Enveric Biosciences Trims Losses, Eyes Key Drug Approval For Difficult-To-Treat Mental Health Disorders

Psychedelics biotech company Enveric Biosciences ENVB provided a corporate update and reported financial results for the third quarter ended Sept. 30, 2024.

“The third quarter of 2024 was highlighted by important progress in the development of EB-003, our neuroplastogenic molecule that is designed to address difficult-to-treat mental health disorders without inducing the hallucinogenic effect common to N,N-Dimethyltryptamine (DMT) and related analogs,” stated Joseph Tucker, Ph.D., director and CEO of Enveric. “Among the key achievements, data confirmed that EB-003 has the potential to be delivered via oral administration and penetrate the brain at levels expected to elicit the desired therapeutic effect. Additionally, preclinical safety and pharmacology studies confirmed that EB-003 targets desired serotonergic receptors while minimizing potentially harmful, off-target interactions common to serotonin-like drug compounds. These are clear differentiators for EB-003, which we believe will add to its value potential.”

Tucker says that “drug technologies that minimize or eliminate the hallucinogenic effect in molecules targeting the 5-HT2A receptor have the potential to become the gold standard in one or more neuropsychiatric indications.” The company plans to submit an EB-003 Investigational New Drug (IND) application to the U.S. Food and Drug Administration in the second half of 2025.

Read Also:Enveric Biosciences Out-Licenses Key Program To MycoMedica In $62M Deal

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 Financial Highlights

Net loss attributable to stockholders was $2.1 million, including $500,000 in net non-cash expense, with a basic and diluted loss per share of $0.24, as compared to a net loss of $2.8 million, including $0.2 million in net non-cash income, with a basic and diluted loss per share of $1.30 for the quarter ended Sept. 30, 2023.

Total operating expenses amounted to $2.08 million, compared to $3.45 million in the same period last year.

At the end of the reporting period on Sept. 30, 2024, Enveric had cash-on-hand of $3.1 million, and accumulated deficit of $102.92 million.

In the quarterly report filed with the SEC, Enveric noted that “further losses are anticipated in the development of its business. Being a research and development company, since inception, the company has not yet generated revenue and the company has incurred continuing losses from its operations. The company’s operations have been funded principally through the issuance of equity. These factors raise substantial doubt about the company’s ability to continue as a going concern for a period of one year from the issuance of these unaudited condensed consolidated financial statements.”

To continue as a going concern, Enveric needs to raise additional capital.

The company had cash-on-hand of $3.1 million for the quarter ended September 30, 2024.

Corporate, Product and Business Development Highlights

- Confirmed oral bioavailability and significant brain exposure in preclinical studies of EB-003, supporting expedited development with IND filing and first patient dosed expected in 2025

- Announced positive results from preclinical safety and pharmacology studies of EB-003, confirming the drug’s selective activity with desired serotonergic neuroreceptors and ability to minimize potential adverse cardiovascular and CNS events

- Presented foundational research involving EB-003 at the 7th Neuropsychiatric Drug Summit and the European Behavioral Pharmacology Society Biennial Workshop

- Strengthened intellectual property estate for EVM301 portfolio and announced the issuance of five additional U.S. patents

- Executed licensing agreement with Aries Science & Technology to clinically develop and market Enveric’s patented product for radiation dermatitis

Price Action

Enveric Biosciences shares closed Friday market session 8.06% lower at 37 cents per share.

Read Next:

Photo created with AI

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

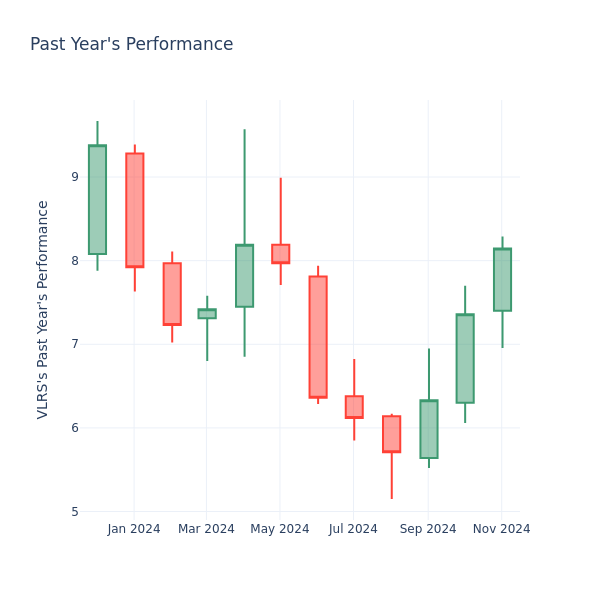

P/E Ratio Insights for Controladora Vuela

In the current session, the stock is trading at $8.10, after a 0.50% spike. Over the past month, Controladora Vuela Inc. VLRS stock increased by 13.61%, and in the past year, by 22.13%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Comparing Controladora Vuela P/E Against Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Controladora Vuela has a lower P/E than the aggregate P/E of 15.38 of the Passenger Airlines industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top Wall Street Forecasters Revamp Twist Bioscience Price Expectations Ahead Of Q4 Earnings

Twist Bioscience Corporation TWST will release earnings results for its fourth quarter, before the opening bell on Monday, Nov. 18.

Analysts expect the South San Francisco, California-based bank to report a quarterly loss at 69 cents per share, versus a year-ago loss of 75 cents per share. Twist Bioscience projects to report revenue of $82.66 million for the recent quarter, compared to $66.95 million a year earlier, according to data from Benzinga Pro.

On Oct. 22, Twist Bioscience entered into royalty purchase agreement with xOMA Royalty for $15 million in cash.

Twist Bioscience shares fell 5.3% to close at $36.89 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Tycho Peterson maintained an Underweight rating and raised the price target from $28 to $35 on Aug. 5. This analyst has an accuracy rate of 77%.

- Baird analyst Catherine Ramsey maintained an Outperform rating and raised the price target from $40 to $46 on Aug. 5. This analyst has an accuracy rate of 78%.

- Goldman Sachs analyst Matthew Sykes maintained a Buy rating and increased the price target from $45 to $55 on July 9. This analyst has an accuracy rate of 64%.

- TD Cowen analyst Steven Mah maintained a Buy rating and raised the price target from $55 to $65 on June 13. This analyst has an accuracy rate of 64%.

Considering buying TWST stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin To $100,000 'Seems Around The Corner,' Bulls Are 'On The Right Side Of History'—Bernstein

In a compelling endorsement of Bitcoin BTC/USD, Bernstein analysts assert that being long on the leading cryptocurrency aligns investors with what they term as “the right side of history.”

What Happened: Their latest report outlines Bitcoin’s robust trajectory, citing regulatory, institutional and macroeconomic catalysts driving its unprecedented growth.

Bitcoin has recently touched new highs, with its price hovering around $90,000 and within striking distance of the $100,000 milestone.

Bernstein analysts believe these gains are only the beginning.

“Bitcoin to $100,000 seems around the corner, and our $200,000 Bitcoin target for 2025 now looks not as delusional,” the report states.

The analysts highlight several catalysts propelling this bullish outlook, including regulatory clarity, Bitcoin ETF inflows and political momentum toward a U.S. Bitcoin reserve.

A shift toward crypto-friendly policies under the Trump administration further strengthens the case for Bitcoin’s dominance.

“We expect the SEC chair and Treasury position to be filled by a pro-crypto candidate, which will set a positive tone for the market regardless of specific appointments,” Bernstein wrote.

The report also underscores a fundamental shift in Bitcoin adoption. What began as a retail-driven market is now led by institutions, corporates and potentially sovereign entities.

Also Read: Dogecoin To $1 By December? Probably Not Happening, Polymarket Traders Say

Bernstein envisions the next Bitcoin cycle being “sovereign-led,” with nation-states recognizing Bitcoin as a strategic asset. “The political winds of change are favoring candidates that prefer crypto deregulation and oppose surveillance from central bank digital currencies,” the analysts noted.

Bitcoin ETFs, a significant driver of demand, have accumulated $92 billion in assets under management. Weekly inflows are averaging $1.7 billion, underscoring the increasing institutional appetite.

Bernstein also pointed to MicroStrategy’s $42 billion fundraising effort over three years as another major source of Bitcoin demand, reflecting a long-term bullish sentiment.

“If you are long, we expect you will be on the right side of Bitcoin history,” the report stated.

Bernstein emphasizes that this is not merely a short-term trade but a structural allocation opportunity with horizons extending 12-18 months or more.

What’s Next: As the crypto industry continues to evolve, these insights will take center stage at Benzinga’s Future of Digital Assets event on Nov. 19, offering investors and enthusiasts a chance to explore the transformative potential of digital currencies like Bitcoin.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SMCI stock jumps on report it plans to submit plan to retain Nasdaq listing

Investing.com — Shares of Super Micro Computer (NASDAQ:SMCI) surged almost 11% in premarket trading on Monday after a report emerged that the company plans to submit a proposal to maintain its listing on the Nasdaq Stock Market.

The news comes amid regulatory concerns and significant challenges for the server maker, known for its role in the artificial intelligence boom.

A source familiar with the matter told Barron’s that SMCI intends to present a compliance plan by Monday. The move is critical for the company to avoid being delisted from the Nasdaq following delayed financial filings and the resignation of its auditor.

Super Micro had received a delisting warning in September, requiring it to either file its overdue reports or submit a plan by November 16.

Super Micro’s troubles mark a stark reversal from its earlier success. At its March peak, the company’s stock was up 318% for the year, fueled by its position as a leader in AI computing.

However, the momentum has sharply waned, with shares now down 33% year-to-date.

Following the Barron’s report, analysts at Lynx Equity Strategies said it “should not come as a surprise since the CFO had said as much during the recent earnings call.”

“We note that as of this writing, we are not aware of a formal announcement from SMCI regarding submitting a plan,” added the firm.

Even so, the firm says that with the delisting possibility likely priced in, it is not unreasonable to “expect the shorts who followed the recommendation of the short-seller report on 8/27 to cover positions.”

“At current level, we think the stock is trading at a deep discount,” Lynx states, adding that they believe it “may be a couple of headlines away from a rapid reversal.”

The firm has a price target of $45 per share on SMCI’s stock.

Related Articles

SMCI stock jumps on report it plans to submit plan to retain Nasdaq listing

Shift4 Payments rises after being added to S&P MidCap 400

Facebook users affected by data breach eligible for compensation, German court says

Stock market today: Dow slips, Nasdaq edges higher as Tesla shines

US stocks traded mixed on Monday amid fading optimism for interest-rate cuts, as investors looked ahead to Nvidia (NVDA) earnings to test the health of the AI trade.

The Dow Jones Industrial Average (^DJI) slipped roughly 0.2%, while the S&P 500 (^GSPC) was broadly flat. The tech-heavy Nasdaq Composite (^IXIC) rose 0.1%, buoyed by a jump in Tesla (TSLA) stock.

Stocks are starting the week on the back foot as the prospect of higher-for-longer rates holds post-election bullishness in check. The S&P 500 has reversed half of its Trump-fueled rally after sharp weekly losses for the major gauges, led by tech.

Signs of a robust economy, combined with comments from Federal Reserve Chair Jerome Powell, have prompted investors to downsize expectations for rate cuts. After the big macro and political events of recent days, the week brings few economic releases seen as likely to reset those calculations.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

Given that, eyes are now on Nvidia’s results on Wednesday for insight into the strength of the AI trade, which has helped drive the S&P 500’s gains over the past year. Production of its flagship Blackwell chip is in focus, especially after The Information reported the next-generation AI chip has run into problems with overheating. Nvidia shares were down nearly 3% in early trading.

Elsewhere in tech, EV maker Tesla’s shares rose more than 6% in the wake of a Bloomberg report that President-elect Donald Trump’s team is looking to ease US rules for self-driving vehicles.

Wall Street continues to monitor Trump’s picks for his cabinet, after his choice of Robert F. Kennedy Jr for top health official rattled vaccine stocks. The incoming president has named Brendan Carr, a critic of Big Techs such as Meta and Apple, as chairman of the Federal Communications Commission. The wait is now on to learn who will win the frenzied race to become Trump’s Treasury Secretary.

Meanwhile, bitcoin (BTC-USD) — a key Trump trade — has rebounded from its biggest retreat since the election at the weekend. The cryptocurrency was trading above $90,000 on Monday.

LIVE 4 updatesCybersecurity Gets A Boost: BlackBerry, Canada, And TMU Team Up To Fortify ASEAN's Digital Defenses

BlackBerry Limited BB, in partnership with the Canadian government and the Toronto Metropolitan University, launched a cybersecurity training initiative in Southeast Asia, backed by a C$3.9 million ($2.7 million) investment.

Canada’s support, delivered through BlackBerry in partnership with TMU’s Rogers Cybersecure Catalyst, aims to train 3,500 cyber-defenders from Malaysia and other ASEAN countries.

This initiative strengthens global public-private collaboration against rising digital threats, aligns with Canada’s Indo-Pacific strategy, and positions Malaysia as a regional hub for cybersecurity excellence in Southeast Asia.

Canada’s support will enhance the Malaysia Cybersecurity Center of Excellence (CCoE) in Cyberjaya with a comprehensive cybersecurity curriculum, including programs for women.

The initiative aims to prepare talent for high-demand cybersecurity roles, position the CCoE as a regional hub, and strengthen government and industry capabilities to address cyber threats and safeguard national security.

BlackBerry CEO John Giamatteo commented, “As the beating heart of the region’s cyber-threat defense capabilities, this world-class facility helps train and upskill Malaysian and regional cyber workforces, and is also an international destination to address emerging cyber threats and coordinate regional incident response.”

“In a growing digital economy, no matter how advanced your cybersecurity arsenal is, nations must have a well-trained cyber-workforce to bolster their front lines of defense.”

The Rt. Hon. Justin Trudeau, Prime Minister of Canada said, “With our government’s investment in Malaysia’s Cybersecurity Center of Excellence in collaboration with BlackBerry, Canada will share cyber-expertise, train the cyber workforce across ASEAN countries, increase public-private sector collaboration, and strengthen our collective capacity to counter, deter and respond to cyber threats.”

This month, the company announced that Hyundai Mobis has selected BlackBerry QNX to power its next-generation digital cockpit platform.

Hyundai Mobis will use BlackBerry’s QNX Hypervisor for Safety and QNX Advanced Virtualization Frameworks (QAVF) for its next-generation digital cockpit platform.

Last month, the company announced details of profitability for its IoT and Cybersecurity divisions, including strategic options for the Cylance business.

Price Action: BB shares are up 0.42% at $2.37 premarket at the last check Monday.

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

C3is Inc. reports third quarter and nine months 2024 financial and operating results

ATHENS, Greece, Nov. 18, 2024 (GLOBE NEWSWIRE) — C3is Inc. CISS (the “Company”), a ship-owning company providing dry bulk and tanker seaborne transportation services, announced today its unaudited financial and operating results for the third quarter and nine months ended September 30, 2024.

OPERATIONAL AND FINANCIAL HIGHLIGHTS

- Our handysize dry bulk carriers are on time charters of short term durations, producing steady cash flows, while our Aframax tanker operates in the spot market, currently achieving voyage charter rates of around $48,000 per day.

- All our handysize dry bulk carriers and our Aframax tanker are unencumbered.

- Fleet operational utilization of 90.2% for the three months ended September 30, 2024, mainly due to the commercial idle days of the vessel that operated in the spot market, as our vessels that operated under time charter employment had few commercial idle days.

- Revenues of $9.3 million for the three months ended September 30, 2024, corresponding to a daily TCE I of $13,084.

- 24% increase in daily TCE for the nine months ended September 30, 2024, as compared to the nine months ended September 30, 2023.

- Net Income of $5.1 million, EBITDAi of $7.0 million and Basic EPS of $0.69 for the three months ended September 30, 2024.

- Net Loss of $2.9 million, EBITDA of $3.0 million and Basic Loss per Share of $1.60 for the nine months ended September 30, 2024.

- Adjusted net incomei of $0.3 million and $7.7 million for the three and nine months ended September 30, 2024, respectively, a decrease of 91% for the 3 months’ period and an increase of 106% for the nine months’ period compared to the 2023 equivalent period.

- Adjusted EBITDAi of $13.5 million for the nine months ended September 30, 2024, an increase of 92% as compared to the nine months ended September 30, 2023.

- In July 2024, the Company paid off the remaining 90% purchase price on the Aframax oil tanker, amounting to $39.5 million, using cash provided by operations, cash on hand and net proceeds from equity offerings.

- The Company recorded a non-cash adjustment of $10.4 million as “Loss on Warrants” for the nine months ended September 30, 2024, which mainly arose due to the change in the fair value of warrants as at September 30, 2024 as compared to the fair value as of their issuance date during Q1 2024.

i TCE, EBITDA, Adjusted EBITDA and Adjusted Net Income are non-GAAP measures. Refer to the reconciliation of these measures to the most directly comparable financial measure in accordance with GAAP set forth later in this release.

Third Quarter 2024 Results:

- Voyage revenues for the three months ended September 30, 2024 amounted to $9.3 million, a decrease of $0.8 million compared to revenues of $10.1 million for the three months ended September 30, 2023, primarily due to the decrease in rates. Total calendar days for our fleet were 368 days for the three months ended September 30, 2024, as compared to 263 days for the same period in 2023. Of the total calendar days in the third quarter of 2024, 245, or 66.6%, were time charter days, as compared to 180 or 68.4% for the same period in 2023. Our fleet utilization was 100.0% and 99.6% for the three months ended September 30, 2024 and 2023 respectively.

- Voyage expenses and vessels’ operating expenses for the three months ended September 30, 2024 were $4.5 million and $2.2 million, compared to $2.8 million and $1.5 million for the three months ended September 30, 2023. The increase in both voyage expenses and vessels’ operating expenses was attributed to the increase in the average number of our vessels. Voyage expenses for the three months ended September 30, 2024 included bunkers cost and port expenses of $1.8 million and $1.5 million, respectively, corresponding to 40% and 33% of total voyage expenses due to the fact that the vessel Afrapearl II operated in the spot market. Operating expenses for the three months ended September 30, 2024 mainly included crew expenses of $1.2 million, corresponding to 55% of total operating expenses, spares and consumables costs of $0.5 million, corresponding to 23% of total vessel operating expenses, and maintenance expenses of $0.2 million, representing works and repairs on the vessels, corresponding to 9% of total vessel operating expenses.

- Depreciation for the three months ended September 30, 2024 was $1.6 million, a $0.2 million increase from $1.4 million for the same period of last year, due to the increase in the average number of our vessels.

- Management fees for the three months ended September 30, 2024 were $0.16 million, a $0.04 million increase from $0.12 million for the same period of last year, due to the increase in the average number of our vessels.

- General and Administrative costs for each of three months’ periods ended September 30, 2024 and 2023 were $0.4 million and were mainly related to expenses incurred as a result of operating as a separate public company.

- Interest and finance costs for the three months ended September 30, 2024 were $0.4 million and mainly related to the accrued interest expense – related party, in connection with the $14.4 million, part of the acquisition price of our bulk carrier, the Eco Spitfire, which is payable by April 2025, while for the three months ended September 30, 2023, $0.6 million related to the accrued interest expense – related party in connection with the $38.7 million, part of the acquisition price of our Aframax tanker, the Afrapearl II, which was completely repaid in July 2024.

- Interest income for the three months ended September 30, 2024 was $0.2 million and related to the interest earned from the time deposits held by the Company.

- Gain on warrants for the three months ended September 30, 2024 was $4.8 million and mainly related to net fair value gains on our Class B-1 and B-2 Warrants and Class C-1 and C-2 warrants which were issued during the first quarter of 2024 in connection with the two public offerings and have been classified as liabilities.

- Adjusted net income was $0.3 million corresponding to an Adjusted EPS, basic of $0.02 for the three months ended September 30, 2024 compared to an Adjusted net income of $3.3 million corresponding to an Adjusted EPS, basic, of $43.00 for the same period of last year.

- Adjusted EBITDA for the three months ended September 30, 2024 and 2023 amounted to $2.2 million and $5.3 million, respectively. Reconciliations of Adjusted Net Income, EBITDA and Adjusted EBITDA to Net Income are set forth below.

- An average of 4.0 vessels were owned by the Company during the three months ended September 30, 2024 compared to 2.9 vessels for the same period in 2023.

Nine months 2024 Results:

- Voyage revenues for the nine months ended September 30, 2024 amounted to $32.9 million, an increase of $17.9 million compared to revenues of $15.0 million for the nine months ended September 30, 2023, primarily due to the increase in the average number of our vessels. Total calendar days for our fleet were 966 days for the nine months ended September 30, 2024, as compared to 625 days for the same period in 2023. Of the total calendar days in the first nine months of 2024, 612 or 63.4%, were time charter days, as compared to 506 or 81.0% for the same period in 2023. Our fleet utilization for the nine months ended September 30, 2024 and 2023 was 99.6% and 99.8%, respectively.

- Voyage expenses and vessels’ operating expenses for the nine months ended September 30, 2024, were $10.4 million and $6.0 million respectively, compared to $3.3 million and $3.3 million for the nine months ended September 30, 2023. The increase in both voyage expenses and vessels’ operating expenses is attributed to the increase in the average number of our vessels. Voyage expenses for the nine months ended September 30, 2024 mainly included bunker costs of $4.9 million, corresponding to 47% of total voyage expenses, and port expenses of $3.4 million, corresponding to 33% of total voyage expenses due to the fact that the vessel Afrapearl II operated in the spot market. Operating expenses for the nine months ended September 30, 2024 mainly included crew expenses of $3.1 million, corresponding to 52% of total operating expenses, spares and consumables costs of $1.3 million, corresponding to 22%, and maintenance expenses of $0.6 million, representing works and repairs on the vessels, corresponding to 10% of total vessel operating expenses.

- Depreciation for the nine months ended September 30, 2024 was $4.6 million, a $1.9 million increase from $2.7 million for the same period of last year, due to the increase in the average number of our vessels.

- Management fees for the nine months ended September 30, 2024 were $0.4 million, a $0.1 million increase from $0.3 million for the same period of last year, due to the increase in the calendar days of our fleet during the current period.

- General and Administrative costs for the nine months ended September 30, 2024 were $2.5 million and mainly related to expenses incurred relating to the two public offerings and the reverse stock split and expenses incurred as a result of operating as a separate public company. General and Administrative costs for the nine months ended September 30, 2023 were $0.9 million.

- Interest and finance costs for the nine months ended September 30, 2024 were $2.1 million and mainly related to the accrued interest expense – related party in connection with the $53.3 million, part of the acquisition prices of our Aframax tanker Afrapearl II, which was completely paid off in July 2024, and of our bulk carrier Eco Spitfire, which is payable by April 2025, while for the nine months ended September 30, 2023 interest and finance costs were $0.6 million related to the accrued interest expense – related party in connection with the $38.7 million, part of the acquisition price of our Aframax tanker Afrapearl II.

- Interest income for the nine months ended September 30, 2024 was $0.8 million and related to the interest earned from the time deposits held by the Company.

- Loss on warrants for the nine months ended September 30, 2024 was $10.4 million and mainly related to the net fair value losses on our Class B-1 and B-2 Warrants and Class C-1 and C-2 warrants which were issued during the first quarter of 2024 in connection with the two public offerings and have been classified as liabilities.

- Adjusted Net Income was $7.7 million corresponding to an Adjusted EPS, basic of $1.06 for the nine months ended September 30, 2024 compared to adjusted net income of $3.7 million, corresponding to an Adjusted EPS, basic of $76.72 for the same period in the last year.

- Adjusted EBITDA for the nine months ended September 30, 2024 and 2023 amounted to $13.5 million and $7.1 million, respectively. Reconciliations of Adjusted Net Income, EBITDA and Adjusted EBITDA to Net Income are set forth below.

- An average of 3.5 vessels were owned by the Company during the nine months ended September 30, 2024 compared to 2.3 vessels for the same period of 2023.

CEO Dr. Diamantis Andriotis commented:

Following the completion of the first 9 months of operations of 2024, C3is has reported Voyage Revenues of $32.9 million – an increase of 119% from 2023, an Adjusted Net Income of $7.7 million – 108% higher than 2023, and an adjusted EBITDA of $13.5 million – 92% higher than 2023.

We have taken delivery of our fourth vessel this year, bringing our total fleet capacity to 213,464 DWT, an increase of 234% from the Company’s inception over a year ago.

In April 2024 we paid off $1.62 million, representing the 10% balance due on the Eco Spitfire, and during the third quarter of 2024, we paid off the remaining balance of $39.5 million due on our Aframax tanker.

We have more than trebled our fleet capacity without incurring any bank debt.

Our strategy of expansion has continuously been bearing fruits, as proven by the results of every single quarter since the Company’s inception.

We will continue to aim at achieving sustainable growth despite the current challenges of macro and micro conditions.

The results of the US elections will have significant implications on the global shipping industry.

The proposed policies of 10% tariff on all U.S. imports and 60% tariff on Chinese products are poised to re-shape trade dynamics, thus affecting shipping.

The industry also faces added uncertainty around the current geopolitical situation, with two major conflicts having a significant impact on shipping markets, combined with the outcome of environmental regulations.

We will closely monitor these evolving situations and maintain an agile and effective control of our business, focusing on maximizing our results.

We will continue to address industry challenges, and will maintain our strategy to provide safe global transportation services in parallel with producing excellent financial performance, attractive returns and growth prospects for our shareholders.

Conference Call details:

On November 18, 2024, at 11:00 am ET, the Company’s management will host a conference call to present the results and the company’s operations and outlook.

Slides and audio webcast:

There will also be a live and then archived webcast of the conference call, through C3is Inc. website (www.c3is.pro). Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

ABOUT C3IS INC.

C3is Inc. is a ship-owning company providing drybulk and crude oil seaborne transportation services. The Company owns four vessels, three Handysize drybulk carriers with a total capacity of 97,664 deadweight tons (dwt) and an Aframax oil tanker with a cargo carrying capacity of approximately 115,800 dwt, resulting in a fleet total capacity of 213,464 dwt. C3is Inc.’s shares of common stock are listed on the Nasdaq Capital Market and trade under the symbol “CISS”.

Forward-Looking Statements

Matters discussed in this release may constitute forward-looking statements. Forward-looking statements reflect our current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events or performance including our intentions relating to fleet growth and diversification and financing, outlook for our shipping sectors and vessel earnings, and our ability to maintain compliance with Nasdaq continued listing requirements, and underlying assumptions and other statements, which are other than statements of historical facts. The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although C3is Inc. believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, C3is Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include risks discussed in our filings with the SEC and the following: the strength of world economies and currencies, general market conditions, including changes in charter hire rates and vessel values, charter counterparty performance, changes in demand that may affect attitudes of time charterers to scheduled and unscheduled drydockings, shipyard performance, changes in C3is Inc.’s operating expenses, including bunker prices, drydocking and insurance costs, ability to fund the remaining purchase price for one of our drybulk vessels, ability to obtain financing and comply with covenants in our financing arrangements, actions taken by regulatory authorities, potential liability from pending or future litigation, domestic and international political conditions, the conflict in Ukraine and related sanctions, the conflict in Israel and Gaza, potential disruption of shipping routes due to ongoing attacks by Houthis in the Red Sea and Gulf of Aden or accidents and political events or acts by terrorists.

Risks and uncertainties are further described in reports filed by C3is INC. with the U.S. Securities and Exchange Commission.

Company Contact:

Nina Pyndiah

Chief Financial Officer

C3is INC.

00-30-210-6250-001

E-mail: info@c3is.pro

Fleet Data:

The following key indicators highlight the Company’s operating performance during the periods ended September 30, 2023 and September 30, 2024

| FLEET DATA | Q3 2023 | Q3 2024 | 9M 2023 | 9M 2024 |

| Average number of vessels (1) | 2.86 | 4.00 | 2.29 | 3.53 |

| Period end number of owned vessels in fleet | 3 | 4 | 3 | 4 |

| Total calendar days for fleet (2) | 263 | 368 | 625 | 966 |

| Total voyage days for fleet (3) | 262 | 368 | 624 | 962 |

| Fleet utilization (4) | 99.6% | 100.0% | 99.8% | 99.6% |

| Total charter days for fleet (5) | 180 | 245 | 506 | 612 |

| Total spot market days for fleet (6) | 82 | 123 | 118 | 350 |

| Fleet operational utilization (7) | 98.5% | 90.2% | 93.6% | 90.3% |

1) Average number of vessels is the number of owned vessels that constituted our fleet for the relevant period, as measured by the sum of the number of days each vessel was a part of our fleet during the period divided by the number of calendar days in that period.

2) Total calendar days for fleet are the total days the vessels we operated were in our possession for the relevant period including off-hire days associated with repairs, drydockings or special or intermediate surveys.

3) Total voyage days for fleet reflect the total days the vessels we operated were in our possession for the relevant period net of off-hire days associated with repairs, drydockings or special or intermediate surveys.

4) Fleet utilization is the percentage of time that our vessels were available for revenue generating voyage days, and is determined by dividing voyage days by fleet calendar days for the relevant period.

5) Total charter days for fleet are the number of voyage days the vessels operated on time or bareboat charters for the relevant period.

6) Total spot market charter days for fleet are the number of voyage days the vessels operated on spot market charters for the relevant period.

7) Fleet operational utilization is the percentage of time that our vessels generated revenue, and is determined by dividing voyage days excluding commercially idle days by fleet calendar days for the relevant period.

Reconciliation of Adjusted Net Income, EBITDA, adjusted EBITDA and adjusted EPS:

Adjusted net income represents net income/(loss) before gain/(loss) on warrants and share based compensation. EBITDA represents net income/(loss) before interest and finance costs, interest income and depreciation. Adjusted EBITDA represents net income/(loss) before interest and finance costs, interest income, depreciation, gain/(loss) on warrants and share based compensation.

Adjusted EPS represents Adjusted net income divided by the weighted average number of shares. EBITDA, adjusted EBITDA, adjusted net income and adjusted EPS are not recognized measurements under U.S. GAAP. Our calculation of EBITDA, adjusted EBITDA, adjusted net income and adjusted EPS may not be comparable to that reported by other companies in the shipping or other industries. In evaluating Adjusted EBITDA, Adjusted net income and Adjusted EPS, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation.

EBITDA, adjusted EBITDA, adjusted net income and adjusted EPS are included herein because they are a basis, upon which we and our investors assess our financial performance. They allow us to present our performance from period to period on a comparable basis and provide investors with a means of better evaluating and understanding our operating performance.

| (Expressed in United States Dollars, except number of shares) |

Third Quarter Ended September 30th, | Nine-Month Period Ended September 30th, | ||

| 2023 | 2024 | 2023 | 2024 | |

| Net Income/(Loss) – Adjusted Net Income | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| (Less)/Plus (gain)/loss on warrants | — | (4,825,723) | — | 10,350,813 |

| Plus share based compensation | — | 78,149 | — | 204,629 |

| Adjusted Net Income | 3,331,044 | 326,989 | 3,719,169 | 7,659,673 |

| Net Income/(Loss) – EBITDA | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| Plus interest and finance costs | 620,282 | 443,387 | 621,011 | 2,143,810 |

| Less interest income | — | (176,333) | — | (818,900) |

| Plus depreciation | 1,382,297 | 1,625,471 | 2,722,425 | 4,552,180 |

| EBITDA | 5,333,623 | 6,967,088 | 7,062,605 | 2,981,321 |

| Net Income/(Loss) – Adjusted EBITDA | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| (Less)/Plus (gain)/loss on warrants | — | (4,825,723) | — | 10,350,813 |

| Plus share based compensation | — | 78,149 | — | 204,629 |

| Plus interest and finance costs | 620,282 | 443,387 | 621,011 | 2,143,810 |

| Less interest income | — | (176,333) | — | (818,900) |

| Plus depreciation | 1,382,297 | 1,625,471 | 2,722,425 | 4,552,180 |

| Adjusted EBITDA | 5,333,623 | 2,219,514 | 7,062,605 | 13,536,763 |

| EPS | ||||

| Numerator | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| Less: Cumulative dividends on preferred shares | (191,667) | (191,667) | (212,500) | (570,833) |

| Less: Undistributed earnings allocate to non-vested shares | — | (41,432) | — | — |

| Less: Down round deemed dividend on Series A Perpetual Convertible Preferred Shares | — | — | — | (2,862,000) |

| Net income/(loss) attributable to common shareholders, basic | 3,139,377 | 4,841,464 | 3,506,669 | (6,328,602) |

| Denominator | ||||

| Weighted average number of shares | 73,012 | 6,974,686 | 45,706 | 3,955,613 |

| EPS – Basic | 43.00 | 0.69 | 76.72 | (1.60) |

| Adjusted EPS | ||||

| Numerator | ||||

| Adjusted net income | 3,331,044 | 326,989 | 3,719,169 | 7,659,673 |

| Less: Cumulative dividends on preferred shares | (191,667) | (191,667) | (212,500) | (570,833) |

| Less: Undistributed earnings allocated to non-vested shares | — | (1,148) | — | (26,884) |

| Less: Down round deemed dividend on Series A Perpetual Convertible Preferred Shares | — | — | — | (2,862,000) |

| Adjusted net income attributable to common shareholders, basic | 3,139,377 | 134,174 | 3,506,669 | 4,199,956 |

| Denominator | ||||

| Weighted average number of shares | 73,012 | 6,974,686 | 45,706 | 3,955,613 |

| Adjusted EPS, Basic | 43.00 | 0.02 | 76.72 | 1.06 |

Reconciliation of TCE:

Time Charter Equivalent rate or “TCE” rate is determined by dividing voyage revenue net of voyage expenses by voyage days for the relevant time period. TCE is a non-GAAP measure which provides additional meaningful information in conjunction with voyage revenues, the most directly comparable GAAP measure to Time charter equivalent revenues assisting the Company’s management in making decisions regarding the deployment and use of its vessels and in evaluating their financial performance. TCE is also a standard shipping industry performance measure used primarily to compare period-to-period changes in a shipping company’s performance despite changes in the mix of charter types (i.e., spot charters or time charters, but not bareboat charters) under which the vessels may be employed between the periods. TCE assists our investors to assess our financial performance from period to period on a comparable basis and provide investors with a means of better evaluating and understanding our operating performance.

| (Expressed in U.S. Dollars except for available days and Time charter equivalent rate) | ||||

| Q3 2023 | Q3 2024 | 9M 2023 | 9M 2024 | |

| Voyage revenues | 10,107,108 | 9,265,750 | 14,962,205 | 32,884,955 |

| Voyage expenses | 2,796,633 | 4,450,905 | 3,255,260 | 10,426,879 |

| Time charter equivalent revenues | 7,310,475 | 4,814,845 | 11,706,945 | 22,458,076 |

| Total voyage days for fleet | 262 | 368 | 624 | 962 |

| Time charter equivalent rate | 27,903 | 13,084 | 18,761 | 23,345 |

C3is Inc.

Unaudited Condensed Consolidated Statements of Operations

(Expressed in United States Dollars, except for number of shares)

| Q3 2023 | Q3 2024 | 9M 2023 | 9M 2024 | ||

| Revenues | |||||

| Revenues | 10,107,108 | 9,265,750 | 14,962,205 | 32,884,955 | |

| Total revenues | 10,107,108 | 9,265,750 | 14,962,205 | 32,884,955 | |

| Expenses | |||||

| Voyage expenses | 2,685,556 | 4,342,258 | 3,085,246 | 10,022,393 | |

| Voyage expenses – related party | 111,077 | 108,647 | 170,014 | 404,486 | |

| Vessels’ operating expenses | 1,441,088 | 2,198,105 | 3,281,260 | 5,928,676 | |

| Vessels’ operating expenses – related party | 21,750 | 37,500 | 51,750 | 104,667 | |

| Drydocking costs | 10,238 | — | 184,387 | — | |

| Management fees – related party | 115,280 | 161,920 | 274,560 | 425,040 | |

| General and administrative expenses | 283,037 | 267,267 | 822,523 | 2,150,779 | |

| General and administrative expenses – related party | 107,716 | 128,868 | 33,497 | 354,313 | |

| Depreciation | 1,382,297 | 1,625,471 | 2,722,425 | 4,552,180 | |

| Total expenses | 6,158,039 | 8,870,036 | 10,625,662 | 23,942,534 | |

| Income from operations | 3,949,069 | 395,714 | 4,336,543 | 8,942,421 | |

| Other (expenses)/income | |||||

| Interest and finance costs | (562) | (2,638) | (1,291) | (11,230) | |

| Interest and finance costs – related party | (619,720) | (440,749) | (619,720) | (2,132,580) | |

| Interest income | — | 176,333 | — | 818,900 | |

| Foreign exchange gain/(loss) | 2,257 | 120,180 | 3,637 | (162,467) | |

| Gain/(loss) on warrants | — | 4,825,723 | — | (10,350,813) | |

| Other (expenses)/income, net | (618,025) | 4,678,849 | (617,374) | (11,838,190) | |

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) | |

| Earnings/(Loss) per share (ii) | |||||

| – Basic | 43.00 | 0.69 | 76.72 | (1.60) | |

| – Diluted | 15.43 | 0.01 | 19.72 | (1.60) | |

| Weighted average number of shares | |||||

| – Basic | 73,012 | 6,974,686 | 45,706 | 3,955,613 | |

| – Diluted | 215,869 | 19,078,149 | 188,563 | 3,955,613 | |

ii The computation of earnings per share gives retroactive effect to the shares issued in connection with the spin-off of our company from Imperial Petroleum Inc. in June 2023 and to the reverse stock split effected in April 2024.

C3is Inc.

Unaudited Condensed Consolidated Balance Sheets

(Expressed in United States Dollars)

| December 31, | September 30, | ||||||

| 2023 | 2024 | ||||||

| Assets | |||||||

| Current assets | |||||||

| Cash and cash equivalents | 695,288 | 8,016,402 | |||||

| Time deposits | 8,368,417 | — | |||||

| Trade and other receivables | 10,443,497 | 1,998,276 | |||||

| Other current assets | 33,846 | 21,158 | |||||

| Inventories | 689,269 | 851,481 | |||||

| Due from related parties | — | 2,685,061 | |||||

| Advances and prepayments | 80,267 | 9,699 | |||||

| Operating lease right-of-use assets | — | 43,821 | |||||

| Total current assets | 20,310,584 | 13,625,898 | |||||

| Non current assets | |||||||

| Vessels, net | 75,161,431 | 85,775,276 | |||||

| Total non current assets | 75,161,431 | 85,775,276 | |||||

| Total assets | 95,472,015 | 99,401,174 | |||||

| Liabilities and Stockholders’ Equity | |||||||

| Current liabilities | |||||||

| Trade accounts payable | 547,017 | 1,436,876 | |||||

| Payable to related parties | 38,531,016 | 14,550,185 | |||||

| Accrued and other liabilities | 634,297 | 1,695,528 | |||||

| Operating lease liabilities | — | 43,821 | |||||

| Deferred income | 215,836 | 741,700 | |||||

| Total current liabilities | 39,928,166 | 18,468,110 | |||||

| Non current liabilities | |||||||

| Warrant liability | — | 9,660,770 | |||||

| Total non current liabilities | — | 9,660,770 | |||||

| Total liabilities | 39,928,166 | 28,128,880 | |||||

| Commitments and contingencies | |||||||

| Stockholders’ equity | |||||||

| Capital stock | 874 | 105,976 | |||||

| Preferred stock, Series A | 6,000 | 6,000 | |||||

| Additional paid-in capital | 47,191,056 | 69,143,001 | |||||

| Retained earnings | 8,345,919 | 2,017,317 | |||||

| Total stockholders’ equity | 55,543,849 | 71,272,294 | |||||

| Total liabilities and stockholders’ equity | 95,472,015 | 99,401,174 | |||||

C3is Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(Expressed in United States Dollars)

| 9M 2023 | 9M 2024 | ||||||||

| Cash flows from operating activities | |||||||||

| Net income/(loss) for the period | 3,719,169 | (2,895,769) | |||||||

| Adjustments to reconcile net income/(loss) to net cash | |||||||||

| provided by operating activities: | |||||||||

| Depreciation | 2,722,425 | 4,552,180 | |||||||

| Share based compensation | — | 204,629 | |||||||

| Unrealized foreign exchange loss on time deposits | — | 156,921 | |||||||

| Loss on warrants | — | 10,350,813 | |||||||

| Non-cash lease expense | — | 18,369 | |||||||

| Offering costs attributable to warrant liability | — | 1,078,622 | |||||||

| Changes in operating assets and liabilities: | |||||||||

| (Increase)/decrease in | |||||||||

| Trade and other receivables | (2,466,091) | 8,445,221 | |||||||

| Other current assets | (112,776) | 12,688 | |||||||

| Inventories | (1,896,180) | (162,212) | |||||||

| Advances and prepayments | 17,943 | 70,568 | |||||||

| Increase/(decrease) in | |||||||||

| Trade accounts payable | 140,386 | 889,859 | |||||||

| Changes in operating lease liabilities | — | (18,369) | |||||||

| Due from related party | — | (2,846,961) | |||||||

| Due to related parties | 2,900,843 | (1,231,831) | |||||||

| Accrued liabilities | 371,148 | 1,061,231 | |||||||

| Deferred income | — | 525,864 | |||||||

| Net cash provided by operating activities | 5,396,867 | 20,211,823 | |||||||

| Cash flows from investing activities | |||||||||

| Cash outflows related to vessel acquisitions | (4,300,000) | (1,623,125) | |||||||

| Increase in bank time deposits | — | (20,001,175) | |||||||

| Maturity of bank time deposits | — | 28,212,671 | |||||||

| Net cash (used in)/ provided by investing activities | (4,300,000) | 6,588,371 | |||||||

| Cash flows from financing activities | |||||||||

| Net transfers from former Parent Company | 3,305,083 | — | |||||||

| Proceeds from follow-on offerings | 5,003,250 | 13,147,990 | |||||||

| Proceeds from exercise of warrants | — | 5,852,396 | |||||||

| Stock issuance costs | (455,847) | (1,778,633) | |||||||

| Dividends paid on preferred shares | — | (570,833) | |||||||

| Repayment of seller financing | — | (36,130,000) | |||||||

| Net cash provided by/ (used in) financing activities | 7,852,486 | (19,479,080) | |||||||

| Net increase in cash and cash equivalents | 8,949,353 | 7,321,114 | |||||||

| Cash and cash equivalents at beginning of period | — | 695,288 | |||||||

| Cash and cash equivalents at end of period | 8,949,353 | 8,016,402 | |||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.