Tower Semiconductor Analyst Raises Forecast On 'Aggressive AI-Levered Demand'

Tower Semiconductor Ltd TSEM tanked in trading on Thursday, after the company reported upbeat third-quarter results.

The company reported strong results and announced higher-than-expected guidance on “aggressive AI-levered demand,” according to Benchmark.

Analyst Cody Acree reiterated a Buy rating on Tower Semiconductor while raising the price target from $55 to $60.

The Tower Semiconductor Thesis: The company reported sales of $371 million and earnings of 57 cents per share, higher than consensus of $370 million and 53 cents per share, respectively, Acree said in the note.

Check out other analyst stock ratings.

Tower Semiconductor announced its December quarter revenues about $9 million higher than consensus on robust demand from “its broader RF (Radio Frequency) business, which includes both RF Mobile, RF SOI switches for the smartphone market, and RF Infrastructure demand for Data Center connectivity applications,” the analyst stated.

“With solid customer demand increasing for its SiGe and SiPho products for optical transceivers servicing AI Data Center applications, Tower is undertaking a new $350 million capacity expansion initiative, where it is planning to invest in multiple existing factories to significantly increase its ability to meet rapidly increasing customer forecasts,” he further wrote.

TSEM Price Action: Shares of Tower Semiconductor had declined by 4.81% to $46.09 at the time of publication on Thursday.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding Block's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Block. Our analysis of options history for Block SQ revealed 15 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $92,180, and 12 were calls, valued at $1,227,460.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $125.0 for Block over the last 3 months.

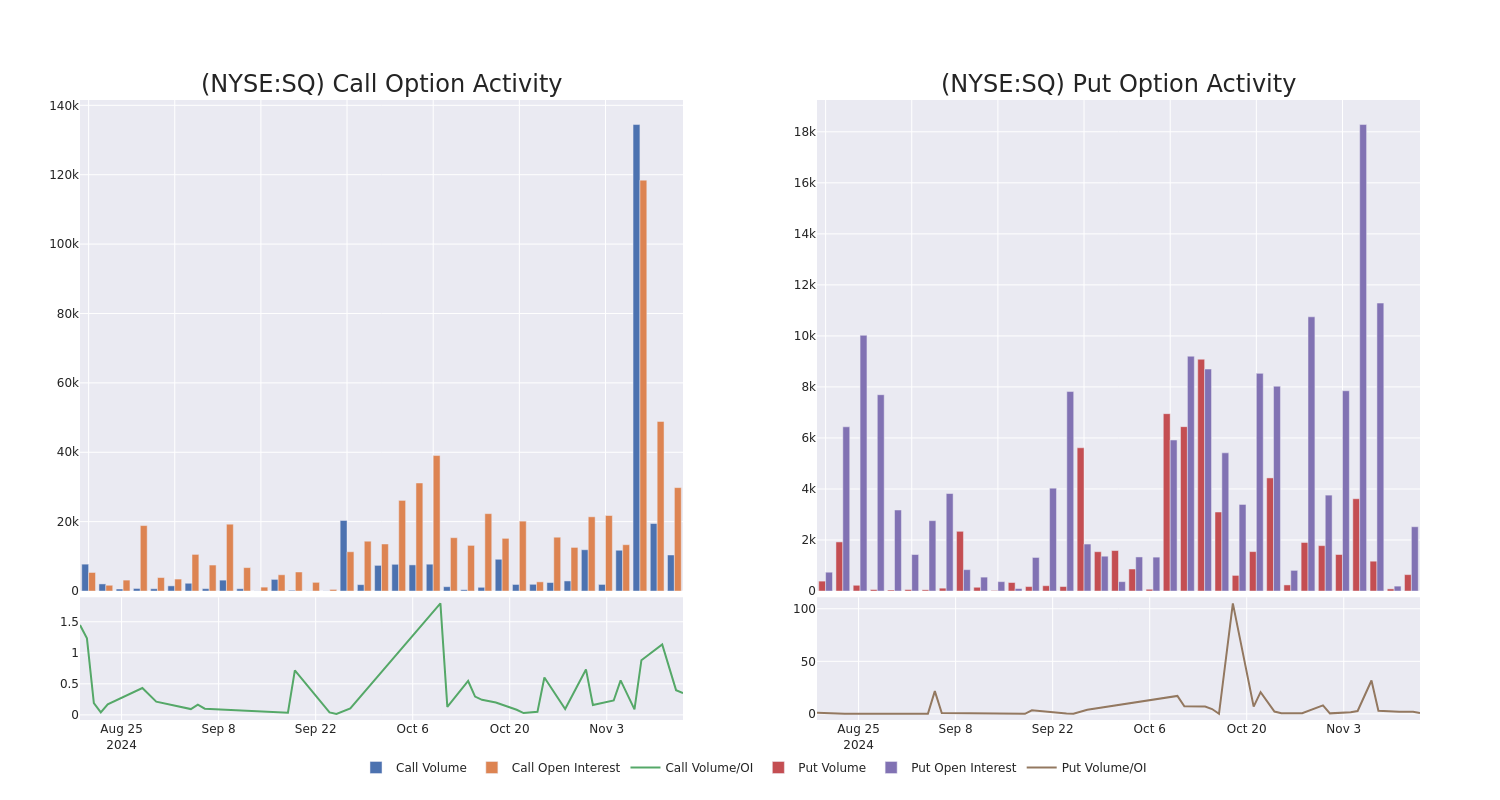

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block’s substantial trades, within a strike price spectrum from $70.0 to $125.0 over the preceding 30 days.

Block Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | TRADE | BEARISH | 01/17/25 | $13.65 | $13.45 | $13.45 | $72.50 | $402.1K | 2.3K | 306 |

| SQ | CALL | SWEEP | BEARISH | 12/20/24 | $2.36 | $2.25 | $2.36 | $90.00 | $202.4K | 3.7K | 1.1K |

| SQ | CALL | TRADE | NEUTRAL | 11/22/24 | $0.27 | $0.23 | $0.25 | $93.00 | $160.6K | 7.3K | 6.7K |

| SQ | CALL | SWEEP | BULLISH | 01/15/27 | $13.55 | $13.45 | $13.55 | $125.00 | $135.5K | 341 | 111 |

| SQ | CALL | SWEEP | BEARISH | 12/20/24 | $15.5 | $15.25 | $15.35 | $70.00 | $75.1K | 2.7K | 51 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square’s payment volume was a little over $200 million.

In light of the recent options history for Block, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Block’s Current Market Status

- Currently trading with a volume of 5,295,109, the SQ’s price is down by -2.13%, now at $83.99.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 98 days.

Professional Analyst Ratings for Block

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $92.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Block with a target price of $90.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $88.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Block, targeting a price of $120.

* In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $83.

* An analyst from Keefe, Bruyette & Woods has decided to maintain their Market Perform rating on Block, which currently sits at a price target of $80.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Block with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inter&Co Inc. Reports Another Record Net Income of R$260M, And Remains On Track On Its Long-Term Plan

MIAMI, Nov. 14, 2024 (GLOBE NEWSWIRE) — Inter&Co Inc. INTR B3: INBR32)), the leading financial super app providing financial and digital commerce services to over 34.9 million customers, today reported financial results for the third quarter of 2024.

Highlights:

- Record Net Income of R$ 260 million ($52 million USD).

- Total Payment Volume (TPV) of R$ 320 million ($64 million USD), up 46% YoY, a R$ 1.2 trillion Run Rate.

- Total Net Revenue of R$ 1.7 billion ($340 million USD), up 32% YoY.

- Net Interest Margin of 9.6%, up from 9.2% last quarter.

- ROE of 11.9%, up 6.2 p.p. YoY.

- 34.9 million clients, with 1.1 million net new active clients, totaling 19.5 million active clients.

Figures in USD have been converted with the USD BRL rate of 1 USD = 5.00 BRL as of Tuesday, November 12 at 9:00 am ET. Exchange rates can fluctuate.

João Vitor Menin, Global CEO of Inter&Co, commented:

“We had a solid third quarter, reporting increased profitability and growth in both fee and interest income. Our focus on executing the 60/30/30 plan by increasing market share and product penetration, while we maintain efficiency gains is paying off.”

“We are constantly innovating, enhancing our super app with new features and hyper-personalizing the client experience. And our clients are rewarding us with more deposits and increased engagement, boosting our revenues. In addition to that, our sound capital allocation strategy has ensured that as our deposits have grown, so has our net interest margin.”

He added, “We are building an increasingly diversified and resilient business, and I’m confident in our ability to continue delivering value to our clients and shareholders in the years to come.”

Conference Call

Inter&Co will discuss its 3Q2024 financial results on November 14th, 2024, at 01 p.m. ET. The webcast details, along with the earnings materials can be accessed on the company’s Investor Relations website at https://investors.inter.co/en/.

About Inter&Co

Inter&Co INTR, the company that controls Banco Inter in Brazil and the subsidiary Inter&Co Payments, is the pioneering financial super app serving over 35 million customers across the Americas. The Inter ecosystem offers a broad array of services, including banking, investments, mortgages, credit, insurance, and cross-border payments. The financial super app also boasts a dynamic marketplace, linking consumers with shopping discounts, cashback rewards, and exclusive access to marquee events across the globe. Focused on innovation and captivating member experiences, Inter&Co delivers comprehensive financial and lifestyle solutions to meet the evolving needs of modern consumers.

Investor Relations:

Rafaela de Oliveira Vitória

ir@inter.co

Media Relations:

Kaio Philipe

kaio.philipe@inter.co

Chemistry Agency

interco@chemistryagency.com

Disclaimer

This report may contain forward-looking statements regarding Inter, anticipated synergies, growth plans, projected results and future strategies. While these forward-looking statements reflect our Management’s good faith beliefs, they involve known and unknown risks and uncertainties that could cause the company’s results or accrued results to differ materially from those anticipated and discussed herein. These statements are not guarantees of future performance. These risks and uncertainties include, but are not limited to, our ability to realize the number of projected synergies and the projected schedule, in addition to economic, competitive, governmental and technological factors affecting Inter, the markets, products and prices and other factors. In addition, this presentation contains managerial figures that may differ from those presented in our financial statements. The calculation methodology for these managerial numbers is presented in Inter’s quarterly earnings release. Statements contained in this report that are not facts or historical information may be forward looking statements under the terms of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may, among other things, beliefs related to the creation of value and any other statements regarding Inter. In some cases, terms such as “estimate”, “project”, “predict”, “plan”, “believe”, “can”, “expectation”, “anticipate”, “intend”, “aimed”, “potential”, “may”, “will/shall” and similar terms, or the negative of these expressions, may identify forward looking statements.

These forward-looking statements are based on Inter’s expectations and beliefs about future events and involve risks and uncertainties that could cause actual results to differ materially from current ones. Any forward-looking statement made by us in this document is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether because of new information, future developments or otherwise. The definition of each such operational metric is included in the earnings release available on our Investor Relations website.

For additional information that about factors that may lead to results that are different from our estimates, please refer to sections “Cautionary Statement Concerning Forward Looking Statements” and “Risk Factors” of Inter&Co Annual Report on Form 20-F. The numbers for our key metrics (Unit Economics), which include, among other, active clients and average revenue per active client (ARPAC), are calculated using Inter’s internal data. Although we believe these metrics are based on reasonable estimates, there are challenges inherent in measuring the use of our business. In addition, we continually seek to improve our estimates, which may change due to improvements or changes in methodology, in processes for calculating these metrics and, from time to time, we may discover inaccuracies and adjust to improve accuracy, including adjustments that may result in recalculating our historical metrics.

About Non-IFRS Financial Measures

To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Inter&Co also presents non-IFRS measures of financial performance, as highlighted throughout the documents. The non-IFRS Financial Measures include, among others: Adjusted Net Income, Cost of Funding, Efficiency Ratio, Cost of Risk, Cards+PIX TPV, Gross ARPAC, Global Clients, Total Gross Revenues, and Return on average equity (ROE).

A “non-IFRS financial measure” refers to a numerical measure of Inter&Co’s historical or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Inter&Co’s financial statements. Inter&Co provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered together with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Inter&Co’s performance to that of other companies.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

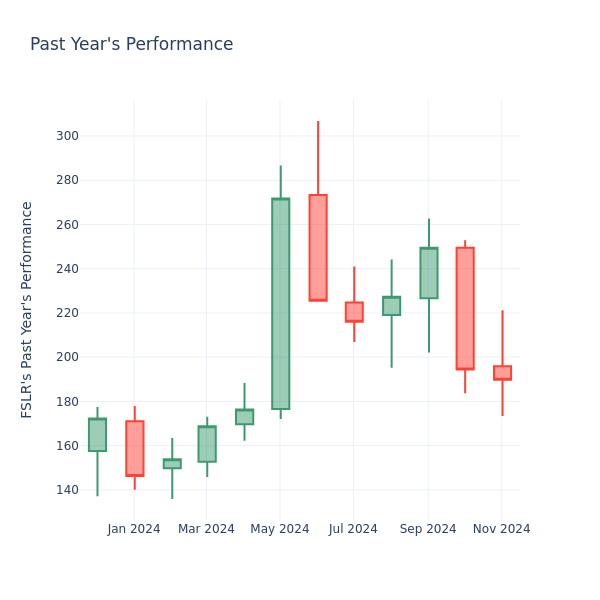

P/E Ratio Insights for First Solar

In the current market session, First Solar Inc. FSLR share price is at $185.90, after a 2.07% increase. Moreover, over the past month, the stock decreased by 6.68%, but in the past year, went up by 22.43%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

A Look at First Solar P/E Relative to Its Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Compared to the aggregate P/E ratio of the 63.99 in the Semiconductors & Semiconductor Equipment industry, First Solar Inc. has a lower P/E ratio of 15.69. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Table Trac, Inc. Reports 2024 Third Quarter Earnings

MINNETONKA, Minn., Nov. 14, 2024 (GLOBE NEWSWIRE) — Table Trac, Inc. TBTC, a developer and provider of casino information and management systems that automate and monitor the operations of casinos, announced financial results for the three and nine months ending September 30, 2024.

The 10-Q can be found @ http://www.sec.gov

Third Quarter 2024 Highlights

- The Company installed two systems.

- The Company had five installations in backlog as of September 30, 2024. The company anticipates that the majority of these contracts will be installed in the fourth quarter. As of the filing date of this report, the Company has signed one new contract.

Financial Results

Total revenue for the nine months ending September 30, 2024, was $8M compared to $6.6M in 2023, an increase of approximately 22%.

Gross profit for the three months ending was $1.8M as compared to $1.4M in 2023.

The following table provides a reconciliation of the numerators and denominators used in calculating basic and diluted earnings per share for the three months ended September 30, 2024 and 2023:

| For the Three Months Ended | ||||||||

| September 30, | ||||||||

| 2024 |

2023 |

|||||||

| Basic and diluted earnings per share calculation: | ||||||||

| Net income | $ | 292,379 | $ | 171,988 | ||||

| Weighted average number of common shares outstanding – basic | 4,575,068 | 4,552,988 | ||||||

| Basic net income per share | $ | 0.06 | $ | 0.04 | ||||

| Weighted average number of common shares outstanding – diluted | 4,622,938 | 4,606,488 | ||||||

| Diluted net income per share | $ | 0.06 | $ | 0.04 | ||||

The following table provides a reconciliation of the numerators and denominators used in calculating basic and diluted earnings per share for the nine months ended September 30, 2024 and 2023:

| For the nine Months Ended | ||||||||

| September 30, | ||||||||

| 2024 |

2023 |

|||||||

| Basic and diluted earnings per share calculation: | ||||||||

| Net income to common stockholders | $ | 1,110,610 | $ | 1,079,239 | ||||

| Weighted average number of common shares outstanding – basic | 4,575,068 | 4,552,481 | ||||||

| Basic net income per share | $ | 0.24 | $ | 0.24 | ||||

| Weighted average number of common shares outstanding – diluted | 4,621,840 | 4,610,786 | ||||||

| Diluted net income per share | $ | 0.24 | $ | 0.23 | ||||

About Table Trac, Inc.

Founded in 1995, Table Trac, Inc. develops, sells and leases information and management systems and provides technical support to casinos. The open architecture of CasinoTrac is designed to provide operators with a secure, scalable, and flexible system that interconnects and operates with most third-party software and hardware. Key products and services include modules that drive player tracking programs, kiosk promotions, and provide vault and cage controls. The Company’s systems are designed to meet strict auditing, accounting and regulatory requirements applicable to the gaming industry.

Additionally, the Company has developed a patented, real-time system that automates and monitors the operations of casino gaming tables.

The Company’s suite of management systems and kiosks are installed with on-going support and maintenance contracts in over 115 casino operators in over 300 casinos worldwide. The Company continues to increase its market share by expanding its product offerings to include new system features, and ancillary products. More information is available at http://www.tabletrac.com/.

Forward Looking Statements

This press release contains forward-looking statements that involve numerous risks and uncertainties. Actual results, performance or achievements could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those set forth in the Company’s filings with the Securities and Exchange Commission.

For more information:

Randy Gilbert, CFO

Table Trac, Inc.

952-548-8877

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JPMorgan Chase Unusual Options Activity For November 14

Investors with a lot of money to spend have taken a bullish stance on JPMorgan Chase JPM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with JPM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 16 uncommon options trades for JPMorgan Chase.

This isn’t normal.

The overall sentiment of these big-money traders is split between 50% bullish and 25%, bearish.

Out of all of the special options we uncovered, 8 are puts, for a total amount of $302,243, and 8 are calls, for a total amount of $826,893.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $205.0 to $260.0 for JPMorgan Chase during the past quarter.

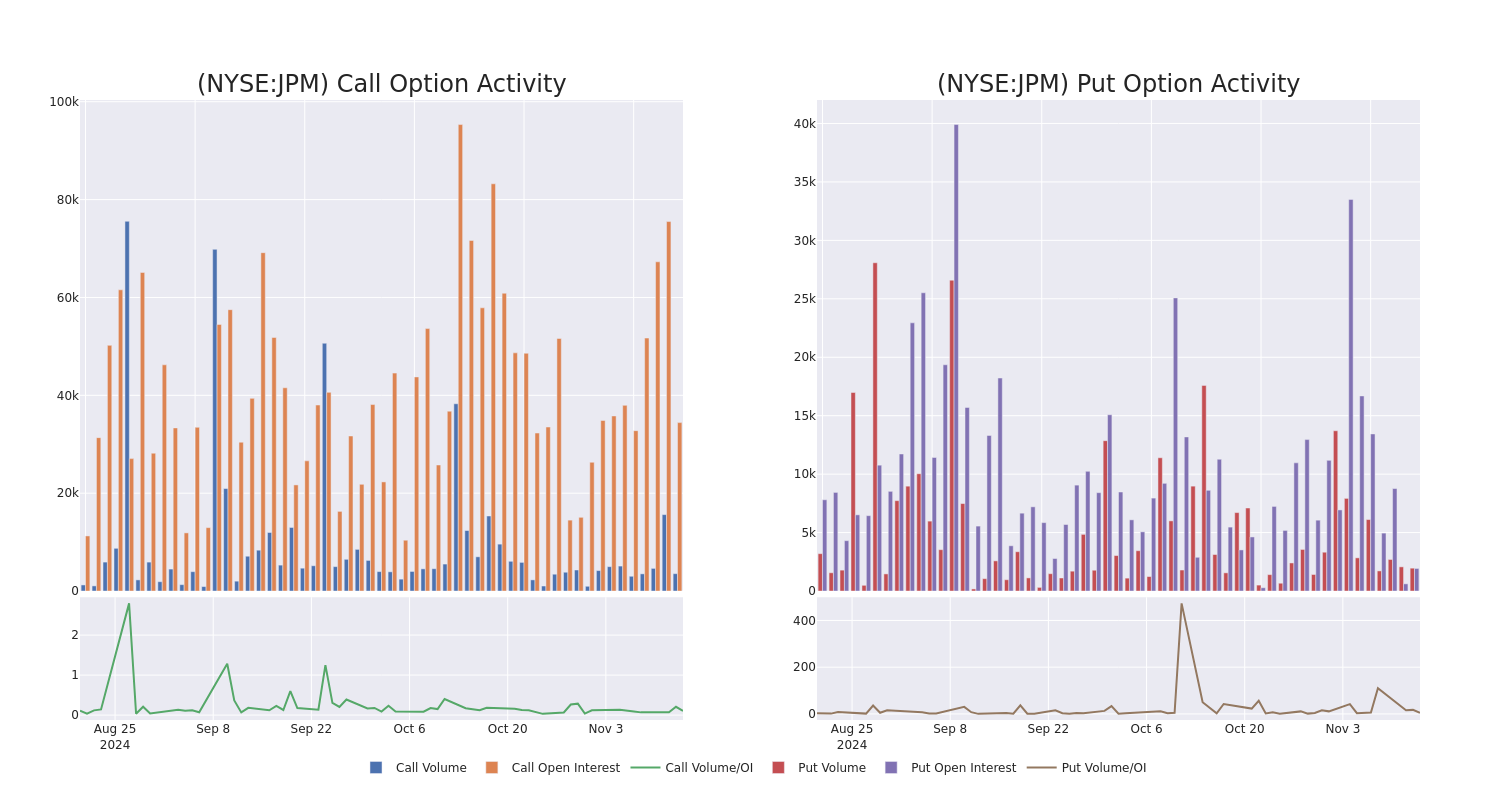

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of JPMorgan Chase stands at 3029.5, with a total volume reaching 5,510.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in JPMorgan Chase, situated within the strike price corridor from $205.0 to $260.0, throughout the last 30 days.

JPMorgan Chase Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | SWEEP | BEARISH | 11/15/24 | $8.1 | $8.0 | $8.0 | $235.00 | $292.8K | 7.5K | 402 |

| JPM | CALL | SWEEP | BEARISH | 01/17/25 | $3.5 | $3.4 | $3.44 | $260.00 | $183.9K | 4.9K | 548 |

| JPM | CALL | SWEEP | BULLISH | 12/20/24 | $4.25 | $4.2 | $4.25 | $250.00 | $104.9K | 6.1K | 321 |

| JPM | CALL | TRADE | BULLISH | 11/15/24 | $13.85 | $12.7 | $13.55 | $230.00 | $101.6K | 5.9K | 103 |

| JPM | PUT | SWEEP | NEUTRAL | 01/17/25 | $9.55 | $9.4 | $9.48 | $245.00 | $50.2K | 296 | 158 |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments–consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

Following our analysis of the options activities associated with JPMorgan Chase, we pivot to a closer look at the company’s own performance.

Present Market Standing of JPMorgan Chase

- With a trading volume of 3,621,824, the price of JPM is up by 0.35%, reaching $242.01.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 62 days from now.

Expert Opinions on JPMorgan Chase

In the last month, 1 experts released ratings on this stock with an average target price of $241.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Oppenheimer has decided to maintain their Outperform rating on JPMorgan Chase, which currently sits at a price target of $241.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JPMorgan Chase options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cummins Director Sold $1.77M In Company Stock

Disclosed on November 13, Bruno Allen Leo Di V, Director at Cummins CMI, executed a substantial insider sell as per the latest SEC filing.

What Happened: V’s decision to sell 4,945 shares of Cummins was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $1,773,081.

The latest update on Thursday morning shows Cummins shares down by 0.61%, trading at $364.1.

Unveiling the Story Behind Cummins

Cummins is the top manufacturer of diesel engines used in commercial trucks, off-highway machinery, and railroad locomotives, in addition to standby and prime power generators. The company also sells powertrain components, which include transmissions, turbochargers, aftertreatment systems, and fuel systems. Cummins is in the unique position of competing with its primary customers, heavy-duty truck manufacturers, who make and aggressively market their own engines. Despite robust competition across all its segments and increasing government regulation of carbon emissions, Cummins has maintained its leadership position in the industry.

Key Indicators: Cummins’s Financial Health

Revenue Growth: Cummins displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 0.3%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: The company sets a benchmark with a high gross margin of 25.67%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Cummins’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 5.9.

Debt Management: With a below-average debt-to-equity ratio of 0.79, Cummins adopts a prudent financial strategy, indicating a balanced approach to debt management.

Market Valuation:

-

Price to Earnings (P/E) Ratio: Cummins’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 23.99.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 1.5 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 12.63, Cummins demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes Worth Your Attention

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Cummins’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Education Plan®: Invest In Education During November's American Education Week

Santa Fe, NM, Nov. 14, 2024 (GLOBE NEWSWIRE) — American Education Week is November 18–22, first celebrated over 100 years ago with the aim to create awareness about the need for education. As we reflect upon and celebrate the role of education and schooling, it’s an ideal time to open or contribute to a 529 education savings plan, an investment in families’ education. 529 education savings plans are tax-advantaged savings plans intended to help make education more affordable or attainable for families. As the costs of education continue to grow, a 529 education savings plan can be a valuable tool.

Higher education has consistently been shown to boost earning potential. According to the U.S. Bureau of Labor Statistics, people who have obtained at least a bachelor’s degree typically earn over 25% more per week than those with only a high school diploma and are employed at a rate that’s nearly double that of their less educated counterparts.

The impact of postsecondary education goes far beyond earnings, as well. An article by Inside Higher Ed, citing a report by the Lumina Foundation and Gallup, notes individuals who attend a higher education institution reported that they are in good health and civically engaged at rates that surpass people with no postsecondary education. Similarly, a Forbes article looks at a poll by ResumeNow where 85% and 83% of respondents with postsecondary degrees expressed more self-confidence and more power to follow their career aspirations, respectively.

“Pursuing higher education can lead to a path of personal and financial fulfillment,” said Natalie Cordova, Executive Director of the New Mexico Education Trust Board, the organization that administers The Education Plan®. “Investing in a 529 plan is a great way to help your family achieve their higher education goals in a way that’s attainable and flexible.”

Funds in a tax-advantaged 529 education savings plan can be used to pay for a wide variety of qualified expenses. Qualified expenses include tuition, room and board, books, supplies, and more at eligible institutions nationwide. The funds in a 529 plan aren’t limited to just traditional four-year colleges. Families can also use the savings to pay for K–12 tuition (up to $10,000 per year), vocational training and even registered apprenticeships. 529 plan withdrawals for qualified expenses are not subject to federal income tax and account earnings are tax free.

Friends and relatives can also make gift contributions to a loved one’s 529 savings plan through a one-time gift or a recurring contribution.

“American Education Week is the perfect time to learn more about the benefits of a 529 education savings plan,” said Cordova. “The gift of education can be made at any time during the year, including in celebration of American Education Week. I encourage everyone to consider making a gift to a 529 plan.”

For more information or to open an account, visit www.TheEducationPlan.com.

Joanie Griffin The Education Plan 505-261-4444 jgriffin@sunny505.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.