Embassy Bancorp, Inc. Announces Results of Operations as of and for the Three and Nine Months ended September 30, 2024

BETHLEHEM, Pa., Nov. 15, 2024 (GLOBE NEWSWIRE) — On November 13, 2024, Embassy Bancorp, Inc. EMYB (the “Company“) filed its Quarterly Report on Form 10-Q for the period ended September 30, 2024, a copy of which can be found at https://investors.embassybank.com/sec-filings/documents/default.aspx.

Highlights of the filing, which includes consolidated financial information of the Company and Embassy Bank For the Lehigh Valley (the “Bank”), the Company’s wholly-owned subsidiary, include:

- Cash and cash equivalents on hand of $91.9 million at September 30, 2024, or 5.4% of total assets.

- Deposits of $1.54 billion at September 30, 2024, an increase of $58.9 million from $1.48 billion at December 31, 2023. The Company does not have any brokered deposits.

- Short term borrowings of $21.9 million at September 30, 2024 were repaid in full on October 1, 2024.

- Bank net interest margin (FTE) increased to 2.21% for the quarter ended September 30, 2024, up from 2.16% for the quarter ended June 30, 2024.

- Bank cost of funds of 1.98% for the quarter ended September 30, 2024, compared to a Pennsylvania peer group (stock banks headquartered in Pennsylvania with assets between $100 million and $5 billion) cost of funds of 2.29%.

- Bank assets per employee of $14.9 million at September 30, 2024, compared to the Pennsylvania peer group assets per employee of $7.7 million.

- Nonperforming assets to total assets of only 0.07% as of September 30, 2024.

- Net income of $2.7 million, or $0.36 per diluted share, for the three months ended September 30, 2024, up from net income of $2.5 million, or $0.33 per diluted share for the three months ended June 30, 2024. Net income of $7.7 million, or $1.02 per diluted share, for the nine months ended September 30, 2024.

About Embassy Bancorp, Inc.

With over $1.7 billion in assets, Embassy Bancorp, Inc. is the parent company of Embassy Bank For the Lehigh Valley, a full-service community bank operating ten branch offices in the Lehigh Valley area of Pennsylvania. The Bank is the largest Lehigh Valley headquartered community bank and was named the 2024 Morning Call Readers’ Choice “Best Bank,” and the 2024 Lehigh Valley Style Who’s Who in Business Lehigh Valley for Bank and Mortgage Company. As of June 30, 2024, the Federal Deposit Insurance Corporation’s Summary of Deposits indicates that the Bank holds the 4th spot in deposit market share in Lehigh and Northampton Counties combined. For more information, visit www.embassybank.com.

Safe Harbor for Forward-Looking Statements

This document may contain forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Actual results and trends could differ materially from those set forth in such statements due to various risks, uncertainties and other factors. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the following: ineffectiveness of the company’s business strategy due to changes in current or future market conditions; the effects of competition, and of changes in laws and regulations, including industry consolidation and development of competing financial products and services; interest rate movements; changes in credit quality; difficulties in integrating distinct business operations, including information technology difficulties; volatilities in the securities markets; and deteriorating economic conditions, and other risks and uncertainties, including those detailed in Embassy Bancorp, Inc.’s filings with the Securities and Exchange Commission (SEC). The statements are valid only as of the date hereof and Embassy Bancorp, Inc. disclaims any obligation to update this information.

Contact:

David M. Lobach, Jr.

Chairman, President and CEO

(610) 882-8800

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at KLA's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on KLA KLAC.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with KLAC, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 19 uncommon options trades for KLA.

This isn’t normal.

The overall sentiment of these big-money traders is split between 52% bullish and 36%, bearish.

Out of all of the special options we uncovered, 13 are puts, for a total amount of $635,864, and 6 are calls, for a total amount of $411,004.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $500.0 to $770.0 for KLA over the last 3 months.

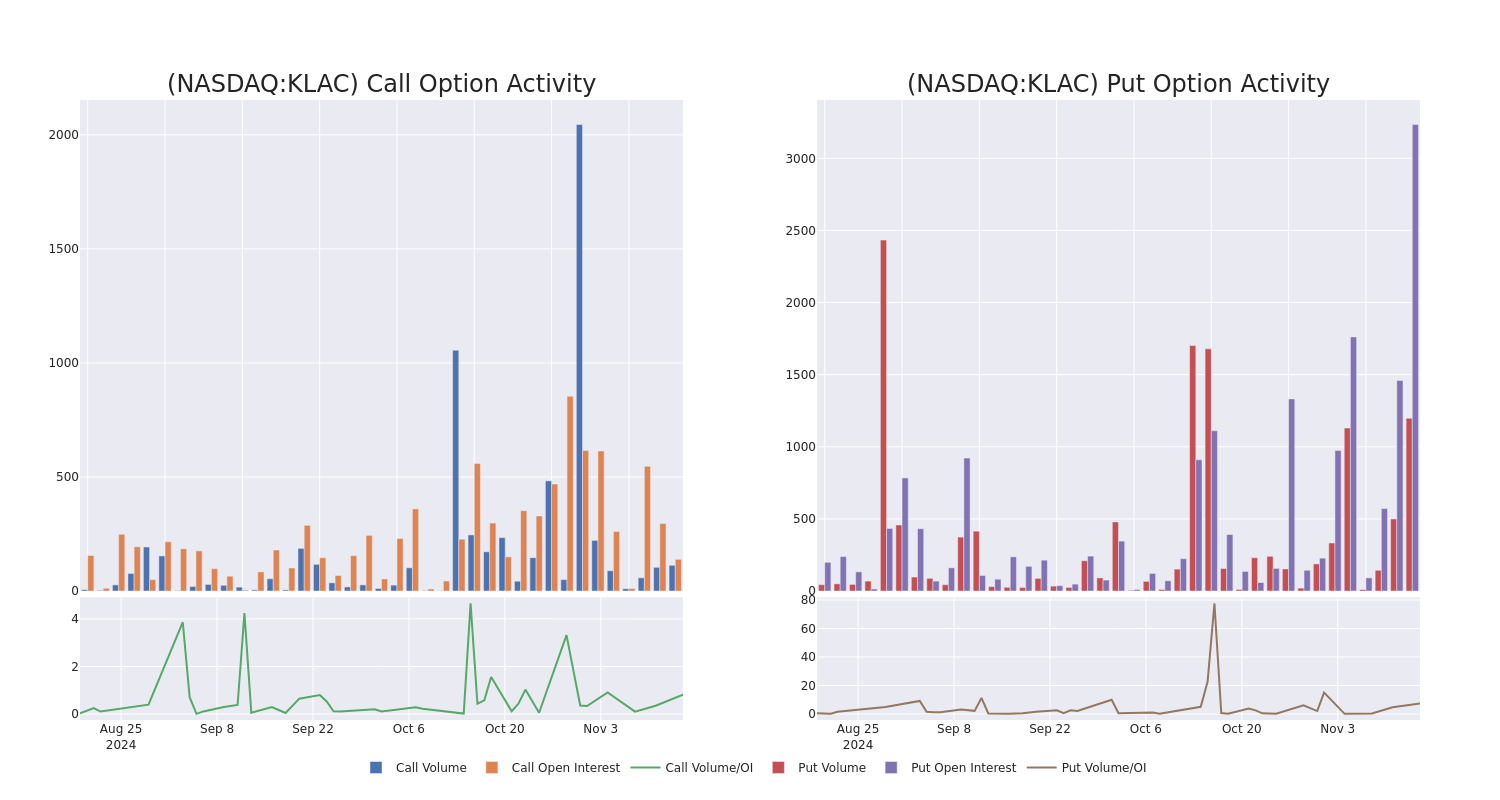

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for KLA’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across KLA’s significant trades, within a strike price range of $500.0 to $770.0, over the past month.

KLA Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KLAC | CALL | TRADE | BULLISH | 06/20/25 | $66.0 | $64.9 | $66.0 | $650.00 | $237.6K | 4 | 36 |

| KLAC | PUT | TRADE | BULLISH | 11/15/24 | $49.0 | $44.0 | $44.0 | $670.00 | $88.0K | 264 | 21 |

| KLAC | PUT | SWEEP | NEUTRAL | 12/20/24 | $30.2 | $27.5 | $28.8 | $630.00 | $83.2K | 117 | 60 |

| KLAC | PUT | SWEEP | BEARISH | 11/15/24 | $17.7 | $15.1 | $17.8 | $640.00 | $70.8K | 984 | 157 |

| KLAC | PUT | TRADE | NEUTRAL | 12/20/24 | $31.6 | $27.8 | $29.7 | $630.00 | $62.3K | 117 | 28 |

About KLA

KLA is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segment of semiconductor process control, wherein machines inspect semiconductor wafers during research and development and manufacturing for defects and verify precise measurements. In this section of the market, KLA holds a majority share. It also has a small exposure to the etch and deposition segments of the WFE market. It counts as top customers the largest chipmakers in the world, including TSMC and Samsung.

Following our analysis of the options activities associated with KLA, we pivot to a closer look at the company’s own performance.

KLA’s Current Market Status

- With a volume of 823,831, the price of KLAC is down -4.03% at $619.0.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 69 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for KLA with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jeff Bezos' Ex-Wife MacKenzie Scott Sells More Amazon Shares

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

MacKenzie Scott, the ex-wife of Amazon.com, Inc. (NASDAQ:AMZN) founder Jeff Bezos, has recently sold 11% of her Amazon shares, valued at over $8 billion.

The Details: Scott received approximately 400 million Amazon shares as part of her divorce settlement with Bezos in 2019 and signed The Giving Pledge, a commitment to donate most of her wealth during her lifetime. The latest sale brings her total Amazon stock sales and donations to 255 million shares valued at approximately $37 billion.

Don’t Miss:

Scott has disposed of two-thirds of her Amazon shares in less than six years since the divorce. According to Forbes, she is one of the five most generous living donors in the U.S. and has given at least $17.3 billion to more than 2,300 separate nonprofit groups.

Forbes speculates the remaining $20 billion could be sitting in her various charitable accounts, with the shares likely sold, regardless of whether Scott moved them into one of her many reported donor-advised funds.

“Most charities have a policy of immediate sale,” Holly Welch Stubbing, CEO of National Philanthropic Trust, a donor-advised-fund sponsor where Scott reportedly has an account, per Forbes.

One organization Scott supported with proceeds from sales of Amazon shares is the West Philadelphia Skills Initiative, which helps job seekers find careers and employers locate top talent. Scott donated $4 million in unrestricted funds to the organization.

Trending: Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

“They’re not asking us to do anything different. They’re saying you’re doing a really good job. Keep going, we trust you,” said Cait Garozzo, executive director of the West Philadelphia Skills Initiative. “And that means a lot. It allows us to experiment and innovate to leverage the investment funds that we already have to grow in a way that feels authentic.”

Stock Selloff Deepens With Fed Cut Bets in Focus: Markets Wrap

(Bloomberg) — Stocks fell, headed for the worst week in more than two months, as Trump trades lost steam and investors bet the Federal Reserve will have to slow the pace of policy easing.

Most Read from Bloomberg

The S&P 500 was just off lows in the last hour of trading, with tech stocks leading declines. The benchmark has now erased over half of the trough-to-peak gains it notched after the US presidential election. Traders see slightly more than even odds of a quarter-point cut next month following comments by Jerome Powell this week indicating the Fed was in no hurry to lower rates and a report Friday on October retail sales that included large upside revisions to the prior month.

As the initial euphoria about Trump’s pro-business agenda begins to fade, investors are coming to terms with the costs of his fiscal plans and their potential to reignite inflation.

“It will come at the expense of potentially larger budget deficits, potentially larger debt and there is also the inflation dimension,” said Charles-Henry Monchau, chief investment officer at Banque Syz & Co. “There’s been a realization that there is a price to pay for this.”

The S&P 500 fell 1.3% and the tech-heavy Nasdaq 100 dropped more than 2%. Shares of all “Magnificent Seven” megacaps declined except Elon Musk’s Tesla Inc., with Amazon.com Inc., Nvidia Corp. and Meta Platforms Inc. sliding more than 3%. Applied Materials Inc., the largest US maker of chip-manufacturing equipment, suffered its worst stock decline in a month after giving a disappointing revenue forecast.

Late Friday, traders priced about a 56% chance the Fed will deliver a quarter-point reduction at its December meeting, down from 80% earlier this week. Bets on cuts were pared after Powell warned Thursday that the central bank may take its time easing policy. Boston Fed President Susan Collins said Friday a December cut remained on the table, emphasizing the central bank’s decision will be guided by incoming data.

“The market is expensive and I think Powell’s speech last night basically saying that Fed officials don’t need to rush to lower rates, that’s probably the main reason why we’re selling off specifically today,” said John Davi, CEO and CIO at Astoria Advisors, by phone. “The higher rates go, the more equity risk premiums tilt more in the favor of bonds.”

Check Out What Whales Are Doing With BIDU

Investors with a lot of money to spend have taken a bullish stance on Baidu BIDU.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with BIDU, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 20 uncommon options trades for Baidu.

This isn’t normal.

The overall sentiment of these big-money traders is split between 70% bullish and 30%, bearish.

Out of all of the special options we uncovered, 8 are puts, for a total amount of $734,906, and 12 are calls, for a total amount of $564,254.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $120.0 for Baidu over the last 3 months.

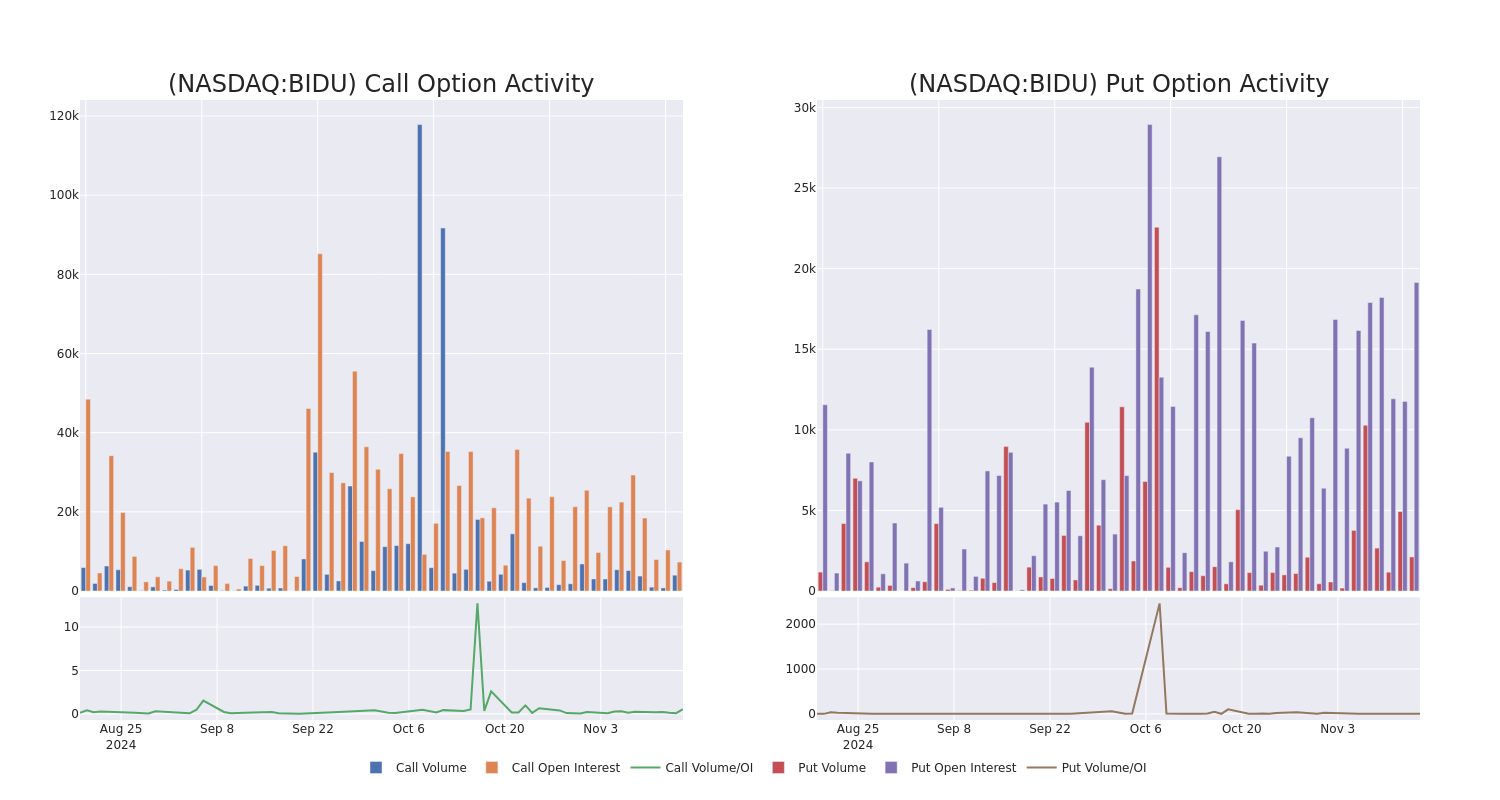

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Baidu’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Baidu’s significant trades, within a strike price range of $75.0 to $120.0, over the past month.

Baidu 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BIDU | PUT | TRADE | BULLISH | 01/16/26 | $38.35 | $38.0 | $38.0 | $120.00 | $228.0K | 376 | 60 |

| BIDU | PUT | TRADE | BULLISH | 03/21/25 | $3.6 | $3.55 | $3.55 | $75.00 | $176.7K | 5.8K | 511 |

| BIDU | PUT | TRADE | BEARISH | 12/20/24 | $16.6 | $16.35 | $16.52 | $100.00 | $82.6K | 2.5K | 56 |

| BIDU | CALL | TRADE | BULLISH | 12/20/24 | $2.55 | $2.53 | $2.55 | $90.00 | $76.2K | 3.6K | 1.0K |

| BIDU | CALL | TRADE | BEARISH | 12/20/24 | $2.55 | $2.5 | $2.51 | $90.00 | $75.2K | 3.6K | 715 |

About Baidu

Baidu is the largest internet search engine in China with over 50% share of the search engine market in 2024 per web analytics firm, Statcounter. The firm generated 72% of core revenue from online marketing services from its search engine in 2023. Outside its search engine, Baidu is a technology-driven company and its other major growth initiatives are artificial intelligence cloud, video streaming services, voice recognition technology, and autonomous driving.

Following our analysis of the options activities associated with Baidu, we pivot to a closer look at the company’s own performance.

Current Position of Baidu

- Currently trading with a volume of 1,780,410, the BIDU’s price is up by 0.47%, now at $84.45.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 6 days.

What Analysts Are Saying About Baidu

In the last month, 1 experts released ratings on this stock with an average target price of $115.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Mizuho continues to hold a Outperform rating for Baidu, targeting a price of $115.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Baidu options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Selling: rl Sa EvomLux Unloads $127.88M Of Informatica Stock

It was reported on November 14, that rl Sa EvomLux, Director at Informatica INFA executed a significant insider sell, according to an SEC filing.

What Happened: EvomLux’s recent move involves selling 5,014,848 shares of Informatica. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $127,878,624.

The latest update on Friday morning shows Informatica shares down by 1.92%, trading at $24.77.

About Informatica

Informatica Inc is a pioneered new category of software, the Intelligent Data Management Cloud, or IDMC. IDMC is an AI-powered platform that connects, manages, and unifies data across any multi-cloud, hybrid system, empowering enterprises to modernize and advance data strategies.

Breaking Down Informatica’s Financial Performance

Positive Revenue Trend: Examining Informatica’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.41% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: The company excels with a remarkable gross margin of 80.68%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Informatica’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of -0.05.

Debt Management: Informatica’s debt-to-equity ratio stands notably higher than the industry average, reaching 0.78. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 109.56, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 4.7 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Informatica’s EV/EBITDA ratio at 28.95 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes Worth Your Attention

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Informatica’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Fall After Fed Comments, Strong Retail Sales Data

Stocks fell Friday, following a solid retail-sales report that could bolster the case that the economy is strong and may not need support in the form of lower borrowing costs.

Separately, a Federal Reserve official said it was too soon to say whether the central bank should cut interest rates at its meeting next month.

Another rate cut in December is “certainly on the table, but it’s not a done deal,” said Boston Fed President Susan Collins in an interview late Thursday. “There’s more data that we will see between now and December, and we’ll have to continue to weigh what makes sense.”

The Dow Jones Industrial Average fell about 350 points, or 0.8%. The S&P 500 dropped more than 1%, and the Nasdaq Composite was down about 2.5%.

The latest moves highlighted investor uncertainty about whether the Fed is in a position to continue cutting rates as much as markets have come to expect—in part because the economy continues to hold up well.

On Friday, the Commerce Department said that retail sales gained 0.4% in October from September, better than economists’ forecasts for a 0.3% increase. Officials also revised their figures for September sales growth sharply upward to 0.8%, from an initial estimate of 0.4% growth.

“Various speeches by Fed officials show growing concern that disinflation is hitting a wall,” Jefferies analyst Thomas Simons wrote to clients after the data Friday. “But we do not think there will be enough evidence to confirm these hypotheses before the next meeting.”

The Fed’s next meeting is Dec. 17-18. Officials will see data on inflation and employment for November before that meeting.

Collins said Thursday she didn’t see any evidence that inflation was picking up due to new sources of strength in the economy, aligning herself with a view Fed Chair Jerome Powell expressed last week. Both of them suggested recent inflation stickiness has instead been an echo or “catch-up” effect of large price increases from the past few years, such as car insurance costs rising to reflect past increases in car prices that have since subsided.

“As far as I can tell, I do not see evidence of new price pressures,” said Collins. Firmer inflation in recent months instead reflects “the effects of the longer-term dynamics of past shocks,” she said.

Spotlight on Applied Optoelectronics: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on Applied Optoelectronics AAOI.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AAOI, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 12 options trades for Applied Optoelectronics.

This isn’t normal.

The overall sentiment of these big-money traders is split between 16% bullish and 83%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $69,300, and 11, calls, for a total amount of $737,150.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $17.5 to $30.0 for Applied Optoelectronics during the past quarter.

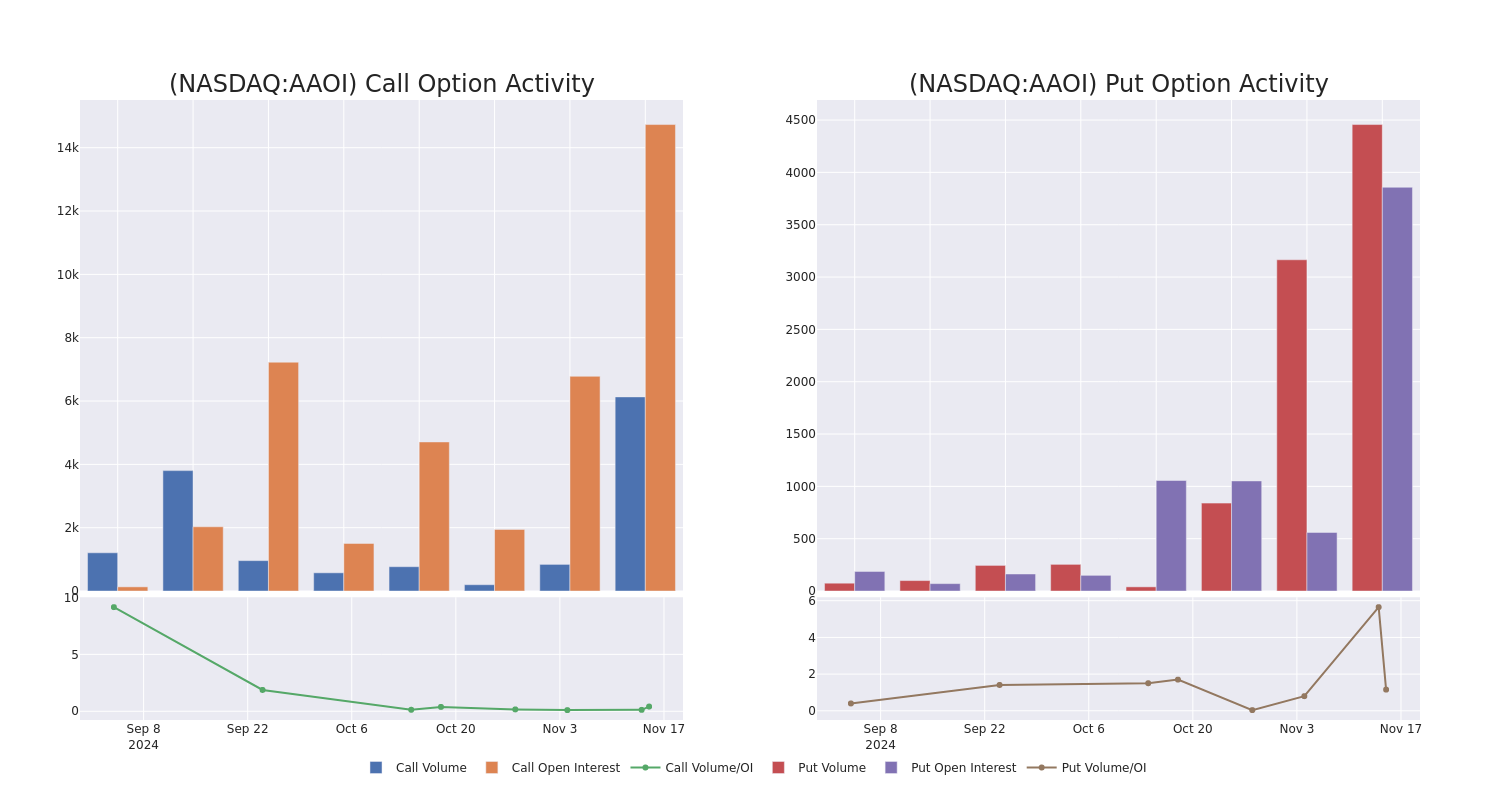

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Applied Optoelectronics’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Applied Optoelectronics’s substantial trades, within a strike price spectrum from $17.5 to $30.0 over the preceding 30 days.

Applied Optoelectronics Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAOI | CALL | SWEEP | BEARISH | 11/15/24 | $4.0 | $3.7 | $3.7 | $22.50 | $122.8K | 1.5K | 595 |

| AAOI | CALL | SWEEP | BEARISH | 11/15/24 | $8.2 | $7.9 | $7.9 | $20.00 | $102.3K | 5.4K | 680 |

| AAOI | CALL | SWEEP | BEARISH | 11/15/24 | $1.35 | $1.25 | $1.35 | $25.00 | $97.4K | 1.3K | 781 |

| AAOI | CALL | TRADE | BEARISH | 11/15/24 | $7.8 | $7.5 | $7.5 | $20.00 | $90.0K | 5.4K | 1.0K |

| AAOI | CALL | TRADE | BEARISH | 11/15/24 | $8.0 | $7.6 | $7.7 | $20.00 | $77.0K | 5.4K | 840 |

About Applied Optoelectronics

Applied Optoelectronics Inc is a provider of fiber-optic networking products for the Internet data center, cable television, telecommunications and fiber-to-the-home end markets. The company focuses on designing and manufacturing a range of optical communication products from components, to subassemblies, and modules to complete turn-key equipment. Demand for Applied Optoelectronics is driven by bandwidth demand in end markets. Through direct sales personnel, and manufacturing teams in the United States, China, and Taiwan, the company coordinates with customers to determine product design, qualifications, and performance. The company derives maximum revenue from Taiwan.

After a thorough review of the options trading surrounding Applied Optoelectronics, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Applied Optoelectronics Standing Right Now?

- Trading volume stands at 2,824,114, with AAOI’s price down by -6.2%, positioned at $26.41.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 97 days.

What The Experts Say On Applied Optoelectronics

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $25.166666666666668.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Northland Capital Markets continues to hold a Outperform rating for Applied Optoelectronics, targeting a price of $25.

* An analyst from Rosenblatt persists with their Buy rating on Applied Optoelectronics, maintaining a target price of $27.

* An analyst from Raymond James persists with their Outperform rating on Applied Optoelectronics, maintaining a target price of $23.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Applied Optoelectronics options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.