Unpacking the Latest Options Trading Trends in Albemarle

Investors with a lot of money to spend have taken a bearish stance on Albemarle ALB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ALB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for Albemarle.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 58%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $645,810, and 3 are calls, for a total amount of $127,222.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $110.0 for Albemarle during the past quarter.

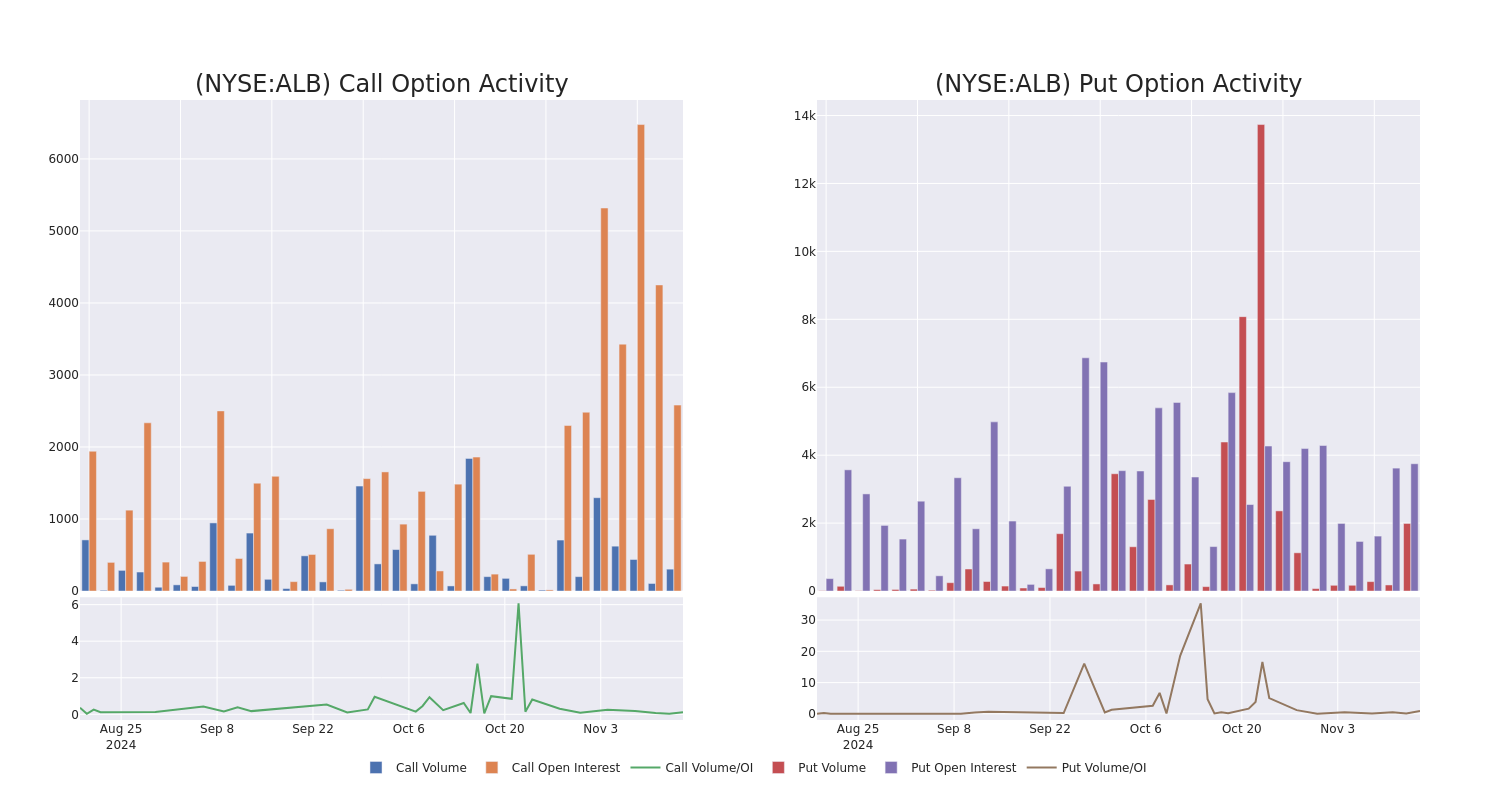

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Albemarle options trades today is 1266.0 with a total volume of 2,294.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Albemarle’s big money trades within a strike price range of $95.0 to $110.0 over the last 30 days.

Albemarle Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALB | PUT | TRADE | BULLISH | 06/20/25 | $11.85 | $11.6 | $11.65 | $95.00 | $291.2K | 790 | 250 |

| ALB | PUT | SWEEP | BULLISH | 01/17/25 | $12.95 | $12.9 | $12.9 | $110.00 | $101.9K | 2.9K | 341 |

| ALB | CALL | SWEEP | BEARISH | 12/20/24 | $7.75 | $7.6 | $7.62 | $100.00 | $57.1K | 1.4K | 219 |

| ALB | PUT | TRADE | NEUTRAL | 01/17/25 | $13.0 | $12.7 | $12.85 | $110.00 | $43.6K | 2.9K | 407 |

| ALB | PUT | SWEEP | BEARISH | 01/17/25 | $13.65 | $13.55 | $13.65 | $110.00 | $42.3K | 2.9K | 81 |

About Albemarle

Albemarle is one of the world’s largest lithium producers. In the lithium industry, the majority of demand comes from batteries, where lithium is used as the energy storage material, particularly in electric vehicles. Albemarle is a fully integrated lithium producer. Its upstream resources include salt brine deposits in Chile and the US and two hard rock mines in Australia, both of which are joint ventures. The company operates lithium refining plants in Chile, the US, Australia, and China. Albemarle is a global leader in the production of bromine, used in flame retardants. It is also a major producer of oil refining catalysts.

Following our analysis of the options activities associated with Albemarle, we pivot to a closer look at the company’s own performance.

Where Is Albemarle Standing Right Now?

- With a volume of 1,232,520, the price of ALB is down -0.61% at $101.48.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 89 days.

What The Experts Say On Albemarle

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $127.25.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Albemarle with a target price of $170.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Albemarle with a target price of $127.

* Maintaining their stance, an analyst from Baird continues to hold a Neutral rating for Albemarle, targeting a price of $79.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Albemarle, which currently sits at a price target of $133.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Albemarle options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Gains and Losses Today: Palantir Stock Jumps as Listing Heads to Nasdaq

David Paul Morris / Bloomberg / Getty Images

-

The S&P 500 fell 1.3% on Friday, Nov. 15, after the Fed chair struck a cautious tone on additional rate cuts and a report showed strong retail sales in October.

-

Semiconductor equipment maker Applied Materials issued soft current-quarter sales guidance, citing weakness in China, and its shares tumbled.

-

Palantir Technologies shares surged after the analytics software provider said it will transfer its stock listing to the Nasdaq.

Major U.S. equities indexes dropped to close out the trading week after Federal Reserve Chair Jerome Powell suggested that the central bank has leeway to ease off on its rate-cutting campaign if needed.

Meanwhile, retail sales data from October came in stronger than expected, with consumer spending remaining robust despite uncertainty around the election and the impact of several major storms. While the strong retail sales figures are a signal of economic resilience, this could provide the Fed with more flexibility as it considers the urgency of additional interest-rate reductions.

The S&P 500 fell 1.3%, while the Dow slipped 0.7%. Underperformance in the tech sector pressured the Nasdaq, which dropped 2.2%.

Applied Materials (AMAT) exceeded top- and bottom-line estimates for the recently completed quarter, but the semiconductor equipment provider offered lower-than-expected sales guidance for the current quarter. Applied Materials shares tumbled 9.2% on Friday, losing the most of any S&P 500 stock.

Shares of marketing and corporate communications firm Omnicom Group (OMC) dropped 7.8%. In its most recent earnings report, released a month ago, Omnicom topped sales and profit expectations, benefitting from its acquisition of digital commerce platform Flywheel Digital, which closed at the beginning of this year. However, analysts indicate that Omnicom faces challenges related to managing costs as well economic uncertainties and possible technological disruptions.

Moderna (MRNA) shares lost 7.3% following reports that President-elect Donald Trump intends to nominate Robert F. Kennedy Jr., who has openly expressed his skepticism about vaccines, as the leader of the Department of Health and Human Services. Kennedy has indicated that he will push for significant changes to the Food and Drug Administration (FDA). Shares of fellow vaccine maker Pfizer (PFE) slid 4.7%.

Palantir Technologies (PLTR) shares logged the top performance of any S&P 500 constituent on Friday, surging 11.1%. The analytics software firm announced that it would move its stock listing to the Nasdaq from the New York Stock Exchange. Palantir’s Class A shares are set to begin trading on the Nasdaq Global Select Market, maintaining the “PLTR” ticker, the company said.

Major Trump Media shareholder sells nearly entire stake

(Reuters) – Trump Media (DJT) & Technology Group’s key shareholder, ARC Global Investments, has unloaded nearly all its stake in the media company, it said in a regulatory filing on Thursday.

ARC and its manager Patrick Orlando now hold about 0.01% stake, down from more than 5% or over 11 million shares in September.

Orlando was the former CEO of the blank-check company Digital World Acquisition that took Trump Media public. He was ousted before the deal closed this year.

A Delaware judge had ruled in September that Trump Media breached an agreement with Orlando’s ARC Global and the fund must receive more than half a million additional shares before a lock-up on insider sales expires.

U.S. President-elect Donald Trump owns nearly 115 million shares and has a nearly 53% stake in Trump Media, which owns the Truth Social media platform.

(Reporting by Jaspreet Singh in Bengaluru; Editing by Arun Koyyur)

IT Tech Packaging Inc. Announces third Quarter 2024 Unaudited Financial Results

BAODING, China, Nov. 15, 2024 /PRNewswire/ — IT Tech Packaging Inc. ITP (“IT Tech Packaging” or the “Company”), a leading manufacturer and distributor of diversified paper products in North China, today announced its unaudited financial results for the nine and three months ended September 30, 2024.

Third Quarter 2024 Unaudited Financial Results

|

For the Three Months Ended September 30, |

|||||

|

($ millions) |

2024 |

2023 |

% Change |

||

|

Revenues |

25.08 |

15.77 |

59.03 % |

||

|

Regular Corrugating Medium Paper (“CMP”)* |

20.91 |

11.95 |

74.93 % |

||

|

Light-Weight CMP** |

4.13 |

3.47 |

19.16 % |

||

|

Offset Printing Paper |

– |

0.07 |

– |

||

|

Tissue Paper Products |

– |

0.26 |

– |

||

|

Face Masks |

– |

0.02 |

– |

||

|

Gross profit (loss) |

1.92 |

(0.15) |

1351.37 % |

||

|

Gross profit (loss) margin |

7.64 % |

-0.97 % |

8.61pp*** |

||

|

Regular Corrugating Medium Paper (“CMP”)* |

7.54 % |

7.01 % |

0.53pp**** |

||

|

Light-Weight CMP** |

7.33 % |

-7.47 % |

14.80pp**** |

||

|

Offset Printing Paper |

– |

7.53 % |

– |

||

|

Tissue Paper Products*** |

– |

-278.10 % |

|||

|

Face Masks |

– |

-15.75 % |

– |

||

|

Operating income(loss) |

(1.46) |

(2.48) |

-41.07 % |

||

|

Net income (loss) |

(1.97) |

(1.98) |

-0.07 % |

||

|

EBITDA |

2.03 |

1.69 |

20.12 % |

||

|

Basic and Diluted earnings (loss) per share |

(0.20) |

(0.20) |

– |

||

|

* Products from PM6 |

|||||

|

** Products from PM1 |

|||||

|

*** Products from PM8 and PM9 |

|||||

|

**** pp represents percentage points |

|||||

- Revenue increased by 59.03% to approximately $25.08 million as compared to the same period of last year. This was mainly due to the increase of sales volume of corrugating medium paper (“CMP”), partially offset by the decrease in average selling prices (“ASP”) of CMP.

- Gross profit increased by 1351.37% to approximately $1.92 million as compared to the same period of last year. Total gross profit margin increased by 8.61 percentage point to 7.64%.

- Loss from operations was approximately $1.46 million, compared to approximately $2.48 million for the same period of last year.

- Net loss was approximately $1.97 million, or loss per share of $0.20, compared to net loss of approximately $1.98 million, or loss per share of $0.20, for the same period of last year.

- Earnings before interest, taxes, depreciation and amortization (“EBITDA”) was approximately $2.03 million, compared to$1.69 million for the same period of last year.

Revenue

For the third quarter of 2024, total revenue increased by 59.03%, to approximately $25.08 million from approximately $15.77 million for the same period of last year. This was mainly due to the increase of sales volume of corrugating medium paper (“CMP”), partially offset by the decrease in average selling prices (“ASP”) of CMP.

The following table summarizes revenue, volume and ASP by product for the third quarter of 2024 and 2023, respectively:

|

For the Three Months Ended September 30, |

|||||||||||

|

2024 |

2023 |

||||||||||

|

Revenue |

Volume |

ASP |

Revenue |

Volume |

ASP |

||||||

|

Regular CMP |

20,910 |

62,121 |

337 |

11,954 |

34,186 |

350 |

|||||

|

Light-Weight CMP |

4,134 |

12,763 |

324 |

3,470 |

10,210 |

340 |

|||||

|

Offset Printing Paper |

– |

– |

– |

69 |

170 |

407 |

|||||

|

Tissue Paper Products |

– |

– |

– |

264 |

241 |

1,096 |

|||||

|

Total |

25,044 |

74,884 |

334 |

15,757 |

44,807 |

352 |

|||||

|

Revenue |

Volume |

ASP |

Revenue |

Volume |

ASP |

||||||

|

Face Masks |

– |

– |

– |

15 |

507 |

30 |

|||||

Revenue from CMP, including both regular CMP and light-Weight CMP, increased by 62.38%, to approximately $25.04 million and accounted for 99.85% of total revenue for the third quarter of 2024, compared to approximately $15.42 million, or 97.79% of total revenue for the same period of last year. The Company sold 74,884 tonnes of CMP at an ASP of $334/tonne during the third quarter of 2024, compared to 44,396 tonnes at an ASP of $347/tonne in the same period of last year.

Of the total CMP sales, revenue from regular CMP increased by 74.93%, to approximately $20.91 million for the third quarter of 2024, compared to revenue of approximately $11.95 million for the same period of last year. The Company sold 62,121 tonnesof regular CMP at an ASP of $337/tonne during the third quarter of 2024, compared to 34,186 tonnes at an ASP of $350/tonne for the same period of last year. Revenue from light-weight CMP increased by 19.16%, to approximately $4.13 million for the third quarter of 2024, compared to revenue of approximately $3.47 million for the same period of last year. The Company sold 12,763 tonnes of light-weight CMP at an ASP of $324/tonne for the third quarter of 2024, compared to 10,210 tonnes at an ASP of $340/tonne for the same period of last year.

Revenue from offset printing paper was $nil for the three months ended September 30, 2024, compared with revenue of $0.07 million for the same period of last year. The Company sold 170 tonnes of offset printing paper at an ASP of $407/tonne in the third quarter of 2023.

Revenue from tissue paper products was $nil for the third quarter of 2024, compared to $0.26 million for the third quarter of 2023. The Company sold 241 tonnes of tissue paper products at an ASP of $1,096/tonne during the third quarter of 2023.

Revenue from face masks was $nil for the third quarter of 2024, compared to $0.02 nillion for the same period of last year. The Company sold 507 thousand pieces of face masks during the third quarter of 2023.

Gross Profit and Gross Margin

Total cost of sales increased by 45.46%, to approximately $23.16 million for the third quarter of 2024 from approximately $15.92 million for the same period of last year. This was mainly due to the increase in sales quantity of CMP, partially offset by the decrease of the unit material cost of CMP products. Costs of sales per tonne for regular CMP, light-weight CMP, offset printing paper, and tissue paper products were $311, $300, $nil and $nil, respectively, for the third quarter of 2024, compared to $325, $365, $377 and $4,143 respectively, for the same period of last year.

Total gross profit was approximately $1.92 million for the third quarter of 2024, compare to the gross loss of approximately $0.15 million for the same period of last year as a result of factors described above. Overall gross profit margin was 7.64% for the third quarter of 2024, compared to gross loss margin of 0.97% for the same period of last year. Gross profit(loss) margins for regular CMP, light-weight CMP, offset printing paper, tissue paper products and face mask products were 7.54%, 7.33%, n/a, n/a and n/a, respectively, for the third quarter of 2024, compared to 7.01%, -7.47%, 7.53%, -278.10% and -15.75%, respectively, for the same period of last year.

Selling, General and Administrative Expenses

Selling, general and administrative expenses (“SG&A”) increased by 44.83%, to approximately $3.38 million for the third quarter of 2024 from approximately $2.33 million for the same period of last year.

Loss from Operations

Loss from operations was approximately $1.46 million for the third quarter of 2024, a decrease of 41.07%, from loss from operations of approximately $2.48 million for the same period of last year. Operating loss margin was 5.84% for the third quarter of 2024, compared to operating loss margin of 15.75% for the same period of last year.

Net Loss

Net loss was approximately $1.97 million, or loss per share of $0.20, for the third quarter of 2024, compared to net loss of approximately $1.98 million, or loss per share of $0.20, for the same period of last year.

EBITDA

EBITDA was approximately $2.03 million for the third quarter of 2024, compared to approximately $1.69 million for the same period of last year.

Note 1: Non-GAAP Financial Measures

In addition to our U.S. GAAP results, this press release includes a discussion of EBITDA, a non-GAAP financial measure as defined by the Securities and Exchange Commission (“SEC”). The Company defines EBITDA as net income before interest, income taxes, depreciation and amortization. EBITDA is a key measure used by management to evaluate our results and make strategic decisions. Management believes this measure is useful to investors because it is an indicator of operational performance. Because not all companies use identical calculations, the Company’s presentation of EBITDA may not be comparable to similarly titled measures of other companies, and should not be viewed as an alternative to measures of financial performance or changes in cash flows calculated in accordance with the U.S. GAAP.

Reconciliation of Net Income to EBITDA

(Amounts expressed in US$)

|

For the Three Months Ended September 30, |

|||||

|

($ millions) |

2024 |

2023 |

|||

|

Net loss |

-1.97 |

-1.98 |

|||

|

Add: Income tax |

0.35 |

0.00 |

|||

|

Net interest expense |

0.17 |

0.25 |

|||

|

Depreciation and amortization |

3.48 |

3.42 |

|||

|

EBITDA |

2.03 |

1.69 |

|||

Nine Months Ended September 30, 2024 Unaudited Financial Results

|

For the Nine Months Ended September 30, |

||||||

|

($ millions) |

2024 |

2023 |

% Change |

|||

|

Revenues |

58.20 |

65.58 |

-11.26 % |

|||

|

Regular Corrugating Medium Paper (“CMP”)* |

48.64 |

50.35 |

-3.39 % |

|||

|

Light-Weight CMP** |

9.44 |

11.07 |

-14.76 % |

|||

|

Offset Printing Paper |

– |

3.23 |

– |

|||

|

Tissue Paper Products |

– |

0.83 |

– |

|||

|

Face Masks |

– |

0.10 |

– |

|||

|

Gross profit |

5.58 |

0.75 |

644.60 % |

|||

|

Gross profit (loss) margin |

9.59 % |

1.14 % |

8.45 pp**** |

|||

|

Regular Corrugating Medium Paper (“CMP”)* |

9.44 % |

5.26 % |

4.18 pp**** |

|||

|

Light-Weight CMP** |

9.33 % |

1.68 % |

7.65 pp**** |

|||

|

Offset Printing Paper |

– |

2.53 % |

– |

|||

|

Tissue Paper Products*** |

– |

-258.64 % |

– |

|||

|

Face Masks |

– |

-9.26 % |

– |

|||

|

Operating loss |

(4.42) |

(5.78) |

-23.50 % |

|||

|

Net loss |

(5.80) |

(5.96) |

-2.75 % |

|||

|

EBITDA |

5.94 |

5.73 |

3.66 % |

|||

|

Basic and Diluted loss per share |

(0.58) |

(0.59) |

-1.69 % |

|||

|

* Products from PM6 |

||||||

|

** Products from PM1 |

||||||

|

*** Products from PM8 and PM9 |

||||||

|

**** pp represents percentage points |

||||||

Revenue

For the nine months ended September 30, 2024, total revenue decreased by 11.26%, to approximately $58.20 million from approximately $65.58 million for the same period of last year. This was mainly due to the decrease in ASP of CMP, partially offset by the increase in sales quantity of regular CMP.

The following table summarizes revenue, volume and ASP by product for the nine months ended September 30, 2024 and 2023, respectively:

|

For the Nine Months EndedSeptember30, |

||||||||||||||

|

2024 |

2023 |

|||||||||||||

|

Revenue |

Volume |

ASP |

Revenue |

Volume |

ASP |

|||||||||

|

Regular CMP |

48,644 |

140,574 |

346 |

50,353 |

135,912 |

370 |

||||||||

|

Light-Weight CMP |

9,440 |

28.345 |

333 |

11,074 |

31,106 |

356 |

||||||||

|

Offset Printing Paper |

– |

– |

– |

3,225 |

5,573 |

579 |

||||||||

|

Tissue Paper Products |

– |

– |

– |

831 |

726 |

1,145 |

||||||||

|

Total |

58,084 |

168,919 |

344 |

65,483 |

173,317 |

378 |

||||||||

|

Revenue |

Volume |

ASP |

Revenue |

Volume |

ASP |

|||||||||

|

Face Masks |

– |

– |

– |

95 |

3,023 |

31 |

||||||||

Revenue from CMP, including both regular CMP and light-Weight CMP, decreased by 5.44%, to approximately $58.08 million and accounted for 99.81% of total revenue for the nine months ended September 30, 2024, compared to approximately $61.43 million, or 93.66% of total revenue for the same period of last year. The Company sold 168,919 tonnes of CMP at an ASP of $344/tonne in nine months ended September 30, 2024, compared to 167,018 tonnes at an ASP of $368/tonne in the same period of last year.

Of the total CMP sales, revenue from regular CMP decreased by 3.39%, to approximately $48.64 million for the nine months ended September 30, 2024, compared to revenue of approximately $50.35 million for the same period of last year. The Company sold 140,574 tonnesof regular CMP at an ASP of $346/tonne during the nine months ended September 30, 2024, compared to 135,912 tonnes at an ASP of $370/tonne for the same period of last year. Revenue from light-weight CMP decreased by 14.76%, to approximately $9.44 million for the nine months ended September 30, 2023, compared to revenue of approximately $11.07 million for the same period of last year. The Company sold 28,345 tonnes of light-weight CMP at an ASP of $333/tonne during the nine months ended September 30, 2023, compared to 31,106 tonnes at an ASP of $356/tonne for the same period of last year.

Revenue from offset printing paper was $nil for the nine months ended September 30, 2024, compared to $3.23 million for the same period of last year. The Company sold 5,573tonnes of offset printing paper at an ASP of $579/tonne in the nine months ended September 30, 2023.

Revenue from tissue paper products was $nil for the nine months ended September 30, 2024, compared to $0.83million for the same period of last year. The Company sold 726 tonnes of tissue paper products at an ASP of $1,145/tonne during the nine months ended September 30, 2023.

Revenue from face masks was $nil for the nine months ended September 30, 2024, compared to $0.10 million for the same period of last year. The Company sold 3,023 thousand pieces of face masks during the nine months ended September 30, 2023.

Gross Profit and Gross Margin

Total cost of sales decreased by 18.85%, to approximately $52.61 million for the nine months ended September 30, 2024 from approximately $64.83 million for the same period of last year. This was mainly due to the decrease in the unit material costs of CMP. Costs of sales per tonne for regular CMP, light-weight CMP, offset printing paper, and tissue paper products were $313, $302, n/a and n/a, respectively, for the nine months ended September 30, 2024, compared to $351, $350, $564 and $4,107, respectively, for the same period of last year.

Total gross profit was approximately $5.58 million for the nine months ended September 30, 2024, compare to the gross profit of approximately $0.75 million for the same period of last year as a result of factors described above. Overall gross margin was 9.59% for the nine months ended September 30, 2024, compared to 1.14% for the same period of last year. Gross profit(loss) margins for regular CMP, light-weight CMP, offset printing paper, tissue paper products and face mask products were 9.44%, 9.33%, n/a, n/a and n/a, respectively, for the nine months ended September 30, 2024, compared to 5.26%, 1.68%, 2.53%, -258.64% and -9.26%, respectively, for the same period of last year.

Selling, General and Administrative Expenses

Selling, general and administrative expenses (“SG&A”) increased by 62.51%, to approximately $10.00 million for the nine months ended September 30, 2024 from approximately $6.15 million for the same period of last year.

Loss from Operations

Loss from operations was approximately $4.42 million for the nine months ended September 30, 2024, a decrease of 23.50%, from loss from operations of approximately $5.78 million for the same period of last year. Operating loss margin was 7.59% for the nine months ended September 30, 2024, compared to operating loss margin of 8.81% for the same period of last year.

Net Loss

Net loss was approximately $5.80 million, or loss per share of $0.58, for the nine months ended September 30, 2024, compared to net loss of approximately $5.96 million, or loss per share of $0.59, for the same period of last year.

EBITDA

EBITDA was approximately $5.94 million for the nine months ended September 30, 2024, compared to approximately $5.73 million for the same period of last year.

Note 1: Non-GAAP Financial Measures

In addition to our U.S. GAAP results, this press release includes a discussion of EBITDA, a non-GAAP financial measure as defined by the Securities and Exchange Commission (“SEC”). The Company defines EBITDA as net income before interest, income taxes, depreciation and amortization. EBITDA is a key measure used by management to evaluate our results and make strategic decisions. Management believes this measure is useful to investors because it is an indicator of operational performance. Because not all companies use identical calculations, the Company’s presentation of EBITDA may not be comparable to similarly titled measures of other companies, and should not be viewed as an alternative to measures of financial performance or changes in cash flows calculated in accordance with the U.S. GAAP.

Reconciliation of Net Income to EBITDA

(Amounts expressed in US$)

|

For the Nine Months Ended September 30, |

|||||

|

($ millions) |

2024 |

2023 |

|||

|

Net loss |

-5.80 |

-5.96 |

|||

|

Add: Income tax |

0.80 |

0.35 |

|||

|

Net interest expense |

0.59 |

0.77 |

|||

|

Depreciation and amortization |

10.35 |

10.57 |

|||

|

EBITDA |

5.94 |

5.73 |

|||

Cash, Liquidity and Financial Position

As of September 30, 2024, the Company had cash and bank balances, short-term debt (including bank loans, current portion of long-term loans from credit union and related party loans), and long-term debt (including related party loans) of approximately $4.41million, $5.95million and $4.57 million, respectively, compared to approximately $3.92million, $8.03million and $4.50 million, respectively, as of December 31, 2023.

Net accounts receivable was approximately $1.73 million as of September 30, 2024, compared to $0.58 million as of December 31, 2023. Net inventory was approximately $5.73 million as of September 30, 2024, compared to approximately $3.56 million as of December 31, 2023. As of September 30, 2023, the Company had current assets of approximately $32.97 million and current liabilities of approximately$20.75 million, resulting in a working capital of approximately $12.22 million. This was compared to current assets of approximately $28.36 million and current liabilities of approximately $21.42 million, resulting in a working capital of approximately $6.94 million as of December 31, 2023.

Net cash provided by operating activities was approximately $2.83 million for the nine months ended September 30, 2024, compared to approximately $7.49 million for the same period of last year. Net cash used in investing activities was approximately $0.32 million for the nine months ended September 30, 2024, compared to approximately $9.21 million for the same period of last year. Net cash provided by financing activities was approximately $2.11 million for the nine months ended September 30, 2024, compared to approximately $2.00 million for the same period of last year.

About IT Tech Packaging, Inc.

Founded in 1996, IT Tech Packaging, Inc. is a leading manufacturer and distributor of diversified paper products and single-use face masks in North China. Using recycled paper as its primary raw material (with the exception of its tissue paper products), ITP produces and distributes three categories of paper products: corrugating medium paper, offset printing paper and tissue paper products. With production based in Baoding and Xingtai in North China’s Hebei Province, ITP is located strategically close to the Beijing and Tianjin region, home to a growing base of industrial and manufacturing activities and one of the largest markets for paper products consumption in the country. ITP has been listed on the NYSE American since December 2009. For more information, please visit: http://www.itpackaging.cn/.

Forward-looking Statement

This release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements give our current expectations, opinion, belief or forecasts of future events and performance. A statement identified by the use of forward-looking words including “will,””may,””expects,””projects,””anticipates,””plans,””believes,””estimate,””should,” and certain of the other foregoing statements may be deemed forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including market and other conditions. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the SEC. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company undertakes no obligation to update any such forward-looking statements after the date hereof to conform to actual results or changes in expectations, except as required by law.

For more information, please contact:

Email: ir@itpackaging.cn

Tel: +86 312 8698215

|

IT TECH PACKAGING, INC. |

|||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||||

|

AS OF SEPTEMBER 30, 2024 AND DECEMBER 31, 2023 |

|||||||

|

(unaudited) |

|||||||

|

September 30, |

December 31, |

||||||

|

2024 |

2023 |

||||||

|

ASSETS |

|||||||

|

Current Assets |

|||||||

|

Cash and bank balances |

$ |

4,414,848 |

$ |

3,918,938 |

|||

|

Restricted cash |

478,066 |

472,983 |

|||||

|

Accounts receivable (net of allowance for doubtful |

1,727,370 |

575,526 |

|||||

|

Inventories |

5,732,539 |

3,555,235 |

|||||

|

Prepayments and other current assets |

19,384,595 |

18,981,290 |

|||||

|

Due from related parties |

1,237,479 |

853,929 |

|||||

|

Total current assets |

32,974,897 |

28,357,901 |

|||||

|

Operating lease right-of-use assets, net |

459,612 |

528,648 |

|||||

|

Property, plant, and equipment, net |

154,755,386 |

163,974,022 |

|||||

|

Value-added tax recoverable |

1,828,344 |

1,883,078 |

|||||

|

Total Assets |

$ |

190,018,239 |

$ |

194,743,649 |

|||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|||||||

|

Current Liabilities |

|||||||

|

Short-term bank loans |

$ |

856,238 |

$ |

423,567 |

|||

|

Current portion of long-term loans |

4,365,385 |

6,874,497 |

|||||

|

Lease liability |

249,976 |

100,484 |

|||||

|

Accounts payable |

– |

4,991 |

|||||

|

Advance from customers |

37,101 |

136,167 |

|||||

|

Due to related parties |

732,982 |

728,869 |

|||||

|

Accrued payroll and employee benefits |

362,996 |

237,842 |

|||||

|

Other payables and accrued liabilities |

13,800,118 |

12,912,517 |

|||||

|

Income taxes payable |

349,828 |

– |

|||||

|

Total current liabilities |

20,754,624 |

21,418,934 |

|||||

|

Long-term loans |

4,566,601 |

4,503,932 |

|||||

|

Lease liability – non-current |

372,966 |

483,866 |

|||||

|

Derivative liability |

3 |

54 |

|||||

|

Total liabilities (including amounts of the consolidated |

25,694,194 |

26,406,786 |

|||||

|

Commitments and Contingencies |

|||||||

|

Stockholders’ Equity |

|||||||

|

Common stock, 50,000,000 shares authorized, $0.001 par |

10,066 |

10,066 |

|||||

|

Additional paid-in capital |

89,172,771 |

89,172,771 |

|||||

|

Statutory earnings reserve |

6,080,574 |

6,080,574 |

|||||

|

Accumulated other comprehensive loss |

(8,770,123) |

(10,555,534) |

|||||

|

Retained earnings |

77,830,757 |

83,628,986 |

|||||

|

Total stockholders’ equity |

164,324,045 |

168,336,863 |

|||||

|

Total Liabilities and Stockholders’ Equity |

$ |

190,018,239 |

$ |

194,743,649 |

|||

|

IT TECH PACKAGING, INC. |

|||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME |

|||||||||||||

|

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 |

|||||||||||||

|

(Unaudited) |

|||||||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||||||

|

September 30, |

September 30, |

||||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||

|

Revenues |

$ |

25,081,500 |

$ |

15,771,560 |

$ |

58,195,129 |

$ |

65,582,351 |

|||||

|

Cost of sales |

(23,164,119) |

(15,924,783) |

(52,613,335) |

(64,832,715) |

|||||||||

|

Gross Profit (Loss) |

1,917,381 |

(153,223) |

5,581,794 |

749,636 |

|||||||||

|

Selling, general and |

(3,381,502) |

(2,334,746) |

(9,999,833) |

(6,153,513) |

|||||||||

|

Loss on impairment of |

– |

3,456 |

– |

(371,680) |

|||||||||

|

Loss from Operations |

(1,464,121) |

(2,484,513) |

(4,418,039) |

(5,775,557) |

|||||||||

|

Other Income |

|||||||||||||

|

Interest income |

7,313 |

93,298 |

12,303 |

283,203 |

|||||||||

|

Interest expense |

(171,430) |

(247,818) |

(593,271) |

(767,668) |

|||||||||

|

Gain on derivative |

2 |

660,429 |

51 |

646,020 |

|||||||||

|

Loss before Income |

(1,628,236) |

(1,978,604) |

(4,998,956) |

(5,614,002) |

|||||||||

|

Income Tax (Expenses) |

(345,710) |

3,236 |

(799,273) |

(348,024) |

|||||||||

|

Net Loss |

(1,973,946) |

(1,975,368) |

(5,798,229) |

(5,962,026) |

|||||||||

|

Other Comprehensive |

|||||||||||||

|

Foreign currency |

2,843,180 |

1,143,608 |

1,785,411 |

(5,417,331) |

|||||||||

|

Total Comprehensive |

$ |

869,234 |

$ |

(831,760) |

$ |

(4,012,818) |

$ |

(11,379,357) |

|||||

|

Losses Per Share: |

|||||||||||||

|

Basic and Diluted |

$ |

(0.20) |

$ |

(0.20) |

$ |

(0.53) |

$ |

(0.59) |

|||||

|

Outstanding – Basic and |

10,065,920 |

10,065,920 |

10,065,920 |

10,065,920 |

|||||||||

|

IT TECH PACKAGING, INC. |

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||

|

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 |

||||||

|

(Unaudited) |

||||||

|

Nine Months Ended |

||||||

|

September 30, |

||||||

|

2024 |

2023 |

|||||

|

Cash Flows from Operating Activities: |

||||||

|

Net income |

$ |

(5,798,229) |

$ |

(5,962,026) |

||

|

Adjustments to reconcile net income to net cash provided by operating |

||||||

|

Depreciation and amortization |

10,346,181 |

10,573,288 |

||||

|

(Gain) Loss on derivative liability |

(51) |

(646,020) |

||||

|

(Gain) Loss from disposal and impairment of property, plant and equipment |

– |

956,406 |

||||

|

(Recovery from) Allowance for bad debts |

30,262 |

(815,317) |

||||

|

Allowances for inventories, net |

(2,951) |

– |

||||

|

Changes in operating assets and liabilities: |

||||||

|

Accounts receivable |

(1,160,996) |

(2,037,003) |

||||

|

Prepayments and other current assets |

(122,747) |

7,968,553 |

||||

|

Inventories |

(2,108,280) |

(2,631,661) |

||||

|

Accounts payable |

(4,979) |

101,328 |

||||

|

Advance from customers |

(99,219) |

19,140 |

||||

|

Related parties |

(365,452) |

120,298 |

||||

|

Accrued payroll and employee benefits |

121,000 |

141,773 |

||||

|

Other payables and accrued liabilities |

1,651,302 |

119,132 |

||||

|

Income taxes payable |

345,270 |

(413,777) |

||||

|

Net Cash Provided by Operating Activities |

2,831,111 |

7,494,114 |

||||

|

Cash Flows from Investing Activities: |

||||||

|

Purchases of property, plant and equipment |

(315,152) |

(9,211,711) |

||||

|

Net Cash Used in Investing Activities |

(315,152) |

(9,211,711) |

||||

|

Cash Flows from Financing Activities: |

||||||

|

Proceeds from short term bank loans |

845,082 |

852,988 |

||||

|

Proceeds from long term loans |

– |

2,558,963 |

||||

|

Repayment of bank loans |

(2,957,788) |

(5,549,150) |

||||

|

Payment of capital lease obligation |

– |

(130,470) |

||||

|

Loan to a related party (net) |

– |

4,264,938 |

||||

|

Net Cash (Used in) Provided by Financing Activities |

(2,112,706) |

1,997,269 |

||||

|

Effect of Exchange Rate Changes on Cash and Cash Equivalents |

97,740 |

(366,599) |

||||

|

Net Increase (Decrease) in Cash and Cash Equivalents |

500,993 |

(86,927) |

||||

|

Cash, Cash Equivalents and Restricted Cash – Beginning of Period |

4,391,921 |

9,524,868 |

||||

|

Cash, Cash Equivalents and Restricted Cash – End of Period |

$ |

4,892,914 |

$ |

9,437,941 |

||

|

Supplemental Disclosure of Cash Flow Information: |

||||||

|

Cash paid for interest, net of capitalized interest cost |

$ |

382,493 |

$ |

1,118,672 |

||

|

Cash paid for income taxes |

$ |

454,003 |

$ |

761,801 |

||

|

Cash and bank balances |

4,414,848 |

9,437,941 |

||||

|

Restricted cash |

478,066 |

– |

||||

|

Total cash, cash equivalents and restricted cash shown in the |

4,892,914 |

9,437,941 |

||||

![]() View original content:https://www.prnewswire.com/news-releases/it-tech-packaging-inc-announces-third-quarter-2024-unaudited-financial-results-302307510.html

View original content:https://www.prnewswire.com/news-releases/it-tech-packaging-inc-announces-third-quarter-2024-unaudited-financial-results-302307510.html

SOURCE IT Tech Packaging, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Pushes Back Above $90,000, Ethereum, Dogecoin Lag To End A Record Week

Cryptocurrency markets are closing the week strong, with Bitcoin pushing above $90,000 at the end of the U.S. trading session.

| Cryptocurrency | Price | Gains +/- |

| Bitcoin BTC/USD | $90,792 | +1.5% |

| Ethereum ETH/USD | $3,061 | -2.3% |

| Solana SOL/USD | $213.8 | -0.5% |

| Dogecoin DOGE/USD | $0.3719 | -5.1% |

| Shiba Inu SHIB/USD | $0.00002439 | -2.7% |

Notable Statistics:

- IntoTheBlock data shows large transaction volume falling by 14% and daily active addresses dropping by 3%.

- Coinglass data reports $453 million in liquidations, $288 million of which were liquidated long positions.

Notable Developments:

Top Gainers:

| Cryptocurrency | Price | Gains +/- |

| Flare FLR/USD | $0.0207 | 46.5% |

| Algorand ALGO/USD | $0.1805 | 20.5% |

| Cardano ADA/USD | $0.6784 | 20.2% |

Trader Notes: Veteran analyst Benjamin Cowen expects Bitcoin dominance to increase for the remainder of the year. He expects a reversal only in 2025.

A poll by trader TheFlowHorse shows his audience divided over whether Bitcoin will trade above $89,500 on the weekend, with a slight 54% majority saying yes.

Technical analyst Pierre outlined the likely paths for Bitcoin in the short term: either a flip of the resistance level around $90,000, which could lead to new highs, or a visit to the bottom of the range around $85,000. In between the two prices, he expects sideways trading action.

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Danaher

Investors with a lot of money to spend have taken a bearish stance on Danaher DHR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DHR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 11 uncommon options trades for Danaher.

This isn’t normal.

The overall sentiment of these big-money traders is split between 18% bullish and 81%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $574,327, and 2 are calls, for a total amount of $150,000.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $210.0 to $260.0 for Danaher over the recent three months.

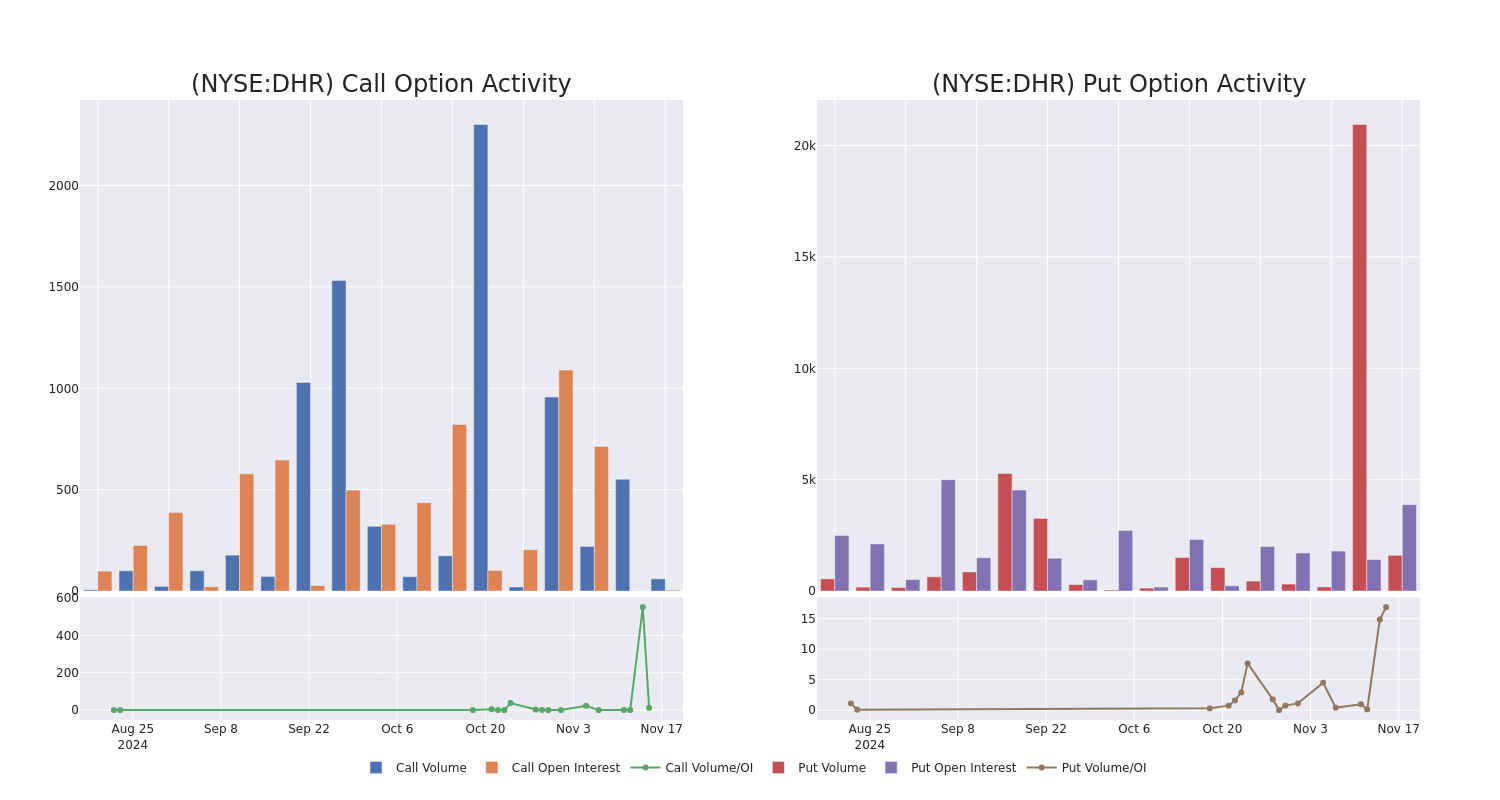

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Danaher stands at 431.56, with a total volume reaching 1,664.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Danaher, situated within the strike price corridor from $210.0 to $260.0, throughout the last 30 days.

Danaher 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | PUT | SWEEP | BEARISH | 03/21/25 | $11.5 | $11.0 | $11.2 | $230.00 | $163.5K | 1.3K | 139 |

| DHR | PUT | SWEEP | BEARISH | 12/20/24 | $4.9 | $4.3 | $4.9 | $230.00 | $147.0K | 1.1K | 300 |

| DHR | CALL | TRADE | BULLISH | 01/15/27 | $44.8 | $42.7 | $44.1 | $230.00 | $110.2K | 0 | 25 |

| DHR | PUT | SWEEP | BULLISH | 12/20/24 | $0.95 | $0.9 | $0.9 | $210.00 | $62.8K | 126 | 699 |

| DHR | PUT | SWEEP | BEARISH | 03/21/25 | $31.6 | $30.2 | $30.7 | $260.00 | $61.4K | 205 | 30 |

About Danaher

In 1984, Danaher’s founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

After a thorough review of the options trading surrounding Danaher, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Danaher

- With a trading volume of 3,258,575, the price of DHR is down by -1.73%, reaching $235.23.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 74 days from now.

Expert Opinions on Danaher

5 market experts have recently issued ratings for this stock, with a consensus target price of $288.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from TD Cowen has decided to maintain their Buy rating on Danaher, which currently sits at a price target of $315.

* An analyst from Barclays persists with their Equal-Weight rating on Danaher, maintaining a target price of $275.

* An analyst from Baird persists with their Outperform rating on Danaher, maintaining a target price of $277.

* An analyst from Stifel persists with their Hold rating on Danaher, maintaining a target price of $265.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Danaher, targeting a price of $310.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Danaher, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chief Operating Officer Of Grand Canyon Education Makes $478K Sale

Making a noteworthy insider sell on November 14, William Stan Meyer, Chief Operating Officer at Grand Canyon Education LOPE, is reported in the latest SEC filing.

What Happened: Meyer’s decision to sell 2,800 shares of Grand Canyon Education was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $478,380.

Monitoring the market, Grand Canyon Education‘s shares down by 0.0% at $164.88 during Friday’s morning.

Delving into Grand Canyon Education’s Background

Grand Canyon Education Inc is a publicly traded education services company dedicated to serving colleges and universities. GCE’s university partner is Grand Canyon University, an Arizona non-profit corporation that operates a comprehensive regionally accredited university that offers graduate and undergraduate degree programs, emphases and certificates across nine colleges both online, on ground at its campus in Phoenix, Arizona and at four off-site classroom and laboratory sites. The Company generates all of its revenue through services agreements with its university partners.

Grand Canyon Education: Delving into Financials

Revenue Growth: Grand Canyon Education’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 7.38%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Evaluating Earnings Performance:

-

Gross Margin: The company sets a benchmark with a high gross margin of 50.01%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Grand Canyon Education’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 1.43.

Debt Management: With a below-average debt-to-equity ratio of 0.14, Grand Canyon Education adopts a prudent financial strategy, indicating a balanced approach to debt management.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 21.67, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 4.77 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Grand Canyon Education’s EV/EBITDA ratio, lower than industry averages at 14.36, indicates attractively priced shares.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Grand Canyon Education’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Eagle Announces Update on Delisting from Nasdaq and SEC Deregistration

WOODCLIFF LAKE, N.J., Nov. 15, 2024 (GLOBE NEWSWIRE) — Eagle Pharmaceuticals, Inc. (Nasdaq and OTCMKTS: EGRX) (the “Company” or “Eagle”) today announced that it has notified The Nasdaq Stock Market, LLC (“Nasdaq”) of its intent to file its own Form 25 (Notification of Removal of Listing) with the U.S. Securities and Exchange Commission (the “SEC”) to complete the previously-disclosed process to delist the Company’s common stock, par value $0.001 per share (the “Common Stock”), from the Nasdaq Global Market in advance of Nasdaq’s anticipated filing of a Form 25 with the SEC.

As previously disclosed, the Common Stock was suspended from trading on Nasdaq as of October 3, 2024, pursuant to a final delisting notice sent to the Company by the Listing Qualifications Department of Nasdaq due to the Company’s inability to regain compliance with Nasdaq Listing Rule 5250(c)(1). The Common Stock has been trading on the OTC Expert Market since October 4, 2024 in connection with its suspension from trading on Nasdaq. The Company currently anticipates that it will file its own Form 25 with the SEC on or after November 25, 2024, which would complete the process for delisting its Common Stock from Nasdaq when the Form 25 becomes effective no earlier than ten days thereafter. The Form 25 would also serve to deregister the Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended, effective 90 days thereafter, which would reduce certain SEC reporting obligations.

About Eagle Pharmaceuticals, Inc.

Eagle is a fully integrated pharmaceutical company with research and development, clinical, manufacturing and commercial expertise. Eagle is committed to developing innovative medicines that result in meaningful improvements in patients’ lives. Eagle’s commercialized products include PEMFEXY®, RYANODEX®, BENDEKA®, BELRAPZO®, TREAKISYM® (Japan), and BYFAVO® and BARHEMSYS® through its wholly owned subsidiary Acacia Pharma Inc. Eagle’s oncology and CNS/metabolic critical care pipeline includes product candidates with the potential to address underserved therapeutic areas across multiple disease states, and the company is focused on developing medicines with the potential to become part of the personalized medicine paradigm in cancer care. Additional information is available on Eagle’s website at www.eagleus.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, and other securities law. Forward-looking statements are statements that are not historical facts. Words and phrases such as “anticipated,” “forward,” “will,” “would,” “could,” “may,” “intend,” “remain,” “regain,” “maintain,” “potential,” “prepare,” “expected,” “believe,” “plan,” “seek,” “continue,” “goal,” “estimate,” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements with respect to the Company’s plans with respect to the delisting and deregistration of its Common Stock and the timing thereof. All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the Company’s control, which could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Such risks and uncertainties include, but are not limited to: the completion of the review and preparation of the Company’s financial information and internal control over financial reporting and disclosure controls and procedures and the timing thereof; the discovery of additional information; further delays in the Company’s financial reporting, including as a result of unanticipated factors; the Company’s ability to obtain resolution with respect to the events of default under its Third Amended and Restated Credit Agreement, as amended; the Company’s ability to obtain financing and the timing and potential terms thereof; whether the objectives of the Company’s review of potential financing and other alternatives will be achieved, the terms, structure, benefits and costs of any arrangement or transaction resulting therefrom, and whether any transaction will be consummated at all; the extent to which the rights under the Company’s stockholder rights agreement become exercisable, if at all; the risk that the Company’s review of potential financing and other alternatives and its announcement could have an adverse effect on the ability of the Company to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other relationships and on its operating results and business generally; the risk that the Company’s review of potential financing and other alternatives could divert the attention and time of the Company’s management; the costs resulting from the review of potential financing and other alternatives; the risk of the Company potentially seeking protection under bankruptcy laws; the possibility that the Company will be unable to re-list its common stock on the Nasdaq or another exchange and, if re-listed, the possibility that the Company thereafter will be unable to comply with the listing rules of such exchange; the limitations on trading of the Company’s common stock related to the Company’s trading on the OTC Expert Market; the impact on the price of the Company’s common stock and the Company’s reputation; the Company’s ability to remediate material weaknesses in its internal control over financial reporting; the Company’s ability to recruit and hire a new Chief Executive Officer and retain key personnel; the ability of the Company to realize the anticipated benefits of its plan designed to improve operational efficiencies and realign its sales and marketing expenditures and the impacts thereof; the Company’s reliance on third parties to manufacture commercial supplies of its products and clinical supplies of its product candidates; the impacts of geopolitical factors such as the conflicts between Russia and Ukraine and Hamas, Iran and Israel; delay in or failure to obtain regulatory approval of the Company’s or its partners’ product candidates and successful compliance with Federal Drug Administration, European Medicines Agency and other governmental regulations applicable to product approvals; changes in the regulatory environment; the uncertainties and timing of the regulatory approval process; whether the Company can successfully market and commercialize its products; the success of the Company’s relationships with its partners; the outcome of litigation and other legal proceedings and the risk of additional litigation and legal proceedings, including with respect to the matters referenced herein; the strength and enforceability of the Company’s intellectual property rights or the rights of third parties; competition from other pharmaceutical and biotechnology companies and competition from generic entrants into the market; unexpected safety or efficacy data observed during clinical trials; clinical trial site activation or enrollment rates that are lower than expected; the risks inherent in drug development and in conducting clinical trials; risks inherent in estimates or judgments relating to the Company’s critical accounting policies, or any of the Company’s estimates or projections, which may prove to be inaccurate; unanticipated factors in addition to the foregoing that may impact the Company’s financial and business projections and may cause the Company’s actual results and outcomes to materially differ from its estimates and projections; and those risks and uncertainties identified in the “Risk Factors” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 23, 2023, the Company’s Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 9, 2023, and for the quarter ended June 30, 2023, filed with the SEC on August 8, 2023, and its subsequent filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements contained in this press release speak only as of the date on which they were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

Investor Relations Contact

Lisa M. Wilson

T: 212-452-2793

E: lwilson@insitecony.com

Timothy McCarthy, CFA

T: 917-679-9282

E: tim@lifesciadvisors.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.