Frozen Seafood Market Size on Track to Surpass USD 42.9 Billion by 2031 at a CAGR of 5.3% | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Nov. 15, 2024 (GLOBE NEWSWIRE) — The frozen seafood market (냉동 해산물 시장) was valued at US$ 27.3 billion in 2022. A CAGR of 5.3% is expected from 2023 to 2031, resulting in an industry value of US$ 42.9 billion at the end of 2031. As freezing technologies advance, frozen seafood products may get even better in texture and quality. Improved packaging and freezing methods could enhance the consumer experience.

Consumers increasingly seek sustainably sourced seafood as they become more aware of environmental concerns. An eco-friendly certification and clear traceability may give frozen seafood products a competitive edge. To meet consumer preferences, frozen seafood companies continuously introduce new products. As a result, new customers will be attracted to products with distinctive flavors, packaging, and cooking methods, thereby creating growth opportunities.

Alternative protein sources, such as plant-based proteins, may impact frozen seafood sales. Companies could develop plant-based seafood alternatives in response to changing dietary preferences and concerns over sustainability. It is crucial to have strict food safety regulations and standards to shape the frozen seafood market. Frozen seafood products are more trustworthy when they comply with these regulations.

Request Sample PDF of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38303

The food industry is facing increasing scrutiny over its products’ origins and production processes. Enhanced traceability and transparency will be crucial for consumer trust in frozen seafood. To appeal to a larger audience, frozen seafood manufacturers might introduce innovative flavors, cooking methods, and product combinations.

Key Findings of the Market Report

- North America dominated the majority of the global landscape in 2022.

- Frozen seafood revenues increase due to the increase in demand for convenient food products

- Growing focus on sustainable fishing practices augments market growth

- Based on end-use, the frozen seafood market will likely be driven by the food processing industry.

- In terms of distribution channels, the business-to-consumer segment is expected to create significant demand in the future.

Global Frozen Seafood Market: Key Players

Companies operating on the global stage to ensure their products’ quality and nutritional value increasingly use sustainable processing methods. The company is also expanding its global distribution network.

- Austevoll Seafood ASA

- Leroy Seafood Group

- Grieg Seafood

- Marine Harvest ASA

- SalMar

- Norway Royal Salmon

- Coast Seafood

- Charoen Pokphand Foods

- Fortune Fish & Gourmet

- Mitsubishi Corporation

- SeaPak Shrimp & Seafood Co

- Inland Seafood

- East Coast Seafood

- Chicken of the Sea

- High Liner Foods

- Tri Marine International

- Bumble Bee Seafoods

- Maruha Nichiro Corp

- Nippon Suisan USA

- Cooke Aquaculture

- Others (on additional request)

Global Frozen Seafood Market: Growth Drivers

- A long storage period without compromising quality makes frozen seafood convenient for consumers. Freezing seafood preserves its freshness while giving consumers access to various options year-round. Nutritious food options are becoming increasingly popular among consumers. Omega-3 fatty acids are commonly found in seafood, making it an important source of protein. Frozen seafood provides consumers with the opportunity to take advantage of these health benefits in a convenient manner.

- Modern freezers help maintain seafood’s taste, texture, and nutritional value by quick-freezing it. Because of these technological advancements, the frozen seafood market has grown. Food options that are convenient and easy to prepare are increasingly in demand due to the busy lifestyles of consumers. Frozen seafood products that have been pre-marinated or pre-cooked meet consumer demands for ready-to-cook or ready-to-eat seafood.

- In recent years, seafood demand has increased due to increasing awareness of the health benefits of seafood consumption. Consumers can conveniently access various seafood products through the frozen seafood market. Retailers have expanded the reach of the frozen seafood market by offering frozen seafood through hypermarkets, supermarkets, and online platforms. The availability of frozen seafood products to consumers has increased, contributing to the market’s growth.

Download Sample PDF Brochure Here: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38303

Global Frozen Seafood Market: Regional Landscape

- The frozen seafood market was dominated largely by North America. Regardless of the season, consumers in North America have access to a wide selection of seafood products, both fresh and frozen. Consumers in North America have a busy lifestyle, creating a high demand for convenient, easy-to-prepare meals. A lifestyle that emphasizes convenience fits well with frozen seafood.

- In North America, seafood consumption has become increasingly popular since it benefits health. Seafood that has been frozen provides individuals with an easy way to include seafood in their diets. Frozen seafood products are more accessible to consumers during grocery shopping. Frozen seafood companies constantly introduce innovative frozen seafood products to meet the changing preferences of consumers.

Global Frozen Seafood Market: Segmentation

By Type

- Marine Pelagic

- Marine Demersal

- Diadromous

- Others

- Shrimps

- Crabs

- Lobsters

- Krill

- Others

By End Use

- Food Processing Industry

- Foodservice

- Retail/Household

By Distribution Channel

- Business to Business

- Business to Consumer

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia

- Oceania

- Middle East & Africa (MEA)

Buy this Premium Research Report @ https://www.transparencymarketresearch.com/checkout.php?rep_id=38303<ype=S

More Trending Report by Transparency Market Research:

- Canned Tuna Market – The global canned tuna market (참치 통조림 시장) stood at US$ 8.9 Bn in 2022 and is projected to reach US$ 13.8 Billion by 2031.

- Seafood Extracts Market – The seafood extracts industry (해산물 추출물 산업) was valued at US$ 8 Mn in 2021. It is estimated to grow at a CAGR of 5.3 % from 2022 to 2031 and reach US$ 13.5 Billion by the end of 2031.

- Rice Flour Market – The global rice flour market (쌀가루 시장) is estimated to grow at a CAGR of 4.8% from 2023 to 2031 and reach US$ 1.3 Billion by the end of 2031.

- Apple Sauce Market – The global apple sauce market (사과 소스 시장) is projected to expand at a CAGR of 3.4% from 2023 to 2031 and reach US$ 2.6 Billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About United Airlines Holdings

Investors with a lot of money to spend have taken a bearish stance on United Airlines Holdings UAL.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with UAL, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 36 options trades for United Airlines Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 22% bullish and 27%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $183,549, and 35, calls, for a total amount of $1,842,350.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $33.0 to $95.0 for United Airlines Holdings over the recent three months.

Analyzing Volume & Open Interest

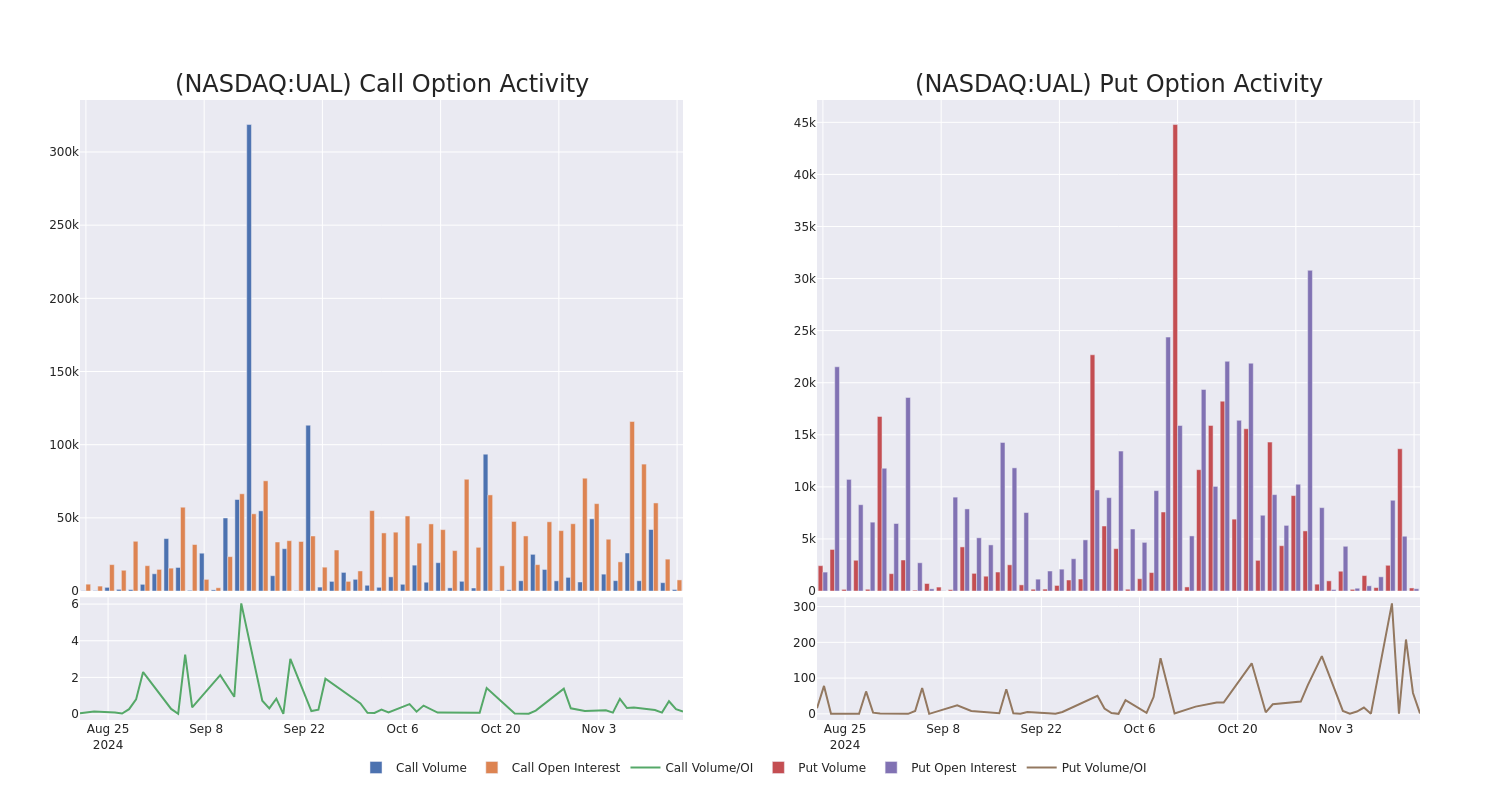

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for United Airlines Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across United Airlines Holdings’s significant trades, within a strike price range of $33.0 to $95.0, over the past month.

United Airlines Holdings 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UAL | PUT | SWEEP | NEUTRAL | 12/20/24 | $6.3 | $6.2 | $6.2 | $95.00 | $183.5K | 222 | 296 |

| UAL | CALL | TRADE | BULLISH | 01/17/25 | $9.55 | $8.9 | $9.4 | $87.50 | $84.6K | 5.3K | 100 |

| UAL | CALL | TRADE | NEUTRAL | 12/18/26 | $64.65 | $61.55 | $63.15 | $33.00 | $63.1K | 56 | 22 |

| UAL | CALL | TRADE | NEUTRAL | 12/18/26 | $65.0 | $61.5 | $63.1 | $33.00 | $63.1K | 56 | 42 |

| UAL | CALL | TRADE | BEARISH | 12/18/26 | $64.85 | $63.05 | $63.05 | $33.00 | $63.0K | 56 | 62 |

About United Airlines Holdings

United Airlines is a major us network carrier with hubs in San Francisco, Chicago, Houston, Denver, Los Angeles, New York/Newark, and Washington, D.C. United operates a hub-and-spoke system that is more focused on international and long-haul travel than its large us peers.

After a thorough review of the options trading surrounding United Airlines Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of United Airlines Holdings

- Trading volume stands at 913,136, with UAL’s price up by 0.46%, positioned at $91.58.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 67 days.

What The Experts Say On United Airlines Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $106.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Jefferies persists with their Buy rating on United Airlines Holdings, maintaining a target price of $95.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for United Airlines Holdings, targeting a price of $84.

* An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $119.

* An analyst from Bernstein has decided to maintain their Outperform rating on United Airlines Holdings, which currently sits at a price target of $85.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on United Airlines Holdings with a target price of $150.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Airlines Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These Analysts Boost Their Forecasts On Intuitive Machines Following Q3 Earnings

Intuitive Machines Inc LUNR posted better-than-expected third-quarter sales on Thursday.

Intuitive Machines reported third-quarter revenue of $58.48 million, beating analyst estimates of $50.89 million, according to Benzinga Pro. Total revenue was up 359% on a year-over-year basis.

The company reported a net loss of $80.44 million, versus net income of $14.31 million in the prior year’s quarter. Backlog grew to $316.2 million in the quarter, the highest in company history. Intuitive Machines ended the quarter with $89.6 million in cash.

“Intuitive Machines had a very strong third quarter highlighted by key wins, revenue growth, and the largest cash balance in Company history,” said Steve Altemus, CEO of Intuitive Machines.

Intuitive Machines narrowed its full-year revenue outlook to a range of $215 million to $235 million. The company also said it expects continued backlog expansion driven by potential upcoming awards including Near Space Network 1.2 / 1.3 Direct to Earth and LTVS Phase 2, as well as task orders for OMES and Near Space Network 2.2.

Intuitive Machines shares gained 12.8% to trade at $11.55 on Friday.

These analysts made changes to their price targets on Intuitive Machines following earnings announcement.

- Benchmark analyst Josh Sullivan maintained Intuitive Machines with a Buy and raised the price target from $10 to $16.

- Cantor Fitzgerald analyst Andres Sheppard maintained the stock with an Overweight and raised the price target from $10 to $15.

- Canaccord Genuity analyst Austin Moeller maintained Intuitive Machines with a Buy and raised the price target from $11 to $12.5.

Considering buying LUNR stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro’s Looming Nasdaq Deadline Stokes Delisting Fears

(Bloomberg) — Super Micro Computer Inc. investors have spent two months waiting for the company to file a plan that would allow it to remain listed on the Nasdaq exchange. With the deadline now just days away, that plan is yet to materialize.

Most Read from Bloomberg

The server maker has until Monday, Nov. 18, to either file a delayed 10-K annual report or submit a plan to file the form to Nasdaq to be in compliance with the exchange’s rules. Super Micro’s original deadline for filing the plan was Saturday, Nov. 16 but in accordance with the Nasdaq’s rules: If the last day of the period is a Saturday, Sunday, federal or Nasdaq holiday, the period then runs until the end of the next day that is not one of those days.

“As we previously disclosed, Super Micro intends to take all necessary steps to achieve compliance with the Nasdaq continued listing requirements as soon as possible,” a Super Micro spokesman said. Shares of Super Micro were up as much as 2.8% in early trading on Friday.

Super Micro delayed its annual filing in August following a damaging report from short seller Hindenburg Research. The company is also facing a US Department of Justice probe, and its auditor, Ernst & Young LLP, resigned in October, citing concerns about Super Micro’s governance and transparency.

This week, Super Micro postponed filing its quarterly 10-Q form for the period ending Sept. 30. The company also said that the committee its board formed to review internal controls had finished its investigation stemming from concerns raised by Ernst & Young, and that while it “has other work that is ongoing” it expects the review to be completed soon.

“Whatever the results are would probably play into whatever their plan is” to hire a new auditor and file their financial reports, Matt Bryson, an analyst at Wedbush, said by phone. “I wouldn’t be shocked if something comes out over the next couple of days.”

Super Micro shares have tumbled nearly 70% since announcing it would be delaying its annual filing in August. The losses are even steeper when measured from the stock’s record high in March. More than $55 billion in value has been erased over that span as Super Micro shares plunged 85%.

If the company submits a plan that Nasdaq approves, its deadline to file will likely get extended into February. If a plan is not approved, the company can appeal the decision. Nasdaq declined to comment.

Despegar.com, Zai Lab, Bloom Energy And Other Big Stocks Moving Higher On Friday

U.S. stocks were lower, with the Dow Jones index falling around 300 points on Friday.

Shares of Despegar.com, Corp. DESP rose sharply during Friday’s session after the company reported better-than-expected third-quarter sales.

The company said it sees FY24 revenue of at least $760 million and adjusted EBITDA of at least $170 million

Despegar.com shares jumped 19.1% to $17.70 on Friday.

Here are some other big stocks recording gains in today’s session.

- Bloom Energy Corporation BE shares jumped 43% to $18.98. Bloom Energy announced a 1 GW fuel cell deal with AEP, providing clean power for AI Data Centers.

- Red Cat Holdings, Inc. RCAT gained 22.3% to $4.9200.

- Intuitive Machines, Inc. LUNR gained 13% to $11.56. The company reported third-quarter results on Thursday.

- Century Aluminum Company CENX rose 12.6% to $23.77.

- COMPASS Pathways plc CMPS jumped 12.5% to $5.50.

- Lifeway Foods, Inc. LWAY gained 11% to $24.85. The company reported quarterly results on Thursday.

- Kingsoft Cloud Holdings Limited KC rose 10.3% to $5.13. Kingsoft Cloud Holdings will release its unaudited financial results for the third quarter before the open of U.S. markets on Tuesday, Nov. 19.

- Alcoa Corporation AA gained 7.7% to $44.40.

- Zai Lab Limited ZLAB shares rose 6.3% to $28.34. The company priced a $200 million public offering of 7,843,137 shares at $25.50 per ADS.

- Palantir Technologies Inc. PLTR gained 6% to $62.72 after the company announced it will transfer its stock exchange listing over to the Nasdaq.

- The Walt Disney Company DIS rose 3% to $112.38. The company reported quarterly results on Thursday.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sigma Lithium Misses Q3 Revenue and EPS Targets Despite Production Gains

Sigma Lithium Corporation SGML reported a third-quarter revenue of $20.9 million, missing the consensus of $72.5 million.

Sales revenue for shipments stood at $44.2 million in the quarter and Concentrate sold came in at 57,483 tonnes vs. 52,572 tonnes in the second quarter of 2024.

Sigma Lithium delivered strong operational results at its Greentech industrial plant in the third quarter, producing 60,237 tonnes of Quintuple Zero Lithium Concentrate, an increase of 22% quarter over quarter and exceeding the 60,000 tonnes guidance.

This performance included multiple daily production records and sustained operations above 860 tonnes per day.

In the third-quarter, Sigma Lithium achieved one of the industry’s lowest cash unit operating costs, with CIF China averaging $513/ tonnes, slightly down from $515/ tonnes in the second quarter of 2024.

At the Grota do Cirilo operations, cash unit operating costs for lithium concentrate averaged $395/t, including a temporary $25/t expense for mobile crushers.

The company reported cash adjusted EBITDA loss of $10.6 million and EBITDA loss of $12.8 million in the quarter. Loss per share of $0.23 missed the EPS consensus of $0.07.

Sigma Lithium ended the third quarter with cash and cash equivalents of $65.6 million, and operating cash flow stood at $34 million in the third quarter.

Outlook: The company anticipates fourth-quarter production to reach at least 60,000 tonnes.

Ana Cabral, Co-Chairperson and CEO said, “This quarter we achieved our production and low industry cost targets, generating robust free cash flow and demonstrating our operational resilience to lithium cycles.”

”We also benefited from our shifted commercial strategy to navigate industry seasonality, enabling us to secure higher average realized prices compared to benchmarks.”

Investors can gain exposure to the stock via Sprott Lithium Miners ETF LITP and VanEck Rare Earth and Strategic Metals ETF REMX.

Price Action: SGML shares are down 2.66% at $12.80 at the last check Friday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyzing NVIDIA In Comparison To Competitors In Semiconductors & Semiconductor Equipment Industry

In today’s rapidly changing and fiercely competitive business landscape, it is essential for investors and industry enthusiasts to thoroughly analyze companies. In this article, we will conduct a comprehensive industry comparison, evaluating NVIDIA NVDA against its key competitors in the Semiconductors & Semiconductor Equipment industry. By examining key financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company’s performance within the industry.

NVIDIA Background

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| NVIDIA Corp | 68.80 | 61.90 | 37.95 | 30.94% | $19.71 | $22.57 | 122.4% |

| Taiwan Semiconductor Manufacturing Co Ltd | 30.23 | 8.02 | 11.98 | 8.36% | $360.77 | $439.35 | 38.95% |

| Broadcom Inc | 137.63 | 12.12 | 16.87 | -2.77% | $6.39 | $8.36 | 47.27% |

| Advanced Micro Devices Inc | 122.87 | 3.95 | 9.34 | 1.36% | $1.55 | $3.42 | 17.57% |

| Texas Instruments Inc | 38.29 | 10.88 | 12.04 | 7.86% | $2.09 | $2.47 | -8.41% |

| Qualcomm Inc | 18.34 | 6.93 | 4.76 | 11.46% | $3.21 | $5.78 | 18.69% |

| ARM Holdings PLC | 225.42 | 23.84 | 40.98 | 1.83% | $0.11 | $0.81 | 4.71% |

| Micron Technology Inc | 141.69 | 2.44 | 4.42 | 1.99% | $3.63 | $2.74 | 93.27% |

| Analog Devices Inc | 63.93 | 2.99 | 10.92 | 1.11% | $1.04 | $1.31 | -24.84% |

| Microchip Technology Inc | 45.56 | 5.61 | 6.49 | 1.24% | $0.34 | $0.67 | -48.37% |

| ON Semiconductor Corp | 16.63 | 3.32 | 3.95 | 4.75% | $0.63 | $0.8 | -19.21% |

| Monolithic Power Systems Inc | 65.03 | 11.96 | 13.84 | 6.35% | $0.17 | $0.34 | 30.59% |

| STMicroelectronics NV | 10.74 | 1.34 | 1.73 | 1.98% | $0.74 | $1.23 | -26.63% |

| First Solar Inc | 16.81 | 2.75 | 5.45 | 4.22% | $0.45 | $0.45 | 10.81% |

| ASE Technology Holding Co Ltd | 19.07 | 2.18 | 1.15 | 3.16% | $28.59 | $26.43 | 3.85% |

| United Microelectronics Corp | 10.58 | 1.57 | 2.47 | 3.76% | $27.9 | $19.98 | 0.89% |

| Skyworks Solutions Inc | 17.36 | 2.12 | 3.10 | 1.9% | $0.25 | $0.36 | -15.47% |

| MACOM Technology Solutions Holdings Inc | 121.88 | 8.12 | 12.78 | 2.67% | $0.04 | $0.1 | 5.37% |

| Universal Display Corp | 33.43 | 4.98 | 12.32 | 4.29% | $0.08 | $0.13 | 14.57% |

| Lattice Semiconductor Corp | 49.64 | 9.93 | 12.47 | 1.03% | $0.03 | $0.09 | -33.87% |

| Average | 62.38 | 6.58 | 9.85 | 3.5% | $23.05 | $27.1 | 5.78% |

By analyzing NVIDIA, we can infer the following trends:

-

At 68.8, the stock’s Price to Earnings ratio significantly exceeds the industry average by 1.1x, suggesting a premium valuation relative to industry peers.

-

It could be trading at a premium in relation to its book value, as indicated by its Price to Book ratio of 61.9 which exceeds the industry average by 9.41x.

-

With a relatively high Price to Sales ratio of 37.95, which is 3.85x the industry average, the stock might be considered overvalued based on sales performance.

-

With a Return on Equity (ROE) of 30.94% that is 27.44% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

-

The company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $19.71 Billion, which is 0.86x below the industry average. This potentially indicates lower profitability or financial challenges.

-

With lower gross profit of $22.57 Billion, which indicates 0.83x below the industry average, the company may experience lower revenue after accounting for production costs.

-

The company is experiencing remarkable revenue growth, with a rate of 122.4%, outperforming the industry average of 5.78%.

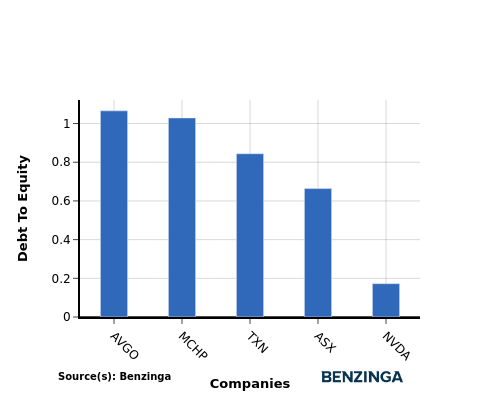

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is an important measure to assess the financial structure and risk profile of a company.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

By evaluating NVIDIA against its top 4 peers in terms of the Debt-to-Equity ratio, the following observations arise:

-

NVIDIA has a stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.17.

-

This suggests that the company has a more favorable balance between debt and equity, which can be perceived as a positive indicator by investors.

Key Takeaways

For NVIDIA, the PE, PB, and PS ratios are all high compared to its peers in the Semiconductors & Semiconductor Equipment industry, indicating that the stock may be overvalued based on these metrics. On the other hand, the high ROE and revenue growth suggest strong performance and potential for future growth. However, the low EBITDA and gross profit numbers may raise concerns about the company’s operational efficiency and profitability compared to industry peers.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.