Survey shows uptick in home renovation projects, but insurance coverage still lags

Though homeowners are making big investments in these projects, more than half have yet to update their insurance policies to protect their upgrades

COLUMBUS, Ohio, Nov. 14, 2024 /PRNewswire/ — As the housing market continues to evolve and mortgage rates remain elevated, many U.S. homeowners are choosing to invest in their current properties rather than enter the uncertain market for a new home. New data from Nationwide shows that many are opting instead to invest in home renovations, repairs, and other upgrades to meet their needs. According to Nationwide’s most recent Homeowners Survey, 51% of homeowners say they have completed a major home renovation project within the past two years.

Empty Nesters Spending Big on Home Renovations

While share of empty nesters undertaking home renovations is similar to that of general U.S. homeowners, empty nesters are spending significantly more on these projects. The survey revealed that they spent an average of $8,670 on home renovations compared to $5,128 for the typical homeowner. They are also investing in more large-scale projects, outspending general homeowners on kitchen remodels and full home renovations.

A comparison of renovation spending by project type:

- Kitchen remodels: U.S. Homeowners – $9,702 average; Empty Nesters – $18,672 average

- Full home renovations: U.S. Homeowners – $36,900 average; Empty Nesters – $90,000 average

- Window replacements: U.S. Homeowners – $4,917 average; Empty Nesters – $15,375 average

“A complex housing market has many homeowners reconsidering plans to sell. For empty nesters, that means upgrading their current homes to meet their needs in the next life stage, rather than relocating,” said Casey Kempton, Nationwide’s President of P&C Personal Lines. “Unfortunately, our research shows that homeowners often overlook necessary policy adjustments after significant renovations, potentially leaving them underinsured in the event of a catastrophe. Every homeowner should review their home insurance coverage with their independent insurance agent regularly to avoid potential gaps.”

Homeowners Confident in Their DIY Abilities

Three in four homeowners cite high costs as a key challenge when seeking contractors for home maintenance work and less than half of homeowners found it easy to find reputable contractors. In this environment, more homeowners are tackling significant DIY projects. The survey revealed that while most homeowners still prefer professional help for major renovations, 38% have taken on projects typically reserved for experts, like kitchen remodels or even home additions.

Top DIY Projects Among Homeowners:

- Basement renovations: 43%

- Front door replacements: 41%

- Bathroom remodels: 39%

- Kitchen remodel: 38%

- Full-home remodel / “gut” renovation: 36%

- Home addition (e.g., additional rooms, separate garage, etc.): 35%

“Although DIY can be an empowering choice, it also introduces risks that may compromise home safety and insurability. Homeowners may not realize that taking on complex projects themselves could impact their insurance,” Kempton noted. “While DIY projects might save on upfront costs, mistakes could lead to safety issues and unexpected expenses. We always recommend consulting with an insurance agent before diving into any major DIY renovation to ensure that all potential risks are covered.”

Interestingly, while almost all homeowners say they rely on the internet for DIY advice, there’s a generational split in how they gather information. Empty nesters are less likely to use social media for project tips—38% of empty nesters compared to 48% of U.S. homeowners overall—relying more on other online resources.

Agents as Partners in Home Projects

Renovations are a significant investment, and updating insurance coverage to reflect these changes is crucial. Yet, the survey found that 55% of homeowners who completed major renovations in the past two years have not adjusted their insurance policies, leaving themselves at risk of being underinsured.

Insurance agents can be a valuable home renovation partner—not just for updating coverage afterward but also in the planning phase. Many agents are well-connected in their local communities, with 76% of agents surveyed saying they often recommend trusted contractors to clients planning major projects. Homeowners who partner with agents early can benefit from smoother project execution and the peace of mind that their insurance fully covers their upgraded home.

As renovations become more common, it is vital for homeowners to work with agents to review and update coverage to avoid gaps particularly following home renovations and unexpected financial hardships should disaster strike. They can avoid costly surprises by ensuring their policy reflects the full scope of their upgrades.

Survey Methodology

Nationwide commissioned Edelman Data & Intelligence to conduct a 15-minute quantitative online survey among a sample of 1,000 adult U.S. homeowners, 400 independent insurance agents, and 131 empty nesters, identified as married or partnered U.S. homeowners aged 50 or older with a primary residence value of $500,000–$750,000, with no children living in the home and have homeowners and auto insurance, between June 24 and July 12, 2024. As a member in good standing with The Insights Association as well as ESOMAR Edelman Data and Intelligence conducts all research in accordance with local, national and international laws as well as in line with all Market Research Standards and Guidelines.

About Nationwide

Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified financial services and insurance organizations in the United States. Nationwide is rated A+ by Standard & Poor’s. An industry leader in driving customer-focused innovation, Nationwide provides a full range of insurance and financial services products including auto, business, homeowners, farm and life insurance; public and private sector retirement plans, annuities and mutual funds; excess & surplus, specialty and surety; and pet, motorcycle and boat insurance.

For more information, visit www.nationwide.com.

Subscribe today to receive the latest news from Nationwide and follow Nationwide PR on X.

Nationwide, Nationwide is on your side and the Nationwide N and Eagle are service marks of Nationwide Mutual Insurance Company. © 2024

Contact:

Lyndsey Kleven

(614) 249-6349

KLEVEL1@nationwide.com

Subscribe to Nationwide News

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/survey-shows-uptick-in-home-renovation-projects-but-insurance-coverage-still-lags-302305936.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/survey-shows-uptick-in-home-renovation-projects-but-insurance-coverage-still-lags-302305936.html

SOURCE Nationwide

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IM Cannabis: 66% Revenue Growth In Germany, Narrows EBITDA Loss In Q3

International medical cannabis company IM Cannabis Corp. IMCC IMCC announced its financial results on Thursday for the third quarter ended Sept. 30, 2024.

The company reported revenue from Germany grew 66% year-over-year, reaching CA$5.8 million ($4.1 million).

“While the 66% growth we delivered in Germany, to reach $5.8M this quarter is a highlight, we spent the quarter focused on building a solid foundation for 2025,” said CEO Oren Shuster. “Our goal was to build a strong, consistent supply chain, along with a laser focus on how to improve the efficiency and accuracy of how we use our resources. I believe that the foundation we built this quarter will be the basis we will use to deliver in 2025.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 Financial Highlights

- Revenue increased by 12% year-over-year to CA$13.9 million, compared to CA$12.4 million in the third quarter of 2023.

- Gross profit was CA$3.1 million, up from CA$2.6 million in the prior year’s period.

- Selling and marketing expenses dropped by 41% over the same period to CA$1.5 million.

- Total operating expenses fell by 16% year-over-year to CA$4.1 million.

- EBITDA loss narrowed by 68% over the period, from a loss of CA$1.6M in the third quarter of 2023 to a loss of CA$0.5 million in the third quarter of 2024. Adjusted EBITDA loss also improved by 82%, down to CA$0.2 million.

- The operational expense ratio improved by 25% year-over-year, falling from 40% in the third quarter of 2023 to 30% in the third quarter of 2024, reflecting improved cost management.

- Net loss narrowed to roughly CA$1 million from CA$2.1 million in the prior year’s period.

IMCC Price Action

IM Cannabis’ shares traded 13.96% lower at $2.5339 per share at the time of writing on Thursday morning.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

What's Going On With Unilever Stock Today?

Unilever PLC UL shares are trading relatively flat on Thursday.

The company is reportedly exploring the sale of some of its smaller food brands, including those based in the Netherlands, as part of a strategic shift under CEO Hein Schumacher.

The company is looking to streamline its portfolio and refocus on its key power brands, reported Reuters, citing sources familiar with the discussions.

This move may improve profitability and better position Unilever for long-term growth.

In addition to its Dutch brands, Unilever is also considering selling smaller food units in the U.K. and other parts of Europe, Reuters added.

This shift in strategy comes amid ongoing tensions with one of its subsidiaries, Ben & Jerry’s, which filed a lawsuit against Unilever on Wednesday.

The lawsuit accuses the parent company of attempting to suppress the ice cream maker’s support for Palestinian refugees and its calls for a ceasefire in Gaza, according to The New York Times.

The legal action deepens a longstanding conflict between the two companies.

According to Benzinga Pro, UL stock has gained over 17% in the past year. Investors can gain exposure to the stock via Absolute Select Value ETF ABEQ and American Century Focused Large Cap Value ETF FLV.

Price Action: UL shares traded higher by 0.19% at $57.49 at the last check Thursday.

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 firm inflation prints just made the Fed's 2025 rate cut path a lot 'murkier'

October inflation readings out this week have shown little progress toward the Fed’s 2% inflation target, putting into question how deeply the Federal Reserve will cut interest rates in 2025.

On Wednesday, the “core” Consumer Price Index (CPI), which strips out the more volatile costs of food and gas, showed prices increased 3.3% for the third consecutive month during October. Then, on Thursday, the “core” Producer Price Index (PPI) revealed prices increased by 3.1% in October, up from 2.8% the month prior and above economist expectations for a 3% increase.

Taken together, the readings are adding to an overall picture of persistent, sticky inflation within the economy. Economists don’t see the data changing the Fed’s outlook come December. And markets agree with the CME FedWatch Tool currently placing a nearly 80% chance the Fed cuts rates by 25 basis points at its December meeting.

But the lack of recent progress on the inflation front could prompt the Fed to adjust its Summary of Economic Projections (SEP), which had forecast the central bank would cut interest rates four times, or by one percentage point in total, throughout 2025.

“PPI won’t decisively alter the Fed’s easing bias, but it makes charting the policy outlook murkier,” Nationwide financial market economist Oren Klachkin wrote in a note to clients today. “We anticipate 75 [basis points] of cumulative Fed easing in 2025, but risks seem to be tilting toward a more gradual pace of easing.”

“Their bias is toward cutting, but they’ll probably have to have to go at a slower pace next year,” Wolfe Research chief economist Stephanie Roth told Yahoo Finance (video above).

Markets have quickly shifted over the past two months to reflect this sentiment. On Sept. 18, when the Fed slashed rates by half a percentage point, markets had projected the Fed would finish 2025 with a federal funds rate around 3%. Now, the market is pricing in about 80 fewer basis points of easing next year.

This speculation has also prompted a large increase in bond yields over the past month. The 10-year Treasury yield (^TNX) has added about 80 basis points since the Fed’s first rate cut in September. But that in itself hasn’t proven to be a headwind for the stock market rally, as all three indexes are within striking distance of new record highs. Investors have attributed the market’s resilience to stronger-than-expected economic data flowing in as bond yields rise.

“The reason it hasn’t hit the stock market is very simply because if the yield is rising, partly because growth is going to be stronger, that effect is going to be stronger on the stock market,” Bridgewater Associates co-chief investment officer Karen Karniol-Tambour said at the Yahoo Finance Invest conference.

California Weed Co. Led By Former LA Cop Reports 32% YoY Q3 Revenue Growth

Vertically integrated Glass House Brands Inc. (CBOE CA: GLAS.A.U) (CBOE CA: GLAS.WT.U) GLASF GHBWF reported its financial results Wednesday for the third quarter ended Sept. 30, 2024.

The cannabis company is focused on strategic growth initiatives, including expanding production capacity, improving cost efficiency and positioning itself to weather challenges in the California weed market. However, retail pricing pressures may continue to affect margins in the near term.

“While we expect lower prices to continue in the short-term, longer-term we expect Glass House will benefit, as our Company is built to weather market cycles and emerge even stronger,” said Kyle Kazan, co-founder, chair, CEO and a former Los Angeles police officer who once arrested a man at a red light for having a cannabis plant in his convertible, which had the top down.

Read Also: California Company Led By Ex-Police Officer-Turned- Cannabis CEO Could Pivot Into Hemp Space

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 2024 Financial Highlights

- Net revenue totaled $63.8 million, up 32% year-over-year from $48.2 million and 18% sequentially from the previous quarter.

- Retail revenue amounted to $11.2 million, a slight increase from the prior period ($10.9 million) and the third quarter of 2023 ($10.1 million).

- CPG revenue amounted to $4.8 million, up 11% YoY and 20% sequentially.

- Gross profit amounted to $33.4 million, compared to $26 million in the prior year’s period and $28.7 million in the second quarter of this fiscal year.

- Gross margin was 52%, down slightly from 54% year-over-year and 53% from the previous quarter.

- Adjusted EBITDA came in positive at a record $20.4 million, up from $10.7 million in the third quarter of 2023 and $12.4 million in the prior period.

- Operating cash flow was $13.2 million, representing a 45% increase year-over-year.

- The company had $35.1 million in cash and restricted cash as of Sept. 30, 2024, up from $25.9 million in the second quarter of 2024.

Operational Developments

- The company’s retail strategic pricing plan has driven increased foot traffic and higher consumer loyalty.

- Glass House is working on the Greenhouse 2 retrofit to increase production capacity by 275,000 pounds annually by the fourth quarter of 2025, aiming for a cost target of $100 per pound.

- The company has obtained a hemp license and is testing strains, with plans to decide on large-scale production by the second quarter of 2025.

- Glass House successfully had the Catalyst lawsuit dismissed, while Hector De La Torre returned to serve on the board of directors.

2024 Outlook

- The company expects $47 million to $49 million in fourth-quarter revenue, representing a 19% year-over-year increase.

- In terms of biomass production, the company provided a guidance of 160,000 to 165,000 pounds, representing 57% year-over-year growth.

- The company forecasted adjusted EBITDA of $3 million to $5 million for the fourth quarter of fiscal 2024.

- Capex is projected at roughly $6 million, with $5 million allocated to Phase III expansion.

- Under the At-The-Market (ATM) program, the company can raise up to $25 million for Phase III expansion.

GLASF Price Action

Glass House Brands’ shares traded 0.61% lower at $8.1 per share after the market close on Wednesday afternoon.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

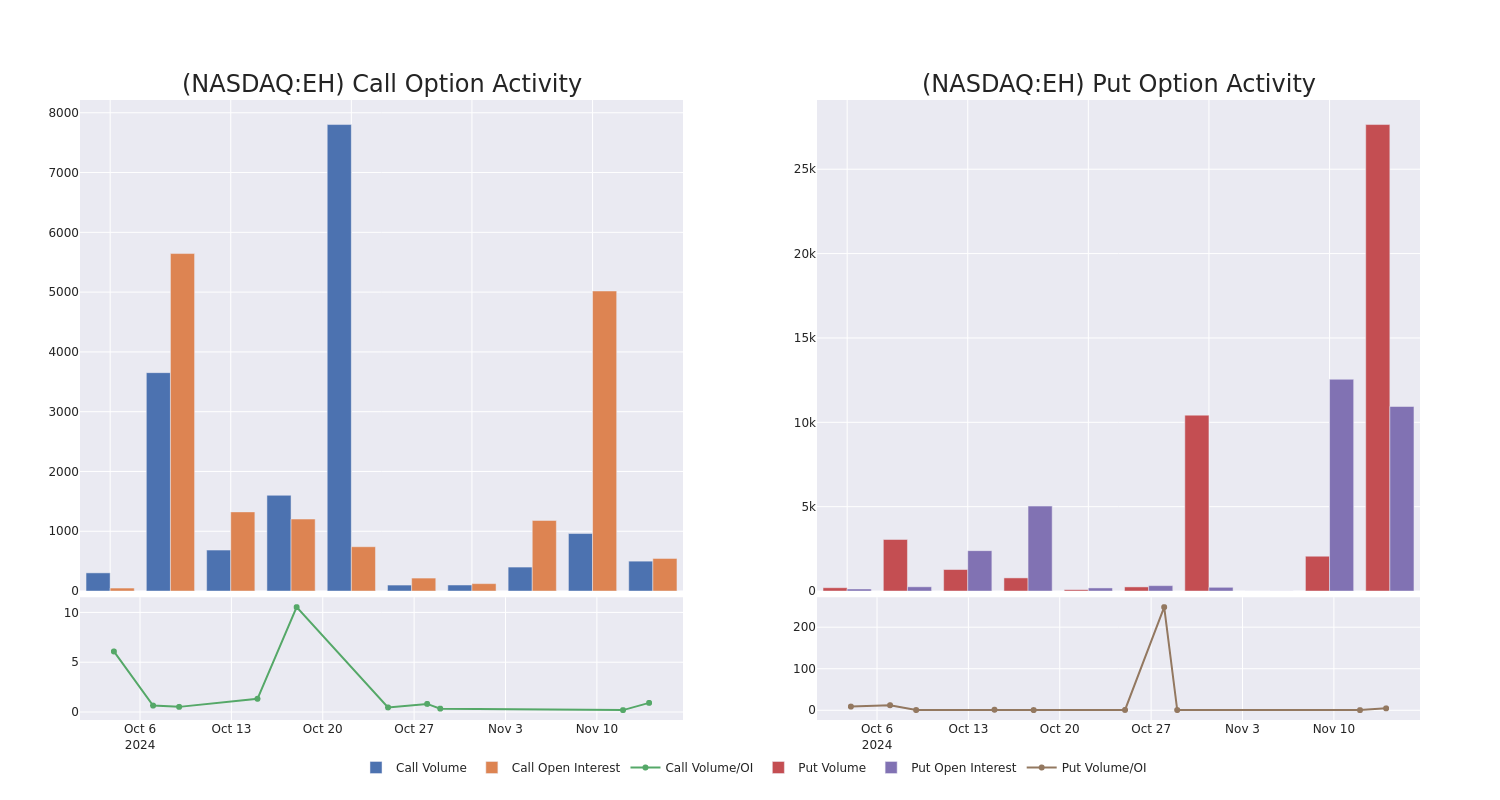

EHang Holdings's Options: A Look at What the Big Money is Thinking

Investors with a lot of money to spend have taken a bearish stance on EHang Holdings EH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don’t know. But when something this big happens with EH, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 11 options trades for EHang Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 9% bullish and 81%, bearish.

Out of all of the options we uncovered, 10 are puts, for a total amount of $539,114, and there was 1 call, for a total amount of $32,500.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $24.0 for EHang Holdings during the past quarter.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of EHang Holdings stands at 3827.67, with a total volume reaching 28,148.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in EHang Holdings, situated within the strike price corridor from $15.0 to $24.0, throughout the last 30 days.

EHang Holdings Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EH | PUT | SWEEP | BEARISH | 01/17/25 | $1.4 | $1.35 | $1.35 | $15.00 | $86.9K | 7.7K | 3.9K |

| EH | PUT | TRADE | BEARISH | 01/17/25 | $1.4 | $1.35 | $1.4 | $15.00 | $70.0K | 7.7K | 5.1K |

| EH | PUT | TRADE | BEARISH | 01/17/25 | $1.4 | $1.35 | $1.4 | $15.00 | $70.0K | 7.7K | 3.0K |

| EH | PUT | SWEEP | BEARISH | 12/20/24 | $0.9 | $0.7 | $0.7 | $15.00 | $70.0K | 3.1K | 2.0K |

| EH | PUT | SWEEP | BEARISH | 01/17/25 | $1.35 | $1.2 | $1.35 | $15.00 | $67.2K | 7.7K | 1.0K |

About EHang Holdings

EHang Holdings Ltd is an autonomous aerial vehicle (AAV) technology platform company. It focuses on making safe, autonomous and eco-friendly air mobility accessible to everyone. EHang provides customers in various industries with AAV products and commercial solutions: air mobility (including passenger transportation and logistics), smart city management and aerial media solutions. As the forerunner of cutting-edge AAV technologies and commercial solutions in the global Urban Air Mobility industry, it continues to explore the boundaries of the sky to make flying technologies benefit life in smart cities.

In light of the recent options history for EHang Holdings, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of EHang Holdings

- With a trading volume of 1,182,794, the price of EH is down by -2.99%, reaching $16.86.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 4 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for EHang Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jensen Huang Reveals 'Nvidia Doesn't Have A Long-Term Strategy' Or Plan. The Reason Behind It Is The Same For Why He Doesn't Wear A Watch

Nvidia’s CEO, Jensen Huang, shared something surprising during a Fireside Chat at the CASPA 2023 Annual Conference. He said that Nvidia (NASDAQ:NVDA) has no long-term plan. This might sound strange coming from the leader of a Big Tech company, but Huang had a simple reason: focus on the present.

Don’t Miss:

Huang said that both in his personal life and in leading Nvidia, he doesn’t believe in stressing over long-term plans. In fact, he doesn’t even wear a watch – on purpose. This choice reflects his belief that the most important time is right now. This mindset, he says, is what has made Nvidia successful, from graphics cards to artificial intelligence. Instead of worrying about the future, Nvidia works on solving today’s problems in the best way possible.

This way of thinking has helped Nvidia become important in gaming, AI, robotics and even climate modeling. Huang explained that planning too far ahead can make you miss what’s happening right before you. For Nvidia, it means staying flexible and being ready to jump on opportunities as they come – something that has worked well since they’ve adapted to meet the needs of fields like digital biology and AI.

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for just $1,000

“We don’t have a long-term strategy,” Huang said. “Our definition of a long-term plan is: what are we doing today?” By focusing on the present, Nvidia has led in areas like AI and accelerated computing that traditional computing hasn’t kept up with.

Not having a strict plan doesn’t mean Nvidia has no direction. Instead, it means they are always learning, changing and adjusting based on what’s happening right before them. Huang said this approach is why Nvidia keeps pushing limits, especially with technologies like CUDA, which many doubted initially but ended up changing computing.

Canadian Households Continue to Face Barriers to Financial Resilience as Cost of Living Outpaces Income Growth

VANCOUVER, British Columbia, Nov. 14, 2024 (GLOBE NEWSWIRE) — Today, the Financial Resilience Institute in partnership with Coast Capital released its latest Economic Inclusion and Mobility Intelligence Memo, which provides robust data and analytics on the intersections between Canadians’ economic inclusion, employment and income volatility and household financial resilience and financial well-being.[1]

The Memo found the depth of financial challenges Canadians face continues to increase. A key finding of the report revealed that 84 per cent of people in Canada reported that the increase in the cost of living has outpaced their household income growth in the past year, underscoring the importance of enabling people in Canada to earn more to build the financial resiliency required to better weather external factors such as inflation and interest rate fluctuations.

Other critical insights from the report include:

- 55% of households report they face barriers impacting their ability to earn money, with one quarter ‘completely agreeing’ they face this economic inclusion barrier.

- Households that completely or somewhat agree they face barriers impacting their ability to earn money are significantly more financially vulnerable: with a mean financial resilience score of 42.6 as of June 2024. This is 20 Index points lower compared to Canadians not facing this economic inclusion barrier (62.9) based on the Institute’s June 2024 Financial Resilience Index model [1].

- Just over one-third of adult Canadian households reported they have taken on additional work or a side hustle in the past year to grow their household income.

- Job insecurity affects 39 per cent of Canadians, with 40 per cent of this group ‘Extremely Vulnerable’ with a financial resilience score of 0 to 30 [1].

- Income volatility or instability in a person’s or household’s income over time is a key issue with nearly one-in-five Canadians reporting their household income varies significantly or quite significantly month-to-month. These households are also more financially vulnerable compared to those not experiencing this challenge.

“Our latest Intelligence Memo shows that economic exclusion increases financial vulnerability for Canadians. 77% of the population experience financial vulnerability, regardless of income, and despite a third of households taking on side gigs in the past twelve months, financial challenges persist. Policymakers, employers, and others must focus on expanding access to employment and economic mobility to help strengthen financial resilience and improve overall well-being, particularly for vulnerable groups facing barriers,” said Eloise Duncan, CEO and Founder of Financial Resilience Institute.

As organizations both committed to strengthening Canadians’ financial resilience and well-being, this partnership demonstrates an innovative model focused on leveraging the expertise of each partner to address pressing societal issues and help support systems change.

“The fact that people in Canada are grappling with increasingly difficult financial circumstances isn’t surprising. However, this data and the broader story that it tells helps us, as a trusted financial partner, to better understand and tailor our advice, education and solutions to break down barriers and unlock financial opportunities for our members, employees and communities,” said Maureen Young, Vice President, Social Purpose, Coast Capital.

Coast Capital’s partnership with the Financial Resilience Institute adds to the federal financial institution’s growing body of initiatives that drive their purpose of Building Better Futures Together through unlocking financial opportunities that positively impact people and communities.

Earlier this year, Coast Capital introduced the latest product innovation focused on driving income growth, its Elevate Chequing Account. The account, which boasts all of the day-to-day banking features people want such as free e-Transfers and ID Assist 24/7 identity theft protection, also offers the added benefit of free access to Coursera’s online training to help advance careers and potentially help people grow their incomes.

To view the Intelligence Memo, visit https://www.finresilienceinstitute.org/economic-inclusion-and-mobility-intelligence-memo/ and to learn more about Coast Capital and its purpose of Building Better Futures Together, visit www.coastcapitalsavings.com/social-purpose.

About Financial Resilience Institute

Financial Resilience Institute is a non-profit organization and the leading independent authority on financial well-being in Canada. It measures and tracks household financial resilience, financial health and financial well-being through its longitudinal Financial Well-Being Studies and peer-reviewed Financial Resilience Index Model [1]. The Institute also recently released its free financial resilience score tool and bank of resources for Canadians, and its publicly available Financial Well-Being Model and Score. The Institute partners with financial institutions, policymakers, employers and innovators in Canada and globally to develop and implement evidence-based solutions that improve financial resilience, health and well-being for all.

About Coast Capital

At Coast Capital, we’re not dreaming about a better future, we’re building one. We’re a member-owned financial cooperative with an 80-year legacy of unlocking financial opportunities that positively impact people and communities. We believe that every Canadian deserves a financial partner who actually cares how things turn out. Driven by our social purpose, we look at everything we do through the lens of how we can help nearly 600,000 members, our employees, and communities. Ranked in the platinum category of the 2022 Corporate Knights’ Social Purpose Ranking and a proud Certified B Corporation™, we’re part of a global movement building a more inclusive, equitable and regenerative economic system. Each year, we invest 10% of our budgeted bottom line into our communities, which totals more than $100M since 2000. We’re deeply committed to making our financial cooperative a great place to work as demonstrated by some of our accolades. Coast Capital is a platinum member of Canada’s Best Managed Companies and one of Canada’s Most Admired Corporate Cultures. To learn more, visit us online at coastcapitalsavings.com.

About the Survey

[1] The proprietary Seymour Financial Resilience Index ® measures household financial resilience, i.e. your ability to get through financial hardship, stressors and shocks as a result of unplanned life events, across nine behavioural sentiment and resilience indicators. Households are scored from 0 to 100, with ‘Extremely Vulnerable’ having a financial resilience score of 0 to 30, ‘Financially Vulnerable’ a score of ‘30.01 to 50, ‘Approaching Resilience’ a score of 50.01 to 70 and ‘Financially Resilient’ a score of 70.01 to 100. The first Index of its kind in the world, it measures household financial resilience in Canada at the national, provincial, and individual levels, backed by over nine years of data and with a pre-pandemic baseline of February 2020. Index data is updated every four months and based on a representative sample of population with 6218 adult decision makers as of June 2024. The Index has been peer-reviewed by Statistics Canada, UN-PRB, C.D. Howe Institute, Haver Analytics, and Financial Institutions using it. It is complemented by the Financial Well-Being studies instrument (2017-2024) and has applications in other countries. More information about the Index indicators, scoring model and development methodology are available at: https://www.finresilienceinstitute.org/indicators-and-scoring-model/

MEDIA CONTACTS:

Phone number: 778.391.6225

Email address: media@coastcapitalsavings.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.