Synopsys Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Synopsys SNPS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SNPS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Synopsys. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 25% leaning bullish and 37% bearish. Among these notable options, 3 are puts, totaling $88,885, and 5 are calls, amounting to $268,163.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $520.0 to $670.0 for Synopsys during the past quarter.

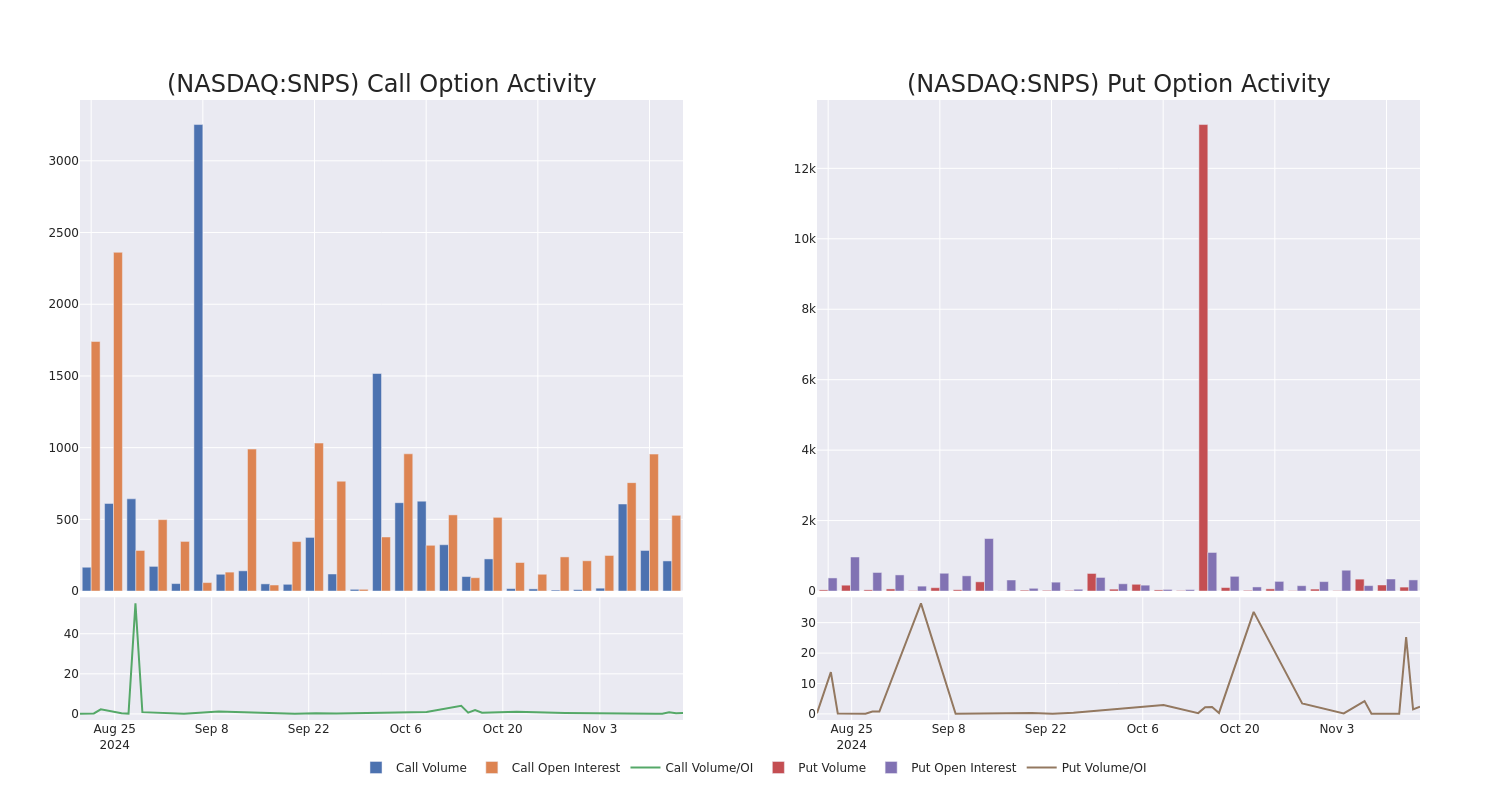

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Synopsys stands at 140.67, with a total volume reaching 322.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Synopsys, situated within the strike price corridor from $520.0 to $670.0, throughout the last 30 days.

Synopsys Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNPS | CALL | SWEEP | BEARISH | 09/19/25 | $54.7 | $54.5 | $54.5 | $600.00 | $76.3K | 13 | 18 |

| SNPS | CALL | SWEEP | NEUTRAL | 01/17/25 | $41.8 | $36.7 | $38.0 | $520.00 | $61.7K | 43 | 0 |

| SNPS | CALL | SWEEP | BULLISH | 12/20/24 | $3.5 | $3.5 | $3.5 | $620.00 | $46.2K | 367 | 154 |

| SNPS | CALL | SWEEP | NEUTRAL | 01/17/25 | $29.3 | $28.4 | $28.0 | $540.00 | $45.7K | 105 | 5 |

| SNPS | CALL | SWEEP | BULLISH | 09/19/25 | $54.5 | $54.5 | $54.5 | $600.00 | $38.1K | 13 | 33 |

About Synopsys

Synopsys is a provider of electronic design automation software, intellectual property, and software integrity products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. The firm’s growing SI business allows customers to continuously manage and test the code base for security and quality. Synopsys’ comprehensive portfolio is benefiting from a mutual convergence of semiconductor companies moving up-stack toward systems-like companies, and systems companies moving down-stack toward in-house chip design. The resulting expansion in EDA customers alongside secular digitalization of various end markets benefits EDA vendors like Synopsys.

Having examined the options trading patterns of Synopsys, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Synopsys’s Current Market Status

- With a trading volume of 217,362, the price of SNPS is down by -3.59%, reaching $528.62.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 19 days from now.

Expert Opinions on Synopsys

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $658.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Loop Capital downgraded its action to Buy with a price target of $675.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Synopsys with a target price of $670.

* In a cautious move, an analyst from Mizuho downgraded its rating to Outperform, setting a price target of $650.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $640.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Synopsys options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

$99 Billion Bet: Warren Buffett Invests Heavily In 2 Stocks Expected To Jump 19% And 20%, Wall Street Analysts Predict

Warren Buffett’s investment strategy is a case study in bold and safe play. Nearly $99 billion is pegged on two iconic names: Apple and Coca-Cola. Through Berkshire Hathaway, Buffett has channeled a whopping half of his equity holdings into Apple alone and he’s held tight to his Coca-Cola shares since the late 1980s.

Don’t Miss:

His strategy here is simple but powerful – backing companies with brand strength and consistent financials. Apple’s stock, for instance, surged 31% this year and many see this as Buffett’s savviest move yet. Some say it’s his “crown jewel,” lauding his foresight in spotting a tech company that’s proven as resilient as it is profitable.

But as with any big bet, Buffett’s heavy reliance on Apple has sparked some chatter. Skeptics say putting so many eggs in one tech basket could be risky. With tech stocks, there’s always the threat of shifting consumer trends, not to mention the occasional market shake-up.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

And while Apple has shown impressive gains this year, the latest numbers hint at a slight cooling. In the last fiscal year, Apple’s total revenue dipped by 0.8% – a small shift but enough to raise eyebrows. Still, Morgan Stanley analyst Erik Woodring believes Apple has room to climb, setting a price target of $273, which would mark a 20% rise from current levels.

Apple’s pivot toward services is holding it steady. Though iPhone sales may ebb and flow, Apple’s revenues from the App Store, streaming and cloud services have grown by 23% over the past few years.

Services have also helped Apple boost its profit margins, going from 43.3% in 2022 to 46.2% in 2024, catching Wall Street’s attention. These margins and the cash flow from services make Apple’s high share prices easier to swallow, especially as it could mean bigger dividends for shareholders.

Trending: Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — you can become an investor for $0.80 per share today.

Christopher T Jenny Implements A Sell Strategy: Offloads $1.14M In CBRE Group Stock

Disclosed on November 14, Christopher T Jenny, Board Member at CBRE Group CBRE, executed a substantial insider sell as per the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, Jenny sold 8,444 shares of CBRE Group. The total transaction value is $1,144,428.

During Friday’s morning session, CBRE Group shares down by 0.0%, currently priced at $132.0.

Unveiling the Story Behind CBRE Group

CBRE Group provides a wide range of real estate services to owners, occupants, and investors worldwide, including leasing, property and project management, and capital markets advisory. CBRE’s investment management arm manages over $140 billion for clients across diverse public and private real estate strategies.

Financial Insights: CBRE Group

Revenue Growth: CBRE Group displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 14.84%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Exploring Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 19.74%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): CBRE Group’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 0.73.

Debt Management: CBRE Group’s debt-to-equity ratio is below the industry average at 0.79, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 42.72 is lower than the industry average, implying a discounted valuation for CBRE Group’s stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 1.19 is lower than the industry average, implying a discounted valuation for CBRE Group’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 23.63 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Breaking Down the Significance of Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of CBRE Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's DOGE Plan: Goldman Sachs Says Defense Stocks Face Risks, IT Firms Could Win

President-elect Donald Trump‘s proposed Department of Government Efficiency (DOGE), led by Elon Musk and Vivek Ramaswamy, is raising questions about the future of U.S. defense contractors and government IT firms.

Could the defense budget flatten—or even fall? And who stands to gain in this new sector shake up?

DOGE Puts Defense Budget Under Pressure

Trump’s plan to restructure federal agencies and reduce wasteful spending through DOGE is a bold move, and its potential ripple effects are hard to ignore—especially for defense and government IT companies.

With the Department of Defense (DoD) being one of the largest slices of federal spending, investors are understandably focused on what’s next for defense stocks in a DOGE-driven world.

On one hand, Trump’s campaign has consistently expressed support for strengthening the U.S. military.

On the other, it’s hard to make sweeping government cuts without touching the $877 billion defense budget, which accounts for 13% of federal spending as of 2023.

Read Also: Elon Musk, Vivek Ramaswamy-Led Department Of Government Efficiency Opens Account On X

Defense Spending At All-Time Highs Spells Risks

Historically, defense spending runs in decades-long cycles. Investment in the sector experiences periods of growth followed by downturns, and we may be nearing the peak of the current cycle, according to Goldman Sachs analyst Noah Poponak.

“The defense budget is at an all-time high, which creates difficult comparisons and challenging base effects,” the analyst said in a note published Friday.

Key Risks For Defense Stocks

- Peak Spending: The defense budget is hovering at historical highs, making future growth difficult.

- Geopolitical Shifts: If major conflicts ease, defense spending could decline.

- Government Debt: U.S. debt-to-GDP ratios are near record levels, increasing pressure to curb federal spending.

Margins in the defense industry are already under pressure due to Pentagon efforts to shift risks onto contractors. Fixed pricing on long-term contracts, for example, has eroded unit economics.

At the same time, defense stocks – as tracked by the SPDR S&P Aerospace & Defense ETF XAR – are trading at valuations above historical averages, leaving them vulnerable to a “de-rating” if the budget flattens or falls.

“It is difficult to embark on any large government spending reduction effort without touching defense, and there are potentially enough inefficiencies within the defense budget to reduce its total level without necessarily reducing military readiness or capability,” Poponak said.

The investment bank maintains a cautious stance on the defense sector, issuing Sell ratings for Lockheed Martin Corp. LMT, Northrop Grumman Corp. NOC, L3Harris Technologies Inc. LHX, and Huntington Ingalls Industries Inc. HII.

Government IT: Winners In The Efficiency Game?

While defense hardware could take a hit, government IT firms might find themselves potentially on the winning side of DOGE.

The sector has been outperforming traditional defense industries in revenue growth, driven by a market share shift toward advanced technologies like artificial intelligence, data analytics, and cybersecurity.

Why IT Could Shine:

- Tech-Driven Efficiency: DOGE’s focus on cutting waste could emphasize the adoption of technologies that streamline government operations.

- Advanced Capabilities: Firms offering cutting-edge solutions may be seen as key enablers of government efficiency.

- Resilient Demand: Even with DoD cuts, IT spending for Operations & Maintenance and national security could remain strong.

Goldman Sachs believes that companies like Booz Allen Hamilton Holding Corp. BAH and Leidos Holdings Inc. LDOS are well-positioned to benefit.

On the flip side, SAIC Inc. SAIC faces challenges due to slower growth and tougher competition, earning it a Sell rating from Goldman Sachs.

The bottom line is that Investors should prepare for a sector shakeup, as the creation of DOGE could mark a significant shift in federal spending priorities.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Syntec Optics (Nasdaq: OPTX) to Host Conference Call to Discuss Financial Results and Business Update

ROCHESTER, NEW YORK, Nov. 15, 2024 (GLOBE NEWSWIRE) — Syntec Optics OPTX, a leading provider of mission-critical products to advanced technology defense, biomedical, and communications equipment manufacturers, today announced it will host a conference call on Monday, November 18, 2024, at 5:00 p.m. Eastern Time (ET) to discuss its financial results and provide a business update.

With nearly 11% of the global GDP light-enabled, Syntec Optics Chairman and CEO Al Kapoor delivered a keynote speech on the Future of Photonics at the Global Photonics Forum in Malaga, Spain, on October 1-2, 2024. At this event organized by Optica, a Society that advances optics and photonics worldwide, 300 leaders in the global Photonics ecosystem discussed the field’s impact.

Conference Call Details:

Date: Monday, November 18, 2024

Time: 5:00 p.m. ET

Dial-In Number: +16469313860,,87521263675# (Please dial in prior to the call)

Webcast: A recording of the conference call will be available under the Latest Events section of the Investors page of Syntec Optics’ website at www.syntecoptics.com.

Replay:

A replay of the webcast will be available approximately three hours after the conclusion of the call. It will remain accessible until Friday, November 29, 2024, in the Investor Relations section of Syntec Optics’ website at www.syntecoptics.com.

About Syntec Optics

Syntec Optics Holdings, Inc. OPTX, headquartered in Rochester, NY, is one of the largest custom and diverse end-market optics and photonics manufacturers in the United States. Operating for over two decades, Syntec Optics runs a state-of-the-art facility with extensive core capabilities of various optics manufacturing processes, both horizontally and vertically integrated, to provide a competitive advantage for mission-critical OEMs. Syntec Optics recently launched new products, including Low Earth Orbit (LEO) satellite optics, lightweight night vision goggle optics, biomedical equipment optics, and precision microlens arrays. To learn more, visit www.syntecoptics.com.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, including certain financial forecasts and projections. All statements other than statements of historical fact contained in this press release, including statements as to the transactions contemplated by the business combination and related agreements, future results of operations and financial position, revenue and other metrics, planned products and services, business strategy and plans, objectives of management for future operations of Syntec Optics, market size, and growth opportunities, competitive position and technological and market trends, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,” “could,” “would,” “continue,” “forecast” or the negatives of these terms or variations of them or similar expressions. All forward-looking statements are subject to risks, uncertainties, and other factors (some of which are beyond the control of Syntec Optics), which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. All forward-looking statements are based upon estimates, forecasts and assumptions that, while considered reasonable by Syntec Optics and its management, as the case may be, are inherently uncertain and many factors may cause the actual results to differ materially from current expectations which include, but are not limited to: 1) risk outlined in any prior SEC filings; 2) ability of Syntec Optics to successfully increase market penetration into its target markets; 3) the addressable markets that Syntec Optics intends to target do not grow as expected; 4) the loss of any key executives; 5) the loss of any relationships with key suppliers including suppliers abroad; 6) the loss of any relationships with key customers; 7) the inability to protect Syntec Optics’ patents and other intellectual property; 8) the failure to successfully execute manufacturing of announced products in a timely manner or at all, or to scale to mass production; 9) costs related to any further business combination; 10) changes in applicable laws or regulations; 11) the possibility that Syntec Optics may be adversely affected by other economic, business and/or competitive factors; 12) Syntec Optics’ estimates of its growth and projected financial results for the future and meeting or satisfying the underlying assumptions with respect thereto; 13) the impact of any pandemic, including any mutations or variants thereof and the Russian/Ukrainian or Israeli conflict, and any resulting effect on business and financial conditions; 14) inability to complete any investments or borrowings in connection with any organic or inorganic growth; 15) the potential for events or circumstances that result in Syntec Optics’ failure to timely achieve the anticipated benefits of Syntec Optics’ customer arrangements; and 16) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in prior SEC filings including registration statement on Form S-4 filed with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Syntec Optics does not give any assurance that Syntec Optics will achieve its expected results. Syntec Optics does not undertake any duty to update these forward-looking statements except as otherwise required by law.

For further information, please contact:

Sara Hart

Investor Relations

InvestorRelations@syntecoptics.com

SOURCE: Syntec Optics Holdings, Inc. OPTX

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir shares rally to fresh record on plans for move to Nasdaq

By Sinéad Carew

(Reuters) – Shares in Palantir Technologies Inc (PLTR) were up more than 6% on Friday, hitting a record high, after it announced late on Thursday that it would list on the Nasdaq and expects eligibility to join the Nasdaq 100 index.

The data analytics software company said it would switch its stock listing from the New York Stock Exchange and begin trading on Nasdaq on Nov. 26.

If it is included in the Nasdaq 100 index, this would mean that “anyone who uses the Nasdaq index as their benchmark will have to buy PLTR,” said Kenny Polcari, Chief Market Strategist for SlateStone Wealth in a research note.

Palantir has already benefited from a boom in GenAI technology, as more companies turn to its AI platform, which is used to test, debug code and evaluate AI-related scenarios.

The stock last traded at $62.90 after earlier hitting a high of $63.50 compared with the median price target of $39 from wall Street analysts according to LSEG, which shows ratings from 19 analysts.

Year-to-date Palantir shares are up about 267%, including a roughly 47% gain over the 7 sessions following its Nov. 4 quarterly update when it raised its 2024 revenue guidance.

Palantir shares are trading at roughly 130 times forward earnings estimates compared with its 2-yr average multiple of around 63.

(Reporting By Sinéad Carew, editing by Franklin Paul)

Biogen Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Biogen BIIB, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BIIB usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 15 extraordinary options activities for Biogen. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 26% leaning bullish and 66% bearish. Among these notable options, 2 are puts, totaling $80,703, and 13 are calls, amounting to $4,937,387.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $110.0 and $230.0 for Biogen, spanning the last three months.

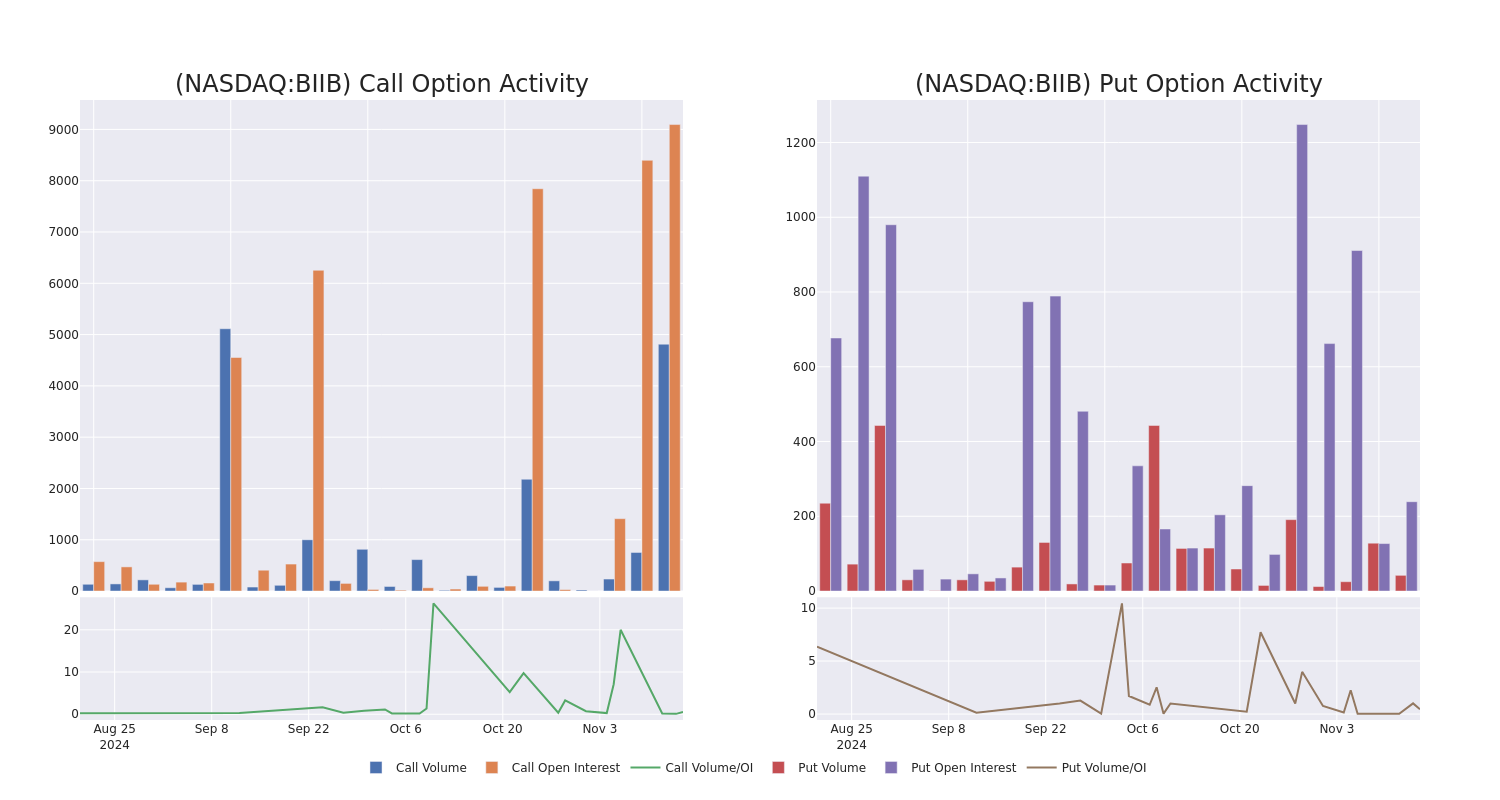

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Biogen options trades today is 1866.8 with a total volume of 4,855.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Biogen’s big money trades within a strike price range of $110.0 to $230.0 over the last 30 days.

Biogen 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BIIB | CALL | TRADE | BULLISH | 01/16/26 | $62.6 | $57.7 | $62.6 | $110.00 | $1.5M | 8.7K | 751 |

| BIIB | CALL | SWEEP | BEARISH | 01/16/26 | $65.6 | $65.5 | $65.5 | $110.00 | $1.0M | 8.7K | 896 |

| BIIB | CALL | SWEEP | BEARISH | 01/16/26 | $63.6 | $62.5 | $62.5 | $110.00 | $625.0K | 8.7K | 100 |

| BIIB | CALL | SWEEP | BEARISH | 01/16/26 | $63.5 | $62.6 | $62.6 | $110.00 | $375.6K | 8.7K | 231 |

| BIIB | CALL | SWEEP | BULLISH | 01/16/26 | $62.6 | $57.7 | $62.6 | $110.00 | $319.2K | 8.7K | 108 |

About Biogen

Biogen and Idec merged in 2003, combining forces to market Biogen’s multiple sclerosis drug Avonex and Idec’s cancer drug Rituxan. Today, Rituxan and next-generation antibody Gazyva (oncology) and Ocrevus (multiple sclerosis) are marketed via a collaboration with Roche. Biogen markets several multiple sclerosis drugs including Plegridy, Tysabri, Tecfidera, and Vumerity. Biogen’s newer products include Spinraza (SMA, with partner Ionis), Leqembi (Alzheimers, with partner Eisai), Skyclarys (Friedreich’s Ataxia, Reata), Zurzuvae (postpartum depression, Sage), and Qalsody (ALS, Ionis). Biogen has several drug candidates in phase 3 trials in neurology, immunology, and rare diseases.

After a thorough review of the options trading surrounding Biogen, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Biogen

- Currently trading with a volume of 610,232, the BIIB’s price is down by -2.38%, now at $160.97.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 88 days.

What The Experts Say On Biogen

In the last month, 5 experts released ratings on this stock with an average target price of $219.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Biogen, targeting a price of $180.

* An analyst from Morgan Stanley has revised its rating downward to Equal-Weight, adjusting the price target to $204.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $270.

* An analyst from Oppenheimer persists with their Outperform rating on Biogen, maintaining a target price of $255.

* Reflecting concerns, an analyst from Citigroup lowers its rating to Neutral with a new price target of $190.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Biogen options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SHAREHOLDER ALERT: Faruqi & Faruqi, LLP Investigates Claims on Behalf of Investors of Edwards Lifesciences Corporation

Faruqi & Faruqi, LLP Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses Exceeding $100,000 In Edwards To Contact Him Directly To Discuss Their Options

If you suffered losses exceeding $100,000 in Edwards between February 6, 2024 and July 24, 2024 and would like to discuss your legal rights, call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310).

[You may also click here for additional information]

NEW YORK, Nov. 15, 2024 (GLOBE NEWSWIRE) — Faruqi & Faruqi, LLP, a leading national securities law firm, is investigating potential claims against Edwards Lifesciences Corporation (“Edwards” or the “Company”) EW and reminds investors of the December 13, 2024 deadline to seek the role of lead plaintiff in a federal securities class action that has been filed against the Company.

Faruqi & Faruqi is a leading national securities law firm with offices in New York, Pennsylvania, California and Georgia. The firm has recovered hundreds of millions of dollars for investors since its founding in 1995. See www.faruqilaw.com.

As detailed below, the complaint alleges that the Company and its executives violated federal securities laws by making false and/or misleading statements and/or failing to disclose that defendants provided investors with material information concerning Edwards’ expected revenue for the fiscal year 2024, particularly as it related to the growth of the Company’s core product, Transcatheter Aortic Valve Replacement (“TAVR”). Defendants’ statements included, among other things, strong commitment to the TAVR platform, confidence in the Company’s ability to capitalize on a subset of untreated patients through scaling of its various patient activation activities, and continued claims of significant demand in allegedly lower-penetrated markets.

On July 24, 2024, Edwards unveiled below-expectation financial results for the second quarter of fiscal 2024 and, in particular, slashed its revenue guidance for the TAVR platform for the full fiscal year 2024. The Company attributed the TAVR setback on the “continued growth and expansion of structural heart therapies … [which] put pressure on hospital workflows.” Investors understood this to mean that developments in new procedures, including Defendant’s own Transcatheter Mitral and Tricuspid Therapies (“TMTT”), put significant strain on hospital structural heart teams such that they were underutilizing TAVR, despite the Company’s continued claim of a significantly undertreated patient population. Moreover, the Company announced three acquisitions during the second quarter designed to embolden their treatments alternative to TAVR, suggesting further that the company was aware of the potential for the TAVR platform’s decelerated growth. Investors and analysts reacted immediately to Edwards’ revelations. The price of Edwards’ common stock declined dramatically. From a closing market price of $86.95 per share on July 24, 2024, Edwards’ stock price fell to $59.70 per share on July 25, 2024, a decline of about 31.34% in the span of just a single day.

The court-appointed lead plaintiff is the investor with the largest financial interest in the relief sought by the class who is adequate and typical of class members who directs and oversees the litigation on behalf of the putative class. Any member of the putative class may move the Court to serve as lead plaintiff through counsel of their choice, or may choose to do nothing and remain an absent class member. Your ability to share in any recovery is not affected by the decision to serve as a lead plaintiff or not.

Faruqi & Faruqi, LLP also encourages anyone with information regarding Edwards’ conduct to contact the firm, including whistleblowers, former employees, shareholders and others.

To learn more about the Edwards Lifesciences Corporation class action, go to www.faruqilaw.com/EW or call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310).

Follow us for updates on LinkedIn, on X, or on Facebook.

Attorney Advertising. The law firm responsible for this advertisement is Faruqi & Faruqi, LLP (www.faruqilaw.com). Prior results do not guarantee or predict a similar outcome with respect to any future matter. We welcome the opportunity to discuss your particular case. All communications will be treated in a confidential manner.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/807ffe71-382e-48fd-91d1-846d96405715

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.