Stock market today: Dow slips, Nasdaq edges higher as Tesla shines

US stocks traded mixed on Monday amid fading optimism for interest-rate cuts, as investors looked ahead to Nvidia (NVDA) earnings to test the health of the AI trade.

The Dow Jones Industrial Average (^DJI) slipped roughly 0.2%, while the S&P 500 (^GSPC) was broadly flat. The tech-heavy Nasdaq Composite (^IXIC) rose 0.1%, buoyed by a jump in Tesla (TSLA) stock.

Stocks are starting the week on the back foot as the prospect of higher-for-longer rates holds post-election bullishness in check. The S&P 500 has reversed half of its Trump-fueled rally after sharp weekly losses for the major gauges, led by tech.

Signs of a robust economy, combined with comments from Federal Reserve Chair Jerome Powell, have prompted investors to downsize expectations for rate cuts. After the big macro and political events of recent days, the week brings few economic releases seen as likely to reset those calculations.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

Given that, eyes are now on Nvidia’s results on Wednesday for insight into the strength of the AI trade, which has helped drive the S&P 500’s gains over the past year. Production of its flagship Blackwell chip is in focus, especially after The Information reported the next-generation AI chip has run into problems with overheating. Nvidia shares were down nearly 3% in early trading.

Elsewhere in tech, EV maker Tesla’s shares rose more than 6% in the wake of a Bloomberg report that President-elect Donald Trump’s team is looking to ease US rules for self-driving vehicles.

Wall Street continues to monitor Trump’s picks for his cabinet, after his choice of Robert F. Kennedy Jr for top health official rattled vaccine stocks. The incoming president has named Brendan Carr, a critic of Big Techs such as Meta and Apple, as chairman of the Federal Communications Commission. The wait is now on to learn who will win the frenzied race to become Trump’s Treasury Secretary.

Meanwhile, bitcoin (BTC-USD) — a key Trump trade — has rebounded from its biggest retreat since the election at the weekend. The cryptocurrency was trading above $90,000 on Monday.

LIVE 4 updatesCybersecurity Gets A Boost: BlackBerry, Canada, And TMU Team Up To Fortify ASEAN's Digital Defenses

BlackBerry Limited BB, in partnership with the Canadian government and the Toronto Metropolitan University, launched a cybersecurity training initiative in Southeast Asia, backed by a C$3.9 million ($2.7 million) investment.

Canada’s support, delivered through BlackBerry in partnership with TMU’s Rogers Cybersecure Catalyst, aims to train 3,500 cyber-defenders from Malaysia and other ASEAN countries.

This initiative strengthens global public-private collaboration against rising digital threats, aligns with Canada’s Indo-Pacific strategy, and positions Malaysia as a regional hub for cybersecurity excellence in Southeast Asia.

Canada’s support will enhance the Malaysia Cybersecurity Center of Excellence (CCoE) in Cyberjaya with a comprehensive cybersecurity curriculum, including programs for women.

The initiative aims to prepare talent for high-demand cybersecurity roles, position the CCoE as a regional hub, and strengthen government and industry capabilities to address cyber threats and safeguard national security.

BlackBerry CEO John Giamatteo commented, “As the beating heart of the region’s cyber-threat defense capabilities, this world-class facility helps train and upskill Malaysian and regional cyber workforces, and is also an international destination to address emerging cyber threats and coordinate regional incident response.”

“In a growing digital economy, no matter how advanced your cybersecurity arsenal is, nations must have a well-trained cyber-workforce to bolster their front lines of defense.”

The Rt. Hon. Justin Trudeau, Prime Minister of Canada said, “With our government’s investment in Malaysia’s Cybersecurity Center of Excellence in collaboration with BlackBerry, Canada will share cyber-expertise, train the cyber workforce across ASEAN countries, increase public-private sector collaboration, and strengthen our collective capacity to counter, deter and respond to cyber threats.”

This month, the company announced that Hyundai Mobis has selected BlackBerry QNX to power its next-generation digital cockpit platform.

Hyundai Mobis will use BlackBerry’s QNX Hypervisor for Safety and QNX Advanced Virtualization Frameworks (QAVF) for its next-generation digital cockpit platform.

Last month, the company announced details of profitability for its IoT and Cybersecurity divisions, including strategic options for the Cylance business.

Price Action: BB shares are up 0.42% at $2.37 premarket at the last check Monday.

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

C3is Inc. reports third quarter and nine months 2024 financial and operating results

ATHENS, Greece, Nov. 18, 2024 (GLOBE NEWSWIRE) — C3is Inc. CISS (the “Company”), a ship-owning company providing dry bulk and tanker seaborne transportation services, announced today its unaudited financial and operating results for the third quarter and nine months ended September 30, 2024.

OPERATIONAL AND FINANCIAL HIGHLIGHTS

- Our handysize dry bulk carriers are on time charters of short term durations, producing steady cash flows, while our Aframax tanker operates in the spot market, currently achieving voyage charter rates of around $48,000 per day.

- All our handysize dry bulk carriers and our Aframax tanker are unencumbered.

- Fleet operational utilization of 90.2% for the three months ended September 30, 2024, mainly due to the commercial idle days of the vessel that operated in the spot market, as our vessels that operated under time charter employment had few commercial idle days.

- Revenues of $9.3 million for the three months ended September 30, 2024, corresponding to a daily TCE I of $13,084.

- 24% increase in daily TCE for the nine months ended September 30, 2024, as compared to the nine months ended September 30, 2023.

- Net Income of $5.1 million, EBITDAi of $7.0 million and Basic EPS of $0.69 for the three months ended September 30, 2024.

- Net Loss of $2.9 million, EBITDA of $3.0 million and Basic Loss per Share of $1.60 for the nine months ended September 30, 2024.

- Adjusted net incomei of $0.3 million and $7.7 million for the three and nine months ended September 30, 2024, respectively, a decrease of 91% for the 3 months’ period and an increase of 106% for the nine months’ period compared to the 2023 equivalent period.

- Adjusted EBITDAi of $13.5 million for the nine months ended September 30, 2024, an increase of 92% as compared to the nine months ended September 30, 2023.

- In July 2024, the Company paid off the remaining 90% purchase price on the Aframax oil tanker, amounting to $39.5 million, using cash provided by operations, cash on hand and net proceeds from equity offerings.

- The Company recorded a non-cash adjustment of $10.4 million as “Loss on Warrants” for the nine months ended September 30, 2024, which mainly arose due to the change in the fair value of warrants as at September 30, 2024 as compared to the fair value as of their issuance date during Q1 2024.

i TCE, EBITDA, Adjusted EBITDA and Adjusted Net Income are non-GAAP measures. Refer to the reconciliation of these measures to the most directly comparable financial measure in accordance with GAAP set forth later in this release.

Third Quarter 2024 Results:

- Voyage revenues for the three months ended September 30, 2024 amounted to $9.3 million, a decrease of $0.8 million compared to revenues of $10.1 million for the three months ended September 30, 2023, primarily due to the decrease in rates. Total calendar days for our fleet were 368 days for the three months ended September 30, 2024, as compared to 263 days for the same period in 2023. Of the total calendar days in the third quarter of 2024, 245, or 66.6%, were time charter days, as compared to 180 or 68.4% for the same period in 2023. Our fleet utilization was 100.0% and 99.6% for the three months ended September 30, 2024 and 2023 respectively.

- Voyage expenses and vessels’ operating expenses for the three months ended September 30, 2024 were $4.5 million and $2.2 million, compared to $2.8 million and $1.5 million for the three months ended September 30, 2023. The increase in both voyage expenses and vessels’ operating expenses was attributed to the increase in the average number of our vessels. Voyage expenses for the three months ended September 30, 2024 included bunkers cost and port expenses of $1.8 million and $1.5 million, respectively, corresponding to 40% and 33% of total voyage expenses due to the fact that the vessel Afrapearl II operated in the spot market. Operating expenses for the three months ended September 30, 2024 mainly included crew expenses of $1.2 million, corresponding to 55% of total operating expenses, spares and consumables costs of $0.5 million, corresponding to 23% of total vessel operating expenses, and maintenance expenses of $0.2 million, representing works and repairs on the vessels, corresponding to 9% of total vessel operating expenses.

- Depreciation for the three months ended September 30, 2024 was $1.6 million, a $0.2 million increase from $1.4 million for the same period of last year, due to the increase in the average number of our vessels.

- Management fees for the three months ended September 30, 2024 were $0.16 million, a $0.04 million increase from $0.12 million for the same period of last year, due to the increase in the average number of our vessels.

- General and Administrative costs for each of three months’ periods ended September 30, 2024 and 2023 were $0.4 million and were mainly related to expenses incurred as a result of operating as a separate public company.

- Interest and finance costs for the three months ended September 30, 2024 were $0.4 million and mainly related to the accrued interest expense – related party, in connection with the $14.4 million, part of the acquisition price of our bulk carrier, the Eco Spitfire, which is payable by April 2025, while for the three months ended September 30, 2023, $0.6 million related to the accrued interest expense – related party in connection with the $38.7 million, part of the acquisition price of our Aframax tanker, the Afrapearl II, which was completely repaid in July 2024.

- Interest income for the three months ended September 30, 2024 was $0.2 million and related to the interest earned from the time deposits held by the Company.

- Gain on warrants for the three months ended September 30, 2024 was $4.8 million and mainly related to net fair value gains on our Class B-1 and B-2 Warrants and Class C-1 and C-2 warrants which were issued during the first quarter of 2024 in connection with the two public offerings and have been classified as liabilities.

- Adjusted net income was $0.3 million corresponding to an Adjusted EPS, basic of $0.02 for the three months ended September 30, 2024 compared to an Adjusted net income of $3.3 million corresponding to an Adjusted EPS, basic, of $43.00 for the same period of last year.

- Adjusted EBITDA for the three months ended September 30, 2024 and 2023 amounted to $2.2 million and $5.3 million, respectively. Reconciliations of Adjusted Net Income, EBITDA and Adjusted EBITDA to Net Income are set forth below.

- An average of 4.0 vessels were owned by the Company during the three months ended September 30, 2024 compared to 2.9 vessels for the same period in 2023.

Nine months 2024 Results:

- Voyage revenues for the nine months ended September 30, 2024 amounted to $32.9 million, an increase of $17.9 million compared to revenues of $15.0 million for the nine months ended September 30, 2023, primarily due to the increase in the average number of our vessels. Total calendar days for our fleet were 966 days for the nine months ended September 30, 2024, as compared to 625 days for the same period in 2023. Of the total calendar days in the first nine months of 2024, 612 or 63.4%, were time charter days, as compared to 506 or 81.0% for the same period in 2023. Our fleet utilization for the nine months ended September 30, 2024 and 2023 was 99.6% and 99.8%, respectively.

- Voyage expenses and vessels’ operating expenses for the nine months ended September 30, 2024, were $10.4 million and $6.0 million respectively, compared to $3.3 million and $3.3 million for the nine months ended September 30, 2023. The increase in both voyage expenses and vessels’ operating expenses is attributed to the increase in the average number of our vessels. Voyage expenses for the nine months ended September 30, 2024 mainly included bunker costs of $4.9 million, corresponding to 47% of total voyage expenses, and port expenses of $3.4 million, corresponding to 33% of total voyage expenses due to the fact that the vessel Afrapearl II operated in the spot market. Operating expenses for the nine months ended September 30, 2024 mainly included crew expenses of $3.1 million, corresponding to 52% of total operating expenses, spares and consumables costs of $1.3 million, corresponding to 22%, and maintenance expenses of $0.6 million, representing works and repairs on the vessels, corresponding to 10% of total vessel operating expenses.

- Depreciation for the nine months ended September 30, 2024 was $4.6 million, a $1.9 million increase from $2.7 million for the same period of last year, due to the increase in the average number of our vessels.

- Management fees for the nine months ended September 30, 2024 were $0.4 million, a $0.1 million increase from $0.3 million for the same period of last year, due to the increase in the calendar days of our fleet during the current period.

- General and Administrative costs for the nine months ended September 30, 2024 were $2.5 million and mainly related to expenses incurred relating to the two public offerings and the reverse stock split and expenses incurred as a result of operating as a separate public company. General and Administrative costs for the nine months ended September 30, 2023 were $0.9 million.

- Interest and finance costs for the nine months ended September 30, 2024 were $2.1 million and mainly related to the accrued interest expense – related party in connection with the $53.3 million, part of the acquisition prices of our Aframax tanker Afrapearl II, which was completely paid off in July 2024, and of our bulk carrier Eco Spitfire, which is payable by April 2025, while for the nine months ended September 30, 2023 interest and finance costs were $0.6 million related to the accrued interest expense – related party in connection with the $38.7 million, part of the acquisition price of our Aframax tanker Afrapearl II.

- Interest income for the nine months ended September 30, 2024 was $0.8 million and related to the interest earned from the time deposits held by the Company.

- Loss on warrants for the nine months ended September 30, 2024 was $10.4 million and mainly related to the net fair value losses on our Class B-1 and B-2 Warrants and Class C-1 and C-2 warrants which were issued during the first quarter of 2024 in connection with the two public offerings and have been classified as liabilities.

- Adjusted Net Income was $7.7 million corresponding to an Adjusted EPS, basic of $1.06 for the nine months ended September 30, 2024 compared to adjusted net income of $3.7 million, corresponding to an Adjusted EPS, basic of $76.72 for the same period in the last year.

- Adjusted EBITDA for the nine months ended September 30, 2024 and 2023 amounted to $13.5 million and $7.1 million, respectively. Reconciliations of Adjusted Net Income, EBITDA and Adjusted EBITDA to Net Income are set forth below.

- An average of 3.5 vessels were owned by the Company during the nine months ended September 30, 2024 compared to 2.3 vessels for the same period of 2023.

CEO Dr. Diamantis Andriotis commented:

Following the completion of the first 9 months of operations of 2024, C3is has reported Voyage Revenues of $32.9 million – an increase of 119% from 2023, an Adjusted Net Income of $7.7 million – 108% higher than 2023, and an adjusted EBITDA of $13.5 million – 92% higher than 2023.

We have taken delivery of our fourth vessel this year, bringing our total fleet capacity to 213,464 DWT, an increase of 234% from the Company’s inception over a year ago.

In April 2024 we paid off $1.62 million, representing the 10% balance due on the Eco Spitfire, and during the third quarter of 2024, we paid off the remaining balance of $39.5 million due on our Aframax tanker.

We have more than trebled our fleet capacity without incurring any bank debt.

Our strategy of expansion has continuously been bearing fruits, as proven by the results of every single quarter since the Company’s inception.

We will continue to aim at achieving sustainable growth despite the current challenges of macro and micro conditions.

The results of the US elections will have significant implications on the global shipping industry.

The proposed policies of 10% tariff on all U.S. imports and 60% tariff on Chinese products are poised to re-shape trade dynamics, thus affecting shipping.

The industry also faces added uncertainty around the current geopolitical situation, with two major conflicts having a significant impact on shipping markets, combined with the outcome of environmental regulations.

We will closely monitor these evolving situations and maintain an agile and effective control of our business, focusing on maximizing our results.

We will continue to address industry challenges, and will maintain our strategy to provide safe global transportation services in parallel with producing excellent financial performance, attractive returns and growth prospects for our shareholders.

Conference Call details:

On November 18, 2024, at 11:00 am ET, the Company’s management will host a conference call to present the results and the company’s operations and outlook.

Slides and audio webcast:

There will also be a live and then archived webcast of the conference call, through C3is Inc. website (www.c3is.pro). Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

ABOUT C3IS INC.

C3is Inc. is a ship-owning company providing drybulk and crude oil seaborne transportation services. The Company owns four vessels, three Handysize drybulk carriers with a total capacity of 97,664 deadweight tons (dwt) and an Aframax oil tanker with a cargo carrying capacity of approximately 115,800 dwt, resulting in a fleet total capacity of 213,464 dwt. C3is Inc.’s shares of common stock are listed on the Nasdaq Capital Market and trade under the symbol “CISS”.

Forward-Looking Statements

Matters discussed in this release may constitute forward-looking statements. Forward-looking statements reflect our current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events or performance including our intentions relating to fleet growth and diversification and financing, outlook for our shipping sectors and vessel earnings, and our ability to maintain compliance with Nasdaq continued listing requirements, and underlying assumptions and other statements, which are other than statements of historical facts. The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although C3is Inc. believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, C3is Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include risks discussed in our filings with the SEC and the following: the strength of world economies and currencies, general market conditions, including changes in charter hire rates and vessel values, charter counterparty performance, changes in demand that may affect attitudes of time charterers to scheduled and unscheduled drydockings, shipyard performance, changes in C3is Inc.’s operating expenses, including bunker prices, drydocking and insurance costs, ability to fund the remaining purchase price for one of our drybulk vessels, ability to obtain financing and comply with covenants in our financing arrangements, actions taken by regulatory authorities, potential liability from pending or future litigation, domestic and international political conditions, the conflict in Ukraine and related sanctions, the conflict in Israel and Gaza, potential disruption of shipping routes due to ongoing attacks by Houthis in the Red Sea and Gulf of Aden or accidents and political events or acts by terrorists.

Risks and uncertainties are further described in reports filed by C3is INC. with the U.S. Securities and Exchange Commission.

Company Contact:

Nina Pyndiah

Chief Financial Officer

C3is INC.

00-30-210-6250-001

E-mail: info@c3is.pro

Fleet Data:

The following key indicators highlight the Company’s operating performance during the periods ended September 30, 2023 and September 30, 2024

| FLEET DATA | Q3 2023 | Q3 2024 | 9M 2023 | 9M 2024 |

| Average number of vessels (1) | 2.86 | 4.00 | 2.29 | 3.53 |

| Period end number of owned vessels in fleet | 3 | 4 | 3 | 4 |

| Total calendar days for fleet (2) | 263 | 368 | 625 | 966 |

| Total voyage days for fleet (3) | 262 | 368 | 624 | 962 |

| Fleet utilization (4) | 99.6% | 100.0% | 99.8% | 99.6% |

| Total charter days for fleet (5) | 180 | 245 | 506 | 612 |

| Total spot market days for fleet (6) | 82 | 123 | 118 | 350 |

| Fleet operational utilization (7) | 98.5% | 90.2% | 93.6% | 90.3% |

1) Average number of vessels is the number of owned vessels that constituted our fleet for the relevant period, as measured by the sum of the number of days each vessel was a part of our fleet during the period divided by the number of calendar days in that period.

2) Total calendar days for fleet are the total days the vessels we operated were in our possession for the relevant period including off-hire days associated with repairs, drydockings or special or intermediate surveys.

3) Total voyage days for fleet reflect the total days the vessels we operated were in our possession for the relevant period net of off-hire days associated with repairs, drydockings or special or intermediate surveys.

4) Fleet utilization is the percentage of time that our vessels were available for revenue generating voyage days, and is determined by dividing voyage days by fleet calendar days for the relevant period.

5) Total charter days for fleet are the number of voyage days the vessels operated on time or bareboat charters for the relevant period.

6) Total spot market charter days for fleet are the number of voyage days the vessels operated on spot market charters for the relevant period.

7) Fleet operational utilization is the percentage of time that our vessels generated revenue, and is determined by dividing voyage days excluding commercially idle days by fleet calendar days for the relevant period.

Reconciliation of Adjusted Net Income, EBITDA, adjusted EBITDA and adjusted EPS:

Adjusted net income represents net income/(loss) before gain/(loss) on warrants and share based compensation. EBITDA represents net income/(loss) before interest and finance costs, interest income and depreciation. Adjusted EBITDA represents net income/(loss) before interest and finance costs, interest income, depreciation, gain/(loss) on warrants and share based compensation.

Adjusted EPS represents Adjusted net income divided by the weighted average number of shares. EBITDA, adjusted EBITDA, adjusted net income and adjusted EPS are not recognized measurements under U.S. GAAP. Our calculation of EBITDA, adjusted EBITDA, adjusted net income and adjusted EPS may not be comparable to that reported by other companies in the shipping or other industries. In evaluating Adjusted EBITDA, Adjusted net income and Adjusted EPS, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation.

EBITDA, adjusted EBITDA, adjusted net income and adjusted EPS are included herein because they are a basis, upon which we and our investors assess our financial performance. They allow us to present our performance from period to period on a comparable basis and provide investors with a means of better evaluating and understanding our operating performance.

| (Expressed in United States Dollars, except number of shares) |

Third Quarter Ended September 30th, | Nine-Month Period Ended September 30th, | ||

| 2023 | 2024 | 2023 | 2024 | |

| Net Income/(Loss) – Adjusted Net Income | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| (Less)/Plus (gain)/loss on warrants | — | (4,825,723) | — | 10,350,813 |

| Plus share based compensation | — | 78,149 | — | 204,629 |

| Adjusted Net Income | 3,331,044 | 326,989 | 3,719,169 | 7,659,673 |

| Net Income/(Loss) – EBITDA | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| Plus interest and finance costs | 620,282 | 443,387 | 621,011 | 2,143,810 |

| Less interest income | — | (176,333) | — | (818,900) |

| Plus depreciation | 1,382,297 | 1,625,471 | 2,722,425 | 4,552,180 |

| EBITDA | 5,333,623 | 6,967,088 | 7,062,605 | 2,981,321 |

| Net Income/(Loss) – Adjusted EBITDA | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| (Less)/Plus (gain)/loss on warrants | — | (4,825,723) | — | 10,350,813 |

| Plus share based compensation | — | 78,149 | — | 204,629 |

| Plus interest and finance costs | 620,282 | 443,387 | 621,011 | 2,143,810 |

| Less interest income | — | (176,333) | — | (818,900) |

| Plus depreciation | 1,382,297 | 1,625,471 | 2,722,425 | 4,552,180 |

| Adjusted EBITDA | 5,333,623 | 2,219,514 | 7,062,605 | 13,536,763 |

| EPS | ||||

| Numerator | ||||

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) |

| Less: Cumulative dividends on preferred shares | (191,667) | (191,667) | (212,500) | (570,833) |

| Less: Undistributed earnings allocate to non-vested shares | — | (41,432) | — | — |

| Less: Down round deemed dividend on Series A Perpetual Convertible Preferred Shares | — | — | — | (2,862,000) |

| Net income/(loss) attributable to common shareholders, basic | 3,139,377 | 4,841,464 | 3,506,669 | (6,328,602) |

| Denominator | ||||

| Weighted average number of shares | 73,012 | 6,974,686 | 45,706 | 3,955,613 |

| EPS – Basic | 43.00 | 0.69 | 76.72 | (1.60) |

| Adjusted EPS | ||||

| Numerator | ||||

| Adjusted net income | 3,331,044 | 326,989 | 3,719,169 | 7,659,673 |

| Less: Cumulative dividends on preferred shares | (191,667) | (191,667) | (212,500) | (570,833) |

| Less: Undistributed earnings allocated to non-vested shares | — | (1,148) | — | (26,884) |

| Less: Down round deemed dividend on Series A Perpetual Convertible Preferred Shares | — | — | — | (2,862,000) |

| Adjusted net income attributable to common shareholders, basic | 3,139,377 | 134,174 | 3,506,669 | 4,199,956 |

| Denominator | ||||

| Weighted average number of shares | 73,012 | 6,974,686 | 45,706 | 3,955,613 |

| Adjusted EPS, Basic | 43.00 | 0.02 | 76.72 | 1.06 |

Reconciliation of TCE:

Time Charter Equivalent rate or “TCE” rate is determined by dividing voyage revenue net of voyage expenses by voyage days for the relevant time period. TCE is a non-GAAP measure which provides additional meaningful information in conjunction with voyage revenues, the most directly comparable GAAP measure to Time charter equivalent revenues assisting the Company’s management in making decisions regarding the deployment and use of its vessels and in evaluating their financial performance. TCE is also a standard shipping industry performance measure used primarily to compare period-to-period changes in a shipping company’s performance despite changes in the mix of charter types (i.e., spot charters or time charters, but not bareboat charters) under which the vessels may be employed between the periods. TCE assists our investors to assess our financial performance from period to period on a comparable basis and provide investors with a means of better evaluating and understanding our operating performance.

| (Expressed in U.S. Dollars except for available days and Time charter equivalent rate) | ||||

| Q3 2023 | Q3 2024 | 9M 2023 | 9M 2024 | |

| Voyage revenues | 10,107,108 | 9,265,750 | 14,962,205 | 32,884,955 |

| Voyage expenses | 2,796,633 | 4,450,905 | 3,255,260 | 10,426,879 |

| Time charter equivalent revenues | 7,310,475 | 4,814,845 | 11,706,945 | 22,458,076 |

| Total voyage days for fleet | 262 | 368 | 624 | 962 |

| Time charter equivalent rate | 27,903 | 13,084 | 18,761 | 23,345 |

C3is Inc.

Unaudited Condensed Consolidated Statements of Operations

(Expressed in United States Dollars, except for number of shares)

| Q3 2023 | Q3 2024 | 9M 2023 | 9M 2024 | ||

| Revenues | |||||

| Revenues | 10,107,108 | 9,265,750 | 14,962,205 | 32,884,955 | |

| Total revenues | 10,107,108 | 9,265,750 | 14,962,205 | 32,884,955 | |

| Expenses | |||||

| Voyage expenses | 2,685,556 | 4,342,258 | 3,085,246 | 10,022,393 | |

| Voyage expenses – related party | 111,077 | 108,647 | 170,014 | 404,486 | |

| Vessels’ operating expenses | 1,441,088 | 2,198,105 | 3,281,260 | 5,928,676 | |

| Vessels’ operating expenses – related party | 21,750 | 37,500 | 51,750 | 104,667 | |

| Drydocking costs | 10,238 | — | 184,387 | — | |

| Management fees – related party | 115,280 | 161,920 | 274,560 | 425,040 | |

| General and administrative expenses | 283,037 | 267,267 | 822,523 | 2,150,779 | |

| General and administrative expenses – related party | 107,716 | 128,868 | 33,497 | 354,313 | |

| Depreciation | 1,382,297 | 1,625,471 | 2,722,425 | 4,552,180 | |

| Total expenses | 6,158,039 | 8,870,036 | 10,625,662 | 23,942,534 | |

| Income from operations | 3,949,069 | 395,714 | 4,336,543 | 8,942,421 | |

| Other (expenses)/income | |||||

| Interest and finance costs | (562) | (2,638) | (1,291) | (11,230) | |

| Interest and finance costs – related party | (619,720) | (440,749) | (619,720) | (2,132,580) | |

| Interest income | — | 176,333 | — | 818,900 | |

| Foreign exchange gain/(loss) | 2,257 | 120,180 | 3,637 | (162,467) | |

| Gain/(loss) on warrants | — | 4,825,723 | — | (10,350,813) | |

| Other (expenses)/income, net | (618,025) | 4,678,849 | (617,374) | (11,838,190) | |

| Net income/(loss) | 3,331,044 | 5,074,563 | 3,719,169 | (2,895,769) | |

| Earnings/(Loss) per share (ii) | |||||

| – Basic | 43.00 | 0.69 | 76.72 | (1.60) | |

| – Diluted | 15.43 | 0.01 | 19.72 | (1.60) | |

| Weighted average number of shares | |||||

| – Basic | 73,012 | 6,974,686 | 45,706 | 3,955,613 | |

| – Diluted | 215,869 | 19,078,149 | 188,563 | 3,955,613 | |

ii The computation of earnings per share gives retroactive effect to the shares issued in connection with the spin-off of our company from Imperial Petroleum Inc. in June 2023 and to the reverse stock split effected in April 2024.

C3is Inc.

Unaudited Condensed Consolidated Balance Sheets

(Expressed in United States Dollars)

| December 31, | September 30, | ||||||

| 2023 | 2024 | ||||||

| Assets | |||||||

| Current assets | |||||||

| Cash and cash equivalents | 695,288 | 8,016,402 | |||||

| Time deposits | 8,368,417 | — | |||||

| Trade and other receivables | 10,443,497 | 1,998,276 | |||||

| Other current assets | 33,846 | 21,158 | |||||

| Inventories | 689,269 | 851,481 | |||||

| Due from related parties | — | 2,685,061 | |||||

| Advances and prepayments | 80,267 | 9,699 | |||||

| Operating lease right-of-use assets | — | 43,821 | |||||

| Total current assets | 20,310,584 | 13,625,898 | |||||

| Non current assets | |||||||

| Vessels, net | 75,161,431 | 85,775,276 | |||||

| Total non current assets | 75,161,431 | 85,775,276 | |||||

| Total assets | 95,472,015 | 99,401,174 | |||||

| Liabilities and Stockholders’ Equity | |||||||

| Current liabilities | |||||||

| Trade accounts payable | 547,017 | 1,436,876 | |||||

| Payable to related parties | 38,531,016 | 14,550,185 | |||||

| Accrued and other liabilities | 634,297 | 1,695,528 | |||||

| Operating lease liabilities | — | 43,821 | |||||

| Deferred income | 215,836 | 741,700 | |||||

| Total current liabilities | 39,928,166 | 18,468,110 | |||||

| Non current liabilities | |||||||

| Warrant liability | — | 9,660,770 | |||||

| Total non current liabilities | — | 9,660,770 | |||||

| Total liabilities | 39,928,166 | 28,128,880 | |||||

| Commitments and contingencies | |||||||

| Stockholders’ equity | |||||||

| Capital stock | 874 | 105,976 | |||||

| Preferred stock, Series A | 6,000 | 6,000 | |||||

| Additional paid-in capital | 47,191,056 | 69,143,001 | |||||

| Retained earnings | 8,345,919 | 2,017,317 | |||||

| Total stockholders’ equity | 55,543,849 | 71,272,294 | |||||

| Total liabilities and stockholders’ equity | 95,472,015 | 99,401,174 | |||||

C3is Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(Expressed in United States Dollars)

| 9M 2023 | 9M 2024 | ||||||||

| Cash flows from operating activities | |||||||||

| Net income/(loss) for the period | 3,719,169 | (2,895,769) | |||||||

| Adjustments to reconcile net income/(loss) to net cash | |||||||||

| provided by operating activities: | |||||||||

| Depreciation | 2,722,425 | 4,552,180 | |||||||

| Share based compensation | — | 204,629 | |||||||

| Unrealized foreign exchange loss on time deposits | — | 156,921 | |||||||

| Loss on warrants | — | 10,350,813 | |||||||

| Non-cash lease expense | — | 18,369 | |||||||

| Offering costs attributable to warrant liability | — | 1,078,622 | |||||||

| Changes in operating assets and liabilities: | |||||||||

| (Increase)/decrease in | |||||||||

| Trade and other receivables | (2,466,091) | 8,445,221 | |||||||

| Other current assets | (112,776) | 12,688 | |||||||

| Inventories | (1,896,180) | (162,212) | |||||||

| Advances and prepayments | 17,943 | 70,568 | |||||||

| Increase/(decrease) in | |||||||||

| Trade accounts payable | 140,386 | 889,859 | |||||||

| Changes in operating lease liabilities | — | (18,369) | |||||||

| Due from related party | — | (2,846,961) | |||||||

| Due to related parties | 2,900,843 | (1,231,831) | |||||||

| Accrued liabilities | 371,148 | 1,061,231 | |||||||

| Deferred income | — | 525,864 | |||||||

| Net cash provided by operating activities | 5,396,867 | 20,211,823 | |||||||

| Cash flows from investing activities | |||||||||

| Cash outflows related to vessel acquisitions | (4,300,000) | (1,623,125) | |||||||

| Increase in bank time deposits | — | (20,001,175) | |||||||

| Maturity of bank time deposits | — | 28,212,671 | |||||||

| Net cash (used in)/ provided by investing activities | (4,300,000) | 6,588,371 | |||||||

| Cash flows from financing activities | |||||||||

| Net transfers from former Parent Company | 3,305,083 | — | |||||||

| Proceeds from follow-on offerings | 5,003,250 | 13,147,990 | |||||||

| Proceeds from exercise of warrants | — | 5,852,396 | |||||||

| Stock issuance costs | (455,847) | (1,778,633) | |||||||

| Dividends paid on preferred shares | — | (570,833) | |||||||

| Repayment of seller financing | — | (36,130,000) | |||||||

| Net cash provided by/ (used in) financing activities | 7,852,486 | (19,479,080) | |||||||

| Net increase in cash and cash equivalents | 8,949,353 | 7,321,114 | |||||||

| Cash and cash equivalents at beginning of period | — | 695,288 | |||||||

| Cash and cash equivalents at end of period | 8,949,353 | 8,016,402 | |||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer Surges In Monday Pre-Market Amid Delisting Concerns: What's Happening?

Shares of Super Micro Computer Inc. SMCI experienced a significant rise of 13.94% during pre-market trading on Monday, as per Benzinga Pro. This surge comes as the company faces potential delisting from the Nasdaq Stock Market.

What Happened: Super Micro is preparing to submit a proposal to Nasdaq to avoid delisting. The company, which has seen considerable success due to the AI boom, is under scrutiny regarding its operations. The proposal is expected to be submitted by Monday, aiming to maintain its trading status on the exchange, Barron’s reported on Monday.

The delisting threat arises from concerns over the company’s operations, despite its recent achievements in the artificial intelligence sector. By taking proactive steps, Super Micro hopes to avert the delisting risk and continue benefiting from the AI industry’s growth.

Why It Matters: The potential delisting of Super Micro is linked to serious issues, including the resignation of its auditor, Ernst & Young, amid allegations of accounting irregularities and possible export control violations. Delisting could trigger an early repayment of up to $1.725 billion in bonds, posing a significant financial challenge for the company.

Furthermore, Super Micro is approaching a critical Nasdaq deadline, with its future potentially hinging on the upcoming earnings report from Nvidia Corp. NVDA. The server manufacturer, once a key player in Nvidia’s AI-driven success, now faces uncertainty as it navigates these challenges. The outcome of Nvidia’s earnings could provide insight into whether Super Micro can stabilize its situation or face further difficulties.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bioactive Protein and Peptide Sales is Estimated to Grow at $172.86 Billion by 2034, with a 9.3% CAGR | Fact.MR Report

Rockville, MD , Nov. 18, 2024 (GLOBE NEWSWIRE) — According to a newly published research report by Fact.MR, a market research and competitive intelligence provider, the global bioactive protein and peptide market is projected to touch a valuation of US$ 70.75 billion in 2024 and is further forecasted to expand at a CAGR of 9.3% over the next ten years.

The growing demand for nutraceuticals and functional food products from consumers who are seeking products that offer health benefits beyond basic nutrition is a key trend in the bioactive protein and peptide market. Due to their ability to improve well-being, prevent disease, and manage medical difficulties, these foods and supplements are becoming more popular in several countries. Bioactive proteins and peptides, which are well-known for their abilities to improve immunological health, increase cardiovascular function, and facilitate muscle recovery, are being added to these products to enhance them.

Click to Request a Sample of this Report for Additional Market Insights

https://www.factmr.com/connectus/sample?flag=S&rep_id=10375

High consumer demand for functional foods and sports nutrition is driving up demand for bioactive proteins and peptides in the North American region. The market is expanding in East Asia at a high pace due to the increasing interest of more people in sports and fitness activities.

Key Takeaways from the Bioactive Protein and Peptide Market Study:

Key Takeaways from the Bioactive Protein and Peptide Market Study:

- The global market for bioactive proteins and peptides is evaluated to touch US$ 172.86 billion by the end of 2034. North America is projected to hold 24.3% of the worldwide market share by 2034.

- In 2024, the East Asia market is estimated to reach a value of US$ 15.85 billion. In East Asia, China is approximated to account for 48.9% of the revenue share in 2024. Worldwide sales of plant-based bioactive proteins and peptides are evaluated to increase at 9.3% CAGR through 2034.

- Demand for bioactive proteins and peptides in Japan is projected to reach US$ 11.74 billion by the end of 2034. Based on application, the functional food segment is analyzed to account for a 29.5% revenue share in 2024.

“Prominent manufacturing companies are investing in R&D activities to expand their product portfolio which will be suited for several applications including dietary supplements, sports nutrition, functional food, nutraceuticals, and others,” says a Fact.MR analyst

Leading Players Driving Innovation in the Bioactive Protein and Peptide Market:

Kerry Group; Archer Daniels Midland Company (ADM); Royal DSM; Bunge Ltd.; Cargill Inc.; Omega Protein Corporation; CHS Inc.; Fonterra Co-operative Group Ltd.; E.I. Du Pont De Nemours and Company; Seagarden AS; BCN Peptides; Selecta Biosciences; Natural Factors Inc.; Gelita AG.

High Consumers Preference for Plant-based Bioactive Proteins and Peptides:

The preference for plant-based bioactive proteins and peptides is high among more consumers globally as they are believed to be more sustainable and environment-friendly. Because of this, a growing number of customers favor peptide and bioactive products made from plants. Aside from this, they satisfy a variety of dietary requirements, including those of vegans, lactose-intolerant individuals, and individuals with allergies to animal proteins.

Plant-based proteins have no negative effects on animal welfare and a lower risk of allergenicity. These benefits are making plant-based bioactive proteins and peptides more appealing to consumers around the world.

Bioactive Protein and Peptide Industry News & Trends:

In December 2023, Gelita introduced PeptEndure, a novel bioactive collagen peptide, as a “training partner” for athletes.

Nuritas and Maastricht University published clinical studies in February 2023 that demonstrated the effectiveness of PeptiStrong, the company’s plant-based bioactive peptide solution. PeptiStrong used precision technology to extract bioactive peptides from fava beans, making it a “game-changing” solution for muscle health.

In this new market analysis, Fact.MR offers comprehensive information on the pricing points of major producers of bioactive proteins and peptides located worldwide, as well as sales growth, production capacity, and potential technological expansion.

Get a Custom Analysis for Targeted Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10375

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the bioactive protein and peptide market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on source (plant [cereals, legumes {soy protein concentrates, soy protein isolates, textured soy protein}, pseudo cereals, brassicaceae species], animal [dairy products {whey, casein, milk protein concentrate}, egg & meat, gelatine, fish & insects, seafood]) and application (functional food, functional beverages, dietary supplements, animal nutrition, personal care), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Discover Additional Market Insights from Fact.MR Research:

Bio-active Peptide Market projects US$ 4,45 mn valuation by 2034. Milk Peptides account for US$ 755.8 mn in 2024 & holds 28.6% of the global share.

Egg White Peptide Market is valued at US$ 23.61 billion in 2023. The global sales are forecasted to reach US$ 40.33 billion by 2033.

Marine Peptides Market is currently valued at US$ 273.8 million in 2023. The global revenue are projected to reach US$ 481.7 million by 2033.

Crocodile Peptide Market to witness steady growth by 2032. Raising awareness about the health benefits of protein is fuelling the demand for Crocodile Peptide.

Skin Bioactive Ingredients Market is forecast to grow at 7.2% CAGR, reaching a US$ 17,737 Mn valuation by 2034. U.S. projects $3,195 Mn valuation.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

US Sales Office: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asset Managers Bet Grid Stocks to Defy Trump’s Anti-ESG Era

(Bloomberg) — After watching wind and solar stocks plummet in the hours after Donald Trump’s election victory, asset managers are zeroing in on a corner of the green transition they say will defy the president-elect’s anti-ESG agenda: the grid.

Most Read from Bloomberg

One day after the election, analysts at TD Securities told clients that grids and the equipment needed to build them now represent one of “the best-positioned energy transition sub-sectors.”

It’s a call that’s already paying off. Since the Nov. 5 election, a key stock-market gauge of the equipment that goes into grids is up about 6%, while the broader S&P Global Clean Energy Index has lost roughly a tenth of its value. In the same period, the S&P 500 is up about 1.5%.

Suppliers in Asia and Europe that get sizable chunks of their revenue from the American market also have rallied, with Japan’s Hitachi Ltd. up more than 6% since the election.

Money managers say investing in US power and grids is a way to dodge the fallout of tariffs that will hurt other sectors. And as Trump’s protectionist policies look set to force more manufacturing back into the US, American demand for energy is set to soar, adding to the investment case.

“We’re really bullish on US power demand,” says Ran Zhou, portfolio manager at New York-based hedge fund Electron Capital Partners LLC. “And associated with that is long-term carbon-free energy.”

Companies developing grid equipment that have seen their share prices rise since the Nov. 5 election include Eaton Corp., Rockwell Automation Inc. and Ametek Inc., which are all up more than 6%. Emerson Electric Co. has added more than 7%.

Companies tied to electrical grids were already outperforming other corners of the green sector well before the US election, with the NASDAQ OMX Clean Edge Smart Grid Infrastructure Index up 20% last year. But a bigger US-based manufacturing sector driven by Trump’s tariffs looks set to trigger a new growth wave for US grid stocks, according to asset managers interviewed by Bloomberg.

Trump has made clear he wants to rescind unspent funds from the Biden administration’s signature climate law, the 2022 Inflation Reduction Act. And his pro-fossil fuel stance has fueled a panic among green investors that a Trump White House will stunt the development of renewable energy projects in the US.

But at the same time, the president-elect has promised US companies access to cheap electricity, something which analysts say isn’t possible without building out renewables.

Preview: XP's Earnings

XP XP is set to give its latest quarterly earnings report on Tuesday, 2024-11-19. Here’s what investors need to know before the announcement.

Analysts estimate that XP will report an earnings per share (EPS) of $0.39.

The announcement from XP is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

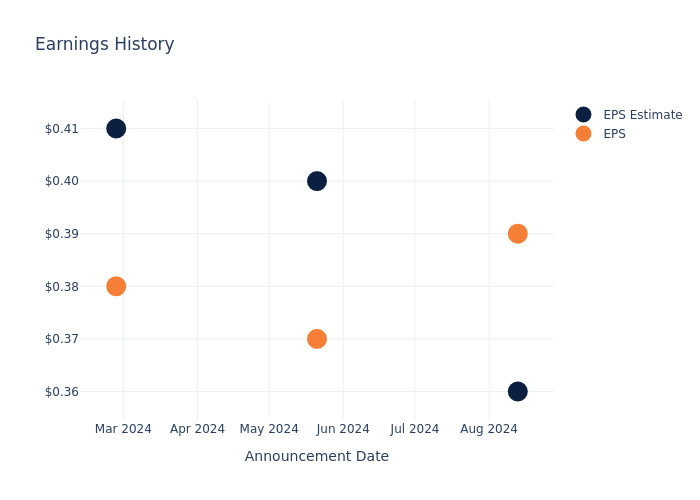

Historical Earnings Performance

The company’s EPS beat by $0.03 in the last quarter, leading to a 6.18% increase in the share price on the following day.

Here’s a look at XP’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.36 | 0.40 | 0.41 | 0.410 |

| EPS Actual | 0.39 | 0.37 | 0.38 | 0.402 |

| Price Change % | 6.0% | -16.0% | -4.0% | 1.0% |

XP Share Price Analysis

Shares of XP were trading at $16.63 as of November 15. Over the last 52-week period, shares are down 27.38%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for XP visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer: Super Group Finally 'Broke Out,' This Basic Materials Stock Is 'Very Hard To Own Here'

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said he has been behind Block, Inc. SQ for a long time. He added, “This stock has now had a major move at last, and it’s not done.”

On Nov. 7, Block reported worse-than-expected third-quarter revenue results.

Cramer said although Northern Trust NTRS is “very good,” but BlackRock BLK is better than it.

On Oct. 23, Northern Trust reported better-than-expected third-quarter financial results.

Dow DOW is “very hard to own here,” Cramer said. “Dow has to do an upside surprise.”

On Nov. 8, Piper Sandler analyst Charles Neivert maintained Dow with an Overweight and lowered the price target from $62 to $60.

Super Group Ltd. SGHC finally “broke out,” the Mad Money host said.

On Nov. 6, Super Group posted third-quarter revenue of €402.9 million and profit of €8.5 million.

Cramer said Sprouts Farmers Market, Inc. SFM is a “quality operator.”

On Oct. 30, Sprouts Farmers Market reported better-than-expected third-quarter financial results and issued fourth-quarter adjusted EPS guidance above estimates.

Price Action:

- Block shares rose 1.1% to settle at $84.30 on Friday.

- Northern Trust shares gained 1.6% to close at $107.60.

- Dow shares fell 1.2% to settle at $44.04 during the session.

- Super Group shares gained 1% to close at $5.32 on Friday.

- Sprouts Farmers Market shares gained 0.1% to settle at $142.00 during the session.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.