The Southern Banc Company, Inc. Announces First Quarter Earnings

GADSDEN, Ala., Nov. 15, 2024 (GLOBE NEWSWIRE) — The Southern Banc Company, Inc. SRNN, the holding company for The Southern Bank Company, formerly First Federal Savings and Loan Association of Gadsden, Alabama, announced a net income of approximately $176,000, or $0.23 per basic and diluted share, for the quarter ended September 30, 2024, as compared to a net income of approximately $367,000, or $0.48 per basic and diluted share, for the quarter ended September 30, 2023.

Gates Little, President and Chief Executive Officer of the Company stated that the Company’s net interest income decreased approximately $95,000 or (5.06%) during the quarter as compared to the same period in 2023. For the three-months ended September 30, 2024, total interest income increased by approximately $536,000 or 23.65% as compared to the same period in 2023. Total interest expense increased approximately $256,000 or 65.79% for the three-months ended September 30, 2024, as compared to the same period in 2023. During the three-months ended September 30, 2024, provisions for credit losses was approximately $373,000 compared to no provisions for the three-months ended September 30, 2023. For the quarter ended September 30, 2024, total non-interest income increased approximately by $3,000 or 2.10%, while total non-interest expense increased approximately by $167,000 or 10.93% as compared to the same three-month period in 2023. The increase in non-interest income was primarily attributable to increases in miscellaneous income of approximately $4,000 or 3.72% offset in part by a decrease in customer service fees of approximately $1,000 or (2.79%). The increase in non-interest expense was primarily attributable to increases in salaries and benefits of approximately $119,000 or 13.09%; occupancy expenses of approximately $8,000 or 9.26%, professional service expenses of approximately $74,000 or 58.41%, offset in part by decreases in other operating expenses of approximately $32,000 or (14.50%) and data processing expenses of approximately $2,000 or (1.60%).

The Company’s total assets at September 30, 2024 were $113.5 million, as compared to $113.0 million at June 30, 2024. Total stockholders’ equity was approximately $15.7 million at September 30, 2024, or 13.82% of total assets, as compared to approximately $14.5 million at June 30, 2024, or approximately 12.80% of total assets.

The Bank has four offices located in Gadsden, Albertville, Guntersville, and Centre, Alabama and a loan production office located in Birmingham, AL. The stock of The Southern Banc Company, Inc. trades in the over-the-counter market under the symbol “SRNN”.

Certain statements in this release contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which statements can generally be identified by the use of forward-looking terminology, such as “may,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “target,” “plan,” “project,” “continue,” or the negatives thereof, or other variations thereon or similar terminology, and are made on the basis of management’s plans and current analyses of the Company, its business and the industry as a whole. These forward-looking statements are subject to risks and uncertainties, including, but not limited to, economic conditions, competition, interest rate sensitivity and exposure to regulatory and legislative changes. The above factors, in some cases, have affected, and in the future could affect the Company’s financial performance and could cause actual results to differ materially from those expressed or implied in such forward-looking statements, even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

| (Selected financial data on following pages) | |||||||

| THE SOUTHERN BANC COMPANY, INC. | |||||||

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | |||||||

| (Dollar Amounts in Thousands) | |||||||

| September 30, | June 30, | ||||||

| 2024 | 2024 | ||||||

| Unaudited | Audited | ||||||

| ASSETS | |||||||

| CASH AND CASH EQUIVALENTS | $ | 12,426 | $ | 12,632 | |||

| SECURITIES AVAILABLE FOR SALE, at fair value | 38,539 | 37,912 | |||||

| FEDERAL HOME LOAN BANK STOCK | 120 | 120 | |||||

| LOANS RECEIVABLE, net of allowance for loan losses | |||||||

| of $1,483 and $1,160 | 58,742 | 58,199 | |||||

| PREMISES AND EQUIPMENT, net | 1,098 | 1,133 | |||||

| ACCRUED INTEREST AND DIVIDENDS RECEIVABLE | 913 | 934 | |||||

| PREPAID EXPENSES AND OTHER ASSETS | 1,698 | 2,124 | |||||

| TOTAL ASSETS | $ | 113,536 | $ | 113,054 | |||

| LIABILITIES | |||||||

| DEPOSITS | $ | 91,098 | $ | 92,250 | |||

| OTHER LIABILITIES | 6,748 | 6,338 | |||||

| TOTAL LIABILITIES | 97,846 | 98,588 | |||||

| STOCKHOLDERS’ EQUITY: | |||||||

| Preferred stock, par value $.01 per share | |||||||

| 500,000 shares authorized; no shares issued | |||||||

| and outstanding | – | – | |||||

| Common stock, par value $.01 per share, | |||||||

| 3,500,000 authorized, 1,454,750 shares issued | 15 | 15 | |||||

| Additional paid-in capital | 13,945 | 13,943 | |||||

| Shares held in trust, 46,454 at cost | (772 | ) | (772 | ) | |||

| Retained earnings | 14,060 | 13,884 | |||||

| Treasury stock, at cost, 648,664 shares | (8,825 | ) | (8,825 | ) | |||

| Accumulated other comprehensive (loss) income | (2,733 | ) | (3,779 | ) | |||

| TOTAL STOCKHOLDERS’ EQUITY | 15,690 | 14,466 | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 113,536 | $ | 113,054 | |||

| THE SOUTHERN BANC COMPANY, INC. | |||||

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME | |||||

| (Dollar Amounts in Thousands, except per share data) | |||||

| Three Months Ended | |||||

| September 30, | |||||

| 2024 | 2023 | ||||

| (Unaudited) | (Unaudited) | ||||

| INTEREST INCOME: | |||||

| Interest and fees on loans | $ | 2,474 | $ | 1,966 | |

| Interest and dividends on securities | 166 | 185 | |||

| Other interest income | 155 | 108 | |||

| Total interest income | 2,795 | 2,260 | |||

| INTEREST EXPENSE: | |||||

| Interest on deposits | 645 | 389 | |||

| Interest on borrowings | – | – | |||

| Total interest expense | 645 | 389 | |||

| Net interest income before provision | 2,150 | 1,871 | |||

| for loan losses | |||||

| Provision for loan losses | 373 | – | |||

| Net interest income after provision | 1,777 | 1,871 | |||

| for loan losses | |||||

| NON-INTEREST INCOME: | |||||

| Fees and other non-interest income | 35 | 36 | |||

| Net gain on sale of securities | – | – | |||

| Miscellaneous income | 113 | 109 | |||

| Total non-interest income | 148 | 145 | |||

| NON-INTEREST EXPENSE: | |||||

| Salaries and employee benefits | 1,025 | 906 | |||

| Office building and equipment expenses | 94 | 86 | |||

| Professional Services Expense | 201 | 127 | |||

| Data Processing Expense | 182 | 184 | |||

| Other operating expense | 185 | 217 | |||

| Total non-interest expense | 1,687 | 1,521 | |||

| Income before income tax expense | 238 | 496 | |||

| INCOME TAX EXPENSE | 62 | 129 | |||

| Net Income | $ | 176 | $ | 367 | |

| INCOME PER SHARE: | |||||

| Basic | $ | 0.23 | $ | 0.48 | |

| Diluted | 0.23 | 0.48 | |||

| DIVIDENDS DECLARED PER SHARE | $ | – | $ | – | |

| AVERAGE SHARES OUTSTANDING: | |||||

| Basic | 759,632 | 761,257 | |||

| Diluted | 765,236 | 768,861 | |||

Contact: Gates Little

(256) 543-3860

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of Tempus AI's Latest Options Trends

Deep-pocketed investors have adopted a bearish approach towards Tempus AI TEM, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TEM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Tempus AI. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 50% bearish. Among these notable options, 6 are puts, totaling $683,586, and 2 are calls, amounting to $99,000.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $55.0 for Tempus AI during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Tempus AI’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Tempus AI’s whale activity within a strike price range from $30.0 to $55.0 in the last 30 days.

Tempus AI 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TEM | PUT | TRADE | BEARISH | 01/17/25 | $5.8 | $4.5 | $5.4 | $45.00 | $246.2K | 85 | 500 |

| TEM | PUT | TRADE | BULLISH | 01/17/25 | $6.3 | $5.0 | $5.4 | $45.00 | $225.7K | 85 | 462 |

| TEM | PUT | SWEEP | BEARISH | 11/29/24 | $4.7 | $4.3 | $4.7 | $52.00 | $92.5K | 206 | 200 |

| TEM | PUT | SWEEP | BEARISH | 12/13/24 | $9.2 | $7.7 | $9.2 | $55.00 | $63.4K | 10 | 90 |

| TEM | CALL | TRADE | NEUTRAL | 11/22/24 | $23.7 | $22.0 | $23.0 | $30.00 | $50.6K | 0 | 44 |

About Tempus AI

Tempus AI Inc is a technology company. It has built the Tempus Platform, which comprises both a technology platform to free healthcare data from silos and an operating system to make the resulting data useful. Its Intelligent Diagnostics use AI, including generative AI, to make laboratory tests more accurate, tailored, and personal.

After a thorough review of the options trading surrounding Tempus AI, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Tempus AI

- With a trading volume of 572,433, the price of TEM is up by 0.32%, reaching $56.81.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 94 days from now.

What Analysts Are Saying About Tempus AI

2 market experts have recently issued ratings for this stock, with a consensus target price of $67.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $70.

* Reflecting concerns, an analyst from Stifel lowers its rating to Hold with a new price target of $65.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Tempus AI with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Polytetrafluoroethylene (PTFE) Market Size Will Estimated to Excess at a CAGR of 3.6 % by 2034 | Transparency Market Research Inc

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Nov. 15, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the polytetrafluoroethylene (PTFE) market (نطاق سوق البولي تترافلوروإيثيلين (PTFE)) size was worth US$ 3.1 Billion in 2023 and is expected to reach US$ 4.9 Billion by the year 2034 at a CAGR of 3.6 % between 2024 and 2034.

Polytetrafluoroethylene (PTFE) is a high-performance fluoropolymer known for its exceptional chemical resistance, thermal stability, and low friction properties. Commonly recognized by the brand name Teflon, PTFE is widely used in various industrial and consumer applications due to its unique characteristics. It is a white, waxy solid that is non-reactive and has a low coefficient of friction, making it ideal for applications that require durability and resistance to harsh environments.

Download Sample Copy of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=305

Polytetrafluoroethylene (PTFE) Market Overview

Polytetrafluoroethylene (PTFE) is a highly versatile fluoropolymer celebrated for its exceptional properties, including chemical resistance, thermal stability, and low friction characteristics. These qualities make PTFE ideal for a wide array of applications across diverse industries. Its non-stick nature is well-known in the culinary world, particularly in non-stick cookware, where it prevents food from adhering and ensures easy cleaning.

Beyond the kitchen, PTFE is utilized in various industrial applications, such as gaskets, seals, and bearings, due to its ability to withstand harsh chemicals and extreme temperatures. Additionally, PTFE is commonly used in electrical insulation, plumbing, and the automotive industry, where its durability and performance are critical.

Several key factors are driving the growth of the PTFE market globally. Firstly, the increasing demand for high-performance materials in sectors such as aerospace, automotive, and chemical processing is a significant catalyst. As industries prioritize efficiency, reliability, and safety, the unique properties of PTFE make it an essential choice for critical components that must perform under demanding conditions.

Moreover, the rise in industrialization and infrastructure development, particularly in emerging economies, is contributing to the growing demand for PTFE. Industries such as oil and gas, pharmaceuticals, and food processing are increasingly utilizing PTFE for its resistance to corrosion and chemical reactions, further expanding its market potential.

Technological advancements in manufacturing processes are also boosting the PTFE market. Innovations that enhance production efficiency and reduce costs are making PTFE more accessible to a broader range of industries. Additionally, the development of PTFE coatings and composites has opened new avenues for application, providing enhanced performance characteristics for various uses.

Another factor propelling the market is the growing awareness of the benefits of fluoropolymers. As companies recognize the advantages of using PTFE in improving product performance and longevity, there is a shift toward incorporating these materials into manufacturing processes.

Finally, stringent regulatory standards concerning safety and environmental impact are encouraging industries to adopt materials like PTFE that can withstand harsh conditions without degrading. This trend is particularly evident in the chemical and food industries, where compliance with safety regulations is paramount.

Download Sample PDF Brochure Here:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=305

Polytetrafluoroethylene (PTFE) Market Regional Insights

- Asia Pacific Estimated to Record Rapid Growth During Forecast Period

The polytetrafluoroethylene (PTFE) market in the Asia Pacific region is experiencing notable growth, driven by several interconnected factors. One of the primary drivers is the rapid industrialization and urbanization taking place across countries such as China, India, and Southeast Asian nations.

As these economies expand, there is an increasing demand for high-performance materials in various sectors, including automotive, electronics, and chemical processing. PTFE’s unique properties—such as excellent chemical resistance, high thermal stability, and low friction—make it an ideal choice for applications in these industries, facilitating its widespread adoption.

Another significant factor contributing to the growth of the PTFE market in Asia Pacific is the rising focus on advanced manufacturing techniques. Many countries in the region are investing in technology upgrades and modern production facilities to enhance efficiency and reduce costs. This shift toward advanced manufacturing allows for improved production processes of PTFE, resulting in higher quality materials and a broader range of applications. Additionally, innovations in PTFE coatings and composites are expanding its use in sectors like construction and electronics, further driving market demand.

Prominent Players operating in Polytetrafluoroethylene (PTFE) Industry

The global polytetrafluoroethylene (PTFE) market is concentrated in nature with a few international and local players operating in it across the globe. There are several small-size and medium-size vendors operating in this market.

3M, Solvay, Gujarat Fluorochemicals Limited, Daikin Industries, Ltd., The Chemours Company, Saint-Gobain Performance Plastics Corporation, Asahi India Glass Limited, HaloPolymer, OJSC, Shamrock Technologies, Micro Powders Inc., and Reprolon Texas are some of the leading players in the polytetrafluoroethylene (PTFE) industry.

Polytetrafluoroethylene (PTFE) Market Segmentation

- Product

- Granular

- Fine Powder

- Micro Powder

- Others (include Dispersions, Liquids, etc.)

- Application

- Industrial and Chemical Processing

- Automotive

- Electrical and Electronics

- Others (Cookware, Building & Construction, and Medical, etc.)

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=305<ype=S

More Trending Reports by Transparency Market Research –

- Calcium Chloride Market Expected to Achieve USD 2.3 billion by 2031 with a 5.3% CAGR from 2023 | Insights from TMR Research

- Chloromethane Market Set to Surge at 4.4% CAGR, to Reach USD 5.4 billion by 2031 | Transparency Market Research, Inc.

- Sodium Cyanide Market is Anticipated to Register a 5.2% CAGR until 2031, Reaching US$ 4 billion: Report from TMR

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Massive Insider Trade At Paylocity Holding

Revealing a significant insider sell on November 14, Jeffrey T Diehl, Board Member at Paylocity Holding PCTY, as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Diehl sold 593 shares of Paylocity Holding. The total transaction amounted to $126,386.

Monitoring the market, Paylocity Holding‘s shares down by 0.3% at $204.89 during Friday’s morning.

Unveiling the Story Behind Paylocity Holding

Paylocity is a provider of payroll and human capital management solutions servicing small- to midsize clients in the United States. The company was founded in 1997 and targets businesses with 10-5,000 employees and services about 39,000 clients as of fiscal 2024. Alongside core payroll services, Paylocity offers HCM solutions such as time and attendance and recruiting software as well as workplace collaboration and communication tools.

Paylocity Holding: A Financial Overview

Revenue Challenges: Paylocity Holding’s revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -12.5%. This indicates a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company maintains a high gross margin of 68.05%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Paylocity Holding’s EPS is below the industry average. The company faced challenges with a current EPS of 0.62. This suggests a potential decline in earnings.

Debt Management: Paylocity Holding’s debt-to-equity ratio is below the industry average at 0.34, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 61.16, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 8.65, Paylocity Holding’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 34.77, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Paylocity Holding’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Paylocity Holding Director Trades $7.67M In Company Stock

Jeffrey T Diehl, Director at Paylocity Holding PCTY, executed a substantial insider sell on November 14, according to an SEC filing.

What Happened: Diehl’s decision to sell 36,133 shares of Paylocity Holding was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $7,674,132.

The latest market snapshot at Friday morning reveals Paylocity Holding shares down by 0.3%, trading at $204.89.

All You Need to Know About Paylocity Holding

Paylocity is a provider of payroll and human capital management solutions servicing small- to midsize clients in the United States. The company was founded in 1997 and targets businesses with 10-5,000 employees and services about 39,000 clients as of fiscal 2024. Alongside core payroll services, Paylocity offers HCM solutions such as time and attendance and recruiting software as well as workplace collaboration and communication tools.

Unraveling the Financial Story of Paylocity Holding

Negative Revenue Trend: Examining Paylocity Holding’s financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -12.5% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company excels with a remarkable gross margin of 68.05%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Paylocity Holding’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.62.

Debt Management: With a below-average debt-to-equity ratio of 0.34, Paylocity Holding adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 61.16, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 8.65 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 34.77, Paylocity Holding demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Paylocity Holding’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Outlook For Zenvia

Zenvia ZENV is gearing up to announce its quarterly earnings on Monday, 2024-11-18. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Zenvia will report an earnings per share (EPS) of $0.02.

Zenvia bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

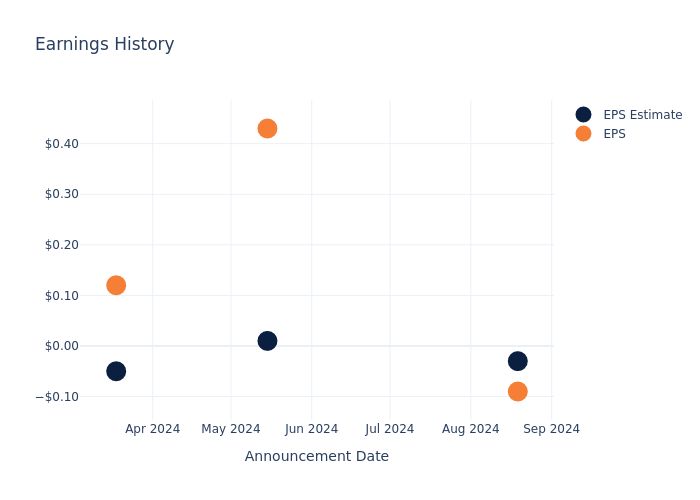

Earnings Track Record

Last quarter the company missed EPS by $0.05, which was followed by a 2.42% drop in the share price the next day.

Here’s a look at Zenvia’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.01 | |||

| EPS Actual | -0.06 | -0.22 | -0.14 | -0.06 |

| Price Change % | -2.0% | 25.0% | 4.0% | -15.0% |

Performance of Zenvia Shares

Shares of Zenvia were trading at $1.19 as of November 14. Over the last 52-week period, shares are up 10.95%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Zenvia visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

XRP Soars 58% On The Week: What Is Going On?

Ripple’s XRP/USD rally is increasingly gaining momentum amid whale accumulation and increased optimism from traders.

What Happened: XRP surged 22% on Friday, bringing its seven-day gains to 57%. The seventh-biggest cryptocurrency in the world has outperformed the two cryptos over the past week.

| Cryptocurrency | Price | Market Cap | 24-Hour Trend | 7-Day Trend |

| XRP XRP/USD | $0.8786 | $50 billion | 22.2% | +58.9% |

| Bitcoin BTC/USD | $88,310.05 | $1.75 trillion | -0.8% | +15.9% |

| Ethereum ETH/USD | $3,029.91 | $364.9 billion | -2% | +3.4% |

Trader Notes: In a podcast update, vetern crypto trader DonAlt identified XRP as being in a monthly breakout phase.

He highlighted resistance levels at $1.50 (2x the current price) and $3.60 (4x).

While not a fan of XRP fundamentally, he sees it as a strong trading opportunity. DonAlt also predicts the return of 2017-era traders who feel comfortable trading XRP.

In his latest tweet, DonAlt stated that Dogecoin and XRP are the retail coins of old, outlining his entry levels for trading the altcoin.

Another trader, Mikybull Crypto, foresees a massive rally taking XRP to new all-time highs by March 2025.

Statistics: Santiment data reveals wallets holding at least 1 million XRP now control a combined 45.61 billion tokens, the highest since June 2018. Over the last two years, whales and sharks accumulated an additional 3.44 billion XRP, reflecting an 8.16% increase.

What’s Next: The future of Ripple is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Next: Bit Digital's Earnings Preview

Bit Digital BTBT is set to give its latest quarterly earnings report on Monday, 2024-11-18. Here’s what investors need to know before the announcement.

Analysts estimate that Bit Digital will report an earnings per share (EPS) of $0.00.

The announcement from Bit Digital is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Past Earnings Performance

The company’s EPS missed by $0.06 in the last quarter, leading to a 20.74% increase in the share price on the following day.

Here’s a look at Bit Digital’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.03 | 0.01 | -0.05 | -0.06 |

| EPS Actual | -0.09 | 0.43 | 0.12 | -0.03 |

| Price Change % | 21.0% | -3.0% | -1.0% | 7.000000000000001% |

Bit Digital Share Price Analysis

Shares of Bit Digital were trading at $4.38 as of November 14. Over the last 52-week period, shares are up 86.83%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for Bit Digital visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.