RLX Technology Announces Unaudited Third Quarter 2024 Financial Results

SHENZHEN, China, Nov. 15, 2024 /PRNEWSWIRE/ – RLX Technology Inc. (“RLX Technology” or the “Company”) RLX, a leading global branded e-vapor company, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Highlights

- Net revenues were RMB756.3 million (US$107.8 million) in the third quarter of 2024, compared with RMB498.9 million in the same period of 2023.

- Gross margin was 27.2% in the third quarter of 2024, compared with 24.1% in the same period of 2023.

- U.S. GAAP net income was RMB169.4 million (US$24.1 million) in the third quarter of 2024, compared with RMB176.6 million in the same period of 2023.

- Non-GAAP net income[1] was RMB261.9 million (US$37.3 million) in the third quarter of 2024, compared with RMB201.4 million in the same period of 2023.

“We delivered another strong performance in the third quarter of 2024, showcasing our ability to consistently excel in diverse markets despite rapidly evolving trends and regulations,” commented Ms. Ying (Kate) Wang, Co-founder, Chairperson of the Board of Directors, and Chief Executive Officer of RLX Technology. “Our efficient, adaptable localization strategies have empowered us to establish market leadership in multiple countries by cultivating strong product-market alignment and building solid relationships with local distributors and retailers. Furthermore, our broad offering of premium, reliable cartridge-based products and growing selection of disposables and open-system products have earned the loyalty of adult smokers worldwide. As a trusted e-vapor brand for adult smokers, we remain committed to creating innovative, high-quality products in line with shifting trends and regulations, meeting users’ needs while driving RLX’s long-term growth.”

Mr. Chao Lu, Chief Financial Officer of RLX Technology, added, “Our robust third quarter results were led by a 51.6% year-over-year increase in net revenues to RMB756.3 million, underscoring the success of our internationalization efforts. Our gross margin also improved year over year, expanding 3.1 percentage points to 27.2%, thanks to a favorable shift in our revenue mix and our effective cost optimization initiatives. Notably, we maintained stable non-GAAP operating expenses while rapidly growing revenue, highlighting our operational leverage. We are also excited to continue returning value to our shareholders with our second cash dividend since our IPO while also executing our share repurchase program. Going forward, we will remain dedicated to pursuing development opportunities that deliver sustainable, growing profits and enhance returns for our shareholders.”

Third Quarter 2024 Financial Results

Net revenues were RMB756.3 million (US$107.8 million) in the third quarter of 2024, compared with RMB498.9 million in the same period of 2023. The increase was primarily due to our international expansion.

Gross profit was RMB206.0 million (US$29.4 million) in the third quarter of 2024, compared with RMB120.0 million in the same period of 2023.

Gross margin was 27.2% in the third quarter of 2024, compared with 24.1% in the same period of 2023. The increase was primarily due to a favorable change in the revenue mix and the cost optimization efforts.

Operating expenses were RMB216.6 million (US$30.9 million) in the third quarter of 2024, compared with RMB154.4 million in the same period of 2023. The increase was primarily due to the fluctuation of share-based compensation expenses, from RMB24.8 million in the third quarter of 2023 to RMB92.5 million (US$13.2 million) in the third quarter of 2024. The changes in share-based compensation expenses were primarily due to the changes in the fair value of the share incentive awards that the Company granted to its employees in line with the fluctuations in the Company’s share price.

Selling expenses were RMB69.0 million (US$9.8 million) in the third quarter of 2024, compared with RMB44.8 million in the same period of 2023, primarily due to an increase in share-based compensation expenses and branding expenses.

General and administrative expenses were RMB123.2 million (US$17.6 million) in the third quarter of 2024, compared with RMB78.8 million in the same period of 2023, primarily due to an increase in share-based compensation expenses.

Research and development expenses were RMB24.4 million (US$3.5 million) in the third quarter of 2024, compared with RMB30.8 million in the same period of 2023, primarily due to a decrease in salaries, welfare benefits and depreciation and amortization expenses, slightly offset by an increase in share-based compensation expenses.

Loss from operations was RMB10.7 million (US$1.5 million) in the third quarter of 2024, compared with RMB34.3 million in the same period of 2023.

Income tax expense was RMB30.4 million (US$4.3 million) in the third quarter of 2024, compared with RMB1.7 million in the same period of 2023.

U.S. GAAP net income was RMB169.4 million (US$24.1 million) in the third quarter of 2024, compared with RMB176.6 million in the same period of 2023.

Non-GAAP net income was RMB261.9 million (US$37.3 million) in the third quarter of 2024, compared with RMB201.4 million in the same period of 2023.

U.S. GAAP basic and diluted net income per American depositary share (“ADS”) were RMB0.135 (US$0.019) and RMB0.129 (US$0.018), respectively, in the third quarter of 2024, compared with U.S. GAAP basic and diluted net income per ADS of RMB0.133 and RMB0.130, respectively, in the same period of 2023.

Non-GAAP basic and diluted net income per ADS[2] were RMB0.211 (US$0.030) and RMB0.200 (US$0.029), respectively, in the third quarter of 2024, compared with non-GAAP basic and diluted net income per ADS of RMB0.152 and RMB0.149, respectively, in the same period of 2023.

Balance Sheet and Cash Flow

As of September 30, 2024, the Company had cash and cash equivalents, restricted cash, short-term bank deposits, net, short-term investments, net, long-term bank deposits, net and long-term investment securities, net of RMB15,361.7 million (US$2,189.0 million), compared with RMB14,930.8 million as of June 30, 2024. In the third quarter of 2024, net cash generated from operating activities was RMB156.6 million (US$22.3 million).

Dividend Payment

The Company announced that its Board of Directors approved a cash dividend of US$0.01 per ordinary share, or US$0.01 per ADS, to holders of ordinary shares and holders of ADSs, respectively, as of the close of business on December 6, 2024 Beijing/Hong Kong Time and New York Time, respectively, payable in U.S. dollars. The payment date is expected to be on or around December 13, 2024 and on or around December 20, 2024 for holders of ordinary shares and holders of ADSs, respectively.

Conference Call

The Company’s management will host an earnings conference call at 7:00 AM U.S. Eastern Time on November 15, 2024 (8:00 PM Beijing/Hong Kong Time on November 15, 2024).

Dial-in details for the earnings conference call are as follows:

|

United States (toll-free): |

+1-888-317-6003 |

|

International: |

+1-412-317-6061 |

|

Hong Kong, China (toll-free): |

+800-963-976 |

|

Hong Kong, China: |

+852-5808-1995 |

|

Mainland China: |

400-120-6115 |

|

Participant Code: |

6222824 |

Participants should dial in 10 minutes before the scheduled start time and ask to be connected to the call for “RLX Technology Inc.” with the Participant Code as set forth above.

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.relxtech.com.

A replay of the conference call will be accessible approximately two hours after the conclusion of the call until November 22, 2024, by dialing the following telephone numbers:

|

United States: |

+1-877-344-7529 |

|

International: |

+1-412-317-0088 |

|

Replay Access Code: |

7489030 |

|

[1] Non-GAAP net income is a non-GAAP financial measure. For more information on the Company’s non-GAAP financial measures, please see the section “Non-GAAP Financial Measures” and the table captioned “Unaudited Reconciliation of GAAP and Non-GAAP Results” set forth at the end of this press release. |

|

[2] Non-GAAP basic and diluted net income per ADS is a non-GAAP financial measure. For more information on the Company’s non-GAAP financial measures, please see the section “Non-GAAP Financial Measures” and the table captioned “Unaudited Reconciliation of GAAP and Non-GAAP Results” set forth at the end of this press release. |

About RLX Technology Inc.

RLX Technology Inc. RLX is a leading global branded e-vapor company. The Company leverages its strong in-house technology, product development capabilities and in-depth insights into adult smokers’ needs to develop superior e-vapor products.

For more information, please visit: http://ir.relxtech.com.

Non-GAAP Financial Measures

The Company uses non-GAAP net income and non-GAAP basic and diluted net income per ADS, each a non-GAAP financial measure, in evaluating its operating results and for financial and operational decision-making purposes. Non-GAAP net income represents net income excluding share-based compensation expenses. Non-GAAP basic and diluted net income per ADS is computed using non-GAAP net income attributable to RLX Technology Inc. and the same number of ADSs used in U.S. GAAP basic and diluted net income per ADS calculation.

The Company presents these non-GAAP financial measures because they are used by the management to evaluate its operating performance and formulate business plans. The Company believes that they help identify underlying trends in its business that could otherwise be distorted by the effect of certain expenses that are included in net income. The Company also believes that the use of the non-GAAP measures facilitates investors’ assessment of its operating performance, as they could provide useful information about its operating results, enhances the overall understanding of its past performance and future prospects and allows for greater visibility with respect to key metrics used by the management in its financial and operational decision making.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. They should not be considered in isolation or construed as an alternative to net income, basic and diluted net income per ADS or any other measure of performance or as an indicator of its operating performance. Investors are encouraged to review its historical non-GAAP financial measures to the most directly comparable U.S. GAAP measures. The non-GAAP financial measures here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to our data. The Company encourages investors and others to review its financial information in its entirety and not rely on any single financial measure.

For more information on the non-GAAP financial measures, please see the table captioned “Unaudited Reconciliation of GAAP and non-GAAP Results” set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB are made at a rate of RMB7.0176 to US$1.00, the exchange rate on September 30, 2024, set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or U.S. dollar amounts referred could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” and similar statements. Among other things, quotations from management in this announcement, as well as the Company’s strategic and operational plans, contain forward- looking statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited to statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s growth strategies; its future business development, results of operations and financial condition; trends and competition in global e-vapor market; changes in its revenues and certain cost or expense items; governmental policies, laws and regulations across various jurisdictions relating to the Company’s industry, and general economic and business conditions globally and in China and assumptions underlying or related to any of the foregoing. Further information regarding these risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release and in the attachments is current as of the date of this press release, and the Company does not undertake any obligation to update such information, except as required under applicable law.

For more information, please contact:

In China:

RLX Technology Inc.

Head of Capital Markets

Sam Tsang

Email: ir@relxtech.com

Piacente Financial Communications

Jenny Cai

Tel: +86-10-6508-0677

Email: RLX@tpg-ir.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

Email: RLX@tpg-ir.com

|

RLX TECHNOLOGY INC. |

|||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

|||

|

(All amounts in thousands) |

|||

|

As of |

|||

|

December 31, |

September 30, |

September 30, |

|

|

2023 |

2024 |

2024 |

|

|

RMB |

RMB |

US$ |

|

|

ASSETS |

|||

|

Current assets: |

|||

|

Cash and cash equivalents |

2,390,298 |

3,255,500 |

463,905 |

|

Restricted cash |

29,760 |

58,265 |

8,303 |

|

Short-term bank deposits, net |

2,631,256 |

2,602,887 |

370,908 |

|

Receivables from online payment platforms |

6,893 |

5,357 |

763 |

|

Short-term investments |

3,093,133 |

2,199,658 |

313,449 |

|

Accounts and notes receivable, net |

60,482 |

121,939 |

17,376 |

|

Inventories |

144,850 |

81,432 |

11,604 |

|

Amounts due from related parties |

118,736 |

248,762 |

35,448 |

|

Prepayments and other current assets, net |

508,435 |

299,409 |

42,666 |

|

Total current assets |

8,983,843 |

8,873,209 |

1,264,422 |

|

Non-current assets: |

|||

|

Property, equipment and leasehold improvement, net |

77,358 |

56,998 |

8,122 |

|

Intangible assets, net |

69,778 |

59,156 |

8,430 |

|

Long-term investments, net |

8,000 |

8,000 |

1,140 |

|

Deferred tax assets, net |

58,263 |

58,262 |

8,302 |

|

Right-of-use assets, net |

52,562 |

31,304 |

4,461 |

|

Long-term bank deposits, net |

1,757,804 |

1,022,279 |

145,674 |

|

Long-term investment securities, net |

5,236,109 |

6,223,159 |

886,791 |

|

Goodwill |

66,506 |

64,528 |

9,195 |

|

Other non-current assets, net |

4,874 |

5,632 |

803 |

|

Total non-current assets |

7,331,254 |

7,529,318 |

1,072,918 |

|

Total assets |

16,315,097 |

16,402,527 |

2,337,340 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|||

|

Current liabilities: |

|||

|

Accounts and notes payable |

266,426 |

352,403 |

50,217 |

|

Contract liabilities |

49,586 |

24,508 |

3,492 |

|

Salary and welfare benefits payable |

39,256 |

75,047 |

10,694 |

|

Taxes payable |

77,164 |

127,526 |

18,172 |

|

Accrued expenses and other current liabilities |

103,996 |

107,771 |

15,357 |

|

Amounts due to related parties |

101,927 |

10,380 |

1,479 |

|

Dividend payable |

881 |

– |

– |

|

Lease liabilities – current portion |

29,435 |

16,710 |

2,381 |

|

Total current liabilities |

668,671 |

714,345 |

101,792 |

|

Non-current liabilities: |

|||

|

Deferred tax liabilities |

23,591 |

21,757 |

3,100 |

|

Lease liabilities – non-current portion |

24,419 |

7,136 |

1,017 |

|

Total non-current liabilities |

48,010 |

28,893 |

4,117 |

|

Total liabilities |

716,681 |

743,238 |

105,909 |

|

Shareholders’ Equity: |

|||

|

Total RLX Technology Inc. shareholders’ equity |

15,609,393 |

15,662,993 |

2,231,959 |

|

Noncontrolling interests |

(10,977) |

(3,704) |

(528) |

|

Total shareholders’ equity |

15,598,416 |

15,659,289 |

2,231,431 |

|

Total liabilities and shareholders’ equity |

16,315,097 |

16,402,527 |

2,337,340 |

|

RLX TECHNOLOGY INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/(LOSS) |

||||||||

|

(All amounts in thousands, except for share and per share data) |

||||||||

|

For the three months ended |

For the nine months ended |

|||||||

|

September 30, |

June 30, |

September 30, |

September 30, |

September 30, |

September 30, |

September 30, |

||

|

2023 (As adjusted) (a) |

2024 |

2024 |

2024 |

2023 (As adjusted) (a) |

2024 |

2024 |

||

|

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

||

|

Net revenues |

498,929 |

627,176 |

756,288 |

107,770 |

1,065,929 |

1,935,087 |

275,748 |

|

|

Cost of revenues |

(278,578) |

(400,712) |

(473,379) |

(67,456) |

(529,004) |

(1,201,701) |

(171,241) |

|

|

Excise tax on products |

(100,313) |

(68,602) |

(76,933) |

(10,963) |

(272,624) |

(226,775) |

(32,315) |

|

|

Gross profit |

120,038 |

157,862 |

205,976 |

29,351 |

264,301 |

506,611 |

72,192 |

|

|

Operating expenses: |

||||||||

|

Selling expenses |

(44,751) |

(62,235) |

(68,975) |

(9,829) |

(175,738) |

(184,097) |

(26,234) |

|

|

General and administrative expenses |

(78,849) |

(128,997) |

(123,226) |

(17,560) |

(293,985) |

(362,177) |

(51,610) |

|

|

Research and development expenses |

(30,783) |

40 |

(24,435) |

(3,482) |

(150,782) |

(55,935) |

(7,971) |

|

|

Total operating expenses |

(154,383) |

(191,192) |

(216,636) |

(30,871) |

(620,505) |

(602,209) |

(85,815) |

|

|

Loss from operations |

(34,345) |

(33,330) |

(10,660) |

(1,520) |

(356,204) |

(95,598) |

(13,623) |

|

|

Other income: |

||||||||

|

Interest income, net |

158,260 |

154,207 |

156,659 |

22,324 |

469,951 |

469,724 |

66,935 |

|

|

Investment income |

21,028 |

12,718 |

13,070 |

1,862 |

63,001 |

38,564 |

5,495 |

|

|

Others, net |

33,412 |

22,739 |

40,745 |

5,806 |

183,949 |

92,427 |

13,171 |

|

|

Income before income tax |

178,355 |

156,334 |

199,814 |

28,472 |

360,697 |

505,117 |

71,978 |

|

|

Income tax expense |

(1,746) |

(21,389) |

(30,423) |

(4,335) |

(35,677) |

(68,156) |

(9,712) |

|

|

Net income |

176,609 |

134,945 |

169,391 |

24,137 |

325,020 |

436,961 |

62,266 |

|

|

Less: net income attributable to noncontrolling interests |

1,579 |

2,631 |

3,737 |

532 |

4,169 |

7,085 |

1,010 |

|

|

Net income attributable to RLX Technology Inc. |

175,030 |

132,314 |

165,654 |

23,605 |

320,851 |

429,876 |

61,256 |

|

|

Other comprehensive (loss)/income: |

||||||||

|

Foreign currency translation adjustments |

(83,978) |

44,174 |

(181,148) |

(25,813) |

331,004 |

(124,268) |

(17,708) |

|

|

Unrealized income on long-term investment securities |

3,508 |

705 |

5,292 |

754 |

11,920 |

5,984 |

853 |

|

|

Total other comprehensive (loss)/income |

(80,470) |

44,879 |

(175,856) |

(25,059) |

342,924 |

(118,284) |

(16,855) |

|

|

Total comprehensive income/(loss) |

96,139 |

179,824 |

(6,465) |

(922) |

667,944 |

318,677 |

45,411 |

|

|

Less: total comprehensive income attributable to noncontrolling |

1,579 |

2,618 |

3,730 |

531 |

4,169 |

7,078 |

1,010 |

|

|

Total comprehensive income/(loss) attributable to RLX |

94,560 |

177,206 |

(10,195) |

(1,453) |

663,775 |

311,599 |

44,401 |

|

|

Net income per ordinary share/ADS |

||||||||

|

Basic |

0.133 |

0.108 |

0.135 |

0.019 |

0.244 |

0.348 |

0.050 |

|

|

Diluted |

0.130 |

0.103 |

0.129 |

0.018 |

0.239 |

0.333 |

0.047 |

|

|

Weighted average number of ordinary shares/ADSs |

||||||||

|

Basic |

1,316,452,743 |

1,228,869,526 |

1,225,417,517 |

1,225,417,517 |

1,317,292,081 |

1,234,501,619 |

1,234,501,619 |

|

|

Diluted |

1,344,359,144 |

1,284,388,803 |

1,287,927,444 |

1,287,927,444 |

1,344,018,578 |

1,289,831,349 |

1,289,831,349 |

|

|

Note (a): The Company acquired various companies on December 13, 2023, which was accounted for as an under common control transaction in accordance with ASC 805-50. The Company retrospectively adjusted the above comparative unaudited condensed consolidated statements of comprehensive income/(loss) in the prior quarter and prior nine months period. |

||||||||

|

RLX TECHNOLOGY INC. |

||||||||

|

UNAUDITED RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

||||||||

|

(All amounts in thousands, except for share and per share data, or otherwise noted) |

||||||||

|

For the three months ended |

For the nine months ended |

|||||||

|

September 30, |

June 30, |

September 30, |

September 30, |

September 30, |

September 30, |

September 30, |

||

|

2023 (As adjusted) (b) |

2024 |

2024 |

2024 |

2023 (As adjusted) (b) |

2024 |

2024 |

||

|

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

||

|

Net income |

176,609 |

134,945 |

169,391 |

24,137 |

325,020 |

436,961 |

62,266 |

|

|

Add: share-based compensation expenses |

||||||||

|

Selling expenses |

(4,045) |

9,172 |

5,768 |

822 |

4,571 |

19,543 |

2,785 |

|

|

General and administrative expenses |

29,771 |

93,026 |

85,295 |

12,154 |

140,190 |

244,735 |

34,874 |

|

|

Research and development expenses |

(936) |

(24,074) |

1,446 |

206 |

1,490 |

(18,747) |

(2,671) |

|

|

Non-GAAP net income |

201,399 |

213,069 |

261,900 |

37,319 |

471,271 |

682,492 |

97,254 |

|

|

Net income attributable to RLX Technology Inc. |

175,030 |

132,314 |

165,654 |

23,605 |

320,851 |

429,876 |

61,256 |

|

|

Add: share-based compensation expenses |

24,790 |

78,124 |

92,509 |

13,182 |

146,251 |

245,531 |

34,988 |

|

|

Non-GAAP net income attributable to RLX Technology Inc. |

199,820 |

210,438 |

258,163 |

36,787 |

467,102 |

675,407 |

96,244 |

|

|

Non-GAAP net income per ordinary share/ADS |

||||||||

|

– Basic |

0.152 |

0.171 |

0.211 |

0.030 |

0.355 |

0.547 |

0.078 |

|

|

– Diluted |

0.149 |

0.164 |

0.200 |

0.029 |

0.348 |

0.524 |

0.075 |

|

|

Weighted average number of ordinary shares/ADSs |

||||||||

|

– Basic |

1,316,452,743 |

1,228,869,526 |

1,225,417,517 |

1,225,417,517 |

1,317,292,081 |

1,234,501,619 |

1,234,501,619 |

|

|

– Diluted |

1,344,359,144 |

1,284,388,803 |

1,287,927,444 |

1,287,927,444 |

1,344,018,578 |

1,289,831,349 |

1,289,831,349 |

|

|

Note (b): The Company acquired various companies on December 13, 2023, which was accounted for as an under common control transaction in accordance with ASC 805-50. The Company retrospectively adjusted the above unaudited reconciliation of GAAP and Non-GAAP results in the prior quarter and prior nine months period. |

||||||||

|

RLX TECHNOLOGY INC. |

|||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||||

|

(All amounts in thousands) |

|||||||||

|

For the three months ended |

For the nine months ended |

||||||||

|

September 30, |

June 30, |

September 30, |

September 30, |

September 30, |

September 30, |

September 30, |

|||

|

2023 (As adjusted) (c) |

2024 |

2024 |

2024 |

2023 (As adjusted) (c) |

2024 |

2024 |

|||

|

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||

|

Net cash generated from/(used in) operating |

82,853 |

196,764 |

156,554 |

22,309 |

(106,494) |

357,338 |

50,920 |

||

|

Net cash generated from investing activities |

967,234 |

557,132 |

139,120 |

19,824 |

1,780,871 |

1,116,917 |

159,159 |

||

|

Net cash used in financing activities |

(206,577) |

– |

(74,780) |

(10,656) |

(401,311) |

(547,665) |

(78,042) |

||

|

Effect of foreign exchange rate changes on cash, |

(5,918) |

10,032 |

(45,818) |

(6,529) |

52,884 |

(32,883) |

(4,685) |

||

|

Net increase in cash and cash equivalents and |

837,592 |

763,928 |

175,076 |

24,948 |

1,325,950 |

893,707 |

127,352 |

||

|

Cash, cash equivalents and restricted cash at |

1,777,444 |

2,374,761 |

3,138,689 |

447,260 |

1,289,086 |

2,420,058 |

344,856 |

||

|

Cash, cash equivalents and restricted cash at |

2,615,036 |

3,138,689 |

3,313,765 |

472,208 |

2,615,036 |

3,313,765 |

472,208 |

||

|

Note (c): The Company acquired various companies on December 13, 2023, which was accounted for as an under common control transaction in accordance with ASC 805-50. The Company retrospectively adjusted the above comparative unaudited condensed consolidated statements of cash flows in the prior quarter and prior nine months period. |

|||||||||

![]() View original content:https://www.prnewswire.com/news-releases/rlx-technology-announces-unaudited-third-quarter-2024-financial-results-302305299.html

View original content:https://www.prnewswire.com/news-releases/rlx-technology-announces-unaudited-third-quarter-2024-financial-results-302305299.html

SOURCE RLX Technology Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Big Short' Investor Michael Burry Doubles Down On Chinese Tech Stocks While Adding Protective Hedges

Michael Burry, the hedge fund manager renowned for predicting the 2008 financial crisis, has significantly increased his exposure to Chinese technology companies while simultaneously implementing protective measures against potential downside risks, according to regulatory filings.

What Happened: Burry’s Scion Asset Management made several notable adjustments to its portfolio during the third quarter, with Chinese companies now representing its largest positions. The firm increased its stake in Alibaba Group Holding Ltd BABA by 29%, making it the fund’s largest holding valued at over $21 million as of September’s end.

In a similar move, Scion doubled its position in JD.Com Inc JD, elevating it to the fund’s second-largest holding at approximately $20 million. The firm also expanded its stake in Chinese search giant Baidu Inc BIDU by 67%, bringing the position to $13.2 million.

However, in what appears to be a cautionary strategy, Burry has simultaneously established put options against these same holdings. Put options typically increase in value when the underlying securities decline, suggesting a hedging strategy designed to protect against potential market volatility.

The timing of these moves coincides with Beijing’s recent economic stimulus announcements aimed at reinvigorating growth in the world’s second-largest economy. While Chinese equities initially rallied in September following these signals, gains have moderated as investors await more concrete fiscal measures.

Beyond his Chinese technology focus, Burry has also increased positions in several U.S. companies, including Shift4 Payments Inc. FOUR, American Coastal Insurance Corp. ACIC, and Molina Healthcare Inc. MOH.

Why It Matters: Burry’s top three Chinese holdings have posted average gains of nearly 60% over a two-month period, according to market data.

Burry’s moves are being closely watched by market participants, particularly given his track record. He gained widespread recognition for his prescient bet against mortgage-backed securities before the 2008 global financial crisis, a story later chronicled in Michael Lewis‘s bestseller “The Big Short” and its subsequent Oscar-winning film adaptation.

It’s worth noting that these positions reflect holdings as of Sep. 30, as required by SEC regulations for funds managing over $100 million in assets. Given the 45-day reporting delay and Burry’s active trading style, current positions may have already changed.

The development comes as other prominent investors adjust their Chinese holdings. Billionaire investor David Tepper’s Appaloosa Management recently reduced its Alibaba stake by 5%, though the position remains the fund’s largest holding at 15.75% of its $6.7 billion portfolio.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Did Super Micro Computer's Troubles Just Deepen?

Earlier this year, Super Micro Computer (NASDAQ: SMCI) reigned with Nvidia as the market’s best-performing stocks. Supermicro advanced 188% in the first half, while Nvidia climbed 149%.

Why did this 30-year-old company suddenly jump into the limelight? The equipment maker, providing elements like servers for artificial intelligence (AI) data centers, saw its earnings soar amid the AI boom.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But this growth story dimmed in recent times as troubles for the company started piling up, and all of this has led to a more than 60% drop in the stock since late August. A short report alleged problems at Supermicro, a newspaper article spoke of a possible Justice Department investigation, and just recently, Supermicro auditor Ernst & Young resigned from the job.

At the same time, Supermicro has fallen behind in financial reporting, and several weeks ago, it said its 10-K annual report would be late. And just this week, the company said it would be unable to file its report for the quarter ended Sept. 30 on time. Did Supermicro’s troubles just deepen?

First, a bit of detail on the various headwinds, starting with the short report, released in late August. In the document, Hindenburg Research alleged a variety of troubles, including “glaring accounting red flags.” It’s important to keep in mind that at the time of the report, Hindenburg held a short position in Supermicro, so it would benefit if the stock fell. This bias makes it difficult for investors to rely on Hindenburg as a source of information regarding the equipment maker.

The Wall Street Journal later reported of a probe into Supermicro launched by the Justice Department. Both the U.S. attorney’s office and the company declined to comment.

Finally, auditor Ernst & Young, after questioning the company’s internal controls back in July, recently resigned, saying it’s “unwilling to be associated with the financial statements prepared by management.” The Supermicro board appointed an independent special committee to review the situation, and just recently, the committee said, “there is no evidence of fraud or misconduct on the part of management or the Board of Directors.” Though the committee hasn’t officially completed its review, these words represent some good news for Supermicro and its shareholders.

Meanwhile, Supermicro informed the Securities and Exchange Commission (SEC) that it would be late filing its 10-K annual report, a move that prompted Nasdaq to send the company a non-compliance letter. Supermicro now has until Nov. 16 to either file or present a plan to regain compliance. Non-compliance eventually results in delisting, an outcome that definitely would be bad news.

Chinese Retail Sales Pickup In October: Here's What's Happening With Alibaba, JD And Pinduoduo Shares

Chinese retail sales grew by 4.8% year-on-year in October picking up from September’s 3.2% growth, as per the National Bureau of Statistics on Friday. That annual retail sales forecast exceeded the 3.8% growth precited by a Reuters poll.

What Happened: The robust growth in Chinese retail sales in October was fueled by the monetary stimulus measures that the People’s Bank of China unveiled in the latter half of September as a last-ditch effort to revive the country’s struggling economy.

The share price of the top three Chinese e-commerce players, Alibaba Group Holding Limited BABA, PDD Holdings PDD and JD.com JD were in red in Hong Kong on Friday.

Meanwhile, Alibaba Group Holding‘s American Depository Receipts BABA have plunged by 11.90% over the last month, according to Benzinga Pro data. PDD Holdings PDD and JD.com JD ADRs have declined by 13.10% and 18.93%, respectively. The shares have underperformed their index, as the NYSE Composite rose by 0.28%, while the Nasdaq Composite advanced by 4.32% in the same period.

Why It Matters: The Chinese stimulus is aimed at stimulating spending and investment in an economy that’s been suffering from weak demand and a cooling property market. The measures also include a stimulus package of around 1 trillion yuan, or more than $140 billion, in liquidity.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia, Apple Suppliers Brace For Trump's Return: Foxconn, Pegatron, Quanta Prepare For Rapid US Investment Boom

Nvidia Corp. NVDA and Apple Inc.’s AAPL key suppliers — Hon Hai Precision Industry Co. Ltd. HNHPF, popularly known as Foxconn, Pegatron Corp. PGTRF, and Quanta Computer QUCCF — plan to quickly increase U.S. investments should trade policies shift under Donald Trump’s second term.

What Happened: Foxconn chairman Young Liu announced on Thursday that the company is ready to expand its U.S. operations. The company is a leading contract electronics manufacturer and has substantial production bases in Texas, Wisconsin, and Ohio.

“We can very quickly adjust our investment if necessary,” Liu said at an investor’s conference, reported Nikkei Asia.

Pegatron, a key supplier to Tesla Inc. TSLA, Microsoft Corp. MSFT, and Apple, is also prepared to respond swiftly to any policy changes.

“If necessary, we can quickly convert [our repair facility in Indiana] into production lines to accommodate policy changes [such as tariffs],” co-CEO Johnson Deng told investors, according to the report.

See Also: Elon Musk Says The ‘Prophecy Has Been Fulfilled’ — Peanut The Squirrel-Themed Meme Coin Spikes 11%

Quanta Computer’s cloud-computing subsidiary, QCT, is ready to expand its manufacturing capacity in California if needed, said the company’s president, Mike Yang.

“We have continued to expand our capacity there in the past two years and have space to further expand anytime if needed. We also have a footprint in Thailand as well.”

Why It Matters: During his campaign, Trump underscored his “America First” agenda and warned of potential tariffs on various countries, creating uncertainty for the tech supply chain.

Despite these political uncertainties, Foxconn and other leading tech suppliers continue to view artificial intelligence as the key growth driver for the industry through 2025, the report noted.

The stock market and cryptocurrency sector have seen significant growth since Trump’s victory, with major U.S. stock indexes hitting record highs since Trump’s win against Vice President Kamala Harris.

Earlier this week, Yang Chin-long, the governor of Taiwan’s central bank, voiced optimism about Taiwan Semiconductor Manufacturing Co.’s TSM upcoming $65 billion investment in U.S. factories.

“Chips and information and telecommunications products are what the U.S. needs most. I don’t think the United States would penalize Taiwan,” he said during a legislative session on Thursday.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Slide as Fed Rate-Cut Bets Pared Back: Markets Wrap

(Bloomberg) — European equities and US futures fell after Jerome Powell indicated the Federal Reserve was in no rush to cut interest rates.

Most Read from Bloomberg

The Stoxx 600 slipped 0.7%, on track for its fourth weekly drop, and S&P 500 futures pointed to a second day of declines on Wall Street. Yields on two-year Treasuries steadied after jumping in the previous session as traders pared back their expectations for an interest-rate reduction from the Fed in December.

A gauge of the dollar was set to rise about 1.4% for the week, having hit a two-year high on Thursday. The greenback has rallied in the wake of Donald Trump’s election win, and the latest boost came from Chair Powell’s comments that the Fed may take its time easing policy. More clarity on the Fed’s path could emerge later Friday as the US releases retail sales data and a host of Fed officials are set to speak.

“Admittedly the US dollar is pricing in a lot of Trump policy without timing or implementation detail, meaning it’s more about embracing a sweeping ‘narrative,’” said Richard Franulovich, head of FX strategy at Westpac Banking Corp. in Sydney. “Markets risk over-egging this story.”

Powell’s remarks that the Fed is not in a hurry to cut rates given the strength of the economy prompted traders to pare back expectations for a December rate cut, taking odds to less than 60% from roughly 80% a day earlier.

Several Fed policymakers have urged a cautious approach to easing, given the strong economy, lingering inflation concerns and broad uncertainty. Their comments come at a time when the equity market is showing signs of fatigue following a post-election surge that spurred calls for a pause, with several measures highlighting “stretched” trader optimism.

In Asia, MSCI’s regional index headed for its first gain this week, while China’s CSI 300 Index dropped despite signs of resilience in the nation’s economy. A monthly activity report showed retail sales expanded at the strongest pace in eight months.

Japan’s yen reversed losses after Finance Minister Katsunobu Kato said authorities are monitoring the forex market.

In commodities, oil headed for a weekly drop, weighed down by the impact of a stronger dollar and concerns the global market will flip to a glut next year. Gold held near a two-month low.

Stock market today: World stocks are mixed after Wall Street's post-election bonanza wanes

HONG KONG (AP) — European shares opened lower while Asian stocks were mixed on Friday after U.S. stocks slipped as the market’s big rally following Trump’s election victory cooled further.

Britain’s FTSE 100 lost 0.4% to 8,038.17 after data from the Office for National Statistics showed economic growth slowed to 0.1% in the July-September quarter from the 0.5% in the previous quarter. It was below analysts’ estimates.

Germany’s DAX dropped 0.6% to 19,148.74. In Paris, the CAC 40 was down 0.8% at 7,252.69.

The future for the S&P 500 was 0.8% lower and that for the Dow Jones Industrial Average fell 0.6%.

In Tokyo, the Nikkei 225 index gained 0.3% to 38,642.91. The yen has been weakening against the U.S. dollar, boosting share prices for exporter like Nissan Motor Co., whose shares jumped 4.5% on Friday.

Japan’s economy grew at a 0.9% annual pace in the July-September quarter, higher than the 0.5% increase in the previous quarter, even as the Bank of Japan raised its key interest rate to 0.25% from 0.1% in July. The BOJ said during its October meeting that it plans to continue increasing rates, with a potential target of 1% in the second half of the next fiscal year, which begins in April, if economic activity and prices develop as expected.

The Hang Seng in Hong Kong slipped 0.1% to 19,426.34 and the Shanghai Composite index dropped 1.5% to 3,330.73 after a report from the National Bureau of Statistics on Friday showed the nation’s retail sales rose 4.8% year-on-year in October, beating forecasts. But industrial output slowed from the previous month and improvements in the property industry were marginal.

Australia’s S&P/ASX 200 gained 0.7% to 8,285.20, while South Korea’s Kospi edged 0.1% lower, to 2,416.86.

On Thursday, the S&P 500 fell 0.6% but remains near its all-time high set on Monday. The Dow Jones Industrial Average dropped 0.5% and the Nasdaq composite sank 0.6%.

Some of the stocks that got the biggest bump from Trump’s election lost momentum. Tesla fell 5.8% for just its second loss since Election Day. It’s run by Elon Musk, who has become a close Trump ally.

Smaller stocks also fell harder than the rest of the market, and the Russell 2000 index of small stocks lost 1.4%. It’s a turnaround from the election’s immediate aftermath, when the thought was that an “America First” president would benefit domestically focused companies more than big multinationals that could be hurt by tariffs and trade wars.

A report showed prices paid at the U.S. wholesale level were 2.4% higher in October from a year earlier. That was an acceleration from September’s 1.9% wholesale inflation rate and a bigger jump than economists had expected.

Hikvision unveils WonderHub and elevates smart collaboration across industries

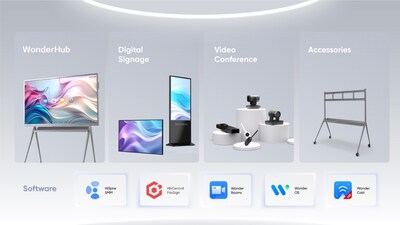

HANGZHOU, China, Nov. 15, 2024 /PRNewswire/ — Hikvision unveiled its fully upgraded smart collaboration business. The event showcased a range of innovative products designed to transform collaboration in education, meetings, retail, and more. Among the highlights were cutting-edge solutions like WonderHub interactive displays, digital signage, and video conference devices. These products underscore Hikvision’s commitment to driving digital transformation and enhancing user experiences in an increasingly connected world.

At the heart of this ecosystem is WonderHub, which features WonderOS, an AI-powered platform that seamlessly connects devices and enhances collaboration. With tools like WonderSpark for interactive whiteboards and WonderCast for wireless content sharing, WonderHub enables users to communicate, create, and collaborate more effectively than ever.

Boosting Classroom Engagement with Innovative Solutions

In education, WonderHub is designed to elevate classroom experiences. The interactive displays enable students to share and express ideas effortlessly, creating a more engaging and dynamic learning environment. The built-in WonderSpark smart whiteboard software uses AI to recognize equations, provide solutions, and generate interactive 3D teaching materials across subjects like mathematics, chemistry, and natural sciences. Teachers can also access licensed images and videos through Creative Commons integration, enriching lesson content and boosting student engagement.

Classrooms equipped with WonderHub also benefit from multi-window modes and a suite of 19 educational tools. These include subject-specific templates and interactive applications. For remote learning, WonderHub integrates seamlessly with third-party conferencing platforms, allowing students to collaborate in real-time, no matter their location.

Empowering Business Meetings with Intelligent Features

Hikvision’s smart collaboration solutions transform business meetings into more efficient and immersive experiences. The WonderHub Ultra Series allows users to easily connect personal devices and leverage the interactive display’s camera, speakers, and microphone for high-quality remote conferencing. The HiSpire meeting management system streamlines meeting logistics, including room scheduling, attendee notifications, post-meeting summaries, and distribution of materials.

Advanced AI features, such as auto-framing and speaker tracking, ensure optimal video quality. Meanwhile, app-free screen casting allows for easy sharing of presentation materials. The X12 and X28 audio-video cameras offer enterprises tailored setups to suit meeting rooms of any size, ensuring seamless communication with high-definition video and precise audio capture.

Transforming Retail Spaces with Dynamic Digital Signage

Hikvision has also advanced its digital signage solutions to enhance customer engagement in retail scenarios. The vibrant displays and centralized content management allow retailers to effectively capture attention. High-brightness window displays attract passersby with promotions and new product highlights. Meanwhile, floor-standing signage supports interactive features, such as self-service ordering. The HikCentral FocSign platform enables retailers to remotely manage and distribute content across multiple locations, improving operational efficiency and ensuring consistent branding.

These digital signage solutions, including the DP and DL series, boast superior brightness and clarity, ensuring visibility even in strong lighting conditions. The displays run on Hikvision’s self-developed platform and support WonderCast wireless casting, enabling quick and easy content sharing from various devices.

Since entering the smart collaboration market in 2017, Hikvision has rapidly become a leading global player. With over 300,000 units sold across more than 140 countries and regions, Hikvision’s smart collaboration business exemplifies the company’s commitment to innovation, quality, and user-centric design. As a key highlight of this evolution, the fully upgraded WonderHub represents the next leap forward in smart collaboration technology.

By bridging advanced technology with practical applications, WonderHub, along with Hikvision’s broader range of smart collaboration solutions, is leading the way in providing more efficient and intelligent solutions for users worldwide.

For more information about Hikvision’s smart collaboration products and solutions, please visit Hikvision’s official website.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hikvision-unveils-wonderhub-and-elevates-smart-collaboration-across-industries-302306901.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hikvision-unveils-wonderhub-and-elevates-smart-collaboration-across-industries-302306901.html

SOURCE Hikvision Digital Technology

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.