Stocks Tumble As Traders Rethink Fed's Action, VIX Spikes 17%, Nasdaq Erases Back Post-Trump Gains: What's Driving Markets Friday?

Risk aversion dominated Wall Street in the final session of the week, driving sharp losses across major indices.

Investors grappled with growing uncertainties surrounding the economic impacts of Donald Trump‘s policies and the Federal Reserve’s next moves.

Fed Chair Jerome Powell‘s remarks from the previous day weighed heavily on risk assets. Powell signaled no need to lower rates, citing the economy’s resilience and emphasizing the importance of fully finishing the inflation jobs.

Boston Fed President Susan Collins added to the uncertainty on Friday, stating she needs to see additional data before deciding on further rate cuts at the Federal Reserve’s upcoming policy meeting.

Expectations for a 25-basis-point rate cut in December were significantly scaled back, with odds falling to 59%, down from 82% just a day earlier.

U.S. indices are poised to end the week in negative territory, as optimism fueled by Trump’s win fizzled. Tech stocks were hit hardest, with the Nasdaq 100 plunging 2.5%, wiping out its post-election gains.

Chipmakers tumbled across the board, with the iShares Semiconductor ETF SOXX reaching a 2-month low, as Applied Materials Inc. AMAT released a disappointing outlook.

The surge in rate-cut uncertainty and broader economic concerns pushed the CBOE Volatility Index (VIX) up by more than 17%, reflecting heightened market fear.

Treasury yields edged lower, indicating a flight to safe-haven bonds. The drop in yields supported the Japanese yen, which ended a four-day losing streak.

The U.S. dollar eased but remains on track for its seventh consecutive week of gains, marking its longest winning streak since September 2023.

Gold prices remained flat despite falling yields and a softer dollar, failing to act as a hedge in a turbulent session. Meanwhile, Bitcoin BTC/USD defied the risk-off sentiment, rising 2.5% to $89,600 in a surprising show of strength.

Friday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Dow Jones | 43,416.20 | -0.8% |

| S&P 500 | 5,869.72 | -1.3% |

| Russell 2000 | 2,302.85 | -1.5% |

| Nasdaq 100 | 20,391.40 | -2.4% |

| CBOE VIX | 16.79 | 17.3% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY fell 1.4% to $585.28.

- The SPDR Dow Jones Industrial Average DIA fell 0.8% to $434.08.

- The tech-heavy Invesco QQQ Trust Series QQQ fell 2.5% to $496.12.

- The iShares Russell 2000 ETF IWM tumbled 1.4% to $228.75.

- The Utilities Select Sector SPDR Fund XLU outperformed, rising 0.8%. The Technology Select Sector SPDR Fund XLY lagged, down 2.7%.

Friday’s Stock Movers

- Palantir Technologies Inc. PLTR skyrocketed 8.4%, on news that the AI-champion will be included in the Nasdaq 100 index.

- Walt Disney Co. DIS rose over 4%, fueling stock momentum after the 6.2% gain on Thursday amid stronger than expected earnings.

- Alcoa Corp. AA rallied over 8% after China announced to end its export-tax rebate for aluminum from Dec. 1.

Stocks reacting on earnings reports were:

- Globant S.A. GLOB, down 11%.

- AST SpaceMobile Inc. ASTS, down 13.8%,

- Post Holdings Inc. POST, down 2.8%.

Now Read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JP Morgan Downgrades Gene Therapy Focused Bluebird Bio, Cites Limited Funding Options

On Thursday, Bluebird Bio Inc. BLUE reported a third-quarter EPS loss of 31 cents, compared to a loss of 80 cents a year ago, beating the consensus loss of 36 cents.

The gene therapy company reported sales of $10.6 million, down from $12.39 million, missing the consensus of $18.1 million.

The company’s cash, cash equivalents, and restricted cash balance were approximately $118.7 million, which is expected to provide a cash runway into the first quarter of 2025.

Also Read: Worries Mount Over Cancer Risks in Bluebird Bio’s Gene Therapy

The company anticipates quarterly cash flow break-even in the second half of 2025, assuming it scales to approximately 40 drug product deliveries per quarter and obtains additional cash resources to extend its runway.

JP Morgan downgraded Bluebird after the third-quarter results. The analyst notes a reduced cash runway to “into 1Q25” from “into 2Q25.”

JP Morgan highlights that Bluebird did achieve the milestone of its first Lyfgenia infusion during the quarter (and revenue recognition) and continues to increase the pace of patient starts (cell collections) across its portfolio but is doing so against a backdrop of continued negative gross margins.

- 57 patient starts completed to date in 2024 (35 Zynteglo, 17 Lyfgenia, 5 Skysona).

- Seventeen additional starts are scheduled through the remainder of 2024.

“Altogether presenting few avenues to emerge from remaining a going concern,” the analyst says. JP Morgan has downgraded from Neutral to Underweight.

The analyst writes that the proxy vote did not gather enough support to approve a reverse stock split and increase the number of shares available for issuance. This outcome effectively eliminates equity financing as an option for raising capital.

In September, Bluebird bio implemented a restructuring to optimize its cost structure and enable quarterly cash flow break-even in the second half of 2025.

Price Action: BLUE stock is down 11.2% at $0.32 at last check Friday.

Photo by Ground Picture on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RH Unusual Options Activity For November 15

Investors with a lot of money to spend have taken a bearish stance on RH RH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for RH.

This isn’t normal.

The overall sentiment of these big-money traders is split between 10% bullish and 80%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $106,519, and 8 are calls, for a total amount of $298,502.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $310.0 to $500.0 for RH over the last 3 months.

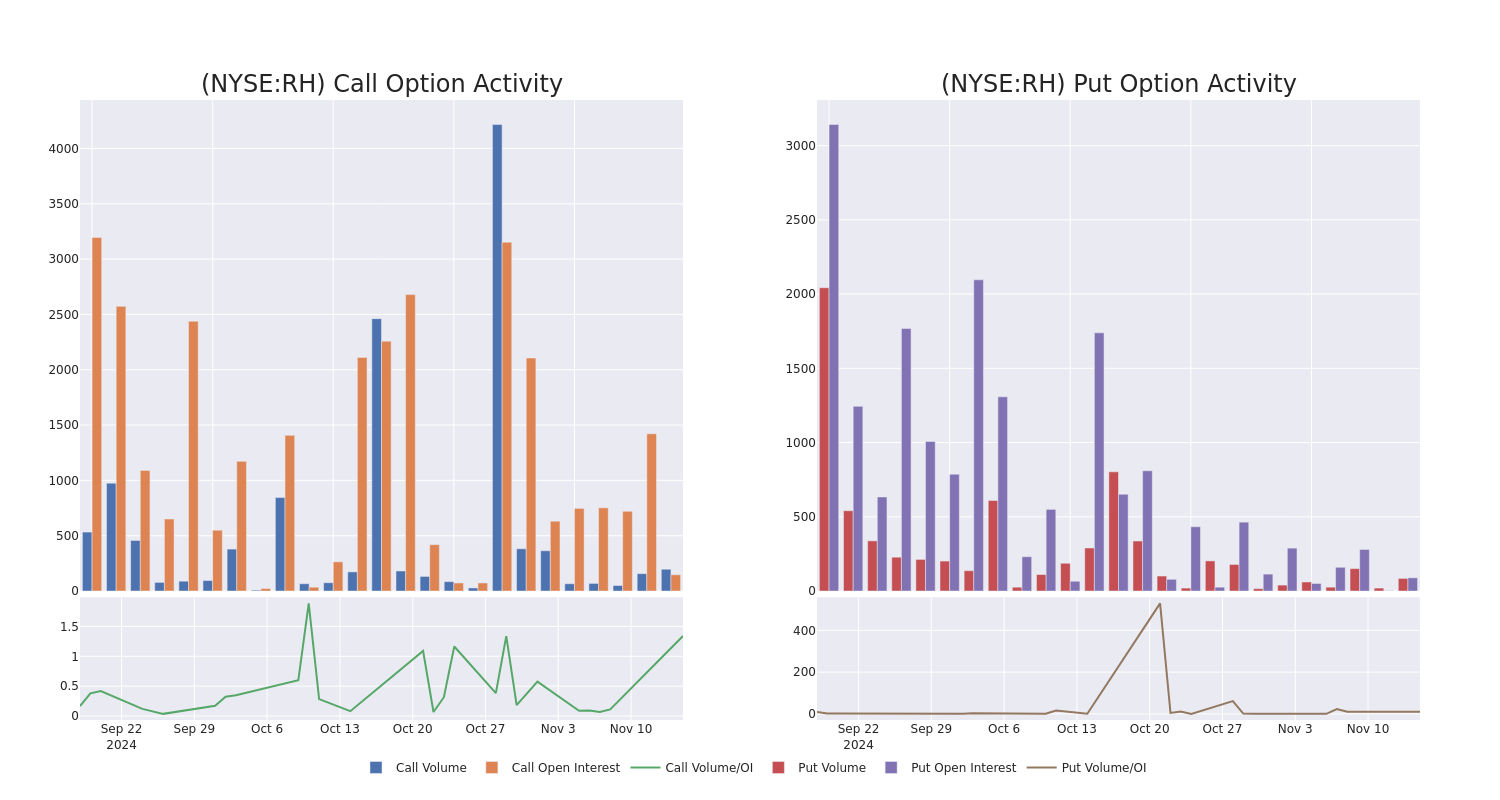

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of RH stands at 59.0, with a total volume reaching 242.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in RH, situated within the strike price corridor from $310.0 to $500.0, throughout the last 30 days.

RH Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RH | CALL | SWEEP | BEARISH | 12/13/24 | $25.4 | $23.9 | $23.69 | $320.00 | $73.0K | 0 | 38 |

| RH | PUT | SWEEP | BEARISH | 11/29/24 | $16.2 | $11.5 | $16.2 | $322.50 | $72.9K | 85 | 45 |

| RH | CALL | TRADE | BEARISH | 01/16/26 | $25.9 | $25.0 | $25.0 | $500.00 | $50.0K | 147 | 54 |

| RH | CALL | TRADE | BEARISH | 01/16/26 | $28.8 | $25.2 | $25.3 | $500.00 | $35.4K | 147 | 54 |

| RH | CALL | TRADE | BEARISH | 09/19/25 | $70.5 | $70.0 | $70.0 | $310.00 | $35.0K | 0 | 5 |

About RH

RH is a luxury furniture and lifestyle retailer operating in the $134 billion domestic furniture and home furnishing industry. The firm offers merchandise across many categories including furniture, lighting, textiles, bath, decor, and children and is growing the presence of its hospitality business with 18 restaurant locations. RH innovates, curates, and integrates products, categories, services, and businesses across channels and brand extensions (RH Modern and Waterworks, for example). RH is fully integrated across channels and is positioned to broaden its addressable market over the next decade by expanding abroad, with its World of RH digital platform (highlighting offerings outside of home furnishings), and with offerings in color, bespoke furniture, architecture, media, and more.

Where Is RH Standing Right Now?

- With a trading volume of 199,342, the price of RH is down by -2.24%, reaching $315.58.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 20 days from now.

What Analysts Are Saying About RH

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $430.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wedbush has elevated its stance to Outperform, setting a new price target at $430.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for RH with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: Christopher Brandt Sells $1.20M Worth Of Chipotle Mexican Grill Shares

On November 14, a recent SEC filing unveiled that Christopher Brandt, Chief Brand Officer at Chipotle Mexican Grill CMG made an insider sell.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Brandt sold 20,000 shares of Chipotle Mexican Grill. The total transaction amounted to $1,200,248.

At Friday morning, Chipotle Mexican Grill shares are down by 1.24%, trading at $59.17.

Discovering Chipotle Mexican Grill: A Closer Look

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is almost exclusively company-owned, with just two license stores opearted through a master franchise relationship with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

Breaking Down Chipotle Mexican Grill’s Financial Performance

Positive Revenue Trend: Examining Chipotle Mexican Grill’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 13.01% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Exploring Profitability:

-

Gross Margin: The company shows a low gross margin of 25.49%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): With an EPS below industry norms, Chipotle Mexican Grill exhibits below-average bottom-line performance with a current EPS of 0.28.

Debt Management: With a below-average debt-to-equity ratio of 1.24, Chipotle Mexican Grill adopts a prudent financial strategy, indicating a balanced approach to debt management.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 55.64, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 7.52 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Chipotle Mexican Grill’s EV/EBITDA ratio stands at 37.23, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Important Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Chipotle Mexican Grill’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crude Oil Dips Over 2%; Bloom Energy Shares Spike Higher

U.S. stocks traded lower toward the end of trading, with the Dow Jones index falling by more than 300 points on Friday.

The Dow traded down 0.78% to 43,410.32 while the NASDAQ fell 2.50% to 18,630.37. The S&P 500 also fell, dropping, 1.51% to 5,859.61.

Check This Out: Top 4 Utilities Stocks That May Keep You Up At Night This Quarter

Leading and Lagging Sectors

Utilities shares rose by 1% on Friday.

In trading on Friday, information technology shares fell by 2.7%.

Top Headline

The total number of active U.S. oil rigs fell by one to 478 rigs this week, Baker Hughes Inc reported.

Equities Trading UP

- The Arena Group Holdings, Inc. AREN shares shot up 181% to $1.63 after it announced its first ever profitable quarter.

- Shares of Bloom Energy Corporation BE got a boost, surging 55% to $20.59 after the energy company became the latest to announce a major deal to power AI data centers. Bloom Energy announced Thursday evening that it has signed a supply agreement with American Electric Power Company, Inc. AEP for up to 1 gigawatt (GW) of its products, the largest commercial procurement of fuel cells in the world to date.

- Simpple Ltd. SPPL shares were also up, gaining 46% to $1.29 after the company announced a $400,000 contract to supply autonomous cleaning robots at Singapore’s International Airport Terminal.

Equities Trading DOWN

- TFF Pharmaceuticals, Inc. TFFP shares dropped 77% to $0.37 after the company announced it will wind down its operations.

- Shares of Eyenovia, Inc. EYEN were down 70% to $0.10 after the company announced that its CHAPERONE trial is not meeting its primary endpoint, prompting the discontinuation of the study and a review of the full data set to evaluate next steps for the program.

- Ryvyl Inc. RVYL was down, falling 26% to $1.26 after the company reported worse-than-expected third-quarter financial results and cut its FY24 sales guidance.

Commodities

In commodity news, oil traded down 2.2% to $67.20 while gold traded down 0.1% at $2,572.20.

Silver traded down 0.5% to $30.425 on Friday, while copper fell 0.5% to $4.0690.

Euro zone

European shares closed mostly lower today. The eurozone’s STOXX 600 fell 0.77%, Germany’s DAX fell 0.27% and France’s CAC 40 fell 0.58%. Spain’s IBEX 35 Index gained 0.97%, while London’s FTSE 100 fell 0.09%.

The annual inflation rate in Italy increased to 0.9% in October versus 0.7% in the prior month, while France’s annual inflation rate rose to 1.2% in October. The GDP in the UK grew by 1% year-over-year during the third quarter.

Asia Pacific Markets

Asian markets closed lower on Friday, with Japan’s Nikkei 225 gaining 0.28%, Hong Kong’s Hang Seng Index falling 0.05% and China’s Shanghai Composite Index dipping 1.45%.

Hong Kong’s economy expanded by 1.8% year-over-year in the third quarter compared to a 3.2% increase in the previous period. China’s retail sales rose by 4.8% year-over-year in October, while industrial production rose by 5.3% year-over-year in October.

Economics

- The NY Empire State Manufacturing Index surged to 31.2 in November versus -11.9 in the previous month and topping market estimates of -0.7.

- U.S. export prices increased by 0.8% in October, while import prices rose by 0.3% month-over-month in October.

- U.S. retail sales rose 0.4% month-over-month in October compared to a revised 0.8% increase in September, and toping market estimates of 0.3%.

- U.S. industrial production declined by 0.3% in October compared to a revised 0.5% declined in September.

- The total number of active U.S. oil rigs fell by one to 478 rigs this week, Baker Hughes Inc reported.

- U.S. business inventories rose 0.1% month-over-month in September compared to a 0.3% gain in August and versus market estimates of 0.2%.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia to report Q3 earnings Wednesday as AI fever continues to power Wall Street

Nvidia (NVDA) will report its Q3 earnings after the bell next Wednesday, giving Wall Street its best and latest look into the strength of the AI trade.

The world’s largest publicly traded company by market cap, Nvidia’s stock price has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond. Shares of Nvidia were up 189% year to date as of Friday, easily outpacing any of the company’s chip rivals. AMD (AMD), Nvidia’s closest competitor, has seen its stock price sink nearly 8% year to date, while Intel (INTC), which is contending with a difficult turnaround, has seen its stock plunge 51%.

Nvidia is expected to report Q3 earnings per share (EPS) of $0.74 on revenue of $33.2 billion, according to analysts’ estimates compiled by Bloomberg. That works out to an 83% year-over-year increase on both the top and bottom lines versus the same period last year when Nvidia saw EPS of $0.40 on revenue of $22.1 billion.

Nvidia’s Data Center segment, its largest business, is set to bring in $29 billion for the quarter. That’s a 100% increase versus the $14.5 billion the company reported in Q3 last year.

Gaming revenue is expected to top out at $3 billion, up 7% from last year when the segment brought in $2.8 billion.

Analysts are anticipating gross margins to hit 75%.

Investors will be on the lookout for not only whether Nvidia beats on the top and bottom lines for the quarter, but if it raises its outlook for Q4 as well. Analysts are expecting Nvidia to announce Q4 guidance of $37 billion in revenue in the coming quarter.

Even if it delivers a stellar report and outlook, shares could still fall following the earnings announcement. Nvidia topped expectations on the top and bottom lines and beat out anticipated guidance in Q2, but shares still fell 6% immediately after it announced its results.

That could have been a sign that some investors weren’t impressed with Nvidia’s performance compared to prior quarters, where it saw revenue growth of 200% and EPS growth of nearly 600%. Or it could simply come down to investors taking profits on their gains at the time.

Investors will also be on the lookout for any insights from CEO Jensen Huang about Nvidia’s next-generation Blackwell line of AI chips, which are used to both train and run AI applications. During the company’s last earnings call in August, Huang said Blackwell production will pick up in Q4, when he expects to see several billions of dollars of revenue from the chips.

At the time, Huang said demand for Blackwell was already outstripping supply, and he expects that to continue in the year ahead. What’s more, he said the company’s Hopper chip, the predecessor to the Blackwell line, is expected to continue selling well into the coming quarter.

Unpacking the Latest Options Trading Trends in Vertiv Hldgs

Deep-pocketed investors have adopted a bearish approach towards Vertiv Hldgs VRT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VRT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 18 extraordinary options activities for Vertiv Hldgs. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 55% bearish. Among these notable options, 6 are puts, totaling $836,940, and 12 are calls, amounting to $727,867.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $160.0 for Vertiv Hldgs over the recent three months.

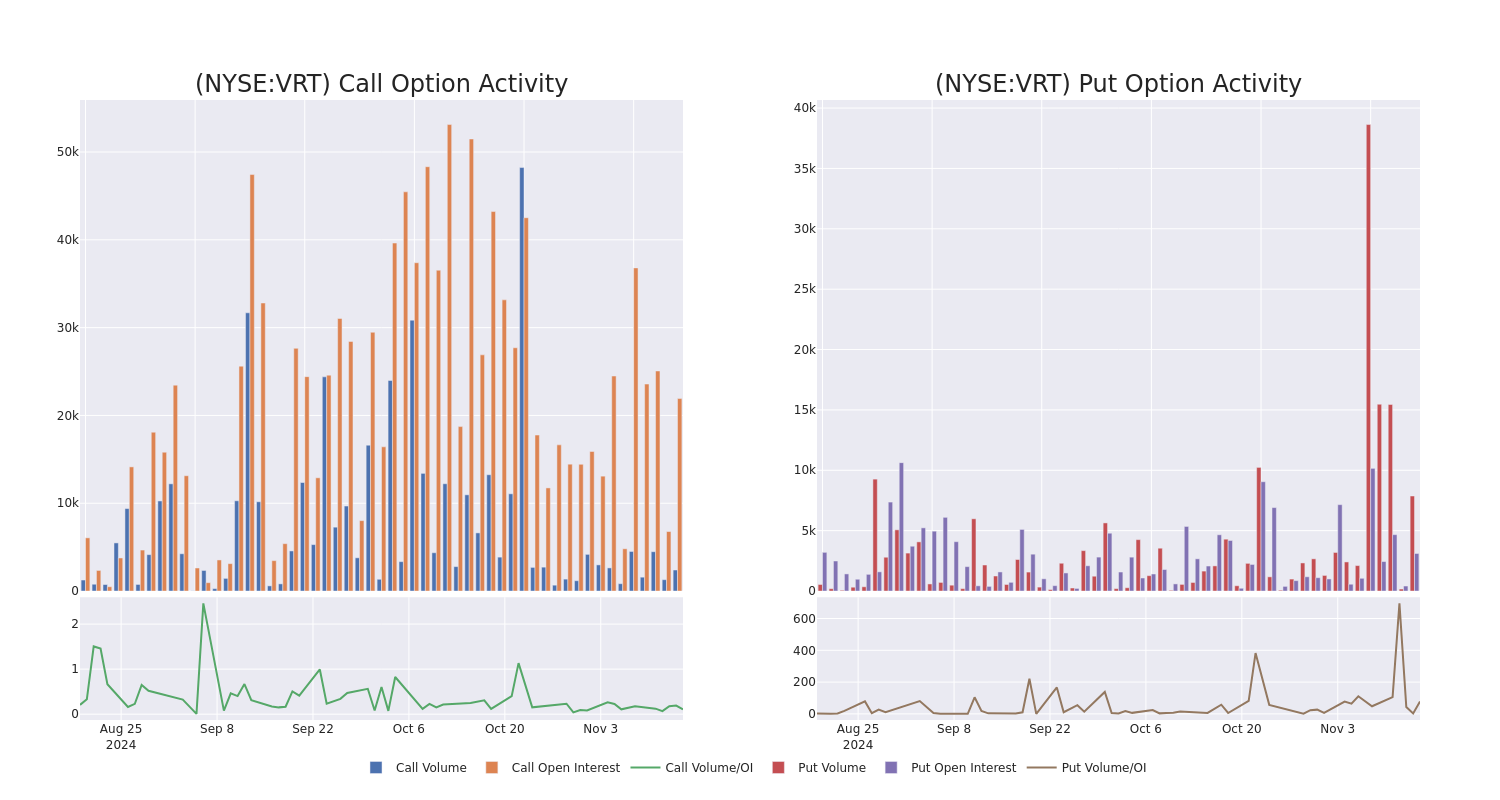

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Vertiv Hldgs’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Vertiv Hldgs’s significant trades, within a strike price range of $70.0 to $160.0, over the past month.

Vertiv Hldgs Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | PUT | SWEEP | BEARISH | 11/29/24 | $3.6 | $3.2 | $3.49 | $115.00 | $350.0K | 96 | 1.0K |

| VRT | PUT | SWEEP | BEARISH | 11/29/24 | $4.6 | $4.3 | $4.49 | $120.00 | $193.0K | 32 | 2.0K |

| VRT | PUT | TRADE | BULLISH | 12/20/24 | $8.2 | $8.1 | $8.1 | $120.00 | $185.4K | 605 | 295 |

| VRT | CALL | SWEEP | BEARISH | 11/15/24 | $2.05 | $2.0 | $2.0 | $120.00 | $100.0K | 5.3K | 547 |

| VRT | CALL | TRADE | BULLISH | 01/17/25 | $4.9 | $4.7 | $4.85 | $140.00 | $96.9K | 2.4K | 215 |

About Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Current Position of Vertiv Hldgs

- Currently trading with a volume of 3,912,933, the VRT’s price is down by -0.88%, now at $119.96.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 96 days.

Expert Opinions on Vertiv Hldgs

In the last month, 5 experts released ratings on this stock with an average target price of $129.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Evercore ISI Group persists with their Outperform rating on Vertiv Hldgs, maintaining a target price of $135.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for Vertiv Hldgs, targeting a price of $115.

* An analyst from UBS has revised its rating downward to Buy, adjusting the price target to $155.

* Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Vertiv Hldgs with a target price of $110.

* An analyst from Citigroup has decided to maintain their Buy rating on Vertiv Hldgs, which currently sits at a price target of $134.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Vertiv Hldgs options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Board Member Of Timken Sold $2.46M In Stock

Disclosed on November 14, Richard G Kyle, Board Member at Timken TKR, executed a substantial insider sell as per the latest SEC filing.

What Happened: Kyle’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday unveiled the sale of 32,764 shares of Timken. The total transaction value is $2,459,921.

Monitoring the market, Timken‘s shares down by 0.09% at $74.89 during Friday’s morning.

Discovering Timken: A Closer Look

The Timken Company is a manufacturer of bearings, gear belts, industrial motion products and chain-related products. The company sells its portfolio of bearings, including tapered, spherical and cylindrical roller bearings, and thrust and ball bearings, through a network of authorized dealers to end users or directly to original equipment manufacturers. End-market sectors include general industrial, automotive, rail, energy, heavy truck, defense, agriculture, metals, mining, civil aerospace, construction, pulp and paper, and cement industries. Its segments are Engineered Bearings and Industrial Motion. Timken generates majority of its revenue in the United States of America.

Breaking Down Timken’s Financial Performance

Revenue Growth: Timken’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -1.39%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company faces challenges with a low gross margin of 30.56%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Timken’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 1.17.

Debt Management: Timken’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.8, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 15.55 is lower than the industry average, implying a discounted valuation for Timken’s stock.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 1.16, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 8.87, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Closer Look at Important Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Timken’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.