Steppe Gold Announces Q3 2024 Financial Results

TORONTO, Nov. 14, 2024 (GLOBE NEWSWIRE) — Steppe Gold Ltd. STGO STPGF (“Steppe Gold” or the “Company”) today reported strong financial and operational results for the third quarter of 2024.

Highlights:

(all figures in US$000‘s)

Strong Operational Performance: Both Boroo Gold LLC (“Boroo Gold”) and Steppe Gold delivered solid production and sales results. Total revenue for the three and nine months ended September 30, 2024, amounted to $37,331 and $131,912, respectively.

- Revenue for Boroo Gold for the three and nine months ended September 30, 2024, amounted to $27,397 and $121,978 on sales of 12,607 and 57,114 gold ounces and 2,833 and 11,833 silver ounces.

- Steppe Gold’s revenue from August 1, 2024, to September 30, 2024, amounted to $9,934 on sales of 3,769 gold ounces and 20,078 silver ounces.

- Average realized prices for Boroo Gold for the three and nine months ended September 30, 2024, were $2,167 and $2,131 per gold ounce and $28 and $25 per silver ounce, respectively.

- Average realized prices for Steppe Gold for the period from August 1, 2024, to September 30, 2024, were $2,623 per gold ounce and $24 per silver ounce.

Robust Financial Results: Revenue and earnings increased significantly compared to the previous quarter. Total operating income before depreciation and depletion for the three and nine months ended September 30, 2024, amounted to $21,487 and $88,148.

- Operating income from Boroo Gold’s mine operations for the three and nine months that ended September 30, 2024, were $16,786 and $83,447.

- Operating income from Steppe Gold’s mine operations for the period from August 1, 2024, to September 30, 2024, was $4,701.

EBITDA for the three and nine months ended September 30, 2024, amounted to $19,453 and $82,687.

Low-Cost Production: All-in Sustaining Costs remained low, enhancing profitability.

- In Sustaining Costs for Boroo Gold were $1,095 and $961 per ounce sold for the three and nine months that ended September 30, 2024.

- All in Sustaining Cost for Steppe Gold from August 1, 2024, to September 30, 2024, were $1,610 per ounce sold.

Company outlook:

The acquisition of Boroo Gold was a transformational step for the Company. It accelerates the path to a multi-asset Mongolia-focused mining group and, importantly, is projected to immediately provide strong cash flow to support growth plans, further improved with the recent strong gold prices.

The near-term focus for the Company is on maximizing production and cash flows at both producing mines and executing on successful completion of the Phase 2 Expansion.

The Company’s condensed interim consolidated financial results for the quarter ended September 30, 2024 have been filed on SEDAR+. The full version of the condensed interim consolidated financial statements and associated management’s discussion & analysis can be viewed on the Company’s website at www.steppegold.com or under the Company’s profile on SEDAR+ at www.sedarplus.ca.

Steppe Gold Ltd.

Steppe Gold is Mongolia’s premier precious metals company.

For Further information, please contact:

Bataa Tumur-Ochir, Chairman and CEO

Elisa Tagarvaa, Investor Relations elisa@steppegold.com

Shangri-La office, Suite 1201, Olympic Street

19A, Sukhbaatar District 1,

Ulaanbaatar 14241, Mongolia

Tel: +976 7732 1914

Non-IFRS Performance Measures

The Company uses the following non-IFRS measures: Adjusted EBITDA, EBITDA and AISC. EBITDA is earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as adjusted earnings before interest, taxes, depreciation and amortization. AISC is calculated using cash costs in addition to general and administration, asset retirement costs, and sustaining capital, less certain non-recurring costs (notably exploration costs at the Mungu deposit) to provide an overall company outlook on the total cost required to sell an ounce of gold.

Management believes that these non-IFRS measures provide useful information to investors in measuring the financial performance of the Company for the reasons outlined below. These measures do not have a standardized meaning prescribed by IFRS and therefore they may not be comparable to similarly titled measures presented by other publicly traded companies and should not be construed as an alternative to other financial measures determined in accordance with IFRS. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these measures is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These measures are not necessarily standard and therefore may not be comparable to other issuers. Further details of non-IFRS measures noted above can be found in the Company’s management’s discussion & analysis for the six months ended June 30, 2024.

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain statements or disclosures relating to the Company that are based on the expectations of its management as well as assumptions made by and information currently available to the Company which may constitute forward-looking statements or information (“forward-looking statements”) under applicable securities laws. All such statements and disclosures, other than those of historical fact, which address activities, events, outcomes, results, or developments that the Company anticipates or expects may, or will occur in the future (in whole or in part) should be considered forward-looking statements. In some cases, forward-looking statements can be identified by the use of the words “continued”, “focus”, “scheduled”, “will”, “projected”, “opportunity”, “expected”, “planned” and similar expressions. In particular, but without limiting the foregoing, this news release contains forward-looking statements pertaining to the following: the anticipated cash flow and other benefits of the Boroo Gold transaction; the potential for value creation to Steppe Gold’s shareholders; the strengths, characteristics and potential of the resulting company and discussion of future plans, projections, objectives, estimates and forecasts and the timing related thereto, including with respect to the Phase 2 Expansion and the ATO gold mine.

The forward-looking statements contained in this news release reflect several material factors and expectations and assumptions of the Company including, without limitation: management team and board of directors of Steppe Gold; material adverse effects on the business, properties and assets of the Company; changes in business plans and strategies; market and capital finance conditions; risks inherent to any capital financing transactions; changes in world commodity markets; currency fluctuations; costs and supply of materials relevant to the mining industry; change in government and changes to regulations affecting the mining industry; discrepancies between actual and estimated production and test results, mineral reserves and resources and metallurgical recoveries; and such other risk factors detailed from time to time in Steppe Gold’s public disclosure documents, including, without limitation, those risks identified in Steppe Gold’s annual information form for the year ended December 31, 2023, which is available on SEDAR+ at www.sedarplus.ca

Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by such forward-looking statements. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Steppe Gold assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Steppe Gold updates any one or more forward-looking statements, no inference should be drawn that the company will make additional updates with respect to those or other forward-looking statements. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mayfair Gold Q3 2024 Financial and Operating Results

VANCOUVER, BC, Nov. 14, 2024 /CNW/ – Mayfair Gold Corp. (“Mayfair”, or the “Company”) MFG MFGCF is pleased to report its operating and financial results for the quarter ended September 30, 2024. Mayfair is focused on the exploration and development of its 100% controlled Fenn-Gib gold project located in the Timmins region of Northeast Ontario (“Fenn-Gib” or the “Project”). The full version of the financial statements and accompanying management discussion and analysis can be viewed on the Company’s website at www.mayfairgold.ca or on SEDAR+ at www.sedarplus.com. Unless otherwise stated, all amounts are presented in Canadian dollars.

Mayfair’s Interim Chief Executive Officer Darren McLean commented,

“Dear Stakeholders,

I am pleased to provide an update on our recent progress at Mayfair Gold. Our pre-feasibility study and metallurgical test programs are progressing well, and we look forward to sharing updates in the new year. As we look ahead to 2025, the company remains well-funded and we continue to work towards bolstering our internal capital markets and technical capacity, allowing us to effectively navigate the transition into the development phase.

Thank you for your ongoing support.”

Corporate Highlights During the Quarter

- On June 20, 2024, the Company granted 50,000 stock options each to two directors of the Company, Zach Allwright and Christine Hsieh with an exercise price of $1.90. The options are exercisable for a five-year term expiring on June 20, 2029, and a third of the options will vest on the anniversary of the grant date for the next three years.

- On September 10, 2024, the Company announced an updated mineral resource estimate at the Company’s 100% controlled Fenn-Gib Gold Project. The updates resource estimate will form the basis of the Company’s Pre-Feasibility Study which is currently underway. Additionally, the Company announced an extension to its metallurgical test work for Fenn-Gib.

- On September 25, 2024, the Company announced its intention to complete a financing of common shares by way of a non-brokered private placement for aggregate proceeds of approximately $6 million, which closed on October 17, 2024 with 3,340,000 of common shares being issued at $1.80 for total gross proceeds of $6,012,000.

- Subsequent to the quarter, the Company appointed Nicholas Campbell as Vice President of Corporate Development, who brings more than 20 years of experience in the mining, minerals, and metals industry, and has held several leadership positions.

Technical Highlights During the Quarter

Mayfair updates Fenn-Gib Open-Pit Mineral Resource and Initiates an Expanded Metallurgical Test Program

September 10, 2024

- Indicated Mineral Resource of 4.31Moz Au (0.3g/t Au cut-off grade);

- 3.40Moz @ 1.00g/t Au (0.5g/t Au cut-off grade);

- Comprehensive metallurgical test program initiated with results expected in Q1 2025.

- This updated Mineral Resource will form the basis of the Company’s Pre-Feasibility Study (PFS) which is currently underway

|

INDICATED |

Cutoff (Au g/t) |

Tonnes |

Au (g/t) |

Au (ounces) |

|

>0.7 |

64,563,000 |

1.26 |

2,615,000 |

|

|

>0.6 |

82,125,000 |

1.13 |

2,984,000 |

|

|

>0.5 |

105,644,000 |

1.00 |

3,397,000 |

|

|

>0.4 |

137,251,000 |

0.87 |

3,839,000 |

|

|

>0.3 |

181,302,000 |

0.74 |

4,313,000 |

|

|

INFERRED |

Cutoff (Au g/t) |

Tonnes |

Au (g/t) |

Au (ounces) |

|

>0.7 |

1,140,000 |

0.96 |

35,000 |

|

|

>0.6 |

1,799,000 |

0.85 |

49,000 |

|

|

>0.5 |

2,710,000 |

0.75 |

65,000 |

|

|

>0.4 |

4,729,000 |

0.62 |

94,000 |

|

|

>0.3 |

8,921,000 |

0.49 |

141,000 |

Selected Financial Data

The following selected financial data is summarized from the Company’s financial statements and related notes thereto (the “Financial Statements”) for the three and nine months ended September 30, 2024 and 2023.

|

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Loss and comprehensive loss |

(1,434,837) |

(2,696,168) |

(10,456,025) |

(10,917,212) |

|

Loss per share – basic and diluted |

(0.01) |

(0.03) |

(0.10) |

(0.12) |

|

September 30, 2024 |

December 31, |

|||

|

Cash and cash equivalents |

5,400,350 |

13,504,009 |

||

|

Total assets |

20.238,119 |

28,493,187 |

||

|

Total current liabilities |

388,257 |

2,546,327 |

||

|

Total liabilities |

388,257 |

2,546,327 |

||

|

Total shareholders’ equity |

19,849,862 |

25,946,860 |

||

2024 Outlook

In the first quarter of 2024, the Company announced the commencement of a pre-feasibility study on the Fenn-Gib project. The study will build further on the metallurgical, geotechnical, hydrogeology, and environmental evaluations completed to date to develop a clearly defined project description in support of a potential environmental assessment. Mayfair Gold has engaged Richard Klue as Vice President of Technical Services to manage the entire Fenn-Gib project, who has included AGP Mining Consultants, Halyard Inc, Terracon Geotechnique and Environmental Applications Group (EAG) as lead engineers and scientists of a multi-disciplinary group to deliver the pre-feasibility study. The pre-feasibility study is a major milestone towards the development of the Fenn-Gib project.

About the Fenn-Gib Project

The Fenn-Gib Project comprises two property packages, referred to as the Fenn-Gib North and South Blocks, which are separated by approximately three kilometers. The Fenn-Gib Deposit is located on the North Block along the regional Contact Fault, an east-west to south-east trending shear zone on the Pipestone Fault, which is interpreted to be a splay off the Porcupine-Destor Fault. The Fenn-Gib Deposit hosts significant concentrations of gold mineralization within two zones: (i) the Main Zone, and (ii) the Deformation Zone. These two zones overlap completely. A third zone of mineralization, known as the Footwall Zone, is located approximately 100 meters to the northwest of the Fenn-Gib Deposit. A fourth zone of mineralization, known as the Contact Zone, is located at depth below the current pit-constrained resource.

September 3, 2024 Fenn-Gib Resource Estimate by Category Using 0.30 g/t Au Cut-Off

|

Style |

Class |

Tonnes |

Au (g/t) |

Au (ounces) |

|

Open pit |

Indicated |

181,302,000 |

0.74 |

4,313,000 |

|

Open Pit |

Inferred |

8,921,000 |

0.49 |

141,000 |

All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum definitions, as required under NI 43-101. Ounce (troy) = metric tonnes x grade / 31.10348. All numbers have been rounded to reflect the relative accuracy of the estimate

QA/QC Controls

Mayfair employs a QA/QC program consistent with NI 43-101 and industry best practices. Surface drilling was conducted by Major/Norex Drilling of Timmins, Ontario and was supervised by the Mayfair exploration team. Mayfair’s drill program includes descriptive logging and sampling of the drill core for analysis at Mayfair’s secure facility located in Matheson, Ontario. Sampled drill core intervals were sawn in half with a diamond blade saw. Half of the sampled core was left in the core box and the remaining half was bagged and sealed. Mayfair utilizes accredited laboratories that include, Activation Laboratories Ltd. (Actlabs) and AGAT Laboratories Ltd. (AGAT) both located in Timmins, Ontario. Mayfair personnel transport the samples directly and deliver to Actlabs, and samples are collected by AGAT personnel directly from Mayfair’s secure core logging facility in Matheson, Ontario. Gold was analyzed by 30-gram fire assay with AA-finish. Certified reference material (CRM) standards and coarse blank material are inserted every twenty-five samples. Mayfair completes routine third-party check assays.

Qualified Person

Tim Maunula, P. Geo., of T. Maunula & Associates Consulting Inc, is a qualified person for the purposes of National Instrument 43-101 and was responsible for the completion of the updated mineral resource estimation. Mr. Maunula has reviewed and approved the technical content with respect to the mineral resource estimate in this news release. Technical information with respect to diamond drilling in this news release has been reviewed by Ali Gelinas-Dechene, P.Geo., Senior Geologist for Mayfair Gold, who oversaw the Mayfair Gold drill program, QA/QC and serves as a Qualified Person under the definition of National Instrument 43-101.

About Mayfair Gold

Mayfair Gold is a Canadian mineral exploration company focused on advancing the 100% controlled Fenn-Gib gold project in the Timmins region of Northern Ontario. The Fenn-Gib gold deposit is Mayfair’s flagship asset and currently hosts an updated NI 43-101 open pit constrained mineral resource estimate with an effective date of September 3, 2024 with a total Indicated Resource of 181.3M tonnes containing 4.313M ounces at a grade of 0.74 g/t Au and an Inferred Resource of 8.92M tonnes containing 0.14M ounces at a grade of 0.49 g/t Au at a 0.30 g/t Au cut-off grade. The Fenn-Gib deposit has a strike length of over 1.5km with widths ranging over 500m. The gold mineralized zones remain open at depth and along strike to the east and west. Recently completed metallurgical tests confirm that the Fenn-Gib deposit can deliver robust gold recoveries of up to 94%.

Cautionary Notes to U.S. Investors Concerning Resource Estimates

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced in this presentation are Canadian mineral disclosure terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). The CIM Standards differ from the mineral property disclosure requirements of the U.S. Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”). As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. Accordingly, the Company’s disclosure of mineralization and other technical information may differ significantly from the information that would be disclosed had the Company prepared the information under the standards adopted under the SEC Modernization Rules.

Forward Looking Information

This news release contains forward-looking information which reflects management’s expectations regarding the Company’s growth, results of operations, performance and business prospects and opportunities. Forward-looking statements in this news release include, but are not limited to, the Company’s focus on the exploration and development of Fenn-Gib, the results of the comprehensive metallurgical test program being expected in Q1 2025, and statements in respect of the pre-feasibility study on the Fenn-Gib project. Forward-looking information is based on various reasonable assumptions including, without limitation, the expectations and beliefs of management; the assumed long-term price of gold; that the Company can access financing, appropriate equipment and sufficient labour and that the political environment where the Company operates will continue to support the development and operation of mining projects. Should underlying assumptions prove incorrect, or one or more of the risks and uncertainties described below materialize, actual results may vary materially from those described in forward-looking statements.

Forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, risks and uncertainties relating to foreign currency fluctuations; risks inherent in mining including environmental hazards, industrial accidents, unusual or unexpected geological formations, ground control problems and flooding; delays or the inability to obtain necessary governmental permits or financing; risks associated with the estimation of mineral resources and reserves and the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; the potential for and effects of labor disputes or other unanticipated difficulties with or shortages of labor; failure of plant, equipment or processes to operate as anticipated; actual ore mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, gold price fluctuations; uncertain political and economic environments; changes in laws or policies.

The Company undertakes no obligation to publicly update or review the forward-looking statements whether as a result of new information, future events or otherwise, other than as required under applicable securities laws. The forward-looking statements reflect management’s beliefs, opinions and projections as of the date of this news release.

SOURCE Mayfair Gold Corp.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/14/c4773.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/14/c4773.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If You Dropped $1,000 On Spotify When Joe Rogan's Show Became An Exclusive, Here's How Much You'd Have Today

The Joe Rogan Experience or JRE premiered exclusively on Spotify Inc. SPOT in Sept. 2020 as part of a multi-year deal reportedly valued at $200 million. This deal wasn’t just big news for podcasting fans—it was a major moment for investors, too.

Rogan’s Impact On Spotify’s Growth

Spotify’s exclusive deal with Rogan was a bet that paid off in multiple ways. Since the partnership, podcast consumption on the platform skyrocketed by 232%, according to the company.

Advertisers took notice, fueling a 2023 revenue increase of 80% since 2021. Rogan’s show, consistently the world’s most-streamed podcast, played a major role in turning Spotify into a podcasting giant.

Rogan’s podcast also held the top spot on Spotify’s podcast chart for the fourth year in a row in 2023.

See Also: Tradepulse Power Inflow Alert: Spotify Technology S.A. Climbs Over 5% After Tradepulse Alert

How $1,000 Invested In Spotify Has Grown

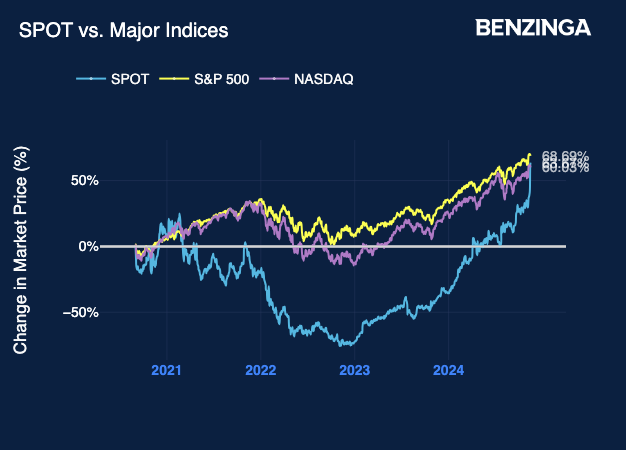

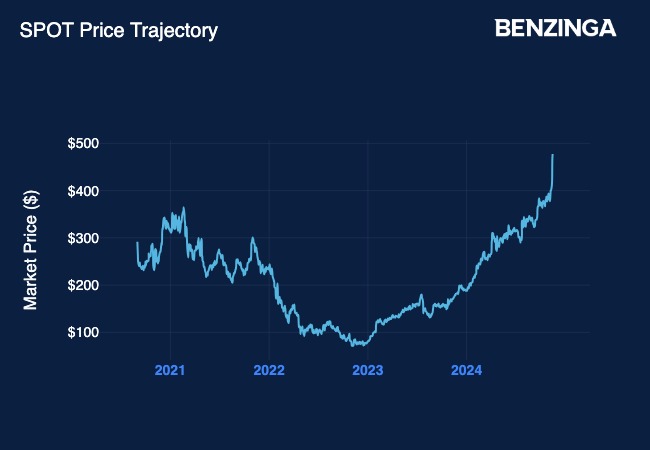

If you had invested $1,000 in Spotify stock on Sept. 1, 2020 — the day Rogan’s show debuted exclusively on the platform — that investment would now be worth approximately $1,696.

This represents a solid return of 69.7%, outpacing the broader market indexes. For context, the S&P 500 rose 68.7%, and the Nasdaq Composite gained 60% over the same period.

A New Chapter For JRE And Spotify

Earlier this year, Spotify renewed its partnership with Rogan, but the show will no longer be exclusive to the platform, expanding to Apple, Amazon, and Google’s YouTube.

Earlier this month, Spotify released its third-quarter financial results reporting earnings of $1.46 per share, which fell short of the analyst consensus of $1.76.

Quarterly revenue came in at $3.99 billion, missing the expected $4.02 billion but reflecting an increase from $3.65 billion in the same quarter last year.

SPOT Price Action: Spotify shares ended Thursday’s session up 2.17%, closing at $477.50. In after-hours trading, however, the stock dipped slightly, settling at $476 as of the latest update, according to Benzinga Pro.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 drivers of the stock market's bull rally are hitting extremes and point to lower returns ahead, economist says

-

Stock market gains will slow as key drivers like valuations and rates hit extremes, David Rosenberg said.

-

He said operating earnings would need to surge to fuel further market gains.

-

“There are few drivers left to keep the equity party going,” Rosenberg said.

The main drivers of significant stock market gains over the past three decades are nearing extremes, suggesting future returns will be significantly lower.

That’s according to economist David Rosenberg, who warned clients in a note on Wednesday to prepare for a period of limited appreciation in US equities.

“There are few drivers left to keep the equity party going,” Rosenberg said.

Rosenberg is particularly concerned about recent trends in valuations, interest rates, and taxes. According to Rosenberg, they’ve hit their extremes, which could put downward pressure on corporate earnings and, therefore, stock prices.

These are the three factors Rosenberg is worried about.

The S&P 500’s forward price-to-earnings ratio of 22.3x is more than one-standard deviation above its historical norm and represents the highest level since the height of the COVID-era tech bubble in 2021, Rosenberg noted.

Those high valuations, combined with extreme bullish sentiment that’s exceeded the levels seen right before the Great Financial Crisis, suggest to Rosenberg that there’s little room for more upside in valuations.

“There is no space for further multiple expansion,” Rosenberg said.

Higher stock market valuations would largely hinge on continued growth in corporate earnings, but Rosenberg said there are reasons to believe that’s unlikely.

Corporate tax rates have been falling for decades, boosting corporate profits and helping drive stock prices higher.

While the Trump trade hinges on potential legislation for the corporate tax rate to fall from 21% to 15%, Rosenberg thinks that is unlikely.

“A razor-thin majority in the House and already low rates mean the runway is much shorter here as well,” Rosenberg said.

With the effective corporate tax rate at 17%, Rosenberg argues that there’s little room for it to fall further, even with Republican control of the White House and Congress.

Falling interest rates have long helped fuel stock market gains, but that trend could be nearing its end.

While the Federal Reserve is cutting interest rates, they’re already near historical lows, suggesting there isn’t much room for them to fall further, especially if President-elect Trump’s agenda is inflationary.

Maui Land & Pineapple Company Reports Fiscal 2024 Third Quarter Results

KAPALUA, Hawai‘i, Nov. 14, 2024 (GLOBE NEWSWIRE) — Maui Land & Pineapple Company, Inc. MLP today reported financial results covering the nine month period ended September 30, 2024.

“Our third-quarter results demonstrate strong momentum across all business segments, with an 18.6% increase in revenue compared to last year,” said CEO Race Randle. “We’re encouraged by this growth as we continue making strategic investments in our portfolio of commercial properties and landholdings. This includes progressing the planning on over 3,500 acres in West Maui and over 600 acres in Hali‘imaile, with improvements and value uplift to occur over the next several years. These initiatives reinforce our commitment to addressing community needs and delivering long-term value to our shareholders.”

| Third Quarter 2024 Highlights |

Strategic investments to elevate and enhance our commercial centers has contributed to an approximately 19% increase in leased area for the nine months ended September 30, 2024. Due to this improved occupancy, a recent land sale of a non-strategic parcel, and operational improvements of resort amenities, the company has experienced an 18.6% growth in overall operating revenue.

Business Segment Results:

- Land Development and Sales

- Land development and sales revenue increased by $181,000 to $200,000 during the nine months ended September 30, 2024, as compared to $19,000 in 2023. This resulted from the first non-strategic parcel sale of an easement in West Maui. Non-strategic parcels are currently being marketed for sale to generate additional cashflow in support of strategic land improvements. Additionally, our first land development project in Hali’imaile, a partnership with a local community builder, began its marketing efforts. As noted in our annual shareholder presentation, while non-strategic parcels will be monetized in the near term, proceeds from improved land sales will generally require years to realize, as necessary improvements are required to enable their productive use.

- Land development and sales related operating costs increased $161,000 year-over-year as we began to implement strategic land improvement efforts, including planning and engineering across ten projects in Upcountry and West Maui. Cash expended toward these active projects amounted to $984,000 during the nine months ended September 30, 2024. These expenditures include planning, engineering, and site preparations to allow the land to be utilized for homes, businesses, farms, temporary housing, resort projects, and other active uses.

- Leasing

- The leased area of our commercial properties increased 19% in 2024 as we continue to reposition and actively lease our portfolio to generate steady operational cashflow in a supply-constrained market.

- Leasing revenues increased by $899,000 to $7,148,000 for the nine months ended September 30, 2024, as compared to $6,249,000 for the nine months ended September 30, 2023, indicating that percentage rents and associated tenant sales have substantially recovered following the August 2023 wildfires. Approximately $169,000 of the increase was due to the 2023 common area maintenance adjustment realized in the third quarter of 2024. We anticipate revenue rising as occupancy continues to increase, improvements are completed, and new tenants open for business.

- Cash expended on tenant improvements at our commercial centers amounted to $1,063,000 during the nine months ended September 30, 2024, and additional capital improvements are expected to continue as needed to support the profitable lease-up of our town centers.

- Resort Amenities and Other

- Revenue from resort amenities and other, including the Kapalua Club, increased by $201,000 to $805,000 for the nine months ended September 30, 2024, compared to the same period last year, due to acceptance of new Kapalua Club memberships and the recognition of additional club dues upon updates of membership levels and groups.

Overall Results:

- Operating Revenues – Operating revenues totaled $8,153,000 for the nine months ended September 30, 2024, an increase of $1,281,000 compared to the nine months ended September 30, 2023, driven primarily by increases in leasing, and resort amenities and other.

- Operating Costs and Expenses – Operating costs and expenses totaled $13,669,000 for the nine months ended September 30, 2024, an increase of $2,895,000 compared to the same period in 2023. This was primarily driven by $4,676,000 in non-cash expenses related to share-based compensation compared to $1,742,000 for the same period in 2023 along with increased expenses related to the lease-up on vacant spaces in our commercial properties.

- Net loss – Net loss was $5,484,000, or ($0.28) per basic common share and ($0.27) per diluted common share, in the nine months ended September 30, 2024, compared to net loss of $3,673,000 or ($0.19) per basic and diluted common share in the nine months ended September 30, 2023. The increased year-over-year net loss of $1,811,000 was primarily driven by non-cash expenses related to share-based compensation amounting to $4,676,000, and severance payments of $321,000 to the former CEO, which will extend through March 31, 2025.

- Adjusted EBITDA (Non-GAAP) – Adjusted EBITDA was ($138,000) for the nine months ended September 30, 2024, after adjusting for net non-cash expenses totaling $5,346,000. Of the negative Adjusted EBITDA, ($321,000) was attributed to the former CEO severance, which will end after the first quarter of 2025.

- Cash and Investments Convertible to Cash (Non-GAAP) – Cash and investments convertible to cash totaled $9,239,000 on September 30, 2024, an increase of $404,000 compared to December 31, 2023. The increase includes a $3,000,000 draw on the Company’s credit facility to invest in strategic improvements to the Company’s portfolio of commercial properties and land.

| Lease to the State of Hawai‘i for Temporary Housing |

In furtherance of our stated mission to productively use our assets to meet the community’s critical needs, we agreed to lease approximately 50 acres of vacant land to the State of Hawai‘i in an area known as Honokeana, near Napili in Lahaina, Maui, to construct temporary housing for individuals and families displaced by the Maui wildfires on August 8, 2023. The lease is at no cost for five years, plus the duration of time necessary to construct the temporary homes.

The State will fund all costs to complete the project, including approximately $35,500,000 to complete the necessary infrastructure improvements, and we have agreed to administer the construction of such improvements and, at the State’s election, the subsequent housing construction. Our administration services will be at cost and will not contribute to our profits.

| Revitalizing MLP‘s Commercial Town Centers |

We continue to prioritize the revitalization of our commercial centers in West Maui and Hali‘imaile. As part of these efforts, we have been actively pursuing new opportunities to optimize existing tenancy and execute new leases for available commercial space.

Hali‘imaile Pineapple Company, well known for their Maui Pineapple Tours and the Maui Gold pineapple farm, has progressed with updates to their flagship store and plans to open before year end. Aloha Training has also signed a lease in Hali‘imaile commercial space and has ramped up activity in the town with their daily jiu jitsu classes.

In West Maui, Kapalua Ziplines has renewed their long-term commercial lease and land license to continue their unique operations and tours in the West Maui mountains. Their commercial space has relocated to the Kapalua Adventure Center, allowing for growth and an improved experience for their visitors. Honolua Store has also renewed their long-term lease to continue their historic location as a visitor destination and general store for the area.

Non-GAAP Financial Measures

Certain non-GAAP financial measures are presented in this press release, including Adjusted EBITDA and Cash and Investments Convertible to Cash, to provide information that may assist investors in understanding the Company’s financial results and financial condition and assessing its prospects for future performance. We believe that Adjusted EBITDA is an important indicator of our operating performance because it excludes items that are unrelated to, and may not be indicative of, our core operating results. We believe Cash and Cash Investments Convertible to Cash are important indicators of liquidity because it includes items that are convertible into cash in the short term. These non-GAAP financial measures are not intended to represent and should not be considered more meaningful measures than, or alternatives to, measures of operating performance or liquidity as determined in accordance with GAAP. To the extent we utilize such non-GAAP financial measures in the future, we expect to calculate them using a consistent method from period to period.

EBITDA is a non-GAAP financial measure defined as net income (loss) excluding interest, taxes, depreciation, and amortization. Adjusted EBITDA is further adjusted for non-cash stock-based compensation expense and pension and post-retirement expenses. Adjusted EBITDA is a key measure used by the Company to evaluate operating performance, generate future operating plans, and make strategic decisions for the allocation of capital. The Company presents Adjusted EBITDA to provide information that may assist investors in understanding its financial results. However, Adjusted EBITDA is not intended to be a substitute for net income (loss). A reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure is provided further below.

Cash and investments convertible to cash is a non-GAAP financial measure defined as cash and cash equivalents plus restricted cash and investments. Cash and cash investments convertible to cash is a key measure used by the Company to evaluate internal liquidity. The inclusion of the convertible investments to cash better describes the overall liquidity of the company as convertible investments convert to cash within forty-eight hours of authorization to liquidate the investment portfolio.

Additional Information

More information about the Company’s fiscal year 2023 operating results and the Company’s quarterly period ended September 30, 2024 operating results are available in the Form 10-K filed with the SEC on March 28, 2024, and the Form 10-Q filed with the SEC on November 14, 2024, each of which are posted at mauiland.com.

About Maui Land & Pineapple Company

Maui Land & Pineapple Company, Inc. MLP is dedicated to the thoughtful stewardship of its portfolio including over 22,400 acres of land and 247,000 square feet of commercial real estate. The Company envisions a future where people can thrive in resilient communities with sufficient housing supply, economic stability, food and water security and deep connections between people and place. For over a century, the Company has built a legacy of authentic innovation through conservation, agriculture, community building and land management. The Company continues this legacy today with a mission to thoughtfully maximize the productive use of its assets to meet the current critical needs and those of future generations.

The Company’s assets include land for future residential and mixed-use projects within the world-renowned Kapalua Resort, home to luxury hotels, such as The Ritz-Carlton Maui and Montage Kapalua Bay, two championship golf courses, pristine beaches, a network of walking and hiking trails, and the Pu‘u Kukui Watershed, the largest private nature preserve in Hawai‘i.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include but are not limited to statements regarding the Company’s ability to repurpose its land for productive use, increase Maui’s housing supply, improve tenanting of the village centers, and fill vacancies in our commercial properties. These forward-looking statements are based on the current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties, and contingencies, many of which are beyond the control of the Company. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Company’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available on the SEC’s Internet site (http://www.sec.gov). We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether because of new information, future developments or otherwise.

# # #

CONTACT

| Investors: | Wade Kodama | Chief Financial Officer | Maui Land & Pineapple Company |

| e: wade@mauiland.com |

| Media: | Ashley Takitani Leahey | Vice President | Maui Land & Pineapple Company e: ashley@mauiland.com Dylan Beesley | Senior Vice President | Bennet Group Strategic Communications e: dylan@bennetgroup.com |

| MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) |

| (UNAUDITED) |

| Nine Months Ended September 30, |

||||||||

| 2024 | 2023 | |||||||

| (in thousands except | ||||||||

| per share amounts) | ||||||||

| OPERATING REVENUES | ||||||||

| Land development and sales | $ | 200 | $ | 19 | ||||

| Leasing | 7,148 | 6,249 | ||||||

| Resort amenities and other | 805 | 604 | ||||||

| Total operating revenues | 8,153 | 6,872 | ||||||

| OPERATING COSTS AND EXPENSES | ||||||||

| Land development and sales | 687 | 526 | ||||||

| Leasing | 3,447 | 2,984 | ||||||

| Resort amenities and other | 992 | 1,113 | ||||||

| General and administrative | 3,336 | 2,996 | ||||||

| Share-based compensation | 4,676 | 2,472 | ||||||

| Depreciation | 531 | 683 | ||||||

| Total operating costs and expenses | 13,669 | 10,774 | ||||||

| OPERATING LOSS | (5,516 | ) | (3,902 | ) | ||||

| Other income | 271 | 598 | ||||||

| Pension and other post-retirement expenses | (234 | ) | (364 | ) | ||||

| Interest expense | (5 | ) | (5 | ) | ||||

| NET LOSS | $ | (5,484 | ) | $ | (3,673 | ) | ||

| Other comprehensive income – pension, net | 204 | 247 | ||||||

| TOTAL COMPREHENSIVE LOSS | $ | (5,280 | ) | $ | (3,426 | ) | ||

| NET LOSS PER COMMON SHARE-BASIC | $ | (0.28 | ) | $ | (0.19 | ) | ||

| NET LOSS PER COMMON SHARE-DILUTED | $ | (0.27 | ) | $ | (0.19 | ) | ||

| MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| September 30, 2024 |

December 31, 2023 | |||||||

| (unaudited) | (audited) | |||||||

| (in thousands except share data) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 6,138 | $ | 5,700 | ||||

| Accounts receivable, net | 1,534 | 1,166 | ||||||

| Investments, current portion | 2,982 | 2,671 | ||||||

| Prepaid expenses and other assets | 795 | 467 | ||||||

| Total current assets | 11,449 | 10,004 | ||||||

| PROPERTY & EQUIPMENT, NET | 17,061 | 16,059 | ||||||

| OTHER ASSETS | ||||||||

| Investments, noncurrent portion | 119 | 464 | ||||||

| Investment in joint venture | 1,627 | 1,608 | ||||||

| Deferred development costs | 13,917 | 12,815 | ||||||

| Other noncurrent assets | 1,743 | 1,273 | ||||||

| Total other assets | 17,406 | 16,160 | ||||||

| TOTAL ASSETS | $ | 45,916 | $ | 42,223 | ||||

| LIABILITIES & STOCKHOLDERS’ EQUITY | ||||||||

| LIABILITIES | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 2,293 | $ | 1,154 | ||||

| Payroll and employee benefits | 631 | 502 | ||||||

| Accrued retirement benefits, current portion | 142 | 142 | ||||||

| Deferred revenue, current portion | 307 | 217 | ||||||

| Long-term debt, current portion | 85 | – | ||||||

| Other current liabilities | 548 | 465 | ||||||

| Total current liabilities | 4,006 | 2,480 | ||||||

| LONG-TERM LIABILITIES | ||||||||

| Accrued retirement benefits, noncurrent portion | 1,485 | 1,550 | ||||||

| Deferred revenue, net of current portion | 1,267 | 1,367 | ||||||

| Deposits | 1,952 | 2,108 | ||||||

| Line of credit | 3,000 | – | ||||||

| Long-term debt | 189 | – | ||||||

| Other noncurrent liabilities | 27 | 14 | ||||||

| Total long-term liabilities | 7,920 | 5,039 | ||||||

| TOTAL LIABILITIES | 11,926 | 7,519 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred stock–$0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding | – | – | ||||||

| Common stock–$0.0001 par value; 43,000,000 shares authorized; 19,657,407 and 19,615,350 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 85,758 | 84,680 | ||||||

| Additional paid-in-capital | 14,026 | 10,538 | ||||||

| Accumulated deficit | (59,101 | ) | (53,617 | ) | ||||

| Accumulated other comprehensive loss | (6,693 | ) | (6,897 | ) | ||||

| Total stockholders’ equity | 33,990 | 34,704 | ||||||

| TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY | $ | 45,916 | $ | 42,223 | ||||

| MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES |

| SUPPLEMENTAL FINANCIAL INFORMATION |

| (NON-GAAP) UNAUDITED |

| Nine months ended | ||||||||

| September 30, | ||||||||

| 2024 | 2023 | |||||||

| (In thousands except per share | ||||||||

| amounts) | ||||||||

| NET LOSS | $ | (5,484 | ) | $ | (3,673 | ) | ||

| Non-cash income and expenses | ||||||||

| Interest expense | 5 | 5 | ||||||

| Depreciation | 531 | 683 | ||||||

| Amortization of licensing fee revenue | (100 | ) | (100 | ) | ||||

| Share-based compensation | ||||||||

| Vesting of Incentive Stock for former CEO and VP upon separation | – | 730 | ||||||

| Vesting of Stock Options granted to Board Chair and Directors | 2,890 | 915 | ||||||

| Vesting of Stock Compensation granted to Board Chair and Directors | 426 | 478 | ||||||

| Vesting of Stock Options granted to CEO | 599 | |||||||

| Vesting of employee Incentive Stock | 761 | 349 | ||||||

| Pension and other post-retirement expenses | 234 | 364 | ||||||

| ADJUSTED EBITDA (LOSS) | $ | (138 | ) | $ | (249 | ) | ||

| September 30, 2024 |

December 31, 2023 |

|||||||

| (unaudited) | (audited) | |||||||

| (in thousands) | ||||||||

| CASH AND INVESTMENTS CONVERTIBLE TO CASH | ||||||||

| Cash and cash equivalents | $ | 6,138 | $ | 5,700 | ||||

| Investments, current portion | 2,982 | 2,671 | ||||||

| Investments, noncurrent portion | 119 | 464 | ||||||

| TOTAL CASH AND INVESTMENTS CONVERTIBLE TO CASH | $ | 9,239 | $ | 8,835 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tilray Joins German Cannabis Fiesta With First Locally Grown Strains

Tilray Medical, a division of Tilray Brands TLRY, announced the launch of its first commercial medical cannabis products cultivated in Germany.

The debut comes from its Aphria RX facility, marking a milestone under the country’s recently updated cultivation regulations, MedCanG.

New Cultivation License Drives Local Production

Tilray was the first company to secure the new cannabis cultivation license under MedCanG in July 2024.

This regulatory shift allows Aphria RX to grow and manufacture a variety of popular medical cannabis strains that were previously imported.

The indoor-grown products are expected to offer consistent quality tailored to German patients’ preferences:

“Our Made in Germany premium cannabis products represent a significant step forward in delivering high-quality medical cannabis to patients,” said Denise Faltischek, Tilray’s chief strategy officer. “This achievement strengthens our position as a leader in cultivation, production, and distribution, while demonstrating our commitment to the German medical cannabis community.”

Read Also: Germany’s Govt. Coalition Crisis, Is Cannabis Reform At Risk?

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Medical Cannabis Market Shows Strong Growth

Germany’s medical cannabis market is rapidly expanding, driven by increased patient adoption that came after cannabis was re-listed as a non narcotic substance.

Companies like Cantourage Group Sell, Bloomwell and Drapalin have reported record revenue, with projections suggesting continued robust growth.

The shift toward local cultivation by companies like Tilray reflects the broader industry trend of securing supply chains, since most cannabis in Germany is imported, mainly from Canada.

Medical cannabis, however, continues to gain traction, with sales projected to reach $1.09 billion by 2028. Recent regulatory changes have streamlined access, treating medical cannabis similarly to over-the-counter medications like ibuprofen.

While Germany has taken steps toward partial cannabis legalization, full-scale recreational sales remain on hold.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

FILAMENT HEALTH ANNOUNCES THIRD QUARTER 2024 FINANCIAL RESULTS AND OPERATIONAL HIGHLIGHTS

VANCOUVER, BC, Nov. 14, 2024 /CNW/ – Filament Health Corp. FLHLF (Cboe CA: FH) 7QS (“Filament” or the “Company”), a clinical-stage natural psychedelic drug development company, released its third quarter financial results and operational highlights for the period ended September 30, 2024.

“This quarter we continued to grow our position as the premier global supplier of cGMP botanical psilocybin,” said Benjamin Lightburn, Chief Executive Officer and Co-Founder at Filament Health. “We were pleased to announce a significant expansion of our intellectual property portfolio, with the issuance of 20 new patents in the US, Canada, and Australia, ensuring the protection of our drug candidates and IP.”

Q3 2024 Financial Highlights:

- Cash and cash equivalents of $878,717;

- Cash used in operating activities of $1,840,498; and

- Total revenues of $426,661.

Q3 2024 Operational Highlights:

- On August 13, 2024, the Company announced the expansion of its intellectual property portfolio with the acceptance of twelve patents by IP Australia related to the development of botanical psychedelic drugs, five patents by the Canadian Intellectual Property Office, and three patents by the United States Patent and Trademark Office.

ABOUT FILAMENT HEALTH FLHLF (CBOE CA:FH) (FSE:7QS)

Filament Health is a clinical-stage natural psychedelic drug development company. We believe that safe, standardized, naturally-derived psychedelic medicines can improve the lives of many, and our mission is to see them in the hands of everyone who needs them as soon as possible. Filament’s platform of proprietary intellectual property enables the discovery, development, and delivery of natural psychedelic medicines for clinical development. We are paving the way with the first-ever natural psychedelic drug candidates.

Learn more at www.filament.health and on Twitter, Instagram and LinkedIn.

FORWARD LOOKING INFORMATION

Certain statements and information contained herein may constitute “forward-looking statements” and “forward-looking information,” respectively, under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as, “expect”, “anticipate”, “continue”, “estimate”, “may”, “will”, “should”, “believe”, “intends”, “forecast”, “plans”, “guidance” and similar expressions are intended to identify forward-looking statements or information. The forward-looking statements are not historical facts, but reflect the current expectations of management of Filament regarding future results or events and are based on information currently available to them. Certain material factors and assumptions were applied in providing these forward-looking statements. The forward-looking statements discussed in this press release may include, but are not limited to, information concerning the impact of the patent on the Company’s business and the ability of the Company to secure future patents. Forward-looking statements regarding the Company are based on the Company’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of Filament to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including status of patent applications and the ability to secure patents. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Filament will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

SOURCE Filament Health Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/14/c2784.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/14/c2784.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Minister Petitpas Taylor to make housing announcement in Moncton

MONCTON, NB, Nov. 14, 2024 /CNW/ – The Honourable Ginette Petitpas Taylor, Minister of Veterans Affairs and Associate Minister of National Defence, alongside the Honourable Dominic LeBlanc, Minister of Public Safety, Democratic Institutions and Intergovernmental Affairs, and Dawn Arnold, Mayor of Moncton, will make an announcement in Moncton about the federal government’s investments in affordable housing in New Brunswick.

A media availability will follow the event.

Date: 15 November 2024

Time (all times local): 15:00

Note for media: Media interested in participating must register and can obtain additional information at media@veterans.gc.ca. Please arrive no later than 14:45.

SOURCE Veterans Affairs Canada – Ottawa

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/14/c6823.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/14/c6823.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.