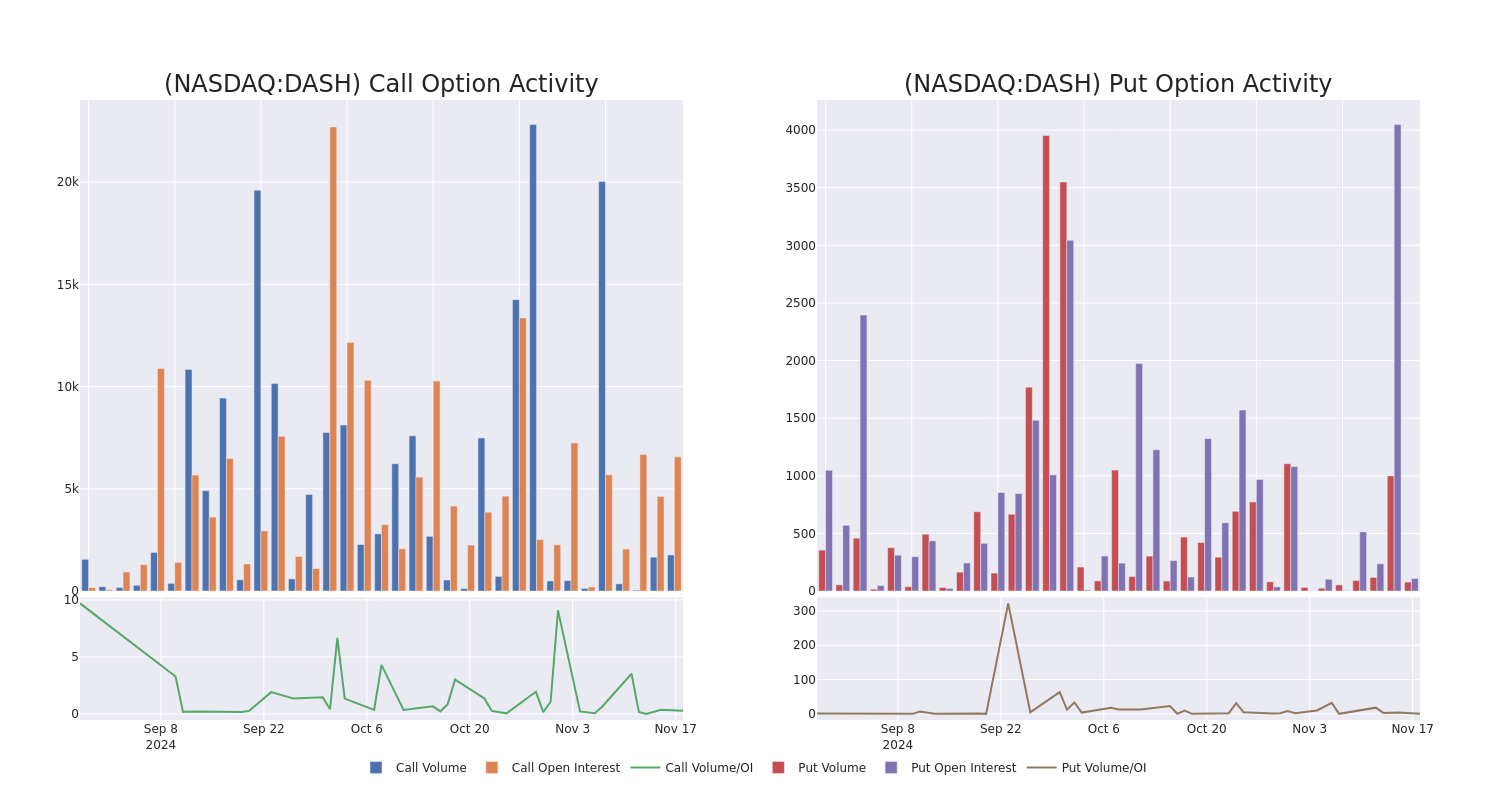

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for DoorDash’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across DoorDash’s significant trades, within a strike price range of $130.0 to $190.0, over the past month.

DoorDash Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DASH | CALL | SWEEP | BULLISH | 01/17/25 | $25.9 | $25.55 | $25.75 | $150.00 | $374.7K | 2.5K | 145 |

| DASH | CALL | SWEEP | BEARISH | 12/20/24 | $1.68 | $1.01 | $1.22 | $190.00 | $118.0K | 68 | 1.0K |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.2 | $39.7 | $39.85 | $135.00 | $79.7K | 1.6K | 71 |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.55 | $39.85 | $39.85 | $135.00 | $79.7K | 1.6K | 27 |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.25 | $40.0 | $40.0 | $135.00 | $76.0K | 1.6K | 143 |

About DoorDash

Founded in 2013 and headquartered in San Francisco, DoorDash is an online food order demand aggregator. Consumers can use its app to order food on-demand for pickup or delivery from merchants mainly in the US. Through the acquisition of Wolt in 2022, the firm also provides this service in Europe. DoorDash provides a marketplace for the merchants to create a presence online, market their offerings, and meet demand by making the offerings available for pickup or delivery. The firm provides similar service to businesses in addition to restaurants, such as grocery, retail, pet supplies, and flowers.

After a thorough review of the options trading surrounding DoorDash, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is DoorDash Standing Right Now?

- Currently trading with a volume of 598,876, the DASH’s price is up by 2.57%, now at $173.78.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 87 days.

Professional Analyst Ratings for DoorDash

In the last month, 5 experts released ratings on this stock with an average target price of $179.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities persists with their Buy rating on DoorDash, maintaining a target price of $172.

* An analyst from Jefferies persists with their Buy rating on DoorDash, maintaining a target price of $180.

* Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for DoorDash, targeting a price of $190.

* An analyst from RBC Capital persists with their Outperform rating on DoorDash, maintaining a target price of $175.

* An analyst from BMO Capital persists with their Outperform rating on DoorDash, maintaining a target price of $180.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DoorDash with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cold Chain Monitoring Market Size is Projected to Reach USD 23.29 Billion by 2033, Growing at a CAGR of 13.2%: Straits Research

New York, United States, Nov. 18, 2024 (GLOBE NEWSWIRE) — In underdeveloped countries, the market for cold chain monitoring is ripe for expansion. An in-depth analysis of the cold chain monitoring market is shown in the study, which provides insights into the present trends, development prospects, and possibilities. The market segmentation and competition analysis are covered throughout the scope of the study.

There is projected to be an increase in demand for cold chain monitoring solutions as governments worldwide focus on improving food, dairy, and pharmaceutical supply chains that require cold chain monitoring systems. Cold chain monitoring systems are to come in demand with strict laws governing the storage and shipping of pharmaceutical items. Over the forecast period, the market for cold chain monitoring is to develop increased expenditures in refrigerated warehouses and initiatives by the government to decrease the spoiling of food and other temperature-sensitive items.

Download Free Sample Report PDF @ https://straitsresearch.com/report/cold-chain-monitoring-market/request-sample

Market Dynamics

Market Potential of Cold Chain Monitoring in the World

Due to increased food waste and the growing desire for better food quality, the cold chain monitoring market is expected to rise in popularity in the next few years. The market for cold chain monitoring solutions shall grow shortly because of the high cost of implementation and the difficulties associated with monitoring and installing these systems. Governments are increasingly concerned about laws on supply chain efficiency in the pharmaceutical industry, which is expected to spur market growth over the next several years.

The global need for temperature-sensitive pharmaceuticals is expected to rise as the healthcare sector continues to grow at a rapid pace. These developments are expected to keep the entire industry growing. Additional potential prospects are expected to be available for the companies in emerging economies, which is expected to fuel market expansion in the coming years.

Monitoring the Cold Chain can be Challenging Due to the Complexity of Installing and Monitoring Systems

The tremendous rise in customer expectations has made cold chain monitoring even more difficult in recent years. Multi-sourcing supply chains have become more complicated as a result of globalization. Temperature-controlled transportation and storage facilities, retail chains and restaurants are part of a cold chain network that can span a geographic region. It’s a huge endeavor to install sensors in all these places. Additional mapping is required for optimal data management from these sensors in a dispersed network. To optimize profit data must be examined. Such challenges as scale visualization, error type identification, and response formulation might be hard.

There are a variety of devices that need to be calibrated for a variety of different uses. As a result, installation service providers in the cold chain monitoring industry face a bigger challenge in providing enough network connectivity in varied places. Cold chain monitoring services must overcome these obstacles to succeed in the market.

Regional Outlook

Geographically, the cold chain market will be dominated by North America and Europe in the future. The growth is expected to be accelerated by well-established healthcare and pharmaceutical sectors in the next few years. North America’s growth is expected to be bolstered by strict laws and regulations governing the monitoring of cold chains. Demand for frozen and chilled meals is expected to expand soon, contributing to the expansion. European economies are expected to develop steadily over several years, followed by those in the Asia-Pacific region.

COVID-19 impact on global Cold chain monitoring market, in 2021

Global economic instability and change have been triggered by the pandemic, in 2020. As a result of the epidemic, several businesses have been forced to close their doors, limit travel, and allow their workers to do their jobs from home. It is assumed that the first three-quarters of FY 20–21 saw minimal growth in the cold chain monitoring market, followed by a steady rebound in the fourth quarter of FY 20–21, according to the realistic approach. The market for cold chain monitoring is predicted to develop at a CAGR of 11.6 percent between 2021 and 2026 in the most probable scenario. Because of the COVID-19 pandemic, the market is predicted to expand by a single-digit percentage in FY 20–21.

To Gather Additional Insights on the Regional Analysis of the Used Cooking Oil Market @ https://straitsresearch.com/report/cold-chain-monitoring-market/request-sample

Key Highlights

- The global cold chain monitoring market size was valued at USD 7.63 billion in 2024 and is projected to reach from USD 8.64 billion in 2025 to USD 23.29 billion by 2033, growing at a CAGR of 13.2% during the forecast period (2025-2033).

- It is projected that the need for pharmaceutical items, particularly in emerging nations, would boost the market for cold chain monitoring.

- Additionally, remote temperature monitoring technologies can assist prevent any public health problems associated with food and medications that are not stored at the proper temperature.

- The cold chain monitoring market is dominated by North America and Europe in the coming years.

Competitive Players

- ORBCOMM (U.S.)

- Sensitech (U.S.)

- Elpro-Buchs (Switzerland)

- Berlinger & Co. (Switzerland)

- Monnit (U.S.)

- Control (Iceland)

Recent Developments

- April 2022: CoolKit Selects ORBCOMM for Monitoring the U.K.’s Largest Fleets of Temperature-Controlled Vans. ORBCOMM Inc., a global provider of IoT solutions, announced that it had been selected by CoolKit, the largest manufacturer of temperature-controlled vans in the United Kingdom, to deliver temperature monitoring, management and compliance for the refrigerated vehicles it provides to customers in the pharmaceutical, healthcare, food & beverage and agricultural industries.

Segmentation

- By Temperature Types

- Frozen

- Chilled

- By Logistics

-

- Storage

- Transportation

- By Applications

-

- Fruits and vegetables

- Fruit pulp & concentrates

- Dairy products

- Fish

- Meat and seafood

- Processed food

- Pharmaceuticals

- Bakery & confectionaries

- By Region

-

- North America

- Europe

- Asia Pacific

- Middle East And Africa

- Latin America

Get Detailed Market Segmentation @ https://straitsresearch.com/report/cold-chain-monitoring-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Phone: +1 646 905 0080 (U.S.)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Outlook For EuroDry

EuroDry EDRY will release its quarterly earnings report on Tuesday, 2024-11-19. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate EuroDry to report an earnings per share (EPS) of $1.35.

Anticipation surrounds EuroDry’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

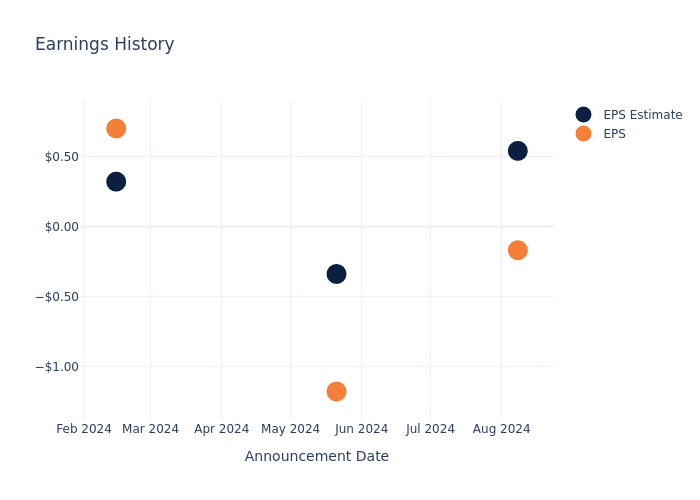

Overview of Past Earnings

Last quarter the company missed EPS by $0.71, which was followed by a 0.69% drop in the share price the next day.

Here’s a look at EuroDry’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.54 | -0.34 | 0.32 | -0.95 |

| EPS Actual | -0.17 | -1.18 | 0.70 | -0.24 |

| Price Change % | -1.0% | -2.0% | 1.0% | 1.0% |

Market Performance of EuroDry’s Stock

Shares of EuroDry were trading at $15.49 as of November 15. Over the last 52-week period, shares are down 8.3%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for EuroDry visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Hims & Hers Health

Deep-pocketed investors have adopted a bullish approach towards Hims & Hers Health HIMS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HIMS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 28 extraordinary options activities for Hims & Hers Health. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 71% leaning bullish and 14% bearish. Among these notable options, 12 are puts, totaling $960,282, and 16 are calls, amounting to $827,190.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $15.0 and $42.0 for Hims & Hers Health, spanning the last three months.

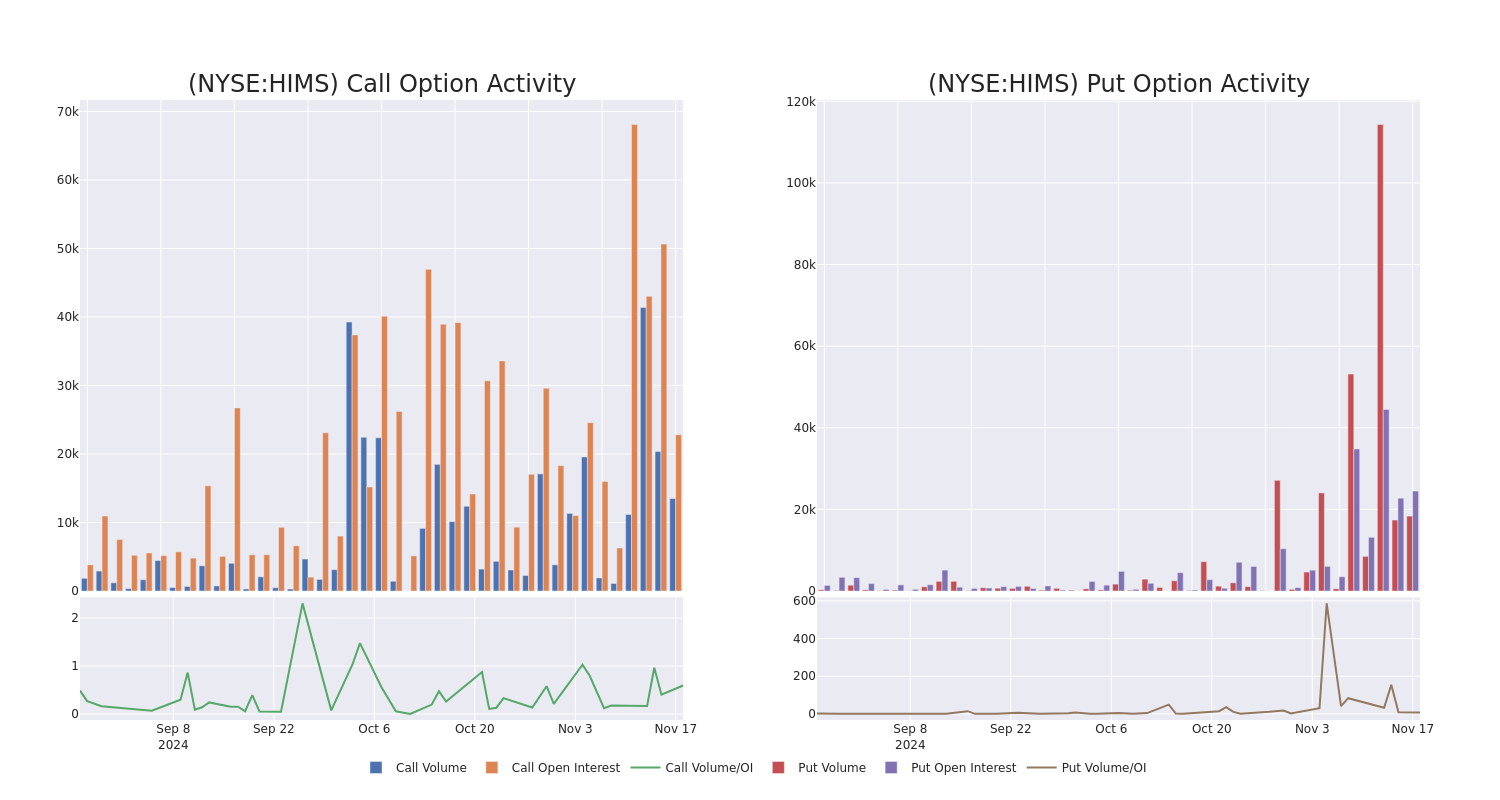

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Hims & Hers Health’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Hims & Hers Health’s whale activity within a strike price range from $15.0 to $42.0 in the last 30 days.

Hims & Hers Health Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HIMS | PUT | SWEEP | BULLISH | 12/20/24 | $5.4 | $5.3 | $5.3 | $25.00 | $208.8K | 3.5K | 1.7K |

| HIMS | PUT | SWEEP | NEUTRAL | 11/29/24 | $1.5 | $1.4 | $1.44 | $20.50 | $147.0K | 2.0K | 2.3K |

| HIMS | CALL | SWEEP | BULLISH | 01/17/25 | $1.35 | $1.25 | $1.34 | $28.00 | $132.7K | 2.7K | 1.2K |

| HIMS | PUT | SWEEP | BULLISH | 01/17/25 | $2.45 | $2.4 | $2.4 | $20.00 | $120.0K | 6.2K | 989 |

| HIMS | PUT | TRADE | NEUTRAL | 12/20/24 | $2.5 | $2.4 | $2.45 | $21.00 | $113.9K | 5.2K | 480 |

About Hims & Hers Health

Hims & Hers Health Inc is a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, primary care, and more.

In light of the recent options history for Hims & Hers Health, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Hims & Hers Health

- Currently trading with a volume of 10,964,198, the HIMS’s price is up by 12.73%, now at $21.78.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 98 days.

What Analysts Are Saying About Hims & Hers Health

In the last month, 5 experts released ratings on this stock with an average target price of $23.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Underperform, setting a price target of $18.

* Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $21.

* An analyst from Canaccord Genuity persists with their Buy rating on Hims & Hers Health, maintaining a target price of $28.

* An analyst from Deutsche Bank has decided to maintain their Hold rating on Hims & Hers Health, which currently sits at a price target of $27.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Hims & Hers Health with a target price of $25.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Hims & Hers Health, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intragastric Balloons Market Size to Surpass USD 160.7 Million by 2031, Expanding at a CAGR of 12.2%| States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. , Nov. 18, 2024 (GLOBE NEWSWIRE) — The global intragastric balloons market (위내 풍선 시장) is estimated to flourish at a CAGR of 12.2% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for intragastric balloons is estimated to reach US$ 160.7 million by the end of 2031. The rise in medical tourism, especially in emerging economies, has significantly contributed to the market’s growth. Patients seeking cost-effective weight loss solutions are opting for intragastric balloons abroad, fostering market expansion.

The aging global population is showing an increasing inclination towards non-invasive weight loss options. Intragastric balloons cater to this demographic by providing a safer alternative, considering the unique health challenges faced by older individuals. The expansion of insurance coverage for intragastric balloon procedures in certain regions is a noteworthy driver. As insurers recognize the long-term benefits and cost-effectiveness of these interventions, more patients gain access to the treatment.

Get Instant Access to Your Visuals-Packed Report, and request a sample: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=26006

Intragastric balloons are utilized as post-bariatric surgery support tools. They aid in weight maintenance and address complications, serving as a complementary approach to ensure sustained weight loss success. Beyond general technological advancements, breakthroughs in biocompatible materials used in intragastric balloons are emerging. Enhanced safety profiles and reduced side effects contribute to increased patient confidence and adoption.

Intragastric Balloons Market: Competitive Landscape

The intragastric balloons market is fiercely competitive, driven by key players continually innovating to address the rising global obesity epidemic. Industry giants like Spatz FGIA, Inc. and Allurion S.a.s. dominate with their adjustable and swallowable balloon systems, respectively.

Smaller entrants like ENDALIS contribute to the landscape with unique offerings in medical aesthetics. Advancements in technology, coupled with a growing demand for minimally invasive weight loss solutions, intensify competition.

Regulatory approvals and strategic partnerships are pivotal, influencing market dynamics. As the quest for effective, patient-friendly intragastric solutions intensifies, the competitive landscape remains dynamic, fostering innovation and improved patient outcomes. Some prominent manufacturers are as follows:

- Apollo Endosurgery Inc.

- ReShape Lifesciences Inc.

- Spatz FGIA Inc.

- Allurion S.a.s.

- ENDALIS

- Helioscopie

- LEXEL S.R.L.

- CSC MEDSIL

Key Findings of the Market Report

- <6 Months duration segment leads the intragastric balloons market, reflecting a preference for shorter-term interventions in weight management.

- Fluid-filled balloons dominate the intragastric balloons market, offering effective weight management solutions with enhanced adjustability and patient comfort.

- Swallowable administration dominates the intragastric balloons market, offering a non-invasive approach that aligns with evolving patient preferences and healthcare trends.

Intragastric Balloons Market Growth Drivers & Trends

- Increasing global obesity prevalence fuels demand for non-surgical weight loss solutions like intragastric balloons.

- Continuous innovations in balloon technology enhance safety, efficacy, and patient experience, driving market growth.

- Growing preference for non-invasive procedures boosts the adoption of intragastric balloons as an effective and safer weight loss alternative.

- Collaborations between key market players and healthcare providers drive market expansion, fostering product development and distribution channels.

- Shifting consumer lifestyles and a focus on preventive healthcare contribute to the upward trajectory of the intragastric balloons market as a proactive weight management solution.

Global Intragastric Balloons Market: Regional Profile

- North America leads the forefront, fueled by a high prevalence of obesity and a robust healthcare infrastructure. The presence of key players like Spatz FGIA, Inc. and Allurion S.a.s. fortifies the market’s growth trajectory, while stringent regulatory frameworks shape product approvals.

- In Europe, increasing awareness of non-surgical weight loss interventions propels market expansion. Innovative offerings from companies like ENDALIS contribute to the region’s dynamic landscape.

- The Asia Pacific, with its burgeoning population and rising health consciousness, presents a lucrative frontier. Growing disposable incomes and evolving healthcare preferences drive demand, fostering partnerships and market entry strategies.

Download Sample PDF Brochure from Here: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=26006

Product Portfolio

- Spatz FGIA Inc. pioneers gastric intervention solutions with its innovative adjustable gastric balloon system. Committed to transformative weight management, Spatz offers a customizable, non-surgical approach, empowering individuals to achieve sustainable lifestyle changes.

- Allurion S.a.s. revolutionizes weight loss with its Elipse gastric balloon system. Delivering a non-invasive, swallowable solution, Allurion empowers individuals globally to embark on a transformative weight loss journey, fostering health and well-being.

- ENDALIS is a trailblazer in medical aesthetics, offering cutting-edge solutions for skin rejuvenation and anti-aging. Their advanced technologies and clinically proven products cater to diverse skincare needs, ensuring clients experience unparalleled results and radiant, youthful skin.

Intragastric Balloons Market: Key Segments

By Duration

- <6 Months

- 6 Months

- >6 Months

By Type

- Fluid-filled Balloons

- Gas-filled Balloons

By Administration

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Access: Buy Today for a Comprehensive Report! https://www.transparencymarketresearch.com/checkout.php?rep_id=26006<ype=S

Have a Look at the Related Reports of the Healthcare Domain:

- Dental Syringe Market – The global market for dental syringes (치과 주사기) was estimated to be worth a market valuation of US$ 343.4 million in 2021. The market is anticipated to advance with a steady 5.1% CAGR from 2022 to 2031 and by 2031, the market is likely to gain US$ 577.8 million.

- Platelet Incubator Market – It platelet incubator market (혈소판 인큐베이터 시장) is estimated to grow a CAGR of 4.9% from 2023 to 2031 and reach US$ 703.8 Million by the end of 2031.

- Cellulite Treatment Market – The global cellulite treatment market (셀룰라이트 치료 시장) is estimated to advance at a CAGR of 10.2% from 2023 to 2031 and reach US$ 1.7 Billion by the end of 2031.

- Hematocrit Test Devices Market – The hematocrit test devices market (적혈구 용적률 테스트 장치 시장) is estimated to grow at a CAGR of 3.4% from 2023 to 2031 and reach US$ 7.0 Billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Analyst With 86% Accuracy Rate Sees Over 8% Upside In Mastercard – Here Are 5 Stock Picks For Last Week From Wall Street's Most Accurate Analysts

U.S. stocks settled lower on Friday, with the Dow Jones falling more than 300 points during the session. The S&P 500 recorded a weekly loss of 2.1%, while the Nasdaq Composite fell around 3.2%. The 30-stock Dow lost 1.2% during the week.

Wall Street analysts make new stock picks on a daily basis. Unfortunately for investors, not all analysts have particularly impressive track records at predicting market movements. Even when it comes to one single stock, analyst ratings and price targets can vary widely, leaving investors confused about which analyst’s opinion to trust.

Benzinga’s Analyst Ratings API is a collection of the highest-quality stock ratings curated by the Benzinga news desk via direct partnerships with major sell-side banks. Benzinga displays overnight ratings changes on a daily basis three hours prior to the U.S. equity market opening. Data specialists at investment dashboard provider Toggle.ai recently uncovered that the analyst insights Benzinga Pro subscribers and Benzinga readers regularly receive can successfully be used as trading indicators to outperform the stock market.

Top Analyst Picks: Fortunately, any Benzinga reader can access the latest analyst ratings on the Analyst Stock Ratings page. One of the ways traders can sort through Benzinga’s extensive database of analyst ratings is by analyst accuracy. Here’s a look at the most recent stock picks from each of the five most accurate Wall Street analysts, according to Benzinga Analyst Stock Ratings.

Analyst: John Todaro

- Analyst Firm: Needham

- Ratings Accuracy: 90%

- Latest Rating: Maintained a Buy rating on Hut 8 Corp HUT and raised the price target from $21 to $32 on Nov. 14. This analyst sees more than 25% increase in the stock.

- Recent News: On Nov. 13, Hut 8 Mining reported better-than-expected third-quarter financial results.

Analyst: Trevor Walsh

- Analyst Firm: JMP Securities

- Ratings Accuracy: 89%

- Latest Rating: Maintained a Market Outperform rating on Cyberark Software Ltd CYBR and boosted the price target from $310 to $360 on Nov. 14. This analyst sees around 18% upside in the stock.

- Recent News: On Nov. 13, CyberArk Software reported better-than-expected earnings for its third quarter.

Analyst: Mike Colonnese

- Analyst Firm: HC Wainwright & Co.

- Ratings Accuracy: 87%

- Latest Rating: Maintained a Buy rating on HIVE Digital Technologies Ltd HIVE and raised the price target from $5 to $8 on Nov. 14. This analyst sees around 77% upside in the stock.

- Recent News: On Nov. 14, HIVE Digital Technologies posted mixed quarterly results.

Analyst: Josh Sullivan

- Analyst Firm: Benchmark

- Ratings Accuracy: 86%

- Latest Rating: Maintained a Buy rating on Intuitive Machines Inc LUNR and increased the price target from $10 to $16 on Nov. 15. This analyst sees around 31% surge in the stock.

- Recent News: On Nov. 14, Intuitive Machines reported third-quarter revenue of $58.48 million, beating analyst estimates of $50.89 million, according to Benzinga Pro.

Analyst: Rufus Hone

- Analyst Firm: BMO Capital

- Ratings Accuracy: 86%

- Latest Rating: Maintained an Outperform rating on Mastercard Inc MA and raised the price target from $550 to $565 on Nov. 14. This analyst sees more than 8% upside in the stock.

- Recent News: Mastercard, last week, unveiled its vision to transform online shopping by 2030, aiming to eliminate the need for physical card numbers, passwords, and one-time codes to streamline the checkout experience.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AdvisorShares Announces Reverse Split For MSOS Daily Leveraged ETF, What Investors Need To Know

AdvisorShares has announced a reverse split for its MSOS Daily Leveraged ETF MSOX, effective November 26, 2024.

A reverse split reduces the number of its outstanding shares, increasing the share price proportionally. In this case, the split will be 1-for-20, with every 20 shares of MSOX consolidated into one share.

Key Details:

- Share Consolidation: If you own 1,000 shares at $10 per share (worth $10,000), post-split you will hold 50 shares at $200 per share, still totaling $10,000. Your investment value remains unchanged, only the number of shares and price per share adjust.

- New CUSIP: The ETF’s identifier (CUSIP) will change to reflect the reverse split, so investors should take note of the updated CUSIP.

- Impact on Trading: MSOX will start trading on a split-adjusted basis on November 26, with the share price expected to be roughly 20 times higher.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Why It Matters:

The reverse split is aimed at reducing the number of outstanding shares, potentially improving liquidity and making the ETF more attractive for institutional trading. However, this ETF is specifically designed for active, sophisticated traders seeking leveraged exposure to the cannabis industry. It targets twice the exposure of its underlying assets but may not always hit this exact leverage.

Tax Consideration

Investors could end up with fractional shares due to the split. Since fractional shares cannot be traded, they will be redeemed for cash, which might trigger a taxable gain or loss.

In summary, the reverse split will not affect the overall value of your investment, but it does change the share count and price. It’s important for investors to consult their financial advisor if they have questions about potential tax implications or the ETF’s risk profile.

Cover: AI Generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Security National Financial Corporation Reports Financial Results for the Quarter Ended September 30, 2024

SALT LAKE CITY, Nov. 18, 2024 (GLOBE NEWSWIRE) — Security National Financial Corporation (SNFC) (NASDAQ symbol “SNFCA”) announced financial results for the quarter ended September 30, 2024.

For the three months ended September 30, 2024, SNFC’s after tax earnings increase nearly 193% from $4,041,000 in 2023 to $11,831,000 in 2024. For the nine months ended September 30, 2024, after tax earnings increased 128% to $26,578,000 from $11,634,000 in 2023.

Scott M. Quist, President of the Company, said:

“I continue to be pleased with our Company’s financial performance in 2024. To have a 128% increase in net income resulting in a nearly 11% return on equity for the first 9 months is an excellent performance in my view. By the numbers, our net income improved from $11.6 million in 2023 to $26.6 million in 2024. We have some definite bright spots in our 3rd quarter performance. Mortgage Segment revenues improved 20.5% during the quarter, showing some growing momentum and probable increase in market share, and the Mortgage Segment was profitable for the second quarter in a row. Our Mortuary and Cemetery revenues improved 15% for the quarter, also showing good and growing momentum. Again, speaking of the quarter, those growing revenues gave us a nearly $3.5 million dollar improvement in income for our Mortgage Segment, and a nearly $1.1 million dollar improvement for our Mortuaries and Cemeteries. It should be noted that for the 9 months our Mortgage Segment has improved its profitability by $9.4 million dollars, reflecting significant expense-reduction work along with the improved revenues. Our Life Insurance Segment revenues are arguably flat, being up only 3.8%, but the Life Insurance Segment’s profitability improved over 40% to $28 million dollars. Driving that profitability increase were decreasing death claims, including a return to more normal age distributions following COVID, and a decrease in the amortization of deferred acquisition costs which is related to the improved profit margins on our products. As a Company, our investment income has certainly benefitted from the higher interest rate environment (although that high-rate environment without question significantly harmed our Mortgage Segment), but our cash balances are probably now too high, so work is needed on that front. All in all, to have a 128% increase in net income and a nearly 11% return on equity is a very credible 9-month performance.”

SNFC has three business segments. The following table shows the revenues and earnings before taxes for the three months ended September 30, 2024, as compared to 2023, for each of the three business segments:

| Revenues | Earnings before Taxes | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Life Insurance | $ | 48,853,000 | $ | 47,200,000 | 3.5 | % | $ | 12,358,000 | $ | 7,175,000 | 72.2 | % | ||||||||

| Cemeteries/Mortuaries | $ | 8,543,000 | $ | 7,416,000 | 15.2 | % | $ | 2,841,000 | $ | 1,470,000 | 93.3 | % | ||||||||

| Mortgages | $ | 30,878,000 | $ | 25,626,000 | 20.5 | % | $ | 16,000 | $ | (3,486,000 | ) | 100.5 | % | |||||||

| Total | $ | 88,274,000 | $ | 80,242,000 | 10.0 | % | $ | 15,215,000 | $ | 5,159,000 | 194.9 | % | ||||||||

For the nine months ended September 30, 2024:

| Revenues | Earnings before Taxes | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Life Insurance | $ | 146,061,000 | $ | 140,686,000 | 3.8 | % | $ | 28,053,000 | $ | 20,017,000 | 40.1 | % | ||||||||

| Cemeteries/Mortuaries | $ | 25,608,000 | $ | 23,427,000 | 9.3 | % | $ | 7,984,000 | $ | 6,083,000 | 31.3 | % | ||||||||

| Mortgages | $ | 83,584,000 | $ | 79,476,000 | 5.2 | % | $ | (1,813,000 | ) | $ | (11,207,000 | ) | 83.8 | % | ||||||

| Total | $ | 255,253,000 | $ | 243,589,000 | 4.8 | % | $ | 34,224,000 | $ | 14,893,000 | 129.8 | % | ||||||||

Net earnings per common share was $1.11 for the nine months ended September 30, 2024, compared to net earnings of $.49 per share for the prior year, as adjusted for the effect of annual stock dividends. Book value per common share was $14.89 as of September 30, 2024, compared to $14.11 as of December 31, 2023.

The Company has two classes of common stock outstanding, Class A and Class C. There were 23,261,730 Class A equivalent shares outstanding as of September 30, 2024.

If there are any questions, please contact Mr. Garrett S. Sill or Mr. Scott Quist at:

Security National Financial Corporation

P.O. Box 57250

Salt Lake City, Utah 84157

Phone (801) 264-1060

Fax (801) 265-9882

This press release contains statements that, if not verifiable historical fact, may be viewed as forward-looking statements that could predict future events or outcomes with respect to Security National Financial Corporation and its business. The predictions in the statements will involve risk and uncertainties and, accordingly, actual results may differ significantly from the results discussed or implied in such forward-looking statements.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.