Nuvem, A Leading Pharmacy Technology and Services Company Appoints New CEO

Mount Laurel, NJ November 14, 2024 –(PR.com)– Nuvem, a high-growth, healthcare technology company offering an integrated suite of pharmacy claims administration, high-level of 340B support and services and onsite pharmacy management services to safety net healthcare providers, announced today that Scott Seidelmann has joined the Company as its new Chief Executive Officer, effective immediately.

Seidelmann has more than 25 years of experience in provider-oriented healthcare and pharmacy technology and services and brings a wealth of knowledge and experience in the 340B industry, with an emphasis on client success and growth. Most recently, Seidelmann was the EVP and Chief Commercial Officer at Omnicell, a publicly traded pharmacy technology and services company primarily serving health systems. Throughout his career, Seidelmann has focused on utilizing technology and services to help providers deliver improved patient care more efficiently and effectively.

“I am excited to join Nuvem and grateful for the opportunity to help steward this incredible Company, alongside the Executive Leadership team,” said Seidelmann. “Pharmacy is an essential aspect of both patient care and financial success for FQHCs, grantees and hospitals. With the 340B program constantly evolving, it is vital for these entities to have a technology expert and trusted, knowledgeable partner to guide them through this shifting landscape. I feel confident, that is Nuvem.”

Kurt Brumme, Partner at Parthenon Capital, said “We are delighted to have Scott join the Nuvem team and believe his deep industry experience and growth mindset are key characteristics that will propel Nuvem into its next phase of transformation.”

Matt Umscheid departed from his role as CEO at the end of October. During his tenure, he unified multiple divisions under the rebrand of Nuvem; introduced a holistic solution that improved client experience, drove significant innovation to entities, while staying true to the Company’s mission and values.

“On behalf of Nuvem, I want to sincerely thank Matt for his contributions and his dedication to our clients, people and brand,” said Brumme. “We wish him the very best and know he will do great things in the future.”

“I would like to thank Parthenon Capital Partners for the opportunity to lead Nuvem during my tenure here,” said Umscheid. “It has been an honor working alongside, what I consider, to be the best in the business. I am proud of what we accomplished to produce a more unified team and a holistic solution that is in line with the changing 340B landscape.”

About Nuvem:

Nuvem is an industry trusted integrated pharmacy partner, offering innovative pharmacy management, 340B technology and compliance solutions. Nuvem provides a holistic solution, empowering healthcare organizations to achieve optimal outcomes and maximize their pharmacy programs’ potential. With a relentless focus on client success and a commitment to innovation, Nuvem is driving lasting change in the healthcare industry. For more information, visit www.nuvem.com

About Parthenon Capital:

Parthenon Capital is a leading growth-oriented private equity firm with offices in Boston, San Francisco and Austin. Parthenon utilizes niche industry expertise and a deep execution team to invest in growth companies in service and technology industries. Parthenon seeks to be an active and aligned partner to management, either through recapitalization transactions or by backing new executives. Parthenon has particular expertise in financial and insurance services, healthcare and technology services, but seeks any service, technology or delivery business with a strong value proposition and proprietary know-how. For more information, visit www.parthenoncapital.com

Contact Information:

Nuvem

Melanie Gaffney

(888) 356-6225

Contact via Email

https://nuvem.com/

All media requests should be directed to the Vice President of Marketing and Communications listed above.

Read the full story here: https://www.pr.com/press-release/925344

Press Release Distributed by PR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Agora Launches Smart Questionnaire to Simplify the Onboarding and Subscription Process For Real Estate Investors

The new tool converts complex signature documents into personalized, interactive, and simple questionnaires.

NEW YORK, Nov. 14, 2024 /PRNewswire/ — Agora, a leading real estate investment management platform with offices in New York City and Tel Aviv, is announcing the launch of its Smart Questionnaire. This tool is designed to help real estate LPs complete subscription agreements, and ultimately empower GPs to raise capital faster. Agora’s Smart Questionnaire reduces the complexity of the subscription process, helping convert complex signature documents into simple, personalized interactive questionnaires.

What the Smart Questionnaire does:

- Transforms Complex Documents: Converts subscription documents into simple, interactive questionnaires that investors can complete with ease.

- Personalizes Content for Investors: Allows GPs to create interactive, pre-filled questionnaires that are simple and efficient for LPs to complete.

- Facilitates Seamless Collaboration: Supports multi-user input, allowing LPs, GPs, family offices, and others to complete sections collaboratively.

- Supports Efficient Revisions: Allows investors to correct only the necessary fields without redoing the entire form, minimizing back-and-forth.

- Streamlines Key Processes: Simplifies creation and completion of subscription agreements, operating agreements, and limited partnership agreements, making onboarding faster and more user-friendly.

“Agora has cracked the code for investor onboarding with our Smart Questionnaire. The tool turns complex subscription agreements into digital, interactive questionnaires that investors can complete in a few clicks,” stated Lior Dolinski, Co-Founder and Chief Product Officer of Agora. “This solution not only simplifies the process for investors but also enhances collaboration between LPs and GPs, creating a smoother, more efficient experience for real estate investment firms.”

Agora’s Smart Questionnaire offers the opportunity to enhance investors’ experiences with personalized workflows, simplify and speed up onboarding and investor commitments, and make for easier collaboration – similar to many of its other tools designed specifically for real estate professionals. Further, the launch of the Smart Questionnaire comes shortly after the launch of Agora’s Report Builder, a first-of-its-kind tool that helps real estate professionals create custom reports for clients, such as distribution notices, quarterly reports, and more, and is similar to website-building tools such as Wix or Squarespace, incorporating drag-and-drop functionality and dynamic fields. Additionally, Agora also launched its Waterfall Tool, which helps professionals navigate waterfall distributions – a method of allocating capital gains or returns among investors.

Book a demo to learn more about Agora here: https://agorareal.com/

About Agora:

Agora, a fintech and SaaS company based in New York City and Tel Aviv, offers an innovative real estate investment management platform designed for modern real estate investment businesses. This comprehensive software solution combines technology, automation, and real estate expertise to streamline investment management. Agora transforms how firms raise and preserve capital, delivering a seamless, efficient experience for both managers and investors by automating back-office tasks, enhancing investor satisfaction, and providing advanced tools to optimize operational efficiency. Core services include investor portals, CRMs, data rooms, automated investor onboarding, and expert CPA for bookkeeping and tax management, giving clients comprehensive control over their financial operations. Additionally, Agora delivers powerful data insights, enabling clients to make informed, data-driven decisions across a wide range of asset classes, including multifamily, residential, industrial, office, agriculture, and debt and equity funds.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/agora-launches-smart-questionnaire-to-simplify-the-onboarding-and-subscription-process-for-real-estate-investors-302304705.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/agora-launches-smart-questionnaire-to-simplify-the-onboarding-and-subscription-process-for-real-estate-investors-302304705.html

SOURCE Agora Real Estate

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

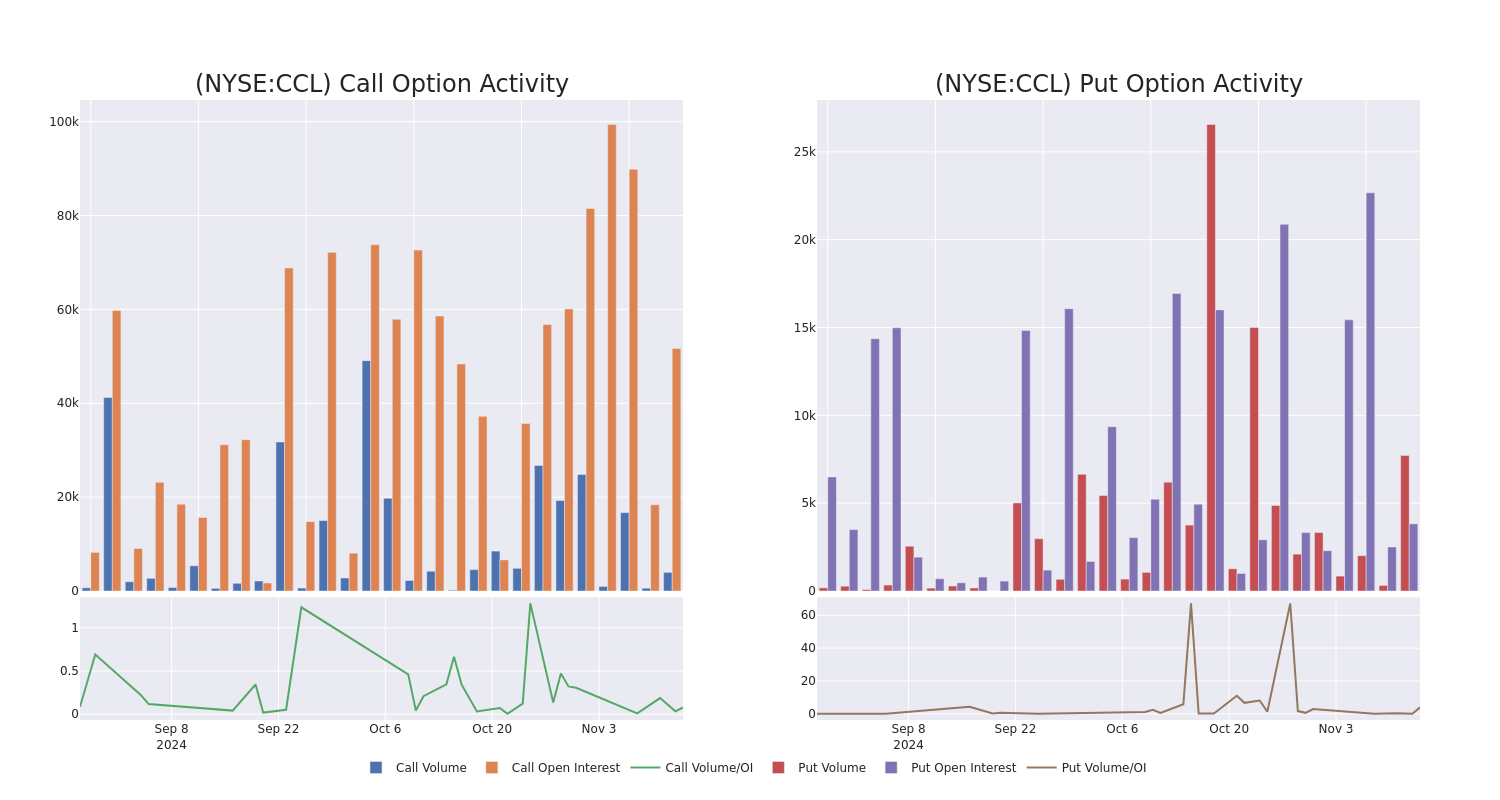

What the Options Market Tells Us About Carnival

Benzinga’s options scanner just detected over 11 options trades for Carnival CCL summing a total amount of $882,973.

At the same time, our algo caught 6 for a total amount of 285,343.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $25.0 for Carnival, spanning the last three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Carnival’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Carnival’s whale activity within a strike price range from $20.0 to $25.0 in the last 30 days.

Carnival Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | CALL | SWEEP | BULLISH | 06/20/25 | $6.3 | $6.1 | $6.15 | $20.00 | $468.6K | 11.3K | 1.0K |

| CCL | CALL | TRADE | BEARISH | 01/16/26 | $6.5 | $6.45 | $6.45 | $22.00 | $301.2K | 1.8K | 2.0K |

| CCL | CALL | TRADE | BEARISH | 01/16/26 | $6.6 | $6.5 | $6.5 | $22.00 | $130.0K | 1.8K | 2.0K |

| CCL | CALL | TRADE | BULLISH | 01/17/25 | $5.15 | $5.0 | $5.15 | $20.00 | $103.0K | 37.0K | 204 |

| CCL | PUT | SWEEP | BULLISH | 01/17/25 | $1.73 | $1.72 | $1.72 | $25.00 | $89.4K | 751 | 520 |

About Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe. It’s currently folding its P&O Australia brand into Carnival. The firm also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival’s brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

Carnival’s Current Market Status

- Trading volume stands at 3,772,389, with CCL’s price up by 1.02%, positioned at $24.8.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 35 days.

Expert Opinions on Carnival

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $28.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities persists with their Buy rating on Carnival, maintaining a target price of $28.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Actelis Networks Reports Q3 2024 Results: 200% Quarterly Revenue Growth; 46% Year-to-Date Growth Reaching $6.7 Million

FREMONT, Calif., Nov. 14, 2024 (GLOBE NEWSWIRE) — Actelis Networks, Inc. ASNS (“Actelis” or the “Company”), a market leader in cyber-hardened, rapid deployment networking solutions for wide area IoT applications, today reported financial results for the fiscal third quarter ended September 30, 2024.

Financial Highlights for the Third Quarter and nine months ending September 30:

- Robust Revenue Growth, Surpassing Full-Year 2023 in Nine Months: Revenue reached $2.54 million in Q3 2024, a 200% year-over-year increase from $0.85 million in Q3 2023. For the nine months ending September 30, 2024, revenue grew to $6.7 million—up 46% from the prior-year period—driven by accelerated execution of large contracts, including $1.1 million of software and support revenues out of a two-year software and services renewal with one of our largest customers.

- Significant Improvement in Gross Margin: Gross margin soared to $1.74 million, or 69%, in Q3 2024, a substantial increase from $0.2 million, or 27%, in the same quarter last year. This boost was driven by an increase in revenues driving lower indirect costs as a percentage of revenues, and the significant software component of revenue. For the nine months ending September 30, 2024, gross margin increased to $3.9 million, or 58%, up from $1.55 million, or 34%, in the prior-year period. This substantial improvement is driven by higher software and services revenue and other high margin sales, along with stable, low indirect costs.

- Continued Reduction in Operating Expenses: Operating expenses continued their downward trend, totaling $2.0 million in Q3-2024, a 12% reduction compared to the same quarter last year. For the nine months ending September 30, 2024, operating expenses reached $6.0 million, down 17%, or $1.22 million, from the prior-year period, aligning with the company’s cost reduction commitment made last year.

- Significant Reduction in Net Loss and Non-GAAP Adjusted EBITDA: Net loss narrowed substantially to $511,000 in Q3 2024, a 41% decrease compared to the prior-year quarter, and by 41% to $2.57 million for the nine months ending September 30, 2024. Non-GAAP Adjusted EBITDA improved sharply, down 87% to $233,000 in Q3 2024, and down 56% to $2.0 million for the nine-month period. These improvements reflect the successful impact of increased revenue, gross margin growth, and ongoing operating cost reductions.

- Liquidity and Nasdaq Compliance Secured: With nearly $5 million raised in June 2024 and a significant reduction in net loss, shareholders’ equity reached $2.8 million as of September 30, 2024. In September, the Company also filed a shelf prospectus and now has an effective At-The-Market (ATM) facility in place.

“Our third-quarter results underscore Actelis’ strong financial performance and continued growth trajectory,” said Tuvia Barlev, Chairman and CEO of Actelis. “With robust revenue growth, a dramatic increase in gross margins, and disciplined cost management, we are achieving the financial resilience needed to support our expanding role in critical sectors. This progress reflects the value of our cyber-hardened, rapid-deployment networking solutions and our commitment to driving sustainable long-term growth for our shareholders.”

Recent Company Highlights

- Actelis continues to gain strong traction with significant contract renewals and new orders across strategic markets. In Q3 2024, Actelis secured the 1.4 million renewal of a two-year software and services contract with one of its largest North American customers out of which recognized 1.1 million in Q3, underscoring the long-standing trust and value Actelis provides while further enhancing our recurring revenue base.

- The Company also received substantial new orders across diverse sectors, solidifying Actelis’ position as a leading provider of cyber-hardened, rapid-deployment networking solutions. Key projects include modernization initiatives for Intelligent Transportation Systems (ITS) in major U.S. cities and counties, deployments for U.S. military bases, and expansion into European markets like Italy’s national highway infrastructure and German utilities.

- Recent follow-on orders with the U.S. Department of Transportation and municipalities in Germany demonstrate Actelis’ capability to serve critical infrastructure, transportation, and government applications with its secure, hybrid-fiber technology.

- Actelis’ expense reduction program continues to yield positive results, with operating expenses for the nine months ending June 30, 2024, reduced by 17% year-over-year, aligning with our strategic cost structure optimization plan, and preparing the Company for a strong trajectory towards 2025.

- Actelis continues to advance its ‘Cyber Aware Networking’ initiative, an AI-powered SaaS layer designed to enhance the security of IoT networks by providing comprehensive threat monitoring and automated response capabilities directly at the network edge. As part of this initiative, and as reported on August 19, 2024, the Company is collaborating with an advanced cybersecurity provider to further develop and deliver these capabilities.

- Following extensive due diligence, Actelis issued a termination notice on October 12, 2024, for its agreement with Quality Industrial Corp., concluding that the deal did not align with our objective to maximize shareholder value.

- Despite ongoing tensions and conflicts in the Middle East, Actelis’ operations remain unaffected. We are closely monitoring the situation and are prepared to make necessary adjustments as events unfold.

“Our third quarter concluded positively, meeting and exceeding key expectations,” noted Tuvia Barlev, Chairman and CEO of Actelis. “Our unique ability to deliver fiber-grade hardware, software, and services across key verticals—such as Intelligent Transportation, Smart Cities, Federal and Military agencies, and Multi-Dwelling Units—positions us well to maximize revenue growth and advance towards profitability. Looking ahead, we remain focused on driving organic growth while also exploring strategic opportunities that align with our strengths and enhance the value we bring to our customers.”

Fiscal Third Quarter and First nine months 2024 Financial Results:

- Revenues: Q3 2024 revenues were $2.54 million, reflecting a 200% year-over-year increase from $0.85 million in Q3 2023. The increase from the corresponding period was primarily attributable to an increase of $1.4 million of revenues generated from North America driven by volume increase and a renewal of a service and software contract and an increase of $0.3 million of revenues generated from Asia Pacific and Europe, the Middle East and Africa driven by volume increase.

For the nine months ended September 30, 2024, revenues were $6.7 million, compared to $4.6 million for the nine months ended September 30, 2023. The increase from the corresponding period was primarily attributable to an increase of $3.4 million in revenues generated from North America associated with volume increase and a renewal of a service and software contract offset by decrease of $1.3 million in revenues generated from Asia Pacific and Europe, the Middle East and Africa associated with completed projects in the prior year period.

- Cost of Revenues: Cost of revenues for Q3 2024 was $0.8 million, compared to $0.6 million in Q3 2023. The increase from the corresponding period was primarily attributable to the increase in revenues as well as change in the product mix.

For the nine months ended September 30, 2024, the cost of revenues was $2.8 million, compared to $3.0 million for the nine months ended September 30, 2023. The decrease from the corresponding period was primarily attributable to the change in regional mix of revenue of an increase in North America revenues, which are more profitable, and a decrease in Europe, Middle East and Africa revenues which are less profitable

- Gross Profit: Gross profit for Q3 2024 was $1.7 million, up from $0.23 in Q3 2023. For the nine months ended September 30, 2024, gross profit reached $3.9 million, compared to $1.5 million in the nine months ended September 30, 2023.

- Research and Development Expenses: R&D expenses for Q3 2024 were $0.5, down from $0.7 in Q3 2023. For the nine months ended September 30, 2024, R&D expenses were $1.8 million, compared to $2.1 million in the same period last year. The decrease is primarily attributable to cost reduction measures taken.

- Sales and Marketing Expenses: Sales and marketing expenses for Q3 2024 were $0.72, compared to $0.69 in Q3 2023. For the nine months ended September 30, 2024, these expenses totaled $2.0 million, down from $2.3 million in the nine months ended September 30, 2023.The decrease was mainly due to cost reduction measures taken.

- General and Administrative Expenses: G&A expenses were $0.79 in Q3 2024, down from $0.97 in Q3 2023. For the nine months ended September 30, 2024, G&A expenses were $2.4 million, compared to $2.80 million for the same period last year. The decrease was mainly due to cost reduction measures taken.

- Other Income: Other Income was $0 in Q3 2024. For the nine months ended September 30, 2024, Other Income was $163,000 driven by a government grant from the state of Israel associated with the Swords of Iron war.

- Operating Profit/Loss: Operating profit for Q3 2024 was $0.32 million, compared to an operating loss of $2.13 million in Q3 2023. For the nine months ended September 30, 2024, the operating loss was reduced to $2.12 million, down from $5.70 million in the nine months ended September 30, 2023. The decrease was mainly due to the increase in revenues, improved gross margin due to regional revenue mix, and cost reduction measures taken, reducing operating expenses.

- Financial Income/(expense) and Interest Expenses: Our financial income, net was $52,000 and our interest expense was $0.2 million for the three months ended September 30, 2024 compared to financial income, net of $1.4 million and $0.2 million interest expenses for the three months ended September 30, 2023. The increase is mainly due to financial income in the prior year from bank deposits and exchange rate differences not repeated in current period.

Our financial income, net was $138,000 and our interest expense was $0.6 million for the nine months ended September 30, 2024 compared to financial income, net of $1.9 million and interest expense of $0.5 million interest expenses for the nine months ended September 30, 2023. The increase is mainly due to financial income in the prior year from bank deposits and exchange rate differences not repeated in current period.

- Net Comprehensive Profit/(Loss): Net comprehensive Loss for Q3 2024 was $0.51 million, a significant turnaround from a net loss of $0.87 million in Q3 2023. For the nine months ended September 30, 2024, the net loss was $2.57 million, compared to a net loss of $4.35 million in the nine months ended September 30, 2023. This decrease was primarily due to the increase in revenues, improved gross margin due to regional revenue mix, and cost reduction measures taken, reducing operating expenses, partially offset by financial income in the prior year not repeating itself.

- Non-GAAP EBITDA: Non-GAAP EBITDA loss was $233,000 in Q3-2024, compared to a non-GAAP EBITDA loss of $1.76 million in the year ago period, driven by increased revenue, better gross margin and reduced operating expenses. For the nine months ended September 30, 2024, non-GAAP EBITDA loss was $2.0 million, from $4.6 million in the year ago period. This decrease was primarily due to the increase in revenues, improved gross margin due to regional revenue mix, and cost reduction measures taken, reducing operating expenses.

About Actelis Networks, Inc.

Actelis Networks, Inc. ASNS is a market leader in hybrid fiber-copper, cyber-hardened networking solutions for rapid deployment in wide-area IoT applications, including government, ITS, military, utility, rail, telecom, and campus networks. Actelis’ innovative portfolio offers fiber-grade performance with the flexibility and cost-efficiency of hybrid fiber-copper networks. Through its “Cyber Aware Networking” initiative, Actelis also provides AI-based cyber monitoring and protection for all edge devices, enhancing network security and resilience. For more information, please visit www.actelis.com.

Use of Non-GAAP Financial Information

Non-GAAP Adjusted EBITDA, and backlog of open orders are Non-GAAP financial measures. In addition to reporting financial results in accordance with GAAP, we provide Non-GAAP operating results adjusted for certain items, including: financial expenses, which are interest, financial instrument fair value adjustments, exchange rate differences of assets and liabilities, stock based compensation expenses, depreciation and amortization expense, tax expense, and impact of development expenses ahead of product launch. We adjust for the items listed above and show Non-GAAP financial measures in all periods presented, unless the impact is clearly immaterial to our financial statements. When we calculate the tax effect of the adjustments, we include all current and deferred income tax expense commensurate with the adjusted measure of pre-tax profitability.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements. Forward-looking statements are not historical facts, and are based upon management’s current expectations, beliefs and projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections are expressed in good faith. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved, and actual results may differ materially from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov.

Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. References and links to websites have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this press release. Actelis is not responsible for the contents of third-party websites.

Media Contact:

Sean Renn

Global VP Marketing & Communications

srenn@actelis.com

Investor Contact:

ARX | Capital Markets Advisors

North American Equities Desk

actelis@arxadvisory.com

-Financial Tables to Follow-

| ACTELIS NETWORKS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (U. S. dollars in thousands) |

|||

| September 30, 2024 |

December 31, 2023 |

||

| Assets | |||

| CURRENT ASSETS: | |||

| Cash and cash equivalents | 2,241 | 620 | |

| Short term deposits | – | 197 | |

| Restricted cash equivalents | 300 | 1,565 | |

| Trade receivables, net of allowance for credit losses of $168 as of September 30, 2024, and December 31, 2023. | 1,828 | 664 | |

| Inventories | 2,372 | 2,526 | |

| Prepaid expenses and other current assets, net of allowance for doubtful debts of $181 and $144 as of September 30, 2024, and December 31, 2023, respectively | 481 | 340 | |

| TOTAL CURRENT ASSETS | 7,222 | 5,912 | |

| NON-CURRENT ASSETS: | |||

| Property and equipment, net | 52 | 61 | |

| Prepaid expenses | 592 | 592 | |

| Restricted cash and cash equivalents | – | 3,330 | |

| Restricted bank deposits | 91 | 94 | |

| Severance pay fund | 200 | 238 | |

| Operating lease right of use assets | 515 | 918 | |

| Long term deposits | 78 | 78 | |

| TOTAL NON-CURRENT ASSETS | 1,528 | 5,311 | |

| TOTAL ASSETS | 8,750 | 11,223 | |

| ACTELIS NETWORKS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (continued) UNAUDITED (U. S. dollars in thousands) |

||||

| September 30, 2024 |

December 31, 2023 |

|||

| Liabilities, Mezzanine Equity and shareholders’ equity | ||||

| CURRENT LIABILITIES: | ||||

| Credit line | 927 | – | ||

| Current maturities of long-term loans | – | 1,335 | ||

| Trade payables | 893 | 1,769 | ||

| Deferred revenues | 277 | 389 | ||

| Employee and employee-related obligations | 760 | 737 | ||

| Accrued royalties | 1,033 | 1,062 | ||

| Current maturities of operating lease liabilities | 450 | 498 | ||

| Other current liabilities | 735 | 1,122 | ||

| TOTAL CURRENT LIABILITIES | 5,075 | 6,912 | ||

| NON-CURRENT LIABILITIES: | ||||

| Long-term loan, net of current maturities | 150 | 3,154 | ||

| Deferred revenues | 160 | 71 | ||

| Operating lease liabilities | 62 | 405 | ||

| Accrued severance | 226 | 270 | ||

| Other long-term liabilities | 16 | 23 | ||

| TOTAL NON-CURRENT LIABILITIES | 614 | 3,923 | ||

| TOTAL LIABILITIES | 5,689 | 10,835 | ||

| COMMITMENTS AND CONTINGENCIES (Note 10) | ||||

| MEZZANINE EQUITY | ||||

| Redeemable convertible preferred stock – $0.0001 par value, 10,000,000 authorized as of September 30, 2024, December 31, 2023. None issued and outstanding as of September 30, 2024, December 31, 2023. | – | – | ||

| WARRANTS TO PLACEMENT AGENT (Note 7) | 228 | 159 | ||

| SHAREHOLDERS’ EQUITY : | ||||

| Common stock, $0.0001 par value: 30,000,000 shares authorized: 6,254,664 and 3,007,745 shares issued and outstanding as of September 30, 2024, and December 31, 2023, respectively. | 1 | 1 | ||

| Non-voting common stock, $0.0001 par value: 2,803,774 shares authorized as of September 30, 2024, and December 31, 2023, None issued and outstanding as of September 30, 2024, and December 31, 2023. | – | – | ||

| Additional paid-in capital | 45,095 | 39,916 | ||

| Accumulated deficit | (42,263 | ) | (39,688 | ) |

| TOTAL SHAREHOLDERS’ EQUITY | 2,833 | 229 | ||

| TOTAL LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY | 8,750 | 11,223 | ||

| ACTELIS NETWORKS, INC. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (UNAUDITED) (U. S. dollars in thousands) |

|||||||||||||||

| Nine months ended September 30, |

Three months ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| REVENUES | 6,698 | 4,589 | 2,541 | 845 | |||||||||||

| COST OF REVENUES | 2,792 | 3,043 | 798 | 619 | |||||||||||

| GROSS PROFIT | 3,906 | 1,546 | 1,743 | 226 | |||||||||||

| OPERATING EXPENSES: | |||||||||||||||

| Research and development expenses | 1,793 | 2,117 | 543 | 691 | |||||||||||

| Sales and marketing expenses | 2,001 | 2,332 | 727 | 691 | |||||||||||

| General and administrative expenses | 2,398 | 2,805 | 790 | 971 | |||||||||||

| Other income | (163 | ) | – | – | – | ||||||||||

| TOTAL OPERATING EXPENSES | 6,029 | 7,254 | 2,060 | 2,353 | |||||||||||

| OPERATING LOSS | (2,123 | ) | (5,708 | ) | (317 | ) | (2,127 | ) | |||||||

| Interest expense | (590 | ) | (512 | ) | (246 | ) | (161 | ) | |||||||

| Other Financial income, net | 138 | 1,865 | 52 | 1,421 | |||||||||||

| NET COMPREHENSIVE LOSS FOR THE PERIOD | (2,575 | ) | (4,355 | ) | (511 | ) | (867 | ) | |||||||

| Net loss per share attributable to common shareholders – basic and diluted | $ | (0.59 | ) | $ | (1.93 | ) | $ | (0.09 | ) | $ | (0.32 | ) | |||

| Weighted average number of common stocks used in computing net loss per share – basic and diluted | 4,429,738 | 2,254,235 | 6,014,548 | 2,685,626 | |||||||||||

Non-GAAP Financial Measures

| (U.S. dollars in thousands) | Three months Ended September 30, 2024 |

Three months Ended September 30, 2023 |

Nine months Ended September 30, 2024 |

Nine months Ended September 30, 2023 |

||||||||||||

| Revenues | $ | 2,541 | $ | 845 | $ | 6,698 | $ | 4,589 | ||||||||

| GAAP net loss | (511 | ) | (867 | ) | (2,575 | ) | (4,355 | ) | ||||||||

| Interest Expense | 246 | 161 | 590 | 512 | ||||||||||||

| Other Financial expenses (income), net | (52 | ) | (1,421 | ) | (138 | ) | (1,865 | ) | ||||||||

| Tax Expense | 1 | 18 | 33 | 58 | ||||||||||||

| Fixed asset depreciation expense | 3 | 7 | 10 | 20 | ||||||||||||

| Stock based compensation | 80 | 106 | 259 | 298 | ||||||||||||

| Research and development, capitalization | – | 113 | – | 371 | ||||||||||||

| Other one-time costs and expenses (income) | – | 120 | (189 | ) | 343 | |||||||||||

| Non-GAAP Adjusted EBITDA | (233 | ) | (1,763 | ) | (2,010 | ) | (4,618 | ) | ||||||||

| GAAP net loss margin | (20.11 | )% | (102.60 | )% | (38.44 | )% | (94.90 | )% | ||||||||

| Adjusted EBITDA margin | (9.17 | )% | (208.64 | )% | (30.00 | )% | (100.63 | )% | ||||||||

| ACTELIS NETWORKS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

|||||

| Nine months ended September 30, |

|||||

| 2024 | 2023 | ||||

| U.S. dollars in thousands | |||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||

| Net loss for the period | (2,575 | ) | (4,355 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||

| Depreciation | 11 | 20 | |||

| Changes in fair value related to warrants to lenders and investors | – | (1,658 | ) | ||

| Warrant issuance costs | – | 223 | |||

| Inventories write-downs | 39 | 132 | |||

| Interest expenses | (56 | ) | – | ||

| Exchange rate differences | (58 | ) | (365 | ) | |

| Share-based compensation | 259 | 298 | |||

| Financial income from short and long term bank deposit | (11 | ) | (78 | ) | |

| Changes in operating assets and liabilities: | |||||

| Trade receivables | (1,164 | ) | 2,319 | ||

| Net change in operating lease assets and liabilities | 12 | 25 | |||

| Inventories | 115 | (1,651 | ) | ||

| Prepaid expenses and other current assets | (140 | ) | 62 | ||

| Long term prepaid expenses | – | (100 | ) | ||

| Trade payables | (875 | ) | 411 | ||

| Deferred revenues | (23 | ) | (262 | ) | |

| Other current liabilities | (350 | ) | (185 | ) | |

| Other long-term liabilities | 35 | (30 | ) | ||

| Net cash used in operating activities | (4,781 | ) | (5,194 | ) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||

| Short term deposits | 198 | 1,363 | |||

| Long term Restricted bank deposits | – | 75 | |||

| Long term deposits | – | (2 | ) | ||

| Purchase of property and equipment | (1 | ) | (6 | ) | |

| Net cash provided by investing activities | 197 | 1,430 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||

| Proceeds from exercise of options | 32 | 10 | |||

| Proceeds from issuance of common stocks, pre-funded warrants and warrants | * | 3,500 | |||

| Proceeds from issuance common stock, net of offering costs | 316 | – | |||

| Proceeds from credit lines with bank, net | 927 | – | |||

| Proceeds from Warrant inducement agreement | 5,248 | ||||

| Underwriting discounts and commissions and other offering costs | (668 | ) | (291 | ) | |

| Early repayment of long-term loan | (4,038 | ) | |||

| Repayment of long-term loan | (193 | ) | (583 | ) | |

| Repurchase of common stock | – | (50 | ) | ||

| Net cash provided by financing activities | 1,624 | 2,586 | |||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AND CASH EQUIVALENTS | (14 | ) | (12 | ) | |

| DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH AND CASH EQUIVALENTS | (2,974 | ) | (1,190 | ) | |

| BALANCE OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH AND CASH EQUIVALENTS AT BEGINNING OF THE PERIOD | 5,515 | 4,279 | |||

| BALANCE OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH AND CASH EQUIVALENTS AT END OF THE PERIOD | 2,541 | 3,089 | |||

* Represents an amount less than $1 thousand.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Board Member At Paylocity Holding Sells $8.01M Of Stock

Jeffrey T Diehl, Board Member at Paylocity Holding PCTY, disclosed an insider sell on November 13, according to a recent SEC filing.

What Happened: Diehl opted to sell 37,801 shares of Paylocity Holding, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $8,010,645.

As of Thursday morning, Paylocity Holding shares are down by 0.0%, currently priced at $211.62.

Delving into Paylocity Holding’s Background

Paylocity is a provider of payroll and human capital management solutions servicing small- to midsize clients in the United States. The company was founded in 1997 and targets businesses with 10-5,000 employees and services about 39,000 clients as of fiscal 2024. Alongside core payroll services, Paylocity offers HCM solutions such as time and attendance and recruiting software as well as workplace collaboration and communication tools.

Key Indicators: Paylocity Holding’s Financial Health

Decline in Revenue: Over the 3 months period, Paylocity Holding faced challenges, resulting in a decline of approximately -12.5% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Key Insights into Profitability Metrics:

-

Gross Margin: With a high gross margin of 68.05%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Paylocity Holding’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.62.

Debt Management: Paylocity Holding’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.34.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: Paylocity Holding’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 63.0.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 8.91 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 35.85 reflects market recognition of Paylocity Holding’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Paylocity Holding’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CANADA NOW RANKED 20TH IN THE WORLD FOR WOMEN & CHILDREN'S RIGHTS, WARNS AGENCY CHILDREN BELIEVE

MARKHAM, Ontario, Nov. 14, 2024 (GLOBE NEWSWIRE) — A new report released to mark the 35th anniversary of the Convention of the Rights of the Child on November 20, indicates that Canada’s global ranking on women and children’s rights has fallen to 20th in the world. According to the ChildFund Alliance World Index, which ranks 157 countries according to 30 different criteria, Canada’s ranking has fallen steadily since 2015 due to such factors as the environment, human capital and violence against children. Children Believe, the alliance’s Canadian member, urges Canada to demonstrate greater rights leadership both at home and abroad as it assumes the G7 presidency in 2025.

“This report should be a wake-up call for the Government of Canada,” says Fred Witteveen, President & CEO of Children Believe. “To build on our Feminist International Assistance Policy, Canada must put more money where its mouth is and make fresh commitments to support the rights of women and children here at home and abroad. A critical contributor to global economic growth, safety and security is to ensure the most vulnerable children, especially girls, have access to their right to an education and to include them in decisions that affect their lives. Because education means choices and is the most powerful tool for all children, everywhere, to be able to change their lives for the better.”

Starting in Budget 2025, Children Believe, as part of the Canadian International Education Policy Working Group (CIEPWG) is calling on the Government of Canada to commit $650 million in new and additional resources towards its Official Development Assistance envelope every year for the next four years (2025-2029). The coalition is asking that Canada helps ensure that all girls and boys complete at least 12 years of education because it improves their future incomes, their health, their choice to marry later and ultimately to be more active and productive in their communities.

“Despite Canada’s disappointing ranking on rights, we still enjoy much greater access than other places in the world that need our support. In 2025, Canada must put access to global education firmly back on the G7 leader’s agenda to not only solidify Charlevoix’s legacy – but expand it.”

Children Believe is dedicated to removing the barriers to education, including rights violations. Last year, over 417,000 children, youth, women, parents, and duty-bearers, from 762 community groups across Children Believe’s six countries of operation, benefited from the organization’s work to prevent various forms of violence, neglect, and abuse.

“Children Believe works in some of the world’s toughest places like Ethiopia, Burkina Faso and Mali which all rank in the bottom 10 of the World Index,” says Witteveen. “We look forward to our ongoing partnership with the Government of Canada to improve lives in these places to build a more just and prosperous world for everyone”.

CHILDFUND ALLIANCE WORLD INDEX: KEY FINDINGS

- Canada’s ranking on the index has been declining over the past ten years. In 2015 Canada was ranked #11, in 2020 it was #15 and in 2021 it was #19.

- In 2023, one in three children and more than one in four women lived in countries with minimal implementation of human rights protections. At the current pace, it may take 113 years to fully implement the rights assessed in this Index.

- While access to information and WASH (Water, Sanitation, and Hygiene) services has improved, today’s societies are generally less democratic and secure for women and children. While child health outcomes have improved, educational rights have not progressed since 2020, a stagnation partly due to pandemic impacts.

- Though women’s education levels and participation in decision-making are increasing, they remain among the most vulnerable and marginalized groups, facing the highest likelihood of human rights abuses worldwide.

HOW CANADIANS CAN HELP

This holiday season Canadians can help disrupt rights violations by empowering women and children. Donations to Help Where Most Needed in Children Believe’s gift catalogue will protect them from grave dangers like violence, abuse and exploitation.

CHILDREN BELIEVE

Children Believe works globally to empower children to dream fearlessly, stand up for what they believe in — and be heard. The organization has developed programs in more than 400 communities across six countries in Africa, Asia and the Americas. For 60-plus years, Children Believe has brought together brave young dreamers, caring supporters and partners, and unabashed idealists with a common belief: creating access to education — inside and outside of classrooms — is the most powerful tool children can use to change their world. Children Believe: Until every child grows up to live the life they choose to live.

CHILDFUND ALLIANCE

ChildFund Alliance is a global network of 11 child-focused development and humanitarian organizations helping nearly 30 million children and their families in more than 70 countries. We work to end violence and exploitation against children; provide expertise in emergencies and disasters; and engage in partnership with children, families and communities to create lasting change. Our commitment, resources, and expertise are a powerful force to transform the lives of children by using our global voice with and for children to address threats to their lives, safety and well-being.

Dave Stell Children Believe 4168986770 dstell@childrenbelieve.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

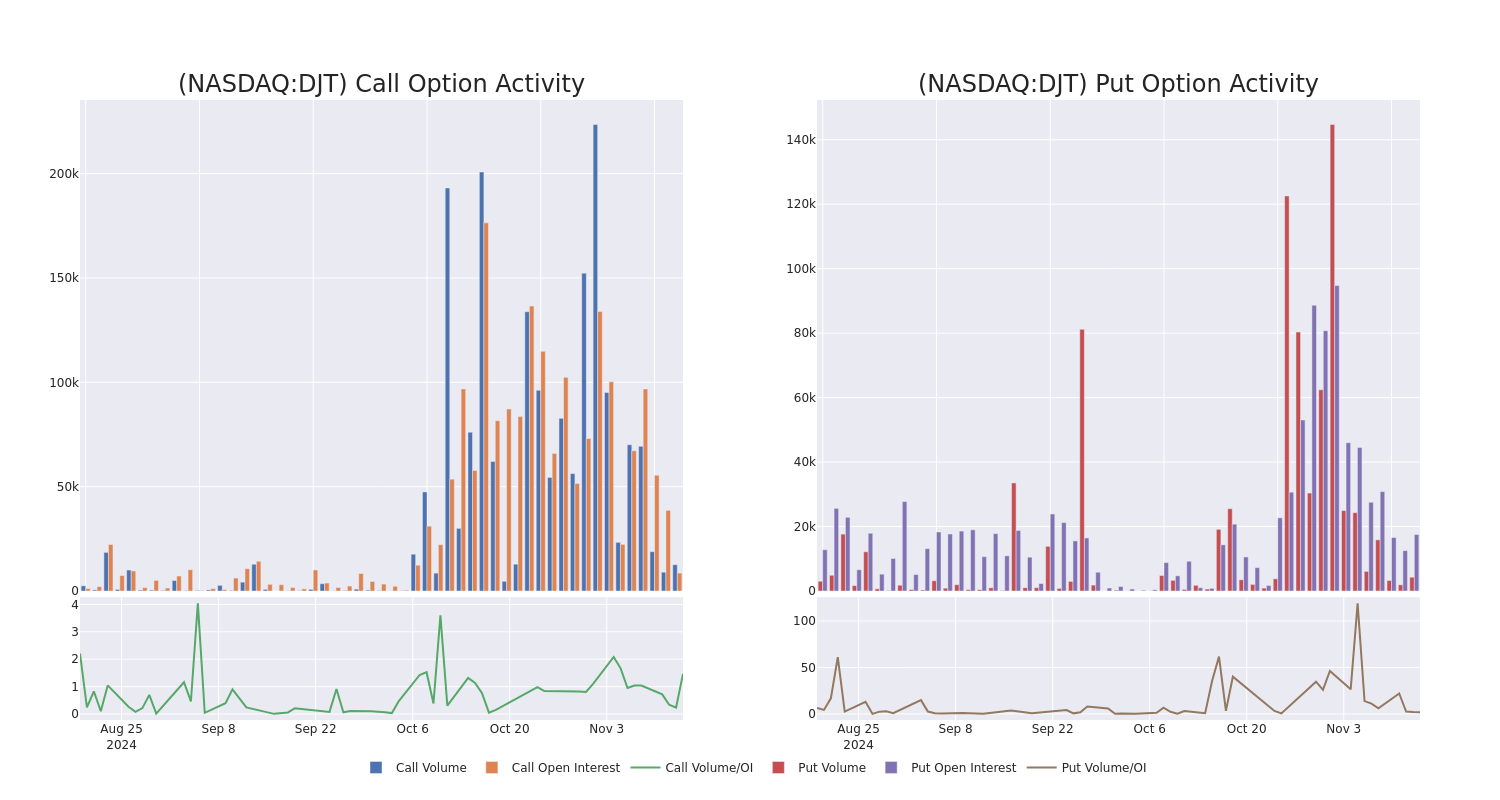

This Is What Whales Are Betting On Trump Media & Technology

Deep-pocketed investors have adopted a bearish approach towards Trump Media & Technology DJT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DJT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 19 extraordinary options activities for Trump Media & Technology. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 47% bearish. Among these notable options, 10 are puts, totaling $744,800, and 9 are calls, amounting to $5,671,118.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Trump Media & Technology, spanning the last three months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Trump Media & Technology’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Trump Media & Technology’s significant trades, within a strike price range of $20.0 to $60.0, over the past month.

Trump Media & Technology Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DJT | CALL | TRADE | BULLISH | 12/20/24 | $8.6 | $8.05 | $8.55 | $23.00 | $4.2M | 401 | 5.0K |

| DJT | CALL | TRADE | BEARISH | 12/20/24 | $9.05 | $8.65 | $8.65 | $21.00 | $653.0K | 406 | 755 |

| DJT | CALL | TRADE | BEARISH | 12/20/24 | $7.25 | $6.85 | $6.93 | $24.00 | $523.2K | 150 | 755 |

| DJT | PUT | SWEEP | BEARISH | 11/15/24 | $6.15 | $5.95 | $6.15 | $33.00 | $305.1K | 1.3K | 595 |

| DJT | PUT | SWEEP | BEARISH | 11/15/24 | $2.7 | $2.62 | $2.7 | $30.00 | $108.0K | 12.1K | 863 |

About Trump Media & Technology

Trump Media & Technology Group Corp is a media and technology company rooted in social media, digital streaming, information technology infrastructure, and more. Its initial product launch will focus on its social media platform, Truth Social, which encourages an open, free, and honest global conversation without discriminating against political ideology.

Having examined the options trading patterns of Trump Media & Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Trump Media & Technology

- With a trading volume of 9,305,086, the price of DJT is down by -6.51%, reaching $27.05.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 81 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Trump Media & Technology with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Edge Lower; Cisco Earnings Top Views

U.S. stocks traded slightly lower this morning, with the Dow Jones index falling by 0.1% on Thursday.

Following the market opening, the Dow traded down 0.09% to 43,917.98 while the NASDAQ fell 0.12% to 19,208.13. The S&P 500 also fell, dropping, 0.15% to 5,976.46.

Check This Out: Jim Cramer Recommends Microsoft, Praises American Water Works For Being ‘Consistent’

Leading and Lagging Sectors

Energy shares rose by 0.1% on Thursday.

In trading on Thursday, real estate shares fell by 0.6%.

Top Headline

Cisco Systems Inc. CSCO reported better-than-expected results for its first quarter and raised its full-year 2025 guidance on Wednesday.

The company reported first-quarter revenue of $13.84 billion, beating the consensus estimate of $13.77 billion. The networking equipment maker reported adjusted earnings of 91 cents per share, beating analyst estimates of 87 cents per share.

Equities Trading UP

- AgEagle Aerial Systems, Inc. UAVS shares shot up 159% to $4.2101 after the company announced 17 new purchase orders for its eBee TAC drones from U.S. defense and security customers.

- Shares of Elevai Labs Inc. ELAB got a boost, surging 58% to $0.0389 after the company announced second-quarter results.

- Gaxos.ai Inc. GXAI shares were also up, gaining 47% to $2.12 after the company’s board approved the purchase of up to $1 million in Bitcoin as a treasury reserve asset.

Equities Trading DOWN

- Nuvectis Pharma, Inc. NVCT shares dropped 48% to $5.55 after the company reported data from its Phase 1b study evaluating NXP800..

- Shares of Sow Good Inc. SOWG were down 41% to $5.82 after the company reported worse-than-expected quarterly financial results.

- Vislink Technologies, Inc. VISL was down, falling 43% to $3.75 after the company reported worse-than-expected third-quarter financial results.

Commodities

In commodity news, oil traded up 0.9% to $69.05 while gold traded down 0.7% at $2,568.70.

Silver traded down 0.9% to $30.400 on Thursday, while copper fell 0.1% to $4.0830.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 1.2%, Germany’s DAX climbed 1.5% and France’s CAC 40 gained 1.4%. Spain’s IBEX 35 Index gained 1.2%, while London’s FTSE 100 rose 0.6%.

Asia Pacific Markets

Asian markets closed lower on Thursday, with Japan’s Nikkei 225 falling 0.48%, Hong Kong’s Hang Seng Index falling 1.96%, China’s Shanghai Composite Index dipping 1.73% and India’s BSE Sensex falling 0.14%.

Economics

- U.S. initial jobless claims declined by 4,000 from the previous week to 217,000 in the week ending Nov. 9, compared to market estimates of 223,000.

- U.S. producer prices rose 0.2% month-over-month in October compared to a revised 0.1% gain in September and in-line with market expectations.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.