This Analyst With 86% Accuracy Rate Sees Over 8% Upside In Mastercard – Here Are 5 Stock Picks For Last Week From Wall Street's Most Accurate Analysts

U.S. stocks settled lower on Friday, with the Dow Jones falling more than 300 points during the session. The S&P 500 recorded a weekly loss of 2.1%, while the Nasdaq Composite fell around 3.2%. The 30-stock Dow lost 1.2% during the week.

Wall Street analysts make new stock picks on a daily basis. Unfortunately for investors, not all analysts have particularly impressive track records at predicting market movements. Even when it comes to one single stock, analyst ratings and price targets can vary widely, leaving investors confused about which analyst’s opinion to trust.

Benzinga’s Analyst Ratings API is a collection of the highest-quality stock ratings curated by the Benzinga news desk via direct partnerships with major sell-side banks. Benzinga displays overnight ratings changes on a daily basis three hours prior to the U.S. equity market opening. Data specialists at investment dashboard provider Toggle.ai recently uncovered that the analyst insights Benzinga Pro subscribers and Benzinga readers regularly receive can successfully be used as trading indicators to outperform the stock market.

Top Analyst Picks: Fortunately, any Benzinga reader can access the latest analyst ratings on the Analyst Stock Ratings page. One of the ways traders can sort through Benzinga’s extensive database of analyst ratings is by analyst accuracy. Here’s a look at the most recent stock picks from each of the five most accurate Wall Street analysts, according to Benzinga Analyst Stock Ratings.

Analyst: John Todaro

- Analyst Firm: Needham

- Ratings Accuracy: 90%

- Latest Rating: Maintained a Buy rating on Hut 8 Corp HUT and raised the price target from $21 to $32 on Nov. 14. This analyst sees more than 25% increase in the stock.

- Recent News: On Nov. 13, Hut 8 Mining reported better-than-expected third-quarter financial results.

Analyst: Trevor Walsh

- Analyst Firm: JMP Securities

- Ratings Accuracy: 89%

- Latest Rating: Maintained a Market Outperform rating on Cyberark Software Ltd CYBR and boosted the price target from $310 to $360 on Nov. 14. This analyst sees around 18% upside in the stock.

- Recent News: On Nov. 13, CyberArk Software reported better-than-expected earnings for its third quarter.

Analyst: Mike Colonnese

- Analyst Firm: HC Wainwright & Co.

- Ratings Accuracy: 87%

- Latest Rating: Maintained a Buy rating on HIVE Digital Technologies Ltd HIVE and raised the price target from $5 to $8 on Nov. 14. This analyst sees around 77% upside in the stock.

- Recent News: On Nov. 14, HIVE Digital Technologies posted mixed quarterly results.

Analyst: Josh Sullivan

- Analyst Firm: Benchmark

- Ratings Accuracy: 86%

- Latest Rating: Maintained a Buy rating on Intuitive Machines Inc LUNR and increased the price target from $10 to $16 on Nov. 15. This analyst sees around 31% surge in the stock.

- Recent News: On Nov. 14, Intuitive Machines reported third-quarter revenue of $58.48 million, beating analyst estimates of $50.89 million, according to Benzinga Pro.

Analyst: Rufus Hone

- Analyst Firm: BMO Capital

- Ratings Accuracy: 86%

- Latest Rating: Maintained an Outperform rating on Mastercard Inc MA and raised the price target from $550 to $565 on Nov. 14. This analyst sees more than 8% upside in the stock.

- Recent News: Mastercard, last week, unveiled its vision to transform online shopping by 2030, aiming to eliminate the need for physical card numbers, passwords, and one-time codes to streamline the checkout experience.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AdvisorShares Announces Reverse Split For MSOS Daily Leveraged ETF, What Investors Need To Know

AdvisorShares has announced a reverse split for its MSOS Daily Leveraged ETF MSOX, effective November 26, 2024.

A reverse split reduces the number of its outstanding shares, increasing the share price proportionally. In this case, the split will be 1-for-20, with every 20 shares of MSOX consolidated into one share.

Key Details:

- Share Consolidation: If you own 1,000 shares at $10 per share (worth $10,000), post-split you will hold 50 shares at $200 per share, still totaling $10,000. Your investment value remains unchanged, only the number of shares and price per share adjust.

- New CUSIP: The ETF’s identifier (CUSIP) will change to reflect the reverse split, so investors should take note of the updated CUSIP.

- Impact on Trading: MSOX will start trading on a split-adjusted basis on November 26, with the share price expected to be roughly 20 times higher.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Why It Matters:

The reverse split is aimed at reducing the number of outstanding shares, potentially improving liquidity and making the ETF more attractive for institutional trading. However, this ETF is specifically designed for active, sophisticated traders seeking leveraged exposure to the cannabis industry. It targets twice the exposure of its underlying assets but may not always hit this exact leverage.

Tax Consideration

Investors could end up with fractional shares due to the split. Since fractional shares cannot be traded, they will be redeemed for cash, which might trigger a taxable gain or loss.

In summary, the reverse split will not affect the overall value of your investment, but it does change the share count and price. It’s important for investors to consult their financial advisor if they have questions about potential tax implications or the ETF’s risk profile.

Cover: AI Generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Security National Financial Corporation Reports Financial Results for the Quarter Ended September 30, 2024

SALT LAKE CITY, Nov. 18, 2024 (GLOBE NEWSWIRE) — Security National Financial Corporation (SNFC) (NASDAQ symbol “SNFCA”) announced financial results for the quarter ended September 30, 2024.

For the three months ended September 30, 2024, SNFC’s after tax earnings increase nearly 193% from $4,041,000 in 2023 to $11,831,000 in 2024. For the nine months ended September 30, 2024, after tax earnings increased 128% to $26,578,000 from $11,634,000 in 2023.

Scott M. Quist, President of the Company, said:

“I continue to be pleased with our Company’s financial performance in 2024. To have a 128% increase in net income resulting in a nearly 11% return on equity for the first 9 months is an excellent performance in my view. By the numbers, our net income improved from $11.6 million in 2023 to $26.6 million in 2024. We have some definite bright spots in our 3rd quarter performance. Mortgage Segment revenues improved 20.5% during the quarter, showing some growing momentum and probable increase in market share, and the Mortgage Segment was profitable for the second quarter in a row. Our Mortuary and Cemetery revenues improved 15% for the quarter, also showing good and growing momentum. Again, speaking of the quarter, those growing revenues gave us a nearly $3.5 million dollar improvement in income for our Mortgage Segment, and a nearly $1.1 million dollar improvement for our Mortuaries and Cemeteries. It should be noted that for the 9 months our Mortgage Segment has improved its profitability by $9.4 million dollars, reflecting significant expense-reduction work along with the improved revenues. Our Life Insurance Segment revenues are arguably flat, being up only 3.8%, but the Life Insurance Segment’s profitability improved over 40% to $28 million dollars. Driving that profitability increase were decreasing death claims, including a return to more normal age distributions following COVID, and a decrease in the amortization of deferred acquisition costs which is related to the improved profit margins on our products. As a Company, our investment income has certainly benefitted from the higher interest rate environment (although that high-rate environment without question significantly harmed our Mortgage Segment), but our cash balances are probably now too high, so work is needed on that front. All in all, to have a 128% increase in net income and a nearly 11% return on equity is a very credible 9-month performance.”

SNFC has three business segments. The following table shows the revenues and earnings before taxes for the three months ended September 30, 2024, as compared to 2023, for each of the three business segments:

| Revenues | Earnings before Taxes | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Life Insurance | $ | 48,853,000 | $ | 47,200,000 | 3.5 | % | $ | 12,358,000 | $ | 7,175,000 | 72.2 | % | ||||||||

| Cemeteries/Mortuaries | $ | 8,543,000 | $ | 7,416,000 | 15.2 | % | $ | 2,841,000 | $ | 1,470,000 | 93.3 | % | ||||||||

| Mortgages | $ | 30,878,000 | $ | 25,626,000 | 20.5 | % | $ | 16,000 | $ | (3,486,000 | ) | 100.5 | % | |||||||

| Total | $ | 88,274,000 | $ | 80,242,000 | 10.0 | % | $ | 15,215,000 | $ | 5,159,000 | 194.9 | % | ||||||||

For the nine months ended September 30, 2024:

| Revenues | Earnings before Taxes | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Life Insurance | $ | 146,061,000 | $ | 140,686,000 | 3.8 | % | $ | 28,053,000 | $ | 20,017,000 | 40.1 | % | ||||||||

| Cemeteries/Mortuaries | $ | 25,608,000 | $ | 23,427,000 | 9.3 | % | $ | 7,984,000 | $ | 6,083,000 | 31.3 | % | ||||||||

| Mortgages | $ | 83,584,000 | $ | 79,476,000 | 5.2 | % | $ | (1,813,000 | ) | $ | (11,207,000 | ) | 83.8 | % | ||||||

| Total | $ | 255,253,000 | $ | 243,589,000 | 4.8 | % | $ | 34,224,000 | $ | 14,893,000 | 129.8 | % | ||||||||

Net earnings per common share was $1.11 for the nine months ended September 30, 2024, compared to net earnings of $.49 per share for the prior year, as adjusted for the effect of annual stock dividends. Book value per common share was $14.89 as of September 30, 2024, compared to $14.11 as of December 31, 2023.

The Company has two classes of common stock outstanding, Class A and Class C. There were 23,261,730 Class A equivalent shares outstanding as of September 30, 2024.

If there are any questions, please contact Mr. Garrett S. Sill or Mr. Scott Quist at:

Security National Financial Corporation

P.O. Box 57250

Salt Lake City, Utah 84157

Phone (801) 264-1060

Fax (801) 265-9882

This press release contains statements that, if not verifiable historical fact, may be viewed as forward-looking statements that could predict future events or outcomes with respect to Security National Financial Corporation and its business. The predictions in the statements will involve risk and uncertainties and, accordingly, actual results may differ significantly from the results discussed or implied in such forward-looking statements.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

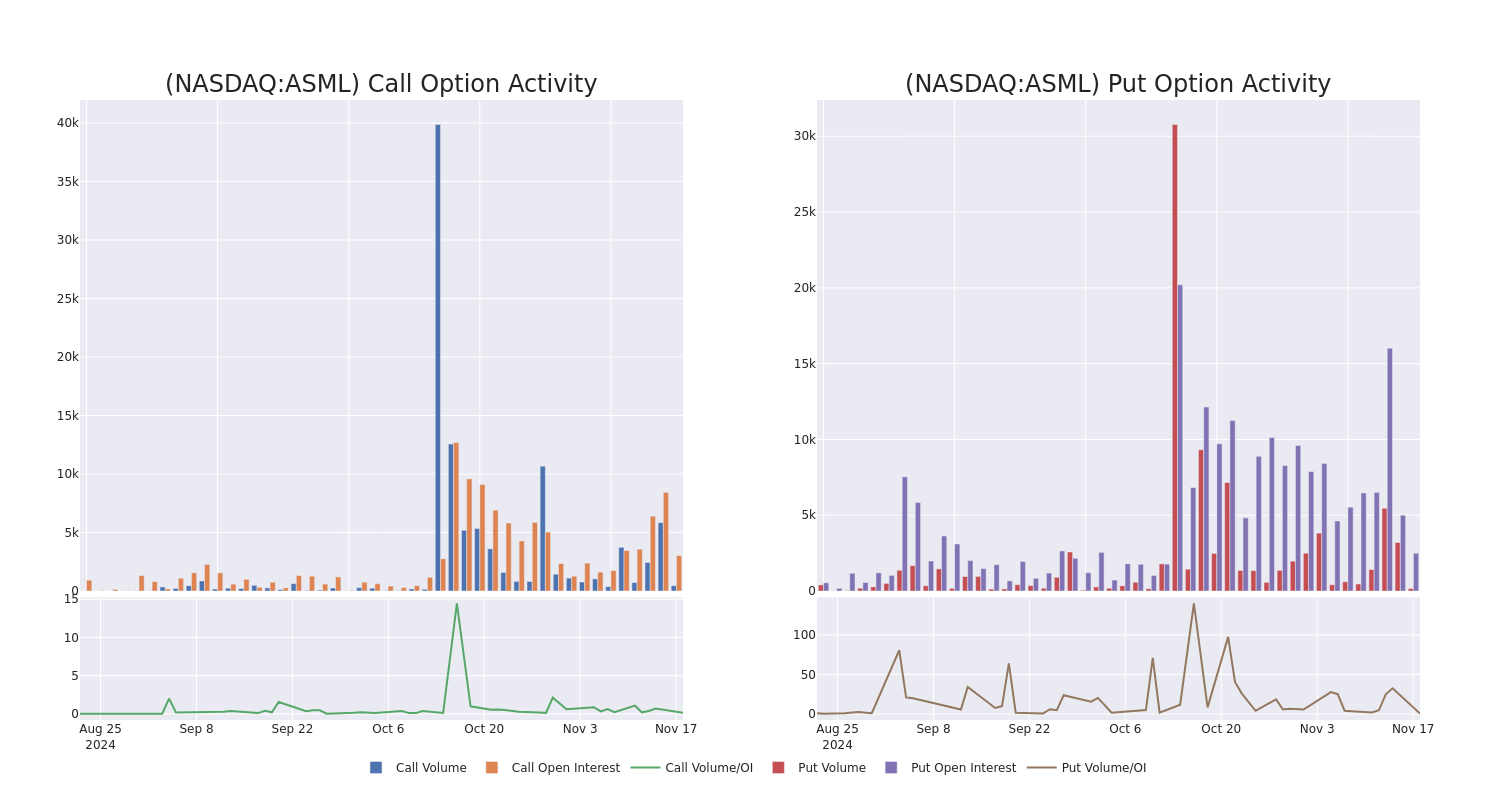

A Closer Look at ASML Holding's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on ASML Holding ASML.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ASML, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 28 uncommon options trades for ASML Holding.

This isn’t normal.

The overall sentiment of these big-money traders is split between 53% bullish and 28%, bearish.

Out of all of the special options we uncovered, 8 are puts, for a total amount of $605,540, and 20 are calls, for a total amount of $1,054,890.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $560.0 to $820.0 for ASML Holding over the last 3 months.

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of ASML Holding stands at 257.2, with a total volume reaching 582.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $560.0 to $820.0, throughout the last 30 days.

ASML Holding Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | CALL | SWEEP | NEUTRAL | 01/17/25 | $41.3 | $38.9 | $41.3 | $650.00 | $185.8K | 513 | 45 |

| ASML | PUT | SWEEP | BULLISH | 12/20/24 | $167.3 | $166.5 | $166.5 | $820.00 | $183.1K | 209 | 11 |

| ASML | CALL | SWEEP | NEUTRAL | 02/21/25 | $84.0 | $82.9 | $83.4 | $600.00 | $108.4K | 34 | 18 |

| ASML | PUT | SWEEP | BULLISH | 11/22/24 | $16.3 | $15.4 | $15.9 | $660.00 | $95.4K | 319 | 61 |

| ASML | PUT | SWEEP | BULLISH | 12/20/24 | $167.3 | $166.5 | $166.5 | $820.00 | $83.2K | 209 | 11 |

About ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML’s main clients are TSMC, Samsung, and Intel.

In light of the recent options history for ASML Holding, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of ASML Holding

- Currently trading with a volume of 418,824, the ASML’s price is up by 0.34%, now at $660.87.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 72 days.

Professional Analyst Ratings for ASML Holding

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $815.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Bernstein continues to hold a Outperform rating for ASML Holding, targeting a price of $815.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ASML Holding, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LaSalle Appoints Tara McCann Head of Americas Investor and Consultant Relations

CHICAGO, Nov. 18, 2024 /PRNewswire/ — LaSalle Investment Management (“LaSalle“), the global real estate investment manager, is pleased to announce the appointment of Tara McCann as Head of Americas Investor and Consultant Relations, effective November 4. In this role, Tara leads LaSalle’s efforts to strengthen relationships with existing institutional investors, enhance consultant relationships and expand the firm’s network across the Americas.

Tara’s appointment reinforces LaSalle’s commitment to continually strengthen its investor relations capabilities as well as to diversify product offerings and broaden distribution channels in the Americas to drive long-term growth. Based in New York, she reports to Samer Honein, Global Head of Investor Relations. Tara will assume the responsibilities of Adam Caskey, Head of Americas Investor Relations, who is set to retire in December this year.

Tara is a real estate industry veteran with over 25 years of experience in senior roles across investor relations, product development, acquisitions, and investment banking. She joins LaSalle from Rockwood, where she served as Head of Capital and Client Strategies, while also spearheading the firm’s ESG initiatives. Prior to that, Tara was a Managing Director with USAA Real Estate Company, serving as the product specialist for opportunistic and credit strategies. She has also held senior roles at H/2 Capital Partners, Ranieri Real Estate Partners and the Deutsche Bank Securities’ Real Estate Investment Banking Group.

Tara received a Master of Business Administration in Finance from Columbia Business School and a Bachelor of Arts in Economics and Urban Studies from Brown University.

Samer Honein, Global Head of Investor Relations at LaSalle, added: “Tara’s experience in investor relations, product development and strategic insights across the real estate industry make her an ideal addition to the team. We look forward to her leadership of our Americas investor relations efforts, reinforcing our commitment to deliver world-class partnerships to our clients.”

Brad Gries, Head of Americas at LaSalle, commented: “Tara’s appointment is a key step in our strategy to enhance our coverage and product offerings in the Americas. Her deep industry knowledge and established relationships will be instrumental as we continue to deliver innovative solutions to meet the evolving needs of our investors in the region.”

Tara McCann, Head of Americas Investor and Consultant Relations at LaSalle said: “I am excited to join a firm with LaSalle’s values and global platform at this exciting time of growth. I look forward to expanding our relationships and continuing LaSalle’s legacy of delivering innovative solutions that meet the evolving needs in real estate investment of our partners.”

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Investing today. For tomorrow.

Contact: Alissa Schachter, LaSalle Investment Management

Email: alissa.schachter@lasalle.com

Telephone: +1-312-339-0625

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lasalle-appoints-tara-mccann-head-of-americas-investor-and-consultant-relations-302307686.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lasalle-appoints-tara-mccann-head-of-americas-investor-and-consultant-relations-302307686.html

SOURCE LaSalle Investment Management

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Supermicro Stock Extends Rally on Anticipation of Plan to Avoid Delisting

Bloomberg / Contributor / Getty Images

-

Super Micro Computer shares rose in early trading Monday, extending their rally on anticipation the tech company is preparing to submit a plan to avoid being delisted.

-

Barron’s reported Friday that Supermicro was on track to file a plan with the stock exchange by Monday to remain listed.

-

The gains come after Supermicro shares lost ground in recent months as it was accused of “accounting manipulation” and delayed the filing of its annual report.

Shares of Super Micro Computer (SMCI) climbed in early trading Monday, extending their rally on anticipation the company is preparing to submit a plan to avoid being delisted from the Nasdaq stock exchange.

Citing a person familiar, Barron’s reported Friday that the server manufacturer expects to be able to meet the deadline set by the Nasdaq by submitting a plan by Monday.

The gains come after the stock took a hit in recent months from concerns about the company’s stock being delisted after it delayed filing its annual report in August. The company said it received a letter from the Nasdaq on Sept. 17 informing Supermicro of a 60-day deadline to file the late report, with a weekend deadline leaving Monday the effective date.

Earlier this month, the company said it “remains unable at this time to predict” when it would file the delayed annual report. Last week, Supermicro said its official first-quarter results would also be delayed, as it hires a new auditor to review its results after accounting firm EY resigned.

EY’s resignation followed months of speculation about Supermicro’s accounting after the annual report was delayed, and a report from short seller Hindenburg Research accused it of “accounting manipulation” and other violations.

Supermicro shares were up over 18% after the market opened Monday, but still down more than 80% from highs in March.

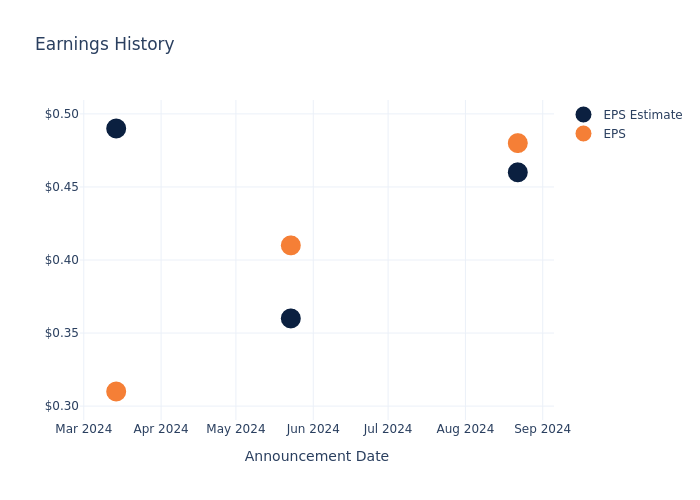

Preview: Weibo's Earnings

Weibo WB is set to give its latest quarterly earnings report on Tuesday, 2024-11-19. Here’s what investors need to know before the announcement.

Analysts estimate that Weibo will report an earnings per share (EPS) of $0.44.

The market awaits Weibo’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Earnings Track Record

Last quarter the company beat EPS by $0.02, which was followed by a 0.0% drop in the share price the next day.

Here’s a look at Weibo’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.46 | 0.36 | 0.49 | 0.56 |

| EPS Actual | 0.48 | 0.41 | 0.31 | 0.57 |

| Price Change % | 0.0% | -0.0% | 4.0% | -1.0% |

Stock Performance

Shares of Weibo were trading at $8.35 as of November 15. Over the last 52-week period, shares are down 29.77%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts’ Take on Weibo

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Weibo.

Weibo has received a total of 2 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $9.75, the consensus suggests a potential 16.77% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Tripadvisor, three key industry players, offering insights into their relative performance expectations and market positioning.

Analysis Summary for Peers

The peer analysis summary presents essential metrics for and Tripadvisor, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Tripadvisor | Neutral | -0.19% | $485M | 4.33% |

Key Takeaway:

Weibo is positioned in the middle among its peers for consensus rating. It ranks at the bottom for revenue growth, with a negative percentage. In terms of gross profit, Weibo is ahead of its peers with a higher amount. However, its return on equity is lower compared to its peers.

Discovering Weibo: A Closer Look

Weibo Corp is a China-based company mainly engaged in the social media advertising business for people to create, discover and distribute content. The Company’s activities include Advertising and Marketing, which mainly provides a full range of advertising customization and marketing solutions. The Value-added Services mainly provide services such as membership services on social platforms, online games, live broadcasts, social e-commerce, and others. The Company’s main product is the social platform Weibo.

Weibo’s Financial Performance

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Challenges: Weibo’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -0.54%. This indicates a decrease in top-line earnings. When compared to others in the Communication Services sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 25.56%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Weibo’s ROE stands out, surpassing industry averages. With an impressive ROE of 3.43%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Weibo’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.56%, the company showcases efficient use of assets and strong financial health.

Debt Management: Weibo’s debt-to-equity ratio surpasses industry norms, standing at 0.8. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Weibo visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

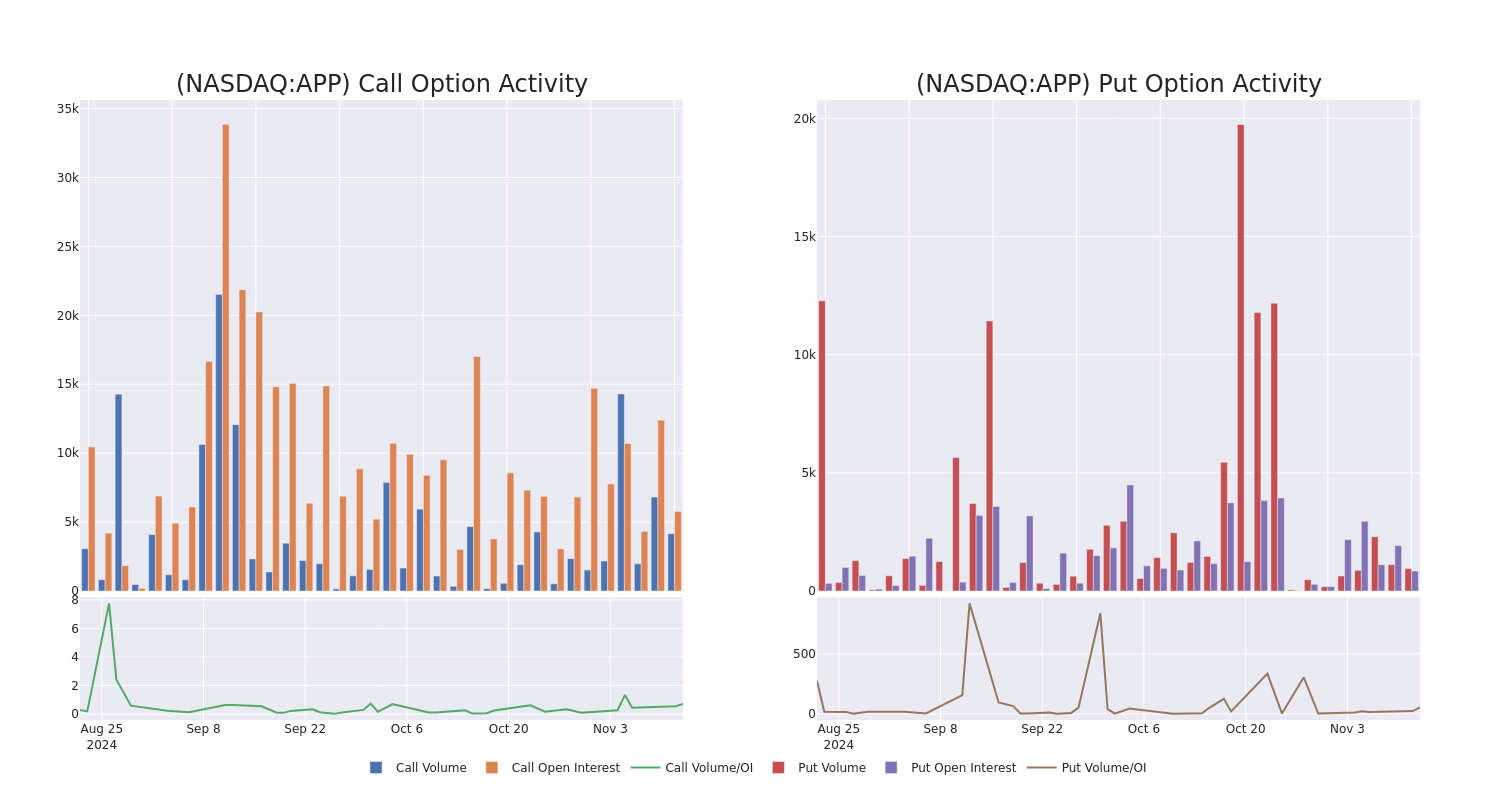

Check Out What Whales Are Doing With APP

Whales with a lot of money to spend have taken a noticeably bearish stance on AppLovin.

Looking at options history for AppLovin APP we detected 31 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $479,510 and 21, calls, for a total amount of $957,724.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $345.0 for AppLovin over the recent three months.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in AppLovin’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to AppLovin’s substantial trades, within a strike price spectrum from $40.0 to $345.0 over the preceding 30 days.

AppLovin Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | TRADE | BEARISH | 11/29/24 | $12.3 | $12.2 | $12.2 | $300.00 | $122.0K | 644 | 250 |

| APP | CALL | SWEEP | BEARISH | 01/16/26 | $92.3 | $88.0 | $90.0 | $300.00 | $89.9K | 71 | 10 |

| APP | PUT | TRADE | BULLISH | 11/29/24 | $9.0 | $8.8 | $8.8 | $280.00 | $88.0K | 34 | 856 |

| APP | CALL | SWEEP | BULLISH | 11/22/24 | $9.0 | $8.7 | $9.0 | $300.00 | $66.4K | 2.3K | 786 |

| APP | CALL | SWEEP | BEARISH | 01/17/25 | $101.7 | $100.8 | $100.8 | $200.00 | $60.4K | 442 | 11 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company’s software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

After a thorough review of the options trading surrounding AppLovin, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is AppLovin Standing Right Now?

- Currently trading with a volume of 1,137,880, the APP’s price is up by 2.17%, now at $297.4.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 86 days.

Expert Opinions on AppLovin

In the last month, 5 experts released ratings on this stock with an average target price of $199.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on AppLovin with a target price of $185.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on AppLovin with a target price of $160.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on AppLovin with a target price of $180.

* An analyst from Macquarie has decided to maintain their Outperform rating on AppLovin, which currently sits at a price target of $270.

* In a cautious move, an analyst from Wells Fargo downgraded its rating to Overweight, setting a price target of $200.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AppLovin with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.