Slate Office REIT Announces Changes to Board of Trustees

TORONTO, Nov. 18, 2024 /CNW/ – Slate Office REIT SOT (the “REIT”), an owner and operator of commercial real estate, today announced the appointment of George Armoyan as Chair of the Board of Trustees (the “Board”) as well as the addition of Shant Poladian to the Board. Sam Altman has stepped down as Chair and has also resigned as a Trustee. The REIT wishes to thank Mr. Altman for his prior service.

“It has been a busy year for the REIT, and it has become clear that a successful turnaround requires a new strategic direction. As Chair, I will be working closely with the Board on the restructuring of the REIT and internalization of management.”, commented Mr. Armoyan.

Shant Poladian will assist the REIT with the internalization of management of the REIT following the previously announced process to terminate the REIT’s management agreement with its external manager, Slate Management ULC.

Mr. Poladian has been actively involved as a senior real estate and capital markets professional for more than two decades. Mr. Poladian has served on the Board of Trustees of Killam Apartment REIT since 2023. He is Managing Director of Springhurst Capital Corp, a real estate advisory firm, and CEO/co-founder of Junction Realty Partners Inc., a boutique developer of mini-midrise rental apartments in Toronto. Previously, Mr. Poladian was the Chief Executive Officer of FAM REIT, the predecessor to Slate Office REIT. Mr. Poladian holds a Bachelor of Commerce degree from the University of Toronto and is a professional accountant in both Canada (CPA-CA Ontario) and the United States (CPA – Delaware).

“I look forward to working with George and the Board to re-imagine and execute a brighter future for the REIT. As an internally managed REIT, we expect that the REIT will be better aligned to drive value going forward,” commented Mr. Poladian.

About Slate Office REIT SOT

The REIT owns and operates a portfolio of well-located commercial real estate assets in North America and Europe. The majority of the REIT’s portfolio is comprised of government and high-quality credit tenants. Visit slateofficereit.com to learn more.

Forward-Looking Statements

Certain information herein constitutes “forward-looking information” as defined under Canadian securities laws which reflect management’s expectations regarding objectives, plans, goals, strategies, future growth, results of operations, performance, business prospects and opportunities of the REIT. The words “plans”, “expects”, “does not expect”, “scheduled”, “estimates”, “intends”, “anticipates”, “does not anticipate”, “projects”, “believes”, or variations of such words and phrases or statements to the effect that certain actions, events or results “may”, “will”, “could”, “would”, “might”, “occur”, “be achieved”, or “continue” and similar expressions identify forward-looking statements. Such statements in this news release may include, without limitation, statements pertaining to: the restructuring of the REIT, the internalization of management, and the REIT’s improved alignment to drive value going forward. Such forward-looking statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations.

Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by management as of the date hereof, are inherently subject to significant business, economic and competitive uncertainties and contingencies. When relying on forward-looking statements to make decisions, the REIT cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties and should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not the times at or by which such performance or results will be achieved. A number of factors could cause actual results to differ, possibly materially, from the results discussed in the forward-looking statements, including those risks and uncertainties relating to: the REIT’s need for additional funding in the near term and amendments to its existing indebtedness in order to continue as a going concern as further described under the heading “Risks and Uncertainties” in the REIT’s management’s discussion and analysis for the period ending September 30, 2024, available on SEDAR+ at www.sedarplus.ca under the REIT’s issuer profile; and other risks and uncertainties contained in the filings of the REIT with securities regulators on SEDAR+.

SOT-SA

SOURCE Slate Office REIT

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/18/c0162.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/18/c0162.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Treasure Global Inc. Reports First Quarter Fiscal Year 2025 Financial Results

NEW YORK and KUALA LUMPUR, Malaysia, Nov. 18, 2024 (GLOBE NEWSWIRE) — Treasure Global Inc. TGL (“Treasure Global” or the “Company”), a leading e-commerce platform operator, had on November 14, 2024 announced its financial results for the first quarter ended September 30, 2024.

Key Financial Highlights

- Revenue for the first quarter was $207,371, compared to $13.46 million for the prior year’s quarter, reflecting the Company’s ongoing pivot toward high-margin business models and deliberate scaling down of low-margin operations. This strategic pivot is expected to benefit long-term revenue quality and stability.

- Gross profit improved by 6% to $172,172, with the gross profit margin soaring to 83.0% compared to 1.2% in the prior year’s quarter, underscoring the Company’s strategic focus on operational efficiency and high-value revenue streams.

- Operating loss reduced by 58% to $811,677, compared to $1.92 million in the same quarter last year.

- Net loss narrowed significantly to $950,707, a 55% reduction from the prior year’s quarter to $2.13 million, reflecting the Company’s ongoing cost optimization and restructuring initiatives.

- Loss per share improved significantly from $(7.83) in the prior year’s quarter to $(0.35) this quarter, highlighting substantial progress in financial health.

Management Commentary

“Our strategic realignment continues to progress, with a focus on optimizing operations and pursuing higher-margin activities,” said Carlson Thow, CEO of Treasure Global. “While we navigate a transitional phase reflected in our revenue performance, the steady gross profit margin and narrowing net losses underscore the positive impact of our restructuring efforts. Our focus on targeted efficiencies and the shift to higher-value business streams positions us to seize future opportunities with greater agility. We are committed to refining our operations, positioning the business model against these key elements, and exploring opportunities that align with achieving our long-term goals.”

Operational Updates

Treasure Global’s transformation efforts continue to focus on enhancing core profitability and streamlining its business operations. The improved gross profit margin underscores management’s strategic shift toward higher-value revenue streams and better cost management. As part of its restructuring efforts, the Company is actively restructuring its product offerings and business model to align with evolving market demands. This includes exploring strategic partnerships and new ventures to accelerate its transition to a more resilient and sustainable growth trajectory.

Business Outlook

Treasure Global anticipates that the next quarter will continue to reflect the transitional phase of its operations as the Company remains committed to prioritizing cost efficiencies and focusing on higher-margin business lines. Management is dedicated to executing its strategic realignment with an emphasis on long-term profitability and sustainability. With over 2.9 million registered users, the Company aims to enhance the functionality of the ZCITY App and introduce innovative features to drive user engagement, leveraging its strengths to capture market opportunities in Malaysia and Southeast Asia. While revenue remains reflective of this transition, the Company will focus on meeting key operational milestones to build a stronger foundation for future growth.

In addition to its core e-commerce platform, Treasure Global is actively exploring other initiatives to drive growth and diversification. These efforts are expected to further strengthen Treasure Global’s market position and support its transition to a more robust and enduring growth path.

About Treasure Global Inc:

Treasure Global is a leading Malaysian solutions provider developing innovative technology platforms. The Company operates the ZCITY Super App, a unique digital ecosystem designed to simplify e-payment experiences while rewarding consumers. As of November 14, 2024, ZCITY boasts over 2.9 million registered users.

For more information, please visit: https://treasureglobal.co

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements reflect the Company’s current expectations, assumptions, and projections about future events and are subject to risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Forward-looking statements typically include terminology such as “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” or similar expressions.

Factors that could cause actual results to differ materially include, without limitation, the Company’s ability to expand its e-commerce platform, customer acceptance of new products and services, changes in economic conditions affecting its operations, the impact of global health crises, supply chain disruptions, competition, and regulatory risks related to data privacy and security. These risks, along with other factors, are discussed in more detail in the Company’s filings with the U.S. Securities and Exchange Commission.

The forward-looking statements in this press release speak only as of the date hereof. The Company assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

CONTACT

Investor and media contact:

Chin Sook Lee

Chief Financial Officer

Treasure Global Inc.

ir_us@treasuregroup.co

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This ETF, Which Allows You To Invest In SpaceX, Surges Nearly 13% In Premarket After Trump Appoints Pro-Starlink Brendan Carr

Destiny Tech100 Inc. DXYZ saw a 12.89% rise in its value during Monday’s premarket after President-elect Donald Trump appointed pro-Starlink Republican Brendan Carr as the new chairperson of the Federal Communications Commission (FCC).

What Happened: The investment firm, Destiny Tech100, primarily focuses on private technology companies, with its largest holding being SpaceX, which constitutes 37.6% of its portfolio. The firm also invests in other space exploration entities like Axiom Space and Relativity Space, but SpaceX remains its most significant asset.

On Sunday, Trump announced Carr’s appointment, highlighting Carr’s commitment to free speech and his opposition to regulatory measures that hinder economic growth. Trump stated that Carr would work to eliminate regulatory barriers affecting American innovators and job creators, particularly in rural areas.

See Also: What’s Going On With Palantir Technologies Stock Today?

Carr, known for his support of Elon Musk‘s Starlink, previously criticized the FCC’s decision to deny nearly $900 million in subsidies to Starlink. He argued that the FCC’s actions were part of a broader trend of administrative agencies targeting Musk’s ventures, especially after his acquisition of Twitter (now X), allegedly under President Joe Biden‘s directives.

Why It Matters: The surge in Destiny Tech100’s stock is part of a broader trend of increased investor interest following Trump’s recent election victory. The company’s shares have climbed over 300% in the past week, reflecting heightened market attention. Destiny Tech100 Inc. is a closed-end management investment firm that invests in private technology companies such as SpaceX, OpenAI, and Epic Games.

Last Friday, SpaceX president Gwynne Shotwell quipped that the next four years might see more than 400 Starship launches, as per Bloomberg. Meanwhile, SpaceX is reportedly preparing to initiate a tender offer next month for the sale of existing shares at $135 each and valuing the company at over $250 billion.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo by Wirestock Creators on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walmart stock set for best year since 1999 as profits jump

By Juveria Tabassum

(Reuters) – Walmart (WMT) shares are set for their best yearly gains in over two decades as the retail behemoth’s low prices for everyday essentials give it an edge over competitors facing weak demand from budget-conscious consumers.

The stock has gained about 60% so far this year, outstripping gains of about 13% in the S&P 500 Consumer Staples sector index, as well as a 21% rise in the S&P 500 Consumer Discretionary index.

Rival Target’s shares are up about 7% this year, while the benchmark S&P 500 (^GSPC) has risen 23%.

The stock jumped 106% in 1998 when the company was expanding its supercenter store format, and solidifying its position in Canada and Mexico.

The record jump was sandwiched between a roughly 70% rise in Walmart’s stock price in 1997 and 1999.

“Organic growth along with a strong balance sheet and low levels of debt make Walmart a very popular stock right now,” said Brian Mulberry, client portfolio manager at Zacks Investment Management.

Walmart is set to report its third-quarter results on Tuesday, Nov. 19, and is expected to post a roughly 4% rise in revenue and 5% growth in adjusted operating income, according to estimates compiled by LSEG.

The retail bellwether has started to benefit from investments in its ecommerce and advertising businesses that have helped the company grow its operating income at a faster clip than its revenue.

The company has invested billions over the last few years on automation in its supply chain to help stock fresher produce at its stores and improve delivery times as consumers increasingly prefer the convenience of purchasing groceries online.

“Walmart is just increasing its addressable market. Their execution has been great, especially against Amazon, which does not have its logistics networks built out in rural parts of America like Walmart does,” said David Wagner, head of equities and portfolio manager at Aptus Capital Advisors.

Walmart has also focused on high-margin revenue streams such as its marketplace and retail media units to support steady demand for lower-priced essentials at it supercenters.

Growth in Walmart’s advertising and membership segments accounted for more than 50% of its operating income growth in the second quarter, CFO John Rainey said on a post-earnings call in August.

While Walmart’s advertising business, which was launched in 2019, is at a much more nascent stage than powerhouse Amazon, the grocer has been seeing strong growth in the unit over the last few quarters, outpacing gains at Amazon’s more diverse platform.

(Reporting by Juveria Tabassum; Editing by Aishwarya Venugopal and Devika Syamnath)

Bit Digital, Inc. Announces Third Quarter of Fiscal Year 2024 Financial Results

NEW YORK, Nov. 18, 2024 /PRNewswire/ — Bit Digital, Inc. BTBT (the “Company”), a global platform for high-performance computing (“HPC”) infrastructure and digital asset production headquartered in New York City, today announced its unaudited financial results for the Third Quarter ended September 30, 2024.

Financial Highlights for the Third Quarter of 2024

- Total revenue was $22.7 million for the Third Quarter of 2024, a 96% increase compared to the Third Quarter of 2023. The increase was primarily driven by the commencement of our high performance computing services (“HPC”) business.

- Revenue from bitcoin mining was $10.1 million for the Third Quarter of 2024, an 11% decrease compared to the prior year’s quarter. The Company’s HPC recognized $12.2 million of revenue during the quarter compared to nil the prior year.

- The Company had cash, cash equivalents and restricted cash of $105.6 million, and total liquidity (defined as cash, cash equivalents and restricted cash, USDC, and the fair market value of digital assets) of approximately $223.6 million[1], as of September 30, 2024.

- Total assets were $376.0 million and Shareholders’ Equity amounted to $315.0 million as of September 30, 2024.

- Adjusted EBITDA[2] was $(21.8) million for the Third Quarter of 2024 compared to $(2.9) million for the Third Quarter of 2023. Adjusted EBITDA includes a $21.9 million unrealized loss on digital assets.

- GAAP loss per share was $0.26 on a fully diluted basis for the Third Quarter of 2024 compared to a loss per share of $0.08 for the Third Quarter of 2023.

Operational Highlights for the Third Quarter of 2024

- The Company earned 165.4 bitcoins during the Third Quarter of 2024, a 59% decrease from the prior year. The decline was primarily driven by a reduction in block rewards following the halving event in April 2024 and by an increase in network difficulty, and partially offset by a 104% increase in the Company’s operational hash rate.

- The Company paid approximately $0.057 per kilowatt hour to its hosting partners for electricity consumed during the Third Quarter of 2024.

- The average fleet efficiency for the active fleet was approximately 27.8 J/TH as of September 30, 2024.

- The Company earned 161.9 ETH from native staking in the Third Quarter of 2024.

- Treasury holdings of BTC and ETH were 731.1 and 27,388.1, respectively, with a fair market value of approximately $46.3 million and $71.3 million on September 30, 2024, respectively.

- The BTC equivalent[3] of our digital asset holdings as of September 30, 2024 (defined as if all ETH and USDC holdings were converted into BTC as of that date) was approximately 1,863 BTC1, or approximately $118.0 million.

- As of September 30, 2024, we had 50,044 miners owned or operating (in Iceland) for bitcoin mining with a total maximum hash rate of 4.3 EH/s.

- The Company’s active hash rate of its bitcoin mining fleet was approximately 2.4 EH/s as of September 30, 2024.

- Approximately 88% of our fleet’s run-rate electricity consumption was generated from carbon-free energy sources as of September 30, 2024. These figures are based on data provided by our hosts, publicly available sources, and internal estimates, demonstrating our commitment to sustainable practices in the digital asset mining industry.

- The Company had approximately 21,568 ETH actively staked in native staking protocols as of September 30, 2024.

- On August 19, 2024, Bit Digital announced that it had signed a binding term sheet with Boosteroid Inc. (“Boosteroid”), the world’s third-largest cloud gaming provider. Upon signing a Master Service and Lease Agreement (“MSA”), Boosteroid will place an initial purchase for a starting quantity of GPU servers with a five-year service duration. Bit Digital will provide Boosteroid with options to draw down additional servers in multiples of 100, up to a total of 50,000 GPU servers within five years after signing the MSA, depending on their deployment plans and subject to market conditions. The entire 50,000 GPU deployment represents an aggregate revenue opportunity to Bit Digital in excess of $700 million over the five-year term. Bit Digital announced it had executed the MSA with Boosteroid on November 4, 2024. The Company finalized an initial purchase order with Boosteroid for a starting quantity of 300 GPUs that are expected to generate approximately $4.6 million of revenue over the five-year term. The Company anticipates additional deployments through the end of 2024 and throughout 2025.

- September 5, 2024, the Company received a 90-days notice of non-renewal of colocation mining services agreement from Coinmint, which informed the Company of its intent not to renew 27 MW of the 36 MW total contracted capacity at its Massena, New York site, effective December 7, 2024. Subsequently, on October 29, 2024, the Company received an additional 90-days notice of non-renewal of colocation mining services agreement from Coinmint, which informed the Company of its intent to not renew the remaining 9 MW of the 36 MW total contracted capacity at its Massena, New York site, effective January 28, 2024. Following the termination, Coinmint will continue to provide approximately 10 MW of capacity at their Plattsburgh, New York facility. As of September 30, 2024, Coinmint provided approximately 46.0 MW of capacity for our miners at their facilities. The Company is currently assessing options for replacing this capacity and plans to high-grade the portion of its fleet composed of older generation miners hosted at the Coinmint locations.

Subsequent Events

- On October 14, 2024, Bit Digital announced the acquisition of Enovum Data Centers (“Enovum”) for a total consideration of CAD $62.8MM (approximately USD $46MM based on a CAD/USD exchange rate of 0.73). The acquisition was completed on a debt-free basis, with a normalized level of working capital acquired, funded by approximately CAD $56 million of cash and approximately 1.62 million share equivalents issued solely to key management who rolled-over a significant portion of their existing ownership in Enovum. The transaction closed on October 11, 2024. The acquisition vertically integrated Bit Digital’s HPC operations with a 4MW Tier 3 datacenter in Montreal that is fully leased to a plurality of colocation customers. It also provided Bit Digital with an expansion pipeline of over 280MW and an experienced team to lead the development process. Immediate term plans include bringing approximately 8MW online by the end of 2Q 2025 for approximately USD $50MM of capex. The Company expects run-rate, colocation EBITDA for the Enovum business to exit 2Q25 at approximately USD $13MM based on that development schedule. Bit Digital may also place its own GPUs at those sites, which could significantly increase EBITDA per MW. The Company is tentatively planning to bring an additional 20MW online by year-end 2025. However, development plans will be contingent on firm customer demand and financing options.

- In October 2024, Bit Digital purchased 42 H200 GPU servers (336 GPUs) for approximately $9.7 million. Those servers were subsequently deployed in Iceland for internal purposes and future client deployments.

- On November 14, 2024, Bit Digital executed term sheets with two new customers. The first deal provides for Bit Digital to supply the customer with 512 H200 GPUs for a period of at least six months, representing an approximate $5.0 million contract value for Bit Digital over the initial six-month term. The MSA has been executed with this client and an initial two server purchase order has been fulfilled and revenue generation has begun on those units. The remainder of the deployment is expected prior to year-end 2024. Under the second deal, Bit Digital will supply a separate customer with 576 H200 GPUs for a twelve-month period, representing a total contract value of approximately $10.1 million over the term. The Company will provide additional details on the deployment schedule upon the execution of MSAs and purchase orders.

- On November 14, 2024, Bit Digital executed an MSA with a new customer. The contract provides for 64 H200 GPUs on a month-to-month basis. The contract represents annual revenue of approximately $1.2 million. The deployment commenced and began revenue generation on November 15, 2024. Bit Digital fulfilled the deployment using on-hand inventory of H200 GPUs.

|

[1] This figure excludes digital assets invested in a third-party managed fund. |

|

[2] Adjusted EBITDA refers to earnings before interest expense, income tax expense and depreciation and amortization expense (“EBITDA”) adjusted to eliminate the effects of certain non-cash and / or non-recurring items. See disclosure about Non-GAAP Financial Measures on page 25 below. |

|

[3] “BTC equivalent” is a hypothetical illustration of the value of our digital asset portfolio in bitcoin terms. BTC equivalent is defined as if all non-BTC digital assets, comprised of ETH and USDC, were converted into BTC as of June 30, 2024, and added to our existing BTC balance. Conversion values are found using the closing price on coinmarketcap.com. Our digital asset portfolio excludes digital assets invested in a third-party managed fund. |

Management Commentary

“The maturation of our HPC business was a defining theme this quarter. We expanded our GPU cloud client base with the addition of Boosteroid and strengthened our team with critical hires, including a new CTO, Head of Revenue, and key talent in sales and engineering. In October, we closed the acquisition of Enovum, further enhancing our HPC capabilities and positioning us to scale quickly to meet growing demand. We believe these investments lay a strong foundation for sustainable growth and set the stage for a robust future.

Our mining business faced anticipated headwinds during the first full quarter post-April halving. Record-low hash prices and seasonal electricity rate increases resulted in compressed mining margins. We intentionally refrained from capital investments to upgrade our fleet to date in 2024, and the impact from legacy miners operating during the third quarter was a drag on our results. The upcoming conclusion of a hosting contract, along with legacy mining rigs at that site, presents an ideal opportunity to replace older units with newer models to reduce our production costs. While we will continue to evaluate mining investment on a case-by-case basis, our primary focus remains on scaling our HPC business, which we believe offers the greatest potential for long-term value creation.

We are committed to expanding our client base, growing our data center footprint, and developing a comprehensive software stack to enhance customer acquisition, retention, and margin growth. We are confident that this strategy will drive sustained value and better serve our long-term goals compared to short-term hash rate growth. With these strategic moves, we are more confident than ever in our direction and excited for the transformative growth that lies ahead. We continue to expect to reach our $100 million run-rate revenue target for our HPC business by the end of 2024.”

About Bit Digital

Bit Digital, Inc. is a global platform for high-performance computing (“HPC”) infrastructure and digital asset production headquartered in New York City . Our bitcoin mining operations are located in the US, Canada, and Iceland. For additional information, please contact ir@bit-digital.com or visit our website at www.bit-digital.com.

Investor Notice

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward-looking statements described under “Risk Factors” in Item 3.D of our Annual Report on Form 20-F for the fiscal year ended December 31, 2023 (“Annual Report”). Notwithstanding the fact that Bit Digital Inc. has not conducted operations in the PRC since September 30, 2021 we have previously disclosed under Risk Factors in our Annual Report: “We may be subject to fines and penalties for any noncompliance with or any liabilities in our former business in China in a certain period from now on.” Although the statute of limitations for non-compliance by our former business in the PRC is generally two years and the Company has been out of the PRC, for more than two years, the Authority may still find its prior bitcoin mining operations involved a threat to financial security. In such event, the two-year period would be extended to five years. If any material risk was to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. Future changes in the network-wide mining difficulty rate or bitcoin hash rate may also materially affect the future performance of Bit Digital’s production of bitcoin. Actual operating results will vary depending on many factors including network difficulty rate, total hash rate of the network, the operations of our facilities, the status of our miners, and other factors. See “Safe Harbor Statement” below.

Safe Harbor Statement

This press release may contain certain “forward-looking statements” relating to the business of Bit Digital, Inc., and its subsidiary companies. All statements, other than statements of historical fact included herein are “forward-looking statements.” These forward-looking statements are often identified by the use of forward-looking terminology such as “believes,” “expects,” or similar expressions, involving known and unknown risks and uncertainties. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on its website at http://www.sec.gov. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not assume a duty to update these forward-looking statements.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bit-digital-inc-announces-third-quarter-of-fiscal-year-2024-financial-results-302307879.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bit-digital-inc-announces-third-quarter-of-fiscal-year-2024-financial-results-302307879.html

SOURCE Bit Digital, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trading Binary Outcomes On An Explosive Stock

An Icarus Stock

After hitting a split-adjusted high price this year of $122.90, Super Micro Computer, inc. SMCI made a new 52-week low on Friday. This happened in the aftermath of its auditor, Ernst & Young, resigning. Nevertheless, there are at least two major catalysts pending for the company:

- Whether it will get delisted by Nasdaq or not. Super Micro Computer could be delisted as soon as Monday if it doesn’t file a plan to get back in compliance with Nasdaq regulations.

- Nvidia, Inc.‘s NVDA conference call next Wednesday. On November 4th, DigiTimes Asia reported that Nvidia was routing some of its chip orders away from Super Micro Computer. Analysts are likely to ask Nvidia to quantify this on Wednesday.

Given those catalysts, SMCI is likely to move strongly in either direction by the end of next week. Update: Looks like the 1st catalyst hit after hours on Friday:

I asked my friend David Janello, PhD, CFA to structure a couple of trades for us that can enable us to profit whether SMCI spikes or tanks next week.

Dr. Janello is the founder of SpreadHunter. He is also the author of The Nuclear Option: Trading To Win With Options Momentum Strategies.

Below is his guest post with the trade, and an elaboration of how you can structure similar trades yourself.

Authored by David Janello at Nuclear Options Trading

Managing Explosive Situations

A Step By Step Guide

Let’s break things down into steps to illustrate how to manage an explosive trade.

Step One : Look at the Straddle Price

The At-The-Money Straddle Price provides a lot of information to traders before a big event. Although it does not indicate which direction the stock will move after the special event (earnings, over time the Straddle Price is downright clairvoyant at predicting the magnitude of the stock move post-event. This is because the really smart money — like corporate insiders — usually have better forecasting powers than everyone else, even if they don’t have access to insider information. A good example is the behavior of Trump Media & Technology Group Corp. DJT stock before the 2024 election. Two weeks before the election DJT was trading for 34.50 and the ATM Straddle Price was 18.00 (9.00 put / 9.00 call). This implies a max price of 34.50 + 18.00 or 52.50. As Trump’s election chances shifted DJT hit a max price of 51.51 on October 29. That was within 1.00 of the price predicted by the Straddle.

What does the Straddle Price suggest for SMCI? When I put the trade Friday morning, SMCI was trading for 17.50 and the SMCI Nov 22 Straddle was trading for about 5.00. This suggests a move of +/-5.00 in either direction.

Step #2 : Evaluate the Alternatives

The most direct bullish options trade is to buy the 17.50 strike call for 2.50. If the stock rallies +5.00, the 17.50 call will be worth 5.00- at expiration, for a 100% gain. However, if the stock collapses, the call loses 100% of its value.

Can we do better with Call Vertical Spreads?

At the same time the Call Option was trading at 2.50, the 19.50-20.50 Call Vertical was trading for 0.32. That was with a max payout of 1.00 at expiration. With SMCI at 22.50, the vertical offers a much bigger payout on a percentage basis than the straight call. Unfortunately, the Call Vertical loses 100% of its value if the stock collapses, just like the Call Option.

We can hedge the downside risk by purchasing a Put Vertical along with the Call Vertical. In this case, the 14-15 Strike Put Vertical was trading for 0.33. The total debit for both spreads is 0.64. The max payout is 1.00 if the stock moves below 14 or above 20.50 at expiration. This combination of Long Call Vertical + Long Put Vertical offers max profit of 56%. It only loses 100% if the stock remains unchanged, which in this case appears to be unlikely.

The combination of two long verticals creates a spread also known as an Iron Condor or Iron Butterfly. At SpreadHunter we prefer to view this spread as two separate verticals. This simplifies things and offers more flexibility entering and exiting the position.

Step #3: Execute The Trade

The stock is Super Micro Computer (SMCI -0.17%↓), and there are two parts to this trade:

- Open a put spread expiring on November 22nd, buying the $15 strike puts and selling the $14 strike puts for a net debit of $0.33.

- Open a call spread expiring on November 22nd, buying the $19.50 strike calls and selling the $20.50 strike calls for a net debit of $0.31.

The max profit is 56%, and that occurs with the stock above $20.50 or below $14 next Friday. The max loss is $100%, and that would occur if the stock doesn’t move at all between now and next Friday.

Step #4: Manage the Position

Step #4: Manage the Position

We’ll be illustrating this in a follow up post!

Maybe This Isn’t For You

Maybe you would rather stay safe. That’s fine; you can download the Portfolio Armor iPhone hedging app by clicking on the QR code below or aiming your iPhone camera at it.

If you’d like to stay in touch

You can subscribe to Dr. Janello’s Substack here.

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. Also, you can follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Immatics Announces Third Quarter 2024 Financial Results, Business Update and First Clinical Data on TCER® IMA402 Targeting PRAME

The Company will now target five major cancer types with its four clinically active compounds across both TCR-T cell therapies and TCR-based Bispecifics

- Today, Company discloses first clinical data from the TCR Bispecific molecule, TCER® IMA402 targeting PRAME, in the Phase 1 dose escalation trial, demonstrating a favorable tolerability profile and signs of dose-dependent and PRAME expression-dependent clinical activity, including first objective responses in melanoma patients; early pharmacokinetics data indicate a median half-life of 7 days, potentially enabling bi-weekly dosing; dose escalation is ongoing

- SUPRAME, the randomized-controlled Phase 3 trial to evaluate ACTengine® IMA203 in 2L+ metastatic melanoma patients, planned to commence in December 2024; pre-specified interim data analysis planned for early 2026

- Recently, Company presented Phase 1b clinical data on ACTengine® IMA203 targeting PRAME that demonstrate deep and durable responses in heavily pretreated metastatic melanoma patients treated at RP2D; IMA203 continues to maintain a favorable tolerability profile in patients treated across all dose levels

- Next-generation ACTengine® IMA203CD8 Phase 1a dose escalation data demonstrate enhanced pharmacology and potency per cell; TCR-T candidate to be evaluated for future development in solid cancers with medium-level PRAME copy numbers, such as ovarian and endometrial cancer

- Clinical proof-of-concept data from the ongoing Phase 1 dose escalation trial with TCER® IMA401 targeting MAGEA4/8 demonstrate initial clinical anti-tumor activity in multiple tumor types and a manageable tolerability profile; dose escalation is ongoing

- $150 million public offering completed on October 15, 2024

- As of September 30, 2024, cash and cash equivalents as well as other financial assets amount to $549.2 million1 (€490.5 million), not including the cash inflow from the public offering on October 15, 2024; updated cash reach guidance into 2H 2027

Houston, Texas and Tuebingen, Germany, November 18, 2024 – Immatics N.V. IMTX “Immatics” or the “Company”)), a clinical-stage biopharmaceutical company active in the discovery and development of T cell-redirecting cancer immunotherapies, today provided a business update and reported financial results for the quarter ended September 30, 2024. The Company also reported the first clinical data update from the ongoing Phase 1 dose escalation trial evaluating its next-generation, half-life extended TCR Bispecific molecule, TCER® IMA402 targeting PRAME.

“This year, Immatics has demonstrated the strength of its pipeline by announcing data on clinical activity for its four clinical-stage assets across two therapeutic modalities. These include ACTengine® IMA203 targeting PRAME positioned in 2L+ melanoma now moving forward into the Phase 3 trial SUPRAME targeting BLA filing in early 2027; ACTengine® IMA203CD8 targeting hard-to-treat solid cancers with an initial focus on ovarian and endometrial cancers; and TCER® IMA401 targeting MAGEA4/8 demonstrating clinical proof-of-concept during dose escalation and positioned in squamous NSCLC and head and neck cancer. Today, we are very pleased to announce first clinical data on TCER® IMA402 targeting PRAME, which show promising signals of anti-tumor activity during early dose escalation and is initially positioned in 1L+ melanoma,” said Harpreet Singh, Ph.D., CEO and Co-Founder of Immatics. “With our enhanced cash runway into the second half of 2027, Immatics is well positioned to advance all four candidates to highly relevant value inflection points with a specific focus on delivering meaningful clinical signals in multiple solid cancers in the coming year.”

Third Quarter 2024 and Subsequent Company Progress

TCER® IMA402 (PRAME)

Today, Immatics is providing the first clinical data update from the ongoing Phase 1 dose escalation trial evaluating its next-generation, half-life extended TCR Bispecific molecule, TCER® IMA402 targeting PRAME.

Patient Population: As of the data cut-off on November 6, 2024, 33 heavily pretreated patients with recurrent and/or refractory solid tumors have been treated with a dose range from 0.02 mg to 4 mg of IMA402 monotherapy. The treated patient population is composed of patients with a median of three and a maximum of five lines of prior systemic treatments. The safety population includes all 33 patients treated with IMA402, of which 21 patients were evaluable for efficacy analysis and are PRAME-positive or were not tested for PRAME. Of these 21 patients, eight patients received at least one dose of IMA402 at dose level 7 (DL7, 3 mg), and one patient received IMA402 at dose level 8 (DL8, 4 mg). Based on preclinical in-vivo data, relevant anti-tumor efficacy was expected starting at ~3 mg human equivalent dose, which aligns with the initial clinical anti-tumor activity reported today.

Safety: IMA402 demonstrated a favorable tolerability profile in the 33 patients treated. The most common treatment-related adverse events (AEs) were mostly mild to moderate cytokine release syndrome (CRS) and transient lymphopenia. Step dosing has been implemented and dose escalation is ongoing. The maximum tolerated dose has not yet been determined.

Pharmacokinetics: Early pharmacokinetic data indicate a median half-life of approximately seven days, potentially enabling bi-weekly dosing.

Initial Anti-Tumor Activity: Initial signs of clinical activity have been observed and are associated with PRAME expression and IMA402 dose levels administered.

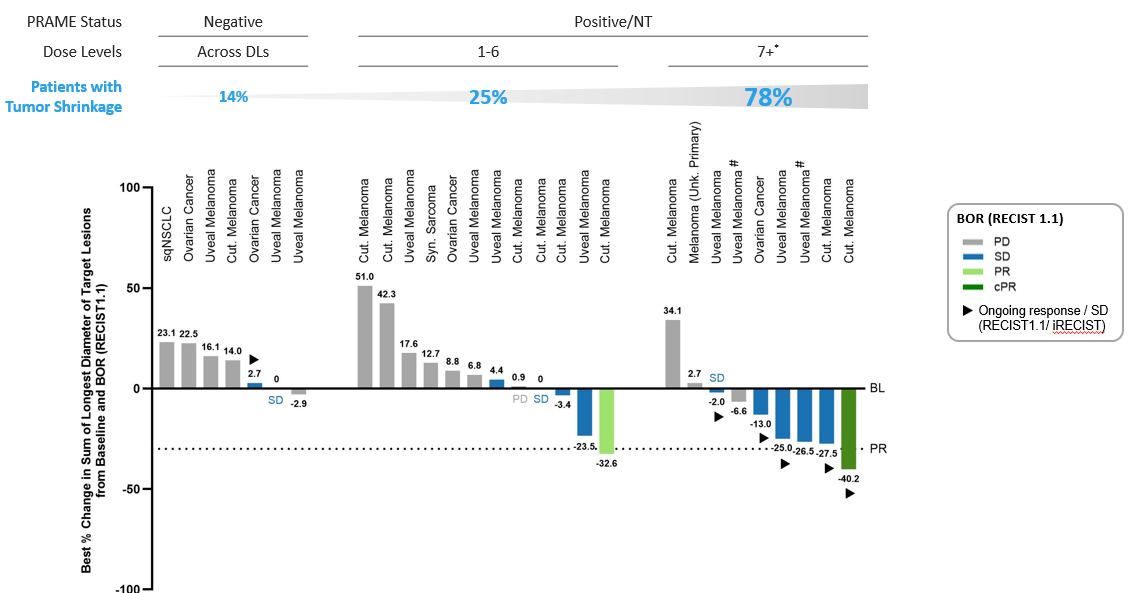

- In the PRAME-negative patient population across all doses and indications, only one patient out of seven (14%) showed tumor shrinkage of -2.9%.

- In comparison, in the PRAME-positive or non-tested patients across all indications treated with low dose levels (DLs 1-6), tumor shrinkage was observed in 25% (3/12) of patients, including one unconfirmed partial response in a cutaneous melanoma patient.

- Nine patients with tumors that tested PRAME-positive or were not tested for PRAME received a relevant dose (8 patients at DL7 and 1 patient at DL8). 78% (7/9) thereof experienced shrinkage of their target lesions, including several patients with significant ongoing tumor shrinkage:

- one cutaneous melanoma patient with an ongoing (at 3 months post first dose at data cut-off) confirmed partial response with -40.2% tumor shrinkage treated at DL7;

- two patients with ongoing (at 6+ weeks and 8+ months) stable diseases with significant tumor shrinkage (-27.5% in a patient with cutaneous melanoma at DL8 and at first scan; -25% in a patient with uveal melanoma deepening over time and treated at escalating doses starting at DL4 and currently at DL7);

- one ovarian cancer patient with ongoing (at 3 months) stable disease and tumor shrinkage of -13% started at DL6 and currently at DL7.

Early Signs of Clinical Activity Associated with PRAME Expression and IMA402 Dose

*Patients who received DL7 or higher, either from start or as part of intra-patient dose-escalation; #continuing treatment; PD: Progressive Disease; SD: Stable Disease; PR: Partial Response; cPR: confirmed Partial Response; BOR: Best Overall Response; BL: Baseline; NT: not tested or not evaluable for PRAME expression

More information and details on the IMA402 clinical data are available on the Events & Presentations page of the Immatics corporate website: https://investors.immatics.com/events-presentations

Based on these initial signs of dose-dependent and PRAME target expression-dependent clinical activity observed during dose escalation, the Company will continue to evaluate IMA402 at higher dose levels to determine the optimal therapeutic dose. The next data update on IMA402 is planned for 2025.

TCER® IMA401 (MAGEA4/8)

On September 16, 2024, Immatics announced the proof-of-concept clinical data for the first candidate of its next-generation, half-life extended TCR Bispecifics platform, TCER® IMA401 (MAGEA4/8), during an oral presentation at the European Society for Medical Oncology (ESMO) Congress 2024.

As of data cut-off on July 23, 2024, 35 heavily pretreated patients with recurrent and/or refractory solid tumors were treated with IMA401 monotherapy across nine escalating dose levels. The treated patient population was composed of patients with 16 different solid tumor indications who were both HLA-A*02:01 and MAGEA4/8-positive, had received a median of four and up to eight lines of prior systemic treatments and the majority had an ECOG performance status of ≥ 1.

Proof-of-concept clinical data from the Phase 1a first-in-human dose escalation basket trial showed initial anti-tumor activity in multiple tumor types, durable objective responses, including confirmed responses ongoing at 13+ months, a manageable tolerability profile and a half-life of 14+ days.

Treatment with IMA401 monotherapy in patients with relevant IMA401 doses and MAGEA4/8high levels (N=17) demonstrated:

- Objective response rate of 29% with confirmed responses observed in 25% of patients

- Disease control rate of 53% and tumor shrinkage of 53%

As the clinical trial progresses, the Company aims to further leverage the potential of IMA401 by focusing on the enrollment of indications with high MAGEA4/8 target expression, such as lung and head and neck cancer patients, seeking to optimize the treatment schedule and also exploring the incremental clinical benefit available to patients through combining IMA401 with a checkpoint inhibitor. The next data update on IMA401 is expected in 2025.

ACTengine® Cell Therapy Programs

ACTengine® IMA203

On November 8, 2024, Immatics announced an expanded clinical dataset that included all infused patients in the Phase 1b dose expansion part of the trial (N=41), consisting of the 28 melanoma patients reported on October 10, 2024, and 13 non-melanoma patients, of which 10 non-melanoma patients were reported on November 8, 2023.

As of the data cut-off on August 23, 2024, treatment with IMA203 monotherapy in the melanoma patient population has demonstrated:

- Confirmed objective response rate of 54% and an objective response rate of 62%

- Disease control rate of 92% and tumor shrinkage in 88% of patients

- 12.1 months median duration of response, 6 months median progression-free survival and >1-year median progression-free survival in patients with deep responses

- Median overall survival has not yet been reached

IMA203 monotherapy has maintained a favorable tolerability profile with no treatment-related Grade 5 events in the entire safety population (N=70 Phase 1a and Phase 1b patients across all dose levels and all tumor types).

Based on the Phase 1b data and discussions with the U.S. Food and Drug Administration, Immatics is on track to commence SUPRAME, the registration-enabling Phase 3 randomized-controlled clinical trial in melanoma for IMA203, in December 2024.

SUPRAME will evaluate IMA203 targeting PRAME in 360 HLA-A*02:01-positive patients with second-line or later (2L+) unresectable or metastatic melanoma who have received prior treatment with a checkpoint inhibitor. Patients will be randomized 1:1 for IMA203 or investigator’s choice of selected approved treatments in the 2L+ setting, including nivolumab/relatlimab, nivolumab, ipilimumab, pembrolizumab, lifileucel (U.S. only) or chemotherapy. The primary endpoint for full approval will be median PFS and secondary endpoints will include objective response rate, safety, duration of response, no overall survival detriment and patient-reported outcomes.

Patient enrollment for SUPRAME is forecast to be completed in 2026, and a pre-specified interim analysis is planned for early 2026. Immatics aims to submit a Biologics License Application (BLA) in early 2027 for full approval.

ACTengine® IMA203CD8 (GEN2) monotherapy

On November 8, 2024, Immatics announced updated Phase 1 dose escalation clinical data on its next-generation ACTengine® IMA203CD8 TCR-T cell therapy in 44 heavily pretreated HLA-A*02:01 and PRAME-positive patients with solid tumors, thereof 41 patients being evaluable for efficacy. Of note, these patients had been treated at substantially lower doses compared to IMA203 (GEN1), i.e. in a range of 0.2-0.48×109 TCR-T cells/m2 BSA (dose level 3) to 0.801-1.2×109 TCR-T cells/m2 BSA (dose level 4c) T cells infused.

As of the data cut-off on September 30, 2024, treatment with IMA203CD8 monotherapy demonstrated:

- Confirmed objective responses observed in 41% of patients

- Median duration of response of 9.2 months at a median follow-up of 13.1 months

- Tumor shrinkage of 84% and disease control rate at week 6 of 85%

- 10 out of 17 responses were ongoing, of which three confirmed responses were ongoing at 14+, 15+ and 24+ months

- Deep responses with ≥50% tumor size reduction were observed in 11 out of 17 responders. This group included two patients with complete response of target lesions, of which one patient showed a complete metabolic response according to PET-CT scan

IMA203CD8 monotherapy has maintained a manageable tolerability profile in the 44 patients treated.

Based on the enhanced pharmacology of IMA203CD8 demonstrated in this trial, the evaluation of higher doses of IMA203CD8 in the ongoing dose escalation trial opens the possibility of addressing hard-to-treat solid tumor indications with a medium-level of PRAME copy numbers, such as ovarian cancer and endometrial cancer.

Corporate Development

In September 2024, Immatics regained full clinical development and commercialization rights to IMA401 due to ongoing portfolio prioritization efforts within Bristol Myers Squibb. The Phase 1 dose escalation trial with IMA401 is ongoing and will continue to be conducted by Immatics.

Third Quarter 2024 Financial Results

Cash Position: Cash and cash equivalents as well as other financial assets total $549.2 million1 (€490.5 million) as of September 30, 2024, compared to $476.8 million1 (€425.9 million) as of December 31, 2023. The increase is mainly due to the public offering in January 2024, partly offset by ongoing research and development activities. Following the $150 million public offering in October 2024, the Company now projects a cash runway into the second half of 2027.

Revenue: Total revenue, consisting of revenue from collaboration agreements, was $56.7 million1 (€50.6 million) for the three months ended September 30, 2024, compared to $6.6 million1 (€5.9 million) for the three months ended September 30, 2023. The increase is mainly the result of a one-time revenue associated with the termination of the IMA401 collaboration by Bristol Myers Squibb during the three months ended September 30, 2024.

Research and Development Expenses: R&D expenses were $43.6 million1 (€38.9 million) for the three months ended September 30, 2024, compared to $34.1 million1 (€30.5 million) for the three months ended September 30, 2023. The increase mainly resulted from costs associated with the advancement of the clinical pipeline candidates.

General and Administrative Expenses: G&A expenses were $12.5 million1 (€11.2 million) for the three months ended September 30, 2024, compared to $10.0 million1 (€8.9 million) for the three months ended September 30, 2023.

Net Profit and Loss: Net loss was $9.6 million1 (€8.6 million) for the three months ended September 30, 2024, compared to a net loss of $29.7 million1 (€26.5 million) for the three months ended September 30, 2023. The decrease in net loss results from the increase in recognized revenue in the period.

Full financial statements can be found in the 6-K filed with the Securities and Exchange Commission (SEC) on November 18, 2024, and published on the SEC website under www.sec.gov.

Upcoming Investor Conferences

Jefferies London Healthcare Conference, London, United Kingdom – November 19 – 21, 2024

To see the full list of events and presentations, visit www.investors.immatics.com/events-presentations.

About IMA402

TCER® IMA402 is a drug candidate owned by Immatics. IMA402 is Immatics’ second TCER® molecule from the bispecifics pipeline and is directed against an HLA-A*02-presented peptide derived from preferentially expressed antigen in melanoma (PRAME), a protein frequently expressed in a large variety of solid cancers, thereby supporting the program’s potential to address a broad cancer patient population. Immatics’ PRAME peptide is present at a high copy number per tumor cell and is homogenously and specifically expressed in tumor tissue. The peptide has been identified and characterized by Immatics’ proprietary mass spectrometry-based target discovery platform, XPRESIDENT®. IMA402 is part of Immatics’ strategy to leverage the full clinical potential of targeting PRAME, one of the most promising targets for TCR-based therapies.

– END –

About Immatics

Immatics combines the discovery of true targets for cancer immunotherapies with the development of the right T cell receptors with the goal of enabling a robust and specific T cell response against these targets. This deep know-how is the foundation for our pipeline of Adoptive Cell Therapies and TCR Bispecifics as well as our partnerships with global leaders in the pharmaceutical industry. We are committed to delivering the power of T cells and to unlocking new avenues for patients in their fight against cancer.

Immatics intends to use its website www.immatics.com as a means of disclosing material non-public information. For regular updates you can also follow us on X, Instagram and LinkedIn.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance. For example, statements concerning timing of data read-outs for product candidates, the timing, outcome and design of clinical trials, the nature of clinical trials (including whether such clinical trials will be registration-enabling), the timing of IND or CTA filing for pre-clinical stage product candidates, estimated market opportunities of product candidates, the Company’s focus on partnerships to advance its strategy, and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “plan”, “target”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Immatics and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management’s control including general economic conditions and other risks, uncertainties and factors set forth in the Company’s Annual Report on Form 20-F and other filings with the Securities and Exchange Commission (SEC). Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no duty to update these forward-looking statements. All the scientific and clinical data presented within this press release are – by definition prior to completion of the clinical trial and a clinical study report – preliminary in nature and subject to further quality checks including customary source data verification.

For more information, please contact:

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Loss of Immatics N.V.

| Three months ended September 30, |

Nine months ended September 30, |

|||

| 2024 |

2023 |

2024 |

2023 |

|

| (Euros in thousands, except per share data) |

(Euros in thousands, except per share data) |

|||

| Revenue from collaboration agreements | 50,559 | 5,926 | 99,583 | 38,076 |

| Research and development expenses | (38,906) | (30,498) | (106,230) | (85,396) |

| General and administrative expenses | (11,156) | (8,881) | (32,925) | (27,825) |

| Other income | 17 | 186 | 54 | 1,134 |

| Operating result | 514 | (33,267) | (39,518) | (74,011) |

| Change in fair value of liabilities for warrants | 3,833 | (1,395) | 4,228 | (7,103) |

| Other financial income | 5,889 | 9,748 | 18,707 | 14,414 |

| Other financial expenses | (12,589) | (1,575) | (5,342) | (4,146) |

| Financial result | (2,867) | 6,778 | 17,593 | 3,165 |

| Loss before taxes | (2,353) | (26,489) | (21,925) | (70,846) |

| Taxes on income | (6,217) | — | (7,720) | — |

| Net loss | (8,570) | (26,489) | (29,645) | (70,846) |

| Net loss per share: | ||||

| Basic | (0.08) | (0.32) | (0.29) | (0.90) |

| Diluted | (0.11) | (0.32) | (0.31) | (0.90) |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Comprehensive Loss of Immatics N.V.

| Three months ended September 30, |

Nine months ended September 30, |

|||

| 2024 |

2023 |

2024 |

2023 |

|

| (Euros in thousands) | (Euros in thousands) | |||

| Net loss | (8,570) | (26,489) | (29,645) | (70,846) |

| Other comprehensive income | ||||

| Items that may be reclassified subsequently to profit or loss | ||||

| Currency translation differences from foreign operations | (1,377) | 429 | (579) | 769 |

| Total comprehensive loss for the year | (9,947) | (26,060) | (30,224) | (70,077) |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Financial Position of Immatics N.V.

| As of |

||

| September 30, 2024 |

December 31, 2023 |

|

| (Euros in thousands) | ||

| Assets | ||

| Current assets | ||

| Cash and cash equivalents | 189,199 | 218,472 |

| Other financial assets | 301,321 | 207,423 |

| Accounts receivables | 2,951 | 4,093 |

| Other current assets | 19,306 | 19,382 |

| Total current assets | 512,777 | 449,370 |

| Non-current assets | ||

| Property, plant and equipment | 48,424 | 43,747 |

| Intangible assets | 1,506 | 1,523 |

| Right-of-use assets | 13,327 | 13,308 |

| Other non-current assets | 1,199 | 2,017 |

| Total non-current assets | 64,456 | 60,595 |

| Total assets | 577,233 | 509,965 |

| Liabilities and shareholders’ equity | ||

| Current liabilities | ||

| Provisions | 5,144 | — |

| Accounts payables | 22,095 | 25,206 |

| Deferred revenue | 68,928 | 100,401 |

| Liabilities for warrants | 14,765 | 18,993 |

| Lease liabilities | 2,825 | 2,604 |

| Other current liabilities | 15,155 | 9,348 |

| Total current liabilities | 128,912 | 156,552 |

| Non-current liabilities | ||

| Deferred revenue | 52,597 | 115,527 |

| Lease liabilities | 13,198 | 12,798 |

| Other non-current liabilities | — | 4 |

| Total non-current liabilities | 65,795 | 128,329 |

| Shareholders’ equity | ||

| Share capital | 1,031 | 847 |

| Share premium | 1,010,648 | 823,166 |

| Accumulated deficit | (626,938) | (597,293) |

| Other reserves | (2,215) | (1,636) |

| Total shareholders’ equity | 382,526 | 225,084 |

| Total liabilities and shareholders’ equity | 577,233 | 509,965 |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Cash Flows of Immatics N.V.

| Nine months ended September 30, |

||

| 2024 |

2023 |

|

| (Euros in thousands) | ||

| Cash flows from operating activities | ||

| Net loss | (29,645) | (70,846) |

| Taxes on income | 7,720 | — |

| Loss before tax | (21,925) | (70,846) |

| Adjustments for: | ||

| Interest income | (18,185) | (8,993) |

| Depreciation and amortization | 9,149 | 5,432 |

| Interest expenses | 654 | 620 |

| Equity-settled share-based payment | 13,112 | 16,299 |

| Loss from disposal of fixed assets | 1 | |

| Net foreign exchange differences and expected credit losses | 4,018 | (760) |

| Change in fair value of liabilities for warrants | (4,228) | 7,103 |

| Changes in: | ||

| Decrease in accounts receivables | 1,142 | 596 |

| Decrease/(increase) in other assets | (2,623) | 658 |

| (Decrease) in deferred revenue, accounts payables and other liabilities | (91,113) | (15,641) |

| Interest received | 11,098 | 4,904 |

| Interest paid | (654) | (221) |

| Income tax paid | — | — |

| Net cash used in operating activities | (99,554) | (60,849) |

| Cash flows from investing activities | ||

| Payments for property, plant and equipment | (14,598) | (21,506) |

| Payments for intangible assets | (148) | (158) |

| Payments for investments classified in other financial assets | (356,596) | (299,018) |

| Proceeds from maturity of investments classified in other financial assets | 266,361 | 229,557 |

| Proceeds from disposal of property, plant and equipment | 1 | — |

| — | — | |

| Net cash used in investing activities | (104,980) | (91,125) |

| Cash flows from financing activities | ||

| Proceeds from issuance of shares to equity holders | 174,554 | 90,404 |

| Transaction costs deducted from equity | (2,039) | |

| Repayments related to lease liabilities | (1,228) | (2,877) |

| Net cash provided by financing activities | 173,326 | 85,488 |

| Net decrease in cash and cash equivalents | (31,208) | (66,486) |

| Cash and cash equivalents at beginning of the year | 218,472 | 148,519 |

| Effects of exchange rate changes, expected credit losses and accrued interest on cash and cash equivalents |

1,935 | 1,413 |

| Cash and cash equivalents at end of the year | 189,199 | 83,446 |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Changes in Shareholders’ Equity of Immatics N.V.

| (Euros in thousands) |

Share capital |

Share premium |

Accumulated deficit |

Other reserves |

Total share- holders’ equity |

| Balance as of January 1, 2023 | 767 | 714,177 | (500,299) | (1,481) | 213,164 |

| Other comprehensive income | — | — | — | 769 | 769 |

| Net loss | — | — | (70,846) | — | (70,846) |

| Comprehensive loss for the year | — | — | (70,846) | 769 | (70,077) |

| Equity-settled share-based compensation | — | 16,299 | — | — | 16,299 |

| Share options exercised | — | 140 | — | — | 140 |

| Issue of share capital – net of transaction costs | 80 | 88,145 | — | — | 88,225 |

| Balance as of September 30, 2023 | 847 | 818,761 | (571,145) | (712) | 247,751 |

| Balance as of January 1, 2024 | 847 | 823,166 | (597,293) | (1,636) | 225,084 |

| Other comprehensive income | — | — | — | (579) | (579) |

| Net loss | — | — | (29,645) | — | (29,645) |

| Comprehensive loss for the year | — | — | (29,645) | (579) | (30,224) |

| Equity-settled share-based compensation | — | 13,112 | — | — | 13,112 |

| Share options exercised | 1 | 1,113 | — | — | 1,114 |

| Issue of share capital – net of transaction costs | 183 | 173,257 | — | — | 173,440 |

| Balance as of September 30, 2024 | 1,031 | 1,010,648 | (626,938) | (2,215) | 382,526 |

1 All amounts translated using the exchange rate published by the European Central Bank in effect as of September 30, 2024 (1 EUR = 1.1196 USD).

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

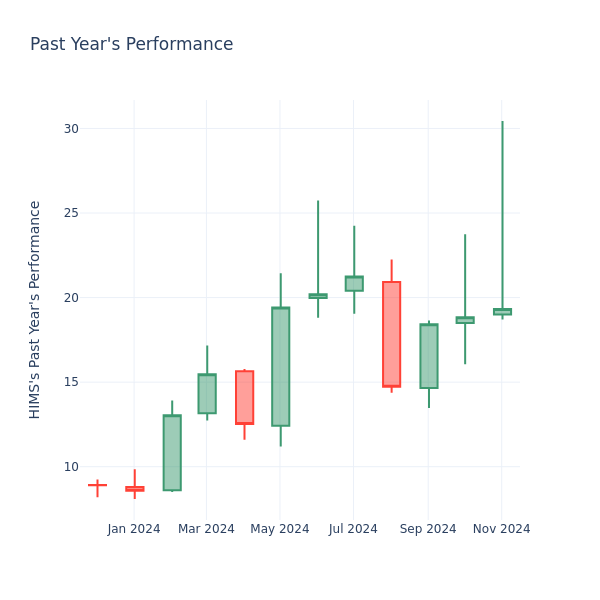

Price Over Earnings Overview: Hims & Hers Health

In the current market session, Hims & Hers Health Inc. HIMS share price is at $19.85, after a 2.74% spike. Moreover, over the past month, the stock decreased by 18.10%, but in the past year, increased by 154.88%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

Comparing Hims & Hers Health P/E Against Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of 41.04 in the Health Care Providers & Services industry, Hims & Hers Health Inc. has a higher P/E ratio of 43.91. Shareholders might be inclined to think that Hims & Hers Health Inc. might perform better than its industry group. It’s also possible that the stock is overvalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.