Morning Bid: Bruised Wall Street keeps wary eye on Nvidia

A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street feels a little bruised after its worst week in 10 spoiled the post-election party, with home truths on interest rates and earnings seeping back in along with all the uncertainty on what a new administration will actually do come January.

Stocks were side-swiped on Friday after a week of irksome inflation readings, hot retail updates and Federal Reserve boss Jerome Powell’s equivocation on future easing.

There was also trepidation, however, ahead of chip giant Nvidia latest earnings report on Wednesday – as the world’s biggest company by market value and artificial intelligence bellwether faces another test of the near 800% stock boom over the past year.

The $3.5 trillion company is expected to post net income of $18.4 billion as revenue jumped over 80% to $33 billion, according to LSEG data. Nvidia’s huge earnings beats over the past year, however, are inevitably becoming more modest.

With reasonable concerns about the chances of a global trade war rumbling in the background, Nvidia’s shares took a 2% hit early on Monday after weekend reports that its new Blackwell AI chips, which have already faced delays, encountered problems with accompanying servers which overheat.

Yet, stock index futures put on a braver face ahead of today’s open and tried to claw back some of last week’s swoon – which chopped almost 50% off the S&P500’s post-election rally.

The broader earnings season has comfortably beaten estimates, with aggregate annual profit growth coming in close to 9% – compared to the 5.3% forecast at the start of October.

Next year’s growth estimates are being pared back, however, with full-year S&P500 profit growth forecasts dropping about one percentage point to 14% over the past two weeks.

Beyond stocks, the restive Treasury market steadied first thing on Monday, with 10-year yields remaining below 4.5%.

Futures pricing for another Fed rate cut next month shows about a 60% chance of further easing in December and 75 basis points of cuts are now priced to the end of next year.

Despite controversial cabinet picks to date, President-elect Donald Trump still has not proposed names for the top economic posts at the Treasury or Commerce departments or the new Trade Representative.

Trump added former Fed Governor Kevin Warsh and billionaire Marc Rowan to the list of candidates to become his Treasury secretary, the New York Times and Wall Street Journal reported on Sunday.

A former investment banker, Warsh served on the Fed Board from 2006 to 2011 and was seen as both a fiscal hawk and a proponent of higher savings rates. Rowan co-founded investment manager Apollo Global Management and became its CEO in 2021.

Smart Glass Market Projected to Hit USD 18.3 billion by 2031, with a 14.5% CAGR | Exclusive Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Nov. 18, 2024 (GLOBE NEWSWIRE) — The global smart glass market (스마트 유리 시장) is estimated to flourish at a CAGR of 14.5% from 2021 to 2031. Transparency Market Research projects that the overall sales revenue for smart glass is estimated to reach US$ 18.3 billion by the end of 2031. Post-pandemic, a heightened focus on health and hygiene is influencing the smart glass market. Antimicrobial coatings and touchless controls are becoming crucial, especially in public spaces.

Smart glass finds unconventional applications in the retail sector, enhancing customer experience with interactive displays and dynamic advertising. Transparency control in storefronts creates engaging, customizable retail environments. The integration of smart glass with renewable energy sources is gaining momentum. Photovoltaic smart glass systems harness solar energy while providing shading, contributing to sustainable energy practices in buildings.

Beyond automotive applications, smart glass is increasingly utilized in transportation infrastructure. Intelligent glass in railways and airports enhances passenger comfort, with tinting options and information displays improving the travel experience. The rise of smart cities drives the adoption of smart glass in urban planning. Energy-efficient smart glass in public buildings, street furniture, and transportation hubs align with the sustainability goals of smart city initiatives.

Download Sample PDF of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1026

Smart Glass Market: Competitive Landscape

The smart glass market boasts a competitive landscape driven by key players innovating in dynamic glazing technologies. Companies like AGC Inc., Saint-Gobain S.A., and Research Frontiers Inc. lead with a diverse range of smart glass solutions for automotive, architectural, and consumer electronics applications.

Intense research and development activities fuel technological advancements, while strategic partnerships and acquisitions enhance market presence.

Emerging players contribute to the competition, introducing niche solutions. As demand grows for energy-efficient and visually dynamic glass solutions, the smart glass market remains dynamic, fostering innovation and addressing evolving consumer and industry needs. Some prominent manufacturers are as follows:

- DuPont

- ASAHI GLASS CO. LTD.

- Saint-Gobain S.A.

- Polytronix Inc.

- ChromoGenics AB

- Smartglass International Limited

- Innovative Glass Corporation

- GUARDIAN INDUSTRIES CORP

- Research Frontiers

- iGlass

Key Findings of the Market Report

- Electrochromic technology leads the smart glass market, offering dynamic tinting and energy-efficient solutions for diverse applications like construction and automotive.

- Architectural end-use segment leads the smart glass market, driven by increasing demand for energy-efficient and visually dynamic building solutions.

- North America leads the smart glass market, driven by robust adoption in sustainable architecture and advancements in automotive applications.

Smart Glass Market Growth Drivers & Trends

- Growing demand for energy-efficient buildings boosts smart glass adoption.

- Integration of smart glass in vehicles enhances user experience and safety, driving market growth.

- Ongoing advancements in smart glass technologies, such as electrochromic and thermochromic systems, propel market expansion.

- Rising awareness of smart glass benefits, including energy savings and enhanced comfort, contributes to market growth.

- Supportive government regulations and incentives for energy-efficient technologies foster the adoption of smart glass in construction and automotive sectors.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1026

Global Smart Glass Market: Regional Profile

- In North America, a mature market witnesses a surge in smart glass adoption, driven by sustainable building trends and automotive advancements.

- Europe embraces smart glass solutions for energy efficiency, with regulatory support accelerating market growth.

- The Asia Pacific stands as a hotbed for innovation, particularly in construction and automotive applications. Rapid urbanization and technological evolution in countries like China and Japan contribute to robust market expansion.

Product Portfolio

- Asahi Glass Co. Ltd. pioneers cutting-edge glass solutions, offering a diverse product portfolio ranging from architectural and automotive glass to electronics and displays. With a commitment to innovation, they shape industries globally, delivering high-performance materials that redefine possibilities.

- Saint-Gobain S.A. leads in sustainable construction materials, providing innovative solutions in insulation, gypsum, and performance plastics. Their diverse product portfolio caters to the evolving needs of the construction industry, ensuring durability, energy efficiency, and environmental responsibility.

- Polytronix, Inc. specializes in cutting-edge liquid crystal technology, offering a comprehensive product portfolio including smart glass solutions for privacy, projection, and energy efficiency. Their innovative applications redefine the possibilities of glass, enhancing functionality and aesthetics in various industries.

Smart Glass Market: Key Segments

By Technology

- Electrochromic

- Thermochromic

- Photochromic

- Liquid Crystal

- Suspended Particle Device

By End Use

- Architectural

- Consumer Electronics

- Transportation

- Solar Power Generation

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=1026<ype=S

More Trending Report by Transparency Market Research:

Microturbines Market (سوق التوربينات الدقيقة) – The global microturbines market is projected to grow at a CAGR of 8.6% from 2022 to 2031

Deoiler Chemicals Market (脱油剤化学品市場) – The global deoiler chemicals market stood at US$ 18.0 billion in 2022 and the global market is projected to reach US$ 27.3 billion by 2031. The global industry is anticipated to expand at a CAGR of 4.8% between 2023 and 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Niu Q3 Earnings: Scooter Volume Up, But Price Drops And Margins Tighten, Strong Q4 Outlook And More

Chinese electric scooter company Niu Technologies NIU reported a fiscal third-quarter 2024 revenue growth of 10.5% to 1.02 billion Chinese yuan ($145.90 million), mainly due to an increase in sales volume of 17.5%, partially offset by a decrease in revenues per e-scooter of 6.0%.

The company reported loss per ADS of $(0.07). Adjusted net loss was (34.25) million Chinese yuan, compared to (69.96) million Chinese yuan loss a year ago.

Also Read: Disney’s Streaming Profits And Park Rebound Lead The Way: Analyst

The number of e-scooters sold increased by 17.5% Y/Y to 312,405, with sales in China growing by 12.4%. International e-scooter sales climbed 50.3% to 53,311 units. The number of franchised stores in China was 3,345 as of September 30, 2024.

The quarterly gross margin declined 760 basis points Y/Y to 13.8%, mainly due to a higher proportion of kick-scooter sales in international markets, changes in the product mix of e-scooters, and increased sales incentives to franchisees in the Chinese market.

The operating loss for the quarter was (58.49) million Chinese yuan versus a loss of (89.52) million Chinese yuan a year ago. The company held 1.05 billion Chinese yuan in cash and equivalents as of September 30, 2024.

CEO Yan Li noted that third-quarter sales growth fell short of targets due to recent policy changes in China affecting sales timing. However, retail demand remains robust, and the upcoming product lineup aligns with the new regulations, positioning the company well to manage these shifts. The launch of the NX Hyper electric motorcycle represents a key milestone, emphasizing a focus on performance and innovation.

Li added that the company has maintained a strong pace of new store openings this year, creating a solid base for future growth. At the recent Milan EICMA event, they introduced a series of new scooters, highlighting advanced design and innovative technology. These models will soon launch in the EU and the US.

Li expressed confidence in navigating market changes and delivering strong performance.

Outlook: Niu expects fourth-quarter revenues of 622 million Chinese yuan – 718 million Chinese yuan, representing a 30%-50% Y/Y increase.

Niu Technologies stock plunged 7% year-to-date.

Price Action: NIU shares closed lower by 0.50% at $1.99 on Friday.

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asia And Europe Markets Mostly Lower, Dollar's Uptrend Continues – Global Markets Today While US Slept

On Friday, November 15, U.S. markets closed lower, with the S&P 500 and Nasdaq recording their steepest losses in two weeks. The decline was fueled by worries over delayed interest rate cuts, reactions to economic data, and Trump’s cabinet picks, including Robert F. Kennedy Jr., raising vaccine policy concerns.

Related: European And U.S. Vaccine Stocks Are Under Pressure – Here’s Why

According to economic data, U.S. export prices rose by 0.8% in October, while import prices increased by 0.3%. Retail sales grew 0.4% month-over-month, exceeding market expectations of 0.3% but lower than September’s revised 0.8% gain.

Most S&P 500 sectors fell, led by losses in tech, communication services, and healthcare, while utilities and financials gained, defying the broader market trend.

The Dow Jones Industrial Average was down 0.47% and closed at 43,750.86, the S&P 500 declined 0.50% to 5,949.17, and the Nasdaq Composite slid 0.64% to finish at 19,107.65.

Asia Markets Today

- On Monday, Japan’s Nikkei 225 declined 1.05% and ended the session at 38,232.50, led by losses in the Real Estate, Shipbuilding, and Financial Services sectors.

- Australia’s S&P/ASX 200 rose 0.18% and ended the day at 8,300.20, led by gains in the Consumer Staples, Utilities and Gold sectors.

- India’s Nifty 50 closed 0.50% lower at 23,462.70, and Nifty 500 down 0.28% at 21,901.10, led by losses in the Technology, Oil & Gas, and Fast Moving Consumer Goods sectors.

- China’s Shanghai Composite declined 0.21% to close at 3,323.85, and the Shenzhen CSI 300 fell 0.46%, finishing the day at 3,950.38.

- Hong Kong’s Hang Seng gained 0.77% and closed the session at 19,576.61.

Eurozone at 05:30 AM ET

- The European STOXX 50 index was down 0.27%.

- Germany’s DAX slid 0.08%.

- France’s CAC fell 0.00%.

- FTSE 100 index traded higher by 0.30%

Commodities at 05:30 AM ET

- Crude Oil WTI was trading higher by 0.70% at $67.39/bbl, and Brent was up 0.73% at $71.56/bbl.

- Oil prices rose amid the escalating Russia-Ukraine conflict. However, market gains were tempered by weak demand in China and a global oil surplus forecast. U.S. support for Ukrainian strikes against Russia increased geopolitical risks.

- Natural Gas rose 2.34% to $2.888.

- Gold was trading higher by 0.99% at $2,595.80, Silver gained 1.27% to $30.820, and Copper rose 0.46% to $4.0830.

- Gold prices rose, supported by a slowing dollar rally. Investors await Federal Reserve comments amid strong U.S. economic data reducing expectations for December rate cuts.

U.S. Futures at 05:30 AM ET

Dow futures declined 0.22%, S&P 500 futures up 0.02%, and Nasdaq 100 futures gained 0.35%.

Forex at 05:30 AM ET

- The U.S. dollar index gained 0.02% to 106.70, the USD/JPY rose 0.41% to 154.97, and the USD/AUD rose 0.08% to 1.5484.

- The dollar strengthened against the yen as Bank of Japan Governor Kazuo Ueda signaled potential future rate hikes without confirming timing.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Seeking up to 14% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

The stock market closed last week on a negative note, weighed down by investor speculation that the Federal Reserve might scale back its pace of policy easing.

Federal Reserve Chair Jerome Powell, in remarks on Thursday, emphasized there was no immediate rush to lower interest rates, citing positive economic indicators. This message was reinforced on Friday by a stronger-than-expected October retail sales report.

Meanwhile, enthusiasm for President-elect Donald Trump’s pro-business agenda is fading, with growing concerns about the potential costs and inflationary risks tied to his fiscal policies.

In this environment, investors will turn toward defensive shares – and that frequently means dividend stocks. These investments offer consistent income, making them a reliable choice during periods of market uncertainty.

So, if Friday’s downbeat day has you seeking out dividends, Wall Street analysts have flagged two dividend stocks to buy, including one with a 14% yield. Let’s take a closer look, with insights drawn from the TipRanks database.

AFC Gamma (AFCG)

We’ll start with a real estate investment trust, a REIT, that operates with a bit of a twist. The company, AFC Gamma, works with the cannabis industry, where it acts as a finance provider, making available commercial real estate loans, as well as loan underwriting and other financial services. The company makes direct loans and bridge loans in the range of $10 million to $100 million – an important source of finance in an industry that is growing rapidly but is also dealing with a complex legal structure. AFC Gamma estimates that the cannabis industry has an addressable market of approximately $30 billion.

The company is based in West Palm Beach, Florida, one of the states with a legal cannabis framework, and its customer base is state-licensed cannabis operators across the country. The cannabis industry has a high overhead, as the grow facilities require a combination of large floor space and heavy use of both water and electric utilities. Access to traditional banking capital can be limited, because cannabis is illegal at the Federal level, and the states present a patchwork of different legal frameworks. All in all, AFC Gamma’s target niche is a bright opportunity for a finance company that can operate outside the banking networks – and the company’s status as the largest REIT in the cannabis industry makes it attractive to dividend investors.

Axalta Marks 10 Years as a Public Company by Ringing the Opening Bell® at the New York Stock Exchange on November 18, 2024

PHILADELPHIA, Nov. 18, 2024 (GLOBE NEWSWIRE) — Axalta AXTA, a leading global coatings company, has announced that Chris Villavarayan, CEO and President, and Rakesh Sachdev, chair of the board, will commemorate 10 years as a publicly traded company by ringing the opening bell at the New York Stock Exchange (NYSE) on Nov. 18, 2024. Axalta’s senior leadership team and employees from the Philadelphia area will also participate in this highly respected and time-honored tradition.

“Ringing the bell at the NYSE is a fitting celebration for Axalta at this point in our history,” said Mr. Villavarayan. “The ONE Axalta team has changed the industry with purpose-driven innovation developed for our 100,000 unique and valued customers. We are breaking the boundaries of external color, efficient application and sustainable solutions while simultaneously growing the company, becoming leaner, and delivering record-setting financial results.”

Since the beginning of 2023, the company has increased its market capitalization by 48 percent and is progressing well against its 2026 A Plan financial targets introduced this year, as reported in third quarter earnings.

Live coverage of the ceremony will begin at 9:28 a.m. EST and will be available for streaming at https://www.NYSE.com/bell.

About Axalta Coating Systems

Axalta is a global leader in the coatings industry, providing customers with innovative, colorful, beautiful, and sustainable coatings solutions. From light vehicles, commercial vehicles and refinish applications to electric motors, building facades and other industrial applications, our coatings are designed to prevent corrosion, increase productivity, and enhance durability. With more than 150 years of experience in the coatings industry, the global team at Axalta continues to find ways to serve our more than 100,000 customers in over 140 countries better every day with the finest coatings, application systems and technology. For more information, visit axalta.com and follow us on LinkedIn and @axalta on X.

Contact Chelsea Quilty 267.216.5603 Chelsea.quilty@axalta.com Axalta.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Refresco completes acquisition of Frías, enhancing Plant-Based beverage portfolio

Press Release

Refresco completes acquisition of Frías, enhancing Plant-Based beverage portfolio

Rotterdam, The Netherlands, November 18, 2024 – Refresco, the global independent beverage solutions provider for retailers and global, national, and emerging (GNE) brands in Europe, North America, and Australia, today announces the successful closing of its acquisition of Frías Nutrición (“Frías”), a leading manufacturer of plant-based drinks in Spain. This transaction, first announced on July 22, 2024, strengthens Refresco’s position in the rapidly growing plant-based beverage category.

Frías, located in Burgos, Spain, employs approximately 250 people and specializes in producing private label plant-based drinks, including almond, rice, hazelnut, and soy options for key retailers in Spain and beyond. This acquisition complements Refresco’s existing operations in Spain and significantly expands its capabilities in the plant-based drinks sector.

CEO Refresco, Hans Roelofs, commented:

“As part of our proven Buy & Build strategy, we are looking to expand our capabilities in existing and adjacent beverage categories. The acquisition of Frías not only enhances our footprint in the plant-based drinks market, but it also allows us to better serve our European customers and accelerates our product innovation capabilities. We are excited to welcome the talented Frías team and are dedicated to a seamless integration process that will drive mutual growth.”

With this acquisition, Refresco reaffirms its commitment to delivering high-quality, innovative beverage solutions to its customers, while also further enhancing its service offerings.

About Refresco

Refresco is the global independent beverage solutions provider for retailers and global, national and emerging brands with production in Europe, North America and Australia. Refresco offers an extensive range of product and packaging combinations from juices to carbonated soft drinks and mineral waters in carton, PET, Aseptic PET, cans and glass. Refresco continuously searches for new and alternative ways to improve the quality of its products and packaging combinations in line with consumer and customer demand, environmental responsibilities and market demand. Refresco is headquartered in Rotterdam, the Netherlands and has more than 14,500 employees. www.refresco.com

Media Contacts

Refresco Corporate Communications

Hendrik de Wit

+31 6 1586 1311

hendrik.dewit@refresco.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Victory-Led Rally In Stocks Shrugged Off Rise In Yields, But Analyst Says If Treasuries 'Don't Find A Ceiling…It Will Become A Problem': Here's What It Means For Investors

The victory of President-elect Donald Trump accompanied by stronger-than-expected economic data has been able to shrug off the worries from the rise in Treasury yields as the S&P 500 Index, which fell by 2.3% last week at 5,870.62 is still higher than its pre-election levels of 5,712.69 points on Monday, Nov. 4.

However, Fed Chair Jerome Powell‘s pirouette on interest rate reduction on Thursday last week may soon start weighing in on the equity markets as experts have highlighted the possible concerns about a “tighter monetary environment” if the economy remains strong.

After the 25 basis Nov. 7 rate cut, Powell said that “the economy is not sending any signals that we need to be in a hurry to lower rates.”

What Happened: Reducing interest rates increases liquidity in the system, thus giving a boost to investment in equities, but on the contrary, holding the interest rates at a higher level causes the liquidity to reduce, yields to rise, and consequently, the economy to shrink.

While the U.S. inflation and economy shows no sign of cooling off, Fed officials may decide not to cut the rates further in their Dec. 17-18 meeting, which will impact the equity markets.

The U.S. two-year Treasury yield rose to 4.31%, whereas the ten-year yield jumped to 4.45% on Friday. “If yields continue to trend up and they don’t find their ceiling, I think it will become a problem because it will basically translate into a tighter monetary environment,” said Irene Tunkel, chief U.S. equity strategist at BCA Research, to Reuters.

Also read: Powell’s Hawkish Remarks Shake Markets: Stocks Fall, Dollar Rockets, Bitcoin Dips

Why It Matters: “A tighter monetary environment” corresponds to higher central bank interest rates, lower bond prices, and higher yields. A tighter monetary policy, causes the yields to rise in the short term and makes borrowing more expensive, gradually reducing the liquidity in the system and hampering the growth while increasing the fear of recession.

The Federal Open Market Committee has the behemoth task of determining the rates and setting the targets while maintaining economic growth. Moreover, a tighter monetary environment is feared by equity investors as fixed-income and debt instruments become more lucrative than equities.

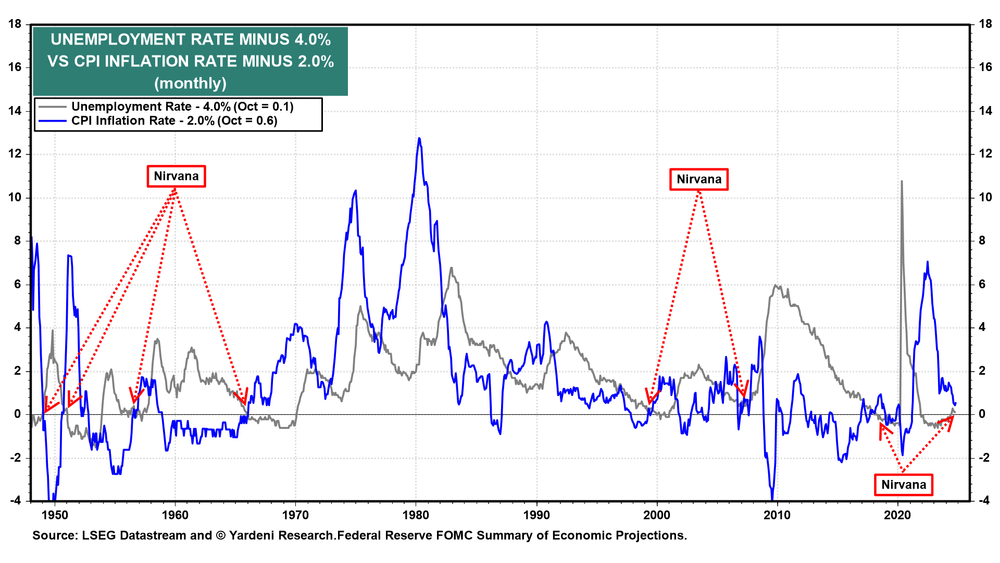

“Just last Thursday, at his presser, he (Powell) claimed that the FFR (Federal Fund Rate) was still too restrictive and had to be lowered to the neutral FFR. Meanwhile, our new ‘Nirvana Model’ shows that both the unemployment rate and inflation rates suggest that the current FFR is at the neutral rate.” said Yardeni Research in one of their quick takes.

Talking about the two-year and ten-year Treasuries, the note added that “we expect both yields to be range bound between 4.25% and 4.75% over the rest of this year and possibly into next year.”

Adding about equities the Yardeni Research note said that “this might be a signal that the stock market could experience a correction now that the Fed might pause rate cutting. Nevertheless, we expect a Santa Claus rally in the S&P 500 to 6,100 points by the end of this year.”

Similar to the S&P 500 Index, the Nasdaq Composite fell by 3.49% last week to 18,680.12 points but remains higher than its Nov. 4 level of 18,179.98 points. NYSE Composite, which was 1.46% lower last week at 19,645.77 points, is also higher than its pre-election level of 19,243.39 points. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had a similar momentum in 2024.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.