US Stocks Erase More Than Half Post-Election Gains: Market Wrap

(Bloomberg) — Stocks fell on Friday, closing out the worst week in more than two months, as Trump trades lost steam and investors bet the Federal Reserve will have to slow the pace of policy easing.

Most Read from Bloomberg

The S&P 500 ended off session lows, with tech stocks leading declines. The benchmark has now erased over half of the trough-to-peak gains it notched after the US presidential election. Traders see slightly more than even odds of a quarter-point cut next month following comments by Jerome Powell this week indicating the Fed was in no hurry to lower rates and a report Friday on October retail sales that included large upside revisions to the prior month.

As the initial euphoria about President-elect Donald Trump’s pro-business agenda begins to fade, investors are coming to terms with the costs of his fiscal plans and their potential to reignite inflation.

“It will come at the expense of potentially larger budget deficits, potentially larger debt and there is also the inflation dimension,” said Charles-Henry Monchau, chief investment officer at Banque Syz & Co. “There’s been a realization that there is a price to pay for this.”

For the week, the S&P 500 was down 2.1% and the tech-heavy Nasdaq 100 dropped more than 3%, both posting the biggest declines for the period since Sept. 6. On Friday, shares of all “Magnificent Seven” megacaps retreated except Elon Musk’s Tesla Inc., with Amazon.com Inc., Nvidia Corp. and Meta Platforms Inc. sliding more than 3%. Applied Materials Inc., the largest US maker of chip-manufacturing equipment, suffered its worst stock decline in a month after giving a disappointing revenue forecast.

Late Friday, traders priced about a 56% chance the Fed will deliver a quarter-point reduction at its December meeting, down from 80% earlier this week. Bets on cuts were pared after Powell warned Thursday that the central bank may take its time easing policy.

Boston Fed President Susan Collins said Friday a December cut remained on the table, emphasizing the central bank’s decision will be guided by incoming data. Chicago Fed chief Austan Goolsbee said as long as inflation continues down toward the central bank’s 2% goal, rates will be “a lot” lower over the next 12-18 months. He agreed with Powell, however, noting policymakers aren’t in a hurry to lower borrowing costs.

Spotlight on Zoom Video Comms: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on Zoom Video Comms ZM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ZM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Zoom Video Comms.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 55%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $285,135, and 4 are calls, for a total amount of $366,055.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $120.0 for Zoom Video Comms during the past quarter.

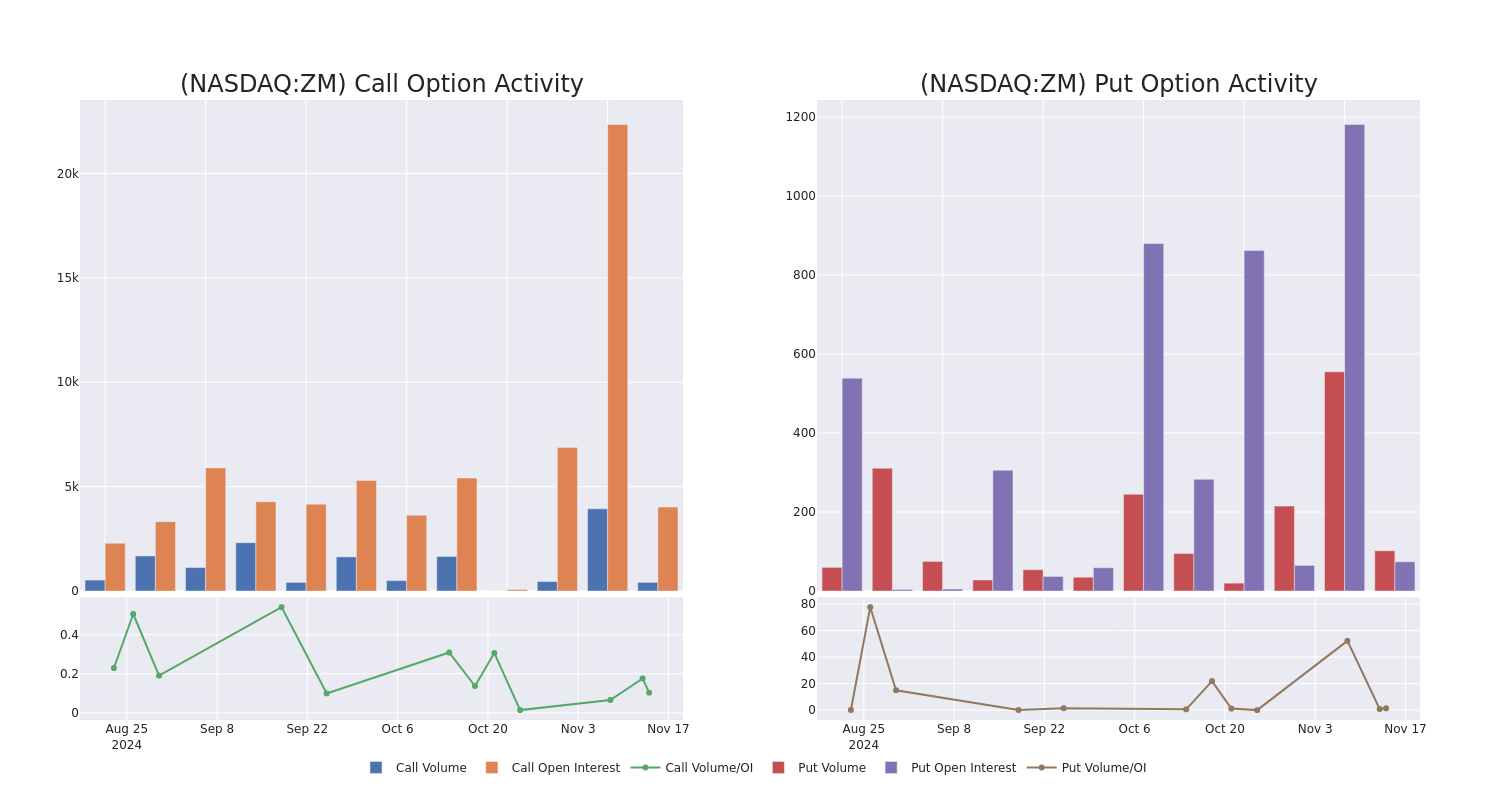

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Zoom Video Comms’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Zoom Video Comms’s whale activity within a strike price range from $75.0 to $120.0 in the last 30 days.

Zoom Video Comms Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZM | PUT | SWEEP | BULLISH | 06/20/25 | $14.95 | $14.9 | $14.9 | $92.50 | $140.0K | 0 | 94 |

| ZM | CALL | SWEEP | BEARISH | 01/16/26 | $3.65 | $3.55 | $3.55 | $120.00 | $121.0K | 394 | 384 |

| ZM | CALL | SWEEP | BEARISH | 03/21/25 | $11.55 | $11.2 | $11.2 | $75.00 | $112.0K | 4.5K | 366 |

| ZM | CALL | SWEEP | BEARISH | 03/21/25 | $10.0 | $9.85 | $9.85 | $77.50 | $98.5K | 231 | 100 |

| ZM | PUT | TRADE | NEUTRAL | 12/20/24 | $6.9 | $6.0 | $6.41 | $85.00 | $38.4K | 275 | 0 |

About Zoom Video Comms

Zoom Video Communications provides a communications platform that connects people through video, voice, chat, and content sharing. The company’s cloud-native platform enables face-to-face video and connects users across various devices and locations in a single meeting. Zoom, which was founded in 2011 and is headquartered in San Jose, California, serves companies of all sizes from all industries around the world.

Following our analysis of the options activities associated with Zoom Video Comms, we pivot to a closer look at the company’s own performance.

Zoom Video Comms’s Current Market Status

- Trading volume stands at 1,232,484, with ZM’s price down by -1.74%, positioned at $81.19.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 10 days.

Professional Analyst Ratings for Zoom Video Comms

In the last month, 2 experts released ratings on this stock with an average target price of $85.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Zoom Video Comms, maintaining a target price of $86.

* In a positive move, an analyst from Wedbush has upgraded their rating to Outperform and adjusted the price target to $85.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Zoom Video Comms options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Badri Kothandaraman Takes a Bullish Stance: Acquires $301K In Enphase Energy Stock

A new SEC filing reveals that Badri Kothandaraman, President & CEO at Enphase Energy ENPH, made a notable insider purchase on November 14,.

What Happened: Kothandaraman demonstrated confidence in Enphase Energy by purchasing 5,000 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the transaction is $301,902.

As of Friday morning, Enphase Energy shares are up by 1.79%, currently priced at $64.7.

Get to Know Enphase Energy Better

Enphase Energy is a global energy technology company. The company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform. The company’s microinverter technology primarily serves the rooftop solar market and produces a fully integrated solar-plus-storage solution. Geographically, it derives a majority of revenue from the United States.

Enphase Energy: Financial Performance Dissected

Decline in Revenue: Over the 3 months period, Enphase Energy faced challenges, resulting in a decline of approximately -30.89% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Exploring Profitability:

-

Gross Margin: The company excels with a remarkable gross margin of 46.78%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Enphase Energy’s EPS is below the industry average. The company faced challenges with a current EPS of 0.34. This suggests a potential decline in earnings.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.4, caution is advised due to increased financial risk.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: Enphase Energy’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 138.17.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 6.95 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 53.06, Enphase Energy demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Enphase Energy’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LuxUrban Hotels Inc. Announces Reverse Stock Split and Nasdaq Compliance Approval

MIAMI, Nov. 15, 2024 (GLOBE NEWSWIRE) — LuxUrban Hotels Inc. LUXH, a hospitality company that leases entire hotels on a long-term basis, manages these hotels, and rents out rooms to guests in the properties it leases, today announced that it will effectuate a one-for-seventy (1:70) reverse stock split of its common stock. This reverse stock split was approved by stockholders at the special meeting held on November 12, 2024, and will be effective at the opening of trading on November 20, 2024.

The reverse stock split is part of LuxUrban Hotels’ strategy to strengthen its position within the Nasdaq Capital Markets, improve the stock’s trading profile, and position the company for future growth and expansion opportunities. Following the reverse split, the number of shares of common stock issued and outstanding will be reduced from approximately 151.85 million to approximately 2.17 million shares.

In addition, stockholders approved a proposal to waive the 19.99% share limitation under Nasdaq Rule 5635(d), allowing the company to issue additional shares of common stock upon the conversion of certain convertible promissory notes and the exercise of outstanding warrants. This approval enables LuxUrban to maintain its compliance with Nasdaq listing standards while maximizing the flexibility of its financing arrangements.

Key details of the reverse stock split include:

- Ratio: 1-for-70, meaning stockholders will receive one share for every 70 shares held.

- Effective Date: November 20, 2024, at the market open.

- CUSIP: The new CUSIP number for the post-split common stock will be 21985R303.

The trading symbol for LuxUrban’s common stock on the Nasdaq Capital Market will remain “LUXH.” Stockholders who would own a fraction of a share as a result of the reverse stock split will instead receive cash in lieu of a fractional share.

Michael James, Chief Financial Officer of LuxUrban Hotels, commented: “The approval of the reverse stock split and Nasdaq compliance proposal marks a significant step in our ongoing efforts to drive shareholder value. We appreciate the support of our stockholders and remain committed to our vision of becoming a leader in the urban lodging market.”

For additional details on the reverse stock split, please refer to the company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission on October 29, 2024, and the related 8-K filing dated November 15, 2024.

LuxUrban Hotels Inc.

LuxUrban Hotels Inc. secures long-term operating rights for entire hotels through Master Lease Agreements (MLA) and rents out, on a short-term basis, hotel rooms to business and vacation travelers. The Company is strategically building a portfolio of hotel properties in destination cities by capitalizing on the dislocation in commercial real estate markets and the large amount of debt maturity obligations on those assets coming due with a lack of available options for owners of those assets. LuxUrban’s MLA allows owners to hold onto their assets and retain their equity value while LuxUrban operates and owns the cash flows of the operating business for the life of the MLA.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). The statements contained in this release that are not purely historical are forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Generally, the words “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this release may include, for example, statements with respect to the Company’s ability to successfully de-platform its properties from its former franchise partner and operate independently, its ability to improve its working capital and cash flow profiles, enhance its balance sheet and deliver organic revenue growth, scheduled property openings, expected closing of noted lease transactions, the Company’s ability to continue closing on additional leases for properties in the Company’s pipeline, as well the Company’s anticipated ability to commercialize efficiently and profitably the properties it leases and will lease in the future. The forward-looking statements contained in this release are based on current expectations and belief concerning future developments and their potential effect on the Company. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements are subject to a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results of performance to be materially different from those expressed or implied by these forward-looking statements, including those set forth under the caption “Risk Factors” in our public filings with the SEC, including in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on April 15, 2024, and any updates to those factors as set forth in subsequent Quarterly Reports on Form 10-Q or other public filings with the SEC, the base prospectus comprising part of the Registration Statement and when filed, the prospectus supplement filed with respect thereto. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

Contact:

Management:

Robert Arigo

(833) 723-7368

Investor Relations:

Jeff Ramson

New York, NY 10001

T: 646-863-6893

jramson@pcgadvisory.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AppTech Payments Reports Third Quarter 2024 Results and Provides Business Update

CARLSBAD, Calif., Nov. 15, 2024 (GLOBE NEWSWIRE) — AppTech Payments Corp. APCX, a pioneering Fintech company powering frictionless commerce, announced its financial results for the third quarter ended September 30, 2024.

Strategic Highlights

In Q3 2024, AppTech continued its strategic focus on platform innovation, operational efficiency, and expanding partnerships within high-growth sectors such as credit unions, Independent Sales Organizations (ISOs), and airports, addressing the increasing demand for seamless, secure, and customized payment solutions. Utilizing its Payments-as-a-Service (PaaS) and Banking-as-a-Service (BaaS) models, AppTech is working to provide ISOs, credit unions, and travel hubs with foundational digital payment capabilities. These ongoing developments are intended to help AppTech’s clients address the operational challenges of digital payments while adapting to changing market demands.

Key growth drivers for AppTech in the upcoming quarters and year include the continued expansion of its BaaS program and white-label solutions, which are the primary drivers for ISOs to transition their portfolios to the FinZeo platform. The rollout of FinZeo is expected to continue, with new airports coming on board by the end of 2024, and plans for nationwide availability to credit unions. Additionally, the anticipated launch of InstaCash is poised to transform the specialty payments space. Another significant growth factor is the onboarding of a new strategic partner with a portfolio of 40,000 clients, which will further expand AppTech’s reach and market presence.

CEO Statement

“Our Q3 results reflect our focused approach to refining digital payment solutions and advancing strategic platform development to serve key sectors better,” said Luke D’Angelo, Chairman and CEO of AppTech. “As we continue enhancing our platform, we remain committed to delivering adaptable payment solutions to Independent Sales Organizations, credit unions, and airports. These efforts demonstrate our dedication to operational efficiency and sustainable growth while building long-term shareholder value.”

Operational Efficiency and Investment in Growth

In Q3 2024, AppTech reported revenues of $43,000, compared to $140,000 in Q3 2023, reflecting a strategic adjustment in the Company’s focus, prioritizing long-term platform development over short-term merchant processing revenue. AppTech aims to support sustainable growth and scalability across key sectors by shifting resources toward enhancing its proprietary digital financial services.

Total operating expenses for the quarter were $1.9 million, a decrease from $3.0 million in Q3 2023, due to disciplined cost management and expense reductions. As a result, net loss narrowed to $2.0 million for Q3 2024, compared to a net loss of $2.9 million in Q3 2023. This improvement underscores the Company’s commitment to efficient resource allocation, ensuring that investments align with strategic goals for long-term value creation.

Capital and Equity Strategy

AppTech raised $0.9 million through a convertible note to support its growth initiatives and $1.0 million from warrant exercises during the quarter. The Company’s financial resources continue to drive shareholder value and advance ongoing technological developments as we invest in the future.

About AppTech Payments Corp.

AppTech Payments Corp. APCX provides digital financial services for financial institutions, corporations, small and midsized enterprises (“SMEs”), and consumers through the Company’s scalable cloud-based platform architecture and infrastructure, coupled with our Specialty Payments development and delivery model. AppTech maintains exclusive licensing and partnership agreements in addition to a full suite of patented technology capabilities. For more information, please visit apptechcorp.com.

Forward-Looking Statements

This press release contains forward-looking statements that are inherently subject to risks and uncertainties. Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate, believe, estimate, expect, forecast, intend, may, plan, project, predict, should, will” and similar expressions as they relate to AppTech are intended to identify such forward-looking statements. These risks and uncertainties include, but are not limited to, general economic and business conditions, effects of continued geopolitical unrest and regional conflicts, competition, changes in methods of marketing, delays in manufacturing or distribution, changes in customer order patterns, changes in customer offering mix, and various other factors beyond the Company’s control. Actual events or results may differ materially from those described in this press release due to any of these factors. AppTech is under no obligation to update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.

AppTech Payments Corp.

760-707-5959

info@apptechcorp.com

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1933 is available at the link below:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1070050/000168316824008000/apptech_i10q-093024.htm

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Return To 5% Bond Yields Could Tempt Investors: Are Stocks At Risk Of Losing Out?

The yield on the 10-year Treasury bond is not too far from the critical 5% mark, and for investors, this could be the financial equivalent of a seismic portfolio shift.

Historically, when bond yields rise this high, they don’t just invite competition with stocks: They start stealing the show.

In a note shared with clients on Friday, Bank of America analyst Savita Subramanian indicated that a 5% yield is the level at which bonds start to be more attractive than stocks.

Here’s the logic: stocks carry risk, volatility, and higher expected returns. Bonds, especially Treasuries, the opposite.

If both assets, for some reason, offer a similar return, why bother with the headaches of equities?

The logic is tied to the equity risk premium (ERP) — the extra return investors demand for holding riskier stocks instead of safer bonds.

Suppose a 10-year Treasury bond yields a 5% return with virtually no risk. In that case, it becomes harder to justify holding volatile equities unless they can deliver returns well above that level.

Also Read: Tesla To Partner With Lyft, Uber? Analyst Has ‘Rising Conviction’ For Future Partnership

What The Data Says

The numbers don’t lie: as yields climb, stock allocations typically fall. BofA’s proprietary sell-side indicator shows that when 10-year yields rise above 5%, Wall Street tends to trim stock allocations.

When yields hit 6% or high, the average investor portfolio’s equity allocation shrinks to around 50%.

David Rosenberg, a veteran economist, echoed this sentiment on social media platform X, writing earlier this week, “With this move in bond yields, we are now just 10 basis points away from the Equity Risk Premium shifting negative. Ergo, investors are willing to pay to take on equity risk instead of getting paid to.”

But Wait—Stocks Don’t Always Follow the Rules

Before you start dumping your Nvidia Corp. NVDA shares for Treasuries, it’s worth noting that the equity risk premium isn’t perfect at predicting short-term market moves.

In fact, periods of low or even negative ERP can persist for months or years while stocks continue to perform well.

For example, in 2023 and 2024, the S&P 500 operated under a low or zero ERP but still delivered stellar returns, defying expectations.

Bank of America acknowledged this potential for resilience. Real rates today—defined as the difference between the yield of a Treasury at 10 years and the 10-year inflation expectations—are around 2%, “but they can move higher without impacting equities.”

In prior cycles, like the productivity boom from 1985 to 2005, real rates averaged 3.5%, yet the S&P 500 posted annual returns of 15%.

A Manageable Rate Risk For S&P 500 Companies?

Despite rising yields, the S&P 500 may be more insulated than some investors think.

Around 80% of S&P 500 debt is long-term and fixed, compared to less than 50% in 2008. This means companies are less exposed to the immediate impact of higher bond yields.

Additionally, the current real yield of roughly 2% is consistent with historical averages since 1950. While rates could climb further, it doesn’t necessarily spell doom for equities.

Bottom line, if 10-year Treasury yields climb above 5%, it could fundamentally shift the risk-reward equation for stocks versus bonds, luring investors toward safer assets. But, the validity of the equity risk premium for market timing is not a crystal ball.

Historical trends and current market conditions suggest stocks may still find a way to thrive, even in a higher-rate environment.

Read Next:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

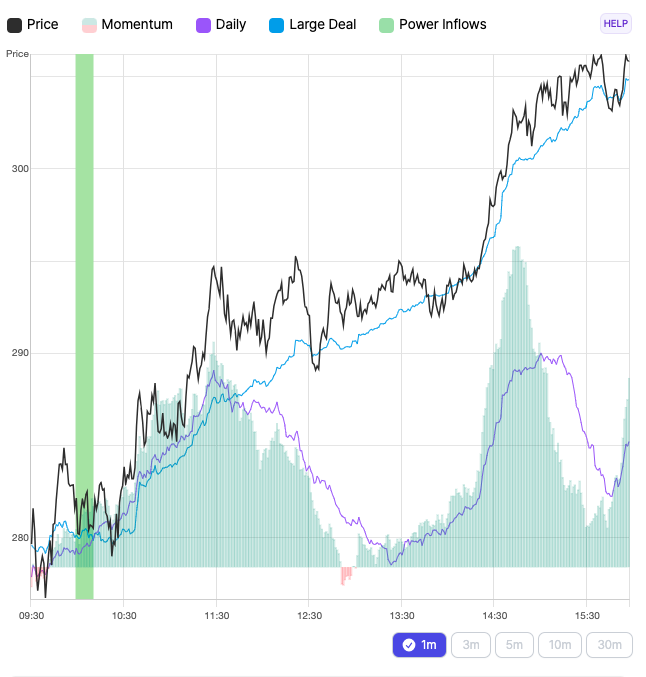

Tradepulse Power Inflow Alert: Coinbase Global Inc. Receives Alert And Climbs Over 25 Points

COIN RISES OVER 9% AT THE HIGH OF THE DAY

Today, Coinbase Global, Inc. COIN experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

Today, at 10:08 AM on November 15th, a significant trading signal occurred for Coinbase Global, Inc.as it demonstrated a Power Inflow at a price of $280.69. This indicator is crucial for traders who want to know directionally where institutions and so-called “smart money” moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Coinbase’s stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Coinbase’s stock price, interpreting this event as a bullish sign.

Signal description

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted as a bullish signal by active traders.

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock’s overall direction, powered by institutional activity in the stock, for the remainder of the day.

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let’s not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

If you want to stay updated on the latest options trades for COIN, Benzinga Pro gives you real-time options trades alerts.

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

The price at the time of the Power Inflow was $280.69. The returns on the high price ($306.17) and close price ($305.82) after the power inflow were 9.0% and 8.7% respectively. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case, the high of the day and close were very close but that is not always the case

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Collective Metals Announces CFO Transition

VANCOUVER, British Columbia, Nov. 15, 2024 (GLOBE NEWSWIRE) — COLLECTIVE METALS INC. (CSE: COMT | OTC: CLLMF | FSE: TO1) (the “Company” or “Collective“) is pleased to announce the appointment of Ms. Devienne Mok, CPA, as Chief Financial Officer of the Company, effective immediately (the “Appointment“).

Ms. Mok is a seasoned accounting and auditing professional with extensive knowledge in IFRS and financial reporting. Throughout her audit career, she has worked with numerous public and going public companies across the junior mining, cannabis, technology, and life sciences sectors. Ms. Mok holds a Bachelor of Business Administration with a major in Accounting from the Beedie School of Business at Simon Fraser University, along with her CPA Professional Designation from CPA BC.

Ms. Mok replaces Mr. Navin Sandhu who resigned from the role of Chief Financial Officer on November 15, 2024. The Company would like to thank Mr. Sandhu for his valuable contributions and wishes him the best.

About Collective Metals:

Collective Metals Inc. (CSE: COMT | OTC: CLLMF | FSE: TO1) is a resource exploration company specializing in precious metals exploration in North America. The Company’s flagship property is the Princeton Project, located in south-central British Columbia, Canada, approximately 10 km west of the currently producing Copper Mountain Mine. The Princeton Project consists of 29 mineral tenures totaling approximately 28,560 ha (70,570 acres) in a well-documented and prolific copper-gold porphyry belt and is easily accessible by road, located immediately west of Highway 3.

The Company’s Landings Lake Lithium Project is located in northwestern Ontario where numerous lithium deposits have been delineated to host significant reserves of Li2O. The Landings Lake Lithium Project is located 53 km east of Ear Falls, Ontario and covers 3,146 hectares. The Whitemud Project, with several identified pegmatite outcrops, neighbours the Landings Lake Project and consists of 381 single cell mining claims totaling 7,775 hectares.

Social Media

ON BEHALF OF COLLECTIVE METALS INC.

Christopher Huggins

Chief Executive Officer

T: 604-968-4844

E: chris@collectivemetalsinc.com

Forward Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as “may”, “expect”, “estimate”, “anticipate”, “intend”, “believe” and “continue” or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, and dependence on key personnel. Forward looking statements in this news release include, but are not limited to, statements respecting the Appointment. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.