Genpact Insider Trades Send A Signal

It was reported on November 14, that Carol Lindstrom, Director at Genpact G executed a significant insider sell, according to an SEC filing.

What Happened: After conducting a thorough analysis, Lindstrom sold 3,218 shares of Genpact. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total transaction value is $149,875.

The latest market snapshot at Friday morning reveals Genpact shares down by 0.0%, trading at $45.1.

Get to Know Genpact Better

Genpact Ltd is a provider of business process management services. Clients are industry verticals and operate in banking and financial services, insurance, capital markets, consumer product goods, life sciences, infrastructure, manufacturing and services, healthcare, and high-tech. Genpact’s services include aftermarket, direct procurement, risk and compliance, human resources, IT, industrial solutions, collections, finance and accounting, and media services. Genpact’s end market by revenue is India. It is a General Electric spin-off, which is still a large source of revenue for Genpact.

Financial Insights: Genpact

Revenue Growth: Genpact displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 2.95%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 35.63%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Genpact’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 0.75.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.77.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 12.39 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 1.75 is lower than the industry average, implying a discounted valuation for Genpact’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 11.16 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Genpact’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Preview For i3 Verticals

i3 Verticals IIIV is gearing up to announce its quarterly earnings on Monday, 2024-11-18. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that i3 Verticals will report an earnings per share (EPS) of $0.20.

i3 Verticals bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

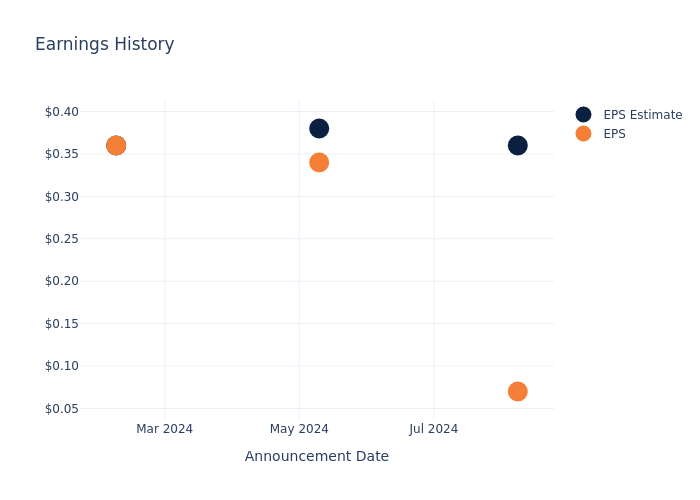

Earnings Track Record

During the last quarter, the company reported an EPS missed by $0.29, leading to a 7.47% drop in the share price on the subsequent day.

Here’s a look at i3 Verticals’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.36 | 0.38 | 0.36 | 0.4 |

| EPS Actual | 0.07 | 0.34 | 0.36 | 0.4 |

| Price Change % | -7.000000000000001% | -10.0% | -2.0% | 0.0% |

i3 Verticals Share Price Analysis

Shares of i3 Verticals were trading at $24.87 as of November 14. Over the last 52-week period, shares are up 19.95%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on i3 Verticals

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on i3 Verticals.

A total of 4 analyst ratings have been received for i3 Verticals, with the consensus rating being Buy. The average one-year price target stands at $29.5, suggesting a potential 18.62% upside.

Comparing Ratings with Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Cantaloupe, IntL Money Express and Repay Holdings, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Cantaloupe, with an average 1-year price target of $10.67, suggesting a potential 57.1% downside.

- Analysts currently favor an Buy trajectory for IntL Money Express, with an average 1-year price target of $27.5, suggesting a potential 10.57% upside.

- Repay Holdings is maintaining an Buy status according to analysts, with an average 1-year price target of $13.0, indicating a potential 47.73% downside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Cantaloupe, IntL Money Express and Repay Holdings are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| i3 Verticals | Buy | -2.14% | $51.31M | -3.02% |

| Cantaloupe | Outperform | 13.01% | $28.85M | 1.78% |

| IntL Money Express | Buy | -0.28% | $60.60M | 12.17% |

| Repay Holdings | Buy | 4.35% | $58.59M | -0.50% |

Key Takeaway:

i3 Verticals is at the bottom for Revenue Growth and Gross Profit, with negative values for both metrics. It is also at the bottom for Return on Equity. Overall, i3 Verticals is performing less favorably compared to its peers in terms of financial metrics.

Delving into i3 Verticals’s Background

i3 Verticals Inc offers integrated payment and software solutions to small and medium-sized businesses and organizations in strategic vertical markets. Its operating segment includes Merchant Services and Software and Services. The company generates maximum revenue from the Software and Services segment. The company’s strategic vertical market includes schools, the public sector, not-for-profit organizations, healthcare and others. It provides various solutions such as, gateway, payment processing, online payment, Document management, and ERP among others.

Financial Milestones: i3 Verticals’s Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: i3 Verticals’s revenue growth over a period of 3 months has faced challenges. As of 30 June, 2024, the company experienced a revenue decline of approximately -2.14%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of -13.46%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): i3 Verticals’s ROE excels beyond industry benchmarks, reaching -3.02%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): i3 Verticals’s ROA excels beyond industry benchmarks, reaching -0.87%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.54.

To track all earnings releases for i3 Verticals visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Bloom Energy Stock Rocketed 48% on Friday

Bloom Energy (NYSE: BE) investors are having a terrific Friday, as shares of the renewable energy company surged 47.8% through 10:30 a.m. ET.

Last night, Bloom Energy announced a deal to supply up to 1 gigawatt’s-worth of fuel cells to electric utility American Electric Power (NASDAQ: AEP).

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Last night’s announcement comes on the heels of a miserable earnings report from Bloom last week — a report that was redeemed by Bloom’s announcement of a deal to set up an 80-megawatt fuel cell system for South Korea’s SK Eternix. There’s 1,000 megawatts in a gigawatt, though.

So today’s news is 12.5 times bigger than that one, which explains the size of the reaction investors are having to it.

As Bloom explained, AEP intends to buy Bloom’s fuel cell systems to deploy them at the location of some of its customers’ AI data centers. (Yes, you read that right. Bloom Energy is an artificial intelligence stock now.) Rollout will begin with an initial order of 100 MW worth of fuel cells (so already more than last week’s announcement), with more fuel cells to be ordered in 2025, and being “rapidly deployed.”

In total, the AEP deal promises to roll out roughly 77% of the volume of fuel cells Bloom has already deployed (1.3 GW) over its entire 23 years of existence. While Bloom didn’t say how big the AEP deal will be in terms of revenue, if you compare historical data on Bloom’s revenues since 2014, which is as far back as the historical data goes on S&P Global Market Intelligence, this implies the AEP deal could eventually yield revenues well in excess of $7 billion for Bloom.

Moreover, Bloom has already reached a point at which this revenue is gross-profitable, generating gross profit margins of nearly 24% in Q3, and while profitable operating and net margins are finally looking achievable.

This deal could be the one that puts Bloom over the top, and finally turns the company profitable.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

S&P 500 Down Over 1%; US Retail Sales Top Expectations

U.S. stocks traded lower midway through trading, with the S&P 500 falling by over 1% on Friday.

The Dow traded down 0.90% to 43,356.00 while the NASDAQ fell 2.26% to 18,676.22. The S&P 500 also fell, dropping, 1.42% to 5,864.40.

Check This Out: Top 4 Utilities Stocks That May Keep You Up At Night This Quarter

Leading and Lagging Sectors

Energy shares rose by 0.4% on Friday.

In trading on Friday, information technology shares fell by 1.9%.

Top Headline

U.S. retail sales rose 0.4% month-over-month in October compared to a revised 0.8% increase in September, and toping market estimates of 0.3%.

Equities Trading UP

- The Arena Group Holdings, Inc. AREN shares shot up 232% to $1.89 after it announced its first ever profitable quarter.

- Shares of Bloom Energy Corporation BE got a boost, surging 49% to $19.80. Bloom Energy announced a 1 GW fuel cell deal with AEP, providing clean power for AI Data Centers.

- Simpple Ltd. SPPL shares were also up, gaining 90% to $1.6601 after the company announced a $400,000 contract to supply autonomous cleaning robots at Singapore’s International Airport Terminal.

Equities Trading DOWN

- TFF Pharmaceuticals, Inc. TFFP shares dropped 78% to $0.3581 after the company announced it will wind down its operations.

- Shares of Eyenovia, Inc. EYEN were down 73% to $0.0932 after the company announced that its CHAPERONE trial is not meeting its primary endpoint, prompting the discontinuation of the study and a review of the full data set to evaluate next steps for the program.

- Ryvyl Inc. RVYL was down, falling 33% to $1.1724 after the company reported worse-than-expected third-quarter financial results and cut its FY24 sales guidance.

Commodities

In commodity news, oil traded down 0.5% to $68.35 while gold traded up 0.2% at $2,579.20.

Silver traded up 0.7% to $30.79 on Friday, while copper rose 0.8% to $4.1220.

Euro zone

European shares were mostly lower today. The eurozone’s STOXX 600 fell 0.58%, Germany’s DAX fell 0.16% and France’s CAC 40 fell 0.26%. Spain’s IBEX 35 Index gained 0.82%, while London’s FTSE 100 fell 0.06%.

The annual inflation rate in Italy increased to 0.9% in October versus 0.7% in the prior month, while France’s annual inflation rate rose to 1.2% in October. The GDP in the UK grew by 1% year-over-year during the third quarter.

Asia Pacific Markets

Asian markets closed lower on Friday, with Japan’s Nikkei 225 gaining 0.28%, Hong Kong’s Hang Seng Index falling 0.05% and China’s Shanghai Composite Index dipping 1.45%.

Hong Kong’s economy expanded by 1.8% year-over-year in the third quarter compared to a 3.2% increase in the previous period. China’s retail sales rose by 4.8% year-over-year in October, while industrial production rose by 5.3% year-over-year in October.

Economics

- The NY Empire State Manufacturing Index surged to 31.2 in November versus -11.9 in the previous month and topping market estimates of -0.7.

- U.S. export prices increased by 0.8% in October, while import prices rose by 0.3% month-over-month in October.

- U.S. retail sales rose 0.4% month-over-month in October compared to a revised 0.8% increase in September, and toping market estimates of 0.3%.

- U.S. industrial production declined by 0.3% in October compared to a revised 0.5% declined in September.

- U.S. business inventories rose 0.1% month-over-month in September compared to a 0.3% gain in August and versus market estimates of 0.2%.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Motorola Solns Recent Insider Activity

A substantial insider sell was reported on November 14, by Gregory Q Brown, Chairman and CEO at Motorola Solns MSI, based on the recent SEC filing.

What Happened: Brown’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday unveiled the sale of 120,000 shares of Motorola Solns. The total transaction value is $59,532,058.

As of Friday morning, Motorola Solns shares are down by 0.51%, currently priced at $491.2.

Discovering Motorola Solns: A Closer Look

Motorola Solutions is a leading provider of communications and analytics, primarily serving public safety departments as well as schools, hospitals, and businesses. The bulk of the firm’s revenue comes from sales of land mobile radios and radio network infrastructure, but the firm also sells surveillance equipment and dispatch software. Most of Motorola’s revenue comes from government agencies, while roughly 25% comes from schools and private businesses. Motorola has customers in over 100 countries and in every state in the United States.

Financial Insights: Motorola Solns

Revenue Growth: Motorola Solns displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 9.15%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 51.36%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Motorola Solns’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 3.36.

Debt Management: With a high debt-to-equity ratio of 4.96, Motorola Solns faces challenges in effectively managing its debt levels, indicating potential financial strain.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: Motorola Solns’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 54.07.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 7.92 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 34.92 positions the company as being more valued compared to industry benchmarks.

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Cracking Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Motorola Solns’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Canadian Cannabis Producer Rubicon Reports Record Q3 Revenue Of $13.5M, 34% YoY Growth

Cannabis producer Rubicon Organics Inc. ROMJ ROMJF reported its third quarter financial results for the three months ended Sept. 30, 2024.

The British Columbia-based company achieved a record net revenue of CA$13.5 million ($9.6 million) for the quarter, representing a 34% increase year-over-year.

“Rubicon Organics continues to innovate and expand our product offerings, solidifying a strong market share in premium flower, pre-rolls, edibles, and more,” said CFO Janis Risbin. “I’m particularly proud of the success of our 2024 vape launch, which has already achieved 55% distribution in just six months. Looking ahead, we expect to drive further growth in Canada and beyond, as we intend for new market entry in 2025.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 2024 Financial Highlights

- Net revenue totaled CA$13.5 million, representing a 34% increase year-over-year.

- Gross profit before fair value adjustments was CA$4.4 million, representing a 35% year-over-year increase.

- Adjusted EBITDA came in positive at CA$2 million, up from CA$1.1 million in the prior year’s period.

- Positive operating cash flow was CA$0.9 million.

Product And Brand Highlights

- Wildflower is one of Canada’s leading cannabis wellness brands, with a 27.8% market share in topicals.

- The company’s premium edibles held a 28.5% market share in the third quarter of 2024.

- Rubicon launched 1964 Supply Co vape products, with strong growth and distribution already at 55% in six months.

ROMJF Price Action

Rubicon’s shares traded 2.5263% lower at $0.2778 per share at the time of writing on Friday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Rescheduling Cannabis Could Allow For Hemp Tobacco Cigarettes, But Not Weed And Tobacco Mixtures: No Spliff For You!

This article was originally published on Cannabis.net and appears here with permission.

Marijuana rescheduling could permit CBD from hemp in tobacco, but not weed!

A recent report from the Congressional Research Service (CRS) has ignited discussions about the potential for incorporating hemp-derived cannabidiol (CBD) into tobacco products, contingent upon the anticipated rescheduling of marijuana. As public perceptions of cannabis evolve and regulatory frameworks shift, this development could have profound implications for both the cannabis and tobacco industries, as well as for public health initiatives aimed at reducing smoking-related harm.

Understanding The Context Of Marijuana Rescheduling

Historically, marijuana has been classified as a Schedule I substance under the Controlled Substances Act (CSA), indicating that it is viewed as having no accepted medical use and a high potential for abuse. However, with growing evidence supporting the medicinal benefits of cannabis and changing public perceptions, there has been increasing momentum toward rescheduling marijuana. In August 2023, the Department of Health and Human Services (HHS) recommended that marijuana be reclassified to Schedule III, which would acknowledge its medical applications and significantly alter the regulatory landscape surrounding cannabis.

Implications Of Rescheduling

If marijuana is rescheduled to Schedule III, it would not only ease restrictions on research and development but also open new avenues for product innovation. According to the CRS report, while marijuana itself would still be prohibited in food, dietary supplements, or cosmetics, hemp-derived CBD could be used as an additive in tobacco products without violating federal law. This distinction is crucial because it allows manufacturers to explore new formulations that combine the non-psychoactive properties of CBD with traditional tobacco.

The Rise Of CBD And Its Potential Benefits

CBD, or cannabidiol, is one of over 100 cannabinoids found in the cannabis plant. Unlike THC (tetrahydrocannabinol), which is responsible for the psychoactive effects commonly associated with marijuana, CBD does not produce a high. Instead, it has gained immense popularity due to its purported health benefits, including anxiety reduction, pain relief, anti-inflammatory properties, and potential neuroprotective effects.

As consumers become more health-conscious and seek alternatives to traditional pharmaceuticals, CBD has emerged as a viable option for many individuals looking to manage various health conditions. Its non-psychoactive nature makes it particularly appealing to those who wish to avoid the intoxicating effects of THC while still benefiting from the therapeutic properties of cannabis.

Potential Health Benefits Of CBD In Tobacco Products

- Reduction in Cravings: By potentially inhibiting nicotine metabolism, CBD may help reduce cravings among smokers trying to quit or cut back on their tobacco use.

- Anxiety Relief: Many smokers use cigarettes as a way to cope with stress or anxiety. Incorporating CBD into tobacco products could provide an alternative method for managing these feelings without resorting solely to nicotine.

- Anti-inflammatory Properties: Research suggests that CBD may have anti-inflammatory effects that could counteract some of the harmful consequences of smoking.

- Harm Reduction: The addition of CBD may make tobacco products less harmful by providing therapeutic benefits that could offset some negative health impacts associated with nicotine consumption.

Regulatory Considerations

Despite these promising developments, any products containing CBD would still require marketing authorization from the Food and Drug Administration (FDA) before they can be legally sold. The FDA’s role in regulating hemp-derived products is crucial to ensuring consumer safety and product efficacy.

Public Health Implications

The potential introduction of CBD into tobacco products raises important public health considerations. While incorporating CBD may reduce some harmful effects associated with traditional smoking, it is crucial to assess whether this combination could inadvertently encourage smoking behavior among new users or young people.

Public health advocates will need to monitor these developments closely to ensure that any new products do not undermine efforts to reduce smoking rates or promote healthier alternatives. Additionally, ongoing research will be necessary to evaluate the long-term effects of using CBD in conjunction with nicotine.

Current Regulatory Landscape

As it stands, hemp-derived CBD is legal at the federal level due to the 2018 Farm Bill, which legalized hemp cultivation and removed hemp-derived products containing less than 0.3% THC from Schedule I classification. However, this legalization does not automatically grant approval for all hemp-derived products; they must still comply with FDA regulations regarding safety and labeling.

The FDA has expressed concerns ove” unregulated CBD products flooding the market without proper testing or oversight. As such, manufacturers seeking to incorporate CBD into tobacco products will need to navigate a complex regulatory landscape while ensuring compliance with all applicable laws.

Potential Challenges Ahead

While the prospect of combining CBD with tobacco presents exciting opportunities, several challenges remain:

-

Regulatory Hurdles: The FDA’s approval process can be lengthy and complex. Manufacturers will need to demonstrate that their products meet safety standards and provide adequate labeling information.

-

Consumer Education: As CBD-infused tobacco products enter the market, educating consumers about their benefits and potential risks will be essential. Misunderstandings about CBD may lead to skepticism or misuse.

-

Market Competition: The tobacco industry is highly competitive; introducing new products requires significant investment in marketing and distribution channels.

-

Quality Control: Ensuring consistent quality across different batches of CBD-infused tobacco products will be critical for maintaining consumer trust and safety.

-

Public Health Concerns: While integrating CBD into tobacco may offer some benefits, there are concerns that it could inadvertently encourage smoking behavior among new users or young people who might view these products as safer alternatives.

Conclusion

The report from the Congressional Research Service highlights a significant shift in how we might view the intersection between cannabis and tobacco industries if marijuana is rescheduled from Schedule I status under federal law. Such changes could pave pathways toward innovative product development incorporating hemp-derived ingredients like cannabidiol (CBD) within traditional smoking contexts—ultimately reshaping consumer choices while addressing pressing public health concerns related directly tied back towards smoking-related harms.

As stakeholders navigate this evolving landscape—collaboration between regulators researchers manufacturers—and public health officials will prove vital moving forward towards creating safe effective options available across diverse populations seeking healthier alternatives amidst ongoing challenges presented by both industries’ histories intertwined within broader societal contexts surrounding drug policy reform overall! By prioritizing safety efficacy through rigorous research transparent communication consumers, this new frontier product development holds promise leading healthier lifestyles across America’s diverse population seeking better choices today.

This article is from an external unpaid contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spectrum Brands Stock Falls After Q4 Earnings Miss On Lower Investment Income: Details

Spectrum Brands Holdings, Inc. SPB shares are trading lower on Friday.

The company reported fourth-quarter adjusted earnings per share of 97 cents, missing the street view of $1.07. Quarterly revenues were $773.7 million (+4.5%), beating the analyst consensus of $747.51 million.

Gross profit surged 17.8% to $288 million. Gross profit and margin increased due to productivity improvements, operational efficiencies, and inventory actions in the prior year, partially offset by ocean freight inflation.

Adjusted EBITDA decreased $42.6 million, driven by $32.5 million of lower investment income and $25.9 million of increased brand-focused investments, offset by gross profit improvements.

As of the fiscal year-end, the company reported a cash balance of $369 million and total liquidity of $860 million, including undrawn capacity on its cash flow revolver.

It had $578 million in outstanding debt, consisting of $496 million in senior unsecured notes and around $82 million in finance lease obligations, resulting in a net debt of approximately $209 million.

Outlook: Spectrum Brands expects low single-digit growth in reported net sales in fiscal 2025 and adjusted EBITDA to increase by mid to high single-digits. Adjusted free cash flow is expected to be approximately 50% of adjusted EBITDA.

The company continues to target a long-term net leverage ratio of 2.0 – 2.5 times.

“I am excited about the upcoming year. Our focus during fiscal 2025 will be to continue the momentum we built in fiscal 2024 by investing in our brands to drive long-term growth, in innovation to expand core and adjacent categories, and in our operations to drive further cost improvement, quality and safety,” said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

Price Action: SPB shares are trading lower by 4.78% to $89.38 at last check Friday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.