Disney's Streaming Profits And Park Rebound Lead The Way: Analyst

BofA Securities analyst Jessica Reif Ehrlich reiterated a Buy rating on Walt Disney Co DIS with a price target of $120.

Ehrlich maintained a positive outlook on Disney following its mixed fiscal fourth-quarter results, focusing on its guidance for fiscal 2025 and beyond.

Disney’s fiscal fourth-quarter revenue grew 6.3% year-over-year to $22.6 billion, slightly above Ehrlich’s forecast of $22.3 billion. Operating income (OI) increased by 16% to $3.66 billion but fell below her estimated $3.70 billion. Adjusted EPS came in at $1.14, surpassing the analyst’s forecast of $1.11.

By segment, Entertainment OI reached $1.07 billion ($1.06 billion expectations), while Sports OI came in lower at $929 million versus the estimated $966 million. Experiences OI matched the forecast at $1.7 billion.

Disney provided its initial guidance for fiscal 2025, targeting high single-digit growth in adjusted EPS, estimated between $5.26 and $5.41, up from the fiscal 2024 base of $4.97. Ehrlich expects double-digit OI growth in the Entertainment segment, 13% OI growth in Sports, and 6-8% growth in Experiences.

Also Read: Netflix Reaches 70 Million Users On Ad-Supported Plan, Boosts Live Sports Ads

The company aims for $15 billion in operating cash flow, with $8 billion allocated for capital expenditures, implying about $7 billion in free cash flow. Additionally, Disney plans to increase dividends in line with earnings growth and conduct $3 billion in share repurchases. For fiscal 2026 and 2027, Ehrlich forecasts double-digit EPS growth, driven by improved margins in the streaming segment and overall earnings expansion.

In the Entertainment division, Linear Networks OI was lower at $498 million, impacted by a decline in domestic revenue due to non-renewed carriage agreements and reduced advertising income. Conversely, Direct-to-Consumer (DTC) OI exceeded estimates, reaching $253 million, boosted by a net increase of 4.4 million Disney+ subscribers and higher subscription revenue from recent price hikes.

Content Sales and Licensing outperformed expectations with $316 million in OI, fueled by strong quarterly theatrical releases. Experiences revenue reached $8.24 billion, driven by 3% domestic growth, although international revenue declined by 5%. Ehrlich noted increased costs from inflation and technology investments, which slightly compressed margins.

The Sports segment reported flat year-over-year revenue of $3.91 billion, slightly below the $3.98 billion estimate. Operating income declined by 5.3% to $929 million due to lower affiliate revenue linked to decreased subscribers. Higher advertising revenue and increased programming costs partially offset this decline.

Ehrlich valued the stock at 22 times her calendar 2025 adjusted EPS estimate. The premium reflects Disney’s strong asset portfolio, including leading content and top-tier theme parks. Ehrlich pointed to two critical near-term catalysts: profitability improvements in the DTC segment and a recovery in the parks business, justifying the multiple valuations in line with Disney’s historical premium.

Walt Disney stock gained 21% year-to-date. Investors can gain exposure to the stock through The Communication Services Select Sector SPDR Fund XLC and SPDR Dow Jones Industrial Average ETF DIA.

Price Actions: DIS stock is up 6.45% at $109.34 at the last check on Thursday.

Image via Shutterstock

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CORRECTION – Elevai Labs Inc.

NEWPORT BEACH, Calif., Nov. 14, 2024 (GLOBE NEWSWIRE) — In a release earlier today by Elevai Labs Inc. ELAB, please note that in the headline and first paragraph, the financial results are from the company’s third fiscal quarter of 2024, not the second fiscal quarter as previously stated; as such, the header over the first bullet list should note the financial results as being from the three and nine months ended September 30, 2024, rather than the three and six months ended June 30, 2024 as previous stated. The corrected release follows:

Elevai Labs Inc. Reports Financial Results for the Third Fiscal Quarter of 2024 and Provides Business Update

- Achieves Robust Financial Performance with 74% Gross Margin and Strategic Public Offering, Bolstering Resources for Continued Growth and Innovation.

- Elevai Enfinity™ Clinical Trials Showcase Breakthroughs in Skin Firmness, Tone, and Wrinkle Reduction, Reinforcing Leadership in Aesthetic Innovation.

- Elevai Biosciences Expands Patent Portfolio with EL-22, a Myostatin-Targeting Treatment for Obesity, Addressing Muscle Preservation in Weight Management

Elevai Labs Inc. ELAB (“Elevai” or the “Company”), a pioneering force in medical aesthetics, today reported financial results for the third quarter ended September 30, 2024 and provided a business update.

Financial Results for the Three and Nine Months Ended September 30, 2024

- $8 Million Public Offering: Elevai raised $8 million in a successful public offering to capitalize the business and support its strategic growth initiatives.

- Revenue decreased by 4.9% to $527,478 for the three months ended September 30, 2024 compared to revenue for the three months ended September 30, 2023. Revenue increased by 72.3% to $1,747,570 for the nine months ended September 30, 2024 compared to revenue for the nine months ended September 30, 2023.

- Gross margins of 74.7% for the three months ended September 30, 2024, and 73.2% for the nine months ended September 30, 2024, compared to 66.0% for the three months ended September 30, 2023 and 66.4% for the nine months ended September 30, 2023.

- Operating expenses of $1,313,738 for the three months ended September 30, 2024, and $5,290,718 for the nine months ended September 30, 2024, compared to $1,151,696 for the three months ended September 30, 2023 and $3,358,152 for the nine months ended September 30, 2023.

- Net loss of $1,501,257 for the three months ended September 30, 2024 and $4,310,998 for the nine months ended September 30, 2024.

Elevai’s Chief Executive Officer and Chief Financial Officer, Graydon Bensler, stated: “Our third fiscal quarter was a period of meaningful and strategic progress for Elevai Labs and our subsidiaries, Elevai Skincare, Elevai Biosciences and Elevai Research. In this fiscal quarter we also strengthened our financial position with the successful completion of an $8 million public offering. We’re excited to continue building on this momentum as we head into the next fiscal quarter. We remain committed to identifying ways to drive value for both our customers and shareholders and are actively exploring strategic, value-driven acquisitions and potential spin out opportunities that we believe will create shareholder value.”

Operational Updates

Elevai Biosciences

- Preclinical Advancements for EL-22 in Obesity Treatment: Elevai Biosciences engaged KCRN Research, Inc., a renowned contract research organization, to support regulatory submissions for EL-22—a novel myostatin-targeting treatment for obesity. EL-22 aims to mitigate muscle loss, a common side effect of GLP-1 medications, by preserving muscle mass while reducing fat mass. This approach leverages EL-22’s novel myostatin pathway blockage, promising an innovative and complementary solution for the weight-loss market.

- Preclinical Data for EL-32: Additional studies validated EL-32, a myostatin/activin-A blocker, which has shown promise in improving grip strength, body composition, and motor function, further positioning Elevai to address muscle preservation needs in obesity. Based on the preclinical data from our licensing partner, Elevai believes that EL-32 has the potential to treat obesity in combination with GLP-1 by preserving muscle mass while decreasing fat mass. The Company intends to conduct additional animal studies to advance EL-32 towards an Investigational New Drug (IND) application. Full preclinical data is expected to be shared at a future scientific conference.

- Patent Filings for EL-22: Elevai Biosciences expanded its patent portfolio with filings for EL-22 as a myostatin-targeting treatment in obesity, reinforcing Elevai’s leadership in clinical innovation for muscle preservation in weight management.

Elevai Skincare

Product Innovation and Clinical Research

- Elevai Enfinity™ Clinical Study: A 12-week study of Elevai Enfinity™ showed improvements in skin firmness, tone, and wrinkle reduction, with full results to be published soon.

- Hair Restoration Research: Research led by Carly Klein confirmed Elevai’s exosome technology aids hair recovery by reducing inflammation and reversing miniaturization, supporting the launch of the new Elevai S-Series Root Renewal System™.

- Ongoing Clinical Study with Dr. Jennifer Pearlman: Elevai partnered with Dr. Pearlman to assess the combined effects of Elevai empower™ and Elevai enfinity™ exosome serums with an energy device, aiming to validate the benefits for skin rejuvenation over 12 weeks.

- Collaboration with Yuva Biosciences: Elevai’s partnership with Yuva Biosciences yielded the Elevai S-Series Root Renewal System™, integrating YuvaBio® Y100™ mitochondrial technology for hair and scalp vitality. BosleyMD® has lauded the Y100 technology as “one of the biggest innovations in hair loss we’ve seen in twenty-five years,” marking its first successful application in their new product line. Elevai Labs’ integration of this technology into the Elevai S-Series Root Renewal System™ is expected to set a new standard in hair care, offering a scientifically validated, easy-to-use, and cost-effective solution for both men and women.

Elevai Research

- Advancement in Exosome Technology: Elevai Research Inc. announced preliminary positive research data highlighting the potential of its proprietary exosome technology for skin health applications. The study, in partnership with Dalhousie University, identified over 800 proteins in Elevai’s exosomes associated with wound healing, immunomodulation, and extracellular matrix remodeling, suggesting their potential to counteract skin aging effects such as thinning, loss of elasticity, and wrinkle formation.

- Exosome Research Presentation: Michelle Combe from Dalhousie University presented research at the Precision Medicine EV Forum 2024 in Cambridge, UK, on exosome protein variability. The study, co-authored by Elevai’s Dr. Jordan Plews, explored how process conditions impact proteins linked to wound healing and immune function, advancing insights for skincare innovation

About Elevai Labs, Inc.

Elevai Labs Inc. ELAB specializes in medical aesthetics and biopharmaceutical drug development, focusing on innovations for skin aesthetics and treatments tied to obesity and metabolic health. The Company operates a diverse portfolio of three wholly owned subsidiaries across the medical aesthetics and biopharmaceutical sectors, Elevai Skincare Inc., Elevai Biosciences Inc., and Elevai Research Inc. For more information please visit www.elevailabs.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “believes,” “expects,” “plans,” “potential,” “would” and “future” or similar expressions such as “look forward” are intended to identify forward-looking statements. Forward-looking statements are made as of the date of this press release and are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, activities of regulators and future regulations and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results. Therefore, you should not rely on any of these forward-looking statements. These and other risks are described more fully in Elevai’s filings with the United States Securities and Exchange Commission (“SEC”), including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 29, 2024, and its other documents subsequently filed with or furnished to the SEC. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at www.sec.gov. All forward-looking statements contained in this press release speak only as of the date on which they were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

IR Contact:

IR@ElevaiLabs.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cronos CEO Mike Gorenstein Says He's Optimistic About Trump's Impact On Cannabis

Cronos group CEO Mike Gorenstein CRON says the cannabis industry should not rely solely on Democratic leadership for reform.

Instead, he says President-elect Donald Trump is personally more open to cannabis reform than Biden, but warned against expecting rapid changes, as cannabis won’t be a top priority for the new administration.

Trump vs. Biden: Cannabis Reform Expectations

In a recent appearance on Cultivated with Jay Rosenthal via X (formerly Twitter), Gorenstein shared his views on the political landscape following the November elections.

Despite poor market response to the results, Gorenstein remains optimistic. He pointed out the successes in red and purple states while acknowledging that traditional blue-state markets like California and Massachusetts are not the best examples of cannabis markets.

In the midst of the expectations created by Trump’s nomination of cannabis legalization supporter Matt Gaetz to his cabinet, Gorenstein advised caution about expecting significant changes in the near future, pointing out that while Trump might be more favorable, cannabis is unlikely to be a top priority for incoming administration.

“As far as timing, you can’t expect it to happen next year. There’s a lot of things that need to be done, and it’s not the primary issue,” he added.

Read Also: Trump Nominates Another Cannabis Supporter To Cabinet: Rep. Matt Gaetz For Attorney General

Focusing on Strategy, Not Stock Prices

Discussing Cronos’ approach, Gorenstein said the company does not need to issue more shares. Instead they are focusing on building a strong portfolio of high-quality cannabis products and expanding to global markets such as Germany.

The company is going through a good moment that reflects in the fact they are running low on product, and needing to invest on escalation of their current operations to catch up with the growing demand.

Still, prices cannabis stocks have been on a downtrend, but for Gorenstein, “you just get used to volatility… it’s a real mistake and a trap to follow stocks every day.”

Earnings Report Q3 2024

Recently Cronos Group reported Q3 2024 net revenue of $34.3 million, a 38% increase driven by stronger cannabis sales across Canada, Israel, and international markets.

Despite a net income turnaround to $7.3 million, adjusted EBITDA remained negative at $6 million.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Move-in Ready Homes Now Available at Toll Brothers at Willow in Punta Gorda, Florida

PUNTA GORDA, Fla., Nov. 14, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, is offering a limited number of move-in ready and quick move-in homes at its Toll Brothers at Willow community in Punta Gorda, Florida. This new construction community offers thoughtfully designed single-family homes in the amenity-rich Willow master plan.

Toll Brothers at Willow features a selection of modern home designs ranging from 1,918 to 2,992 square feet, with 3 to 4 bedrooms, 2 to 3.5 bathrooms, and 2- or 3-car garages. Home buyers can choose from one- and two-story floor plans that include popular design features such as flex rooms and beautiful covered lanais. Move-in ready homes in the community with Designer Appointed Features are available now and priced from $449,995.

“The move-in ready homes at Toll Brothers at Willow offer home buyers an exceptional combination of a prime location close to downtown Punta Gorda, outstanding amenities, and luxury home designs – all within a timeline that fits their needs,” said Tom Murray, Regional President of Toll Brothers in Florida. “With our distinctive architecture, quality craftsmanship, and Designer Appointed Features selected by a professional designer, we are offering home buyers the best in luxury living.”

Toll Brothers at Willow is situated within the beautiful Willow master-planned community, conveniently located near charming downtown Punta Gorda. This ideal community is close to everyday conveniences as well as destinations for recreation, shopping, and dining including Ponce de Leon Beach, Fishermen’s Village, and a range of outdoor activities and cultural experiences. Home buyers will also enjoy a future amenity center in the community featuring an outdoor pool, spa, fishing pond, and sport courts for pickleball and tennis.

The Toll Brothers at Willow Sales Center and model home is located at 11526 Willowleaf Boulevard in Punta Gorda, Florida. For more information on Toll Brothers at Willow and other Toll Brothers communities throughout Florida, call 844-551-2787 or visit TollBrothers.com/FL.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d9a96f25-68e7-40e2-97f1-b0716262527f

https://www.globenewswire.com/NewsRoom/AttachmentNg/973ae80d-87fa-4645-9eda-29df57f42885

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cisco Shares Are Dropping Today: What's Going On?

Cisco Systems, Inc. CSCO shares are trading lower Thursday following the release of the networking equipment company’s first-quarter fiscal 2025 results. Here’s what you need to know.

What To Know: Cisco reported revenue of $13.84 billion for the quarter, beating analyst estimates of $13.77 billion. Adjusted earnings per share came in at 91 cents, exceeding the expected 87 cents per share, according to Benzinga Pro. This marks the tenth consecutive quarter that Cisco has topped estimates for revenue and earnings.

Although Cisco beat analyst expectations, total revenue fell 6% year-over-year as product revenue declined 9%, and services revenue increased 6%. The company generated $3.7 billion in cash flow from operations, a 54% increase compared to the same quarter last year, and ended the period with $18.7 billion in cash and investments.

Looking ahead, Cisco anticipates fiscal second-quarter revenue between $13.75 billion and $13.95 billion, and adjusted earnings per share in the range of 89 cents to 91 cents. The company projects full-year 2025 revenue between $55.3 billion and $56.3 billion, and full-year adjusted earnings between $3.60 and $3.66 per share.

“Cisco is off to a strong start to fiscal 2025. Our customers are investing in critical infrastructure to prepare for AI, and with the breadth of our portfolio, we are uniquely positioned to capitalize on this opportunity,” said Chuck Robbins, chair and CEO of Cisco.

See Also: Disney Q4 Earnings: Revenue And Profit Beat, Best Film Studio Performance, 3-Year Outlook And More

Following the earnings report, multiple analysts raised price targets on Cisco stock.

- Piper Sandler maintained a Neutral and raised the price target from $52 to $57.

- Morgan Stanley maintained an Overweight and raised the price target from $58 to $62

- Barclays maintained an Equal-Weight and raised the price target from $49 to $56.

- Wells Fargo maintained an Equal-Weight and raises the price target from $57 to $60.

- BofA Securities maintained a Buy and raised the price target from $60 to $72.

CSCO Price Action: Cisco shares were down 2.14% at $57.90 at the time of writing, according to Benzinga Pro.

Read Next:

Image via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Campbell Soup Rao's Brand Growth Strong And US Sales Trend Improving, Analyst Upgrades Stock

Piper Sandler analyst Michael S. Lavery upgraded Campbell Soup Company CPB to Overweight from Neutral, raising the price forecast from $47 to $56.

The analyst upgraded Campbell Soup due to improved long-term growth prospects from its Rao’s brand and better sales trends in the U.S. (excluding SOVO brands).

Despite better trends, the stock has had a 15% pullback since mid-September. The analyst sees this as a good buying opportunity.

Lower steel costs (down 25%) and secured contracts for 2025 further support growth.

The analyst raised 2025 and 2026 earnings per share (EPS) estimates slightly, from $3.20 to $3.21 and $3.37 to $3.38, respectively.

Per the analyst, the stock is considered well-positioned among large-cap food stocks.

Also Read: What’s Going On With Ford Motor Stock Today?

Campbell Soup has agreed to sell its Noosa yogurt business for an undisclosed amount, with the deal expected to close in first quarter of 2025. The company acquired Noosa as part of its SOVO purchase in March 2024.

The analyst assumes the sale will be finalized on January 1, 2025, with proceeds of around $250 million.

Per the analyst, the divestiture is expected to reduce sales by approximately $177 million annually and will slightly lower F25 earnings per share (EPS) by $0.01.

However, this impact is expected to be more than offset by higher revenue growth expectations.

The analyst raised the 2025 EPS estimates from $3.20 to $3.21 and the 2026 EPS expectations from $3.37 to $3.38.

Price Action: CPB shares are trading higher by 1.16% to $44.79 at last check Thursday.

Photo via Wikimedia Commons

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Charles F. Willis IV Implements A Sell Strategy: Offloads $151K In Willis Lease Finance Stock

Charles F. Willis IV, Executive Chairman at Willis Lease Finance WLFC, executed a substantial insider sell on November 13, according to an SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that IV sold 700 shares of Willis Lease Finance. The total transaction amounted to $151,971.

At Thursday morning, Willis Lease Finance shares are up by 5.06%, trading at $210.0.

Discovering Willis Lease Finance: A Closer Look

Willis Lease Finance Corp with its subsidiaries is a lessor and servicer of commercial aircraft and aircraft engines. The company has two reportable business segments namely Leasing and Related Operations which involves acquiring and leasing, pursuant to operating leases, commercial aircraft, aircraft engines and other aircraft equipment and the selective purchase and resale of commercial aircraft engines and other aircraft equipment and other related businesses and Spare Parts Sales segment involves the purchase and resale of after-market engine parts, whole engines, engine modules and portable aircraft components. The company generates the majority of its revenue from leasing and related operations.

Key Indicators: Willis Lease Finance’s Financial Health

Revenue Growth: Willis Lease Finance’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 38.28%. This signifies a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Insights into Profitability:

-

Gross Margin: Achieving a high gross margin of 73.39%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Willis Lease Finance’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 3.51.

Debt Management: Willis Lease Finance’s debt-to-equity ratio surpasses industry norms, standing at 3.84. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Willis Lease Finance’s P/E ratio of 14.18 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 2.52 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 9.95 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Willis Lease Finance’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of Spectrum Brands Holdings's Earnings

Spectrum Brands Holdings SPB is set to give its latest quarterly earnings report on Friday, 2024-11-15. Here’s what investors need to know before the announcement.

Analysts estimate that Spectrum Brands Holdings will report an earnings per share (EPS) of $1.02.

Investors in Spectrum Brands Holdings are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

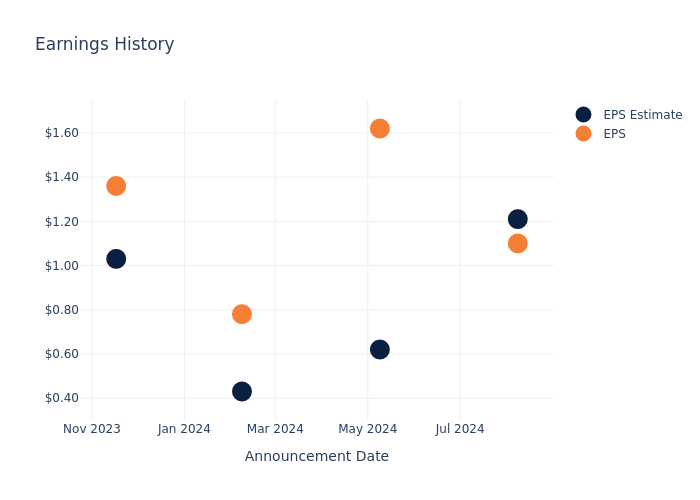

Earnings History Snapshot

In the previous earnings release, the company missed EPS by $0.11, leading to a 2.92% drop in the share price the following trading session.

Here’s a look at Spectrum Brands Holdings’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.21 | 0.62 | 0.43 | 1.03 |

| EPS Actual | 1.10 | 1.62 | 0.78 | 1.36 |

| Price Change % | -3.0% | 0.0% | -0.0% | -12.0% |

Market Performance of Spectrum Brands Holdings’s Stock

Shares of Spectrum Brands Holdings were trading at $93.7 as of November 13. Over the last 52-week period, shares are up 39.68%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.