Powell Speaks The Truth – Market Does Not Like It, Consternation About Kennedy, Gaetz, And Hegseth

To gain an edge, this is what you need to know today.

Powell Speaks The Truth

Please click here for an enlarged chart of SPDR S&P 500 ETF Trust SPY which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- It is worth a reminder that The Arora Report is politically agnostic. Our sole job is to help our members extract the maximum amount of money out of the markets with the least possible risk.

- The price action on the chart shows that the rip roaring Trump rally is taking a breather.

- The chart shows that the stock market is still above the breakout line.

- RSI on the chart shows that the stock market has pulled back, reflecting a loss of momentum. The stock market is still overbought.

- The chart shows that the volume remains low. This indicates that institutional investors are not rushing to buy stocks.

- Yesterday, Powell spoke that truth – the market did not like it. Powell said, “The economy is not sending any signals that we need to be in a hurry to lower rates.” Powell elaborated, “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

- Powell’s remarks brought some selling into stocks and bonds.

- This morning, in the early trade, selling continues.

- The reason for some selling is that the prevailing wisdom on Wall Street has been that another rate cut in December was a sure thing. The Arora Report has been questioning Wall Street’s wisdom and sharing with you that the data does not support another rate cut.

- Some conservative commentators are upset believing that the reason Powell started rate cuts with a 50 bps cut was to help Kamala Harris get elected. Now that Trump has been elected, Powell is in no hurry to cut rates.

- In The Arora Report analysis, even though the data does not support a rate cut in December, Powell is going to feel pressure from Trump and Republicans to cut rates. There is also a significant amount of data between now and the December Fed meeting.

- In The Arora Report analysis, based on a 360 degree view, including the political pressure and the pressure from Wall Street to cut rates, the probability of a rate cut in December is now about 60%.

- There is consternation about several Trump picks. Impacting the market most are Trump’s picks of RKF Jr, Matt Gaetz, and Pete Hegseth. These picks are bringing selling in vaccine makers such as Moderna Inc MRNA, BioNTech SE ADR BNTX, Novavax Inc NVAX, Merck & Co Inc MRK, and Pfizer Inc PFE. There is also selling in other healthcare stocks, including weight loss drug companies Eli Lilly And Co LLY and Novo Nordisk A/S NVO, and packaged food stocks such as The Kraft Heinz Co KHC. There is also selling in defense stocks such as Boeing Co BA, Lockheed Martin Corp LMT, Northrop Grumman Corp NOC, and Rtx Corp RTX. There is also selling in big tech stocks.

- The latest economic data is strong. The U.S. economy is about 70% consumer based. For this reason, prudent investors pay attention to retail sales. Here are the details of the just released data:

- Retail sales came at 0.4% vs. 0.3% consensus.

- Retail sales ex-auto came at 0.1% vs. 0.2% consensus.

- There are hundreds of indicators. At The Arora Report, the system has been refined through decades of research to share with you only those indicators that matter. Normally, we do not mention the NY Fed Empire State Manufacturing Index. Today, we are mentioning it due to its exceptional strength. The index came at 31.2 vs. 3.3 consensus. This indicates that manufacturing in the New York area has picked up steam. If similar strength is happening in the rest of the country, that would argue against further cutting interest rates. The problem for investors is that stock valuations are so high that to sustain them, rate cuts are needed.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Tesla Inc TSLA.

In the early trade, money flows are negative in Apple Inc AAPL, Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, Meta Platforms Inc META, Microsoft Corp MSFT, and NVIDIA Corp NVDA.

In the early trade, money flows are negative in S&P 500 ETF (SPY) and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Even the slightest dips in Bitcoin BTC/USD are being bought.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. The proprietary protection band from The Arora Report is very popular. The protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Musk expands lawsuit against OpenAI, adding Microsoft and antitrust claims

By Mike Scarcella

(Reuters) -Billionaire entrepreneur Elon Musk expanded his lawsuit against ChatGPT maker OpenAI, adding federal antitrust and other claims and adding OpenAI’s largest financial backer Microsoft as a defendant.

Musk’s amended lawsuit, filed on Thursday night in federal court in Oakland, California, said Microsoft and OpenAI illegally sought to monopolize the market for generative artificial intelligence and sideline competitors.

Like Musk’s original August complaint, it accused OpenAI and its chief executive, Samuel Altman, of violating contract provisions by putting profits ahead of the public good in the push to advance AI.

“Never before has a corporation gone from tax-exempt charity to a $157 billion for-profit, market-paralyzing gorgon — and in just eight years,” the complaint said. It seeks to void OpenAI’s license with Microsoft and force them to divest “ill-gotten” gains.

OpenAI in a statement said the latest lawsuit “is even more baseless and overreaching than the previous ones.” Microsoft declined to comment.

“Microsoft’s anticompetitive practices have escalated,” Musk’s attorney Marc Toberoff said in a statement. “Sunlight is the best disinfectant.”

Musk has a long-simmering opposition to OpenAI, a startup he co-founded and that has since become the face of generative AI through billions of dollars in funding from Microsoft.

Musk has gained new prominence as a key force in U.S. President-elect Donald Trump’s incoming administration. Trump named Musk to a new role designed to cut government waste, after he donated millions of dollars to Trump’s Republican campaign.

The expanded lawsuit said OpenAI and Microsoft violated antitrust law by conditioning investment opportunities on agreements not to deal with the companies’ rivals. It said the companies’ exclusive licensing agreement amounted to a merger lacking regulatory approvals.

In a court filing last month, OpenAI accused Musk of pursuing the lawsuit as part of an “increasingly blusterous campaign to harass OpenAI for his own competitive advantage.”

(Reporting by Mike Scarcella; editing by David Bario and Jonathan Oatis)

California Cannabis Company Lowell Farms Reports 48% YoY Revenue Decline In Q3

California cannabis company Lowell Farms Inc. LOWLF announced its unaudited revenue and operating results Thursday for the third quarter of 2024, reporting net revenue of $3.2 million, down 48% from $6.2 million in the same period last year. Net revenue decreased by 8% from $3.5 million in the second quarter of 2024.

“We’re happy to share the progress Lowell Farms made towards expanding our footprint into the California retail market,” stated co-founder and CEO Mark Ainsworth. “This strategic move marks a new chapter for us, enabling us to further showcase the strength of our brand portfolio, now in our own retail spaces and deliver an enhanced customer experience. As we focus on strategic, selective growth, we’re confident that this expansion will solidify Lowell’s position in the market, bringing us closer to our vision for sustainable and meaningful growth.”

Read Also: IM Cannabis: 66% Revenue Growth In Germany, Narrows EBITDA Loss In Q3

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 Financial Highlights

- CPG revenue decreased 26% compared to the same quarter of 2023.

- Bulk product revenue from self-grown wholesale products was $nil million compared to $1.2 million for the quarter ended Sept. 30, 2023, reflecting our exit from the cultivation facility in January 2024.

- Gross margin was negative 29.0% representing a gross loss of $900,000, reflecting the sell through of higher cost inventory associated with the cultivation facility which adversely impacted cost of goods sold by $600,000 in the third quarter.

- Operating loss was $2.8 million, compared to operating loss of $2.9 million for the same period last year.

- Net loss was $3.6 million compared to a net loss of $20.2 million for the comparable period of 2023.

- Adjusted EBITDA was negative $2.1 million compared to adjusted EBITDA of negative $1.4 million for the third quarter last year.

Price Action

Lowell Farms shares closed Thursday’s market session flat at $0.015 per share.

Read Next:

Photo: Courtesy of YARphotographer via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

British Economy Slows On Lackluster Services, Budget Jitters

The British economy expanded less than forecast in the third quarter as the service sector and budget concerns slowed momentum.

Gross domestic product (GDP) grew by 0.1% for the quarter, compared with growth of 0.5% in Q2, data from the Office for National Statistics (ONS) showed on Friday. That compared with economists’ expectations of 0.3% for Q3.

“The economy grew a little in the latest quarter overall as the recent slowdown in growth continued,” Liz McKeown, Director of Economic Statistics at ONS, said. “Generally, growth was subdued across most industries in the latest quarter.”

The services sector, which accounts for 79% of the UK’s GDP, rose only 0.1%, weighing on the UK GDP as technical activities and wholesale and retail trade showed marginal improvements. Business-facing services saw no growth.

British Economy Hurt By Manufacturing Contraction

The British economy contracted by 0.1% in September month-on-month, missing forecasts of a 0.1% expansion. Services on a monthly basis showed “no growth,” McKeown said, adding that “production fell overall, driven by manufacturing,” with a contraction of 1%.

The weak data underlines the challenges that the Labour Party faces as it tries to revive economic growth. Industrial production contracted by 0.5% in September, missing forecasts of 0.2% growth month-on-month.

The British pound fell to the lowest level against the dollar since early July, extending a five-day decline to $1.2629. The pound has been weighed down by fears of trade escalation and poor relations with the US under President-elect Donald Trump.

British Foreign Secretary David Lammy has described Trump as “deluded, dishonest, xenophobic, narcissistic” and a “neo-Nazi-sympathizing sociopath.”

Slow British Economy Growth Brings Rate Cut On Table

The latest UK GDP figures have shifted the focus on the Bank of England’s (BoE) monetary policy trajectory. The BoE lowered interest rates on November 6 by 0.25 percentage points to 4.75%, the second cut this year.

“We shouldn’t overthink the GDP numbers we’ve been getting recently,” ING said. “The Bank of England has made it abundantly clear that it’s not putting much weight on them. Barring any downside surprises, we think the next move in December is a pause, before another rate cut in February.”

Most economists broadly expect a hold on December 19, when the Monetary Policy Committee meets next. But some argue that the UK GDP data make a solid case for a rate cut.

The data “are likely to open the door” to cuts before year’s end, Wealth Club investment manager, Isaac Stell, said. If growth slows again, there is a “good chance” of cuts, University of Liverpool Management School Professor, Costas Milas, said.

Labour Faces Challenges Spurring British Economy

Chancellor Rachel Reeves has made improving GDP at “the heart of everything.” The budget “tackled” public finances and greater public investment “in our plan for economic growth,” Reeves said on November 14.

The fiscal plan will provide “economic stability” by putting “our public finances back on a firm footing,” she said. “Instability in our public finances leads to instability in our financial markets. That is not good for investment.”

The government increased taxes by £40 billion to repair public finances and improve public services. It earmarked £22.6 billion for the National Health Service and a 1.2% increase in employers’ national insurance contributions.

Conservative MP Robert Jenrick called the tax increase “the biggest heist in modern history.” Conservative leader Kemi Badench questioned why Labour’s strategy always focused on “higher taxes, more borrowing, and lower growth.”

British Economy Faces ‘Big Risks’ in Budget

Reeves has argued that the tax hikes, aimed at the wealthiest, are necessary to sustain investments in healthcare, education, and infrastructure. However, the director of the Institute for Fiscal Studies (IFS), Paul Johnson, warned of “big risks lurking” in the budget.

“Big increases in taxes and borrowing are not costless,” he wrote on October 31. “Not all of the extra borrowing, by any means, was for investment spending.”

The Office for Budget Responsibility (OBR) cautioned on October 30 that rising government debt levels could put upward pressure on inflation. Having fallen back to around the 2% target in mid-2024, “we expect CPI inflation to pick up to 2.6% in 2025 partly due to the direct and indirect impact of Budget measures,” it said.

The British Chambers of Commerce (BCC) has warned of further employment costs and how much businesses could absorb. This could weaken GDP growth, which the OBR projects at 1.1% for 2024 and 2% for 2025.

“We need urgent action to drive growth, tackle the skills crisis, boost workforce health and reduce inactivity in the labor market,” the BCC said on November 12.

Public Spending Alone Won’t Spur British Economy

The government plans to spend £975 million over the next five years to create “thousands” of jobs in the aerospace industry. The extension will speed up innovation, create job opportunities and support an industry, the government said.

Deputy chief economist Luke Bartholomew at abrdn believes the budget will expand the UK government’s spending by £70bn over the next five years. This will lead to higher inflation and growth next year, he said.

For BoE governor Andrew Bailey, government spending won’t be enough to spur growth, especially as borrowing costs remain elevated. The average annual potential growth rate fell to 0.7% between 2020-2023, down from 1.3% between 2009-2019 and 2.6% between 1990-2008.

Business investment in the UK has been particularly weak by G7 standards,” he said in a speech on November 14. “We need to encourage business investment in the UK,” he said.

“Public investment is important as a foundation,” he said. “But, to those who have pointed out that this will not raise the potential growth rate substantially, my response is ‘of course not.'”

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Tumble as Post-Election Euphoria Fades: Markets Wrap

(Bloomberg) — Stocks fell as Trump trades lost steam and investors bet the Federal Reserve will have to slow the pace of policy easing.

Most Read from Bloomberg

The S&P 500 dropped for a second day, with tech stocks leading the decline. Including losses on Friday, the benchmark has now ceded more than half of the trough-to-peak gains it notched after the US presidential election.

Bond yields ticked higher as traders now see the probability of a quarter-point cut next month as a coin toss after a report on retail sales included large upside revision to September’s figure.

As the initial euphoria about Trump’s pro-business agenda begins to fade, investors are coming to terms with the costs of his fiscal plans and their potential to reignite inflation.

“It will come at the expense of potentially larger budget deficits, potentially larger debt and there is also the inflation dimension,” said Charles-Henry Monchau, chief investment officer at Banque Syz & Co. “There’s been a realization that there is a price to pay for this.”

The S&P 500 fell 1.2% and the tech-heavy Nasdaq 100 dropped more than 2%. Yields on 10-year Treasuries jumped to 4.5%, the highest since May 31.

Traders priced in a 50% chance the Fed will deliver a quarter-point reduction at its December meeting, down from 80% earlier this week. Bets on cuts were pared after Fed Chair Jerome Powell warned Thursday that the central bank may take its time easing policy. Boston Fed President Susan Collins said Friday a December cut remained on the table, emphasizing the central bank’s decision will be guided by incoming data.

Meanwhile, drugmakers Moderna Inc. and Pfizer Inc. came under pressure in New York trading after Trump named a prominent vaccine skeptic Robert F. Kennedy Jr. to a top health-policy role.

The greenback eased off two-year highs but is on track for its seventh straight weekly gain. Another of the so-called Trump trades, Bitcoin, has given up some gains this week, trading below $90,000 on Friday after hitting a record level above $93,000 earlier this week on hopes of crypto-friendly policies from the new US administration.

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 1.2% as of 11:37 a.m. New York time

-

The Nasdaq 100 fell 2.1%

-

The Dow Jones Industrial Average fell 0.7%

-

The Stoxx Europe 600 fell 0.8%

-

The MSCI World Index fell 1%

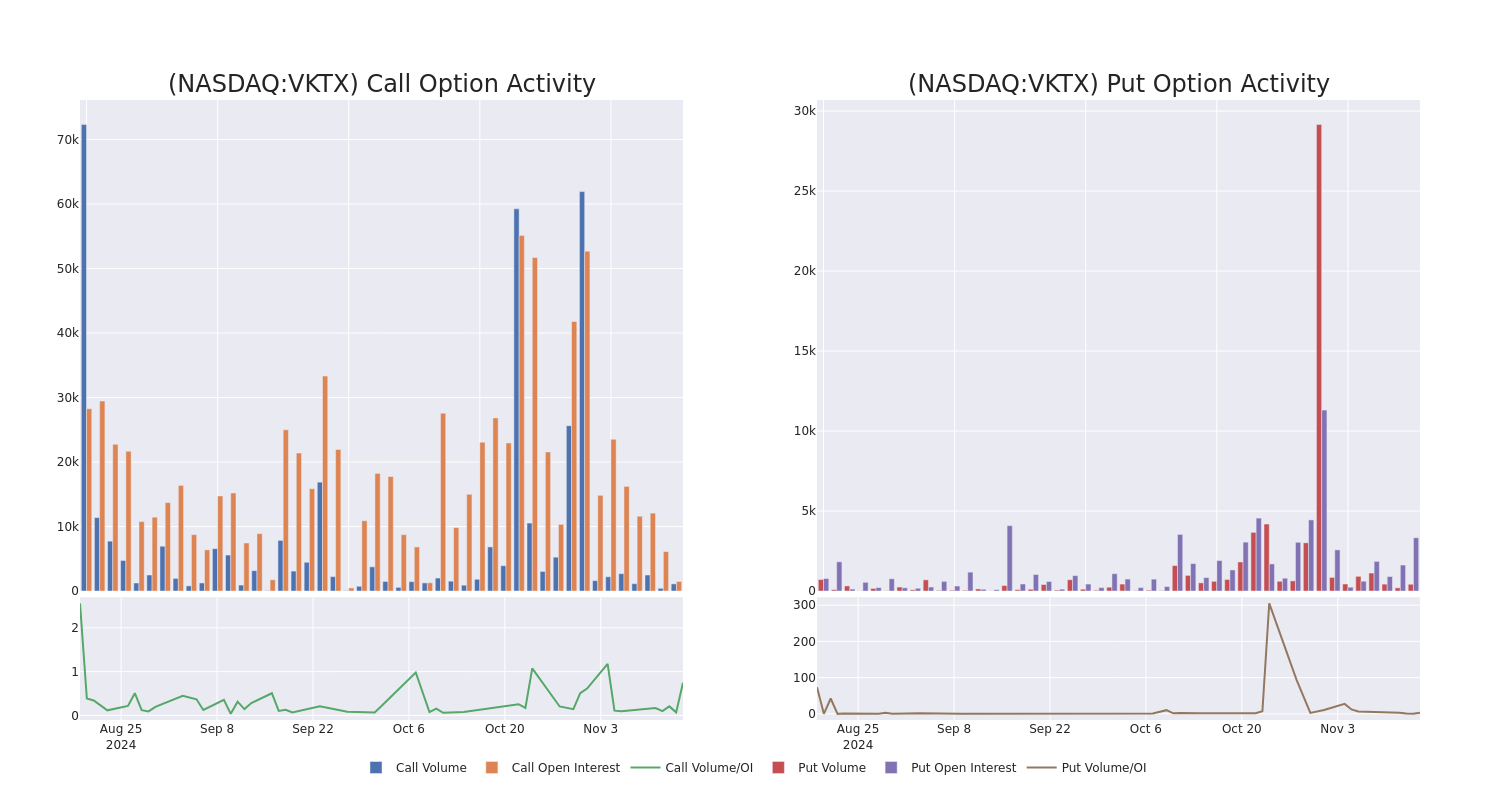

Market Whales and Their Recent Bets on VKTX Options

Investors with a lot of money to spend have taken a bearish stance on Viking Therapeutics VKTX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with VKTX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 14 uncommon options trades for Viking Therapeutics.

This isn’t normal.

The overall sentiment of these big-money traders is split between 42% bullish and 50%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $521,480, and 7 are calls, for a total amount of $238,153.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $40.0 and $100.0 for Viking Therapeutics, spanning the last three months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Viking Therapeutics options trades today is 344.29 with a total volume of 1,535.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Viking Therapeutics’s big money trades within a strike price range of $40.0 to $100.0 over the last 30 days.

Viking Therapeutics Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | PUT | SWEEP | BULLISH | 05/16/25 | $22.3 | $22.1 | $22.2 | $67.50 | $288.6K | 73 | 138 |

| VKTX | CALL | TRADE | BULLISH | 05/16/25 | $3.4 | $3.3 | $3.4 | $100.00 | $68.0K | 545 | 207 |

| VKTX | PUT | TRADE | BEARISH | 12/06/24 | $20.1 | $16.5 | $18.95 | $70.00 | $56.8K | 83 | 30 |

| VKTX | PUT | TRADE | NEUTRAL | 01/16/26 | $33.9 | $32.4 | $33.08 | $75.00 | $52.9K | 373 | 16 |

| VKTX | PUT | TRADE | BULLISH | 11/22/24 | $5.2 | $4.8 | $4.92 | $55.00 | $34.4K | 155 | 152 |

About Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company’s clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

In light of the recent options history for Viking Therapeutics, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Viking Therapeutics’s Current Market Status

- Currently trading with a volume of 2,854,236, the VKTX’s price is down by -4.56%, now at $51.13.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 82 days.

Expert Opinions on Viking Therapeutics

2 market experts have recently issued ratings for this stock, with a consensus target price of $96.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from HC Wainwright & Co. lowers its rating to Buy with a new price target of $90.

* Consistent in their evaluation, an analyst from HC Wainwright & Co. keeps a Buy rating on Viking Therapeutics with a target price of $102.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Viking Therapeutics, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Co. Vireo Reports 2% YoY Revenue Growth, Secures $10M In Financing

Vireo Growth Inc., formerly known as Goodness Growth Holdings, VREO VREOF reported on Wednesday financial results for its third quarter ended Sept. 30, 2024.

“Our third quarter results reflect continued solid performance across our core markets, but as we discussed anticipating last quarter, year-over-year comparisons of financial performance are less significant now that we have passed the one-year anniversary of the launch of adult-use sales in Maryland,” CEO Amber Shimpa said. “Our teams continue to focus on preparing for the launch of adult-use sales in Minnesota next year, and our recently announced $10.0 million financing commitment gives us additional flexibility to support this launch and continue executing our CREAM & Fire strategy.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 2024 Financial Highlights

- Revenue increased by 2% year-over-year to $25.2 million

- Revenue, excluding discontinued operations and the New York market, was up 6.2% year-over-year.

- Gross profit decreased by 6.6% year-over-year, reaching $12.3 million, with a gross margin of 49%, down from 53.5% in the prior year’s quarter.

- Operating income was $3.9 million, down 34.4% compared to the previous year’s third quarter.

- EBITDA dropped 19.4% to $5.7 million.

- Selling, general and administrative expenses increased by 2.4% year-over-year.

- Retail revenue grew 2% year-over-year and wholesale revenue saw a 24.4% increase over the same period.

- Vireo’s operations in Maryland and Minnesota showed mixed results with Maryland achieving 12.1% year-over-year growth, while Minnesota saw a slight decline.

In November, Vireo secured a new $10 million convertible debt facility to support its upcoming adult-use sales launch in Minnesota and continued operations.

VREOF Price Action

Vireo’s shares traded 5.15% lower at 4 cents per share after the market close on Thursday afternoon.

Read Also:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

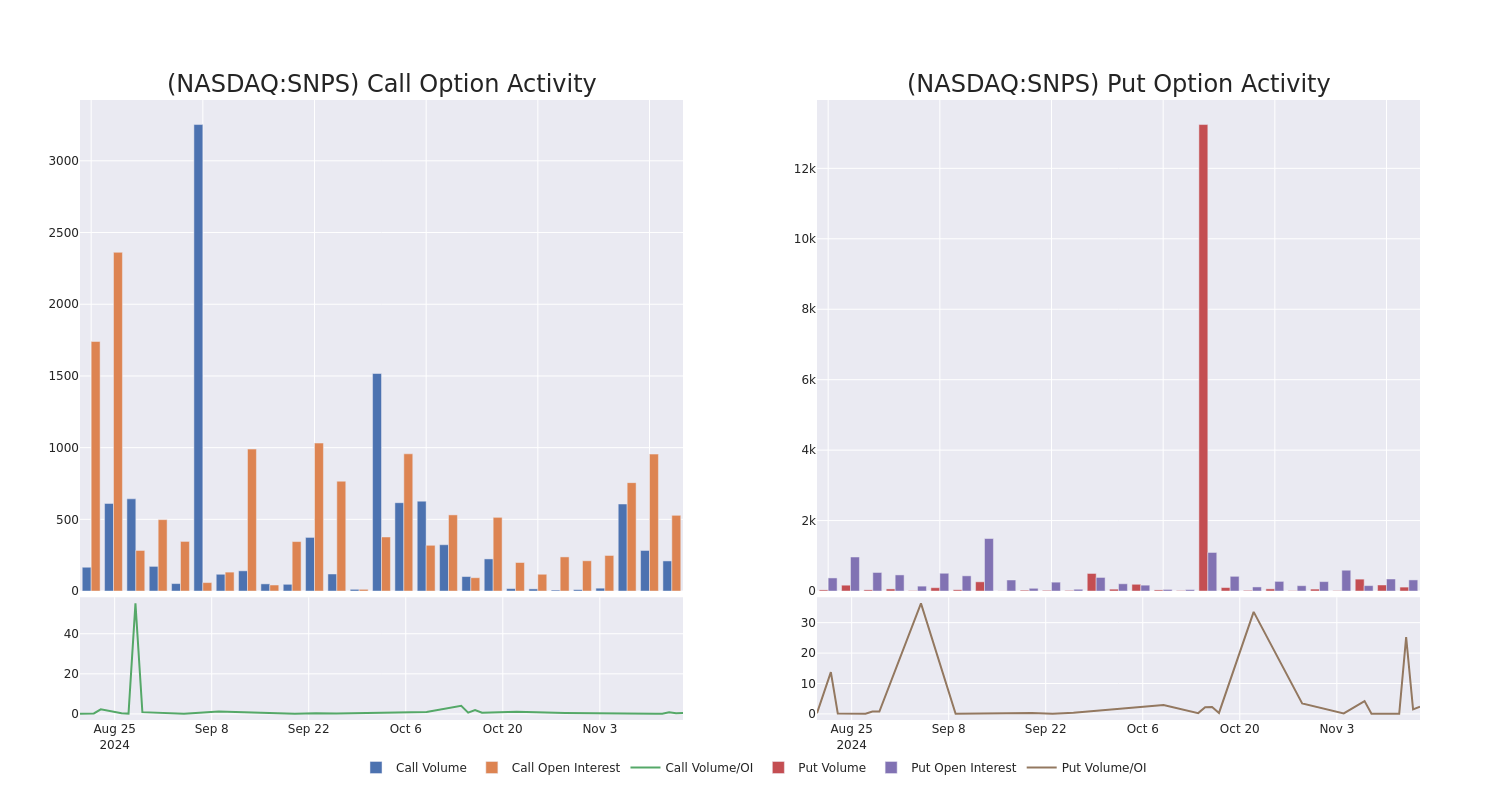

Synopsys Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Synopsys SNPS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SNPS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Synopsys. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 25% leaning bullish and 37% bearish. Among these notable options, 3 are puts, totaling $88,885, and 5 are calls, amounting to $268,163.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $520.0 to $670.0 for Synopsys during the past quarter.

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Synopsys stands at 140.67, with a total volume reaching 322.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Synopsys, situated within the strike price corridor from $520.0 to $670.0, throughout the last 30 days.

Synopsys Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNPS | CALL | SWEEP | BEARISH | 09/19/25 | $54.7 | $54.5 | $54.5 | $600.00 | $76.3K | 13 | 18 |

| SNPS | CALL | SWEEP | NEUTRAL | 01/17/25 | $41.8 | $36.7 | $38.0 | $520.00 | $61.7K | 43 | 0 |

| SNPS | CALL | SWEEP | BULLISH | 12/20/24 | $3.5 | $3.5 | $3.5 | $620.00 | $46.2K | 367 | 154 |

| SNPS | CALL | SWEEP | NEUTRAL | 01/17/25 | $29.3 | $28.4 | $28.0 | $540.00 | $45.7K | 105 | 5 |

| SNPS | CALL | SWEEP | BULLISH | 09/19/25 | $54.5 | $54.5 | $54.5 | $600.00 | $38.1K | 13 | 33 |

About Synopsys

Synopsys is a provider of electronic design automation software, intellectual property, and software integrity products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. The firm’s growing SI business allows customers to continuously manage and test the code base for security and quality. Synopsys’ comprehensive portfolio is benefiting from a mutual convergence of semiconductor companies moving up-stack toward systems-like companies, and systems companies moving down-stack toward in-house chip design. The resulting expansion in EDA customers alongside secular digitalization of various end markets benefits EDA vendors like Synopsys.

Having examined the options trading patterns of Synopsys, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Synopsys’s Current Market Status

- With a trading volume of 217,362, the price of SNPS is down by -3.59%, reaching $528.62.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 19 days from now.

Expert Opinions on Synopsys

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $658.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Loop Capital downgraded its action to Buy with a price target of $675.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Synopsys with a target price of $670.

* In a cautious move, an analyst from Mizuho downgraded its rating to Outperform, setting a price target of $650.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $640.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Synopsys options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.