Price Over Earnings Overview: Hims & Hers Health

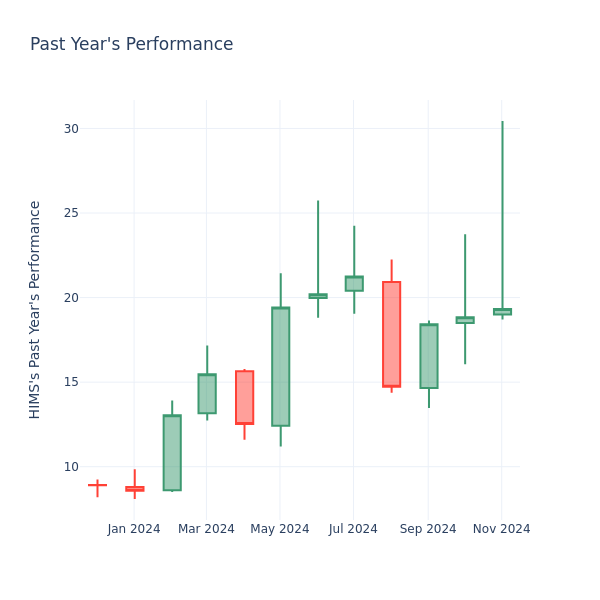

In the current market session, Hims & Hers Health Inc. HIMS share price is at $19.85, after a 2.74% spike. Moreover, over the past month, the stock decreased by 18.10%, but in the past year, increased by 154.88%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

Comparing Hims & Hers Health P/E Against Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of 41.04 in the Health Care Providers & Services industry, Hims & Hers Health Inc. has a higher P/E ratio of 43.91. Shareholders might be inclined to think that Hims & Hers Health Inc. might perform better than its industry group. It’s also possible that the stock is overvalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pearl Powder Market to Reach US$ 1,532.3 Million by 2034 with a CAGR of 8.1% | Fact.MR Report

Rockville, MD , Nov. 18, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global Pearl Powder Market is estimated to reach a valuation of US$ 703.2 million in 2024 and is expected to grow at a CAGR of 8.1% during the forecast period of (2024 to 2034).

The pearl powder market is growing steadily, mainly on account of rising demand in the cosmetics and nutraceutical industries. This ground powdery product, whether from freshwater or saltwater pearls, is prized for its myriad claimed aesthetic and health benefits.

More and more, in the cosmetics industry, pear powder is being used as a natural ingredient for skincare products and cosmetic treatments and premium spa regimes. These bright, light-diffusing particles are prized for their ability to give delicate, luminous radiance to the skin. Luxury beauty brands infuse pearl powder into their products and tout it as a quality, rare ingredient that makes skin look radiantly youthful.

The nutraceuticals industry remains a strong driver for the pearl powder market. Pearl powder has been conventionally applied in Chinese medicine to enhance brightness of skin, bone strength, and energy. It found its way into the majority of the dietary supplements and functional foods as increased consumer interest built in natural supplements. The market is reportedly growing on the back of increasing consumer awareness toward natural and organic beauty products. Pearl powder, in that regard, is a natural commodity, fitting into this category, although issues surrounding sustainability, coupled with resultant high production costs, may limit its wide usage.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10457

Key Takeaways from Market Study:

- The global pearl powder market is projected to grow at 8.1% CAGR and reach US$ 1,532.3 million by 2034

- The market created an opportunity of US$ 829.1 million between 2024 to 2034

- East Asia is a prominent region that is estimated to hold a market share of 31.5% in 2024

- Freshwater pearl powder under product type segment is estimated to grow at a CAGR of 8.1% creating an absolute $ opportunity of US$ 478.9 million between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 455.9 million collectively

“The pearl powder market is growing due to rising consumer interest in natural beauty and wellness. Its use in cosmetics, supplements, and traditional medicine is increasing. However, challenges in sourcing quality pearls and regulatory issues may affect the market.” says a Fact.MR analyst.

Leading Players Driving Innovation in the Pearl Powder Market:

Key players in the Pearl Powder market are Zhejiang Fenix Pharmaceutical Co., Ltd., Guangdong Yueqing Pharmaceutical Co., Ltd., Shaanxi Sangherb Bio-Tech Co., Ltd., Xi’an Victar Bio-Tech Corp., Hongkong Yuexiu Industry Co., Ltd., Hunan Nutramax Inc., Dongguan Tianxin Pharmaceutical Co., Ltd., and Shaanxi Jintai Biological Engineering Co. Ltd..

The US Market is Growing Due to the Demand for High-End Beauty Products.

The pearl powder market in the United States is expected to reach US$ 101.9 million in 2024 and grow at a compound annual growth rate (CAGR) of 8.3% through 2034, creating an absolute opportunity of US$ 124.9 million.

According to reports, end customers’ growing desire for premium, organic beauty goods is driving up demand for pearl powder in the US market. Due to increased consumer awareness of skin care ingredients, many consumers are gravitating toward solutions that provide several advantages without the use of harsh chemicals or artificial additions

Pearl powder’s rejuvenating, age-defying, and skin-enhancing qualities undoubtedly align with modern consumers’ desires for improved skin health. Celebrities that promote the advantages of pearl powder and encourage their fans to investigate this ingredient’s potential are fueling the trend of integrating beauty with wellness.

Pearl Powder Industry News:

- PLAYT and Wai Yuen Tong have teamed up to introduce a health-conscious buffet menu in September 2024 that has nutrient-dense items including “Wild Cordyceps,” “Pearl Powder,” and “Lycii Fructus.” Through this partnership, pearl powder’s appeal in creative health and wellness dining experiences is promoted by fusing traditional Chinese ingredients with contemporary culinary techniques.

- “Wedding Veil,” a white pearl powder nail polish, was introduced by Latina-owned Lights Lacquer in June 2024 as part of their debut bridal line. This demonstrates how pearl powder is becoming more and more popular in upscale beauty applications, especially for its luminous properties in specialized sectors like bridal cosmetics.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10457

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global Pearl Powder market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of By Product Type (Freshwater Pearl Powder, Saltwater Pearl Powder), By Form (Powder, Capsules/Tablets), By Grade (Cosmetic Grade, Pharmaceutical Grade, Food Grade), By Application (Cosmetics, Pharmaceuticals, Nutraceuticals, Food & Beverages, and Others) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Segmentation of Pearl Powder Industry Research:

- By Product Type :

- Freshwater Pearl Powder

- Saltwater Pearl Powder

- By Form :

- By Grade :

- Cosmetic Grade

- Pharmaceutical Grade

- Food Grade

- By Application :

- Cosmetics

- Pharmaceuticals

- Nutraceuticals

- Food & Beverages

- Others

Check out More Related Studies Published by Fact.MR Research:

Stick to skin materials market is valued at US$ 3.4 billion in 2022 and is forecast to reach US$ 6.8 billion by the end of 2032, expanding at a high CAGR of 7.2% between 2022 and 2032.

Soft skin adhesives market is estimated to be valued at US$ 841.1 million in 2023 and it is expected to grow at a CAGR of 8.3% to reach US$ 1,866.9 million by the end of 2033.

Open top meat membrane skinning machine market is projected to register 4.8% CAGR over the next ten years and top a valuation of US$ 120.7 million by 2034.

Cosmetic chemicals market is expected to grow from US$ 24 billion in 2024 to US$ 38 billion by 2034, with a CAGR of 4.7%.

Hydrogenated cosmetic ingredients market is estimated to expand at a CAGR of 4.7% to reach US$ 94.9 million by the end of 2033 from the valuation of US$ 59.6 million in 2023.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kandi Technologies Reports Third Quarter 2024 Financial Results

- Nine-Month Revenue of Nearly $90M, with Off-Road Vehicles as the Core Revenue Driver

- Strong Financial Position with $260M in Liquidity

- New Leadership to Drive Technology Innovation and Expand Growth, Boosting Market Edge and Launching a Fresh Chapter for the Company

JINHUA, China, Nov. 18, 2024 (GLOBE NEWSWIRE) — Kandi Technologies Group, Inc. (the “Company”, “we” or “Kandi”) (NASDAQ GS: KNDI), today announced its financial results for the third quarter of 2024.

Third Quarter and Nine Months 2024 Financial Highlights

- Q3 revenues decreased to $29.9 million, from $36.4 million in the same period of 2023.

- Nine-month revenues of $89.8 million slipped 5.7% year-over-year.

- Off-road vehicles and associated parts in Q3 were the primary source of revenue, decreasing by 9.2% y/y to $27.5 million, compared to $30.2 million in the same period of 2023.

- Nine-month revenue from off-road vehicles and associated parts decreased by 1.0% y/y to $81.5 million, compared to $82.3 million in the same period of 2023.

- Nine-month net loss was $1.8 million, or $0.02 loss per fully diluted share, compared to a net income of $6.3 million, or $0.08 income per fully diluted share for the same period of 2023.

- Solid financial standing with $260 million in cash and cash equivalents, restricted cash, short term investment, and certificate of deposit as of September 30, 2024.

Feng Chen, Kandi’s newly appointed CEO, stated, “Revenue temporarily declined this year due to changes in the sales model for our fully-electric off-road vehicles. In response, the new management team has developed a comprehensive 2025-2029 growth plan, tailored to our current position and approved by the Board. With disciplined execution of our strategic and operational plans, we are confident that each business segment is positioned to reach new height.”

“We see significant growth potential in the all-electric off-road vehicle segment. Over the past few years, we’ve built a solid foundation in technology, product offerings, and market presence. Our golf carts and other models are highly competitive, well-regarded by consumers, and supported by strong partnerships with key clients like Lowe’s. Notably, the recent launch of our NFL-branded golf carts, featuring all 32 NFL teams and available exclusively at Lowe’s, has further strengthened the Kandi brand. Moving forward, we will build on our advantages in technological innovation, product enhancement, and distribution to grow our market share.”

“In today’s complex global economic environment, we are mindful of concerns about trade tensions. To address these challenges, our 2025-2029 growth plan includes targeted measures. We intend to set up U.S.-based production lines for golf carts, utility vehicles, and lithium batteries to better serve the North American market. These local facilities will bring our products closer to key markets, significantly enhancing delivery times and after-sales support. At the same time, we will continue expanding our global presence, targeting new markets in Southeast Asia, the Middle East, Europe, and beyond with a competitive product portfolio.”

“Even as we navigate shifts in international markets, we are implementing a strategy for growth in China. Our initial focus will be on expanding into smart mobility, a high-growth sector gaining traction with Chinese consumers, where we aim to establish a strong position. Additionally, we will leverage our expertise in manufacturing battery swapping equipment and our experience in battery swapping operations to support major providers in China with advanced technology and services, striving to position Kandi as a leading supplier and operator in China’s battery-swapping market to drive further growth for the company.”

Share Repurchase

As of September 30, 2024, the Company had repurchased a total of 1,480,786 common shares at an average price of $2.49 per share under the repurchase plan, including a total of 58,022 common shares at an average price of $2.18 per share repurchased in the third quarter of 2024.

Q3 2024 Key Financial Results

Net Revenues and Gross Profit (in USD millions)

| Q3 2024 | Q3 2023 | Y-o-Y% | ||||||

| Net Revenues | $29.9 | $36.4 | -17.8% | |||||

| Gross Profit | $9.4 | $10.9 | -14.2% | |||||

| Gross Margin% | 31.3% | 30.0% | – | |||||

- Total revenues in the third quarter of 2024 were $29.9 million, compared to $36.4 million in the same period of 2023, representing a decrease of 17.8%, mainly due to a decrease in sales of off-road vehicles, EV parts and lithium-ion cells compared to the prior period.

- Cost of goods sold in the third quarter of 2024 was $20.6 million, compared to $25.5 million in the same period of 2023, representing a decrease of 19.4%. The decrease was primarily due to the corresponding decrease in sales.

- Gross profit in the third quarter of 2024 was $9.4 million, compared to $10.9 million in the same period of 2023, representing a decrease of 14.2%. The overall gross margin for the third quarter was 31.3%, up slightly from 30.0% in the same period of 2023, showing a modest year-over-year improvement in gross margin between the two periods.

Operating Loss (in USD millions)

| Q3 2024 | Q3 2023 | Y-o-Y% | ||||||

| Operating Expenses | ($16.1 | ) | ($14.5 | ) | 11.0% | |||

| Loss from Operations | ($6.7 | ) | ($3.6 | ) | 87.6% | |||

| Operating Margin% | -22.5% | -9.8% | – | |||||

- Research and development expenses totaled $2.3 million for the third quarter of 2024, an increase of 148.7% compared to $0.9 million for the same period in 2023. The increase was mainly due to a research and development project for battery products conducted in the third quarter.

- Selling and distribution expenses totaled $3.1 million for the third quarter of 2024, a decrease of 26.0% compared to $4.2 million for the same period in 2023. The decrease was mainly due to lower shipping and storage expenses incurred in the third quarter.

- General and administrative expenses totaled $10.7 million for the third quarter of 2024, an increase of 13.7% compared to $9.5 million for the same period in 2023. The increase was primarily due to higher salaries and professional service fees incurred in the third quarter.

Net Income (loss) (in USD millions)

| Q3 2024 | Q3 2023 | Y-o-Y% | ||||

| Net (Loss) Income | ($4.2 | ) | $1.3 | NM | ||

| Net (Loss) Income per Share, Basic and Diluted | ($0.05 | ) | $0.02 | – | ||

| Net (Loss) Income attributable to Kandi | ($4.1 | ) | $0.9 | NM | ||

| Net (Loss) Income attributable to Kandi per Share, Basic and Diluted | ($0.05 | ) | $0.01 | – | ||

- Net loss was $4.2 million for the third quarter of 2024, compared to net income of $1.3 million for the same period in 2023. The shift was mainly driven by a decrease in gross profit and other income, along with increased operating expenses compared to the prior period.

Balance Sheet (in USD millions)

- Working capital was $274.9 million as of September 30, 2024.

Third Quarter 2024 Conference Call Details

The Company has scheduled a conference call and live webcast to discuss its financial results at 8:00 A.M. Eastern Time (9:00 P.M. Beijing Time) on Monday, November 18, 2024. Management will deliver prepared remarks to be followed by a question and answer session.

The dial-in details for the conference call are as follows:

The live audio webcast of the call can also be accessed by visiting Kandi’s Investor Relations page on the Company’s website at http://www.kandivehicle.com. An archive of the webcast will be available on the Company’s website following the live call.

About Kandi Technologies Group, Inc.

Kandi Technologies Group, Inc. (KNDI), headquartered in Jinhua New Energy Vehicle Town,Zhejiang Province, is engaged in the research, development, manufacturing, and sales of various vehicular products. Kandi conducts its primary business operations through its wholly-owned subsidiary, Zhejiang Kandi Technologies Group Co., Ltd. (“Zhejiang Kandi Technologies”), formerly, Zhejiang Kandi Vehicles Co., Ltd. and its subsidiaries including Kandi Electric Vehicles (Hainan) Co., Ltd. and SC Autosports, LLC (d/b/a Kandi America), the wholly-owned subsidiary of Kandi in the United States, and its wholly-owned subsidiary, Kandi America Investment, LLC. Zhejiang Kandi Technologies has established itself as one of China’s leading manufacturers of pure electric vehicle parts and off-road vehicles.

Safe Harbor Statement

This press release contains certain statements that may include “forward-looking statements.” All statements other than statements of historical fact included herein are “forward-looking statements.” These forward-looking statements are often identified by the use of forward-looking terminology such as “believes,” “expects” or similar expressions, involving known and unknown risks and uncertainties. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including the risk factors discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on the SEC’s website (http://www.sec.gov). All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these risk factors. Other than as required under the applicable securities laws, the Company does not assume a duty to update these forward-looking statements.

Follow us on Twitter: @ Kandi_Group

Contacts:

Kandi Technologies Group, Inc.

Ms. Kewa Luo

+1 (212) 551-3610

IR@kandigroup.com

The Blueshirt Group

Mr. Gary Dvorchak, CFA

gary@blueshirtgroup.co

| KANDI TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (All amounts in thousands) |

||||

| September 30, 2024 | December 31, 2023 | |||

| (Unaudited) | ||||

| CURRENT ASSETS | ||||

| Cash and cash equivalents | $ | 53,526 | $ | 33,757 |

| Restricted cash | 165,391 | 59,873 | ||

| Short term investment | 713 | – | ||

| Certificate of deposit | 39,921 | 33,947 | ||

| Accounts receivable | 35,215 | 18,952 | ||

| Inventories | 85,797 | 61,551 | ||

| Notes receivable | 64 | 124,473 | ||

| Other receivables | 10,614 | 6,477 | ||

| Prepayments and prepaid expense | 4,848 | 1,909 | ||

| Advances to suppliers | 593 | 2,609 | ||

| TOTAL CURRENT ASSETS | 396,682 | 343,548 | ||

| NON-CURRENT ASSETS | ||||

| Property, plant and equipment, net | 92,726 | 98,804 | ||

| Intangible assets, net | 5,141 | 6,396 | ||

| Land use rights, net | 2,713 | 2,754 | ||

| Deferred tax assets | 849 | 815 | ||

| Goodwill | 33,358 | 33,147 | ||

| Other long-term assets | 10,740 | 9,993 | ||

| TOTAL NON-CURRENT ASSETS | 145,527 | 151,909 | ||

| TOTAL ASSETS | $ | 542,209 | $ | 495,457 |

| CURRENT LIABILITIES | ||||

| Accounts payable | $ | 31,044 | $ | 28,745 |

| Other payables and accrued expenses | 6,152 | 7,253 | ||

| Short-term loans | 24,521 | 9,072 | ||

| Notes payable | 51,531 | 24,071 | ||

| Income tax payable | 2,568 | 2,130 | ||

| Other current liabilities | 5,949 | 5,402 | ||

| TOTAL CURRENT LIABILITIES | 121,765 | 76,673 | ||

| NON-CURRENT LIABILITIES | ||||

| Long-term loans | 7,855 | 8,389 | ||

| Deferred taxes liability | 853 | 964 | ||

| Contingent consideration liability | 1,648 | 2,693 | ||

| Other long-term liabilities | 536 | 227 | ||

| TOTAL NON-CURRENT LIABILITIES | 10,892 | 12,273 | ||

| TOTAL LIABILITIES | 132,657 | 88,946 | ||

| STOCKHOLDER’S EQUITY | ||||

| Kandi technologies group, inc. stockholders’ equity | 407,172 | 404,126 | ||

| Non-controlling interests | 2,380 | 2,385 | ||

| TOTAL STOCKHOLDERS’ EQUITY | 409,552 | 406,511 | ||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 542,209 | $ | 495,457 |

| KANDI TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (UNAUDITED) (All amounts in thousands, except for share and per share data) |

|||||||

| Three Months Ended | |||||||

| September 30, 2024 | September 30, 2023 | ||||||

| REVENUES, NET | $ | 29,945 | $ | 36,426 | |||

| COST OF GOODS SOLD | (20,571 | ) | (25,507 | ) | |||

| GROSS PROFIT | 9,374 | 10,919 | |||||

| OPERATING EXPENSE: | |||||||

| Research and development | (2,283 | ) | (918 | ) | |||

| Selling and marketing | (3,071 | ) | (4,152 | ) | |||

| General and administrative | (10,750 | ) | (9,458 | ) | |||

| Impairment of goodwill | – | 8 | |||||

| Impairment of long-lived assets | – | 14 | |||||

| TOTAL OPERATING EXPENSE | (16,104 | ) | (14,506 | ) | |||

| LOSS FROM OPERATIONS | (6,730 | ) | (3,587 | ) | |||

| OTHER INCOME (EXPENSE): | |||||||

| Interest income | 2,948 | 1,927 | |||||

| Interest expense | (653 | ) | (355 | ) | |||

| Change in fair value of contingent consideration | 109 | – | |||||

| Government grants | 95 | 668 | |||||

| Other income, net | 649 | 2,611 | |||||

| TOTAL OTHER INCOME , NET | 3,148 | 4,851 | |||||

| (LOSS) INCOME BEFORE INCOME TAXES | (3,582 | ) | 1,264 | ||||

| INCOME TAX (EXPENSE) BENEFIT | (593 | ) | 12 | ||||

| NET (LOSS) INCOME | (4,175 | ) | 1,276 | ||||

| LESS: NET (LOSS) INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | (64 | ) | 408 | ||||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS | (4,111 | ) | 868 | ||||

| OTHER COMPREHENSIVE INCOME (LOSS) | |||||||

| Foreign currency translation adjustment | 13,082 | (2,102 | ) | ||||

| COMPREHENSIVE INCOME (LOSS) | $ | 8,907 | $ | (826 | ) | ||

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC | 86,068,123 | 79,174,343 | |||||

| WEIGHTED AVERAGE SHARES OUTSTANDING DILUTED | 86,068,123 | 81,234,002 | |||||

| NET (LOSS) INCOME PER SHARE, BASIC | $ | (0.05 | ) | $ | 0.02 | ||

| NET (LOSS) INCOME PER SHARE, DILUTED | $ | (0.05 | ) | $ | 0.02 | ||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, BASIC | $ | (0.05 | ) | $ | 0.01 | ||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, DILUTED | $ | (0.05 | ) | $ | 0.01 | ||

| Nine Months Ended | |||||||

| September 30, 2024 | September 30, 2023 | ||||||

| REVENUES, NET | $ | 89,770 | $ | 95,242 | |||

| COST OF GOODS SOLD | (61,429 | ) | (62,559 | ) | |||

| GROSS PROFIT | 28,341 | 32,683 | |||||

| OPERATING EXPENSE: | |||||||

| Research and development | (3,969 | ) | (2,671 | ) | |||

| Selling and marketing | (10,094 | ) | (8,760 | ) | |||

| General and administrative | (25,362 | ) | (25,856 | ) | |||

| Impairment of goodwill | – | (500 | ) | ||||

| Impairment of long-lived assets | – | (948 | ) | ||||

| TOTAL OPERATING EXPENSE | (39,425 | ) | (38,735 | ) | |||

| LOSS FROM OPERATIONS | (11,084 | ) | (6,052 | ) | |||

| OTHER INCOME (EXPENSE): | |||||||

| Interest income | 6,581 | 5,982 | |||||

| Interest expense | (1,618 | ) | (723 | ) | |||

| Change in fair value of contingent consideration | 1,045 | 1,803 | |||||

| Government grants | 1,146 | 1,478 | |||||

| Other income, net | 3,174 | 3,685 | |||||

| TOTAL OTHER INCOME , NET | 10,328 | 12,225 | |||||

| (LOSS) INCOME BEFORE INCOME TAXES | (756 | ) | 6,173 | ||||

| INCOME TAX (EXPENSE) BENEFIT | (1,041 | ) | 86 | ||||

| NET (LOSS) INCOME | (1,797 | ) | 6,259 | ||||

| LESS: NET (LOSS) INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | (1 | ) | 1,691 | ||||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS | (1,796 | ) | 4,568 | ||||

| OTHER COMPREHENSIVE INCOME (LOSS) | |||||||

| Foreign currency translation adjustment | 3,260 | (19,799 | ) | ||||

| COMPREHENSIVE INCOME (LOSS) | $ | 1,463 | $ | (13,540 | ) | ||

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC | 86,463,327 | 75,931,247 | |||||

| WEIGHTED AVERAGE SHARES OUTSTANDING DILUTED | 86,463,327 | 77,645,533 | |||||

| NET (LOSS) INCOME PER SHARE, BASIC | $ | (0.02 | ) | $ | 0.08 | ||

| NET (LOSS) INCOME PER SHARE, DILUTED | $ | (0.02 | ) | $ | 0.08 | ||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, BASIC | $ | (0.02 | ) | $ | 0.06 | ||

| NET (LOSS) INCOME ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, DILUTED | $ | (0.02 | ) | $ | 0.06 | ||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Robinhood Analyst Turns Bullish; Here Are Top 5 Upgrades For Monday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

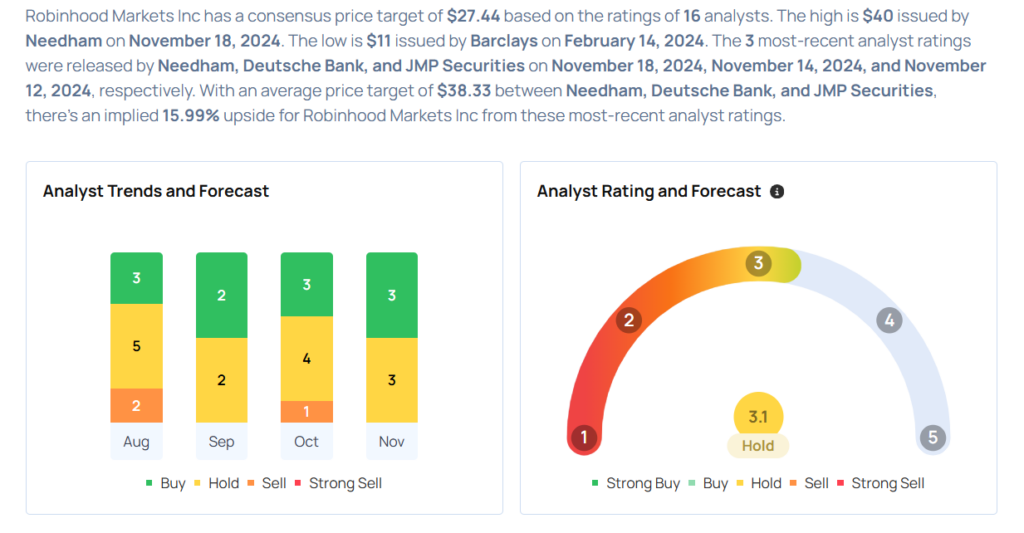

Considering buying HOOD stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: 3 Nuclear Stocks That Will Pull Back Under a Trump Presidency

Nuclear stocks are glowing green.

Uranium mining companies such as Cameco, Denison Mines, and Uranium Energy have marched higher in lockstep over the past 52 weeks, rising 26%, 28%, and 30%, respectively, through close of trading Tuesday. Utility companies that use nuclear power plants to produce electricity seem popular, too. Inspired by news of its groundbreaking deal to reactivate Three Mile Island and use it to power Microsoft server farms, Constellation Energy shares have gained 87% in 52 weeks — twice as much as the mining stocks.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But none of those are what I want to talk about today.

Instead, I want to talk about the nuclear power start-ups that hope to replace traditional nuclear power plants like the ones Constellation operates, and generate nuclear power at the local level, using small nuclear reactors. I want to talk about NuScale Power (NYSE: SMR), Oklo (NYSE: OKLO), and Nano Nuclear Energy (NASDAQ: NNE) — and why they’re about to cost investors a lot of money.

Now I don’t want to lump these three stocks all together entirely. There are differences. NuScale Power and Oklo specialize in the development of small modular nuclear reactors, designed to produce a fraction of the power output of a traditional 1 gigawatt-plus nuclear power plant. NuScale’s Voygr modules, for example, are designed to output 77 megawatts of power each.

Like the name implies, though, “Nano” Nuclear is going even smaller, focusing on microreactors producing as few as one to 20 megawatts (i.e., as little as 1/1,000 the size of a traditional nuclear reactor). On its website, Nano Nuclear touts its microreactors’ suitability for even small-scale applications such as powering satellites, spacecraft, and moon bases.

But in general, yes, all three of these companies are developing smaller-than-usual nuclear reactors. More importantly for investors are the similarities in stock performance. Over the last 12 months, Oklo stock is up more than 100%, Nano Nuclear shares have risen nearly 350%, and NuScale stock is approaching an 800% gain!

Oklo, Nano Nuclear, and NuScale, though, also differ from other “nuclear” stocks in another respect: Electric utility stocks such as Constellation usually are consistently profitable, and even uranium miners Denison and Cameco (if not Uranium Energy) generally manage to earn a profit.

Wheel Axle Market is Projected to Grow at a 4.1% CAGR, Reaching US$ 99.73 Billion by 2034 | Fact.MR Report

Rockville, MD , Nov. 18, 2024 (GLOBE NEWSWIRE) — According to a recently updated industry report by Fact.MR, the global wheel axle market is estimated to reach US$ 66.73 billion in 2024 and advance further at a CAGR of 4.1% from 2024 to 2034.

An axle is a central shaft for a rotating wheel that can be attached to the wheels, rotate with them, or remain stationary while the wheels rotate around it. This is a critical component of any wheeled vehicle and can be classified as front, rear, full-floating, or semi-floating axles.

In developing countries, rapid expansion of the industrial sector and improved logistics are constantly pushing the demand for commercial vehicles, driving up the market for wheel axles in parallel. Governments are focusing on expanding transit facilities due to population growth and urbanization, which is putting added pressure on the transport and automobile sectors.

Rolling stock, including locomotives, carriages, and wagons, is in substantial demand due to its high transportation capacity compared to other modes. The market is mainly expanding due to growth in the automotive and transportation industries, electric axles in trailers, and emission regulations for transport refrigeration units. East Asia and North America will be key regional markets for wheel axle sales, together accounting for around two-thirds market share throughout the next ten years.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=4559

Key Takeaways from Market Study

- The global market for wheel axles is projected to expand at a CAGR of 1% from 2024 to 2034.

- The market has been forecasted to climb to a value of US$ 99.73 billion by the end of 2034.

- The market in the United States is expected to reach a value of US$ 7.53 million in 2024.

- Japan is projected to occupy a market share of 6% in East Asia in 2024.

- Revenue from the rail end-use segment is forecasted to reach US$ 25.03 billion by the end of 2034.

- The market in East Asia is analyzed to expand at a CAGR of 4.6% from 2024 to 2034.

“Growing industrial sectors and need for improved logistics operations in developing countries driving demand for commercial vehicles, which will also push the need for wheel axles over the coming years,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Wheel Axle Market

Key players in the wheel axle market are Dana Incorporated, American Axle and Manufacturing Inc., Daimler AG, Meritor Inc., GNA Group, Melrose Industries Plc., ZF Friedrichshafen AG, BorgWarner Inc., Hyundai Wia Corporation, Talbros Engineering Limited.

Increasing Demand for More Efficient and Durable Axle Systems

Global vehicle manufacturing is increasing, particularly in emerging markets as more vehicles enter the market, demand for axles rises in tandem. The rapid growth of the EV market necessitates specialized axle designs. The emphasis is on lightweight axles to improve range and efficiency.

There is also a strong demand for more efficient and durable axle systems, which is fueling interest in SUVs and off-road vehicles. There is also a need for axles that can withstand rough terrain. Globally, aging vehicle fleets are increasing demand for replacement axles. Increased logistics and transportation activities are increasing the demand for heavy-duty axles.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=4559

Wheel Axle Industry News:

- The Protec independent front suspension for motor coaches, built especially to support large loads, was introduced by Meritor Inc. in June 2022.

- ai, a self-driving startup, said in July 2022 that it would collaborate with Sany Heavy Industry to mass-produce self-driving trucks in China. With their sophisticated axle and drivetrain systems and “Level 4” autonomous driving technology, these trucks will be able to drive themselves fully on city streets and highways.

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the wheel axle market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges insights into the wheel axle market based on end use (vehicles, rail) and drive torque (below 300 Nm, 300 to 600 Nm, 600 to 900 Nm, 900 to 1,200 Nm, 1,200 to 1,500 Nm, above 1,500 Nm), across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR:

Wheel and Tire Service Equipment Market: Size is estimated to reach valuation of US$ 4,046.6 Million in 2023 and will top US$ 5,893.9 Million by 2033, growing with a CAGR of around 3.8% from 2023-2033.

Trailer Axle Market: Size is forecasted to increase from US$ 8.42 billion in 2024 to US$ 13.95 billion by 2034-end, expanding at a CAGR of 5.2% over the next ten years.

Wheel Balancing Weight Market: Size is anticipated to grow from a 2024 valuation of US$ 727.8 million to US$ 1.35 billion by the end of 2034, with a compound annual growth rate (CAGR) of 6.4%.

Automotive Wheel Market: Size is forecasted to reach US$ 34.42 billion in 2024, further increasing at a CAGR of 6.4% to end up at US$ 63.95 billion by 2034.

Motorcycle Suspension System Market: Size is valued at US$ 499.8 million in 2023. Expanding at a CAGR of 6.1%, worldwide sales of motorcycle suspension systems are projected to reach US$ 903.6 million by 2033-end.

Trailer Suspension System Market: Size is estimated to be valued at US$ 4,089.7 million in 2024. Projections indicate a steady expansion with a CAGR of 5.1%, and is forecast to reach the valuation of US$ 6,725.3 million from 2024 to 2034

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Dow slips, Nasdaq pops as Tesla and bitcoin shine

US stock futures traded mixed on Monday amid fading optimism for interest-rate cuts, as investors looked ahead to Nvidia (NVDA) earnings to test the health of the AI trade.

Dow Jones Industrial Average futures (YM=F) slipped roughly 0.2%, while S&P 500 futures (ES=F) were broadly flat. Contracts on the tech-heavy Nasdaq 100 (NQ=F) rose 0.3%, buoyed by a jump in Tesla (TSLA) stock.

Stocks are starting the week on the back foot as the prospect of higher-for-longer rates holds post-election bullishness in check. The S&P 500 has reversed half of its Trump-fueled rally after sharp weekly losses for the major gauges, led by tech.

Signs of a robust economy, combined with comments from Federal Reserve Chair Jerome Powell, have prompted investors to downsize expectations for rate cuts. After the big macro and political events of recent days, the week brings few economic releases seen as likely to reset those calculations.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

Given that, eyes are now on Nvidia’s results on Wednesday for insight into the strength of the AI trade, which has helped drive the S&P 500’s gains over the past year. Production of its flagship Blackwell chip is in focus, especially after The Information reported the next-generation AI chip has run into problems with overheating. Nvidia shares were down over 2% in premarket trading.

Elsewhere in tech, EV maker Tesla’s shares rose almost 7% in the wake of a Bloomberg report that President-elect Donald Trump’s team is looking to ease US rules for self-driving vehicles.

Wall Street continues to monitor Trump’s picks for his cabinet, after his choice of Robert F. Kennedy Jr for top health official rattled vaccine stocks. The incoming president has named Brendan Carr, a critic of Big Techs such as Meta and Apple, as chairman of the Federal Communications Commission. The wait is now on to learn who will win the frenzied race to become Trump’s Treasury Secretary.

Meanwhile, bitcoin (BTC-USD) — a key Trump trade — has rebounded from its biggest retreat since the election at the weekend. The cryptocurrency was trading above $90,000 early on Monday.

LIVE 2 updatesThis TechnipFMC Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Monday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Citigroup analyst Atif Malik initiated coverage on Astera Labs, Inc. ALAB with a Buy rating and announced a price target of $120. Astera Labs shares closed at $86.45 on Friday. See how other analysts view this stock.

- Jones Trading analyst Catherine Novack initiated coverage on Korro Bio, Inc. KRRO with a Buy rating and announced a price target of $130. Korro Bio shares closed at $47.56 on Friday. See how other analysts view this stock.

- B of A Securities analyst Ruplu Bhattacharya initiated coverage on Ingram Micro Holding Corporation INGM with a Buy rating and announced a price target of $30. Ingram Micro shares closed at $22.75 on Friday. See how other analysts view this stock.

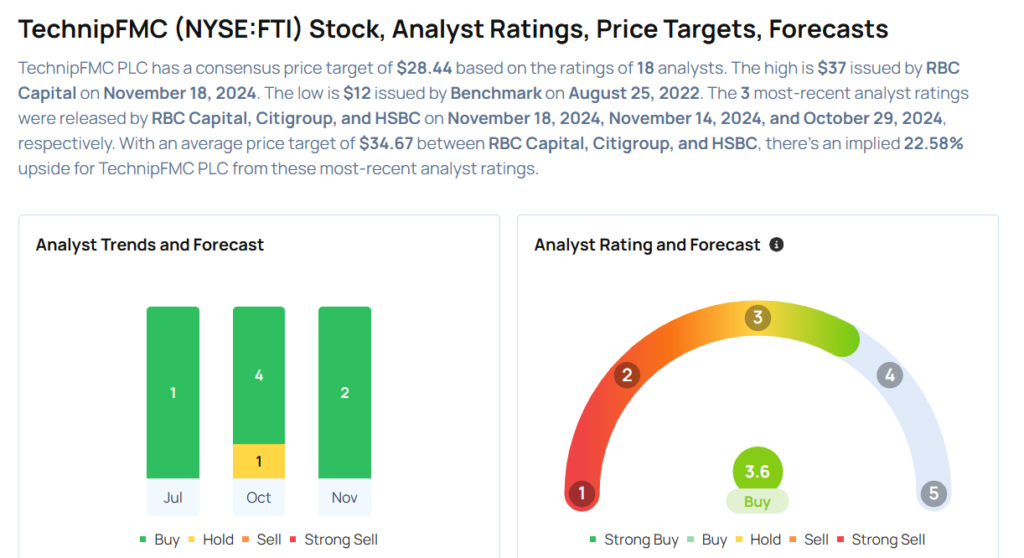

- RBC Capital analyst Victoria McCulloch initiated coverage on TechnipFMC plc FTI with an Outperform rating and announced a price target of $37. TechnipFMC shares closed at $28.18 on Friday. See how other analysts view this stock.

- JMP Securities analyst Silvan Tuerkcan initiated coverage on enGene Holdings Inc. ENGN with a Market Outperform rating and announced a price target of $18. enGene shares closed at $7.63 on Friday. See how other analysts view this stock.

Considering buying FTI stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.