Axalta Marks 10 Years as a Public Company by Ringing the Opening Bell® at the New York Stock Exchange on November 18, 2024

PHILADELPHIA, Nov. 18, 2024 (GLOBE NEWSWIRE) — Axalta AXTA, a leading global coatings company, has announced that Chris Villavarayan, CEO and President, and Rakesh Sachdev, chair of the board, will commemorate 10 years as a publicly traded company by ringing the opening bell at the New York Stock Exchange (NYSE) on Nov. 18, 2024. Axalta’s senior leadership team and employees from the Philadelphia area will also participate in this highly respected and time-honored tradition.

“Ringing the bell at the NYSE is a fitting celebration for Axalta at this point in our history,” said Mr. Villavarayan. “The ONE Axalta team has changed the industry with purpose-driven innovation developed for our 100,000 unique and valued customers. We are breaking the boundaries of external color, efficient application and sustainable solutions while simultaneously growing the company, becoming leaner, and delivering record-setting financial results.”

Since the beginning of 2023, the company has increased its market capitalization by 48 percent and is progressing well against its 2026 A Plan financial targets introduced this year, as reported in third quarter earnings.

Live coverage of the ceremony will begin at 9:28 a.m. EST and will be available for streaming at https://www.NYSE.com/bell.

About Axalta Coating Systems

Axalta is a global leader in the coatings industry, providing customers with innovative, colorful, beautiful, and sustainable coatings solutions. From light vehicles, commercial vehicles and refinish applications to electric motors, building facades and other industrial applications, our coatings are designed to prevent corrosion, increase productivity, and enhance durability. With more than 150 years of experience in the coatings industry, the global team at Axalta continues to find ways to serve our more than 100,000 customers in over 140 countries better every day with the finest coatings, application systems and technology. For more information, visit axalta.com and follow us on LinkedIn and @axalta on X.

Contact Chelsea Quilty 267.216.5603 Chelsea.quilty@axalta.com Axalta.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Refresco completes acquisition of Frías, enhancing Plant-Based beverage portfolio

Press Release

Refresco completes acquisition of Frías, enhancing Plant-Based beverage portfolio

Rotterdam, The Netherlands, November 18, 2024 – Refresco, the global independent beverage solutions provider for retailers and global, national, and emerging (GNE) brands in Europe, North America, and Australia, today announces the successful closing of its acquisition of Frías Nutrición (“Frías”), a leading manufacturer of plant-based drinks in Spain. This transaction, first announced on July 22, 2024, strengthens Refresco’s position in the rapidly growing plant-based beverage category.

Frías, located in Burgos, Spain, employs approximately 250 people and specializes in producing private label plant-based drinks, including almond, rice, hazelnut, and soy options for key retailers in Spain and beyond. This acquisition complements Refresco’s existing operations in Spain and significantly expands its capabilities in the plant-based drinks sector.

CEO Refresco, Hans Roelofs, commented:

“As part of our proven Buy & Build strategy, we are looking to expand our capabilities in existing and adjacent beverage categories. The acquisition of Frías not only enhances our footprint in the plant-based drinks market, but it also allows us to better serve our European customers and accelerates our product innovation capabilities. We are excited to welcome the talented Frías team and are dedicated to a seamless integration process that will drive mutual growth.”

With this acquisition, Refresco reaffirms its commitment to delivering high-quality, innovative beverage solutions to its customers, while also further enhancing its service offerings.

About Refresco

Refresco is the global independent beverage solutions provider for retailers and global, national and emerging brands with production in Europe, North America and Australia. Refresco offers an extensive range of product and packaging combinations from juices to carbonated soft drinks and mineral waters in carton, PET, Aseptic PET, cans and glass. Refresco continuously searches for new and alternative ways to improve the quality of its products and packaging combinations in line with consumer and customer demand, environmental responsibilities and market demand. Refresco is headquartered in Rotterdam, the Netherlands and has more than 14,500 employees. www.refresco.com

Media Contacts

Refresco Corporate Communications

Hendrik de Wit

+31 6 1586 1311

hendrik.dewit@refresco.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Victory-Led Rally In Stocks Shrugged Off Rise In Yields, But Analyst Says If Treasuries 'Don't Find A Ceiling…It Will Become A Problem': Here's What It Means For Investors

The victory of President-elect Donald Trump accompanied by stronger-than-expected economic data has been able to shrug off the worries from the rise in Treasury yields as the S&P 500 Index, which fell by 2.3% last week at 5,870.62 is still higher than its pre-election levels of 5,712.69 points on Monday, Nov. 4.

However, Fed Chair Jerome Powell‘s pirouette on interest rate reduction on Thursday last week may soon start weighing in on the equity markets as experts have highlighted the possible concerns about a “tighter monetary environment” if the economy remains strong.

After the 25 basis Nov. 7 rate cut, Powell said that “the economy is not sending any signals that we need to be in a hurry to lower rates.”

What Happened: Reducing interest rates increases liquidity in the system, thus giving a boost to investment in equities, but on the contrary, holding the interest rates at a higher level causes the liquidity to reduce, yields to rise, and consequently, the economy to shrink.

While the U.S. inflation and economy shows no sign of cooling off, Fed officials may decide not to cut the rates further in their Dec. 17-18 meeting, which will impact the equity markets.

The U.S. two-year Treasury yield rose to 4.31%, whereas the ten-year yield jumped to 4.45% on Friday. “If yields continue to trend up and they don’t find their ceiling, I think it will become a problem because it will basically translate into a tighter monetary environment,” said Irene Tunkel, chief U.S. equity strategist at BCA Research, to Reuters.

Also read: Powell’s Hawkish Remarks Shake Markets: Stocks Fall, Dollar Rockets, Bitcoin Dips

Why It Matters: “A tighter monetary environment” corresponds to higher central bank interest rates, lower bond prices, and higher yields. A tighter monetary policy, causes the yields to rise in the short term and makes borrowing more expensive, gradually reducing the liquidity in the system and hampering the growth while increasing the fear of recession.

The Federal Open Market Committee has the behemoth task of determining the rates and setting the targets while maintaining economic growth. Moreover, a tighter monetary environment is feared by equity investors as fixed-income and debt instruments become more lucrative than equities.

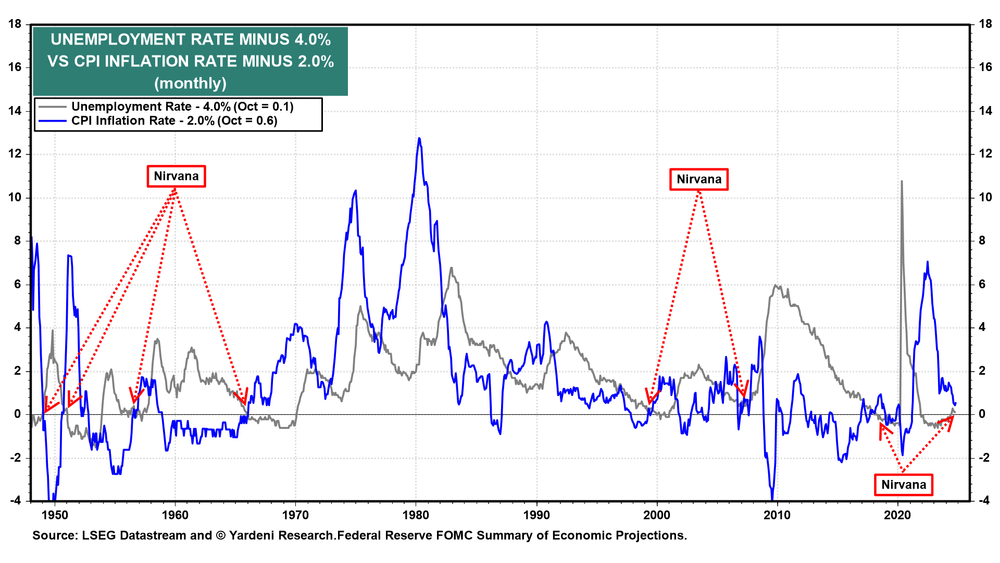

“Just last Thursday, at his presser, he (Powell) claimed that the FFR (Federal Fund Rate) was still too restrictive and had to be lowered to the neutral FFR. Meanwhile, our new ‘Nirvana Model’ shows that both the unemployment rate and inflation rates suggest that the current FFR is at the neutral rate.” said Yardeni Research in one of their quick takes.

Talking about the two-year and ten-year Treasuries, the note added that “we expect both yields to be range bound between 4.25% and 4.75% over the rest of this year and possibly into next year.”

Adding about equities the Yardeni Research note said that “this might be a signal that the stock market could experience a correction now that the Fed might pause rate cutting. Nevertheless, we expect a Santa Claus rally in the S&P 500 to 6,100 points by the end of this year.”

Similar to the S&P 500 Index, the Nasdaq Composite fell by 3.49% last week to 18,680.12 points but remains higher than its Nov. 4 level of 18,179.98 points. NYSE Composite, which was 1.46% lower last week at 19,645.77 points, is also higher than its pre-election level of 19,243.39 points. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had a similar momentum in 2024.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Warren Buffett Sold 67% of Berkshire's Stake in Apple and Is Piling Into a Beloved Consumer Brand Whose Stock Has Soared by 7,000% Since Its IPO

There isn’t a money manager who commands more attention from the investment community than billionaire Warren Buffett. In his nearly six decades as CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), the aptly dubbed “Oracle of Omaha” has overseen a cumulative return in his company’s Class A shares (BRK.A) of greater than 5,660,000%, as of the closing bell on Nov. 14.

Buffett’s ability to consistently outperform Wall Street’s major indexes over lengthy timelines has some investors eager to ride his coattails. Thanks to Form 13F filings with the Securities and Exchange Commission, this can be done with relative ease.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

A 13F is a required filing by institutional investors with at least $100 million in assets under management. It provides investors with a snapshot of which stocks Wall Street’s smartest money managers purchased and sold in the latest quarter. Nov. 14 was the filing deadline to disclose trading activity for the September-ended quarter.

Consistent with Berkshire Hathaway’s 13Fs over the last two years, Buffett and his team have been net sellers of equities and very selective buyers. Based on the latest round of 13Fs, one top holding continues to get the heave-ho, while another beloved consumer goods brand is suddenly a popular buy.

Based on Berkshire Hathaway’s consolidated cash flow statements, Buffett and his team have sold more stocks than they’ve purchased for eight consecutive quarters (dating back to Oct. 1, 2022), totaling an aggregate of $166.2 billion. No stock accounts for a greater percentage of this $166.2 billion than top consumer brand Apple (NASDAQ: AAPL).

Over the trailing year, ended Sept. 30, Berkshire Hathaway has sold 615,560,382 shares of Apple, which reduced its stake in Wall Street’s second-largest company by a staggering 67%. Keep in mind that even after dumping 615.56 million shares of Apple, it’s still Berkshire’s largest holding by almost $25 billion in market value.

During Berkshire Hathaway’s annual shareholder meeting in early May, Buffett opined during the question-and-answer session with investors that the corporate income tax rate would likely head higher. He thus intimated that selling Apple’s stock was a way for Berkshire to lock in sizable unrealized gains at a favorable tax rate.

However, with Donald Trump winning the presidency and Republicans controlling both houses of Congress, corporate income tax increases look to be firmly off the table for at least the next four years. Considering that Apple’s stock has risen significantly on its artificial intelligence (AI) aspirations as Buffett has sold, it’s fair to say that Berkshire Hathaway has missed out on a pretty penny in gains.

Man Who Facilitated Bitcoin Laundering Worth Over $300M Sentenced To 3 Years In Prison

An Ohio-based operator of the darknet cryptocurrency mixer has been sentenced to a three-year prison term after being found guilty of laundering over $300 million in Bitcoin BTC/USD.

What Happened: According to the U.S. Department of Justice, 41-year-old Larry Dean Harmon was the brains behind Helix, a darknet mixer that played a crucial role in laundering customers’ Bitcoin from 2014 to 2017. The platform became a preferred choice for online drug dealers looking to hide the trail of their illegal earnings.

The service processed about 354,468 Bitcoin, equivalent to around $311.14 million at the time of the transactions and more than $32.52 billion at current market rates

On Aug. 18, 2021, Harmon admitted to conspiracy to commit money laundering. Besides his prison term, Harmon was sentenced to three years of supervised release and ordered to forfeit over $400 million in seized cryptocurrencies, real estate, and other monetary assets.

Why It Matters: This case is part of a broader crackdown on darknet cryptocurrency mixers in recent years.

In 2022, Tornado Cash, arguably the most popular of all cryptocurrency mixers, was blacklisted by the Department of Treasury, making it illegal for U.S. citizens, residents, and companies to use.

Tornado Cash founders, Roman Storm, and Roman Semenov were indicted in 2023 for allegedly operating a cryptocurrency mixer that laundered more than $1 billion, including funds from the notorious North Korean cybercrime group Lazarus Group.

The darknet has been a hotbed for illicit activities, with cryptocurrencies often used as a medium for transactions. In a similar case, Ross Ulbricht, the creator of the online illegal drug marketplace Silk Road, has been serving a double life sentence since 2013.

Ulbricht awaits a pardon from President-elect Donald Trump, who promised to commute the former’s sentence if elected to power.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: Nvidia Stock Will Soar After Nov. 20 for These 3 Simple Reasons

Semiconductor company Nvidia (NASDAQ: NVDA) has become the quintessential artificial intelligence (AI) stock for many investors. Since ChatGPT launched in late 2022, Nvidia shares have surged about 950%, making it the best performing stock in the S&P 500 (SNPINDEX: ^GSPC).

On Wednesday, Nov. 20, Nvidia will announce earnings for the third quarter of fiscal 2025, which ended in October 2024. I expect the stock to soar in the days and weeks following the report for three simple reasons. Read on to learn more.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia builds the most coveted graphics processing units (GPUs) in the computing industry, as they have become the gold standard in accelerating artificial intelligence (AI) workloads. Indeed, Nvidia holds over 80% market share in AI accelerators, and Forrester Research recently wrote, “Without Nvidia GPUs, modern AI wouldn’t be possible.”

Nvidia told investors last quarter that the production ramp for its next-generation Blackwell GPU would begin in the fourth fiscal quarter (i.e., the current one) of 2025, which ends in January 2025. Management will likely provide an update during the third-quarter earnings call, and shareholders have reason to anticipate good news. Earlier this year, CEO Jensen Huang said Blackwell would be the most successful product launch in company history.

Additionally, Nvidia executives recently told analysts that Blackwell GPUs are already “booked out 12 months.” That means demand for the new processors is so strong that it will take the company an entire year to work through its existing order backlog. Consequently, Nvidia will like give encouraging guidance on Nov. 20, which sould drive the stock higher.

Nvidia has provided encouraging third-quarter guidance. Management said revenue would increase 80% to $32.5 billion (plus or minus 2%) due to continued demand for the current generation of GPUs, called Hopper. Management also said non-GAAP earnings would increase 80% to $0.72 per diluted share (plus or minus 2%).

However, Wall Street analysts have steadily raised their third-quarter earnings estimates since Nvidia gave its initial guidance. The consensus now calls for earnings to increase 85% to $0.74 per diluted share, according to LSEG. Analysts have also raised their price targets, such that the consensus of $156 per share implies 10% upside from the current share price of $142.

EHang Reports Third Quarter 2024 Unaudited Financial Results

- Record-High Quarterly Revenues, Up 347.8% YoY

- Achieved Quarterly Adjusted Operating Income2 (non-GAAP) and the Second Consecutive Quarter of Adjusted Net Income3 (non-GAAP)

- Maintained Positive Operating Cash Flow for the Fourth Consecutive Quarter

- Over US$22 Million Strategic PIPE Investment to Further Strengthen Liquidity

- Significant eVTOL Sales and Operational Progress in Pioneering Chinese Cities

- New Orders from KC Smart Mobility and Sunriver

- Steady Progress in Air Operator Certification for Commercial Operations

- Strategic Partnership with Civil Aviation Flight University of China for eVTOL Talent Training

- Expanded International Presence with Flights in Brazil, Thailand, Japan and the UAE

- Breakthrough in Solid-State Battery Technology: EH216-S Completes First eVTOL Solid-State Battery Flight Test

- Strategic Partnership with Enpower for Advanced eVTOL Integrated Electric Motor Drive Systems

- Lift-and-Cruise eVTOL Model Upgraded to VT-35

GUANGZHOU, China, Nov. 18, 2024 (GLOBE NEWSWIRE) — EHang Holdings Limited (“EHang” or the “Company”) EH, the world’s leading Urban Air Mobility (“UAM”) technology platform company, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Financial and Operational Highlights for the Third Quarter 2024

- Sales and deliveries of EH216 series products1 were 63 units, the highest quarterly delivery volume in the Company’s history, compared with 13 units in the third quarter of 2023, and 49 units in the second quarter of 2024.

- Total revenues reached a record high of RMB128.1 million (US$18.3 million), representing an increase of 347.8% from RMB28.6 million in the third quarter of 2023, and an increase of 25.6% from RMB102.0 million in the second quarter of 2024.

- Gross margin was 61.2%, representing a decrease of 3.4 percentage points from 64.6% in the third quarter of 2023, and a decrease of 1.2 percentage points from 62.4% in the second quarter of 2024.

- Operating loss was RMB54.7 million (US$7.8 million), representing a 21.8% improvement from RMB70.0 million in the third quarter of 2023 and a 29.3% improvement from RMB77.4 million in the second quarter of 2024.

- Adjusted operating income2 (non-GAAP) was RMB9.0 million (US$1.3 million), compared with adjusted operating loss of RMB34.2 million in the third quarter of 2023, and adjusted operating loss of RMB4.7 million in the second quarter of 2024.

- Net loss was RMB48.1 million (US$6.9 million), representing a 28.3% improvement from RMB67.1 million in the third quarter of 2023, and a 32.8% improvement from RMB71.6 million in the second quarter of 2024.

- Adjusted net income3 (non-GAAP) was RMB15.7 million (US$2.2 million), compared with adjusted net loss3 of RMB31.3 million in the third quarter of 2023, and representing an increase of 1,262.0% from RMB1.2 million in the second quarter of 2024, achieving the second consecutive quarter of non-GAAP profitability.

- Cash and cash equivalents, short-term deposits, restricted short-term deposits and short-term investments balances were RMB1,077.6 million (US$153.6 million) as of September 30, 2024.

- Positive cash flow from operations continued in the third quarter of 2024. This was the fourth consecutive quarter that the Company generated positive cash flow from operations.

Business Highlights for the Third Quarter 2024 and Recent Developments

- Significant eVTOL Sales and Operational Progress in Pioneering Chinese Cities

After receiving the type certificate, production certificate and standard airworthiness certificate for the EH216-S pilotless passenger eVTOL aircraft, EHang is now prepared for mass production and deliveries. The Company is working closely with customers and partners to establish UAM demonstration projects in several Chinese cities such as Hefei, Guangzhou, Shenzhen, Taiyuan, Wencheng, Zhuhai, and more, to showcase eVTOL operations. These efforts include assisting customers obtain their Air Operator Certificate (“OC”), training eVTOL operators and maintenance personnel, building EH216-S vertiports and UAM operational sites, planning flight routes and business strategies, and promoting eVTOL sales and operations across China.

In Hefei, EHang, in collaboration with the Hefei municipal government, launched a new UAM Hub named “Ascend” at Luogang Central Park in November. This marks the second eVTOL operation site for EH216-S in Hefei, following the first UAM Operation Center established in May. The UAM Hub spans nearly 2,000 square meters and can accommodate up to 20 units of EH216-S. It includes dedicated zones for ticketing, passenger waiting, boarding, a command-and-control center, and charging and maintenance facilities. In the third quarter of this year, EHang delivered an additional five units of EH216-S to the Hefei customer for deployment at the new UAM Hub. According to the Hefei government’s plan, over 30 vertiports for eVTOLs will be established in Hefei over the next three years to create a UAM passenger transportation network for aerial sightseeing, multimodal air transport, emergency response, peri-urban travel, and more.

In Guangzhou, EHang’s customer Heli launched the first-ever cross-river round-trip flights with the EH216-S eVTOL between Tiande Plaza and Haixinsha Island in downtown Guangzhou in September, showcasing aerial tourism and air transportation use cases in the city’s central business district. In October, the EH216-S also completed a pilotless passenger-carrying flight in Nansha District, where a comprehensive unmanned system across sea, land and air is planned. EHang is committed to developing more flight routes within a 30-kilometer UAM living circle in Guangzhou, transforming the city’s transportation landscape.

In Shenzhen, five more units of the EH216-S were delivered to the customer Boling for a repeat order in the third quarter. These units will be deployed at Boling’s second UAM Operation Center in Luohu District, following the establishment of the first center in Bao’an District in December 2023.

In Taiyuan, EHang, in collaboration with Xishan Tourism, conducted its debut passenger-carrying flights of the EH216-S at Paddy Field Park in July, after delivering 10 units of the EH216-S to the customer in the second quarter. During the third quarter, an additional 40 units were delivered to Taiyuan for low-altitude sightseeing and tourism uses.

In Wencheng, an additional three units of the EH216-S were delivered to the local customer in the third quarter, following the delivery of 27 units in the second quarter. Several bespoke eVTOL vertiports and flight routes for the EH216-S have been established in Wencheng for aerial sightseeing and tourism. EHang has also formed a joint venture with Wencheng Transportation Development Group to handle eVTOL demonstration, sales, leasing, maintenance, and future operations. Wencheng is currently constructing a commercial center, covering 20,000 square meters, that integrates business, living, operations, and EH216-S display and delivery areas.

In Zhuhai, EHang, in partnership with Wanshan Development Group, established the Wanshan Land-Island Low-altitude Operation Center in July. This center integrates aerial logistics and passenger transportation using EHang’s eVTOLs. EHang, in collaboration with China Post, has jointly launched the first island logistics route “Zhuhai Drone #1”. EHang’s VT-20 series logistic eVTOLs completed a debut round-trip flight, transporting parcels and seafood between Zhuhai Center and Gui Mountain. The 37km trip took 25 minutes, saving 80% of the time compared with traditional transportation methods. Additionally, the EH216-S completed passenger-carrying flights for aerial sightseeing.

Furthermore, the Company also secured new orders from, and completed deliveries for clients in Fujian, Chongqing, Tianjin, Guizhou and Shaanxi in the third quarter of 2024.

- Partnership with KC Smart Mobility with Purchase Plan for 30 Units of the EH216-S to Advance Sale and Tourism and Travel Operations in Hong Kong, Macau and Hubei Province in China

In July, EHang signed a purchase and operations cooperation agreement with KC Smart Mobility, a subsidiary of Kwoon Chung Bus Holdings Limited (“KCBH”) (0306.HK), Hong Kong’s largest non-franchised bus operator, providing passenger transport services between mainland China and Hong Kong, as well as local transport and tourism services in Hong Kong and other locations. KC Smart Mobility plans to purchase a total of 30 units of the EH216-S from EHang for tourism and travel operations in Hong Kong, Macau, as well as the cities of Xiangyang and Shiyan in China’s Hubei Province by the end of 2026. Previously, as part of the 30-unit purchase plan, the first order of five units has been placed and delivered to Hubei for aerial sightseeing uses in the first quarter of 2024.

- Cooperation with Sunriver to Expand Chinese Cultural Tourism Market with Purchase Plan for 50 Units of the EH216-S

In November, EHang signed a cooperation framework agreement with Sunriver (600576.SH), a China A-share listed tourism company with over 40 tourism attractions under its and its parent company’s management, to jointly explore an industrial model that integrates low-altitude economy with cultural tourism in China. Sunriver plans to purchase 50 units of the EH216-S or similar pilotless passenger aircraft from EHang for its cultural tourism projects based on market development needs. Sunriver has placed a purchase order for 5 units of EH216-S as the first batch.

- Steady Progress in Air Operator Certification for Commercial Operations

In July 2024, the Civil Aviation Administration of China (“CAAC”) formally accepted the OC applications submitted by EHang General Aviation and Heyi Aviation, the low-altitude economy operating company in Hefei. This marks the world’s first OC certification project for pilotless passenger eVTOL aircraft, indicating that the first related operational standards are about to be established, ensuring safety for the commercial operations of the EH216-S in China. The OC review is progressing steadily, with the first OC expected to be issued by the end of this year. The Company is also actively assisting other customers and partners in Guangzhou, Shenzhen, Wuxi, Wencheng and Zhuhai with their OC applications to accelerate the commercial operations of the EH216-S nationwide and promote the development of low-altitude economy demonstration zones in more cities.

- Strategic Partnership with Civil Aviation Flight University of China for eVTOL Talent Training

In October 2024, EHang entered into a strategic partnership with the Civil Aviation Flight University of China (“CAFUC”). Building upon the CAFUC’s extensive expertise in civil aviation education, research, and talent development, the two parties will work together to train skilled personnel, including operators and maintenance staff for EHang’s pilotless eVTOL aircraft. This training will cover personnel licensing and operational supervision. This partnership aims to address the growing demand for an estimated millions of talents in the low-altitude economy and support the sustainable, high-quality development of the civil unmanned aerial vehicle industry.

- Expanded International Presence with Flights in Brazil, Thailand, Japan and the UAE

In Brazil, the National Civil Aviation Agency (“ANAC”) granted the Experimental Flight Authorization Certificate for the EH216-S in September, allowing trial operations of this aircraft system. Following this, the EH216-S made its debut flight in Brazil in collaboration with the Company’s local partner Gohobby. The two parties are carrying out extensive trial and test campaigns in Brazil to facilitate local airworthiness certification, working with the ANAC, the Brazilian Airspace Control Department, and the CAAC.

In Thailand, the Civil Aviation Authority of Thailand (“CAAT”) issued a Demonstration Flight Permit, allowing the EH216-S to debut a series of passenger-carrying flights in central Bangkok during the Thailand Drone Exhibition & Symposium 2024 in November. EHang, in collaboration with the CAAT, plans to conduct flight tests with the EH216-S in Thailand and aims to launch commercial flight operations in various regions such as Phuket and Koh Samui by 2025.

In Japan, EH216-S completed a new round of four-city flight tour in Japan in October, expanding its flight footprint to a total of 16 Japanese cities. This tour showcased the EH216-S’s versatility in various use cases, including aerial sightseeing, island transportation, aerial logistics, and emergency services.

In the United Arab Emirates (“UAE”), EHang and its Middle East partner, Wings Logistic Hub, continued to explore the use cases of pilotless eVTOL in the region. In November, the EH216-L, which was delivered to Wings Logistic Hub in the first quarter of 2024, completed a cross-sea flight on the Abu Dhabi, demonstrating its excellent stability and safety as a logistics eVTOL.

To date, EHang and its local partners have conducted over 56,000 safe flights with pilotless eVTOLs in 18 countries across Asia, Europe, North America, and Latin America.

- Breakthrough in Solid-State Battery Technology: EH216-S Completes First eVTOL Solid-State Battery Flight Test

In November, EHang announced a significant breakthrough in high-energy solid-state battery technology, developed in collaboration with Inx, a leading lithium metal solid-state battery provider invested in by EHang, under the support of the Low-Altitude Economy Battery Research Institute of the Hefei International Advanced Technology Application Promotion Center. The EH216-S completed the first eVTOL solid-state battery flight test, lasting 48 minutes and 10 seconds, significantly improving its flight endurance by 60%-90%. Compared to liquid lithium batteries, solid-state batteries offer higher energy density, better thermal stability, reduced flammability, a wider working temperature range, improved storage stability and excellent maintenance-free qualities. EHang will continue to cooperate with Inx to further test and optimize the battery’s performance and stability, aiming for large-scale production of certified solid-state batteries for the EH216-S by the end of 2025.

- Strategic Partnership with Enpower for Advanced eVTOL Integrated Electric Motor Drive Systems

In November, EHang entered into a long-term strategic partnership and technology development cooperation with Zhuhai Enpower Electric Co., Ltd. (“Enpower”, SZ300681), a Chinese leading new energy vehicle power systems provider, with the aim to co-develop high-performance electric motors and motor controllers with lighter weight, higher power density, superior cooling performance, and broader compatibility for EHang’s suite of eVTOL models.

- Lift-and-Cruise eVTOL Model Upgraded to VT-35

Building on the VT-30 prototype, EHang has upgraded its lift-and-cruise eVTOL model to the VT-35. This long-range model complements the Company’s existing product portfolio by targeting application scenarios such as inter-city, cross-bay, and cross-mountain routes, extending beyond the EH216-S’s intra-city UAM coverage. With the EH216 series and VT series, the Company aims to provide comprehensive coverage for low-altitude flights across various scenarios.

- Over US$22 Million Strategic PIPE Investment to Further Strengthen Liquidity

In November, EHang announced a strategic investment totaling over US$22 million from Enpower, and a strategic institutional investor from the Middle East. Both investors agree to a 180-day lock-up period. This strategic investment brings EHang’s total year-to-date financing to nearly US$100 million, enhancing the Company’s financial position as it embarks on its next phase of development and growth in the global UAM industry. The financing proceeds will bolster EHang’s efforts to advance the Company’s next-generation eVTOL technologies and products, scale production capacity, expand its team, establish new headquarters and operation sites, and support general corporate activities.

Management Remarks

Mr. Huazhi Hu, Founder, Chairman and Chief Executive Officer of EHang, commented, “In Q3, EHang once again made remarkable milestones that reinforce our leadership and strategic vision in UAM. As the first eVTOL manufacturer to receive three key certifications for pilotless aerial vehicles, coupled with strengthened government initiatives, we saw an increase in orders from a diverse customers base. Quarterly deliveries of the EH216-S hit a new high of 63 units, more than quadrupling from the prior year, driving robust revenue growth and reflecting strong market demand and recognition of our innovative eVTOL solutions.

Our progress towards obtaining the OC for pilotless passenger-carrying aircraft is on track, marking a global first that will indicate readiness for full-scale operations. We are also actively assisting customers and partners across multiple regions to expedite their OC applications, accelerating the nationwide commercialization of the EH216-S. Additionally, we continue to build the low-altitude ecosystem, including launching a UAM Hub in Hefei, forming a strategic partnership with CAFUC for talent development, and establishing a comprehensive after-sales maintenance system. As part of our global expansion, we have extended our flight footprint to 18 countries and made significant progress in overseas markets.

Looking ahead, we remain committed to advancing technology, including breakthroughs in solid-state batteries to enhance flight endurance and the development of long-range eVTOL aircraft. These efforts are critical to expanding our operations, supporting both intra- and inter-city routes, and meeting the growing demands of our industry and stakeholders. EHang’s unwavering focus on safety, innovation, and sustainable growth positions us to seize the substantial opportunities within the low-altitude economy. We are excited to bring our unique operational and flight experiences to more cities, both in China and abroad.”

Mr. Conor Yang, Chief Financial Officer of EHang, stated, “Driven by our pioneering eVTOL products, industry-first certifications, and deepened policy support, we continued to deliver outstanding financial performance that surpassed our guidance. Specifically, our Q3 revenue surged 347.8% year-over-year, reaching a record high of RMB128.1 million, a testament to the powerful market resonance of our advanced EH216-S pilotless eVTOLs.

We also saw significant improvements in profitability, including a quarterly adjusted operating income2 and the second consecutive quarter of adjusted net income3. Furthermore, we strengthened our cash position for the next phase of growth, with positive operating cash flow for four consecutive quarters and year-to-date financing approaching US$100 million. This includes a recent PIPE investment of over US$22 million from two strategic investors, Enpower and an institutional investor from the Middle East. For the coming quarters, we believe that our strategic foresight, capital preparedness, and core strengths gives us strong capability to sustain this upward trajectory as we accelerate our development while driving innovation at every step.”

Financial Results for the Third Quarter 2024

Revenues

Total revenues were RMB128.1 million (US$18.3 million), representing an increase of 347.8% from RMB28.6 million in the third quarter of 2023, and an increase of 25.6% from RMB102.0 million in the second quarter of 2024. The year-over-year and quarter-over-quarter increases were primarily due to the increase in the sales volume of EH216 series products.

Costs of revenues

Costs of revenues were RMB49.7 million (US$7.1million), compared with RMB10.1 million in the third quarter of 2023 and RMB38.4 million in the second quarter of 2024. The year-over-year and quarter-over-quarter increases were in line with the increase in the sales volume of EH216 series products.

Gross profit and gross margin

Gross profit was RMB78.4 million (US$11.2 million), representing an increase of 324.3% from RMB18.5 million in the third quarter of 2023, and an increase of 23.2% from RMB63.7 million in the second quarter of 2024. The year-over-year and quarter-over-quarter increases were primarily due to the increase in the sales volume of EH216 series products.

Gross margin was 61.2%, representing a 3.4 percentage points decrease from 64.6% in the third quarter of 2023, and a 1.2 percentage points decrease from 62.4% in the second quarter of 2024. The year-over-year and quarter-over-quarter decreases were mainly due to changes in revenue mix and increased cost per unit of the airworthiness certified EH216-S product.

Operating expenses

Total operating expenses were RMB150.7 million (US$21.5 million), compared with RMB89.8 million in the third quarter of 2023, and RMB143.3 million in the second quarter of 2024.

- Sales and marketing expenses were RMB47.3 million (US$6.7 million), compared with RMB13.7 million in the third quarter of 2023, and RMB27.3 million in the second quarter of 2024. The year-over-year and quarter-over-quarter increases were mainly attributable to increased sales-related compensation and associated share-based compensation expenses due to modification of outstanding share-based awards, as well as increased expansion of sales channels.

- General and administrative expenses were RMB59.5 million (US$8.5 million), compared with RMB38.4 million in the third quarter of 2023, and RMB54.2 million in the second quarter of 2024. The year-over-year increase was mainly attributable to increased employee compensation and related share-based compensation expenses due to modification of outstanding share-based awards and the higher expected credit loss expenses. The quarter-over-quarter increase was mainly attributable to higher expected credit loss expenses for receivables on certain customers, while partially offset by the reduction in the share-based compensation expenses.

- Research and development expenses were RMB43.9 million (US$6.3 million), compared with RMB37.7 million in the third quarter of 2023, and RMB61.8 million in the second quarter of 2024. The year-over-year increase was mainly attributable to incremental expenditures on different models of eVTOL aircraft and increased employee compensation. The quarter-over-quarter decreases was mainly attributable to lower share-based compensation expenses due to modification of outstanding share-based awards in the second quarter of 2024.

Adjusted operating expenses4 (non-GAAP)

Adjusted operating expenses were RMB86.9 million (US$12.4 million), representing an increase of 60.9% from RMB54.0 million in the third quarter of 2023, and an increase of 23.1% from RMB70.6 million in the second quarter of 2024. Adjusted sales and marketing expenses, adjusted general and administrative expenses, and adjusted research and development expenses were RMB20.3 million (US$2.9 million), RMB31.3 million (US$4.5 million) and RMB35.3 million (US$5.0 million) in the third quarter of 2024, respectively.

Operating loss

Operating loss was RMB54.7 million (US$7.8 million), representing a 21.8% improvement from RMB70.0 million in the third quarter of 2023, and a 29.3% improvement from RMB77.4 million in the second quarter of 2024.

Adjusted operating income (loss) (non-GAAP)

Adjusted operating income was RMB9.0 million (US$1.3 million), compared with adjusted operating loss of RMB34.2 million in the third quarter of 2023, and adjusted operating loss of RMB4.7 million in the second quarter of 2024.

Net loss

Net loss was RMB48.1 million (US$6.9 million), representing an improvement of 28.3% from RMB67.1 million in the third quarter of 2023, and an improvement of 32.8% from RMB71.6 million in the second quarter of 2024.

Adjusted net income (loss) (non-GAAP)

Adjusted net income was RMB15.7 million (US$2.2 million), compared with adjusted net loss of RMB31.3 million in the third quarter of 2023, and representing an increase of 1,262.0% from RMB1.2 million in the second quarter of 2024.

Adjusted net income attributable to EHang’s ordinary shareholders was RMB15.7 million (US$2.2 million). Adjusted net loss attributable to EHang’s ordinary shareholders in the third quarter of 2023 was RMB31.3 million, and adjusted net income attributable to EHang’s ordinary shareholders was RMB1.2 million in the second quarter of 2024.

Earnings (loss) per share and per ADS

Basic and diluted net loss per ordinary share were both RMB0.35 (US$0.05). Adjusted basic and diluted net earnings per ordinary share5 (non-GAAP) were both RMB0.11 (US$0.016).

Basic and diluted net loss per ADS were both RMB0.70 (US$0.10). Adjusted basic and diluted net earnings per ADS6 (non-GAAP) were both RMB0.22 (US$0.032).

Balance Sheets

Cash and cash equivalents, short-term deposits, restricted short-term deposits and short-term investments balances were RMB1,077.6 million (US$153.6 million) as of September 30, 2024.

Business Outlook

For the fourth quarter of 2024, the Company expects the total revenues to be around RMB135 million, representing an increase of 138.5% year-over-year. With that, the total revenue for the year of 2024 is expected to reach RMB427 million, with a year-on-year increase of 263.5%.

The above outlook is based on information available as of the date of this press release and reflects the Company’s current and preliminary views regarding its business situation and market conditions, which are subject to change.

Conference Call

EHang’s management team will host an earnings conference call at 8:00 AM on Monday, November 18, 2024, U.S. Eastern Time (9:00 PM on Monday, November 18, 2024, Beijing/Hong Kong Time).

To join the conference call via telephone, participants must use the following link to complete an online registration process. Upon registering, each participant will receive email instructions to access the conference call, including dial-in information and a PIN number allowing access to the conference call.

Participant Online Registration:

English line: https://s1.c-conf.com/diamondpass/10043281-hguy76.html

Chinese line: https://s1.c-conf.com/diamondpass/10043282-jh7y6t.html

A live and archived webcast of the conference call will be available on the Company’s investors relations website at http://ir.ehang.com/.

About EHang

EHang Holdings Limited EH (“EHang”) is the world’s leading urban air mobility (“UAM”) technology platform company. Our mission is to enable safe, autonomous, and eco-friendly air mobility accessible to everyone. EHang provides customers in various industries with unmanned aerial vehicle (“UAV”) systems and solutions: air mobility (including passenger transportation and logistics), smart city management, and aerial media solutions. EHang’s EH216-S has obtained the world’s first type certificate, production certificate and standard airworthiness certificate for passenger-carrying pilotless eVTOL aircraft issued by the Civil Aviation Administration of China. As the forerunner of cutting-edge UAV technologies and commercial solutions in the global UAM industry, EHang continues to explore the boundaries of the sky to make flying technologies benefit our life in smart cities. For more information, please visit www.ehang.com.

Safe Harbor Statement

This press release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to” and similar statements. Statements that are not historical facts, including statements about management’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to those relating to certifications, our expectations regarding demand for, and market acceptance of, our products and solutions and the commercialization of UAM services, our relationships with strategic partners, and current litigation and potential litigation involving us. Management has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While they believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond management’s control. These statements involve risks and uncertainties that may cause EHang’s actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements.

Non-GAAP Financial Measures

The Company uses adjusted operating expenses, adjusted sales and marketing expenses, adjusted general and administrative expenses, adjusted research and development expenses, adjusted operating income (loss), adjusted net income (loss), adjusted net income (loss) attributable to ordinary shareholders, adjusted basic and diluted earnings (loss) per ordinary share and adjusted basic and diluted earnings (loss) per ADS (collectively, the “Non-GAAP Financial Measures”) in evaluating its operating results and for financial and operational decision-making purposes. There was no income tax impact on the Company’s non-GAAP adjustments because the non-GAAP adjustments are usually recorded in entities located in tax-free jurisdictions, such as the Cayman Islands.

The Company believes that the Non-GAAP Financial Measures help identify underlying trends in its business that could otherwise be distorted by the effects of items of (i) share-based compensation expenses and (ii) certain non-operational expenses, such as amortization of debt discounts, which are included in their comparable GAAP measures. The Company believes that the Non-GAAP Financial Measures provide useful information about its operating results, enhance the overall understanding of its past performance and future prospects and allow for greater visibility with respect to key metrics used by its management members in their financial and operational decision-making.

The Non-GAAP Financial Measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The Non-GAAP Financial Measures have limitations as analytical tools. One of the key limitations of using the Non-GAAP Financial Measures is that they do not reflect all items of expense that affect the Company’s operations. Share-based compensation expenses have been and may continue to be incurred in the business and are not reflected in the presentation of the Non-GAAP Financial Measures. Further, the Non-GAAP Financial Measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the Non-GAAP Financial Measures to the nearest U.S. GAAP measures, all of which should be considered when evaluating the Company’s performance.

Each of the Non-GAAP Financial Measures should not be considered in isolation or construed as an alternative to its comparable GAAP measure or any other measure of performance or as an indicator of the Company’s operating performance or financial results. Investors are encouraged to review the Company’s most directly comparable GAAP measures in conjunction with the Non-GAAP Financial Measures. The Non-GAAP Financial Measures presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to the Company’s data. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

For more information on the Non-GAAP Financial Measures, please see the table captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

Exchange Rate

This press release contains translations of certain RMB amounts into U.S. dollars (“USD”) at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB 7.0176 to US$1.00, the noon buying rate in effect on September 30, 2024 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred to in this press release could have been converted into USD or RMB, as the case may be, at any particular rate or at all.

Investor Contact: ir@ehang.com

Media Contact: pr@ehang.com

| EHANG HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

||||||

| As of | As of | |||||

| December 31, 2023 | September 30, 2024 | |||||

| RMB | RMB | US$ | ||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||

| ASSETS | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | 228,250 | 611,745 | 87,173 | |||

| Short-term deposits | 14,397 | 115,534 | 16,463 | |||

| Short-term investments | 57,494 | 309,915 | 44,163 | |||

| Restricted short-term deposits | 33,942 | 40,419 | 5,760 | |||

| Accounts receivable, net7 | 34,786 | 18,399 | 2,622 | |||

| Inventories | 59,488 | 67,879 | 9,673 | |||

| Prepayments and other current assets | 24,691 | 29,796 | 4,246 | |||

| Total current assets | 453,048 | 1,193,687 | 170,100 | |||

| Non-current assets: | ||||||

| Property and equipment, net | 44,623 | 43,416 | 6,187 | |||

| Operating lease right‑of‑use assets, net | 74,528 | 124,255 | 17,706 | |||

| Intangible assets, net | 2,426 | 2,383 | 340 | |||

| Long-term loans receivable | 4,215 | – | – | |||

| Long-term investments | 18,369 | 22,718 | 3,237 | |||

| Other non-current assets | 1,436 | 2,063 | 294 | |||

| Total non-current assets | 145,597 | 194,835 | 27,764 | |||

| Total assets | 598,645 | 1,388,522 | 197,864 | |||

| EHANG HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (CONT’D) (Amounts in thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

||||||||||||

| As of | As of | |||||||||||

| December 31, 2023 | September 30, 2024 | |||||||||||

| RMB | RMB | US$ | ||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||

| Current liabilities | ||||||||||||

| Short-term bank loans | 69,798 | 69,592 | 9,917 | |||||||||

| Short-term debt | – | 90,000 | 12,825 | |||||||||

| Notes payables | – | 3,977 | 567 | |||||||||

| Accounts payable | 35,101 | 100,514 | 14,323 | |||||||||

| Contract liabilities8 | 37,169 | 54,593 | 7,779 | |||||||||

| Current portion of long-term bank loans | 3,538 | 10,000 | 1,425 | |||||||||

| Mandatorily redeemable non-controlling interests | 40,000 | 5,700 | ||||||||||

| Accrued expenses and other liabilities | 94,149 | 118,178 | 16,841 | |||||||||

| Current portion of lease liabilities | 5,595 | 10,958 | 1,562 | |||||||||

| Deferred income | 1,549 | 1,533 | 218 | |||||||||

| Deferred government subsidies | 3,147 | 822 | 117 | |||||||||

| Income taxes payable | 29 | 128 | 18 | |||||||||

| Total current liabilities | 250,075 | 500,295 | 71,292 | |||||||||

| Non-current liabilities: | ||||||||||||

| Long-term bank loans | 9,308 | 7,500 | 1,069 | |||||||||

| Mandatorily redeemable non-controlling interests | 40,000 | – | – | |||||||||

| Deferred tax liabilities | 292 | 292 | 42 | |||||||||

| Unrecognized tax benefit | 5,480 | 5,480 | 781 | |||||||||

| Lease liabilities | 75,308 | 123,138 | 17,547 | |||||||||

| Deferred income | 1,486 | 319 | 45 | |||||||||

| Other non-current liabilities | 2,477 | 4,701 | 670 | |||||||||

| Total non-current liabilities | 134,351 | 141,430 | 20,154 | |||||||||

| Total liabilities | 384,426 | 641,725 | 91,446 | |||||||||

| Shareholders’ equity: | ||||||||||||

| Ordinary shares | 80 | 87 | 12 | |||||||||

| Additional paid-in capital | 1,951,936 | 2,677,148 | 381,491 | |||||||||

| Statutory reserves | 1,239 | 1,239 | 177 | |||||||||

| Accumulated deficit | (1,754,542) | (1,937,460) | (276,086) | |||||||||

| Accumulated other comprehensive income | 15,079 | 5,593 | 797 | |||||||||

| Total EHang Holdings Limited shareholders’ equity | 213,792 | 746,607 | 106,391 | |||||||||

| Non-controlling interests | 427 | 190 | 27 | |||||||||

| Total shareholders’ equity | 214,219 | 746,797 | 106,418 | |||||||||

| Total liabilities and shareholders’ equity | 598,645 | 1,388,522 | 197,864 | |||||||||

| EHANG HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (Amounts in thousands of Renminbi (“RMB”) and US dollars (“US$”) except for per share data and per ADS data) |

|||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, 2023 |

June 30, 2024 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||

| Total revenues | 28,615 | 102,019 | 128,128 | 18,258 | 60,822 | 291,874 | 41,592 | ||||||||||||

| Costs of revenues | (10,136 | ) | (38,367 | ) | (49,713 | ) | (7,084 | ) | (22,129 | ) | (111,616 | ) | (15,905 | ) | |||||

| Gross profit | 18,479 | 63,652 | 78,415 | 11,174 | 38,693 | 180,258 | 25,687 | ||||||||||||

| Operating expenses: | |||||||||||||||||||

| Sales and marketing expenses | (13,677 | ) | (27,321 | ) | (47,279 | ) | (6,737 | ) | (39,677 | ) | (94,824 | ) | (13,512 | ) | |||||

| General and administrative expenses | (38,409 | ) | (54,235 | ) | (59,559 | ) | (8,487 | ) | (94,466 | ) | (163,470 | ) | (23,294 | ) | |||||

| Research and development expenses | (37,686 | ) | (61,800 | ) | (43,866 | ) | (6,251 | ) | (129,175 | ) | (143,502 | ) | (20,449 | ) | |||||

| Total operating expenses | (89,772 | ) | (143,356 | ) | (150,704 | ) | (21,475 | ) | (263,318 | ) | (401,796 | ) | (57,255 | ) | |||||

| Other operating income | 1,284 | 2,261 | 17,543 | 2,500 | 3,565 | 23,511 | 3,350 | ||||||||||||

| Operating loss | (70,009 | ) | (77,443 | ) | (54,746 | ) | (7,801 | ) | (221,060 | ) | (198,027 | ) | (28,218 | ) | |||||

| Other income (expense): | |||||||||||||||||||

| Interest and investment income | 2,196 | 6,763 | 8,944 | 1,275 | 4,145 | 18,571 | 2,646 | ||||||||||||

| Interest expenses | (718 | ) | (799 | ) | (847 | ) | (121 | ) | (2,248 | ) | (2,505 | ) | (357 | ) | |||||

| Amortization of debt discounts | – | – | – | – | (12,023 | ) | – | – | |||||||||||

| Foreign exchange gain (loss) | 821 | (483 | ) | 353 | 50 | (303 | ) | (375 | ) | (53 | ) | ||||||||

| Other non-operating income, net | 974 | 911 | 43 | 6 | 3,700 | 1,991 | 284 | ||||||||||||

| Total other income (expense) | 3,273 | 6,392 | 8,493 | 1,210 | (6,729 | ) | 17,682 | 2,520 | |||||||||||

| Loss before income tax and loss from equity method investment | (66,736 | ) | (71,051 | ) | (46,253 | ) | (6,591 | ) | (227,789 | ) | (180,345 | ) | (25,698 | ) | |||||

| Income tax expenses | (118 | ) | (18 | ) | (190 | ) | (27 | ) | (132 | ) | (209 | ) | (30 | ) | |||||

| Loss before loss from equity method investment | (66,854 | ) | (71,069 | ) | (46,443 | ) | (6,618 | ) | (227,921 | ) | (180,554 | ) | (25,728 | ) | |||||

| Loss from equity method investment | (262 | ) | (565 | ) | (1,689 | ) | (241 | ) | (1,959 | ) | (2,601 | ) | (371 | ) | |||||

| Net loss | (67,116 | ) | (71,634 | ) | (48,132 | ) | (6,859 | ) | (229,880 | ) | (183,155 | ) | (26,099 | ) | |||||

| EHANG HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (CONT’D) (Amounts in thousands of Renminbi (“RMB”) and US dollars (“US$”) except for per share data and per ADS data) |

|||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, 2023 |

June 30, 2024 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||

| Net loss | (67,116 | ) | (71,634 | ) | (48,132 | ) | (6,859 | ) | (229,880 | ) | (183,155 | ) | (26,099 | ) | |||||

| Net loss attributable to non-controlling interests | 68 | 97 | 76 | 11 | 444 | 237 | 34 | ||||||||||||

| Net loss attributable to ordinary shareholders | (67,048 | ) | (71,537 | ) | (48,056 | ) | (6,848 | ) | (229,436 | ) | (182,918 | ) | (26,065 | ) | |||||

| Net loss per ordinary share: | |||||||||||||||||||

| Basic and diluted | (0.54 | ) | (0.54 | ) | (0.35 | ) | (0.05 | ) | (1.91 | ) | (1.39 | ) | (0.20 | ) | |||||

| Shares used in net loss per ordinary share computation (in thousands of shares): | |||||||||||||||||||

| Basic | 123,866 | 131,537 | 137,807 | 137,807 | 120,167 | 132,037 | 132,037 | ||||||||||||

| Diluted | 123,866 | 131,537 | 137,807 | 137,807 | 120,167 | 132,037 | 132,037 | ||||||||||||

| Loss per ADS (2 ordinary shares equal to 1 ADS) Basic and diluted |

(1.08 | ) | (1.08 | ) | (0.70 | ) | (0.10 | ) | (3.82 | ) | (2.78 | ) | (0.40 | ) | |||||

| Other comprehensive income | |||||||||||||||||||

| Foreign currency translation adjustments net of nil tax | 348 | 2,816 | (13,053 | ) | (1,860 | ) | 4,594 | (9,486 | ) | (1,352 | ) | ||||||||

| Total other comprehensive income (loss), net of tax | 348 | 2,816 | (13,053 | ) | (1,860 | ) | 4,594 | (9,486 | ) | (1,352 | ) | ||||||||

| Comprehensive loss | (66,768 | ) | (68,818 | ) | (61,185 | ) | (8,719 | ) | (225,286 | ) | (192,641 | ) | (27,451 | ) | |||||

| Comprehensive loss attributable to non-controlling interests | 68 | 97 | 76 | 11 | 444 | 237 | 34 | ||||||||||||

| Comprehensive loss attributable to ordinary shareholders | (66,700 | ) | (68,721 | ) | (61,109 | ) | (8,708 | ) | (224,842 | ) | (192,404 | ) | (27,417 | ) | |||||

| EHANG HOLDINGS LIMITED UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS (Amounts in thousands of Renminbi (“RMB”) and US dollars (“US$”) except for per share data and per ADS data) |

|||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, 2023 |

June 30, 2024 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||

| Gross profit | 18,479 | 63,652 | 78,415 | 11,174 | 38,693 | 180,258 | 25,687 | ||||||||||||

| Plus: Share-based compensation | – | – | – | – | – | – | – | ||||||||||||

| Adjusted gross profit | 18,479 | 63,652 | 78,415 | 11,174 | 38,693 | 180,258 | 25,687 | ||||||||||||

| Sales and marketing expenses | (13,677 | ) | (27,321 | ) | (47,279 | ) | (6,737 | ) | (39,677 | ) | (94,824 | ) | (13,512 | ) | |||||

| Plus: Share-based compensation | 4,767 | 11,725 | 26,963 | 3,842 | 14,373 | 47,505 | 6,769 | ||||||||||||

| Adjusted sales and marketing expenses | (8,910 | ) | (15,596 | ) | (20,316 | ) | (2,895 | ) | (25,304 | ) | (47,319 | ) | (6,743 | ) | |||||

| General and administrative expenses | (38,409 | ) | (54,235 | ) | (59,559 | ) | (8,487 | ) | (94,466 | ) | (163,470 | ) | (23,294 | ) | |||||

| Plus: Share-based compensation | 22,327 | 31,848 | 28,281 | 4,030 | 42,183 | 89,650 | 12,775 | ||||||||||||

| Adjusted general and administrative expenses | (16,082 | ) | (22,387 | ) | (31,278 | ) | (4,457 | ) | (52,283 | ) | (73,820 | ) | (10,519 | ) | |||||

| Research and development expenses | (37,686 | ) | (61,800 | ) | (43,866 | ) | (6,251 | ) | (129,175 | ) | (143,502 | ) | (20,449 | ) | |||||

| Plus: Share-based compensation | 8,679 | 29,211 | 8,551 | 1,218 | 44,611 | 52,710 | 7,512 | ||||||||||||

| Adjusted research and development expenses | (29,007 | ) | (32,589 | ) | (35,315 | ) | (5,033 | ) | (84,564 | ) | (90,792 | ) | (12,937 | ) | |||||

| Operating expenses | (89,772 | ) | (143,356 | ) | (150,704 | ) | (21,475 | ) | (263,318 | ) | (401,796 | ) | (57,255 | ) | |||||

| Plus: Share-based compensation | 35,773 | 72,784 | 63,795 | 9,090 | 101,167 | 189,865 | 27,056 | ||||||||||||

| Adjusted operating expenses | (53,999 | ) | (70,572 | ) | (86,909 | ) | (12,385 | ) | (162,151 | ) | (211,931 | ) | (30,199 | ) | |||||

| Operating loss | (70,009 | ) | (77,443 | ) | (54,746 | ) | (7,801 | ) | (221,060 | ) | (198,027 | ) | (28,218 | ) | |||||

| Plus: Share-based compensation | 35,773 | 72,784 | 63,795 | 9,090 | 101,167 | 189,865 | 27,056 | ||||||||||||

| Adjusted operating (loss) income | (34,236 | ) | (4,659 | ) | 9,049 | 1,289 | (119,893 | ) | (8,162 | ) | (1,162 | ) | |||||||

| EHANG HOLDINGS LIMITED UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS (CONT’D) (Amounts in thousands of Renminbi (“RMB”) and US dollars (“US$”) except for per share data and per ADS data) |

|||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, 2023 |

June 30, 2024 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

|||||||||||||||

| RMB | RMB | RMB | US$ | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||

| Net loss | (67,116 | ) | (71,634 | ) | (48,132 | ) | (6,859 | ) | (229,880 | ) | (183,155 | ) | (26,099 | ) | |||||

| Plus: Share-based compensation | 35,773 | 72,784 | 63,795 | 9,090 | 101,167 | 189,865 | 27,056 | ||||||||||||

| Plus: Amortization of debt discounts | – | – | – | – | 12,023 | – | – | ||||||||||||

| Adjusted net (loss) income | (31,343 | ) | 1,150 | 15,663 | 2,231 | (116,690 | ) | 6,710 | 957 | ||||||||||

| Net loss attributable to ordinary shareholders | (67,048 | ) | (71,537 | ) | (48,056 | ) | (6,848 | ) | (229,436 | ) | (182,918 | ) | (26,065 | ) | |||||

| Plus: Share-based compensation | 35,773 | 72,784 | 63,795 | 9,090 | 101,167 | 189,865 | 27,056 | ||||||||||||

| Plus: Amortization of debt discounts | – | – | – | – | 12,023 | – | – | ||||||||||||

| Adjusted net (loss) income attributable to ordinary shareholders | (31,275 | ) | 1,247 | 15,739 | 2,242 | (116,246 | ) | 6,947 | 991 | ||||||||||

| Shares used in net earnings (loss) per ordinary share computation (in thousands of shares): | |||||||||||||||||||

| Basic | 123,866 | 131,537 | 137,807 | 137,807 | 120,167 | 132,037 | 132,037 | ||||||||||||

| Diluted | 123,866 | 134,037 | 140,516 | 140,516 | 120,167 | 134,221 | 134,221 | ||||||||||||

| Adjusted basic and diluted net earnings (loss) per ordinary share | (0.25 | ) | 0.01 | 0.11 | 0.016 | (0.97 | ) | 0.05 | 0.01 | ||||||||||

| Adjusted basic and diluted net earnings (loss) per ADS | (0.50 | ) | 0.02 | 0.22 | 0.032 | (1.94 | ) | 0.10 | 0.02 | ||||||||||

______________________________________

1 The EH216 series products include EH216-S, the standard model for passenger transportation, EH216-F model for aerial firefighting, and EH216-L model for aerial logistics.

2 Adjusted operating income (loss) is a non-GAAP financial measure, which is defined as operating loss excluding share-based compensation expenses. Operating loss was RMB54.7 million (US$7.8 million) in the third quarter of 2024. See “Non-GAAP Financial Measures” below.

3 Adjusted net income (loss) is a non-GAAP financial measure, which is defined as net loss excluding share-based compensation expenses and certain non-operational expenses. Net loss was RMB48.1 million (US$6.9 million) in the third quarter of 2024. See “Non-GAAP Financial Measures” below.

4 Adjusted operating expenses is a non-GAAP financial measure, which is defined as operating expenses excluding share-based compensation expenses. See “Non-GAAP Financial Measures” below.

5 Adjusted basic and diluted net earnings (loss) per ordinary share is a non-GAAP financial measure, which is defined as basic and diluted loss per ordinary share excluding share-based compensation expenses and certain non-operational expenses. See “Non-GAAP Financial Measures” below.

6 Adjusted basic and diluted net earnings (loss) per ADS is a non-GAAP financial measure, which is defined as basic and diluted loss per ADS excluding share-based compensation expenses and certain non-operational expenses. See “Non-GAAP Financial Measures” below.

7 As of December 31, 2023 and September 30, 2024, amount due from a related party of RMB1,700 and RMB1,530 (US$218) are included in accounts receivable, net, respectively.

8 As of December 31, 2023 and September 30, 2024, amount due to a related party of RMB2,000 and RMB2,000 (US$285) are included in contract liabilities, respectively.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dell Ships First 72-Nvidia GPU Monster: 'AI Rocket Just Got A Massive Boost,' Says CEO

Dell Technologies Inc DELL has reached a major milestone by becoming the first company to deliver a new generation of super-powerful computer systems designed specifically for artificial intelligence.

What Happened: Michael Dell, the company’s CEO, announced on social media platform X that Dell is shipping its first liquid-cooled PowerEdge XE9712 systems to CoreWeave, a company that provides computing power for AI applications.

“The AI rocket just got a massive boost!” Michael Dell in his announcement, highlighted the significance of this achievement.

These new systems, developed in partnership with tech giant NVIDIA Corp NVDA, are unlike traditional computers. They use special cooling technology that helps them handle the intense processing needed for advanced AI tasks. Think of it as the difference between a regular car engine and a Formula 1 racing engine – both are engines, but one is designed for much more powerful performance.

Why It Matters: The system, called the GB200 NVL72, combines 72 powerful processing chips (GPUs) and 36 central computers (CPUs) working together as one unit. This allows it to run AI programs 30 times faster than previous systems, particularly when handling complex AI tasks like chatbots and image generation.

CoreWeave, the company receiving these first systems, specializes in providing high-powered computing services to businesses working with AI. They work closely with Nvidia, which designed the core technology inside these systems.

This development is particularly important as companies worldwide are racing to build and access more powerful AI computing systems. Industry experts predict high demand for these systems, with estimates suggesting 20,000 to 25,000 similar systems could be shipped in 2025.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.