Insider Transaction: Troy Little Sells $168K Worth Of Boise Cascade Shares

It was reported on November 13, that Troy Little, EVP at Boise Cascade BCC executed a significant insider sell, according to an SEC filing.

What Happened: Little opted to sell 1,192 shares of Boise Cascade, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $168,590.

Boise Cascade shares are trading up 1.0% at $143.98 at the time of this writing on Thursday morning.

About Boise Cascade

Boise Cascade Co is a producer of engineered wood products (EWP) and plywood. The firm operates in two segments namely Wood Products and Building Materials Distribution. Wood Products segment manufactures EWP, consisting of laminated veneer lumber (LVL), I-joists, and laminated beams. The Building Materials Distribution segment is engaged in the wholesale of building materials. It distributes products such as plywood, OSB, and lumber items such as siding, doors, metal products, insulation, and roofing, EWP and others. The company generates a majority of its revenue from the Building Material Distribution segment.

Financial Insights: Boise Cascade

Revenue Growth: Boise Cascade’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -6.58%. This indicates a decrease in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: With a low gross margin of 19.72%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Boise Cascade’s EPS reflects a decline, falling below the industry average with a current EPS of 2.34.

Debt Management: Boise Cascade’s debt-to-equity ratio is below the industry average. With a ratio of 0.24, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 13.96 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.83, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 7.37, Boise Cascade could be considered undervalued.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Unlocking the Meaning of Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Boise Cascade’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sensus Healthcare Reports Third Quarter 2024 Financial Results With Revenues More than Doubling Versus 2023 Third Quarter

- Revenues of $8.8 million compare with $3.9 million in the prior-year quarter, adjusted EBITDA (a non-GAAP measure) of $1.6 million compares with negative $1.7 million a year ago

- Signed a Fair Deal Agreement with Platinum Dermatology, a leading dermatology network with 130 clinics across the U.S.

Conference call begins at 4:30 p.m. Eastern time today

BOCA RATON, Fla., Nov. 14, 2024 (GLOBE NEWSWIRE) — Sensus Healthcare, Inc. SRTS, a medical device company specializing in highly effective, non-invasive, minimally-invasive and cost-effective treatments for oncological and non-oncological skin conditions, announces financial results for the three and nine months ended September 30, 2024.

Highlights from the third quarter of 2024 and recent weeks include the following:

- Revenues increased 127% over the comparable 2023 quarter to $8.8 million, reflecting higher superficial radiotherapy (SRT and IG-SRT) unit sales

- Shipped 27 systems including one SRT-100 unit to an international customer, compared with 11 systems shipped in the 2023 quarter

- Entered into Fair Deal Agreements for seven SRT-100 Vision (IG-SRT) units, bringing the total to 22 units since the program’s introduction in March

- Net income was $1.2 million, or $0.07 per diluted share, compared with a net loss of $1.5 million, or $0.09 per share, for the 2023 quarter

- Exited the quarter with $22.6 million in cash and cash equivalents, and no debt

- Sold an SRT system to the radiation oncology department of Providence Swedish Hospital in Seattle

- Attended the American Society for Radiation Oncology (ASTRO) 66th annual meeting, where non-melanoma skin cancer treatment continues to show increased interest

- Signed a Fair Deal Agreement with Platinum Dermatology Partners, a network of more than 130 dermatology clinics across the U.S.

Management Commentary

“Continued growth in revenues and earnings reflects our success in engaging customers with both existing and new sales options. Our revenues more than doubled year-over-year for the second consecutive quarter, and we maintained profitability despite the summer seasonality of our business,” said Joe Sardano, chairman and chief executive officer of Sensus Healthcare. “Our revenue-sharing Fair Deal Agreement, which allows customers to deploy capital elsewhere in their businesses, continues to attract significant attention. Since our launch at the American Academy of Dermatology meeting in March, we signed 22 agreements as of September 30th. In addition, the signing of an agreement with Platinum Dermatology Partners, a rapidly-growing network of 130 dermatology clinics, is a major step forward. We believe this is the first of many such groups to consider the Fair Deal Agreement.”

Commenting on the agreement, Anthony Petelin, M.D., president of Platinum Dermatology Partners, said, “I’m incredibly excited for Platinum Dermatology Partners to enter into this expanded services agreement with Sensus Healthcare, with support from Sensus’ outstanding team. This agreement enables us to broaden access to SRT for our patients, reinforcing the exceptional, highest-quality dermatologic care that is our hallmark. Over the years, SRT has proven itself to be an integral part of a comprehensive treatment plan, primarily for those diagnosed with non-melanoma skin cancer.”

Mr. Sardano added, “With the Platinum Fair Deal Agreement, we have exceeded our goal of having up to 50 Fair Deal Agreements signed by the end of 2024, and we expect to be generating recurring revenue from these SRT-100 Vision (IG-SRT) systems in 2025. Given the growing utilization of SRT to treat non-melanoma skin cancer and keloid scars, and the interest we have generated to date, we expect this model to contribute to our growth for years to come. This model would not be possible without Sentinel IT, our proprietary HIPAA-compliant software with clinical billing and asset management utility that also allows us to track utilization in real time. We believe this intellectual property is a very valuable asset to Sensus.”

Mr. Sardano concluded, “The market for non-melanoma skin cancer treatments is enormous, with an estimated one in five Americans developing skin cancer during their lifetime, representing some 70 million people. Globally, more than 1.2 million people develop non-melanoma skin cancer annually. Clearly SRT is becoming the ‘people’s choice’ on how they wish to be treated.”

Third Quarter Financial Results

Revenues for the third quarter of 2024 were $8.8 million, compared with $3.9 million for the third quarter of 2023, an increase of $4.9 million, or 127%. The increase was primarily driven by a higher number of SRT systems sold to a large customer.

Cost of sales was $3.6 million for the third quarter of 2024, compared with $1.9 million for the prior-year quarter. The increase was primarily related to a higher number of units sold in the 2024 quarter.

Gross profit was $5.2 million for the third quarter of 2024, or 59.3% of revenues, compared with $2.0 million, or 51.0% of revenues, for the third quarter of 2023. The increase was primarily driven by the higher number of units sold in the 2024 quarter.

Selling and marketing expense was $1.3 million for the third quarter of 2024, unchanged from the third quarter of 2023.

General and administrative expense was $1.6 million for the third quarter of 2024, compared with $1.5 million for the third quarter of 2023. The increase was primarily due to higher compensation and bad debt expense, which were offset by a reduction in bank fees.

Research and development expense was $0.9 million for the third quarter of 2024, compared with $1.1 million for the third quarter of 2023. The decrease was primarily due to expenses, mostly incurred in the 2023 quarter, related to a project to develop a drug delivery system for aesthetic use.

Other income of $0.3 million for the third quarter of 2024 was mostly related to interest income, and was unchanged from the prior-year quarter.

Net income for the third quarter of 2024 was $1.2 million, or $0.07 per diluted share, compared with a net loss of $1.5 million, or $0.09 per share, for the third quarter of 2023.

Adjusted EBITDA for the third quarter of 2024 was $1.6 million, compared with negative $1.7 million for the third quarter of 2023. Adjusted EBITDA, a non-GAAP financial measure, is defined as earnings before interest, taxes, depreciation, amortization and stock-compensation expense. Please see below for a reconciliation between GAAP and non-GAAP financial measures, and the reasons these non-GAAP financial measures are provided.

Cash and cash equivalents were $22.6 million as of September 30, 2024, compared with $23.1 million as of December 31, 2023. The Company had no outstanding borrowings under its revolving line of credit. Accounts receivable were $17.0 million as of September 30, 2024, compared with $10.6 million as of December 31, 2023, with the increase reflecting the increase in sales and concentration of sales to a large customer that is subject to extended payment terms.

Nine Month Financial Results

Revenues for the nine months ended September 30, 2024 were $28.7 million, compared with $11.8 million for the nine months ended September 30, 2023, an increase of $16.9 million, or 143%. The increase was primarily driven by a higher number of units sold to a large customer.

Cost of sales was $11.4 million for the nine months ended September 30, 2024, compared with $5.6 million for the nine months ended September 30, 2023. The increase was primarily related to higher sales in the 2024 period.

Gross profit was $17.3 million, or 60.3% of revenues, for the nine months ended September 30, 2024, compared with $6.2 million, or 52.6% of revenues, for the nine months ended September 30, 2023. The increase was primarily driven by a higher number of units sold in the 2024 period.

Selling and marketing expense was $3.6 million for the nine months ended September 30, 2024, compared with $5.0 million for the nine months ended September 30, 2023. The decrease was primarily attributable to a decline in marketing agency expense, travel expense and lower headcount.

General and administrative expense was $4.7 million for the nine months ended September 30, 2024, compared with $4.2 million for the nine months ended September 30, 2023. The increase was primarily due to higher compensation and bad debt expense, which were offset by a reduction in bank fees and insurance expense.

Research and development expense was $2.7 million for the nine months ended September 30, 2024, compared with $3.0 million for the nine months ended September 30, 2023. The decrease was primarily due to a project to develop a drug delivery system for aesthetic use.

Other income of $0.7 million and $0.8 million for the nine months ended September 30, 2024 and 2023, respectively, relates primarily to interest income.

Net income for the nine months ended September 30, 2024 was $5.1 million, or $0.31 per diluted share, compared with a net loss of $3.7 million, or $0.23 per share, for the nine months ended September 30, 2023.

Adjusted EBITDA for the nine months ended September 30, was $6.7 million, compared with negative $5.4 million for the nine months ended September 30, 2023.

Use of Non-GAAP Financial Information

This press release contains supplemental financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). Sensus Healthcare management uses Adjusted EBITDA, a non-GAAP financial measure, in its analysis of the Company’s performance. Adjusted EBITDA should not be considered a substitute for GAAP basis measures, nor should it be viewed as a substitute for operating results determined in accordance with GAAP. Management believes the presentation of Adjusted EBITDA, which excludes the impact of interest, income taxes, depreciation, amortization and stock-compensation expense, provides useful supplemental information that is essential to a proper understanding of the financial results of Sensus Healthcare. Non-GAAP financial measures are not formally defined by GAAP, and other entities may use calculation methods that differ from those used by Sensus Healthcare. As a complement to GAAP financial measures, management believes that Adjusted EBITDA assists investors who follow the practice of some investment analysts who adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability. A reconciliation of the GAAP net loss to Adjusted EBITDA is provided in the schedule below.

| SENSUS HEALTHCARE, INC. | |||||||||||||||||||||

| GAAP TO NON-GAAP RECONCILIATION | |||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||

| (in thousands) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Net income (loss), as reported | $ | 1,215 | $ | (1,451 | ) | $ | 5,101 | $ | (3,725 | ) | |||||||||||

| Add: | |||||||||||||||||||||

| Depreciation and amortization | 53 | 60 | 154 | 216 | |||||||||||||||||

| Stock compensation expense | 45 | 67 | 201 | 276 | |||||||||||||||||

| Income tax expense (benefit) | 559 | (125 | ) | 1,965 | (1,428 | ) | |||||||||||||||

| Interest income, net | (279 | ) | (277 | ) | (702 | ) | (764 | ) | |||||||||||||

| Adjusted EBITDA, non GAAP | $ | 1,593 | $ | (1,726 | ) | $ | 6,719 | $ | (5,425 | ) | |||||||||||

Conference Call and Webcast

Sensus Healthcare will host an investment community conference call today beginning at 4:30 p.m. Eastern time during which management will discuss these financial results, provide a business update and answer questions.

Participants are encouraged to pre-register for the conference call here to receive a unique dial-in number that will permit them to bypass the live operator. Participants may pre-register at any time, including up to and after the call start time. Alternatively, participants can access the conference call by dialing 844-481-2811 (U.S. and Canada Toll Free) or 412-317-0676 (International). Please direct the operator to be connected to the Sensus Healthcare conference call. The call will be webcast live and can be accessed here or in the Investor Relations section of the Company’s website at www.sensushealthcare.com.

Following the conclusion of the conference call, a replay will be available until December 14, 2024 and can be accessed by dialing 877-344-7529 (U.S. Toll Free), 855-669-9658 (Canada Toll Free) or 412-317-0088 (International), using replay code 3932512. An archived webcast of the call will also be available in the Investors section of the Company’s website.

About Sensus Healthcare

Sensus Healthcare, Inc. is a global pioneer in the development and delivery of non-invasive treatments for skin cancer and keloids. Leveraging its cutting-edge superficial radiotherapy (SRT and IG-SRT) technology, the company provides healthcare providers with a highly effective, patient-centric treatment platform. With a dedication to driving innovation in radiation oncology, Sensus Healthcare offers solutions that are safe, precise, and adaptable to a variety of clinical settings. For more information, please visit www.sensushealthcare.com.

Forward-Looking Statements

This press release includes statements that are, or may be deemed, ”forward-looking statements.” In some cases, these statements can be identified by the use of forward-looking terminology such as “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately,” “potential” or negative or other variations of those terms or comparable terminology, although not all forward-looking statements contain these words.

Forward-looking statements involve risks and uncertainties because they relate to events, developments, and circumstances relating to Sensus, our industry, and/or general economic or other conditions that may or may not occur in the future or may occur on longer or shorter timelines or to a greater or lesser degree than anticipated. In addition, even if future events, developments, and circumstances are consistent with the forward-looking statements contained in this press release, they may not be predictive of results or developments in future periods. Although we believe that we have a reasonable basis for each forward-looking statement contained in this press release, forward-looking statements are not guarantees of future performance, and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this press release, as a result of the following factors, among others: our ability to maintain profitability; our ability to sell the number of SRT units we anticipate for the balance of 2024; the possibility that inflationary pressures continue to impact our sales; the level and availability of government and/or third party payor reimbursement for clinical procedures using our products, and the willingness of healthcare providers to purchase our products if the level of reimbursement declines; the regulatory requirements applicable to us and our competitors; our ability to efficiently manage our manufacturing processes and costs; the risks arising from doing business in China and other foreign countries; legislation, regulation, or other governmental action that affects our products, taxes, international trade regulation, or other aspects of our business; concentration of our customers in the U.S. and China, including the concentration of sales to one particular customer in the U.S.; the performance of the Company’s information technology systems and its ability to maintain data security; our ability to obtain and maintain the intellectual property needed to adequately protect our products, and our ability to avoid infringing or otherwise violating the intellectual property rights of third parties; and other risks described from time to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

To date, we do not expect that the Middle East conflict, the Russian invasion of Ukraine and global geopolitical uncertainties have had any particular impact on our business, but we continue to monitor developments and will address them in future disclosures, if applicable.

Any forward-looking statements that we make in this press release speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this press release, except as may be required by applicable law. You should read carefully our “Introductory Note Regarding Forward-Looking Information” and the factors described in the “Risk Factors” section of our periodic reports filed with the Securities and Exchange Commission to better understand the risks and uncertainties inherent in our business.

Contact:

Alliance Advisors IR

Kim Sutton Golodetz

212-838-3777

kgolodetz@allianceadvisors.com

(Tables to follow)

| SENSUS HEALTHCARE, INC. | |||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||

| September 30, | September 30, | ||||||||||||||||

| (in thousands, except share and per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | ||||||||||||||

| Revenues | $ | 8,839 | $ | 3,898 | $ | 28,741 | $ | 11,838 | |||||||||

| Cost of sales | 3,599 | 1,909 | 11,416 | 5,609 | |||||||||||||

| Gross profit | 5,240 | 1,989 | 17,325 | 6,229 | |||||||||||||

| Operating expenses: | |||||||||||||||||

| Selling and marketing | 1,309 | 1,290 | 3,575 | 4,983 | |||||||||||||

| General and administrative | 1,573 | 1,511 | 4,731 | 4,204 | |||||||||||||

| Research and development | 863 | 1,083 | 2,655 | 3,001 | |||||||||||||

| Total operating expenses | 3,745 | 3,884 | 10,961 | 12,188 | |||||||||||||

| Income (loss) from operations | 1,495 | (1,895 | ) | 6,364 | (5,959 | ) | |||||||||||

| Other income: | |||||||||||||||||

| Gain on sale of assets | – | 42 | – | 42 | |||||||||||||

| Interest income, net | 279 | 277 | 702 | 764 | |||||||||||||

| Other income, net | 279 | 319 | 702 | 806 | |||||||||||||

| Income (loss) before income tax | 1,774 | (1,576 | ) | 7,066 | (5,153 | ) | |||||||||||

| Provision for (benefit from) income tax | 559 | (125 | ) | 1,965 | (1,428 | ) | |||||||||||

| Net Income (loss) | $ | 1,215 | $ | (1,451 | ) | $ | 5,101 | $ | (3,725 | ) | |||||||

| Net income (loss) per share – basic | $ | 0.07 | $ | (0.09 | ) | $ | 0.31 | $ | (0.23 | ) | |||||||

| – diluted | $ | 0.07 | $ | (0.09 | ) | $ | 0.31 | $ | (0.23 | ) | |||||||

| Weighted average number of shares used in computing net income (loss) per share – basic | 16,321,131 | 16,270,403 | 16,304,913 | 16,255,263 | |||||||||||||

| – diluted | 16,345,749 | 16,270,403 | 16,332,485 | 16,255,263 | |||||||||||||

| SENSUS HEALTHCARE, INC. | |||||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||||

| As of September 30, | As of December 31, | ||||||||

| (in thousands, except shares and per share data) | 2024 | 2023 | |||||||

| (unaudited) | |||||||||

| Assets | |||||||||

| Current assets | |||||||||

| Cash and cash equivalents | $ | 22,558 | $ | 23,148 | |||||

| Accounts receivable, net | 16,961 | 10,645 | |||||||

| Inventories | 11,968 | 11,861 | |||||||

| Prepaid inventory | 1,723 | 2,986 | |||||||

| Other current assets | 1,596 | 888 | |||||||

| Total current assets | 54,806 | 49,528 | |||||||

| Property and equipment, net | 1,635 | 464 | |||||||

| Deferred tax asset | 2,197 | 2,140 | |||||||

| Operating lease right-of-use assets, net | 630 | 774 | |||||||

| Other noncurrent assets | 590 | 804 | |||||||

| Total assets | $ | 59,858 | $ | 53,710 | |||||

| Liabilities and stockholders’ equity | |||||||||

| Current liabilities | |||||||||

| Accounts payable and accrued expenses | $ | 3,973 | $ | 2,793 | |||||

| Product warranties | 351 | 538 | |||||||

| Operating lease liabilities, current portion | 200 | 187 | |||||||

| Income tax payable | – | 37 | |||||||

| Deferred revenue, current portion | 686 | 657 | |||||||

| Total current Liabilities | 5,210 | 4,212 | |||||||

| Operating lease liabilities, net of current portion | 451 | 596 | |||||||

| Deferred revenue, net of current portion | 66 | 60 | |||||||

| Total liabilities | 5,727 | 4,868 | |||||||

| Commitments and contingencies | |||||||||

| Stockholders’ equity | |||||||||

| Preferred stock, 5,000,000 shares authorized and none issued and outstanding | – | – | |||||||

| Common stock, $0.01 par value – 50,000,000 authorized; 16,930,845 issued and 16,390,051 outstanding at September 30, 2024; 16,907,095 issued and 16,374,171 outstanding at December 31, 2023 | 169 | 169 | |||||||

| Additional paid-in capital | 45,640 | 45,405 | |||||||

| Treasury stock, 540,794 and 532,924 shares at cost, at September 30, 2024 and December 31, 2023, respectively | (3,566 | ) | (3,519 | ) | |||||

| Retained earnings | 11,888 | 6,787 | |||||||

| Total stockholders’ equity | 54,131 | 48,842 | |||||||

| Total liabilities and stockholders’ equity | $ | 59,858 | $ | 53,710 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

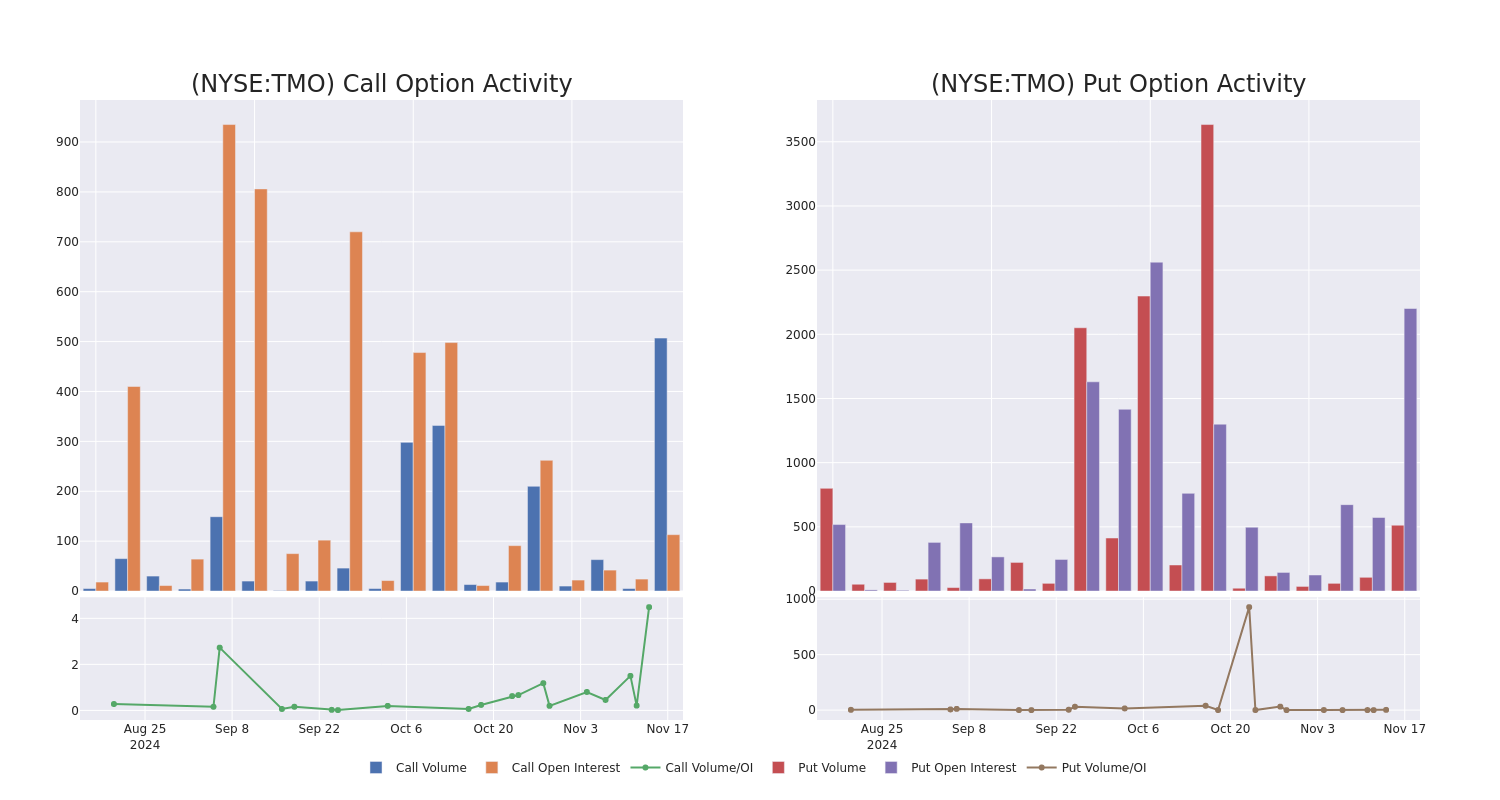

Check Out What Whales Are Doing With TMO

Financial giants have made a conspicuous bullish move on Thermo Fisher Scientific. Our analysis of options history for Thermo Fisher Scientific TMO revealed 12 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $638,204, and 6 were calls, valued at $1,331,814.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $520.0 to $610.0 for Thermo Fisher Scientific during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Thermo Fisher Scientific’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Thermo Fisher Scientific’s whale activity within a strike price range from $520.0 to $610.0 in the last 30 days.

Thermo Fisher Scientific Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | CALL | SWEEP | NEUTRAL | 01/15/27 | $98.2 | $98.0 | $98.0 | $540.00 | $588.0K | 3 | 101 |

| TMO | PUT | TRADE | BEARISH | 12/20/24 | $77.1 | $71.2 | $77.1 | $610.00 | $308.4K | 40 | 52 |

| TMO | CALL | SWEEP | BULLISH | 01/15/27 | $98.4 | $91.0 | $98.4 | $540.00 | $196.8K | 3 | 40 |

| TMO | CALL | SWEEP | BULLISH | 01/15/27 | $98.1 | $98.1 | $98.1 | $540.00 | $196.2K | 3 | 135 |

| TMO | CALL | SWEEP | BULLISH | 01/15/27 | $98.4 | $98.5 | $98.5 | $540.00 | $187.1K | 3 | 19 |

About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of mid-2024 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (11%); life science solutions (22%); and lab products and services, which includes CRO services (54%).

Following our analysis of the options activities associated with Thermo Fisher Scientific, we pivot to a closer look at the company’s own performance.

Thermo Fisher Scientific’s Current Market Status

- Trading volume stands at 1,042,301, with TMO’s price down by -0.94%, positioned at $536.79.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 76 days.

Expert Opinions on Thermo Fisher Scientific

In the last month, 5 experts released ratings on this stock with an average target price of $647.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Stifel persists with their Buy rating on Thermo Fisher Scientific, maintaining a target price of $665.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Thermo Fisher Scientific with a target price of $718.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Thermo Fisher Scientific, targeting a price of $610.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Thermo Fisher Scientific with a target price of $620.

* Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for Thermo Fisher Scientific, targeting a price of $622.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Thermo Fisher Scientific, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Selling: Bradley Pearce Unloads $111K Of Koppers Hldgs Stock

Bradley Pearce, Chief Accounting Officer at Koppers Hldgs KOP, disclosed an insider sell on November 13, according to a recent SEC filing.

What Happened: Pearce’s decision to sell 3,000 shares of Koppers Hldgs was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $111,570.

The latest market snapshot at Thursday morning reveals Koppers Hldgs shares down by 0.0%, trading at $37.92.

Delving into Koppers Hldgs’s Background

Koppers Holdings Inc through its subsidiaries, manufactures and sells wood products, wood treatment chemicals, and carbon compounds used in markets such as railroad, aluminum and steel, agriculture, utilities, and residential lumber. The company is organized into three business segments: railroad and utility products and services, performance chemicals, and carbon materials and chemicals. Its product portfolio includes treated and untreated wood products like crossties used in railroads, wood preservation chemicals, and carbon compounds such as creosote used in the treatment of wood crossties, among others. The majority of its revenue comes from the company’s railroad and utility products and services segment, and more than half of the company’s revenue is earned in the United States.

Koppers Hldgs: Financial Performance Dissected

Positive Revenue Trend: Examining Koppers Hldgs’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.71% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: With a high gross margin of 21.87%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Koppers Hldgs’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.12.

Debt Management: Koppers Hldgs’s debt-to-equity ratio surpasses industry norms, standing at 2.02. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 10.77 is lower than the industry average, implying a discounted valuation for Koppers Hldgs’s stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.38, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Koppers Hldgs’s EV/EBITDA ratio at 7.31 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Koppers Hldgs’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

60 Degrees Pharmaceuticals Announces Third Quarter 2024 Results

- Q3 2024 sales revenue increased 164% year-over-year to $135 thousand.

- Sequential (quarter-over-quarter) net product revenue growth of 8.3%.

- Gross profit increased from ($20 thousand) to $24 thousand.

WASHINGTON, Nov. 14, 2024 (GLOBE NEWSWIRE) — 60 Degrees Pharmaceuticals, Inc. SXTP SXTPW)) (the “Company”), a pharmaceutical company focused on developing new medicines for infectious diseases, reported today their financial results for the third fiscal quarter of the 2024 year, ended September 30, 2024.

Financial Highlights for the Quarter Ended September 30, 2024:

- A 140% increase in ARAKODA® pharmacy deliveries from 550 boxes (Q3 2023) to 1,319 boxes (Q3 2024) generated 164% in sales revenues from $51 thousand for the third quarter of 2023 to approximately $135 thousand for the third quarter of 2024.

- The Company achieved a gross profit of approximately $24 thousand in the third quarter of 2024, compared to an approximate gross loss of $20 thousand in the third quarter of 2023.

- Operating expenses were approximately $2.16 million in the third quarter of 2024, compared to approximately $1.58 million in the third quarter of 2023. The increase in operating expenses was primarily due to the delivery of $600,000 of research material previously paid for in stock prior to our initial public offering in July of 2023.

- Net loss attributable to common shareholders in the third quarter of 2024 was approximately $2.27 million, or ($0.93) per share, compared to a net income of approximately $4.09 million, or $9.13 per share in the third quarter of 2023, representing a $6.36 million decline. This decline is nearly entirely attributable to a change in the fair value of liabilities of $6.20 million in Q3 2023 to ($0.06) million in Q3 2024.

- A $4 million private placement priced at-the-market comprising common stock and associated warrants at $1.38 per share was concluded in September with net proceeds to support working capital, commercialization of ARAKODA (tafenoquine), and ongoing R&D efforts.

Business Highlights for the Quarter Ended September 30, 2024

- 60 Degrees Pharmaceuticals granted the University of Kentucky right of reference to the Company’s new drug application (NDA) for ARAKODA® (tafenoquine). The right of reference will allow FDA to review clinical efficacy and safety data, non-clinical data, and chemistry, manufacturing and controlled information on ARAKODA as the agency reviews protocols and new IND submissions related to the University of Kentucky SJ733 Phase IIb program.

- The Company was awarded a fixed-price contract with the United States Army Medical Materiel Development Activity to support commercial validation of new bottle and replacement blister packaging of ARAKODA® (tafenoquine).

- Ethics approval of an open label, expanded access study of the ARAKODA® regimen of tafenoquine in combination with standard of care regimens in immunosuppressed patients with persistent/relapsing babesiosis was granted in the third quarter of 2024.

- The Company signed clinical trial agreements with all planned trial sites for the Tafenoquine Babesiosis Study.

About 60 Degrees Pharmaceuticals, Inc.

60 Degrees Pharmaceuticals, Inc., founded in 2010, specializes in developing and marketing new medicines for the treatment and prevention of infectious diseases that affect the lives of millions of people. 60 Degrees Pharmaceuticals, Inc. achieved FDA approval of its lead product, ARAKODA® (tafenoquine), for malaria prevention, in 2018. 60 Degrees Pharmaceuticals, Inc. also collaborates with prominent research organizations in the U.S., Australia, and Singapore. The 60 Degrees Pharmaceuticals, Inc. mission has been supported through in-kind funding from the U.S. Department of Defense and private institutional investors including Knight Therapeutics Inc., a Canadian-based pan-American specialty pharmaceutical company. 60 Degrees Pharmaceuticals, Inc. is headquartered in Washington D.C., with a majority-owned subsidiary in Australia. Learn more at www.60degreespharma.com.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward‐looking statements reflect the current view about future events. When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward‐looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, activities of regulators and future regulations and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: there is substantial doubt as to our ability to continue on a going-concern basis; we might not be eligible for Australian government research and development tax rebates; if we are not able to successfully develop, obtain FDA approval for, and provide for the commercialization of non-malaria prevention indications for tafenoquine (ARAKODA® or other regimen) or Celgosivir in a timely manner, we may not be able to expand our business operations; we may not be able to successfully conduct planned clinical trials; and we have no manufacturing capacity which puts us at risk of lengthy and costly delays of bringing our products to market. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the information contained in our Annual Report on Form 10-K filed with the SEC on April 1, 2024, and our subsequent SEC filings. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at www.sec.gov. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, the Company’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Media Contact:

Sheila A. Burke

SheilaBurke-consultant@60degreespharma.com

(484) 667-6330

Investor Contact:

Patrick Gaynes

patrickgaynes@60degreespharma.com

(310) 989-5666

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

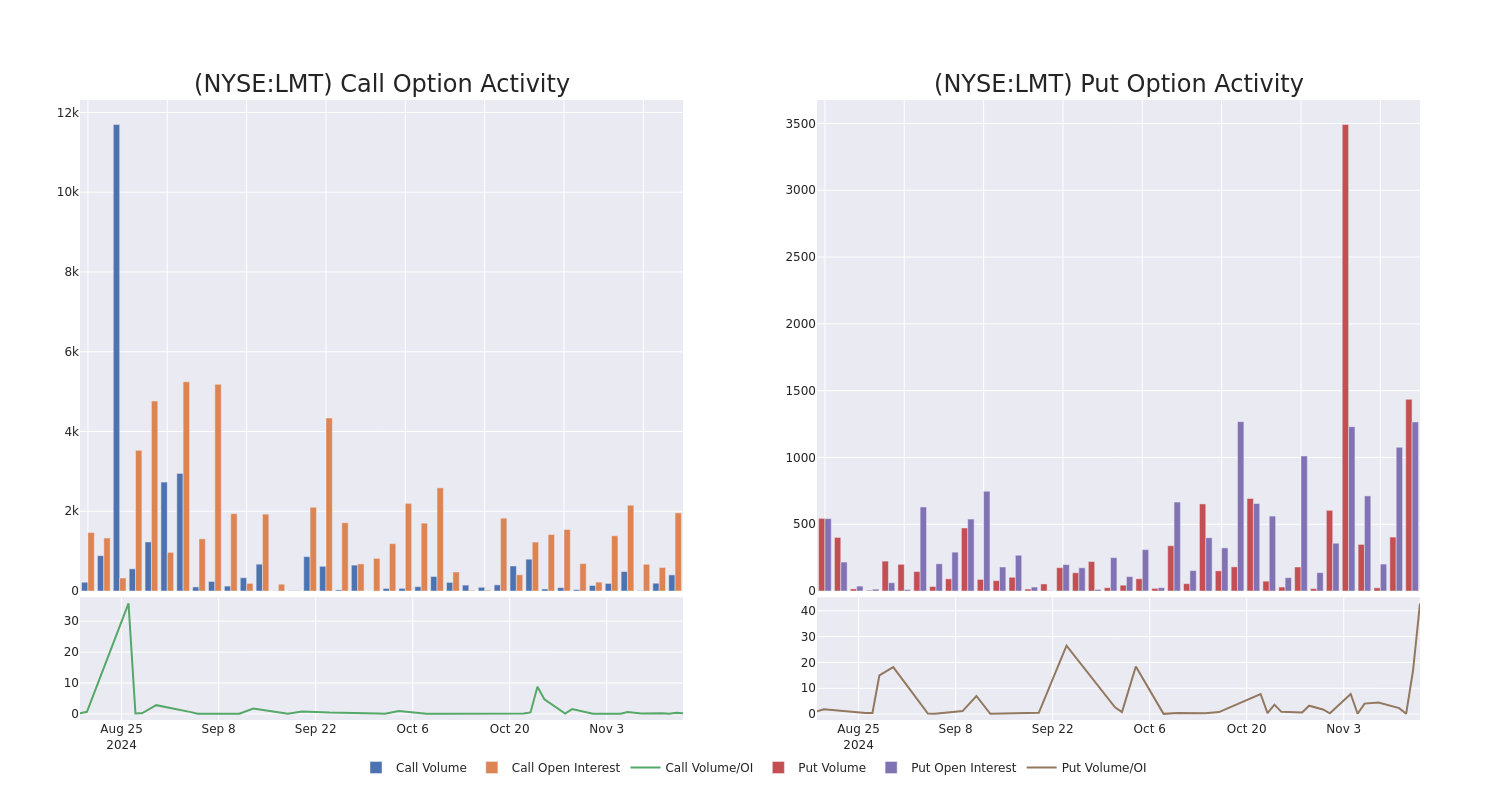

Looking At Lockheed Martin's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on Lockheed Martin. Our analysis of options history for Lockheed Martin LMT revealed 17 unusual trades.

Delving into the details, we found 23% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $701,289, and 4 were calls, valued at $318,390.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $485.0 to $590.0 for Lockheed Martin during the past quarter.

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Lockheed Martin stands at 201.56, with a total volume reaching 1,815.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lockheed Martin, situated within the strike price corridor from $485.0 to $590.0, throughout the last 30 days.

Lockheed Martin Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | PUT | SWEEP | NEUTRAL | 01/17/25 | $16.7 | $16.6 | $16.7 | $535.00 | $128.6K | 98 | 87 |

| LMT | CALL | TRADE | BEARISH | 01/16/26 | $47.5 | $46.0 | $46.0 | $570.00 | $115.0K | 274 | 25 |

| LMT | PUT | TRADE | BULLISH | 12/20/24 | $1.6 | $1.4 | $1.45 | $485.00 | $87.0K | 27 | 600 |

| LMT | CALL | SWEEP | NEUTRAL | 12/20/24 | $3.9 | $3.6 | $3.8 | $570.00 | $83.9K | 137 | 230 |

| LMT | PUT | TRADE | NEUTRAL | 01/17/25 | $20.4 | $19.7 | $20.1 | $540.00 | $70.3K | 339 | 48 |

About Lockheed Martin

Lockheed Martin is the world’s largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed’s largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed’s remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

Having examined the options trading patterns of Lockheed Martin, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Lockheed Martin

- Trading volume stands at 1,228,085, with LMT’s price down by -3.37%, positioned at $538.92.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 68 days.

Professional Analyst Ratings for Lockheed Martin

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $655.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from TD Cowen persists with their Buy rating on Lockheed Martin, maintaining a target price of $610.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Lockheed Martin with a target price of $695.

* An analyst from UBS has decided to maintain their Neutral rating on Lockheed Martin, which currently sits at a price target of $603.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Lockheed Martin with a target price of $665.

* An analyst from Susquehanna has decided to maintain their Positive rating on Lockheed Martin, which currently sits at a price target of $705.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lockheed Martin, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disney stock jumps as earnings, streaming profit, and guidance top estimates

Disney stock (DIS) popped on Thursday after the company reported fiscal fourth quarter earnings per share and revenue that topped Wall Street estimates and its direct-to-consumer business built on recent momentum and swung to a profit.

Strong guidance for the next two years also fueled investor optimism, sending shares up over 10% in early trading following the results. The stock pared gains slightly to just around 6% by late afternoon trade.

The media and experiences giant reported Q4 adjusted earnings of $1.14 per share, above the $1.10 expected by analysts polled by Bloomberg and higher than the $0.82 Disney reported in the prior-year period.

Revenue came in at $22.57 billion, outstripping consensus expectations for $22.47 billion as well as the $21.24 billion reported in the year-ago period.

Disney’s direct-to-consumer (DTC) streaming business — which includes Disney+, Hulu, and ESPN+ — posted operating income of $321 million for the three months ending Sept. 28. That compares to a loss of $387 million in the prior-year period.

Analysts polled by Bloomberg had expected DTC operating income to come in around $203 million after the company reached its first quarter of streaming profitability in its Q3 results.

Achieving consistent profits in streaming is critical for Disney and other media giants amid a growing shift by consumers to DTC services from traditional pay-TV packages.

In mid-October, the company hiked the price of its various subscription plans, highlighting a trend that has gained traction over the past year. With such moves, media companies are attempting to boost margins on direct-to-consumer (DTC) offerings in the face of rising declines in linear television.

Disney said Thursday that it expects DTC operating income of approximately $875 million in fiscal 2025.

On the earnings call, Disney CFO Hugh Johnston noted gains in streaming serve as a “natural hedge” against struggling linear networks, which saw revenue fall 6%, while operating income for the segment plunged 38% compared to the prior-year period.

Management warned linear networks are expected to continue to decline as more consumers abandon their cable packages.

The entertainment giant’s results come as it searches for a successor to current CEO Bob Iger to help it navigate a changing industry. A recent report from the Wall Street Journal said the pool of candidates is expanding, as the executive is set to leave Disney for a second time by the end of 2026.

Last month, Disney said it plans to announce its next CEO in early 2026, with current Disney board member and former Morgan Stanley (MS) CEO James Gorman leading the charge. He will serve as the company’s new chairman of the board, effective Jan. 2, 2025.

Stocks Lose Steam as Rally Goes Too Far, Too Fast: Markets Wrap

(Bloomberg) — Stocks lost traction following a furious post-election rally that spurred calls for a pause amid signs of buyer fatigue.

Most Read from Bloomberg

Equities fell from near all-time highs, with the S&P 500 pushing away from technically overbought levels. That’s after a surge that drove the benchmark gauge up 25% this year. Several measures highlight “stretched” trader optimism, including the latest figures from the American Association of Individual Investors, which showed a spike in bullish sentiment.

“The stock market is showing signs that it’s getting ‘tired’,” said Matt Maley at Miller Tabak + Co. “It wouldn’t surprise us at all if it saw a bit of a pullback over the very short-term or at least a further breather.”

In the run-up to Jerome Powell’s speech on Thursday, traders waded through economic data. US producer prices picked up, fueled in part by gains in portfolio management and other categories that feed into the Federal Reserve’s preferred inflation gauge. Applications for unemployment benefits fell to the lowest level since May.

“The question we have is whether Powell’s dovishness will reset the tone for higher long rates. On that question alone, we say ‘no for now’,” noted Andrew Brenner at NatAlliance Securities. “But he will continue to support Fed easing in the near term, and even that will have a limited effect.”

The S&P 500 dropped 0.3% to around 5,970. The Nasdaq 100 slipped 0.3%. The Dow Jones Industrial Average lost 0.2%. Automakers like Tesla Inc. and Rivian Automotive Inc. slumped as Reuters reported President-elect Donald Trump plans to eliminate the $7,500 consumer tax credit for electric-vehicle purchases. Walt Disney Co. jumped on a profit beat.

Treasury 10-year yields slid three basis points to 4.42%. The Bloomberg Dollar Spot Index wavered.

Equities lost steam after a strong post-election rally that reflected optimism that Trump’s agenda would support corporate growth.

To Jose Torres at Interactive Brokers, while the stock rally has been ferocious, investors see few reasons to sell before the shift in Washington control, which is widely viewed as positive for risk assets and the economy.

Investors seem reluctant to sell just yet, but caution is warranted, according to Fawad Razaqzada at City Index and Forex.com. The S&P 500 is clearly overbought by several metrics, signaling that a correction or consolidation may be due, he noted.