Reedy & Company Selects AppFolio to Drive Ongoing Performance

SANTA BARBARA, Calif., Nov. 20, 2024 (GLOBE NEWSWIRE) — AppFolio, Inc. APPF, the technology leader powering the future of the real estate industry, announced Reedy & Company, a leading Memphis-based property management company has signed a five-year contract and is fully integrated with AppFolio’s suite of products to support its entire portfolio.

Reedy & Company manages a diverse portfolio of more than 3,500 properties including multi-family, single-family, affordable housing and commercial units across Tennessee, Mississippi and Arkansas. After identifying the need for a robust, scalable solution to support its growing real estate portfolio and evaluating a number of leading property management software companies, the team selected AppFolio Property Manager Max to manage its real estate portfolio due to its industry-leading innovation and AI capabilities.

“We chose AppFolio for its innovative property management solutions that align perfectly with our commitment to operational excellence and enhancing resident and owner experiences. Its comprehensive technology platform replaced five other solutions we had previously been using. By leveraging AppFolio’s advanced automation, data analytics, and AI-driven tools, we expect to streamline our workflows, improve communication, and gain valuable insights that will significantly impact our operations,” said Grant Hubbard, Vice President at Reedy & Company.

“With a diverse portfolio and plans to utilize key features such as Leasing CRM, Leasing Signals, and Database API, we are confident that the transition to AppFolio Property Manager will enhance our ability to manage our growing number of units efficiently while continuing to provide exceptional service to our residents and owners,” Hubbard continued.

“Reedy & Company exemplifies the type of multifaceted property management company that we look for in a customer,” said Katelyn Graumann, Vice President of Customer Success and Growth at AppFolio. “Our customers continue to see great value in our one powerful platform and AI-powered offerings that set the standard for innovation within the industry and help them grow their businesses.”

Over the past year, AppFolio has continued to innovate aggressively to provide the most comprehensive property management software platform on the market. This includes the announcement of FolioSpace, a next-generation resident experience that redefines how property managers and renters connect throughout the entire resident journey, along with new capabilities for Realm-X, its embedded generative AI that provides intelligent, real-time assistance by combining the latest foundation models with industry-specific context.

About AppFolio, Inc.

AppFolio is the technology leader powering the future of the real estate industry. Our innovative platform and trusted partnership enable our customers to connect communities, increase operational efficiency, and grow their business.

For more information about AppFolio, visit appfolio.com.

For more information, please contact:

Mission North for AppFolio

appfolio@missionnorth.com

About Reedy & Company

Reedy & Company, based in Memphis, Tennessee, is a premier property management firm dedicated to creating value for property owners and delivering exceptional living experiences for residents. With a firm commitment to integrity, accountability, and excellence, Reedy & Company has become a trusted partner for investors seeking both tenant satisfaction and asset growth.

For more information, visit reedyandcompany.com

For more information, please contact:

Reedy & Company

press@reedyandcompany.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/277508f7-43dd-4686-aae2-3f8eba9be144

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P Global Market Intelligence Report Finds Commercial Real Estate Lenders Feeling Stress but Weathering the Storm

NEW YORK, Nov. 20, 2024 /PRNewswire/ — Changes in post-pandemic behavior and a larger debt service due to higher interest rates presents challenges to the viability of many commercial real estate borrowers. While those headwinds will lead to higher defaults, stress will differ across asset classes and could take longer to play out than many think. The newly published report, Commercial Real Estate Outlook: Weathering the Storm, is part of S&P Global Market Intelligence’s Big Picture 2025 Outlook Report Series.

In this new report, S&P Global Market Intelligence’s Financial Institutions Research Team discusses how insurers, banks and their regulators are responding to concerns over potential stress in the commercial real estate (CRE) market. The report includes details on recent investment activity from life insurers in the CRE market and expectations for future loss content banks will record from the CRE segment. The report also highlights how publicly traded real estate investment trusts (REITs) can offer some insight into market conditions since they trade daily.

“Commercial real estate borrowers’ mettle will be tested over the coming year as they seek to refinance loans coming due. Many borrowers will find credit less available or at least significantly more expensive, leading to more defaults, particularly in the office segment, but not all CRE loans face the same fate,” said Nathan Stovall, director of financial institutions research at S&P Global Market Intelligence. “Any pain should not be great enough to spur deleveraging in the financial system and threaten the US economy.”

Key highlights from the report include:

- Banks with elevated CRE exposures have faced scrutiny from regulators and investors. Banks will feel some pain in their CRE books, particularly as borrowers seeking to refinance maturing credits find it more difficult to access credit, or they will at least face a significantly higher debt service given the increase in interest rates.

- S&P Global Market Intelligence’s analysis of property records nationwide found that approximately $950 billion of CRE mortgages were set to mature in 2024 and carried rates nearly 200 basis points below those originated this year.

- Office REITs continue to trade at vast discounts to their estimated net asset value estimates, but valuations have improved from the low point in 2023.

- Despite asset quality concerns, life insurers holdings of mortgage loans have continued to reach record highs in 2024.

To request a copy of Commercial Real Estate Outlook: Weathering the Storm, please contact press.mi@spglobal.com.

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global SPGI. S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781-301-9311

katherine.smith@spglobal.com or press.mi@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-report-finds-commercial-real-estate-lenders-feeling-stress-but-weathering-the-storm-302311672.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-report-finds-commercial-real-estate-lenders-feeling-stress-but-weathering-the-storm-302311672.html

SOURCE S&P Global Market Intelligence

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Snowflake Q3 Earnings: Revenue Beat, EPS Beat, Guidance Raise, AI Acquisition, Anthropic Partnership And More

Snowflake Inc SNOW reported third-quarter financial results after the market close on Wednesday. Here’s a rundown of the report.

Q3 Earnings: Snowflake reported third-quarter revenue of $942.09 million, beating the consensus estimate of $896.99 million. The data cloud company reported adjusted earnings of 20 cents per share, beating analyst estimates of 15 cents per share, according to Benzinga Pro.

Total revenue was up 28% year-over-year. Product revenue came in at $900.3 million, up 29% year-over-year. Net revenue retention rate was 127% in the quarter.

Remaining performance obligations totaled $5.7 billion, up 55% year-over-year. Snowflake said it ended the quarter with 542 customers with trailing 12-month product revenue greater than $1 million.

“Our obsessive drive to produce product cohesion and ease of use has built Snowflake into the easiest and most cost-effective enterprise data platform. That is what’s leading us to win new logo after new logo, expand within our customer base, and displace our competition over and over again,” said Sridhar Ramaswamy, CEO of Snowflake.

Don’t Miss: Walmart Posts Q3 Sales Beat, Raises Guidance: Analysts Expect Strong Earnings Growth Ahead

Outlook: Snowflake expects fourth-quarter product revenue in the range of $906 million to $911 million, up approximately 23% year-over-year. The company also raised its full-year product revenue guidance from $3.356 billion to $3.43 billion, representing 29% year-over-year growth.

Management will hold a call to further discuss the quarter with analysts and investors at 5 p.m. ET.

What Else: Snowflake announced it signed a definitive agreement to acquire enterprise AI company Datavolo. Snowflake expects the acquisition to help the company simplify data engineering workloads and deliver data interoperability and extensibility, a building block for effective enterprise AI.

Snowflake also announced a strategic multi-year partnership with AI data cloud company Anthropic, which is backed by Amazon.com Inc AMZN. The partnership is expected to help enable global enterprises develop and scale easy, efficient and trusted AI products.

Snowflake said Anthropic’s newest Claude 3.5 models will be available to leverage within Snowflake Cortex AI on Amazon Web Services.

“Our partnership with Anthropic represents a massive leap forward in expanding on our promise to provide thousands of global customers with easy, efficient, and trusted AI for a holistic set of enterprise use cases,” said Christian Kleinerman, executive vice president of Product at Snowflake.

“By bringing Anthropic’s industry-leading models to customers’ enterprise data where it already lives, within the security and governance boundaries of the AI Data Cloud, we will unleash new ways for businesses to harness this data for agentic use cases, coding assistants, document chatbots, unstructured data analytics, and more.”

SNOW Price Action: Snowflake shares were down about 34% year-to-date heading into the print. The stock was up 18.65% in after-hours, trading at $153.23 at the time of publication Wednesday, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of Spotify Technology's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Spotify Technology SPOT.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SPOT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 25 uncommon options trades for Spotify Technology.

This isn’t normal.

The overall sentiment of these big-money traders is split between 68% bullish and 16%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $163,255, and 20 are calls, for a total amount of $809,694.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $720.0 for Spotify Technology over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Spotify Technology’s options for a given strike price.

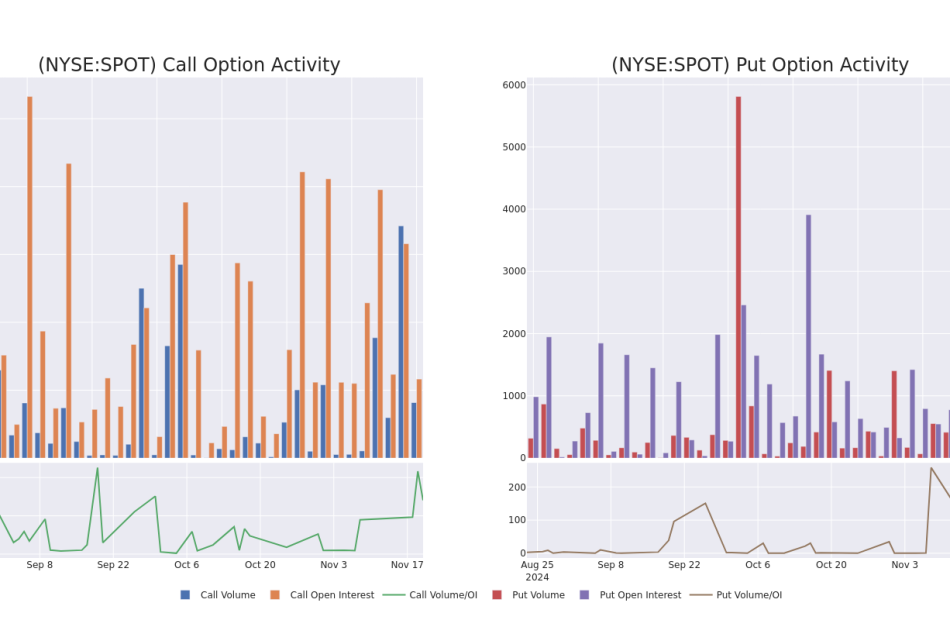

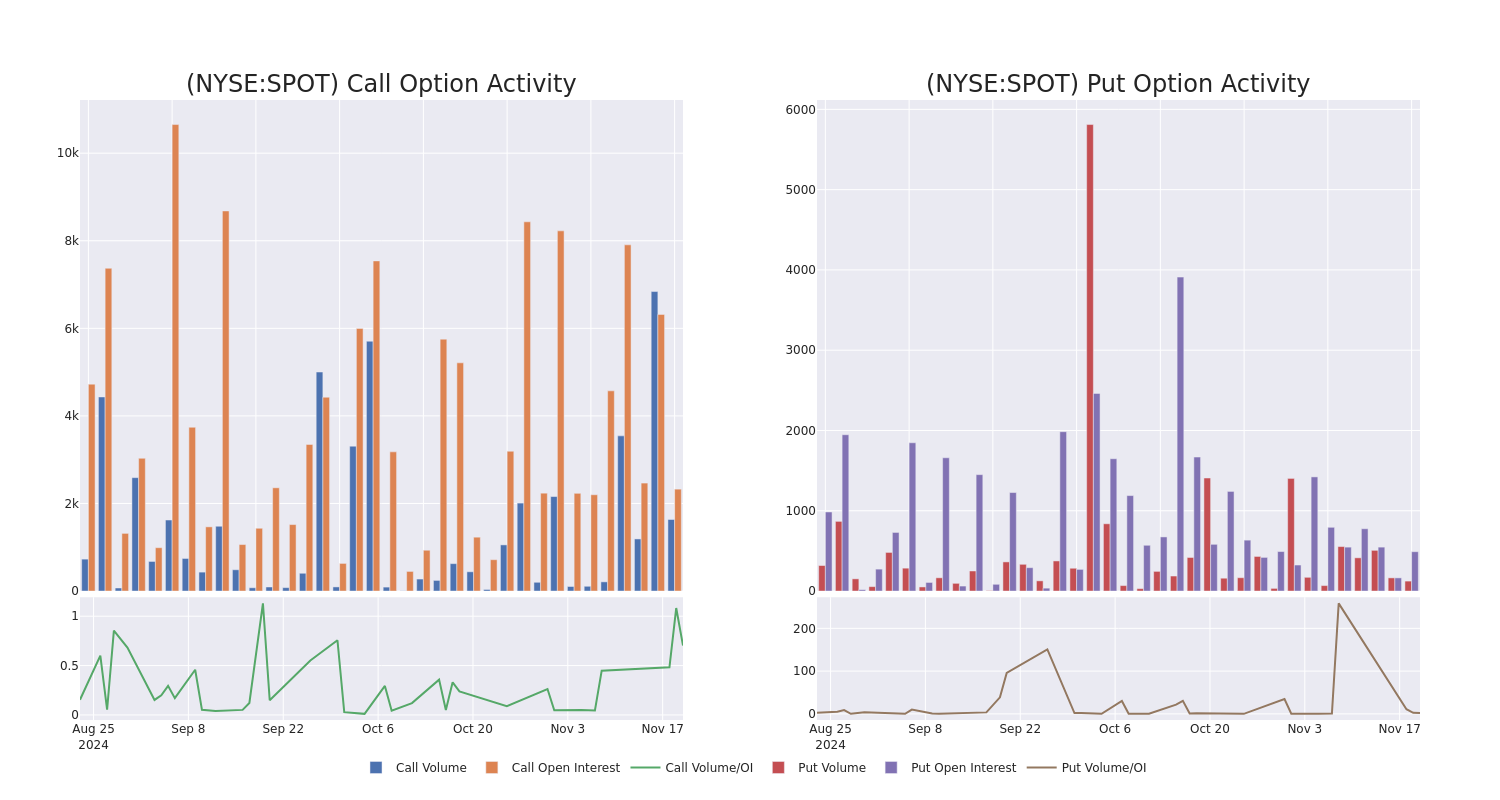

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Spotify Technology’s whale activity within a strike price range from $180.0 to $720.0 in the last 30 days.

Spotify Technology Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPOT | CALL | TRADE | BULLISH | 01/15/27 | $57.8 | $48.9 | $54.35 | $720.00 | $119.5K | 2 | 0 |

| SPOT | CALL | TRADE | NEUTRAL | 12/20/24 | $142.9 | $137.4 | $140.5 | $330.00 | $70.2K | 420 | 0 |

| SPOT | CALL | TRADE | BULLISH | 06/20/25 | $12.1 | $11.7 | $12.1 | $650.00 | $60.5K | 81 | 50 |

| SPOT | CALL | SWEEP | BULLISH | 11/29/24 | $5.45 | $5.0 | $5.45 | $480.00 | $52.8K | 176 | 232 |

| SPOT | CALL | SWEEP | BULLISH | 12/06/24 | $9.45 | $9.25 | $9.25 | $480.00 | $43.4K | 155 | 48 |

About Spotify Technology

Spotify is the leading global music streaming service provider, with over 600 million monthly active users and 250 million paying subscribers, with the latter comprising the firm’s premium segment. most of the firm’s revenue and nearly all its gross profit come from the subscribers, who pay a monthly fee to access a very comprehensive music library that consists of most of the most popular songs ever recorded, including all from the major record labels. The firm also sells separate audiobook subscriptions and integrates podcasts within its standard music app. Podcast content is not exclusive and is typically free to access on other platforms. Ad-supported users can access a similar music catalog but cannot customize a similar on-demand experience.

Spotify Technology’s Current Market Status

- With a volume of 1,737,074, the price of SPOT is up 1.71% at $471.76.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 76 days.

Professional Analyst Ratings for Spotify Technology

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $500.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Spotify Technology with a target price of $460.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Spotify Technology with a target price of $515.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Spotify Technology with a target price of $520.

* An analyst from JP Morgan persists with their Overweight rating on Spotify Technology, maintaining a target price of $530.

* An analyst from Barclays has decided to maintain their Overweight rating on Spotify Technology, which currently sits at a price target of $475.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Spotify Technology options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bridget Ross At LeMaitre Vascular Decides to Exercises Options Worth $276K

On November 19, it was revealed in an SEC filing that Bridget Ross, Board Member at LeMaitre Vascular LMAT executed a significant exercise of company stock options.

What Happened: Ross, Board Member at LeMaitre Vascular, exercised stock options for 3,750 shares of LMAT stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The exercise price of the options was $30.0 per share.

LeMaitre Vascular shares are trading, exhibiting down of 0.0% and priced at $103.74 during Wednesday’s morning. This values Ross’s 3,750 shares at $276,525.

Get to Know LeMaitre Vascular Better

LeMaitre Vascular Inc manufactures and distributes medical devices for the treatment of peripheral vascular disease. Its products are used during open vascular surgery and address several anatomical areas, such as the carotid, lower extremities, upper extremities, and aorta. The firm’s lower extremities product line contributes towards the proportion of revenue, followed by the carotid product line. LeMaitre’s surgical devices include angioscopes, balloon catheters, carotid shunts, phlebectomy devices, vascular grafts, vascular patches, and vessel closure systems. LeMaitre generates the majority of its revenue in the United States.

LeMaitre Vascular: A Financial Overview

Revenue Growth: Over the 3 months period, LeMaitre Vascular showcased positive performance, achieving a revenue growth rate of 15.63% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Insights into Profitability:

-

Gross Margin: The company maintains a high gross margin of 67.82%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, LeMaitre Vascular exhibits below-average bottom-line performance with a current EPS of 0.5.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.06.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 57.0 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 11.03 is above industry norms, reflecting an elevated valuation for LeMaitre Vascular’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 36.2, LeMaitre Vascular’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

The Insider’s Guide to Important Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of LeMaitre Vascular’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Beats Q3 Revenue, EPS Estimates, Supply Constraints Ding Stock: Huang Says 'Age Of AI Is In Full Steam'

NVIDA Corporation NVDA continued its streak of beating expectations with third-quarter revenue and earnings per share coming in ahead of Street estimates Wednesday

Nvidia’s Key Q3 Numbers: Nvidia reported third-quarter revenue of $35.1 billion, up 94% year-over-year, which beat a Street consensus estimate of $33.12 billion, according to data from Benzinga Pro.

The company reported earnings per share of 81 cents, which beat Street consensus estimate of 75 cents per share.

The company has beaten analyst estimates for revenue in nine straight quarters.

The company has beaten analyst estimates for earnings per share in eight straight quarters.

Analysts and Benzinga readers predicted Nvidia would meet or exceed third-quarter expectations ahead of the report.

“What’s your boldest prediction for Nvidia’s earnings report on Wednesday?” Benzinga asked readers.

The results were:

- Meets expectations: 45%

- Blowout beat: 42%

- Misses expectations: 13%

The majority of Benzinga readers expected the company to meet or beat the estimates from analysts. While more readers expected the company to meet estimates, 42% believed the company will beat estimates Wednesday.

Read Also: Nvidia Stock Historically Drops In December After Q3 Earnings

Nvidia’s Q3 Performance By Segment: The data center business posted a quarterly record for revenue in the third quarter.

Here is a look at the revenue performance by operating business segment.

| Segment | Revenue | Year-over-Year change | Quarter-over-Quarter change |

| Data Center | $30.8 billion | +112% | +17% |

| Gaming & AI PC | $3.3 billion | +15% | +14% |

| Professional Vizualization | $486 million | +17% | +7% |

| Auto | $449 million | +72% | +30% |

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” Nvidia CEO Jensen Huang said.

“Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.

Huang said countries have “awakened to the importance” of AI.

“AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI.”

Nvidia Q4 Outlook: Nvidia said it expects fourth-quarter revenue to be $37.5 billion plus or minus 2%.

The company said Blackwell production shipments are scheduled to begin in the fourth quarter of 2025 and will ramp into fiscal 2026. Nvidia said Hopper and Blackwell are seeing “certain supply constraints.”

Demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026, the company said.

What’s Next: With the chance of an earnings beat, Benzinga recently asked readers about their expectations for the stock if Nvidia blows out earnings estimates.

“If Nvidia shatters expectations, how high could its stock go by the end of 2024?” Benzinga asked.

The results were:

- $150 to $180: 55%

- $180 to $200: 26%

- Above $200: 18%

Benzinga readers predicted the stock will hit new all-time highs if third-quarter results come in ahead of analyst estimates.

If the stock goes higher, CEO Huang would continue to benefit as one of the key shareholders of the stock. Huang’s wealth has soared to $128 billion in 2024, ranking 11th in the world according to Bloomberg.

Huang has added $84.3 billion to his wealth and is around $17 billion away from cracking the top 10 richest people in the world milestone. If shares continue to trade higher to the end of the year, this milestone could be within reach.

NVDA Price Action: Nvidia stock is down 2.7% to $141.93 in after-hours trading Wednesday versus a 52-week trading range of $45.01 to $149.76. The stock closed Wednesday down 0.8% to $145.89. Nvidia stock was up over 200% year-to-date ahead of Wednesday’s earnings report

Read Next:

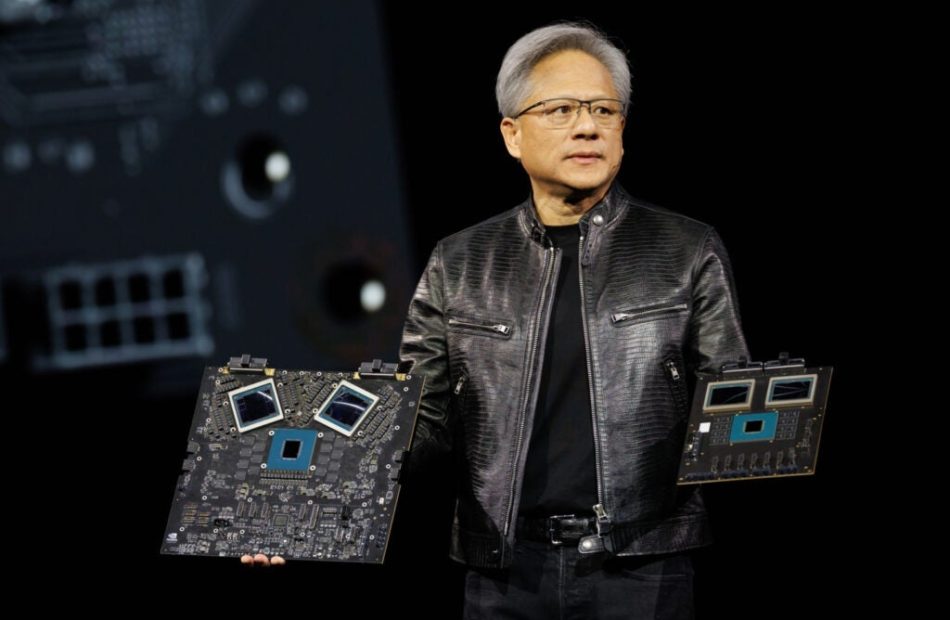

Nvidia CEO Jensen Huang. Photo courtesy of Nvidia.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Astera Labs Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bearish stance on Astera Labs.

Looking at options history for Astera Labs ALAB we detected 43 trades.

If we consider the specifics of each trade, it is accurate to state that 27% of the investors opened trades with bullish expectations and 53% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $451,810 and 34, calls, for a total amount of $2,558,039.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $62.5 to $110.0 for Astera Labs during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Astera Labs options trades today is 1110.79 with a total volume of 37,537.00.

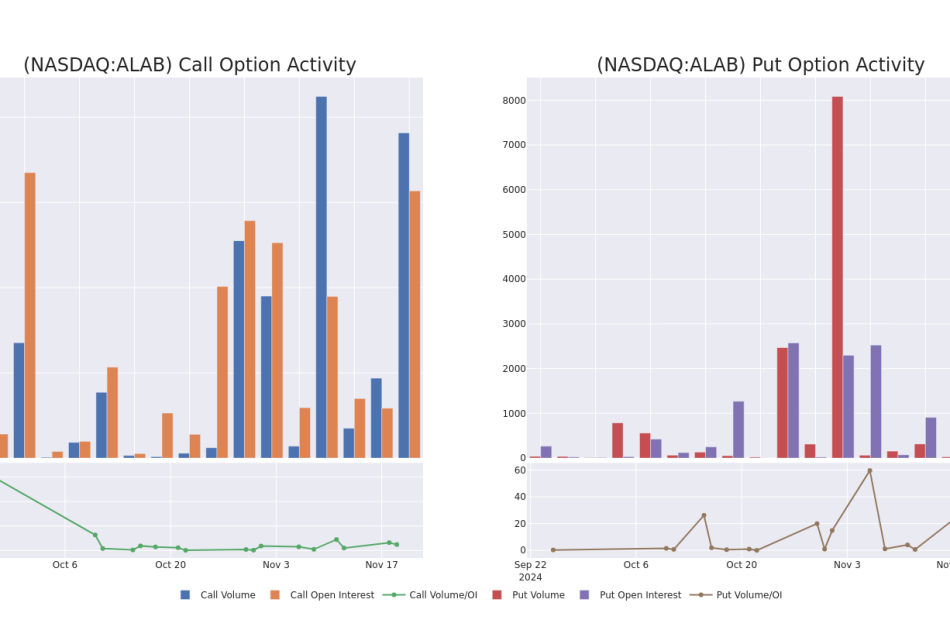

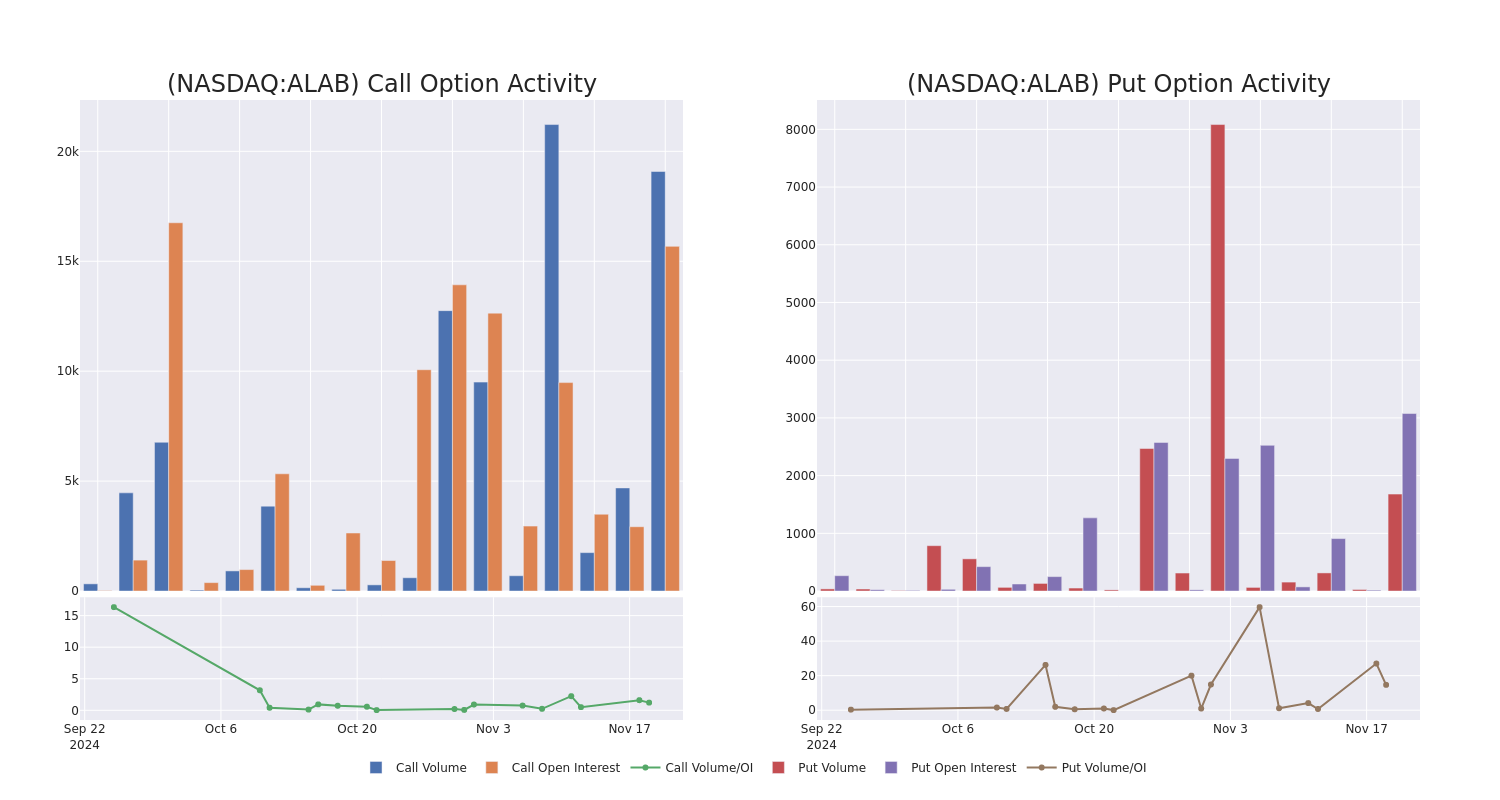

In the following chart, we are able to follow the development of volume and open interest of call and put options for Astera Labs’s big money trades within a strike price range of $62.5 to $110.0 over the last 30 days.

Astera Labs Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALAB | CALL | SWEEP | BEARISH | 07/18/25 | $16.7 | $16.4 | $16.45 | $110.00 | $466.9K | 105 | 500 |

| ALAB | CALL | SWEEP | BULLISH | 01/17/25 | $15.6 | $15.3 | $15.35 | $85.00 | $435.9K | 795 | 500 |

| ALAB | CALL | SWEEP | BEARISH | 01/17/25 | $32.0 | $31.6 | $31.61 | $62.50 | $158.1K | 70 | 50 |

| ALAB | PUT | SWEEP | BEARISH | 04/17/25 | $10.5 | $10.5 | $10.5 | $85.00 | $105.0K | 25 | 100 |

| ALAB | PUT | TRADE | BEARISH | 12/20/24 | $7.8 | $7.4 | $7.7 | $97.50 | $77.0K | 54 | 100 |

About Astera Labs

Astera Labs Inc is a company that offers an Intelligent Connectivity Platform, comprised of Semiconductor-based, high-speed mixed-signal connectivity products that integrate a matrix of microcontrollers and sensors. COSMOS, their software suite which is embedded in its connectivity products and integrated into their customers’ systems. The Company delivers critical connectivity performance, enables flexibility and customization, and supports observability and predictive analytics. This approach addresses the data, network, and memory bottlenecks, scalability, and other infrastructure requirements of hyperscalers and system original equipment manufacturers.

After a thorough review of the options trading surrounding Astera Labs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Astera Labs

- Currently trading with a volume of 4,536,588, the ALAB’s price is down by -0.76%, now at $94.46.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 124 days.

Expert Opinions on Astera Labs

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $104.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Astera Labs, targeting a price of $100.

* An analyst from Craig-Hallum has decided to maintain their Buy rating on Astera Labs, which currently sits at a price target of $105.

* Reflecting concerns, an analyst from Citigroup lowers its rating to Buy with a new price target of $120.

* An analyst from Roth MKM persists with their Buy rating on Astera Labs, maintaining a target price of $105.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Astera Labs, targeting a price of $94.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Astera Labs, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia earnings, forecasts top expectations as 'age of AI is in full steam'

Nvidia (NVDA) reported third quarter earnings after the bell on Wednesday that topped expectations on the strength of sales of its high-powered AI chips powering what its CEO Jensen Huang called the “age of AI.”

The world’s largest publicly traded company by market cap, Nvidia reported earnings per share (EPS) of $0.81 on revenue of $35.1 billion. Analysts were anticipating EPS of $0.74 on revenue of $33.2 billion.

Nvidia also said it anticipates revenue of $37.5 billion, plus or minus 2%. That’s just ahead of Wall Street expectations of $37 billion.

Nvidia’s stock price fell roughly 1% on the news.

“The age of AI is in full steam, propelling a global shift to Nvidia computing,” CEO Jensen Huang, said in a statement. “Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.”

The chip giant’s Data Center business, which makes up the vast majority of its revenue, brought in $30.8 billion in the quarter, topping analysts’ expectations of $29 billion. The segment generated $14.5 billion in Q3 last year.

Nvidia’s gaming revenue came in at $3.3 billion from the $2.8 billion the division brought in last year. Analysts were looking for $3 billion.

Nvidia’s stock has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond.

Nvidia also appeared to assuage concerns about potential slowdowns in the availability of its next-generation Blackwell chip, with CFO Colette Kress saying that the AI GPU will begin shipping in its current quarter and ramp into the year ahead.

“Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026,” she added.

Shares of Nvidia were up 192% year to date as of Wednesday, easily outpacing any of the company’s chipmaker rivals. AMD (AMD), the closest competitor, has seen its stock price sink over 5% year to date, while Intel (INTC), which is contending with a difficult turnaround, has seen its stock plunge nearly 52%.

Nvidia is facing an uncertain future, given that Donald Trump has threatened to put blanket tariffs on products from around the world.

In addition, the president-elect has raised the specter of tariffs on Taiwan-made chips. That would be a potential alternative to the CHIPS Act, which is designed to bring semiconductor manufacturing back to the US.

The vast majority of Nvidia’s chips are built by TSMC in Taiwan. A tariff could mean that Nvidia will charge more for its AI chips, depressing margins, or pass the added cost on to its customers. Investors are sure to be looking for any guidance Huang has to offer on the topic.