Dell Ships First 72-Nvidia GPU Monster: 'AI Rocket Just Got A Massive Boost,' Says CEO

Dell Technologies Inc DELL has reached a major milestone by becoming the first company to deliver a new generation of super-powerful computer systems designed specifically for artificial intelligence.

What Happened: Michael Dell, the company’s CEO, announced on social media platform X that Dell is shipping its first liquid-cooled PowerEdge XE9712 systems to CoreWeave, a company that provides computing power for AI applications.

“The AI rocket just got a massive boost!” Michael Dell in his announcement, highlighted the significance of this achievement.

These new systems, developed in partnership with tech giant NVIDIA Corp NVDA, are unlike traditional computers. They use special cooling technology that helps them handle the intense processing needed for advanced AI tasks. Think of it as the difference between a regular car engine and a Formula 1 racing engine – both are engines, but one is designed for much more powerful performance.

Why It Matters: The system, called the GB200 NVL72, combines 72 powerful processing chips (GPUs) and 36 central computers (CPUs) working together as one unit. This allows it to run AI programs 30 times faster than previous systems, particularly when handling complex AI tasks like chatbots and image generation.

CoreWeave, the company receiving these first systems, specializes in providing high-powered computing services to businesses working with AI. They work closely with Nvidia, which designed the core technology inside these systems.

This development is particularly important as companies worldwide are racing to build and access more powerful AI computing systems. Industry experts predict high demand for these systems, with estimates suggesting 20,000 to 25,000 similar systems could be shipped in 2025.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Mixed as Traders Ponder Trump Picks, Rates: Markets Wrap

(Bloomberg) — Stocks posted small moves after last week’s retreat erased a big chunk of the equity-market gains since Donald Trump’s US election win, with traders looking to fresh pointers on growth and the path of interest rates.

Most Read from Bloomberg

Europe’s Stoxx 600 was little changed, while contracts for the S&P 500 edged higher. The underlying index has given up more than half its post-election gains as the prospect of a more-hawkish Federal Reserve forced traders to dial down their enthusiasm for so-called Trump trades. Ten-year Treasury yields steadied after topping 4.5% for the first time since May last Friday.

Concerns are lingering about the President-elect’s potentially inflationary economic policies, with attention now on his pick for Treasury secretary. Friday’s upbeat US retail sales data reduced expectations for the Fed to cut interest rates.

“It should be a quieter week as the recent relentless wave of US macro and political news flow in theory slows down,” said Jim Reid, Deutsche Bank’s global head of macro and thematic research. “The main story on this front being on potential political appointments for the new Trump administration with Treasury secretary the one creating most interest.”

Longer-term, there are hopes that the stocks gains will resume. Morgan Stanley’s Mike Wilson, once considered a prominent bear on Wall Street, sees US equities benefiting from improving economic growth and further Fed interest-rate cuts in 2025. He predicts the S&P 500 will end next year up around 11% from Friday’s close.

Inflation, Nvidia

Eurozone and UK inflation readings on Tuesday and Wednesday, respectively, will help investors gauge the outlook for Bank of England and European Central Bank policy. A swathe of officials from the respective institutions are also due to speak. Nvidia Corp.’s results on Wednesday may test the sustainability of AI-led stock gains.

Asian shares struggled for direction after a policy-induced intraday rally in China lost steam, offsetting strong gains in heavyweight Samsung Electronics Co.

The resumed selling in Chinese stocks offers another reminder of the difficulties faced by Beijing to prop up the market in the absence of potent fiscal stimulus.

In currencies, the Bloomberg dollar index was largely steady after reaching a two-year high last week. Bitcoin recovered from its biggest two-day retreat since the US election in choppy trading that reflects shifting assessments of the impact of Trump’s policy agenda.

Pierre Ferragu Says 'Robotaxi Never Felt That Close Ever Before' After Tesla Drove Through Challenging Roads With No Intervention

A prominent Wall Street analyst has reported a milestone for Tesla Inc.’s TSLA Full Self-Driving technology, completing an unassisted journey from Manhattan to Connecticut, marking a notable advancement in the company’s autonomous driving capabilities.

What Happened: Pierre Ferragu, an analyst at New Street Research, shared his experience on X, formerly Twitter, stating, “Last night FSD got me out of deep into Manhattan and drove me back home to Connecticut. Got through a number of challenging and confusing situations with mastery. Not a single intervention. Robotaxi never felt that close ever before.”

For context, the drive from Manhattan to Connecticut spans approximately 94.7 miles and typically takes up to 1 hour and 45 minutes.

The successful navigation of complex urban environments represents a significant step forward for Tesla’s autonomous driving technology, particularly in challenging city conditions where self-driving systems typically face their greatest tests.

This development comes as Tesla continues to enhance its FSD technology amid growing competition in the autonomous vehicle sector from companies like Alphabet Inc GOOGL GOOG-backed Waymo, Baidu BIDU and Mobileye Global MBLY.

Why It Matters: The achievement is particularly notable given New York City’s demanding driving environment, known for its dense traffic, complex intersections, and unpredictable pedestrian movements.

Tesla’s autonomous driving progress comes at a crucial time as reports suggest a potential easing of federal regulations for self-driving vehicles, which could accelerate the company’s robotaxi ambitions.

The stock has shown significant volatility over the past year, trading between $138.80 and $358.64, as investors weigh the company’s autonomous driving progress against market challenges, including changes to the federal EV tax credit structure.

Price Action: Tesla stock closed at $320.72 on Friday, gaining 3.07% for the day. In after-hours trading, the stock edged up 0.0062%. Year to date, Tesla’s stock has risen by 29.10%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Tumbles Over 300 Points Following Economic Reports, Nvidia, Microsoft Decline: Fear & Greed Index Moves To 'Neutral' Zone

The CNN Money Fear and Greed index showed a further decline in the overall market sentiment, with the index moving to the “Neutral” zone on Friday.

U.S. stocks settled lower on Friday, with the Dow Jones falling more than 300 points during the session. The S&P 500 recorded a weekly loss of 2.1%, while the Nasdaq Composite fell around 3.2%. The 30-stock Dow lost 1.2% during the week.

Major tech stocks recorded losses, with Nvidia Corp. NVDA shares falling over 3% on Friday, and Microsoft Corp. MSFT stock losing around 2.8% during the session. However, shares of Tesla Inc. TSLA gained around 3% on Friday.

Shares of vaccine companies settled lower on Friday after President-elect Trump nominated Robert F. Kennedy Jr. to lead the HHS. Moderna Inc. MRNA shares dipped over 7%, while Amgen Inc. AMGN shares declined more than 4% during the session. The SPDR S&P Biotech ETF dipped over 5%, recording its worst week since 2020.

On the economic data front, U.S. export prices increased by 0.8% in October, while import prices rose by 0.3% month-over-month in October. U.S. retail sales rose 0.4% month-over-month in October compared to a revised 0.8% increase in September, topping market estimates of 0.3%

Most sectors on the S&P 500 closed on a negative note, with information technology, communication services, and healthcare stocks recording the biggest losses on Friday. However, utilities and financials stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed lower by around 306 points to 43,444.99 on Friday. The S&P 500 fell 1.32% to 5,870.62, while the Nasdaq Composite fell 2.24% at 18,680.12 during Friday’s session.

Investors are awaiting earnings results from Trip.com Group Limited TCOM, Brady Corporation BRC, and AECOM ACM today.

What is CNN Business Fear & Greed Index?

At a current reading of 50.9, the index moved to the “Neutral” zone on Friday, versus a prior reading of 58.2.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Nvidia Soar After Nov. 20? The Evidence is Piling up and it Says This.

The S&P 500 is rallying toward a 25% increase this year, and many growth stocks have greatly contributed to the gain. The one that stands out, though, is Nvidia (NASDAQ: NVDA). It’s become a stock market star thanks to its leadership in the artificial intelligence (AI) chip market, holding about 80% share. AI customers have been flocking to Nvidia for its AI chips and related products and services, and this has helped earnings soar in the triple digits quarter after quarter.

And speaking of quarterly performance, investors now are turning to one particular event set to unfold in just a couple of days. Nvidia plans to report fiscal 2025 third-quarter earnings on Nov. 20. We might be optimistic since the company has a track record of surpassing expectations and has recently spoken of “insane” demand for its products. Still, Nvidia already has climbed nearly 200% this year. And it’s important to remember that this particular quarter may represent a transition for the chip designer, as it prepares to launch its new Blackwell architecture.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Now the question is: Will Nvidia soar after Nov. 20? Evidence is piling up, and it’s pointing to one particular outcome. Let’s find out more.

So, first, let’s consider Nvidia’s story so far. The company’s graphics processing units (GPUs) are considered the best around, and this explains why customers rush to get in on them — and don’t mind paying a higher price or waiting to get their hands on the latest version. Nvidia also sells a broad range of products and services so customers can go to the company for all of their AI needs. Even better, Nvidia is present across all public clouds, making it easy and convenient to access these offerings.

All of this has helped Nvidia report record revenue in recent quarters, driven by the data center business. In the most recent period, data center accounted for 87% of the company’s total revenue of $30 billion. And that level of revenue surpasses full-year revenue as recently as two years ago. Importantly, Nvidia is highly profitable on its sales, with gross margin topping 70%.

As mentioned, the upcoming report represents a bit of a transition for this tech giant. In the third quarter, Nvidia was preparing for the production ramp of Blackwell — set to happen in the fourth quarter. And the company has grown revenue so much in recent years that, for the third quarter, it predicts a double-digit increase year over year — instead of the triple-digit increases we’ve seen in past quarters.

Cathie Wood Redirects Elon Musk's DOGE Focus Toward Nuclear Energy Amid Regulatory Challenges: Here's How Oklo, Cameco, Centrus Energy And Other Stocks Performed

Nuclear energy stocks and ETFs have come to the fore as ARK Invest’s founder Cathie Wood reshared the firm’s study on how regulatory hurdles and anti-nuclear sentiment have caused cost overruns and rendered nuclear energy less cost-competitive than natural gas today.

This comes as Tesla Inc. and SpaceX CEO Elon Musk is all set to co-lead the Department of Government Efficiency (DOGE) along with Republican politician Vivek Ramaswamy. As the task force promises to dismantle bureaucracy, reduce regulations, and cut wasteful expenditures, ARKinvest tried to redirect DOGE’s official page on X (formerly Twitter) to focus on the regulatory hurdles that nuclear energy as a sector has faced in the last 20 years.

What Happened: “The International Energy Agency has identified nuclear energy as vital to achieving net zero emissions by 2050, yet nuclear power in the United States has stagnated at ~20% of the energy mix since the Chernobyl disaster in 1986,” said an ARKInvest note based on data from IEA as of October 2023.

In addition to its cost-effectiveness, nuclear power provides a reliable, continuous, and carbon-free supply of energy. These are important now since an explosion in demand for artificial intelligence is taxing the electricity consumption of data centers.

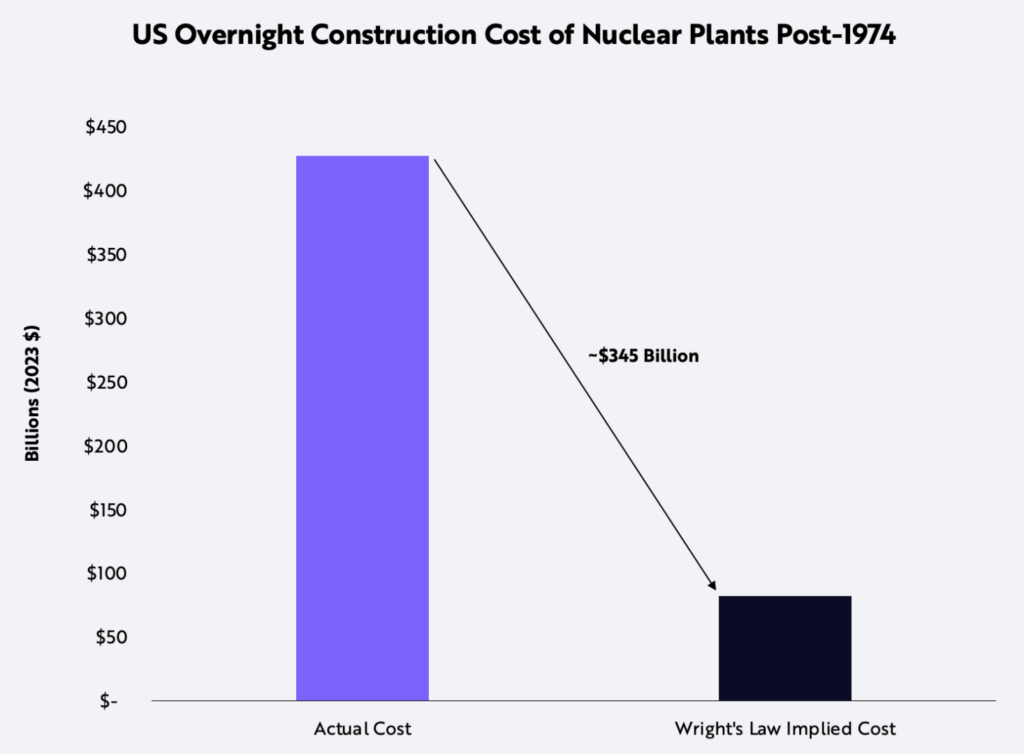

Daniel Maguire, research associate at ARKInvest stated in his report dated April 2024 that stringent regulatory changes and anti-nuclear sentiment have stunted the build-out of nuclear capacity and caused cost overruns in developing US nuclear plants.

Regulatory changes in the mid-to-late seventies, including the establishment of the Nuclear Regulatory Commission and the Energy Research and Development Administration, introduced stricter licensing measures, increasing costs significantly. Without such stringent regulations, ARKInvest’s research suggests that lower cost trajectories could have saved the US about $345 billion, or ~72% of the total.

Why It Matters: With the introduction of the U.S. Advanced Reactor Demonstration Project and other emerging government support programs, nuclear cost overruns should reverse course as countries look for robust clean energy solutions to meet their net carbon emissions reduction commitments.

Maguire’s tweet shared by Wood, tagged the Department of Government Efficiency, to bring this to light. The department is scheduled to complete its work by July 4, 2026, coinciding with America’s 250th independence anniversary. Focus on this area could help spur activity in the nuclear energy sector by developing clean, carbon-free energy production avenues at lower costs.

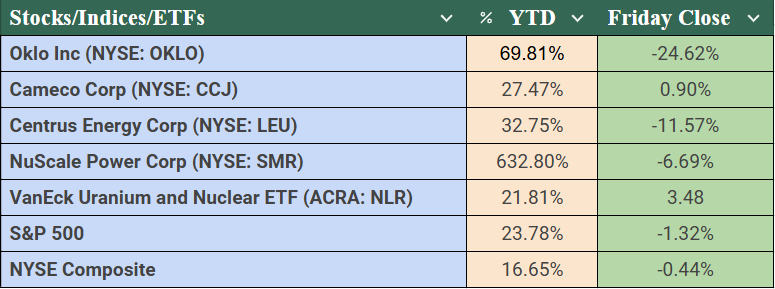

Price Action: Despite long-running regulatory hurdles and higher costs, nuclear energy stocks have performed well on a year-to-date basis. Oklo Inc OKLO, Cameco Corp CCJ, Centrus Energy Corp LEU, NuScale Power Corp (SMR) and VanEck Uranium and Nuclear ETF NLR have all outperformed NYSE composite on a year-to-date basis, which only rose by 16.65%.

The five-year charts as per Benzinga Pro, show that Centrus Energy Corp shares have been volatile, whereas NuScale Power Corp has achieved consistent returns.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Dominance Decline Expected Next Month, Analyst Projects 'Altseason' To Peak By March 2025

Cryptocurrency analysts are forecasting a significant shift in market dynamics, suggesting Bitcoin‘s BTC/USD recent dominance could decline in favor of alternative cryptocurrencies by the end of this month.

What Happened: Leading cryptocurrency trader Milkybull predicts a “violent decline” in Bitcoin’s market dominance next month, projecting an “altseason” that could extend through March. “It’s going to get wild for the next few months,” Milkybull posted on X, formerly Twitter.

Technical analyst Ash Crypto echoed similar sentiments, citing that the altcoin market cap’s two-week MACD indicator approaches a “golden cross,” a pattern not seen since 2023. “Last time it happened, altcoin market cap pumped 300%,” Ash noted, predicting “the biggest altseason” within 4-6 weeks.

The MACD, or Moving Average Convergence/Divergence indicator, is a technical indicator that is used to trade based on trends.

Why It Matters: Altcoin Season occurs when 75% of alternative cryptocurrencies outperform Bitcoin. Several major altcoins have already shown momentum, with Ethereum ETH/USD, Cardano ADA/USD, Solana SOL/USD, Ripple XRP/USD, Dogecoin DOGE/USD, and Polkadot DOT/USD each gaining over 10% in the past week.

Meanwhile, Bitcoin continues its strong performance, trading at $91,648.28, marking a 34% increase over the past month. However, analysts suggest this growth might temporarily slow as investors rotate into altcoins.

The timing of these predictions coincides with Bitcoin’s recent all-time highs and the growing institutional adoption of cryptocurrencies, particularly following the approval of spot Bitcoin ETFs in January.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Scheduled For November 18, 2024

Companies Reporting Before The Bell

• Niu Techs NIU is expected to report earnings for its third quarter.

• Bit Digital BTBT is estimated to report quarterly loss at $0.02 per share on revenue of $22.91 million.

• Twist Bioscience TWST is likely to report quarterly loss at $0.69 per share on revenue of $82.66 million.

• Mondee Hldgs MOND is likely to report quarterly loss at $0.10 per share on revenue of $54.49 million.

• Brady BRC is projected to report quarterly earnings at $1.10 per share on revenue of $365.85 million.

• Bitdeer Technologies BTDR is expected to report quarterly loss at $0.05 per share on revenue of $77.45 million.

• Cellectar Biosciences CLRB is likely to report earnings for its third quarter.

• Kandi Technologies Group KNDI is estimated to report earnings for its third quarter.

• EHang Holdings EH is likely to report quarterly loss at $0.12 per share on revenue of $16.30 million.

• C3is CISS is projected to report earnings for its third quarter.

Companies Reporting After The Bell

• Trip.com Group TCOM is likely to report quarterly earnings at $0.91 per share on revenue of $2.20 billion.

• Tuya TUYA is projected to report quarterly earnings at $0.03 per share on revenue of $75.49 million.

• BellRing Brands BRBR is estimated to report quarterly earnings at $0.50 per share on revenue of $545.01 million.

• i3 Verticals IIIV is projected to report quarterly earnings at $0.19 per share on revenue of $61.55 million.

• AECOM ACM is likely to report quarterly earnings at $1.25 per share on revenue of $4.12 billion.

• Symbotic SYM is projected to report quarterly earnings at $0.06 per share on revenue of $470.27 million.

• Zenvia ZENV is estimated to report earnings for its third quarter.

• TAT Techs TATT is likely to report earnings for its third quarter.

• FinVolution Gr FINV is estimated to report earnings for its third quarter.

• Zepp Health ZEPP is estimated to report earnings for its third quarter.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.