Stock market today: Dow, S&P 500, Nasdaq slip with Powell speech, Trump-led sweep in focus

US stocks were little changed on Thursday as investors waited for a Jerome Powell speech to set the tone for interest rate cuts and assessed the impact of a Republican sweep of political power.

The Dow Jones Industrial Average (^DJI) slipped 0.2%, while the S&P 500 (^GSPC) dipped 0.2%. The Nasdaq Composite (^IXIC) was down 0.2%, coming off a mixed day for the three major gauges.

Though the mood is muted, stocks are still riding high near records after the latest consumer inflation data kept hopes for a December rate cut aloft. That optimism broadly held after a reading on wholesale inflation showed prices firmed slightly more than expected in October.

The focus is on how the Federal Reserve chair sees inflation developing as investors gauge the odds of rates going back to staying higher for longer. The market is already weighing the potential upward pressure on prices from President-elect Donald Trump’s policies.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

Republicans held onto their slim majority in the House of Representatives, handing Trump and his party a “trifecta” — unified control of power across Washington. The sweep limits curbs on implementing the incoming president’s aggressive economic agenda, which has helped spur the post-election breakneck rally in stocks.

Worries about Trump’s America-first plans helped drag Chinese stocks down as much as 20% from their October high in Hong Kong, with tech hardest hit.

In corporates, Disney’s (DIS) quarterly earnings beat estimates as its streaming unit swung to a profit. The stock jumped as much as 8% after revenue also topped Wall Street expectations.

LIVE 7 updates-

-

Tesla slides 3% as post-election Trump trade wanes

Tesla (TSLA) shares declined more than 3.5% on Thursday as investors are taking profits off the table following a massive surge in the “Trump trade” favorite.

With Thursday’s slide, the stock is still up more than 25% since Donald Trump’s White House victory last week over optimism that CEO Elon Musk’s close ties to the president-elect will loosen regulations around autonomous driving.

Meanwhile, on Wednesday the electric vehicle giant issued its sixth recall this year. The company recalled 2,400 Cybertruck pickups due to a faulty part could lead to a loss of power and increase the risk of a collision.

-

-

-

-

-

Board Member At Plexus Sells $417K Of Stock

It was reported on November 13, that Dean A Foate, Board Member at Plexus PLXS executed a significant insider sell, according to an SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, Foate sold 2,500 shares of Plexus. The total transaction value is $417,764.

The latest update on Thursday morning shows Plexus shares down by 0.65%, trading at $154.87.

Get to Know Plexus Better

Plexus Corp is a U.S based Electronic Manufacturing Services company that provides a range of services, from conceptualization and design to fulfilling orders and providing sustaining solutions, such as replenishment and refurbishment. The company’s segments comprise AMER, APAC,ge and EMEA.

A Deep Dive into Plexus’s Financials

Revenue Growth: Over the 3 months period, Plexus showcased positive performance, achieving a revenue growth rate of 9.35% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 10.27%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 1.52, Plexus showcases strong earnings per share.

Debt Management: Plexus’s debt-to-equity ratio is below the industry average at 0.21, reflecting a lower dependency on debt financing and a more conservative financial approach.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: Plexus’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 38.87.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.1, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Plexus’s EV/EBITDA ratio of 26.38 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Essential Transaction Codes Unveiled

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Plexus’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Falls Over 100 Points; US Producer Prices Rise In October

U.S. stocks traded lower midway through trading, with the Nasdaq Composite falling over 50 points on Thursday.

The Dow traded down 0.29% to 43,828.65 while the NASDAQ fell 0.29% to 19,175.65. The S&P 500 also fell, dropping, 0.33% to 5,965.40.

Check This Out: Jim Cramer Recommends Microsoft, Praises American Water Works For Being ‘Consistent’

Leading and Lagging Sectors

Financials shares rose by 0.3% on Thursday.

In trading on Thursday, health care shares fell by 0.9%.

Top Headline

U.S. producer prices rose 0.2% month-over-month in October compared to a revised 0.1% gain in September and in-line with market expectations.

Equities Trading UP

- AgEagle Aerial Systems, Inc. UAVS shares shot up 162% to $4.1996 after the company announced 17 new purchase orders for its eBee TAC drones from U.S. defense and security customers.

- Shares of Hillenbrand, Inc. HI got a boost, surging 15% to $34.53 following upbeat quarterly results.

- Gaxos.ai Inc. GXAI shares were also up, gaining 33% to $1.9210 after the company’s board approved the purchase of up to $1 million in Bitcoin as a treasury reserve asset.

Equities Trading DOWN

- Nuvectis Pharma, Inc. NVCT shares dropped 44% to $6.00 after the company reported data from its Phase 1b study evaluating NXP800.

- Shares of Sow Good Inc. SOWG were down 48% to $5.13 after the company reported worse-than-expected quarterly financial results.

- Vislink Technologies, Inc. VISL was down, falling 25% to $4.8904 after the company reported worse-than-expected third-quarter financial results.

Commodities

In commodity news, oil traded up 0.2% to $68.54 while gold traded down 0.8% at $2,566.20.

Silver traded down 1.1% to $30.340 on Thursday, while copper fell 0.1% to $4.0780.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 1.03%, Germany’s DAX climbed 1.34% and France’s CAC 40 gained 1.22%. Spain’s IBEX 35 Index gained 1.21%, while London’s FTSE 100 rose 0.42%.

Asia Pacific Markets

Asian markets closed lower on Thursday, with Japan’s Nikkei 225 falling 0.48%, Hong Kong’s Hang Seng Index falling 1.96%, China’s Shanghai Composite Index dipping 1.73% and India’s BSE Sensex falling 0.14%.

Economics

- U.S. initial jobless claims declined by 4,000 from the previous week to 217,000 in the week ending Nov. 9, compared to market estimates of 223,000.

- U.S. producer prices rose 0.2% month-over-month in October compared to a revised 0.1% gain in September and in-line with market expectations.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Walmart

Deep-pocketed investors have adopted a bullish approach towards Walmart WMT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WMT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 23 extraordinary options activities for Walmart. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 60% leaning bullish and 26% bearish. Among these notable options, 3 are puts, totaling $153,872, and 20 are calls, amounting to $2,986,061.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $86.67 for Walmart over the recent three months.

Volume & Open Interest Development

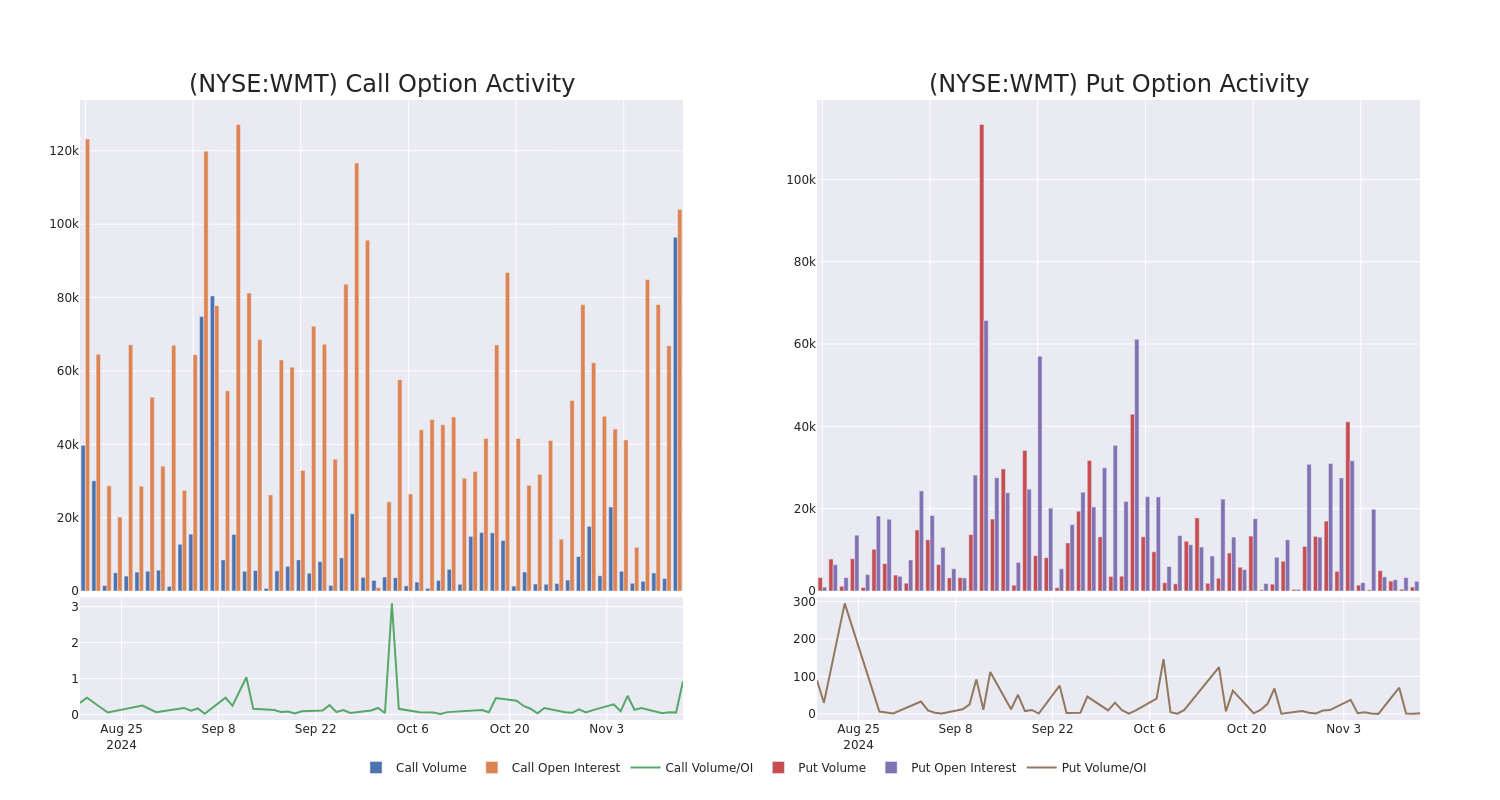

In today’s trading context, the average open interest for options of Walmart stands at 10636.8, with a total volume reaching 97,378.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walmart, situated within the strike price corridor from $60.0 to $86.67, throughout the last 30 days.

Walmart Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.57 | $2.54 | $2.57 | $86.67 | $476.0K | 10.0K | 3.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.59 | $2.55 | $2.58 | $86.67 | $464.9K | 10.0K | 6.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.57 | $2.55 | $2.58 | $86.67 | $398.6K | 10.0K | 1.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.58 | $2.55 | $2.58 | $86.67 | $231.9K | 10.0K | 4.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.59 | $2.55 | $2.58 | $86.67 | $206.6K | 10.0K | 7.5K |

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Walmart’s Current Market Status

- With a trading volume of 2,967,114, the price of WMT is up by 0.04%, reaching $85.53.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 5 days from now.

What Analysts Are Saying About Walmart

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $89.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Walmart, targeting a price of $89.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Walmart with a target price of $87.

* Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for Walmart, targeting a price of $92.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Walmart, which currently sits at a price target of $90.

* An analyst from Keybanc persists with their Overweight rating on Walmart, maintaining a target price of $88.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walmart options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kraft Heinz must face Mac & Cheese lawsuit, judge rules

By Jonathan Stempel

(Reuters) – A federal judge said Kraft Heinz (KHC) must face a proposed nationwide class action alleging that it defrauded consumers by claiming its Kraft macaroni and cheese, one of its best-known products, contains no artificial preservatives.

In a decision on Wednesday, U.S. District Judge Mary Rowland said the Illinois, California and New York consumers leading the lawsuit plausibly alleged that Kraft Mac & Cheese contained a synthetic form of citric acid that differed from the natural variety, and also contained sodium phosphates.

The Chicago-based judge said the plaintiffs specifically alleged that the ingredients functioned as preservatives, making Kraft Heinz’s claim of “No Artificial Flavors, Preservatives or Dyes” on labels false, and cited academic studies and U.S. Food and Drug Administration guidance to support their case.

“These allegations are enough to withstand a motion to dismiss,” she wrote.

Rowland agreed with Kraft Heinz that the plaintiffs lacked standing to demand new labels because they are now aware of its alleged deceptive practices and face no risk of future harm.

In seeking a dismissal, Kraft Heinz said there were no factual allegations that it used artificial preservatives in its “iconic” Mac & Cheese, or that reasonable consumers would view its ingredients as artificial.

Kraft Heinz and its lawyers did not immediately respond to requests for comment on Thursday. Lawyers for the plaintiffs did not immediately respond to similar requests.

The plaintiffs are seeking damages for fraud, unjust enrichment, and violations of state consumer protection laws.

Their lawsuit is one of many challenging the accuracy or precision of food labels.

In July 2023, a Miami federal judge dismissed a lawsuit accusing Kraft Heinz of understating how long it took to prepare microwaveable Velveeta macaroni and cheese.

Kraft Heinz is based in Chicago and Pittsburgh. Berkshire Hathaway owns 26.9% of its stock.

The case is Hayes et al v. Kraft Heinz Co, U.S. District Court, Northern District of Illinois, No. 23-16596.

(Reporting by Jonathan Stempel in New York; Editing by Rod Nickel)

Paylocity Holding Board Member Sold $861K In Company Stock

Revealing a significant insider sell on November 13, Jeffrey T Diehl, Board Member at Paylocity Holding PCTY, as per the latest SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday outlined that Diehl executed a sale of 4,017 shares of Paylocity Holding with a total value of $861,741.

Tracking the Thursday’s morning session, Paylocity Holding shares are trading at $211.62, showing a down of 0.0%.

Unveiling the Story Behind Paylocity Holding

Paylocity is a provider of payroll and human capital management solutions servicing small- to midsize clients in the United States. The company was founded in 1997 and targets businesses with 10-5,000 employees and services about 39,000 clients as of fiscal 2024. Alongside core payroll services, Paylocity offers HCM solutions such as time and attendance and recruiting software as well as workplace collaboration and communication tools.

Paylocity Holding’s Economic Impact: An Analysis

Revenue Growth: Paylocity Holding’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -12.5%. This indicates a decrease in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Navigating Financial Profits:

-

Gross Margin: Achieving a high gross margin of 68.05%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Paylocity Holding’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.62.

Debt Management: Paylocity Holding’s debt-to-equity ratio is below the industry average. With a ratio of 0.34, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 63.0 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 8.91 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Paylocity Holding’s EV/EBITDA ratio, surpassing industry averages at 35.85, positions it with an above-average valuation in the market.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Unlocking the Meaning of Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Paylocity Holding’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Next Week Could Be Huge for Super Micro Computer Stock. 2 Big Things Investors Need to Watch

Like a frog in a pot of boiling water, things keep getting more uncomfortable for Super Micro Computer (NASDAQ: SMCI) as times goes on.

Supermicro’s growing accounting debacle began in late August as the target of a short report from Hindenburg Research. Just a day later, the company delayed its 10-K filing. In September, the Department of Justice launched an investigation into the company over accounting issues, according to The Wall Street Journal, and last month, Ernst & Young resigned as the company’s auditor, a glaring red flag.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Since then, the company reported preliminary fiscal 2025 first-quarter results but offered little clarity on the status of its 10-K filing and other challenges. Unsurprisingly, the company just filed to delay its 10-Q report as well.

Consequently, the stock has declined 65% since Hindenburg published its report.

Investors anxious to see where Supermicro is headed next may not have to wait very long as these issues could come to a head next week. There are two major reasons why.

Supermicro received notice from Nasdaq on Sept. 17 that it was not in compliance with the exchange’s rules that require timely filing of reports with the Securities and Exchange Commission (SEC). According to that notice, Super Micro Computer has 60 days to file its 10-K or submit a plan to Nasdaq to regain compliance. That period expires on Nov. 16, which means the delisting procedure could begin as soon as Monday, Nov. 18. That would mean the stock would trade over the counter (OTC) and lose its place in the S&P 500, as well as the wide range of exchange-traded funds (ETFs) that hold the stock.

Currently, it’s unclear how the company plans to handle the delisting notice as it doesn’t seem to be on the verge of filing its 10-K statement, especially since it still doesn’t have an auditor. In the preliminary first-quarter earnings report from Nov. 5, management said it intends to take the necessary steps to get back into compliance with Nasdaq as soon as possible. Since it seems unlikely the company will file its 10-K in the next few days, investors should expect it to deliver a plan to regain compliance, though it’s unclear what that would include.

Supermicro also shared an update from its recently formed Independent Special Committee on Nov. 5, which said the Audit Committee acted independently of any influence from CEO Charles Liang, and there was no evidence of fraud or misconduct by management or the board of directors.

Golden Years For M&A Deals Ahead Under Trump? Analysts Highlight Top 10 Large-Cap Candidates

With Republicans taking control of Congress, Wall Street is buzzing about a potential boom in mergers and acquisitions (M&A) under the upcoming Trump administration.

Bank of America analysts see brighter days ahead for deal-making, anticipating that Trump could remove Federal Trade Commission Chair Lina Khan, whose aggressive antitrust stance has been a major roadblock for M&A activity across sectors.

Combined with favorable macro factors and investor demand for capex and M&A over debt paydown, there are plenty of reasons to believe that 2025 and beyond could see significant deal activity.

Banks And Biotech: Two Key Sectors To Watch

Analysts at Bank of America’s U.S. banks team are particularly bullish about the M&A prospects for financials, which have historically enjoyed more than 50% higher deal activity under Republican administrations than Democratic ones. With regulatory scrutiny expected to loosen, the landscape is ripe for a surge in bank deals.

Deal activity in biotech has already started picking up, especially in smaller acquisitions. Big Pharma faces mounting pressure to offset patent expirations, so it’s hunting for acquisition targets to replenish its drug pipelines. Lower rates and potential deregulation could further fuel biotech M&A as we head into 2025.

“The election results could lead to a less restrictive regulatory environment, which may open the door for more bank mergers and acquisitions,” Jill Carey Hall, CFA, a Bank of America analyst, said.

Macro Factors: Green And Yellow Lights for M&A

Several macroeconomic factors support a cyclical pick-up in M&A activity.

Strong equity market returns, cheap small-cap valuations relative to large caps and tight credit spreads all suggest a favorable environment for deal-making.

Not all signals are flashing green. Slowing GDP growth, rate uncertainty and high volatility could throw some caution flags. Long-term growth expectations for small caps, though improved, still remain below average.

Bank of America’s credit strategists predict that 2025 could be a better year for M&A activity as rate cuts begin to materialize and volatility subsides.

“Sponsors are sitting on a pile of uncalled capital, and there’s a real incentive to deploy it in a friendlier economic environment,” Hall said.

Who Stands To Gain: Small-Cap Targets, Large-Cap Acquirers

With large deals on the decline, smaller targets have become the prime candidates for takeovers.

Aggregate deal value has been falling in recent years as mega-cap deals have dried up and smaller, more manageable transactions have become the norm.

This trend has paid off for both sides: small-cap targets have outperformed post-announcement and large-cap acquirers have seen record one-day gains in 2023 despite paying higher deal premiums.

This pattern suggests that investors are rewarding companies that buy growth, especially in today’s uncertain economic landscape.

10 Potential M&A Candidates Among Large Caps

Bank of America’s latest screening of potential M&A candidates includes high-growth, undervalued names, each with distinct value propositions that may appeal to suitors looking for long-term growth.

| Company | Sector | Market Cap ($M) | Free Cash Flows-to-Enterprise Value (%) | Long-Term Growth Expectations (%) |

|---|---|---|---|---|

| Universal Health Services Inc. UHS | Health Care | 13,932 | 4.4 | 25.3 |

| Ralph Lauren Corp. RL | Consumer Disc. | 12,473 | 5.99 | 10.5 |

| Paramount Global PARA | Comm. Services | 7,250 | 3.4 | 46.4 |

| Jabil Inc. JBL | Technology | 14,480 | 6.39 | 12.7 |

| Hasbro Inc. HAS | Consumer Disc. | 9,215 | 3.6 | 27.5 |

| F5 Inc. FFIV | Technology | 13,431 | 6.39 | 9.9 |

| DaVita Inc. DVA | Health Care | 11,976 | 5.39 | 15.4 |

| BorgWarner Inc. BWA | Consumer Disc. | 7,316 | 6.5 | 12.0 |

| Aptiv plc APTV | Consumer Disc. | 13,143 | 4.4 | 23.7 |

| A. O. Smith Corp. AOS | Industrials | 10,895 | 2.3 | 10.0 |

Read Next:

Photo by Capri23auto from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.