Ibotta Analysts Slash Their Forecasts After Q3 Earnings Results

Ibotta, Inc. IBTA reported better-than-expected third-quarter sales on Wednesday.

Ibotta posted third-quarter adjusted earnings of 94 cents per share, which may not compare to market estimates of 35 cents per share. The company’s sales came in at $98.60 million, beating expectations of $94.05 million.

Ibotta said it sees fourth-quarter revenue of $100 million to $106 million, versus analysts’ estimates of $110.29 million. The company expects adjusted EBITDA of $30 million to $34 million.

Ibotta shares fell 2.1% to close at $74.93 on Wednesday.

These analysts made changes to their price targets on Ibotta following earnings announcement.

- Needham analyst Bernie McTernan maintained Ibotta with a Buy and lowered the price target from $100 to $80.

- JMP Securities analyst Andrew Boone maintained Ibotta with a Market Outperform and lowered the price target from $111 to $85.

- UBS analyst Chris Kuntarich downgraded Ibotta from Buy to Neutral and lowered the price target from $90 to $65.

- Wells Fargo analyst Ken Gawrelski maintained Ibotta with an Overweight and lowered the price target from $95 to $86.

Considering buying IBTA stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Global Dental Membrane and Bone Graft Substitute Market Size/Share Worth USD 2,533.3 Million by 2033 at a 9.24% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate)

Austin, TX, USA, Nov. 14, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Dental Membrane and Bone Graft Substitute Market Size, Trends and Insights By Product Type (Dental Membrane, Resorbable Membranes, Non-Resorbable Membranes, Bone Graft Substitutes, Demineralized Bone Matrix, Xenograft, Allograft, Autograft, Others), By Material Type (Hydrogel, Collagen, Polytetrafluoroethylene (PTFE), Human Cell Sources, Hydroxypatite (HA), Tricalcium Phosphate (TCP), Others), By End Users (Hospitals, Dental Clinics, Ambulatory Surgical Centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

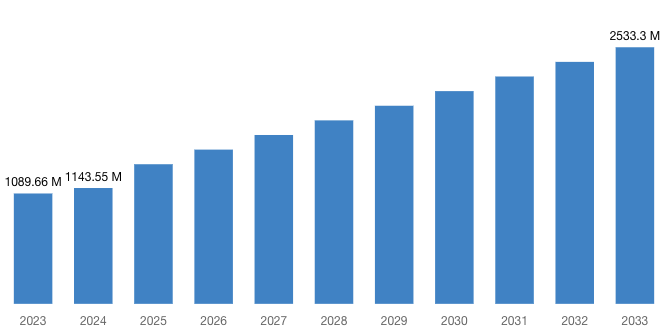

“According to the latest research study, the demand of global Dental Membrane and Bone Graft Substitute Market size & share was valued at approximately USD 1,089.66 Million in 2023 and is expected to reach USD 1,143.55 Million in 2024 and is expected to reach a value of around USD 2,533.3 Million by 2033, at a compound annual growth rate (CAGR) of about 9.24% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Dental Membrane and Bone Graft Substitute Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54329

Dental Membrane and Bone Graft Substitute Market: Growth Factors and Dynamics

- Increasing Prevalence of Dental Disorders: The rising incidence of dental conditions such as periodontal diseases, tooth loss, and maxillofacial defects is a significant driver of the global Dental Membrane and Bone Graft Substitute market. As the population ages and lifestyle factors contribute to dental issues, the demand for regenerative dental procedures continues to grow.

- Advancements in Dental Technology: Technological innovations in dental membranes and bone graft substitutes have significantly improved their efficacy, safety, and ease of use. Novel materials, manufacturing techniques, and delivery systems enhance treatment outcomes, driving adoption among dental professionals and patients.

- Rising Demand for Dental Implants: Dental implants have become a preferred treatment option for tooth replacement, leading to an increased demand for bone graft substitutes to augment bone volume and ensure implant stability. The growing acceptance of dental implants as a reliable and aesthetic solution fuels the demand for associated regenerative products.

- Growing Aging Population: The global demographic shift towards an aging population presents a significant opportunity for the Dental Membrane and Bone Graft Substitute market. Older adults are more prone to dental conditions and may require regenerative procedures to restore oral health and function, creating a larger patient pool for these products.

- Expansion of Dental Tourism: The rise of dental tourism, particularly in emerging markets, offers opportunities for market growth. Patients seeking affordable dental treatments abroad contribute to the demand for regenerative procedures, driving the adoption of dental membranes and bone graft substitutes in popular dental tourism destinations.

- Customized Treatment Solutions: The trend towards personalized medicine extends to the field of dentistry, with a growing emphasis on customized treatment solutions tailored to individual patient needs. Dental membranes and bone graft substitutes are increasingly being developed and utilized in combination with advanced imaging and digital planning technologies to optimize treatment outcomes and patient satisfaction.

- Minimally Invasive Techniques: Minimally invasive approaches to dental surgery are gaining traction, driven by patient demand for less invasive procedures, reduced postoperative discomfort, and faster recovery times. Dental membranes and bone graft substitutes compatible with minimally invasive techniques are in high demand, facilitating bone regeneration with minimal trauma to surrounding tissues.

Request a Customized Copy of the Dental Membrane and Bone Graft Substitute Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=54329

Dental Membrane and Bone Graft Substitute Market: Partnership and Acquisitions

- In March 2022, Biocomposites, a global medical devices company specializing in engineering, manufacturing, and marketing cutting-edge products for bone regeneration and infection management in bone and soft tissue, unveiled a multiyear partnership with Zimmer Biomet (NYSE and SIX: ZBH), a renowned global leader in medical technology. This agreement entails the exclusive distribution of genex Bone Graft Substitute, accompanied by its new mixing system and delivery options, within the orthopedic market in the United States.

- On December 13, 2021, Osteopore disclosed the commencement of an agreement with NDCS and A*STAR to initiate a dental implant project valued at US$12.4 million). The project’s primary objectives entail integrating patented biological additives and polymer compounds to conduct assessments for adverse reactions, evaluating osteogenic differentiation to ascertain bone growth, and enhancing osteogenic differentiation to showcase accelerated bone growth.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 1,143.55 Million |

| Projected Market Size in 2033 | USD 2,533.3 Million |

| Market Size in 2023 | USD 1,089.66 Million |

| CAGR Growth Rate | 9.24% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Product Type, Material Type, End Users and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Dental Membrane and Bone Graft Substitute report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Dental Membrane and Bone Graft Substitute report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Dental Membrane and Bone Graft Substitute Market Report @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

Dental Membrane and Bone Graft Substitute Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Dental Membrane and Bone Graft Substitute Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Delayed and Canceled Dental Procedures: During the height of the pandemic, many dental practices were temporarily closed or limited to providing emergency care only. Routine dental procedures, including those requiring dental membranes and bone graft substitutes, were delayed or canceled, leading to a significant decline in market demand.

- Practice Closures and Restrictions: During the initial stages of the pandemic, many dental practices were forced to close or limit operations to emergency procedures only as mandated by government regulations and public health guidelines. This led to a significant reduction in revenue for dental practices and disrupted the delivery of routine dental care.

- Shift to Emergency and Urgent Care: Dental practices that remained open during the pandemic focused primarily on providing emergency and urgent dental care to patients in need. Routine dental procedures, such as cleanings and elective treatments, were postponed or rescheduled, leading to changes in practice workflows and revenue streams.

- Implementation of Enhanced Infection Control Measures: In response to the pandemic, dental practices implemented enhanced infection control measures and safety protocols to minimize the risk of COVID-19 transmission. This included increased use of PPE, enhanced cleaning and disinfection procedures, and modifications to office layouts to facilitate social distancing.

- Adoption of Telemedicine and Virtual Consultations: To adapt to social distancing guidelines and reduce in-person interactions, many dental practices adopted telemedicine and virtual consultation platforms. While these technologies enabled remote patient care, they also limited the opportunity for in-person assessments and treatment planning, potentially affecting the use of dental membranes and bone graft substitutes.

In conclusion, the COVID-19 pandemic has had a mixed impact on the dental membrane and bone graft substitute market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Dental Membrane and Bone Graft Substitute Market Report @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

Key questions answered in this report:

- What is the size of the Dental Membrane and Bone Graft Substitute market and what is its expected growth rate?

- What are the primary driving factors that push the Dental Membrane and Bone Graft Substitute market forward?

- What are the Dental Membrane and Bone Graft Substitute Industry’s top companies?

- What are the different categories that the Dental Membrane and Bone Graft Substitute Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Dental Membrane and Bone Graft Substitute market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Dental Membrane and Bone Graft Substitute Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

Dental Membrane and Bone Graft Substitute Market – Regional Analysis

The Dental Membrane and Bone Graft Substitute Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: The North American region, comprising the United States and Canada, stands as a pivotal hub for the dental membrane and bone graft substitute market. The region benefits from advanced healthcare infrastructure, with well-established dental clinics and hospitals equipped with state-of-the-art facilities. High prevalence rates of dental disorders, including periodontal diseases and tooth loss, drive the demand for regenerative dental procedures, such as bone graft surgeries and dental implant placements.

- Europe: Europe emerges as a significant market for dental membrane and bone graft substitute products, driven by various factors unique to the region. Supportive government policies and reimbursement schemes for dental procedures encourage the adoption of advanced dental technologies and treatments. These factors, coupled with the presence of a robust healthcare infrastructure and a strong emphasis on education and research, propel the growth of the Dental Membrane and Bone Graft Substitute market in Europe.

- Asia-Pacific: The Asia Pacific region experiences robust growth in the dental membrane and bone graft substitute market, fuelled by several key factors. The burgeoning middle-class population, along with increasing disposable incomes, drives demand for dental treatments and aesthetic procedures, including dental implants and bone graft surgeries. Rising healthcare expenditure and investments in healthcare infrastructure across Asia Pacific countries further contribute to market expansion.

- LAMEA (Latin America, Middle East, and Africa): LAMEA represents a region of significant growth potential for the dental membrane and bone graft substitute market, driven by various socioeconomic and healthcare factors. Efforts to improve access to healthcare services in LAMEA countries contribute to the increasing demand for dental treatments, including implant surgeries and bone graft procedures. Governments and private sector investments in healthcare infrastructure and technology enhance the availability and quality of dental care services in the region.

Request a Customized Copy of the Dental Membrane and Bone Graft Substitute Market Report @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Dental Membrane and Bone Graft Substitute Market Size, Trends and Insights By Product Type (Dental Membrane, Resorbable Membranes, Non-Resorbable Membranes, Bone Graft Substitutes, Demineralized Bone Matrix, Xenograft, Allograft, Autograft, Others), By Material Type (Hydrogel, Collagen, Polytetrafluoroethylene (PTFE), Human Cell Sources, Hydroxypatite (HA), Tricalcium Phosphate (TCP), Others), By End Users (Hospitals, Dental Clinics, Ambulatory Surgical Centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

List of the prominent players in the Dental Membrane and Bone Graft Substitute Market:

- ACE Surgical Supply Co. Inc.

- Biohorizons Inc.

- Botiss Biomaterials GmbH

- Collagen Matrix Inc.

- CURASAN AG

- Dentsply Sirona

- Geistlich Pharma Ag

- KLS Martin Group

- Lifenet Health

- Medtronic

- NovaBone Products LLC

- RTI Surgical Holdings Inc.

- Salvin Dental Specialities Inc.

- Straumann Group

- Zimmer Biomet

- Others

Click Here to Access a Free Sample Report of the Global Dental Membrane and Bone Graft Substitute Market @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

US Facial Injectables Market: US Facial Injectables Market Size, Trends and Insights By Product (Collagen & PMMA Microspheres, Hyaluronic Acid (HA), Botulinum Toxin Type A, Calcium Hydroxylapatite (CaHA), Poly-L-lactic Acid (PLLA), Others), By Application (Facial Line Correction, Lip Augmentation, Face Lift, Acne Scar Treatment, Lipoatrophy Treatment, Others), By End-Use (MedSpas, Dermatology Clinics, Hospitals), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Weight Loss Market: Europe Weight Loss Market Size, Trends and Insights By Application (Dietary Supplements, Fitness Equipment, Meal Replacements, Weight Loss Programs), By Product Type (Conventional Weight Loss Products, Organic Weight Loss Products, Meal Plans & Services), By End User (Adults, Teenagers, Elderly), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Pacemaker Manufacturers Market: US Pacemaker Manufacturers Market Size, Trends and Insights By Product (Implantable pacemakers, External pacemakers), By Technology (Single Chamber, Dual Chamber, Biventricular Chamber), By Type (MRI Compatible Pacemakers, Conventional Pacemakers), By Application (Arrhythmias, Atrial Fibrillation, Heart Block, Long QT Syndrome, Congestive Heart Failure, Others), By End User (Hospitals, Cardiac Surgery Centers, Ambulatory Surgical Centers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Intravascular Ultrasound Devices Market: Intravascular Ultrasound Devices Market Size, Trends and Insights By Product Type (IVUS Consoles, IVUS Catheters), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Research Institutes), By Application (Coronary Diagnosis, Coronary Intervention, Coronary Research, Non-coronary/Peripheral Applications), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Ascites Market: Ascites Market Size, Trends and Insights By Types (Transudative, Exudative, Others), By Diagnosis (Ultrasound, CT Scan, MRI, Blood Test, Laparoscopy, Angiography, Others), By Treatment (Medication, Paracentesis, Surgery, Others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Homecare, Specialty Clinics, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Surgical Site Infection Control Market: Surgical Site Infection Control Market Size, Trends and Insights By Product (Surgical scrubs, Hair clippers, Surgical drapes, Surgical irrigation), By Surgery/Procedure (Cataract surgery, Cesarean section, Dental restoration, Gastric bypass, Others), By Type of Infection (Superficial incisional SSI, Deep incisional SSI, Organ or space SSI), By End-use (Hospitals, Ambulatory surgical centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Clinical Trial Outsourcing Market: Clinical Trial Outsourcing Market Size, Trends and Insights By Services (Protocol Designing, Site Identification, Patient Recruitment, Laboratory Services, Bioanalytical Testing Services, Clinical Trial Data Management Services, Others), By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional, Observational, Expanded Access), By Applications (Cancer, Cardiovascular Diseases, Nervous System Diseases, Infectious Diseases, Musculoskeletal Disease, Gastroenterology Diseases, Others), By End-User (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Veterinary Orthopedic Implants Market: Veterinary Orthopedic Implants Market Size, Trends and Insights By Product Type (Plates, Screws, Others), By Application (Cruciate Ligament Rupture, Bone Fractures, Elbow Dysplasia, Hip Dysplasia, Others), By End User (Veterinary Hospitals, Veterinary Clinics, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Dental Membrane and Bone Graft Substitute Market is segmented as follows:

By Product Type

- Dental Membrane

- Resorbable Membranes

- Non-Resorbable Membranes

- Bone Graft Substitutes

- Demineralized Bone Matrix

- Xenograft

- Allograft

- Autograft

- Others

By Material Type

- Hydrogel

- Collagen

- Polytetrafluoroethylene (PTFE)

- Human Cell Sources

- Hydroxypatite (HA)

- Tricalcium Phosphate (TCP)

- Others

By End Users

- Hospitals

- Dental Clinics

- Ambulatory Surgical Centers

- Others

Click Here to Get a Free Sample Report of the Global Dental Membrane and Bone Graft Substitute Market @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Dental Membrane and Bone Graft Substitute Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Dental Membrane and Bone Graft Substitute Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Dental Membrane and Bone Graft Substitute Market? What Was the Capacity, Production Value, Cost and PROFIT of the Dental Membrane and Bone Graft Substitute Market?

- What Is the Current Market Status of the Dental Membrane and Bone Graft Substitute Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Dental Membrane and Bone Graft Substitute Market by Considering Applications and Types?

- What Are Projections of the Global Dental Membrane and Bone Graft Substitute Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Dental Membrane and Bone Graft Substitute Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Dental Membrane and Bone Graft Substitute Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Dental Membrane and Bone Graft Substitute Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Dental Membrane and Bone Graft Substitute Industry?

Click Here to Access a Free Sample Report of the Global Dental Membrane and Bone Graft Substitute Market @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

Reasons to Purchase Dental Membrane and Bone Graft Substitute Market Report

- Dental Membrane and Bone Graft Substitute Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Dental Membrane and Bone Graft Substitute Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Dental Membrane and Bone Graft Substitute Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Dental Membrane and Bone Graft Substitute Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Dental Membrane and Bone Graft Substitute market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Dental Membrane and Bone Graft Substitute Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Dental Membrane and Bone Graft Substitute market analysis.

- The competitive environment of current and potential participants in the Dental Membrane and Bone Graft Substitute market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Dental Membrane and Bone Graft Substitute market should find this report useful. The research will be useful to all market participants in the Dental Membrane and Bone Graft Substitute industry.

- Managers in the Dental Membrane and Bone Graft Substitute sector are interested in publishing up-to-date and projected data about the worldwide Dental Membrane and Bone Graft Substitute market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Dental Membrane and Bone Graft Substitute products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Dental Membrane and Bone Graft Substitute Market Report @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Dental Membrane and Bone Graft Substitute Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/dental-membrane-and-bone-graft-substitute-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: Joey Kawaja Sells $1.07M Worth Of Noble Corp Shares

It was reported on November 13, that Joey Kawaja, SVP at Noble Corp NE executed a significant insider sell, according to an SEC filing.

What Happened: Kawaja’s recent move involves selling 30,000 shares of Noble Corp. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value is $1,072,800.

Monitoring the market, Noble Corp‘s shares up by 0.69% at $34.85 during Thursday’s morning.

Get to Know Noble Corp Better

Noble Corp PLC is an offshore drilling contractor for the oil and gas industry that provides contract drilling services to the international oil and gas industry with its fleet of mobile offshore drilling units. The company focuses on a high-specification fleet of floating and jackup rigs and the deployment of its drilling rigs in oil and gas basins around the world.

Financial Milestones: Noble Corp’s Journey

Revenue Growth: Noble Corp’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 14.78%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 28.52%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Noble Corp’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.41.

Debt Management: With a below-average debt-to-equity ratio of 0.42, Noble Corp adopts a prudent financial strategy, indicating a balanced approach to debt management.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: Noble Corp’s current Price to Earnings (P/E) ratio of 10.18 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.84 is above industry norms, reflecting an elevated valuation for Noble Corp’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 7.89, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Noble Corp’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amgen's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Amgen AMGN, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMGN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Amgen. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 25% bearish. Among these notable options, 4 are puts, totaling $137,540, and 4 are calls, amounting to $285,919.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $290.0 to $340.0 for Amgen over the recent three months.

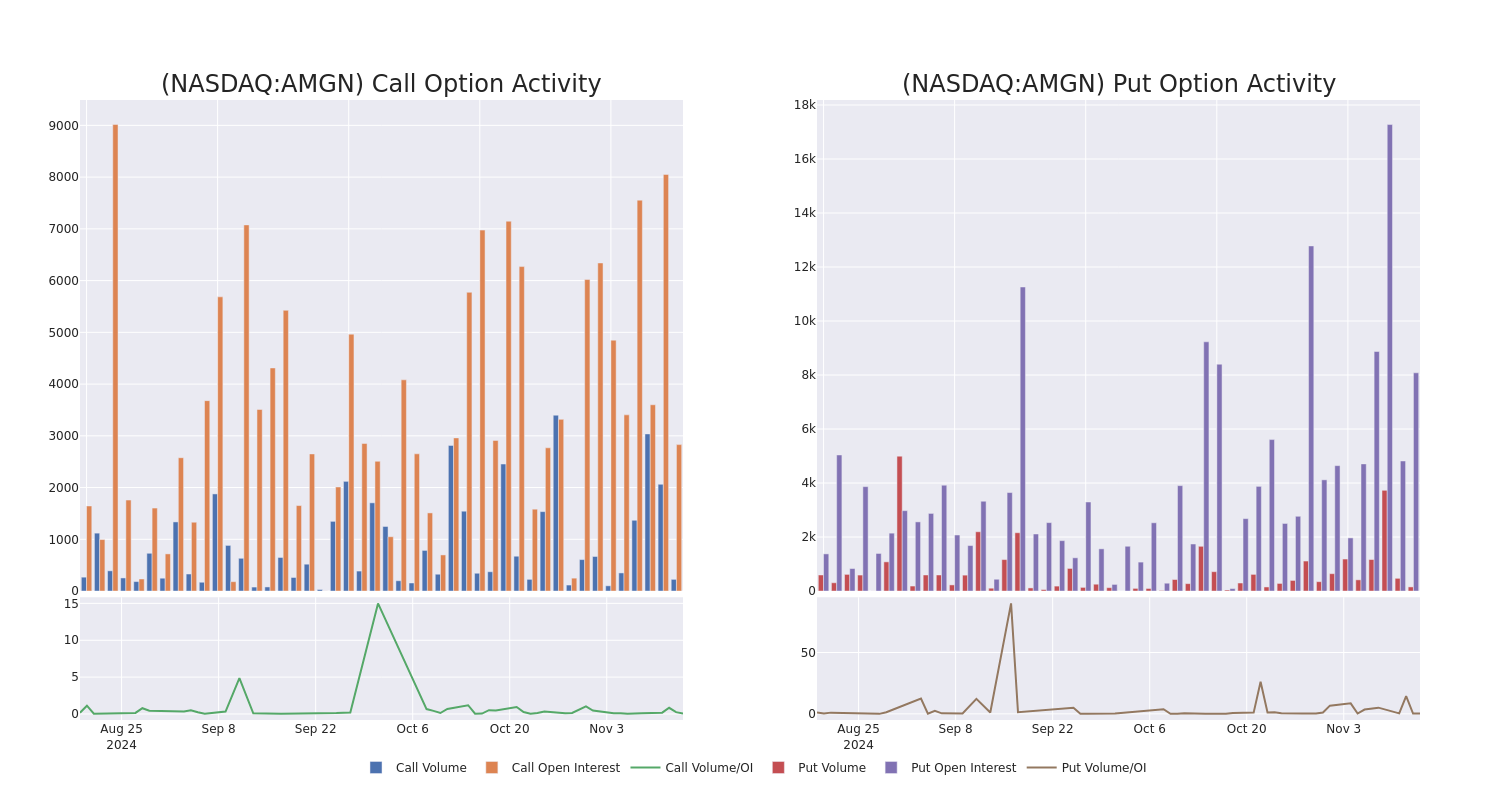

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Amgen’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amgen’s whale activity within a strike price range from $290.0 to $340.0 in the last 30 days.

Amgen Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | CALL | SWEEP | BULLISH | 01/15/27 | $43.6 | $43.55 | $43.6 | $300.00 | $196.2K | 25 | 0 |

| AMGN | PUT | SWEEP | BULLISH | 01/17/25 | $52.8 | $51.5 | $51.5 | $340.00 | $51.5K | 190 | 19 |

| AMGN | CALL | TRADE | BULLISH | 12/20/24 | $10.3 | $9.2 | $10.0 | $310.00 | $38.0K | 1.8K | 62 |

| AMGN | PUT | SWEEP | NEUTRAL | 12/20/24 | $15.65 | $15.2 | $15.45 | $290.00 | $33.9K | 1.5K | 30 |

| AMGN | CALL | TRADE | BEARISH | 12/06/24 | $2.95 | $2.08 | $2.29 | $340.00 | $26.5K | 112 | 121 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm’s therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Amgen’s Current Market Status

- Currently trading with a volume of 856,173, the AMGN’s price is down by -2.03%, now at $295.33.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 82 days.

What Analysts Are Saying About Amgen

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $360.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Bernstein downgraded its action to Outperform with a price target of $380.

* Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Amgen, targeting a price of $380.

* In a cautious move, an analyst from Citigroup downgraded its rating to Neutral, setting a price target of $335.

* An analyst from TD Cowen persists with their Buy rating on Amgen, maintaining a target price of $383.

* Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Amgen, targeting a price of $326.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Amgen, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crown Reports Third Quarter 2024 Results

Achieved Record Quarterly Revenue of $8.0 Million

Reiterates Fourth Quarter and Full Year 2024 Revenue Guidance of $9 Million and $22 Million, Respectively

Conference Call and Webcast Scheduled for Today, November 14th at 11:00 a.m. ET

LOS ANGELES, Nov. 14, 2024 (GLOBE NEWSWIRE) — Crown Electrokinetics Corp. CRKN (“Crown” or the “Company”), a leading provider of innovative technology infrastructure solutions that benefit communities and the environment, today reported its financial results for the third quarter ended September 30, 2024.

“We’re pleased with our strong third quarter performance, achieving record quarterly revenue of $8.0 million. Crown’s results this quarter reflect the solid foundation and growing operational momentum across our three highly scalable businesses,” said Doug Croxall, CEO and Chairman, Crown. “With diverse and related business divisions, we are focused on developing and providing cutting-edge solutions for multiple large and growing addressable markets. The second half of 2024 continues to bring increased demand for our solutions, as evidenced by recent project wins for lead pipe identification and remediation, slant wells installations, and fiber optic network construction, as well as a strong pipeline for upcoming projects. Crown is well positioned to achieve our growth objectives for the remainder of 2024, and importantly remaining on track to achieve profitability in full year 2025.”

“In 2024, we strategically sought and established a leadership team comprised of industry experts, each bringing a track record of proven success in business, paired with a desire to disrupt the status quo with innovation. We are excited to witness our team execute our vision and plan to provide innovative solutions that benefit communities and the environment, deliver positive societal change, and shape a better future,” concluded. Mr. Croxall.

Recent Business Highlights

Smart Windows

- Announced three-phase product rollout strategy of its first-generation Smart Window Inserts expected to commence in the first quarter of 2025.

Fiber Optics

- Secured three major customer agreements for design and construction of fiber optics networks in Oregon and Nevada.

Water Solutions

Slant Wells

- Commenced installation of two proprietary design slant wells at Vista Serena’s Twin Dolphin in Cabo San Lucas, Mexico, unlocking a new source of water in an area challenged with clean water access.

- Engaged with new customers for survey work in the Los Cabos area to prepare for future slant well installations.

Lead Pipes: Element 82 & PE Pipelines

- Secured initial lead pipe detection projects for Element 82 in the states of Florida and New York.

- Signed over $15 million in Element 82 lead pipe inspection projects in Washington, D.C. and Maryland.

- Awarded two initial lead pipe remediation contracts for PE Pipelines, totaling $33 million.

Financial Results for Third Quarter Ended September 30, 2024

Revenue was $8.0 million for the third quarter 2024, increased from zero in the same period of 2023. Increased revenue is primarily attributable to new contracts from Crown’s Fiber Optics and Water Solutions businesses, including the new Element 82 lead detection business.

Gross profit was $1.4 million for the third quarter 2024, compared to gross profit of zero in the same period of 2023.

Operating expenses were approximately $7.2 million for the third quarter 2024, up from $3.4 million in same period of 2023.

Net loss was $5.9 million for the third quarter 2024, compared with net loss of $2.9 million in the same period of 2023.

Financial Results for the Nine Months Ended September 30, 2024

Revenue was $13.4 million for the nine-months ended September 30, 2024, increased from $0.1 million in the same period of 2023. Increased revenue is primarily attributable to new Fiber Optics and Water Solutions contracts, including the new Element 82 business.

Gross profit was $0.9 million for the nine-months ended September 30, 2024, compared to gross profit of zero in the same period of 2023.

Operating expenses were approximately $15.4 million for the nine-months ended September 30, 2024, up from $12.4 million in same period of 2023.

Net loss was $15.5 million for the nine-months ended September 30, 2024, compared with net loss of $19.7 million in the same period of 2023.

Balance Sheet and Liquidity

As of September 30, 2024, Stockholders’ Equity was $9.9 million, and cash was approximately $3.1 million.

Outlook

Crown reiterates its fourth quarter and full year 2024 revenue guidance of $9.0 million and $22.0 million, respectively. The Company introduces its full year 2025 outlook, anticipating revenue between $30 million and $35 million, while remaining on track to achieve profitability in 2025.

Conference Call and Webcast Information

The Company will host a conference call and audio webcast today, Thursday, November 14th at 11:00 a.m. Eastern Time featuring remarks by Crown’s management team.

Conference Call Information

Date: Thursday, November 14, 2024

Time: 11:00 a.m. Eastern Time / 8:00 a.m. Pacific Time

Live Call: +1-877-451-6152 or +1-201-389-0879 or Call me™

Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1689461&tp_key=0bee79c89d

For interested individuals unable to join the conference call, a replay will be available through November 28, 2024, at +1-844-512-2921 or +1-412-317-6671. Participants must use the following code to access the replay of the call: 13748946. An archived version of the webcast will also be available on Crown’s Investor Relations site: https://ir.crownek.com/.

About Crown

Crown CRKN is an innovative infrastructure solutions provider dedicated to benefiting communities and the environment. Comprised of three business divisions, Smart Windows, Fiber Optics, and Water Solutions, Crown is developing and delivering cutting edge solutions that are challenging the status quo and redefining industry standards. For more information, please visit www.crownek.com.

Forward Looking Statements

Certain statements in this news release may be “forward-looking statements” (within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995) regarding future events or Crown’s future financial performance that involve certain contingencies and uncertainties, including those discussed in Crown’s Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent reports Crown files with the U.S. Securities and Exchange Commission from time to time, in the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements speak only as of the date of this news release and Crown Electrokinetic Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

For more information, please contact:

Investor Relations

info@crownek.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shopify Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Shopify.

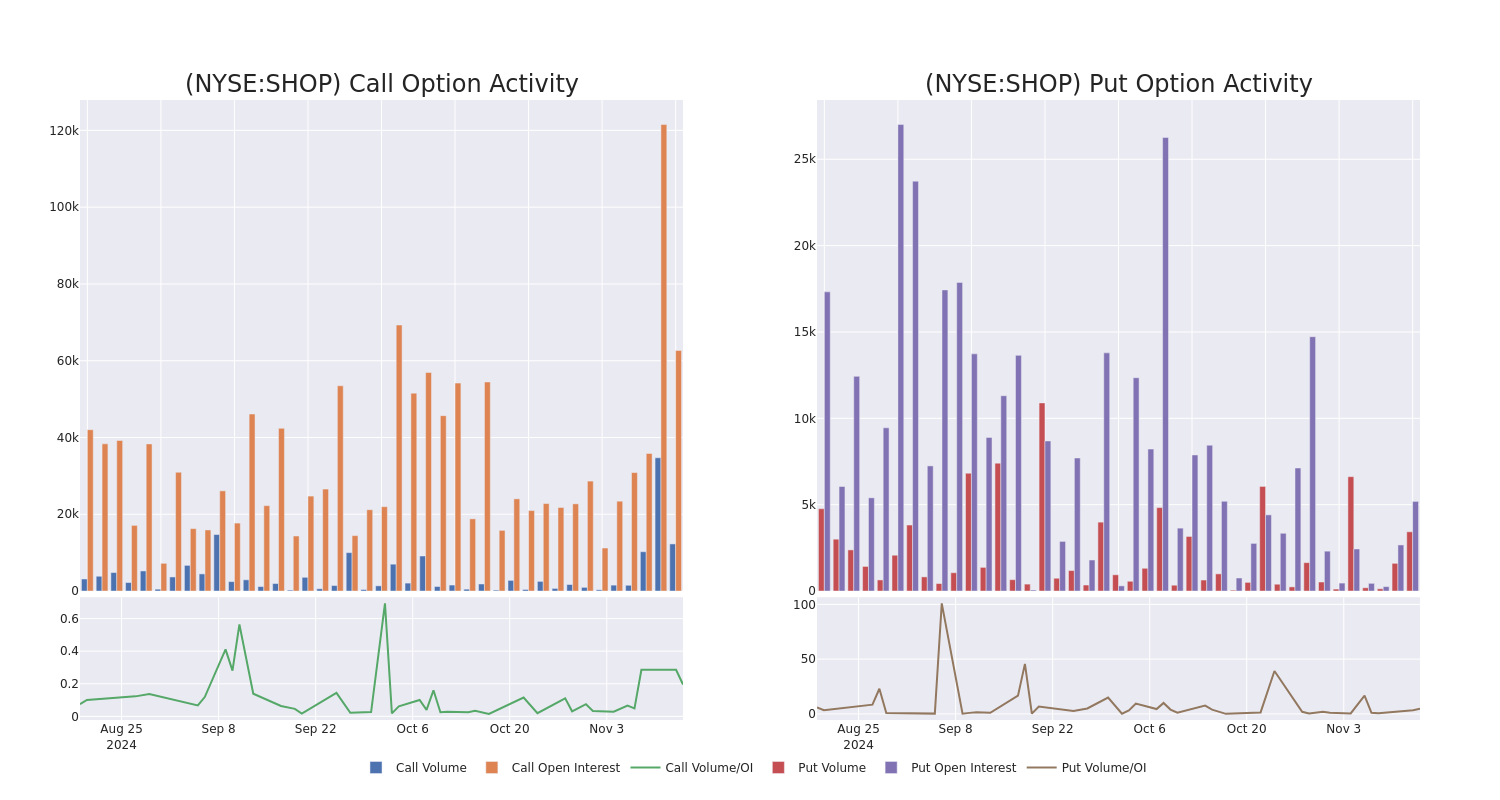

Looking at options history for Shopify SHOP we detected 42 trades.

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $691,916 and 33, calls, for a total amount of $5,852,437.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $120.0 for Shopify over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Shopify’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Shopify’s whale trades within a strike price range from $40.0 to $120.0 in the last 30 days.

Shopify 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | SWEEP | NEUTRAL | 06/20/25 | $29.4 | $28.8 | $29.04 | $90.00 | $1.1M | 4.3K | 2.0K |

| SHOP | CALL | SWEEP | BULLISH | 01/16/26 | $22.7 | $22.0 | $22.7 | $115.00 | $1.1M | 2.2K | 1.8K |

| SHOP | CALL | TRADE | BEARISH | 01/16/26 | $22.6 | $22.4 | $22.4 | $115.00 | $672.0K | 2.2K | 1.8K |

| SHOP | CALL | SWEEP | NEUTRAL | 06/20/25 | $15.9 | $15.15 | $15.54 | $115.00 | $634.6K | 6.0K | 2.0K |

| SHOP | CALL | SWEEP | BULLISH | 06/20/25 | $15.55 | $15.15 | $15.48 | $115.00 | $485.3K | 6.0K | 2.0K |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company’s website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

In light of the recent options history for Shopify, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Shopify Standing Right Now?

- With a trading volume of 5,624,338, the price of SHOP is down by -4.56%, reaching $109.84.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 89 days from now.

What Analysts Are Saying About Shopify

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $112.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Shopify with a target price of $130.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Shopify, targeting a price of $93.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Shopify with a target price of $94.

* Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on Shopify with a target price of $125.

* Consistent in their evaluation, an analyst from JMP Securities keeps a Market Outperform rating on Shopify with a target price of $120.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Shopify options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBD Pharma Co. MediPharm: 37% Increase In Q3 International Sales, 15% YoY Revenue Growth

CBD-based pharmaceutical company MediPharm Labs Corp. LABS MEDIF MLZ announced its third quarter financial results Thursday for the three months ended Sept. 30, 2024.

Q3 Financial Highlights

- Net revenue totaled CA$9.8 million ($7 million), representing a 15% increase year-over-year, with international medical cannabis sales growing 37% over the same period, accounting for 36% of total revenue.

- Gross margin improved to 32% from 29% in the prior year’s period, driven by cost reductions, production efficiencies, and a favorable product mix.

- Adjusted EBITDA came in negative at $743 000, compared to a larger adjusted EBITDA loss of $2.4 million in the prior year’s period.

- Total comprehensive loss for the period totaled CA$2.7 million, down from CA$4.2 million in the prior year’s period.

- MediPharm said it has fully paid off its CA$2.2 million convertible debt in the third quarter of 2024, making the company without any material debt and fully owning its production facilities.

- At the end of the quarter, the company had CA$13 million in cash.

“Q3 2024 was a major step in the right direction towards profitability,” said CFO Greg Hunter. “Paying off our debt and rationalizing facilities, pursuing cost efficiencies while growing our higher margin international revenues are all critical elements to position us for long-term sustainable growth.”

Read Also: MediPharm Q2 Loss Narrows, Adjusted EBITDA Climbs As Gross Profit Improves Nearly 300% YoY

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

International Expansion

MediPharm saw growth, with Beacon branded flower sales increasing in Germany and Australia.

During the quarter the company launched 11 new SKUs, including live resin GMP vapes for the Australian medical market.

The company said its Canadian cannabis clinic business, Harvest Medicine, was profitable.

It is positioned for continued international expansion, with late-stage regulatory registrations in the UK, Brazil and New Zealand, as well as early to mid-stage regulatory registrations that include France, Spain, Poland and Switzerland.

“As a global GMP player, our international sales grew 37% vs. Q3 2023, resulting in over 35% of revenue coming from outside Canada,” David Pidduck, the company’s CEO, said.

MEDIF Price Action

MediPharm’s shares traded 6% higher at $0.053 per share after the market close on Wednesday afternoon.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Two firm inflation prints just made the Fed's 2025 rate cut path a lot 'murkier'

October inflation readings out this week have shown little progress toward the Fed’s two percent inflation target, putting into question how deeply the Federal Reserve will cut interest rates in 2025.

On Wednesday, the “core” Consumer Price Index (CPI), which strips out the more volatile costs of food and gas, showed prices increased 3.3% for the third consecutive month during October. Then on Thursday, the “core” Producer Price Index (PPI) revealed prices increased by 3.1% in October, up from 2.8% the month prior and above economist expectations for a 3% increase.

Taken together, the readings are adding to an overall picture of persistent, sticky inflation within the economy. Economists don’t see the data changing the Fed’s outlook come December. And markets agree with the CME FedWatch Tool currently placing a nearly 80% chance the Fed cuts rates by 25 basis points at its December meeting.

But the lack of recent progress on the inflation front could prompt the Fed to adjust its Summary of Economic Projections (SEP), which had forecast the central bank would cut interest rates four times, or by one percentage point in total, throughout 2025.

“PPI won’t decisively alter the Fed’s easing bias, but it makes charting the policy outlook murkier,” Nationwide financial markets economist Oren Klachkin wrote in a note to clients today. “We anticipate 75 [basis points] of cumulative Fed easing in 2025, but risks seem to be tilting toward a more gradual pace of easing.”

“Their bias is toward cutting, but they’ll probably have to have to go at a slower pace next year,” Wolfe Research chief economist Stephanie Roth told Yahoo Finance (video above).

Markets have quickly shifted over the past two months to reflect this sentiment. On Sep. 18, when the Fed slashed rates by half a percentage point, markets had projected the Fed would finish 2025 with a Federal Funds rate around 3%. Now, the market is pricing in about 80 fewer basis points of easing next year.

This speculation has also prompted a large increase in bond yields over the past month. The 10-year Treasury yield (^TNX) has added about 80 basis points since the Fed’s first rate cut in September. But that in itself hasn’t proved to be a headwind for the stock market rally, as all three indexes are within striking distance of new record highs. Investors have attributed the market’s resilience to stronger-than-expected economic data flowing in as bond yields rise.

“The reason it hasn’t hit the stock market is very simply because if the yield is rising, partly because growth is going to be stronger, that effect is going to be stronger on the stock market,” Bridgewater Associates co-chief investment officer Karen Karniol-Tambour said at the Yahoo Finance Invest conference.