Banzai Reports Third Quarter 2024 Financial Results; Annualized Adjusted Net Loss Improvement of $12.2 Million

Q3 2024 Annual Recurring Revenue Increased by 31% Annualized to $4.4 Million, a 7% Sequential Increase from Q2 2024

Q3 2024 Annualized Adjusted Net Loss Improved by $12.2 Million, a $3.0 Million Sequential Increase to ($1.45) Million, Bringing the Company Closer to Profitability

Management to Host Third Quarter 2024 Results Conference Call Today, November 14, 2024 at 5:30 p.m. Eastern Time

SEATTLE, Nov. 14, 2024 (GLOBE NEWSWIRE) — Banzai International, Inc. BNZI (“Banzai” or the “Company”), a leading marketing technology company that provides essential marketing and sales solutions, today reported financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Key Financial & Operational Highlights

- Q3 2024 Annual Recurring Revenue (ARR) of $4.4 million, a 7% sequential increase from Q2 2024. This represents a 31% annualized ARR growth rate.

- Q3 2024 Adjusted Net Loss was ($1.45) million, a $3.0 million sequential improvement from Q2 2024 Adjusted Net Loss of ($4.5) million. This represents an annualized improvement of $12.2 million.

- Net Revenue Retention (NRR) reached a historic high in Q3 2024.

- Q3 2024 Adjusted EBITDA was ($1.5) million, a $0.5 million sequential improvement from Q2 2024 EBITDA of ($2.0) million. This represents an annualized improvement of $2.0 million.

- As of September 30, 2024, cash of approximately $4.3 million was at an all-time high.

- Added 172 customers in September 2024 and 179 customers in October 2024, for a total of 1,785 customers YTD through October 2024.

- Added 26 Reach customers through October 2024, demonstrating the growth and revenue potential of the Reach product.

- Launched Curate, an AI-powered newsletter platform designed to streamline content creation and audience engagement for organizations of all sizes. Sold 10 workspace licenses in the initial weeks since launch, demonstrating the tremendous market potential of the Curate product.

- Expanded partnership with Salesforce, today’s industry leading AI CRM company, for smarter webinar campaigns with significant enhancements to its Demio platform through deeper integration with Salesforce.

- Released enhanced Demio HubSpot integration, delivering a seamless experience, with new updates focused on transforming webinar data management with advanced synchronization and tracking.

- Launched a comprehensive initiative designed to significantly improve net income by up to $13.5 million annually while maintaining its growth outlook.

- Entered into agreements with lenders and service providers to restructure and write off up to $28.8 million of outstanding liabilities including write-off of up to $5.6 million of outstanding liabilities and restructuring of a further $19.2 million of its existing debt obligations, substantially improving the Company’s overall financial position.

- Closed a $5 million private placement priced at-the-market under Nasdaq rules.

- Company’s securities were transferred from the Nasdaq Global Market to the Nasdaq Capital Market at the opening of business on October 31, 2024.

Outlook

- The Company anticipates Net Income will be approximately ($0.7) million in Q4 2024 and approximately ($0.7) million in Q1 2025, representing substantial increases driven by a reduction in operating and interest expenses due to the recently announced $28.8 million debt restructuring and $13.5 million Net Income Improvement initiative.

- The Company anticipates Adjusted EBITDA to be approximately ($1.4) million in Q4 2024, and approximately ($1.1) million in Q1 2025, representing substantially improved runway and progress towards profitability and positive cash-flow.

“It is hard to overstate how important the third quarter of 2024 was for Banzai,” said Joe Davy, Founder and CEO of Banzai. “We believe this marks a turning point for the Company in many ways. Banzai achieved a 31% annualized Annual Recurring Revenue growth rate and a historic record for Net Revenue Retention. We also made game-changing improvements to our balance sheet and cost structure to set us up for sustainable profitability in the future. Growth was driven by our focus on the Reach product through re-engineering and expanded sales efforts, leading to the addition of 1,785 customers through October 2024. In total, we now serve nearly 3,000 customers that have contributed to top and bottom-line sequential improvements from the second quarter.

“To better serve our customers, we have continued to invest in our software platforms and growth. We’ve launched a new product, Curate, to bring AI-powered newsletters that leverage OpenAI’s GPT-4o to automate the newsletter creation process by writing relevant, branded articles that resonate with target audiences. We added significant enhancements to our Demio platform through deeper integration with Salesforce, the industry leading AI CRM company, with key enhancements designed to maximize efficiency and insight, offering marketers a more scalable, data-rich experience. We also released a major improvement to the Demio HubSpot integration. This upgrade offers unparalleled flexibility and efficiency in managing webinar data, empowering marketers to streamline their webinar management and marketing efforts, leading to better decision-making and higher ROI.

“Alongside a $5.0 million private placement transaction and debt restructuring transactions we executed, we implemented a strategic initiative that we expect will enable us to significantly improve net income, substantially extend our cash runway and invest in growth. We are making significant progress on these goals and overall improvement in net income is expected to be approximately $12.2 million annually when fully implemented, while maintaining our growth outlook.

“Looking ahead, our ability to leverage deep analytics and insights to drive marketing decisions combined with leveraging AI to launch exciting new products and capabilities, will continue to drive growth. We will continue to manage costs efficiently while investing in our software platform, sales and marketing and product development. We look forward to additional updates on our anticipated milestones in the weeks and months to come,” concluded Davy.

Third Quarter 2024 Financial Results

Banzai believes its non-GAAP financial measure ARR is more meaningful in evaluating its performance. The Company’s management team evaluates its financial and operating results utilizing this non-GAAP measure. For the three months ended September 30, 2024, ARR increased 7% sequentially, representing a 31% annualized ARR growth rate.

Total revenue for the three months ended September 30, 2024, was $1.1 million, a sequential increase of 0.5% from the three months ended June 30, 2024, and a decrease of 2.5% compared to the prior year quarter.

Total cost of revenue for the three months ended September 30, 2024 was $0.3 million, compared to $0.3 million in the prior year quarter, a decrease of 1%. The decrease was proportional to the revenue for the corresponding period.

Gross profit for the three months ended September 30, 2024, was $0.7 million, compared to $0.8 million in the prior year quarter. Gross margin was 68.7% in the third quarter of 2024, compared to 69.2% in the third quarter of 2023.

Total operating expenses for the three months ended September 30, 2024, were $3.5 million, compared to $2.8 million in the prior year quarter.

Net loss for the three months ended September 30, 2024, was $8.5 million, compared to $0.8 million in the prior year quarter. The greater net loss is primarily due to the change in fair valuation of various financial instruments related to the debt restructuring in the third quarter of 2024, which increased by approximately $14.5 million over the three months ended September 30, 2024 when compared to the three months ended September 30, 2023. These non-cash valuation charges do not represent present or future cash obligations of the Company, and as a result, the Company believes Adjusted Net Loss is a better representation of the financial performance of the company for the third quarter 2024.

Adjusted Net Loss for the three months ended September 30, 2024, was ($1.45) million, compared to ($3.6) million in the prior year quarter. This improvement was driven by improvements to the Company’s efficiency and by write-off agreements entered into for certain liabilities, substantially reducing the Company’s current and future cash liabilities.

Adjusted EBITDA Loss for the three months ended September 30, 2024, was ($1.5) million, compared to Adjusted EBITDA Loss of ($2.0) million for the prior year quarter, representing an improvement of $0.5 million.

Nine Month 2024 Financial Results

Total revenue for the nine months ended September 30, 2024 and 2023, was $3.2 million and $3.5 million, respectively, a decrease of 7.2%. This decrease is primarily attributable to lower Reach revenue which declined by approximately $44 thousand due to the discontinuation of the legacy Reach 1.0 product, which was discontinued on December 31, 2023. In 2024, Banzai has revitalized its focus on the Reach product through re-engineering and expanded sales efforts. Demio revenue was lower by approximately $0.2 million for the nine months ended September 30, 2024, as compared to the nine months ended September 30, 2023, due to lower new unit sales period-over-period, due to the company’s strategic shift to focus on mid-market customers, which the Company hopes will ultimately result in higher Average Customer Value and Net Retention Rate for the Demio product. Demio Net Revenue Retention reached an all-time historic high in the three months ended September 30, 2024.

Cost of revenue for the nine months ended September 30, 2024 and 2023 was $1.0 million and $1.1 million, respectively. This represents a decrease of approximately $84 thousand, or approximately 7.4%, for the nine months ended September 30, 2024 as compared to the nine months ended September 30, 2023. This decrease is due primarily to the company’s focus on Mid-Market customers that led to an approximately 12% higher average cost per customer, driven by the increase in the streaming services costs of approximately $150 thousand that were offset by lower infrastructure costs / data licenses of approximately $117 thousand, payroll and contracted services of approximately $98 thousand, and merchant fee costs of approximately $12 thousand.

Gross profit for the nine months ended September 30, 2024 and 2023 was $2.2 million and $2.3 million, respectively. This represents a decrease of approximately $167 thousand, or approximately 7.1%, which was due to the decreases in revenue of approximately $251 thousand and decreases in cost of revenue of approximately $84 thousand described above. Gross margin for the nine months ended September 30, 2024 and 2023 was 67.5% and 67.4%, respectively.

Total operating expenses for the nine months ended September 30, 2024 and 2023, were $11.7 million and $8.9 million, respectively, an increase of 31.1%. This increase was due primarily to an overall increase in salaries and related expenses by approximately $0.3 million, marketing expenses by approximately $0.6 million, costs associated with audit, technical accounting, and legal and other professional services of approximately $1.6 million. The company has implemented a plan to reduce annualized operating expenses by up to $13.5 million by the end of the first quarter 2025.

Net loss for the nine months ended September 30, 2024 and 2023, was $23.7 million and $8.0 million, respectively. The greater net loss is primarily due to an increase in total other expenses of approximately $12.6 million, an increase in operating expenses of approximately $2.8 million, and a decrease in gross profit of approximately $0.2 million during the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023.

Adjusted Net Loss for the nine months ended September 30, 2024 and 2023, was ($10.0)

million and ($10.0) million, respectively.

Net cash used in operating activities for the nine months ended September 30, 2024, was $11.9 million, compared to $5.8 million for the nine months ended September 30, 2023.

Cash totaled $4.3 million as of September 30, 2024, compared to $2.1 million as of December 31, 2023, representing a historic high.

End-of-Year 2024 Target

Banzai targets December 2024 ARR to be $8.1 – $10 million, based on the Company’s March 2024 ARR, organic growth during the year as demonstrated by year-to-date 2024 customer wins and reactivations, and currently signed non-binding LOIs to acquire other marketing technology businesses.

The midpoint target, or $9.1 million, foresees a 97% increase in ARR, which would be attributable to both organic growth and the acquisitions currently under LOI. Banzai’s management anticipates tracking the Company’s progress to its targeted December 2024 ARR as part of the Company’s 2024 quarterly earnings reports.

Annual recurring revenue refers to revenue, normalized on an annual basis, that Banzai expects to receive from its customers for providing them with products or services. The December 2024 ARR information provided above is based on Banzai’s current estimates of internal growth, the completion of acquisitions, and those companies contributing ARR based on current levels, and is not a guarantee of future performance. These statements are forward-looking and actual ARR may differ materially. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause Banzai’s actual ARR to differ materially from these forward-looking statements.

Third Quarter 2024 Results Conference Call

Banzai Founder & CEO Joe Davy and Interim CFO Alvin Yip will host the conference call, followed by a question-and-answer session. The conference call will be accompanied by a presentation, which can be viewed during the webcast or accessed via the investor relations section of the Company’s website here.

To access the call, please use the following information:

| Date: | Thursday, November 14, 2024 |

| Time: | 5:30 p.m. Eastern Time, 2:30 p.m. Pacific Time |

| Toll-free dial-in number: | 1-877-425-9470 |

| International dial-in number: | 1-201-389-0878 |

| Conference ID: | 13749747 |

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact MZ Group at 1-949-491-8235.

The conference call will be broadcast live and available for replay at https://viavid.webcasts.com/starthere.jsp?ei=1694251&tp_key=65eec38e9b and via the investor relations section of the Company’s website here.

A replay of the webcast will be available after 9:30 p.m. Eastern Time through February 14, 2025.

| Toll-free replay number: | 1-844-512-2921 |

| International replay number: | 1-412-317-6671 |

| Replay ID: | 13749747 |

About Banzai

Banzai is a marketing technology company that provides essential marketing and sales solutions for businesses of all sizes. On a mission to help their customers achieve their mission, Banzai enables companies of all sizes to target, engage, and measure both new and existing customers more effectively. Banzai customers include Square, Hewlett Packard Enterprise, Thermo Fisher Scientific, Thinkific, Doodle and ActiveCampaign, among thousands of others. Learn more at www.banzai.io. For investors, please visit https://ir.banzai.io.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often use words such as “believe,” “may,” “will,” “estimate,” “target,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “propose,” “plan,” “project,” “forecast,” “predict,” “potential,” “seek,” “future,” “outlook,” and similar variations and expressions. Forward-looking statements are those that do not relate strictly to historical or current facts. Examples of forward-looking statements may include, among others, statements regarding Banzai International, Inc.’s (the “Company’s”): future financial, business and operating performance and goals; annualized recurring revenue and customer retention; ongoing, future or ability to maintain or improve its financial position, cash flows, and liquidity and its expected financial needs; potential financing and ability to obtain financing; acquisition strategy and proposed acquisitions and, if completed, their potential success and financial contributions; strategy and strategic goals, including being able to capitalize on opportunities; expectations relating to the Company’s industry, outlook and market trends; total addressable market and serviceable addressable market and related projections; plans, strategies and expectations for retaining existing or acquiring new customers, increasing revenue and executing growth initiatives; and product areas of focus and additional products that may be sold in the future. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Forward-looking statements are not guarantees of future performance, and our actual results of operations, financial condition and liquidity and development of the industry in which the Company operates may differ materially from those made in or suggested by the forward-looking statements. Therefore, investors should not rely on any of these forward-looking statements. Factors that may cause actual results to differ materially include changes in the markets in which the Company operates, customer demand, the financial markets, economic, business and regulatory and other factors, such as the Company’s ability to execute on its strategy. More detailed information about risk factors can be found in the Company’s Annual Report on Form 10-K and the Company’s Quarterly Reports on Form 10-Q under the heading “Risk Factors,” and in other reports filed by the Company, including reports on Form 8-K. The Company does not undertake any duty to update forward-looking statements after the date of this press release.

Investor Relations

Chris Tyson

Executive Vice President

MZ Group – MZ North America

949-491-8235

BNZI@mzgroup.us

www.mzgroup.us

Media

Rachel Meyrowitz

Director, Demand Generation, Banzai

media@banzai.io

| BANZAI INTERNATIONAL, INC. Condensed Consolidated Balance Sheets |

||||||||

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 4,263,567 | $ | 2,093,718 | ||||

| Accounts receivable, net of allowance for credit losses of $5,694 and $5,748, respectively | 37,386 | 105,049 | ||||||

| Prepaid expenses and other current assets | 753,746 | 741,155 | ||||||

| Total current assets | 5,054,699 | 2,939,922 | ||||||

| Property and equipment, net | 918 | 4,644 | ||||||

| Goodwill | 2,171,526 | 2,171,526 | ||||||

| Operating lease right-of-use assets | 2,386 | 134,013 | ||||||

| Other assets | 38,381 | 38,381 | ||||||

| Total assets | 7,267,910 | 5,288,486 | ||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | 9,997,052 | 6,439,863 | ||||||

| Accrued expenses and other current liabilities | 3,633,072 | 5,194,240 | ||||||

| Convertible notes (Yorkville) | — | 1,766,000 | ||||||

| Convertible notes – related party | — | 2,540,091 | ||||||

| Convertible notes | 3,517,742 | 2,693,841 | ||||||

| Notes payable | 7,083,905 | 6,659,787 | ||||||

| Notes payable – related party | — | 2,505,137 | ||||||

| Notes payable, carried at fair value | 1,393,592 | — | ||||||

| Deferred underwriting fees | 4,000,000 | 4,000,000 | ||||||

| Deferred fee | — | 500,000 | ||||||

| Warrant liability | 79,000 | 641,000 | ||||||

| Warrant liability – related party | 230,000 | 575,000 | ||||||

| Earnout liability | 37,125 | 59,399 | ||||||

| Due to related party | 167,118 | 67,118 | ||||||

| GEM commitment fee liability | — | 2,000,000 | ||||||

| Deferred revenue | 1,220,572 | 1,214,096 | ||||||

| Operating lease liabilities, current | 2,352 | 234,043 | ||||||

| Total current liabilities | 31,361,530 | 37,089,615 | ||||||

| Other long-term liabilities | 75,000 | 75,000 | ||||||

| Total liabilities | 31,436,530 | 37,164,615 | ||||||

| Commitments and contingencies (Note 14) | ||||||||

| Stockholders’ deficit: | ||||||||

| Common stock, $0.0001 par value, 275,000,000 shares authorized and 3,760,174 and 2,585,297 issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 410 | 259 | ||||||

| Preferred stock, $0.0001 par value, 75,000,000 shares authorized, 0 shares issued and outstanding at September 30, 2024 and December 31, 2023 | — | — | ||||||

| Additional paid-in capital | 39,297,867 | 14,889,936 | ||||||

| Accumulated deficit | (63,466,897 | ) | (46,766,324 | ) | ||||

| Total stockholders’ deficit | (24,168,620 | ) | (31,876,129 | ) | ||||

| Total liabilities and stockholders’ deficit | $ | 7,267,910 | $ | 5,288,486 | ||||

| BANZAI INTERNATIONAL, INC. Unaudited Condensed Consolidated Statements of Operations |

||||||||||||||||

| For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Operating income: | ||||||||||||||||

| Revenue | $ | 1,080,607 | $ | 1,108,412 | $ | 3,228,276 | $ | 3,478,794 | ||||||||

| Cost of revenue | 338,023 | 341,151 | 1,049,411 | 1,132,671 | ||||||||||||

| Gross profit | 742,584 | 767,261 | 2,178,865 | 2,346,123 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative expenses | 2,942,008 | 2,838,052 | 11,569,951 | 8,937,265 | ||||||||||||

| Depreciation expense | 900 | 1,571 | 3,725 | 5,596 | ||||||||||||

| Total operating expenses | 2,942,908 | 2,839,623 | 11,573,676 | 8,942,861 | ||||||||||||

| Operating loss | (2,200,324 | ) | (2,072,362 | ) | (9,394,811 | ) | (6,596,738 | ) | ||||||||

| Other expenses (income): | ||||||||||||||||

| GEM settlement fee expense | 60,000 | — | 260,000 | — | ||||||||||||

| Other expense (income), net | (62,927 | ) | 14,114 | (2,900 | ) | (70,569 | ) | |||||||||

| Interest income | — | — | (10 | ) | (111 | ) | ||||||||||

| Interest expense | 495,679 | 820,096 | 1,343,097 | 1,879,394 | ||||||||||||

| Interest expense – related party | 589,614 | 678,398 | 1,552,601 | 1,614,085 | ||||||||||||

| Gain on extinguishment of liability | (22,282 | ) | — | (550,262 | ) | — | ||||||||||

| Loss on debt issuance | — | — | 171,000 | — | ||||||||||||

| Loss on debt issuance of term notes | 381,000 | — | 381,000 | — | ||||||||||||

| Loss on debt issuance of convertible notes | — | — | — | — | ||||||||||||

| Loss on conversion and settlement of Alco promissory notes | 4,808,882 | — | 4,808,882 | — | ||||||||||||

| Loss on conversion and settlement of CP BF notes | — | — | — | — | ||||||||||||

| Change in fair value of warrant liability | — | — | (562,000 | ) | — | |||||||||||

| Change in fair value of warrant liability – related party | — | — | (345,000 | ) | — | |||||||||||

| Change in fair value of simple agreement for future equity | — | (276,436 | ) | — | (184,993 | ) | ||||||||||

| Change in fair value of simple agreement for future equity – related party | — | (3,139,564 | ) | — | (1,927,007 | ) | ||||||||||

| Change in fair value of bifurcated embedded derivative liabilities | — | 198,728 | — | 36,500 | ||||||||||||

| Change in fair value of bifurcated embedded derivative liabilities – related party | — | 413,272 | — | 72,359 | ||||||||||||

| Change in fair value of convertible notes | (77,000 | ) | — | 501,000 | — | |||||||||||

| Change in fair value of term notes | 66,813 | — | 66,813 | — | ||||||||||||

| Change in fair value of convertible bridge notes | — | — | — | — | ||||||||||||

| Yorkville prepayment premium expense | 14,000 | — | 94,760 | — | ||||||||||||

| Total other expenses (income), net | 6,253,779 | (1,291,392 | ) | 7,718,981 | 1,419,658 | |||||||||||

| Loss before income taxes | (8,454,103 | ) | (780,970 | ) | (17,113,792 | ) | (8,016,396 | ) | ||||||||

| Income tax expense | 1,010 | 1,332 | 6,701 | 17,081 | ||||||||||||

| Net loss | $ | (8,455,113 | ) | $ | (782,302 | ) | $ | (17,120,493 | ) | $ | (8,033,477 | ) | ||||

| Net loss per share | ||||||||||||||||

| Basic and diluted | $ | (2.68 | ) | $ | (0.33 | ) | $ | (5.99 | ) | $ | (3.36 | ) | ||||

| Weighted average common shares outstanding | ||||||||||||||||

| Basic and diluted | 3,150,057 | 2,394,122 | 2,857,350 | 2,394,067 | ||||||||||||

| BANZAI INTERNATIONAL, INC. Unaudited Condensed Consolidated Statements of Cash Flow |

||||||||

| For the Nine Months Ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (17,120,493 | ) | $ | (8,033,477 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation expense | 3,726 | 5,596 | ||||||

| Provision for credit losses on accounts receivable | 54 | 3,879 | ||||||

| Non-cash share issuance for marketing expenses | — | — | ||||||

| Non-cash settlement of GEM commitment fee | 200,000 | — | ||||||

| Non-cash share issuance for Yorkville redemption premium | — | — | ||||||

| Non-cash interest expense | 379,354 | 914,944 | ||||||

| Non-cash interest expense – related party | 261,775 | 345,382 | ||||||

| Amortization of debt discount and issuance costs | 68,459 | 646,684 | ||||||

| Amortization of debt discount and issuance costs – related party | 873,728 | 1,268,703 | ||||||

| Amortization of operating lease right-of-use assets | 131,627 | 129,705 | ||||||

| Stock based compensation expense | 665,409 | 830,791 | ||||||

| Gain on extinguishment of liability | (550,262 | ) | — | |||||

| Loss on debt issuance | 171,000 | — | ||||||

| Loss on debt issuance of term notes | 381,000 | — | ||||||

| Loss on debt issuance of convertible notes | — | — | ||||||

| Change in fair value of warrant liability | (562,000 | ) | — | |||||

| Change in fair value of warrant liability – related party | (345,000 | ) | — | |||||

| Change in fair value of simple agreement for future equity | — | (184,993 | ) | |||||

| Change in fair value of simple agreement for future equity – related party | — | (1,927,007 | ) | |||||

| Change in fair value of bifurcated embedded derivative liabilities | — | 36,500 | ||||||

| Change in fair value of bifurcated embedded derivative liabilities – related party | — | 72,359 | ||||||

| Change in fair value of convertible promissory notes | 501,000 | — | ||||||

| Change in fair value of term notes | 66,813 | — | ||||||

| Change in fair value of convertible bridge notes | — | — | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 67,609 | (29,861 | ) | |||||

| Deferred contract acquisition costs, current | — | 48,191 | ||||||

| Prepaid expenses and other current assets | (12,591 | ) | 120,459 | |||||

| Deferred offering costs | — | (766,409 | ) | |||||

| Accounts payable | 3,557,189 | 1,296,098 | ||||||

| Deferred revenue | 6,476 | (39,428 | ) | |||||

| Accrued expenses | (432,073 | ) | (128,027 | ) | ||||

| Operating lease liabilities | (231,691 | ) | (211,204 | ) | ||||

| Earnout liability | (22,274 | ) | (206,985 | ) | ||||

| Net cash used in operating activities | (11,941,165 | ) | (5,808,100 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Payment of GEM commitment fee | (1,200,000 | ) | — | |||||

| Repayment of convertible notes (Yorkville) | (750,000 | ) | — | |||||

| Proceeds from related party advance | 100,000 | — | ||||||

| Proceeds from term notes, net of issuance costs | 1,000,000 | — | ||||||

| Repayment of notes payable, carried at fair value | (412,421 | ) | — | |||||

| Proceeds from Yorkville redemption premium | 35,040 | — | ||||||

| Proceeds from issuance of promissory notes – related party | — | 1,150,000 | ||||||

| Proceeds from issuance of convertible notes, net of issuance costs | 2,502,000 | 1,485,000 | ||||||

| Proceeds from issuance of convertible notes, net of issuance costs – related party | — | 2,533,000 | ||||||

| Proceeds received for exercise of Pre-Funded warrants | 17 | — | ||||||

| Proceeds from issuance of common stock and warrants | 6,257,370 | 13,362 | ||||||

| Net cash provided by financing activities | 7,532,006 | 5,181,362 | ||||||

| Net decrease in cash | (4,409,159 | ) | (626,738 | ) | ||||

| Cash at beginning of period | 2,093,718 | 1,023,499 | ||||||

| Cash at end of period | $ | (2,315,441 | ) | $ | 396,761 | |||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | 306,109 | 313,813 | ||||||

| Cash paid for taxes | 5,075 | 8,825 | ||||||

| Non-cash investing and financing activities | ||||||||

| Shares issued to Roth for advisory fee | 578,833 | — | ||||||

| Shares issued to GEM | 529,943 | — | ||||||

| Shares issued for marketing expenses | 334,772 | — | ||||||

| Shares issued to MZHCI for investor relations services | 94,800 | — | ||||||

| Shares issued to J.V.B for payment of outstanding debt | 115,000 | — | ||||||

| Settlement of GEM commitment fee | 200,000 | — | ||||||

| Shares issued to Yorkville for commitment fee | 500,000 | — | ||||||

| Shares issued to Yorkville for redemption premium | 115,800 | |||||||

| Shares issued for exercise of Pre-Funded warrants | 866 | |||||||

| Issuance of convertible promissory note – GEM | 1,000,000 | — | ||||||

| Conversion of convertible notes – Yorkville | 2,002,000 | — | ||||||

| Conversion of convertible notes – related party | 2,540,091 | — | ||||||

| Bifurcated embedded derivative liabilities at issuance | — | 623,065 | ||||||

| Bifurcated embedded derivative liabilities at issuance—related party | — | 1,062,776 | ||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Reviva Reports Third Quarter 2024 Financial Results and Recent Business Highlights

– 108 patients have completed 1-year of treatment in 1-year open-label extension (OLE) trial –

– Vocal biomarker speech latency data from RECOVER trial reinforce brilaroxazine’s improvement on negative symptoms and other key symptom domains of schizophrenia –

– Topline data from OLE trial expected in December 2024 –

CUPERTINO, Calif., Nov. 14, 2024 (GLOBE NEWSWIRE) — Reviva Pharmaceuticals Holdings, Inc. RVPH (“Reviva” or the “Company”), a late-stage pharmaceutical company developing therapies that seek to address unmet medical needs in the areas of central nervous system (CNS), inflammatory and cardiometabolic diseases, today reported financial results for the third quarter ended September 30, 2024 and summarized recent business highlights.

“We continue to advance our late-stage brilaroxazine program with initial focus in schizophrenia and expansion potential across indications driven by underlying disruption in serotonin signaling,” said Laxminarayan Bhat, Ph.D., Founder, President, and CEO of Reviva. “Our global 1-year OLE trial is progressing well, and we have over 100 patients who have completed one year of treatment which is a requirement for New Drug Application (NDA) submission. Importantly, we expect topline data from the OLE trial in December 2024. In addition to long-term safety, tolerability and efficacy, the full data analysis of the OLE trial expected in the first quarter of 2025 will also include vocal and blood biomarker data designed to support the strong efficacy of brilaroxazine for negative symptoms and other key symptom domains of schizophrenia. We remain highly encouraged by the differentiated potential of once-daily brilaroxazine to address major unmet needs for patients with schizophrenia and are targeting a potential NDA submission for brilaroxazine in the second quarter of 2026.”

Third Quarter 2024 and Recent Business Highlights

Clinical Program Highlights

- Provided an enrollment update to the ongoing 1-year open-label extension (OLE) study evaluating the long-term safety and tolerability of brilaroxazine in patients with schizophrenia (November 2024).

- Global trial progressing well

- 108 patients have completed 1-year (12-month) of treatment

- Over 250 patients have completed 6-months of treatment

- Blood and digital biomarkers designed to independently support efficacy

- Long-term safety data from 100 patients who have completed 12 months of treatment is a requirement for brilaroxazine’s NDA submission to the FDA

- 12 months long-term safety study expected to complete in Q1 2025

- Presented vocal biomarker data from Phase 3 RECOVER trial of brilaroxazine in schizophrenia during a virtual key opinion leader event hosted by the Company featuring Brian Kirkpatrick, MD, MSPH (Professor, Psychiatric Research Institute, University of Arkansas for Medical Sciences, Arkansas) and Mark Opler, PhD, MPH (Chief Research Officer at WCG Inc., Executive Director of the PANSS Institute, New York) (September 2024).

- Speech latency is an emerging objective vocal biomarker that can help validate scale-based assessments completed by human raters

- Brilaroxazine demonstrated a strong efficacy for negative symptoms and other key symptoms of schizophrenia such as total and positive symptoms, disorganization, and social functioning in the pivotal phase 3 RECOVER trial in schizophrenia

- Statistically significant results of the vocal biomarker speech latency data analysis from the RECOVER trial further support the strong efficacy of brilaroxazine for negative symptoms and other key symptom domains of schizophrenia

Corporate Highlights

- Positive speech latency data for brilaroxazine in schizophrenia from the Phase 3 RECOVER trial presented as a poster presentation at the Central Nervous System (CNS) Summit 2024 on Tuesday, November 12th in Boston, Massachusetts

Anticipated Milestones and Events

- Topline data from 1-year OLE trial expected in December 2024

- Full data analysis of the OLE trial including long-term safety, tolerability and efficacy, as well as vocal and blood biomarker data expected in Q1 2025

- Initiation of registrational Phase 3 RECOVER-2 trial evaluating brilaroxazine for the treatment of schizophrenia expected in Q1 2025, subject to receipt of additional financing

- Potential NDA submission for brilaroxazine in schizophrenia targeted for Q2 2026

- Investigational new drug application (IND) submission for liposomal-gel formulation of brilaroxazine in psoriasis expected in 2025

- Pursue partnership opportunities for the development of our pipeline

Third Quarter 2024 Financial Results

The Company reported a net loss of approximately $8.4 million, or $0.25 per share, for the three months ended September 30, 2024, compared to a net loss of approximately $11.3 million, or $0.48 per share, for the same period in 2023 (as restated).

The Company reported a net loss of approximately $23.7 million, or $0.75 per share, for the nine months ended September 30, 2024, compared to a net loss of approximately $29.9 million, or $1.32 per share, for the same period in 2023 (as restated).

As of September 30, 2024, the Company’s cash totaled approximately $5.6 million compared to approximately $23.4 million as of December 31, 2023.

About Brilaroxazine

Brilaroxazine is an in-house discovered new chemical entity with potent affinity and selectivity against key serotonin and dopamine receptors implicated in the pathobiology of several conditions including schizophrenia, psoriasis and interstitial lung diseases like pulmonary hypertension, pulmonary arterial hypertension (PAH) and idiopathic pulmonary fibrosis (IPF).

Positive topline data from the global Phase 3 RECOVER-1 trial in schizophrenia demonstrated the trial successfully met all primary and secondary endpoints with statistically significant and clinically meaningful reductions across all major symptom domains including reduction in key proinflammatory cytokines implicated in the pathobiology of schizophrenia and comorbid inflammatory conditions at week 4 with 50 mg of brilaroxazine vs. placebo with a generally well-tolerated side effect profile comparable to placebo and discontinuation rates lower than placebo. Positive data from a clinical drug-drug interaction (DDI) study investigating the potential effect of CYP3A4 enzyme on brilaroxazine in healthy subjects supports no clinically significant interaction when combined with a CYP3A4 inhibitor. Reviva believes that a full battery of regulatory compliant toxicology and safety pharmacology studies has been completed for brilaroxazine. Reviva intends to develop brilaroxazine for other neuropsychiatric indications including bipolar disorder, major depressive disorder (MDD) and attention-deficit/hyperactivity disorder (ADHD).

Additionally, brilaroxazine has shown promising nonclinical activity for inflammatory diseases psoriasis, pulmonary arterial hypertension (PAH) and idiopathic pulmonary fibrosis (IPF) with mitigation of fibrosis and inflammation in translational animal models. Brilaroxazine has already received Orphan Drug Designation by the U.S. FDA for the treatment of PAH and IPF conditions.

To learn more about the clinical and preclinical data available for brilaroxazine, please visit revivapharma.com/publications.

About Reviva

Reviva is a late-stage biopharmaceutical company that discovers, develops, and seeks to commercialize next-generation therapeutics for diseases representing unmet medical needs and burdens to society, patients, and their families. Reviva’s current pipeline focuses on the central nervous system (CNS), inflammatory and cardiometabolic diseases. Reviva’s pipeline currently includes two drug candidates, brilaroxazine (RP5063) and RP1208. Both are new chemical entities discovered in-house. Reviva has been granted composition of matter patents for both brilaroxazine and RP1208 in the United States, Europe, and several other countries.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act, as amended, including those relating to the Company’s 1-year open label extension (OLE) trial evaluating the long-term safety and tolerability for brilaroxazine in schizophrenia, the registrational Phase 3 RECOVER-2 trial, the Company’s expectations regarding the anticipated clinical profile of its product candidates, including statements regarding anticipated efficacy or safety profile, and those relating to the Company’s expectations, intentions or beliefs regarding matters including product development and clinical trial plans, clinical and regulatory timelines and expenses, planned or intended additional trials or studies and the timing thereof, planned or intended regulatory submissions and the timing thereof, trial results, market opportunity, ability to raise sufficient funding, competitive position, possible or assumed future results of operations, business strategies, potential opportunities for development including partnerships, growth or expansion opportunities and other statements that are predictive in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s current beliefs and assumptions.

These statements may be identified by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “potential, “predict,” “project,” “should,” “would” and similar expressions and the negatives of those terms. These statements relate to future events or our financial performance and involve known and unknown risks, uncertainties, and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include those set forth in the Company’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and the Company’s other filings from time to time with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

Corporate Contact:

Reviva Pharmaceuticals Holdings, Inc.

Laxminarayan Bhat, PhD

www.revivapharma.com

Investor Relations Contact:

LifeSci Advisors, LLC

Bruce Mackle

bmackle@lifesciadvisors.com

REVIVA PHARMACEUTICALS HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

September 30, 2024 and December 31, 2023

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 5,558,817 | $ | 23,367,456 | ||||

| Prepaid clinical trial costs | 925,526 | 78,295 | ||||||

| Prepaid expenses and other current assets | 325,808 | 254,637 | ||||||

| Total current assets | 6,810,151 | 23,700,388 | ||||||

| Non-current prepaid clinical trial costs | 819,721 | — | ||||||

| Total Assets | $ | 7,629,872 | $ | 23,700,388 | ||||

| Liabilities and Stockholders’ Equity (Deficit) | ||||||||

| Liabilities | ||||||||

| Short-term debt | $ | 83,000 | $ | — | ||||

| Accounts payable | 8,777,579 | 3,849,108 | ||||||

| Accrued clinical expenses | 7,362,666 | 11,966,812 | ||||||

| Accrued compensation | 881,830 | 958,607 | ||||||

| Other accrued liabilities | 428,801 | 400,490 | ||||||

| Total current liabilities | 17,533,876 | 17,175,017 | ||||||

| Warrant liabilities | 77,884 | 806,655 | ||||||

| Total Liabilities | 17,611,760 | 17,981,672 | ||||||

| Commitments and contingencies (Note 6) | ||||||||

| Stockholders’ Equity (Deficit) | ||||||||

| Common stock, par value of $0.0001; 115,000,000 shares authorized; 33,441,199 and 27,918,560 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 3,344 | 2,792 | ||||||

| Preferred Stock, par value of $0.0001; 10,000,000 shares authorized; 0 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | — | — | ||||||

| Additional paid-in capital | 148,028,341 | 140,070,172 | ||||||

| Accumulated deficit | (158,013,573 | ) | (134,354,248 | ) | ||||

| Total stockholders’ equity (deficit) | (9,981,888 | ) | 5,718,716 | |||||

| Total Liabilities and Stockholders’ Equity (Deficit) | $ | 7,629,872 | $ | 23,700,388 | ||||

REVIVA PHARMACEUTICALS HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

For the Three and Nine Months Ended September 30, 2024 and 2023

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Operating expenses | (as restated) | (as restated) | ||||||||||||||

| Research and development | $ | 6,858,285 | $ | 9,572,180 | $ | 18,226,497 | $ | 23,312,661 | ||||||||

| General and administrative | 1,604,249 | 1,991,774 | 6,287,786 | 6,571,629 | ||||||||||||

| Total operating expenses | 8,462,534 | 11,563,954 | 24,514,283 | 29,884,290 | ||||||||||||

| Loss from operations | (8,462,534) | (11,563,954) | (24,514,283) | (29,884,290) | ||||||||||||

| Other income (expense) | ||||||||||||||||

| Gain (loss) on remeasurement of warrant liabilities | 72,321 | 139,079 | 728,771 | (305,972) | ||||||||||||

| Interest expense | (5,146) | (5,901) | (13,786) | (20,414) | ||||||||||||

| Interest income | 53,248 | 91,763 | 313,956 | 341,854 | ||||||||||||

| Other income (expense), net | (23,687) | 5,194 | (159,202) | (15,220) | ||||||||||||

| Total other income, net | 96,736 | 230,135 | 869,739 | 248 | ||||||||||||

| Loss before provision for income taxes | (8,365,798) | (11,333,819) | (23,644,544) | (29,884,042) | ||||||||||||

| Provision for income taxes | — | 12,117 | 14,781 | 21,531 | ||||||||||||

| Net loss | $ | (8,365,798) | $ | (11,345,936) | $ | (23,659,325) | $ | (29,905,573) | ||||||||

| Net loss per share: | ||||||||||||||||

| Basic and diluted | $ | (0.25) | $ | (0.48) | $ | (0.75) | $ | (1.32) | ||||||||

| Weighted average shares outstanding | ||||||||||||||||

| Basic and diluted | 33,804,693 | 23,637,367 | 31,424,395 | 22,655,737 | ||||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Iris Energy's Options: A Look at What the Big Money is Thinking

Investors with a lot of money to spend have taken a bearish stance on Iris Energy IREN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with IREN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 25 uncommon options trades for Iris Energy.

This isn’t normal.

The overall sentiment of these big-money traders is split between 24% bullish and 76%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $363,576, and 18 are calls, for a total amount of $1,432,624.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $7.5 and $25.0 for Iris Energy, spanning the last three months.

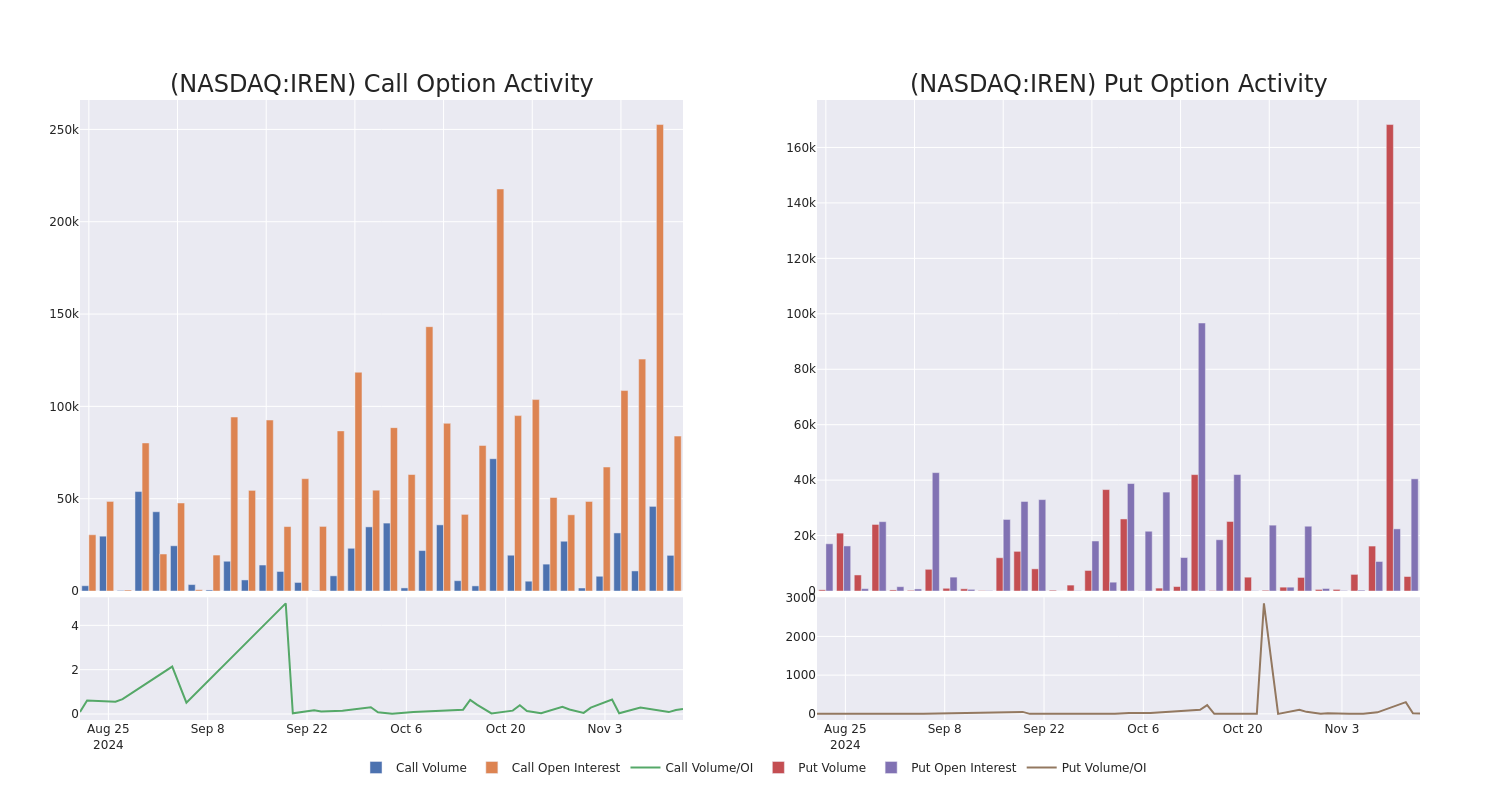

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Iris Energy stands at 9568.85, with a total volume reaching 24,574.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Iris Energy, situated within the strike price corridor from $7.5 to $25.0, throughout the last 30 days.

Iris Energy Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IREN | CALL | TRADE | BEARISH | 03/21/25 | $3.9 | $3.7 | $3.72 | $8.00 | $354.1K | 4.3K | 1.0K |

| IREN | CALL | TRADE | BEARISH | 05/16/25 | $3.8 | $3.2 | $3.3 | $10.00 | $164.3K | 6.1K | 686 |

| IREN | CALL | SWEEP | BEARISH | 05/16/25 | $2.95 | $2.9 | $2.9 | $12.00 | $162.1K | 7.4K | 1.8K |

| IREN | PUT | SWEEP | BULLISH | 11/29/24 | $1.7 | $1.6 | $1.62 | $11.50 | $121.5K | 261 | 750 |

| IREN | PUT | SWEEP | BEARISH | 01/17/25 | $3.4 | $3.3 | $3.4 | $12.50 | $90.1K | 38.9K | 913 |

About Iris Energy

Iris Energy Ltd is a Bitcoin mining company. It builds, owns, and operates data centers and electrical infrastructure for the mining of Bitcoin powered by renewable energy. The company’s mining operations generate revenue by earning Bitcoin through a combination of block rewards and transaction fees from the operation of its specialized computers called Application-specific Integrated Circuits and exchanging these Bitcoin for currencies such as USD or CAD on a daily basis.

Following our analysis of the options activities associated with Iris Energy, we pivot to a closer look at the company’s own performance.

Where Is Iris Energy Standing Right Now?

- Trading volume stands at 13,425,692, with IREN’s price down by -4.09%, positioned at $10.44.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 12 days.

Professional Analyst Ratings for Iris Energy

1 market experts have recently issued ratings for this stock, with a consensus target price of $20.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Iris Energy options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Powell's Hawkish Remarks Shake Markets: Stocks Fall, Dollar Rockets, Bitcoin Dips

Federal Reserve Chair Jerome Powell‘s unexpectedly hawkish remarks on Thursday sent markets into a tailspin. Major U.S. equity indices closed in the red, and the dollar soared for a fifth consecutive session.

In a speech to Dallas business leaders, Powell highlighted the remarkable strength of the U.S. economy, indicating that there’s no need for the Fed to “be in a hurry to lower rates.”

He reiterated the central bank’s commitment to reaching its 2% inflation target, stressing the need for careful decision-making as inflation remains above desired levels.

He highlighted productivity gains, which he said have “grown faster over the past five years than at any point in the two decades preceding the pandemic,” positioning the U.S. economy as “the best-performing among major economies.”

Addressing the October producer price index (PPI) uptick, Powell labeled it “more than an upward bump” but maintained confidence in the trajectory toward the 2% inflation goal.

Markets Reassess Interest Rate Path: Traders Are Less Confident On A December Cut

Powell’s comments impacted the interest-rate market, with fed futures now reflecting a reduced likelihood of a 25-basis-point cut in December.

The CME FedWatch tool shows the odds of such a move dropped to 58%, sharply down from around 80% earlier in the day.

The S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY, closed down 0.6%, fully erasing gains from last week’s rate cut. Energy was the only sector in positive territory, rising 0.4%, while industrials and health care led declines, each down 0.7%.

Top performers in the S&P 500 included Tapestry Inc. TPR, Wynn Resorts Ltd. WYNN, and First Solar Inc. FSLR, which rose 12.8%, 8.7%, and 7.2%, respectively. Among the laggards were Leidos Holdings Inc. LDOS and Super Micro Computer Inc. SMCI, down 13.6% and 11.4%, respectively.

Tech stocks, as tracked by the Invesco QQQ Trust QQQ, declined 0.7%, marking a fourth consecutive loss. Blue chips followed by the SPDR Dow Jones Industrial Average ETF DIA slipped 0.5%, while small caps in the iShares Russell 2000 ETF IWM underperformed, falling 1.3%.

The dollar continued to attract liquidity, with the Invesco DB USD Index Bullish Fund ETF UUP logging a fifth consecutive gain, reaching levels last seen in late October 2023.

Treasury yields also rose, with the 10-year yield closing at 4.46%. Gold, tracked by the SPDR Gold Trust GLD, marked its fifth straight loss.

In crypto markets, Bitcoin BTC/USD was 1.7% lower in the past 24 hours to $88,013 at 5:21 p.m. ET, on track for its worst day in November.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Borealis Foods Reports Third Quarter 2024 Financial Results

Results Highlighted by Continued Gross Margin Improvement

NEW YORK, Nov. 14, 2024 /PRNewswire/ – Borealis Foods Inc. (“Borealis” or the “Company”) BRLS, a food-tech innovator, and creator of the popular high-protein Chef Woo ramen, Ramen Express and Woodles brand of noodles, today announced financial results for its third quarter ended September 30, 2024.

Financial & Business Highlights

- Third quarter net sales of $7.7 million, compared with $5.3 in Q2 2024, representing improvement of over 45% from $5.3 million.

- Gross margin of 17% more than doubled from 8% in the second quarter of 2024. Non-GAAP gross margin, which excludes depreciation of the Company’s manufacturing plant, reached 23% in the third quarter, compared with 15% in Q2 of 2024.

- On a year-over-year basis, gross margin of 17% in the third quarter was improved from (6)% a year ago. Improving gross margin, both sequentially and from the prior year, was driven by the Company’s focus on shifting its product mix to Chef Woo and Woodles, which are premium brand products.

- As a result of the factors cited above, third quarter gross profit grew to $1.3 million, more than tripling from $0.4 million in the second quarter.

- The Company continued to drive its national expansion, centered on its flagship Chef Woo brand, with the addition of key Walmart locations announced subsequent to Q3, bringing the total retail store count to over 23,000 in the US and Canada.

- Began full-scale shipments of Woodles to schools during the third quarter, marking a successful initial rollout with further expansion expected in the fourth quarter and into 2025.

- Launched in late Q2, Woodles gained immediate market acceptance. Together with Chef Woo, the two premium product lines accounted for approximately 39% of third quarter revenue.

- Subsequent to Q3, Borealis announced an agreement for its Palmetto Gourmet Foods subsidiary to be the exclusive US ramen manufacturing partner for a leading, global food conglomerate. The partnership is expected to begin contributing revenue in Q1 2025.

Management Commentary

Borealis CEO Reza Soltanzadeh commented, “The third quarter of 2024 marked an important inflection point for our company as our business development initiatives began delivering additional revenue streams while our focus on optimizing our sales mix helped drive continued gross margin expansion. A key focus during the quarter was improving our business mix as we devoted more shelf space to our Chef Woo line of products and began deliveries of Woodles. That work led to a healthy expansion of our non-GAAP gross margin to 23%. While that is an achievement our team can be proud of, we have ample room to continue expanding our margins.”

Mr. Soltanzadeh added, “A key aspect of our strategy has been the development of a proper foundation for success, highlighted by our world-class manufacturing facility in Saluda, South Carolina, with substantial capacity for growth. Having our manufacturing here in the US is a significant advantage for our company as it qualifies us to provide products for the USDA, which oversees public school lunch programs across the country and was a key factor in our successful Woodles rollout this quarter. We are looking forward to building on that success as we expand Woodles to more schools in the fourth quarter and into 2025. We are also busy working on other, similar opportunities such as hospitals, correctional facilities, and universities.”

Mr. Soltanzadeh noted, “In our retail sales channel, we also recently announced an expansion of our partnership with Walmart that will see our ramen products carried at many of their best-performing stores. That announcement highlighted two exciting new ramen flavors developed by our brand ambassador Gordon Ramsay, which consumers are sure to love. We expect those new flavors – Black Garlic Beef and Shiitake Mushroom Chicken – to really set Chef Woo apart from the other ‘run of the mill’ ramen in stores. Importantly, these are just the first two of a regular cadence of exciting new recipes and flavors from Gordon.”

Mr. Soltanzadeh further added, “As we pursue our mission to build a leading food tech company, we have focused on pioneering food science and innovation that will enable us to continue introducing new products to the market. That commitment was highlighted by our announcement in September of a Texas Tech University study which revealed that a meal containing Chef Woo’s high-protein ramen noodles significantly reduced caloric intake at the next meal. We are very proud of this result as it validates the hard work of everyone on our team while providing a foundation for further studies and future products. Our technology and platform enable continuous innovation and consumer product development.”

Mr. Soltanzadeh concluded, “We expect sequential sales growth in the fourth quarter driven by several factors. First, as the weather turns colder, sales of soup and similar products such as ramen normally see a seasonal boost in consumption. Second, we expect our further rollout with Walmart and the new flavors developed by Gordon Ramsay to stimulate additional sales. Lastly, we continue to expand our Woodles penetration in schools across the US. Driving sales of Chef Woo and Woodles products is a key focus for our team and as we do so, we expect gross margins to continue to increase, resulting in continued bottom-line improvement in the fourth quarter and in 2025. We are enthusiastic about Borealis’ long-term growth prospects and look forward to reporting on the Company’s developments.”

Third Quarter 2024 Financial Results Detail:

- Net revenues of $7.7 million, compared with $5.3 million in Q2 as the Company focused on driving sales of higher margin Chef Woo and Woodles items which together accounted for 39% of sales.

- Gross profit of $1.3 million, compared with $0.4 million in the second quarter and a gross loss of $(0.5) million in the year-ago period. Gross margin of 17%, improved from 8% in the second quarter and (6)% in the year ago period, with the improvement in both gross profit dollars and margin due to solid execution of the Company’s strategy to shift product mix in favor of higher margin items.

- Non-GAAP gross profit of $1.8 million, compared with $0.8 million in the second quarter. Non-GAAP gross profit excludes depreciation expense of $0.5 million and $0.4 million in the third and second quarters respectively.

- SG&A expense of $4.9 million, compared with $5.6 million during the second quarter of 2024, as the Company streamlined its investment in business development, expanded distribution, influencer marketing programs, and incurred public company expenses. Spending on distribution expansion, such as support for Woodles, coupled with sales and marketing, including online and in-store promotions, represented strategic investment designed to drive revenue growth in current and future periods.

- Interest expense of $1.2 million was relatively unchanged from $1.1 million in the second quarter. Interest expense levels continued to be lower than in the year ago period due to the conversion of convertible notes in conjunction with the Company’s business combination completed during the first quarter of 2024.

- Net loss of $(4.8) million, improved from a net loss of $(6.3) million in the second quarter due to the combination of increased revenues and improvement in gross margins.

- Financial position: as of September 30, 2024, the Company had $0.7 million of cash on hand and $3.5 million of borrowing capacity available on its revolving credit facility. Anticipated sales growth and margin expansion are expected to drive improving operating cash flow to support ongoing operations.

Borealis Foods Inc. and Subsidiaries

Condensed Consolidated Statements of Operations (Unaudited)

|

For the Three Months Ended |

For the Nine Months Ended |

||||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

||||||||||||

|

Gross sales |

$ |

8,075,788 |

$ |

8,264,745 |

$ |

22,036,285 |

$ |

23,870,009 |

|||||||

|

Sales discounts & allowances |

(387,889) |

(539,392) |

(1,127,673) |

(1,342,799) |

|||||||||||

|

Revenue, net |

7,687,899 |

7,725,353 |

20,908,612 |

22,527,210 |

|||||||||||

|

Cost of goods sold |

5,953,089 |

7,205,527 |

17,109,095 |

21,449,469 |

|||||||||||

|

Depreciation |

461,540 |

996,625 |

1,861,351 |

2,938,098 |

|||||||||||

|

Total cost of goods sold |

6,414,629 |

8,202,152 |

18,970,446 |

24,387,567 |

|||||||||||

|

Gross profit (loss) |

1,273,270 |

(476,799) |

1,938,166 |

(1,860,357) |

|||||||||||

|

Sales and marketing |

1,123,460 |

312,289 |

5,073,810 |

1,677,316 |

|||||||||||

|

Business development |

1,306,589 |

196,243 |

2,475,764 |

435,015 |

|||||||||||

|

Training |

477,752 |

651,500 |

1,364,149 |

2,130,207 |

|||||||||||

|

General and administrative expenses |

1,986,517 |

2,786,155 |

8,807,852 |

9,332,345 |

|||||||||||

|

Total SG&A Expenses |

4,894,318 |

3,946,187 |

17,721,575 |

13,574,883 |

|||||||||||

|

Loss from operations |

(3,621,048) |

(4,422,986) |

(15,783,409) |

(15,435,240) |

|||||||||||

|

Other income (expense): |

|||||||||||||||

|

(Loss) Gain on foreign exchange rates |

(2,765) |

4,298 |

3,368 |

163,588 |

|||||||||||

|

Interest expense |

(1,207,524) |

(2,166,413) |

(3,766,542) |

(5,535,932) |

|||||||||||

|

Total other expense |

(1,210,289) |

(2,162,115) |

(3,763,174) |

(5,372,344) |

|||||||||||

|

Loss before income taxes |

(4,831,337) |

(6,585,101) |

(19,546,583) |

(20,807,584) |

|||||||||||

|

Income tax expense |

(832) |

0 |

(14,948) |

(15,092) |

|||||||||||

|

Net loss |

$ |

(4,832,169) |

$ |

(6,585,101) |

$ |

(19,561,531) |

$ |

(20,822,676) |

|||||||

|

Earnings per share from net loss |

|||||||||||||||

|

Basic |

$ |

(0.23) |

$ |

(0.61) |

$ |

(0.98) |

$ |

(1.94) |

|||||||

|

Diluted |

$ |

(0.23) |

$ |

(0.61) |

$ |

(0.98) |

$ |

(1.94) |

|||||||

|

Weighted average shares outstanding |

|||||||||||||||

|

Basic |

21,378,890 |

10,731,583 |

19,951,016 |

10,731,583 |

|||||||||||

|

Diluted |

21,378,890 |

10,731,583 |

19,951,016 |

10,731,583 |

|||||||||||

Borealis Foods Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

|

September 30, 2024 |

December 31, 2023 |

|||

|

(Unaudited) |

||||

|

Assets |

||||

|

Current Assets |

||||

|

Cash |

$ |

721,542 |

$ |

7,615,630 |

|

Accounts receivable, net |

2,907,790 |

1,775,756 |

||

|

Inventories, net |

8,750,399 |

6,945,028 |

||

|

Prepaid expenses |

1,048,029 |

845,878 |

||

|

Total current assets |

13,427,760 |

17,182,292 |

||

|

Property, plant and equipment, net |

46,066,397 |

46,408,540 |

||

|

Intangible assets |

253,017 |

— |

||

|

Right – of-use asset, net |

77,311 |

108,469 |

||

|

Goodwill |

1,917,356 |

1,917,356 |

||

|

Other non-current assets |

169,685 |

169,685 |

||

|

Total assets |

$ |

61,911,526 |

$ |

65,786,342 |

|

Liabilities and Shareholders’ equity (deficit) |

||||

|

Current liabilities: |

||||

|

Accounts payable and accrued expenses |

$ |

8,596,330 |

$ |

10,887,730 |

|

Due to related parties |

15,427,453 |

7,825,790 |

||

|

Convertible notes payable, current portion |

— |

47,300,000 |

||

|

Notes payable, current portion, net of capitalized loan costs |

5,706,934 |

681,121 |

||

|

Operating lease payable, current portion |

17,776 |

43,794 |

||

|

Finance leases payable, current portion |

550,212 |

565,353 |

||

|

Total current liabilities |

30,298,705 |

67,303,788 |

||

|

Line of credit |

6,500,000 |

— |

||

|

Convertible notes payable, net of current portion |

3,000,000 |

3,000,000 |

||

|

Notes payable, net of current portion |

14,149,885 |

13,509,189 |

||

|

Operating lease payable, net of current portion |

43,793 |

71,119 |

||

|

Finance leases payable, net of current portion |

1,283,129 |

1,683,308 |

||

|

Deferred tax liability |

1,566,233 |

1,566,233 |

||

|

Total liabilities |

56,841,745 |

87,133,637 |

||

|

Shareholders’ equity (deficit) |

||||

|

Common shares, no par value |

— |

— |

||

|

Additional paid-in capital |

90,096,688 |

44,118,081 |

||

|

Accumulated deficit |

(85,026,907) |

(65,465,376) |

||

|

Total shareholders’ equity (deficit) |

5,069,781 |

(21,347,295) |

||

|

Total liabilities and shareholders’ equity (deficit) |

$ |

61,911,526 |

$ |

65,786,342 |

Borealis Foods, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited)

|

Nine Months Ended |

Nine Months Ended |

|||

|

Cash Flows from Operating Activities: |

||||

|

Net loss |

$ |

(19,561,531) |

$ |

(20,822,676) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||

|

Non-cash compensation expense related to stock options |

1,273,053 |

392,141 |

||

|

Depreciation and amortization |

1,861,351 |

2,938,098 |

||

|

Amortization of loan costs |

232,798 |

28,266 |

||

|

Provision for credit losses |

96,217 |

49,642 |

||

|

Provision for inventory reserve |

(33,534) |

(141,440) |

||

|

Changes in operating assets and liabilities: |

||||

|

Accounts receivable |

(1,228,251) |

(726,552) |

||

|

Inventories |

(1,771,837) |

(389,911) |

||

|

Prepaid expenses and other |

(202,151) |

119,921 |

||

|

Operating lease payable |

(22,185) |

— |

||

|

Accounts payable and accrued expenses |

5,085,952 |

2,497,246 |

||

|

Net cash used in operating activities |

(14,270,118) |

(16,055,265) |

||

|

Cash flows from investing activities |

||||

|

Purchases of property, plant and equipment |

(1,519,208) |

(3,516,490) |

||

|

Purchases of intangible assets |

(253,017) |

— |

||

|

Proceeds from reverse capitalization |

63,575 |

— |

||

|

Net cash used in investing activities |

(1,708,650) |

(3,516,490) |

||

|

Cash flows from financing activities |

||||

|

Net payments to related parties |

— |

(500,000) |

||

|

Proceeds from convertible notes payable |

3,000,000 |

25,000,000 |

||

|

Payments on convertible notes payable |

— |

(4,500,000) |

||

|

Payments on finance leases payable |

(415,320) |

(366,846) |

||

|

Borrowings on line of credit |

6,500,000 |

— |

||

|

Payments on line of credit |

— |

(10,630,000) |

||

|

Payments on notes payable |

— |

15,000,000 |

||

|

Payments on loan fees |

— |

(607,436) |

||

|

Net cash provided by financing activities |

9,084,680 |

23,395,718 |

||

|

Net change in cash |

(6,894,088) |

3,823,963 |

||

|

Cash, beginning of period |

7,615,630 |

5,146,616 |

||

|

Cash, end of period |

$ |

721,542 |

$ |

8,970,579 |

Our adjustments to EBITDA are related to expenses and gains that we believe are not indicative of normal, ongoing operations. While these items may be recurring in nature and should not be disregarded in evaluation of our earnings performance, it is useful to exclude such items when analyzing current results and trends as these items can vary significantly from period to period depending on specific underlying transactions or events that may occur. Therefore, while we may incur or recognize these types of expenses and gains in the future, we believe that removing these items for purposes of calculating the Adjusted EBITDA financial measures provides a more focused presentation of our ongoing operating performance.

We view EBITDA as an important indicator of performance. We define EBITDA as net income/(loss) plus net interest expense, income taxes, depreciation, and amortization. We define Adjusted EBITDA as EBITDA further adjusted for any foreign exchange gains/(losses), share-based compensation expense and non-recurring items if identified. EBITDA and Adjusted EBITDA are supplemental measures utilized by our management and other users of our financial statements such as investors, research analysts and others, to assess the financial performance of our assets without regard to financing methods, capital structure or historical cost basis. Adjusted EBITDA is a key performance measure that our management uses to assess its operating performance. We facilitate internal comparisons of our operating performance on a more consistent basis. We use these performance measures for business planning purposes and forecasting. We believe that EBITDA and Adjusted EBITDA enhances an investor’s understanding of our financial performance as they are useful in assessing our operating performance from period-to-period by excluding certain items that we believe are not representative of our core business.

|

Reconciliation of Net Income (Loss) to Adjusted EBITDA |

||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||

|

Sept 30, |

June 30, |

|||||||

|

(in thousands) |

2024 |

2023 |

2024 |

2023 |

||||

|

Net income (loss) |

$ |

(4,832) |

$ |

(6,585) |

$ |

(19,562) |

$ |

(20,823) |

|

Plus: Taxes |

(1) |

0 |

15 |

15 |

||||

|

Plus: Depreciation and amortization |

472 |

997 |

1,861 |

2,938 |

||||

|

Plus: Loss on disposal |

0 |

0 |

0 |

0 |

||||

|

Plus: Interest expense |

1,208 |

2,166 |

3,767 |

5,536 |

||||

|

EBITDA |

(3,153) |

(3,422) |

(13,919) |

(12,334) |

||||

|

Plus: non-recurring expenses |

||||||||

|

Marketing |

1,123 |

312 |

5,074 |

1,677 |

||||

|

One time crew training |

477 |

652 |

1,364 |

2,130 |

||||

|

Stock compensation |

0 |

100 |

1,273 |

392 |

||||

|

Transaction costs |

263 |

1,241 |

1,770 |

4,005 |

||||

|

Product development expenses |

1,307 |

196 |

2,477 |

435 |

||||

|

Total non-recurring expenses |

3,170 |

2,501 |

11,958 |

8,639 |

||||

|

Adjusted EBITDA |

$ |

17 |

$ |

(921) |

$ |

(1,961) |

$ |

(3,695) |

About Borealis Foods

Borealis Foods BRLS is a pioneering, integrated food manufacturing company with a mission to disrupt and elevate the ready-to-eat meal and dry soup categories by offering premium and super-premium, nutritious products. Known for popular ramen noodle brands like the high protein Chef Woo, Ramen Express, and Woodles, Borealis Foods brings innovative fusion flavors from diverse culinary traditions, creating delicious and nutritious meal options for consumers. With U.S.-based production facilities, the company’s portfolio reflects a commitment to quality, innovation, and sustainability.

An essential aspect of Borealis Foods’ success is its strategic partnerships with prominent national and international food producers, retailers, and distributors. Serving as an innovation partner to global food leaders, Borealis Foods leverages these collaborations to expand its offerings, enhance technological capabilities, and deliver food products that embody its values of healthy nutrition and innovation.

For more information on Borealis Foods, please visit https://borealisfoods.com/.

Forward Looking Statements

Certain statements made in this release are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, including statements regarding the and future financial condition and performance of Borealis, and the expected financial impacts of the Business Combination (including future revenue and pro forma enterprise value), markets, and expected future growth and market opportunities. Forward-looking statements generally relate to management’s current expectations, hopes, beliefs, intentions, strategies, plans, objections or projections about future events or Borealis’ future financial condition or operating performance. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. As such, readers are cautioned not to place undue reliance on any forward-looking statements and readers should not rely on these forward-looking statements as predictions of future events.

Forward-looking statements are based upon estimates and assumptions that, while considered reasonable by management of Borealis, are inherently uncertain. Factors that may cause actual result to differ from current expectations include, but are not limited to: financial and operating performance; changes to existing applicable laws or regulations; the possibility that Borealis or the combined company may be adversely affected by economic, business, or competitive factors; Borealis’ estimates of revenue, expenses, operating costs and profitability; the evolution of the markets in which Borealis competes and Borealis’ ability to enter new markets effectively; and the ability of Borealis to implement its strategic initiatives and continue to innovate its existing services.

Forward-looking statements speak only as of the date they are made. Investors are cautioned not to put undue reliance on forward-looking statements and Borealis assumes no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities and other applicable laws.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/borealis-foods-reports-third-quarter-2024-financial-results-302306413.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/borealis-foods-reports-third-quarter-2024-financial-results-302306413.html

SOURCE Borealis Foods, Inc.