Tapestry Poised For Solid Growth After Capri Merger Termination, Analysts Cite Struggles And Missteps At Capri

On Thursday, Tapestry, Inc. TPR announced the termination of its merger agreement with Capri Holdings Limited CPRI, citing uncertainty in the legal process.

Following the termination of the merger agreement, Tapestry said it will redeem $6.1 billion in senior notes tied to the acquisition, paying 101% of their principal amount plus accrued interest, as per the Special Mandatory Redemption clause. Tapestry will also reimburse Capri $45 million for transaction-related expenses.

Here are the analysts’ takes on the termination news:

Telsey Advisory Group: Analyst Dana Telsey maintained the Market Perform rating on Capri Holdings, lowering the price forecast to $23 from $26. Considering the string of disappointing results over the past several quarters, the analyst trimmed the price forecast.

Per the analyst, the company saw some initial successes, but the campaigns didn’t connect well with its core customers. It raised price points too quickly. Additionally, the brand reduced its signature products and introduced too much fashion, leading to deeper promotions to drive sales.

However, for Tapestry, the analyst raised the price forecast to $67 from $58, with an Outperform rating. Telsey is optimistic about earnings growth from the new buyback authorization and the company’s strong balance sheet.

The analyst sees no near-term acquisitions while focusing on improving Kate’s performance.

Meanwhile, the Coach brand remains resilient, with a 2% increase in constant currency last quarter, the analyst writes.

Guggenheim: Analyst Robert Drbul maintained a Neutral rating on Capri Holdings, citing the company’s deteriorating results over the past few years. The analyst pointed out “multiple missteps” by the company, including focus on younger consumers, rapid price increases, and reduced promotions.

Drbul also criticized the reduction of signature styles and overemphasis on “fashion” at Michael Kors. At Versace, the shift toward luxury/quality alienated the aspirational consumer by removing statement items. The analyst lowered FY25/FY26 EPS estimates to $1.50/$2.00, down from $1.85/$2.10. Per Drbul, Capri’s current low valuation could attract offers.

Drbul reiterated the Buy rating on Tapestry, raising the price forecast to $70 from $60. The analyst notes Tapestry will focus on strengthening Coach and Kate Spade, not pursuing acquisitions for now. With the Capri merger behind, Drbul sees value in Tapestry’s current portfolio.

The company is expected to benefit from pricing power in FY25 and may reach a 19% operating margin, with long-term potential to return to pre-COVID margins, driven by DTC growth and expansion in Asia, Drbul writes.

JP Morgan: Analyst Matthew R. Boss reiterated the Neutral rating on Capri Holdings, with a price forecast of $15. The analyst projects FY25 EPS of $1.44, 17% below consensus, with a 14% year over year revenue decline and a 45bps gross margin contraction.

For the second half of 2025, the analyst projects revenues to be down 13% (an improvement from the first half’s -15%), gross margins to decrease by 10bps year over year (compared to the first half’s -80bps).

Capri Holdings’ shift to a higher direct-to-consumer sales mix has boosted full-price selling, but also increased operating expenses, Boss writes. The analyst warns that with limited opportunities to cut SG&A costs, this could be challenging amid a slowing top-line growth.

Price Action: CPRI shares are trading higher by 1.80% to $20.89 at last check Friday, while TPR shares are trading lower by 0.98% to $57.26.

Image via Unsplash

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Avicanna Reduces Net Loss And Improves Gross Profit, Focusing On International Markets

Avicanna Inc. AVCNF announced its financial results Thursday for the third quarter, disclosing revenue of CA$6.27 million ($4.49 million), compared to CA$6.25 million in the same period last year. The Toronto-based cannabis company also reported improved consolidated gross margin to 57% from 46% for the same period in 2023.

“We are pleased to report the results of another quarter showing progressive improvements across our four business pillars,” stated CEO Aras Azadian. “Our continuous optimization efforts contributed to improvements in our overall financial performance, consolidated gross margins, and balance sheet. We are now better positioned to turn our attention towards our international growth initiatives and take further steps towards advancing our long-term business model.”

Read Also: Agrify’s Q3 Revenue Drop, $18.6M Loss Amid New Leadership

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 Financial Highlights

- Gross profit was CA$3.7 million compared to CA$2.9 million in the comparable quarter last year.

- Adjusted EBITDA was a loss of CA$293,931 compared to adjusted EBITDA loss of $473,650 in the corresponding period last year.

- Net loss amounted to CA$786,388 compared to net loss of CA$1.42 million in the third quarter of 2023.

- Fully repaid outstanding principle balance of approximately CA$1.3 million owed under non-convertible debenture.

Recent Milestones

In August, the biopharmaceutical company announced the successful export of its Aureus-branded cannabigerol (CBG) products to Denmark. This marked the 19th international market for Aureus-branded products and the 22nd market overall for Avicanna’s product range. The export was facilitated through Avicanna’s majority-owned subsidiary, Santa Marta Golden Hemp SAS.

The same month, Avicanna closed a non-brokered private placement offering of its 6,620,692 units at $0.30 per unit for aggregate gross proceeds of $1,986,207.

This year also, the company confirmed that the United States Patent and Trademark Office (USPTO) has issued U.S. Patent No. US 20230025693A1, covering the company’s deep penetrating topical cannabinoid composition and methods for treating musculoskeletal inflammation and pain.

Price Action

Avicanna shares closed Thursday’s market session flat at 17 cents a share.

Read Next:

Photo: Courtesy of Avicanna

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

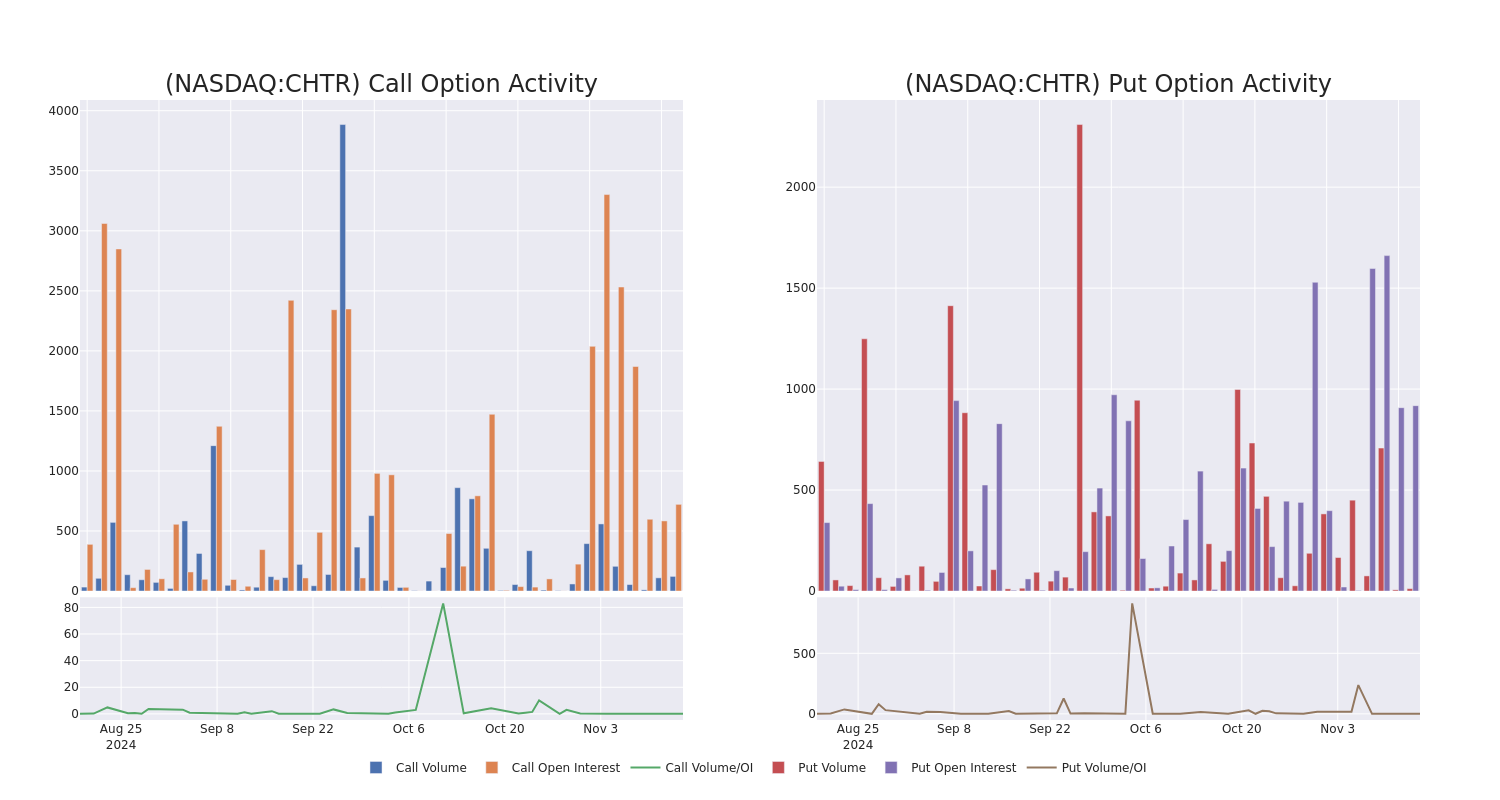

Spotlight on Charter Communications: Analyzing the Surge in Options Activity

High-rolling investors have positioned themselves bullish on Charter Communications CHTR, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CHTR often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 14 options trades for Charter Communications. This is not a typical pattern.

The sentiment among these major traders is split, with 35% bullish and 7% bearish. Among all the options we identified, there was one put, amounting to $36,400, and 13 calls, totaling $389,626.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $130.0 and $400.0 for Charter Communications, spanning the last three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Charter Communications’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Charter Communications’s substantial trades, within a strike price spectrum from $130.0 to $400.0 over the preceding 30 days.

Charter Communications Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CHTR | CALL | TRADE | BEARISH | 01/15/27 | $152.6 | $151.3 | $151.3 | $300.00 | $75.6K | 722 | 12 |

| CHTR | PUT | TRADE | BULLISH | 01/15/27 | $75.0 | $72.8 | $72.8 | $400.00 | $36.4K | 918 | 12 |

| CHTR | CALL | TRADE | NEUTRAL | 01/17/25 | $265.8 | $257.7 | $262.21 | $130.00 | $26.2K | 0 | 13 |

| CHTR | CALL | TRADE | BULLISH | 01/17/25 | $264.8 | $257.6 | $262.21 | $130.00 | $26.2K | 0 | 10 |

| CHTR | CALL | TRADE | BULLISH | 01/17/25 | $262.5 | $257.7 | $262.15 | $130.00 | $26.2K | 0 | 18 |

About Charter Communications

Charter is the product of the 2016 merger of three cable companies, each with a decades-long history in the business: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 58 million US homes and businesses, around 35% of the country. Across this footprint, Charter serves 29 million residential and 2 million commercial customer accounts under the Spectrum brand, making it the second-largest US cable company behind Comcast. The firm also owns, in whole or in part, sports and news networks, including Spectrum SportsNet (long-term local rights to Los Angeles Lakers games), SportsNet LA (Los Angeles Dodgers), SportsNet New York (New York Mets), and Spectrum News NY1.

In light of the recent options history for Charter Communications, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Charter Communications’s Current Market Status

- With a volume of 452,368, the price of CHTR is down -0.95% at $390.52.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 77 days.

Professional Analyst Ratings for Charter Communications

5 market experts have recently issued ratings for this stock, with a consensus target price of $386.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Charter Communications, targeting a price of $400.

* Consistent in their evaluation, an analyst from Barclays keeps a Underweight rating on Charter Communications with a target price of $315.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Charter Communications, maintaining a target price of $400.

* Showing optimism, an analyst from B of A Securities upgrades its rating to Buy with a revised price target of $450.

* An analyst from Deutsche Bank persists with their Hold rating on Charter Communications, maintaining a target price of $365.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Charter Communications options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Co. Grown Rogue Reports 7% Increase In Q3 Revenue, Focuses On New Jersey And Illinois Expansion

Grown Rogue International Inc. GRIN GRUSF reported its third quarter 2024 results on Thursday for the three months ended Sept. 30, 2024.

“This was another exciting quarter for Grown Rogue with solid financial metrics showing the continued execution by our team in competitive markets against a backdrop of modest price compression,” CEO Obie Strickler said. “We continue to see strong indoor production yields of craft-quality flower, retail buyer and consumer loyalty, and great initial reception and sell-through with our branded pre-rolls, including our newest brand Yeti.”

Q3 2024 Financial Highlights

The comparison period for 2023 is the three months ended Oct. 31, 2023, due to the fiscal year-end change from Oct. 31 to Dec. 31.

- Revenue totaled $7 million, up 7% compared to $6.5 million in the fourth quarter of 2023.

- Gross profit amounted to $3.9 million, a decrease from $4.4 million in Q4 2023, primarily due to lower margins in Oregon and pricing pressures.

- Adjusted EBITDA was positive at $2.1 million, unchanged from the previous quarter. Its margin was 30%, down 210 basis points from the fourth quarter of 2023.

- Operating cash flow was $1.21 million, down 24% from $1.5 million in the fourth quarter of 2023. The decrease was attributed to increased spending on the New Jersey market launch.

- Operating expenses increased by 35% to $2.95 million due to higher selling, general and administrative expenses.

- The net loss was $667,240, an improvement from the $2.01 million recorded in the same period last year.

- Cash and cash equivalents totaled $5.6 million, down from $6.8 million as of Dec. 31, 2023.

- Positive cash flow of $5.01 million for the quarter.

- Total assets grew to $41.3 million, up from $29.6 million at year-end 2023.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Other Business Highlights

In New Jersey, Grown Rogue announced competition of the company’s first harvest in the state, with product drops expected in Dec. 2024. The company is optimistic about generating significant cash flow from this market.

It also announced the commencement of phase I operations in the Garden State, which includes roughly 8,000 square feet of flowering canopy that will produce 500-600 pounds of whole flower per month with sales anticipated in the fourth quarter of 2024.

In Illinois, phase II construction is progressing, with a target of 1,100 pounds of whole flower production per month once completed in mid-2025.

Subsequent to quarter-end, the company announced the termination of an advisory agreement with Vireo Growth Inc. VREOF.

Outlook

Grown Rogue said it will focus on its New Jersey and Illinois expansions as primary growth drivers for 2025.

Additionally, Phase II of the New Jersey operation is expected to be completed by mid-2025, with the Illinois project following later in the year.

GRUSF Price Action

Grown Rogue’s shares traded 2.94% higher at 7 cents per share after the market close on Thursday afternoon.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Genpact Director Sold $93K In Company Stock

It was reported on November 14, that N. V. Tyagarajan, Director at Genpact G executed a significant insider sell, according to an SEC filing.

What Happened: Tyagarajan’s recent move involves selling 2,000 shares of Genpact. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $93,400.

Genpact‘s shares are actively trading at $45.1, experiencing a down of 0.0% during Friday’s morning session.

Unveiling the Story Behind Genpact

Genpact Ltd is a provider of business process management services. Clients are industry verticals and operate in banking and financial services, insurance, capital markets, consumer product goods, life sciences, infrastructure, manufacturing and services, healthcare, and high-tech. Genpact’s services include aftermarket, direct procurement, risk and compliance, human resources, IT, industrial solutions, collections, finance and accounting, and media services. Genpact’s end market by revenue is India. It is a General Electric spin-off, which is still a large source of revenue for Genpact.

Genpact: Delving into Financials

Revenue Growth: Over the 3 months period, Genpact showcased positive performance, achieving a revenue growth rate of 2.95% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 35.63%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 0.75, Genpact showcases strong earnings per share.

Debt Management: Genpact’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.77.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 12.39 is lower than the industry average, implying a discounted valuation for Genpact’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.75 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 11.16 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Genpact’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

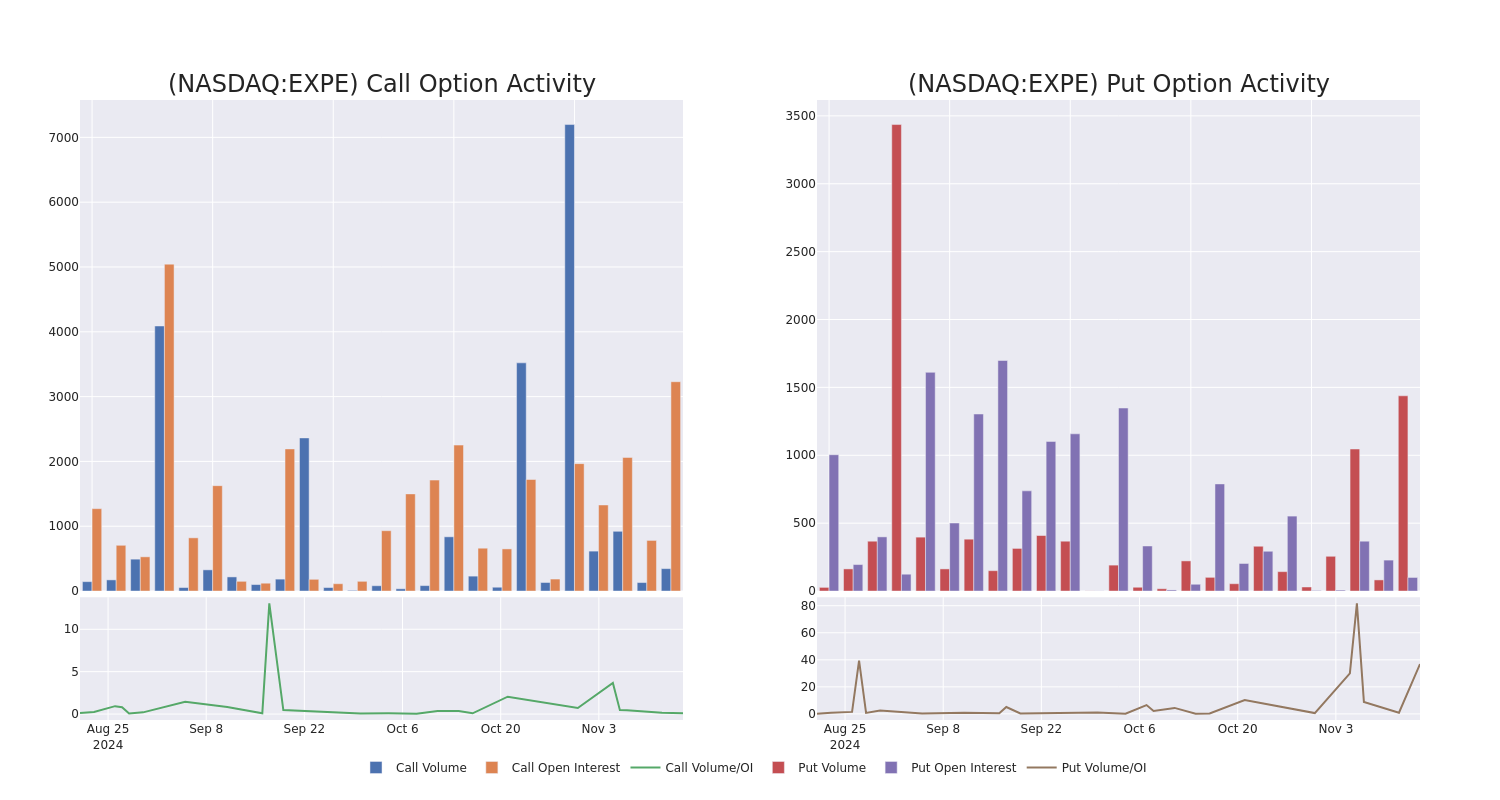

Expedia Group Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Expedia Group.

Looking at options history for Expedia Group EXPE we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $203,880 and 6, calls, for a total amount of $424,321.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $192.5 for Expedia Group over the recent three months.

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Expedia Group stands at 475.71, with a total volume reaching 1,784.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Expedia Group, situated within the strike price corridor from $110.0 to $192.5, throughout the last 30 days.

Expedia Group Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXPE | CALL | SWEEP | BULLISH | 01/17/25 | $21.5 | $21.1 | $21.5 | $160.00 | $107.6K | 1.3K | 151 |

| EXPE | CALL | TRADE | BEARISH | 01/17/25 | $21.95 | $21.0 | $21.28 | $160.00 | $106.4K | 1.3K | 51 |

| EXPE | PUT | TRADE | BULLISH | 11/22/24 | $1.43 | $0.72 | $0.74 | $172.50 | $88.8K | 54 | 1.2K |

| EXPE | CALL | TRADE | BULLISH | 01/17/25 | $21.3 | $21.05 | $21.3 | $160.00 | $78.8K | 1.3K | 101 |

| EXPE | CALL | TRADE | BEARISH | 01/17/25 | $41.75 | $40.25 | $40.81 | $140.00 | $65.2K | 1.3K | 16 |

About Expedia Group

Expedia is the world’s second-largest online travel agency by bookings, offering services for lodging (80% of total 2023 sales), air tickets (3%), rental cars, cruises, in-destination, and other (11%), and advertising revenue (6%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

Having examined the options trading patterns of Expedia Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Expedia Group

- With a volume of 719,408, the price of EXPE is down -1.06% at $180.33.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 83 days.

Expert Opinions on Expedia Group

In the last month, 5 experts released ratings on this stock with an average target price of $173.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Expedia Group, targeting a price of $210.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Expedia Group, targeting a price of $166.

* An analyst from Jefferies persists with their Hold rating on Expedia Group, maintaining a target price of $160.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Expedia Group with a target price of $153.

* An analyst from Wedbush persists with their Neutral rating on Expedia Group, maintaining a target price of $180.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Expedia Group options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

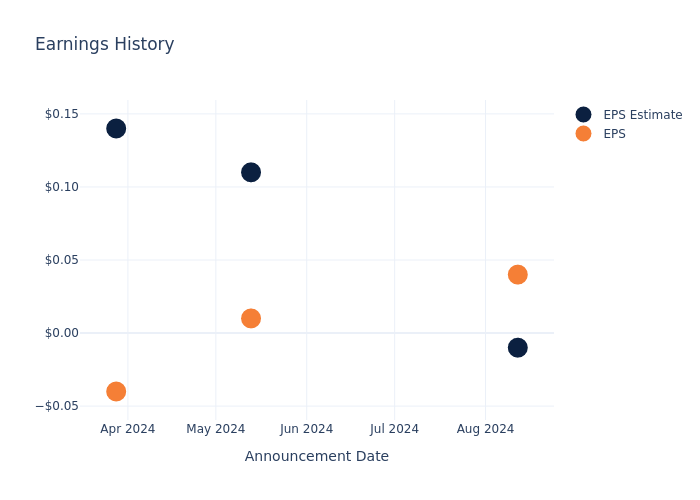

Insights Ahead: Bitdeer Technologies's Quarterly Earnings

Bitdeer Technologies BTDR will release its quarterly earnings report on Monday, 2024-11-18. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Bitdeer Technologies to report an earnings per share (EPS) of $-0.07.

The market awaits Bitdeer Technologies’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Performance in Previous Earnings

The company’s EPS beat by $0.05 in the last quarter, leading to a 3.68% increase in the share price on the following day.

Here’s a look at Bitdeer Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.01 | 0.11 | 0.14 | -0.04 |

| EPS Actual | 0.04 | 0.01 | -0.04 | -0.02 |

| Price Change % | 4.0% | -1.0% | 1.0% | 33.0% |

Market Performance of Bitdeer Technologies’s Stock

Shares of Bitdeer Technologies were trading at $10.74 as of November 14. Over the last 52-week period, shares are up 128.99%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Bitdeer Technologies

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Bitdeer Technologies.

With 7 analyst ratings, Bitdeer Technologies has a consensus rating of Buy. The average one-year price target is $12.57, indicating a potential 17.04% upside.

Analyzing Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of LiveRamp Holdings, PagerDuty and Iris Energy, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Buy trajectory for LiveRamp Holdings, with an average 1-year price target of $39.5, implying a potential 267.78% upside.

- PagerDuty received a Neutral consensus from analysts, with an average 1-year price target of $21.0, implying a potential 95.53% upside.

- Iris Energy received a Buy consensus from analysts, with an average 1-year price target of $15.67, implying a potential 45.9% upside.

Overview of Peer Analysis

The peer analysis summary presents essential metrics for LiveRamp Holdings, PagerDuty and Iris Energy, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Bitdeer Technologies | Buy | 5.77% | $24.41M | -4.08% |

| LiveRamp Holdings | Buy | 16.02% | $134.25M | 0.18% |

| PagerDuty | Neutral | 7.73% | $95.86M | -7.82% |

| Iris Energy | Buy | 70.58% | $49.01M | -3.05% |

Key Takeaway:

Bitdeer Technologies ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is at the top for Consensus rating and in the middle for Return on Equity.

Unveiling the Story Behind Bitdeer Technologies

Bitdeer Technologies Group is principally engaged in provision of digital asset mining services. Its majority business segments are: proprietary mining, cloud hash rate sharing and cloud hosting. The company operates five proprietary mining datacenters in the United States and Norway.

Unraveling the Financial Story of Bitdeer Technologies

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Bitdeer Technologies displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 5.77%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Bitdeer Technologies’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -17.88%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -4.08%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Bitdeer Technologies’s ROA excels beyond industry benchmarks, reaching -2.34%. This signifies efficient management of assets and strong financial health.

Debt Management: Bitdeer Technologies’s debt-to-equity ratio is below the industry average. With a ratio of 0.24, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Bitdeer Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

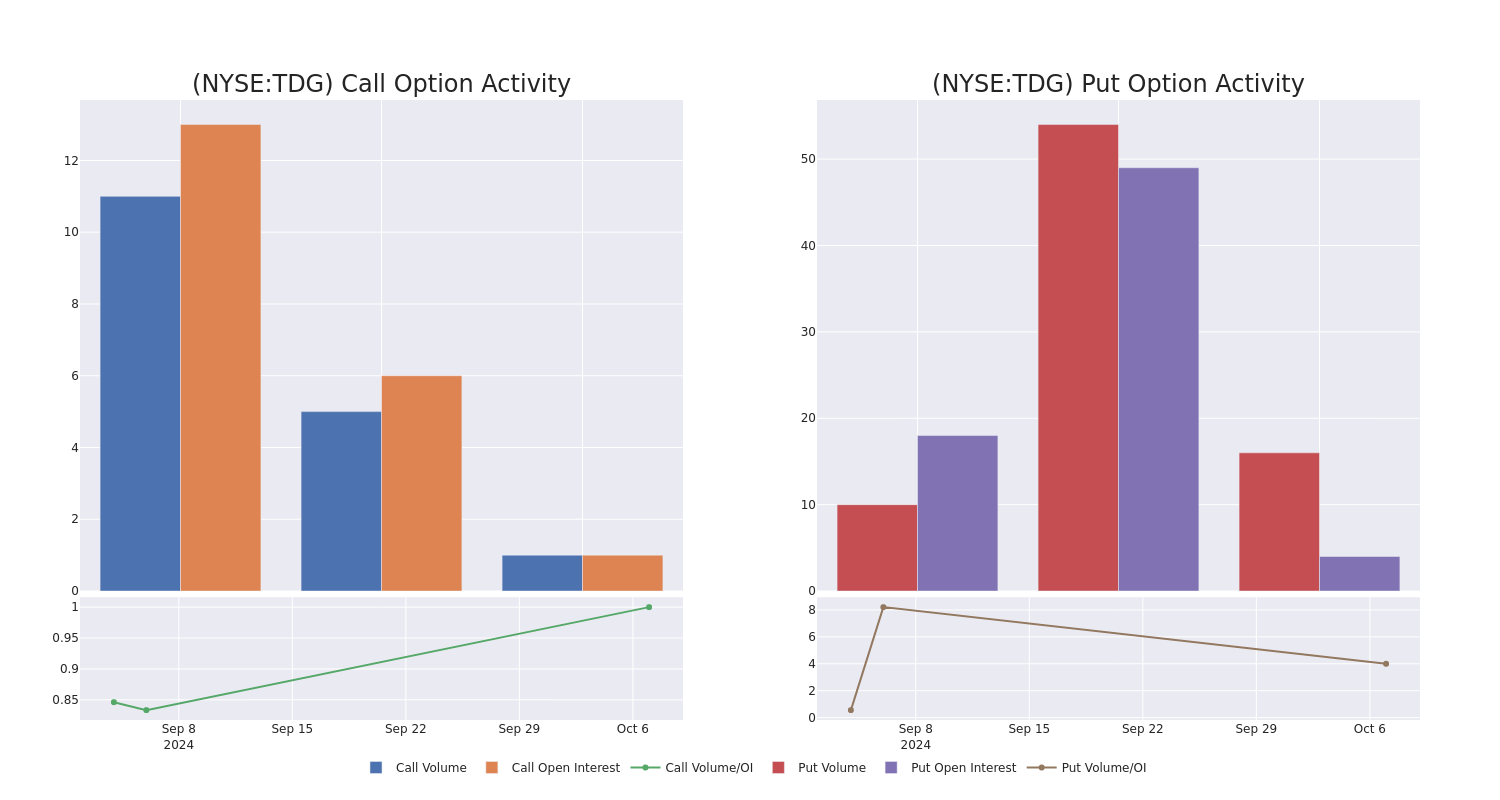

TransDigm Gr Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on TransDigm Gr TDG.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TDG, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for TransDigm Gr.

This isn’t normal.

The overall sentiment of these big-money traders is split between 26% bullish and 60%, bearish.

Out of all of the special options we uncovered, 12 are puts, for a total amount of $1,689,007, and 3 are calls, for a total amount of $122,970.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $765.0 and $1325.0 for TransDigm Gr, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for TransDigm Gr’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of TransDigm Gr’s whale trades within a strike price range from $765.0 to $1325.0 in the last 30 days.

TransDigm Gr Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TDG | PUT | SWEEP | BULLISH | 11/15/24 | $31.3 | $30.6 | $31.3 | $1305.00 | $356.8K | 121 | 114 |

| TDG | PUT | SWEEP | BEARISH | 01/17/25 | $54.2 | $52.0 | $53.5 | $1250.00 | $292.5K | 0 | 83 |

| TDG | PUT | SWEEP | BULLISH | 12/20/24 | $30.7 | $29.0 | $29.0 | $1200.00 | $287.1K | 4 | 205 |

| TDG | PUT | SWEEP | NEUTRAL | 12/20/24 | $26.8 | $22.4 | $26.0 | $1200.00 | $252.2K | 4 | 103 |

| TDG | PUT | SWEEP | BEARISH | 11/15/24 | $17.0 | $11.2 | $17.0 | $1265.00 | $170.0K | 34 | 102 |

About TransDigm Gr

TransDigm manufactures and services a diverse set of specialized parts for commercial and military aircraft. The firm organizes itself in three segments: power and control, airframes, and a small non-aviation segment, which serves mostly off-road vehicles and mining equipment. It operates as an acquisitive holding company that focuses its portfolio on firms that make proprietary aerospace products with substantial aftermarket demand. TransDigm regularly employs financial leverage to amplify its operating results.

Having examined the options trading patterns of TransDigm Gr, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of TransDigm Gr

- With a trading volume of 236,246, the price of TDG is up by 1.44%, reaching $1290.0.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 83 days from now.

Professional Analyst Ratings for TransDigm Gr

In the last month, 2 experts released ratings on this stock with an average target price of $1531.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on TransDigm Gr with a target price of $1500.

* An analyst from Citigroup has decided to maintain their Buy rating on TransDigm Gr, which currently sits at a price target of $1563.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest TransDigm Gr options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.