Fairway Independent Mortgage Corporation Promotes Linda Davidson

MADISON, Wis., Nov. 15, 2024 /PRNewswire/ — Fairway Independent Mortgage Corporation, the #2 U.S. retail mortgage lender, today announced the promotion of industry veteran Linda Davidson to the pivotal role of President of National Branch Optimization – Operations.

With a remarkable 28-year career in the mortgage industry, including six successful years at Fairway, Davidson brings a wealth of experience to her new position. She has consistently excelled in various roles, including top Loan Originator, top Branch Manager, and top Area Leader. Additionally, her insights have been invaluable as a member of the Core Executive Advisory Team, where she has contributed her extensive origination and management expertise.

In her expanded role, Davidson will continue to lead her branches and region while spearheading strategic initiatives at the corporate level to drive operational efficiencies and solidify Fairway’s position as the industry leader in operational support. By fostering collaboration between branches, loan officers, support teams, and the corporate office, Davidson aims to further enhance the company’s ability to deliver exceptional service to clients as well as the street.

“Fairway’s commitment to operational excellence and our core value of ‘Speed to Respond’ is unparalleled in the industry,” said Davidson. “I am excited to work alongside our talented teams to further enhance our support systems and empower our branches and loan officers to deliver exceptional service to our clients.”

“Linda embodies two of Fairway’s most important Core Values – Humility and Creating an Amazing Experience for our customers,” said Fairway CEO and Founder Steve Jacobson. “Having Linda lead company-wide initiatives to improve our operations will result in an improved borrowing experience for our clients.”

About Fairway Independent Mortgage Corp.

Madison, WI– and Carrollton, TX-based Fairway Independent Mortgage Corporation (NMLS #2289) is a full-service mortgage lender licensed in all 50 states. Fairway is the #2 overall retail lender in the U.S.

![]() View original content:https://www.prnewswire.com/news-releases/fairway-independent-mortgage-corporation-promotes-linda-davidson-302306650.html

View original content:https://www.prnewswire.com/news-releases/fairway-independent-mortgage-corporation-promotes-linda-davidson-302306650.html

SOURCE Fairway Independent Mortgage Corporation

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gouverneur Bancorp Announces Fiscal 2024 Fourth Quarter and Fiscal Year Results

GOUVERNEUR, N.Y., Nov. 15, 2024 (GLOBE NEWSWIRE) — Gouverneur Bancorp, Inc. GOVB (the “Company”), the holding company for Gouverneur Savings and Loan Association (the “Bank”), today announced the results for the fourth quarter and full fiscal year ended September 30, 2024.

The Company reported net income of $136,000, or $0.13 per basic and diluted share, for the quarter ended September 30, 2024, compared to net income of $86,000, or $0.04 per basic and diluted share, for the quarter ended September 30, 2023. The Company reported adjusted net income(1) of $161,000 for the quarter ended September 30, 2024, compared to adjusted net income(1) of $100,000 for the quarter ended September 30, 2023.

The Company also reported net income of $539,000, or $0.51 per basic and diluted share, for the fiscal year ended September 30, 2024, compared to net income of $317,000, or $0.16 per basic and diluted share, for the fiscal year ended September 30, 2023. The Company reported adjusted net income(1) of $729,000 for the fiscal year ended September 30, 2024, compared to adjusted net income(1) of $951,000 for the fiscal year ended September 30, 2023.

Completion of the Second-Step Conversion

On October 31, 2023, the Bank completed its “second-step” conversion from the mutual holding company form of organization to the stock holding company form of organization. In connection with the transaction, the Company sold a total of 723,068 shares of its common stock at a price of $10.00 per share, which includes 57,845 shares sold to the Bank’s employee stock ownership plan. In addition, as part of the conversion transaction, each outstanding share of common stock of Gouverneur Bancorp, the former mid-tier stock holding company for the Bank (the “Mid-Tier Holding Company”), owned by the public stockholders of the Mid-Tier Holding Company (stockholders other than Cambray Mutual Holding Company) as of the closing date was converted into shares of Company common stock based on an exchange ratio of 0.5334 shares of Company common stock for each share of Mid-Tier Holding Company common stock. Cash was issued in lieu of a fractional share of Company common stock based on the offering price of $10.00 per share.

Summary of Financial Results

Our results of operations depend primarily on our net interest income. Net interest income is the difference between the interest income we earn on our interest-earning assets, consisting primarily of loans and securities, and the interest we pay on our interest-bearing liabilities, consisting of savings and club accounts, NOW and money market accounts and time certificates. Our results of operations also are affected by our provisions for credit losses, non-interest income and non-interest expense. Non-interest income currently consists primarily of service charges, unrealized gains (losses) on swap agreements, earnings on bank owned life insurance and loan servicing fees. Non-interest expense currently consists primarily of salaries and employee benefits, directors’ fees, occupancy and data processing expense and professional fees. Our results of operations also may be affected significantly by general and local economic and competitive conditions, changes in market interest rates, governmental policies and actions of regulatory authorities.

| (1) | As used in this press release, adjusted net income is a non-GAAP financial measure. This non-GAAP financial measure excludes unrealized gain (loss) on swap agreements and changes in earnings and interest and tax calculations from income adjustments. For a reconciliation of this and other non-GAAP financial measures to their comparable GAAP measures, see “Reconciliation of Non-GAAP Measures”. | |

Total assets decreased by $8.6 million or 4.19%, from $205.9 million at September 30, 2023 to $197.3 million at September 30, 2024. Securities available for sale decreased $1.3 million, or 2.74%, from $46.6 million as of September 30, 2023 to $45.3 million as of September 30, 2024 as securities maturities were offset by the market value adjustment increasing with falling rates. Net loans decreased by $1.2 million from September 30, 2023 to September 30, 2024. The Bank made a $70,000 provision for credit loss in fiscal 2024, a decrease from the $122,000 provision made in fiscal 2023.

Deposits increased $1.1 million or 0.71%, to $159.9 million at September 30, 2024 from $158.8 million at September 30, 2023. The Bank currently holds no advances from FHLB.

Shareholders’ equity was $32.8 million at September 30, 2024, representing an increase of 30.50% from the September 30, 2023 balance of $25.1 million. The increase in shareholders’ equity was primarily a result of the completion of the second-step conversion on October 31, 2023, at which time the Company sold, for gross proceeds of $7.2 million, a total of 723,068 shares of common stock at $10.00 per share. The Company’s book value was $29.59 per common share based on 1,107,134 shares issued and outstanding at September 30, 2024. The Company’s book value was $12.36 per common share based on 2,031,377 shares issued and outstanding at September 30, 2023.

Net interest spread, the difference between the rate earned on interest-earning assets and the rate paid on interest-bearing liabilities, was 3.86% at September 30, 2024 and 4.14% at September 30, 2023 as interest rates on interest bearing deposits increased faster than the interest rates on loans during fiscal 2024.

Interest Rate Swap Agreements

The Company has held numerous interest rate swap agreements (“swaps”) with FHLBNY as a means to hedge the cost of certain borrowings and to increase the interest rate sensitivity of certain assets. Activity in the fiscal years ended September 30, 2024 and 2023 resulted in an unrealized loss on the fair market value of these swaps due to a decrease in longer term U.S. Treasury bond rates. The accounting for changes in the fair market value of these swaps (unrealized gains or losses) is currently recognized in earnings as non-interest income (loss). The Company has both the intent and ability to hold these swaps to maturity regardless of the changes in market condition, liquidity needs or changes in general economic conditions.

During the fiscal year ended September 30, 2024, the market value of the swaps decreased, resulting in an unrealized loss in market value of $240,000 for fiscal 2024, in comparison to an unrealized loss in swap market value of $802,000 for fiscal 2023.

While the swaps market value will fluctuate with long term bond rates and projected short-term rates, the Company continues to mitigate its interest rate risk through the agreements.

Financial and Operational Metrics (GAAP)

| For the Quarter Ending | For the Fiscal Year Ending | ||||||||||||||

| 09/30/24 | 09/30/23 | 09/30/24 | 09/30/23 | ||||||||||||

| (In Thousands except per share data) | (In Thousands except per share data) | ||||||||||||||

| (unaudited) | (unaudited) | ||||||||||||||

| Statement of Earnings (GAAP) | |||||||||||||||

| Interest Income | $ | 2,148 | $ | 2,097 | $ | 8,565 | $ | 8,162 | |||||||

| Interest Expense | 370 | 283 | 1,418 | 570 | |||||||||||

| Net Interest Income | 1,778 | 1,814 | 7,147 | 7,592 | |||||||||||

| Provision for Credit Loss | – | 30 | 70 | 122 | |||||||||||

| Net Interest Income After Provision for Credit Loss | 1,778 | 1,784 | 7,077 | 7,470 | |||||||||||

| Non-interest Income | 245 | 166 | 772 | 71 | |||||||||||

| Non-interest Expenses | 1,910 | 1,853 | 7,373 | 7,308 | |||||||||||

| Income Before Income Tax | 113 | 97 | 476 | 233 | |||||||||||

| Income Tax (Benefit) | (23 | ) | 11 | (63 | ) | (84 | ) | ||||||||

| Net Income | $ | 136 | $ | 86 | $ | 539 | $ | 317 | |||||||

| Performance Ratios (GAAP) | |||||||||||||||

| Basic and Diluted Earnings per Share | $ | 0.13 | $ | 0.04 | $ | 0.51 | $ | 0.16 | |||||||

| Annualized Return on Average Assets | 0.27 | % | 0.17 | % | 0.27 | % | 0.15 | % | |||||||

| Annualized Return on Average Equity | 1.68 | % | 1.32 | % | 1.76 | % | 1.23 | % | |||||||

| Net Interest Spread | 3.84 | % | 3.88 | % | 3.86 | % | 4.14 | % | |||||||

Reconciliation of Non-GAAP Measures

To supplement our financial information, which is prepared and presented in accordance with generally accepted accounting principles in the United States of America, or GAAP, we used the following non-GAAP financial measures: Adjusted Non-interest Income, Adjusted Earnings Before Income Tax (AEBIT), Adjusted Income Tax (Benefit), and Adjusted Net Income. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our recurring business operating results. The non-GAAP financial information excludes from non-interest income, the non-cash measurement of the unrealized gains or losses in market value on swap agreements held with Federal Home Loan Bank of New York (“FHLBNY”). Management believes that by eliminating fluctuations in market value from the GAAP statements, it is able to provide a more accurate picture of Company’s financial and operational results.

These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance. We believe these non-GAAP financial measures are also useful to investors because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business.

There are a number of limitations related to the use of non-GAAP financial measures. In light of these limitations, we provide specific information regarding the GAAP amounts excluded from these non-GAAP financial measures and evaluate these non-GAAP financial measures together with their relevant financial measures in accordance with GAAP.

Adjusted Non-Interest Income We define Adjusted Non-Interest Income as total non-interest earnings excluding certain items that may not be indicative of our recurring business operating results. Adjusted non-interest income excludes from other non-interest income the non-cash measurement of the unrealized gains or losses in market value on swap agreements.

Adjusted Earnings Before Income Tax We define AEBIT as net income (loss) before income tax, excluding certain items that may not be indicative of our recurring business operating results. AEBIT excludes from total earnings before income tax the non-cash measurement of the unrealized gains or losses in market value on swap agreements.

We have included AEBIT because it is a key measure used by our management team to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those related to operating expenses. Accordingly, we believe that AEBIT provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management team and board of directors. In addition, it provides a useful measure for period-to-period comparisons of our business as it removes the effect of certain non-cash items with variable unrealized gains and losses. AEBIT is not meant as a substitute for the related financial information prepared in accordance with GAAP.

Adjusted Income Tax (Benefit) We define Adjusted Income Tax (Benefit) as the income tax calculated from the adjusted earnings before income tax.

Adjusted Net Income We define Adjusted Net Income as net income less certain items that may not be indicative of our recurring business operating results. Adjusted Net Income excludes the non-cash measurement of the unrealized gains or losses in market value on swap agreements held with FHLBNY and the subsequent recalculation of associated income tax. Adjusted Net Income should be considered a supplement, and not a substitute for, net income prepared in accordance with GAAP.

Financial and Operational Metrics (Non-GAAP)

| For the Quarter Ending | For the Fiscal Year Ending | ||||||||||||||

| 09/30/24 | 09/30/23 | 09/30/24 | 09/30/23 | ||||||||||||

| (In Thousands except per share data) | (In Thousands except per share data) | ||||||||||||||

| (unaudited) | (unaudited) | ||||||||||||||

| Adjusted Statement of Earnings (Non-GAAP) | |||||||||||||||

| Interest Income | $ | 2,148 | $ | 2,097 | $ | 8,565 | $ | 8,162 | |||||||

| Interest Expense | 370 | 283 | 1,418 | 570 | |||||||||||

| Net Interest Income | 1,778 | 1,814 | 7,147 | 7,592 | |||||||||||

| Provision for Credit Loss | – | 30 | 70 | 122 | |||||||||||

| Net Interest Income After Provision for Credit Loss | 1,778 | 1,784 | 7,077 | 7,470 | |||||||||||

| Non-interest Income | 245 | 166 | 772 | 71 | |||||||||||

| Deduct: Unrealized gain (loss) on swap agreement | (32 | ) | (18 | ) | (240 | ) | (802 | ) | |||||||

| Adjusted Non-interest Income(2) | 277 | 184 | 1,012 | 873 | |||||||||||

| Non-interest Expenses | 1,910 | 1,853 | 7,373 | 7,308 | |||||||||||

| Adjusted Earnings Before Income Tax(2) | 145 | 115 | 716 | 1,035 | |||||||||||

| Income Tax (Benefit) | (23 | ) | 11 | (63 | ) | (84 | ) | ||||||||

| (Addback) Deduct: change in EBIT tax calculation per income adjustment | (7 | ) | (4 | ) | (50 | ) | (168 | ) | |||||||

| Adjusted Income Tax (Benefit)(2) | (16 | ) | 15 | (13 | ) | 84 | |||||||||

| Adjusted Net Income (Non-GAAP)(2) | $ | 161 | $ | 100 | $ | 729 | $ | 951 | |||||||

| Performance Ratios (Non-GAAP) | |||||||||||||||

| Basic and Diluted Earnings per Share | $ | 0.15 | $ | 0.05 | $ | 0.69 | $ | 0.47 | |||||||

| Annualized Return on Average Assets | 0.32 | % | 0.19 | % | 0.36 | % | 0.46 | % | |||||||

| Annualized Return on Average Equity | 1.98 | % | 1.53 | % | 2.38 | % | 3.70 | % | |||||||

| Net Interest Spread | 3.84 | % | 3.88 | % | 3.86 | % | 4.14 | % | |||||||

| (2) | “Adjusted Non-interest Income”, “Adjusted Earnings Before Income Tax”, “Adjusted Income Tax (Benefit)”, and “Adjusted Net Income” are non-GAAP measures. See “Definitions of Non-GAAP Measures” and “Reconciliation of Non-GAAP Measures” sections herein for an explanation and reconciliation of non-GAAP measures used throughout this release. | |

| Reconciliation of GAAP Net Income to Non-GAAP Adjusted Net Income | |||||||||||||||

| (in thousands) (unaudited) | |||||||||||||||

| For the Quarter Ending: | For the Fiscal Year Ending: | ||||||||||||||

| 09/30/24 | 09/30/23 | 09/30/24 | 09/30/23 | ||||||||||||

| Net Income (GAAP) | $ | 136 | $ | 86 | $ | 539 | $ | 317 | |||||||

| (Addback) Deduct: Unrealized gain (loss) on swap agreement | (32 | ) | (18 | ) | (240 | ) | (802 | ) | |||||||

| Addback (Deduct): Change in EBIT tax calc. per income adj. | (7 | ) | (4 | ) | (50 | ) | (168 | ) | |||||||

| Adjusted Net Income (Non-GAAP) | $ | 161 | $ | 100 | $ | 729 | $ | 951 | |||||||

About Gouverneur Bancorp, Inc.

Gouverneur Bancorp, Inc. is the holding company for Gouverneur Savings and Loan Association, which is a New York chartered savings and loan association founded in 1892 that offers deposit and loan services for businesses, families and individuals. At September 30, 2024, Gouverneur Bancorp, Inc. had total assets of $197.3 million, total deposits of $159.9 million and total stockholders’ equity of $32.8 million.

Forward-Looking Statements

This press release may contain forward-looking statements, which can be identified by the use of words such as “believes,” “expects,” “anticipates,” “estimates” or similar expressions. Such forward-looking statements and all other statements that are not historic facts are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors. These factors include, among others, the following: the ability to successfully integrate acquired entities, such as Citizens Bank of Cape Vincent, which we acquired on September 16, 2022, and realize expected cost savings associated with completed mergers and acquisitions; changes in interest rates; national and regional economic conditions; legislative and regulatory changes; monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Federal Reserve Board; the size, quality and composition of the loan or investment portfolios; demand for loan products; deposit flows and our ability to effectively manage liquidity; competition; demand for financial services in our market area; changes in real estate market values in our market area; changes in relevant accounting principles and guidelines; and our ability to attract and retain key employees. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Should one or more of these risks materialize, actual results may vary from those anticipated, estimated or projected.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Except as may be required by applicable law or regulation, Gouverneur Savings & Loan Association and Gouverneur Bancorp, Inc. assume no obligation to update any forward-looking statements.

For more information, contact Robert W. Barlow, President and Chief Executive Officer at (315) 287-2600.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Calidi Biotherapeutics Announces Closing of $7.5 Million Public Offering of Common Stock

SAN DIEGO, Nov. 15, 2024 (GLOBE NEWSWIRE) — Calidi Biotherapeutics Inc. CLDI (“Calidi”), a clinical-stage biotechnology company developing a new generation of targeted antitumor virotherapies, today announced the closing of its previously announced public offering of 4,437,869 shares of common stock at $1.69 per share for gross proceeds of approximately $7.5 million.

Ladenburg Thalmann & Co. Inc. acted as the exclusive placement agent for this offering.

The securities described above public offering were offered pursuant to registration statements on Form S-3 (File No. 333-282456), which were declared effective by the United States Securities and Exchange Commission (“SEC”) on October 10, 2024. The offering was made solely by means of a prospectus. A final prospectus relating to the offering was filed with the SEC on November 15, 2024, and is available on the SEC’s website located at http://www.sec.gov. Copies of the final prospectus can be obtained at the SEC’s website at http://www.sec.gov or from Ladenburg Thalmann & Co. Inc. Electronic copies of the final prospectus relating to the offering may be obtained, when available, from Ladenburg Thalmann & Co. Inc., 640 Fifth Avenue, 4th Floor, New York, New York 10019, or by telephone at (212) 409-2000, or by email at prospectus@ladenburg.com. This press release does not constitute an offer to sell or the solicitation of an offer to buy, nor will there be any sales of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

About Calidi Biotherapeutics

Calidi Biotherapeutics CLDI is a clinical-stage immuno-oncology company with proprietary technology designed to arm the immune system to fight cancer. Calidi’s novel stem cell-based platforms are utilizing potent allogeneic stem cells capable of carrying payloads of oncolytic viruses for use in multiple oncology indications, including high-grade gliomas and solid tumors. Calidi’s clinical stage off-the-shelf, universal cell-based delivery platforms are designed to protect, amplify, and potentiate oncolytic viruses leading to enhanced efficacy and improved patient safety. Calidi’s preclinical off-the-shelf enveloped virotherapies are designed to target disseminated solid tumors. This dual approach can potentially treat, or even prevent, metastatic disease. Calidi Biotherapeutics is headquartered in San Diego, California. For more information, please visit www.calidibio.com.

Forward-Looking Statements

This press release may contain forward-looking statements for purposes of the “safe harbor” provisions under the United States Private Securities Litigation Reform Act of 1995. Terms such as “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “towards,” “would” as well as similar terms, are forward-looking in nature, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements concerning upcoming key milestones (including the reporting of interim clinical results and the dosing of patients), planned clinical trials, and statements relating to the safety and efficacy of Calidi’s therapeutic candidates in development. Any forward-looking statements contained in this discussion are based on Calidi’s current expectations and beliefs concerning future developments and their potential effects and are subject to multiple risks and uncertainties that could cause actual results to differ materially and adversely from those set forth or implied in such forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that Calidi is not able to raise sufficient capital to support its current and anticipated clinical trials, the risk that early results of clinical trials do not necessarily predict final results and that one or more of the clinical outcomes may materially change following more comprehensive review of the data, and as more patient data becomes available, the risk that Calidi may not receive FDA approval for some or all of its therapeutic candidates. Other risks and uncertainties are set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Registration Statements filed with the SEC on (i) Form S-4 filed on August 2, 2023 and the corresponding prospectus filed on August 4, 2023, and (ii) on Form S-1 filed on April 15, 2024, and the Company’s periodic reports filed with the SEC on (i) Form 10-K filed on March 15, 2024, (ii) Form 10-Q filed on May 14, 2024, (iii) Form 10-Q filed on August 13, 2024 and (iv) Form 10-Q filed on November 12, 2024. These reports may be amended or supplemented by other reports we file with the SEC from time to time.

For Investors:

Dave Gentry, CEO

RedChip Companies, Inc.

1-407-644-4256

CLDI@redchip.com

Source: Calidi Biotherapeutics, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Akhil Jain Executes Sell Order: Offloads $310K In Gartner Stock

A substantial insider sell was reported on November 14, by Akhil Jain, EVP at Gartner IT, based on the recent SEC filing.

What Happened: Jain’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday unveiled the sale of 562 shares of Gartner. The total transaction value is $310,475.

Monitoring the market, Gartner‘s shares down by 1.14% at $530.99 during Friday’s morning.

All You Need to Know About Gartner

Gartner Inc provides independent research and analysis on information technology and other related technology industries. Its research is delivered to clients’ desktops in the form of reports, briefings, and updates. Typical clients are chief information officers and other business executives who help plan companies’ IT budgets. Gartner also provides consulting services. The Company operates through three business segments, namely Research, Conferences and Consulting. The company generates majority of the revenue from Research segment.

Gartner’s Financial Performance

Revenue Growth: Gartner’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 5.36%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: The company maintains a high gross margin of 67.98%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Gartner’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 5.36.

Debt Management: Gartner’s debt-to-equity ratio surpasses industry norms, standing at 2.73. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 39.67 is lower than the industry average, implying a discounted valuation for Gartner’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 6.88, Gartner’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 25.35 positions the company as being more valued compared to industry benchmarks.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Gartner’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Informatica Director Trades Company's Stock

Making a noteworthy insider sell on November 14, Ithaca LP, Director at Informatica INFA, is reported in the latest SEC filing.

What Happened: LP’s decision to sell 1,861,011 shares of Informatica was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $47,455,780.

Informatica‘s shares are actively trading at $24.77, experiencing a down of 1.92% during Friday’s morning session.

Unveiling the Story Behind Informatica

Informatica Inc is a pioneered new category of software, the Intelligent Data Management Cloud, or IDMC. IDMC is an AI-powered platform that connects, manages, and unifies data across any multi-cloud, hybrid system, empowering enterprises to modernize and advance data strategies.

Unraveling the Financial Story of Informatica

Revenue Growth: Informatica’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 3.41%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Evaluating Earnings Performance:

-

Gross Margin: The company excels with a remarkable gross margin of 80.68%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Informatica exhibits below-average bottom-line performance with a current EPS of -0.05.

Debt Management: Informatica’s debt-to-equity ratio stands notably higher than the industry average, reaching 0.78. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 109.56 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 4.7, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 28.95, Informatica presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Breaking Down the Significance of Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Informatica’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LAKESIDE HOLDING PROVIDES FIRST QUARTER OF FISCAL YEAR 2025 RESULTS

ITASCA, Ill., Nov. 15, 2024 /PRNewswire/ — Lakeside Holding Limited (“Lakeside” or the “Company”) LSH, a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market operating under the brand American Bear Logistics (“ABL”), today announced financial results for the first quarter of fiscal 2025, ended September 30, 2024.

Q1 2025 Financial Results:

- Total revenues decreased by $66,922, or 1.6%, from $4,148,476 for the three months ended September 30, 2023, to $4,081,554 for the three months ended September 30, 2024. The decrease was primarily driven by a decrease in revenues from our cross-border airfreight solutions, partially offset by an increase in revenues from our cross-border ocean freight solutions.

- Revenue from our cross-border airfreight solutions segment decreased by $0.2 million or 8.2%, from $2.4 million in the three months ended September 30, 2023, to $2.2 million in the three months ended September 30, 2024. The decrease was primarily due to a decrease in the volume of cross-border air freight processed, from approximately 7,816 tons for the three months ended September 30, 2023, to approximately 7,273 tons for the three months ended September 30, 2024.

- Revenue from our cross-border ocean freight solutions segment increased by $0.1 million, or 7.8%, from $1.7 million in the three months ended September 30, 2023, to $1.8 million in the three months ended September 30, 2024. This growth was primarily due to an increase in the volume of cross-border ocean freights processed and forwarded, rising from 1,290 TEU in the three months ended September 30, 2023, to 1,430 TEU in the three months ended September 30, 2024.

Revenues by Customer Geographic

|

For the three months ended September 30, |

||||||||||||||||||||||||||

|

2024 |

2023 |

|||||||||||||||||||||||||

|

Revenues |

Amount |

% of |

Amount |

% of |

Amount |

Percentage |

||||||||||||||||||||

|

Asia-based |

$ |

2,809,636 |

68.8 |

% |

$ |

1,694,223 |

40.8 |

% |

$ |

1,115,413 |

65.8 |

% |

||||||||||||||

|

U.S.- |

1,271,918 |

31.2 |

% |

2,454,253 |

59.2 |

% |

(1,182,335) |

(48.2) |

% |

|||||||||||||||||

|

Total revenues |

$ |

4,081,554 |

100.0 |

% |

$ |

4,148,476 |

100.0 |

% |

$ |

(66,922) |

(1.6) |

% |

||||||||||||||

-

- Revenues from Asia-based customers increased by $1.1 million, or 65.8%, from $1.7 million in the three months ended September 30, 2023, to $2.8 million in the three months ended September 30, 2024. The increase in revenues from Asia-based customers was driven by a surge in volume from these customers, particularly those serving large e-commerce platforms. This growth reflects the rising demand for our services, a direct result of the overall expansion of the U.S. e-commerce market.

- Revenues from U.S.-based customers decreased by $1.2 million, or 48.2%, from $2.5 million in the three months ended September 30, 2023, to $1.3 million in the same period in 2024.

- Cost of revenues increased by $0.1 million, or 1.7%, from $3.5 million in the three months ended September 30, 2023, to $3.6 million in the three months ended September 30, 2024.

- Gross profit decreased by $0.1 million, or 19.3%, from $0.6 million in the three months ended September 30, 2023, to $0.5 million in the three months ended September 30, 2024. Our gross margin was 12.8% for the three months ended September 30, 2024, compared to 15.6% for the three months ended September 30, 2023. The decline in gross margin was primarily attributable to reduced revenue from the airfreight solutions segment and 2) an increase in our cost of revenue in warehouse services, customs declaration, and terminal charges.

- General and administrative expenses increased by $1.0 million, or 114.7%, from $0.9 million in the three months ended September 30, 2023, to $1.8 million in the three months ended September 30, 2024. These expenses represented 45.0% and 20.6% of our total revenues for the three months ended September 30, 2024 and 2023, respectively. The increase was primarily attributed to higher salary and employee benefit expenses, professional fees, office and travel expenses, insurance, and entertainment expenses. The increase was primarily attributed to the following:

- Salaries and employee benefits expenses increased by $0.3 million, or 116.9%, from $0.5 million in the three months ended September 30, 2023, to $0.8 million in the three months ended September 30, 2024. Our salaries and employee benefits expenses represented 50.3% and 66.8% of our total general and administrative expenses for the three months ended September 30, 2024, and 2023, respectively. The increase was mainly due to recruiting additional sales, customer services, and back-office support personnel to support our business growth.

- Professional fees increased by $0.3 million, or 1,839.6%, from $17,535 in the three months ended September 30, 2023, to $340,114 in the three months ended September 30, 2024. Our professional fee represented 18.5% and 2.0% of our total general and administrative expenses for the three months ended September 30, 2024 and 2023, respectively. The increase was primarily due to audit fees, legal fees, consulting expenses, investor-related expenses, and financial reporting service fees for the three months ended September 30, 2024. In the three months ended September 30, 2023, most expenses directly related to the offering were not included in professional fees, as they were accounted for as deferred initial public offering assets.

- Net loss was $1.3 million and $0.3 million for the three months ended September 30, 2024 and 2023, respectively.

Management Commentary

Henry Liu, Chairman and Chief Executive Officer of Lakeside, commented, “Our first quarter results for fiscal year 2025 reflect both ongoing growth opportunities and some temporary challenges in our cross-border airfreight segment. Although total revenue declined slightly by 1.6% compared to the same quarter last year, we achieved solid gains in cross-border ocean freight, with segment revenues increasing by 7.8% due to stronger demand from Asia-based customers. This demand surge, particularly among large e-commerce clients, affirms our strategy to focus on expanding high-growth markets and highlights the success of our operational partnerships in the region.”

“As we look ahead, we anticipate a rebound in revenue for the next quarter, driven by increased air freight demand for the upcoming holiday season as online purchases ramp up. We have expanded our production capacity to accommodate higher volumes and are prepared to meet rising customer demand efficiently. Additionally, the continued decrease in ocean freight charges is fueling import and export activities, while the broader shift toward e-commerce underscores the need for timely and competitively priced deliveries. We are confident in our ability to deliver on these needs, backed by our investments in advanced logistics technology and strategic facility expansions, including our new Dallas-Fort Worth site. We believe these efforts position us well for the quarters ahead as we strive to enhance value for our shareholders and customers, ” said Mr. Liu.

Q1 2025 Operational Highlights

- In July, we closed our upsized initial public offering of 1,500,000 shares of common stock at a public offering price of $4.50 per share to the public for a total of $6,750,000 of gross proceeds to the Company before deducting underwriting discounts and offering expenses.

- In July, we entered into a one-year renewable agreement with a leading Asia-based e-commerce platform to provide logistics services, including freight, customs, and parcel handling. The partnership uses advanced API integration to offer real-time supply chain visibility for sellers, enhancing the customer experience.

- In August, we announced a partnership to provide customs brokerage services for a major social media and e-commerce platform, offering real-time logistics data through API integration. This deal streamlines customs clearance and enhances inventory and delivery visibility for platform sellers.

- In September, we announced the launch of a Pick & Pack Fulfillment service for a major Chinese logistics company, offering inventory management and order processing across U.S. hubs. The service improves lead times and optimizes fulfillment efficiency.

- In September, we announced the expansion of our Dallas-Fort Worth operations, more than doubling its space to 46,657 sq. ft. and increasing staff to meet growing demand. The new facility is equipped with advanced technology to improve logistics efficiency and support business growth.

About Lakeside Holding Limited

Lakeside Holding Limited, based in Itasca, IL, is a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market, including China and South Korea. Operating under the brand American Bear Logistics, we primarily provide customized cross-border ocean freight solutions and airfreight solutions in the U.S. that specifically cater to our customers’ requirements and needs in transporting goods into the U.S. We are an Asian American-owned business rooted in the U.S. with in-depth understanding of both the U.S. and Asian international trading and logistics service markets. Our customers are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms, and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. For more information, please visit https://lakeside-holding.com.

Safe Harbor Statement

This press release contains forward-looking statements that reflect our current expectations and views of future events. Known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements involve various risks and uncertainties. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. We qualify all of our forward-looking statements by these cautionary statements.

Investor Relations Contact:

Matthew Abenante, IRC

President

Strategic Investor Relations, LLC

Tel: 347-947-2093

Email: matthew@strategic-ir.com

*** tables follow ***

|

LAKESIDE HOLDING LIMITED |

|||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||||

|

(UNAUDITED) |

|||||||

|

As of |

As of |

||||||

|

September 30, |

June 30, |

||||||

|

2024 |

2024 |

||||||

|

(unaudited) |

(audited) |

||||||

|

ASSETS |

|||||||

|

CURRENT ASSETS |

|||||||

|

Cash and cash equivalent |

$ |

2,739,275 |

$ |

123,550 |

|||

|

Accounts receivable – third parties, net |

1,786,451 |

2,082,152 |

|||||

|

Accounts receivable – related party, net |

505,361 |

763,285 |

|||||

|

Prepayment and other receivable |

113,198 |

– |

|||||

|

Contract assets |

41,301 |

129,506 |

|||||

|

Due from related parties |

645,318 |

441,279 |

|||||

|

Total current assets |

5,830,904 |

3,539,772 |

|||||

|

NON-CURRENT ASSETS |

|||||||

|

Investment in other entity |

15,741 |

15,741 |

|||||

|

Property and equipment at cost, net of accumulated depreciation |

314,496 |

344,883 |

|||||

|

Right of use operating lease assets |

4,320,579 |

3,471,172 |

|||||

|

Right of use financing lease assets |

29,881 |

37,476 |

|||||

|

Deferred tax asset |

– |

89,581 |

|||||

|

Deferred offering costs |

– |

1,492,798 |

|||||

|

Deposit and repayment |

298,217 |

202,336 |

|||||

|

Total non-current assets |

4,978,914 |

5,653,987 |

|||||

|

TOTAL ASSETS |

$ |

10,809,818 |

$ |

9,193,759 |

|||

|

LIABILITIES AND EQUITY |

|||||||

|

CURRENT LIABILITIES |

|||||||

|

Accounts payables – third parties |

$ |

758,963 |

$ |

1,161,858 |

|||

|

Accounts payables – related parties |

70,872 |

227,722 |

|||||

|

Accrued liabilities and other payables |

869,109 |

1,335,804 |

|||||

|

Current portion of obligations under operating leases |

1,891,877 |

1,186,809 |

|||||

|

Current portion of obligations under financing leases |

34,214 |

37,619 |

|||||

|

Loans payable, current |

484,725 |

746,962 |

|||||

|

Dividend payable |

98,850 |

98,850 |

|||||

|

Tax payable |

79,825 |

79,825 |

|||||

|

Due to shareholders |

138,107 |

1,018,281 |

|||||

|

Total current liabilities |

4,426,542 |

5,893,730 |

|||||

|

NON-CURRENT LIABILITIES |

|||||||

|

Loans payable, non-current |

105,166 |

136,375 |

|||||

|

Obligations under operating leases, non-current |

2,646,597 |

2,506,402 |

|||||

|

Obligations under financing leases, non-current |

13,233 |

17,460 |

|||||

|

Total non-current liabilities |

2,764,996 |

2,660,237 |

|||||

|

TOTAL LIABILITIES |

$ |

7,191,538 |

$ |

8,553,967 |

|||

|

Commitments and Contingencies |

|||||||

|

EQUITY |

|||||||

|

Common stocks, $0.0001 par value, 200,000,000 shares authorized, |

750 |

600 |

|||||

|

Subscription receivable |

– |

(600) |

|||||

|

Additional paid-in capital |

4,942,791 |

642,639 |

|||||

|

Accumulated other comprehensive income |

15,965 |

2,972 |

|||||

|

Deficits |

(1,341,226) |

(5,819) |

|||||

|

Total equity |

3,618,280 |

639,792 |

|||||

|

TOTAL LIABILITIES AND EQUITY |

$ |

10,809,818 |

$ |

9,193,759 |

|||

|

LAKESIDE HOLDING LIMITED |

||||||||

|

CONDENSED CONSOLIDATED STATEMENT OF INCOME (LOSS) AND |

||||||||

|

(UNAUDITED) |

||||||||

|

For the Three Months Ended |

||||||||

|

2024 |

2023 |

|||||||

|

Revenue from third party |

$ |

3,599,787 |

$ |

4,054,287 |

||||

|

Revenue from related parties |

481,767 |

94,189 |

||||||

|

Total revenue |

4,081,554 |

4,148,476 |

||||||

|

Cost of revenue from third party |

2,994,285 |

2,905,597 |

||||||

|

Cost of revenue from related parties |

564,730 |

595,336 |

||||||

|

Total cost of revenue |

3,559,015 |

3,500,933 |

||||||

|

Gross profit |

522,539 |

647,543 |

||||||

|

Operating expenses: |

||||||||

|

General and administrative expenses |

1,837,206 |

855,778 |

||||||

|

Loss from deconsolidation of a subsidiary |

– |

73,151 |

||||||

|

Provision of allowance for expected credit loss |

12,837 |

52,122 |

||||||

|

Total operating expenses |

1,850,043 |

981,051 |

||||||

|

Loss from operations |

(1,327,504) |

(333,508) |

||||||

|

Other income (expense): |

||||||||

|

Other income, net |

109,788 |

46,949 |

||||||

|

Interest expense |

(28,110) |

(22,785) |

||||||

|

Total other income, net |

81,678 |

24,164 |

||||||

|

Loss before income taxes |

(1,245,826) |

(309,344) |

||||||

|

Income taxes expense (recovery) |

89,581 |

(2,059) |

||||||

|

Net loss and comprehensive loss |

(1,335,407) |

(307,285) |

||||||

|

Net loss attributable to non-controlling interest |

– |

(3,025) |

||||||

|

Net loss attributable to common stockholders |

(1,335,407) |

(304,260) |

||||||

|

Other comprehensive loss |

||||||||

|

Foreign currency translation gain |

12,993 |

3,122 |

||||||

|

Comprehensive loss |

(1,322,414) |

(304,163) |

||||||

|

Less: comprehensive loss attributable to non-controlling interest |

– |

(3,119) |

||||||

|

Comprehensive loss attributable to the common shareholders |

$ |

(1,322,414) |

$ |

(301,044) |

||||

|

Loss per share – basic and diluted |

$ |

(0.18) |

$ |

(0.05) |

||||

|

Weighted average shares outstanding – basic and diluted* |

7,500,000 |

6,000,000 |

||||||

|

LAKESIDE HOLDING LIMITED |

||||||||

|

CONDENSSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||

|

(UNAUDITED) |

||||||||

|

For the Three Months Ended |

||||||||

|

September 30, |

||||||||

|

2024 |

2023 |

|||||||

|

Cash flows from operating activities: |

||||||||

|

Net loss |

$ |

(1,335,407) |

$ |

(307,285) |

||||

|

Adjustments to reconcile net loss to net cash provided by operating |

||||||||

|

Depreciation – G&A |

17,995 |

17,995 |

||||||

|

Depreciation – cost of revenue |

18,164 |

18,165 |

||||||

|

Amortization of operating lease assets |

466,723 |

219,571 |

||||||

|

Depreciation of right-of-use finance assets |

7,595 |

7,332 |

||||||

|

Provision of allowance for expected credit loss |

12,837 |

52,122 |

||||||

|

Deferred tax expense (benefit) |

89,581 |

(2,059) |

||||||

|

Loss from derecognition of shares in subsidiary |

– |

73,151 |

||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Accounts receivable – third parties |

282,864 |

(138,491) |

||||||

|

Accounts receivable – related parties |

257,924 |

(65,995) |

||||||

|

Contract assets |

88,205 |

26,213 |

||||||

|

Due from related parties |

(77,812) |

49,182 |

||||||

|

Prepayment, other deposit |

(176,572) |

2,623 |

||||||

|

Accounts payables – third parties |

(402,895) |

133,904 |

||||||

|

Accounts payables – related parties |

(156,850) |

141,213 |

||||||

|

Accrued expense and other payables |

(24,876) |

37,739 |

||||||

|

Operating lease liabilities |

(470,260) |

(225,023) |

||||||

|

Net cash (used in) provided by operating activities |

(1,402,784) |

40,357 |

||||||

|

Cash flows from investing activities: |

||||||||

|

Payment made for investment in other entity |

– |

(29,906) |

||||||

|

Net cash outflow from deconsolidation of a subsidiary (Appendix A) |

– |

(48,893) |

||||||

|

Prepayment for system installation |

(32,507) |

– |

||||||

|

Acquisition of property and equipment |

(5,772) |

– |

||||||

|

Net cash used in investing activities |

(38,279) |

(78,799) |

||||||

|

Cash flows from financing activities: |

||||||||

|

Proceeds from loans |

– |

225,000 |

||||||

|

Repayment of loans |

(265,456) |

(122,137) |

||||||

|

Repayment of equipment and vehicle loans |

(27,990) |

(29,678) |

||||||

|

Principal payment of finance lease liabilities |

(7,632) |

(6,425) |

||||||

|

Proceeds from initial public offering, net of share issuance costs |

5,351,281 |

– |

||||||

|

Advanced to related parties |

(126,227) |

– |

||||||

|

Repayment to shareholders |

(879,574) |

– |

||||||

|

Net cash provided by financing activities |

4,044,402 |

66,760 |

||||||

|

Effect of exchange rate changes on cash and cash equivalents |

12,386 |

3,216 |

||||||

|

Net decrease in cash and cash equivalent |

2,615,725 |

31,534 |

||||||

|

Cash and cash equivalent, beginning of the period |

123,550 |

174,018 |

||||||

|

Cash and cash equivalent, end of the period |

$ |

2,739,275 |

$ |

205,552 |

||||

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW |

||||||||

|

Cash paid for income tax |

$ |

— |

$ |

— |

||||

|

Cash paid for interest |

$ |

6,274 |

$ |

6,462 |

||||

|

SUPPLEMENTAL SCHEDULE OF NON-CASH IN FINANCING |

||||||||

|

Deferred offering costs within due to shareholders |

$ |

— |

$ |

230,000 |

||||

|

NON-CASH ACTIVITIES |

||||||||

|

Right of use assets obtained in exchange for operating lease |

$ |

1,244,140 |

$ |

— |

||||

|

Right of use assets obtained in exchange for finance lease obligation |

$ |

— |

$ |

— |

||||

|

APPENDIX A – Net cash outflow from deconsolidation of a |

||||||||

|

Working capital, net |

$ |

29,812 |

||||||

|

Investment in other entity recognized |

(15,741) |

|||||||

|

Elimination of NCl at deconsolidation of a subsidiary |

10,187 |

|||||||

|

Loss from deconsolidation of a subsidiary |

(73,151) |

|||||||

|

Cash |

$ |

(48,893) |

||||||

![]() View original content:https://www.prnewswire.com/news-releases/lakeside-holding-provides-first-quarter-of-fiscal-year-2025-results-302307095.html

View original content:https://www.prnewswire.com/news-releases/lakeside-holding-provides-first-quarter-of-fiscal-year-2025-results-302307095.html

SOURCE Lakeside Holding Limited

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

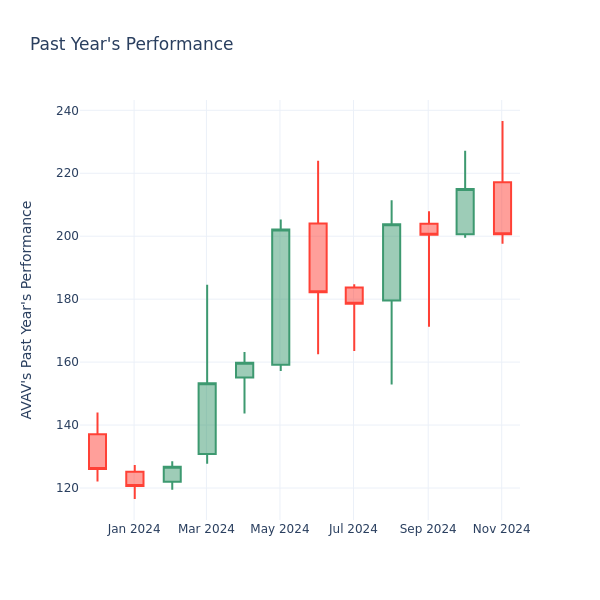

A Look Into AeroVironment Inc's Price Over Earnings

In the current market session, AeroVironment Inc. AVAV share price is at $205.00, after a 0.37% spike. Moreover, over the past month, the stock fell by 7.54%, but in the past year, increased by 56.33%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

A Look at AeroVironment P/E Relative to Its Competitors

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

AeroVironment has a better P/E ratio of 97.73 than the aggregate P/E ratio of 80.64 of the Aerospace & Defense industry. Ideally, one might believe that AeroVironment Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's Post-Election Rally Fades, Dollar Surges To Over 1-Year Highs, Powell Puts December Interest Rate Cut Into Question: This Week In The Market

Wall Street experienced a sharp reality check this week as the post-election rally following Donald Trump‘s victory unraveled. Major indices fell in unison as investors reassessed the economic outlook in light of potential policy shifts.

Republicans secured a majority in the House of Representatives, marking a GOP sweep of Washington, D.C. and giving the incoming Trump administration significant leeway to enact economic policies.

Uncertainty looms large with the specter of higher tariffs and potential cuts to government spending, particularly given Trump’s plan for the creation of the Department of Government Efficiency (DOGE), triggering turbulence across various sectors and markets.

In economic data, consumer inflation rose as expected in October, but producer inflation surpassed forecasts, raising some fresh concerns about the durability of the disinflationary trend heading into the year’s final quarter.

Risk sentiment took a deeper hit on Thursday and Friday after Federal Reserve Chair Jerome Powell delivered unexpectedly hawkish remarks. Powell indicated the Fed is in “no hurry to lower rates,” citing the strength of the U.S. economy, which allows policymakers to proceed “carefully.”

As a result, expectations for a December interest rate cut have sharply diminished, with traders growing increasingly uncertain about the possibility of an easing move at the Fed’s final meeting of the year.

The dollar marked its seventh consecutive week of gains, reaching levels last seen in October 2023. Bitcoin continued its remarkable ascent, surging to a peak of $93,500 on Wednesday before retreating slightly.

According to a Benzinga survey, readers say Tesla Inc. TSLA’s potential all-time highs in 2025 will be influenced by CEO Elon Musk‘s relationship with Trump, anticipating favorable policies and regulatory support that could boost the company’s stock performance.

Musk supports ending electric vehicle subsidies, asserting that Tesla can thrive without them. A former Tesla executive warned that removing these incentives could lead to a significant decline in EV adoption, potentially harming the broader industry.

Ford Motor Co. F is cutting production of its electric Capri and Explorer models at the Cologne factory due to significantly lower-than-expected demand. This follows a recent pause in F-150 Lightning production, reflecting broader challenges in the EV market.

Read Next:

Photo: Owlie Productions via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.