Cathie Wood Keeps Betting On Amazon's 'Haul' Play: Ark Loads Up $6M Worth Of Shares

On Thursday, Ark Invest, led by Cathie Wood, made significant trades in Amazon.com Inc. AMZN and Rocket Lab USA Inc. RKLB, according to the firm’s daily trade data.

The Amazon Trade

Ark picked up 28,509 Amazon shares for ARK Autonomous Technology & Robotics ETF ARKQ, Ark Fintech Innovation ETF ARKF, and ARK Space Exploration & Innovation ETF ARKX in a transaction valued at $6.03 million. As of Thursday, Amazon’s stock closed at $211.48, reflecting a decrease of 1.22%.

Ark Invest’s move on Amazon comes in the wake of the e-commerce giant’s recent launch of a low-cost online storefront, “Haul”, designed to compete with Chinese e-commerce platforms. According to a report, Amazon initiated discussions with China-based sellers earlier this year about offering a similar service. The exact details of Ark’s trade in Amazon were not disclosed in the data provided.

The Rocket Lab Trade

Ark Invest sold 627,775 shares in Rocket Lab, valued at almost $10.09 million. The trades were made through the ARKQ and ARKX ETFs.

This sale followed a significant surge in Rocket Lab’s shares, which shot up over 28% to $18.83 on Wednesday. As of Thursday, Rocket Lab’s stock closed at $17.36, reflecting a decrease of 7.81%.

The earlier surge was triggered by the company’s announcement of better-than-expected third-quarter financial results, a multi-launch agreement with a confidential commercial satellite constellation operator, and a federal defense contract worth up to $8 million.

Other Key Trades:

- Ark continued to purchase shares of eVTOL companies like Archer Aviation Inc. ACHR and Joby Aviation Inc. JOBY on Thursday. The firm picked up 409474 ACHR shares worth $1.76 million and 303674 JOBY shares worth $1.8 million.

- The Wood-led firm purchased 2,706 shares of Advanced Micro Devices, Inc. AMD, worth $375,701, through its ARKX fund.

- Ark Invest bought shares of Schrodinger Inc (SDGR) and shares of Guardant Health Inc (GH) through its ARK Genomic Revolution ETF (ARKG).

- The firm also sold shares of Moderna Inc (MRNA) and shares of Repare Therapeutics Inc (RPTX) through the same ETF.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

G Mining Ventures Reports Third Quarter 2024 Production and Financial Results

All amounts are in USD unless stated otherwise

BROSSARD, QC, Nov. 14, 2024 /PRNewswire/ – G Mining Ventures Corp. (“GMIN” or the “Corporation” or “we“) GMIN GMINF is pleased to, for the first time, report its production and financial results for the three and nine months ended September 30, 2024, and provide an operational update.

“I am proud to reflect on the significant milestones achieved this quarter, from our first gold pour and the launch of commercial production at TZ, to the release of robust PEA results for the generational Oko West project, to the acquisition of the highly prospective CentroGold project in Brazil,” commented Louis-Pierre Gignac, President & Chief Executive Officer, “These results mark important steps in GMIN’s evolution from developer to producer, and reflect our strategic execution, backed by a skilled management team, strong partnerships, and a multi-asset portfolio of long-life, low-cost operations that offer multiple value-creation catalysts. As we approach 2025, we are focused on expanding production at TZ, advancing Oko West’s feasibility study, and finalizing the CentroGold acquisition to drive continued growth.”

- Gold production of 22,071 ounces at AISC of $1,226 per ounce sold

- 17,144 ounces of gold sold during the quarter at average realized price per ounce of $2,508

- Net Income of $24.3 million and EBITDA of $25.7 million

- Earnings per share of $0.12

Q3 2024 Highlights

Safety:

- Strong safety performance to deliver the Tocantinzinho (“TZ“) gold mine with a Lost Time Incident Frequency Rate and Total Recordable Incident Frequency Rate of 0.03 and 0.17, respectively, after a total of 5.8 million person-hours worked.

Operational Results:

- Achieved commercial production at TZ gold mine on September 1, 2024, resulting in one month of commercial production preceded by two months of commissioning during the quarter

- Invested total capital expenditures of $456.9 million to bring TZ to commercial production (1) (2)

- Produced 22,071 ounces (“oz“) of gold (“Au“) in Doré during the quarter

- Mined 4.7 million tonnes (“Mt“) during the quarter, including 1.8 Mt of ore grading 0.98 g/t with an average waste to ore strip ratio of 1.55

- Processed 716,000 tonnes of ore at an average grade of 1.20 g/t with an average recovery rate of 84.5%

- Sold 17,144 oz of gold at average realized price per ounce of $2,508, with the rest of the Q3 production sold in October

|

_________________________________ |

|

1 All production numbers are based on the third quarter of 2024 data compiled for the two months of commissioning (July and August), and one month of commercial production (September). |

|

2 Inclusive of pre-production revenue and pre-production costs |

Financial Results:

- Revenue of $43 million during the quarter (includes commissioning period)

- Cash costs and all-in sustaining costs (“AISC“) of $879/oz and $1,226/oz, respectively (includes commissioning period)

- Net income of $24.3 million

- Earnings before Interest, Taxes, Depreciation and amortization (“EBITDA“) of $25.7 million

- Basic and Diluted Earnings per share (“EPS“) of $0.12

- Cash and cash equivalents of $104.6 million

Consolidated Financial and Operational Summary

|

Three months ended |

Nine months ended September 30 |

||||||||||

|

In thousands of $, except as otherwise noted |

2024 |

2023 |

2024 |

2023 |

|||||||

|

Operating Results |

|||||||||||

|

Gold Produced |

oz |

22,071 |

– |

22,071 |

– |

||||||

|

Gold Sold |

oz |

17,144 |

– |

17,144 |

– |

||||||

|

Total Cash Costs3 |

$/oz |

879 |

– |

879 |

– |

||||||

|

All-in Sustaining Costs3 |

$/oz |

1,226 |

– |

1,226 |

– |

||||||

|

Average Realized Gold Price3 |

$/oz |

2,508 |

– |

2,508 |

– |

||||||

|

Financial Results |

|||||||||||

|

Revenue |

$ |

42,997 |

– |

42,997 |

– |

||||||

|

Cost of Goods Sold |

$ |

(18,350) |

– |

(18,350) |

– |

||||||

|

Cash Margin3 |

$ |

27,919 |

– |

27,919 |

– |

||||||

|

Net Income (Loss) |

$ |

24,307 |

(1,106) |

14,408 |

(5,730) |

||||||

|

Per Share – Basic |

$/share |

0.12 |

(0.01) |

0.10 |

(0.05) |

||||||

|

Per Share – Diluted |

$/share |

0.12 |

(0.01) |

0.10 |

(0.05) |

||||||

|

Adjusted Net Income (Loss)3 |

$ |

17,131 |

(1,177) |

13,130 |

(4,120) |

||||||

|

Per share – Basic |

$/share |

0.09 |

(0.01) |

0.09 |

(0.04) |

||||||

|

Per share – Diluted |

$/share |

0.08 |

(0.01) |

0.09 |

(0.04) |

||||||

|

EBITDA3 |

$ |

25,727 |

(1,106) |

15,828 |

(5,730) |

||||||

|

Adjusted EBITDA3 |

$ |

25,525 |

(1,177) |

21,524 |

(4,120) |

||||||

|

Operating cash flows |

$ |

1,660 |

61,284 |

(14,909) |

241,734 |

||||||

|

Per share – Basic |

$/share |

0.01 |

0.55 |

(0.10) |

2.16 |

||||||

|

Per share – Diluted |

$/share |

0.01 |

0.55 |

(0.10) |

2.16 |

||||||

|

Free Cash Flows3 |

$ |

(6,239) |

61,284 |

(22,808) |

241,734 |

||||||

|

Per share – Basic |

$/share |

(0.03) |

0.55 |

(0.16) |

2.16 |

||||||

|

Per share – Diluted |

$/share |

(0.03) |

0.55 |

(0.16) |

2.16 |

||||||

|

_________________________________ |

|

3 These measures are non-IFRS financial measures. Refer to section “Non-IFRS Financial Performance Measures” in the associated MD&A for further information and a detailed reconciliation to comparable IFRS measures. |

Liquidity and Capital Resources

GMIN has cash and cash equivalents of $104.6 million as at September 30, 2024 with available equipment financing facility credit of $7.8 million to finance the purchase of equipment related to sustaining capital.

The cash balance as at September 30, 2024 reflects the gross proceeds of $50.0 million received from private placements and $55.9 million received from the exercise of warrants and options during the nine month period ending at the same date.

TZ Mine Review

In Q3-2024, GMIN produced 22,071 oz of gold at TZ and sold 17,144 oz, with the rest sold in October. At the end of Q3-2024 gold in-circuit inventory of 1,348 ounces was cumulated. The plant achieved several days above 100% of nameplate capacity and we continue to work on increasing plant availability. All aspects of the process plant including crushing, gravity, flotation and leaching circuits are performing well having yielded an average recovery of 84.5% for Q3-2024 with higher recoveries of approximately 90% targeted for Q4-2024 in line with estimates in the Feasibility Study (“FS“) dated February 09, 20224.

During the third quarter of 2024, the drilling programs at the mine focused on regional exploration targets. These targets were identified through geophysics, geochemical soil anomalies, general knowledge of the Tapajos Region and evidence of past artisanal mining and are part of GMIN’s exploration strategy to extend the mine life and add additional deposits within 15 km of the mine infrastructure.

|

________________________________ |

|

4 Filed under GMIN’s profile on SEDAR+ at www.sedarplus.ca, entitled “Feasibility Study – NI 43-101 Technical Report, Tocantinzinho Gold Project.” |

Oko West Project Review

On July 15, 2024, the Corporation announced that the transaction between GMIN and Reunion Gold Corporation has been completed, representing the addition of the Guyana-based Oko West gold project, into the Corporation’s portfolio of high-quality gold assets.

During Q3-2024, GMIN also reported preliminary economic assessment (“PEA“) results for the Oko West gold project, demonstrating after-tax net present value at 5% of US$1.4 billion, internal rate of return of 21% and a payback period of 3.8 years at $1,950/oz base case gold price (long-term consensus). The average annual gold production is estimated to be 353,000 ounces at an AISC of $986/oz over a 12.7-year mine life. The initial capital cost is estimated to be $936 million, with sustaining capital costs of $537 million over the life of mine (see news release dated September 9, 2024).

This year, the exploration and drilling strategy focused on expanding resources at Oko West to better delineate mineralized structures within the pit footprints and to explore the Oko West property to identify other deposits on the land package. During the quarter, a definition drilling program was completed at Oko West in support of the upcoming Feasibility Study. Additionally, a new regional exploration drilling program began at Oko West to investigate structures identified through geophysics and geochemical soil anomalies.

Corporate Update and Outlook

GMIN continues to execute its “Buy. Build. Operate.” strategy. The Corporation’s strategic focus remains identifying and developing quality advanced-stage precious metals projects in Tier 1 jurisdictions that demonstrate a path to near-term production.

In Q3-2024, GMIN entered into a purchase and sale agreement to acquire tenements in the Gurupi Gold Belt from wholly owned subsidiaries of BHP Group Limited (“BHP”). In consideration for the acquisition, the Corporation granted BHP a 1.0% NSR royalty on the first million ounces of gold produced at the tenements and a 1.5% NSR royalty on gold production thereafter (the “Transaction“), which is expected to result in little to no share dilution. The Transaction is expected to close during the first quarter of 2025, which is expected to be followed by the publication of a National Instrument 43-101 (“NI 43-101”) compliant resource also planned for the first quarter of 2025.

At TZ, the objective for the remainder of the year is to continue ramping up plant throughput towards the nominal nameplate capacity of 12,890 tpd, with Q4-2024 gold production outlook expected to be between 30,000 and 40,000 oz of gold. GMIN plans to provide 2025 annual production and cost guidance in January 2025.

Mining activities are performing according to plan and procurement activities for the addition of a third primary loading unit and three additional mine trucks to bring the fleet size to 19 will be completed during Q4-2024. Commissioning of these additional units is anticipated in the second half of 2025, which will allow the mine to reach a mining rate of 77,150 tpd in 2025.

At Oko West, GMIN plans to submit the environmental and social impact assessment for the project during the fourth quarter of 2024, while advancing towards a FS in Q1-2025.

Several FS workstreams are in progress at Oko West. These workstreams include the completion of infill drilling and updated mineral resource estimates; geotechnical recommendations for the open pit slopes and underground workings; mine design optimization, mineral reserve estimation, production planning and final equipment selection; metallurgical test work programs to support the FS level engineering, flowsheet design, recovery expectations and equipment selection; and procurement activities related to long lead items such as primary crusher, grinding mills and power generators will be an immediate focus along with several packages to support early works activities.

Qualified Person

Louis-Pierre Gignac, President & Chief Executive Officer of GMIN, a QP as defined in NI 43-101, has reviewed the press release on behalf of the Corporation and has approved the technical disclosure contained in this press release.

About G Mining Ventures Corp.

G Mining Ventures Corp. GMIN GMINF is a mining company engaged in the acquisition, exploration and development of precious metal projects to capitalize on the value uplift from successful mine development. GMIN is well-positioned to grow into the next mid-tier precious metals producer by leveraging strong access to capital and proven development expertise. GMIN is currently anchored by the Tocantinzinho Gold Mine in Brazil and Oko West Project in Guyana, both mining friendly and prospective jurisdictions.

Additional Information

For further information on GMIN, please visit the website at www.gmin.gold

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact, contained in this press release constitute “forward-looking information” and “forward-looking statements” within the meaning of certain securities laws and are based on expectations and projections as of the date of this press release. Forward-looking statements contained in this press release include, without limitation, those related to (i) the targeted higher recoveries at TZ for Q4 2024; (ii) GMIN’s exploration strategy to extend mine life at TZ; (iii) the PEA results and various assumptions set out therein; (iv) exploration programs at Oko West and expectations in respect thereof; (v) GMIN closing the Transaction in Q1 2025; (vi) GMIN’s plans to update Gurupi tenements’ existing resource to NI 43-101 standards; (vii) GMIN’s priorities to ramp up the TZ plant to nameplate capacity and to advance Oko West through the FS; (viii) the planned addition of equipment at TZ; (ix) the quoted comments and expectations of GMIN’s President & Chief Executive Officer; and * more generally, the sections entitled “Corporate Update and Outlook” and “About G Mining Ventures Corp.”.

Forward-looking statements are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Corporation as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Such assumptions include, without limitation, those relating to the price of gold and currency exchange rates, those outlined in the feasibility and other technical studies (e.g., the PEA) relating to the TZ mine and GMIN’s other projects, and those underlying the items listed on the above sections entitled “Corporate Update and Outlook” and “About G Mining Ventures Corp.”.

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. There can be no assurance that, notably but without limitation, (i) GMIN’s positive safety record will continue over time, (ii) any of GMIN’s exploration targets at TZ and Oko West will lead to additional resources and eventually to gold production, (iii) the expected TZ mine life and annual gold production will materialize, (iv) GMIN’s outlook, as set out in the section entitled “Corporate Update and Outlook” will materialize, (v) GMIN’s asset portfolio will ultimately turn into high-quality gold assets, (vi) GMIN will finalize and submit the FS (and other technical reports) in a timely manner, or at all, or (vi) GMIN will use TZ and Oko West to grow into the next intermediate producer, as future events could differ materially from what is currently anticipated by the Corporation. In addition, there can be no assurance that Brazil and/or Guyana will remain mining friendly and prospective jurisdictions.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. All of the forward-looking statements made in this press release are qualified by these cautionary statements and those made in the Corporation’s other filings with the securities regulators of Canada including, but not limited to, the cautionary statements made in the relevant sections of the (i) Annual Information Form of G Mining TZ Corp. (then known as G Mining Ventures Corp.) dated March 27, 2024, for the financial year ended December 31, 2023, (ii) Annual Information Form of Reunion Gold dated April 25, 2024, for the financial year ended December 31, 2023, and (iii) Management Discussion & Analysis. The Corporation cautions that the foregoing list of factors that may affect future results is not exhaustive, and new, unforeseeable risks may arise from time to time. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

Consolidated Statements of Financial Position

(Unaudited – Tabular amounts expressed in Thousands of United States Dollars)

|

September 30, 2024 |

December 31, 2023 |

||

|

Assets |

$ |

$ |

|

|

Current |

|||

|

Cash and Cash Equivalents |

104,602 |

52,398 |

|

|

Receivables and Other Current Assets |

7,738 |

1,788 |

|

|

Inventories |

52,572 |

7,967 |

|

|

Prepaid Expenses and Deposits |

1,283 |

1,270 |

|

|

166,195 |

63,423 |

||

|

Non-current |

|||

|

Deferred Financing Fees |

826 |

3,359 |

|

|

Long Term Deposits on Equipment |

849 |

10,402 |

|

|

Property, Plant & Equipment and Mineral Property |

596,263 |

503,663 |

|

|

Exploration and Evaluation Assets |

729,339 |

4,537 |

|

|

Investment in Associate |

2,326 |

– |

|

|

Other Non-current Assets |

31,828 |

2,321 |

|

|

Deferred Tax Assets |

6,974 |

– |

|

|

1,534,600 |

587,705 |

||

|

Liabilities |

|||

|

Current |

|||

|

Accounts Payable and Accrued Liabilities |

35,405 |

27,030 |

|

|

Current Portion of Contract Liability |

41,659 |

14,549 |

|

|

Current Portion of Lease Liability |

201 |

74 |

|

|

Current Portion of Long-term Debt |

19,946 |

7,515 |

|

|

Deferred Consideration |

60,000 |

– |

|

|

Derivative Warrant Liability |

8,724 |

4,235 |

|

|

165,935 |

53,403 |

||

|

Non-current |

|||

|

Long-term Contract Liability |

219,540 |

240,783 |

|

|

Long-term Debt |

93,397 |

24,828 |

|

|

Long-term Liability |

– |

1,298 |

|

|

Long-term Lease Liability |

400 |

241 |

|

|

Rehabilitation Provision |

4,434 |

4,113 |

|

|

317,771 |

271,263 |

||

|

Shareholders’ Equity |

|||

|

Share Capital |

1,054,324 |

247,870 |

|

|

Share-based Payments Reserve |

20,899 |

4,143 |

|

|

Accumulated Other Comprehensive Income (Loss) |

(25,562) |

24,083 |

|

|

Retained Earnings (Deficit) |

1,233 |

(13,057) |

|

|

1,050,894 |

263,039 |

||

|

1,534,600 |

587,705 |

Consolidated Statements of Income (Loss) and Comprehensive Income (Loss)

(Unaudited – Tabular amounts expressed in Thousands of United States Dollars, except for number of shares)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

$ |

$ |

$ |

$ |

||||||

|

Revenue |

42,997 |

– |

42,997 |

– |

|||||

|

Cost of Goods Sold |

(18,350) |

– |

(18,350) |

– |

|||||

|

Income from Mining Operations |

24,647 |

– |

24,647 |

– |

|||||

| Other Expenses

|

|||||||||

|

General & Administration Expenses |

2,850 |

1,825 |

7,021 |

5,429 |

|||||

|

Finance Expenses |

2,053 |

– |

2,053 |

– |

|||||

|

Change in Fair Value of Financial Instruments |

(542) |

229 |

4,548 |

1,972 |

|||||

|

Other (Income) Expenses |

(116) |

(948) |

522 |

(1,671) |

|||||

|

(4,245) |

(1,106) |

(14,144) |

(5,730) |

||||||

|

Income (Loss) Before Income Tax |

20,402 |

(1,106) |

10,503 |

(5,730) |

|||||

|

Current and Deferred Income Tax Recovery |

3,905 |

– |

3,905 |

– |

|||||

|

Net Income (Loss) for the Period |

24,307 |

(1,106) |

14,408 |

(5,730) |

|||||

|

Currency Translation Adjustment |

22,854 |

(19,506) |

(49,645) |

6,998 |

|||||

|

Net Comprehensive Income (Loss) for the Period |

47,161 |

(20,612) |

(35,237) |

1,268 |

|||||

|

Net Income (Loss) per Share |

|||||||||

|

Basic |

0.12 |

(0.01) |

0.10 |

(0.05) |

|||||

|

Diluted |

0.12 |

(0.01) |

0.10 |

(0.05) |

|||||

|

Weighted Average Number of Common Shares |

|||||||||

|

Basic |

201,351,009 |

111,879,265 |

142,406,155 |

111,879,265 |

|||||

|

Diluted |

204,752,373 |

111,879,265 |

145,534,886 |

111,879,265 |

|||||

Consolidated Statements of Cash Flows

(Unaudited – Tabular amounts expressed in Thousands of United States Dollars)

|

Three Months Ended |

Nine Months Ended |

||||||||

|

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

||||||

|

Operating Activities |

$ |

$ |

$ |

$ |

|||||

|

Net Income (Loss) for the Period |

24,307 |

(1,106) |

14,408 |

(5,730) |

|||||

|

Items Not Involving Cash |

|||||||||

|

Depreciation |

3,426 |

24 |

3,505 |

67 |

|||||

|

Share-based Compensation |

558 |

445 |

926 |

1,291 |

|||||

|

Unrealized Foreign Exchange (Gain) Loss |

324 |

(309) |

1,126 |

(375) |

|||||

|

Standby Fees |

21 |

257 |

48 |

699 |

|||||

|

Cumulative Catch-up Adjustment on Gold Streaming Agreement |

(272) |

– |

(272) |

– |

|||||

|

Depletion of the Deposit on Gold Streaming Agreement |

(1,628) |

– |

(1,628) |

– |

|||||

|

Finance Expenses |

2,053 |

– |

2,053 |

– |

|||||

|

Change in Fair Value of Derivative Warrant Liability |

(526) |

238 |

4,570 |

1,985 |

|||||

|

Deferred Income Tax Recovery |

(6,974) |

– |

(6,974) |

– |

|||||

|

Accretion Expense of Rehabilitation Provision |

123 |

80 |

370 |

170 |

|||||

|

21,412 |

(371) |

18,132 |

(1,893) |

||||||

|

Proceeds from Gold Streaming Agreement |

– |

66,192 |

– |

250,000 |

|||||

|

Changes in Non-cash Working Capital |

|||||||||

|

Receivables and Other Current Assets |

(794) |

(311) |

(1,699) |

(565) |

|||||

|

Inventories |

(14,220) |

(3,482) |

(30,861) |

(5,443) |

|||||

|

Prepaid Expenses and Deposits |

(122) |

(492) |

69 |

(627) |

|||||

|

Accounts Payable and Accrued Liabilities |

(4,616) |

(252) |

(550) |

262 |

|||||

|

Cash Provided by (Used in) Operating Activities |

1,660 |

61,284 |

(14,909) |

241,734 |

|||||

|

Investing Activities |

|||||||||

|

Acquisition of Reunion Gold, Net of Cash Acquired |

21,067 |

– |

21,067 |

– |

|||||

|

Receivables and Other Non-current Assets |

(104) |

(104) |

– |

||||||

|

Additions of Property, Plant & Equipment and Mineral Property, Net of Long-term Deposits |

(7,885) |

(82,820) |

(109,779) |

(229,066) |

|||||

|

Proceeds on Disposal of Property, Plant & Equipment and Mineral Property |

– |

– |

– |

14 |

|||||

|

Exploration and Evaluation Expenditures |

(425) |

(1,758) |

(4,829) |

(3,192) |

|||||

|

Cash Provided by (Used in) Investing Activities |

12,653 |

(84,578) |

(93,645) |

(232,244) |

|||||

|

Financing Activities |

|||||||||

|

Shares Issued for Cash |

50,000 |

– |

50,000 |

– |

|||||

|

Share Issue Cost |

(77) |

– |

(77) |

– |

|||||

|

Replacement Options Exercised |

1,620 |

– |

1,620 |

– |

|||||

|

Repayment of Lease Liability |

(14) |

(9) |

(77) |

(23) |

|||||

|

Repayment of Long-term Debt |

(4,889) |

(1,451) |

(7,236) |

(2,463) |

|||||

|

Deferred Financing Fees |

– |

(31) |

(29) |

(204) |

|||||

|

Net Proceeds from the Drawdowns of Long-term Debt |

5,177 |

– |

82,025 |

21,886 |

|||||

|

Proceeds from the Exercise of Warrants |

40,118 |

– |

50,765 |

– |

|||||

|

Cash Provided by (Used in) Financing Activities |

91,935 |

(1,491) |

176,991 |

19,196 |

|||||

|

Effect on Foreign Exchange Rate Differences on Cash and Cash Equivalents |

(14,703) |

(990) |

(16,233) |

1,240 |

|||||

|

Increase (Decrease) in Cash and Cash Equivalents |

91,545 |

(25,775) |

52,204 |

29,926 |

|||||

|

Cash and Cash Equivalents, Beginning of the Period |

13,057 |

137,593 |

52,398 |

81,892 |

|||||

|

Cash and Cash Equivalents, End of the Period |

104,602 |

111,818 |

104,602 |

111,818 |

|||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/g-mining-ventures-reports-third-quarter-2024-production-and-financial-results-302306498.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/g-mining-ventures-reports-third-quarter-2024-production-and-financial-results-302306498.html

SOURCE G Mining Ventures Corp

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Earnings Will Be Hit Hardest If $7.5K EV Credit Gets Cut By Trump, Warns Gary Black: 'Do The Math'

Investment veteran Gary Black cautions that Tesla Inc TSLA will lose the most if the $7,500 federal electric vehicle tax credit is eliminated, citing the company’s overwhelming dependence on EV sales compared to traditional automakers.

What Happened: Black, managing partner at The Future Fund LLC, points to Tesla’s recent history of price-related challenges as evidence for his concern. “Tesla’s earnings power declined by 45% and shares fell by 70% in 15 months” following price cuts of 15-20% in late 2022 and 2023, he noted on social media platform X.

The potential loss of the tax credit could effectively increase Tesla’s U.S. vehicle prices by 20%, affecting approximately 30% of the company’s global sales volume. Black emphasizes that Tesla’s vulnerability stems from its business model, where electric vehicles represent about 80% of revenue.

“No one else has anywhere near that degree of exposure to EVs,” Black wrote, contrasting Tesla’s position with traditional automakers. He dismisses concerns about the impact on legacy manufacturers, noting that companies like General Motors Co GM and Toyota Motor Corp TM saw earnings growth during Tesla’s recent downturn.

Black’s analysis challenges some Tesla supporters who suggest the credit’s removal would primarily hurt traditional automakers. He argues that mathematical analysis doesn’t support this view, pointing out that EVs typically constitute only 5-10% of legacy automakers’ business.

“Why would raising price on 5-10% of legacy auto’s business bankrupt them? C’mon folks – please do the math,” Black wrote.

See Also: Warren Buffett’s Berkshire Hathaway Slashes Apple, BofA Holdings, Adds Domino’s Pizza In Q3

Why It Matters: The potential elimination of the $7,500 EV tax credit has been a topic of concern for Tesla and the EV industry as a whole. Despite the negative implications, some analysts believe that this move could be beneficial for Tesla.

Meanwhile, Tesla’s stock has been on the rise since the 2024 presidential election, with Elon Musk‘s endorsement of President-elect Donald Trump being seen as a significant factor in this growth.

Furthermore, the recent announcement of Musk as the co-lead for the Department of Government Efficiency (DOGE) has been met with mixed reactions from analysts, with Black suggesting that this appointment may not have a significant impact on Tesla’s stock.

Price Action: Tesla stock closed at $311.18 on Thursday, down 5.77% for the day. In after-hours trading, Tesla slipped a further 1.15%. Despite recent drops, Tesla’s stock has gained 25.26% year to date, according to data from Benzinga Pro.

Read Next:

Image via Tesla

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mohamed El-Erian Criticizes Fed Chair Powell's Interview Performance: 'He Struggled With Some Of The Smart Questions'

Federal Reserve Chair Jerome Powell faced sharp criticism from prominent economist Mohamed El-Erian following a Dallas Chamber event Thursday, where Powell’s cautious stance on rate cuts triggered significant market movements.

What Happened: El-Erian, Chief Economic Advisor at Allianz, critiqued Powell’s performance on social media platform X, noting that the Fed chair “struggled with smart questions” and “confused the economics of different possible scenarios.”

El-Erian suggested Powell might avoid similar interview formats in the future, particularly highlighting the chair’s unclear response regarding new monetary frameworks.

During the Dallas event, Powell emphasized the U.S. economy’s exceptional strength while maintaining a careful position on potential rate cuts. “Inflation is running much closer to our 2% longer-run goal, but it is not there yet. We are committed to finishing the job,” Powell stated, indicating no rush to lower rates despite market expectations.

See Also: Cathie Wood Keeps Betting On Amazon’s ‘Haul’ Play: Ark Loads Up $6M Worth Of Shares

Why It Matters: The Fed chair pointed to increased productivity as a key factor in recent economic performance, noting that productivity growth over the past five years has outpaced the two decades before the pandemic. This strength, Powell suggested, allows for a more measured approach to monetary policy decisions.

The SPDR S&P 500 ETF Trust SPY, which tracks the benchmark S&P 500 index, fell 0.64% as investors recalibrated their rate cut expectations. Technology stocks felt the pressure, with the Invesco QQQ Trust QQQ, representing the Nasdaq-100 index, declining 0.69%. Small-cap stocks bore the brunt of the selling, as evidenced by the iShares Russell 2000 ETF IWM dropping 1.35%, according to data from Benzinga Pro.

Powell’s remarks triggered a sharp repricing in rate cut expectations, with the CME FedWatch Tool showing the probability of a December rate reduction falling to 58.9% from nearly 80%. This shift came after Powell emphasized the economy’s remarkable strength and indicated no urgency to lower rates.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Co. 4Front Sees Loss Narrow In Q3, Major Growth In MA, IL

4Front Ventures Corp. FFNT FFNTF, a U.S. multi-state cannabis operator, announced its Q3 2024 revenue Thursday of $17.1 million, down from $18.7 million in the previous quarter. The company highlighted substantial gains in Massachusetts and promising developments in Illinois as the Matteson facility ramps up production.

Q3 2024 Financial Highlights

- Revenue was $17.1 million, a decrease from $23 million in Q3 2023.

- Net Loss was $6.4 million, an improvement from a net loss of $62.1 million in Q3 2023.

- Adjusted EBITDA was $1 million, compared to an adjusted EBITDA loss of $4.8 million in Q3 2023.

- Gross Profit was $3.7 million, down from $9.3 million in Q3 2023.

Scalable Production, Strategic Expansion Powers Market Growth

The Matteson facility, nearing full operational capacity, is expected to address Illinois’ supply constraints, boosting 4Front’s market share. CEO Andrew Thut stressed the strong demand. “Early responses to Matteson’s production have been highly positive.” The facility’s scalability aligns with strategic growth plans, leveraging new supply agreements.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Massachusetts saw a 56% quarter-over-quarter growth in wholesale revenue, driven by consistent high-quality production. Meanwhile, in Washington, 4Front returned to record revenues, showcasing its adaptability in competitive markets.

New product launches, including the “Smoke Breaks” pre-rolls, expanded the company’s offerings in Illinois and Massachusetts.

4Front’s CEO Optimistic Amid Regulatory Uncertainty

“Despite the uncertainties surrounding federal cannabis reform, we’re optimistic, especially given signs that we may have unexpected advocates in the incoming administration,” said Thut. The company expects its operational momentum to continue into Q4, targeting positive cash flows and expanded market reach.

Read Also: Cannabis Stocks Pop Chris Christie’s Prediction On Trump

Capital Optimization, Product Diversification To Drive Expansion

4Front has also retained Canaccord Genuity to optimize its capital structure, a move aimed at securing growth capital and enhancing financial performance. With the scaling of the Matteson facility and a focus on diversifying its product lines, the company is heading for sustained operational growth and shareholder value.

FFNTF Price Action

FFNTF’s shares were trading 11.76% lower at $0.03 per share at the time of market close Thursday.

Read Next:

Image created using artificial intelligence with Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Peter Schiff's Cheeky Bitcoin Turnaround Post Earns Reaction From Popular Analyst: 'You Buy It And Become Rich Or You Keep Hating And Turn Crazy'

Widely-followed cryptocurrency analyst Willy Woo threw a jibe at economist Peter Schiff for attempting to stay relevant by dunking on Bitcoin BTC/USD.

What Happened: On Thursday, Woo took to X to describe a rather unique perspective on Bitcoin. He said that the leading cryptocurrency was more than just a digital form of money, instead likening it to a “squatter living rent-free in people’s minds.”

“After a while, there’s only 2 paths: you buy it and become rich or you keep hating and turn crazy,” Woo added.

See Also: 18 Republican States Sue Biden’s SEC Over Harsh Crypto Crackdown

Woo’s remark was in response to Schiff, who sarcastically suggested that the Social Security Trust Fund should sell all of its Treasuries to buy Bitcoin.

Schiff’s comment was a tongue-in-cheek critique of Bitcoin’s volatile nature and the potential economic catastrophe he believed could ensue if the U.S. government were to establish a Bitcoin BTC/USD reserve.

Why It Matters: Schiff’s views on Bitcoin have been controversial, and many have accused him of doing engagement farming by repeatedly mentioning the coin in his X posts.

His critics believe he secretly owns Bitcoin, in contrast to the overtly critical positions he takes on social media. The economist has consistently denied this claim

Earlier this week, Schiff dismissed Bitcoin’s bull run as a “popular delusion” and “madness of crowds,” predicting staggering losses when the bubble finally pops. He has also warned that if the U.S. government began buying Bitcoin, it could trigger a market crash.

Price Action: At the time of writing, Bitcoin was trading at $88,160.96, down 2.36% in the last 24 hours, according to data from Benzinga Pro. The coin was up over 16% in the last week.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TEAM Software Data Breach Exposes Personal Information: Murphy Law Firm Investigates Legal Claims

OKLAHOMA CITY, Nov. 14, 2024 (GLOBE NEWSWIRE) — Murphy Law Firm is investigating claims on behalf of all individuals whose personal and confidential information was compromised in the data breach involving TEAM Software. To join the class action lawsuit, visit our site HERE.

On July 26, 2024, TEAM Software detected suspicious activity on its TEAM Software application, indicating a data breach. Based on a subsequent forensic investigation, TEAM Software determined that cybercriminals infiltrated its inadequately secured computer environment and thereby gained access to its data files. The investigation further determined that, through this infiltration, cybercriminals potentially accessed and acquired files containing the sensitive personal information of approximately 99,525 individuals. The information exposed in the data breach includes, but is not limited to:

- Names

- Social Security numbers

- Driver’s license numbers

If you received notice of the data breach or if your personal information was compromised in the breach, please visit our site HERE. Murphy Law Firm is evaluating legal options, including a potential class action lawsuit, to recover damages on behalf of individuals who were affected by the data breach.

As a result of the data breach, these individuals’ personal and highly sensitive information may be in the hands of cybercriminals who can place the information for sale on the dark web or use the information to perpetrate identity theft.

To join a class action lawsuit, click HERE

Murphy Law Firm specializes in data breach class actions, consumer class actions, and federal securities class actions. The firm has extensive experience in securing highly favorable recoveries for its clients.

Contact:

Murphy Law Firm

abm@murphylegalfirm.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chartwell Announces Strong Third Quarter 2024 Results, Provides an Update on Growth and Portfolio Optimization Activities and Launches At-the-Market Program

MISSISSAUGA, ON, Nov. 14, 2024 /CNW/ – Chartwell Retirement Residences (“Chartwell”) CSH announced today its results for the three and nine months ended September 30, 2024.

Q3 2024 Highlights

- Resident revenue increased by $34.6 million from Q3 2023.

- Net income was $23.6 million compared to $158.2 million in Q3 2023 that included the gain on sale of $178.9 million due to the sale of the Ontario Long Term Care platform (“OLTC Platform”)(4).

- Funds from Operations (“FFO”)(1) up 43.2% from Q3 2023.

- Same property adjusted net operating income (“NOI”)(1) up 17.1% from Q3 2023.

- Same property adjusted operating margin(1) up 200 basis points (“bps”) from Q3 2023.

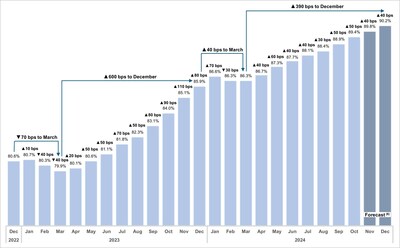

- Weighted average same property occupancy up 610 bps from Q3 2023 and expected to grow to 90.2% by December 2024.

“Our teams delivered another quarter of strong operating and financial performance in Q3 2024. Importantly, we made great strides toward achieving our aspirational 2025 strategic objectives. Our 2024 Employee Engagement score of 57% highly engaged employees exceeded our 2025 target of 55%, our 2024 Resident Satisfaction score of 66% very satisfied residents was within one percentage point of our 2025 target, and with the forecasted December 2024 same property occupancy of 90.2%, we are well on the way to our 2025 target of 95%,” commented Vlad Volodarski, Chartwell’s CEO. “2024 is shaping up to be a record year of transactional activity for Chartwell. To date, we have announced transactions valued at over $1.2 billion, adding newer, well-located, high-quality properties to our portfolio and divesting older non-core assets. Our investment team continues their great work investigating many other growth and portfolio optimization opportunities to further our strategy of portfolio renewal and growth. I am proud of our recent successes and grateful to our teams for their dedication, exceptional work and focus on driving results in all aspects of our business.”

Results of Operations

The following table summarizes select financial and operating performance measures:

|

Three Months Ended |

Nine Months Ended |

||||||

|

($000s, except per unit amounts, number of units, and percentages) |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

|

Resident revenue |

207,995 |

173,383 |

34,612 |

581,478 |

507,378 |

74,100 |

|

|

Direct property operating expense |

128,389 |

113,344 |

15,045 |

370,472 |

344,508 |

25,964 |

|

|

Net income |

23,603 |

158,156 |

(134,553) |

18,834 |

141,446 |

(122,612) |

|

|

FFO(1) |

|||||||

|

Continuing operations |

55,861 |

36,087 |

19,774 |

139,798 |

82,905 |

56,893 |

|

|

Total |

55,861 |

39,002 |

16,859 |

139,798 |

94,091 |

45,707 |

|

|

FFO per unit(1) |

|||||||

|

Continuing operations |

0.20 |

0.15 |

0.05 |

0.55 |

0.34 |

0.21 |

|

|

Total |

0.20 |

0.16 |

0.04 |

0.55 |

0.39 |

0.16 |

|

|

Weighted average number of units outstanding (000s)(2) |

274,318 |

242,258 |

32,060 |

254,956 |

241,157 |

13,799 |

|

|

Weighted average same property occupancy rate (3) |

88.5 % |

82.4 % |

6.1pp |

87.4 % |

81.1 % |

6.3pp |

|

|

Same property adjusted NOI(1) |

63,643 |

54,357 |

9,286 |

181,067 |

150,219 |

30,848 |

|

|

Same property adjusted operating margin(1) |

38.4 % |

36.4 % |

2.0pp |

37.3 % |

34.5 % |

2.8pp |

|

|

G&A expenses |

11,731 |

14,403 |

(2,672) |

39,126 |

46,995 |

(7,869) |

|

For Q3 2024, resident revenue increased $34.6 million or 20.0% and direct property operating expense increased $15.0 million or 13.3%.

For Q3 2024, net income was $23.6 million compared to $158.2 million in Q3 2023 that included the gain on sale of $178.9 million due to the sale of the OLTC Platform. The remaining differences are due to:

- deferred tax expense in Q3 2024 as compared to a deferred tax benefit in Q3 2023,

- higher direct property operating expense,

- higher negative changes in fair value of financial instruments, primarily due to increases in trading prices of our Trust Units,

- higher finance costs, and

- higher depreciation of property, plant and equipment (“PP&E”).

partially offset by:

- higher gain on disposal of assets,

- higher resident revenue,

- lower current income tax expense due to the sale of the OLTC Platform,

- lower general, administrative, and Trust (“G&A”) expenses, and

- higher net income from joint ventures.

For Q3 2024, FFO from continuing operations was $55.9 million or $0.20 per unit, compared to $36.1 million or $0.15 per unit for Q3 2023. The change in FFO from continuing operations was primarily due to:

- higher adjusted NOI from continuing operations of $20.7 million,

- lower G&A expenses of $2.7 million,

- one-time retroactive government funding related to the sale of the OLTC Platform of $1.4 million,

- higher interest income of $0.3 million, and

- lower depreciation of PP&E and amortization of intangibles assets used for administrative purposes of $0.1 million,

partially offset by:

- higher finance costs of $5.1 million, and

- lower management fees of $0.3 million.

For Q3 2024, FFO from continuing operations includes $0.2 million of Lease-up-Losses and Imputed Cost of Debt related to our development projects (Q2 2023 – $0.5 million). Total FFO for Q3 2023 includes results of discontinued operations from the OLTC Platform of $2.9 million or $0.01 per unit.

For 2024 YTD, resident revenue increased $74.1 million or 14.6%, and direct property operating expense increased $26.0 million or 7.5%.

For 2024 YTD, net income was $18.8 million compared to $141.4 million in 2023 YTD that included the gain on sale of $178.9 million due to the sale of the OLTC Platform. The remaining differences are due to:

- deferred tax expense in 2024 YTD as compared to a deferred tax benefit in 2023 YTD,

- higher direct property operating expense,

- higher negative changes in fair value of financial instruments, primarily due to increases in trading prices of our Trust Units,

- higher finance costs,

- higher transaction costs related to dispositions, and

- higher depreciation of PP&E.

partially offset by:

- higher resident revenue,

- higher gain on disposal of assets,

- lower current income tax expense due to the sale of the OLTC Platform,

- lower G&A expenses, and

- higher net income from joint ventures.

For 2024 YTD, FFO from continuing operations was $139.8 million or $0.55 per unit, compared to $82.9 million or $0.34 per unit for 2023 YTD. The change in FFO from continuing operations was primarily due to:

- higher adjusted NOI from continuing operations of $54.4 million,

- lower G&A expenses of $7.9 million,

- one-time retroactive government funding related to the sale of the OLTC Platform of $1.4 million,

- higher interest income of $1.1 million, and

- lower depreciation of PP&E and amortization of intangibles assets used for administrative purposes of $0.4 million,

partially offset by:

- higher finance costs of $7.8 million, and

- lower management fees of $0.5 million.

For 2024 YTD, FFO from continuing operations includes $0.9 million of Lease-up-Losses and Imputed Cost of Debt related to our development projects (2023 YTD – $1.6 million). Total FFO for 2023 YTD includes results of discontinued operations from the OLTC Platform of $11.2 million or $0.05 per unit.

Financial Position

As at September 30, 2024, liquidity(1) amounted to $385.3 million, which included $26.1 million of cash and cash equivalents and $359.2 million of available borrowing capacity on our credit facilities.

The interest coverage ratio(5) was 2.6 at September 30, 2024, compared to 2.3 at December 31, 2023. The net debt to adjusted EBITDA ratio(5) at September 30, 2024 was 8.3 compared to 10.2 at December 31, 2023.

2024 Outlook and Recent Developments

An updated discussion of our business outlook can be found in the “2024 Outlook” section of our Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 (the “Q3 2024 MD&A”).

Operations

The chart included (Figure 1) provides an update in respect of our same property occupancy.

We continue to experience strong demand fundamentals having achieved occupancy growth through the historically weaker winter season. Our same property portfolio occupancy increased from December to March by 40 bps compared to a 70 bps decline for the same period last year. Initial contacts and personalized tour activity remains robust, we have experienced strong conversion rates to permanent move-ins and expect this positive momentum to continue through to the end of 2024. As such, we expect to reach 90.2% occupancy in our same property portfolio in December 2024, representing a 430 bps growth over the prior year. The growth in same property occupancy combined with our blended rental and service rate growth of 3.9%, resulted in an 11.0% increase in same property adjusted resident revenue in Q3 2024 compared to Q3 2023. 2024 YTD same property adjusted resident revenue grew 11.6% as compared to 2023 YTD from blended rental and service rate growth of 4.3% and 630 bps of occupancy growth.

Acquisition in Victoria, British Columbia

On November 14, 2024, we entered into a definitive agreement to acquire an upscale, 131-suite ISL retirement residence in Victoria, B.C. for a purchase price of $75.0 million. Constructed in 2021, all suites in the residence have full kitchens, in-suite laundry, and modern finishes, with many offering unobstructed views of Victoria’s harbour and major landmarks. Current occupancy is 28%. The acquisition will be our fourth property on Vancouver Island adding critical mass in the region and is expected to close in Q1 2025.

“We are pleased to add this modern, urban residence to our Western Canada platform below current replacement cost. This acquisition furthers our strategy to refresh and grow our portfolio with high quality assets. The quality of this residence and its location, combined with our operating expertise and branding strength will support successful lease up and multiyear occupancy and market rate growth,” added Jonathan Boulakia, Chief Investment Officer.

Growth and Portfolio Optimization Activities

We continue to execute on our portfolio strategies of enhancing our asset base to generate increased NOI, acquiring new strategic properties in core markets and selling non-core properties, including:

- On July 22, 2024, we completed the previously announced acquisition of a 100% ownership interest in a portfolio of five retirement residences (1,428 suites) located in Quebec. The purchase price was $297.0 million and, subject to normal working capital and other closing adjustments, was paid in cash. Acquisition related costs of $3.4 million have been capitalized.

- On July 31, 2024, we acquired the remaining 10% ownership interest in land located in Pickering, Ontario, which was previously accounted for as a joint operation. The purchase price of $1.2 million was paid in cash.

- On August 29, 2024, we entered into definitive agreements to acquire three modern retirement residences on Vancouver Island totalling 384 suites for an aggregate purchase price of $226.9 million and paid an $11.0 million deposit. Details of these acquisitions are as follows:

- On October 31, 2024, we acquired the 152-suite Vista Retirement Residence, located in Victoria. The purchase price was $103.9 million, subject to normal working capital and other closing adjustments and was paid in cash. The vendor provided us with a 24-month NOI guarantee, with $9.2 million of the purchase price held in escrow to support the vendor’s obligation.

- On October 31, 2024, we acquired the 77-suite Nanaimo Memory Care, located in Nanaimo. The purchase price was $20.3 million, subject to normal working capital and other closing adjustments and was paid in cash.

- The Edgewater Retirement Residence, located adjacent to Nanaimo Memory Care, is currently under construction and will be comprised of 155 suites. The purchase price is $102.7 million, subject to normal working capital and other closing adjustments, and is expected be paid in cash utilizing a combination of net proceeds from the sales of our non-core assets, cash on hand, and credit facilities. The vendor has agreed to provide us with a 36-month NOI guarantee, with $8.7 million of the purchase price to be held in escrow to support the vendor’s obligation. We will acquire the residence upon construction completion, which is expected in Q2 2025.

- On August 15, 2024, we completed the sale of one non-core property in Ontario for a sale price of $10.8 million, which was settled in cash.

- On August 30, 2024, we completed the sale of one non-core property in Ontario for a sale price of $4.6 million, which was settled in cash. In addition, we entered into a leaseback agreement for the land and building until the property is vacated.

- On September 18, 2024, we completed the sale of one non-core property in Ontario for a sale price of $79.5 million, which was settled in cash.

Liquidity and Financing

On July 22, 2024, we entered into a $150.0 million unsecured term loan agreement with a Canadian chartered bank. The terms of the loan include borrowings based on either the bank’s Prime rate or CORRA, with an initial term of six months and an optional extension for an additional six months. On October 31, 2024, we repaid $75.0 million.

On October 24, 2024, CMHC confirmed the termination of our Large Borrower Agreement (“LBA”) and the transition to a Large Borrower Risk Management Framework (the “LBRMF”). The LBRMF provides a more flexible financing environment and improved liquidity and removes previous financial covenant and cross collateralization requirements.

On October 28, 2024, we issued $150.0 million of 4.400% Series D senior unsecured debentures (the “Series D Debentures”) due on November 5, 2029. The net proceeds of the Series D Debentures was used to repay existing indebtedness, including indebtedness under our secured credit facility and term loan, and to partially finance certain previously announced acquisitions of retirement residences expected to close in the fourth quarter of 2024.

As at November 14, 2024, liquidity amounted to $401.3 million, which included $54.1 million of cash and cash equivalents and $347.2 million of available borrowing capacity on our Credit Facilities.

As of the date of this release, we have $98.8 million of mortgage debt maturing in 2024 with a weighted average interest rate of 7.08%. At November 14, 2024, 10-year CMHC-insured mortgage rates are estimated at approximately 4.08% and five-year conventional mortgage financing is available at 5.01%.

At-the-Market Equity Distribution Program

On November 14, 2024, Chartwell will file a prospectus supplement to establish an at-the-market equity distribution program (the “ATM Program”). The ATM Program will allow Chartwell to issue up to $250 million of trust units (“Trust Units”) from treasury to the public from time to time during the term of the ATM Program, at its discretion. The ATM Program is designed to provide Chartwell with additional financing flexibility, should it be required in the future. Chartwell intends to use the net proceeds from the ATM Program, if any, for future property acquisitions, development and redevelopment opportunities, repayment of indebtedness and for general trust purposes.

“We are very excited to launch our inaugural ATM Program today. The ATM Program, which may be used from time to time during favourable market conditions, provides Chartwell with a new cost-effective tool to raise equity to match our capital requirements as required, including to support our growth strategy,” commented Jeffrey Brown, Chief Financial Officer.

In connection with the establishment of the ATM Program, Chartwell has entered into an equity distribution agreement dated November 14, 2024 (the “Distribution Agreement”) with TD Securities Inc. and Scotia Capital Inc. (collectively, the “Agents”). Any Trust Units sold under the ATM Program will be distributed through the Toronto Stock Exchange or any other permitted marketplace at the market prices prevailing at the time of sale. The volume and timing of distributions under the ATM Program, if any, will be determined at Chartwell’s sole discretion. There is no certainty that any Trust Units will be offered or sold under the ATM Program. The ATM Program will terminate upon the earlier of (i) May 30, 2026, (ii) the issuance and sale of all of the Trust Units qualified for distribution under the ATM Program, and (iii) the termination of the Distribution Agreement (as set out in the Distribution Agreement).

Given that Trust Units sold in the ATM Program, if any, will be distributed at the market prices prevailing at the time of sale, prices may vary among purchasers during the period of the distribution. Distributions of Trust Units through the ATM Program, if any, will be made pursuant to the terms of the Distribution Agreement. In connection with the establishment of the ATM Program, Chartwell will file a prospectus supplement dated November 14, 2024 (the “Prospectus Supplement”) to the final base shelf prospectus dated April 30, 2024 (the “Base Shelf Prospectus”). The Prospectus Supplement, the Distribution Agreement and the Base Shelf Prospectus will be available on SEDAR+ at www.sedarplus.com under Chartwell’s profile. Alternatively, the Agents will send copies of the Prospectus Supplement, the Distribution Agreement and the Base Shelf Prospectus, as applicable, to investors upon request to TD Securities Inc. at 1625 Tech Avenue, Mississauga, Ontario L4W 5P5, attention: Symcor, NPM, by telephone at (289) 360-2009, or by email at sdcconfirms@td.com. and Scotia Capital Inc. at 40 Temperance Street, 6th Floor, Toronto, Ontario M5H 0B4, by telephone at (416) 863-7704 or by email at equityprospectus@scotiabank.com.

This press release does not constitute an offer to sell securities, nor is it a solicitation of an offer to buy securities, in any jurisdiction in which such offer or solicitation is unlawful. This press release is not an offer of securities for sale in the United States (“U.S.”). The securities being offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and accordingly are not being offered for sale and may not be offered, sold or delivered, directly or indirectly within the U.S., its possessions and other areas subject to its jurisdiction or to, or for the account or for the benefit of a U.S. person, except pursuant to an exemption from the registration requirements of that Act.

Quarterly Investor Materials and Conference Call

We invite you to review our Q3 2024 investor materials on our website at investors.chartwell.com

Q3 2024 Financial Statements

Q3 2024 MD&A

Q3 2024 Investor Presentation

A conference call hosted by Chartwell’s senior management will be held Friday, November 15, 2024, at 10:00 AM ET. The telephone numbers to participate in the conference call are: Local: (416) 340-2217 or Toll Free: 1-800-806-5484. The passcode for the conference call is: 5352093#. Please log on at least 15 minutes before the call commences to register for the Q&A. A slide presentation to accompany management’s comments during the conference call will be available on the website. A live webcast of the call will be available at https://events.q4inc.com/attendee/632664840. Joining via webcast is recommended for those who will not be participating in the Q&A.

The telephone numbers to listen to the call after it is completed (Instant Replay) are: Local (905) 694-9451 or Toll-Free: 1-800-408-3053. The Passcode for the Instant Replay is 5208327#. These numbers will be available for 30 days following the call. An audio file recording of the call, along with the accompanying slides, will also be archived on Chartwell’s website at investors.chartwell.com.

Footnotes

|

(1) |

FFO, FFO for continuing operations, Total FFO, including per unit amounts, adjusted resident revenue, adjusted direct property operating expense, adjusted NOI, adjusted operating margin, liquidity, interest coverage ratio, Lease-up Losses, Imputed Cost of Debt, and net debt to adjusted EBITDA ratio are non-GAAP measures. These measures do not have standardized meanings prescribed by GAAP and, therefore, may not be comparable to similar measures used by other issuers. These measures are used by management in evaluating operating and financial performance. Please refer to the heading “Non-GAAP Financial Measures” on page 8 of this press release. Certain information about non-GAAP financial measures, non-GAAP ratios, capital management measures, and supplementary measures found in Chartwell’s Q3 2024 MD&A, is incorporated by reference. Full definitions of FFO & FFO per unit can be found on page 16, same property adjusted NOI on page 17, adjusted NOI on page 17, adjusted operating margin on page 17, liquidity on page 24, interest coverage ratio on page 39, and net debt to adjusted EBITDA ratio on page 40 of the Q3 2024 MD&A available on Chartwell’s website, and under Chartwell’s profile on the System for Electronic Document and Analysis Retrieval (“SEDAR+”) website at sedarplus.com. The definition of these measures have been incorporated by reference. |

|

(2) |

Includes Trust Units, Class B Units of Chartwell Master Care LP, and Trust Units issued under Executive Unit Purchase Plan and Deferred Trust Unit Plan. |

|

(3) |

‘pp’ means percentage points. |

|

(4) |

Refer to the “Significant Events – Portfolio Optimization” section on page 12 of the Q3 2024 MD&A. |

|

(5) |

Non-GAAP; calculated in accordance with the Trust indentures for Chartwell’s 4.211% Series B senior unsecured debentures and 6.000% Series C senior unsecured debentures and may not be comparable to similar metrics used by other issuers or to any GAAP measures. |

|

(6) |

Forecast includes leases and notices as at October 31, 2024, and an estimate of mid-month move-ins of 10 bps for November and 50 bps for December, based on the preceding 12-month average of such activity. |

Forward-Looking Information

This press release contains forward-looking information that reflects the current expectations, estimates and projections of management about the future results, performance, achievements, prospects or opportunities for Chartwell and the seniors housing industry. Forward-looking statements are based upon a number of assumptions and are subject to a number of known and unknown risks and uncertainties, many of which are beyond our control, and that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking statements. Examples of forward-looking information in this document include, but are not limited to, statements regarding our business strategies, operational sales, marketing and portfolio optimization strategies including targets, and the expected results of such strategies, predictions and expectations with respect to industry trends including growth in the senior population, a deficit of long term care beds and the slow down of new construction starts, expectations with respect to taxes that are expected to be payable in the current and future years and statements regarding the tax classification of distributions, and occupancy rate forecasts. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those expected or estimated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. These factors are more fully described in the “Risks and Uncertainties and Forward-Looking Information” section in Chartwell’s Q3 2024 MD&A, and in materials filed with the securities regulatory authorities in Canada from time to time, including but not limited to our most recent Annual Information Form the (“AIF”). A copy of the Q3 2024 MD&A, the AIF, and Chartwell’s other publicly filed documents can be accessed under Chartwell’s profile on the SEDAR+ website at sedarplus.com. Except as required by law, Chartwell does not intend to update or revise any forward-looking statements, whether as a result of new information, future events, or for any other reason.

About Chartwell

Chartwell is in the business of serving and caring for Canada’s seniors, committed to its vision of Making People’s Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents. Chartwell is an unincorporated, open-ended real estate trust which indirectly owns and operates a complete range of seniors housing communities, from independent living through to assisted living and long term care. Chartwell is one of the largest operators in Canada, serving approximately 25,000 residents in four provinces across the country. For more information visit www.chartwell.com.

For more information, please contact:

Chartwell Retirement Residences

Jeffrey Brown, Chief Financial Officer

Tel: (905) 501-6777

Email: investorrelations@chartwell.com

Non-GAAP Financial Measures

Chartwell’s condensed consolidated interim financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). Management uses certain financial measures to assess Chartwell’s operating and financial performance, which are measures not defined in generally accepted accounting principles (“GAAP”) under IFRS. The following measures: FFO, FFO per unit, same property adjusted NOI, adjusted NOI, adjusted operating margin, liquidity, interest coverage ratio and net debt to adjusted EBITDA ratio as well as other measures discussed elsewhere in this release, do not have a standardized definition prescribed by IFRS. They are presented because management believes these non-GAAP measures are relevant and meaningful measures of Chartwell’s performance and as computed may differ from similar computations as reported by other issuers and may not be comparable to similarly titled measures reported by such issuers. For a full definition of these measures, please refer to the Q3 2024 MD&A available on Chartwell’s website and on SEDAR+.

The following table reconciles resident revenue and direct property operating expense from our financial statements to adjusted resident revenue and adjusted direct property operating expense and NOI to Adjusted NOI from continuing operations and Adjusted NOI and identifies contributions from our same property portfolio, our growth portfolio, and our repositioning portfolio:

|

($000s, except occupancy rates) |

Q3 2024 |

Q3 2023 |

Change |

2024 YTD |

2023 YTD |

Change |

|

Resident revenue |

207,995 |

173,383 |

34,612 |

581,478 |

507,378 |

74,100 |

|

Add (Subtract): |

||||||

|

Share of resident revenue from joint ventures (1) |

35,071 |

32,103 |

2,968 |

102,945 |

93,605 |

9,340 |

|

Resident revenue from LTC Discontinued Operations (2) |

– |

45,521 |

(45,521) |

– |

167,068 |

(167,068) |

|

Share of resident revenue from non-controlling interest (3) |

(1,328) |

– |

(1,328) |

(1,328) |

– |

(1,328) |

|

Adjusted resident revenue |

241,738 |

251,007 |

(9,269) |

683,095 |

768,051 |

(84,956) |

|

Comprised of: |

||||||

|

Same property |

165,615 |

149,138 |

16,477 |

485,511 |

434,942 |

50,569 |

|

Growth |

42,459 |

22,870 |

19,589 |

95,582 |

66,567 |

29,015 |

|

Repositioning |

33,664 |

78,999 |

(45,335) |

102,002 |

266,542 |

(164,540) |

|

Adjusted resident revenue |

241,738 |

251,007 |

(9,269) |

683,095 |

768,051 |

(84,956) |

|

Direct property operating expense |

128,389 |

113,344 |

15,045 |

370,472 |

344,508 |

25,964 |

|

Add (Subtract): |

||||||

|

Share of direct property operating expense from joint ventures (1) |

22,187 |

21,036 |

1,151 |

67,040 |

64,655 |

2,385 |

|

Direct property operating expense from LTC Discontinued Operations (2) |

– |

41,330 |

(41,330) |

– |

151,266 |

(151,266) |

|

Share of direct property operating expense from non-controlling interest (3) |

(677) |

– |

(677) |

(677) |

– |

(677) |

|

Adjusted direct property operating expense |

149,899 |

175,710 |

(25,811) |

436,835 |

560,429 |

(123,594) |

|

Comprised of: |

||||||

|

Same property |

101,972 |

94,781 |

7,191 |

304,444 |

284,723 |

19,721 |

|

Growth |

23,554 |

14,599 |

8,955 |

56,377 |

44,131 |

12,246 |

|

Repositioning |

24,373 |

66,330 |

(41,957) |

76,014 |

231,575 |

(155,561) |

|

Adjusted direct property operating expense |

149,899 |

175,710 |

(25,811) |

436,835 |

560,429 |

(123,594) |

|

NOI |

79,606 |

60,039 |

19,567 |

211,006 |

162,870 |

48,136 |

|

Add (Subtract): |

||||||

|

Share of NOI from joint ventures |

12,884 |

11,067 |

1,817 |

35,905 |

28,950 |

6,955 |

|

Share of NOI from non-controlling interest |

(651) |

– |

(651) |

(651) |

– |

(651) |

|

Adjusted NOI from continuing operations |

91,839 |

71,106 |

20,733 |

246,260 |

191,820 |

54,440 |

|

Add (Subtract): |

||||||

|

NOI from LTC Discontinued Operations |

– |

4,191 |

(4,191) |

– |

15,802 |

(15,802) |

|

Adjusted NOI |

91,839 |

75,297 |

16,542 |

246,260 |

207,622 |

38,638 |

|

Comprised of: |

||||||

|

Same property |

63,643 |

54,357 |

9,286 |

181,067 |

150,219 |

30,848 |

|

Growth |

18,905 |

8,271 |

10,634 |

39,205 |

22,436 |

16,769 |

|

Repositioning |

9,291 |

12,669 |

(3,378) |

25,988 |

34,967 |

(8,979) |

|

Adjusted NOI |

91,839 |

75,297 |

16,542 |

246,260 |

207,622 |

38,638 |

|

Weighted average occupancy rate: |

||||||

|

Same property portfolio |

88.5 % |

82.4 % |

6.1pp |

87.4 % |

81.1 % |

6.3pp |

|

Growth portfolio |

88.4 % |

76.9 % |

11.5pp |

87.2 % |

75.1 % |

12.1pp |

|

Repositioning portfolio |

84.9 % |

85.2 % |

(0.3pp) |

84.3 % |

84.2 % |

0.1pp |

|

Total portfolio |

87.9 % |

82.5 % |

5.4pp |

86.9 % |

81.2 % |

5.7pp |

|

(1) |

Non-GAAP; represents Chartwell’s proportionate share of the resident revenue and direct property operating expense of our Equity-Accounted JVs, respectively. |

|

(2) |

Represents the resident revenue and direct property operating expense related to LTC Discontinued Operations, respectively. |

|

(3) |

Non-GAAP; represents Chartwell’s proportionate share of the resident revenue and direct property operating expense of our non-controlling interest, respectively. |

The following table provides a reconciliation of net income/(loss) to FFO for continuing operations:

|

($000s, except per unit amounts and number of units) |

Q3 2024 |

Q3 2023 |

Change |

2024 YTD |

2023 YTD |

Change |

|

|

Net income/(loss) |

23,603 |

(23,330) |

46,933 |

18,834 |

(48,183) |

67,017 |

|

|

Add (Subtract): |

|||||||

|

B |

Depreciation of PP&E |

43,009 |

38,027 |

4,982 |

117,146 |

115,050 |

2,096 |

|

D |

Amortization of limited life intangible assets |

521 |

566 |

(45) |

1,710 |

2,058 |

(348) |