Acutus Medical Reports Third Quarter and Year-To-Date 2024 Financial Results

CARLSBAD, Calif., Nov. 14, 2024 (GLOBE NEWSWIRE) — Acutus Medical, Inc. (“Acutus” or the “Company”) AFIB today reported results for the third quarter and year-to-date of 2024.

Recent Highlights:

- Third quarter revenue from Continuing Operations of $5.3 million grew 156% year-over-year, from $2.1 million in the same quarter last year.

- Operating income for continuing operations was $0.1 million, an improvement of 119% compared to the same period last year.

- Recorded $2.4 million in gain on sale of business, a decrease of 8% compared to the same period last year.

- Cash, cash equivalents, marketable securities and restricted cash were $12.6 million as of September 30, 2024.

Third Quarter 2024 Financial Results

Revenue from Continuing Operations was $5.3 million for the third quarter of 2024, an increase of 156% compared to $2.1 million for the third quarter of 2023.

Gross margin on a GAAP basis for continuing operations was 7% for the third quarter of 2024 compared to negative 53% for the same quarter last year. The improvement was driven by higher production volumes related to left-heart access manufacturing and reduced manufacturing overhead expenses.

Operating income for continuing operations on a GAAP basis was $0.1 million for the third quarter of 2024 compared to Operating expenses of $0.6 million for the same period last year. The decrease in operating expenses from reduced discretionary spend under this new business model.

Net loss on continuing operations on a GAAP basis was $0.8 million for the third quarter of 2024 and net loss per share was $0.03 on a weighted average basic and diluted outstanding share count of 29.8 million, compared to a net loss of $1.9 million and a net loss per share of $0.7 on a weighted average basic and diluted outstanding share count of 29.3 million for the same period last year.

Cash, cash equivalents, marketable securities and restricted cash were $12.6 million as of September 30, 2024.

Loss on Discontinued Operations

Loss on discontinued operations was $4.8 million for third quarter of 2024, compared to $13.2 million for the same period last year.

Outlook

Due to the announced plan to realign resources to support the left-heart access distribution business and exit from the electrophysiology mapping and ablation businesses, the Company will no longer provide financial guidance.

About Acutus

Acutus is focused on the production of left-heart access products under its distribution agreement with Medtronic, Inc. Founded in 2011, Acutus is based in Carlsbad, California.

Caution Regarding Forward-Looking Statements

This press release includes statements that may constitute “forward-looking” statements, usually containing the words ‘believe”, “estimate”, “project”, “expect” or similar expressions. Forward looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, the Company’s ability to continue to manage expenses and cash burn rate at sustainable levels, successful completion of the Company’s restructuring plan, continued acceptance of the Company’s left-heart access products in the marketplace, the effect of global economic conditions on the ability and willingness of Medtronic to purchase the Company’s left-heart access products and the timing of such purchases, competitive factors, changes resulting from healthcare policy in the United States and globally including changes in government reimbursement of procedures, dependence upon third-party vendors and distributors, timing of regulatory approvals, the Company’s ability to maintain its listing on Nasdaq, and other risks discussed in the Company’s periodic and other filings with the Securities and Exchange Commission. By making these forward-looking statements, Acutus undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Contact:

Chad Hollister

Acutus Medical, Inc.

investors@acutus.com

| Acutus Medical, Inc. Consolidated Balance Sheets |

|||||||

| September 30, 2024 |

December 31, 2023 |

||||||

| (in thousands, except share and per share amounts) | (unaudited) | ||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 12,595 | $ | 19,170 | |||

| Marketable securities, short-term | — | 3,233 | |||||

| Restricted cash, short-term | — | 7,030 | |||||

| Accounts receivable | 9,970 | 11,353 | |||||

| Inventory | 4,191 | 4,278 | |||||

| Prepaid expenses and other current assets | 403 | 678 | |||||

| Current assets of discontinued operations (Note 3) | — | 510 | |||||

| Total current assets | 27,159 | 46,252 | |||||

| Property and equipment, net | 736 | 825 | |||||

| Right-of-use assets, net | 2,647 | 3,189 | |||||

| Other assets | 94 | 94 | |||||

| Non-current assets of discontinued operations (Note 3) | 1,531 | 3,600 | |||||

| Total assets | $ | 32,167 | $ | 53,960 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | 1,711 | 2,761 | |||||

| Accrued liabilities | 1,702 | 2,887 | |||||

| Operating lease liabilities, short-term | 897 | 718 | |||||

| Long-term debt, current portion | 7,084 | 1,864 | |||||

| Warrant liability | 302 | 409 | |||||

| Current liabilities of discontinued operations (Note 3) | 2,969 | 10,303 | |||||

| Total current liabilities | 14,665 | 18,942 | |||||

| Operating lease liabilities, long-term | 2,532 | 3,243 | |||||

| Long-term debt | 25,269 | 32,654 | |||||

| Total liabilities | 42,466 | 54,839 | |||||

| Commitments and contingencies (Note 11) | |||||||

| Stockholders’ deficit | |||||||

| Preferred stock, $0.001 par value; 5,000,000 shares authorized as of September 30, 2024 and December 31, 2023; 6,666 shares of preferred stock, designated as Series A Common Equivalent Preferred Stock, are issued and outstanding as of September 30, 2024 and December 31, 2023 | — | — | |||||

| Common stock, $0.001 par value; 260,000,000 shares authorized as of September 30, 2024 and December 31, 2023; 29,912,305 and 29,313,667 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 30 | 29 | |||||

| Additional paid-in capital | 598,670 | 599,935 | |||||

| Accumulated deficit | (608,118 | ) | (599,977 | ) | |||

| Accumulated other comprehensive loss | (881 | ) | (866 | ) | |||

| Total stockholders’ deficit | (10,299 | ) | (879 | ) | |||

| Total liabilities and stockholders’ deficit | $ | 32,167 | $ | 53,960 | |||

| Acutus Medical, Inc. Consolidated Statements of Operations and Comprehensive Loss |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| (in thousands, except share and per share amounts) | (unaudited) | ||||||||||||||

| Revenue | $ | 5,266 | $ | 2,060 | $ | 13,027 | $ | 4,816 | |||||||

| Cost of products sold | 4,894 | 3,150 | 13,019 | 7,835 | |||||||||||

| Gross profit (loss) | 372 | (1,090 | ) | 8 | (3,019 | ) | |||||||||

| Operating expenses (income): | |||||||||||||||

| Research and development | — | 896 | — | 2,752 | |||||||||||

| Selling, general and administrative | 2,318 | 2,354 | 7,880 | 9,502 | |||||||||||

| Change in fair value of contingent consideration | — | — | — | 123 | |||||||||||

| Gain on sale of business | (2,435 | ) | (2,648 | ) | (8,096 | ) | (5,927 | ) | |||||||

| Total operating expenses (income) | (117 | ) | 602 | (216 | ) | 6,450 | |||||||||

| Gain (loss) from operations | 489 | (1,692 | ) | 224 | (9,469 | ) | |||||||||

| Other income (expense): | |||||||||||||||

| Change in fair value of warrant liability | (174 | ) | 636 | 107 | 1,478 | ||||||||||

| Interest income | 153 | 547 | 641 | 2,223 | |||||||||||

| Interest expense | (1,395 | ) | (1,409 | ) | (4,384 | ) | (4,110 | ) | |||||||

| Other revenue | 111 | — | 187 | — | |||||||||||

| Total other expense, net | (1,305 | ) | (226 | ) | (3,449 | ) | (409 | ) | |||||||

| Loss from continuing operations before income taxes | (816 | ) | (1,918 | ) | (3,225 | ) | (9,878 | ) | |||||||

| Net loss from continuing operations | (816 | ) | (1,918 | ) | (3,225 | ) | (9,878 | ) | |||||||

| Discontinued operations: | |||||||||||||||

| Loss from discontinued operations before taxes | (4,791 | ) | (11,244 | ) | (4,906 | ) | (37,945 | ) | |||||||

| Income tax expense – discontinued operations | — | 75 | 10 | 75 | |||||||||||

| Net loss from discontinued operations | (4,791 | ) | (11,319 | ) | (4,916 | ) | (38,020 | ) | |||||||

| Net loss | $ | (5,607 | ) | $ | (13,237 | ) | $ | (8,141 | ) | $ | (47,898 | ) | |||

| Other comprehensive loss | |||||||||||||||

| Unrealized loss (gain) on marketable securities | — | 4 | — | 7 | |||||||||||

| Foreign currency translation adjustment | (15 | ) | (66 | ) | (15 | ) | (91 | ) | |||||||

| Comprehensive loss | $ | (5,622 | ) | $ | (13,299 | ) | $ | (8,156 | ) | $ | (47,982 | ) | |||

| Net loss per share, basic and diluted: | |||||||||||||||

| Loss from continuing operations | $ | (0.03 | ) | $ | (0.07 | ) | $ | (0.11 | ) | $ | (0.34 | ) | |||

| Loss from discontinued operations | $ | (0.16 | ) | $ | (0.39 | ) | $ | (0.17 | ) | $ | (1.31 | ) | |||

| Net loss per common share | $ | (0.19 | ) | $ | (0.45 | ) | $ | (0.27 | ) | $ | (1.65 | ) | |||

| Weighted average shares outstanding, basic and diluted | 29,799,241 | 29,262,768 | 29,768,208 | 29,024,353 | |||||||||||

| Acutus Medical, Inc. Consolidated Statements of Cash Flows |

|||||||

| Nine Months Ended September 30, | |||||||

| 2024 | 2023 | ||||||

| (in thousands) | (unaudited) | ||||||

| Cash flows from operating activities | |||||||

| Net loss | $ | (8,141 | ) | $ | (47,898 | ) | |

| Less: Loss from discontinued operations | 4,916 | 38,020 | |||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

| Depreciation expense | 235 | 384 | |||||

| Non-cash stock-based compensation expense | 459 | 1,272 | |||||

| Accretion of discounts on marketable securities, net | (28 | ) | (1,318 | ) | |||

| Amortization of debt issuance costs | 460 | 325 | |||||

| Amortization of operating lease right-of-use assets | 542 | 513 | |||||

| Gain on sale of business, net | (8,096 | ) | (5,927 | ) | |||

| Change in fair value of warrant liability | (107 | ) | (1,478 | ) | |||

| Loss on disposal of property and equipment | — | — | |||||

| Change in fair value of contingent consideration | — | 123 | |||||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable | (3,499 | ) | 3,247 | ||||

| Inventory | 87 | 11,567 | |||||

| Employer retention credit receivable | — | 4,703 | |||||

| Prepaid expenses and other current assets | 286 | 2,010 | |||||

| Accounts payable | (1,050 | ) | (3,020 | ) | |||

| Accrued liabilities | (1,442 | ) | (8,043 | ) | |||

| Operating lease liabilities | (532 | ) | (253 | ) | |||

| Other long-term liabilities | — | 20 | |||||

| Net cash used in operating activities – continuing operations | (15,910 | ) | (5,753 | ) | |||

| Net cash used in operating activities – discontinued operations | (11,692 | ) | (39,352 | ) | |||

| Net cash used in operating activities | (27,602 | ) | (45,105 | ) | |||

| Cash flows from investing activities | |||||||

| Proceeds from sale of business | 13,235 | 17,000 | |||||

| Purchases of available-for-sale marketable securities | — | (38,521 | ) | ||||

| Sales of available-for-sale marketable securities | 500 | — | |||||

| Maturities of available-for-sale marketable securities | 2,750 | 70,250 | |||||

| Purchases of property and equipment | (148 | ) | (1,187 | ) | |||

| Net cash provided by investing activities – continuing operations | 16,337 | 47,542 | |||||

| Net cash provided by (used in) investing activities – discontinued operations | 339 | (207 | ) | ||||

| Net cash provided by investing activities | 16,676 | 47,335 | |||||

| Cash flows from financing activities | |||||||

| Repayment of debt | (2,625 | ) | — | ||||

| Proceeds from the exercise of stock options | — | 4 | |||||

| Repurchase of common shares to pay employee withholding taxes | — | (35 | ) | ||||

| Proceeds from employee stock purchase plan | — | 25 | |||||

| Net cash (used in) provided by financing activities – continuing operations | (2,625 | ) | (1,929 | ) | |||

| Net cash used in financing activities – discontinued operations | (41 | ) | (240 | ) | |||

| Net cash used in financing activities | (2,666 | ) | (2,169 | ) | |||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (13 | ) | (294 | ) | |||

| Net change in cash, cash equivalents and restricted cash | (13,605 | ) | (233 | ) | |||

| Cash, cash equivalents and restricted cash, at the beginning of the period | 26,200 | 31,348 | |||||

| Cash, cash equivalents and restricted cash, at the end of the period | $ | 12,595 | $ | 31,115 | |||

| Supplemental disclosure of cash flow information: | |||||||

| Cash paid for interest | 3,394 | 3,731 | |||||

| Supplemental disclosure of noncash investing and financing activities: | |||||||

| Accounts receivable from sale of business | $ | 4,478 | $ | 6,111 | |||

| Change in unrealized (gain) on marketable securities | $ | — | $ | (7 | ) | ||

| Change in unpaid purchases of property and equipment | $ | — | $ | 35 | |||

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Massive Insider Trade At Gartner

On November 13, a recent SEC filing unveiled that Kenneth Allard, EVP at Gartner IT made an insider sell.

What Happened: Allard’s decision to sell 3,015 shares of Gartner was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $1,652,786.

Gartner shares are trading down 1.64% at $542.75 at the time of this writing on Thursday morning.

About Gartner

Gartner Inc provides independent research and analysis on information technology and other related technology industries. Its research is delivered to clients’ desktops in the form of reports, briefings, and updates. Typical clients are chief information officers and other business executives who help plan companies’ IT budgets. Gartner also provides consulting services. The Company operates through three business segments, namely Research, Conferences and Consulting. The company generates majority of the revenue from Research segment.

Gartner: Delving into Financials

Revenue Growth: Gartner displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 5.36%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: The company sets a benchmark with a high gross margin of 67.98%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 5.36, Gartner showcases strong earnings per share.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.73, caution is advised due to increased financial risk.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 40.75 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 7.07, Gartner’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 26.02 reflects market recognition of Gartner’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Breaking Down the Significance of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Gartner’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

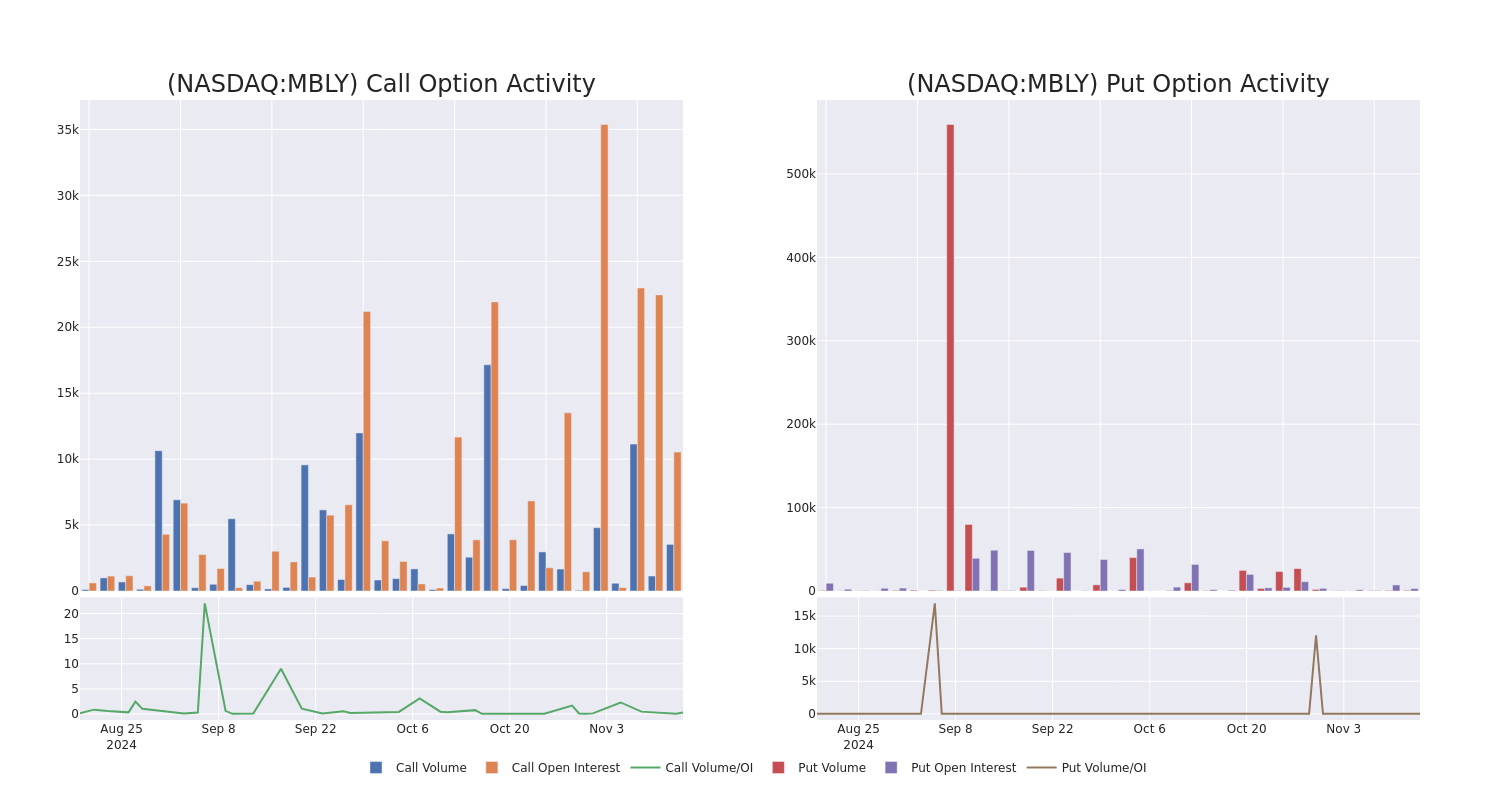

Mobileye Global Options Trading: A Deep Dive into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Mobileye Global MBLY, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MBLY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Mobileye Global. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 33% bearish. Among these notable options, 5 are puts, totaling $421,273, and 4 are calls, amounting to $694,236.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $12.0 to $21.0 for Mobileye Global over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Mobileye Global’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Mobileye Global’s whale trades within a strike price range from $12.0 to $21.0 in the last 30 days.

Mobileye Global Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MBLY | CALL | TRADE | BEARISH | 11/22/24 | $2.6 | $2.35 | $2.37 | $14.00 | $592.5K | 1.1K | 2.5K |

| MBLY | PUT | SWEEP | NEUTRAL | 01/15/27 | $5.5 | $5.3 | $5.4 | $15.00 | $99.5K | 152 | 225 |

| MBLY | PUT | SWEEP | BULLISH | 01/17/25 | $5.4 | $5.2 | $5.2 | $21.00 | $94.6K | 831 | 185 |

| MBLY | PUT | SWEEP | NEUTRAL | 01/15/27 | $5.5 | $5.3 | $5.4 | $15.00 | $94.2K | 152 | 408 |

| MBLY | PUT | SWEEP | NEUTRAL | 01/15/27 | $3.8 | $3.6 | $3.7 | $12.00 | $68.2K | 1.9K | 225 |

About Mobileye Global

Mobileye Global Inc engages in the development and deployment of ADAS and autonomous driving technologies and solutions. It is building a portfolio of end-to-end ADAS and autonomous driving solutions to provide the capabilities needed for the future of autonomous driving, leveraging a comprehensive suite of purpose-built software and hardware technologies. Mobileye is the Company’s only reportable operating segment. Its solutions comprise Driver Assist, Cloud-Enhanced Driver Assist, Mobileye SuperVision Lite, Mobileye SuperVision, Mobileye Chauffeur, Mobileye Drive, Self-Driving System & Vehicles. It also provides data services to Expedite Maintenance Operations with AI-Powered Road Survey Technology.

After a thorough review of the options trading surrounding Mobileye Global, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Mobileye Global Standing Right Now?

- With a trading volume of 5,576,962, the price of MBLY is down by -7.89%, reaching $15.95.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 70 days from now.

Expert Opinions on Mobileye Global

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $20.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Mobileye Global with a target price of $19.

* An analyst from Barclays has decided to maintain their Overweight rating on Mobileye Global, which currently sits at a price target of $18.

* Reflecting concerns, an analyst from Loop Capital lowers its rating to Buy with a new price target of $20.

* Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on Mobileye Global with a target price of $25.

* An analyst from Needham persists with their Buy rating on Mobileye Global, maintaining a target price of $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Mobileye Global options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LifeWallet Announces Third Quarter 2024 Financial Results

MIAMI, Nov. 14, 2024 (GLOBE NEWSWIRE) — MSP Recovery, Inc. d/b/a LifeWallet LIFW (“LifeWallet,” or the “Company”), a Medicare, Medicaid, commercial, and secondary payer reimbursement recovery and technology leader, today announced financial results for the quarter ended September 30, 2024.

LifeWallet Chief Executive Officer, John H. Ruiz, said, “From additional settlements to the processing of additional claims data, we continue to see progress across all lines of business. We’re also reaping the rewards of reduced operating expenses, which have had a positive impact on our financials. In addition to providing invaluable technological resources to patients, providers, payers, and attorneys, our cost-cutting solutions can discover wasted federal funds and recover Medicare reimbursements to preserve tax dollars, benefiting all Americans.”

Third Quarter Highlights

- On July 22, 2024, the Company announced a new comprehensive settlement with another group of affiliated property and casualty insurance carriers (“P&C Insurers”) doing business in multiple states, which includes the P&C Insurers’ agreement to provide ten years of historical data and data sharing of future claims, implementation of LifeWallet’s clearinghouse solution to settle future claims, and assignment of additional rights to collect against additional third parties related to the settled claims.

- The Company entered into a confidential pharmaceutical antitrust settlement totaling $3.1 million. As part of LifeWallet’s owned claims portfolio, the Company has claims against multiple pharmaceutical and medical device manufacturers based on allegations of defective products or anti-competitive pricing.

- The Company launched an initiative to secure new agreements with health plans, providers, insurers and attorneys, while continuing to reduce operating costs.

- Creditors Virage Capital Management LP; Virage Recovery Master, LP; Hazel Holdings I, LLC; and Hazel Partners Holdings, LLC agreed to waive certain provisions in their agreements with the Company that would accelerate the payment of amounts due in the event that the Company receives a negative going concern opinion from its auditors for the year ending December 31, 2024.

Subsequent Events

- On November 11, 2024, the Company announced new comprehensive settlements with P&C Insurers, totaling $5.2 million, continued progress in recoveries on owned claims and acquiring rights to additional claims, as well as initiatives to eliminate wasteful Medicare spending by launching beta testing of its clearinghouse solution, built in partnership with Palantir Technologies, Inc. PLTR.

- LifeWallet is also currently in negotiations with other property and casualty insurers to resolve claims on a similar basis, including one of the country’s largest P&C Insurers. Some of these negotiations have resulted in collaborative statistical sampling and extensive data-matching to determine the size and scope of claims that are owned by the Company that LifeWallet has asserted repayment is due pursuant to Medicare Secondary Payer and other related laws.

- The Company entered into a confidential settlement with a medical device manufacturer totaling $760,000. As part of LifeWallet’s owned claims portfolio, the Company has ongoing litigation against other pharmaceutical and medical device manufacturers based on claims of defective products or anti-competitive pricing.

- The Company acquired the recovery rights to additional Medicare Secondary Payer claims consisting of more than 450,000 Medicare members, as documented by health insurance plans, with an estimated total claims Paid Amount exceeding $10.6 billion.1

- LifeWallet strategically reduced its operating costs in 2023 and continues to do so in 2024. These cost reductions do not impact the systems that the Company has already created to support recovery efforts of the claims owned by the Company or other resources available to third parties. The Company anticipates these reductions could continue to contribute savings to operating expenses for the year ending December 31, 2024.

- The Company is advancing initiatives to eliminate wasteful spending of federal dollars and unnecessary Medicare secondary payments, utilizing its clearinghouse system, created through its exclusive healthcare partnership with Palantir Technologies. The clearinghouse solution utilizes the Palantir Foundry platform, AI tools, natural language processing, and machine learning, resulting in the development of a sophisticated data analytics system that captures and manages healthcare data, enhancing LifeWallet’s Chase to Pay model.

Third Quarter Financial Highlights

- Revenue: Total revenue for the three months ended September 30, 2024 was $3.7 million compared to $0.4 million for three months ended September 30, 2023.

- Operating loss: Operating loss for the three months ended September 30, 2024 was $129.9 million, compared to $136.7 million during three months ended September 30, 2023. Adjusted operating loss for the three months ended September 30, 2024 was $8.4 million, excluding non-cash claims amortization expense of $121.0 million and professional fees paid in stock of $0.4 million.

- Net loss: Net loss for the three months ended September 30, 2024 was $190.4 million and $160.5 million to controlling members, or net loss per share of $1.26 per share, Class A Common Stock, based on 23,764,079 million weighted average shares of Class A Common Stock outstanding. Adjusted net loss for the three months ended September 30, 2024 was $11.0 million, excluding the non-cash item noted above, change in fair value of warrant and derivative liabilities of $45.3 million, and $103.3 million related to interest expense.

- Liquidity: As of September 30, 2024, cash totaled $4.7 million, and as of October 31, 2024, cash totaled $5.6 million. The Company continually monitors its liquidity and may in the future access debt and equity markets as necessary in order to meet its ongoing liquidity needs, including by drawing upon its working capital facility. For the three months ended September 30, 2024, the Company received $5.25 million of funding for working capital. Subsequently, the Company has received additional working capital funding of $3.5 million, and it has $5.25 million of remaining capacity to draw from its working capital facility as of the date of filing of the Quarterly Report on Form 10-Q for the period ending September 30, 2024.

Assigned Recovery Rights, Claims Paid and Billed Value

The table below outlines the Company’s claims data for the most recent periods. The amounts represent data received from current and new assignors:

| $ in billions | Nine Months Ended September 30, 2024 | Year Ended December 31, 2023 |

Year Ended December 31, 2022 |

||||||||

| Paid Amount | $ | 380.5 | $ | 369.8 | $ | 374.8 | |||||

| Paid Value of Potentially Recoverable Claims(2) | 87.8 | 88.9 | 89.6 | ||||||||

| Billed Value of Potentially Recoverable Claims | 375.3 | 373.5 | 377.8 | ||||||||

| Recovery Multiple | N/A(1) | N/A | N/A | ||||||||

| Penetration Status of Portfolio | 86.8 | % | 86.8 | % | 85.8 | % | |||||

1) During the nine months ended September 30, 2024, the Company has received total recoveries of $9.9 million. However, the settlement amounts do not provide a large enough sample to be statistically significant, and are therefore not shown in the table.

2) On August 10, 2022, the United States Court of Appeals, Eleventh Circuit held that a four-year statute of limitations period applies to certain claims brought under the Medicare Secondary Payer Act’s private cause of action, and that the limitations period begins to run on the date that the cause of action accrued. This opinion may render certain Claims held by the Company unrecoverable and may substantially reduce PVPRC and BVPRC as calculated. As our cases were filed at different times and in various jurisdictions, and prior to data matching with a defendant we are not able to accurately calculate the entirety of damages specific to a given defendant, we cannot calculate with certainty the impact of this ruling at this time. However, the Company has deployed several legal strategies (including but not limited to seeking to amend existing lawsuits in a manner that could allow claims to relate back to the filing date as well as asserting tolling arguments based on theories of fraudulent concealment) that would apply to tolling the applicable limitations period and minimizing any material effect on the overall collectability of its claim rights. In addition, the Eleventh Circuit decision applies only to district courts in the Eleventh Circuit. Many courts in other jurisdictions have applied other statutes of limitations to the private cause of action, including borrowing the three-year statute of limitations applicable to the government’s cause of action; and borrowing from the False Claims Act’s six-year period. The most recent decision on the issue from the District Court of Massachusetts, for example, applies the same statute of limitations as Eleventh Circuit, but expressly disagrees with the Eleventh Circuit’s application of the “accrual” rule and instead adopted the notice-based trigger that the company has always argued should apply. This would mean that the limitations period for unreported claims has not even begun to accrue. This is a complex legal issue that will continue to evolve in jurisdictions across the country. Nevertheless, if the application of the statute of limitations as determined by the Eleventh Circuit was applied to all Claims assigned to us, we estimate that the effect would be a reduction of PVPRC by approximately $9.9 billion. As set forth in our Risk Factors, PVPRC is based on a variety of factors. As such, this estimate is subject to change based on the variety of legal claims being litigated and statute of limitations tolling theories that apply.

Going Concern

As disclosed in the Company’s Quarterly Report on Form 10-Q, the Company has concluded that, despite the financing arrangements entered into by the Company, there is substantial doubt about its ability to continue as a going concern. Unless the Company is successful in raising additional funds through the offering of debt or equity securities, the Company has concluded it is probable the Company will be unable to continue to operate as a going concern beyond the next 12 months.

Non-GAAP Financial Measures

Additional information regarding the non-GAAP financial measures discussed in this release, including an explanation of these measures and how each is calculated, is included below under the heading “Non-GAAP Financial Measures.” A reconciliation of GAAP to non-GAAP financial measures has also been provided in the financial tables.

About LifeWallet

Founded in 2014 as MSP Recovery, LifeWallet has become a Medicare, Medicaid, commercial, and secondary payer reimbursement recovery leader, disrupting the antiquated healthcare reimbursement system with data-driven solutions to secure recoveries from responsible parties. LifeWallet innovates technologies and provides comprehensive solutions for multiple industries including healthcare, legal, and sports NIL. For more information, visit: LIFEWALLET.COM

Forward Looking Statements

This release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may generally be identified by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “plan” and “will” or, in each case, their negative, or other variations or comparable terminology. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. As a result, these statements are not guarantees of future performance or results and actual events may differ materially from those expressed in or suggested by the forward-looking statements. Any forward-looking statement made by MSP Recovery herein speaks only as of the date made. New risks and uncertainties come up from time to time, and it is impossible for LIFW to predict or identify all such events or how they may affect it. LIFW has no obligation, and does not intend, to update any forward-looking statements after the date hereof, except as required by federal securities laws. Factors that could cause these differences include, but are not limited to, LIFW’s ability to capitalize on its assignment agreements and recover monies that were paid by the assignors; the inherent uncertainty surrounding settlement negotiations and/or litigation, including with respect to both the amount and timing of any such results; the validity of the assignments of claims to LIFW; the ability to successfully expand the scope of LIFW’s claims or obtain new data and claims from LIFW’s existing assignor base or otherwise; LIFW’s ability to innovate and develop new solutions, and whether those solutions will be adopted by LIFW’s existing and potential assignors; negative publicity concerning healthcare data analytics and payment accuracy; and those additional factors included in LIFW’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed by it with the Securities and Exchange Commission. These statements constitute the Company’s cautionary statements under the Private Securities Litigation Reform Act of 1995.

Contact

Media:

Investors:

| MSP RECOVERY, INC. and Subsidiaries Condensed Consolidated Balance Sheets (Unaudited) |

||||||||

| September 30, | December 31, | |||||||

| (In thousands, except share and per share data) | 2024 | 2023 | ||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 4,746 | $ | 11,633 | ||||

| Accounts receivable | 3,100 | 217 | ||||||

| Affiliate receivable (1) | 1,222 | 1,188 | ||||||

| Prepaid expenses and other current assets (1) | 1,692 | 8,908 | ||||||

| Total current assets | 10,760 | 21,946 | ||||||

| Property and equipment, net | 4,866 | 4,911 | ||||||

| Intangible assets, net (2) | 2,771,969 | 3,132,796 | ||||||

| Right-of-use assets | 257 | 342 | ||||||

| Total assets | $ | 2,787,852 | $ | 3,159,995 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 10,767 | $ | 6,244 | ||||

| Affiliate payable (1) | 20,637 | 19,822 | ||||||

| Commission payable | 1,222 | 821 | ||||||

| Derivative liability | 110 | 37 | ||||||

| Warrant liability (1) | 27,012 | 268 | ||||||

| Guaranty obligation (1) | 1,077,070 | — | ||||||

| Claims financing obligation and notes payable (1) | 43,267 | — | ||||||

| Interest payable (1) | 11,096 | — | ||||||

| Other current liabilities (1) | 14,813 | 19,314 | ||||||

| Total current liabilities | 1,205,994 | 46,506 | ||||||

| Guaranty obligation (1) | — | 941,301 | ||||||

| Claims financing obligation and notes payable (1) | 588,513 | 548,276 | ||||||

| Lease liabilities | 138 | 235 | ||||||

| Loan from related parties (1) | 130,328 | 130,709 | ||||||

| Interest payable (1) | 12,655 | 73,839 | ||||||

| Other long-term liabilities | 3,236 | — | ||||||

| Total liabilities | $ | 1,940,864 | $ | 1,740,866 | ||||

| Commitments and contingencies (Note 13) | ||||||||

| Stockholders’ Equity: | ||||||||

| Class A common stock, $0.0001 par value; 5,500,000,000 shares authorized; 30,975,324 and 14,659,794 issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | $ | 3 | $ | 1 | ||||

| Class V common stock, $0.0001 par value; 3,250,000,000 shares authorized; 124,067,498 and 124,132,398 issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 12 | 12 | ||||||

| Additional paid-in capital | 459,748 | 357,928 | ||||||

| Accumulated deficit | (159,416 | ) | (85,551 | ) | ||||

| Total stockholders’ equity | $ | 300,347 | $ | 272,390 | ||||

| Non-controlling interest | 546,641 | 1,146,739 | ||||||

| Total equity | $ | 846,988 | $ | 1,419,129 | ||||

| Total liabilities and equity | $ | 2,787,852 | $ | 3,159,995 | ||||

1) As of September 30, 2024 and December 31, 2023, the total affiliate receivable, affiliate payable, warrant liability, guaranty obligation and loan from related parties balances are with related parties. In addition, the prepaid expenses and other current assets, claims financing obligation and notes payable, other current liabilities, and interest payable include balances with related parties. See Note 15, Related Party Transactions, for further details.

2) As of September 30, 2024 and December 31, 2023, intangible assets, net included $2.0 billion and $2.2 billion, respectively, related to a consolidated VIE. See Note 9, Variable Interest Entities, for further details.

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| MSP RECOVERY, INC. and Subsidiaries Condensed Consolidated Statements of Operations (Unaudited) |

||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (In thousands, except share and per share data) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Claims recovery income | $ | 3,577 | $ | 440 | $ | 9,879 | $ | 6,479 | ||||||||

| Claims recovery service income | — | — | — | 498 | ||||||||||||

| Other | 91 | — | 127 | — | ||||||||||||

| Total Revenues | $ | 3,668 | $ | 440 | $ | 10,006 | $ | 6,977 | ||||||||

| Operating expenses | ||||||||||||||||

| Cost of revenues (1) | 1,671 | 574 | 3,453 | 1,972 | ||||||||||||

| Claims amortization expense | 121,007 | 121,008 | 363,027 | 355,481 | ||||||||||||

| General and administrative (2) | 5,329 | 6,130 | 17,145 | 20,691 | ||||||||||||

| Professional fees | 3,248 | 2,466 | 12,030 | 15,611 | ||||||||||||

| Professional fees – legal (3) | 2,213 | 6,871 | 9,146 | 25,889 | ||||||||||||

| Allowance for credit losses | — | — | — | 5,000 | ||||||||||||

| Depreciation and amortization | 71 | 85 | 206 | 182 | ||||||||||||

| Total operating expenses | 133,539 | 137,134 | 405,007 | 424,826 | ||||||||||||

| Operating Loss | $ | (129,871 | ) | $ | (136,694 | ) | $ | (395,001 | ) | $ | (417,849 | ) | ||||

| Interest expense (4) | (106,653 | ) | (88,279 | ) | (306,596 | ) | (204,287 | ) | ||||||||

| Other income (expense), net | 799 | 408 | 1,140 | 8,697 | ||||||||||||

| Change in fair value of warrant and derivative liabilities | 45,341 | 348 | 121,625 | 4,247 | ||||||||||||

| Net loss before provision for income taxes | $ | (190,384 | ) | $ | (224,217 | ) | $ | (578,832 | ) | $ | (609,192 | ) | ||||

| Provision for income tax expense | — | — | — | — | ||||||||||||

| Net loss | $ | (190,384 | ) | $ | (224,217 | ) | $ | (578,832 | ) | $ | (609,192 | ) | ||||

| Less: Net loss attributable to non-controlling interests | 160,537 | 204,462 | 504,967 | 576,301 | ||||||||||||

| Net loss attributable to MSP Recovery, Inc. | $ | (29,847 | ) | $ | (19,755 | ) | $ | (73,865 | ) | $ | (32,891 | ) | ||||

| Basic and diluted weighted average shares outstanding, Class A Common Stock | 23,764,079 | 12,703,472 | 18,586,357 | 7,097,032 | ||||||||||||

| Basic and diluted net loss per share, Class A Common Stock | $ | (1.26 | ) | $ | (1.56 | ) | $ | (3.97 | ) | $ | (4.63 | ) | ||||

1) For both the three and nine months ended September 30, 2024, cost of revenue included $1.3 million of related party expenses. For both the three and nine months ended September 30, 2023, cost of revenue included $0.3 million of related party expenses. See Note 15, Related Party Transactions, for further details.

2) For the three and nine months ended September 30, 2024, general and administrative expenses included $89.1 thousand and $180.8 thousand of related party expenses, respectively. See Note 15, Related Party Transactions, for further details. No such related party expenses were present for the three and nine months ended September 30, 2023.

3) For the three and nine months ended September 30, 2024 and 2023, Professional Fees—legal included $1.7 million and $7.7 million, and $4.6 million and $13.5 million, respectively, of related party expenses related to the Law Firm. See Note 15, Related Party Transactions, for further details.

4) For the three and nine months ended September 30, 2024 and 2023, interest expense included $80.8 million and $233.3 million, and $69.1 million and $163.1 million, respectively, related to interest expense due to related parties. See Note 15, Related Party Transactions, for further details.

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Non-GAAP Financial Measures

| MSP RECOVERY, INC. and Subsidiaries Non-GAAP Reconciliation |

||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| GAAP Operating Loss | $ | (129,871 | ) | $ | (136,694 | ) | $ | (395,001 | ) | $ | (417,849 | ) | ||||

| Professional fees paid in stock | 416 | 1,875 | 1,484 | 1,875 | ||||||||||||

| Claims amortization expense | 121,007 | 121,008 | 363,027 | 355,481 | ||||||||||||

| Allowance for credit losses | — | — | — | 5,000 | ||||||||||||

| Adjusted Operating Loss | $ | (8,448 | ) | $ | (13,811 | ) | $ | (30,490 | ) | $ | (55,493 | ) | ||||

| GAAP Net Loss | $ | (190,384 | ) | $ | (224,217 | ) | $ | (578,832 | ) | $ | (609,192 | ) | ||||

| Professional fees paid in stock | 416 | 1,875 | 1,484 | 1,875 | ||||||||||||

| Claims amortization expense | 121,007 | 121,008 | 363,027 | 355,481 | ||||||||||||

| Allowance for credit losses | — | — | — | 5,000 | ||||||||||||

| Interest expense (1) | 103,336 | 88,279 | 302,101 | 204,287 | ||||||||||||

| Change in fair value of warrant and derivative liabilities | (45,341 | ) | (348 | ) | (121,625 | ) | (4,247 | ) | ||||||||

| Adjusted Net Loss | $ | (10,966 | ) | $ | (13,403 | ) | $ | (33,845 | ) | $ | (46,796 | ) | ||||

In addition to the financial measures prepared in accordance with GAAP, this Quarterly Report also contains non-GAAP financial measures. We consider “adjusted net loss” and “adjusted operating loss” as non-GAAP financial measures and important indicators of performance and useful metrics for management and investors to evaluate the Company’s ongoing operating performance on a consistent basis across reporting periods. We believe these measures provide useful information to investors. Adjusted net loss represents net loss adjusted for certain non-cash and non-recurring expenses, and adjusted operating loss items represents operating loss adjusted for certain non-cash and non-recurring expenses. A reconciliation of these non-GAAP measures to their most relevant GAAP measure is included above.

(1) Interest expense included above excludes any interest expense payments made in cash during the three and nine months ended September 30, 2024.

_______________________________

1 “Paid Amount” (a/k/a Medicare Paid Rate or wholesale price) means the amount paid to the provider from the health plan or insurer. This amount varies based on the party making payment. For example, Medicare typically pays a lower fee for service rate than commercial insurers. The Paid Amount is derived from the Claims data we receive from our Assignors. In the limited instances where the data received lacks a paid value, our team calculates the Paid Amount with a formula. The formula used provides rates for outpatient services and is derived from the customary rate at the 95th percentile as it appears from standard industry commercial rates or, where that data is unavailable, the Billed Amount if present in the data. These amounts are then adjusted to account for the customary Medicare adjustment to arrive at the calculated Paid Amount. Management believes that this formula provides a conservative estimate for the Medicare paid amount rate, based on industry studies which show the range of differences between private insurers and Medicare rates for outpatient services. We periodically update this formula to enhance the calculated paid amount where that information is not provided in the data received from our Assignors. Management believes this measure provides a useful baseline for potential recoveries, but it is not a measure of the total amount that may be recovered in respect of potentially recoverable Claims, which in turn may be influenced by any applicable potential statutory recoveries such as double damages or fines. Where we have to extrapolate a Paid Amount to establish damages, the calculated amount may be contested by opposing parties. The figures pertaining to Medicare Member Lives as well as the paid amount were tabulated based on the data provided by health care plans; these figures may be subject to adjustment upon further investigation of the paid amounts reflected by the health plans.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BEN Reports Third Quarter 2024 Financial Results

JACKSON, Wyo., Nov. 14, 2024 (GLOBE NEWSWIRE) — Brand Engagement Network Inc. (“BEN”) BNAI, a global leader in secure and reliable conversational AI solutions, today announced its financial results and key business highlights for the third quarter ended September 30, 2024.

“In the third quarter, we made significant progress in delivering secure, scalable AI solutions and advancing our mission to transform industries with intelligent technology,” said Paul Chang, CEO of BEN. “As we look ahead, BEN is poised to accelerate growth and deliver value to our customers, reinforcing our leadership in closed-loop Gen AI.”

Q3 2024 Key Business Highlights:

- KangarooHealth Partnership: BEN partnered with KangarooHealth to enhance remote patient monitoring and chronic care management through AI, aiming to scale their platform for patients with chronic conditions.

- IntelliTek Collaboration: BEN’s agreement with IntelliTek broadens global access to AI solutions for healthcare, supporting patient engagement and optimizing healthcare operations across multiple regions.

- INTERVENT & Members Only Health Contracts: BEN signed with INTERVENT and Members Only Health to deploy AI assistants for health coaching and in-home healthcare, enhancing patient engagement and access.

- Vybroo & Farmacia Roma Partnership: BEN collaborated with Vybroo and Farmacia Roma to offer AI-driven audio engagement, enhancing brand-consumer relationships through accessible, everyday channels.

- New SEPA Agreement: BEN entered into a $50 million Standby Equity Purchase Agreement (SEPA) with Yorkville Advisors, providing financial flexibility.

- Leadership Promotion: Paul Chang was promoted to CEO, reinforcing BEN’s commitment to strategic growth and customer-focused initiatives.

- New Board Member: Dr. Richard S. Isaacs, former CEO of Kaiser Permanente, was appointed to BEN’s board of directors, bringing healthcare technology innovation and leadership expertise.

Q3 2024 Financial Overview:

- Revenue Growth: Achieved increase in revenue compared to the same period last year, driven by new partnerships and market expansion.

- Operational Efficiency: Improved operational metrics through continued cost discipline, resulting in a sequential reduction in operating costs and quarter-over-quarter operating loss improvement, coupled with strategic collaborations and technology advancements.

- Cash Position: Quarter over-quarter sequential improvement in Cash Flow from Operations driven by disciplined cost management. Implementing the Standby Equity Purchase Agreement (SEPA) provided cost-effective and efficient access to capital and liquidity.

- Significant subsequent event: In October, the Company announced its agreement to acquire 100% of Cantaneo Gmbh, a leading media technology company based in Germany, for $19.5 million in cash and stock. BEN expects to close this transaction by the end of the year.

Conference Call and Webcast Information

The Company will host a conference call and webcast today, Thursday, November 14, 2024, at 5:00 p.m. ET. CEO Paul Chang and CFO Bill Williams will lead the call, introducing Tina, one of BEN’s AI Assistants.

Participants can register here to access the live webcast of the conference call. Those who prefer to join the call via phone can register using this link to receive a dial-in number and unique PIN.

The webcast will be archived for one year following the conference call and can be accessed on BEN’s investor relations website at https://investors.beninc.ai/.

For more information about BEN’s safe, intelligent, scalable AI, please visit www.beninc.ai.

About BEN

Brand Engagement Network Inc. is a global leader in providing secure and reliable conversational AI solutions for businesses and consumers. With offices in Jackson, Wyoming, and Seoul, South Korea, BEN offers a powerful and flexible platform that enhances customer experiences, boosts productivity, and delivers business value. At the heart of BEN’s offerings are AI-powered digital assistants and lifelike avatars, providing more personal and engaging experiences through browsers, mobile applications, and even life-size kiosks. These safe, intelligent, and inherently scalable AI solutions empower businesses to efficiently serve customers using validated data delivered through SaaS, Private Cloud, and On-Premises technology. BEN’s commitment to data sovereignty ensures that consumer and business data remain private, protected, and wholly owned by the respective parties. BEN’s mission is to make AI friendly and helpful for all, ensuring more people benefit from the AI-enhanced world. For more information about BEN’s safe, intelligent, scalable AI, please visit www.beninc.ai.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are not historical facts, and involve risks and uncertainties that could cause actual results of BEN to differ materially from those expected and projected. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “anticipates,” “believes,” “continue,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” or “would,” or, in each case, their negative or other variations or comparable terminology.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside BEN’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: uncertainties as to the timing of the acquisition with Cataneo Gmbh (the “Acquisition”); the risk that the Acquisition may not be completed on the anticipated terms in a timely manner or at all; (the failure to satisfy any of the conditions to the consummation of the Acquisition, including the ability to obtain financing to fund the Acquisition on terms that are agreeable to the parties or at all; the possibility that any or all of the various conditions to the consummation of the Acquisition may not be satisfied or waived; the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreement; the effect of the announcement or pendency of the transactions contemplated by the purchase agreement on the Company’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and others with whom it does business, or its operating results and business generally; risks related to diverting management’s attention from the Company’s ongoing business operations; uncertainty as to the timing of completion of the Acquisition; risks that the benefits of the Acquisition are not realized when and as expected; risks relating to the uncertainty of the projected financial information with respect to BEN; uncertainty regarding and the failure to realize the anticipated benefits from future production-ready deployments; the attraction and retention of qualified directors, officers, employees and key personnel; our ability to grow our customer base; BEN’s history of operating losses; BEN’s need for additional capital to support its present business plan and anticipated growth; technological changes in BEN’s market; the value and enforceability of BEN’s intellectual property protections; BEN’s ability to protect its intellectual property; BEN’s material weaknesses in financial reporting; BEN’s ability to navigate complex regulatory requirements; the ability to maintain the listing of BEN’s securities on a national securities exchange; the ability to implement business plans, forecasts, and other expectations; the effects of competition on BEN’s business; and the risks of operating and effectively managing growth in evolving and uncertain macroeconomic conditions, such as high inflation and recessionary environments. The foregoing list of factors is not exhaustive.

BEN cautions that the foregoing list of factors is not exclusive. BEN cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. BEN does not undertake nor does it accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, and it does not intend to do so unless required by applicable law. Further information about factors that could materially affect BEN, including its results of operations and financial condition, is set forth under “Risk Factors” in BEN’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q subsequently filed with the Securities and Exchange Commission.

BEN Contacts:

Investor Relations

Susan Xu

E: sxu@allianceadvisors.com

P: 778-323-0959

Media Contact

Amy Rouyer

E: amy@beninc.ai

P: 503-367-7596

Source: Brand Engagement Network, Inc. (BEN)

| BRAND ENGAGEMENT NETWORK INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||||

| September 30, 2024 |

December 31, 2023* |

||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 72,878 | $ | 1,685,013 | |||

| Accounts receivable, net of allowance | 30,888 | 10,000 | |||||

| Due from Sponsor | 3,000 | — | |||||

| Prepaid expenses and other current assets | 1,075,103 | 201,293 | |||||

| Total current assets | 1,181,869 | 1,896,306 | |||||

| Property and equipment, net | 285,305 | 802,557 | |||||

| Intangible assets, net | 17,006,906 | 17,882,147 | |||||

| Other assets | 13,475,000 | 1,427,729 | |||||

| TOTAL ASSETS | $ | 31,949,080 | $ | 22,008,739 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 5,376,310 | $ | 1,282,974 | |||

| Accrued expenses | 4,185,315 | 1,637,048 | |||||

| Due to related parties | 693,036 | — | |||||

| Deferred revenue | — | 2,290 | |||||

| Convertible note | 1,900,000 | — | |||||

| Short-term debt | 891,974 | 223,300 | |||||

| Total current liabilities | 13,046,635 | 3,145,612 | |||||

| Warrant liabilities | 1,150,868 | — | |||||

| Note payable – related party | — | 500,000 | |||||

| Long-term debt | — | 668,674 | |||||

| Total liabilities | 14,197,503 | 4,314,286 | |||||

| Commitments and contingencies (Note M) | |||||||

| Stockholders’ equity: | |||||||

| Preferred stock par value $0.0001 per share, 10,000,000 shares authorized, none designated. There are no shares issued or outstanding as of September 30, 2024 or December 31, 2023 | — | — | |||||

| Common stock par value of $0.0001 per share, 750,000,000 shares authorized. As of September 30, 2024 and December 31, 2023, respectively, 37,931,764 and 23,270,404 shares issued and outstanding | 3,794 | 2,327 | |||||

| Additional paid-in capital | 46,806,699 | 30,993,846 | |||||

| Accumulated deficit | (29,058,916 | ) | (13,301,720 | ) | |||

| Total stockholders’ equity | 17,751,577 | 17,694,453 | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 31,949,080 | $ | 22,008,739 | |||

| * Derived from audited information | |||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| BRAND ENGAGEMENT NETWORK INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenues | $ | 50,000 | $ | — | $ | 99,790 | $ | — | |||||||

| Cost of revenues | — | — | — | — | |||||||||||

| Gross profit | 50,000 | — | 99,790 | — | |||||||||||

| Operating expenses: | |||||||||||||||

| General and administrative | 4,203,946 | 2,282,434 | 15,969,617 | 7,678,880 | |||||||||||

| Depreciation and amortization | 972,375 | 209,729 | 1,771,966 | 449,663 | |||||||||||

| Research and development | 153,191 | 75,450 | 759,427 | 153,828 | |||||||||||

| Total operating expenses | 5,329,512 | 2,567,613 | 18,501,010 | 8,282,371 | |||||||||||

| Loss from operations | (5,279,512 | ) | (2,567,613 | ) | (18,401,220 | ) | (8,282,371 | ) | |||||||

| Other income (expenses): | |||||||||||||||

| Interest expense | (18,055 | ) | (34,507 | ) | (62,508 | ) | (34,507 | ) | |||||||

| Interest income | 92 | — | 3,324 | — | |||||||||||

| Gain on debt extinguishment | 98,318 | — | 1,946,310 | — | |||||||||||

| Change in fair value of warrant liabilities | (632,969 | ) | — | 762,869 | — | ||||||||||

| Other | 9,043 | 19,789 | (5,971 | ) | (11,961 | ) | |||||||||

| Other income (expenses), net | (543,571 | ) | (14,718 | ) | 2,644,024 | (46,468 | ) | ||||||||

| Loss before income taxes | (5,823,083 | ) | (2,582,331 | ) | (15,757,196 | ) | (8,328,839 | ) | |||||||

| Income taxes | — | — | — | — | |||||||||||

| Net loss | $ | (5,823,083 | ) | $ | (2,582,331 | ) | $ | (15,757,196 | ) | $ | (8,328,839 | ) | |||

| Net loss per common share- basic and diluted | $ | (0.16 | ) | $ | (0.12 | ) | $ | (0.50 | ) | $ | (0.42 | ) | |||

| Weighted-average common shares – basic and diluted | 35,539,043 | 22,409,790 | 31,623,082 | 19,928,947 | |||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| BRAND ENGAGEMENT NETWORK INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT) |

|||||||||||||||||||||

| Preferred Stock | Common Stock | Additional Paid-in Capital |

Accumulated Deficit |

Total Stockholders’ Equity |

|||||||||||||||||

| Shares | Par Value | Shares | Par Value | ||||||||||||||||||

| Balance at December 31, 2023 | — | $ | — | 23,270,404 | $ | 2,327 | $ | 30,993,846 | $ | (13,301,720 | ) | $ | 17,694,453 | ||||||||

| Stock issued to DHC shareholders in reverse recapitalization | — | — | 7,885,220 | 789 | (10,722,277 | ) | — | (10,721,488 | ) | ||||||||||||

| Issuance of common stock pursuant to Reseller Agreement | — | — | 1,750,000 | 175 | 13,474,825 | — | 13,475,000 | ||||||||||||||

| Sale of common stock | — | — | 645,917 | 65 | 6,324,935 | — | 6,325,000 | ||||||||||||||

| Warrant exercises | — | — | 40,514 | 4 | 15,260 | — | 15,264 | ||||||||||||||

| Stock-based compensation | — | — | — | — | 698,705 | — | 698,705 | ||||||||||||||

| Net loss | — | — | — | — | — | (6,884,409 | ) | (6,884,409 | ) | ||||||||||||

| Balance at March 31, 2024 | — | — | 33,592,055 | 3,360 | 40,785,294 | (20,186,129 | ) | 20,602,525 | |||||||||||||

| Stock issued in settlement of accounts payable and loans payable | — | — | 93,333 | 9 | 321,999 | — | 322,008 | ||||||||||||||

| Sale of common stock | — | — | 877,500 | 198 | 1,993,552 | — | 1,993,750 | ||||||||||||||

| Warrant exercises | — | — | 13,505 | 1 | 4,999 | — | 5,000 | ||||||||||||||

| Stock-based compensation, including vested restricted shares | — | — | 381,915 | 42 | 768,497 | — | 768,539 | ||||||||||||||

| Net loss | — | — | — | — | — | (3,049,704 | ) | (3,049,704 | ) | ||||||||||||

| Balance at June 30, 2024 | — | — | 34,958,308 | 3,610 | 43,874,341 | (23,235,833 | ) | 20,642,118 | |||||||||||||

| Issuance of common stock for Standby Equity Purchase Agreement commitment fee | — | — | 280,899 | 28 | 499,972 | — | 500,000 | ||||||||||||||

| Stock issued in settlement of accrued expenses | — | — | 151,261 | 15 | 261,667 | — | 261,682 | ||||||||||||||

| Sale of common stock | — | — | 602,500 | 131 | 1,756,056 | — | 1,756,187 | ||||||||||||||

| Option and warrant exercises | — | — | 98,335 | 10 | 79,750 | — | 79,760 | ||||||||||||||

| Stock-based compensation, including vested restricted shares | — | — | 35,461 | — | 334,913 | — | 334,913 | ||||||||||||||

| Net loss | — | — | — | — | — | (5,823,083 | ) | (5,823,083 | ) | ||||||||||||

| Balance at September 30, 2024 | — | $ | — | 36,126,764 | $ | 3,794 | $ | 46,806,699 | $ | (29,058,916 | ) | $ | 17,751,577 | ||||||||

| BRAND ENGAGEMENT NETWORK INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT) |

||||||||||||||||||||

| Preferred Stock | Common Stock | Additional Paid-in Capital |

Accumulated Deficit |

Total Stockholders’ Deficit |

||||||||||||||||

| Shares | Par Value | Shares | Par Value | |||||||||||||||||

| Balance at December 31, 2022 | — | $ | — | 17,057,085 | $ | 1,705 | $ | 1,528,642 | $ | (1,570,454 | ) | $ | (40,107 | ) | ||||||

| Warrant exercises | — | — | 81,030 | 8 | 29,992 | — | 30,000 | |||||||||||||

| Stock issued in conversion of accounts payable and loans payable | — | — | 135,050 | 14 | 49,986 | — | 50,000 | |||||||||||||

| Stock-based compensation | — | — | — | — | 2,442,701 | — | 2,442,701 | |||||||||||||

| Net loss | — | — | — | — | — | (2,637,956 | ) | (2,637,956 | ) | |||||||||||

| Balance at March 31, 2023 | — | — | 17,273,165 | 1,727 | 4,051,321 | (4,208,410 | ) | (155,362 | ) | |||||||||||

| Stock issued for DM Lab APA | — | — | 4,325,043 | 433 | 16,012,317 | — | 16,012,750 | |||||||||||||

| Options and warrant exercises | — | — | 56,552 | 10 | 20,928 | — | 20,938 | |||||||||||||

| Stock issued in conversion of convertible notes | — | — | 378,140 | 38 | 1,399,962 | — | 1,400,000 | |||||||||||||

| Stock issued in settlement of accounts payable and loans payable | — | — | 103,439 | 10 | 382,953 | — | 382,963 | |||||||||||||

| Stock-based compensation | — | — | — | — | 1,841,767 | — | 1,841,767 | |||||||||||||

| Net loss | — | — | — | — | — | (3,108,552 | ) | (3,108,552 | ) | |||||||||||

| Balance at June 30, 2023 | — | — | 22,136,339 | 2,218 | 23,709,248 | (7,316,962 | ) | 16,394,504 | ||||||||||||

| Options and warrant exercises | — | — | 64,993 | 3 | 9,997 | — | 10,000 | |||||||||||||

| Vesting of early exercised options | — | — | — | — | 1,563 | — | 1,563 | |||||||||||||

| Stock issued in conversion of convertible notes | — | — | 432,160 | 43 | 1,599,957 | — | 1,600,000 | |||||||||||||

| Sale of common stock, net of issuance costs | — | — | 123,333 | 12 | 949,988 | — | 950,000 | |||||||||||||

| Stock-based compensation | — | — | — | — | 464,075 | — | 464,075 | |||||||||||||

| Net loss | — | — | — | — | — | (2,582,331 | ) | (2,582,331 | ) | |||||||||||

| Balance at September 30, 2023 | — | $ | — | 22,756,825 | $ | 2,276 | $ | 26,734,828 | $ | (9,899,293 | ) | $ | 16,837,811 | |||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| BRAND ENGAGEMENT NETWORK INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS |

|||||||

| Nine Months Ended September 30, |

|||||||

| 2024 | 2023 | ||||||

| Cash flows from operating activities: | |||||||

| Net loss | $ | (15,757,196 | ) | $ | (8,328,839 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

| Depreciation and amortization expense | 1,771,966 | 449,663 | |||||

| Allowance for uncollected receivables | 30,000 | — | |||||

| Write off of deferred financing fees | 1,427,729 | — | |||||

| Change in fair value of warrant liabilities | (762,869 | ) | — | ||||

| Gain on debt extinguishment | (1,946,310 | ) | — | ||||

| SEPA financing costs | 525,000 | — | |||||

| Stock based compensation, including the issuance of restricted shares | 1,581,744 | 4,727,799 | |||||

| Changes in operating assets and liabilities: | |||||||

| Prepaid expense and other current assets | (856,986 | ) | (103,917 | ) | |||

| Accounts receivable | (50,888 | ) | 500 | ||||

| Accounts payable | 5,393,334 | 62,373 | |||||

| Accrued expenses | (3,019,367 | ) | 431,194 | ||||

| Other assets | — | 8,850 | |||||

| Deferred revenue | (2,290 | ) | — | ||||

| Net cash used in operating activities | (11,666,133 | ) | (2,752,377 | ) | |||

| Cash flows from investing activities: | |||||||

| Purchase of property and equipment | (53,023 | ) | (28,465 | ) | |||

| Purchase of patents | — | (379,864 | ) | ||||

| Capitalized internal-use software costs | (162,940 | ) | (310,944 | ) | |||

| Asset acquisition (Note D) | — | (257,113 | ) | ||||

| Net cash used in investing activities | (215,963 | ) | (976,386 | ) | |||

| Cash flows from financing activities: | |||||||

| Cash and cash equivalents acquired in connection with the reverse recapitalization | 858,292 | — | |||||

| Proceeds from the sale of common stock | 10,274,937 | 1,000,000 | |||||

| Proceeds from convertible notes | — | 3,075,000 | |||||

| Proceeds from related party note | — | 620,000 | |||||

| Proceeds received from option and warrant exercises | 100,024 | 22,500 | |||||

| Payment of financing costs | (883,292 | ) | (107,310 | ) | |||

| Payment of related party note | (80,000 | ) | — | ||||

| Advances to related parties | — | (39,065 | ) | ||||

| Proceeds received from related party advance repayments | — | 138,110 | |||||

| Net cash provided by financing activities | 10,269,961 | 4,709,235 | |||||

| Net (decrease) increase in cash and cash equivalents | (1,612,135 | ) | 980,472 | ||||

| Cash and cash equivalents at the beginning of the period | 1,685,013 | 2,010 | |||||

| Cash and cash equivalents at the end of the period | $ | 72,878 | $ | 982,482 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| BRAND ENGAGEMENT NETWORK INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS |

|||||

| Nine Months Ended September 30, |

|||||

| 2024 | 2023 | ||||

| Supplemental Cash Flow Information | |||||

| Cash paid for interest | $ | — | $ | — | |

| Cash paid for income taxes | $ | — | $ | — | |

| Supplemental Non-Cash Information | |||||

| Capitalized internal-use software costs in accrued expenses | $ | — | $ | 46,963 | |

| Issuance of common stock pursuant to Reseller Agreement | $ | 13,475,000 | $ | — | |

| Issuance of common stock for Standby Equity Purchase Agreement commitment fee | $ | 500,000 | $ | — | |

| Stock-based compensation capitalized as part of capitalized software costs | $ | 220,413 | $ | 20,745 | |

| Settlement of liabilities into common shares | $ | 583,690 | $ | 432,963 | |

| Settlement of accounts payable into convertible note | $ | 1,900,000 | $ | — | |

| Conversion of convertible notes into common shares | $ | — | $ | 3,000,000 | |

| Warrants exercise through settlement of accounts payable | $ | — | $ | 40,000 | |

| Financing costs in accounts payable and accrued expenses | $ | 200,000 | $ | 687,609 | |

| Issuance of common stock in connection with asset acquisition | $ | — | $ | 16,012,750 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Quarterra Multifamily Announces the Start of Leasing at Cordelia Apartments

High-Rise Community Offers the Closest Luxury Living to the Water in Sarasota Bay

SARASOTA, Fla., Nov. 14, 2024 /PRNewswire/ — Quarterra Multifamily, a subsidiary of Lennar Corporation and a multifamily apartment developer, property manager, and asset manager, today announced the start of leasing at Cordelia, a luxury high-rise community in Downtown Sarasota, Fla., on Sarasota Bay.

Part of a 14-acre master development, Cordelia includes 240 luxury homes and 13,811 square feet of ground floor retail space. The community sits along a central green space with spectacular views of the bay and exceptional access to downtown. Cordelia will feed off its vibrant and diverse location, combining a unique blend of urban energy and natural beauty for a distinctly upscale Florida living experience.

“Cordelia is designed to capture and complement both downtown and bayside vibes, and offer residents the best of both worlds,” said Cameron Palm, Senior Development Manager with Quarterra. “From the community’s exquisite large balconies with waterfront views and top-flight amenities package to the seemingly endless dining and entertainment opportunities, residents will find themselves in an ideal place to live their best lives. It’s exciting to reach this milestone in the property’s development and stride one step closer to welcoming residents home.”

Situated at 468 Quay Commons, Cordelia positions residents within easy reach of a myriad of downtown dining destinations. Hot spots include: 1592 Wood Fired Kitchen & Cocktails, Boca, The Breakfast House, Café Epicure, Caragiulos, C’est La Vie, Drunken Poet, Duval’s, Indigenous, Jack Dusty, Lila, Made, Mattison’s City Grille, Mediterraneo, Owen’s Fish Camp, II Panificio, Pho Cali, Sage, Selva, Siegfried’s Restaurant, and State Street Eating House + Cocktails. Ocean Prime is slated to open later this year giving residents another high-end restaurant experience.

Residents will also find themselves in close proximity to shopping at Main Street, St. Armands Circle and The Mall at University Town Center, as well as the Sarasota Farmers Market. Entertainment venues, including Van Wezel Performing Arts Hall, Sarasota Opera House, Sarasota Orchestra, The Belle Haven, The Florida Studio Theatre, The Asolo Repertory Theatre, IMG Sports Complex, Robarts Arena, Ed Smith Stadium, The Bay Park and The John and Mable Ringling Museum are also nearby.

Cordelia is positioned along Tamiami Trail and adjacent to Fruitville Road, providing simple connectivity to the rest of Sarasota and surrounding municipalities. SCAT bus service and Bay Runner trolley are both easily accessible from the property, creating easy commutes to regional employers like Bealls, Tropicana, PGT Industries and Sarasota Memorial Healthcare. A newly designed trail system skirts the perimeter of the community, accessing the bay, beaches and parks. A seven-floor above/below ground parking garage, featuring several EV charging stations, will accommodate resident vehicles.

Cordelia consists of studio, one-, two- and three-bedroom apartment homes. Homes range from 558 to 1,480 square feet and are highlighted by floor-to-ceiling windows, designer pendant and sconce lighting and ceramic tile flooring in living spaces. Kitchens showcase under-cabinet lighting, stainless steel appliances, shaker cabinets, quartz countertops, islands, tile backsplashes and wine fridges. Bathrooms include oversized tubs and walk-in showers.

All residents have access to a picturesque rooftop pool, sky terrace and sun deck with outdoor bar, grill stations, fireplaces and lounge areas. Other amenity highlights include a catering kitchen, flex fitness studio, yoga studio, pet spa, maker space, co-working spaces, private dining area, wine lounge with tasting room, and gaming room with golf simulator.

About Quarterra

Quarterra Group, Inc., a wholly-owned subsidiary of Lennar Corporation (NYSE: LEN and LEN.B), is a multi-strategy, real estate focused, alternative asset management company comprising three rapidly growing verticals: Multifamily, Single-Family Rental, and Land. Launched in 2011, Quarterra Multifamily, previously known as LMC, is among the nation’s most active developers, builders, and managers and has been on the National Multi-Housing Council’s (NMHC) annual Top 50 list for nine consecutive years.

Quarterra creates extraordinary communities where people can live remarkably.

www.Quarterra.com

Media Contact

Marlena DeFalco

marlena@linnelltaylor.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/quarterra-multifamily-announces-the-start-of-leasing-at-cordelia-apartments-302306145.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/quarterra-multifamily-announces-the-start-of-leasing-at-cordelia-apartments-302306145.html

SOURCE Quarterra

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JOHN HANCOCK CLOSED-END FUNDS RELEASE EARNINGS DATA

BOSTON, Nov. 14, 2024 /PRNewswire/ – The John Hancock Closed-End Funds listed in the table below announced earnings1 for the three months ended October 31, 2024. The same data for the comparable three-month period ended October 31, 2023 is also available below.

|

Ticker |

Fund Name |

Current |

Net |

Per |